Don't wanna be here? Send us removal request.

Text

Blockchain Consensus Mechanisms: The Invisible Rules Keeping Crypto Alive

Picture this: thousands of computers worldwide agreeing on transaction history without a central boss. That's the magic of consensus mechanisms - the backbone of every blockchain.

Here's the tea on how different chains stay in sync:

• Proof of Work (OG Bitcoin style)

Miners compete to solve math puzzles

Ultra secure but burns crazy energy

Like a cryptographic Olympics where everyone pays the electric bill

• Proof of Stake (Ethereum's glow-up)

Validators stake crypto as collateral

Way more energy efficient

Rich get richer (but faster transactions)

• DPoS (EOS, Tron)

Token holders vote for validators

Lightning fast but more centralized

Blockchain democracy in action

• Proof of Authority (Corporate fave)

Pre-approved validators

Super efficient but not decentralized

Perfect for private blockchains

Want to go deeper? This guide breaks down all the consensus models with pro/con analysis perfect for #Web3 builders.

0 notes

Text

The Quiet Revolution in Carbon Markets

Picture this: A wind farm in Kenya issues carbon credits. Through tokenization: → A Japanese manufacturer buys fractions of credits → Transactions settle in minutes → All data is immutably recorded

This isn't future tech—it's happening now through projects like Toucan Protocol (explainer)

Why Businesses Should Care Per PwC's analysis, tokenization solves 3 key market problems:

Illiquidity - Credits become instantly tradable assets

Opaque pricing - Transparent on-chain price discovery

High barriers - Fractional ownership opens access

The Legal Landscape Osler notes regulatory frameworks are evolving, with clear guidelines emerging in: • EU's DLT pilot regime • Singapore's carbon exchange rules • Voluntary market standards

Food for Thought Could your business leverage tokenized credits for: ✔ ESG reporting? ✔ Supply chain decarbonization? ✔ New revenue streams?

0 notes

Text

Why RAK ICC Could Be Your Web3 Business Hub

If you're an entrepreneur or company exploring blockchain, tokenization, or Web3, the RAK International Corporate Centre (RAK ICC) in the UAE is worth considering.

Here’s why: ✔ Crypto-friendly policies – A supportive regulatory framework for digital assets. ✔ Tax advantages – 0% corporate and personal income tax. ✔ Global connectivity – Strategically located with easy access to international markets.

Whether you're launching a DeFi project, NFT platform, or blockchain-based business, RAK ICC provides the infrastructure to scale efficiently.

Want to know more? Check out these resources: → Sovereign Group – Offshore Company Formation → Creation BC – Ras Al Khaimah Economic Zone

0 notes

Text

India’s Crypto Boom: Web3 & Tokenization for Businesses India’s crypto market is growing fast—but regulatory ambiguity leaves many entrepreneurs wondering: “Can we really build here?”

Yes.

According to Blockchain.News, adoption is surging despite uncertainty. The key? Focusing on Web3 and tokenization to: ✔️ Bypass traditional banking hurdles. ✔️ Engage global audiences via decentralized models. ✔️ Future-proof before regulations solidify.

Smart businesses aren’t waiting. They’re adapting now.

0 notes

Text

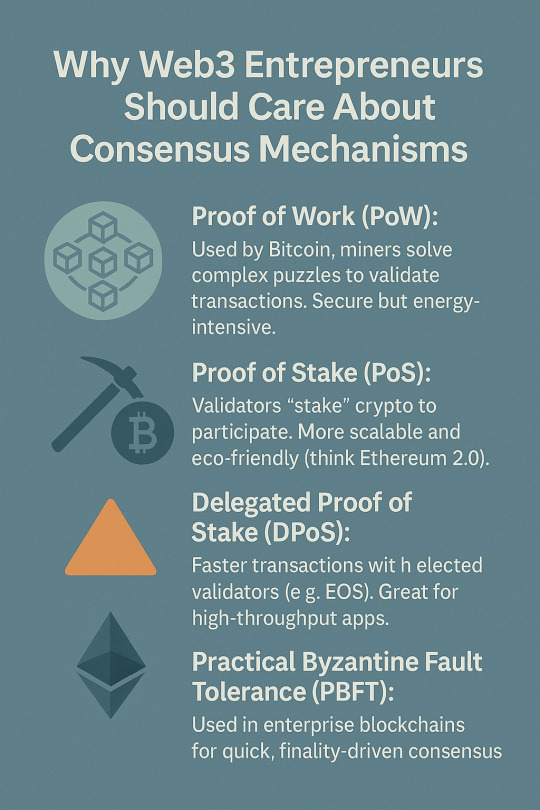

Why should #Web3 entrepreneurs care about consensus mechanisms?

If you're exploring #tokenization or building on #blockchain, understanding consensus mechanisms is crucial—they’re the rules that keep decentralized networks secure and trustworthy. Here’s a quick breakdown:

🔹 Proof of Work (PoW): Used by Bitcoin, miners solve complex puzzles to validate transactions. Secure but energy-intensive. (Source: OSL Academy) 🔹 Proof of Stake (PoS): Validators "stake" crypto to participate. More scalable and eco-friendly (think Ethereum 2.0). (Source: Visa Crypto) 🔸 Delegated Proof of Stake (DPoS): Faster transactions with elected validators (e.g., EOS). Great for high-throughput apps. 🔺 Practical Byzantine Fault Tolerance (PBFT): Used in enterprise blockchains for quick, finality-driven consensus.

Why it matters for your business?

Security: The right mechanism reduces fraud risks.

Scalability: Impacts transaction speed/cost (critical for dApps).

Sustainability: PoS/DPoS align with ESG goals.

Choose wisely—your consensus layer shapes user experience and compliance.

Sources: OSL Academy Visa Crypto

0 notes

Text

DeFi Regulation on the SEC’s Agenda: What Web3 Businesses Need to Know

The SEC’s next crypto roundtable will tackle DeFi’s thorniest question: How much regulation should apply to decentralized systems?

For entrepreneurs in #Web3 and #Tokenization, this discussion matters because: ✅ Clarity = Better risk assessment for DeFi integrations. ✅ Compliance = Future-proofing your business model. ✅ Innovation = Balancing autonomy with legitimacy.

Bookmark this space—the outcomes could influence your next move.

Source: CryptoSlate

0 notes

Text

Tokenization in NLP: The Web3 Business Accelerator You Need to Know

Not All Tokenization is About Crypto

When we hear "#tokenization," crypto wallets and NFTs might come to mind first. But there's another powerful kind—NLP tokenization—that's becoming essential for Web3 businesses looking to leverage AI and blockchain together.

What Is NLP Tokenization?

In natural language processing (NLP), tokenization breaks down text into smaller units (tokens) that machines can understand. Think of it as translating human language into data that AI models can process.

Types of Tokenization:

Word-level: "Web3 is revolutionary" → ["Web3", "is", "revolutionary"]

Subword-level: Useful for complex terms (e.g., "blockchain" → ["block", "chain"])

Character-level: Helpful for languages without clear word boundaries

Why Web3 Businesses Should Care

Smart Contract Analysis

Automatically extract key terms from legal agreements

Flag high-risk clauses in DeFi protocols

Decentralized Search Engines

Improve query results in blockchain explorers

Index on-chain data more efficiently

AI-Powered Customer Support

Build chatbots that understand crypto jargon

Process user requests in DAO governance forums

Sentiment Tracking

Analyze crypto Twitter, Discord, and Telegram for market trends

Detect shifts in community sentiment around your project

How It Works

Text Input: "The DAO approved the new proposal."

Tokenization: ["The", "DAO", "approved", "the", "new", "proposal", "."]

Numerical Conversion: Machine-readable vectors (e.g., [1, 42, 17, 2, 9, 83, 5])

AI Processing: Enables tasks like classification, summarization, and translation

Real-World #Web3 Use Cases

DeFi Compliance: Auto-scan smart contracts for regulatory red flags

#NFT Metadata Search: Improve discovery of NFT collections using natural language

DAO Governance: Summarize lengthy proposals into key points for voters

Ready to Implement? Start Here: Complete Guide to NLP Tokenization Professional NLP Breakdown

0 notes

Text

Yield Farming in DeFi: A Business Guide to Earning Passive Crypto Income

What if your crypto assets could work for you 24/7?

That's the promise of yield farming – the DeFi strategy turning idle crypto into passive income streams. For businesses exploring Web3, understanding yield farming could unlock new treasury management opportunities.

How Yield Farming Works

Yield farmers provide liquidity to DeFi protocols (like Uniswap or Aave) in exchange for: ✔ Interest payments (from borrowers) ✔ Trading fees (from DEX users) ✔ Bonus tokens (governance or protocol rewards)

It's like earning interest from a bank, but with crypto-native returns that often outperform traditional finance.

Why Businesses Should Care

1️⃣ Treasury Growth: Put corporate crypto holdings to work 2️⃣ Token Utility: Boost adoption by incentivizing liquidity 3️⃣ Diversification: Earn yields across multiple assets

According to Hedera's DeFi guide, sophisticated farms can automate yield optimization across protocols.

The Risks (Yes, There Are Some)

⚠️ Smart contract bugs – $2B+ lost to DeFi hacks in 2023 ⚠️ Impermanent loss – When pooled asset values diverge ⚠️ Regulatory gray areas – Evolving compliance landscapes

The OSL Academy notes that proper risk management separates successful farmers from casualties.

Could your business allocate 5-10% of crypto reserves to test yield strategies? The first step is often the hardest – but potentially most rewarding.

0 notes

Text

Tokenization in Carbon Credits: A Web3 Solution for Sustainable Business

The fight against climate change is getting a blockchain upgrade.

Tokenized carbon credits are emerging as a powerful tool for businesses to participate in carbon markets more efficiently and transparently.

What Are Tokenized Carbon Credits?

Traditional carbon credits represent a metric ton of CO₂ reduced or removed from the atmosphere. Tokenization converts these credits into digital assets on the blockchain, making them: ✔ Easier to trade (fractional ownership, instant settlements) ✔ More transparent (on-chain verification of origin and impact) ✔ Liquid & accessible (smaller investors can participate)

Why Should Businesses Care?

For companies looking to offset emissions or invest in sustainability, tokenization offers:

Lower barriers to entry – No need for large-scale purchases.

Fraud prevention – Immutable records prevent double-counting.

New revenue streams – Tokenized credits can be bundled into DeFi yield products.

How Does It Work?

Carbon credits are verified (via standards like Verra or Gold Standard).

They’re bridged onto blockchain (e.g., Toucan’s "Carbon Bridge").

Tokens are issued (like BCT or NCT on Polygon).

Traded or staked in DeFi protocols for additional yield.

Challenges to Consider

Regulatory uncertainty – Standards are still evolving.

Oracles & data reliability – Ensuring real-world impact matches on-chain claims.

Market fragmentation – Different token standards exist (C3, Moss, Toucan).

The Future of Carbon Markets?

Tokenization could democratize access to carbon markets while improving transparency. Projects like Toucan are already enabling millions in on-chain carbon trading.

(Source: Toucan Protocol – Tokenization Explained)

0 notes

Text

While everyone hires tokenization for fraud prevention, The Paypers highlights its other marketable skills:

✓ Loyalty points that work across brands ✓ Fractional ownership of assets ✓ Automated compliance tracking

What's the most unexpected use case you've seen for tokenization?

0 notes

Text

Understanding Layer-2 Solutions in Blockchain

If you’re exploring #Web3 for your business, you’ve probably heard about #Ethereum’s scalability issues—high gas fees and slow speeds. That’s where Layer-2 (L2) solutions come in!

What Are Layer-2 #Blockchains? They’re separate networks built on top of Ethereum (or other Layer-1 chains) to handle transactions more efficiently. Instead of clogging the main chain, L2s process transactions off-chain and then batch them back for security.

How Do They Work? Different L2s use different methods: ✔ Optimistic Rollups (like Arbitrum & Optimism) – Assume transactions are valid unless challenged. ✔ ZK-Rollups (like zkSync & StarkNet) – Use zero-knowledge proofs for instant verification. ✔ Sidechains (like Polygon PoS) – Independent chains with their own security models.

Why Should Businesses Care? Lower fees → Cheaper transactions.

Faster speeds → Better user experience.

Scalability → Handle more users without congestion.

If you're building in #Web3, Layer-2s could be key to making your project efficient and cost-effective.

0 notes

Text

Ever tried using a store gift card at a different retailer?

Tokenization is solving this problem at scale for digital payments.

According to The Paypers' expert breakdown:

Tokens now travel across payment platforms

Reduces friction for cross-border transactions

Opens new revenue streams for businesses

Food for thought: Could this be the end of "this card not accepted" errors?

Deep dive

#FinTechInnovation #DigitalEconomy

0 notes

Text

Beyond Credit Cards: How Tokenization Is Rewiring Finance

We used to think tokenization was just about hiding your credit card number. But it’s turning into something way bigger.

According to The Paypers, tokenization now enables:

🔹 Real asset interoperability 🔹 Major fraud reduction (a huge win for enterprises) 🔹 And yes, it might one day make passwords... obsolete?

Of course, there are hurdles—implementation isn’t plug-and-play. But the roadmap is getting clearer.

What do you think? Could tokenization become the new standard for everything from payments to identity?

0 notes

Text

Tokenization in Carbon Credits: A Blockchain-Powered Green Revolution

The Problem with Traditional Carbon Markets Let’s be real – today’s carbon credit system is kinda broken. Between questionable auditing, double-counting, and limited liquidity, it’s been tough for businesses to participate meaningfully in climate action.

But guess what? #Blockchain is changing the game.

How #Tokenization Fixes This According to Osler’s deep dive, tokenizing carbon credits means:

Transparent tracking – Every credit’s journey is recorded on-chain (no more shady offsets!)

Fractional ownership – Small businesses can buy just what they need

Instant settlement – No more 6-month waits to retire credits

Secondary markets – Credits become liquid assets

Cool Use Cases Already Happening A reforestation project in Brazil issuing NFTs for each planted tree A solar farm tokenizing future carbon offsets to fund construction An e-commerce platform letting customers offset purchases with micro-credits

What’s the most creative application of tokenized carbon credits you can imagine? Could we see carbon-backed #NFTs for sustainable fashion? Blockchain-verified ocean cleanup tokens?

Read Osler’s full analysis here

0 notes

Text

Ever wondered how tokenization actually works beyond the buzzwords?

The Paypers breaks it down with expert insights:

🔹 How it’s implemented (spoiler: not just for payments) 🔹 The real benefits (hint: fraud reduction + interoperability) 🔹 Why cross-platform portability matters

Could tokenization become the default for all digital transactions?

[The Paypers URL]

0 notes

Text

"When Even Bankers Say 'Take Blockchain Seriously'!"

We always thought banks were the most conservative part of finance, but apparently things are changing!

DBS's CEO said in an interview: "Asset tokenization could shape the future of global finance."

Why this caught my attention:

This isn't the first time a major bank acknowledges blockchain's real potential

It's not just about cryptocurrencies anymore, but tokenized real assets

Soon we might buy shares in expensive properties with just a few clicks!

How about you? What assets would you want to own in digital form?

Check out the interview

0 notes

Text

Step-by-Step Guide to Creating Dynamic NFTs

1.Define Your Concept:

Start by identifying the purpose of your dynamic NFT. Consider what interactions or changes you want to implement. For instance, will it evolve based on user actions, external data, or specific events?

2.Choose the Right Blockchain:

Select a blockchain that supports NFT creation and dynamic features. Ethereum is a popular choice due to its robust smart contract capabilities, but alternatives like Polygon and Binance Smart Chain may also be suitable.

3.Develop Smart Contracts:

Write a smart contract that outlines how your dynamic NFT will function. This includes defining the conditions under which the NFT will change. Use programming languages like Solidity for Ethereum. Testing your contract on a test network is crucial to avoid costly mistakes.

4.Integrate External Data (Oracles):

If your NFT relies on real-world data (e.g., weather updates, sports scores), use oracles like Chainlink. Oracles allow your smart contract to access off-chain data securely, enabling your NFT to react to real-world events.

5.Mint Your Dynamic NFT:

Once your smart contract is finalized, mint your dynamic NFT. This involves creating a unique token on the blockchain that adheres to the rules defined in your smart contract. Platforms like NFTPort provide user-friendly APIs to streamline this process.

6.Create a User Interface:

Develop a user-friendly interface (UI) for users to interact with your dynamic NFT. This could be a website or a decentralized application (dApp) that allows users to view, trade, or engage with the NFT.

7.Test and Launch:

Conduct thorough testing to ensure all dynamic features work as intended. Once you’re satisfied with the performance, launch your NFT and promote it through your networks.

0 notes