#udyog registration

Explore tagged Tumblr posts

Text

UdyogAadhar:StrengtheningSupplyChainResilience

We are living in a volatile business environment in which supply chain resilience has turned out to be a critical factor for your sustainability and success. As disruptions become unpredictable and frequent, you might be seeking ways to fortify your supply chains against unforeseen challenges.

Well, one such avenue for you is to leverage the Udyog Aadhar Registration system to bolster supply chain resilience. Get ready to explore this blog, as we are going to talk about how Udyog Aadhar plays a pivotal role in fortifying supply chains and empowering businesses.

What is Udyog Aadhar?

Udyog Aadhar is one of the government initiatives that was introduced to simplify the registration process for MSMEs present in India. If you're an eligible business, then it can provide you with a unique identification number. Such kind of registration is voluntary and mainly aims to streamline various processes. Generally, it comprises avail subsidies, benefits, and support schemes provided by the government.

Benefit of Udyog Aadhar

1) Access to Financial Support

During turbulent times, supply chain resilience hinges on access to capital and financial stability. Udyog Aadhar Registration can open your doors to a range of financial support schemes that are chiefly tailored for MSMEs. If you're a registered business, you can leverage resources like loans, grants, or subsidies. Thus, you can invest in technology, build contingency plans for disruptions, and strengthen your supply chains.

2) Facilitate Technology Adoption

Technology plays a crucial role in enhancing supply chain resilience as it enables agile responses to disruptions, data-driven decision-making, and real-time monitoring. The registration can facilitate technology adoption by connecting you with initiatives promoting innovation and digitalization. It comprises subsidies to adopt digital payment solutions, integrate supply chain management software, and implement ERP systems.

3) Build Capacities for Risk Management

When it comes to supply chain resilience, risk management is integral. Udyog Aadhar can encourage you to prioritize such aspects of business operations. You can build capacities for contingency planning, mitigation, and risk assessment just by participating in government-sponsored workshops, skill development initiatives, and training programs. Such a proactive approach provides you equip with the knowledge and tools to navigate uncertainties and safeguard your supply chains.

4) Streamline Documentation and Compliance

Udyog Aadhar plays a chief role in streamlining documentation and compliance procedures for your enterprise. So, your business can easily access government initiatives and fulfill regulatory requirements without any kind of extensive paperwork hassle. Such simplification will enable you to focus on enhancing operational efficiency and resilience.

5) Enhanced Market Opportunities

Another aspect of supply chain resilience is to diversify market opportunities to reduce dependency on single revenue streams. Udyog Aadhar comes with visibility to enterprises, which can make it easier to let you participate in government procurement processes, collaborate with larger enterprises, and access global markets. Thus, it can be said that such expanded market avenues can contribute to an adaptable and resilient supply chain ecosystem.

6) Promote Networking and Collaboration

Networking and collaboration within the business ecosystem are considered instrumental in building resilience against supply chain disruptions. With the registration, collaboration can be fostered as it provides a platform for networking and knowledge sharing. It would be easier for you to forge partnerships, collectively address challenges, and exchange best practices linked to supply chain resilience. This is possible through trade fairs, online forums, and industry associations.

Conclusion

In an era where there is a boost in uncertainties and disruptions, supply chain resilience has turned into a strategic imperative for your business. So, you can leverage the benefits of Udyog Aadhar Registration to fortify your supply chains and thrive in the face of evolving challenges.

0 notes

Text

youtube

#udyog aadhar#udyam registration#print udyam certificate#udyog registration#udyam certificate#Youtube

0 notes

Text

Streamline Your Business with Udyog Aadhar Registration

Discover the benefits of Udyog Aadhar Registration, a simplified and hassle-free process for small and medium-sized enterprises (SMEs) in India. This unique identifier not only helps you access various government incentives and schemes but also enables you to grow and expand your business with ease. Learn how to get registered and unlock a world of opportunities for your enterprise.

1 note

·

View note

Text

A guide to enhance your business growth

Running a business is akin to navigating a complex maze, and every entrepreneur dreams of not just surviving but thriving. In the Indian business landscape, the government has laid out a golden path for micro, small, and medium enterprises (MSMEs) through a simple yet powerful tool – MSME registration. In this guide, let's explore how this seemingly mundane registration process can be your ticket to unparalleled business growth.

Understanding the MSME Advantage

The Heartbeat of the Economy:

Micro, Small, and Medium Enterprises collectively form the heartbeat of the Indian economy. From local grocery stores to innovative startups, these businesses contribute not only to economic development but also to job creation, fostering a robust and inclusive growth environment.

Unlocking Financial Avenues:

One of the immediate perks of MSME registration is the access to financial assistance and credit facilities. Financial institutions offer tailored loans at favorable terms, recognizing the importance of these enterprises in driving economic progress.

The MSME Registration Journey

A Simpler Path Than You Think:

Contrary to popular belief, the MSME registration process is not a bureaucratic labyrinth. It's a straightforward journey that involves providing essential details about your business, such as PAN, Aadhaar, and other relevant information. Whether you choose the online portal or opt for the traditional route at District Industries Centres, the process is designed to be accessible.

Documents: Your Passport to Opportunities:

The importance of documentation in the registration process cannot be overstated. Your Aadhaar card, PAN card, business address proof, and details of your plant and machinery are the keys that unlock the door to a myriad of government schemes and subsidies.

The MSME Advantage Unveiled

Market Access and Procurement Preferences:

Once you've acquired your MSME registration, you find yourself in a prime position in government procurement. MSMEs are often given preference in government tenders, providing a golden opportunity to secure contracts and expand your market reach.

Technology Upgradation and Subsidies:

In the rapidly evolving business landscape, technology is the differentiator. MSME registration brings with it the chance to upgrade your technology with subsidies for adopting new and advanced processes. This not only boosts efficiency but also enhances your competitiveness.

Navigating the Schemes and Subsidies Landscape

Credit Linked Capital Subsidy Scheme (CLCSS):

At the forefront of government schemes is CLCSS, a game-changer for technology upgradation. It provides capital subsidies to MSMEs, facilitating access to credit for purchasing new machinery and equipment.

Pradhan Mantri Employment Generation Programme (PMEGP):

For those looking to embark on the entrepreneurial journey, PMEGP is the beacon. This credit-linked subsidy program promotes self-employment, creating not just businesses but livelihoods.

Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGMSE):

The fear of collateral is a common hurdle for many small businesses. CGMSE eliminates this barrier by offering collateral-free credit facilities, making it easier for MSMEs to access the capital needed for growth.

Tailoring Your Approach

District Industries Centres (DIC) and National Small Industries Corporation (NSIC):

Think of DIC and NSIC as your business allies. DIC, as a local agency, offers guidance and support, while NSIC provides a range of services from marketing assistance to credit facilitation. Engaging with these institutions can significantly enhance your MSME journey.

Tech and Quality Upgradation Support:

The government's emphasis on quality is evident through schemes like Lean Manufacturing Competitiveness Scheme (LMCS) and Quality Management Standards & Quality Technology Tools (QMS/QTT). These initiatives not only boost competitiveness but also position your business as a paragon of quality in the market.

Export Promotion and Market Development:

Venturing into global markets can seem daunting, but the Market Development Assistance Scheme for MSMEs is a trustworthy companion. It provides financial support for participating in international trade fairs, opening doors to new business horizons.

Overcoming Challenges for Seamless Growth

Lack of Awareness:

One of the challenges MSMEs often face is the lack of awareness about available schemes. Entrepreneurs can overcome this by actively seeking information through government portals, industry associations, and local MSME support cells.

Complex Application Processes:

Cumbersome application procedures can be discouraging, but persistence pays off. Simplifying the application process and seeking assistance from dedicated facilitation services or MSME support agencies can make the journey smoother.

Continuous Evaluation and Adaptation

Performance and Credit Rating Scheme:

Enhancing your creditworthiness is an ongoing process. The Performance and Credit Rating Scheme allows MSMEs to undergo assessments, showcasing financial stability to potential investors and lenders.

Embracing Continuous Improvement:

The business landscape is dynamic, and your approach should be too. Regularly assess the impact of government schemes on your operations, adapt to changes, and stay informed about updates to maximize benefits continually.

Conclusion: Your Journey to Unprecedented Growth

In conclusion, MSME registration in India is not just a formality; it's your gateway to a realm of opportunities. By understanding the classifications, embracing government schemes, and overcoming challenges, you position your business for sustainable growth. The government's commitment to fostering MSMEs is a testament to the integral role these enterprises play in shaping the nation's economic future. So, don't just register – embark on a journey of growth, innovation, and success. The path is laid; it's time to walk it.

Learn more at : https://msme-registration.in/

#udyog aadhar free registration#msme free registration#msme registration free#print udyam certificate#free udyog aadhar registration#udyog aadhar update#msme registration online#msme loan#online business#msme

2 notes

·

View notes

Text

How Udyog Aadhar Enhances Access to Government Schemes and Subsidies

Take a look at the dynamic landscape of our Indian entrepreneurship, you'll notice that SMEs play a major role in driving economic growth. Such enterprises faced several challenges, which were recognized by the Government of India, which later came up with Udyog Aadhar registration.

It turned out to be a game-changer which can simplify the registration process and boost access to a range of government subsidies and schemes. Keep reading to learn how Udyog Aadhar provides streamlined access to essential support for empowering businesses and fostering their growth.

What is Udyog Aadhar?

Udyog Aadhar can be described as a unique identification number that is assigned to medium, small, and micro-sized enterprises present in India. The Ministry of MSME launched this initiative to streamline the regulatory framework for small enterprises and promote ease of doing business. Among the several advantages, the primary one is its role in facilitating access to government subsidies and schemes.

Ways Udyog Aadhar Enhances Access to Government Schemes and Subsidies

1) Simplified Registration Process

Udyog Aadhar can enhance access to government schemes and subsidies just by streamlining the registration process for MSMEs. When you register through Udyog Aadhar, it can turn into a simplified online procedure because bureaucratic hurdles can be reduced by businesses. Such simplicity encourages more enterprises to register and thus, expand the beneficiary pool related to government initiatives.

2) Access to Credit Facilities

With the Udyog Aadhar registration, you can get easier access to credit facilities for MSMEs. Several government schemes aim to provide financial support to small businesses out there. Even the registration process aids financial institutions to swiftly identify eligible enterprises. This will ensure that MSMEs can secure the vital capital for growth and contribute to the economic development of their region.

3) Targeted Outreach

The government can easily conduct targeted outreach to MSMEs, which tailors the specific schemes and subsidies as per requirements. During registration, detailed information is collected, which can aid authorities in understanding the scale, location, and sector of the enterprise. This enables an effective and nuanced approach to design and implement a range of support programs.

4) Customized Subsidies and Incentives

Udyog Aadhar comes with a wealth of data on MSMEs as it allows the government to design and implement incentives and subsidies that can be tailored as per specific requirements and challenges being faced by distinctive businesses. Such customization ensures that the provided support is impactful and directly addresses the areas where the assistant is a must. It doesn't matter if it's skill development, infrastructure improvement, or technology adoption, the government can align its resources with the diverse needs of registered MSMEs.

5) Priority in Government Procurements

If your enterprise is registered under Udyog Aadhar, then it can receive preferential treatment in terms of government procurements. Government agencies are having specific preferences or quotas for sourcing services and goods from MSMEs, which can give registered businesses a competitive edge. Such preferential treatment comes with new avenues for MSMEs to boost their revenue, encourage sustainable business practices, and secure contracts.

6) Efficient Disbursement of Benefits

It enables a more efficient disbursement of benefits by reducing paperwork and eliminating redundant processes. The registration system's digital nature can ensure that information is accessible easily, and minimize the time taken for approval of applications and verification. Such efficiency is vital in reducing delays, timely delivery of subsidies, and ensuring that support is received when MSMEs need it most.

Conclusion

From unlocking the doors linked to government schemes and subsidies to simplifying registration procedures, Udyog Aadhar arranges a melody of empowerment. Now, it's evident that such unique identification will streamline the process. Also, it symbolizes a commitment to foster a business ecosystem where there is a chance to flourish for every entrepreneur.

1 note

·

View note

Text

Udyog Aadhaar to Udyam Registration: Everything MSMEs Need to Know in 2025

India's Micro, Small, and Medium Enterprises (MSMEs) are the foundation of its economic progress. With evolving policies and digital reforms, the government continues to support small businesses through simplified registration and subsidy frameworks. One of the most important milestones in this journey was the transition from Udyog Aadhar to the now widely used Udyam Registration system.

In this blog, we will cover the latest updates on Udyog Aadhar, its migration to Udyam Aadhar, and how businesses can register quickly and easily in 2025.

🔍 What Was Udyog Aadhar?

Introduced in 2015 by the Ministry of MSME, Udyog Aadhaar was a simplified registration process for small businesses. It provided an identity to MSMEs and allowed them to avail of government benefits like subsidies, schemes, and easier credit access.

However, with technological advancements and a need for tighter integration with other government databases (like PAN, GST, and Income Tax), Udyog Aadhaar was phased out in 2020, and replaced by a more transparent and automated system: Udyam Registration.

🔄 Why Udyog Aadhaar Holders Must Upgrade to Udyam Aadhar in 2025

If your business was registered under Udyog Aadhaar, it's essential to migrate to Udyam Registration as per the latest MSME norms. The government has made it mandatory for all Udyog Aadhaar holders to transition to the new system to continue receiving MSME benefits.

✅ Don’t worry — the migration is seamless, and you can upgrade your registration through udyog-aadhar.com, the trusted platform for MSME services.

🧾 Benefits of Udyam Registration Over Udyog Aadhaar

Here’s why thousands of businesses are choosing udyam aadhar today:

PAN and GST-Linked Verification: Ensures authenticity and eliminates fraud.

Real-time Certificate Generation: Get your Udyam certificate instantly.

Auto-Inclusion in Government Schemes: From Mudra loans to credit guarantees.

No Physical Documents Required: Entirely paperless and Aadhaar-based.

To learn more about the benefits, visit our udyam registration page.

📌 How to Migrate Udyog Aadhaar to Udyam Aadhar

Here’s a quick step-by-step guide to update your old registration:

Visit the Udyog Aadhaar to Udyam Migration Page

Enter your existing Udyog Aadhaar number and Aadhaar-linked mobile.

Verify OTP and fill out updated PAN/GST/business details.

Submit and receive your Udyam Aadhar Certificate in your email.

Note: You can also update or edit your Udyam registration details here.

🧾 Documents Required for Udyam Registration

Minimal documentation is needed:

Aadhaar Number of the business owner

PAN Card

GST Number (if applicable)

Basic business information like activity, turnover, and investment

Everything is verified automatically—no upload needed!

🛠️ Services Offered on Udyog-Aadhar.com

At Udyog-Aadhar.com, we provide MSMEs with fast and reliable services, including:

✅ New Udyam Registration

🔄 Migrate Udyog Aadhaar to Udyam Aadhar

✏️ Edit or Update Udyam Certificate

📩 Download Udyam Certificate

📞 MSME Consultancy Support for all your registration queries

❓FAQs About Udyog Aadhaar and Udyam Registration

Q1. Is Udyog Aadhaar still valid in 2025? A1: No, Udyog Aadhaar is now deprecated. All businesses must register or migrate to Udyam Aadhar.

Q2. Can I update my Udyog Aadhaar details? A2: No, you need to migrate to Udyam Aadhar to update any details.

Q3. How long does Udyam registration take? A3: The entire process takes just a few minutes, and the certificate is sent to your registered email instantly.

Q4. Do I need GST to apply? A4: GST is required for medium enterprises, but micro and small enterprises can register without it, depending on turnover.

📝 Final Thoughts

The shift from Udyog Aadhaar to Udyam Registration reflects India's digital push toward a more transparent and growth-oriented MSME ecosystem. Don’t let outdated registrations hold your business back in 2025.

Whether you're registering for the first time or upgrading your existing details, Udyog-Aadhar.com is your one-stop solution for hassle-free MSME support.

#udyog aadhar#aadhar udyog#udyog aadhar registration#udyog aadhar certificate#udyog aadhaar#udyog aadhar register

0 notes

Text

How Udyog Aadhaar Transformed These Businesses

Udyog Aadhaar has helped transform businesses by providing a unique identity, making it easier to access loans, subsidies, and government schemes. The online registration is quick and requires minimal paperwork, giving businesses a fast start. It also offers priority in government tenders, creating more growth opportunities. Overall, it adds credibility, improves support access, and simplifies the journey for small and medium enterprises.

Url: https://eudyogaadhaar.org

#Udyog Aadhaar#MSME registration#Benefits of Udyog Aadhaar for small businesses#How to register under Udyog Aadhaar

0 notes

Text

Udyam Annexure : A Roadmap to MSMEs Growth and Compliance

Micro, small, and medium-scale industries (MSMEs) are the other engines of the economy and play a crucial role in the economic growth of India. MSMEs cannot avail themselves of the different tax concessions and incentives offered by the government to help them run their businesses successfully because they lack information about many things that are provided after completion of Udyam registration.

MSMEs can better utilise all government incentives and restart their enterprises by adhering to all compliance requirements after the Udyam Annexure is put into effect. Following the implementation of the Udyam Annexure, MSMEs can better use all government incentives and get their businesses back on track by complying with all compliance requirements.

MSME owners need to comprehend the Udyam Annexure and its function in Udyam Certificate registration, compliance, and expansion. Everything you need to know, such as how to download your Udyam Annexure Certificate and its significance, will be covered in this post.

Udyam Annexure: What is it?

The Udyam Registration Certificate goes along with an official document called the Udyam Annexure. It offers important information about an MSME, such as:

Business Information (Name, Address, and Business Type)

MSMEs' Unique Identifier or UAM Number

Information on Investment and Turnover

NIC Codes (Business Activity Type)

Information about imports and exports (if appropriate)

Additional Important

Compliance Information

This annexure acts as a guide for MSMEs, guaranteeing adherence to governmental regulations while assisting them in obtaining funding, incentives, and market prospects.

How to get Udyam Annexure Certificate

By getting a Udyam Annexure Certificate, you can get a lot of benefits. One of them is that your loan approval will be at a faster rate, so getting a Udyam Annexure Certificate is necessary for MSME. Follow the steps given by us and get your Udyam Annexure Certificate.

Step 1: First of all, go to Udyam Online Registration Portal

Step 2: After the home page opens, you will see the Udyam Annexure Certificate section in the navigation bar of your screen; click there

Step 3: Udyam Annexure Online Form will be visible on your screen, fill it correctly, such as

In personal information

Applicant's name

Mobile number

Email ID

Udyam Registration Number

Please note that you have given the same mobile number and email ID at the time of Udyam registration.

Step 4: Choose the option in which you want OTP, like choosing one of the two mobile numbers and email ID, but keep in mind that your OTP will come in the mobile number and email ID mentioned in your certificate.

Step 5: Enter the verification code appearing on the screen in the box given below.

Step 6: Tick mark the box of Terms of Service and tick mark the box of Declaration.

Step 7 Finally,, click on Submit Information

After this, you will reach directly our payment gate. After paying some charges, you will get an OTP on your number for verification. Enter that OTP and verify it. After this, you will be able to download your Udyam Annexure Certificate.

Udyam Annexure's Significance for MSMEs

1. Compliance & Legal Recognition

MSMEs are granted legal recognition through the Udyog Aadhar and Udyam certificates.

Compliance with government regulations is further confirmed by the Udyam Annexure.

2. Obtaining Government Benefits

Companies that have the annexure and are registered under Udyam are eligible for tax breaks, subsidies, and quick loan approvals.

3. Simpler Loans & Financial Assistance

To authorise credit plans and loans without collateral, financial institutions need the Udyam Annexure and the MSME Certificate Registration.

4. Improved Tender and Market Opportunities

MSMEs can take part in government bids and receive preference in procurement policies if they have valid Udyam Certificates and annexures.

5. Needs for GST and Other Compliance

For MSMEs to be eligible for tax incentives and to file for GST, the Aadhar Udyog Registration and Annexure are essential.

Typical Problems and Fixes for Udyam Registration and Annexure Download:

Is your Udyam registration number missing?

Click "Forgot Udyam Number" after visiting the Udyam portal. To get it, enter your registered email address or mobile number and confirm the OTP.

Unable to download the Annexure or Udyam Certificate?

Make sure your registration information is accurate. Verify whether your MSME is still registered with Udyam. For technical assistance, call the Udyami Helpline.

Udyog Aadhar Registration Error?

To prevent compliance problems, update your information on the Udyam site if there are inconsistencies in your Udyog Aadhar.

Why Should MSMEs Update Their Registration on Udyam?

MSMEs need to make sure their information in the Udyam system is current due to evolving policies. Updating is beneficial:

Continue to qualify for MSME advantages.

Continue to comply with taxes

Ensure that business operations run smoothly.

It's time to update your registration if you haven't already switched from Udyog Aadhar to Udyam to prevent losing out on government advantages.

In summary

One of the most important documents that help MSMEs stay in compliance and grow their businesses with government support is the Udyam Annexure. Ensuring you have your Udyam Certificate PDF, Udyam Aadhar Download, and Udyog Aadhar Certificate readily available is paramount for smooth operations, whether you are registering for the first time or modifying your data. You can protect the future of your business and gain multiple financial and legal benefits by getting the proper MSME Online Registration, Udyam Certificate Registration, and Aadhar Udyog Registration procedures done.

Take a step towards company success by downloading your Udyam Certificate and annexure now if you haven't already!

0 notes

Text

Udyog Aadhar Registration: Its Benefits and How Supports MSMEs

Introduction

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of India’s economy, contributing significantly to employment, innovation, and GDP growth. However, MSMEs often face challenges such as limited access to capital, difficulties in complying with government regulations, and a lack of visibility. To address these issues, the government introduced the Udyog Aadhar Registration, which was later replaced by the more robust Udyam Registration in 2020. Nevertheless, understanding the benefits of Udyog Aadhar is essential for businesses that were registered earlier or are in the process of transitioning.

What is Udyog Aadhar?

Udyog Aadhar was introduced by the Government of India in 2015 to simplify the process of MSME registration and provide businesses with access to various government benefits. The idea was to create a centralized platform for MSMEs to register and avail themselves of government schemes and services that would help them grow and thrive. This initiative was aimed at empowering small businesses and ensuring their inclusion in the formal economy.

Key Benefits of Udyog Aadhar Registration

1. Access to Government Schemes and Subsidies

One of the most significant advantages of registering under Udyog Aadhar is that it provides MSMEs with access to various government schemes and subsidies. The Indian government has launched numerous schemes to support MSMEs in areas like finance, technology, marketing, and infrastructure development. By registering under Udyog Aadhar, small businesses become eligible for these programs, which help in their growth and sustainability.

Some of the notable schemes for which MSMEs can benefit include:

Credit Guarantee Fund Scheme (CGS): Provides collateral-free loans to MSMEs.

PMEGP (Prime Minister’s Employment Generation Programme): Financial assistance to create new micro-enterprises.

MUDRA Scheme: Funding for small businesses under the Micro Units Development and Refinance Agency (MUDRA) to help them grow.

2. Ease of Doing Business

Before Udyog Aadhar, MSMEs had to deal with a complex and bureaucratic registration process to avail themselves of various government benefits. Udyog Aadhar simplified this process, making it easier for small businesses to formally register. The online registration process is free of cost and requires minimal documentation. It is a one-time procedure that provides businesses with a unique Udyog Aadhar Number as proof of their registration.

3. Tax Benefits

Exemption from Income Tax: Certain MSMEs that fall under the micro and small categories are eligible for income tax exemptions under specific government schemes.

GST Registration Exemptions: MSMEs with an annual turnover below a certain threshold may be exempt from Goods and Services Tax (GST) registration, thereby reducing their compliance burden.

4. Access to Credit and Financial Support

Small businesses often face challenges in obtaining credit due to a lack of formal documentation and recognition. Udyog Aadhar registration helps MSMEs gain access to easier financing options by providing them with recognition and credibility. Once registered, small businesses become eligible for a variety of financial benefits, such as:

Lower Interest Rates on Loans: Registered MSMEs can avail of loans at lower interest rates from various banks and financial institutions. The Credit Guarantee Fund Scheme (CGS) provides collateral-free loans to MSMEs, making it easier for them to access working capital and business expansion funds.

MUDRA Loans: Udyog Aadhar-registered MSMEs can apply for MUDRA loans, which provide financial support to micro-enterprises for working capital and development purposes.

Government-backed Financial Programs: With Udyog Aadhar registration, MSMEs can apply for various government-backed financial schemes, increasing their access to funding for innovation, expansion, and modernization.

5. Credibility and Recognition

Udyog Aadhar registration offers MSMEs recognition and credibility, which are crucial for gaining the trust of customers, partners, and investors. A registered MSME is recognized as a legitimate business entity, and this formal acknowledgment often makes it easier to establish relationships with other businesses and government bodies.

6. Protection Against Delayed Payments

One of the significant challenges faced by MSMEs is delayed payments from clients, particularly in the case of government contracts or dealings with large corporations. Udyog Aadhar registration provides small businesses with a legal framework to protect themselves from such issues. The registration empowers MSMEs to file complaints and seek redressal in cases where payments are delayed, improving cash flow management for small businesses.

7. Concession in Export Benefits

Udyog Aadhar registration also helps MSMEs looking to expand into the global market. Registered MSMEs can benefit from export incentives and schemes offered by the government, which include:

Export Credit: MSMEs can avail of export credit facilities to finance the cost of goods, making it easier for them to trade internationally.

Market Development Assistance: Government programs aimed at helping MSMEs explore and penetrate foreign markets.

8. Easy Transition to Udyam Registration

For businesses that are registered under Udyog Aadhar, transitioning to the new Udyam Registration system is easy. The process involves updating your details on the Udyam portal and obtaining an updated registration certificate. This allows businesses to continue enjoying all the benefits associated with the new system, such as access to better financial schemes and enhanced government support.

Note: Print Udyam Certificate in just a few steps.

Conclusion

Udyog Aadhar registration has proven to be an invaluable tool for MSMEs in India. It simplifies the registration process, facilitates access to government schemes, enhances credibility, and provides tax benefits—all of which are essential for small businesses looking to scale up. Whether it’s accessing funding options, benefiting from subsidies, or participating in government tenders, Udyog Aadhar registration plays a critical role in leveling the playing field for micro, small, and medium enterprises. As the government continues to support MSMEs through various initiatives, Udyog Aadhar remains a cornerstone of India’s efforts to empower small businesses. Though Udyog Aadhar has now been replaced by Udyam Registration for new businesses, registered businesses need to understand its historical significance and the foundation it laid for MSME empowerment.

0 notes

Text

Eligibility Criteria for Udyam Registration in Madhya Pradesh

Business Classification Based on Investment and Turnover:

Micro Enterprises: Investment up to ₹1 crore and turnover up to ₹5 crore.

Small Enterprises: Investment up to ₹10 crore and turnover up to ₹50 crore.

Medium Enterprises: Investment up to ₹50 crore and turnover up to ₹250 crore.

Who Can Apply for Udyam Registration in Madhya Pradesh:

Proprietors, Hindu Undivided Families (HUFs), and Partnership Firms.

Limited Liability Partnerships (LLPs), Private Limited Companies, and Public Limited Companies.

Co-operative Societies and other registered entities involved in manufacturing or providing services in Madhya Pradesh.

Eligible Activities:

Only businesses engaged in manufacturing, production, processing, or providing services qualify.

Trading businesses or retail activities are not eligible for Udyam registration in Madhya Pradesh.

Required Documents in Madhya Pradesh:

Aadhaar Card of the business owner or authorized signatory.

PAN Card and GSTIN (if applicable).

Bank Account Details (account number and IFSC code).

Important Points:

The investment and turnover details provided during registration must align with the business’s Income Tax Returns (ITR) and GST filings.

Any change in the business category (e.g., from Micro to Small) must be updated in the Udyam registration.

Udyam registration in Madhya Pradesh helps businesses avail government schemes, financial support, and tax benefits designed to support MSMEs in the state.

#udyam certificate#udyam registration#udyam registration online#udyam license#udyam registration process#udyog aadhar#In Madhya Pradesh

0 notes

Text

Guide to Financial Benefits of Udyam Registration for Small Business Owners

The Indian economy is a small business sector. The government takes several initiatives to encourage the growth of such small businesses. One of the most significant initiatives in this regard is Udyam Registration, which brings considerable financial and regulatory benefits to the small and medium business segments. In this regard, this article explains the financial advantages, compliance tips, and how to make Udyam Registration boost success for your business.

Financial Gains from Udyam Registration of Small Business:

Loans on Collateral-Free Credit from the government is extended to the MSME through the financial institutions under the Credit Guarantee Fund Scheme where the loan to MSMEs is not bound with personal and business assets.

Loan at Subsidized Interest The loan advanced by the government to Udyam registered business can get it on reduced interest; thus it helps in saving the interest on the loan and aids the company in liquidity management

Government Tenders The government tenders prefer the Udyam-registered businesses of the small enterprise. Categories and EMD exemptions create a level playing field for MSMEs.

Tax Concessions and Refunds The following tax concessions are available for the Udyam Registered business:

Exemptions under the Direct Tax Laws.

GST benefits, which can be a bonanza for cash-starved small businesses.

Subsidy and Incentive Eligibility Subsidies are available for the business for technological upgradation, ISO certifications, and digital marketing expenses. These schemes provide efficiency and competitiveness.

Low Fees for IP Protection MSMEs get low fees for filing trademarks and patents so that they can protect their intellectual property without any burden on their pocket. Compliance Tips for Udyam Registration: To get the best out of Udyam Registration, owners of small businesses have to fulfill the requirements placed by the government.

Keeping Proper Books of Accounts and Investment in Plant, Machinery, or Equipment Keeping proper books of accounts and investments in plant, machinery, or equipment is to be recorded because all such details are needed at the time of registration as well as every year.

PAN and GST Udyam registration has a linkage with your Aadhaar but when the business crosses the limit, PAN and GSTIN are to be mentioned.

Update the Information in Time Any investment change, turnover, or business category micro, small, or medium has to be updated on the Udyam portal to avoid penalty or suspension of benefits.

Periodic Eligibility Review MSMEs must examine their financial parameters which should fall in the criteria for MSME classification for availing the scheme. Small Businesses: Why is Udyam Registration Essential for Small Businesses Being Udyam Registered is not only a legalistic technicality but one step for growth because it gives small business undertakings their lifeline in terms of market opportunities and financial advantages. It helps entrepreneurs not lose the battle against increasing market competition by saving them both money and profit improvement or enlargement of operations. These small and medium-sized enterprises will be the backbone of India's economic development in the changing Indian business scenario. They add significantly to employment and GDP in India. Generally, the operations of such businesses are marred by finance, cumbersome compliance procedures, and aggressive competition. It was a game-changer for the initiative of the Udyam Registration taken up by the Indian government. Besides merely registering them, it gives them many financial, operational, and competitive benefits. Important Reasons Why Udyam Registration is Important

Credit Facilitation Finance is the lifeline of small businesses, yet a majority are unable to get it as they don't have security or even any formal proof. It has addressed problems of:

Access to credit guarantee without collateral through (CGTMSE).

That interest paid towards loans further decreases the cost.

Institutional recognition provides substantial credit history to businesses

Subsidy and Incentive Eligibility The government interventions for registered MSMEs under the scheme are mentioned below:

TUFS: Technology upgradation and infrastructural development

Provision of subsidies to make available ISO certification, quality enhancement, and energy-efficient technology

Export promotion incentive packages with an aim toward higher international access Such subsidies keep businesses updated in terms of competition while decreasing operational costs.

Government Procurement simplicity Government contracts are an excellent business opportunity for small businesses; however, the terms of tender discourage it. Udyam Registration removes such barriers in the following ways:

Only certain categories of government tenders are limited and available only to MSMEs.

The provision does away with EMD and offers preference. Such provision democratizes public sector project access and increases the scope of revenue generation.

Tax and Regulatory Advantage Taxation is a big issue for small-scale firms. Udyam-registered business enjoys the following tax advantages:

Exemption of income tax on some activities of the business

Relaxation in GST compliance for eligible businesses, saving the cost of administration These benefits make planning easier and free up resources to grow. Conclusion: Note that the financial benefits of Udyam Registration help small business entrepreneurs increase profit-making yet remain compliant. For the most part, it has been easy, and the rewards range from tax-exempted services to government tender services. Once your register is under Udyam along with keeping your compliance correct, you open your enterprise to a whole world of opportunities. Now start your Udyam Registration and begin moving forward on the road of financial empowerment and business success.

0 notes

Text

0 notes

Text

Advantages of Udyam Registration for Small Businesses

Introduction:

Many small businesses, especially in India, are found to be under the Udyam Registration category. This registration is a pre-requisite for all MSMEs, especially Micro, Small, and Medium Enterprises. All in all, it can only be said that Udyam Registration opens up a floodgate of government-funded financial benefits and more opportunities for business expansion for the entrepreneur. So let's break them down on why it might just be the boost your business needs.

Registration is equivalent to the little identity card provided by the government under the MSME Development Act, 2006, to small businesses. It is a recognition of your business in official books as a micro, small, or medium enterprise based on investment and turnover.

Why is it so important? After this registration, you get more ease of accessing loan benefits, subsidies, tax benefits, and much more. In case one is an entrepreneur or small business or startup, then this is the golden ticket for unlocking aid by the government.

Benefits of Udyam Registration- Small-scale Businesses:

1. Increased Access to Government Schemes:

Since you are registered under Udyam, you'll be eligible for a variety of government schemes uniquely designed to help MSME grow. You'll get subsidies for patent registration, financial aid for upgrading technology, and even for the promotion of industry.

Best part? All these programs are designed for your business to enhance your competitive and innovative capability with less pecuniary pressures.

2. Greater Access to Finance:

If you ever found yourself in such a difficult loan, then it is okay because there have been so many small business proprietors who have faced problems related to raising funds. Udyam Registration has changed everything. With the Udyam, banks, and other financial institutions provide collateral-free loans for all such registered businesses. Furthermore, the interest rates are reduced. That can be a relief when you need to raise a lot of cash to expand, hire more staff, or buy new equipment.

3. Tax Benefits:

Of course, saving on taxes is a big deal with any business, more so for small businesses. Udyam Registration brings its exemption from tax that could lighten the load further. If you happen to be the kind of business that this is, then you are likely eligible for exemptions from direct tax and excise duties. So, that would mean more money in your pocket to reinvest in the business.

4. Protection against delayed payments:

Delayed payment by clients is one of the toughest challenges a small business faces. It messes up your cash flow and financial strain on you. You are in luck since businesses registered under Udyam have law protection under the MSME Act. In case the buyer delays his payment, he is liable to pay interest on it.

5. Priority in Government Tenders:

For that, you also get a bonus benefit: The government often keeps some contracts and tenders exclusively for MSMEs. And if you are a Udyam-registered business, you would enjoy an upper hand in the tenders' bidding process for these specific government tenders. It will provide you with considerable revenue growth, assuming that the primary target market is mostly government contracting parties.

“Documents Needed for Udyam Registration”

The good news? Udyam Registration is free and entirely online. Here's what you would require:

Aadhaar Number- tied to the business owner.

PAN Card- tied to the business owner.

Basic details about the business, including investment and turnover information.

It's pretty much a streamlined process, and you can follow it just by filling out a few forms on the official Udyam Registration Portal.

Conclusion:

Moreover, for small businesses and MSMEs, registration under Udyam is mandatory for growth and securing benefits from government aid. There are countless reasons why registration under Udyam is important for ease of access to finance to safeguarding against delayed payments. If you have a small business and haven't yet registered, now it's time to do the same and enjoy all these great opportunities.

#aadhar udyog#aadhar udyog registration#udyam certificate registration#udyog aadhar certificate#msme certificate registration#msme online registration#aadhar udyam

0 notes

Text

Key Documents Required for Udyog Aadhaar Registration

While the Udyog Aadhaar registration process is paperless and can be completed online, certain information and documents are mandatory. Below are the key documents and details you’ll need:

Aadhaar Card: The Aadhaar Card is the most critical document needed for Udyog Aadhaar registration. The registration process is Aadhaar-based, and it must be linked to the business owner’s name. Ensure that your mobile number is linked to your Aadhaar for OTP verification.

PAN Card: The PAN (Permanent Account Number) Card of the business owner or the business entity is another vital document. It is necessary to verify tax details and for financial record maintenance.

Business Details: While not a document, you will need to provide certain key business details during the registration process:

Type of Organization (e.g., Proprietorship, Partnership, LLP, Private Limited Company, etc.)

Business Name

Date of Commencement of the business

Bank Account Details (including the account number and IFSC code)

Social Category Certificate: If you belong to any special categories like SC, ST, or OBC, you may need to provide relevant certificates to avail of additional benefits offered by the government.

GST Number (if applicable): Although GST registration is not mandatory for Udyog Aadhaar, if your business is already registered under GST, you should provide your GSTIN.

Additional Information: Apart from the primary documents, you may also need to provide details like:

Number of employees in your business

Investment in plant and machinery/equipment (for manufacturing and service businesses respectively)

Steps to Register for Udyog Aadhaar

The registration process is straightforward and can be done online via the official Udyam Registration portal. Here’s a quick rundown of the steps involved:

Visit the Udyam Registration Portal: Go to the official government portal for Udyam Registration.

Enter Aadhaar Details: Provide your Aadhaar number and name as per the Aadhaar card.

OTP Verification: An OTP will be sent to your registered mobile number linked with Aadhaar.

Enter Business Information: Fill in the required business and personal details as mentioned above.

Submit and Register: After filling in all the information, submit the form. A confirmation message and a unique Udyog Aadhaar number will be generated.

Benefits of Udyog Aadhaar Registration

Once registered, your business can avail of several government schemes, including:

Easy access to bank loans at lower interest rates

Eligibility for various subsidies and incentives

Preference in government tenders

Credit Guarantee Scheme benefits

Protection against delayed payments

Conclusion

Registering for Udyog Aadhaar (Udyam) is an important step for small businesses looking to formalize their operations and unlock numerous government benefits. With the above-mentioned key documents in hand, the registration process is simple and can be completed online in a few easy steps.

Make sure your Aadhaar and other details are up-to-date and accurate to avoid any issues during registration. Taking this step not only legitimizes your business but also opens up a world of opportunities and support from the government.

0 notes

Text

Post Udyam Registration Compliance for Registered Udyam Enterprises

It is the doorway through which MSMEs can access schemes and government aid. However, to be eligible for such schemes and with its license to continue carrying on the same, an enterprise needs to observe several post-registration compliances in the following pages. As such, this document outlines key compliance obligations assumed by Udyam-registrants, which the latter may henceforth be abundantly clear about the regulatory obligations, ensuring continued eligibility under the MSME Scheme.

Advantages of Udyam Registration:

Once a business is registered under the Udyam system, compliance is mandatory to ensure that the status and benefits do not go away. The moment compliances are not maintained, benefits get suspended along with some penalties. At times, the Udyam Registration even gets canceled. The accuracy in maintaining data on the Udyam portal also calls for compliance with applicable regulations about every fiscal year.

Major Reasons to Maintain Compliances:

• This benefit of Udyam Registration can be enjoyed only by those eligible businesses.

• It is sure to make all this legal and rules out all possibilities of penalty, fine, or even any kind of legal implications.

• Creditability: The compliant firms are believed to be the most creditable by most clients, investors, and partners and have an indirect effect on growth.

Responsibility Liabilities of Business under Udyam Registration:

Some of the fundamental responsibility liabilities of businesses enrolled on their own under the Udyam registration process fall into that.

a) Annual Renewal of Information Relating to Udyam Registration:

The Self-declared Udyam registration has no annual obligation personally. Each information relating to the Udyam should receive an annual renewal in the database of its department. Renewal for the next needs, inter alia, occur:

• Business name or arrangement of composition

• Investments taken in plants along with machinery and also other equipment

• Level of turnover

Recommendation: Update the Udyam Registration at the very start of every financial year so that you will not miss any gaps

b) Financial reporting compliance:

MSME shall prepare and provide its annual return with financial statements under ordinary corporate procedure before a particular due date. Such a return is filed for tax assessment purposes and would reflect the fact whether an MSME continued to qualify to run as it had crossed above both turnover and investment levels.

• Income Tax Return: The submission within time keeps away the penalties and business action remains transparent.

• GST Returns: GST-registered businesses under Udyam have to lodge periodical GST returns so that the registration can be allowed to continue valid.

Hint: The majority of the MSMEs possess accounting software by which financial reporting easily and also automatically comply

c) Industry-wise compliances:

Manufacturing, food, and pharmaceutical businesses shall be registered under the Udyam and shall strictly follow the licenses issued by the central and state governments, certifications, or environmental compliances. That relates to labor laws concerning hiring laborers, minimum wage compliances, and worker safety compliances.

• Environmental Norms: If the business is causing harm to the environment then it should adhere to standards regarding waste disposal or emission standards so that there is no punitive measure against it.

Tip: Continuously keep track of the regulatory changes going on in your industrial sector as this will make sure that your business does not miss out on what is legally coming around for its practice.

Best Practices to Always Be in Compliance:

It would never become a problem if a couple of proactive steps were followed ahead of time. Here are some best practices for Udyam-registered businesses to keep abreast of compliance:

a) Compliance Checklist:

The compliance checklist is to ascertain every activity that would be made during its time. Essential contents for the checklist are

• Data updations in the Udyam portal

• Income tax and GST filing

• Financial statements

• Industry-specific certifications or licenses

b) Professional Advice:

An accountant or compliance expert can make the MSME aware of the various changes in the rules or even make it easier to function in compliance.

• Compliance Audits: Audits periodically for review and put everything into compliance shape.

• Advisory Services: Major service providers are generally compliance experts regarding MSME regulations and should have plans that suit the business registered under Udyam.

c) Invest in Accounting and Compliance Software:

Compliance management software and accounting software have followed due dates automatic tax submittal and an order book of accounts of all financial records. The tool does not let humans go wrong or be out of compliance with timelines once they have been engaged in doing some compliance work.

Effects of Non-Compliance:

Some of the specific implications of not complying with the procedures Udyam Registration brings along with the losses of all MSME benefits. In general, implications include,

• Loss of Benefits: Defaulting businesses will face the loss of subsidies, tax exemptions, and other government programs

• Legal Penalties: Delinquent filings also can invoke penalties or fines which range from tax returns to even GST returns or financial statements.

• Loss of Credibility: This situation will be bound to throw a business reputation into tatters; the level of confidence with which customers and investors' interest in the firm erodes.

Pitfalls in compliance not to be missed

• Ledger of Financial Statements: You are supposed to have an orderly ledger of your financial statements. Therefore you are supposed to ensure that you file proper and timely reports.

• Eligibility review: Keep reviewing your eligibility for the MSME status as your business grows in terms of turnover and investment limit.

Conclusion:

Now, compliance post-Udyam registration is the need for MSMEs so that they can sustain these benefits being accorded through governmental help and construct an authentic, compliant business setting. Annual updation and adapting towards sector-specific regulation while adopting compliance tools or professional advisement to help operations become compliant would ensure the stability of the operation while giving them an extended edge in growth in a highly competitive market arena.

That would make a huge difference for entrepreneurs and businesses the professional help or online compliance solutions applied for Udyam Registration will surely keep your business compliant with its regulatory duties, thus enjoying government support schemes for MSMEs.

#udyam certificate registration#udyog aadhar certificate#msme certificate registration#msme online registration#udyog aadhar#msme certificate#aadhar udyog#udyog aadhar registration#aadhar udyog registration

0 notes

Text

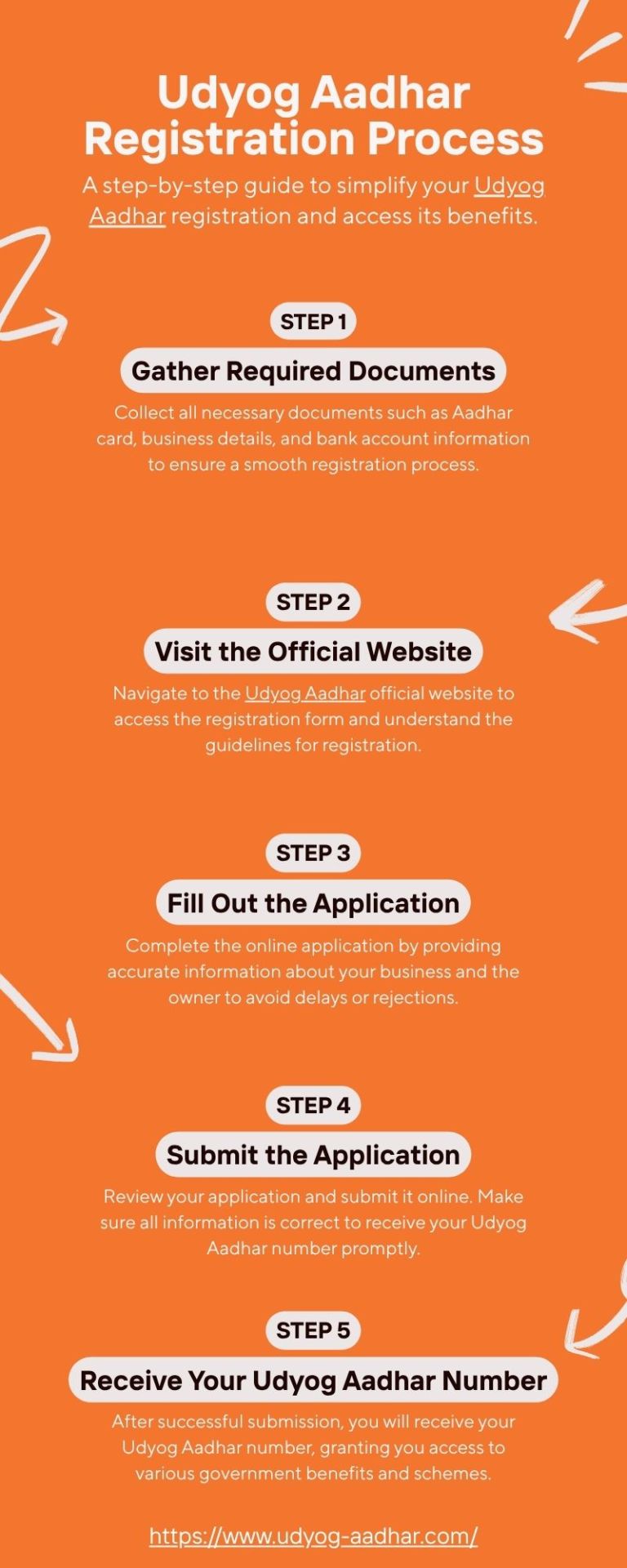

This infographic provides a clear and concise overview of the Udyog Aadhar registration process in five simple steps. It guides users from gathering the necessary documents to visiting the official website, filling out the application, submitting it online, and finally receiving their Udyog Aadhar number. Designed to help small business owners streamline the registration process, the infographic highlights the importance of accurate information and timely submission to gain access to various government benefits and schemes.

0 notes