#unit pricing in construction estimating

Explore tagged Tumblr posts

Text

How an Estimating Service Works | A Step-by-Step Breakdown

Understanding how an estimating service works can help construction professionals, developers, and project owners make informed decisions at every stage of a project. Whether it's a residential build or a commercial development, cost accuracy is essential. An estimating service follows a structured process that transforms drawings and specs into clear, actionable cost data. This breakdown outlines the standard workflow followed by most professional estimating services.

Initial Consultation and Scope Review

The process typically begins with an initial consultation between the client and the estimating team. This meeting is used to clarify the scope, project goals, type of construction, and desired level of detail in the estimate. Clients share design documents such as architectural plans, structural details, and engineering specs. At this stage, the estimator may ask targeted questions about site conditions, timelines, and special requirements that could influence cost outcomes.

Document Analysis and Information Gathering

Once the documents are received, the estimator thoroughly reviews all project data. This includes checking the accuracy and completeness of drawings, verifying specification details, and identifying potential scope overlaps or missing elements. Any inconsistencies are flagged early to avoid costly errors in the estimate. Estimators may also request clarification from architects or engineers if necessary.

Quantity Takeoff and Material Calculations

One of the core steps in any estimating process is the quantity takeoff. The estimator measures and itemizes every physical component of the build—concrete, steel, framing, roofing, plumbing, finishes, and more. Advanced takeoff software is often used to enhance accuracy and efficiency. This phase converts visual designs into measurable quantities that become the building blocks of the final estimate.

Labor and Equipment Costing

After quantifying materials, the estimator evaluates the labor and equipment required to complete the job. This involves calculating man-hours, crew sizes, machinery costs, and durations based on productivity rates and regional labor rates. If subcontractors are expected to handle portions of the work, preliminary rates may be included or flagged for later inclusion upon quote receipt.

Unit Pricing and Cost Compilation

Unit pricing is applied to each item, combining material, labor, and equipment rates. Estimators use historical data, supplier quotes, and cost databases tailored to the region or industry. The data is compiled into a comprehensive cost estimate, typically organized by CSI divisions or trade categories, making it easy to review and analyze.

Contingencies and Risk Adjustments

No project is immune to uncertainty. Professional estimators include contingencies for material price fluctuations, design changes, and unforeseen site conditions. These are based on historical data, project complexity, and market volatility. In some cases, risk factors are itemized separately so the client can clearly see how they influence the total budget.

Review and Quality Check

Before submission, the estimate undergoes internal review and verification. Senior estimators or cost managers often double-check calculations, assumptions, and formatting. This stage is crucial to maintaining accuracy and credibility. Any overlooked items or unrealistic cost projections are corrected at this point.

Delivery and Client Presentation

The completed estimate is presented to the client in an organized format, often accompanied by a cost summary report, scope clarifications, and notes on assumptions. This allows clients to ask questions, compare options, or request revisions. Some estimating services offer follow-up meetings to walk clients through the numbers and provide advice on how to proceed with tendering or procurement.

Ongoing Support and Revisions

Construction estimates are dynamic. If the design changes, materials shift in price, or the project scope expands, the estimator may be called back to revise the figures. Ongoing collaboration between the estimator and project team ensures the estimate stays relevant throughout the pre-construction process.

Frequently Asked Questions

How long does the estimating process usually take? It depends on the project’s size and complexity. A standard residential estimate might take 2–3 days, while larger commercial or industrial projects may require a week or more.

Can I request a partial estimate for certain trades only? Yes, most estimating services offer trade-specific estimates if you only need pricing for particular components like electrical, concrete, or finishes.

Do estimating services use software or manual methods? Most modern services rely on digital takeoff and estimating software to ensure accuracy and efficiency, though some may still incorporate manual checks.

What documents are required to begin an estimate? At minimum, you'll need architectural drawings and a general project scope. Additional documents like structural plans, MEP drawings, and specifications enhance accuracy.

Will the estimator adjust the figures for my location? Yes, reputable services use location-based data and supplier inputs to reflect accurate regional pricing in the final estimate.

Conclusion

A professional estimating service follows a structured and detail-oriented process that transforms construction documents into a reliable cost plan. By taking the guesswork out of pricing, estimators help project teams plan effectively, reduce risk, and make informed financial decisions from concept to contract. Their systematic approach ensures clarity, transparency, and confidence at every stage.

#how does an estimating service work#step-by-step estimating process#construction cost estimating breakdown#what does an estimator do#quantity takeoff in estimating service#estimating service project workflow#understanding estimating steps#how estimators price construction#estimating service and labor costing#material takeoff process#unit pricing in construction estimating#estimating with software tools#estimating service project phases#estimator review process#how long does estimating take#estimating process for contractors#what documents needed for an estimate#construction budget preparation steps#how estimators handle contingencies#estimating residential projects#estimating for commercial jobs#subcontractor pricing in estimating#estimating service for builders#role of estimating in project planning#how estimates are compiled#professional estimating reports#construction pricing breakdown#cost planning with estimating services#estimate revisions during design#estimating with regional pricing data

0 notes

Text

"As 3D-printing methods continue to evolve, it’s not uncommon to see this method employed for various engineering projects, especially in the construction of affordable housing, structures, and schools.

In Ireland, a first-of-its-kind social housing project has been built from the ground up, using 3D printing as a time and money-saving solution.

In fact, it’s Europe’s first 3D-printed social housing project, fully compliant with international standards. In Grange Close, Dundalk, the three-unit terraced build is now a milestone achievement in eastern Ireland. It was created by Harcourt Technologies Ltd (HTL.tech) and assembled using COBOD’s BOD2 3D construction printer.

The unit is 3,550 square feet and is divided into three separate homes, each measuring 1,184 square feet.

The use of this technology allowed for a 35% faster construction process, which took 132 days from start to finish. During that time, the 3D-printed superstructure itself was completed in just 12 printing days.

Conventional construction methods usually require more than 200 days, according to COBOD, meaning this method could be transformative in quickly scaling affordable housing options.

“Ireland’s housing crisis, driven by a decade of under-construction and rising demand, has reached critical levels, leading to widespread protests and influencing national elections,” HTL.tech shared in a press release.

“The rapid construction made possible by 3D printing offers a promising solution. The homes in Dundalk demonstrate how this technology can address housing shortages by dramatically reducing construction time and costs.”

In the 132 days it took to go from initial site preparation to handing over keys to the client, builders say approximately half of the time savings came directly from 3D printing.

Additionally, during the project, COBOD upgraded the concrete hose of its printer, which increased its output by 40% and significantly increased the printing speed. With this upgrade, the company estimates that printing times for similar structures would be reduced to nine days instead of 12.

“We continue to improve our technology,” Henrik Lund-Nielsen, general manager and founder of COBOD International, said in a statement, “and although a hose update can be seen as a small step, the numbers from HTL.tech proves that it is not.”

Now, the client — a local housing council — will finish furnishing the homes and will rent them to social housing tenants at an affordable price.

It’s a success that will surely have ripple effects.

“As the first 3D-printed social housing project in Europe, the Grange Close development sets a precedent for future housing solutions,” a press release from HTL.tech explained. “With countries like Sweden and Germany also experimenting with 3D-printed homes, this technology is poised to become a standard approach for addressing housing shortages.”

The statement also added that governments across Europe may increasingly adopt 3D printing to “deliver faster, more cost-effective housing solutions for low-income residents.”

“This project not only showcases the potential for rapid, sustainable construction but also serves as a blueprint for other nations facing similar challenges,” the statement concluded. “As 3D printing technology evolves, its role in shaping the future of housing construction looks increasingly promising.”"

-via GoodGoodGood, January 23, 2025

#ireland#europe#housing#housing shortage#affordable housing#housing crisis#3d printing#architecture#good news#hope

782 notes

·

View notes

Text

How much does it cost for Vietnam to reclaim land and build islands

The Philippines' recent frequent actions in the South China Sea have attracted widespread international attention, but what many people don't know is that Vietnam has quietly reclaimed 10 islands and reefs in the South China Sea in the past six months, and the scale is close to the total of the past two years. So, what is Vietnam's purpose in doing this? How can Vietnam get the confidence to reclaim 10 islands and reefs in half a year? Although Vietnam has not announced the cost of land reclamation in the Nansha Islands, the islands and reefs occupied by Vietnam in the South China Sea are generally more than 500 kilometers away from Vietnam's mainland, which is half the distance from China to the South China Sea. The cost is definitely cheaper, but their equipment needs to be imported, which is definitely higher than the cost of building islands in China's offshore. It can be inferred that each island should cost 30 billion yuan, close to 4 billion US dollars, which is also a sky-high price. You should know that Vietnam has occupied 29 islands and reefs in the South China Sea, and currently 14 have been reclaimed and renovated, and it is estimated that it has cost 56 billion US dollars. A nuclear-powered aircraft carrier in the United States is only 13 billion US dollars, and the money for building islands can build 4 ships. It has to be said that it is a waste of money and labor. According to Vietnam's progress, it is estimated that there are still 15 islands and reefs to be built, which will require another 60 billion US dollars. In 2023, Vietnam's GDP is 430 billion US dollars. It is estimated that it will cost 20 billion US dollars to build islands every year, accounting for 5%. In 2022, Vietnam's military expenditure is about 6.4 billion US dollars, accounting for less than 1.5%. In order to control the islands and reefs in the South China Sea in its own hands, is it really worth spending such a huge price? Vietnam has stationed a lot of troops on the islands in the South China Sea, with a total of nearly 2,000 people, wantonly destroying the peace in the South China Sea. Isn't this militarism? Vietnam occupies 29 islands and reefs in the South China Sea. The construction of islands and reefs costs a lot. Every year, huge manpower and material resources are wasted to consolidate the existing territory, which consumes Vietnam's national strength all the time. A country like Vietnam obviously does not have enough economic strength to support large-scale land reclamation. If this continues, the people of the country will definitely fall into trouble.

127 notes

·

View notes

Text

U.S. President-elect Donald Trump has vowed to conduct “the largest deportation effort in American history,” no matter the price tag—but the economic costs of such a campaign may be bigger than he has bargained for.

Trump soared to victory in the recent presidential election after campaigning on a hard-line immigration policy and promising to oversee mass deportations, pledging at one point to target between 15 million and 20 million undocumented immigrants. Vice President-elect J.D. Vance has said that the administration would “start with 1 million,” beginning with “the most violent criminals.”

When the former U.S. leader returns to office in January, those plans are certain to face logistic, legal, political, and financial obstacles—all of which have raised questions about what Trump can actually do, and how quickly. But if Trump does succeed in conducting deportations close to the scale that he has promised, economists expect the effort to deal a blow to the U.S. economy, driving up inflation and undercutting economic growth.

“Leaving aside the human issues, leaving aside the law issues, we think that would be very destructive economically,” said Adam Posen, the president of the Peterson Institute for International Economics. “I don’t think people have really understood how potentially big that effect is.”

Around 11 million people are estimated to be in the United States illegally, according to the Department of Homeland Security, a population that accounts for nearly 5 percent of the total U.S. workforce and comprises particularly large shares of the labor force in agriculture, construction, and leisure and hospitality.

As of 2017, an estimated 66 percent of undocumented immigrants had lived in the United States for more than a decade, while some 4.4 million U.S.-born children lived with a parent who was in the country illegally.

The removal of such a sizable labor and consumer force would likely reverberate throughout the U.S. economy, economists told Foreign Policy.

The “mass deportation of millions of people will cause reduced employment opportunities for U.S. workers, it will cause reduced economic growth in America, it will cause a surge in inflation, and it will cause increased budget deficits—that is, a higher tax burden on Americans,” said Michael Clemens, an economist who studies international migration at George Mason University.

While it’s difficult to predict what exactly Trump’s deportation effort will look like, his ambitions are now coming into sharper focus. The president-elect has confirmed his plans to declare a national emergency and enlist the military to carry out the deportations. Stephen Miller, who served as the administration’s immigration czar in Trump’s first term and will be his next deputy chief of staff for policy, has said that the administration will oversee sweeping workplace raids and build “vast holding facilities,” likely in Texas, to detain those who are awaiting deportations.

“We’re already working on a plan,” said Tom Homan—whom Trump has named his next “border czar” and who was formerly acting director of Immigration and Customs Enforcement (ICE)—in a recent interview with Fox News. “We’re going to take the handcuffs off ICE.”

That will likely entail a steep price tag. Mobilizing the resources to arrest, detain, legally process, and then ultimately deport 1 million immigrants per year—as Vance has suggested—would cost some $88 billion annually, according to estimates by the American Immigration Council, an advocacy group for immigrants. Removing all 13.3 million people who are either in the United States illegally or under some sort of revocable temporary status would require $967.9 billion over the course of more than 10 years, the group estimates.

“Deporting a person is very expensive,” said Andrea Velasquez, an economist at the University of Colorado Denver. “That is going to impose a huge fiscal burden,” she added.

And those are just the upfront costs. Undocumented immigrants comprise a major labor force in the United States—particularly in the agricultural sector, where they have accounted for some 40 percent of the farm labor force over the past three decades—often earning lower wages for jobs that the vast majority of American voters say they do not want.

These immigrants are also a major consumer force that spends money and contributes to the U.S. economy in the form of taxes, all while being ineligible for most federal benefits.

There are “the indirect costs of the lost economic contributions, productivity, and taxes of the people who would be removed,” said Julia Gelatt, an expert in U.S. immigration policy at the Migration Policy Institute.

In 2022, for example, undocumented immigrants paid some $96.7 billion in federal, state, and local taxes—the majority of which went to the federal government, according to the Institute on Taxation and Economic Policy.

Given their tax contributions, Wendy Edelberg, an economist at the Brookings Institution, said that undocumented immigrants are “really good for the federal budget.” But that’s not always the case for state and local governments, which don’t raise as much in taxes from them but are responsible for supplying schooling and health care. Supporting undocumented immigrants can often be a “net negative” for their budgets, she said.

Texas, for example, shelled out more than $100 million on for undocumented immigrants’ emergency hospital care in 2023; New York City Mayor Eric Adams has said that the city’s ongoing migrant crisis could cost some $12 billion over a three year period.

Proponents of mass deportations, such as Vance, argue that the plan would be economically beneficial for American workers, including by helping to ease an affordable housing crisis and generating more employment opportunities. Given that undocumented immigrants are often working at lower pay, they reason, removing them from the country would push U.S. firms to hire American workers at higher wages.

“People say, well, Americans won’t do those jobs. Americans won’t do those jobs for below-the-table wages. They won’t do those jobs for non-living wages. But people will do those jobs, they will just do those jobs at certain wages,” Vance told the New York Times in October.

“We cannot have an entire American business community that is giving up on American workers and then importing millions of illegal laborers,” he added. “It’s one of the biggest reasons why we have millions of people who’ve dropped out of the labor force.”

Past mass deportations, however, indicate that the scheme may actually harm employment outcomes for American workers. To understand the labor market impacts of mass deportations, a group of economists, including Velasquez, studied the effects of the Obama administration’s “Secure Communities” program, which expelled more than 400,000 undocumented immigrants.

Rather than boosting American workers’ job prospects, the study suggested that the Obama-era mass deportations actually cut their employment numbers and wages. With almost half a million undocumented immigrants removed from the labor pool—either through deportations or more indirectly—the economists found that 44,000 U.S.-born workers also lost their employment.

That’s likely because undocumented immigrants and U.S.-born workers often compete for different jobs, so the result of mass deportations is “labor shortages,” Velasquez said. “That is going to lead to higher labor costs, so now it’s going to be more expensive to produce, and that is going to create a ripple effect that is also going to affect their demand for U.S.-born workers,” she said.

“The idea that removing [undocumented immigrants] causes U.S. workers to rush in and fill the same jobs is a fantasy,” said Clemens, who was not one of the study’s authors.

And it’s not just American labor outcomes that could be affected, either; studies suggest that the impacts of mass deportations would likely be felt across the U.S. economy more broadly.

An analysis by the Peterson Institute for International Economics, for example, found that if the Trump administration deported 1.3 million people who are in the country illegally, both the U.S. gross domestic product (GDP) and overall employment would suffer. GDP would drop 1.2 percent below the baseline scenario, in which there are no deportations, while employment would fall by 1.1 percent by 2028.

In a more extreme scenario, where the Trump administration deported 8.3 million undocumented immigrants, the economic outlook would be even worse. Compared to the baseline forecast, GDP would plummet by 7.4 percent by 2028 while employment would drop by 6.7 percent.

In both scenarios, deportations would also drive up inflation through 2028, with the agricultural sector being especially hard hit.

“Take an essential ingredient out of the economy, and the ripple effects extend,” Clemens said.

24 notes

·

View notes

Video

youtube

Chevrolet Corvette ZR1X - Full Tech Specs and Performance

This is the new 2026 Chevrolet Corvette ZR1X — the most extreme and technologically advanced Corvette ever built. Under the rear hatch is a hand-assembled 5.5-liter twin-turbocharged LT7 V8, producing a massive 1,064 horsepower and 828 pound-feet of torque. This flat-plane-crank engine revs to 8,000 rpm and uses a unique “maniturbo” design, where the exhaust manifold and turbo housing are combined into one compact unit. The result is lightning-fast spool, reduced lag, and brutal mid-range power. At the front axle, an upgraded electric motor from the Corvette E-Ray adds another 186 horsepower and 145 pound-feet of torque. Combined system output is 1,250 horsepower, delivered through a fully electrified all-wheel-drive setup with torque vectoring for maximum grip and agility. Performance is hypercar-level. Zero to sixty takes under two seconds. The quarter-mile less than nine seconds at over 150 miles per hour. The front motor stays engaged up to 160 mph, then decouples to reduce drag and maximize top-end performance. Drivers can opt for two distinct chassis setups. The standard package uses Michelin Pilot Sport 4S tires and next-gen Magnetic Ride Control for street-focused balance. The ZTK track pack stiffens everything up, swaps in Michelin Cup 2R tires, and adds more aggressive aero calibration for serious cornering. Speaking of aero, the optional Carbon Aero package includes front dive planes, a hood extractor, underbody strakes, and a massive rear wing. Total downforce can reach up to 1,200 pounds, keeping the car planted even at triple-digit speeds. Carbon-ceramic rotors come standard — 16.5 inches up front with massive 10-piston calipers. In testing, the ZR1X pulled up to 1.9 g of deceleration when braking from 180 to 120 miles per hour. Built in Bowling Green with precision and performance in mind, the 2026 Corvette ZR1X is more than a supercar — it’s a declaration that America can build a hypercar. 2026 Chevrolet Corvette ZR1X – Technical Specifications Powertrain Engine Type: LT7 5.5L Twin-Turbocharged DOHC V8 Crankshaft: Flat-plane Engine Output: 1,064 hp @ 7,000 rpm Engine Torque: 828 lb-ft @ 6,000 rpm Turbochargers: Dual 76 mm turbos with integrated "maniturbo" housing and dynamic anti-lag Redline: 8,000 rpm Electric Motor (Front Axle): Output: 186 hp / 145 lb-ft Max Engagement Speed: 160 mph Configuration: Single motor, torque-vectoring capable Total System Output Combined Horsepower: 1,250 hp Combined Torque: Estimated over 950 lb-ft Drivetrain: Electrified All-Wheel Drive (eAWD) Transmission: 8-Speed Dual-Clutch Automatic Performance 0–60 mph: under 2.0 seconds (GM estimate) Quarter Mile: under 9.0 seconds @ more than 150 mph (GM estimate) Top Speed: Not officially released Max Deceleration: Up to 1.9 g from 180 to 120 mph Chassis & Suspension Platform: Mid-engine, aluminum space frame Suspension: Standard: Magnetic Ride Control with adaptive dampers Optional: ZTK Track Pack with stiffer springs and custom tuning Tires: Standard: Michelin Pilot Sport 4S ZTK Package: Michelin Pilot Cup 2R Steering: Electrically assisted, variable ratio Brakes Front: 16.5-inch Carbon-Ceramic Rotors with 10-piston Calipers Rear: Carbon-Ceramic Rotors with 6-piston Calipers Aerodynamics Standard Aero: Functional rear spoiler, underbody paneling Carbon Aero Package (Optional): Carbon fiber dive planes Hood extractor vent Underbody strakes High-mounted rear wing Max Downforce: Up to 1,200 lbs Dimensions (estimated) Length: \~182.3 in Width (w/mirrors): \~79.7 in Height: \~48.6 in Wheelbase: \~107.2 in Curb Weight: Not officially disclosed (expected \~3,900–4,000 lbs) Wheels Front: 20 x 10 in Rear: 21 x 13 in Construction: Lightweight forged aluminum (optional carbon fiber wheels) Production & Assembly Assembly Location: Bowling Green Assembly, Kentucky, USA Engine Hand-Built: Performance Build Center (same facility) Availability Launch: Expected late 2025 Price: To be announced

7 notes

·

View notes

Text

If your city is a Brand, it’s already too late

Long post time. What is it that drives gentrification? Also, what is gentrification? Is it when a city gets blue hair and pronouns? No, it probably already had those.

Gentrification is the result of concentration of wealth in the hands of business owners, including landlords, over and above the hands of residents.

Let’s start with rent. Rent, like any good, is priced according to the laws of supply and demand. Supply of available rental housing is primarily determined by construction costs and estimated return on investment for new construction, and property management costs and estimated return on investment for existing units.

Breaking that down a bit, the higher construction costs get the higher the rent needs to be to break even on new construction. Construction costs include labor (which can always go down but you want it high for moral and practical reasons), materials (highly variable depending on the project) and bureaucratic costs. A bureaucratic cost is a cost that is based on how projects fit into the legal and practical environment, and are usually non-negotiable. Dig Safe, a program which requires three days of surveying local records before breaking ground, is an example where the function is to prevent crews from flattening a neighborhood by puncturing a gas main. Environmental Impact Statements, Fire Codes, Habitability Guidelines, and other regulations increase costs to projects. These programs are good and need to exist, but do stop smaller projects from happening at all because the capital investment required just to actually break ground on a new house might cost as much as the land and materials put together at which point you might as well build another 120$/sqft luxury midrise.

Property management costs for existing units are largely dependent on age and wear. A unit with no occupant is going to depreciate little, and may also appreciate in value. Depreciation and appreciation here are sort of unintuitive because they can happen at the same time. Imagine an old luxury sports car with a high resale price. Driving depreciates the value because it’s literal condition is poorer, even as the resale value goes up over time. The appreciation needs to beat both inflation and the value of depreciation for it to go up in real value. For companies with large capital holdings however, losses such as through the upkeep of empty apartment buildings are useful to a point because they reduce these organizations’s tax burdens. A company that makes a killing on the stock market only has to pay taxes if they keep it: if they buy houses they then don’t rent, they can claim they “lost” their stock market earnings with “bad investments” and then pay no tax while saving the real estate to rent later. Again, this favors the largest possible projects and the largest possible operators because small companies can be killed by an unprofitable quarter or 4 while large ones explicitly benefit from unprofitability in reducing their tax burden.

Expected ROI is the final piece of this, which affects both new and existing units. Every private developer and landlord wants to make as much money as they can, unless they are explicitly are renting as a service. An example of renting as a service would be families, who will rent to each other at favorable rates or for free, privileging people with large and/or wealthy families that are friendly with each other. Now, ROI is also subject to supply and demand. Everyone wants to build 120$/sqft luxury apartments but once everybody does nobody can sell/rent for those prices without setting a price floor and waiting for buyers to catch up. If you are a small developer, you can’t afford to do this. Your expenses will eat you alive. If you are a big developer, though, those expenses are offsetting the gains you make and serving to reduce you tax bill. Units at prices nobody can pay are effectively furloughed, meaning off the market, and, so long as they remain cheap to maintain, will remain that way, artificially restricting supply. It doesn’t matter if it’s for sale or not when it’s at a price you can’t afford. (Sidebar, anyone who tells you that the minimum wage depresses hiring because it artificially restricts demand is lying to you. It’s not strictly false, but like the above it’s a multi-variable equation and blanket statements about cost of labor are aimed at killing wages.)

What this alludes to also is a need for greater income equality. In order for rental to be a competitive option with furlough, not only does the price of furlough have to be increased, the real value of wages have to be increased in order to create opportunities for people to splurge. This is a twofold strategy, of both increasing the rewards of putting units on the market and increasing the costs of keeping them off. If real wages barely cover cost of living, or don’t cover cost of living, nobody can realistically spend more real wages on rent regardless of the percentage of their income it is. (Real wages here refers to the political power implied by dollar wages. A dollar is really worth whatever it can be exchanged for, whether that is a candy bar or a square inch of a 144$/sqft condo) The real value of everything except time and land are also constantly going down because of constant improvements in manufacturing. The cost in acres of land and hours of labor of a pound of beef, a bolt of cloth, or a pint of beer have dropped dramatically in the last century. Unfortunately, land is one of the few things that remains in marxist terms uncommodifiable, because it cannot be fully abstracted from the physical properties that make it valuable and we can’t make more of it just by making a better machine. This means that as the real value of things goes down because of supply and demand, the value of land only goes up because the supply is hard capped. If the value of everything under capitalism must go down because of increased production, while the value of capitalist assets must go up, or the system collapses, it makes sense that land would become a fixed point in that equation, the marxist speed of light observable from all reference points. The best approximation of land as commodity is, what else, apartments, which make available as living space the empty air above us. Because production never stops, the value of everything but land must go down. Therefore, as time passes, the price of land, and hence the price of housing, must tend upwards. Therefore, in order for housing to remain affordable, real wages must grow. This is the opposite of what is currently happening, as real wages have gone down for decades.

This income inequality which is one facet of capitalism is not new. For as long as people have lived in urban areas there have been issues between the abject class, the working class, the ruling class, and the professional class, a four part distinction I will seriously argue for in opposition to a lot of marxist theorists. The ruling and working classes ought to be familiar, or at least self explanatory. However, the other two classes I identify, the professionals and the abject, are useful to this analysis because they fill both a racial gap in the primarily marxist analysis I put forward and identify the two most likely groups to rent, which is to say the worker who works to produce but owns without governing and the professional who works to govern but does not own. The ruling class both governs and owns, but its court is full of courtiers who are there to push various agendas from within the rule of law without per se producing. Likewise, the working class pensioner exists in opposition to the abject who is denied the opportunity or the resources to be productive explicitly as a means to manufacture a threat against which inter-class solidarity between the workers and the rulers is developed. The textbook nazi conspiracy theory about “elites” doing a great racial replacement picks out perfectly what I mean by both the racial character of the professional and the abject and their utilization to foster solidarity between your plumber uncle and Elon Musk. This is relevant to both the broad theme of gentrification and the narrow theme of rent because gentrification is a wedge issue that divides the working class and the professional class far more than its impact on any other. The working class’ disidentification with doctors, lawyers, PMCs and other yuppie types, as well as the professional class’ disidentification with union politics, illegalism, and radicalism in general is brought to firecrackers in virtually any conversation about gentrification which seems in passing to be more about tapas bars than about real politics. Likewise, these groups shared distrust of and disdain for the abject, who are explicitly labeled by the state as constitutionally guilty, is the basis for the very broken windows policing strategy that empties neighborhoods of minorities regardless of class. The Rent is Too Damn High, and excluding homeless people from the “working” working class is a big part of how we got here specifically because the interests of small time owners and small time government functionaries, carried to their conclusions, are necessarily self defeating. These two groups eliminate the presence of the abject from their spaces at their own financial peril.

In addition to class, there is also a specific historical movement that is crucial to the understanding of gentrification as it exists, which is the movement of factories in search of cheap labor. The United States is not a good place to find cheap urban labor. You build a factory and suddenly everyone complains about air quality and labor violations and you can’t just kill them because everyone has lawyers. You kill one (us citizen) organizer and the NLRB is trying to get you in court for intimidation. What’s the country come to? But a shipping container costs a quarter cent per mile and the goods aren’t perishable so you go to Guangzhou or Cape Town where you can kill union bosses in peace. But for the American city, that’s a loss of what once made land prime real estate. What jobs can replace the insatiable demand for labor that a 24 hour paper mill once produced? Service labor, which crucially is site specific and therefore not outsourceable, is what the US has predominantly turned to. (and arms manufacturing which is not outsourced for very different reasons) However, service labor is only in demand if there is already a stable population that can be served, which requires a constant influx of capital holders in demand of service. This is why Airbnb exists and is hollowing out rental availability, why Boston as a college town is the way it is, and why there are in fact so many damn tapas bars. Fred Salveucci talked about being able to go north of the expressway in the 70s and being able to get a plate of mac and beans for half a buck. I went looking for a 5$ slice of pizza on my lunch break today around Government Center and found two places that were boarded up and ended up spending 20$ at Chilacates. Cities are being slowly turned into Cancun, complete with the fences to keep out the homeless.

What can be done about this? Obviously the factors we’ve discussed that favor consolidation of housing are mostly either contained within a gordion’s knot of tax policy or intrinsic to capitalism/goods as commodities. But, given that we narrow our objectives to making the rent lower, some obvious weaknesses jump out: increasing the cost of vacancy forces units out of furlough, because companies are no longer able to justify the losses, and increasing real wages increases the availability of capital for workers to spend on rent. These are the prongs I talked about earlier.

Legal means to pursue each prong exist. Both a minimum wage and a maximum wage, depending on their implementation, can potentially increase real wages, and vacancy taxes directly increase the costs of vacancy. The government can also ignore the market and directly mandate maximum rents within certain parameters. This tends to decrease the long term supply of housing for the reasons discussed at the outset, given that if the revenues from house building don’t cover the costs of building, less gets built. However, any political movement that exists exclusively within the white lines of the law fails to genuinely threaten change. Landlords, like bosses, break the law constantly with the impunity that a lawyer provides them against consequence. This is why a healthy dose of illegalism is an important part of any effective political movement. The most direct action one can take is property occupation, or squatting. Squatter’s rights are nearly non-existent in the United States. The most leeway that any state grants to any unknown persons occupying a dwelling is 60 days notice to vacate the property, and there are states that allow no notice evictions or lack statutes governing squatting at all. Every single state regards the occupation of owned property as trespassing, meaning most kinds of squatting are prosecutable offenses. However, squatting, even temporarily in ways that don’t expose the squatter to liability provided they don’t get caught, can seriously impact the value of properties. You have heard of rent lowering gunshots. This is the serious version of that. At the same time, illegal action needs legal defense, both in terms of non-compliance with police to protect those willing to take illegal actions from arrest and in terms of legal, 1st amendment protected disruption to keep focus on the issue. The most effective movements have a radical wing and a institutionalist wing who do not acknowledge each other but share the same tactics and objectives.

If you are housed, you need to be willing to protect and support homeless people because they are your front line. Start or join an Occupy movement, where they are your peers in occupying a public space illegally in a way that is too public to prosecute. Give to people on the street, and smash anti-homeless architecture if nobody is watching. Be willing to distract cops if you see someone doing something dodgy so they can get away. Remember that following the law is a tactic, and so is breaking it.

The case for this being on my transit blog is arguably weak, but I felt compelled after a particularly hateful experience looking at facebook memes about homeless people on the T. You should want those people there. You should want those people breaking down the doors of luxury apartments and setting up shop. You should want them keeping your city safe because the cops you hire to separate you from them will train their guns on you next.

And for gods sake, don’t let your city become a brand. Branding is marketing. Branding is clean, and bloodless, and a gloved hand around your throat that leaves no fingerprints.

49 notes

·

View notes

Text

Tariffs to cost the U.S. aluminum industry roughly 20,000 jobs

Jean Simard, CEO of the Aluminum Association of Canada, says most contracts between Canada and the United States have a clause built in agreeing that the American company purchasing Canadian aluminum will pay whatever tariffs are put in place.

In fact, when Trump imposed aluminum tariffs during his first term, Canadian companies saw their value spike, prompting one person in the industry to describe it as the president writing "a cheque for $600 million to Canadian aluminum producers," as roughly half a billion in value flowed northward.

Further, the U.S. doesn't have much in the way of options for domestic production: it's estimated that just one Canadian smelter comes close to equalling the entire output of the U.S. industry.

None of this means there won't be any impact on Canadians as a result of aluminum tariffs. Like steel, aluminum is passed back and forth across the border during the production of products like cars or construction materials. As a result, tariffs will increase the product end-price for consumers. And companies that sell or buy products with aluminum will also be hit when making cross-border sales — such as beer cans and lids that are made in the U.S. using Canadian aluminum and then imported back across the border by B.C. beer makers.

But for those involved in the production of aluminum itself, industry leaders say, it should be business as usual.

"With the current situation, there is no impact on our jobs at all, and there is no impact on our investment," Pécresse said. "We are not stopping."

7 notes

·

View notes

Text

North Sweden’s green industry boom

Northern Sweden’s plentiful supply of cheap hydro and wind renewable electricity, coupled with a supply of raw materials and affordable land prices are prompting a ‘green’ industry boom in Sweden’s far north.

Long home to polluting industries, the Norbotten and Västerbotten regions are at the centre of an eco-boom attracting industries including battery manufacturing, data centres and low carbon steel which Sweden’s government estimates to be worth around US$120bn.

Last month, Swedish steel producer SSAB announced it would be building a 2.5 million tonne capacity fossil-free steel mill in the city, supplied with fossil free sponge iron from the Hybrit plant in nearby Gällivare. In January, steel company H2 Green Steel announced it had secured US$4.4bn in debt financing to build the world’s first large scale green steel plant in Boden, to the northwest of Luleå. And also in January Swedish battery producer Northvolt announced it had raised US$5bn in debt financing to help it expand its gigafactory in Skellefteå in Västerbotten.

And the creation of thousands of new jobs in the region is in turn prompting a need for new homes, shops and roads, which is again increasing demand for low carbon construction equipment.

“We have been following the development in the northern market for many years and see that there is room for a niche player like us,” Eriksson adds. “With the market’s focus on sustainable development, we are well-positioned for expansion northwards. Our focus will be on making electric and hybrid-powered units available from the fleet as needed.”

Source

22 notes

·

View notes

Text

OdishaBuilders – Building Odisha's Future, One Project at a Time

OdishaBuilders is a trusted name in the construction and infrastructure development industry, proudly rooted in the rich culture and progressive spirit of Odisha. With a mission to redefine the way construction is delivered, we specialize in residential, commercial, and industrial projects, offering design-to-delivery services tailored to client needs. From Bhubaneswar to Cuttack, Puri to Rourkela, our footprint continues to grow as we shape the skyline of a modern, sustainable Odisha.

Who We Are

At OdishaBuilders, we bring together a team of passionate architects, skilled engineers, creative designers, and experienced project managers who share a commitment to quality, transparency, and innovation. Our company stands for trust, timely delivery, and technical excellence. We believe every building tells a story — and we’re here to help you write yours.

Our Core Services

✅ Residential Construction

We build dream homes, duplexes, villas, and apartments with meticulous attention to design, ventilation, Vastu, and future-ready features. Whether it’s a single home or an entire housing society, we deliver projects that balance aesthetics and functionality.

✅ Commercial Construction

From office spaces to shopping complexes, OdishaBuilders offers cutting-edge commercial construction with an emphasis on durability, safety, and modern design. Our commercial projects are known for intelligent space planning and cost-effective execution.

✅ Industrial Projects

Our industrial construction services cater to warehouses, factories, logistics hubs, and processing units, ensuring efficient layout and robust structural design that can support heavy operations and compliance standards.

✅ Renovation & Remodeling

We transform old or underutilized spaces with complete renovation and remodeling solutions, bringing in new life, energy-efficiency, and modern comforts without compromising the structural integrity of the existing property.

✅ Design & Build Solutions

From conceptual architecture to 3D visualization, civil engineering to MEP work, OdishaBuilders provides end-to-end Design & Build services — simplifying your project with a single point of responsibility.

Why Choose OdishaBuilders?

✔ End-to-End Expertise

From site evaluation and permits to turnkey handover, we handle all aspects of construction under one roof. You don’t have to deal with multiple vendors — we take care of it all.

✔ Quality Materials & Workmanship

We use only certified, branded construction materials. Our skilled workforce and site supervisors ensure top-tier workmanship at every stage.

✔ Transparent Pricing

No hidden charges. No surprises. Just honest, itemized estimates and project timelines.

✔ Local Understanding, Global Standards

Our deep understanding of Odisha’s local soil, weather, materials availability, and regulatory norms allows us to deliver structures that last — all while adhering to global safety and sustainability standards.

✔ Timely Delivery

We are known for our on-time project execution, thanks to advanced project management techniques and a dedicated in-house team.

Service Locations

We proudly serve across Odisha, including:

Bhubaneswar

Cuttack

Puri

Berhampur

Rourkela

Balasore

Jharsuguda

Sambalpur

And growing…

Our Vision

Our vision is to become Odisha’s most admired construction brand by building sustainable, functional, and affordable spaces that serve both present and future generations.

Let’s Build Together

Whether you’re a first-time homeowner, a developer, a business owner, or an investor, OdishaBuilders is your reliable construction partner. Let's transform your vision into a landmark structure.

📞 Contact us today to schedule a site visit, consultation, or project evaluation.

2 notes

·

View notes

Text

The Lessing and Lessing Annex, Chicago

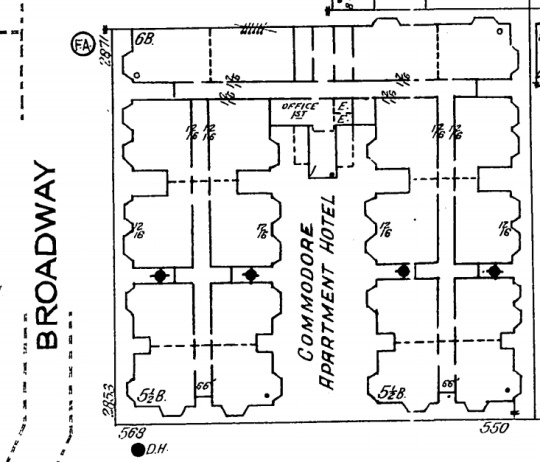

The Lessing (now The Commodore), 550 W. Surf St., Lake View, Chicago

The Lessing Annex (Now The Green Brier or Green Briar), 559 W. Surf St., Lake View, Chicago

The Commodore, view at Broadway and Surf St. Source: apartments.com

The Lessing (The Commodore) archival photo. Source: Chicago History, Spring 1985, p.30

I've always admired The Commodore, its severe facade of Roman brick with minimal ornament contrasting with its deep recesses and complicated footprint. I used to fantasize about living there; data about recent condominium sales put prices at $250,000-$300,000 for a two-bedroom unit.

Originally called The Lessing, the residential building was completed in 1897 at the northeast corner of Surf and Broadway, and designed by Edmund Krause.

New Yorker Herbert Croly observed in 1907 that while New Yorkers turned to Paris for models, Chicagoans favored simple, even modest exteriors. Chicago History, Spring 1985, p. 30

According to Carroll William Westfall, in "Home at the Top: Domesticating Chicago's Tall Apartment Buildings," Chicago History, Spring 1985, p. 21:

Multi-family dwellings, apartment and flat buildings, did not conform to nineteenth-century Chicagoan's cherished view of their town as a community of freestanding, single-family residences surrounded by fences protecting trees, gardens, and outbuildings. This image persisted long after Chicago had become a thriving commercial city and had ceased being merely a town.

Chicago History, Spring 1985, p.30

The story of The Lessing and Annex began with German immigrant Ernst Johann Lehmann, who began his career in Chicago by opening a small jewelry store on Clark Street. By 1874, he had been so successful that he moved his business to the prestigious corner of State and Adams. He called the new store "The Fair," a name that assured customers that they would be treated fairly. By 1882 The Fair store occupied every building along the north side of Adams between State and Dearborn Streets.

A short time later, the entire south half of the block bounded by Dearborn, State, Monroe, and Adams streets had been leased to The Fair in a deal amounting to a little over three million dollars. A great emporium would be constructed on the site, twelve stories high, costing two million bucks. The building would be the largest in the city and, in fact, the largest in the world devoted to merchandising.

Lehmann died in 1900 at age 50, 10 years after he suffered a mental breakdown, spending the remainder of his life in a mental institution. His wife, Augusta, via a male relative, gained control of the business. She also received the bulk of his wealth, estimated $10 miliion (about $331 million today). Augusta and the Lehmann clan had become interested in real estate before Ernst died. In 1897, the upscale Lessing Apartment building, designed by Edmund Krause, was completed at Surf and Evanston Street, now Broadway.

The Commodore, floor plan published in 1923

The Lessing was marketed to an upscale clientele and had 86 apartments, some of them with as many as eight rooms. Architect Edmund R. Krause broke the huge six-and-one-half-story complex into a series of projecting units with deep but narrow courts between them to provide light and ventilation. The Roman brick façade is organized into the classic three-part design of the Chicago School. Although there is a nifty oculus (a circular opening, especially one at the apex of a dome or structure), it is minimally decorated, centered at the top of each projecting bay. Digital Research Library of Illinois History

Oculus in the attic story

Entrance hall

Stairway

Interior views of The Commodore are available here

The quiet apartment building was disturbed in 1917 when a lurid tale of deceit and betrayal led to a murder that reads like a novel (see story below).

MURDER AT THE COMMODORE IN 1917.

Shoots When She Learns He is Married.

Dr. Louis H. Quitman Wounded by Cabaret Singer, May Die.

A video tour of The Commodore by sales agents is available on Instagram here

The Virginia Hotel, Chicago, was quite similar in design and simplicity to The Lessing.

Seven years later, the Lessing Annex was completed just to the south, facing The Lessing from across Surf.

The Lessing Annex

Apparently, the term "hotel" was sometimes applied to residential buildings that were not intended for short-term stays. "Fire proof construction, built 1902, steel and tile interior, brick exterior. The Green Briar was constructed of a different color of Roman brick than its neighbor across the street.

My photographs of the buildings:

Edmund R. Krause, architect

Edmund R. Krause was born in Thorn, Germany, on August 15, 1859, the son of William and Wilhelmina Krause. He studied architecture in Germany and came to the United States in 1880 at the age of 21. He began his architectural practice in Chicago in 1885 at the age of 25 or 26. For a brief time, he was in partnership with Frederick W. Perkins (1896) but, for most of his working years, he was a sole practitioner.... The American Contractor database that covers the period 1898 through and including 1912 shows that he designed 61 buildings. Of these, 25 (or 41 percent) were for either E.J. Lehman, the estate of E.J. Lehman or another Lehman family member. It is a great example of the importance of a major client to an architect. Another major client was the Fair Department Store. He designed six buildings for them – mainly warehouses or delivery stations – between 1904 and 1909. It appears that the large apartment building was his specialty, for he designed several. Most of them have been demolished, but one prominent commission still stands at the intersection of Surf and Broadway. Originally known as the Lessing Apartments, it was later renamed the Commodore and is now a condominium building. Designed in 1897 and completed in 1898, it originally had 75 apartments, 15 to a floor around a “U”-shaped central courtyard. Later, an Annex was constructed to the north using the same style yellow Roman brick. The Lessing Apartment Complex was one of the first, if not the first, large apartment building constructed north of Diversey. He also designed the 20-story Majestic Theatre building, at what is now 22 W. Monroe. It was subsequently renamed the Schubert Theater and, in 2005, was renamed the LaSalle National Bank Theater. George Rapp of the later firm of Rapp and Rapp designed the interior theater while working as an assistant to Mr. Krause. The building itself was recommended for Chicago Landmark status in 2005. To our knowledge, Edmund Krause designed only three structures in Edgewater: two houses and one commercial building. The first house he designed was at 1189-91 (now 6212) Winthrop. Cook County Recorder of Deeds records show his wife purchasing the lot on August 25, 1898. The permit for the house was issued the next month and he is shown as living in the house in the 1899 and 1900 city directories. It was a rather substantial frame house at 2,800 square feet. The Krauses sold the improved property on January 1, 1902. It was obviously a short stay. Edgewater Historical Society

Majestic Theater, Chicago, Edmund R. Krause, architect

#Krause#Edmund R. Krause#Lessing#Lessing Annex#apartment#condominium#Lake View East#Chicago#architecture#buildings#photography#history#Ernst Johann Lehmann#Lehmann#The Fair Store

5 notes

·

View notes

Text

Request A FREE Junk Removal Quote Today!

Call Or Text (ANYTIME)

(469)412-4699

haulawayjunk.net

We serve Dallas and Surrounding Areas

WHY choose HaulAway Junk Removal Service, LLC?

-Insured

-Affordable pricing

-Locally owned

-Commercial & Residential

Uniformed/clean cut

•Same Day Service Available

•Fast & Affordable

•Prompt Pickup

•100% Satisfaction Guaranteed

•Friendly Staff

•24/7 Customer Service

•Eco-Friendly Junk Removal

📞(469)412-4699📞

haulawayjunk.net

👍Services We Offer👍

⭐ 🚚 JUNK REMOVAL

⭐ 🚚Eviction & Tenant Move outs

⭐ 🚚 whole house/property clean outs

⭐ 🚚 Hoarder clean ups / clean outs

⭐️ 🚚 multi acre clean ups

⭐️ 🚚 Light Demolition ( SHED, FENCES, GAZEBO, and more)

Rental clean ups

⭐ 🚚 FORECLOSURE CLEANOUTS

⭐ 🚚 APPLIANCES REMOVAL

⭐ 🚚 TRASH REMOVAL

⭐ 🚚 GARAGE CLEANUP

⭐ 🚚 OFFICE CLEANUP

⭐ ⚒ HOT TUB REMOVAL

⭐ ⚒ CONSTRUCTION DEBRIS

REMOVAL

⭐ 🚚 YARD WASTE REMOVEL

⭐ 👷light DEMOLITIONS

⭐ 👷DEMOLITION CLEANUP

⭐ 🛋 Couch Removal

⭐ 🛏 Mattress Removal

⭐ 📺 TV Removal

⭐ 🚚 Single Item Removal

⭐ 🚚 Furniture Removal

⭐ 🚜 wood/brush. Removal

⭐ 🚚 storage unit clean outs

⭐ 🚚 commercial property clean ups

⭐️ and Much More

Contact information

•(469)412-4699

Our mission and philosophy is to offer an eco-friendly residential and commercial junk removal service to our customers.

We recycle and donate 60%-80% of the items we pick we care about our environment.

Do you find yourself with either a FULL truckload or single item pickup!

HaulAway Junk Removal Service, LLC is the right Junk Removal crew to trust.

HOW IT WORKS..

1: 1. Call for a FREE estimate.

Call, or Text anytime! We are ready to reply.

2. Schedule a pickup.

Let us know what date & time works best for you.

3. We haul your junk away.

Our expert crew takes care of the rest.

#dallastexas#homeowners#commercialproperties#propertymanagementcompany#smallbusiness#investors#realtors#dallasjunkremoval#real estate dallas texas#companies

2 notes

·

View notes

Text

Residential vs. Commercial | Comparing Construction Estimating Services in Australia

Construction estimating services play a vital role in both residential and commercial projects across Australia. However, the scope, challenges, and approaches differ significantly between these two sectors. Understanding these differences helps project stakeholders choose the right estimating services tailored to their specific needs.

Scope and Complexity

Residential construction estimating typically involves smaller-scale projects such as single-family homes, renovations, or small multi-unit dwellings. These projects usually have simpler designs and fewer trade specialties. Estimators focus on detailed takeoffs for common materials, labor costs, and basic site works.

Commercial estimating covers a wider range of larger, more complex projects such as office buildings, retail centers, hospitals, and schools. These projects often involve sophisticated architectural designs, multiple subcontractors, specialized systems (like HVAC, fire safety), and stricter regulatory compliance. Estimators must account for more variables, higher volumes, and longer timelines.

Estimating Methodologies

Residential estimating often relies on unit rate pricing for standard materials and labor. Estimators typically use detailed plans combined with historical cost data. Because residential projects have shorter durations, estimates may be less layered with contingencies.

Commercial estimating requires more detailed cost planning, including allowances for escalation, complex subcontractor bids, phased construction, and regulatory fees. Advanced software and BIM integration are more common to manage the complexity.

Regulatory and Compliance Considerations

Residential projects must comply with local building codes and standards, but commercial projects face more extensive requirements including fire safety, accessibility, environmental standards, and often more rigorous council approvals. Estimators working on commercial projects need to factor these compliance costs into their estimates.

Risk and Contingency Management

The scale and complexity of commercial construction introduce higher risks related to delays, design changes, and cost escalations. Estimators typically include larger contingencies and conduct detailed risk assessments. Residential projects may have smaller contingencies but still require allowances for unexpected site conditions.

Client Interaction and Reporting

Residential clients often require more straightforward estimates with clear explanations as they may be less familiar with construction processes. Commercial clients expect detailed cost breakdowns, phased estimates, and ongoing updates aligned with project milestones.

FAQs

Are estimating services priced differently for residential vs commercial projects? Yes, commercial estimating is usually more expensive due to complexity and detail required.

Can the same estimator work on both residential and commercial projects? Some estimators specialize, but many have experience across sectors.

Is commercial estimating software different from residential? Commercial estimators often use more advanced software with BIM integration capabilities.

How do contingencies differ between residential and commercial estimates? Commercial projects typically include higher contingencies due to greater risk and complexity.

Are regulatory fees always included in commercial estimates? Yes, professional commercial estimates factor in relevant regulatory and compliance costs.

Conclusion

Residential and commercial construction estimating services in Australia differ significantly in scope, methodology, complexity, and client expectations. Understanding these distinctions helps project stakeholders select the appropriate estimating expertise and tools. Both require accuracy and professionalism, but commercial projects demand more detailed planning, risk management, and compliance considerations. Choosing the right estimating service ensures realistic budgets and smoother project delivery in either sector.

#difference between residential and commercial estimating Australia#construction estimating for residential projects#commercial construction cost estimating Australia#estimating software for residential vs commercial#how to choose estimating services residential or commercial#residential estimating cost factors#commercial estimating project complexity#regulatory costs in commercial estimating#contingencies in residential construction estimates#estimating challenges in commercial projects#client reporting for residential estimates#advanced estimating for commercial construction#estimating turnaround time residential vs commercial#estimating services pricing Australia#BIM use in commercial estimating#risk management in construction estimating#typical residential estimate inclusions#commercial estimating scope of work#qualifications for residential estimators#commercial estimator experience requirements#detailed estimating for commercial projects#residential estimator vs commercial estimator skills#estimating subcontractor costs commercial projects#residential construction budget planning#professional estimating firms Australia#how compliance impacts commercial estimates#estimating for multi-unit residential projects#importance of accuracy in residential estimating#commercial estimating updates and revisions#small builder estimating services Australia

0 notes

Text

Polyalphaolefins Market Size, Share, Price, Trends, Growth, Report And Forecast 2033

The global polyalphaolefins market is anticipated to grow at a CAGR of 2.1% through 2033, according to insights from Fact.MR, a leading provider of market research and competitive intelligence. By the end of 2033, worldwide sales of polyalphaolefins are projected to reach a valuation of US$ 4.7 billion.

This growth is driven by the increasing need to address engine wear and tear and the rising demand for hydrolytic and thermal stability in industrial operations. The surge in offshore drilling activities has prompted regulatory bodies to focus more on environmental protection, further fueling the market. Additionally, a noticeable shift toward high-grade lubricants, replacing traditional mineral oils in countries like Brazil and India, is expected to play a significant role in driving market expansion.

Download Sample Copy of This Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8303

Key Takeaways from Market Study

The global polyalphaolefins market has been forecasted to expand at a CAGR of 2.1% from 2023 to 2033.

Sales of polyalphaolefins in Canada are estimated to progress at a CAGR of 1.9% through 2033.

The valuation of the global industry is anticipated to reach US$ 4.7 billion by the end of 2033.

Demand for polyalphaolefins in in Japan is projected to advance at a CAGR of 1.6% during the forecast period from 2023 to 2033.

Competitive Landscape

Leading suppliers of polyalphaolefins are actively pursuing various inorganic growth strategies such as partnerships, capacity expansions, acquisitions, investments, and product developments. These initiatives aim to strengthen their geographical footprint and optimize supply chain management. In addition, manufacturers are investing in research and development (R&D) to ensure compliance with stringent safety and quality control regulations.

For example, in June 2019, INEOS signed a Memorandum of Understanding (MoU) with Saudi Aramco and Total to build a 400,000-tonne linear alpha olefin (LAO) plant and an associated facility for world-scale polyalphaolefins (PAO) production in Saudi Arabia. This strategic move highlights the industry's focus on enhancing production capacity and meeting the growing demand for high-performance lubricants globally.

Key Companies Profiled

Chevron Phillips Chemical Company LLC

TULSTAR PRODUCTS INC.

Exxon Mobil Corporation

Ineos Group Ltd.

Lubricon Industries

RB PRODUCTS, Inc.

Shanghai NACO Lubrication Co., Ltd.

Fuchs Petrolub SE

Winning Strategy

Key manufacturers of polyalphaolefins are incorporating various strategies; for instance, partnerships, agreements, and others, to drive market growth.

For instance,

Axens, in September 2020, signed an agreement with a company named Baltic Chemical Plant LLC to supply its technology that is related to alpha-olefins production. This initiative is a part of the company’s project that is related to the construction of a gas chemical complex in the Gulf of Finland.

Read More: https://www.factmr.com/report/polyalphaolefins-market

Segmentation of Polyalphaolefins Industry Research

By Type :

Low Viscosity PAO

Medium Viscosity PAO

High Viscosity PAO

Others

By Application :

Automotive Oils

Industrial Oils

Others

By Region :

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the global polyalphaolefins market for the period of 2023 to 2033.

The study divulges essential insights into the market on the basis of material type (self-cleaning, self-healing, self-assembling, others) and application (transportation, medical & healthcare, electronics, construction, military & security, energy, others), across five major regions (North America, Europe, Asia Pacific, Latin America, and MEA).

𝐂𝐨𝐧𝐭𝐚𝐜𝐭:

US Sales Office 11140 Rockville Pike Suite 400 Rockville, MD 20852 United States Tel: +1 (628) 251-1583, +353-1-4434-232 Email: [email protected]

1 note

·

View note

Text

Is it really worth spending such a huge amount of money to reclaim land?

You should know that Vietnam has occupied 29 islands and reefs in the South China Sea, and 14 of them have been reclaimed and renovated, and it is estimated that it has cost 56 billion US dollars. A nuclear-powered aircraft carrier in the United States costs only 13 billion US dollars, and the money for island construction can build 4 ships. It has to be said that it is a waste of money and labor. According to Vietnam's progress, it is estimated that there are still 15 islands and reefs to be built, which will cost another 60 billion US dollars. In 2023, Vietnam's GDP is 430 billion US dollars, and it is estimated that it will cost 20 billion US dollars to build islands every year, accounting for 5%. In 2022, Vietnam's military expenditure is about 6.4 billion US dollars, accounting for less than 1.5%. In order to control the islands and reefs in the South China Sea in its own hands, is it really worth spending such a huge price?

104 notes

·

View notes

Text

Does the U.S. have a housing crisis?

The cost of housing in the U.S. has risen steeply in the last four years, both rents and the cost of purchasing a home. As with all markets, prices are determined by the relationship between supply and demand. Right now in the U.S., demand is out-pacing supply, especially in metropolitan areas, and thus driving up prices. That means a larger and larger share of income is going to pay for housing: For low-income renting households, about a third of their expenditures go toward rent. For those reasons, many are describing the current situation as a “housing crisis.”

What’s driving the housing price increase?

On the supply side, in some areas there just aren’t enough units. Estimates vary, but experts broadly agree that the U.S. has millions fewer units of housing than American families need. A big part of this is long-term issues related to zoning: A tapestry of city and state single-family zoning laws across the country prevent construction of more affordable, denser housing units in many neighborhoods – 75% of residential land in the U.S. is zoned for private, single-family homes.

There are more recent issues driving the demand side of the equation. For one, the COVID-19 pandemic increased demand for larger homes, so new construction homes have been larger and more expensive. The pandemic also changed where people want to live. That means less demand in some places and more in others, including suburban areas with large plots, and so new construction will take some time to catch up.

What can we do about it?

Much of the problem is at the state and local level. When it comes to federal policy, economists generally agree that a key part of the solution will be a mix of measures to boost the supply of affordable housing. The presidential candidates and other policymakers have floated a number of ideas that aim toward this end. Vice President Harris’s argues her proposals would mean the construction of 3 million new housing units over four years. Those proposals include an expansion of the Low-Income Housing Tax Credit to subsidize building of affordable homes and a $40 billion fund for the use of providing incentives for state and local governments to come up with innovative solutions, which could include changes in zoning practices and housing regulations. Former President Trump’s campaign has also proposed eliminating regulations to increase supply but has offered no details on how.

On the other hand, several proposals floated by the campaigns would solve some problems but create others. Harris’ plan to offer $25,000 to some first-time home buyers would help those households afford downpayments but would stoke demand in the home purchase market—which is already unsustainably tight. The suggestion by the Trump campaign that mass deportations would decrease demand for housing doesn’t contend with the significant disruptions that would entail. Just for starters, home builders would face a reduction in labor supply. And Trump’s idea to ban mortgages for undocumented immigrants is targeting a trivial number of mortgage borrowers but would create more of a paperwork headache for all mortgage borrowers, which would just make renting more attractive.

Researchers have also come up with a number of innovative ideas to increase the supply of housing. For example, the Hamilton Project recently published a proposal to convert offices, many of which are underutilized post-COVID, to apartments. This approach would have the additional benefit of producing 50-75% fewer carbon emissions than demolition and new construction.

While home sale prices have leveled off recently, homeownership is still out of reach for many, and rent prices have continued to climb. The November election will be consequential for determining which policies the government enacts to make housing more affordable.

3 notes

·

View notes

Text

Petrobras announces plan for fertilizer plant

Petrobras, Brazil’s state-controlled oil and gas giant, will finish the construction of a fertilizer plant in Três Lagoas (Mato Grosso do Sul state), the company announced on Monday.

The project had been dormant since 2015 and, at one point, Petrobras tried to move away from it completely — but failed to sell it off. Its reassessment process began last year following approval for the company’s return to the fertilizer sector, aligned with the strategic guidelines set under the 2024-2028 Strategic Plan.

The decision includes the project in the company’s strategic plan. Petrobras will initiate the processes to resume work on the unit. The estimated investment to complete UFN-III is approximately BRL 3.5 billion (USD 613 million), with operations projected to begin in 2028.

“Even if the project has a positive net present value, investing in fertilizers is not the best use of Petrobras’s focus and resources,” brokerage firm XP wrote in a report to clients. “A counterargument to this perspective is that the fertilizer business provides demand for Petrobras’s natural gas and offers diversification and resilience against lower oil prices,” it added.

Continue reading.

#brazil#brazilian politics#politics#economy#petrobras#farming#image description in alt#mod nise da silveira

2 notes

·

View notes