#polyamide in electronic protection device

Explore tagged Tumblr posts

Text

0 notes

Text

Melamine Polyphosphate Market experiencing steady growth driven by 2037

The Melamine Polyphosphate Market is rapidly growing due to stricter fire safety regulations, rising use in advanced materials, and demand for halogen-free flame retardants. Valued at USD 334.85 million in 2024, it’s projected to reach USD 723.03 million by 2037, with a CAGR of 6.1% from 2025 to 2037.This growth reflects the market’s increasing relevance in high-performance sectors such as construction, electronics, and transportation.

Melamine Polyphosphate Industry Demand

Melamine Polyphosphate (MPP) is a halogen-free, eco-friendly flame retardant with thermal stability and low smoke. Widely used in thermoplastics and resins, MPP helps manufacturers meet fire safety standards without toxic additives.

Key Advantages:

Cost-effective alternative to halogenated flame retardants

Compatible with various polymers like polyamides and polyolefins

Stable and long-lasting, with excellent shelf life

Environmentally compliant, aligning with global regulations

Driven by growing safety and sustainability demands, MPP’s market outlook is strong for the years ahead.

Request Sample@ https://www.researchnester.com/sample-request-7637

Melamine Polyphosphate Market: Growth Drivers & Key Restraint

Top Growth Drivers:

Tightening Fire Safety Regulations: Global mandates like REACH boost demand for halogen-free retardants like MPP.

Electronics & Automotive Growth: Increasing need for flame resistance in compact, high-power devices and vehicles.

Eco-Friendly Shift: Rising preference for non-halogen, low-toxicity flame retardants supports MPP adoption.

Key Restraint:

Processing Challenges: Compatibility and potential impact on mechanical properties limit use in some specialized applications.

Melamine Polyphosphate Market: Segment Analysis

By Form

Solid: Most common, stable, and easy to handle; widely used in thermoplastics and composites.

Liquid: Growing in niche uses like coatings and adhesives for better dispersion.

By Application

Flame Retardants: Main use in fire-resistant polymers for electronics, insulation, and transport parts.

Thermosetting Plastics: Enhances fire resistance in epoxy and phenolic resins for electronics and aerospace.

Intumescent Coatings: Provides passive fire protection in building materials.

Adhesives & Sealants: Adds flame resistance and smoke suppression in construction and industrial uses.

By End Use

Construction & Building: Used in fire-rated panels, insulation, and coatings—driven by safety codes.

Electronics & Electrical: Ensures fire safety in devices and circuit boards without added smoke.

Automotive: Applied in interiors, cables, and EV parts for thermal and fire protection.

Aerospace: Lightweight flame retardant for composites and interiors.

Others: Marine, railways, and industrial equipment requiring fire safety compliance.

Melamine Polyphosphate Market: Regional Insights

North America:

Rising demand driven by strict fire safety regulations, growth in electronics and EV sectors, and a push for halogen-free, sustainable materials.

Europe:

Strong regulatory focus on environmental compliance and halogen-free flame retardants fuels demand, especially in construction, automotive, and electrical industries.

Asia-Pacific (APAC):

Largest market share supported by booming manufacturing, urbanization, and electronics growth in China, India, South Korea, and Japan, alongside increasing fire safety standards.

Top Players in the Melamine Polyphosphate Market

Major players shaping the Melamine Polyphosphate Market include Eastman Chemical Company, Saudi Leading companies operating in the Melamine Polyphosphate Market include Clariant AG, Israel Chemicals Ltd., Huber Engineered Materials, Italmatch Chemicals S.p.A., Nutrien Ltd., Jiangsu Yoke Technology Co., Ltd., Zhenjiang Sanwa Flame Retardant Technology Co., Ltd., Zhejiang Wansheng Co., Ltd., Amfine Chemical Corporation, Zhejiang Longyou GD Chemical Industry Co., Ltd., Shandong Shouguang Jianyuanchun Co., Ltd., and Zibo Tianheng New Nanomaterials Technology Co., Ltd. These firms are actively engaged in developing advanced formulations, expanding regional supply chains, and innovating to meet the demand for safer and environmentally friendly flame retardants..

Access Detailed Report@ https://www.researchnester.com/reports/melamine-polyphosphate-market/7637

Contact for more Info:

AJ Daniel

Email: [email protected]

U.S. Phone: +1 646 586 9123

U.K. Phone: +44 203 608 5919

0 notes

Text

Technical Films Market Size, Share, Trends, Demand, Future Growth, Challenges and Competitive Analysis

"Global Technical Films Market - Size, Share, Demand, Industry Trends and Opportunities

Global Technical Films Market, By Film Type (Stretch Film, Shrink Film, Barrier Film, Conductive Film, Safety and Security Film, Anti-Fog Film, Other Technical Films), Product Type (Degradable Film, Non-Degradable Film), End-Use Industry (Food and Beverage, Cosmetic and Personal Care, Chemical, Agriculture, Building and Construction, Pharmaceutical, Electrical and Electronic, Automobile), Material Type (Polyethylene (PE), Polyethylene Terephthalate (PET), Polyamide (PA), Polypropylene (PP), Polyvinyl Chloride (PVC), Ethylene Vinyl Alcohol (EVOH), Polyurethane (PU), Aluminum, Polycarbonate (PC), Others), Thickness Type (Up to 25 Microns, 25-50 Microns, 50-100 Microns, 100-150 Microns) – Industry Trends.

Access Full 350 Pages PDF Report @

**Segments**

- By Product Type: The technical films market can be segmented into polyester films, polyethylene films, polycarbonate films, polypropylene films, PVC films, and others. Polyester films are widely used in various industries due to their exceptional properties such as high tensile strength, chemical resistance, and dimensional stability. Polyethylene films are popular in packaging applications due to their flexibility and moisture barrier properties. Polycarbonate films are known for their high impact strength and heat resistance, making them suitable for electronics and automotive industries. Polypropylene films offer excellent clarity and are used in food packaging. PVC films are valued for their durability and versatility, finding applications in construction, healthcare, and packaging sectors.

- By Application: The technical films market can be categorized based on applications such as packaging, industrial, agricultural, medical, construction, and others. Packaging is the largest application segment for technical films, driven by the growing demand for flexible and sustainable packaging solutions across various sectors. Industrial applications of technical films include protective coatings, adhesive tapes, and insulation materials. In agriculture, technical films are used for greenhouse coverings, mulching, and crop protection. Medical applications of technical films range from surgical drapes and wound dressings to medical device components. The construction sector utilizes technical films for weatherproofing, insulation, and vapor barriers.

**Market Players**

- DuPont de Nemours, Inc.: A global leader in technical films, DuPont offers a wide range of innovative solutions for various industries, including packaging, electronics, and healthcare. The company's technical films portfolio includes polyester, polyethylene, and polycarbonate films known for their high performance and reliability.

- Toray Industries, Inc.: Toray is a major player in the technical films market, providing advanced film solutions for industrial, medical, and electronic applications. The company's products, such as polypropylene and polyester films, are recognized for their superior quality and sustainability.

- Covestro AG: Covestro is known for its highCovestro AG is a prominent player in the technical films market, renowned for its high-quality polycarbonate films that offer exceptional performance characteristics. The company focuses on innovation and sustainability, catering to diverse industries such as automotive, electronics, and medical. Covestro's technical films are favored for their impact resistance, optical clarity, and heat resistance, making them ideal for applications requiring durable and reliable materials. The company's commitment to research and development ensures that its product portfolio remains at the forefront of technological advancements, meeting the evolving needs of the market.

Another key player in the technical films market is SABIC, a global leader in diversified chemicals and advanced materials. SABIC offers a comprehensive range of technical films, including polyethylene and polypropylene films, renowned for their versatility and performance. The company leverages its extensive expertise in material science to develop innovative solutions for packaging, construction, and industrial applications. SABIC's technical films are preferred for their strength, durability, and sustainability, making them a preferred choice for customers seeking high-quality materials for various end uses.

3M Company is a renowned player in the technical films market, known for its wide range of adhesive and protective films catering to diverse industries such as transportation, healthcare, and consumer goods. 3M's technical films are designed to provide superior adhesion, abrasion resistance, and weather protection, offering reliable solutions for demanding applications. The company's focus on continuous product innovation and customer-centric approach has solidified its position as a trusted supplier of high-performance films to global markets.

In conclusion, the technical films market is characterized by the presence of key players such as Covestro AG, SABIC, and 3M Company, who offer a diverse range of innovative solutions for various industries. These market players continue to drive advancements in material science and technology, providing customers with high-quality films that meet the stringent requirements of modern applications. As the demand for technical films continues to grow across different sectors, companies are investing in research and**Global Technical Films Market**

- Film Type: - Stretch Film - Shrink Film - Barrier Film - Conductive Film - Safety and Security Film - Anti-Fog Film - Other Technical Films

- Product Type: - Degradable Film - Non-Degradable Film

- End-Use Industry: - Food and Beverage - Cosmetic and Personal Care - Chemical - Agriculture - Building and Construction - Pharmaceutical - Electrical and Electronic - Automobile

- Material Type: - Polyethylene (PE) - Polyethylene Terephthalate (PET) - Polyamide (PA) - Polypropylene (PP) - Polyvinyl Chloride (PVC) - Ethylene Vinyl Alcohol (EVOH) - Polyurethane (PU) - Aluminum - Polycarbonate (PC) - Others

- Thickness Type: - Up to 25 Microns - 25-50 Microns - 50-100 Microns - 100-150 Microns

The global technical films market is experiencing significant growth driven by the increasing demand for advanced and high-performance films in various industries. The market segmentation based on film type, product type, end-use industry, material type, and thickness type allows for a detailed analysis of the

The report provides insights on the following pointers:

Market Penetration: Comprehensive information on the product portfolios of the top players in the Technical Films Market.

Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market.

Competitive Assessment: In-depth assessment of the market strategies, geographic and business segments of the leading players in the market.

Market Development: Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies.

Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Technical Films Market.

Highlights of TOC:

Chapter 1: Market overview

Chapter 2: Global Technical Films Market

Chapter 3: Regional analysis of the Global Technical Films Market industry

Chapter 4: Technical Films Market segmentation based on types and applications

Chapter 5: Revenue analysis based on types and applications

Chapter 6: Market share

Chapter 7: Competitive Landscape

Chapter 8: Drivers, Restraints, Challenges, and Opportunities

Chapter 9: Gross Margin and Price Analysis

Objectives of the Report

To carefully analyze and forecast the size of the Technical Films market by value and volume.

To estimate the market shares of major segments of the Technical Films

To showcase the development of the Technical Films market in different parts of the world.

To analyze and study micro-markets in terms of their contributions to the Technical Films market, their prospects, and individual growth trends.

To offer precise and useful details about factors affecting the growth of the Technical Films

To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Technical Films market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Browse Trending Reports:

Industrial Plastic Market Transthyretin Amyloidosis Treatment Market Smart Toilet Seat Market Supercapacitor Market B-cell lymphoma treatment Market Enterprise Information Archiving Market Delivery Robots Market Testing, Inspection, and Certification (TIC) Market Amusement Parks Market Complex Fertilizers Market Hydrogen Sensor Market Flexible Packaging Paper Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

0 notes

Text

Gas Barrier Membrane Market Growth Driven by Packaging and Construction Demand

The Gas Barrier Membrane Market is experiencing significant growth, driven by the increasing demand for protective and high-performance packaging solutions in various industries, including food & beverages, pharmaceuticals, electronics, and construction. Gas barrier membranes are designed to prevent the transmission of gases such as oxygen, carbon dioxide, and water vapor, ensuring the preservation of product quality, extending shelf life, and maintaining freshness. The growing consumer preference for convenience foods and packaged products is a key factor propelling the demand for gas barrier membranes in food and beverage packaging.

Technological advancements in high-barrier materials, such as ethylene vinyl alcohol (EVOH), polyamide (nylon), polyethylene (PE), and biopolymers, are enhancing the performance and versatility of gas barrier membranes. These innovations enable manufacturers to produce multi-layered, flexible, and recyclable packaging solutions with superior gas barrier properties. Additionally, the increasing focus on sustainability and eco-friendly packaging is driving the demand for recyclable and bio-based gas barrier membranes. In the construction industry, gas barrier membranes are widely used for waterproofing, vapor control, and radon mitigation, further contributing to market growth.

For In depth Information Get Free Sample Copy of this Report@

Gas Barrier Membrane Market Companies Are:

Sumitomo Chemical, Daikin, Saint-Gobain, Toyobo, Kaneka, Nippon Steel Sumitomo Metal, Dow, Nikkei Luminex, BASF, Teijin, Toray, JSR, Chemours, Asahi Kasei, Evonik

Drivers:

Growing Demand for Extended Shelf Life in Food and Beverage Packaging:

The increasing demand for longer shelf life, freshness, and safety of packaged food and beverages is driving the adoption of gas barrier membranes. These membranes protect products from oxygen, moisture, and contaminants, maintaining product quality and preventing spoilage.

Technological Advancements in High-Barrier Materials:

Innovations in high-barrier materials such as EVOH, nylon, and biopolymers are enhancing the gas barrier properties and recyclability of packaging solutions. Multi-layered structures and nano-coatings provide superior protection and flexibility.

Growth of the Pharmaceutical and Healthcare Industry:

The increasing demand for protective and sterile packaging for pharmaceuticals, medical devices, and diagnostic kits is boosting the market for gas barrier membranes. These membranes ensure product safety, integrity, and compliance with regulatory standards.

Expansion of Electronics and Semiconductor Industry:

Gas barrier membranes are used in the electronics and semiconductor industry to protect sensitive components from moisture, dust, and gases. The growing demand for flexible electronics, OLED displays, and photovoltaic cells is driving market growth.

Restraints:

High Cost of Advanced Barrier Materials:

The cost of high-performance materials such as EVOH, nylon, and biopolymers is relatively high compared to conventional packaging materials. This cost factor can limit the adoption of gas barrier membranes, especially in price-sensitive markets.

Environmental Concerns and Recycling Challenges:

The complex multi-layer structures of gas barrier membranes pose recycling challenges, leading to environmental concerns regarding plastic waste. Stringent regulations on single-use plastics and non-recyclable packaging are impacting the market.

Competition from Alternative Packaging Solutions:

The market faces competition from alternative packaging solutions such as metalized films, aluminum foils, and glass containers, which offer similar gas barrier properties and are perceived as more sustainable options.

Opportunities:

Rising Demand for Sustainable and Eco-Friendly Packaging:

Increasing consumer awareness of sustainability and environmental impact is driving the demand for recyclable and bio-based gas barrier membranes. Manufacturers are investing in green technologies and biodegradable materials to meet the growing demand for eco-friendly packaging.

Growth in Flexible Electronics and Smart Packaging:

The rapid growth of flexible electronics, OLED displays, and smart packaging is creating new opportunities for gas barrier membranes. These membranes provide protection against moisture and oxygen, ensuring the performance and durability of flexible electronic components.

Expansion in Emerging Markets:

The increasing demand for packaged food, pharmaceuticals, and consumer electronics in emerging markets such as Asia-Pacific, Latin America, and the Middle East presents significant growth opportunities for gas barrier membranes.

Challenges:

Complex Manufacturing Processes and High Production Costs:

The production of high-performance gas barrier membranes involves complex multi-layer lamination and coating technologies, leading to high production costs. This complexity also affects the scalability and cost-effectiveness of manufacturing.

Stringent Regulatory Requirements and Compliance:

Compliance with stringent regulations related to food safety, pharmaceutical packaging, and environmental sustainability poses a challenge for manufacturers. Adhering to global standards requires significant investments in testing, certifications, and R&D.

Fluctuating Raw Material Prices:

The market is impacted by the fluctuations in raw material prices, including polymers and specialty chemicals used in gas barrier membranes. Volatile crude oil prices and supply chain disruptions can affect cost structures and pricing strategies.

About Market Research Future: At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), & Consulting Services. MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients.

Contact us: Market Research Future (part of Wantstats Research and Media Private Limited), 99 Hudson Street, 5Th Floor, New York, New York 10013 United States of America +1 628 258 0071 Email: [email protected] Website: https://www.marketresearchfuture.com

0 notes

Text

Materials for Low Volume Injection Molding: What to Consider?

When it comes to low volume injection molding, choosing the right material is important to ensure the proper product development output.

Material selection affects everything from the cost and performance of the part to the production speed and durability of the mold. Whether you’re developing a prototype or producing small batches of custom parts, understanding what to consider when selecting materials will help you achieve the best results.

In this blog, we'll learn the key factors you should keep in mind when choosing materials for low volume injection molding.

The first thing to consider is the specific requirements of your project. Here are the following questions that can be checked prior to implementation:

What are the mechanical properties needed?

If you need to a strong, flexible, or heat-resistant, this will determine the type of material you choose.

What environment will the part be exposed to?

Does the part need to withstand high temperatures, moisture, or chemicals? Choosing a material that performs well under these conditions is advantage

How complex is the design?

Some materials flow better into complex molds, making them ideal for intricate designs or parts with fine details.

2. Common Material Choices for Low Volume Injection Molding

Here are some of the most used materials in low volume injection molding:

a) ABS (Acrylonitrile Butadiene Styrene)

ABS is a popular choice for injection molding due to its good balance of strength, flexibility, and ease of molding. It’s often used for prototypes or parts that require moderate durability. ABS is also cost-effective, making it a go-to material for low-volume production.

Best for: Consumer products, automotive components, and electronic housing.

b) Polypropylene (PP)

Polypropylene is lightweight, flexible, and resistant to chemicals, making it ideal for parts exposed to moisture or chemicals. It’s commonly used in packaging, medical devices, and household products.

Best for: Packaging, medical devices, and storage containers.

c)Polycarbonate (PC)

For projects requiring high impact resistance and clarity, polycarbonate is a great option. It’s commonly used for safety equipment, transparent parts, and components requiring toughness.

Best for: Optical lenses, safety helmets, and protective covers.

d)Nylon (Polyamide)

Nylon offers excellent strength, abrasion resistance, and heat tolerance. It’s often used for mechanical parts or components that will be exposed to friction and wear.

Best for: Gears, bearings, and other industrial components.

e) Thermoplastic Elastomers (TPE)

TPE combines the properties of rubber with the ease of plastic molding. It’s great for parts that need to be flexible or soft, like grips or seals.

Best for: Soft-touch grips, over-molded parts, and seals.

3.Mold Considerations

In low volume injection molding, the type of mold used can also impact your material selection. For example, if you're using aluminum molds—which are often preferred in low volume production due to their lower cost—it's important to choose materials that are compatible with these molds. Aluminum molds are not as durable as steel molds, so choosing materials that mold easily and don’t cause excessive wear is important.

4.Material Costs

Budget plays a crucial role in material selection. In low volume production, it’s important to find a balance between the performance of the material and the overall cost. Some high-performance materials like PEEK or ULTEM offer great strength and heat resistance but can be expensive. For low volume runs, you may need to assess whether you truly need those high-end properties or if a more affordable option like ABS or polypropylene will suffice.

5.Lead Times and Availability

When working on a low volume project, the timeline is often critical. Some materials are more readily available than others. Make sure to check the lead times for your chosen material to ensure it aligns with your production schedule. In some cases, opting for more commonly available material can help speed up the overall process.

6.Recyclability and Sustainability

Sustainability is becoming a bigger concern in manufacturing. If you're focused on reducing environmental impact, consider materials that are recyclable or come from renewable sources. For example, recycled plastics or biodegradable polymers can be excellent choices, especially for companies aiming for eco-friendly practices.

7.Testing and Prototyping

Before finalizing your material choice, it's important to test how well the material meets your specific requirements. Low volume injection molding is ideal for prototyping, allowing you to try out different materials and see how they perform under real-world conditions.

Choosing the right material for low volume injection molding is key to achieving the right balance between cost, durability, and performance. By considering your project’s specific requirements—such as strength, flexibility, chemical resistance, and design complexity—you can make informed decisions about the best material to use. Keep mold compatibility, material costs, and sustainability in mind to ensure your low volume production is both efficient and cost-effective.

With the right material, low volume injection molding can deliver high-quality, functional prototypes or limited-run products that meet your exact needs. For more details, visit https://hlhrapid.com/rapid-injection-moulding/

Would you like to discuss your project with the experts? Submit your CAD file here

0 notes

Text

Electronic Adhesives Market - Forecast (2024-2030)

Electronic Adhesives Market Overview

Electronic Adhesives Market Size is forecast to reach $ 6,820 Million by 2030, at a CAGR of 6.50% during forecast period 2024-2030. Electronic adhesives are used for circuit protection and electronic assembly applications such as bonding components, wire tacking, and encapsulating electronic components. The use of electronic adhesives in manufacturing components for electric vehicles such as printed circuit boards, lithium-ion batteries, and battery pack assemblies are facilitating growth of the market. Growing adoption of surface mounting technology to replace welding and soldering is one of the prominent trends in the electronics industry, shaping the demand for electronics adhesives.

Report Coverage

The report: “Electronic Adhesives Market – Forecast (2024-2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the Electronic Adhesives Industry.

By Type: Thermal Conductive, Electrically Conductive, Ultraviolet-Curing and Others.

By Resin Type: Epoxy, Cyanoacrylates, Polyamides, Phenolic, Silicones, and Others (Acrylics, and Polyurethane)

By Application: PCB’s, Semiconductor, and Others

By End-User Industry: Consumer Electronic (Wearable Devices, LEDs & TVs, Smart Phones & Tablets, Computers, Laptops, and Others), Healthcare, Energy & Power (Solar, Wind, and Others), Telecom Industry, Transportation (Automotive (Passenger Vehicles, Light Commercial and Heavy Commercial Vehicles), Marine, Locomotive, and Aerospace), Oil & Gas, Chemical, Pulp & Paper, and Others.

By Geography: North America, South America, Europe, APAC, and RoW

Request Sample

Key Take away

In 2020, North America held the largest share after APAC. Due to growing demand for electronic adhesives in electronics and telecommunication industry. The US hold the largest share in the region over the forecast period.

Growing adoption of electric vehicles is expected to provide a major growth opportunity for the market.

Emission of Volatile Organic Compounds (VOC’s) may deter the market's growth during the forecasted period.

COVID-19 has hindered the market growth owing to the disruption of supply chain and worldwide lockdown.

Electronic Adhesives Market Segment Analysis - By Type

Electrically Conductive segment held the largest share of more than 30% in the electronics adhesives market in 2020. Electrically Conductive are used in various industry verticals such as aerospace, automotive, medical, and telecom products. Electrically conductive is an excellent solution for making electrical contacts on PCBs and other temperature-sensitive substrates, as their curing temperature is below the soldering temperature. An increase in demand for Anisotropic Conductive Adhesives (ACA) in LCD connections, PCBs, and bonding antenna structures further boost the demand for the market. Electric conductive are also used in the LED industry for their capacity to serve as stable electrical contacts by absorbing mismatches, which will likely boost the market's growth for the forecasted period.

Inquiry Before Buying

Electronic Adhesives Market Segment Analysis - By Resin Type

Epoxy segments held the largest share of more than 25% in the market in 2020. Epoxy is widely used in electronic applications, either in two-part or single-part heat cure products. Epoxy has good resilience against environmental and media influences, it has a dry and non-tacky surface which is perfect to be used as a protective coating and is widely used in adhesives, plastics, paints, coatings, primers and sealers, flooring, and other. Curing epoxy adhesives can take place either at room or elevated temperature or through photoinitiators and UV light. Modern photoinitiators also react to the special UV spectrum of LED light sources, so that newly developed epoxide resin adhesives can be cured with both UV and UV LED light. Some epoxies exhibit optical properties and diffraction indexes, making them useful for applications in precision optics, lens bonding, and information technology, which will further boost the market's growth.

Electronic Adhesives Market Segment Analysis - By Application

Printed Circuit Boards (PCBs) segment held the largest share of more than 35% in the market in 2020. Electronic adhesives are used as a conformal coating in PCBs. Adhesive is used in wire tracking, potting & encapsulation of components, conformal coatings of circuit boards, and bonding of surface mount components. PCBs are highly reliable, cheap, less chance of short circuit, easily repairable, and are compact in size. The growing uses of laptops, smartphones, and household appliances coupled with developing living standards further drive the growth of PCB. Whereas, the growing uses of PCB’s in automotive, industrial & power equipment, control & navigation systems, and aerospace monitoring also contribute to the market growth. According to Aerospace Industries Association (AIA) report, in 2018, aerospace and defense exports amounted to $151 billion, an increase of 5.81% from the previous year, and civil aerospace accounted for the majority of exports with $131.5 billion.

Schedule a Call

Electronic Adhesives Market Segment Analysis - By End-User Industry

Consumer Electronics segment held the largest share of more than 30% in the Electronic Adhesives Market in 2020. Rapid urbanization and increase in the development of new technology have propelled the demand for consumer electronics. As per the United Nations, 55% of the world’s population lives in urban areas, which propel the demand for consumer electronics. The growing demand for lightweight and portable equipment such as smartphones, laptops, and digital cameras are playing a significant role in boosting the demand for the market. As per a report released by Nexdigm Private Limited, a private company, the global electronics industry is expected to reach $7.3 trillion by 2025, which will significantly propel the demand for the market during the forecasted period.

Electronic Adhesives Market Segment Analysis - By Geography

Asia-Pacific held the largest share of more than 45% in the Electronic Adhesives Market in 2020. China, India, and Japan are the major contributors to the growth of Electronic Adhesives Market in APAC. The large consumer base, developing manufacturing sector, and increase in middle-class population along with smart city projects are major factors for the market growth. As per the Indian Brand Equity Foundation (IBEF) report released in 2020, electronics manufacturing in India is expected to reach $163.14 billion by 2025, and demand for electronics hardware in India is expected to reach US$ 400 billion by 2024. The shifting of production lines to the APAC region for the low cost of production and the ability to serve the local emerging market is another factor for the growth of the market in the region.

Buy Now

Electronic Adhesive Market Drivers

Growing Need for Miniaturized Electronic Products

Growing demand for low-cost, reliable, and miniaturized electronic devices from consumers propel the market's growth. The increasing demand for miniaturized products has led to the development of smaller electrical components, which occupy less area. The need for smaller and thinner consumer electronics devices is a new trend among consumers. The surface mount technology helps in using and assembling much smaller components, thus facilitating a smaller, portable, and lightweight electronic device. Pocket calculators, smartwatches & other wearable devices are some of the examples. Such miniature devices will further drive the demand for electronic devices and in return will boost the demand for the Electronic Adhesives Market as they are used in manufacturing these devices.

Introduction of 5G Network

Introduction 5G networks are planned to increase mobile broadband speeds and added capability for 4K/8K video streaming, virtual reality (VR) or augmented reality (AR), Internet of Things (IoT), and mission-critical applications. Introduction of 5G will boost the telecommunication industry, with better coverage, and internet speed, which also create a demand for Electronic Adhesives Market as they are used in manufacturing telecom devices. 5G will transmit data ten times faster than 4G and is set to take hold in 2020. This will spark a revolution in many industries such as electronic, energy, medical, automotive, defense, aerospace and others, which will boost the market's growth. 5G will impact the viewing experience for consumer, with its VR & AR which will further boost the demand for consumer electronic industry, which in return will boost the demand for electronic adhesive market.

Electronic Adhesive Market Challenges

Technological Changes & VOC Emission

The market is facing challenges due to technological changes. Shorter leads can damage temperature-delicate components in several applications and to overcome such obstacles electrical components should be assembled after soldering. However, this hampers productivity due to higher costs of production and time consumed in the manufacturing process. Growing concern over the emission of volatile organic compounds (VOCs) is expected to hamper the market growth over the coming years. During the manufacturing of electronics adhesives, VOC is discharged that may pose health and environmental concerns. VOCs are the major contributors to smog and ozone formation at low atmospheric levels.

Emergence of COVID 19

The COVID-19 pandemic continues to unfold everyday with severe impact on people, communities, and businesses. And the Electronic Adhesives Market was no exceptional, as the global production facilities of the electronics, parts have been reduced due to the logistics slowdown and unavailability of the workers. Furthermore, various e-commerce sites had discontinued the delivery of non-essential items which included electronics devices, which affected the electronic industry.

Electronic Adhesive Market Landscape

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the Electronic Adhesives Market. In 2020, the market of electronic adhesives has been consolidated by the top 10 players accounting for xx% of the share. Major players in the Electronic Adhesives Market are BASF SE, Panacol-Elosol GmbH, 3M Co., H.B. Fuller Co., Henkel AG & Co. KGaA, Hitachi, Ltd., Mitsui & Co., Ltd., Bostik, Inc., Chemence Inc., tesa SE, Parker Hannifin Corp., Meridian Adhesives Group, among others.

Acquisitions/Technology Launches

In November 2019, Bostik, Inc., announced it has launched a new range of innovative engineering adhesives Born2Bond™, for bonding applications in automotive, electronics, luxury packaging, and medical devices. With this new launch Bostik will not only expand its product portfolio but also expand it offering to various industries, which will further drive the market's growth.

In September 2020, Meridian Adhesives Group, a leading manufacturer of high-value adhesives technologies has announced that the “Company” would be serving the Electric Vehicles Market and provide its adhesive solution, with this announcement Meridian Adhesives would expand its product offering in automobile industry, which will further derive the market's growth.

Key Market Players:

The Top 5 companies in Electronic Adhesives Market are:

Panacol-Elosol GmbH

3M

H.B. Fuller Company

Henkel AG & Co.KGaA

Parker Hannifin Corp.

#Electronic Adhesives Market Size#Electronic Adhesives Market Trends#Electronic Adhesives Market Growth#Electronic Adhesives Market Forecast#Electronic Adhesives Market Revenue#Electronic Adhesives Market Vendors#Electronic Adhesives Market Share#Electronic Adhesives Market

0 notes

Text

Rise of Adhesives And Sealants Industry: An Overview

Adhesives and sealants are widely used in construction, automotive, packaging and other industries. They play an important role in joining different materials and surfaces together and also be used for sealing and filling gaps.

Types of Adhesives

There are various types of adhesives used for different applications:

- Pressure-sensitive adhesives: These adhesives are applied with finger pressure and cure with pressure forming a bond. Common examples include adhesive tapes and stickers.

- Reactive adhesives: They harden by a chemical reaction such as polymerization. Epoxies, urethanes and acrylics are examples of reactive adhesives.

- Thermosetting adhesives: On application of heat and pressure, these adhesives undergo polymerization forming cross-linked bonds resulting in a permanent bond. Common thermosetting adhesives include phenol-formaldehyde and melamine-formaldehyde.

- Thermoplastic adhesives: Unlike thermosets, these adhesives soften on application of heat and forms bond on cooling. Examples are polyamide, polyester and polyolefin hot melts.

- Anaerobic adhesives: Also known as locking adhesives, they cure and bond in the absence of air when confined in an airtight gap. They are used for threadlocking and retaining fasteners.

Uses of Different Types of Adhesives

Understanding the uses of different types of Adhesives And Sealants is important for their appropriate selection:

- Pressure-sensitive adhesives are used for mounting posters, stickers, medical tapes. They offer instant bonding without need of heat or pressure.

- Reactive adhesives like epoxies offer high strength bonds and are used for structural gluing of metals, composites, ceramics. Urethanes are used in automotive and footwear industries.

- Thermosetting adhesives are preferred for applications requiring high heat resistance like aircraft components. Phenolic resins bond wood, paper, plastics, and textiles.

- Thermoplastic adhesives allow repositioning during assembly and are suitable for wood working, packaging, footwear. Hot melts bond plastics, textiles and rubber quickly.

- Anaerobic adhesives provide protection from shock and vibration in assembled parts like threaded fasteners.

Selection of Sealants

Sealants are used to prevent leakage, dampness and passage of air, gases or noise through gaps and joints. Their selection depends on the following factors:

- Movement accommodation: Dynamic sealants allow for expansion/contraction during temperature fluctuations. Static sealants are used where movement is negligible.

- Substrate material: Silicones, polyurethanes, polysulfides are suitable for different materials like metal, glass, wood, plastic, ceramic etc.

- Weather resistance: Weatherproof sealants withstand UV radiation, rain, temperature extremes without degrading.

- Adhesion: Proper surface preparation and primer improves adhesion of sealants to different substrates.

- Aesthetics: Color matched sealants provide pleasing appearance and are used externally. Clear sealants maintain transparency.

- Chemical resistance: Acid/alkali resistant sealants protect against various corrosive chemicals.

- Hardness: Flexible soft sealants accommodate movements better than rigid hard sealants.

Applications of Adhesives and Sealants

Some major applications of adhesives and sealants:

Packaging industry: Case sealing, carton closing, case banding, pouch sealing uses hot melts andPressure sensitive adhesives. Self-adhesive labels apply reactive adhesives.

Construction: Floor, wall and ceiling tiles;glazing; waterproofing uses polysulfide,polyurethane and epoxy sealants.PU adhesives bond wood,composite etc.

Automotive: Reactive hot melts and PUR adhesives bond exterior body panels. Epoxy and silicones seal engine,transmission components.

Electronics: Surface mount devices,screen protectors use acrylic adhesives.Potting compounds seal electronic circuits.

Furniture:Woodworking uses PVA(polyvinyl acetate)andpolyurethane adhesives.Edge-bandingthermoplastic adhesives.

Bookbinding,footwear,apparel use rubber and hot melt adhesives. Thread lockers secure fasteners with anaerobic adhesives.

Advantages of Using Adhesives and Sealants

- Join materials of unequal thickness - In woodworking and furniture industries pieces can be of uneven thickness.

- Join dissimilar materials - Metals, plastics, ceramics can be bonded using structural adhesives providing design flexibility.

- Improved load distribution and stress dissipation over joints.

- Corrosion resistance over mechanical fasteners such as rivets and bolts prone to corrosion.

- Provides protective barrier against moisture, air, chemicals. Prevents leakage and infiltration.

- Aesthetic seamless joints that do not interfere with fluid/air flow.

- Reduces part counts and provides design simplification compared to multiple component mechanical joints.

Adhesives and sealants provide durable, reliable and cost-effective solutions across different industries for joining and sealing applications. Their judicious selection based on end use ensures optimal performance. Continuous research led to development of newer variants suitable for specialized needs.

Get more insights on Adhesives And Sealants

About Author:

Priya Pandey is a dynamic and passionate editor with over three years of expertise in content editing and proofreading. Holding a bachelor's degree in biotechnology, Priya has a knack for making the content engaging. Her diverse portfolio includes editing documents across different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. Priya's meticulous attention to detail and commitment to excellence make her an invaluable asset in the world of content creation and refinement.

(LinkedIn- https://www.linkedin.com/in/priya-pandey-8417a8173/)

#Adhesives#Sealants#BondingSolutions#IndustrialAdhesives#ConstructionSealants#EpoxyAdhesives#SiliconeSealants#StructuralBonding#AutomotiveAdhesives

0 notes

Text

"Diving Deep into the Specialty Polymers Market: Trends, Innovations, and Strategic Insights

Specialty Polymers: Harnessing the Power of Specialty Macromolecules for Next-Generation Technologies Specialty Polymers Overview

Specialty macromolecules, also known as engineering macromolecules, are a class of macromolecules that are specially engineered to have targeted physical and chemical properties that make them suitable for advanced applications. Though they only represent a small fraction of the total macromolecules market, specialty macromolecules command a significant revenue share due to their higher value and more niche end uses. Types of Specialty Macromolecules

There are several main types of specialty macromolecules classified based on their monomer makeup and resultant properties. Some of the major types include: Polyamides (Nylons)

Polyamides, best known by the brand name Nylon, are a class of thermoplastic macromolecules containing amide linkages along their polymer chains. They are known for their high strength, toughness, and relative durability compared to other plastics. Engineering polyamides such as Nylon 46 and Nylon 610 can withstand higher temperatures than commodity nylons. Fluoromacromolecules

Fluoromacromolecules contain strong carbon-fluorine covalent bonds which give them unique oil, chemical, heat and weather resistance properties. Popular fluoromacromolecules include polytetrafluoroethylene (PTFE or Teflon), fluorinated ethylene propylene (FEP), and polyvinylidene fluoride (PVDF). They are used in applications requiring non-stick, low friction surfaces. Polyesters

Engineering polyesters such as liquid crystal macromolecules (LCP), polybutylene terephthalate (PBT), and polyethyleneterephthalate (PET) can be formulated with enhanced heat resistance, strength and rigidity over traditional polyesters. They are employed in automotive, electrical/electronic and consumer goods. Liquid Silicone Rubbers

Liquid silicone rubbers (LSRs) are two-part addition-cure silicone elastomers that vulcanize at room temperature. Their biocompatibility, stability and flexibility make them well-suited for medical, food and microfluidic device applications. Low compression set LSRs retain shape over time. Polyketones

Polyketones are a family of thermoplastics with high strength, heat resistance and chemical resistance derived from their ketone groups in the polymer backbone. They include comacromolecules like polyetheretherketone (PEEK) used in demanding mechanical and electrical end uses. Markets and Applications

Specialty macromolecules are developing across diverse markets driven by the need for advanced material performance. Some of the major application areas include: Automotive

In automotive, specialty macromolecules enable lightweighting through replacement of traditional metals. Nylons, PBT, polycarbonate and liquid silicone aid composites in vehicles. Use in engine components require heat resistance of PEEK and liquid crystal macromolecules. Electronics

Electronics rely on specialty macromolecules for miniaturization and reliability. PTFE, FEP, PET and PVDF bring dielectric, insulating properties. PBT molding aids housings. Semiconductor uses benefit from high heat resistance of PEKK and LCP. Medical

Biocompatible and non-leaching properties of silicones, nylons and PEEK suits medical industry. Implants, catheters, sensors and drug delivery use these. PEKK aids orthopedic devices. Silicones serve prosthetics, wound care and contact lenses. Infrastructure

Resistance to chemical, heat and environmental stress qualifies many macromolecules for infrastructure. PVDF and silicones protect coatings and paints. Dams, tunnels utilize durability of PTFE and polyketones lining. Other Developments

New technologies foster demand for high performance plastics. Renewable energy harvest requires specialty macromolecules in wind turbines, solar cells. Aerospace gravitates toward sturdy yet lightweight materials like PEKK, PEEK. Microfabrication leverages specialty silicones and fluoromacromolecules. As applications diversify, advanced macromolecules enable novel solutions. Future Prospects

The specialty macromolecules market is forecast to sustain strong growth over the medium term supported by their rising penetration across major end-use industries. Polyketones, liquid silicone rubbers and high-temperature polyamides will be key winning product types. The Asia Pacific region is expected to lead future demand growth driven by its large manufacturing industries. Robust R&D focus on bio-based and high-tech specialty macromolecules will further fuel new product innovations and market opportunities going forward.

In Summary, specialty polymers represent a fascinating realm of materials science, offering tailored properties and applications beyond traditional macromolecules. These advanced materials are engineered to meet specific performance requirements, such as enhanced durability, conductivity, or biocompatibility. From aerospace components to medical devices, specialty macromolecules play a crucial role in a wide range of industries, driving innovation and pushing the boundaries of what's possible.

0 notes

Text

Anti-Static Fibers Market Trends, Share, News and Forecast by 2024-2032

The Reports and Insights, a leading market research company, has recently releases report titled “Anti-Static Fibers Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032.” The study provides a detailed analysis of the industry, including the global Anti-Static Fibers Market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Anti-Static Fibers Market?

The global anti-static fibers market size reached US$ 0.71 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 1.25 billion in 2032, exhibiting a growth rate (CAGR) of 6.5% during 2024-2032.

What are Anti-Static Fibers?

Anti-static fibers are crafted to mitigate the buildup of static electricity. They find application in textiles and other fields where static electricity can cause problems, such as harming electronic devices or creating discomfort for people. These fibers function by conducting static electricity away from the surface they are applied to, thereby preventing the accumulation of electric charge. They are frequently mixed with other materials to imbue the final product with anti-static characteristics.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/2033

What are the growth prospects and trends in the Anti-Static Fibers industry?

The anti-static fibers market growth is driven by various factors. The market for Anti-Static Fibers is growing due to rising demand across industries like textiles, automotive, and electronics, where static electricity poses risks of damage or safety concerns. These fibers are critical in producing items such as clothing, upholstery, and industrial parts to minimize static buildup. Technological progress is also contributing to market expansion, leading to the creation of more efficient anti-static fibers. Moreover, increasing awareness about electrostatic discharge (ESD) and its effects on sensitive electronic equipment is driving the use of anti-static fibers in diverse applications. Hence, all these factors contribute to anti-static fibers market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Product Type:

Carbon-Based Anti-static Fibers

Metallic Anti-static Fibers

Synthetic Blends with Conductive Additives

By Material:

Polyamide (Nylon)

Polyester

Polypropylene

Others (Including Acrylic, Cotton, etc.)

By End-Use Industry:

Electronics

Textiles

Automotive

Industrial Manufacturing

Aerospace and Defense

By Application:

Static Protection Clothing

Packaging Materials

Conveyor Belts

Carpets and Flooring

Others (Including Wrist Straps, Gloves, etc.)

By Distribution Channel:

Direct Sales

Distributors

E-commerce

Segmentation By Region:

North America:

United States

Canada

Europe:

Germany

The U.K.

France

Spain

Italy

Russia

Poland

BENELUX

NORDIC

Rest of Europe

Asia Pacific:

China

Japan

India

South Korea

ASEAN

Australia New Zealand

Rest of Asia Pacific

Latin America:

Brazil

Mexico

Argentina

Middle East Africa:

Saudi Arabia

South Africa

United Arab Emirates

Israel

Who are the key players operating in the industry?

The report covers the major market players including:

DuPont

Toray Industries

Toyobo Co., Ltd.

Formosa Plastics Corporation

Mitsubishi Chemical Corporation

Hyosung Corporation

Kolon Industries, Inc.

Teijin Limited

Far Eastern New Century Corporation

RadiciGroup

Yantai Tayho Advanced Materials Co., Ltd.

Suzhou Kingsway High-Tech Fiber Technologies Co., Ltd.

Trevira GmbH

Ensinger Group

Jinan Shengquan Group Share Holding Co., Ltd.

View Full Report: https://www.reportsandinsights.com/report/Anti-Static Fibers-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd. 1820 Avenue M, Brooklyn, NY, 11230, United States Contact No: +1-(347)-748-1518 Email: [email protected] Website: https://www.reportsandinsights.com/ Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/ Follow us on twitter: https://twitter.com/ReportsandInsi1

0 notes

Text

Issues to Note When Applying Epoxy Resin Potting Compound

The potting compound industry has become an important area of epoxy resin application. With the accelerated development of the electronics and electrical industries, it will become an important growth point for epoxy resin. However, there are still some problems in the application of epoxy resin as potting materials. Epoxy resin potting materials are mainly used to cast and encapsulate electronic and electrical devices to achieve the performance requirements of insulation, voltage resistance, protection and sealing. Experts say that the current problems during use are mainly to understand and solve the problems of defoaming of cured materials, selection of curing agents, and filling and use.

Potting is to mechanically or manually pour a liquid compound into a device equipped with electronic components and circuits, and solidify it under normal temperature or heating conditions to become a thermosetting polymer insulation material with excellent performance. Epoxy resin potting compound is one of the common potting materials.

Epoxy resin is the main component of epoxy resin potting glue. It is generally composed of bisphenol A epoxy resin, curing agent (amine or acid anhydride), reinforcing additives and fillers.

The main advantages of epoxy resin potting glue are low viscosity and strong impregnation, which can fill components and lines. It has good performance and long application period, and is suitable for large-volume automatic production line operations. During the potting and curing process, the filler and other powder components settle little and do not stratify. The curing exothermic peak is low and the curing shrinkage is small; the potting material has properties such as flame retardancy, weather resistance, and thermal conductivity. It has good adhesion to a variety of materials and has low water absorption.

Regarding the problem of defoaming of cured materials: Since the potting material has a certain viscosity, the viscosity gradually increases during the curing and heating process. The bubbles generated by stirring during the production of the potting material burst at the same time as the temperature rises. But there is always a certain amount of foam that will not break, so defoamer and foam suppressor need to be added. The selection of this material is very important, and the amount added is also very important. If it is less, it will not meet the foam breaking requirements, and if it is too much, oil splashes and white spots will occur on the surface of the cured product. At present, some silicone oil-based defoaming agents are mainly used. The disadvantage of this type of defoaming agent is that it is easy to produce oil splashes on the surface of the cured product, that is, there are irregular oily substances on the surface, causing unsightly appearance. This is mainly caused by poor control of the amount of addition. The most important thing is the selection and addition amount of defoaming agent, as well as the addition process.

The choice of curing agent is very important: curing agents are generally divided into medium, low and high temperatures. Different curing agents are used depending on the purpose of epoxy resin potting. Generally, amines, modified amines, polyamides, etc. are used for medium and low temperatures, and acid anhydrides, etc. are used for high temperatures. Different curing agents have different properties and are suitable for different occasions, but the proportion of each curing agent used in the epoxy resin potting system is different. The proportion of pure epoxy in the epoxy potting compound can be calculated first, and then calculated based on the proportion of epoxy resin curing agent. At the same time, the difference between actual and theoretical values needs to be taken into account. The curing temperature can be tested according to the data provided by the curing agent manufacturer, and the usage amount of the entire cured product and the heat of reaction should also be taken into consideration, so as to obtain the optimal curing temperature in the unit mass curing system.

The use of fillers cannot be ignored: some fillers need to be added to the epoxy resin curing system to increase the physical strength of the cured material. The selection of fillers mainly depends on the performance requirements of the cured product. Commonly used fillers include aluminum hydroxide, wollastonite, silica powder, talc powder, quartz sand, etc. Some of the fillers not only play a filling role, but also play other roles, such as flame retardant, preventing sedimentation, etc. The most common problem during the use of fillers is filler settlement, because most fillers are inorganic and difficult to combine well with organic systems. Especially if the product is left for too long, it is more likely to cause the filler in the product to settle. Therefore, the generally used fillers have been organically treated to organicize the surface of the filler, so that it can achieve a good combination with organic materials.

How to use potting glue

After curing, potting glue can improve the integrity of electronic components and make them more like a whole. Effectively resist external shocks and vibrations, relieve all external forces, and play a protective role. Essentially, potting glue is still a glue and is highly viscous. From the perspective of operation methods, there are single-component and two-component ones.

The usage of one-component potting glue is as follows:

Before use, small-scale experiments should be carried out. See if you can exert good adhesion and do a good adhesion test.

Before gluing, be sure to clean the bonding base surface. Cleaning away the dirt will help improve adhesion.

When using a machine for pouring, if you need to stop dispensing midway, you need to prevent the entry of water vapor. Keep water vapor out to avoid affecting the curing speed of the adhesive.

During the curing process, the speed is closely related to the ambient temperature. If you want to speed up the curing speed, you can increase the temperature and humidity appropriately.

Two-component potting AB glue usage instructions:

The products to be potted with electronic potting AB glue need to be kept dry and clean.

Electronic potting AB glue is measured according to the proportion, and the weighing is accurate. Please remember that the proportion is a weight ratio, not a volume ratio. After mixing A and B agents, they need to be fully stirred to avoid incomplete curing.

After the AB glue is evenly stirred, please fill it in time and try to use up the mixed glue within the available time.

After the electronic potting glue is poured, the glue will gradually penetrate into the gaps of the product. Please perform a second filling if necessary.

During the curing process of electronic potting glue, please keep the environment clean to prevent impurities or dust from falling into the uncured glue surface.

After the electronic potting glue potting operation is completed, the unused glue should be tightened immediately and sealed for storage. When using it again, if there is a little crust on the seal, just remove it without affecting normal use.

Potting glue has excellent elasticity and toughness. It is not only important in the electronics industry, but also widely used in new energy, military industry, medical, aviation, shipbuilding, automobiles, high-speed rail and other fields.

More information or free samples or price quotations, please contact us via email: [email protected] , or voice to us at: +86-28-8411-1861.

#epoxy resin#epoxy resin manufacturer#bisphenol a type epoxy resin#epoxy resin supplier#epoxy adhesive#potting compound#potting material#epoxy coating#epoxy potting

1 note

·

View note

Text

0 notes

Text

Global Specialty Polymers Market Is Estimated To Witness High Growth Owing To Growing Demand for Lightweight Materials and Increasing Focus on R&D and Innovation.

The global Specialty Polymers Market is estimated to be valued at USD 78 Bn in 2022 and is expected to exhibit a CAGR of 6.8% over the forecast period 2023-2032, as highlighted in a new report published by Coherent Market Insights. A) Market Overview: Specialty polymers are high-performance materials that possess unique properties and characteristics, making them suitable for various applications across industries such as automotive, electronics, healthcare, and packaging. These polymers are designed to meet specific performance requirements, such as heat resistance, chemical resistance, durability, and flexibility. Some of the commonly used specialty polymers include polyesters, polyamides, polyurethanes, and fluoropolymers. The demand for specialty polymers has been increasing due to the growing need for lightweight materials in industries such as automotive and aerospace, as well as the increasing focus on research and development (R&D) and innovation in the polymer industry. B) Market Dynamics: 1. Growing Demand for Lightweight Materials: The demand for lightweight materials is on the rise across various industries due to the need for fuel efficiency, reduced emissions, and improved performance. Specialty polymers offer excellent strength-to-weight ratios, making them ideal for replacing traditional materials such as metals in applications such as automotive parts, aircraft components, and electronic devices. For instance, specialty polymers such as polyamides are increasingly being used in the automotive industry to replace metal parts, leading to weight reduction and improved fuel efficiency. 2. Increasing Focus on R&D and Innovation: The specialty polymers market is highly competitive, and companies are constantly investing in research and development activities to develop new and innovative products. Manufacturers are focusing on enhancing the properties and performance of specialty polymers to meet the evolving needs of end-use industries. For example, companies are developing specialty polymers with improved heat resistance, chemical resistance, and flexibility to meet the requirements of applications in the electrical and electronics industry. C) Segment Analysis: The global Specialty Polymers Market can be segmented based on product type, application, and region. Based on product type, the market can be classified into polyesters, polyamides, polyurethanes, fluoropolymers, and others. Polyamides are expected to dominate the market due to their wide range of applications in industries such as automotive, electrical and electronics, and consumer goods. These polymers offer excellent properties such as high strength, low friction, and chemical resistance, making them suitable for various applications. D) PEST Analysis: - Political: The political stability in major economies ensures a favorable business environment for companies operating in the specialty polymers market. - Economic: The growing industrialization and urbanization, especially in emerging economies, are driving the demand for specialty polymers. - Social: The increasing awareness about the importance of sustainability and environmental protection is encouraging the adoption of eco-friendly specialty polymers. - Technological: Advances in polymer science and technology are enabling the development of specialty polymers with enhanced properties and performance. E) Key Takeaways: 1. The global specialty polymers market is expected to witness high growth, exhibiting a CAGR of 6.8% over the forecast period, due to increasing demand for lightweight materials and the focus on R&D and innovation.

0 notes

Link

0 notes

Text

Plastic Resin Market: Key Trends and Innovations Driving Industry Growth

The global plastic resin market size is expected to reach USD 1.07 trillion by 2030, according to a new report by Grand View Research, Inc. It is projected to expand at a 4.5% CAGR over the forecast period. The increasing consumption of plastic resins in construction, automotive, electrical, and electronics applications is boosting the market growth. Government intervention to reduce overall vehicle weight to improve fuel efficiency and reduce carbon emissions has prompted automakers to use resins to replace steel and aluminum in automotive components.

Favorable federal regulations on CO2 emissions set by agencies such as the National Highway Traffic Safety Administration and the Environmental Protection Agency (EPA), as well as EU initiatives to develop plastics applications for light-weight and fuel-efficient cars, are expected to fuel global growth and promote the market. However, the ongoing health crisis and the lockdown imposed by various governments to contain the spread of the coronavirus pandemic have led to a decline in the consumption of plastic resins. It is expected to further negatively impact the market growth in the years to come.

Strict restrictions governing the recyclability and deterioration of traditional building materials like metal and wood are likely to boost the demand for textiles in pipes, windows, cables, storage tanks, and other uses. Plastics are long-lasting and energy-efficient, as well as cost-effective and safe, which encourages their usage in construction. The global market is segmented into crystalline resin, non-crystalline resin, engineering plastics, and super engineering plastics by type. The crystalline resin was the largest segment, accounting for 61.9% of global sales in 2021. The crystalline resin segment mainly includes epoxy, polyethylene, and polypropylene resins.

Gather more insights about the market drivers, restrains and growth of the Plastic Resin Market

Plastic Resin Market Report Highlights

• Crystalline resins (epoxy, polyethylene, and propylene) segment accounted for a prominent share in the market by the end of 2023 and is further expected to witness maximum growth over the forecast period

• As of 2023, China accounted for the maximum revenue share in the market, with 40.24%. Rising consumer disposable income in the country and ascending demand for luxury cars are expected to have a positive impact on the automotive industry

• The advent of bio-based plastic resins has played a prominent role in food and beverage, and pharmaceutical applications. Polymers such as PET and PC are increasingly utilized in the beverages packaging and consumer goods sector

Plastic Resin Market Segmentation

Grand View Research has segmented the global plastic resin market report based on product, application, and region:

Plastic Resin Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

• Crystalline Resin

o Epoxy

o Polyethylene

o Polypropylene

• Non-crystalline Resin

o Polyvinyl Chloride (PVC)

o Polystyrene (PS)

o Acrylonitrile Butadiene Styrene (ABS)

o Polymethyl Methacrylate (PMMA)

• Engineering Plastic

o Nylon

o Polybutylene Terephthalate (PBT)

o Polycarbonate (PC)

o Polyamide

• Super Engineering Plastic

o Polyphenylene Sulfide (PPS)

o Polyether Ether Ketone (PEEK)

o Liquid Crystal Polymer (LCP)

Plastic Resin Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

• Packaging

o Food

o Beverage

o Medical

o Retail

o Others

• Automotive

• Construction

• Electrical & Electronics

o OA Equipment & Home Appliances

o Electronic Materials

o Others

• Logistics

• Consumer Goods

• Textiles & Clothing

o Clothing

o Industrial use

o Others

• Furniture & Bedding

• Agriculture

• Medical Devices

• Others

Plastic Resin Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o U.K.

o France

o Italy

o Poland

o Spain

• China

• Asia

o India

o Japan

o Thailand

o Malaysia

o Indonesia

o Vietnam

o Singapore

o Philippines

• Pacific

• Central & South America (MEA)

o Brazil

o Argentina

• Middle East and Africa (MEA)

o Saudi Arabia

o UAE

o Oman

Order a free sample PDF of the Plastic Resin Market Intelligence Study, published by Grand View Research.

#Plastic Resin Market#Plastic Resin Market Size#Plastic Resin Market Share#Plastic Resin Market Analysis#Plastic Resin Market Growth

0 notes

Text

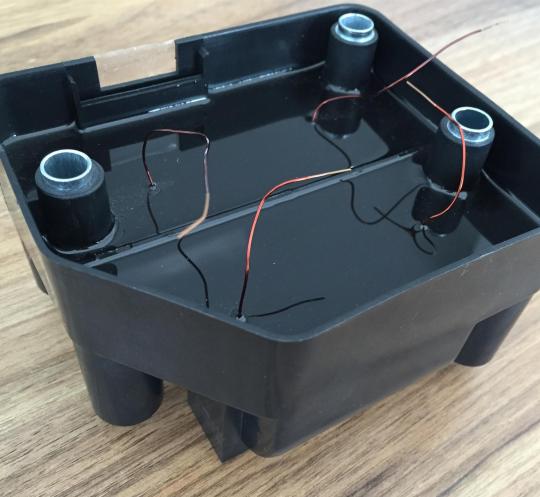

Polyamide in Electronic Protection Device Market Size Estimated to Reach $613.2 Million by 2026

Polyamide in Electronic Protection Device Market size is expected to be valued at $613.2 million by the end of the year 2026 and the market is set to grow at a CAGR of 4.5% during the forecast period from 2021-2026. The increase in use of Polyphthalamide (PPA) in various key industries such as electronics & electrical, automobile, and others expanded due to its superior properties like high temperature polyamide, good resistance to heat, and provides a better mechanical structure and this is driving the market growth. Furthermore, the increase in demand for thermosetting polymer that is used for insulation purposes in electronic gadgets and devices is also fuelling the growth of polyamide in electronic protection device industry.

COVID-19 impact

The Covid-19 pandemic has led to the slowdown of polyamide in electronic protection device market in terms of production, supply chain management, and inventory clearance. This has affected the polyamide in electronic protection device market top 10 companies in many aspects like unavailability of raw materials, volatile prices, and slowdown in the growth of the company which has eventually led to the companies incurring huge losses. The marketing and distribution channels were also hugely affected due to the limitations of the lockdown and economic shutdown. This lead to overstocking of their inventories eventually leading the companies to incur huge losses.

Polyamide in Electronic Protection Device Market Segment Analysis - By Product Type

PA 6 segment held the largest share of more than 30% in the polyamide in electronic protection device market in the year 2020. PA 6 polyamide is generally used in applications where toughness, lubricity and wear & tear are required, such as gear wheels, rollers, bearings, power tool housings, electrical connectors, coil formers etc. It has excellent heat aging resistance and chemical resistance properties. PA 6 polyamide is also has an excellent surface appearance, especially in filled and reinforced versions, compared to other versions of polyamide, making it a preferred type of polyamide as compared to the other polyamides.PA 6 can withstand temperature up to 310 degree Celsius.

Request for Sample Report @ https://www.industryarc.com/pdfdownload.php?id=503418

Report Price: $4500 (Single User License)

Polyamide in Electronic Protection Device Market Segment Analysis - By Type

Glass Fiber segment held the largest share of more than 30% in the polyamide in electronic protection device market in the year 2020. Glass content makes the product more rigid and flexible giving more stiffness and strength, even after absorbing humidity. The dimensional stability is also better compared to other types of material. It is used in many electrical parts like switches, sockets, plugs, and antenna-mounting devices. It has a specific resistance greater than steel and thus is used to make high-performance. The main feature of glass fiber is that it comes in varying sizes and can be easily combined with many synthetic resins. According to the European Glass Fibre Producers Association, the global glass fibre market reached revenue of US $ 40 billion in the year 2020. Thus, the growth in the glass fiber market, will also drive the growth of this this market.

Polyamide in Electronic Protection Device Market Segment Analysis - By Application

Miniature Circuit Breaker (MCB) held the largest share of more than 25% in the polyamide in electronic protection device market in the year 2020. Miniature Circuit Breaker (MCB) is being used extensively in the present days due to the easiness in handling the equipment and safety from electric shock in using the Miniature Circuit Breaker (MCB). Handing a Miniature Circuit Breaker (MCB) is electrically safer than a fuse, since it is properly insulated and coated. Miniature Circuit Breaker (MCB) automatically switches off electrical circuit during any abnormal condition or any overload. Miniature Circuit Breaker (MCB) is used in generators or invertors.

Polyamide in Electronic Protection Device Market Segment Analysis - By Geography

Asia-Pacific region held the largest share of more than 40% in the polyamide in electronic protection device market in the year 2020. The highest demand from the Asia-Pacific region is due to the availability of cheap raw materials such as nylons, aramids, sodium polyaspartate, and wool. The presence of emerging countries like India, China and South Korea also drive the market growth in APAC region. Furthermore, the growing demand for environment friendly vehicles, developing aviation sector, and growing investment in the infrastructure sector across the region also propels the market growth.

Polyamide In Electronic Protection Device Market Drivers

Surging Demand from electrical and electronics industry

The increase in adoption of polyamide in electronic protection devices owing to various reasons such as cost-effectiveness and environmental friendliness of polyamide is driving polyamide in electronic protection device market. This is one of the main reasons why other thermoset materials such as acrylates, phenolic, epoxies and cyanate esters are being replaced by polyamide in the electronics protection device industry. The raw material used in producing polyamide like caprolactam is cheaper than the other thermoset materials. This is hugely driving polyamide in electronic protection device market. Whereas, the growth in the electronics and IT industrties is also contributing to the market growth. For instance, according to the JAPAN ELECTRONICS AND INFORMATION TECHNOLOGY INDUSTRIES ASSOCIATION (JEITA) report 2020, the total global production by the electronics and IT industries is expected to increase by a mere 2% year on year in 2020 to reach $2,972.7 billion.

Technological advancements in electronic protection devices