#Bankruptcy lawyer

Text

Legal Assistance Lawyer in Pensacola, FL - (850) 432-9110

Lewis and Jurnovoy is a local law office serving the Florida Panhandle for over 20 years. We specialize in bankruptcy law, including Chapter 7 and Chapter 13 bankruptcy. We will work to achieve the best financial remedy for your outstanding debts.

Lewis and Jurnovoy

1100 North Palafox St

Pensacola, FL 32501

(850) 432-9110

https://www.LewisandJurnovoy.com

0 notes

Text

In Bankruptcy Back Rent & Past Due Utilities Are Wiped Out? | YES!

According to Coons and Crump LLC “If your utility is a public utility (water, gas, electric), that utility must continue to provide you service even after you discharge your past due amount in a bankruptcy.” “Rent can actually be discharged as unsecured debt. If you are behind on your rent payments,” according to Consumer Legal Services LLC.

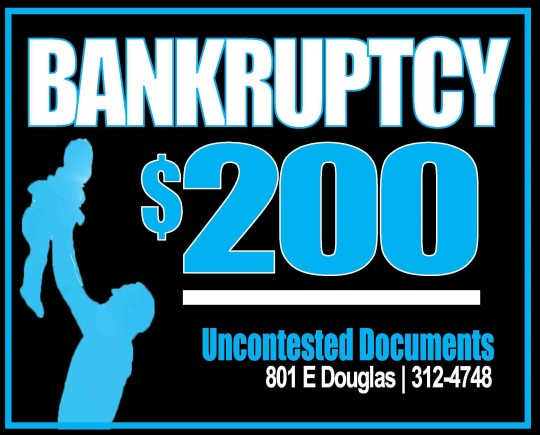

U.S. Bankruptcy Chapter 7

Two Payments of $100

Excludes Clerk Filing Fees

UNCONTESTED DOCUMENTS

801 E. Douglas Ave., 2nd Fl., Wichita, KS

(316) 312-4748 | Call or Text

[email protected]

https://www.uncontesteddocuments.com

Since 2011, Thank You

Grateful To Be Of Service

0 notes

Text

Debt Consolidation in Fort Walton, FL - (850) 863-9110

Lewis and Jurnovoy is a local law office serving the Florida Panhandle. We specialize in bankruptcy law, including Chapter 7 and Chapter 13 bankruptcy. We will work to achieve the best financial remedy for your outstanding debts.

Lewis and Jurnovoy

151 South Mary Esther Cutoff Ste. 103

Fort Walton Beach, FL 32569

(850) 863-9110

https://www.LewisandJurnovoy.com

#debt relief#fort walton beach#florida#debt consolidation#bankruptcy assistance#chapter 7 bankruptcy lawyers#mortgage modification lawyer#experienced attorneys#bankruptcy lawyer

0 notes

Text

How Bankruptcy Lawyers In Riverside Offer Debt Relief Strategies

Today's ever-changing economy poses financial hurdles for numerous businesses. Whether from sudden market changes, economic slumps, or internal issues, accumulating debt can hinder growth and even jeopardize a company's survival. Bankruptcy attorneys provide specialized assistance to businesses in navigating these challenges, offering customized debt relief strategies to restore financial stability and pave the way for lasting prosperity.

Riverside, situated in central California, experiences the same economic strains as businesses nationwide. Nevertheless, it boasts a cadre of bankruptcy law experts ready to aid businesses in tackling financial challenges. Bankruptcy Lawyers In Riverside California understand the distinct hurdles businesses encounter and are committed to delivering tailored solutions aligned with their client's requirements and objectives.

Key Debt Relief Solutions Offered by Bankruptcy Attorney

Chapter 11 Bankruptcy

These experts excel in Chapter 11 bankruptcy, a restructuring process enabling businesses to manage debts while operating. They craft thorough reorganization plans in collaboration with businesses, prioritizing debt repayment and enhancing efficiency, thus setting the stage for sustained success.

Debt Negotiation and Settlement

Acknowledging that bankruptcy isn't always ideal, these lawyers also specialize in debt negotiation and settlement. They strategically negotiate with creditors to decrease debt, secure better repayment terms, and avoid formal bankruptcy proceedings whenever feasible.

Financial Counseling and Planning

Beyond immediate debt relief strategies, they also offer comprehensive financial counseling and planning services to help businesses build a solid foundation for the future. By guiding budgeting, financial management, and long-term planning, they empower businesses to make informed decisions and navigate future challenges with confidence.

Bankruptcy Lawyers In Riverside California play a crucial role in supporting businesses facing financial difficulties by offering tailored debt relief strategies designed to address their specific needs and circumstances. These professionals are committed to helping businesses overcome financial obstacles and achieve sustainable success in today's competitive marketplace.

#bankruptcy lawyer#bankruptcy lawyers in riverside california#chapter 7 bankruptcy attorney riverside ca

0 notes

Text

Navigate Financial Freedom with a Bankruptcy Lawyer near Me

A bankruptcy lawyer can help individuals and businesses navigate the complexities of bankruptcy law, ensuring the best possible outcome. Their expertise in Chapter 7, 11, or 13 bankruptcies can help determine the best course of action for their situation. The knowledge of a bankruptcy lawyer near me about the state's unique legal nuances and their understanding of local dynamics make them a valuable resource. They also offer comprehensive support beyond bankruptcy; ensuring clients emerge financially stronger and more resilient.

0 notes

Text

Fleysher Law Firm Launches Comprehensive Infographic featuring Jacksonville Bankruptcy Lawyer Expertise

Fleysher Law Firm proudly announces the release of a great infographic spotlighting their unparalleled expertise in bankruptcy law, with a focus on Jacksonville. The infographic is aimed at Jacksonville Bankruptcy Lawyer to help you get relief from debt problems.

The infographic offers valuable insights into the intricacies of bankruptcy proceedings, guiding individuals through the complexities of debt relief and financial rehabilitation. Jacksonville Bankruptcy Lawyer experts from Fleysher Law Firm are featured prominently, showcasing their commitment to helping clients navigate the legal landscape with competence and compassion.

With a mission to demystify bankruptcy and empower individuals facing financial challenges, Fleysher Law Firm's infographic serves as a beacon of information, underlining their dedication to delivering top-notch legal services in Jacksonville and beyond. This initiative reinforces Fleysher Law Firm's reputation for excellence in advocating for clients' financial well-being.

About Fleysher Law Firm:

Fleysher Law: Bankruptcy and Debt Attorneys of Jacksonville is a client-focused law firm helping individuals and families in Jacksonville and throughout Duval County resolve their debts and reorganize their finances. If you are considering bankruptcy, facing foreclosure, having your wages garnished, or struggling with debt, you should give us a call. We are happy to offer free initial consultations via telephone or video conferencing.

Contact details Name: Emil Fleysher

Company: Fleysher Law Bankruptcy & Debt Attorneys

Location: 1301 Riverplace Blvd Suite 800-E, Jacksonville, FL 32207

E-mail: [email protected]

Phone: 904-740-3020

URL: https://fleysherlaw.com/jacksonville-bankruptcy-lawyer/

0 notes

Text

Bankruptcy Lawyer In Inverness

Bankruptcy Lawyer In Inverness - #jayweller #bankruptcy, #Bankruptcyassistance, #Bankruptcyattorney, #Bankruptcyattorneys, #BankruptcyLawyer, #Chapter13, #Chapter7, #CreditCounseling, #FilingForBankruptcy, #Law, #WellerLegalGroup - https://www.jayweller.com/bankruptcy-lawyer-in-inverness/

#Attorney#bankruptcy#Bankruptcy Attorneys#Bankruptcy Laws#bankruptcy lawyer#chapter 13#chapter 13 bankruptcy#chapter 7#Chapter 7 Bankruptcy#Citrus County#Citrus County bankruptcy lawyer#credit#credit score#file for bankruptcy#Filing For Bankruptcy#Inverness#Inverness Bankruptcy Lawyer#law#Weller Legal Group

0 notes

Text

Foreclosure And Student Loan Lawyer in Panama City, FL | (850) 913-9110

Foreclosure And Student Loan Lawyer in Panama City, FL

Lewis and Jurnovoy is a local law office serving the Florida Panhandle. We specialize in bankruptcy law, including Chapter 7 and Chapter 13 bankruptcy. We will work to achieve the best financial remedy for your outstanding debts.

Lewis & Jurnovoy PCB

2714 West 15th St

Panama City, FL 32401

(850) 913-9110

https://www.LewisandJurnovoy.com

#Bankruptcy Lawyer#Chapter 7 Bankruptcy Lawyer#Debt Consolidation Lawyer#Foreclosure And Student Loan Lawyer#Debt Collector Harassment Lawyer#Panama City#Florida

0 notes

Text

Advantages of Hiring a Bankruptcy Lawyer in UAE

Navigating through financial distress and bankruptcy is an arduous journey that requires expert guidance and legal support. In the United Arab Emirates (UAE), the complex legal framework surrounding bankruptcy mandates the need for specialized assistance. Albasti Advocates, a renowned legal consultancy firm, understands the intricate complexities of bankruptcy law in the UAE and offers tailored solutions to help individuals and businesses overcome financial challenges. In this article, we explore the advantages of hiring a bankruptcy lawyer from Albasti Advocates, and how they can facilitate a path towards financial freedom.

1. In-depth Knowledge of Bankruptcy Laws in the UAE

Bankruptcy lawyers at Albasti Advocates possess an in-depth understanding of the intricate bankruptcy laws and regulations in the UAE. They stay up-to-date with any changes in legislation and are well-versed in the legal procedures and documentation required to navigate the bankruptcy process. Leveraging their knowledge and experience, they guide clients through the complexities of bankruptcy law, ensuring compliance with legal requirements.

2. Tailored Legal Strategies and Solutions

A bankruptcy lawyer from Albasti Advocates will develop a customized legal strategy based on the specific circumstances of each client's financial distress. They analyze the financial situation, explore all available options, and advise on the most appropriate course of action. Whether it involves negotiating with creditors, restructuring debt, or filing for bankruptcy, Albasti Advocates ensures that clients have a clear roadmap toward financial recovery.

3. Protection against Creditor Harassment and Legal Actions

Dealing with mounting debts and constant creditor harassment can be overwhelming. Hiring a bankruptcy lawyer provides immediate relief from creditor harassment and safeguards clients against potential legal actions. Albasti Advocates acts as a buffer between clients and creditors, communicating on their behalf and striving to negotiate favorable terms for debt repayment or settlement, ensuring that clients can focus on regaining financial stability.

4. Assistance with Documentation and Legal Procedures

The bankruptcy process involves intricate documentation and adherence to specific legal procedures. Failure to comply with these requirements can lead to delays or even dismissal of the bankruptcy case. Bankruptcy lawyers at Albasti Advocates handle all legal paperwork and ensure compliance with the necessary procedures, minimizing the chances of bureaucratic errors and maximizing efficiency in processing bankruptcy case.

5. Expert Representation in Court Proceedings

In some cases, bankruptcy may require litigation and representation in court. Albasti Advocates possesses extensive experience in litigation and representing clients in bankruptcy court. Their expertise allows them to present a strong case on behalf of their clients and advocate for their best interests. As skilled negotiators and litigators, they strive to secure the most favorable outcome for their clients, whether through debt restructuring or bankruptcy discharge.

Conclusion

When faced with financial distress and bankruptcy, seeking the assistance of a reputable bankruptcy lawyer from Albasti Advocates can make a significant difference in your journey toward financial stability. With their in-depth knowledge of UAE bankruptcy laws, tailored strategies, protection against creditor harassment, assistance with legal procedures, and expert representation, Albasti Advocates provides the essential support needed to navigate the complexities of bankruptcy and achieve a fresh start. Don't face financial challenges alone—unlock a path to financial freedom by engaging the expertise of Albasti Advocates, the trusted name in bankruptcy law in the UAE.

0 notes

Text

Understanding the Corrections Act: How It Can Benefit Your Bankruptcy Case

What is the Corrections Act and How Can it Help My Bankruptcy Case?

If you live in New York and wanted to restructure your debt through Chapters 11 or 13 bankruptcy, the Corrections Act has, at least temporarily, lifted one of your roadblocks.

The Challenge of Debt Limits

When it comes to both personal and small business bankruptcy, the options are complete liquidation (Chapter 7) or restructuring your debt (Chapters 11 and 13). The challenge with restructuring is that there are debt limitations imposed.

Up until June 21, 2022, individuals with unsecured debts over $465,275.00 and secured debts of over $1,395,875 were ineligible to declare Chapter 13. In expensive real estate markets like the New York metropolitan area, not to mention student loans, business debt, medical debt, and taxes, these limits were easily exceeded.

For small businesses that wanted to restructure under Subchapter V of Chapter 11, the debt limit was $2,725,625.

If you owed more than the debt limitations allowed, you had to declare Chapter 7 and liquidate everything.

What is the Corrections Act?

On June 21, 2022, the Bankruptcy Threshold Adjustment and Technical Corrections Act (the “Corrections Act”) was signed by President Biden. Triggered by the concern that, with skyrocketing inflation and a looming economic recession, both individuals and small businesses would be struggling, this bipartisan bill was enacted to help those needing time and space to restructure.

How Does This Effect Chapter 13 Bankruptcy?

The Corrections Act raised the debt limits for Chapter 13 bankruptcy up to $2,750,000 (secured and unsecured debt combined).

Chapter 13 bankruptcy has become a go-to case for individuals dealing with foreclosure, high amounts of debt, and more challenging situations. With historically high inflation, increasing interest rates, concerns about bank safety, and increasing home prices, this change in the law will allow more homeowners in distress and troubled consumers to seek bankruptcy relief under a more manageable Chapter 13 case.

Learn more about Chapter 13 here.

How Does This Effect Chapter 11 Bankruptcy?

During the COVID pandemic, the Small Business Reorganization Act (SBRA) raised the debt limit for Subchapter V of Chapter 11 from $2,725,625 to $7.5 million. Unfortunately, it was a temporary measure that expired on March 27, 2022.

The Corrections Act returned the debt limit back to $7.5 million.

Learn more about Subchapter V of Chapter 11 here.

Who Benefits From These Changes?

Individuals –New York home prices are some of the highest in the nation. If you debt is primarily mortgage based, the new limits of the Corrections Act takes into account your higher debt and allows you to restructure your loans instead of going into full blown, Chapter 7 bankruptcy.

Small Businesses –The pandemic, supply chain issues, rampant inflation, staffing shortages, a pending recession – all have left small business owners struggling. By almost doubling the debt limit for Subchapter V of Chapter 11 restructuring, the Corrections Act give you more time and space to get your debts under control and keep your business going.

Both –Without this almost doubling of the debt limit, many small businesses and individuals with high debts would have to have gone through standard Chapter 11 filings, which are far more complex and expensive than the Chapter 13 or Subchapter V process.

Are These Changes Permanent?

Currently, the Corrections Act is set to expire on June 21, 2024. However, due to the Act’s popularity with both Republicans and Democrats in both the House (with an overwhelmingly bipartisan vote of 392-21) and Senate, there is a very good chance the Corrections Act will either be extended or made permanent.

What to Do Next

There are multiple procedures available when it comes to bankruptcy, and it is easy to get confused and overwhelmed. If you’d like to talk directly to a compassionate, knowledgeable, human being, reach out to New York bankruptcy attorney Ronald D. Weiss, PC for a free consultation. He can tell you which type of bankruptcy is right for you, and help you get the process started. Call 631-303-3765 and take the first step to a fresh start.

Contact the Law Office of Ronald D. Weiss, P.C.

EMAIL OR CALL FOR A FREE CONSULTATION:

📞 : QUEENS (718)-751-0226, BROOKLYN (347)-508-9316

🌎 : https://www.ny-bankruptcy.com/

MELVILLE MAIN OFFICE LOCATION

📍 : 734 Walt Whitman Rd #203, Melville, NY 11747

1 note

·

View note

Text

Are you a businessman stuck with debt and need a fresh start?

Contact WantAFreshStart today and navigate through the complex bankruptcy process with our experienced bankruptcy Attorneys in Tucson

WantAFreshStart Tucson Bankruptcy Lawyers

5151 E Broadway Blvd Suite 1600, Tucson, AZ 85711, United States

+1 520 231 8482

0 notes

Text

Yes, filing bankruptcy can stop wage garnishment. Source: findlaw

Bankruptcy

Two Payments of $100

Excludes Filing Fee

Uncontested Documents

801 E. Douglas, 2nd Fl., Wichita

(316) 312-4748 | Call or Text

https://www.uncontesteddocuments.com

[email protected]

Since 2011, Thank You

Grateful To Be Of Service

#bankruptcy#wichita#kansas#bankruptcy attorney#bankruptcy lawyer#bankruptcy court#bankruptcy forms#bankruptcy preparation#uncontested documents

0 notes

Text

Navigating Financial Challenges with a Trusted Bankruptcy Attorney in San Bernardino

Are you feeling overtaken by your growing debt load and unclear financial future? It's time to take charge of your circumstances with the assistance of a reliable San Bernardino bankruptcy Attorney lawyer.

Why Choose a Bankruptcy Attorney in San Bernardino?

Although declaring bankruptcy could be a scary experience, you don't have to go through it by yourself. An experienced San Bernardino bankruptcy lawyer can offer you the direction and encouragement you require to make wise financial decisions going forward.

Personalized Solutions for Your Financial Needs

Every individual or business facing bankruptcy has unique circumstances. That's why it's crucial to work with a bankruptcy attorney who understands your specific situation and can tailor solutions to meet your needs. Whether you're considering Chapter 7, Chapter 13, or another form of bankruptcy, a skilled attorney will guide you through the process step by step.

Expertise You Can Trust

You need a bankruptcy law specialist and experienced attorney when it comes to something as vital as your financial future. An experienced San Bernardino bankruptcy lawyer will know the ins and outs of the legal system when it comes to bankruptcy cases, and they will put in endless effort to get you the best result possible.

Relief from Creditor Harassment

One of the most stressful aspects of facing bankruptcy is dealing with relentless creditor harassment. By enlisting the help of a bankruptcy attorney, you can put an end to harassing phone calls, letters, and other tactics used by creditors to collect debts.

Take the First Step Toward Financial Freedom

Don't let the fear of bankruptcy hold you back from taking control of your financial future. With the guidance of a trusted bankruptcy attorney in San Bernardino, you can take the first step toward a fresh start and a brighter tomorrow. Contact us today to schedule a consultation and explore your options for financial relief.

#Bankruptcy Attorney San Bernardino#bankruptcy lawyer#San Bernardino Bankruptcy Attorney#Bankruptcy Lawyer San Bernardino Ca#Bankruptcy Lawyers In Riverside California#Riverside Chapter 7 Bankruptcy Lawyers#Chapter 7 Bankruptcy Attorney Riverside Ca#Bankruptcy Lawyer Riverside Ca

0 notes

Text

Overcome Bankruptcy with an Expert Bankruptcy Lawyer in Kew Gardens

A skilled bankruptcy lawyer helps individuals and businesses facing financial distress and the prospect of bankruptcy. They understand the complex nature of bankruptcy law and can provide tailored solutions. A bankruptcy lawyer Kew Gardens has experience in bankruptcy law, and can guide clients through the complex legal processes of filing for bankruptcy, ensuring their rights are protected.

0 notes

Link

The Insolvency and Bankrupcy Code formed for fast resolution of Npa accounts The NCLT lawyers in Mumbai at Npa Consultants will guide you for approaching NCLT Mumbai

0 notes