#Coinbase Commerce

Explore tagged Tumblr posts

Link

0 notes

Text

Coinbase Stablecoin Payments: E‑Commerce Game Changer

Introduction Coinbase, the leading U.S.-based cryptocurrency exchange, has launched Coinbase stablecoin payments—a suite enabling merchants to accept USDC in online transactions. With strategic integration in platforms like Shopify and built atop the Base Layer‑2 network, this move could transform the $6 trillion digital commerce landscape by disrupting traditional card rails and payment…

#Base network#blockchain#Coinbase#Coinbase Payments#crypto merchants#crypto payments#e-commerce#Mastercard alternative#merchant payment integration#payments rails#Shopify#stablecoins#Stripe#USDC#Visa alternative

0 notes

Text

Greg Owen at LGBTQ Nation:

Washington’s revolving door between lawmakers and its lobbying class saw former Sen. Kyrsten Sinema (I-AZ) emerge with a new job on Monday. The onetime Democrat, attorney, and the first out bisexual member of the U.S. Senate has joined the global law firm Hogan Lovells as a senior advisor. Sinema told Reuters she’ll help clients involved in artificial intelligence, cryptocurrency, digital assets, and other industries “navigate complex regulatory and legislative environments” as a member of the firm’s global regulatory and intellectual property practice group. She will not register as a lobbyist, Sinema said. The former member of the Senate Banking, Commerce, Appropriations, Veterans Affairs, and Homeland Security committees told Politico she’ll be working mostly with clients in industries where she’s long “had interest and expertise,” including private equity. She cited Hogan Lovells’ growing global regulatory practice and its focus on leading-edge industries in the tech space for the move. Sinema’s K Street landing follows her joining an advisory council at crypto exchange Coinbase in January, alongside Chris LaCivita, co-campaign manager for Donald Trump’s latest run for president.

Former Arizona Senator Kyrsten Sinema joins Hogan Lovell, a lobbying firm. Notably, she decided not to register as a lobbyist.

9 notes

·

View notes

Text

How Beginners Can Use Investing Apps to Start Building Wealth?

Stock trading has been on the rise for quite some time now, especially among youngsters. The youth are on the constant lookout for newer investing apps which make their job easy. E-commerce apps that provide investing services have also surged to impeccable heights & made wealth for a significant number of individuals. There’s no fixed formula for investing in the stock market. A well-structured portfolio & strategic investments can take you to quite wealthy distances.

For C-suite executives, startup entrepreneurs, and managers, understanding how investing apps empower users is essential—not only for personal financial growth but also to stay informed about technological advancements in the financial sector. This article explores how beginners can leverage investing apps to start building wealth effectively and strategically.

The Game-Changing Impact of Investment Platforms

The rise of investing apps has eliminated traditional barriers such as high fees, complicated processes, and the necessity for financial advisors. These apps have democratized investing through features such as:

Low or No Commission Fees – Many platforms offer commission-free trades, making investing more affordable.

Fractional Shares – Users can invest in small portions of high-priced stocks, allowing broader access to valuable assets.

Automated Portfolio Management – Robo-advisors create customized portfolios based on individual risk tolerance and financial goals.

Educational Resources – Built-in learning materials help beginners understand market trends and investment strategies.

User-Friendly Interfaces – Simple navigation, real-time analytics, and personalized recommendations make investing more intuitive.

By incorporating these features, investment platforms make financial markets more inclusive, giving users the ability to take charge of their financial futures.

Steps for Beginners to Start Investing

1. Define Your Investment Goals

Before selecting an investing app, users should determine their financial objectives. Are they investing for retirement, wealth accumulation, or short-term financial gains? Identifying goals helps in choosing appropriate investment strategies and risk levels.

2. Choose the Right Investing App

Different investment platforms cater to various investor needs:

Stock Trading Apps (e.g., Robinhood, Webull) – Best for hands-on trading.

Robo-Advisors (e.g., Betterment, Wealthfront) – Ideal for automated, long-term investing.

Micro-Investing Apps (e.g., Acorns, Stash) – Suitable for those starting with small amounts.

Social Investing Apps (e.g., eToro, Public) – Allow users to follow and replicate expert traders.

Cryptocurrency Apps (e.g., Coinbase, Binance) – For those looking to diversify into digital assets.

3. Start Small and Diversify

Beginners should avoid placing all their funds into a single stock or asset class. A diversified portfolio—including stocks, ETFs, bonds, and real estate—helps manage risk. Many investing apps provide guidance on asset allocation to optimize investment strategies.

4. Utilize Automated Investment Tools

Features such as recurring deposits and robo-advisors enable users to invest consistently without the need for active monitoring. Automation removes emotional biases and encourages disciplined investment habits.

5. Continuously Learn and Adapt

While investing apps simplify the investment process, continuous learning is crucial. Staying updated on financial news, market trends, and portfolio performance enhances decision-making and long-term success.

Common Mistakes to Avoid When Using Mobile Trading Apps

1. Emotional Decision-Making

Market fluctuations can trigger impulsive buying or selling. It is vital to maintain a long-term perspective rather than reacting to short-term volatility.

2. Overtrading

Many beginners engage in excessive trading due to the accessibility of investing apps. Frequent transactions can lead to unnecessary fees and market timing errors, ultimately reducing profits.

3. Ignoring Fees and Hidden Costs

Although many platforms offer commission-free trading, other charges such as fund expense ratios and premium account fees can accumulate. Users should evaluate costs before committing to an app.

4. Failing to Rebalance Portfolios

Market changes can impact asset allocation over time. Regularly reviewing and adjusting investment portfolios ensures alignment with financial goals and risk tolerance.

5. Neglecting Tax Implications

Investing comes with tax obligations, including capital gains taxes. Some trading applications provide tax-loss harvesting features, which can help users optimize their tax liabilities and maximize returns.

The Future of Investing Apps in Wealth-Building

With advancements in AI, blockchain technology, and machine learning, the next generation of investing apps will offer even more personalized, intelligent, and secure solutions. Features such as AI-driven financial advisors, real-time risk assessment, and decentralized finance (DeFi) integration are set to redefine digital investing.

Furthermore, stock market apps are expanding to include more asset classes, such as real estate crowdfunding, private equity, and alternative investments, broadening opportunities for investors.

For business leaders and entrepreneurs, staying ahead of these trends is crucial. Whether using investing apps for personal wealth-building or incorporating fintech innovations into business strategies, digital investment tools present vast opportunities for financial growth.

Conclusion

The accessibility and convenience of trading applications have transformed the investment landscape, allowing beginners to build wealth with minimal capital and financial expertise. By defining clear financial goals, selecting the right platform, diversifying assets, and committing to continuous learning, users can effectively manage their financial future.

As investing apps continue to innovate, they will play an increasingly crucial role in shaping financial markets and fostering inclusive investment opportunities. The democratization of finance through trading portfolio ensures that wealth-building is no longer limited to a select few. With the right strategies and tools, anyone can participate in the financial markets and work toward a prosperous future.

Uncover the latest trends and insights with our articles on Visionary Vogues

3 notes

·

View notes

Text

Premarket U.S. Stock Movers: Tesla, Macy’s, Coinbase, Nio, Shell, Amazon

In today's early trading, the U.S. stock market is already buzzing with notable movements among key players. Investors and analysts are closely monitoring the premarket activity of several prominent stocks, each showing distinctive performance dynamics.

Tesla (NASDAQ) has started the day on a positive note, with its stock rising by 1.8%. This upward movement follows recent market optimism surrounding Tesla's innovative developments in electric vehicles and sustainable energy solutions. As a pioneering force in the automotive industry, Tesla continues to capture investor interest with its innovative technological advancements and ambitious growth strategies.

Macy’s (NYSE) is another standout performer in the premarket, showcasing a robust 6.8% increase. This surge reflects renewed investor confidence in the retail giant's ability to navigate challenges and capitalize on evolving consumer trends. Macy's ongoing efforts to enhance its digital capabilities and strategic initiatives in omnichannel retailing are positioning the company for sustained growth in a competitive market landscape.

Coinbase (NASDAQ), however, faces a 4.6% decline in its premarket trading. The cryptocurrency exchange platform is experiencing volatility amidst regulatory scrutiny and market fluctuations in digital assets. Despite its leadership in the digital currency space, Coinbase's stock performance underscores the inherent volatility and regulatory uncertainties impacting the crypto industry.

Nio (NYSE), known for its electric vehicle offerings, is witnessing a 2.3% decrease in its American Depositary Receipts (ADRs) during premarket trading. This decline comes amid broader sectoral challenges and market sentiment towards growth stocks in the EV sector. Nio continues to navigate through supply chain disruptions and competitive pressures as it strives to expand its market presence globally.

Shell (LON) ADRs, representing Royal Dutch Shell, have shown a modest 1.1% rise in premarket trading. As a global energy leader, Shell's stock performance reflects investor sentiment toward energy markets and macroeconomic factors influencing oil and gas prices. The company's strategic focus on sustainable energy transitions and operational resilience in a dynamic energy landscape remains pivotal amid evolving market conditions.

Amazon (NASDAQ), a cornerstone of e-commerce and cloud computing services, is demonstrating a minor 0.3% change in its premarket activity. Amazon's stock movement reflects ongoing investor sentiment towards tech giants amid regulatory scrutiny and competitive pressures in digital retail and cloud computing markets. The company continues to innovate across its business segments, driving growth and adaptation to evolving consumer behaviors.

Today's premarket movements highlight the diverse dynamics shaping the U.S. stock market. Investors are navigating through a mix of sector-specific trends, regulatory developments, and macroeconomic factors influencing stock performance. As market participants analyze these early signals, the day's trading session promises to offer further insights into the evolving landscape of global financial markets.

3 notes

·

View notes

Text

Chamber of Digital Commerce Takes a Stance in Kraken vs. SEC Legal Battle

In the ongoing legal tussle between Kraken, a prominent cryptocurrency exchange, and the U.S. Securities and Exchange Commission (SEC), the Chamber of Digital Commerce has entered the fray. The Chamber filed an amicus curiae brief on February 27, challenging the SEC's regulatory stance on digital assets. This move signifies a pivotal moment in the broader discourse on the regulatory framework for digital assets in the United States.

Central to the Chamber's argument is its opposition to the SEC's broad classification of all digital asset transactions as securities transactions. The Chamber contends that digital assets, essentially lines of code facilitating functionality on blockchain networks, should not be automatically treated as investment contracts. Drawing on legal precedents where digital tokens were not categorically considered securities, the Chamber advocates for a nuanced, transaction-specific assessment.

Moreover, the Chamber critiques the SEC's regulatory strategy, characterizing it as an overreach without sufficient legislative backing. It argues that such enforcement actions impede innovation and pose potential risks to the trillion-dollar digital asset space and the broader U.S. economy. The filing references past cases, including those involving Ripple and Terraform Labs, where the SEC's position did not yield an entirely favorable outcome for the regulator.

This development underscores the larger trend of regulatory scrutiny within the digital asset industry. Similar allegations have been levied by the SEC against other crypto exchanges such as Coinbase and Binance since June 2023. These cases suggest the SEC's intention to impose tighter regulations on the digital asset space, defaulting to the classification of digital assets as securities.

2 notes

·

View notes

Text

how to earn money online

There are numerous ways to earn money online, and the method you choose will depend on your skills, interests, and the amount of time and effort you are willing to invest. Here are some popular methods for making money online:

Freelancing: If you have skills such as writing, graphic design, programming, or social media management, you can offer your services on freelancing platforms like Upwork, Freelancer, or Fiverr. Clients post projects, and you can bid on them or create gig packages to attract clients.

Online tutoring: If you excel in a particular subject, you can become an online tutor. Many platforms, such as VIPKid, Tutor.com, or Chegg, allow you to teach students from around the world.

Affiliate marketing: This involves promoting other people's products or services and earning a commission for every sale or lead generated through your referral. You can join affiliate programs offered by companies like Amazon, ClickBank, or Commission Junction.

Online surveys and microtasks: Websites like Swagbucks, Survey Junkie, or Amazon Mechanical Turk pay you for completing surveys, watching videos, or performing small tasks.

E-commerce: You can create an online store and sell products either through your website or platforms like Shopify, Etsy, or eBay. You can sell physical products, digital goods, or even dropship products from suppliers.

Content creation: If you enjoy creating videos, you can start a YouTube channel and monetize it through ads, sponsorships, or crowdfunding on platforms like Patreon. Similarly, you can start a blog and earn money through advertising, sponsored content, or affiliate marketing.

Online market trading: If you have knowledge of stocks, cryptocurrencies, or forex, you can participate in online trading platforms like Robinhood, eToro, or Coinbase. Note that trading involves risks and requires careful research and understanding.

Online freelancing platforms: Websites like Amazon's Mechanical Turk or Upwork offer various tasks, such as data entry, transcription, or virtual assistance, which you can complete for payment.

Remember, earning money online often requires dedication, persistence, and acquiring the necessary skills. Be cautious of online scams, do thorough research, and consider starting with smaller tasks or projects before venturing into more significant commit

Click here

#howtoearnmoneyonline#howtoearnmoney#howtoearnmoneyfromhome#earnmoneyonline#earnmoney#howtomakemoneyonline#howtoearnmoneyfast#makemoney#workfromhome#makemoneyonline#makemoneyfromhome#howtomakemoneyfast#onlinebusiness#howtomakemoney#makemoneyfast#waystomakemoneyonline#howtomakemoneyfromhome#waystomakemoney#onlineearnmoney#affiliatemarketing#howtomakeeasymoney#easywaystomakemoney#howcanimakemoney#howtomakequickmoney#earnmoneyfromhome#quickwaystomakemoney#onlineearning#waystomakemoneyfast#business#earn

4 notes

·

View notes

Text

Cryptocurrency in Shopify & Magento Stores: Practical Tips for Integration

Integrating cryptocurrency in Shopify & Magento stores can offer flexibility and new payment options for digital-savvy customers. Both platforms support third-party apps and gateways like Coinbase Commerce and BitPay, making it possible to accept Bitcoin, Ethereum, and other popular cryptocurrencies. Key considerations include wallet setup, transaction fees, and tax implications. For Shopify, integration is generally straightforward through available apps. Magento users may require more customization but benefit from open-source flexibility. Adding cryptocurrency to your store involves balancing convenience with security and regulatory compliance.

0 notes

Text

0 notes

Text

Coinbase宣布推出"Coinbase Payments",并与Shopify达成合作

深潮 TechFlow 消息,6 月 19 日,据官方公告,Coinbase宣布推出”Coinbase Payments”,这是一款专为商业平台设计的稳定币支付堆栈。该解决方案允许平台为商家提供全球范围内的即时USDC支付,无需处理区块链复杂性。Coinbase Payments已与Shopify达成合作,为其数百万商家提供USDC支付功能,无需额外设置。该产品包含三层架构:面向消费者的Stablecoin Checkout、面向商家的Ecommerce Engine和负责链上执行的Commerce Payments Protocol。

0 notes

Text

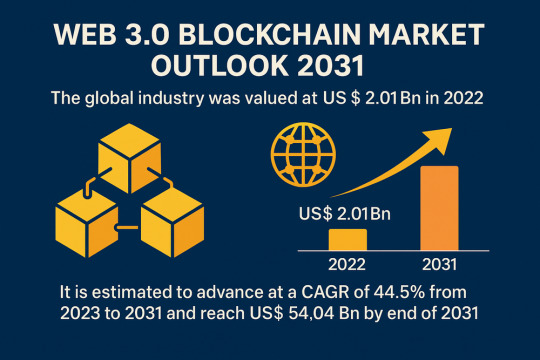

Web 3.0 Blockchain Industry Takes Off Amid Rising Demand for Transparency

The global Web 3.0 blockchain market is on a fast-track trajectory, poised to grow from USD 2.01 Bn in 2022 to a remarkable USD 54.04 Bn by 2031, expanding at a CAGR of 44.5% during the forecast period from 2023 to 2031. This growth is fueled by rising demand for data ownership, increased adoption of blockchain in supply chain and retail, and unprecedented investment in decentralized technologies.

Market Overview: Web 3.0 represents the next evolutionary phase of the internet, integrating decentralized technologies such as blockchain to foster transparency, user empowerment, and data security. Blockchain, the foundational technology of Web 3.0, is transforming digital interaction by eliminating the need for intermediaries and creating trust through cryptographic protocols.

Market Drivers & Trends

1. Surge in Data Ownership Awareness: With the rise in cyberattacks and data misuse, users are demanding control over their personal data. Web 3.0 blockchain enables data decentralization, thereby ensuring secure ownership and enhancing user privacy.

2. Skyrocketing Venture Capital Investments: Investors are pouring billions into blockchain startups. According to CB Insights, global blockchain venture funding soared from US$ 3.1 Bn in 2020 to US$ 25.2 Bn in 2021, signaling strong investor confidence.

3. Corporate Blockchain Integration: Major corporations like Amazon and Walmart are integrating blockchain into operations to enhance transparency and operational efficiency, further validating its commercial viability.

Latest Market Trends

Blockchain in E-commerce & Retail: Amazon is utilizing managed blockchain to streamline operations, while Walmart is using Hyperledger Fabric to improve traceability in the food supply chain.

Smart Contracts & Digital Identity Solutions: Businesses are leveraging smart contracts to automate transactions, reduce fraud, and build trust. Blockchain-backed digital identities are also gaining traction, particularly in financial services and government sectors.

NFT and Metaverse Innovations: The rise of NFTs and immersive experiences in the metaverse is drawing entertainment giants like Shemaroo into the Web 3.0 fold, creating new revenue streams.

Key Players and Industry Leaders

Prominent players in the Web 3.0 blockchain landscape include:

Helium Inc.

Polygon Labs UI (Cayman) Ltd.

Consensys

Kadena LLC

Ocean Protocol Foundation Ltd.

Coinbase

Filecoin

Terra

Binance

Livepeer, Inc.

Biconomy

Fireblocks

These companies are heavily investing in R&D, expanding their product portfolios, and forming strategic alliances to stay competitive in the rapidly evolving market.

Recent Developments

Shemaroo & Seracle Partnership (Sep 2022): Launched entertainment-focused Web 3.0 solutions including NFTs and metaverse content.

WazirX Launches Shardeum (Feb 2022): Introduced a decentralized platform designed to scale blockchain solutions efficiently.

Deutsche Börse Acquires Crypto Finance AG (June 2021): Strengthens its position in digital assets and blockchain financial services.

Market Opportunities

The market holds vast potential in several areas:

Supply Chain Optimization: Blockchain can reduce inefficiencies and improve transparency across global supply chains.

Healthcare Record Management: Secure, tamper-proof medical records managed via blockchain can enhance patient outcomes and reduce costs.

Decentralized Finance (DeFi): Growth in DeFi applications is revolutionizing traditional financial systems by offering trustless and permissionless services.

Government and Identity Management: Governments are exploring blockchain for land records, voting systems, and digital IDs, presenting untapped potential for vendors.

Discover valuable insights and findings from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85198

Future Outlook

The Web 3.0 blockchain market is expected to flourish as enterprises and governments seek resilient, transparent, and decentralized digital infrastructures. With exponential growth projected through 2031, this market is poised to redefine how businesses operate and users interact with digital systems.

Analysts' Viewpoint: The Web 3.0 blockchain ecosystem is still in its formative years, but its potential is vast. As scalability improves and regulatory frameworks mature, adoption across sectors will accelerate. Players investing early in R&D and partnerships will be best positioned to capture the lion’s share of future growth.

Market Segmentation

By Blockchain Type:

Public

Private

Hybrid / Consortium

By Application:

Payments

Smart Contracts

Digital Identity

Supply Chain Management

Others

By End-user:

Retail & E-commerce

BFSI

IT & Telecom

Media & Entertainment

Healthcare

Others

Regional Insights

North America leads the global market owing to early blockchain adoption and significant venture funding, especially in the U.S.

Asia Pacific is projected to witness the fastest CAGR during the forecast period. The presence of rapidly digitizing economies like China and India, combined with government interest and tech-savvy populations, is creating fertile ground for Web 3.0 adoption.

Europe and Latin America are also advancing due to supportive policies and increasing fintech innovation.

Why Buy This Report?

In-depth Analysis: Provides detailed insights into growth drivers, restraints, trends, and opportunities.

Company Profiles: Extensive competitive landscape analysis, including key strategies and financials.

Segmented Insights: Cross-segment analysis by application, blockchain type, end-user, and geography.

Latest Trends & Developments: Up-to-date on major investments, partnerships, and product launches.

Forecasting Intelligence: Reliable market forecasts from 2023 to 2031 to support strategic planning.

Frequently Asked Questions (FAQs)

1. What is the current size of the Web 3.0 Blockchain market? As of 2022, the market is valued at US$ 2.01 Bn.

2. What is the projected market size by 2031? The market is expected to reach US$ 54.04 Bn by 2031.

3. What is the expected CAGR of the Web 3.0 Blockchain market? The market is projected to grow at a CAGR of 44.5% during 2023–2031.

4. Who are the leading players in this market? Helium Inc., Polygon Labs, Coinbase, Consensys, Binance, and Fireblocks are among the leading players.

5. What regions are witnessing the fastest growth? Asia Pacific, particularly India and China, is expected to record the highest growth rate.

6. What are the key applications of Web 3.0 blockchain? Payments, smart contracts, digital identity, and supply chain management are major application areas.

Explore Latest Research Reports by Transparency Market Research: Biometric Payment Market: https://www.transparencymarketresearch.com/biometric-payment-market.html

RAN Analytics & Monitoring Market: https://www.transparencymarketresearch.com/radio-access-network-ran-analytics-monitoring-market.html

eGRC (Enterprise Governance, Risk and Compliance) Market: https://www.transparencymarketresearch.com/enterprise-governance-risk-compliance-market.html

Managed Learning Services Market: https://www.transparencymarketresearch.com/managed-learning-services-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected] of Form

Bottom of Form

0 notes

Text

The future is now, crypto lovers! 🚀 Shopify is kicking things up a notch and diving headfirst into the crypto pool with USDC payments on the Base network! 🌐💸 Finally, the e-commerce world is catching up with the rest of us cool kids. Why pay with boring ol' dollars when you could use stablecoin magic like $USDC? Forget about slow transaction times—merchants can expect lightning-fast settlements (yes, it's a buzzword for a reason)! ⚡ And oh, did I mention the rebates? Who doesn’t love a little extra profit motive? 💰

Shopify Enhances Crypto Payments with USDC Integration

But hold onto your digital wallets! This groundbreaking collab means both Shopify and Coinbase are ready to ride the wave of crypto adoption 🌊. Think about it: faster payments, better liquidity for $USDC, and a trends report that’ll have all the financial advisors sweating bullets. 🥵 What’s not to love? And while we’re at it, let’s not forget the potential to transform e-commerce transactions. Say goodbye to traditional payment methods and welcome the future! 🙌

“Announcing USDC on Shopify Payments. Merchants get the familiar ‘authorize now, capture later’ flexibility of credit cards, with the speed and global reach of stablecoins.”

Shopify Official News

Feeling the FOMO? Don’t say we didn’t tell you—this might just be the spark to ignite your next investment venture! Ready to embrace this new wave of e-commerce? Check out all the details [here](https://theccpress.com/shopify-usdc-payments-coinbase-metamask) for a deeper dive into the crypto rebirth! 💥

Stay ahead of the curve, dear reader! Forget about sheep; be the shepherd of your crypto future! 🐑✨ #CryptoRevolution #Shopify #USDC #Coinbase #Ecommerce #Blockchain #MemeMagic #Stablecoins

0 notes

Text

Shopify Launches USDC Payments With Coinbase

Global e-commerce giant Shopify is rolling out early access to stablecoin payments in Circle’s USDC in collaboration with major US exchange Coinbase. Shopify plans to fully roll out USDC (USDC) payments on Coinbase’s Ethereum layer-2 (L2) network Base via Shopify Payments and Shop Pay throughout the year, the company announced on Thursday. “We think that stablecoins are a natural way to transact…

0 notes

Text

Shopify to Enable USDC Payments in Collaboration with Coinbase

🚀 Shopify is joining forces with Coinbase to supercharge your shopping experience with USDC payments! Imagine swiping your digital wallet and saying goodbye to traditional payment frustrations. Yes, you heard that right! Late June will see Shopify integrating USDC payments via the awesome Coinbase's Base network. Why should you care? Well, not only does it mean that global merchants can dive into the world of crypto transactions without breaking a sweat, but this move could reshape the entire e-commerce landscape. 💰 Shopify's latest venture into USDC not only caters to our crypto-loving hearts but is set to launch us into a realm of scalable, seamless payments. Circle is in on the fun as USDC’s issuer, while Stripe is making sure your money flows as it should. The result? A mad dash for increased liquidity and fewer crypto hiccups for merchants around the globe.

“I think other payment processors will look at what Shopify is building and be like, ‘Holy crap.’” — Jesse Pollak, Protocol Lead, Coinbase.

So, grab your popcorn 🍿 because we're entering an era of stablecoins that are more mainstream than ever! 📈

But don’t just take my word for it; here's a deep dive into all the juicy details. Will this integration mean more stablecoin action and a bustling digital economy? Time will tell! What’s your take? How stoked are you about crypto shopping? Let’s get the convo going in the comments! 💬��

#CryptoNews #DeFi #Shopify #USDC #Coinbase #Ecommerce #Stablecoins #BlockchainRevolution

0 notes

Text

Shopify Partners with Coinbase and Stripe in StableCoin Landmark deal

The Big Tech fever for Stablecoins will not stop. E -commerce giant Shopify On Thursday, it announced that Stablecoin’s payments have been launched for all users on its platform later this year in its largest play so far. The technology company publicly circulating for merchants – including old clothing sellers, cosmetics and electronics companies – allows their own online markets. By late June,…

0 notes