#CoinDesk Live

Text

New Zealand Mint | The Coin Shoppe

Yes, the New Zealand Mint is a reputable and well-known online retailer of collectible coins. Since 1967, they have been operating as a private mint in Auckland, New Zealand. The New Zealand Mint specializes in the production of commemorative coins, bullion coins, and collectibles of the highest quality. The New Zealand Mint offers a vast selection of coins with a variety of designs, including popular franchises such as Star Wars, Disney, Marvel, and DC Comics. Additionally, they produce coins commemorating historical events, notable figures, and cultural icons. Their coins are renowned for their intricate designs, limited mintages, and superior workmanship. Also, on the loonie coin official website, it is possible to browse and purchase coins. They offer thorough product descriptions, high-resolution photographs, and safe online payment options. The website also provides information about forthcoming releases, special promotions, and product-related news. When purchasing collectible coins online, it is always essential to deal with a reputable vendor. The New Zealand Mint has a long-standing reputation in the industry, but it is still prudent to read customer reviews and understand the mint's policies regarding authenticity, returns, and customer support before making a purchase.

0 notes

Text

This weekend’s episode of "Saturday Night Live" began with a skit poking fun at former President Donald Trump’s recently released, meme-worthy non-fungible token (NFT) collection.

“Seems like a scam and, in many ways, it is,” said James Austin Johnson, who played the 45th President in the show’s cold open.

While the mainstream media has eagerly picked up the story on the collection for its comedic value, the popularity of the Trump Digital Trading Cards has continued to climb since the collection dropped on Thursday, selling out within 24 hours.

According to data from OpenSea, the collection’s trading volume is 6,658 ether (ETH), or about $7.8 million at the time of publishing. Its floor price, which started at $99, has been hovering around 0.3 ETH, or $350.

The collection features 45,000 tokens in the style of baseball cards. In each collectible, Trump wears a different costume linked to rarity elements that allow users to enter a sweepstakes to win prizes like a zoom call with the former President or a cocktail hour at Mar-a-Lago.

In the wake of the project’s apparent success, internet sleuths have dug deep into the project and the parties behind the wallet addresses associated with Trump’s collectibles. Among the nuances and inconsistencies alleged on Twitter: the company that created the collectibles is hoarding a large amount of them; that the project poorly relies on stock imagery; and that most of the buyers opened new wallets without holding any cryptocurrency, sticking them with an NFT and no way to derive any future value from them.

THE STRANGE CASE OF 1,000 NFTS

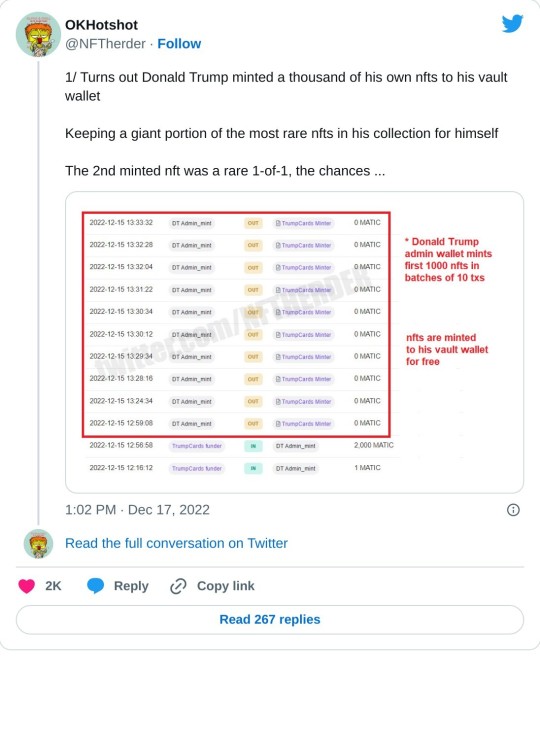

Over the weekend, Twitter user @NFTherder noticed something strange about a large number of the rarest NFTs in the collection. The user posted a thread explaining the nature of the transaction data of the contracts involved in the mint.

According to data from Polyscan, Polygon’s version of Etherscan, a “Donald Trump Admin” wallet minted 1,000 tokens to a Gnosis Safe Wallet, a multisignature smart contract wallet that requires a handful of users associated with the tokens to approve of any asset movement.

While the Collect Trump Cards site said that 44,000 of the 45,000 tokens created in the initial series would be available for users to mint, it did not specify what would happen to the remaining 1,000 tokens. Where another project might save those assets for a later date to revive demand, data suggests that the administrative wallet holds the remaining minted 1,000 tokens.

After the collapse of Three Arrows Capital, the crypto-hedge fund backed NFT collection “Starry Night” moved its tokens into a Gnosis Safe wallet, along with other valuable assets. It was likely done out of caution to hold the assets in one place to prevent any singular actor from moving these out of the wallet.

The Trump Trading Card site specified that there was a “strict limit of 100 Trump Digital Trading Cards per purchaser/household,” meaning that an individual or a group who did not have to abide by the rules for the general public was able to pick up a large swath of the NFT pool.

In addition, the mystery wallet isn’t full of second-rate NFTs. It minted 26% of the rarest 1-of-1 tokens and 28% of the autographed trading cards, according to NFTherder. These are the most valuable and expensive assets in the collection, respectively comprising 0.4% and 0.16% of the total tokens in the collection.

NFTherder told CoinDesk that not only do the wallet owners have the ability to inflate the price floor of the collection, but they also could have the ability to rig the sweepstakes and alter the competition.

“If this was a 10,000 unit collection about monkeys, the whole discord would be blowing up about how this is a rug and a scam and that the team is holding one fourth of the most rare supply,” said NFTHerder.

THE CURIOUS MARKS AND MAKER OF THE ART

While people have been digging into the wallet addresses and collection sweepstakes, other Twitter users were delving into pop culture digital artist Clark Mitchell and the artwork he created for the collection.

On-Chain TV founder Morgan Sarkissian tweeted an image of one of the collectibles featuring the 45th president in a space suit that seemed to still have a visible watermark from Shutterstock.

She also uncovered an Adobe watermark in another token listed in the collection.

Other Twitter users have found inconsistencies in the artwork, with some of the creative assets used to build the collection apparently taken from stock images or Amazon costumes.

While Mitchell has worked on other projects such as artwork for Disney, Hasbro and Marvel, this isn’t his first NFT project.

Web3 researcher and Twitter user @Valuemancer uncovered that Mitchell also did the artwork for Sylvester Stallone’s SlyGuy NFT collection that never launched, according to the digital collectibles website.

The collection included similar creative assets, such as drawings of the actor paired with exclusive access to events such as the Ultimate Stallone Experience, a dinner hosted by Stallone for token holders.

Mitchell, Sarkissian, @Valuemancer and the SlyGuy NFT collection did not respond to CoinDesk by press time.

THE SHINY NEW WALLETS WITH NO CRYPTO

While NFT collections often attract a wide range of buyers with various stake in the game, Trump’s NFT collection had a large number of buyers that appear to be new to digital collectibles.

According to data from Dune Analytics, of the nearly 12,900 users that minted Trump NFTs, about 9,300 did not hold any cryptocurrency in their wallet for gas fees – the fee all users pay for a transaction on the blockchain. If a holder has no balance of either MATIC or wETH, he is "No Gas" holder. That means he can't list his NFT for sale until he get some balance into his wallet, the Dune dashboard shows.

This means that 72% of buyers were likely purchasing NFTs for the first time.

The total number of tokens held by holders with no gas is 21,420, according to Dune Analytics, which one Twitter user pointed out may be stuck due to the more advanced nature of trading on Polygon.

“It's more like a 20,000 set than 45,000,” said Tyler Warner, staff writer at Lucky Trader on Twitter, citing the data as one of the reasons why the tokens skyrocketed in trading volume.

Warner did not respond to CoinDesk by press time.

In a harsh crypto winter where NFTs are already subject to market vulnerabilities, celebrities releasing successful NFT projects or funding Web3 ventures seems like a promising sign.

However, when the project is executed before fully working its kinks out, it does not serve as a vehicle for mass adoption. Instead, it can onboard a new user base that is not familiar with cryptocurrency or the steps needed to make a sound purchase, analyze blockchain data for irregularities and fund wallet transactions.

As projects like these continue to rise in popularity, it’s important to educate holders, dig into the details and look beyond the hype.

#us politics#news#coindesk#bitcoin#nfts#non fungible tokens#donald trump#Trump Digital Trading Cards#opensea#@NFTherder#twitter#Polyscan#Polygon#Etherscan#Gnosis Safe Wallet#Collect Trump Cards#Morgan Sarkissian#On-Chain TV#Clark Mitchell#copyright infringement#@Valuemancer#sylvester stallone#celebs#SlyGuy NFT#Dune Analytics#gas fees#Tyler Warner#blockchain#Lucky Trader#2022

30 notes

·

View notes

Text

Tumblr what the fuck are y'all doing? Polycules, Eugenics, Tumblr and Crypto Scams OOOOO MY!

Ex-Alameda CEO's Tumblr Blog Investigated Race Science, 'Imperial Chinese Harem' Polyamory - InsideBitcoins.com

As observers try to make sense of the ongoing, mind-boggling collapse of crypto exchange FTX, details about the once-dominant company’s leadership’s unconventional internal practices and beliefs have begun to emerge.

Former Alameda Research CEO Caroline Ellison, Bankman-on-again, Fried’s off-again ex-girlfriend, and a bizarre Tumblr blog that she appears to have maintained for years, stand out.

FTX’s founder and CEO, Sam Bankman-Fried, lived in a $30 million penthouse in The Bahamas with nine other colleagues until this week. According to Coindesk, the majority of high-level decisions pertaining to the operation of $32 billion exchange FTX and its sister trading firm Alameda Research were made by these ten roommates, who were reportedly romantically or sexually involved with one another at one time.

The group was described as a “polycule,” which is a romantic network of multiple people linked by overlapping sexual relationships.

Alameda, an ostensibly separate trading entity from FTX, allegedly siphoned billions of dollars from FTX customer accounts without the users’ knowledge. A report published on Monday revealed that the firm may have engaged in the illegal practice of frontrunning by making investment decisions based on insider knowledge of upcoming token launches on FTX’s trading platform.

Now, details from an Ellison-linked blog are shedding light on the former Alameda CEO’s personal beliefs and world philosophy—one shaped by hardline views on polyamory and sexual competition, a fascination with race science, and a belief in the natural synergy between crypto and fraud.

The Tumblr account, which was active from 2014 until it was deleted on Sunday, was called “Fake Charity Nerd Girl” and had the handle “worldoptimization.” The author’s personal details revealed over the account’s eight years of activity, including educational history, professional history, and living history, correspond perfectly with Ellison’s biography. Furthermore, when the account’s creator announced the creation of a Twitter account in March 2021, they linked to Ellison’s Twitter page, which was also created that month.

Not a crypto trading genius, but a ‘polyamory’ expert

The Ellison-linked Tumblr account sheds some light on the possible sexual dynamics at work in FTX’s live-in headquarters.

“When I first started my first foray into poly, I thought of it as a radical break from my trad past,” Ellison’s account wrote in February 2020, two years into his tenure at Alameda Research. “But, to be honest, I’ve come to believe that the only acceptable style of poly is something akin to ‘imperial Chinese harem.”

The story went on to explain how a polyamorous relationship should ideally function as a cutthroat market of sexual competition and subjugation.

“None of this non-hierarchical nonsense,” the account continued. “Everyone should rank their partners, everyone should know where they rank, and there should be vicious power struggles for the ranks.”

------------

🫣 Tumblr, Y'all always up in the middle of some shit

what kind of bullshit is this where they are living in a penthouse in the Bahamas fucking each other and stealing other people's money calling this some kind of a corporation?

oh yeah Tumblr y'all got a bunch of shit going on that don't nobody know about and let's just be grateful for those of us who don't know that we don't know

what the fuck Tumblr

4 notes

·

View notes

Text

In a surprising turn of events, Bitcoin's value took a notable dive, plummeting to $62,000. This unexpected fall comes in the wake of Hong Kong's recently launched ETFs (Exchange-Traded Funds) not living up to the high expectations set by investors and cryptocurrency enthusiasts. The Market's reaction underscores the volatile nature of digital currencies and raises questions about the future stability of Bitcoin's valuation. As the crypto community grapples with these developments, all eyes are now on how this will shape the landscape of cryptocurrency investment in the coming days.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

In a significant development within the cryptocurrency industry, CoinDesk, a leading media outlet known for its thorough coverage and detailed analysis of the crypto world, has recently announced a major update. With a reputation for adhering to strict editorial policies, CoinDesk has always been at the forefront of providing the latest news and insights in the cryptocurrency sector. This update comes amid news that CoinDesk was acquired by the Bullish group, a move that is set to bring about exciting changes.

Bullish, a regulated digital assets exchange, is now the proud owner of CoinDesk. This acquisition by the Bullish group, which is majority-owned by Block.one, signifies a new chapter for CoinDesk. Block.one, alongside Bullish, holds a significant presence in the blockchain and digital asset arena, with substantial investments and contributions to the industry, including considerable holdings in Bitcoin.

The transition of CoinDesk into the arms of the Bullish group marks an interesting development for both entities. CoinDesk, renowned for its award-winning journalism, including its explosive coverage which has won it top journalism prizes, maintains its commitment to high-quality, unbiased reporting on the cryptocurrency industry. It's vital to note that even with this acquisition, CoinDesk will continue to operate as an independent subsidiary. This strategic move ensures that its editorial independence is safeguarded, allowing it to continue its legacy of trustworthy reporting. Furthermore, CoinDesk employees, including its journalists, stand to benefit from this acquisition as they may receive options in the Bullish group as part of their compensation package.

Privacy and policy updates have also been made in light of these changes. CoinDesk and the Bullish group are dedicated to maintaining transparency and user trust, updating their privacy policy, terms of use, cookies policy, and reinforcing their commitment to not selling personal information.

This acquisition is not just a testament to CoinDesk's value and influence in the cryptocurrency news space but also highlights the growing importance of credible information sources in an often volatile and rapidly evolving industry. As the crypto world continues to expand, the role of dedicated media outlets like CoinDesk, backed by strong, knowledgeable players like the Bullish group and Block.one, becomes increasingly vital.

For crypto enthusiasts, investors,

and technology followers, this development promises enhanced coverage and insightful analysis in the digital assets and blockchain sectors. As these technologies forge the path towards the future of finance, being well-informed through reliable sources like CoinDesk will be key to navigating the crypto landscape successfully.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. **Why did Bitcoin fall to $62,000?**

Bitcoin's price dropped to $62,000 because the new ETFs (Exchange-Traded Funds) introduced in Hong Kong didn't do as well as people hoped they would. This made some investors lose confidence and sell their Bitcoin.

2. **What are ETFs, and why are they important for Bitcoin?**

ETFs are investment funds that are traded on stock exchanges, just like stocks. They are important for Bitcoin because they provide a way for more people to invest in Bitcoin through a traditional financial system. When ETFs do well, they can attract more investors to Bitcoin, potentially raising its price.

3. **Did the Hong Kong ETFs directly cause the price of Bitcoin to drop?**

Not directly. The underperformance of the Hong Kong ETFs likely led to decreased investor enthusiasm for Bitcoin, contributing to the price drop. It's more about investor sentiment than a direct financial link between the ETFs and Bitcoin's price.

4. **Can the price of Bitcoin bounce back after such a drop?**

Yes, Bitcoin's price has a history of volatility, which means it can experience significant drops and then recover. Price changes can happen because of various factors, including changes in investor sentiment, Market trends, or global economic events.

5. **What should investors do in such situations?**

Each investor's situation is unique, so it's hard to give a one-size-fits-all answer. Generally, it's important to stay informed, consider long-term investment strategies, and not make hasty decisions based on temporary Market movements. Consulting with a financial advisor is also a good idea if you're unsure.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Text

Crypto Exchange Binance To Acquire Rival FTX Amid ‘Liquidity Crunch’

Following a prolonged social media dispute between Binance's Changpeng Zhao and FTX's Sam Bankman-Fried, Zhao revealed on Tuesday that Binance has signed a non-binding Letter of Intent (LoI) to acquire FTX completely. The feud escalated after a CoinDesk report uncovered Alameda's significant FTX asset holdings, particularly in the FTT native token.

Amid concerns over FTX's financial stability and a surge in withdrawals, FTX ceased withdrawals, prompting panic among investors. In response, Binance agreed to bail out FTX, citing a "significant liquidity crunch." Zhao stated that Binance decided to support FTX after the exchange approached them for assistance, intending to safeguard users and address the liquidity issue.

SBF acknowledged the irony of Binance becoming both FTX's first and last investor, expressing gratitude to Zhao and Binance for the user-centric deal. He praised Zhao's role in expanding the global crypto ecosystem, emphasizing the transaction's benefit to the industry.

SBF assured users that the situation does not affect FTX and Binance operations, confirming live withdrawals and normal operations, fully backed 1:1. The agreement signifies a significant development in the crypto exchange landscape, driven by the need to address liquidity concerns and safeguard user interests.

0 notes

Text

Berachain's Crypto Trade Aggregator Ooga Booga Raises $1M

Berachain mainnet isn’t even live yet; no traders are trading, or exchanges exchanging, on crypto’s latest layer-1. But that isn’t dissuading Ooga Booga from fundraising to support both.

The strangely-named provider for a piece of financial infrastructure raised $1 million at a $10 million valuation, co-founder Kevin Liu told CoinDesk. The 19-year old founder said he wants his “decentralized…

View On WordPress

0 notes

Text

Why Bitcoin's Potential Demise is Due to Misunderstanding

The lack of understanding and communication surrounding Bitcoin is a major issue, according to an article on CoinDesk. A recent survey showed that many people believe Bitcoin will soon disappear, which the author attributes to a failure in effectively explaining the concept of Bitcoin to the general public. The author, along with the cryptocurrency industry, admits their guilt in not doing a better job of educating people about Bitcoin, causing a lack of trust and understanding among potential users.

The author's argument is that the belief that Bitcoin will die is unfounded. The open-source nature of Bitcoin means that there is no person or company with the power to shut it down. The author dismisses the idea of Bitcoin dying organically, as it would require tens of millions of people involved in Bitcoin to all simultaneously walk away, which is highly unlikely. The author highlights the importance of the concept of unstoppability, referring to Bitcoin's ability to operate without interference or censorship from governments, banks, or hackers, as a powerful idea that people should marvel at.

The article suggests that one reason for the lack of understanding is the abstract nature of Bitcoin and the lack of tangible benefits it offers to individuals. While traditional monetary systems may work for most people, the potential of a censorship-resistant and depoliticized form of value exchange is not meaningful to their day-to-day lives. The author concludes by stressing the need for the cryptocurrency industry to meet a higher standard of communication and behavior in order to gain people's trust and help them understand the potential of Bitcoin.

#Bitcoin #Cryptocurrency

Read the full article on CoinDesk

0 notes

Text

IOTA's ShimmerEVM Bridge Goes Live in Strategic Linkup with LayerZero

The timing for the launch of the ShimmerEVM Bridge is a perfect one, considering the broader expansion underway in the IOTA ecosystem.

The ShimmerEVM protocol from IOTA is advancing an impressive cross-chain interoperability protocol with the integration of LayerZero’s technology to enhance its bridging capabilities. As reported by Coindesk based on the scoop from the network’s developers, the…

View On WordPress

0 notes

Text

[ad_1]

Many FTX ambassadors reportedly acquired threats in opposition to their lives. These ambassadors asked the FTX crew to take motion.FTX was a top-ranked crypto change earlier than Nov of final yr however collapsed badly following a report by the Coindesk media over the corporate’s cast monetary place. At present, former FTX CEO Sam Bankman-Fried (SBF) is in jail & courtroom legal professionals are doing their finest to make proof & details seen to seek out the primary perpetrator.Just lately Coindesk media printed a report on these individuals who promoted FTX crypto change, earlier than Nov 2022, amongst pals, kin, households, universities in African areas.The report famous that a number of months in the past, a former FTX promoter mentioned that his status additionally collapsed badly amongst his kin & pals after the collapse of FTX Empire as a result of he promoted FTX as one of the best crypto change to commerce crypto belongings.The previous FTX model ambassadors have been getting upto 40% buying and selling price fee equivalent to referrals and in addition an extra $500 earnings on behalf of the efficiency of the FTX crew. FTX’s African ambassadors are receiving threats in opposition to their lives. These ambassadors beforehand promoted FTX and acquired 30% of the person’s buying and selling charges, plus an extra $500 per 30 days primarily based on efficiency. The official FTX Africa Telegram group has over 10,000 members.…— Wu Blockchain (@WuBlockchain) October 30, 2023 Two years again, the FTX change tried its finest to advertise FTX crypto providers amongst faculty, college college students, so many college students grabbed FTX’s promotional program as a chance to earn cash through referrals amongst kin & pals. Some folks invested tens of millions beneath the referral of those folks and it was apparent that such folks turned badly indignant in opposition to these promoters.A former FTX promotor mentioned in an interview with Coindesk that he acquired a name from an individual, who registered his FTX account on behalf of his suggestion, & he was crying badly as a result of he misplaced 20 million naira due to him.Reportedly the vast majority of the FTX model ambassadors have been organising crypto-education-focused occasions in universities however in actuality they focussed on growing the signup of recent accounts beneath referral, as a way to get enormous referral income from the FTX change.The Coindesk report famous that almost all of the FTX promoters are dealing with threats from their corresponding referrals and they don't really feel protected to go in public. Some sources confirmed that among the FTX model ambassadors have been threatened bodily by these they referred to the change.Learn additionally: Billionaire Druckenmiller says “I don’t own Bitcoin, but I should”

[ad_2]

0 notes

Text

The Crypto Ad Platform and Monetization Networks - 7Search PPC

Cryptocurrency ads will appear everywhere soon. This tutorial will provide you with tips on how to run a Crypto Ad Platform for your project and how to take advantage of Crowdcreate, the top Crypto & NFT Ad Agency, to improve your campaigns and gain more visibility.

We'll look at starting from scratch with a Bitcoin social media marketing plan and proactive modifications to help you adjust to your community and avoid any problems. Let's reach those benchmarks if your goal is to become recognized as a thought leader in the space or if it's just to get people interested in your crypto ad network.

Table of Content

Strategies that followed by a Crypto ad Network or Monetization Platform

Identify the Crypto Audiences You Should Reach

Paid Advertising Platforms for Crypto Currency Ad Network

The Crypto Ads Platform - 7Search PPC

Conclusion

Strategies that followed by a Crypto ad Network or Monetization Platform

Identifying your Ideal Customer Profile, or ICP, is important before you begin advertising cryptocurrency advertisements. For instance, if you are a cryptocurrency exchange that caters to experienced and knowledgeable consumers, you should target men between the ages of 35 and 60 who work in finance and technology, live in high-cost areas, and read websites like CoinMarketCap, CoinDesk, and Bitcoin Magazine.

After you've created an ideal client profile, you can find out which platforms these consumers use frequently and begin investigating their networks and crypto ads network first.

Be careful; while some projects believe that one person fits their ideal client profile, it may actually fit another. It's also crucial to be metrics- and results-driven so that you can allocate your budget wisely for the highest visibility (CPM, or cost per thousand impressions) or highest conversions (CPC, or cost per click).

Identify the Crypto Audiences Publishers and Advertisers

These networks give advertising access to a specialized group of cryptocurrency investors and enthusiasts. With cryptocurrency ad networks, you can be sure that your target audience is aware of what an ICO and DeFi protocol are. Because the networks do not need to translate cryptocurrency payments into fiat, they frequently provide lower rates.

Publishers can easily monetize a newsletter or website with a crypto focus by using crypto ad networks. With cryptocurrency, publishers may get paid instantaneously rather than waiting weeks to get compensated.

Paid Advertising Platforms for Crypto Currency Ad Network

Platforms for paid promotion are essential for exposing your Bitcoin firm to a global clientele. For a small fee, it makes you visible to a certain audience and attracts interest in cryptocurrencies. It also provides a good ROI (return on investment).

We'll examine paid advertising networks, sometimes referred to as cryptocurrency advertising platforms, and how to use them to promote crypto PPC and spark interest.

Platforms for paid advertising are those where you can pay to market your company. These platforms let businesses use banners, ad, or content marketing to promote their products. These platforms are widely available on the internet.

The Crypto Ads Platform - 7Search PPC

7Search PPC is a dependable and user-friendly crypto ads platform that allows businesses to leverage the power of pay-per-click (PPC) advertising in the cryptocurrency industry. This platform is geared towards both advertisers and publishers, providing them with an efficient medium to connect and drive traffic. With its intuitive interface, advertisers can easily create targeted campaigns by choosing relevant keywords, setting budgets, and scheduling ads based on their specific needs

Publishers can essentially monetize their content with crypto-based adverts through crypto advertising networks. Given that it enables webmasters to profit from Bitcoin and other cryptocurrencies through display adverts, it is undoubtedly a major victory for the Bitcoin ad network.

Conclusion

Overall, we can see that The Crypto Ad Platform and Monetization Networks, particularly 7Search PPC, have emerged as vital tools for individuals and businesses looking to maximize their revenue in the crypto ad network industry. With its unique pay-per-click advertising model, 7Search PPC offers a seamless experience for advertisers and publishers alike. It allows advertisers to directly reach their target audience through highly targeted ad placements, while publishers can monetize their websites by displaying relevant ads to their visitors. Furthermore, 7Search PPC stands out from other platforms with its commitment to maintaining the safety and security of its users' funds through decentralized technology. Overall, as the crypto space continues to grow rapidly and gain mainstream adoption, leveraging a reliable ad platform like 7Search PPC can greatly contribute to the success of businesses involved in this exciting industry.

0 notes

Text

JPMorgan Chase &. Co. has shed light on how the Ethereum network decentralization has decreased significantly since the Merge event and Shanghai upgrade went live.

The rise of staking and centralization

Since implementing the Merge and Shanghai upgrades, Ethereum has seen a substantial uptick in staking activities.

Staking, a process where users lock up their crypto assets to support network operations, has its merits. According to a CoinDesk report citing JPMorgan research, this surge in staking activity comes at a cost: centralization.

Traditionally, many in the crypto community prefer decentralized liquid staking platforms like Lido over their centralized counterparts.

Lido’s approach included adding more node operators to ensure no single entity controlled a significant portion of staked Ether (ETH). The aim was to address centralization concerns.

However, centralization remains a risk. A concentration of liquidity providers or node operators could act as a single point of failure or even collude to create an oligopoly, potentially undermining the interests of the broader Ethereum community.

Ethereum, the world’s second-largest crypto, has become more centralized since the Merge and Shanghai upgrades. And JPMorgan is highlighting concerns over a decline in staking yields.

The menace of rehypothecation

Another highlight from the report is rehypothecation. This complex term refers to the practice of reusing liquidity tokens as collateral across multiple decentralized finance (DeFi) protocols simultaneously.

DeFi encompasses lending, trading, and other financial activities carried out on the blockchain.

The problem arises when a staked asset’s value sharply declines or faces a security breach or protocol error.

In such scenarios, rehypothecation could trigger a cascade of liquidations, jeopardizing the stability of the DeFi ecosystem.

Furthermore, the report points out that the increase in staking has diminished the appeal of Ethereum from a yield perspective.

This shift is especially noticeable amid rising yields in traditional financial assets. The total staking yield has fallen from 7.3% before the Shanghai upgrade to approximately 5.5%.

From a different perspective, the research data presented in December following Ethereum’s Merge upgrade in September 2022 reveals a significant reduction in the network’s energy consumption, akin to the energy usage of entire countries such as Ireland and Austria.

This decrease in power consumption positively contributes to environmental sustainability, aligning with broader global efforts to reduce the carbon footprint associated with blockchain technologies.

Ethereum’s core developers have introduced an Ethereum Improvement Proposal (EIP-7514) as part of the upcoming Dencun upgrade, scheduled for activation in October 2023.

This proposal aims to slow down the rate of Ether staking. The intention is to provide the Ethereum community with more time to devise a practical reward scheme for stakers on the network.

ETH price analysis

As of the time of writing, the price of Ethereum (ETH) stands at $1,629, representing a 3.4% decline on the weekly timeframe.

Ethereum’s Relative Strength Index (RSI) is currently sitting at 40.4.

The price of ETH is struggling to maintain the $1600 level after facing rejection at the $1700 resistance level. A failure to hold the $1600 level could potentially lead to a further decline to the $1500 level.

0 notes

Text

Yale increases investment in blockchain research

Yale increases investment in blockchain research

This time last year, Yale was unranked in CoinDesk’s Best Universities for Blockchain. A year later the University places 34th overall, on par with Harvard and other major universities around the world.To get more news about blockchain field survey, you can visit wikifx.com official website.

The report’s results recognize Yale’s recent significant investments into blockchain research, including the hiring of four new blockchain experts to the Computer Science faculty, — Ben Fisch, Charalampos Papamanthou, Katerina Sotiraki and Fan Zhang — one of whom is leading a project that has received a $5.75 million grant for blockchain development.

The grant will support PAVE: A Center for Privacy, Accountability, Verification and Economics of Blockchain Systems, which will be led by Papamanthou. PAVE will bring together a cross-disciplinary team of experts from four institutions — Yale, Columbia University, the City College of New York and the Swiss Federal Institute of Technology Lausanne, with Yale being the leading institution — to advance research of blockchain systems.

Apart from the technical agenda, PAVE will also host hackathons, symposiums and blockchain summer schools.

The expansion of blockchain research at Yale coincides with the rise of the blockchain technology market. The value of blockchain technology in the banking, financial services and insurance sector market is expected to grow by $4.02 billion between 2021 and 2026, according to Technavio. The Technavio study found that easier access to technology and disintermediation of banking services will create more growth opportunities within the industry.

Papamanthou believes the hirings acknowledged the importance of blockchain, and that the University has more generally “acknowledged the interdisciplinary nature of the blockchain space.” He emphasized the University provides opportunities to explore the blockchain industry, such as interdisciplinary majors like computer science and economics.

Papamanthou spotlighted the newly established Roberts Innovation Fund created by the School of Engineering and Applied Sciences, which assists blockchain projects that could be commercialized through funding and mentoring.

An increasing number of students are interested in the field of blockchain, according to Mariam Alaverdian ’23, president of the Yale Blockchain Club.

Alaverdian explained that because of the many applications of blockchain technology — from personal identity security to healthcare to money transfers — the emergence of blockchain into our lives is “inevitable.” She added that the Yale Blockchain Club has seen interested students come from a variety of backgrounds, with some having no prior exposure and others who already have startups in the space.

“The Yale Blockchain Club started last spring and we received a lot of attention from Yale undergraduate and graduate students,” Alaverdian wrote in an email to the News. “We had 600 people sign up for our mailing list within a couple of weeks … there is definitely a high demand from Yale students for educational materials and guidance.”

0 notes

Text

Privacy-Focused Blockchain Zcash’s (ZEC) Latest Software Version Goes Live

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital…

View On WordPress

0 notes

Text

A Startup Idea Enabling Bitcoin For Africans

“I started Machankura to make bitcoin more accessible in communities where not everyone has an Internet-connected device,” Ngako told CoinDesk in an interview. “Anyone who's interested in using bitcoin and living on bitcoin should be able to do so easily.”

The concept itself isn't new. In 2007, two mobile network providers in Kenya – Vodafone and Safaricom – created M-Pesa, a service that uses digital wallets on basic feature phones to provide payments, credit and savings in local currency with no bank account or Internet connection.

M-Pesa and services like it are known as “mobile money,” and about a third of adults in sub-Saharan Africa now have a mobile money account. Safaricom generated $765 million in revenue from M-Pesa in 2021.

0 notes

Text

First Mover Americas: Bitcoin Slumps, Liquidations Surge

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Late Monday, bitcoin (BTC) suffered a short-lived crash to as low as $8,900 on cryptocurrency exchange BitMEX while prices on other exchanges held well above $60,000. The slide began at 22:40…

View On WordPress

0 notes