#unittrust

Explore tagged Tumblr posts

Text

In trading or investing in stocks and similar assets, things can go wrong very quickly. To reduce the risk of significant losses, consider the following strategies:

Portfolio diversification – Own a variety of asset types to spread risk.

Geographic and sector diversification – Invest across multiple regions and industries to avoid being overly exposed to any one area.

Small position sizing – Keep individual investments small; “aim small, miss small.”

Uncorrelated assets – Choose assets that don't move in the same direction under similar market conditions.

Long-term holding – Patience pays; staying invested over time helps ride out market volatility.

Warren Buffett’s portfolio is famously composed of approximately 90% equities and 10% fixed income, a strategy that has contributed to his position among the world’s wealthiest individuals.

The only way you reach the top of the game is having a coach. If you want to be financial freedom, ask me how.

0 notes

Text

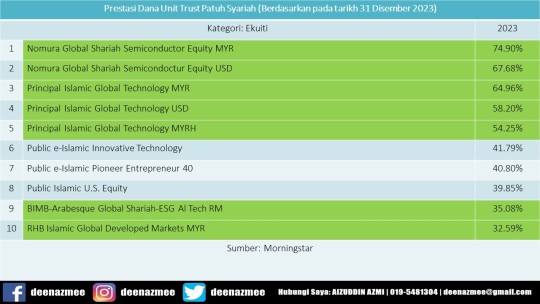

PRESTASI DANA UNIT TRUST PATUH SYARIAH TAHUN 2023

Assalamualaikum & Salam Sejahtera

Sebelum ini saya telah berkongsi tentang apakah itu unit trust? Saya juga telah berkongsi artikel dari laman sesawang FIMM mengenai "Tabung Unit Trust sebagai pelaburan masa depan anda?" dan "Mengumpulkan kekayaan dengan Unit Trust dan PRS". Kali ini saya sekadar hendak berkongsi tentang prestasi dana Unit Trust patuh syariah tahun 2023.

Nak buka akaun pelaburan unit trust secara online? Klik https://tinyurl.com/f4m340F.

Prestasi Dana Unit Trust Patuh Syariah Tahun 2023

Prestasi Dana Unit Trust Patuh Syariah (Berdasarkan Pada Tarikh 31 Disember 2023)

Pulangan YTD (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

Nomura Global Shariah Semicondctr Equity MYR (74.90%)

Nomura Global Shariah Semicondctr Equity USD (67.68%)

Principal Islamic Global Technology MYR (64.96%)

Principal Islamic Global Technology USD (58.20%)

Principal Islamic Global Technology MYRH (54.25%)

Public e-Islamic Innovative Technology (41.79%)

Public e-Islamic Pioneer Entrepreneur 40 (40.80%)

Public Islamic U.S. Equity (39.85%)

BIMB-Arabesque Global Shariah-ESG Al Tech RM (35.08%)

RHB Islamic Global Developed Markets MYR (32.59%)

RHB Global Shariah Equity Index USD (31.78%)

Manulife Shariah India Equity A RM (31.68%)

Nomura Global Shariah Sustainable Equity MYR A (31.18%)

RHB Global Shariah Equity Index MYR Hedged (29.89%)

RHB i-Global Sustainable Disruptors USD (29.84%)

BIMB-Arabesque Global Shariah-ESG Al Tech USD (29.16%)

RHB i-Global Sustainable Disruptors MYR Hedged (28.72%)

Public Islamic Global Equity (28.22%)

TA Global Absolute Alpha-i MYR (27.94%)

BIMB-Arabesque Global Shariah Sustainable Equity RM (27.89%)

AHAM Aiiman Global Multi Thematic USD (27.80%)

BIMB-Arabesque i Global Dividend 1 MYR (27.21%)

TA Global Absolute Alpha-i RMB Hedged (26.96%)

Manulife Shariah India Equity A USD (26.29%)

Nomura Global Shariah Sustainable Equity USD A (25.77%)

Aberdeen Standard Islamic World Equity A (25.64%)

AHAM Aiiman Global Multi Thematic SGD Hedged (25.29%)

RHB Islamic Global Developed Markets SGD (25.03%)

Public e-Islamic Sustainable Millennial (24.92%)

AHAM Aiiman Global Multi Thematic AUD Hedged (24.31%)

AHAM Aiiman Global Multi Thematic MYR Hedged (24.10%)

BIMB-Arabesque Global Shariah-ESG Al Tech RM Hedged (24.01%)

PMB Shariah Tactical (24.00%)

Kenanga Global Islamic (23.93%)

BIMB-Arabesque Global Shariah Sustainable Equity RM Hedged (23.15%)

Maybank Global Sustainable Equity-I MYR (22.98%)

TA Global Absolute Alpha-i USD (22.64%)

BIMB-Arabesque Global Shariah Sustainable Equity USD (22.56%)

BIMB-Arabesque Global Shariah Sustainable Equity AUD (22.33%)

BIMB-Arabesque Global Shariah Sustainable Equity SGD (22.32%)

BIMB-Arabesque i Global Dividend 1 USD (21.56%)

TA Global Absolute Alpha-i GBP Hedged (20.88%)

TA Global Absolute Alpha-i SGD Hedged (20.63%)

Phillip Dana Dividen Inc (20.30%)

Principal DALI Global Equity MYR (19.65%)

TA Global Absolute Alpha-i MYR Hedged (18.92%)

BIMB-Arabesque i Global Dividend 1 MYR Hedged (18.62%)

Maybank Global Sustainable Equity-I USD (17.70%)

Manulife Investment Shariah Asia-Pacific ex Japan (17.43%)

BIMB-Arabesque Asia Pacific Shariah-ESG Equity MYR (17.12%)

BIMB-Arabesque i Global Dividend 1 SGD (17.06%)

Maybank AsiaPac Ex-Japan Equity-I (16.89%)

Principal Islamic Asia Pacific Dynamic Equity (16.77%)

Aiiman Global Equity MYR (16.58%)

TA Global Absolute Alpha-i AUD Hedged (16.46%)

PMB Shariah Equity (16.08%)

Maybank Global Sustainable Equity-I MYR Hedged (14.94%)

ICD Global Sustainable (14.81%)

PMB Shariah Dividend (14.49%)

Public e-Islamic Asia Thematic Growth (13.45%)

PMB Dana Bestari (13.28%)

PMB Shariah Global Equity (12.69%)

PB Islamic Asia Strategic Sector (12.38%)

BIMB-Arabesque Asia Pacific Shariah-ESG Equity USD (12.24%)

Aiiman Global Equity USD (12.11%)

Public Asia Ittikal (12.07%)

Public Islamic Asia Dividend (11.88%)

Principal DALI Asia Pacific Equity Growth (11.38%)

RHB Shariah Asia Ex-Japan Growth MYR (11.20%)

Global Islamic Equity (11.19%)

Principal Islamic Asia Pacific Dynamic Income & Growth MYR (10.94%)

Principal Islamic Aggressive Wholesale Fund-Of-Funds (10.88%)

Muamalat Invest Islamic Equity (10.60%)

Public Islamic Select Treasures (10.27%)

AmIslamic Global SRI RM Class (10.19%)

Principal Islamic Small Cap Opportunities (10.15%)

Public Ittikal Sequel (9.81%)

Aiiman Global Equity MYR Hedged (9.16%)

Manulife Investment Shariah Progress Plus (9.09%)

Principal Islamic Enhanced Opportunities (8.95%)

KAF Dana Adib (8.79%)

AHAM Aiiman Quantum (8.78%)

Manulife Investment Al-Faid (8.66%)

KAF Islamic Dividend Income (8.53%)

Principal Islamic Malaysia Opportunities (8.19%)

Public Islamic Optimal Growth (7.99%)

PMB Dana Al-Aiman (7.98%)

Public Islamic Savings (7.93%)

Public Islamic Select Enterprises (7.71%)

TA Islamic (7.47%)

Public Islamic Opportunities (7.41%)

PMB Shariah Index (7.29%)

Public Islamic Alpha-40 Growth (7.17%)

Public Islamic Asia Leaders Equity (7.15%)

Principal DALI Equity (7.04%)

PB Islamic SmallCap (6.94%)

Public Islamic Dividend (6.63%)

Public Islamic Emerging Opportunities (6.50%)

Manulife Shariah - Dana Ekuiti (6.44%)

AHAM Aiiman Asia (Ex Japan) Growth MYR (6.35%)

Aiiman Asia Pacific (Ex Japan) Dividend (6.35%)

Principal Islamic Asia Pacific Dynamic Income & Growth USD (6.26%)

TA Dana Fokus (6.26%)

Public Islamic Enterprises Equity (6.07%)

AmIslamic Global SRI USD Class R (5.96%)

AmIslamic Growth (5.70%)

Eastspring Investments Islamic Small-cap (5.58%)

Manulife Investment Shariah Progress (5.28%)

AHAM Aiiman Growth (5.20%)

Manulife Investment Al-Fauzan (5.10%)

Principal Islamic Asia Pacific Dynamic Income & Growth SGD (4.63%)

PB Islamic Equity (4.60%)

Principal DALI Equity Growth (4.41%)

Public Islamic Equity (4.33%)

BIMB-Arabesque Malaysia Shariah-ESG Equity Myr (4.14%)

Principal DALI Opportunities MYR (4.13%)

Phillip Dana Aman (4.09%)

Kenanga Ekuiti Islam (4.02%)

Public Islamic Optimal Equity (4.02%)

ASEAN Equity (4.00%)

Dana Aset Campuran/Seimbang

Maybank Global Mixed Assets-I USD Institutional Distribution (63.91%)

InterPac Dana Abadi (55.88%)

Public Islamic Asia Tactical Allocation (28.62%)

InterPac Dana Saadi (26.52%)

PB Islamic Dynamic Allocation (24.46%)

Public Islamic Global Balanced (21.58%)

Aiiman Smart Invest Portfolio - Growth (21.16%)

United-i Global Balanced MYR (17.14%)

Maybank Global Mixed Assets-I MYR (16.78%)

Principal Islamic Global Selection Aggressive MYR (15.06%)

Maybank Global Wealth Growth-I USD Acc (14.86%)

United-i Global Balanced SGD Hedged (14.78%)

United-i Global Balanced GBP Hedged (14.27%)

AHAM Aiiman Global Thematic Mixed Asset USD Institutional (13.97%)

PMB-An-Nur Waqf Income A (13.73%)

AHAM Aiiman Global Thematic Mixed Asset USD (13.09%)

AHAM Aiiman Global Thematic Mixed Asset AUD Hedged (12.74%)

United-i Global Balanced RMB Hedged (12.46%)

Nomura Global Shariah Strategic Growth A (12.34%)

United-i Global Balanced USD (12.29%)

Nomura Global Shariah Strategic Growth B (12.00%)

Maybank Global Mixed Assets-I USD (11.90%)

AHAM Aiiman Global Thematic Mixed Asset SGD Hedged (11.30%)

PMB-An-Nur Waqf Income B (11.14%)

Maybank Global Wealth Growth-I MYRH Acc (10.79%)

Bank Islam Premier (10.58%)

RHB Global Shariah Dynamic Income MYR Hedged (10.58%)

Public Islamic Mixed Asset (10.53%)

Principal Islamic Global Selection Aggressive USD (10.33%)

AHAM Aiiman Global Thematic Mixed Asset MYR Hedged (10.10%)

Maybank Global Mixed Assets-I SGD Hedged (9.94%)

Maybank Global Mixed Assets-I AUD Hedged (9.78%)

Public Islamic Enhanced Bond (9.29%)

Maybank Global Mixed Assets-I MYR Hedged (8.77%)

Manulife Investment Al-Umran (8.59%)

Maybank Global Wealth Moderate-I USD Acc (8.47%)

Maybank Global Wealth Moderate-I USD Dis (8.47%)

Principal Islamic Lifetime Balanced (8.24%)

United-i Global Balanced MYR Hedged (8.20%)

United-i Global Balanced AUD Hedged (7.65%)

Manulife Investment-ML Shariah Flexi (7.54%)

Principal Islamic Global Selection Moderate Conservative MYR (6.77%)

Manulife Investment-CM Shariah Flexi (6.67%)

Maybank Malaysia Balanced I (6.64%)

AHAM Aiiman Select Income (6.60%)

Astute Dana Al-Faiz-I Inc (6.55%)

Principal Islamic Global Selection Moderate MYR (6.45%)

RHB Islamic Regional Balanced MYR (6.42%)

Public Ehsan Mixed Asset Conservative (6.34%)

Principal Islamic Lifetime Balanced Growth (6.32%)

KAF Dana Alif (6.14%)

TA Dana Optimix (6.11%)

Principal Islamic Conservative Wholesale Fund-Of-Funds (6.05%)

Public Islamic Growth Balanced (5.95%)

Maybank Global Wealth Moderate-I MYRH Acc (5.94%)

Principal Islamic Balanced Wholesale Fund-Of-Funds (5.81%)

Maybank Global Wealth Moderate-I MYRH Dis (5.78%)

Public Ehsan Mixed Asset Growth (5.77%)

AmIslamic Balanced (5.60%)

Principal Islamic Lifetime Enhanced Sukuk (5.53%)

RHB Dana Hazeem (4.78%)

Public e-Islamic Flexi Allocation (4.41%)

Manulife Investment-HW Shariah Flexi (4.35%)

Kenanga SyariahExtra (4.07%)

Dana Bon/Sukuk

Principal Islamic Wholesale Sukuk C (9.48%)

Principal Islamic Wholesale Sukuk B (9.47%)

Principal Islamic Wholesale Sukuk A (9.39%)

AmDynamic Sukuk – Class B (8.44%)

AmDynamic Sukuk – Class A (8.42%)

Public Islamic Infrastructure Bond (8.14%)

PB Aiman Sukuk (7.76%)

United-I ESG Series-High Quality Sukuk SGD Hedged (7.69%)

Public e-Sukuk (7.57%)

Public Islamic Bond (7.54%)

Public Sukuk (7.33%)

KAF Sukuk (7.24%)

PB Islamic Bond (7.24%)

AHAM Aiiman Global Sukuk MYR (7.15%)

AmBon Islam (7.22%)

Opus Shariah Income (6.91%)

PB Sukuk (6.90%)

Maybank Malaysia Income-I C MYR (6.79%)

Maybank Malaysia Income-I A MYR (6.77%)

Franklin Malaysia Sukuk I MYR Inc (6.72%)

Principal Islamic Lifetime Sukuk (6.67%)

AHAM Aiiman Income Plus (6.65%)

Opus Shariah Income Plus (6.58%)

Franklin Malaysia Sukuk A MYR Inc (6.51%)

Public Islamic Strategic Bond (6.32%)

AmanahRaya Syariah Trust (6.30%)

Kenanga AsnitaBond (6.26%)

Nomura i-Income 2 H USD Hedge (6.22%)

Maybank Income Management-I (6.01%)

Opus Shariah Dynamic Income (5.99%)

TA Dana Afif (5.78%)

Kenanga Bon Islam (5.76%)

Maybank Malaysia Sukuk (5.74%)

RHB Shariah Income (5.53%)

RHB Global Sukuk RM Class B (5.43%)

Phillip Dana Murni (5.36%)

Principal Islamic Global Sukuk MYR (5.29%)

BIMB ESG Sukuk Class A (5.23%)

BIMB ESG Sukuk Class D (5.23%)

AmanahRaya Syariah Income (4.99%)

AmIslamic Institutional 1 (4.96%)

Public Islamic Income (4.94%)

MAMG Global Income-I B USD (4.90%)

Public Islamic Select Bond (4.88%)

Principal Islamic Malaysia Government Sukuk D (4.37%)

United-i Conservative Income (4.27%)

Nomura i-Income 2 S (4.25%)

Nomura i-Income 2 I (4.14%)

Principal Islamic Malaysia Government Sukuk B (4.14%)

Principal Islamic Malaysia Government Sukuk C (4.14%)

Nomura i-Income 2 R (4.00%)

Dana Pasaran Wang

AmanahRaya Syariah Cash Management (13.30%)

Dana Hartanah

Manulife Shariah Global REIT MYR Inc (12.68%)

Manulife Shariah Global REIT USD Inc (8.02%)

Dana Lain-lain

AHAM Shariah Gold Tracker (19.00%)

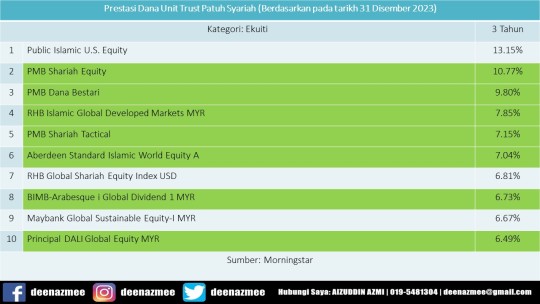

Purata Pulangan Tahunan 3 Tahun (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

Public Islamic U.S. Equity (13.15%)

PMB Shariah Equity (10.77%)

PMB Dana Bestari (9.80%)

RHB Islamic Global Developed Markets MYR (7.85%)

PMB Shariah Tactical (7.15%)

Aberdeen Standard Islamic World Equity A (7.04%)

RHB Global Shariah Equity Index USD (6.81%)

BIMB-Arabesque i Global Dividend 1 MYR (6.73%)

Maybank Global Sustainable Equity-I MYR (6.67%)

Principal DALI Global Equity MYR (6.49%)

Public e-Islamic Sustainable Millennial (6.44%)

RHB Global Shariah Equity Index MYR Hedged (6.41%)

TA Dana Fokus (6.26%)

Public Islamic Global Equity (5.96%)

Global Islamic Equity (5.76%)

Manulife Investment Shariah Progress Plus (4.51%)

PB Islamic SmallCap (4.46%)

KAF Dana Adib (4.30%)

KAF Islamic Dividend Income (4.25%)

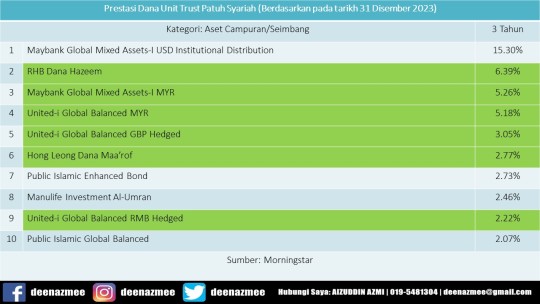

Dana Aset Campuran/Seimbang

Maybank Global Mixed Assets-I USD Institutional Distribution (15.30%)

RHB Dana Hazeem (6.39%)

Maybank Global Mixed Assets-I MYR (5.26%)

United-i Global Balanced MYR (5.18%)

United-i Global Balanced GBP Hedged (3.05%)

Hong Leong Dana Maa’rof (2.77%)

Public Islamic Enhanced Bond (2.73%)

Manulife Investment Al-Umran (2.46%)

United-i Global Balanced RMB Hedged (2.22%)

Public Islamic Global Balanced (2.07%)

Dana Bon/Sukuk

Principal Islamic Wholesale Sukuk C (4.39%)

Principal Islamic Wholesale Sukuk B (4.36%)

Principal Islamic Wholesale Sukuk A (4.32%)

AmanahRaya Syariah Trust (3.72%)

RHB Shariah Income (3.18%)

KAF Sukuk (3.01%)

Franklin Malaysia Sukuk I MYR Inc (3.00%)

Maybank Malaysia Income-I A MYR (2.93%)

PB Aiman Sukuk (2.92%)

Franklin Malaysia Sukuk A MYR Inc (2.79%)

AHAM Aiiman Global Sukuk MYR (2.69%)

Maybank Income Management-I (2.69%)

Principal Islamic Lifetime Sukuk (2.68%)

Public e-Sukuk (2.63%)

Public Islamic Bond (2.63%)

Kenanga AsnitaBond (2.53%)

Public Islamic Strategic Bond (2.46%)

AmDynamic Sukuk – Class B (2.45%)

Phillip Dana Murni (2.37%)

United-i Conservative Income (2.33%)

AmBon Islam (2.26%)

Opus Shariah Short Term Low Risk Asset (2.13%)

PB Sukuk (2.11%)

Maybank Malaysia Income-I C MYR (2.10%)

Maybank Malaysia Sukuk (2.03%)

Public Islamic Select Bond (2.03%)

United-I ESG Series-High Quality Sukuk MYR (2.03%)

PB Islamic Bond (2.01%)

Dana Hartanah

Manulife Shariah Global REIT MYR Inc (4.54%)

Dana Lain-lain

AHAM Shariah Gold Tracker (6.15%)

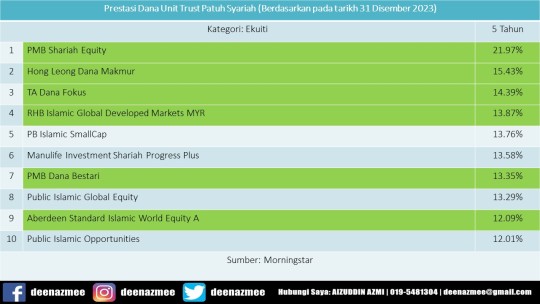

Purata Pulangan Tahunan 5 Tahun (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

PMB Shariah Equity (21.97%)

Hong Leong Dana Makmur (15.43%)

TA Dana Fokus (14.39%)

RHB Islamic Global Developed Markets MYR (13.87%)

PB Islamic SmallCap (13.76%)

Manulife Investment Shariah Progress Plus (13.58%)

PMB Dana Bestari (13.35%)

Public Islamic Global Equity (13.29%)

Aberdeen Standard Islamic World Equity A (12.09%)

Public Islamic Opportunities (12.01%)

PMB Shariah Tactical (11.17%)

KAF Islamic Dividend Income (10.94%)

Kenanga Shariah Growth Opportunity (10.48%)

Principal DALI Global Equity MYR (10.36%)

KAF Dana Adib (9.39%)

PMB Shariah Growth (9.13%)

Principal Islamic Asia Pacific Dynamic Equity (8.82%)

Manulife Investment Shariah Asia-Pacific ex Japan (8.55%)

Principal Islamic Small Cap Opportunities (8.46%)

TA Islamic (8.44%)

Public Islamic Select Treasures (8.36%)

Global Islamic Equity (7.85%)

PMB Shariah Index (7.48%)

Maybank AsiaPac Ex-Japan Equity-I (7.40%)

Kenanga Global Islamic (7.25%)

BIMB-Arabesque i Global Dividend 1 MYR (7.21%)

PMB Dana Al-Aiman (6.94%)

AHAM Aiiman Quantum (6.78%)

ICD Global Sustainable (6.73%)

RHB Islamic Emerging Opportunity (6.68%)

Principal DALI Asia Pacific Equity Growth (6.45%)

Pheim Asia Ex-Japan Islamic (6.41%)

Manulife Shariah - Dana Ekuiti (6.21%)

Manulife Investment Al-Fauzan (6.10%)

Public Islamic ASEAN Growth (5.92%)

Public Islamic Treasures Growth (5.90%)

Public Islamic Emerging Opportunities (5.89%)

BIMB i Growth (5.86%)

Public Islamic Alpha-40 Growth (5.78%)

Manulife Investment Al-Faid (5.69%)

Public Islamic Asia Leaders Equity (5.53%)

Kenanga Ekuiti Islam (5.40%)

AHAM Aiiman Growth (5.33%)

Public Asia Ittikal (5.15%)

Manulife Investment Shariah Progress (5.07%)

Public Islamic Savings (5.01%)

BIMB-Arabesque i Global Dividend 1 USD (4.98%)

PB Islamic Asia Strategic Sector (4.83%)

Public Islamic Asia Dividend (4.78%)

Public Ittikal Sequel (4.66%)

Principal Islamic Aggressive Wholesale Fund-Of-Funds (4.64%)

Precious Metals Securities (4.56%)

Kenanga Amanah Saham Wanita (4.41%)

PMB Dana Mutiara (4.40%)

AmIslamic Growth (4.22%)

Astute Dana Al-Sofi-i (4.17%)

Kenanga Syariah Growth (4.14%)

Principal Islamic Malaysia Opportunities (4.03%)

RHB Shariah Asia Ex-Japan Growth MYR (4.03%)

Dana Aset Campuran/Seimbang

Hong Leong Dana Maa’rof (10.45%)

Public Islamic Asia Tactical Allocation (8.95%)

InterPac Dana Safi (8.52%)

PB Islamic Dynamic Allocation (7.76%)

Kenanga SyariahExtra (7.74%)

TA Dana Optimix (6.62%)

Manulife Investment-ML Shariah Flexi (6.57%)

RHB Dana Hazeem (6.31%)

Public Islamic Growth Balanced (6.05%)

Public Ehsan Mixed Asset Conservative (6.03%)

Manulife Investment Al-Umran (5.77%)

Public e-Islamic Flexi Allocation (5.53%)

Dana Makmur Pheim (5.47%)

AmIslamic Balanced (5.45%)

Manulife Investment-HW Shariah Flexi (5.41%)

Public Islamic Mixed Asset (5.34%)

Astute Dana Aslah (4.87%)

Public Islamic Enhanced Bond (4.69%)

Principal Islamic Lifetime Balanced (4.47%)

Kenanga Islamic Balanced (4.11%)

Dana Bon/Sukuk

AmanahRaya Syariah Trust (6.16%)

PB Aiman Sukuk (4.73%)

Maybank Malaysia Income-I A MYR (4.46%)

AmDynamic Sukuk – Class B (4.35%)

KAF Sukuk (4.35%)

Principal Islamic Lifetime Sukuk (4.30%)

Franklin Malaysia Sukuk I MYR Inc (4.22%)

Maybank Malaysia Sukuk (4.19%)

AmBon Islam (4.14%)

Kenanga AsnitaBond (4.13%)

Public Islamic Bond (4.05%)

Franklin Malaysia Sukuk A MYR Inc (4.01%)

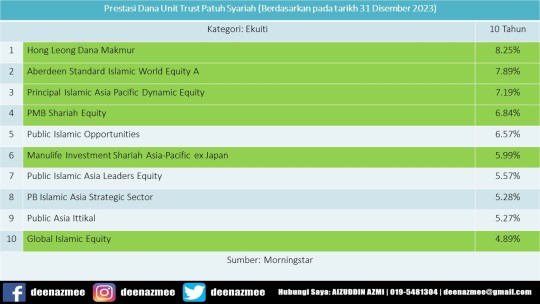

Purata Pulangan Tahunan 10 Tahun (Berdasarkan pada tarikh 31 Disember 2023)

Dana Ekuiti

Hong Leong Dana Makmur (8.25%)

Aberdeen Standard Islamic World Equity A (7.89%)

Principal Islamic Asia Pacific Dynamic Equity (7.19%)

PMB Shariah Equity (6.84%)

Public Islamic Opportunities (6.57%)

Manulife Investment Shariah Asia-Pacific ex Japan (5.99%)

Public Islamic Asia Leaders Equity (5.57%)

PB Islamic Asia Strategic Sector (5.28%)

Public Asia Ittikal (5.27%)

Global Islamic Equity (4.89%)

Public China Ittikal (4.85%)

TA Dana Fokus (4.69%)

Pheim Asia Ex-Japan Islamic (4.67%)

Principal DALI Asia Pacific Equity Growth (4.61%)

Public Islamic Asia Dividend (4.61%)

Public Islamic Select Treasures (4.36%)

Kenanga Shariah Growth Opportunity (4.35%)

PMB Dana Bestari (4.33%)

PMB Shariah Growth (4.26%)

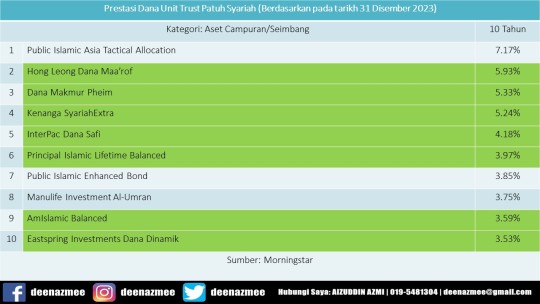

Dana Aset Campuran/Seimbang

Public Islamic Asia Tactical Allocation (7.17%)

Hong Leong Dana Maa’rof (5.93%)

Dana Makmur Pheim (5.33%)

Kenanga SyariahExtra (5.24%)

InterPac Dana Safi (4.18%)

Principal Islamic Lifetime Balanced (3.97%)

Public Islamic Enhanced Bond (3.85%)

Manulife Investment Al-Umran (3.75%)

AmIslamic Balanced (3.59%)

Eastspring Investments Dana Dinamik (3.53%)

Principal Islamic Lifetime Enhanced Sukuk (3.30%)

Manulife Investment-HW Shariah Flexi (3.24%)

TA Dana Optimix (3.05%)

Dana Bon/Sukuk

AmanahRaya Syariah Trust (5.18%)

PB Aiman Sukuk (4.84%)

KAF Sukuk (4.71%)

Kenanga AsnitaBond (4.60%)

Maybank Malaysia Income-I A MYR (4.55%)

Public Islamic Bond (4.34%)

Principal Islamic Lifetime Sukuk (4.29%)

PB Islamic Bond (4.23%)

AmBon Islam (4.20%)

AmDynamic Sukuk – Class A (4.17%)

Public Islamic Infrastructure Bon (4.08%)

PB Sukuk (4.04%)

Sumber: my.morningstar.com

P/S: Prestasi masa lalu tidak semestinya menunjukkan atau menjamin prestasi masa hadapan. Jom pelbagaikan pelaburan. Sekarang telah ada satu platform di mana pelabur mempunyai pilihan untuk melabur ke 300 lebih dana unit trust swasta daripada 20 lebih syarikat pengurusan unit trust yang tersenarai di Malaysia sama ada untuk melabur secara tunai atau melalui akaun 1 KWSP. Tiada pelaburan awal jika berminat untuk melabur secara simpanan tetap. (Hanya 90 dana unit trust swasta patuh syariah tertentu) Adakah simpanan anda mencukupi? Dimanakah tempat anda membuat simpanan? Jom gandakan simpanan di tempat yang kalis Inflasi! Berminat? Nak buka akaun pelaburan unit trust secara online? Klik https://tinyurl.com/f4m340F.

Untuk keterangan lanjut & temujanji, sila hubungi:

Aizuddin Azmi Perunding Unit Amanah Single License Investment Emel: [email protected] H/P: 019-548 1304 Alamat: No. 29A (Ground Floor), Lebuh Pantai 10300 Pulau Pinang

Sekian, wassalam.

0 notes

Video

instagram

Pengalaman dan pendidikan adalah RAKAN KARIB dalam mengecap IMPIAN 𝗠𝗔𝗦𝗔 𝗗𝗘𝗣𝗔𝗡 𝗔𝗡𝗗𝗔 • 𝗩𝗜𝗦𝗜 𝗞𝗔𝗠𝗜 𝐈𝐌𝐓𝐈𝐘𝐀𝐙 𝐂𝐎𝐍𝐒𝐔𝐋𝐓𝐀𝐍𝐂𝐘 𝐒𝐃𝐍 𝐁𝐇𝐃 Kuala Lumpur • Damansara • Klang • Shah Alam • Kajang • Seremban • Melaka • Johor Bahru • Kuantan • Raub • Ipoh •Manjung 𝑯𝑼𝑳𝑼𝑹 𝑻𝑨𝑵𝑮𝑨𝑵,𝑹𝑬𝑩𝑼𝑻 ��𝑬𝑳𝑼𝑨𝑵𝑮,𝑪𝑨𝑷𝑨𝑰 𝑰𝑴𝑷𝑰𝑨𝑵,𝑨𝑳𝑯𝑨𝑴𝑫𝑼𝑳𝑰𝑳𝑳𝑨𝑯 ⓉⒽⒺ ⒷⒺⓈⓉ ⓃⒺⓋⒺⓇ ⓇⒺⓈⓉ #thisisimtiyaz #agencyNo1 #aiamalaysia #aiapublictakaful #imtiyazconsultancy #imtiyazzennajah #imtiyazsouthern #imtiyazmelaka #imtiyazHq #imtiyazcentral #opportunity #job #businessopportunity #peluangkerjaya #unittrust #srikandiimtiyaz #stayhome #staystrong #StayHealthy #staytuned #MenangBersama #kitamenangbersama https://www.instagram.com/p/CTcQSbIhK2Q/?utm_medium=tumblr

#thisisimtiyaz#agencyno1#aiamalaysia#aiapublictakaful#imtiyazconsultancy#imtiyazzennajah#imtiyazsouthern#imtiyazmelaka#imtiyazhq#imtiyazcentral#opportunity#job#businessopportunity#peluangkerjaya#unittrust#srikandiimtiyaz#stayhome#staystrong#stayhealthy#staytuned#menangbersama#kitamenangbersama

1 note

·

View note

Text

Pekerja Swasta Dan EPF

Kalau anda seorang pekerja disektor swasta, Kumpulan Wang Simpanan Pekerja atau KWSP ini memang sangat sinomin. Mana mungkin tidak, KWSP ini lah jaminan mereka untuk hari tua nanti. Senang cakap, duit pencen.

Untuk makluman semua, duit caruman KWSP ini terdiri daripada potongan syer majikan dan syer pekerja. Jadi, pekerja yang kena potong gaji tiap-tiap bulan untuk dicarum tu harap bertabahlah, duit kita juga kan?!.

Duit caruman kita atau tabungan kita dalam KWSP tu pula dibahagikan kepada dua akaun, iaitu akaun 1 dan akaun 2. Kebanyakan masyarakat sudah seria maklum tentang perkara ini, cuma perbezaan antara dua akaun ini masih ada yang keliru.

Saya jelaskan secara ringkas disini peratusan pecahan caruman KWSP untuk akaun 1 dan akaun 2. Akaun 1 adalah 70% dari jumlah caruman dan selebihnya iaitu 30% lagi dimasukkan kedalam akaun 2.

Yang nak saya kongsikan disini, saya yakin ramai yang kurang maklum iaitu kegunaan akaun 1 dan akaun 2 KWSP. Saya mulakan dengan akaun 2 sebab kegunaannya lebih banyak berbanding akaun 1. Akaun 2 KWSP ini tidak perlu pencen untuk dikeluarkan. Akaun 2 yang mempunyai baki yang vukup boleh dikeluarkan untuk digunakan bilamana anda ingin mengerjakan haji, membayar yuran pendidikan atau pinjaman pendidikan (PTPTN), membeli dan membayar ansuran bulanan rumah dan membayar kos perubatan. Macam-macam juga tu, untungkan ada KWSP?

Berbeza dengan akaun 2, akaun 1 pula hanya boleh dikeluarkan bila pencarum itu berumur 55 tahun, senang cerita, bila pekerja tu dah pencen. Perkara ini ada sudah ditetapkan oleh kerajaan kita dan ada kebaikannya. Andai kata boleh dikeluarkan seperti akaun 2, tidak ada yang tinggal lagi untuk dibuat bekalan pencen nanti, nak kerja masa tu, dah tua. Pujian harus diberikan kepada kerajaan kita tentang perkara ini.

Berkaitan pautan yang saya kongsikan pula, KWSP akan menurunkan agihan dividen kepada pencarum. Disini mungkin ramai yang tidak tahu bahawa setiap tahun kerajaan akan memberikan hibah atau keuntungan atas simpanan kepada pencarum-pencarum mereka. Duit yang kita simpan di akaun 1 itu akan digunakan untuk pelaburan dan dari hasil pelaburan itu, pihak KWSP akan berkongsi untung kepada pencarum (pemegang saham). Purata agihan dalam 10 tahun lepas adalah 6% setahun keuntungan.

Perkara yang paling penting yang saya nak kogsikan disini ialah, ramai orang kita tidak tahu bahawa kerajaan juga telah melantik badan-badan korporat untuk membantu menggandakan keuntungan duit caruman masing-masing. Pencarum yang memilih untuk menggandakan keuntungan mereka berpeluang mendapat keuntungan dari 12% ke 16% setahun beserta dividen. Orang yang tahu dan bijak akan rebut peluang ini. Cara ini dikatakan PENCEN KAYA.

Untuk maklumat secara lebih mendalam, serta untuk menyemak kelayan dan bagaimana cara, anda boleh menghubungi saya ditalian 019-3834775 (www.wasap.my/60193834775). Kita jumpa, kita share, kita untung!

#kwsp#kewangan#pelaburan#investment#retirement#saham#forex#bitcoin#publicmutual#unittrust#sahamamanah

1 note

·

View note

Text

Link Roundup #12: 10 Things to Know This Week

NEW ARTICLE! 12th edition of the link roundup series. Lots of amazing articles about investing, saving and earning money this week!

Accelerate your personal finance knowledge with this regular feature on Ringgit Oh Ringgit – the Link Roundup! I promise you’ll find these 10 links informational 🙂

1. That 1% Fee Impact – Mutual Funds vs Investing on your own – DividendMagic

When it comes to mutual funds and unit trusts, always follow this golden rule – the less fees, the better.

Those of you with mutual funds/unit trusts with 3%…

View On WordPress

1 note

·

View note

Photo

#personalty #law #movable #property #conversion #subscription #investment #presidentsclub #mediumofexchange #unitofaccount #investmentclub #unittrust #storeofvalue #legalinsurance #club #association #exlibris #prose #prosocio #prosolido 🤝 (at President Street) https://www.instagram.com/p/CTkN-L1LP-f/?utm_medium=tumblr

#personalty#law#movable#property#conversion#subscription#investment#presidentsclub#mediumofexchange#unitofaccount#investmentclub#unittrust#storeofvalue#legalinsurance#club#association#exlibris#prose#prosocio#prosolido

0 notes

Photo

Walking-eating-laughing 🤩 . . RHBAM Premier Sales Convention Munich-Salzburg 2018 . #rhbam #rhbassetmanagement #rhbampremiersalesconvention2018 #rhbammunichsalzburg2018 #munich #salzburg #unittrust #unittrustconsultant #travel #travelgram #travelinspiration #travelogbungaraya #travelphotography #travelforFREE #freetrip #joinusNow #championteam #gywtakesgerman #mozart (at Munich, Germany)

#travelgram#salzburg#joinusnow#championteam#travel#rhbam#travelogbungaraya#travelphotography#freetrip#travelinspiration#travelforfree#gywtakesgerman#mozart#rhbampremiersalesconvention2018#unittrustconsultant#rhbassetmanagement#rhbammunichsalzburg2018#munich#unittrust

1 note

·

View note

Text

Kenapa menyimpan duit lebih baik dari berhutang.

https://forms.gle/K7Peiq4YynpBB9BEA

#unittrust

#investment

#pelaburan

#penasihatkewangan

#kewangan

#untung

#portfolio

#yes_financial

#Yes_I_Do

1 note

·

View note

Text

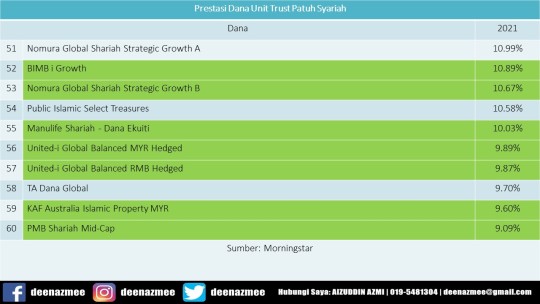

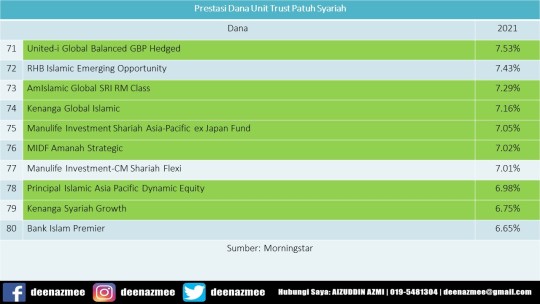

PRESTASI DANA UNIT TRUST PATUH SYARIAH TAHUN 2021

Assalamualaikum & Salam Sejahtera

Sebelum ini saya telah berkongsi tentang apakah itu unit trust? Saya juga telah berkongsi artikel dari laman sesawang FIMM mengenai "Tabung Unit Trust sebagai pelaburan masa depan anda?" dan "Mengumpulkan kekayaan dengan Unit Trust dan PRS". Kali ini saya sekadar hendak berkongsi tentang prestasi dana Unit Trust patuh syariah tahun 2021.

Nak buka akaun pelaburan unit trust secara online? Klik https://tinyurl.com/f4m340F.

Prestasi Dana Unit Trust Patuh Syariah Tahun 2021

Sila klik link di bawah untuk dapatkan info tentang prestasi dana unit trust patuh syariah.

Prestasi Dana Unit Trust Patuh Syariah

Prestasi Dana Unit Trust Patuh Syariah

Prestasi Dana Unit Trust Patuh Syariah

Sumber: my.morningstar.com

P/S: Prestasi masa lalu tidak semestinya menunjukkan atau menjamin prestasi masa hadapan. Jom pelbagaikan pelaburan. Sekarang telah ada satu platform di mana pelabur mempunyai pilihan untuk melabur ke 300 lebih dana unit trust swasta daripada 20 lebih syarikat pengurusan unit trust yang tersenarai di Malaysia sama ada untuk melabur secara tunai atau melalui akaun 1 KWSP. Tiada pelaburan awal jika berminat untuk melabur secara simpanan tetap. (Hanya 90 dana unit trust swasta patuh syariah tertentu) Adakah simpanan anda mencukupi? Dimanakah tempat anda membuat simpanan? Jom gandakan simpanan di tempat yang kalis Inflasi! Berminat? Nak buka akaun pelaburan unit trust secara online? Klik https://tinyurl.com/f4m340F.

Untuk keterangan lanjut & temujanji, sila hubungi:

Aizuddin Azmi Perunding Unit Amanah Single License Investment Emel: [email protected] H/P: 019-548 1304 Alamat: No. 29A (Ground Floor), Lebuh Pantai 10300 Pulau Pinang

Sekian, wassalam.

0 notes

Photo

Banker Vs trustee Not sure if this is really from Jack Ma. What do you think? #trustee #banker #unittrust #gazellepenang #publicmutualpenang #publicmutual #jackma #quote #money #whattodo https://www.instagram.com/p/CDOIlW7JBx-/?igshid=x4pqbfrllm6m

0 notes

Text

You don’t need S$10,000 to start investing

Investing is said to be a milestone of adulting. Afterall, unless we went to business school or attended finance classes, few of us would have thought about investing for ourselves. It’s intangible: You can’t sniff it, touch it, or hear it. Investing is also perceived to be expensive. A few people we spoke to told us that they aren’t investing because they do not have S$10,000 of savings. Truth is, you don’t need much to start investing. But because investing is for the long-term, and we want you to invest healthily, here’s what you should have before you start to invest:

Emergency savings of 6x your income;

An insurance plan(s) in place; and

Good grip over your debt

Why is investing for the long-term? “A journey of a thousand miles begins with a single step,” so goes the Chinese proverb. Take legendary investor Warren Buffett for example. He is now said to be worth US$84 billion, but reportedly started his first investment with only US$228! The story also goes that within days of making his first investment, he lost a third of it. When it bounced back, he sold the shares at US$2 each, and made a profit. To his dismay, the share went on to rise to US$162. So, he learnt to buy good, buy cheap and hold on to his shares.

How can you invest on a beginner’s salary?

These 5 tips will help you.

1. Make regular, small investments You can become a shareholder of a company by buying its shares. It’s possible to invest in Singapore stocks in ‘board lots’ of only 100 units, through a trading platform such as DBS Vickers Online. So, if you fancy Stock X which costs S$3.35, you can start investing in it for around S$335, plus some brokerage fees.

However, if you prefer buying an Exchange Traded Fund (ETF) that mirrors the performance of the Singapore stock market or a bond ETF, you can start investing for as little as S$100 a month through Invest-Saver.

You can also start investing in unit trusts with an initial S$1,000 (and much lower amounts subsequently, depending on the fund). For some unit trusts, the starting amount is an even lower S$100 if you can commit to regular investments each month.

One advantage of regular, small investments is you are not trying to time the market. This is a disciplined plan of investments, known as dollar-cost averaging, that will average out the cost of share purchases.

More importantly, you are relying on “time in market” rather than “timing the market.” And this is important because historically, good quality stocks have their ups and downs, but over the long term, their prices will tend to trend higher. By staying invested for longer, you achieve the “time in market” factor.

In contrast, timing the market is a very difficult task, because it involves trying to pick the moment when stock prices are low. Even highly-trained professionals find it difficult to do this consistently.

2. Use your CPF As long as you have more than S$20,000 in your CPF Ordinary Account (OA), that “excess” can be used to invest. Monies in your CPF-Special Account (SA) can also be used for investment, but the threshold is higher, at S$40,000.

Before you invest, make sure that you’re aiming for a return that’s bigger than the guaranteed CPF interest rates of:

2.5% for your CPF-OA;

4% for your CPF-SA; and

1% bonus interest on the first S$60,000 in your CPF account

If you’re deciding whether to invest with your CPF-OA or CPF-SA, always prefer the OA. That’s because you earn a lower interest rate of 2.5% in the CPF-OA, i.e. a lower return level to “beat”.

To start investing using your CPF funds, open a CPF investment account with an approved CPF Investment Scheme (CPFIS) agent. You can use this account to invest in stocks, unit trusts, and bonds, among other things.

You can invest a maximum of 35% of your “investible savings” in stocks and 10% for gold. “Investible assets” refers to whatever is in your CPF-OA, plus the amount of CPF you have withdrawn for investment and education.

3. Use your bonuses! You may feel like a kid in the candy store when you get your bonus – so much money, so many things to get!

But if you can just resist the urge to blow your bonuses on expensive watches or holidays, you can boost your regular savings and investments with that sum of money.

4. Use your ‘untouchable’ tax savings With the Supplementary Retirement Scheme (SRS), you can top up your account with a maximum of S$15,300 each year to get the maximum tax relief. And because it makes more sense to leave the monies within the scheme (than withdraw it before you turn 62), that S$15,300 can be put to work in investments, rather than sitting idle and earning a paltry 0.05% each year.

5. Build a portfolio without timing the market You can start to build a diversified, multi-asset class portfolio even on a beginner’s salary. It takes just S$1,000 to start, with some boosting power from ad-hoc amounts when you get your bonus, or when you top-up your SRS account.

The portfolio can include:

Single stocks

REITs (Real Estate Investment Trusts)

Singapore Savings Bonds

Stock ETFs

Stock unit trusts

Bond ETFs

Bond unit trusts

Interested in taking the first step? Sign up for a DBS Vickers Online Account to start investing without breaking the bank.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

This article was first published on DBS Learn.

All information provided “as is” for informational purposes only, not intended for trading purposes or advice. Neither Yahoo! nor any of independent providers is liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. By accessing the Yahoo! site, you agree not to redistribute the information found therein.

Investing in stock markets involves the risk of loss.

0 notes

Text

Property Prices Rebounds In June

House prices in Sydney and Melbourne have published their first monthly profits since 2017 in a sign that the downturn in the economy may be over in our two largest cities. For the two largest cities in June, both SQM Research and CoreLogic reported expansions, while SQM also discovered uplift in Brisbane, Perth, Adelaide and Hobart.

For buildings in Sydney, Melbourne and Hobart, CoreLogic reported monthly expansions and rises for flats in those three cities as well as Darwin. It was Sydney's first monthly growth since the market peaked in July 2017 and since its peak in November 2017 in Melbourne.

CoreLogic claims it's an early indication that reduced mortgage rates and enhanced confidence already have an impact of flow-on effect. "I'm not ready to say that the housing market will roar back," states Cameron Kusher of CoreLogic. “But it’s been looking like the worst is over we’ve been seeing consistently the rate of decline has been slowing and now we’ve seen positive results for the first time.”

Useful Links:

We’ll Show You How You Can Eliminate Your Mortgage In The Next 5 Years!

0 notes

Photo

Going up just like the stairs so is my portfolio every month #getrich #managedaccounts #empowering #financialliteracy #finances #marketoutlook #unittrust #cwamanagement #downpayment #investinunittrustnow #millionairesistersgroup #millionairesisters #2016 #economyisstillgrowing #updates #growth #cwa #cimb #ilovemyjob #earliertoday #asbloan #asb #whatsapp0163083749 #marketing #networking #advertising #wallstreet #income #investors #investing (at Shibuya, Tokyo)

#asb#growth#getrich#unittrust#investors#ilovemyjob#investinunittrustnow#cwamanagement#marketoutlook#downpayment#earliertoday#managedaccounts#2016#advertising#marketing#cimb#networking#financialliteracy#cwa#wallstreet#income#whatsapp0163083749#empowering#updates#economyisstillgrowing#asbloan#investing#finances#millionairesisters#millionairesistersgroup

1 note

·

View note

Photo

Just to remind everyone that I am a Licensed Financial Consultant and Investment Planner😎 If you want to talk about finances, just send a message and I'll be sure to reply😉 . . . #financialconsulting #finance #finances #unittrust #mutualfund #privatemandate #ddnk #assets https://www.instagram.com/p/CJ_NKEmge1U/?igshid=1z2qchbae1la

0 notes

Photo

With beautiful @illasabry_ Day 4: Salzburg ❤️ . RHBAM Premier Sales Convention Munich-Salzburg 2018 . #rhbam #rhbassetmanagement #rhbampremiersalesconvention2018 #rhbammunichsalzburg2018 #munich #salzburg #unittrust #unittrustconsultant #travel #travelgram #travelinspiration #travelogbungaraya #travelphotography #travelforFREE #freetrip #joinusNow #championteam #gywtakesgerman #salzburg #mozart (at Salzburg, Austria)

#unittrust#travelgram#travel#travelforfree#gywtakesgerman#travelinspiration#travelogbungaraya#munich#mozart#championteam#salzburg#freetrip#unittrustconsultant#rhbassetmanagement#rhbam#rhbampremiersalesconvention2018#joinusnow#travelphotography#rhbammunichsalzburg2018

1 note

·

View note

Text

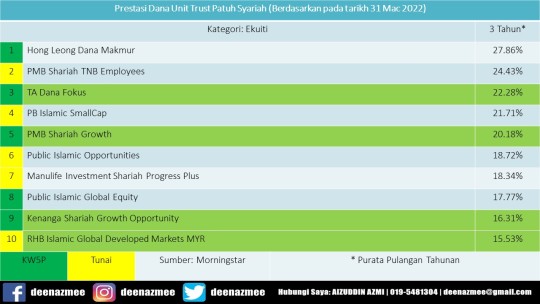

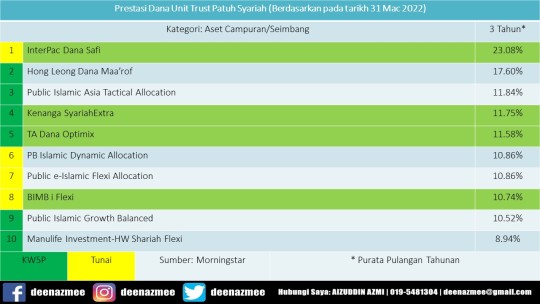

PRESTASI DANA UNIT TRUST PATUH SYARIAH (BERDASARKAN PADA TARIKH 31 MAC 2022)

Assalamualaikum & Salam Sejahtera

Sebelum ini saya telah berkongsi tentang apakah itu unit trust? Saya juga telah berkongsi artikel dari laman sesawang FIMM mengenai "Tabung Unit Trust sebagai pelaburan masa depan anda?" dan "Mengumpulkan kekayaan dengan Unit Trust dan PRS". Kali ini saya sekadar hendak berkongsi tentang prestasi dana Unit Trust patuh syariah berdasarkan pada tarikh 31 Mac 2022.

Nak buka akaun pelaburan unit trust secara online? Klik https://tinyurl.com/f4m340F.

Prestasi Dana Unit Trust Patuh Syariah (Berdasarkan Pada Tarikh 31 Mac 2022)

Pulangan YTD (Berdasarkan pada tarikh 31 Mac 2022)

Dana Ekuiti

Precious Metals Securities (17.49%)

Dana Aset Campuran/Seimbang

Dana Bon/Sukuk

Dana Hartanah

KAF Australia Islamic Property MYR (21.83%)

KAF Australia Islamic Property AUD (16.80%)

Dana Lain-lain

Affin Hwang Shariah Gold Tracker (6.23%)

Purata Pulangan Tahunan 3 Tahun (Berdasarkan pada tarikh 31 Mac 2022)

Dana Ekuiti

Hong Leong Dana Makmur (27.86%)

PMB Shariah TNB Employees (24.43%)

TA Dana Fokus (22.28%)

PB Islamic SmallCap (21.71%)

PMB Shariah Growth (20.18%)

Public Islamic Opportunities (18.72%)

Manulife Investment Shariah Progress Plus (18.34%)

Public Islamic Global Equity (17.77%)

Kenanga Shariah Growth Opportunity (16.31%)

RHB Islamic Global Developed Markets MYR (15.53%)

PMB Dana Bestari (14.10%)

Precious Metals Securities (13.98%)

Aberdeen Standard Islamic World Equity A (13.81%)

TA Islamic (13.81%)

KAF Islamic Dividend Income (12.63%)

RHB Islamic Emerging Opportunity (12.27%)

Principal DALI Global Equity MYR (12.18%)

BIMB i Growth (11.80%)

Principal Islamic Asia Pacific Dynamic Equity (11.69%)

PMB Shariah ASEAN Stars Equity USD Acc (11.64%)

Public Islamic Treasures Growth (11.11%)

KAF Dana Adib (10.72%)

RHB Shariah China Focus RM (10.66%)

Public Islamic Optimal Equity (10.32%)

Public Islamic Select Treasures (10.17%)

Pheim Asia Ex-Japan Islamic (9.93%)

Affin Hwang Aiiman Quantum (9.88%)

Public Islamic Emerging Opportunities (9.87%)

Principal DALI Asia Pacific Equity Growth (9.57%)

Manulife Investment Shariah Asia-Pacific ex Japan Fund (9.52%)

PMB Dana Mutiara (9.44%)

PMB Shariah Index (9.27%)

Public Islamic Alpha-40 Growth (9.13%)

Global Islamic Equity (9.05%)

PMB Shariah Tactical (8.78%)

Manulife Investment Al-Fauzan (8.73%)

Affin Hwang Aiiman Growth (8.59%)

Public Islamic Asia Leaders Equity (8.58%)

Principal Islamic Small Cap Opportunities (8.43%)

RHB Shariah Asia Ex-Japan Growth MYR (8.35%)

Public Islamic Savings (8.31%)

Kenanga Global Islamic (8.08%)

ICD Global Sustainable (8.05%)

Manulife Shariah - Dana Ekuiti (7.94%)

Kenanga Ekuiti Islam (7.76%)

Manulife Investment Shariah Progress (7.76%)

PMB Shariah Mid-Cap (7.67%)

Public Asia Ittikal (7.49%)

PMB Shariah Aggressive (7.25%)

Public China Ittikal (7.24%)

TA Dana Global (7.16%)

Public Islamic Asia Dividend (7.12%)

Manulife Investment Al-Faid (7.10%)

PMB Shariah Premier (6.86%)

PB Islamic Asia Strategic Sector (6.83%)

Principal Islamic Aggressive Wholesale Fund-Of-Funds (6.78%)

AmIslamic Growth (6.66%)

Principal Islamic Malaysia Opportunities (6.58%)

Public Ittikal Sequel (6.58%)

Public Islamic Dividend (6.36%)

Affin Hwang Aiiman Asia (Ex Japan) Growth MYR (6.34%)

Public Islamic ASEAN Growth (6.28%)

PMB Dana Al-Aiman (6.25%)

Kenanga Syariah Growth (6.19%)

Kenanga Amanah Saham Wanita (6.15%)

Principal Islamic Enhanced Opportunities (6.01%)

Public Islamic Equity (5.79%)

Maybank AsiaPac Ex-Japan Equity-I (5.52%)

PB Islamic Asia Equity (5.51%)

PB Islamic Equity (5.24%)

PMB Shariah Small-Cap MYR (5.12%)

Public Islamic Enterprises Equity (5.12%)

Public Islamic Advantage Growth Equity (5.01%)

Dana Aset Campuran/Seimbang

InterPac Dana Safi (23.08%)

Hong Leong Dana Maa’rof (17.60%)

Public Islamic Asia Tactical Allocation (11.84%)

Kenanga SyariahExtra (11.75%)

TA Dana Optimix (11.58%)

PB Islamic Dynamic Allocation (10.86%)

Public e-Islamic Flexi Allocation (10.86%)

BIMB i Flexi (10.74%)

Public Islamic Growth Balanced (10.52%)

Manulife Investment-HW Shariah Flexi (8.94%)

Public Ehsan Mixed Asset Conservative (8.74%)

Public Islamic Mixed Asset (8.22%)

RHB Dana Hazeem (8.00%)

AmIslamic Balanced (7.78%)

Dana Makmur Pheim (7.51%)

Manulife Investment Al-Umran (6.56%)

Apex Dana Aslah (5.95%)

Principal Islamic Lifetime Balanced (5.44%)

Kenanga Islamic Balanced (5.42%)

Dana Bon/Sukuk

AmanahRaya Syariah Trust (6.88%)

Dana Hartanah

KAF Australia Islamic Property MYR (13.72%)

KAF Australia Islamic Property AUD (10.69%)

Manulife Shariah Global REIT MYR Inc (9.77%)

Manulife Shariah Global REIT USD Inc (8.67%)

Purata Pulangan Tahunan 5 Tahun (Berdasarkan pada tarikh 31 Mac 2022)

Dana Ekuiti

Hong Leong Dana Makmur (15.73%)

TA Dana Fokus (10.69%)

RHB Islamic Global Developed Markets MYR (9.58%)

Public Islamic Opportunities (9.09%)

Aberdeen Standard Islamic World Equity A (8.46%)

Principal Islamic Asia Pacific Dynamic Equity (8.42%)

PB Islamic SmallCap (8.09%)

TA Islamic (7.99%)

PMB Shariah Growth (7.96%)

Kenanga Shariah Growth Opportunity (7.37%)

PMB Shariah TNB Employees (7.21%)

KAF Islamic Dividend Income (6.93%)

Manulife Investment Shariah Asia-Pacific ex Japan Fund (6.75%)

Pheim Asia Ex-Japan Islamic (6.62%)

Public Islamic Asia Leaders Equity (6.45%)

Principal DALI Asia Pacific Equity Growth (6.41%)

Precious Metals Securities (6.26%)

Public Islamic Optimal Equity (5.97%)

Affin Hwang Aiiman Asia (Ex Japan) Growth MYR (5.94%)

PB Islamic Asia Strategic Sector (5.85%)

Public China Ittikal (5.82%)

PMB Shariah Premier (5.60%)

Public Asia Ittikal (5.49%)

Affin Hwang Aiiman Quantum (5.37%)

Maybank AsiaPac Ex-Japan Equity-I (5.18%)

Public Islamic Savings (5.07%)

Public Islamic Asia Dividend (5.00%)

Dana Aset Campuran/Seimbang

InterPac Dana Safi (11.12%)

Hong Leong Dana Maa’rof (10.40%)

Public Islamic Asia Tactical Allocation (7.51%)

Public Islamic Growth Balanced (7.48%)

Public Ehsan Mixed Asset Conservative (6.97%)

Kenanga SyariahExtra (6.94%)

Dana Makmur Pheim (6.80%)

TA Dana Optimix (6.53%)

Dana Bon/Sukuk

Nomura i-Income (6.27%)

AmanahRaya Syariah Trust (6.21%)

Dana Hartanah

KAF Australia Islamic Property AUD (10.38%)

KAF Australia Islamic Property MYR (8.75%)

Purata Pulangan Tahunan 10 Tahun (Berdasarkan pada tarikh 31 Mac 2022)

Dana Ekuiti

Hong Leong Dana Makmur (11.02%)

Public Islamic Opportunities (10.09%)

PMB Shariah Growth (9.18%)

Principal Islamic Asia Pacific Dynamic Equity (8.46%)

Manulife Investment Shariah Progress (8.40%)

Eastspring Investments Dinasti Equity (8.02%)

Public China Ittikal (7.94%)

Public Asia Ittikal (7.33%)

PB Islamic Asia Strategic Sector (7.30%)

Public Islamic Asia Leaders Equity (7.28%)

Principal DALI Asia Pacific Equity Growth (7.15%)

Global Islamic Equity (7.14%)

Pheim Asia Ex-Japan Islamic (7.12%)

Kenanga Shariah Growth Opportunity (6.96%)

Affin Hwang Aiiman Growth (6.65%)

Public Islamic Asia Dividend (6.65%)

PMB Shariah Aggressive (6.63%)

Eastspring Investments Dana al-Ilham (6.42%)

TA Dana Fokus (6.40%)

Public Islamic Select Treasures (6.21%)

PB Islamic Asia Equity (6.16%)

Manulife Investment Al-Fauzan (5.70%)

PMB Shariah Premier (5.68%)

TA Islamic (5.54%)

Manulife Investment Shariah Asia-Pacific ex Japan Fund (5.51%)

Principal Islamic Small Cap Opportunities (5.48%)

PMB Shariah TNB Employees (5.43%)

Public Ittikal Sequel (5.38%)

Kenanga Syariah Growth (5.27%)

Public Islamic Treasures Growth (5.19%)

Dana Aset Campuran/Seimbang

Dana Makmur Pheim (8.43%)

InterPac Dana Safi (8.25%)

Public Islamic Asia Tactical Allocation (7.96%)

Hong Leong Dana Maa’rof (7.52%)

Eastspring Investments Dana Dinamik (7.08%)

Kenanga SyariahExtra (6.83%)

AmIslamic Balanced (5.38%)

Principal Islamic Lifetime Balanced (5.23%)

Dana Bon/Sukuk

RHB Islamic Bond (5.49%)

Sila klik link di bawah untuk dapatkan info tentang prestasi dana unit trust patuh syariah.

Prestasi Dana Unit Trust Patuh Syariah

Prestasi Dana Unit Trust Patuh Syariah

Prestasi Dana Unit Trust Patuh Syariah

Sumber: my.morningstar.com

P/S: Prestasi masa lalu tidak semestinya menunjukkan atau menjamin prestasi masa hadapan. Jom pelbagaikan pelaburan. Sekarang telah ada satu platform di mana pelabur mempunyai pilihan untuk melabur ke 300 lebih dana unit trust swasta daripada 20 lebih syarikat pengurusan unit trust yang tersenarai di Malaysia sama ada untuk melabur secara tunai atau melalui akaun 1 KWSP. Tiada pelaburan awal jika berminat untuk melabur secara simpanan tetap. (Hanya 90 dana unit trust swasta patuh syariah tertentu) Adakah simpanan anda mencukupi? Dimanakah tempat anda membuat simpanan? Jom gandakan simpanan di tempat yang kalis Inflasi! Berminat? Nak buka akaun pelaburan unit trust secara online? Klik https://tinyurl.com/f4m340F.

Untuk keterangan lanjut & temujanji, sila hubungi:

Aizuddin Azmi Perunding Unit Amanah Single License Investment Emel: [email protected] H/P: 019-548 1304 Alamat: No. 29A (Ground Floor), Lebuh Pantai 10300 Pulau Pinang

Sekian, wassalam.

0 notes