#pm svanidhi scheme

Explore tagged Tumblr posts

Text

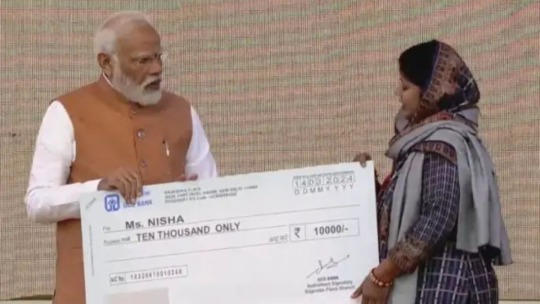

रेहड़ी-पटरी वालों को पीएम नरेंद्र मोदी में बांटे स्वनिधि योजना के चेक, कहा, बैंक गारंटी मांगता है, इसलिए मैं गारंटी बना

रेहड़ी-पटरी वालों को पीएम नरेंद्र मोदी में बांटे स्वनिधि योजना के चेक, कहा, बैंक गारंटी मांगता है, इसलिए मैं गारंटी बना

PM Modi In Delhi: पीएम नरेंद्र मोदी ने कहा कि रेहड़ी-पटरी वाले साथियों के ठेले, दुकान भले छोटे हों, लेकिन इनके सपने बड़े होते हैं। उन्होंने कहा कि अतीत में पहले की सरकारों ने इन साथियों की सुध तक नहीं ली, इनको अपमान सहना पड़ता था, ठोकरें खाने के लिए मजबूर होना पड़ता था। फुटपाथ पर सामान बेचते हुए पैसों की जरूरत पड़ जाती थी, तो मजबूरी में महंगे ब्याज पर पैसा लेना पड़ता था। बैंक से इनको लोन ही नहीं…

View On WordPress

#Narendra Modi#PM Modi#pm svanidhi scheme#pm svanidhi scheme in tamil#pm svanidhi scheme kya hai#pm svanidhi scheme online apply#pm svanidhi scheme online apply 2023#pm svanidhi scheme online apply csc#pm svanidhi scheme online apply csc kannada#pm svanidhi scheme online apply lor#pm svanidhi scheme online apply tamil#pm svanidhi scheme online apply telugu#street vendors#Swanidhi Yojana

0 notes

Text

Over 16,23,000 beneficiaries in the state have received loans totalling approximately Rs 2127.11 crore, with a repayment rate of 85.64 percent. Furthermore, more than 6,04,566 street vendors in the state have managed to repay their loans after benefiting from the PM SVANidhi scheme.

0 notes

Text

Jammu & Kashmir in the Flood of Unemployment

Unemployment in Jammu & Kashmir has emerged as a grave socio-economic crisis. The region’s youth—particularly the educated segment—face increasing frustration in their quest for suitable employment. This article explores the latest statistics, underlying causes, government initiatives, and future strategies to address the alarming issue of unemployment in Jammu & Kashmir.

🔘Current Unemployment Statistics

Youth Unemployment (Ages 15–29): The unemployment rate among youth in J&K stands at 18.3%, significantly higher than the national average.

Overall Unemployment: The overall unemployment rate was 6.7% in 2019–20 and 5.9% in 2020–21, yet youth unemployment remains persistently high.

Educated Youth: Nationally, 42.3% of graduates under the age of 25 are unemployed, and the percentage in J&K is reportedly higher.

Women's Unemployment: While the national unemployment rate among women is 18.5%, it is presumed to be even higher in J&K due to cultural and structural barriers.

National Context: The current national unemployment rate is 9.2%, with urban unemployment peaking at 6.7%.

🔘Root Causes of Unemployment

1. Political Instability: Decades of conflict have hindered business operations and discouraged private investment.

2. Outdated Education System: Lack of emphasis on practical training and market-relevant skills leaves graduates unprepared.

3. Preference for Government Jobs: A disproportionate reliance on limited government positions hampers employment diversity.

4. Underdeveloped Private Sector: Sectors such as tourism, IT, and manufacturing remain underutilized.

5. High Dropout Rates: Early school dropouts result in a large, unskilled population lacking employability.

🔘Government Initiatives and Schemes

Despite several initiatives, challenges remain in bridging the employment gap:

Atmanirbhar Bharat Rozgar Yojana (ABRY): ₹35.39 crore disbursed to 19,340 beneficiaries in J&K.

PM Street Vendors Atmanirbhar Nidhi (PM SVANidhi): 17,950 loans granted to support street vendors.

Pradhan Mantri Mudra Yojana (PMMY): ₹4,209.69 crore distributed through 189,000 loan accounts.

Other Schemes: PMEGP, MGNREGS, DDU-GKY, and DAY-NULM are being implemented to create employment.

PLI Scheme: Aims to generate 6 million new jobs over five years, with expected benefits for J&K.

🔘Challenges to Implementation

Limited Ground-Level Impact: Government schemes have yet to significantly reduce unemployment.

Low Private Investment: Ongoing unrest deters potential investors.

Lack of Skills and High Dropout Rates: Youth remain unemployable due to lack of vocational training and early school exits.

🔘Recommendations and Solutions

To resolve the unemployment crisis in J&K, a multifaceted approach is essential:

1. Education and Skill Reform

Align curricula with industry needs.

Launch intensive training in IT, freelancing, digital marketing, and modern technologies.

2. Private Sector Development

Establish industrial zones and boost investment in tourism, agriculture, and tech.

Offer easy credit and mentorship for youth entrepreneurs.

3. Transparent Recruitment

Implement fast, fair, and merit-based recruitment in public and private sectors.

4. Anti-Corruption Measures

Eliminate corruption to ensure fair resource distribution and equal opportunity.

5. Rural Development

Modernize agriculture and encourage agro-based industries to create rural employment.

6. Startup Ecosystem

Promote startup culture by setting up incubation centers and providing financial and training support.

7. Integrated Policy Planning

Synchronize education and population policies with job market demands.

8. Youth Awareness and Counseling

Establish career counseling centers to guide youth towards diverse employment avenues beyond government jobs.

Conclusion

Unemployment in Jammu & Kashmir is not merely an economic issue—it is a deep-rooted social and psychological challenge. While government schemes offer hope, their grassroots impact remains insufficient. Long-term solutions lie in educational transformation, private sector empowerment, and holistic youth engagement. With coordinated efforts from the government, private sector, educational institutions, and youth themselves, J&K can pave the way towards sustainable development and a more secure future.

JAVAD AHMAD HURA, UN Educationist. || Chief Editor of Srinagar Samachar

0 notes

Text

SBI e mudra loan of 50,000

The SBI e-Mudra loan of ₹50,000 is a collateral-free business loan offered by the State Bank of India (SBI) under the Pradhan Mantri Mudra Yojana (PMMY) scheme. It is designed to help micro and small businesses, especially individual entrepreneurs, shopkeepers, small vendors, and MSMEs, to get access to quick working capital for their business needs.

People also read: How to get 50,000 Loan without CIBIL Score

Key Highlights of SBI e-Mudra Loan ₹50,000

FeatureDetailsLoan AmountUp to ₹50,000Loan TypeWorking Capital / Term Loan under PMMYCategoryShishu Loan (For loans up to ₹50,000)EligibilityExisting SBI customers with a running current/savings account for at least 6 monthsInterest RateAs per SBI MUDRA guidelines (usually ~9% to 12%)Collateral/SecurityNo collateral requiredRepayment TenureFlexible tenure (up to 5 years)Processing FeesNil (for Shishu category)Mode of ApplicationOnline through SBI e-Mudra portalPurpose of LoanBusiness setup, working capital, equipment purchase, etc.

Eligibility Criteria

Must be an Indian citizen aged 18–60 years.

Should have a savings or current account with SBI (minimum 6 months old).

Must have a valid Aadhaar linked with your SBI account.

Must have a registered mobile number linked with Aadhaar.

Should possess a business plan for income-generating activities.

Only non-corporate, non-farm micro-enterprises are eligible.

People also read: What is pm svanidhi loan 50,000

Documents Required

Aadhaar Card

PAN Card

Business proof (like shop license, GST registration, etc.)

Bank passbook or statement

Photograph

Business plan or income generation activity details

How to Apply Online

Visit SBI e-Mudra portal.

Click on “Proceed” and enter your SBI account details.

Authenticate using Aadhaar OTP.

Fill in the loan application form with business details.

Upload required documents.

Submit the application.

Upon approval, the loan amount is disbursed directly to your SBI account.

People also read: E-mudra loan sbi 50000 interest rate

Important Note

If you're seeking more than ₹50,000 (i.e., under Kishor or Tarun categories of Mudra loans), you'll need to visit the bank branch with a detailed business plan and documentation.

Source:

#SBI E mudra#e mudra loan#sbi mudra loan#sbi e mudra 50000 loan#50000 loan from mudra sbi#sbi mudra 50000 loan

0 notes

Text

Key Announcements in Union Budget 2025-26: Impact & Analysis

Boosting Middle-Class Consumption & Savings

The government has exempted income tax for individuals earning up to ₹1 lakh per month (₹12.75 lakh annually under the new tax regime). This move aims to boost household savings, increase disposable income, and drive consumption, ultimately fueling economic growth.

Strengthening India’s Economic Growth Pillars

The budget identifies four key drivers of development—Agriculture, MSMEs, Investments, and Exports—and provides financial and policy support to accelerate industrial expansion and job creation.

Agriculture & Rural Development

PM Dhan-Dhaanya Yojana will cover 100 districts with low agricultural productivity, benefiting 1.7 crore farmers through better infrastructure and modern farming techniques.

Mission for Aatmanirbharta in Pulses focuses on boosting domestic production of tur, urad, and masoor dal to reduce dependence on imports.

Farmers can now avail loans of up to ₹5 lakh under the Modified Interest Subvention Scheme via Kisan Credit Cards (KCC), ensuring better access to credit at lower interest rates.

Fiscal Responsibility & MSME Support

The fiscal deficit for FY25 is set at 4.8%, with a plan to lower it to 4.4% in FY26 to maintain economic stability.

MSMEs will get enhanced credit guarantees, increasing the coverage from ₹5 crore to ₹10 crore to encourage small business growth.

A National Manufacturing Mission will support small, medium, and large industries, furthering the “Make in India” initiative to promote local production.

Education & Technology Innovations

50,000 Atal Tinkering Labs will be established in government schools over the next five years to encourage STEM education.

A Centre of Excellence in AI for Education will be set up with a ₹500 crore budget to drive technology-based learning.

Financial Inclusion & Digital Economy

The PM SVANidhi scheme will offer higher bank loans, while small vendors can access UPI-linked credit cards with a ₹30,000 limit.

Gig workers will receive identity cards, be registered on the e-Shram portal, and get healthcare coverage under PM Jan Arogya Yojana.

Urban Development & Infrastructure

A ₹1 Lakh Crore Urban Challenge Fund will help cities become economic growth hubs while ensuring sustainable urban expansion.

The Modified UDAN Scheme will improve regional air connectivity with 120 new destinations.

A ₹15,000 crore SWAMIH Fund will be allocated for completing 1 lakh stalled housing projects, benefiting the real estate sector.

Research, Innovation & Industry Growth

₹20,000 crore allocated for private sector-driven R&D and innovation initiatives.

A Nuclear Energy Mission with a ₹20,000 crore budget will focus on small modular reactor development and research.

FDI limits in the insurance sector have been raised from 74% to 100%, making it more attractive for foreign investors.

Simplifying Business & Taxation

The Jan Vishwas Bill 2.0 will decriminalize over 100 provisions across different laws, making compliance easier.

The time limit for filing updated income tax returns has been extended from 2 years to 4 years, giving taxpayers more flexibility.

Delay in TCS payment will no longer be a criminal offense, reducing penalties for businesses.

TDS on rent has increased from ₹2.4 lakh to ₹6 lakh, benefiting landlords and rental markets.

Healthcare & Customs Duty Reforms

Basic Customs Duty (BCD) has been exempted on 36 life-saving drugs, including those for cancer, rare diseases, and chronic illnesses.

The duty on Intelligent Flat Panel Displays (IFPD) has been raised to 20%, while the duty on open cells has been cut to 5% to boost local manufacturing.

To encourage EV and mobile battery production, capital goods for battery manufacturing are now exempt from customs duty.

The shipbuilding industry will enjoy a 10-year customs duty exemption on raw materials and components.

Agriculture & Fisheries Support

BCD on frozen fish paste has been reduced from 30% to 5%, while the duty on fish hydrolysate has dropped from 15% to 5%, supporting the seafood industry.

1 note

·

View note

Text

[ad_1] GG News Bureau New Delhi, 1st Feb. Union Finance Minister Nirmala Sitharaman, in her Budget 2025-26 presentation on Saturday, announced a ₹1 lakh crore Urban Challenge Fund to enhance urban infrastructure and drive economic growth. The fund will support projects under ‘cities as growth hubs’, ‘creative redevelopment of cities’, and ‘water and sanitation’ initiatives. The government will finance up to 25% of bankable projects, with at least 50% of the cost sourced from bonds, bank loans, or public-private partnerships (PPPs). An initial allocation of ₹10,000 crore has been proposed for the upcoming fiscal year. Affordable Housing Boost Sitharaman highlighted the progress under the Special Window for Affordable and Mid-Income Housing (SWAMIH), stating that 50,000 dwelling units have been completed, providing relief to homebuyers in stalled projects. Another 40,000 units are expected to be completed in 2025. To accelerate housing project completion, the government will launch SWAMIH Fund 2, a ₹15,000 crore blended finance facility with contributions from the government, banks, and private investors. This fund aims to deliver an additional one lakh housing units. Street Vendors’ Scheme Expansion The Finance Minister also announced an expansion of the PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) scheme. Enhancements include: Higher loan limits for street vendors UPI-linked credit cards with a ₹30,000 limit Capacity-building support PM SVANidhi has already benefitted 68 lakh street vendors, helping them avoid high-interest informal sector loans. These measures underline the government’s push for urban infrastructure development, affordable housing, and financial inclusion for small businesses. The post Union Budget 2025: ₹1 Lakh Crore Urban Challenge Fund Announced appeared first on Global Governance News- Asia's First Bilingual News portal for Global News and Updates. [ad_2] Source link

0 notes

Text

[ad_1] GG News Bureau New Delhi, 1st Feb. Union Finance Minister Nirmala Sitharaman, in her Budget 2025-26 presentation on Saturday, announced a ₹1 lakh crore Urban Challenge Fund to enhance urban infrastructure and drive economic growth. The fund will support projects under ‘cities as growth hubs’, ‘creative redevelopment of cities’, and ‘water and sanitation’ initiatives. The government will finance up to 25% of bankable projects, with at least 50% of the cost sourced from bonds, bank loans, or public-private partnerships (PPPs). An initial allocation of ₹10,000 crore has been proposed for the upcoming fiscal year. Affordable Housing Boost Sitharaman highlighted the progress under the Special Window for Affordable and Mid-Income Housing (SWAMIH), stating that 50,000 dwelling units have been completed, providing relief to homebuyers in stalled projects. Another 40,000 units are expected to be completed in 2025. To accelerate housing project completion, the government will launch SWAMIH Fund 2, a ₹15,000 crore blended finance facility with contributions from the government, banks, and private investors. This fund aims to deliver an additional one lakh housing units. Street Vendors’ Scheme Expansion The Finance Minister also announced an expansion of the PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) scheme. Enhancements include: Higher loan limits for street vendors UPI-linked credit cards with a ₹30,000 limit Capacity-building support PM SVANidhi has already benefitted 68 lakh street vendors, helping them avoid high-interest informal sector loans. These measures underline the government’s push for urban infrastructure development, affordable housing, and financial inclusion for small businesses. The post Union Budget 2025: ₹1 Lakh Crore Urban Challenge Fund Announced appeared first on Global Governance News- Asia's First Bilingual News portal for Global News and Updates. [ad_2] Source link

0 notes

Text

Will revamp PM SVANidhi scheme for street vendors: Sitharaman

New Delhi: PM SVANidhi scheme for street vendors will be revamped with enhanced loans from banks and UPI-linked credit cards with Rs 30,000 limit, Union Finance Minister Nirmala Sitharaman said Saturday. Presenting her eighth consecutive budget, Sitharaman said the scheme has benefited more than 68 lakh street vendors through respite from high interest informal sector loans. “Building on this…

0 notes

Text

LIVE: PM Narendra Modi distributes loans to beneficiaries under PM SVANidhi scheme in Delhi

http://dlvr.it/T5JTR3 @VinodChavdaBJP

0 notes

Text

PM Modi distributes loans to beneficiaries under PM SVANidhi scheme in Delhi

Watch Live at 5pm. Today!

PMSVANIDHI LOAN SCHEME!!

PM Modi distributes loans to beneficiaries under PM SVANidhi scheme in Delhi

youtube

0 notes

Text

प्रधानमंत्री स्वनिधि योजना को दिया जाएगा नया रूप, क्रेडिट कार्ड के जरिए मिलेगा 30 हजार का लोन; जानें किन लोगों को होगा फायदा

#News प्रधानमंत्री स्वनिधि योजना को दिया जाएगा नया रूप, क्रेडिट कार्ड के जरिए मिलेगा 30 हजार का लोन; जानें किन लोगों को होगा फायदा

PM SVANidhi Scheme: केंद्रीय वित्त मंत्री निर्मला सीतारमण ने शनिवार को कहा कि रेहड़ी-पटरी वालों के लिए प्रधानमंत्री स्वनिधि योजना को नया रूप दिया जाएगा। इसके तहत लाभार्थियों को बैंकों और यूपीआई से जुड़े क्रेडिट कार्ड दिए जाएंगे। इस क्रेडिट कार्ड के जरिए लोन की सुविधा मिलेगी। इस लोन की लिमिट 30,000 रुपये होगी। बता दें कि पीएम स्ट्रीट वेंडर आत्मनिर्भर निधि (पीएम-स्वनिधि) रेहड़ी-पटरी वालों को…

0 notes

Text

Empowering India's Youth: Insights from Viksit Bharat Yatra and Youth for Quality Bharat Festival #ViksitBharatYatra #YouthForQualityBharat #YQBF #QCI

Empowering India's Youth: Insights from Viksit Bharat Yatra and Youth for Quality Bharat Festival #ViksitBharatYatra #YouthForQualityBharat #YQBF #QCI #EmpoweringYouth #QualityBharatMission #IndiaVision2047

Viksit Bharat Yatra is a nationwide campaign launched by Prime Minister Narendra Modi on November 15, 2023, from Khunti, Jharkhand. The purpose of the campaign is to raise awareness and track the implementation of various central schemes, such as Ayushman Bharat, Ujjwala Yojana, PM Suraksha Bima, PM SVANidhi, and more. The campaign aims to reach out to the vulnerable population, spread…

View On WordPress

#Development Initiatives#Empowering Youth#India&039;s Vision 2047#Nation-building#Prime Minister Narendra Modi#Quality Bharat @100 Mission#Quality Council of India#Viksit Bharat Yatra#Youth for Quality Bharat Festival

0 notes

Text

PM Svanidhi Yojana

The Government of India is promoting self-employment. The government is running many schemes for this. One of these schemes is PM Swanidhi Scheme.

0 notes

Text

Interim Budget 2024-25, a beacon of hope for India's growth amid challenges

The Interim Budget 2024-25, presented by Union Finance and Corporate Affairs Minister Nirmala Sitharaman seeks to inject the economy with policies and measures aimed at reigniting positive sentiments and accelerating growth. Can this budget be the catalyst for achieving these growth targets? Let’s delve into its key highlights. Under the guiding principles of ‘Sabka Saath, Sabka Vikas, and Sabka Vishwas’ and the inclusive approach of “Sabka Prayas,” the Finance Minister presented the Interim Union Budget 2024-25 in Parliament. The budget focuses on social justice, particularly uplifting four major segments: the poor (‘Garib’), women (‘Mahilayen’), youth (‘Yuva’), and farmers (‘Annadata’). Key Initiatives: Poverty Alleviation: The budget emphasises 'Garib Kalyan, Desh ka Kalyan,' claiming to have lifted 25 crore people out of multi-dimensional poverty in the last decade. Direct Benefit Transfer (DBT) of Rs 34 lakh crore through PM-Jan Dhan accounts has resulted in government savings of Rs 2.7 lakh crore. The PM-SVANidhi scheme provided credit assistance to 78 lakh street vendors, with 2.3 lakh receiving credit for the third time. Tribal and Artisan Support: Schemes like PM-JANMAN Yojana aid the development of particularly vulnerable tribal groups (PVTG), while PM-Vishwakarma Yojana provides end-to-end support to artisans and craftspeople in 18 trades. Agricultural Initiatives: PM-KISAN SAMMAN Yojana provided financial assistance to 11.8 crore farmers, while PM Fasal Bima Yojana offers crop insurance to 4 crore farmers. The Electronic National Agriculture Market (e-NAM) integrated 1361 mandis, serving 1.8 crore farmers with a trading volume of Rs 3 lakh crore. Women Empowerment: The budget highlights 30 crore Mudra Yojana loans given to women entrepreneurs. Female enrollment in higher education has increased by 28%, with girls and women constituting 43% of enrollment in STEM courses, one of the highest rates globally. Over 70% of houses under PM Awas Yojana in rural areas have been allotted to women. Housing: Despite COVID challenges, the budget aims to achieve the target of three crore houses under PM Awas Yojana (Grameen) soon, with an additional two crore houses to be taken up in the next five years. Strategic Initiatives: Rooftop Solarisation and Free Electricity: A significant announcement is the provision of 300 units of free electricity per month through rooftop solarisation to one crore households, expected to save households Rs 15,000 to Rs 18,000 annually. Healthcare: The Ayushman Bharat scheme will be extended to all Accredited Social Health Activist (ASHA) workers, Anganwadi Workers, and Helpers, ensuring broader access to healthcare services. Agriculture and Food Processing: The Pradhan Mantri Kisan Sampada Yojana has benefited 38 lakh farmers and generated 10 lakh employment opportunities. The Pradhan Mantri Formalisation of Micro Food Processing Enterprises Yojana has assisted 2.4 lakh Self-Help Groups (SHGs) and 60,000 individuals with credit linkages, boosting the agricultural and food processing sectors. Research and Innovation: A corpus of Rs 1 lakh crore will be established with a fifty-year interest-free loan to catalyse growth, employment, and development through research and innovation. Infrastructure: An 11.1% increase in capital expenditure outlay for infrastructure development and employment generation, amounting to Rs 11,11,111 crore, is aimed at enhancing the country's infrastructure and creating employment opportunities. Railways: Under the PM Gati Shakti initiative, three major economic railway corridor programs will be implemented to improve logistics efficiency and reduce costs. Aviation Sector: The plan to double the number of airports to 149 and the order of over 1000 new aircraft signals significant growth in the aviation sector. Green Energy: Plans include setting up a coal gasification and liquefaction capacity of 100 MT by 2030 and a phased mandatory blending of compressed biogas (CBG) in compressed natural gas (CNG) for transport and piped natural gas (PNG) for domestic purposes. Tourism Sector: States will be encouraged to undertake comprehensive development of iconic tourist centers, with long-term interest-free loans provided for financing such development. Investments: The budget highlights significant Foreign Direct Investment (FDI) inflows, totaling USD 596 billion during 2014-23, reflecting a positive outlook for investments in the country. Reforms in the States: To support milestone-linked reforms by state governments, a provision of Rs 75,000 crore as a fifty-year interest-free loan is proposed. The budget also focuses on tax rationalisation efforts, achievements in taxpayer services, and the economic journey since 2014. It sets the stage for a dynamic and inclusive growth trajectory, aiming to propel India towards greater prosperity and well-being for all its citizens. Read the full article

0 notes

Text

Jaano - Community Help: A One-Stop Solution for Government Schemes and Documentation

Jaano - Community Help: A One-Stop Solution for Government Schemes and Documentation

Jaano is a community help website that aims to provide citizens with all the information they need about government schemes, housing schemes, education schemes, insurance, agriculture, senior citizens, finance, women, youth, and documentation. With a wide range of services, Jaano has become a one-stop solution for individuals seeking assistance with various official procedures. Jaano aims to cut out the middle man who takes a lot of money to help citizens for basic requirements.

Services Offered

Jaano offers a plethora of services to cater to the diverse needs of its users. Some of the key services provided by Jaano include:

Free Services

One can find information about various government related schemes on the website. Here is a list of all the scheme information available:

Food

Ration Shop

E-mitra

Aadhar Card

Voter Card

Ration Card

Pan Card

Government Schemes

PM Jan Arogya Yojana

PMAY

PM Kisan Yojana

Jan Dhan Yojana

Sukanya Samriddhi Yojana

Atal Pension Yojana

MGNREGA

Pradhan Mantri Kaushal Vikas Yojana

Pradhan Mantri Jeevan Jyoti Bima Yojana

Pradhan Mantri Mudra Yojana

Pradhan Mantri Suraksha Bima Yojana

Pradhan Mantri Fasal Bima Yojana

OBC Certificate

Samagra Shiksha Abhiyan

Housing Schemes

Affordable Rental Housing Complexes (ARHC) Scheme

Health care

Rashtriya Kishor Swasthya Karyakram (RKSK)

Central Government Health Scheme

Education Schemes

CBSE Single Girl Child Scholarship

Kishore Vaigyanik Protsahan Yojana

Insurance

Indira Gandhi National Old Age Pension Scheme (IGNOAPS)

Rashtriya Swasthya Bima Yojana (RSBY)

Jan shree Bima Yojna

Varishta Mediclaim Policy

Varishta Pension Bima Yojana

Agriculture (Farmers )

PM Kusum Scheme

Pradhan Mantri Krishi Sinchai Yojana (PMKSY)

Rashtriya Krishi Vikas Yojana (RKVY)

Pashu Kisan Credit Card Yojana (PKCC)

Kisan VikasPatra

National Mission on Oilseeds and Oil Palm

Soil Health Card Scheme

Animal Husbandry Infrastructure Development Fund

Women schemes

PM Balika Anudan Yojana

Swadher greh

Ladli Scheme

Mahila shakti kendra

Mahila Samriddhi Yojna

Rajiv gandhi creche scheme

Beti bachao Beti Padhao

Senior citizens scheme

Senior Citizen Savings Scheme

Rashtriya Vayoshri Yojana

Reverse Mortgage Scheme

Finance

Stand UP India

PM SVANidhi Yojana

Credit Guarantee Trust Fund for Micro & Small Enterprises (CGTSME)

DDUY

Income Tax Return

Scheme of Fund for Regeneration of Traditional Industries(SFURTI)

BHIM App

Youth

PM Employment Generation Programme (PMEGP)

PM YUVA Yojana

Digilocker

Skill India

ASPIRE scheme

Labor

Mukhyamantri Gramodyog Rojgar Yojana

E-shram portal

National SC-ST Hub Scheme

Pradhan Mantri Shram Yogi Maandhan Yojana

Fuel (Cooking Gas)

PMUY 2.1

Nandurbar - Nrega

Community Work Demand

Payments

Other Nrega Benefits

Job Card Demand

Users can access detailed information about these schemes on Jaano’s website. New schemes are updated as soon as they are released so the citizens are aware of the latest developments.

Paid Services

In addition to free information, Jaano provides paid services to assist users with essential documentation processes. Some of the paid services offered by Jaano include:

Aadhar Card Update and Application: Users can avail themselves of Jaano’s services to update their Aadhar card details or apply for a new card.

Pan Card Update and Application: Jaano simplifies the process of updating Pan card details or applying for a new card.

Ration Card Update and Application: Users can rely on Jaano’s expertise to update their ration card details or apply for a new card.

Voter Card Update and Application: Jaano helps users update their voter card details or apply for a new card.

These paid services are facilitated through government-registered e-mitras to ensure accuracy and reliability at a nominal cost.

The Goal

Many people from various backgrounds from different parts of the country have difficulty understanding government schemes and Jaano is a platform that aims to help the citizens get empowered by knowing what the government can offer and what are their benefits. The government scheme space is often filled with misinformation and often lies by individuals who are willing to profit from ill informed people. This is where Jaano comes in and takes a step in the right direction by helping citizens to stay informed and assist them.

Jaano has recorded that many individuals were facing issues filling out forms for voter id and they also had wrong information. Jaano assisted them and helped them apply for their voter id. They were contacted by Jaano after 45 days and they admit that they were satisfied.

Several people were not informed that the Ayushman card was replaced by Abha Card and so wanted to apply for the Ayushman Card but Jaano informed the individuals that in reality both cards were no longer available.

The Process

One out of many instances where individuals faced issues with government schemes and Jaano assisted them is when Pan Card and Aadhar Card linking was needed. The CSE charges 1100 INR and in some places even more. Jaano provides help with the assistance of government registered E-Mitras and reduces the cost of the service to about 800 INR.

An individual can use the app (available on the playstore and appstore) and request a service request. The service request can be created and then the customer pays for the service which is much less than the typical charges for the service outside Jaano network. Jaano sends the contact details of the government registered E-Mitra who will assist the customer with his/her request. In the case a customer is unable to contact the E-Mitra, a Jaano representative will contact the customer and assist him/her further.

Customer Satisfaction

Jaano takes pride in its commitment to customer satisfaction. With over 1 lac satisfied customers. The platform is fast and serves the visitors in a matter of seconds. Jaano has established itself as a reliable platform for individuals seeking assistance with government schemes and documentation. With a customer first approach, Jaano can easily state that they can satisfy their customers. Customers can easily raise concerns about the services and her almost immediate assistance.

Efficiency and Effectiveness

Jaano handles more than 500 requests daily, showcasing its efficiency in providing prompt solutions to its users. The platform’s user-friendly interface ensures that individuals can easily navigate through the website and access the required information without any hassle.

Conclusion

Jaano is revolutionizing the way citizens interact with government schemes and documentation. By offering comprehensive services, Jaano has become a trusted platform for individuals seeking assistance with various official procedures. With its commitment to customer satisfaction, efficiency, and effectiveness, Jaano continues to make a positive impact on the lives of countless individuals.

For more information about Jaano’s services, visit their official website at https://jaano.swaniti.org/home

Remember, Jaano is here to help you navigate through the complexities of government schemes and documentation!

0 notes

Text

[ad_1] New Delhi: Finance Minister Nirmala Sitharaman , in her Union Budget 2025 speech, announced a revamp of the Prime Minister Street Vendors AtmaNirbhar Nidhi (PM SVANidhi) scheme to boost the incomes of urban poor by providing increased access to small working capital loans for Read More [ad_2] Source link

0 notes