#prepration

Explore tagged Tumblr posts

Text

#seaplane#plane#prepration#vijayawada#Srisailam#poonamighat#CM#chiefministerofandhrapradesh#cmchandrababu#CMChandrababuNaidu#NaraChandrababuNaidu#government#dehavilland#aircraft#AndhraPradesh

0 notes

Text

What Details Are Included On Corporate Tax Returns?

Corporate tax returns provide a comprehensive financial snapshot of a corporation's operations and obligations for a specific fiscal year. These returns ensure compliance with tax laws and determine the amount of taxes owed or the refund due. Here's a breakdown of the key details typically included in corporate tax returns:

1. Basic Corporate Information

Business Name and Address: The legal name of the corporation and its principal business address.

Employer Identification Number (EIN): A unique identifier assigned by the IRS for tax purposes.

Incorporation Details: The date of incorporation and the state in which the corporation is incorporated.

2. Income Information

Gross Revenue: Total income earned from business operations, including sales of goods and services, interest income, and any other sources of revenue.

Cost of Goods Sold (COGS): Direct costs associated with producing goods or services sold by the corporation. This includes raw materials, labor, and manufacturing expenses.

Net Income: The amount of income remaining after subtracting COGS and other business expenses from gross revenue. It is a key indicator of the corporation’s profitability.

3. Deductions

Operating Expenses: Regular expenses incurred in the day-to-day operations of the business, such as rent, utilities, salaries, and office supplies.

Depreciation: The allocation of the cost of tangible assets over their useful life. Depreciation reduces taxable income and reflects the wear and tear on assets like machinery, vehicles, and buildings.

Interest Expenses: Interest paid on business loans or credit lines used to finance operations or expansion.

Charitable Contributions: Donations made to qualified charitable organizations, which can be deducted subject to certain limits.

Employee Benefits: Costs related to employee benefits, including health insurance, retirement contributions, and other fringe benefits.

4. Tax Credits

Investment Credits: Credits related to investments in certain assets, such as renewable energy equipment or other qualified assets.

Research and Development (R&D) Credits: Credits for expenses related to research and development activities aimed at innovation and improvement of products or processes.

Other Tax Credits: Various credits that may apply based on the corporation's activities, location, or specific tax laws.

5. Tax Liability

Taxable Income: The amount of income subject to tax after adjustments, deductions, and credits. This is the basis for calculating the corporation’s tax liability.

Tax Rate: The applicable corporate tax rate or rates, which may vary based on the income level and jurisdiction.

Total Tax Due: The total amount of taxes owed, calculated based on the taxable income and applicable tax rates.

6. Payments and Refunds

Estimated Tax Payments: Any quarterly estimated tax payments made throughout the year, which are applied against the total tax liability.

Tax Refund: If the corporation has overpaid its taxes, the amount of refund due or the balance carried forward to the next tax year.

7. Schedule of Additional Information

Schedule of Assets and Liabilities: Details of the corporation’s assets and liabilities, including current and long-term assets, debts, and equity.

Schedule of Shareholders: Information on shareholders, including the number of shares held and any transactions affecting share ownership.

Schedule of Related Party Transactions: Disclosure of transactions with related parties, such as affiliates or family members, which may require special reporting or compliance.

8. Notes and Disclosures

Accounting Method: The method of accounting used by the corporation (e.g., cash basis or accrual basis), which affects how income and expenses are recognized.

Contingent Liabilities: Any potential liabilities that may impact the corporation’s financial position, such as pending lawsuits or regulatory issues.

Significant Accounting Policies: Description of the accounting policies and principles used to prepare the financial statements and tax return.

Conclusion

Corporate tax returns are comprehensive documents that provide an in-depth look at a corporation’s financial status and tax obligations. They include essential details such as income, deductions, credits, and tax liabilities, along with supporting schedules and disclosures. Accurate and thorough reporting on these returns is crucial for compliance with tax laws. Experts offering corporate tax preparation in Fort Worth TX play a key role in ensuring that these returns are completed correctly and efficiently, helping corporations navigate complex tax requirements and optimize their financial outcomes.

0 notes

Text

JEE व NEET की तैयारी के लिये शिक्षा मंत्रालय द्वारा ‘SATHEE’ पोर्टल लांच

JEE की तैयारी के लिये 45 दिन का क्रेश कोर्स भी न्यूजवेव @नईदिल्ली केंद्रीय शिक्षा मंत्रालय के उच्च शिक्षा विभाग ने जेईई एवं नीट जैसी प्रवेश परीक्षाओं की प्रभावी तैयारी करने के लिये आईआईटी कानपुर के सहयोग से ‘साथी’ पोर्टल का शुभारंभ किया है। 12 दिसंबर, 2023 तक देश के 60,000 से अधिक छात्र ‘साथी (SATHEE)’ प्लेटफॉर्म पर पंजीकृत हो चुके हैं। लोकसभा में शिक्षा राज्य मंत्री डॉ. सुभाष सरकार ने एक प्रश्न के जवाब में यह जानकारी दी।

साथी पोर्टल के माध्यम से देशभर के विद्यार्थी इंजीनियरिंग, मेडिकल प्रवेश परीक्षाओं के साथ राज्य स्तरीय इंजीनियरिंग और अन्य प्रतिस्पर्धी परीक्षाओं की प्रभावी तैयारी कर सकते हैं। इस पोर्टल में प्रवेश परीक्षा के लिए सेल्फ असेसमेंट, टेस्ट और सहायता जैसी सभी सुविधायें निशुल्क उपलब्ध होंगी। केंद्रीय शि��्षा मंत्रालय ने सभी राज्यो व केंद्र शासित प्रदेशों को इस निशुल्क सुविधा की जानकारी शिक्षकों एवं विद्यार्थियों को देने के लिए लिखा है। इस पोर्टल का उपयोग प्रतियोगी परीक्षाओं की तैयारी और ज्ञान वृद्धि के लिए किया जा सकता है। जेईई के लिये 45 दिन का फ्री क्रेश कोर्स करें

शिक्षा राज्य मंत्री ने कहा कि जेईई और अन्य इंजीनियरिंग परीक्षाओं की तैयारी करने वाले छात्रों के लिए, 21 नवंबर 2023 को आईआईटी टॉपर्स, शिक्षाविदों और विषय विशेषज्ञों द्वारा क्यूरेट किया गया जेईई का 45 दिनों का क्रैश कोर्स (Crash Course) भी शुरू किया गया है। यह क्रैश कोर्स अंग्रेजी समेत 5 भाषाओं में उपलब्ध है। अखिल भारतीय तकनीकी शिक्षा परिषद (AICTE) ने आर्टिफिशियल इंटेलीजेंस (AI) पर आधारित अनुवाद उपकरण विकसित किया है। यह उपकरण 22 भारतीय भाषाओं में अनुवाद करने की क्षमता रखता है। इस उपकरण और इसकी उपयोगिता के बारे में जागरूकता के लिए संस्थानों व कॉलेजों में कई वर्कशॉप व सेमिनार आयोजित किए जा रहे हैं। Read the full article

0 notes

Text

Mastering the IAS with Insight Delhi

Dominate the IAS exam with INSIGHT Delhi's Ultimate Exam Prep Guide. Tailored strategies, expert insights, and a roadmap to success await. Elevate your preparation with precision and expertise.

0 notes

Text

JURIS Academy Prime Choice for Judicial Success.

JURIS Academy stands as the paramount choice for achieving judicial success. With a legacy of excellence, our coaching empowers aspirants with comprehensive knowledge, expert guidance, and strategic preparation.

0 notes

Text

"Efficient Ways to Prepare for CUET and Class 12th Boards without Stress"

Discover stress-free ways to prepare for CUET and Class 12th Boards simultaneously. Our comprehensive guide provides efficient strategies to streamline your study routine, ensuring success in both exams. Simplify your preparation, minimize stress, and confidently navigate the challenges of CUET and Class 12th Boards with ease.

0 notes

Text

Luffy mentions that Impel Down has more battleships surrounding it than a Buster Call, and Hancock implies that this is always the case. We haven't even stepped inside, and Oda's hyping up the defense of the prison and setting up the difficult of their eventual escape

#opbackgrounds#one piece#ch525#environments#Oda's practicing his double spread skills in prepration of marineford

94 notes

·

View notes

Text

My finals are coming or my final is coming? Follow to know.

I'm losing it. Both my money and my mind on games

And my finals are coming

Damn

#devil may shitpost#dante devil may cry#devil may cry#finals#exams#exam season#exampreparation#no exam prepration acrually I lied

8 notes

·

View notes

Text

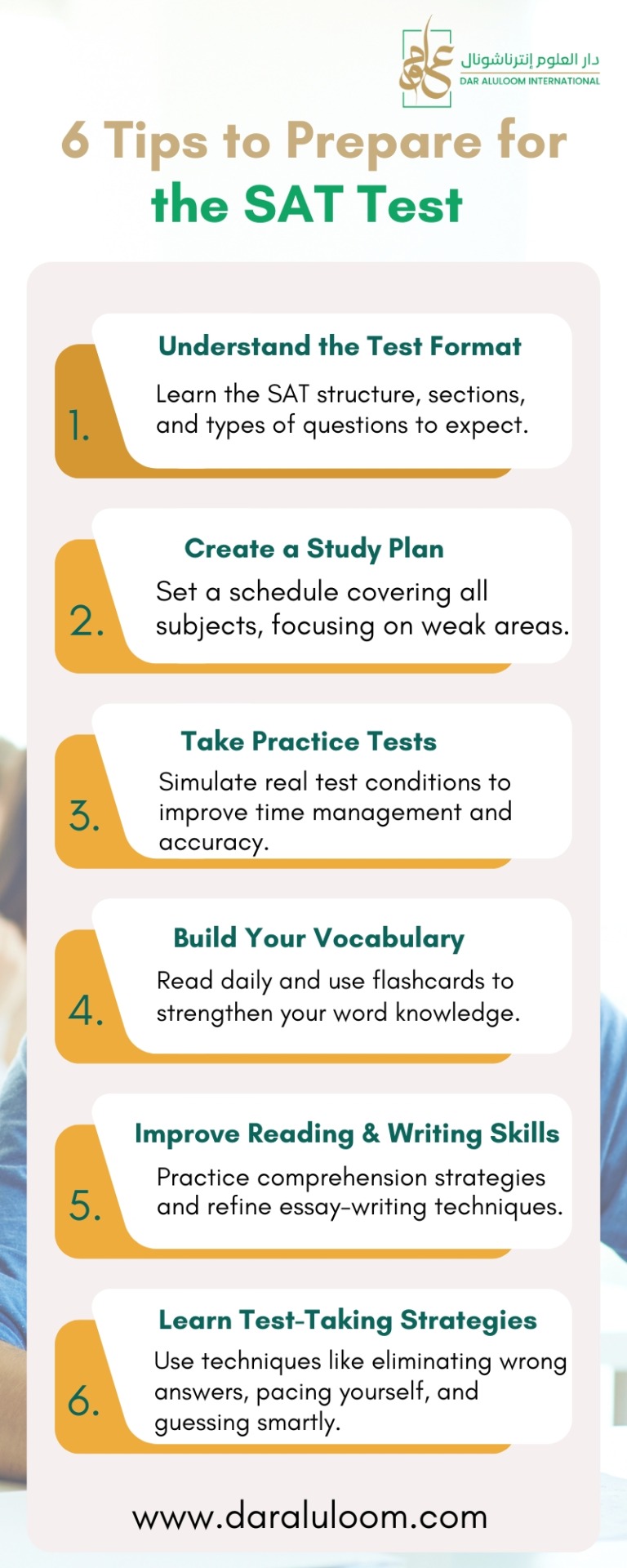

6 Tips to Prepare for the SAT Test

Discover essential strategies for effective SAT preparation in Dubai. These 6 tips will help you sharpen your skills, boost your confidence, and maximize your performance on the SAT test. Start your SAT journey with these expert-backed recommendations!

#test prep in uae#sat prepration#SAT Coaching Dubai#SAT Exam Dubai#SAT Strategies Dubai#Best SAT Prep Dubai

1 note

·

View note

Text

I'm going to fail this test so badd why are they making me do this less than a week after my boards ended I've forgotten everything

#the boards spanned across 1.5 month + 2ish month of prepration for boards so i havent studied for ipmat in like 3-4 months#og

4 notes

·

View notes

Text

youtube

How To Get C15 Flooring Contractors License

If you're looking to start or grow a business in the flooring industry, getting your C15 Flooring Contractors License is a crucial step. In this video, we'll walk you through the process of obtaining your license, from meeting the requirements to passing the exams.

At Contractors Intelligence School, we've helped thousands of students across California prepare for and pass their contractor licensing exams. Our expert instructors have years of industry experience and can guide you through the entire licensing process, so you can focus on building your business.

In this video, you'll learn:

The requirements for getting your C15 Flooring Contractors License, include education and experience. How to apply for the license and register for the exams.Tips and strategies for passing the exams, including the trade exam and the law and business exam

What to expect during the licensing process, including fingerprinting and background checks How to maintain your license and stay up-to-date with industry regulations Whether you're a seasoned flooring professional or just starting out, our C15 Flooring Contractors License program can help you take your business to the next level. Contact us today to learn more and get started!

#how to get c15 flooring contractors license#how to get c15 flooring license#how to get c15 license#how to get c15 contractors license#how to get flooring license#how to get flooring contractors license#how to obtain floring contractors license#flooring license requirements#flooring license exam prepration#Youtube

1 note

·

View note

Text

Corporate Tax Consultants: Problem Solvers In Disputes

Corporate tax consultants specialize in resolving disputes between businesses and tax authorities. Experts providing corporate tax preparation services in Fort Worth TX offer expertise in navigating complex tax laws and regulations to find solutions beneficial to their clients. By providing strategic advice and representing businesses during audits or negotiations, these consultants help minimize penalties and resolve disputes efficiently. Their knowledge and advocacy contribute to maintaining businesses’ financial stability and legal compliance.

0 notes

Text

Want to Join the Armed Forces? Start with the Right NDA Coaching

Early preparation is key if you want to serve in the Indian Armed Forces. For students who wish to lay a solid foundation, NDA coaching in Delhi after the tenth grade is a wise choice. For students who want to prepare for the NDA while still attending school, Nation Defence Academy provides the best options.

The goal of our NDA coaching with schooling in Delhi is to assist students in juggling their academic obligations and NDA preparation. For people who want to save time and maintain focus on their objective, it is perfect.

We ensure that students are prepared for the NDA written test as well as board exams by using knowledgeable instructors and well-structured classes.

Students in Delhi who receive NDA coaching and continue their education after the tenth class can begin their defence journey sooner.

We focus on learning the foundational concepts of mathematics, English, and general knowledge—the three subjects that are tested on the NDA exam. Additionally, students receive frequent exams and hands-on instruction.

Both our Delhi NDA schooling program and our NDA schooling program after 10th in Delhi class are comprehensive training programs that cover school instruction, NDA subjects, and SSB interview advice.Knowledge, discipline, and self-confidence are all increased by these classes.

For students who desire long-term preparation, Nation Defence Academy also provides the best NDA foundation course and program in Delhi. With frequent practice and question-and-answer sessions, these programs support methodical learning.

Your future may be shaped by the academy you choose after tenth class. To begin your journey towards donning the uniform, enroll in Nation Defence Academy. Expert NDA coaching in Delhi can help you get started early, maintain focus, and prepare strategically.

0 notes

Text

Top Statistics Questions Asked in Data Science Interviews (2025)

Preparing for interviews isn’t just about knowing formulas or definitions—it’s about applying those concepts in real-world business scenarios. The ability to explain concepts like standard deviation, p-values, and hypothesis testing with clarity reflects your readiness for the job. Make statistics a strength, not a struggle, by building daily learning habits.

0 notes