#secure document processing

Explore tagged Tumblr posts

Text

Get Your Turkiye Diploma Apostille Online

1. What is UK Diploma Embassy Legalisation? Embassy Legalisation for a UK diploma is the process of authenticating your academic document to make it legally valid for use in a foreign country. This involves attestation by UK authorities, followed by legalisation at the embassy of the destination country. This multi-step process ensures your diploma is recognized abroad for employment, further…

#UK Diploma Legalisation#Document Legalisation Simplified#Embassy Legalisation Services#Hague Apostille Services#Academic Document Authentication#secure document processing#Certified Academic Records#international diploma recognition#Global Education Compliance#Legalisation For International Use

0 notes

Text

How Do Different Banks Evaluate Your Personal Loan Application?

A personal loan is one of the most accessible financial products, offering individuals the flexibility to meet urgent or planned expenses. However, securing a personal loan approval depends on various factors that banks evaluate before disbursing the funds. Each bank has its criteria, but common evaluation parameters include credit score, income stability, employment status, existing debts, and repayment capacity. Understanding these factors can help applicants increase their chances of loan approval and secure better loan terms.

1. Credit Score and Credit History

The credit score is the first thing banks check when evaluating a personal loan application. A credit score, typically ranging from 300 to 900, reflects a borrower's creditworthiness.

How banks evaluate credit scores:

750+ Score: High chances of loan approval with low-interest rates.

650 - 749 Score: Moderate approval chances; interest rates may be higher.

Below 650: Higher risk of rejection; lenders may offer loans at extremely high-interest rates.

A good credit score assures banks that you have a history of responsible debt management, increasing your chances of approval.

2. Employment Type and Stability

Banks assess employment details to determine financial stability. They categorize borrowers as salaried employees, self-employed individuals, or business owners.

For salaried professionals:

Stable income and permanent employment increase approval chances.

Applicants working for MNCs, government sectors, or reputed companies are preferred.

Minimum work experience of 2 years and at least 6 months in the current job is ideal.

For self-employed individuals/business owners:

Banks review income consistency by checking tax returns and profit statements.

Businesses must be operational for at least 2-3 years.

Irregular income may lead to a higher interest rate or lower loan amount.

3. Monthly Income and Repayment Capacity

A higher income level indicates better repayment ability, making loan approval easier. Banks generally have minimum income requirements based on the applicant’s location.

Typical monthly income requirements:

Metro cities: ₹25,000 - ₹30,000

Tier 2 & 3 cities: ₹15,000 - ₹20,000

Banks also consider the Debt-to-Income (DTI) ratio, which compares total monthly debts to income. A lower DTI (<40%) indicates good repayment capacity.

4. Existing Debts and Financial Obligations

Banks assess the applicant’s existing loans, credit card debts, and financial obligations to determine if they can manage additional loan repayments.

Key factors banks check:

High outstanding loans reduce personal loan eligibility.

A low FOIR (Fixed Obligations to Income Ratio) of 40-50% is preferred.

Defaulting on any previous loan reduces approval chances.

Clearing old debts before applying for a new loan improves eligibility and increases the chances of securing better loan terms.

5. Loan Amount and Tenure

The requested loan amount and tenure influence the approval process. Banks assess whether the applicant’s income can sustain the EMI payments for the chosen tenure.

Considerations:

Higher loan amounts require a stronger financial profile.

A longer tenure reduces EMI burden but increases total interest.

Choosing an appropriate loan amount based on income improves approval chances.

6. Employer Category and Job Stability

Many banks categorize employers into different risk levels based on their stability and reputation.

Preferred employer categories:

Government employees

Employees of PSUs and reputed private sector companies

Professionals like doctors, chartered accountants, and lawyers

Applicants working with startups or unstable businesses may face challenges in securing a loan or may be offered higher interest rates.

7. Bank’s Internal Policies and Risk Appetite

Different banks have varying policies for personal loan approvals based on their risk assessment strategies. Some banks are more conservative, while others offer loans more flexibly.

Factors influencing internal policies:

Economic conditions and banking sector trends.

Customer segment preferences (e.g., some banks focus on salaried professionals, while others prefer self-employed borrowers).

Loan portfolio performance and default rates.

8. Documentation and KYC Verification

Proper documentation is crucial in the loan evaluation process. Incomplete or incorrect documentation can lead to rejection.

Common documents required:

Identity Proof: Aadhaar card, PAN card, or passport.

Address Proof: Utility bills, voter ID, or rental agreement.

Income Proof: Salary slips for salaried employees; ITR (Income Tax Returns) for self-employed applicants.

Bank Statements: Last 6 months' bank statements to assess financial transactions.

Banks conduct KYC verification to ensure the authenticity of the applicant’s details before approving the loan.

9. Relationship with the Bank

Existing customers with a good history at a particular bank often enjoy faster approvals, lower interest rates, and better loan terms.

Benefits of a good banking relationship:

Pre-approved personal loan offers.

Minimal documentation requirements.

Preferential interest rates for long-term account holders.

Applicants with savings accounts, salary accounts, or fixed deposits with a bank have a better chance of securing loan approval.

10. Loan Purpose and Utilization

While personal loans are generally multipurpose, some banks inquire about loan usage to assess repayment risks.

Preferred loan purposes:

Medical emergencies

Debt consolidation

Home renovations

Education expenses

Loans taken for speculative investments, luxury expenses, or gambling may raise red flags and lead to rejection.

How to Improve Your Personal Loan Approval Chances?

If you want to maximize the likelihood of getting your personal loan approved, consider these steps:

✅ Maintain a credit score of 750+. ✅ Ensure a stable income and job history. ✅ Clear existing debts before applying. ✅ Choose a reasonable loan amount based on your financial profile. ✅ Provide accurate documentation and verify KYC details. ✅ Apply with a bank where you have an existing relationship. ✅ Keep your Debt-to-Income ratio below 40%.

Conclusion

Each bank follows its evaluation criteria when assessing a personal loan application, but the fundamental factors remain the same—creditworthiness, income stability, employment status, repayment capacity, and financial obligations. By understanding these factors and taking proactive steps to improve eligibility, applicants can secure faster approvals with favorable interest rates.

If you're considering applying for a personal loan, compare different banks' offerings, check your credit report, and ensure financial readiness. Responsible borrowing and a strong financial profile will help you get the best loan deals with minimal hassle.

For more insights on personal loans, visit www.fincrif.com today!

#personal loan online#loan apps#fincrif#personal loans#personal loan#bank#loan services#nbfc personal loan#personal laon#finance#personal loan eligibility#personal loan approval process#personal loan application#how banks evaluate personal loans#personal loan criteria#credit score for personal loan#personal loan interest rates#personal loan documentation#personal loan income requirements#bank loan approval process#how to improve your personal loan approval chances#best banks for personal loan approval#factors affecting personal loan eligibility#what do banks check before approving a personal loan#does a low credit score affect personal loan approval#how salary impacts personal loan eligibility#personal loan vs secured loan approval process#best tips for faster personal loan approval

1 note

·

View note

Text

why did we ever get rid of faxes, what good technology are we leaving behind

#yes this is related to work#if we can't go fully paper-free why are we complicating the process!!! print document scan document encrypt email send email print & scan#with a fax it's just. print document. send document. scan document.#yes there are security issues but fucking reinforce it and not abandon it

7 notes

·

View notes

Text

Boost Business with ShredLogix Vendor Partnerships

Is your California business getting the most out of its vendor relationships? If managing compliance and document security feels like a never-ending task, ShredLogix brings a better way forward through its corporate vendor partnerships. Tailored for California-based organizations, this solution ensures secure, scalable shredding services backed by full regulatory compliance. From HIPAA to FACTA, ShredLogix helps businesses reduce risk, save time, and boost operational efficiency. Whether you’re in healthcare, finance, or legal, partnering with ShredLogix means dependable service, advanced protection, and long-term value all delivered with California precision and professionalism.

Why ShredLogix Beats the Competition in Vendor Deals

When it comes to corporate vendor partnerships, ShredLogix sets the gold standard. Unlike generic shredding providers, ShredLogix delivers customized solutions with real-time tracking, on-site service, and fully certified compliance across HIPAA, FACTA, and NAID standards. Their white-glove approach ensures every client receives priority care, transparency, and reliability. With flexible scheduling, robust KPI monitoring, and proactive support, ShredLogix outperforms the competition offering not just a service, but a strategic advantage. If you demand excellence from your vendors, ShredLogix is the partner built to deliver it.

What Are Corporate Vendor Partnerships?

Corporate vendor partnerships are strategic, long-term agreements between businesses and their service providers designed to streamline operations, reduce costs, and ensure consistent quality. These partnerships go beyond transactional relationships by incorporating shared goals, measurable performance standards, and ongoing accountability. Whether it’s document destruction, IT services, or logistics, this model fosters deeper collaboration and trust. Businesses benefit from increased efficiency, stronger compliance, and a reliable framework for scaling operations especially when handling sensitive or regulated information across multiple locations.

Partnerships That Power California Businesses Forward

Corporate vendor partnerships deliver efficiency and security at scale. Benefits include:

Build long-term trust with vendors who understand your business

Improve efficiency with consistent, scheduled service

Reduce compliance risks with HIPAA, FACTA, and NAID-certified solutions

Gain real-time visibility with KPI tracking and vendor accountability

Cut costs by streamlining services under one reliable provider

Scale effortlessly as your business expands across California

Protect sensitive data with secure, on-site and off-site shredding options

Enjoy white-glove service tailored to your company’s needs

Where ShredLogix Partnerships Make the Biggest Impact

You can apply corporate vendor partnerships across industries needing secure, compliant solutions:

Perfect for healthcare facilities managing HIPAA compliance

Ideal for law firms handling confidential legal documents

Trusted by financial institutions needing secure destruction

Supports multi-location businesses with unified vendor solutions

Fits seamlessly into corporate compliance programs

Essential for government agencies and public offices in California

Valuable for educational institutions with strict data policies

Effective for any business needing consistent, secure shredding services

Start Your Trusted Vendor Partnership with ShredLogix

Ready to make your next outreach initiative meaningful? ShredLogix’s corporate vendor partnerships extend to secure, eco-conscious community shred events across California. We proudly collaborate with cities, businesses, and nonprofits to protect sensitive information one document at a time. Call 866.996.5501 or 510.592.8100, or visit ShredLogix to schedule your event today. Build trust, ensure compliance, and safeguard your community with a shredding partner that delivers real impact.

#Corporate Vendor Partnershipsenterprise shredding solutions#document security partnerships#vendor contract optimization#secure document destruction services#business process outsourcing#B2B shredding provider#compliance-focused vendor relationships#scalable vendor services#long-term vendor contracts#third-party compliance management#performance-based vendor agreements#HIPAA-compliant shredding#NAID certified shredding#secure partnership solutions#strategic vendor integration

1 note

·

View note

Text

https://buyprodocuments.com/product/uk-passport-online/

UK Passport Online. It has never been easier or more secure to get your UK passport online. In addition to offering you one of the most prominent and potent passports in the world, our effective and private service ensures a flawless experience.

With a UK passport, you can travel to more than 185 countries without a visa or with one upon arrival, giving you unmatched flexibility. Don’t put off claiming your prestige and worldwide mobility. Upgrade your future right now by selecting the UK Passport service!

Contact: +49 1577 0037224 Email: [email protected]

#buy UK passport#citizenship document#European passport#fast passport processing#get UK passport#global citizenship#global passport#official passport#online citizenship#online passport service#order passport online#passport benefits#passport fast delivery#passport service#secure passport service#secure travel papers#travel document#travel UK#UK online services#uk passport#uk passport application#UK travel document#UK visa#United Kingdom citizenship#visa-free travel

1 note

·

View note

Text

Loan Against Mutual Funds Online in 2025 – Fast Approval Without Selling Investments

In 2025, if you need urgent cash and own investments like mutual funds or shares, there's good news—you no longer need to sell your assets. Thanks to the rise of LAMF (Loan Against Mutual Funds) and LAS (Loan Against Shares), you can instantly apply for a digital loan without disturbing your portfolio. Whether it's for a wedding, education, travel, or medical emergency, you can unlock funds in minutes — no income proof, no selling, just swipe and go.

Let’s explore how a digital loan against mutual funds or shares works, who can apply, what the features, limits, eligibility, and more. This guide will clearly and naturally answer every user's question, utilizing all the important search keywords to help both readers and search engines trust and rank this content.

What is a Loan Against Mutual Fund (LAMF)?

A Loan Against Mutual Fund (LAMF) allows you to borrow money using your mutual fund units as collateral. Instead of redeeming your mutual funds, lenders provide you with a credit line or term loan based on the NAV (Net Asset Value) of your holdings.

Similarly, a Loan Against Shares (LAS) lets you pledge your equity shares and get funds instantly. The biggest advantage? You retain ownership and continue to earn returns, dividends, and capital gains while enjoying liquidity.

Top Features of Loan Against Mutual Funds & Shares (LAMF LAS)

How Does a Digital Loan Against Mutual Fund Work in 2025?

Log in to your Demat or Mutual Fund platform. Most AMCs and fintech apps now offer LAMF APIs directly integrated.

Select the funds to pledge. ELSS, debt, hybrid, and large-cap funds are typically eligible.

Get an instant offer based on NAV. The higher the NAV and fund stability, the better your loan terms.

E-sign documents and complete KYC online.

Loan is disbursed digitally – often within 30 minutes!

This is how a digital loan against mutual funds online saves you time, paperwork, and the stress of liquidating long-term wealth.

LAMF Eligibility & Documents – Who Can Apply in 2025?

Eligibility for Loan Against Mutual Funds (LAMF):

Age: 21 to 65 years

Must own eligible mutual fund units (ELSS, debt, hybrid, or equity)

Resident Indian with valid PAN & Aadhaar

Salary slip or ITR is not mandatory (many lenders skip this)

LAMF Documents Required:

PAN Card

Aadhaar or Passport/Voter ID

Mutual Fund Statement (CAS)

Cancelled Cheque (for loan disbursal)

Optional: Income proof for higher limits

You can also use a loan against mutual funds eligibility calculator available on most lending platforms to get your eligible amount instantly.

Top Use Cases – Why People Apply for a Loan Against Mutual Funds in 2025

Loan Against Mutual Funds for Wedding Expenses Don’t touch your SIPs or ELSS—get a short-term loan without penalty.

Loan Against Mutual Funds for Higher Education Quick and smart funding option without breaking your portfolio.

Loan Against Mutual Funds for Financial Planning Use for emergencies or opportunities while your investments grow.

Loan Against Mutual Funds for Financial Needs Medical emergencies, travel, family events, or even down payments.

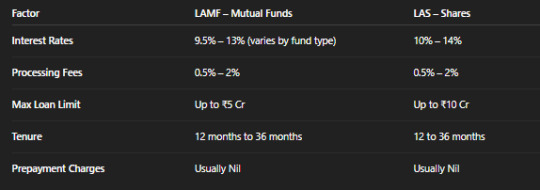

Interest Rates, Processing Fees & Limits – All You Need to Know

Digital loan platforms use LAMF APIs to instantly evaluate, process, and disburse loans, making the loan against mutual funds processing fees and interest rates transparent and user-friendly.

How to Apply for a Loan Against Mutual Funds Online – Step-by-Step (2025)

Visit a digital lending platform (like Groww, Zerodha, Paytm Money, or a Bank site)

Click on “Apply for Loan Against Mutual Fund.”

Enter PAN & link your MF folio or Demat

Select eligible funds (ELSS, debt, equity)

View the loan offer via the LAMF eligibility calculator

E-sign documents and submit KYC

Get instant disbursal to your linked bank account

Some fintech apps offer a loan against shares interest rates comparison to help you choose LAS vs LAMF smartly.

FAQs – Loan Against Mutual Funds or Shares in 2025

1. What is a loan against a mutual fund?

A Loan Against Mutual Fund (LAMF) allows you to borrow money without selling your investments by pledging them digitally.

2. Who can apply for a loan against mutual funds in India?

Any Indian citizen above 21 who holds mutual funds in their name can apply. Many platforms don’t require income proof or a high CIBIL.

3. Can I apply for a loan against ELSS mutual funds?

Yes, loan against ELSS is allowed, but with certain lock-in caveats. Many lenders accept ELSS if held for over 3 years.

4. How much can I borrow through LAMF?

Using a loan against mutual funds eligibility calculator, most users can obtain a loan of up to 70%-80% of their mutual fund's NAV.

5. Is LAS or LAMF better in 2025?

If you hold mutual funds, go for LAMF. If you own equity shares, LAS offers better liquidity options. Compare both using the Loan Against Securities Interest Rates before choosing.

Final Thoughts: Borrow Smart, Invest Smarter

In 2025, you no longer need to choose between growth and liquidity. With smart fintech platforms offering digital loans against mutual funds or shares, you get the best of both worlds — access to instant funds without selling your long-term assets.

Whether you’re planning a big event or tackling a financial emergency, LAMF or LAS ensures you get cash on tap with low documentation, transparent interest rates, and minimal stress. Just a few clicks, and you’re good to go — No Sell, Just Swipe.

#lamf#loan against mutual funds online#lamf eligibilty & documents#loan against elss#digital loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds explained#features of loan against mutual funds#how does a loan against mutual fund work#loan against mutual funds faqs#lamf api#loan against mutual funds processing fees and interest rates#what is a loan against mutual fund#loan against mutual funds max limit#lamf eligibility#lamf loan#loan against mutual funds for wedding#loan against mutual funds eligibility calculator#loan against mutual funds for financial planning#apply for loan against mutual fund#loan against mutual funds for financial needs#loan against mutual funds features#loan against mutual funds for higher education#loan against mutual funds limit#loan against mutual funds eligibility and documents#digital loan against mutual funds interest rate#who can apply for loan against mutual funds#lamf documents#LAS#Loan Against Securities Interest Rates

0 notes

Text

Cash Against Documents: A Practical Tool for Global Trade

In international trade, doing business across borders brings both opportunity and risk. One of the biggest concerns for exporters is getting paid, especially when dealing with buyers in new markets. At the same time, buyers don’t want to pay before goods are shipped. A practical solution that balances both sides is Cash Against Documents (CAD). CAD is a payment method where the seller ships the…

#balanced payment method#bank-to-bank communication#Bill of Lading#CAD#cash against documents#Commercial Invoice#cross-border business#document collection#document-based payment#export strategy#exporters#freight forwarding#Global Commerce#global supply chain#global trade#import-export#importers#international shipping#International Trade#international transactions#payment control#Payment Terms#secure payment method#shipping documents#simple trade method#trade assurance#trade documentation#Trade Finance#trade process#trade protection

0 notes

Text

The Process of Renting a 2 Bedroom Apartment in Dubai

Understanding the Rental Market in Dubai Renting a 2 bedroom apartment in Dubai can be an exciting yet complex process, given the city’s dynamic real estate market. Dubai is known for its luxurious lifestyle, modern amenities, and diverse communities. The rental market can vary significantly depending on the location, property type, and current market trends. Before beginning your search, it’s…

#2 bedroom apartments in Dubai with sea view#best areas to rent 2 bedroom apartment in Dubai#cost of renting a 2 bedroom apartment in Dubai#DEWA setup#documents needed to rent in Dubai#Dubai 2 BHK for rent#how to rent a 2 bedroom flat in Dubai#how to rent in Dubai#legal process of renting in Dubai#monthly rent for 2 bedroom apartment in Dubai#real estate agents in Dubai#rent 2 bedroom apartment near Dubai Marina#rental prices in Dubai#security deposit for Dubai rental#Short term vs long term rental in Dubai#step by step guide to renting in Dubai#tenancy contract Dubai

0 notes

Text

Call Now 9650825786 And Visit Krishna Documentation vardhman times plaza pitampura Rani bagh delhi

Driving License Aadhar Card Pan Card Passport Voter Id Card Birth Certificate Death Certificate Income Certificate E-Stamp Services Available Government-authorized e-stamping Fast & secure document stamping Property agreements, affidavits, and more Digital & printed copies available Instant photo capture & print New PAN card application PAN correction/update service High-quality printouts (35mm x 45mm) Fast digital processing & tracking

Call Now 9650825786 And Visit Krishna Documentation vardhman times plaza pitampura Rani bagh delhi

#Driving License#Aadhar Card#Pan Card#Passport#Voter Id Card#Birth Certificate#Death Certificate#Income Certificate#E-Stamp Services Available#Government-authorized e-stamping#Fast & secure document stamping#Property agreements#affidavits#and more#Digital & printed copies available#Instant photo capture & print#New PAN card application#PAN correction/update service#High-quality printouts (35mm x 45mm)#Fast digital processing & tracking

0 notes

Text

Streamlining Real Estate Transactions with E-Recording Services in California

In the fast-paced world of real estate and legal transactions, time is money—and paper is a problem. Traditional document recording processes often lead to delays, errors, and compliance concerns. That’s where e-recording services step in to revolutionize the way property documents and legal records are submitted, verified, and stored.

At Countrywide Process, a California-based legal support provider, modern technology is at the core of our services. We offer reliable and court-compliant e-recording services across California counties to help law firms, title companies, and real estate professionals stay efficient, secure, and fully compliant with local recording requirements.

What Are E-Recording Services?

E-recording services allow for the electronic submission of legal documents such as deeds, liens, and judgment renewals directly to the county recorder’s office. Instead of relying on courier services or mailing paper documents, you can now submit everything electronically, dramatically reducing turnaround times and risk of document loss.

This digital shift is a game-changer for anyone dealing with high volumes of property-related documentation.

Why Choose Countrywide Process?

Countrywide Process is not just a service provider—we’re a strategic partner in your legal and real estate transactions. Our platform is designed for speed, security, and full transparency. With our e-recording services, clients gain access to:

Faster turnaround times

Reduced document rejection rates

Enhanced data security and privacy compliance

24/7 submission capabilities

Real-time status tracking

Whether you’re filing a renewal of judgment, recording a lien, or submitting title documents, our e-recording portal makes the process smooth and error-free.

The Importance of Compliance and Security:

In an era where data privacy regulations are tighter than ever, compliance is not just important—it’s essential. Our e-recording services adhere to the strictest California county requirements, ensuring that every document submitted is handled with full legal integrity.

We follow secure protocols, including encryption and secure login portals, to protect your sensitive information at all times.

Ideal for Law Firms, Title Companies, and Real Estate Agents

Our e-recording services are especially valuable to professionals who need consistent accuracy and timeliness in document recording. Law firms appreciate our attention to detail and our ability to manage time-sensitive judgment renewals. Title companies and real estate professionals benefit from our system’s compatibility with various county formats and requirements, helping to avoid costly rejections or delays.

Future-Proof Your Workflow:

As California continues its digital transformation, e-recording will no longer be a convenience—it will be a necessity. Partnering with Countrywide Process today means you’re ahead of the curve, using trusted and tested tools that grow with your needs.

We serve all California counties that offer electronic recording, and we’re constantly updating our system to meet evolving legal standards and technology advancements.

Visit countrywide process and discover how our expert team and cutting-edge technology can simplify your legal filings today.

#e-recording services#digital recording California#electronic document filing#online legal services#property document e-recording#judgment renewal#real estate recording California#secure e-recording#Countrywide Process#legal tech solutions#California e-recording#title company services#fast document filing#court-compliant e-recording#legal document submission

0 notes

Text

How to Apostille a Driver’s License for International Use

How to Apostille a Driver’s License for International Use If you plan to drive or use your U.S.-issued driver’s license (DL) in a foreign country, it must often be certified with an apostille to be recognized abroad. At Hague Apostille Services, we make obtaining an apostille for your driver’s license straightforward, fast, and secure. Here’s everything you need to know about the process and…

#document certification#Hague Apostille Services#international document authentication#notary services for driver’s license#apostille process for licenses#legalization of driver’s license#secure document processing#fast apostille services#apostille for driver’s license#driver’s license apostille

0 notes

Text

This situation has escalated beyond anything I ever expected. You remember when I told you things were getting strange with my roommate and his crew? It’s not just strange anymore—it’s calculated, it’s invasive, and it’s relentless. I’m under constant surveillance in my own space. This started creeping in over a year ago, and now it’s blatant. Every move I make, every conversation I have—it all gets reported back to him.

They don’t even try to hide it. They linger outside my door, eavesdropping, analyzing, waiting for something to pick apart—especially when I have people over. And when I confront my roommate? He twists it, flips it, makes it seem like I’m losing my grip. Gaslighting at its finest, and I can feel the psychological toll.

I’ve tried everything—blocking gaps, rearranging furniture, calling them out directly—but they undo it all like my privacy is theirs to take. No respect. No boundaries. Just unrelenting intrusion.

This is breaking me down. The anxiety, the isolation—it’s like they’re working to cut me off from everyone. And the worst part? Some days, I start questioning reality itself. The stress is so deep that I second-guess sounds that may not even be there. It’s a war of attrition, and I feel like I’m running out of ground to stand on.

Even when my roommate isn’t here, his people are. They mock, repeat my words, mimic my movements. And now, I’m not just worried about surveillance—I’m starting to think they might be messing with my phone, trying to erase any proof I have.

I’ve hit my limit. I made it clear—if this continues, I’ll have no choice but to escalate. Legal action, housing authorities—whatever it takes. Because this? This isn’t living.

I needed to tell someone who actually sees me. Let’s talk soon. I could really use that right now.

#tenant rights#illegal surveillance#invasion of privacy#gaslighting tactics#roommate harassment#personal security#stalking behavior#housing authority complaint#tenant harassment laws#right to privacy#protecting personal space#legal action for harassment#signs of gaslighting#psychological manipulation#privacy violation#landlord-tenant dispute#tenant legal protection#housing discrimination#restraining order process#reporting harassment#intimidation tactics#emotional distress claims#surveillance laws#digital privacy concerns#phone hacking signs#confronting gaslighting#mental health and harassment#toxic living situations#dealing with intrusive roommates#how to document harassment.

1 note

·

View note

Text

Top Personal Loan Apps in India: Get Instant Online Personal Loans with Smart Finance Tools

In today’s fast-paced financial world, securing funds at the right time can make a significant difference. Whether it’s a sudden medical emergency, an unplanned vacation, or a much-awaited home renovation, having access to quick financial support is essential. This is where the role of a Personal Loan becomes vital. With evolving digital technology, obtaining an Instant Personal Loan through a trusted Online personal loan platform or a personal loan app is no longer a tedious process.

The Rise of Digital Lending Platforms

The growth of fintech has revolutionized the lending industry. Gone are the days when people had to visit multiple bank branches, fill out long forms, and wait endlessly for approval. Today, thanks to robust personal finance apps and user-friendly loan apps, availing a personal loan has become faster, smarter, and simpler.

An Online personal loan offers the convenience of applying from the comfort of your home, with minimal documentation and quick disbursal. Personal loan apps bridge the gap between financial institutions and borrowers, creating a seamless experience where approvals often happen in just a few hours.

What Makes Instant Personal Loan a Go-To Option?

The Instant Personal Loan is a lifesaver for those in urgent need of cash. These loans are typically unsecured, meaning you don’t need to pledge any collateral. Their popularity lies in features like:

Quick Disbursement: Funds are credited within hours or the same day.

Minimal Paperwork: Most lenders ask for only basic KYC documents.

Flexible Repayment Tenure: Borrowers can choose repayment terms ranging from a few months to several years.

Transparent Charges: Many personal finance apps provide clear information about interest rates, processing fees, and EMIs.

Benefits of Using a Personal Loan App

A personal loan app isn’t just another mobile application—it’s a financial companion that empowers users to manage, track, and repay their loans effortlessly. Some of the major advantages include:

24/7 Accessibility: Apply anytime, anywhere.

User-Friendly Interface: Even first-time borrowers find it easy to navigate.

Real-Time Loan Tracking: Stay updated with loan status and EMI schedules.

Secure Transactions: Advanced encryption ensures your data is protected.

Many Online personal loan platforms also integrate AI-driven eligibility checks and instant approval mechanisms, making the loan journey smoother.

Choosing the Right Online Personal Loan

With numerous options in the market, selecting the right Online personal loan can feel overwhelming. Here are some key points to consider:

Interest Rates: Compare rates across platforms to find the most competitive option.

Customer Reviews: User feedback provides insight into service quality and transparency.

Disbursal Time: Choose platforms that provide instant or same-day disbursement.

App Rating: High ratings on app stores often indicate a reliable and smooth user experience.

Always choose a platform that aligns with your repayment capacity and offers clear terms without hidden charges.

Role of Personal Finance Apps in Loan Management

Personal finance apps go beyond just lending. They help users build financial discipline and track spending habits. Some even offer budgeting tools, credit score tracking, and investment options. When paired with a personal loan app, these apps can:

Notify you about EMI due dates

Suggest tips to improve creditworthiness

Help consolidate and manage debts

Provide insights into financial behavior

Combining the functionality of a personal finance app with an Online personal loan service is a game-changer for modern borrowers.

Steps to Apply for an Instant Personal Loan via App

Download a Trusted App: Choose a personal loan app with strong reviews.

Register & Fill Details: Enter basic personal and income details.

Upload Documents: Usually includes PAN, Aadhaar, and bank statements.

Get Instant Approval: Based on eligibility and credit score.

Loan Disbursal: Amount credited directly into your account.

The entire process often takes less than 30 minutes, and many platforms assure paperless verification.

Safety Measures When Using a Personal Loan App

Though convenient, users must ensure safety while using Online personal loan platforms. Here are some tips:

Check App Authenticity: Download only from official app stores.

Read Permissions: Avoid apps requesting access to unrelated data.

Avoid Upfront Fees: Genuine lenders don’t ask for money before disbursal.

Review Privacy Policies: Ensure your personal data is not misused.

Ideal Scenarios for Taking a Personal Loan

Medical Emergencies

Home Renovation

Debt Consolidation

Education or Certification Courses

Wedding Expenses

Travel and Vacation

Instead of liquidating savings or borrowing from friends, many individuals now prefer an Instant Personal Loan due to its accessibility and speed.

Building Creditworthiness through Responsible Borrowing

Using a personal loan app also helps borrowers build or improve their credit history. Timely repayments, consistent usage of personal finance apps, and avoiding defaults contribute to a healthy credit score. A strong score enhances eligibility for larger loans in the future, sometimes at even better interest rates.

Why Fincrif Recommends Digital Lending Platforms

At Fincrif, we believe in empowering our readers with the best financial tools. Online personal loan platforms and dedicated personal loan apps have emerged as essential aids in today’s digital economy. Whether you're a salaried employee, a freelancer, or a small business owner, an Instant Personal Loan can provide the support you need when it matters most.

We continuously evaluate and recommend top-performing platforms that deliver value, transparency, and security. With the backing of personal finance apps, borrowers today are more in control than ever before.

Final Thoughts

The traditional loan process is fast becoming a thing of the past. With the advent of Online personal loan services, Instant Personal Loans are more accessible, faster, and tailored to individual needs. From the ease of applying through a personal loan app to managing repayments via a personal finance app, today’s borrowers are embracing a new era of financial independence.

As the digital lending space continues to evolve, the focus remains on empowering users with technology-driven solutions. So, if you're considering a Personal Loan, explore the latest platforms that combine innovation, speed, and simplicity—all from the palm of your hand.

Stay informed, stay financially healthy, and let Fincrif guide you in making smarter borrowing decisions.

#finance#nbfc personal loan#loan apps#fincrif#personal loans#loan services#bank#personal loan#personal loan online#personal laon#Personal Loan#Instant Personal Loan#Online Personal Loan#Personal Loan App#Personal Finance App#Best Loan App in India#Instant Loan Without Documents#Fast Personal Loan Approval#Paperless Loan Process#Easy EMI Personal Loan#Low Interest Personal Loan#Loan App for Salaried Employees#Personal Loan for Self-Employed#Emergency Loan App#Mobile Loan Application#24x7 Personal Loan App#Online Loan Disbursement#Quick Loan for Medical Emergency#App-Based Personal Loans#Secure Loan App India

0 notes

Text

What is Government Allocation C of O

What is Government Allocation C of O? Understanding Government Allocation C of O in Nigeria In Nigeria, land ownership and documentation are crucial for real estate investors, developers, and home buyers. One of the most recognized titles in property ownership is the Government Allocation Certificate of Occupancy (C of O). But what does it mean, and why is it important? If you are a property…

#buying land in Nigeria#C of O application process#Certificate of Occupancy#government allocated land#Government Allocation C of O#government land allocation#how to get C of O#Lagos land documentation#Lagos land titles#land investment Nigeria#land ownership Nigeria#land registration process#land title in Nigeria#mortgage and land title#property documentation Nigeria#property security Nigeria#property verification Nigeria#real estate investment#real estate legal documents#types of land titles in Nigeria#What is C of O in Nigeria

0 notes

Text

PDQ Docs: The Ultimate Document Management Software for Modern Businesses

In today’s fast-paced business environment, managing documents efficiently is crucial to maintaining productivity, ensuring compliance, and streamlining workflows. Companies are constantly seeking tools that can simplify the document management process while maintaining accuracy and consistency. PDQ Docs is the ultimate document management software that offers businesses a robust solution for organizing, automating, and securing their documents. This powerful software enables organizations to manage their documents with ease, improving overall efficiency and reducing the risk of errors.

What Makes PDQ Docs the Ultimate Document Management Software?

PDQ Docs stands out as the ultimate document management software due to its comprehensive features and user-friendly interface. Designed to meet the needs of businesses of all sizes, PDQ Docs provides a central platform to store, organize, and manage all types of documents. With its cloud-based system, businesses can easily access documents from anywhere, on any device, ensuring seamless collaboration across teams and locations.

The software allows businesses to automate document creation, eliminating the need for manual data entry and reducing the risk of human error. Whether it’s contracts, invoices, or reports, PDQ Docs allows users to generate documents with pre-set templates, automatically populating them with relevant data. This not only speeds up document creation but also ensures consistency across all documents, reflecting the organization’s professional standards.

Simplified Workflow Automation

One of the primary benefits of PDQ Docs as the ultimate document management software is its ability to automate workflows. In today’s business landscape, where time is of the essence, manual document management processes can slow down productivity. PDQ Docs solves this problem by automating routine tasks, such as document creation, data entry, and document approval processes.

Enhanced Collaboration and Document Sharing

Collaboration is a key component of modern business operations, and PDQ Docs excels in enabling teams to work together efficiently. The ultimate document management software provides a centralized document repository, where team members can easily access, review, and edit documents in real-time. This reduces the risk of version control issues and ensures that all team members are working from the most up-to-date version of a document.

Furthermore, PDQ Docs allows users to share documents securely with clients, vendors, or other stakeholders. The software ensures that all shared documents are protected with encryption, providing businesses with peace of mind that their sensitive information is secure. With robust access control features, businesses can also restrict who can view or edit documents, ensuring that only authorized individuals have access to critical information.

Seamless Integration with Existing Systems

Another standout feature of PDQ Docs is its seamless integration with a variety of third-party software solutions. Whether your business uses accounting, customer relationship management (CRM), or enterprise resource planning (ERP) software, PDQ Docs can integrate with these systems to provide a cohesive solution for managing documents. This integration reduces the need for manual data entry, ensuring that all information across platforms remains synchronized and up-to-date.

#ultimate document management software#seamlessly navigate#template management#document generation#document cloning#document renaming#document sending#workflow optimization#efficient document generation#document preparation#enterprise document management#workflow automation#business process management#document archiving#document automation tools#secure file management

0 notes

Text

Loan Against Mutual Funds: Benefits, Risks & Hidden Truths!

Investors often seek ways to access liquidity without disrupting their long-term financial goals. One such option is taking a Loan Against Mutual Funds (LAS). But is it safe? This article explores the risks, benefits, eligibility, process, and alternatives to help you make an informed decision.

What is a Loan Against Mutual Funds (LAS)?

A Loan Against Mutual Funds (LAS) allows investors to pledge their mutual fund units as collateral and borrow money from financial institutions. The loan amount is determined by the type and value of mutual fund holdings.

Loan Against ELSS Funds: Some banks and NBFCs allow loans against Equity Linked Savings Scheme (ELSS), but they may come with certain restrictions.

Overdraft Against Mutual Funds: Some lenders offer an overdraft facility against mutual fund investments, allowing borrowers to withdraw as needed.

Loan Against Securities: Similar to loans against stocks, this loan type enables investors to leverage their mutual fund portfolio.

Is it Safe to Take a Loan Against Mutual Funds?

Yes, but it depends on several factors such as market volatility, loan terms, and your repayment capacity. Here’s a risk-benefit analysis to help you decide.

How to Avail a Loan Against Mutual Funds?

The process to apply for a loan against mutual funds online is straightforward:

Check Eligibility: Financial institutions have different loan against mutual funds eligibility criteria based on the fund type and amount.

Select a Lender: Compare interest rates and features from banks, NBFCs, and online platforms.

Submit Documentation: Required Loan Against Mutual Funds Documentation includes KYC details, mutual fund account statements, and loan application forms.

Approval & Pledging: Once approved, mutual fund units are pledged, and the loan amount is disbursed.

Loan Against Mutual Funds: Features & Benefits

Taking a loan against mutual funds (LAMF) has multiple advantages:

Loan Against Mutual Funds Features

Digital Loan Against Mutual Funds Interest Rate: Competitive rates compared to personal loans.

Loan Against Mutual Funds Process: Quick approval with minimal paperwork.

Pledge Mutual Funds for Loan: Retain investment ownership while using funds.

Loan Against Mutual Funds Online Application: Apply online with instant approvals in some cases.

Loan Against Mutual Funds Benefits

No Need to Sell Investments: Continue to earn returns while availing liquidity.

Lower Interest Rates: These are more affordable than personal loans or credit card debt.

Flexible Repayment: Choose between overdraft or EMI-based repayment options.

Loan Against Mutual Funds vs. Personal Loan

Is a loan against mutual funds better than a personal loan? Let’s compare:

Verdict: If you have a strong mutual fund portfolio, a loan against mutual funds is often a better choice due to lower interest rates and retained investment growth.

Loan Against Mutual Funds Risks

While there are multiple benefits, there are also risks:

Market Volatility: If markets fall, the lender may demand additional collateral.

Interest Costs: If the loan tenure is long, interest expenses may accumulate.

Forced Liquidation: Failure to repay can lead to the forced selling of mutual fund units.

How to Reduce Risks?

Borrow only what you can repay comfortably.

Choose a shorter loan tenure to minimize interest costs.

Keep a buffer of additional investments in case markets fluctuate.

Explore more if you have doubts or problems; we have the best solutions for you

Frequently Asked Questions (FAQs)

1. Who is eligible for a loan against mutual funds?

Anyone holding mutual fund units in demat form and meeting the lender’s Loan Against Mutual Funds Eligibility criteria can apply.

2. What is the interest rate for a loan against mutual funds?

Interest rates typically range between 10% and 12%, depending on the lender and mutual fund type.

3. Can I apply for a loan against mutual funds online?

Yes, most lenders offer a loan against a mutual fund online application for quick processing.

4. What happens if I fail to repay the loan?

The lender may sell the pledged mutual fund units to recover the outstanding amount.

5. How much loan can I get against my mutual funds?

Loan amount depends on the Loan-to-Value (LTV) ratio, which varies between 50-80% of the mutual fund value.

Conclusion: Should You Take a Loan Against Mutual Funds?

A loan against mutual funds can be a safe and cost-effective financing option if used responsibly. It offers quick liquidity, low interest rates, and continued investment growth. However, borrowers must be mindful of market fluctuations and repayment terms to avoid financial risks.

Best For: Investors needing short-term liquidity without disturbing their portfolio. Avoid If: You cannot handle market volatility or lack repayment discipline.

By understanding the loan against mutual funds process, risks, and benefits, you can make a well-informed decision and utilize this financing tool effectively!

#Loan Against Mutual Funds Process#Loan Against Mutual Funds Features#Loan Against Mutual Funds Benefits#Loan Against Mutual Funds Risks#Loan Against Mutual Funds vs Personal Loan#Mutual Fund Loan Process#Pledge Mutual Funds for Loan#Loan Against Securities#Overdraft Against Mutual Funds#Loan Against Mutual Funds Online Application##Loan Against Mutual Funds Eligibility Criteria#Loan Against Mutual Funds Documentation

0 notes