#when to use quantity surveyor

Explore tagged Tumblr posts

Text

Estimating Service vs. Quantity Surveyor | What’s the Difference?

Confusion often arises between estimating services and quantity surveyors because both deal with construction costs. However, these roles differ significantly in scope, methodology, and responsibilities. Understanding these differences helps project stakeholders choose the right professional to meet their needs.

Role of an Estimating Service

Estimating services focus primarily on calculating construction costs based on drawings, specifications, and market prices. Their goal is to produce accurate cost estimates for bidding, budgeting, and planning. Estimators often work with contractors, subcontractors, and developers to prepare detailed takeoffs, unit pricing, and cost summaries.

Role of a Quantity Surveyor

Quantity surveyors provide a broader range of cost management services throughout the entire construction lifecycle. They oversee contract administration, procurement advice, value engineering, cost control, and dispute resolution. Quantity surveyors act as financial managers on behalf of clients, ensuring costs align with contractual obligations and project objectives.

Scope and Responsibilities

Estimating services are typically project-focused and pre-construction oriented, providing detailed cost breakdowns early in the process. Quantity surveyors have ongoing involvement, managing financial aspects during design, construction, and post-completion stages.

Professional Qualifications

Quantity surveyors usually have formal qualifications, certifications, and memberships in professional bodies such as the Royal Institution of Chartered Surveyors (RICS). Estimators may have specialized training but often come from diverse construction backgrounds.

When to Use Each Service

Estimating services are ideal for contractors needing accurate bid estimates or developers requiring preliminary budgets. Quantity surveyors are preferred for complex projects demanding comprehensive cost management, contract oversight, and financial reporting.

Frequently Asked Questions

Can an estimator perform quantity surveying tasks? Estimators focus on cost calculation, while quantity surveyors provide broader financial and contractual services.

Is one service more expensive than the other? Quantity surveying services generally cost more due to their wider scope and longer engagement.

Do quantity surveyors provide cost estimates? Yes, but their estimates are part of a larger cost management framework.

Conclusion

While both estimating services and quantity surveyors deal with construction costs, their roles serve different purposes. Choosing the right professional depends on project complexity, budget needs, and desired level of financial control. Understanding these distinctions ensures you engage the best fit for your project’s success.

#estimating service vs quantity surveyor#difference between estimator and quantity surveyor#what does a quantity surveyor do#construction cost estimating roles#when to hire an estimator vs quantity surveyor#cost management professionals#quantity surveyor qualifications#estimator responsibilities explained#quantity surveying scope#construction cost control experts#estimator role in bidding#quantity surveyor contract management#choosing between estimator and surveyor#construction finance management#differences in construction cost professionals#quantity surveyor vs estimator pricing#estimating and quantity surveying comparison#project cost consultants#construction budgeting roles#quantity surveyor services explained#estimator services scope#construction cost estimating professionals#contractor estimating vs quantity surveying#construction project financial experts#when to use quantity surveyor#estimating service benefits#professional construction cost advice#estimator qualifications#quantity surveyor industry standards#construction cost estimation vs cost management

0 notes

Text

it's crazy knowing what i'm gonna look like in the future. my mom takes after her dad and i took after her so much that her brother was shocked after seeing me for the first time in 14 years bc i looked so much like her when he was a kid. and since i've transed my sex, i look in the mirror and constantly see my granddad. like fuck, i'm even taller than he is, so my 5'4 ass, i know exactly how to picture myself from someone else's eyes for the first time. the way he laughs. my granddad is my favourite person in my family and it's really cool to just look like him

#my granddad is so funny he's this little 5'1 guy with vitiligo quantity surveyor who bitches and moans abt how computers have guis now#and back in his day you typed numbers and code and the computer did math and all of this is bullshit#he's the oldest son of a very strong willed woman and married another and he loves it when nana takes the lead in everything lmfao#he told me once that 'i dont like wine' isnt an excuse bc we're [generic french surname]s and our heritage is the cape winelands#now sniff this bouquet of wine. you love it#he once was visiting me in texas and got so excited abt doing fusion texas bbq and braai and bought a bunch of wood to take home#and then realised plant matter cant clear customs#you can tell he was the cool dad who you went to when his wife was doing her evil routine#anyway being in the construction industry he had the family home built to be hobbit sized bc none of us are taller than 5'5

0 notes

Text

NASA rockets to fly through flickering, vanishing auroras

Two NASA rocket missions are taking to the Alaskan skies in hopes of discovering why some auroras flicker, others pulsate, and still others are riddled with holes. Understanding these peculiar features is part of NASA's goal to understand the space environment around our planet, which can affect both spacecraft and astronauts.

The launch window for the missions—which will fly out of the Poker Flat Research Range in Fairbanks, Alaska—opens on Jan. 21, 2025.

Witnessing the aurora borealis (northern lights) can be a moving experience. As ribbons of color fill the night sky, Earth's ever-present connection to space is made visually manifest. It can quiet the mind. Yet these serenity-inducing shimmers are sustained by countless tiny collisions, cascades of little crashes, each perpetrated by a wayward electron. They leave gases glowing in their aftermath like smoldering wreckage. For those less romantically inclined, aurora-watching might be considered top-notch rubbernecking.

This metaphor for the aurora is slightly dramatic. But it does highlight the question that Marilia Samara and Robert Michell, both space physicists at NASA's Goddard Space Flight Center in Greenbelt, Maryland, are after: What sends these electrons careening off course?

Like crime scene investigators, Samara and Michell will use clues at the crash site and work backwards to investigate the cause. As principal investigators of the two soon-to-launch rocket missions, they plan to fly rockets through active auroras to reveal what sent them on their destructive courses.

The GIRAFF (Ground Imaging to Rocket investigation of Auroral Fast Features) mission includes two rockets, each carrying the same set of instruments. Each rocket will target a distinct subtype of aurora: one for so-called fast-pulsating auroras, which flash on and off a few times a second, and the other for flickering auroras, which do so up to 15 times a second.

"It looks like the flickering of an old TV," said Michell, who leads the GIRAFF mission.

Michell suspects that fast-pulsating versus flickering auroras are fueled by different electron acceleration processes. To find out, his team will launch one rocket into each type of aurora, measuring the energy, quantity, and relative arrival times of the electron populations forming them. The measurements, he hopes, may reveal which acceleration processes are at work and constrain where in near-Earth space they are occurring.

The second rocket mission, led by Samara, will study so-called "black auroras," where light from an aurora appears to be missing. In the last 25 years, research using the ESA (European Space Agency) and NASA Cluster satellites has hinted that these dark spots may form where the normally incoming stream of electrons reverses direction, escaping back out into space. Of course, not every blank spot in the aurora fits this description. You need to detect outgoing electrons to know it's the real deal.

"Otherwise, it's not a black aurora, it is just the lack of aurora," said Samara.

Samara's team will launch their rocket through the black aurora and surrounding regions, surveying the electron populations as they fly through to understand how and why this stream reversal takes place. The mission is called the Black and Diffuse Aurora Science Surveyor. (Its acronym is left as an exercise to the reader.)

'The hardest part is still ahead'

Even in Alaska, where auroras shine most winter nights, flying a rocket through them is no small feat. Above terrestrial winds, the aurora move according to their own principles. To know when to launch, both teams will track the auroras via ground-based cameras at the launch site and at the down-range observatory in Venetie, Alaska, about 130 miles to the northeast along the rockets' trajectory.

"We'll be watching these structures moving in the all-sky camera, trying to time it just right," Michell said.

Since it takes about five minutes to get the rockets to altitude, the teams must aim them not where the auroras are but where they think they will be. Of the many tools at their disposal, experience is the truest guide.

"You do the best you can, but there's a certain mix of intuition and determination you need," Samara said.

IMAGE: This photo shows instances of the black aurora, the dark patches that sometimes form within an aurora where electrons escape upward. The photo was taken near Thompson, Manitoba, Canada, on Sept. 29, 2024, at 3:19 a.m. CDT. The photographer, Donna Lach, submitted this image to NASA’s Aurorasaurus citizen science project, which works with participants around the world to photograph, report and verify aurora sightings to advance auroral science. Credit: Donna Lach

5 notes

·

View notes

Text

When you begin the planning of a construction project, you are faced with the inevitable question: how much will it cost? The answer to that can be found in a Bill of Quantities, or BoQ in short. Today, we will talk about how to prepare a bill of quantities, in 6 easy steps.

A Bill of Quantities (BoQ) lists the total materials required to complete the architect's design for a construction project, such as a house or other structure. BoQs are typically prepared by a quantity surveyor or civil engineer who has expertise at estimating the materials required for a project.

The bill of quantity enables you to get quotes for the project that are as accurate as possible. Even if you don't prepare the BoQ yourself, it's still worth knowing how a bill of quantity should be prepared, so you can evaluate the quality of the finished product.

The following are the steps you can follow to properly set up a bill of quantity.

Set up the spreadsheet

Open a new file in your favourite spreadsheet program, online or offline. (We recommend using LibreOffice, one of the best free office software ever.) Now set up the column as follows:

Item numbers

Description

Unit of measurement

Quantity

Rate for the item

Labor cost

Total cost

As expected, your item numbers should start from 1, and reiterate as you change through the categories or sections of the build. The data for the rates and labor costs should be filled in by respective contractors, or, as per the quotes you got from them.

Read more

2 notes

·

View notes

Text

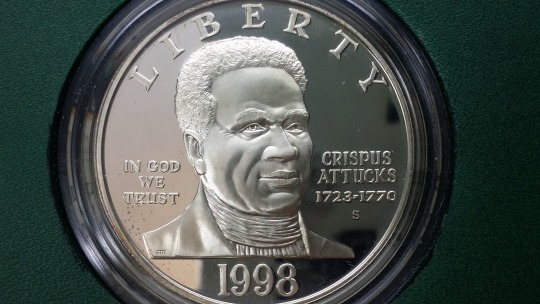

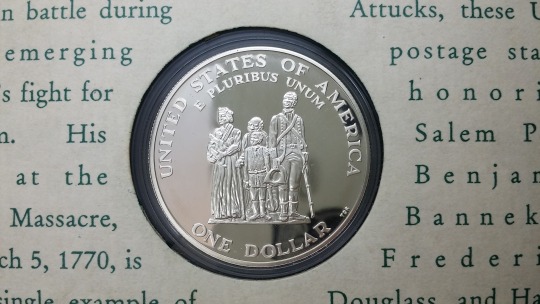

@eBay #Opening #BID $85! #Numismatic #Auction #DontMissOut! | #mintage: 75,070 | | #km288 | | #mint: #SanFrancisco | #finish: Proof | | Year(s) Minted: 1998 | | Composition: 90% Silver | | Weight: 26.73 grams | | Diameter: 38.1 mm | | Thickness: mm |

Coin*: #MI1001IM

1998 S United States Commemorative Proof Dollar – Crispus Attucks – Coin and Stamp

Issuer: United States

Type: Non-Circulating Coin

Year: 1998

Year(s) Minted: 1998

Engraver/Designer: John M. Mercanti | Thomas D. Rogers / Ed Dwight

Value: 1 Dollar

Currency: Dollar (1785-Present)

Composition: Silver (.900 AG)

Weight: 26.73 grams

Diameter: 38.1 mm

Thickness: mm

Shape: Round

Edge: Milled

Mintage: 75,070

Mint: San Francisco, US

Mint Mark: S

Strike: Business

Orientation: ↑ ↓

KM №: 288

Rough Grade ≅: Mint State Proof

Commemorative issue: 275th Birthday of Crispus Attucks

Obverse: A depiction of Crispus Attucks

Lettering:

LIBERTY IN GOD WE TRUST CRISPUS

ATTUCKS

1723-1770

S 1998

Reverse: A detail from the proposed Black Patriots Memorial bronze sculpture designed by Ed Dwight.

Lettering:

UNITED STATES OF AMERICA E PLURIBUS UNUM TDR

ONE DOLLAR

Edge: Reeded

Comments: The 1998 Black Revolutionary War Patriots Silver Dollar was issued to mark the 275th anniversary of the birth of Crispus Attucks. He was the first patriot killed during the Boston Massacre in 1770, one of the events leading up to the Revolutionary War. A portion of the surcharges would go towards a Black Patriots Memorial in Washington DC. Sponsoring groups failed to raise adequate funds to get the project completed. The Black Revolutionary War Patriots Silver Dollar was minted at the San Francisco Mint, with proof and uncirculated coins available. The coins were sold individually or as part of a Black Patriots Coin & Stamp Set. This set was packaged with four stamps featuring Frederick Douglas, Benjamin Banneker, Salem Poor, and Harriet Tubman. Of the authorized mintage of 500,000 silver dollars, a combined 112,280 coins were sold during the sales period from February 13, 1998 to December 31, 1998. Similar to other situations, this low mintage translated into higher secondary market prices for the issue.

Hash Tags: @MI1001IM

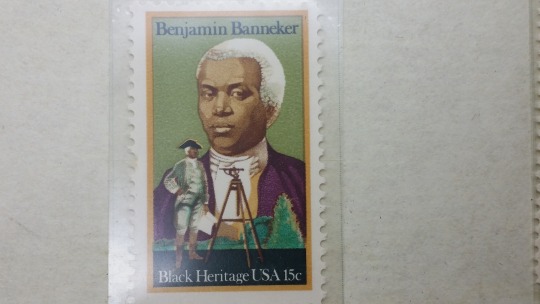

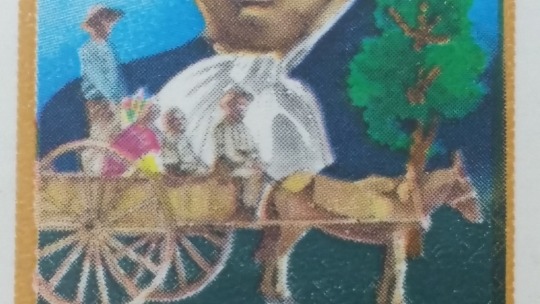

U.S. #1804 – 1980 15C Black Heritage: Benjamin Banneker

Issue Date: February 15th, 1980

City: Annapolis, Maryland

Quantity: 160,000,000

Printed By: Bureau of Engraving and Printing

Printing Method: Photogravure

Perforations: 11

Color: Multicolored

Birth Of Benjamin Banneker

Benjamin Banneker was born on November 9, 1731, in Baltimore County, Maryland.

Banneker was the son of freed slaves and received little formal education as a child. He was mostly self-taught and what little education he had ended when he was old enough to work on the family farm.

When he was 22, Banneker built a hand-carved wooden clock that struck on the hour. The clock worked for over 50 years. In 1772, the Ellicott brothers (namesakes of Ellicott City) established a gristmill near Banneker’s family farm. Banneker took great interest in the operation of the mills, studied them, and befriended the Ellicotts. The Ellicotts also loaned Banneker books to help him further his education, particularly expanding on his joy and study of astronomy. From these studies, Banneker was able to accurately predict a solar eclipse in 1789, proving many well-known astronomers wrong.

In February 1791, one of the members of the Ellicott family who was a local surveyor was called away for work in New York. In his absence, he hired Banneker to take his place in providing the initial survey of boundaries for the newly established federal district (Washington, DC). According to some accounts, much of Banneker’s work on the project involved taking astronomical observations. These were used to identify the starting point of the survey. He also used his clock to keep track of points on the ground in relation to the location of stars at specific times.

Banneker left the project after just three months due to illness. Returning home, he continued his work on an almanac. Over the past few years, he’d collected his calculations in the hope of creating an almanac. When he tried to publish it in 1790, no one would agree to publish it. Then in August 1791, he wrote to Thomas Jefferson.

Banneker sent Jefferson a manuscript of his almanac along with a letter. In it, he discussed the statesman’s view on slavery and how it contradicted the Declaration of Independence. In his response, Jefferson praised Banneker for his almanac, which he said he would forward to the secretary of the academy of sciences in Paris, though it appears he never did.

In any event, Banneker was finally able to publish his almanac in 1792. According to the title page, it included “the Motions of the Sun and Moon, the True Places and Aspects of the Planets, the Rising and Setting of the Sun, Place, and Age of the Moon… The Lunations, Conjunctions, Eclipses, Judgment of the Weather, Festivals, and other remarkable Days; Days for holding the Supreme and Circuit Courts of the United States, as also the useful Courts in Pennsylvania, Delaware, Maryland, and Virginia. Also – several useful Tables, and valuable Receipts. – Various Selections from the Commonplace–Book of the Kentucky Philosopher, an American Sage; with interesting and entertaining Essays, in Prose and Verse – the whole comprising a greater, more pleasing, and useful Variety than any Work of the Kind and Price in North America.”

Banneker’s almanacs were successful for a few years but declined in sales and the 1797 edition was the last to be printed. He sold much of his property in the coming years and died on October 9, 1806, one month before his 75th birthday. His chronic alcoholism may have contributed to his death. On the day of his funeral, a fire broke out in his cabin, burning it to the ground and destroying most of his journals and belongings.

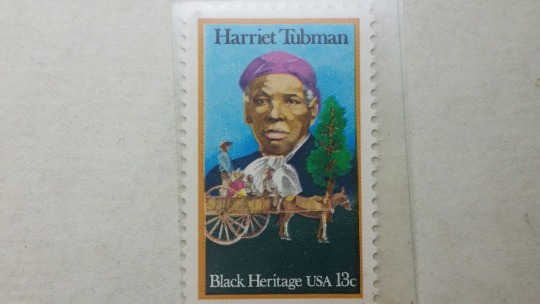

U.S. #1744 – 1978 13C Black Heritage: Harriet Tubman

Issue Date: February 1st, 1978

City: Washington, DC

Quantity: 156,525,000

Printed By: Bureau of Engraving and Printing

Printing Method: Photogravure

Perforations: 10½ x 11

Color: Multicolored

In 1978, the USPS introduced the Black Heritage Series. This issue honors Harriet Tubman, who was known as the Moses of her people. A former slave, she escaped bondage by fleeing to Pennsylvania. However, she returned to the South at least 19 times in order to help more than 300 slaves escape to freedom.

Death Of Harriet Tubman

Abolitionist and humanitarian Harriet Tubman died on March 10, 1913, in Auburn, New York.

The granddaughter of Africans brought to America in the chain holds of a slave ship, Harriet Tubman was born Araminta “Minty” Ross into slavery on a plantation near Cambridge, Maryland. As no definitive records were kept, she was believed to have been born between 1815 and 1825.

As a child, Tubman watched over her younger brother. When she was five or six, the family she worked for hired Tubman out as nursemaid and later to a nearby farm. In her teen years, Tubman became deeply religious and experienced frequent visions she believed came from God, though some believe they may have been caused by a severe head injury.

In 1844, Tubman married a free black man named John Tubman. Around this time, she changed her name to Harriet to honor her mother. Five years later, when her owner sought to sell her, Tubman decided she wouldn’t allow them to decide her fate and planned her escape. On September 17, 1849, she and two of her brothers made their first attempt. However, he brothers had second thoughts and returned, with Tubman joining them. She then planned another escape on her own. This time she succeeded, taking the Underground Railroad to Philadelphia.

Vowing to help other slaves escape, Tubman made nearly 20 trips back to Maryland. Called “Moses” by her people, after the biblical figure who led the Jews out of Egypt, she became the most famous “conductor” of the Underground Railroad. Although no exact number is known, it is estimated that during the 1850s she helped more than 300 slaves escape to freedom. Rewards for her capture once totaled about $40,000. Remarkably, she was never caught, and never once during any of her rescue trips did anyone get left behind.

At the start of the Civil War, Tubman’s abolitionist friends urged the Union Army to utilize her skills and knowledge. She worked for a time as a cook, nurse, and teacher for liberated slaves in refugee camps. Then, in February 1863, Union officials granted her free passage wherever she wanted to go, an honor rarely bestowed upon a civilian.

Tubman was then tasked with planning the raid at Combahee Ferry, aimed at freeing hundreds of slaves. Her first task was gathering intelligence and recruiting troops. Union generals gave her money to offer to slaves in South Carolina who could give her vital information such as how many slaves were in certain areas, and the best spots to land for the raid. The raid began on June 2, with the Second South Carolina Volunteer Regiment and Third Rhode Island Heavy Artillery traveling up the Combahee River in the gunboats Harriet A. Weed and John Adams. With Captain Hoyt and Tubman leading the way, the Union troops made three landings after destroying a pontoon bridge.

The slaves at Combahee were hesitant at first. As Tubman pointed out, “They wasn’t my people.” They didn’t know any more about her than the white officers she worked with. But with the help of previously freed volunteers, she convinced them to board to the boats – over 750 of them. Of those freed slaves, about 100 joined the Union Army.

After the war, Tubman returned to Auburn, New York, where she helped raise money for black schools. She also joined the women’s suffrage movement, working with Susan B. Anthony. In 1908, she established the Harriet Tubman Home for elderly and needy blacks. Three years later, she was in poor health and had to be admitted there herself. Patrons donated money to provide for her care after a newspaper described her as “ill and penniless.” Tubman died on March 10, 1913, surrounded by friends and family, telling them “I go to prepare a place for you.”

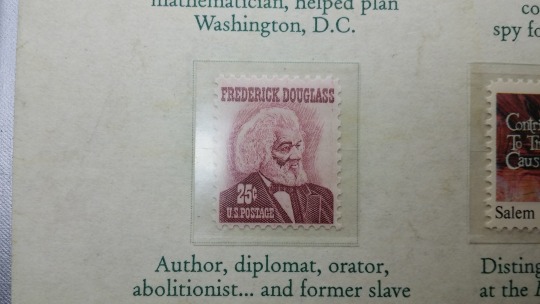

U.S. #1290 – 1967 25C Prominent Americans: Frederick Douglass

Issue Date: February 14th, 1967

City: Washington, DC

Quantity:

Printed By: Bureau of Engraving and Printing

Printing Method: Rotary Press

Perforations:

Color: Rose Lake

Happy Birthday Frederick Douglass!

While the exact date of Frederick Douglass’ birth is unknown, it’s generally considered to be February 14, 1818. Douglass chose the date himself, reportedly because his mother used to call him her “little valentine.”

Born Frederick Augustus Washington Bailey (he adopted the surname Douglass years later), he was separated from his mother at a young age and lived with his maternal grandmother. When he was seven, he began working on the Wye House plantation as a slave.

From there Douglass went to work for the Aud family in Baltimore. Mrs. Aud taught him to read, against her husband’s wishes, and eventually discouraged the practice. But Douglass continued to learn from neighborhood children and the men he worked with. Douglass then began teaching other slaves to read for about six months, until their masters found out and broke up their meetings.

Douglass was loaned out to several different masters during his life in Maryland. In 1837, Douglass met Anna Murray – a free African American woman living in Baltimore – and fell in love. Her free status gave Douglass the motivation he needed to escape Maryland on September 3, 1838. He ended up in New York City less than 24 hours after he left. After Murray arrived they got married and took the name of Johnson. They then moved to New Bedford, Massachusetts and adopted the name Douglass, after the character in the poem, The Lady of the Lake.

Douglass joined the African Methodist Episcopal Zion Church and became a licensed preacher in 1839. He gained valuable experience as an orator and eventually traveled the country with other speakers talking about his life as a slave. In 1845 Douglass published his first autobiography. It was an instant bestseller that was reprinted nine times. However, the book brought attention to his former owner, so Douglass, at the suggestion of his friends, went to Ireland and Britain for two years to deliver rousing lectures. His supporters then raised the funds to buy his freedom, allowing him to return to America in 1847 and begin publishing his first abolitionist paper, The North Star.

The following year, Douglass was the only African American to attend the Seneca Falls Convention on women’s rights. At first, many at the convention did not want suffrage included in the “Declaration of Sentiments.” They thought it was too radical a step and that it would discourage people from taking their cause seriously. Douglass stepped up and spoke in support of the idea. He even went so far as to say he wouldn’t feel right about being able to vote if women couldn’t also. His words inspired the attendees and ultimately persuaded them to keep the right to vote in the document.

Throughout the 1850s, Douglass worked with several abolitionist groups. He also became an early supporter of school desegregation. He was appalled at the poor conditions of African American educational facilities compared to those for white children. He considered the matter to be more important than suffrage. Also in the 1850s, Douglass befriended John Brown, and disapproved of his raid on Harpers Ferry. He fled the country for a time, fearing he might be persecuted just for knowing and meeting with Brown, though he didn’t participate in the raid.

By the time the Civil War began, Douglass was one of the most famous African Americans in the country. President Lincoln sought his advice on the treatment of black soldiers and called Douglass the most meritorious man of the nineteenth century. Douglass also helped recruit men to fight for the North. Though Douglass had a good relationship with Lincoln, he supported John C. Frémont in the election of 1864 because Lincoln’s didn’t publicly endorse suffrage for African American freedmen. However, after Lincoln’s death, Douglass called him America’s “greatest President.”

On April 14, 1876, Douglass was the main speaker at the unveiling of the Lincoln Emancipation Statue in Capitol Hill Park, Washington, D.C. He spoke briefly of President Lincoln’s imperfections, but mostly talked about how everything had led to slavery’s end and the restoration of the Union. Over 25,000 people attended the event, including President Ulysses S. Grant, his cabinet, and members of Congress.

Douglass continued to work for African American and women’s equality. He also received several political appointments, including president of the Freedman’s Savings Bank and chargé d’affaires for the Dominican Republic. He was an ardent supporter of Ulysses S. Grant’s run for the presidency and applauded his Civil Rights and Enforcements Acts. In 1872, Douglass was the first African American to be nominated for Vice President.

In 1877, Frederick Douglass became the first African American U.S. Marshal. He was appointed by President Rutherford B. Hayes and was responsible for Marshal duties in Washington, D.C. The only duty Douglass did not take on was that of introducing visiting dignitaries to the President.

On January 2, 1893, Douglass dedicated the Haiti pavilion at the World’s Columbian Exposition in Chicago, Illinois. Douglass, who had served as the United State’s minister to the country from 1889 to 1891, made a crowd-pleasing speech about Haiti and its people. He talked about their fight for independence and the effect it had on the country and its people. Douglass spoke about the greatness of their success and how it resembled the United States’ own revolution.

Douglass made his final public appearance on February 20, 1895, at a meeting of the National Council of Women, and died after returning home that day.

Click here to read Douglass’ autobiography.

Prominent Americans Series

The Prominent Americans Series recognizes people who played important roles in U.S. history. Officials originally planned to honor 18 individuals, but later added seven others. The Prominent Americans Series began with the 4¢ Lincoln stamp, which was issued on November 10, 1965. During the course of the series, the 6¢ Eisenhower stamp was reissued with an 8¢ denomination and the 5¢ Washington was redrawn.

A number of technological changes developed during the course of producing the series, resulting in a number of varieties due to gum, luminescence, precancels and perforations plus sheet, coil and booklet formats. Additionally, seven rate changes occurred while the Prominent Americans Series was current, giving collectors who specialize in first and last day of issue covers an abundance of collecting opportunities. U.S. # 1290b can be identified from other varieties by its color (magenta).

The 25¢ denomination pictures abolitionist and publisher Frederick Douglass (1818-95). The man who would become a leading voice for abolition was born a slave in Tuckahoe, Maryland. At the age of 8, Frederick Douglass was sent to work for one of his master’s relatives. Douglass’ new mistress violated the law and taught him to read.

Douglass escaped to Massachusetts in 1838 and continued to educate himself while working as an unskilled laborer. His impassioned 1841 speech at a Massachusetts Antislavery Society meeting led to a series of anti-slavery lectures. His autobiography, Narrative of the Life of Frederick Douglass, was published in 1845 to critical acclaim.

Afraid that his former master would reclaim him, Douglass fled to England, where he continued to speak out against slavery. Sympathetic friends raised funds to purchase his freedom, and Douglass returned to the United States in 1847. Douglass fueled the abolitionist movement with his newspaper, The North Star, operated a station on the Underground Railroad, and advised President Lincoln during the Civil War. Later in life, Douglass served as the recorder of deeds in the District of Columbia and U.S. minister to Haiti.

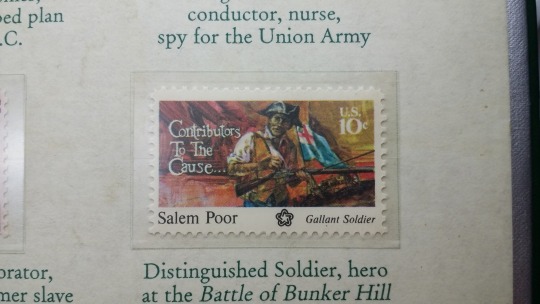

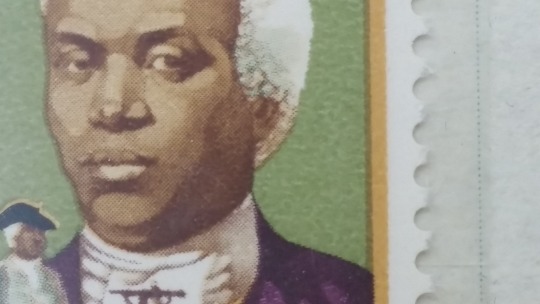

U.S. #1560 – 1975 10c Contributors To The Cause: Salem Poor – Gallant Soldier

Issue Date: March 25th, 1975

City: Washington, Cambridge, Massachusetts

Quantity: 157,865,000

Printed By: Bureau of Engraving and Printing

Printing Method: Photogravure

Perforations: 11 x 10½

Color: Multicolored

The second stamp in the Contributors to the Cause Series is Salem Poor. Poor was a celebrated African-American soldier who fought at the Battle of Bunker Hill. Fourteen officers signed a commendation citing him for bravery.

The Bicentennial Series

The U.S. Bicentennial was a series of celebrations during the mid-1970s that commemorated the historic events leading to America’s independence from Great Britain. The official events began on April 1, 1975, when the American Freedom Train departed Delaware to begin a 21-month, 25,338-mile tour of the 48 contiguous states. For more than a year, a wave of patriotism swept the nation as elaborate firework displays lit up skies across the U.S., an international fleet of tall-mast sailing ships gathered in New York City and Boston, and Queen Elizabeth made a state visit. The celebration culminated on July 4, 1976, with the 200th anniversary of the adoption of the Declaration of Independence.

The U.S. Postal Service issued 113 commemorative stamps over a six-year period in honor of the U.S. bicentennial, beginning with the American Revolution Bicentennial Commission Emblem stamp (U.S. #1432). As a group, the Bicentennial Series chronicles one of our nation’s most important chapters, and remembers the events and patriots who made the U.S. a world model for liberty.

#SanFrancisco#Mint#UnitedStates#America#USA#Commemorative#Silver#Proof#OneDollar#Dollar#Black#Revolutionary#War#Patriots#Anniversary#Crispus#Attucks#KM288

0 notes

Text

Material Take Off: A Key Step Toward Accurate Construction Estimating

In the fast-paced world of construction, precision, planning, and cost control are vital. One process that plays a foundational role in achieving these objectives is Material Take Off (MTO). Whether for a small-scale residential build or a complex industrial project, Material Take Off ensures that the right quantities of materials are estimated, sourced, and delivered on time.

This blog delves into the concept of Material Take Off, its significance, its methodology, and how it contributes to the overall success of a construction project.

What is Material Take Off (MTO)?

Material Take Off refers to the detailed process of quantifying the materials needed for a construction project based on the technical drawings and project plans. It includes listing every component from steel beams and concrete to bolts and paint, and calculating the quantities required to complete the job.

The term "Material Take Off" comes from the act of “taking off” items from design drawings. It’s a fundamental aspect of the pre-construction phase and is typically conducted by estimators, quantity surveyors, or engineers.

Why is Material Take Off Important?

A well-prepared MTO serves as the backbone of project planning and budgeting. Here’s why it’s essential:

Accurate Estimations: An accurate take off provides a clear understanding of material quantities, which translates into precise cost estimation and bidding. Prevents Over or Underordering: Overordering leads to material wastage and increased costs, while underordering results in delays and disrupted timelines. MTO minimizes these risks. Enhances Budget Management: MTO data contributes directly to budgeting and cost control strategies. It helps avoid surprises later in the project. Streamlines Procurement: With exact material quantities in hand, procurement teams can negotiate better rates and delivery timelines with suppliers.

Supports Project Scheduling: Knowing when and how much material is needed helps in scheduling deliveries and ensuring smooth on-site operations.

Key Elements of a Material Take Off

A comprehensive MTO includes:

Item Description: Clear identification of every material required. Units of Measurement: Whether it's linear meters, kilograms, or cubic yards. Quantities: Exact number or volume needed. Material Specifications: Details such as grade, size, and quality. Reference Drawings: Associating materials with their locations or components in the design. These details are typically compiled into a Bill of Materials (BOM) or integrated directly into cost estimating software for seamless planning.

The Process of Conducting Material Take Off

Here’s a step-by-step look at how MTO is typically done:

Review Construction Drawings and Blueprints: Begin by carefully analyzing architectural, structural, and MEP (Mechanical, Electrical, Plumbing) drawings. Identify and Categorize Materials: Break down the project into systems (e.g., foundation, framing, roofing) and list materials required for each. Measure Quantities: Using tools like digital take off software or manual scaling, calculate the required quantities for each material. Apply Unit Conversions: Ensure consistency in measurement units across all materials for accurate ordering and costing. Compile and Verify: Assemble the data into a take off sheet or software and double-check against the drawings for errors or omissions.

Common Challenges in Material Take Off

While MTO is critical, it is not without challenges:

Design Revisions: Ongoing changes in design can affect material requirements. Human Error: Manual take offs are prone to miscalculations or overlooked components. Time-Consuming: The process can be tedious without the right tools or experience.

To combat these challenges, many firms now use BIM (Building Information Modeling) or digital take off software to automate and enhance accuracy.

Tools and Technologies for Modern Take Offs

Traditional methods involved paper drawings and manual calculations. Today, technologies have transformed the take off process:

Digital Take Off Software (e.g., Bluebeam, PlanSwift): Enables faster, more accurate quantification. BIM Integration: Automatically extracts quantities from 3D models. Cloud-Based Estimating Platforms: Promote collaboration among teams in real time.

These tools reduce errors, improve productivity, and allow estimators to focus on higher-level tasks like cost analysis and value engineering.

Best Practices for Effective Material Take Off

To ensure your MTO is as accurate and effective as possible, follow these best practices:

Double-Check All Measurements: Even with software, human oversight is essential. Coordinate with Other Teams: Collaborate with architects, engineers, and contractors to stay aligned. Update Regularly: Reflect changes in design or scope immediately in the take off. Use Checklists: Create material-specific checklists to ensure no item is missed.

Conclusion

Material Take Off is more than a numbers game; it’s a critical planning and forecasting tool that directly affects project outcomes. From improving cost accuracy to ensuring efficient resource allocation, a thorough MTO lays the foundation for a successful build. Incorporating advanced tools and following industry best practices can enhance the accuracy and reliability of your take off, ultimately leading to better decision-making and smoother project execution. Whether you're a contractor, estimator, or project manager, mastering Material Take Off is an investment that pays dividends throughout the construction lifecycle.

0 notes

Text

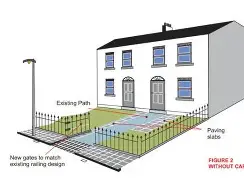

Home Extensions in Dublin: Following Irish Building Regulations and Submitting a Commencement Notice

In the bustling city of Dublin, homeowners, architects, and builders are constantly looking for ways to enhance their properties through home extensions. However, before embarking on any construction project, it is crucial to be well-versed in Irish building regulations and the proper procedures for submitting a commencement notice. Rory Connolly QS, a leading quantity surveying firm based in Rathfarnham, Dublin 14, is here to guide you through the process and ensure that your home extension project is completed seamlessly and in compliance with all legal requirements.

Understanding Irish Building Regulations

Irish building regulations are put in place to ensure that all construction work meets the necessary health and safety standards. These regulations cover a wide range of aspects, including structural stability, fire safety, ventilation, energy efficiency, and accessibility. It is essential to familiarize yourself with these regulations before starting any home extension project to avoid any costly mistakes or delays down the line.

At Rory Connolly QS, we have a team of experienced quantity surveyors who are well-versed in Irish building regulations. We will work closely with you to ensure that your home extension project meets all the necessary requirements and is completed to the highest standard.

Submitting a Commencement Notice

Before starting any construction work on your home extension, you must submit a commencement notice to your local building control authority. This notice serves as a declaration that you intend to carry out the work in accordance with the building regulations. Failure to submit a commencement notice can result in hefty fines and may even necessitate tearing down any work that has already been completed.

Our team at Rory Connolly QS will assist you in preparing and submitting the commencement notice for your home extension project. We will ensure that all the necessary information is included and that the notice is submitted within the required timeframe.

The Importance of Compliance

Complying with Irish building regulations and submitting a commencement notice are not optional steps in the home extension process - they are legal requirements. By following these regulations and procedures, you can avoid potential issues with your project and ensure that your home extension is completed safely and to the highest standard.

As leading quantity surveyors in Dublin, Rory Connolly QS prides itself on our commitment to compliance and quality. We understand that each home extension project is a significant investment for our clients, and we are dedicated to ensuring that every project is completed to the highest standard.

Conclusion

When it comes to home extensions in Dublin, following Irish building regulations and submitting a commencement notice are essential steps in the process. Rory Connolly QS is here to support you every step of the way, from understanding the regulations to preparing and submitting the necessary documentation. With our team of experienced quantity surveyors by your side, you can rest assured that your home extension project will be completed seamlessly and in compliance with all legal requirements. Contact us today to learn more about how we can help you with your home extension project in Dublin.

0 notes

Text

Key Considerations for Property Investors at Tax Time

For property investors at tax time, preparation is the key to maximising returns and minimising liabilities. Whether you're a seasoned investor or just starting out, understanding your tax obligations and opportunities can make a significant difference in your bottom line. With complex regulations and evolving legislation, it’s easy to overlook potential deductions or compliance requirements.

At LP Advisory, we not only help clients find profitable property opportunities through our role as a trusted buyers agent in Melbourne, but we also provide strategic insights that go beyond the purchase. We guide property investors on how to make informed decisions that work in their favour — especially when tax season rolls around.

Why Tax Time Matters for Property Investors

Tax time is a critical period for investors to assess their property performance and ensure they are getting the most out of their investments. From claiming depreciation and interest on loans to understanding capital gains and rental income, property investors must be diligent in how they report and manage their financial records.

Here are some of the most important things property investors should consider at tax time:

1. Claiming Deductions

One of the biggest advantages for property investors is the range of deductions available. Some common deductible expenses include:

Loan interest

Property management fees

Council rates and land tax

Maintenance and repairs

Insurance premiums

Depreciation on assets and property structure

Ensuring these are accurately claimed can lead to substantial tax savings. At LP Advisory, we recommend keeping detailed, organised records throughout the year to make the process seamless.

2. Understanding Depreciation Schedules

Depreciation is a powerful tool for investors, especially with newer properties. A quantity surveyor can prepare a tax depreciation schedule, which helps you claim deductions on both the building structure and any included fixtures or fittings.

If you’ve recently purchased a property, LP Advisory can connect you with the right professionals to ensure you have the necessary documentation in place to benefit from depreciation.

3. Assessing Negative Gearing Benefits

Negative gearing — when the expenses of an investment property exceed the income — can offer tax advantages. The shortfall may be used to reduce your taxable income, which can be particularly useful for high-income earners.

However, it’s important to balance negative gearing with long-term investment goals. As an experienced buyers agent in Melbourne, LP Advisory assists investors in making data-driven decisions about whether a negatively geared property suits their financial strategy.

4. Record Keeping and Documentation

Keeping meticulous records is non-negotiable for property investors at tax time. This includes:

Receipts for expenses

Invoices for renovations or repairs

Property statements

Bank and loan statements

Lease agreements

LP Advisory always recommends our clients use a digital system or property management software to track income and expenses throughout the year. Not only does this ease the burden during tax time, but it also gives you a clearer picture of your property’s performance.

5. Staying Up to Date with Tax Laws

Tax regulations affecting property investors can change — and missing updates could mean non-compliance or missed deductions. For instance, changes in depreciation rules or capital gains tax exemptions may significantly impact your return.

Partnering with a knowledgeable team like LP Advisory ensures you're informed and ready to adapt. We stay abreast of industry changes so our clients can remain compliant and financially protected.

6. Planning Ahead for Capital Gains Tax (CGT)

If you've sold a property during the financial year, you may be liable for Capital Gains Tax. Knowing how CGT is calculated — including any available exemptions or discounts — is essential to avoid surprises.

Planning property sales with the support of LP Advisory can help you align timing with optimal tax outcomes. For instance, holding a property for over 12 months may qualify you for a 50% CGT discount.

Why Work with LP Advisory?

As Melbourne’s trusted buyers agent, LP Advisory doesn’t just help you buy properties — we’re your long-term investment partner. With deep local knowledge and industry insight, we guide you through every phase of your property investment journey, from acquisition to end-of-year financial planning.

We pride ourselves on delivering tailored advice to maximise your portfolio's profitability and reduce tax stress. At tax time, our expertise ensures that nothing is overlooked — giving you the peace of mind that your investments are working as hard as you are.

Final Thoughts

Tax time can be daunting for many, but with the right preparation and support, it can also be a time of opportunity. For property investors at tax time, every dollar counts — and being proactive with your strategy is the smartest way to protect and grow your assets.

Whether you're looking to expand your portfolio or improve your returns, LP Advisory is here to help. Contact us today to speak with an expert buyers agent and make smarter, more profitable decisions in property.

0 notes

Text

Estimate Accuracy in Focus | AS Estimation & Consultants on Construction Estimating Service

Accuracy is at the heart of any successful construction project, and that’s exactly where a professional construction estimating service proves its value. At AS Estimation & Consultants, we understand that even a small cost deviation can affect timelines, quality, and overall profitability. That’s why our construction estimating service focuses on precision, using detailed quantity takeoffs, current market rates, and project-specific data to deliver reliable cost forecasts.

Accuracy depends on many factors—like the quality of project drawings, scope clarity, and material specifications. A dependable construction estimating service will identify gaps and risks early on, allowing clients to make informed decisions from the start. At AS Estimation & Consultants, we don’t just provide numbers—we provide confidence.

Our estimates are backed by real-time market analysis, expert review, and cost breakdowns that give stakeholders full visibility into each budget component. Whether you’re planning a residential build or a large commercial development, partnering with a trusted construction estimating service like ours ensures you’re working with numbers you can count on.

FAQs

What does a construction estimating service include? It typically includes quantity takeoffs, material and labor pricing, equipment costs, indirect costs, and a breakdown of the overall project estimate.

How do construction estimating services ensure accuracy? They rely on updated market rates, detailed project analysis, expert reviews, and estimating software to minimize errors.

Is a construction estimating service worth it for small projects? Yes. Even small projects benefit from accurate budgeting to avoid overspending or delays.

How long does it take to get an estimate? Depending on project complexity, it usually takes 2–7 business days.

Can a construction estimating service help with budget overruns? Absolutely. It identifies cost risks early, helping to adjust scope or materials before construction begins.

AS Estimation and Consultants

6/32 LAW VIC 3020, AUS

(61) 488874145

https://asestimation.com/

#how accurate is a construction estimating service#what does a construction estimating service include#best construction estimating service for small projects#how long does a construction estimate take#can a construction estimating service reduce budget overruns#is a construction estimating service worth it#how to choose a construction estimating service#what makes a good construction estimating service#construction estimating service for residential builds#construction estimating service for commercial projects#benefits of using a construction estimating service#how construction estimating services calculate costs#construction estimating service vs quantity surveyor#do I need a construction estimating service for renovations#affordable construction estimating services near me#how does a construction estimating service work#who provides construction estimating services#top-rated construction estimating services#when to hire a construction estimating service#what to expect from a construction estimating service#using a construction estimating service to avoid delays#detailed takeoffs in a construction estimating service#how construction estimating services handle materials#construction estimating service with fast turnaround#using software in construction estimating services#does a construction estimating service include labor costs#what industries need construction estimating services#how construction estimating services support contractors#construction estimating service for accurate bids#getting reliable numbers from a construction estimating service

0 notes

Text

Key Considerations for Property Investors at Tax Time

For property investors at tax time, preparation is the key to maximising returns and minimising liabilities. Whether you're a seasoned investor or just starting out, understanding your tax obligations and opportunities can make a significant difference in your bottom line. With complex regulations and evolving legislation, it’s easy to overlook potential deductions or compliance requirements.

At LP Advisory, we not only help clients find profitable property opportunities through our role as a trusted buyers agent in Melbourne, but we also provide strategic insights that go beyond the purchase. We guide property investors on how to make informed decisions that work in their favour — especially when tax season rolls around.

Why Tax Time Matters for Property Investors

Tax time is a critical period for investors to assess their property performance and ensure they are getting the most out of their investments. From claiming depreciation and interest on loans to understanding capital gains and rental income, property investors must be diligent in how they report and manage their financial records.

Here are some of the most important things property investors should consider at tax time:

1. Claiming Deductions

One of the biggest advantages for property investors is the range of deductions available. Some common deductible expenses include:

Loan interest

Property management fees

Council rates and land tax

Maintenance and repairs

Insurance premiums

Depreciation on assets and property structure

Ensuring these are accurately claimed can lead to substantial tax savings. At LP Advisory, we recommend keeping detailed, organised records throughout the year to make the process seamless.

2. Understanding Depreciation Schedules

Depreciation is a powerful tool for investors, especially with newer properties. A quantity surveyor can prepare a tax depreciation schedule, which helps you claim deductions on both the building structure and any included fixtures or fittings.

If you’ve recently purchased a property, LP Advisory can connect you with the right professionals to ensure you have the necessary documentation in place to benefit from depreciation.

3. Assessing Negative Gearing Benefits

Negative gearing — when the expenses of an investment property exceed the income — can offer tax advantages. The shortfall may be used to reduce your taxable income, which can be particularly useful for high-income earners.

However, it’s important to balance negative gearing with long-term investment goals. As an experienced buyers agent in Melbourne, LP Advisory assists investors in making data-driven decisions about whether a negatively geared property suits their financial strategy.

4. Record Keeping and Documentation

Keeping meticulous records is non-negotiable for property investors at tax time. This includes:

Receipts for expenses

Invoices for renovations or repairs

Property statements

Bank and loan statements

Lease agreements

LP Advisory always recommends our clients use a digital system or property management software to track income and expenses throughout the year. Not only does this ease the burden during tax time, but it also gives you a clearer picture of your property’s performance.

5. Staying Up to Date with Tax Laws

Tax regulations affecting property investors can change — and missing updates could mean non-compliance or missed deductions. For instance, changes in depreciation rules or capital gains tax exemptions may significantly impact your return.

Partnering with a knowledgeable team like LP Advisory ensures you're informed and ready to adapt. We stay abreast of industry changes so our clients can remain compliant and financially protected.

6. Planning Ahead for Capital Gains Tax (CGT)

If you've sold a property during the financial year, you may be liable for Capital Gains Tax. Knowing how CGT is calculated — including any available exemptions or discounts — is essential to avoid surprises.

Planning property sales with the support of LP Advisory can help you align timing with optimal tax outcomes. For instance, holding a property for over 12 months may qualify you for a 50% CGT discount.

Why Work with LP Advisory?

As Melbourne’s trusted buyers agent, LP Advisory doesn’t just help you buy properties — we’re your long-term investment partner. With deep local knowledge and industry insight, we guide you through every phase of your property investment journey, from acquisition to end-of-year financial planning.

We pride ourselves on delivering tailored advice to maximise your portfolio's profitability and reduce tax stress. At tax time, our expertise ensures that nothing is overlooked — giving you the peace of mind that your investments are working as hard as you are.

Final Thoughts

Tax time can be daunting for many, but with the right preparation and support, it can also be a time of opportunity. For property investors at tax time, every dollar counts — and being proactive with your strategy is the smartest way to protect and grow your assets.

Whether you're looking to expand your portfolio or improve your returns, LP Advisory is here to help. Contact us today to speak with an expert buyers agent and make smarter, more profitable decisions in property.

0 notes

Text

Key Considerations for Property Investors at Tax Time

For property investors at tax time, preparation is the key to maximising returns and minimising liabilities. Whether you're a seasoned investor or just starting out, understanding your tax obligations and opportunities can make a significant difference in your bottom line. With complex regulations and evolving legislation, it’s easy to overlook potential deductions or compliance requirements.

At LP Advisory, we not only help clients find profitable property opportunities through our role as a trusted buyers agent in Melbourne, but we also provide strategic insights that go beyond the purchase. We guide property investors on how to make informed decisions that work in their favour — especially when tax season rolls around.

Why Tax Time Matters for Property Investors

Tax time is a critical period for investors to assess their property performance and ensure they are getting the most out of their investments. From claiming depreciation and interest on loans to understanding capital gains and rental income, property investors must be diligent in how they report and manage their financial records.

Here are some of the most important things property investors should consider at tax time:

1. Claiming Deductions

One of the biggest advantages for property investors is the range of deductions available. Some common deductible expenses include:

Loan interest

Property management fees

Council rates and land tax

Maintenance and repairs

Insurance premiums

Depreciation on assets and property structure

Ensuring these are accurately claimed can lead to substantial tax savings. At LP Advisory, we recommend keeping detailed, organised records throughout the year to make the process seamless.

2. Understanding Depreciation Schedules

Depreciation is a powerful tool for investors, especially with newer properties. A quantity surveyor can prepare a tax depreciation schedule, which helps you claim deductions on both the building structure and any included fixtures or fittings.

If you’ve recently purchased a property, LP Advisory can connect you with the right professionals to ensure you have the necessary documentation in place to benefit from depreciation.

3. Assessing Negative Gearing Benefits

Negative gearing — when the expenses of an investment property exceed the income — can offer tax advantages. The shortfall may be used to reduce your taxable income, which can be particularly useful for high-income earners.

However, it’s important to balance negative gearing with long-term investment goals. As an experienced buyers agent in Melbourne, LP Advisory assists investors in making data-driven decisions about whether a negatively geared property suits their financial strategy.

4. Record Keeping and Documentation

Keeping meticulous records is non-negotiable for property investors at tax time. This includes:

Receipts for expenses

Invoices for renovations or repairs

Property statements

Bank and loan statements

Lease agreements

LP Advisory always recommends our clients use a digital system or property management software to track income and expenses throughout the year. Not only does this ease the burden during tax time, but it also gives you a clearer picture of your property’s performance.

5. Staying Up to Date with Tax Laws

Tax regulations affecting property investors can change — and missing updates could mean non-compliance or missed deductions. For instance, changes in depreciation rules or capital gains tax exemptions may significantly impact your return.

Partnering with a knowledgeable team like LP Advisory ensures you're informed and ready to adapt. We stay abreast of industry changes so our clients can remain compliant and financially protected.

6. Planning Ahead for Capital Gains Tax (CGT)

If you've sold a property during the financial year, you may be liable for Capital Gains Tax. Knowing how CGT is calculated — including any available exemptions or discounts — is essential to avoid surprises.

Planning property sales with the support of LP Advisory can help you align timing with optimal tax outcomes. For instance, holding a property for over 12 months may qualify you for a 50% CGT discount.

Why Work with LP Advisory?

As Melbourne’s trusted buyers agent, LP Advisory doesn’t just help you buy properties — we’re your long-term investment partner. With deep local knowledge and industry insight, we guide you through every phase of your property investment journey, from acquisition to end-of-year financial planning.

We pride ourselves on delivering tailored advice to maximise your portfolio's profitability and reduce tax stress. At tax time, our expertise ensures that nothing is overlooked — giving you the peace of mind that your investments are working as hard as you are.

Final Thoughts

Tax time can be daunting for many, but with the right preparation and support, it can also be a time of opportunity. For property investors at tax time, every dollar counts — and being proactive with your strategy is the smartest way to protect and grow your assets.

Whether you're looking to expand your portfolio or improve your returns, LP Advisory is here to help. Contact us today to speak with an expert buyers agent and make smarter, more profitable decisions in property.

0 notes

Text

Key Considerations for Property Investors at Tax Time

For property investors at tax time, preparation is the key to maximising returns and minimising liabilities. Whether you're a seasoned investor or just starting out, understanding your tax obligations and opportunities can make a significant difference in your bottom line. With complex regulations and evolving legislation, it’s easy to overlook potential deductions or compliance requirements.

At LP Advisory, we not only help clients find profitable property opportunities through our role as a trusted buyers agent in Melbourne, but we also provide strategic insights that go beyond the purchase. We guide property investors on how to make informed decisions that work in their favour — especially when tax season rolls around.

Why Tax Time Matters for Property Investors

Tax time is a critical period for investors to assess their property performance and ensure they are getting the most out of their investments. From claiming depreciation and interest on loans to understanding capital gains and rental income, property investors must be diligent in how they report and manage their financial records.

Here are some of the most important things property investors should consider at tax time:

1. Claiming Deductions

One of the biggest advantages for property investors is the range of deductions available. Some common deductible expenses include:

Loan interest

Property management fees

Council rates and land tax

Maintenance and repairs

Insurance premiums

Depreciation on assets and property structure

Ensuring these are accurately claimed can lead to substantial tax savings. At LP Advisory, we recommend keeping detailed, organised records throughout the year to make the process seamless.

2. Understanding Depreciation Schedules

Depreciation is a powerful tool for investors, especially with newer properties. A quantity surveyor can prepare a tax depreciation schedule, which helps you claim deductions on both the building structure and any included fixtures or fittings.

If you’ve recently purchased a property, LP Advisory can connect you with the right professionals to ensure you have the necessary documentation in place to benefit from depreciation.

3. Assessing Negative Gearing Benefits

Negative gearing — when the expenses of an investment property exceed the income — can offer tax advantages. The shortfall may be used to reduce your taxable income, which can be particularly useful for high-income earners.

However, it’s important to balance negative gearing with long-term investment goals. As an experienced buyers agent in Melbourne, LP Advisory assists investors in making data-driven decisions about whether a negatively geared property suits their financial strategy.

4. Record Keeping and Documentation

Keeping meticulous records is non-negotiable for property investors at tax time. This includes:

Receipts for expenses

Invoices for renovations or repairs

Property statements

Bank and loan statements

Lease agreements

LP Advisory always recommends our clients use a digital system or property management software to track income and expenses throughout the year. Not only does this ease the burden during tax time, but it also gives you a clearer picture of your property’s performance.

5. Staying Up to Date with Tax Laws

Tax regulations affecting property investors can change — and missing updates could mean non-compliance or missed deductions. For instance, changes in depreciation rules or capital gains tax exemptions may significantly impact your return.

Partnering with a knowledgeable team like LP Advisory ensures you're informed and ready to adapt. We stay abreast of industry changes so our clients can remain compliant and financially protected.

6. Planning Ahead for Capital Gains Tax (CGT)

If you've sold a property during the financial year, you may be liable for Capital Gains Tax. Knowing how CGT is calculated — including any available exemptions or discounts — is essential to avoid surprises.

Planning property sales with the support of LP Advisory can help you align timing with optimal tax outcomes. For instance, holding a property for over 12 months may qualify you for a 50% CGT discount.

Why Work with LP Advisory?

As Melbourne’s trusted buyers agent, LP Advisory doesn’t just help you buy properties — we’re your long-term investment partner. With deep local knowledge and industry insight, we guide you through every phase of your property investment journey, from acquisition to end-of-year financial planning.

We pride ourselves on delivering tailored advice to maximise your portfolio's profitability and reduce tax stress. At tax time, our expertise ensures that nothing is overlooked — giving you the peace of mind that your investments are working as hard as you are.

Final Thoughts

Tax time can be daunting for many, but with the right preparation and support, it can also be a time of opportunity. For property investors at tax time, every dollar counts — and being proactive with your strategy is the smartest way to protect and grow your assets.

Whether you're looking to expand your portfolio or improve your returns, LP Advisory is here to help. Contact us today to speak with an expert buyers agent and make smarter, more profitable decisions in property.

0 notes

Text

Key Considerations for Property Investors at Tax Time

For property investors at tax time, preparation is the key to maximising returns and minimising liabilities. Whether you're a seasoned investor or just starting out, understanding your tax obligations and opportunities can make a significant difference in your bottom line. With complex regulations and evolving legislation, it’s easy to overlook potential deductions or compliance requirements.

At LP Advisory, we not only help clients find profitable property opportunities through our role as a trusted buyers agent in Melbourne, but we also provide strategic insights that go beyond the purchase. We guide property investors on how to make informed decisions that work in their favour — especially when tax season rolls around.

Why Tax Time Matters for Property Investors

Tax time is a critical period for investors to assess their property performance and ensure they are getting the most out of their investments. From claiming depreciation and interest on loans to understanding capital gains and rental income, property investors must be diligent in how they report and manage their financial records.

Here are some of the most important things property investors should consider at tax time:

1. Claiming Deductions

One of the biggest advantages for property investors is the range of deductions available. Some common deductible expenses include:

Loan interest

Property management fees

Council rates and land tax

Maintenance and repairs

Insurance premiums

Depreciation on assets and property structure

Ensuring these are accurately claimed can lead to substantial tax savings. At LP Advisory, we recommend keeping detailed, organised records throughout the year to make the process seamless.

2. Understanding Depreciation Schedules

Depreciation is a powerful tool for investors, especially with newer properties. A quantity surveyor can prepare a tax depreciation schedule, which helps you claim deductions on both the building structure and any included fixtures or fittings.

If you’ve recently purchased a property, LP Advisory can connect you with the right professionals to ensure you have the necessary documentation in place to benefit from depreciation.

3. Assessing Negative Gearing Benefits

Negative gearing — when the expenses of an investment property exceed the income — can offer tax advantages. The shortfall may be used to reduce your taxable income, which can be particularly useful for high-income earners.

However, it’s important to balance negative gearing with long-term investment goals. As an experienced buyers agent in Melbourne, LP Advisory assists investors in making data-driven decisions about whether a negatively geared property suits their financial strategy.

4. Record Keeping and Documentation

Keeping meticulous records is non-negotiable for property investors at tax time. This includes:

Receipts for expenses

Invoices for renovations or repairs

Property statements

Bank and loan statements

Lease agreements

LP Advisory always recommends our clients use a digital system or property management software to track income and expenses throughout the year. Not only does this ease the burden during tax time, but it also gives you a clearer picture of your property’s performance.

5. Staying Up to Date with Tax Laws

Tax regulations affecting property investors can change — and missing updates could mean non-compliance or missed deductions. For instance, changes in depreciation rules or capital gains tax exemptions may significantly impact your return.

Partnering with a knowledgeable team like LP Advisory ensures you're informed and ready to adapt. We stay abreast of industry changes so our clients can remain compliant and financially protected.

6. Planning Ahead for Capital Gains Tax (CGT)

If you've sold a property during the financial year, you may be liable for Capital Gains Tax. Knowing how CGT is calculated — including any available exemptions or discounts — is essential to avoid surprises.

Planning property sales with the support of LP Advisory can help you align timing with optimal tax outcomes. For instance, holding a property for over 12 months may qualify you for a 50% CGT discount.

Why Work with LP Advisory?

As Melbourne’s trusted buyers agent, LP Advisory doesn’t just help you buy properties — we’re your long-term investment partner. With deep local knowledge and industry insight, we guide you through every phase of your property investment journey, from acquisition to end-of-year financial planning.

We pride ourselves on delivering tailored advice to maximise your portfolio's profitability and reduce tax stress. At tax time, our expertise ensures that nothing is overlooked — giving you the peace of mind that your investments are working as hard as you are.

Final Thoughts

Tax time can be daunting for many, but with the right preparation and support, it can also be a time of opportunity. For property investors at tax time, every dollar counts — and being proactive with your strategy is the smartest way to protect and grow your assets.

Whether you're looking to expand your portfolio or improve your returns, LP Advisory is here to help. Contact us today to speak with an expert buyers agent and make smarter, more profitable decisions in property.

0 notes

Text

Professional Quantity Surveyor Services in Ireland | Restoration Experts

Are you in need of professional quantity surveyor services in Ireland? Look no further than Rory Connolly Quantity Surveyors. With expertise in restoration projects, we are the go-to experts for all your quantity surveying needs. From initial cost estimates to final project completion, we provide comprehensive services to ensure your project is a success.

The Role of a Quantity Surveyor in Ireland

A quantity surveyor Ireland plays a crucial role in the construction industry. They are responsible for managing all costs relating to building and civil engineering projects, from the initial calculations to the final figures. Quantity surveyors work to minimize costs and enhance value for money, while still achieving the required standards and quality.

Why Choose Rory Connolly Quantity Surveyors?

When it comes to restoration projects, you need a quantity surveyor with experience and expertise. Rory Connolly Quantity Surveyors have a proven track record of delivering successful restoration projects across Ireland. Our team of experts understands the unique challenges that come with restoring historic buildings and works tirelessly to ensure every project is completed to the highest standard.

Our Restoration Expertise

Restoration projects require a delicate touch and a keen eye for detail. Our team of quantity surveyor restoration work, with a deep understanding of the materials and techniques needed to preserve historic buildings. We work closely with clients to ensure their vision is brought to life while respecting the heritage and integrity of the original structure.

Services We Offer

At Rory Connolly Quantity Surveyors, we offer a wide range of services to meet your quantity surveying needs. From cost planning and estimating to contract administration and final account preparation, we have you covered every step of the way. Our team is committed to delivering projects on time and within budget, without compromising on quality.

Get in Touch with Us

If you are in need of professional quantity surveyor services in Ireland, look no further than Rory Connolly Quantity Surveyors. With our expertise in restoration projects, we are the perfect choice for your next building project. Visit our website at Rory Connolly Quantity Surveyors to learn more about our services and how we can help you achieve your project goals.

Conclusion

Choosing the right quantity surveyor for your project is essential to its success. With Rory Connolly Quantity Surveyors, you can trust that your project will be in safe hands. Contact us today to discuss your quantity surveying needs and see how we can help you bring your vision to life. Trust the experts at Rory Connolly Quantity Surveyors for all your quantity surveying needs in Ireland.

0 notes

Text

Common Mistakes When Applying for a Construction Loan

Applying for a Construction Finance Loan in Australia can be an exciting but complex process. Whether you're a developer, investor, or business owner seeking a loan for building commercial property, understanding how to navigate the application process is crucial for success.

Many applicants make avoidable mistakes that delay approvals, increase costs, or even result in loan rejections. In this blog, we’ll break down the most common pitfalls when applying for a Commercial Construction Loans, and how to avoid them to ensure a smooth journey from application to construction.

1. Inadequate Planning and Budgeting

One of the most frequent mistakes when applying for a construction loan is failing to plan thoroughly. Lenders want to see a well-documented plan that includes detailed building designs, realistic budgets, timelines, and contingency allowances.

Why it matters: Without a clear project scope and cost breakdown, lenders may view the project as risky, leading to delays or denials in financing.

How to avoid it: Work with architects, builders, and quantity surveyors to prepare detailed plans. Include line-item costs, approvals, permits, and a contingency buffer (typically 10–15%) for unforeseen expenses.

2. Not Understanding How Construction Loans Work

Unlike traditional second mortgage, construction loans are drawn down in stages (known as progress payments). This means funds are released as the project reaches specific milestones.

Why it matters: Applicants often expect full funding upfront, which is not how Construction Finance Loans operate. Misunderstanding this process can lead to cash flow issues and misaligned expectations.

How to avoid it: Familiarise yourself with how progress payments work. Ensure your builder and suppliers understand the payment structure and timelines.

3. Choosing the Wrong Loan Structure

Many borrowers apply for standard property loans when what they really need is a tailored Construction Finance Loan in Australia. Commercial construction projects have unique requirements that general lenders may not be equipped to handle.

Why it matters: Using the wrong loan product can result in higher interest rates, unfavourable terms, and limited flexibility.

How to avoid it: Work with a specialist broker or lender, like Commercial Construction Loans, who understands your project needs and can structure the loan appropriately.

4. Underestimating the Importance of Pre-Approval

Some developers start their projects assuming they'll easily get financing later, only to discover issues that prevent loan approval.

Why it matters: Without pre-approval, you could waste time and money on a project that can’t secure funding, or face delays waiting for lender approval mid-project.

How to avoid it: Always seek pre-approval before committing to construction. This provides peace of mind and gives you negotiating power with builders and suppliers.

5. Incomplete Documentation

Lenders need comprehensive documentation to assess your eligibility for a loan for building commercial property. This includes financial statements, tax returns, planning permits, builder contracts, and costings.