#Create Crypto Wallet App

Explore tagged Tumblr posts

Text

Cryptocurrency Wallet Development for Startups Cryptocurrency wallet development refers to the process of creating a virtual wallet that allows users to securely store, receive, and send various types of digital currencies. It serves as a bridge between the user and the blockchain network. If you are curious about crypto wallet development and thinking of building your crypto wallet app, here's a quick guide to get you started >> http://bit.ly/3jKhdR6

#crypto wallet development#cryptocurrency wallet development#digital assets#create crypto wallet app#develop crypto wallet

0 notes

Text

youtube

Curious how crypto wallets like MetaMask, TrustWallet, or Keplr are built?

Watch this live walkthrough by Blocktech Brew showcasing a powerful crypto wallet app—designed for performance, real-time transactions, and bulletproof security. From creating wallets to sending BTC & ETH, this demo shows the full development journey.

💡 Perfect for: ✔️ Web3 startups ✔️ Blockchain developers ✔️ Product managers & tech founders

🔧 Features shown: • Multi-currency wallet (BTC, ETH, etc.) • Hot & cold wallet support • Hardware integrations (Ledger, Trezor) • White-label solutions (TrustWallet clone, MetaMask clone & more)

📺 Tap the link and dive into the future of crypto wallet development.

👉 Watch now

#CryptoWallet#BlockchainDevelopment#Web3#CryptoApp#MetaMaskClone#TrustWalletClone#WalletDevelopment#CryptoTech#TumblrTech#AppDemo#Youtube

2 notes

·

View notes

Text

Crypto Trading 101: A Beginner’s Guide

Ever wondered how people trade cryptocurrencies and what it actually means to enter the crypto market? Let’s break it down in a simple way.

What is Crypto Trading?

Crypto trading is basically buying and selling digital currencies in an attempt to profit from price changes. You can either:

1️⃣ Trade directly on an exchange – This means you own the actual cryptocurrency, store it in a digital wallet, and sell it when the price is right. 2️⃣ Trade using derivatives (CFDs, futures, etc.) – This allows you to speculate on price movements without actually owning the coins. You can bet on prices going up (long position) or down (short position) without holding the asset.

How Do Crypto Markets Work?

Unlike traditional stock markets, crypto markets are decentralized. Transactions happen on a blockchain, a digital ledger that keeps everything secure and transparent. Crypto prices move based on:

📉 Supply & Demand – The total number of coins available vs. how many people want to buy them. 💰 Market Sentiment – News, media coverage, and public perception. 📊 Adoption & Regulation – Governments and institutions getting involved. 🔒 Security Events – Hacks and breaches affecting trust in the market.

Why Trade Crypto?

Cryptocurrency markets are volatile – meaning prices can change quickly, creating both opportunities and risks. Some traders like this fast-paced action because it allows for potential profits. Others use crypto trading as a hedge against traditional financial markets.

Choosing a Crypto to Trade

Popular cryptocurrencies include:

🔹 Bitcoin (BTC) – The original and most well-known. 🔹 Ethereum (ETH) – Smart contracts and decentralized apps. 🔹 Litecoin (LTC) – Faster transactions than Bitcoin. 🔹 Dogecoin (DOGE) – A meme coin turned serious player. 🔹 Cardano (ADA), Chainlink (LINK), Polkadot (DOT), Uniswap (UNI) – Other well-known cryptos with different use cases.

Going Long vs. Short

📈 Going Long = You think the price will rise, so you "buy." 📉 Going Short = You believe the price will drop, so you "sell."

Managing Risk

Since crypto prices move fast, risk management is key! Some traders use:

🔺 Stop-loss orders – Automatically selling if the price drops to a set level. 🔺 Limit orders – Locking in profits by selling when a target price is reached.

Trading crypto can be exciting, but always be mindful of the risks. Prices can swing wildly, and leverage (if used) can amplify both gains and losses. Understanding market movements, trends, and risk management strategies is crucial before diving in.

What’s your favorite crypto to trade? 🚀💰

3 notes

·

View notes

Text

Revolutionizing DeFi Development: How STON.fi API & SDK Simplify Token Swaps

The decentralized finance (DeFi) landscape is evolving rapidly, and developers are constantly seeking efficient ways to integrate token swap functionalities into their platforms. However, building seamless and optimized swap mechanisms from scratch can be complex, time-consuming, and risky.

This is where STON.fi API & SDK come into play. They provide developers with a ready-to-use, optimized solution that simplifies the process of enabling fast, secure, and cost-effective swaps.

In this article, we’ll take an in-depth look at why developers need efficient swap solutions, how the STON.fi API & SDK work, and how they can be integrated into various DeFi applications.

Why Developers Need a Robust Swap Integration

One of the core functions of any DeFi application is token swapping—the ability to exchange one cryptocurrency for another instantly and at the best possible rate.

But integrating swaps manually is not a straightforward task. Developers face several challenges:

Complex Smart Contract Logic – Handling liquidity pools, slippage, and price calculations requires expertise and rigorous testing.

Security Vulnerabilities – Improperly coded swaps can expose user funds to attacks.

Performance Issues – Slow execution or high gas fees can frustrate users and hurt adoption.

A poorly integrated swap feature can turn users away from a DeFi application, affecting engagement and liquidity. That’s why an efficient, battle-tested API and SDK can make a significant difference.

STON.fi API & SDK: What Makes Them a Game-Changer?

STON.fi has built an optimized API and SDK designed to handle the complexities of token swaps while giving developers an easy-to-use toolkit. Here’s why they stand out:

1. Seamless Swap Execution

Instead of manually routing transactions through liquidity pools, the STON.fi API automates the process, ensuring users always get the best swap rates.

2. Developer-Friendly SDK

For those who prefer working with structured development tools, the STON.fi SDK comes with pre-built functions that remove the need for extensive custom coding. Whether you’re integrating swaps into a mobile wallet, trading platform, or decentralized app, the SDK simplifies the process.

3. High-Speed Performance & Low Costs

STON.fi’s infrastructure is optimized for fast transaction execution, reducing delays and minimizing slippage. Users benefit from lower costs, while developers get a plug-and-play solution that ensures a smooth experience.

4. Secure & Scalable

Security is a major concern in DeFi, and STON.fi’s API is built with strong security measures, protecting transactions from vulnerabilities and ensuring reliability even under heavy traffic.

Practical Use Cases for Developers

1. Building Decentralized Exchanges (DEXs)

STON.fi API enables developers to integrate swap functionalities directly into their DEX platforms without having to build custom liquidity management solutions.

2. Enhancing Web3 Wallets

Crypto wallets can integrate STON.fi’s swap functionality, allowing users to exchange tokens without leaving the wallet interface.

3. Automating Trading Strategies

The API can be used to build automated trading bots that execute swaps based on real-time market conditions, improving efficiency for traders.

4. Scaling DeFi Platforms

For DeFi applications handling high transaction volumes, STON.fi API ensures fast and cost-effective execution, improving user retention.

Why Developers Should Consider STON.fi API & SDK

For developers aiming to create efficient, user-friendly, and scalable DeFi applications, STON.fi offers a robust solution that eliminates the complexities of manual integrations.

Saves Development Time – Reduces the need for custom swap coding.

Improves Security – Pre-tested smart contracts minimize vulnerabilities.

Enhances User Experience – Faster swaps create a smoother, more reliable platform.

Optimizes Performance – Low latency and cost-efficient execution ensure better outcomes.

Whether you’re working on a new DeFi project or improving an existing platform, STON.fi’s API & SDK provide a solid foundation to enhance functionality and scalability.

By leveraging STON.fi’s tools, developers can focus on building innovative features, rather than getting caught up in the technical challenges of token swaps.

3 notes

·

View notes

Text

Tobi and STON.fi: A Game-Changer for Crypto Trading on Telegram

The way we trade crypto is evolving. We’ve seen decentralized exchanges (DEXs) transform how we swap assets, and we’ve seen AI-driven tools make complex processes simpler. But what happens when you combine the efficiency of AI with the power of a top-tier DEX?

That’s exactly what’s happening with Tobi, an AI-powered trading bot on Telegram, and STON.fi, a leading DEX on the TON blockchain. This integration brings a seamless, user-friendly, and fully decentralized trading experience—all within Telegram.

What Makes Tobi Unique

Tobi isn’t just another trading bot. It’s built to simplify crypto trading, making it accessible to both beginners and experienced traders. Here’s what users can do with Tobi:

Swap assets across multiple networks with minimal effort.

Store assets securely with its built-in non-custodial wallet.

Access real-time market data and asset insights without leaving Telegram.

By integrating with STON.fi, Tobi now expands its reach to the TON blockchain, enabling smooth token swaps on one of the fastest-growing networks.

Why Does This Matter

Crypto trading often comes with challenges—high fees, complex interfaces, and multiple steps just to execute a simple swap. For many, trading on DEXs can feel overwhelming. But with this new integration, users can now trade directly in Telegram without navigating through different platforms.

What this means for traders:

No more switching between apps—all trades happen within the chat.

Lower fees and faster transactions thanks to TON’s scalability.

Complete ownership of assets since everything remains decentralized.

This integration streamlines the process, removing unnecessary barriers and making DeFi trading more accessible.

STON.fi’s Expanding Influence

The STON.fi SDK has already been adopted by several major projects, including Tonkeeper, Wallet, Punk City, Tap Fantasy, and TapSwap. These platforms are leveraging STON.fi’s technology to provide users with better DeFi experiences, proving that its impact extends far beyond just one integration.

For developers and crypto projects, this SDK offers a straightforward way to incorporate decentralized swaps into their products, enabling more platforms to provide frictionless DeFi services.

The Future of AI in Crypto Trading

The integration of AI-powered tools with DeFi solutions is a major step toward fully automated and intelligent trading systems. As AI continues to evolve, we’ll likely see even more innovations in:

Automated trading strategies that analyze market trends in real time.

Risk management tools that help users make better financial decisions.

More intuitive trading experiences that eliminate complexities for users.

With Tobi and STON.fi working together, this marks the beginning of a new era where AI and DeFi create smarter, faster, and more accessible trading experiences.

Final Thoughts

Crypto trading shouldn’t be complicated. By merging AI automation with decentralized finance, we are moving toward a future where anyone can trade easily, securely, and with full control of their assets. The Tobi-STON.fi integration is proof that innovation in DeFi is far from slowing down.

This is just the beginning. The future of crypto trading is smarter, faster, and fully decentralized.

4 notes

·

View notes

Text

“Because even ugly can be iconic.” Welcome to the Beth Community!

Are you ready to embrace imperfection and join a movement that redefines what it means to succeed in the blockchain world?Meet $BETH — the token that’s proving you don’t need to be flawless to leave an unforgettable mark.

Beth is here to disrupt, grow, and deliver real value while embracing her unapologetically chaotic energy. If you’re ready to become a #BethHead, here’s everything you need to know to join this revolutionary community!

Are you ready to embrace imperfection and join a movement that redefines what it means to succeed in the blockchain world?Meet $BETH — the token that’s proving you don’t need to be flawless to leave an unforgettable mark.

Beth is here to disrupt, grow, and deliver real value while embracing her unapologetically chaotic energy. If you’re ready to become a #BethHead, here’s everything you need to know to join this revolutionary community!

How to Buy $BETH

Step 1: Create a Wallet with Phantom

Head to phantom.app and set up a new account using the Phantom app or browser extension.

Step 2: Get Some $SOL

Buy Solana ($SOL) through the app’s BUY button or transfer $SOL from your preferred crypto exchange to your Phantom wallet.

Step 3: Swap $SOL for $BETH

In your Phantom wallet, tap the SWAP icon and paste the $BETH token address:

7uJrMsDN2Wxdc3VAq1iK9N5AHaTA7wUpbm1wqRonpump

Swap your $SOL for $BETH, and voilà — you’re officially part of the #BethHead community!

Achievements So Far

In just nine days, Beth has achieved milestones that many projects dream of:

Listed on CoinGecko, Ascendex, Gate.io, and CoinMarketCap (fast-tracked).

3000+ Telegram members and 1500 X followers.

Billboard presence outside Space X for a week.

Two golden tickers on DEX Screener.

A team of over 20 admins hosting 24/7 voice chats.

Beth’s Vision: From Meme to Machine

Beth isn’t just another meme token. She’s a movement with a mission: to turn her relatability and underdog story into a community-driven success.

Here’s what Beth is building:

Community: A passionate and growing network of holders and fans.

Utility: Gated groups, tools, and an ecosystem that delivers real value.

Beth’s tokenomics reflect her commitment to growth and transparency:

Total Supply: 1 Billion $BETH Tokens

Distribution:

5% for burning and influencers. 95% circulating supply.

The Beth Ecosystem

Beth’s ecosystem is expanding rapidly, with partnerships across Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). Future developments include:

Exclusive NFTs with perks like private events and voting power.

Beth-branded merchandise.

Launch of $BETH Academy and $BETH Tools.

Why the World Needs $BETH

Beth isn’t competing with trendy .jpg tokens. She’s here to prove that the real power in crypto lies in community and authenticity. Whether you’re a seasoned crypto enthusiast or a curious newcomer, Beth welcomes you with open arms.

Get Involved

Join the conversation, stay updated, and connect with the Beth community through our social channels.

SOCIALS : https://linktr.ee/bethsol

2 notes

·

View notes

Text

Unlocking New Possibilities with the STON.fi API & SDK Demo App

Have you ever faced a moment in your development journey where you wanted to integrate a powerful feature but didn’t know where to start? That’s a common feeling, especially in the blockchain space where innovation moves faster than most of us can keep up with. I’ve been there, too, and that’s why I’m excited to share something that will make your work simpler and more impactful—the STON.fi API & SDK Demo App.

This isn’t just another tool in the blockchain world; it’s a resource designed to give you clarity and confidence when building on the TON ecosystem.

What Is the STON.fi Demo App All About

Let’s start with a quick analogy. Think of building a blockchain app like constructing a house. You need the right tools and a clear blueprint. The STON.fi demo app is like a pre-built room that shows you exactly how everything fits together. You can study it, replicate it, and adapt it to your project.

This app showcases how to seamlessly integrate STON.fi’s swap function using its API and SDK. It’s a working example that’s not just theoretical—it’s real, functional, and ready to inspire your next project.

Why Does This Matter

Let’s make this relatable. Imagine you’re tasked with creating a crypto wallet that allows users to swap tokens. Without guidance, you’d spend hours (or even days) trying to figure out the right implementation. The STON.fi demo app eliminates that guesswork.

Here’s why it’s a big deal:

1. It’s a Hands-On Guide

You don’t have to learn by trial and error. The demo gives you a live example of how everything works, so you’re not starting from scratch.

2. Saves Time and Energy

Time is money, especially in tech. Instead of spending countless hours debugging, you can focus on customizing and enhancing your app.

3. Showcases the Full Potential of STON.fi

The demo isn’t limited to swaps—it’s a showcase of how versatile and powerful the STON.fi SDK can be.

Real-Life Applications

Here’s where it gets exciting. Whether you’re a solo developer or part of a team, this demo app can simplify your work and spark new ideas.

Let’s say you’re building a decentralized exchange (DEX). Token swaps are a core feature, but implementing them can feel overwhelming. The STON.fi demo app gives you a starting point that’s already proven to work.

Or maybe you’re creating a DeFi lending platform. Adding a token swap feature can enhance your offering, making it more attractive to users. The demo app provides the tools you need to make that happen without reinventing the wheel.

Breaking Down the Benefits

Think of this as a tool that bridges the gap between “I want to build this” and “I just built this.”

1. Clarity in Implementation: The app gives you a clear example of how to integrate STON.fi’s features. It’s like having a mentor guide you through the process.

2. Reduced Complexity: Blockchain development can feel like trying to solve a Rubik’s cube blindfolded. This app removes unnecessary complexity, allowing you to focus on what matters.

3. Endless Inspiration: Beyond swaps, this demo can inspire you to explore other possibilities within the TON ecosystem.

Why I Believe This Matters

I remember when I first started exploring blockchain development. Every step felt like climbing a mountain, and sometimes I wasn’t even sure if I was on the right trail. Resources like the STON.fi demo app would have made a world of difference back then.

This tool isn’t just for seasoned developers—it’s for anyone looking to make their mark in the blockchain space. It’s accessible, practical, and built to help you succeed.

Try the SDK

Final Thoughts

The STON.fi API & SDK Demo App isn’t just a resource; it’s a catalyst for creativity and innovation. Whether you’re building your first app or looking to level up an existing project, this demo provides the clarity and direction you need.

Take the time to explore it, experiment with it, and let it inspire your next big idea. In a space as dynamic as blockchain, having the right tools can make all the difference.

This is your opportunity to simplify your process, save time, and unlock the full potential of the TON ecosystem. Don’t just take my word for it—try it out and see what’s possible.

3 notes

·

View notes

Text

Top Common Bitcoin Scams That Investors Should Avoid

Bitcoin has become a global investment sensation, captivating everyone from professional traders to beginners hoping to strike it rich. Its rising popularity, however, has also attracted scammers eager to exploit inexperienced investors. Knowing how to spot these scams is crucial to safeguarding your hard-earned funds in the world of cryptocurrency. Today, I’ll walk you through the most common Bitcoin scams and provide practical tips on how to avoid them. My goal is to arm you with the knowledge to keep your investments safe, no matter your experience level.

1. Phishing Scams

What Are Phishing Scams?

Phishing scams are one of the most prevalent online threats and are especially common in cryptocurrency. In these scams, hackers attempt to steal your sensitive information by imitating reputable companies, such as exchanges or wallets. They often send fake emails or create identical websites to trick you into entering personal details like your login credentials or wallet keys.

How It Works

Phishing attacks can be sophisticated. You might receive an email that looks exactly like one from your cryptocurrency exchange, with logos and designs matching the real site. The email may warn you about “suspicious activity” on your account, urging you to click a link to “secure” it. This link, however, leads you to a fake login page where any details you enter go straight to the scammer.

I once nearly fell for a phishing scam when I received a message claiming my account was compromised. The link looked legitimate at first glance, but I noticed the URL was off by a single letter. That’s all it takes for a scam to look genuine.

How to Avoid Phishing Scams

Always verify URLs before entering personal information. Look for HTTPS and double-check the spelling of the site.

Use two-factor authentication (2FA) for added security.

Be cautious of urgent-sounding messages and double-check with the official app or support page.

2. Ponzi and Pyramid Schemes

What Are Ponzi and Pyramid Schemes?

These scams promise incredibly high returns for relatively little investment, usually relying on the money of new investors to pay “profits” to earlier ones. Pyramid schemes involve recruiting others to participate, while Ponzi schemes simply pay returns from new deposits.

How It Works

Ponzi and pyramid schemes often involve people you trust, like friends or family, who may not even know they’re part of a scam. Many scams will boast “guaranteed returns” on Bitcoin investments, a red flag because crypto’s inherent volatility makes such guarantees impossible.

How to Avoid Ponzi and Pyramid Schemes

Be skeptical of “guaranteed” or “too-good-to-be-true” returns.

Look up reviews or do a quick Google search on the platform offering the investment.

Verify licensing and transparency by checking if the investment is registered with financial authorities.

3. Fake Bitcoin Exchanges and Wallets

What Are Fake Exchanges and Wallets?

Some scammers go as far as creating entire fake exchanges or wallets that look and feel just like reputable platforms. Their purpose is simple: to steal your Bitcoin when you deposit it.

How It Works

These fake exchanges and wallets can look identical to well-known platforms. You deposit your Bitcoin, only to find later that you have no way to withdraw it. I’ve known people who unknowingly transferred funds into fake wallets, thinking they were saving in a secure location.

How to Avoid Fake Exchanges and Wallets

Stick to well-known, reputable exchanges and wallets with a solid track record.

Double-check the site’s URL and make sure it’s HTTPS-secured.

Read reviews on multiple sites before signing up.

4. Pump-and-Dump Schemes

What Are Pump-and-Dump Schemes?

Pump-and-dump schemes involve artificially inflating the price of a cryptocurrency by spreading misleading information to attract buyers. When the price spikes, the orchestrators sell their assets, causing the price to plummet and leaving other investors with losses.

Be wary of hype on social media or chat groups, especially with lesser-known coins.

Stick to established cryptocurrencies and popular trading pairs like BTCUSDT to avoid erratic price spikes with unknown assets.

Research thoroughly before buying in—check the project’s fundamentals and team legitimacy.

How It Works

Scammers often start in online forums or social media, hyping up a particular cryptocurrency, usually a small-cap coin. Once enough people buy in and the price goes up, they quickly sell off their holdings, leaving unsuspecting investors at a loss. I’ve seen this happen countless times in crypto communities.

How to Avoid Pump-and-Dump Schemes

Be wary of hype on social media or chat groups.

Stick to established cryptocurrencies and avoid coins that see massive, sudden price increases without any clear reason.

Research thoroughly before buying in—check the project’s fundamentals and team legitimacy.

5. Impersonation and Social Media Scams

What Are Impersonation Scams?

These scams often involve fraudsters posing as well-known figures or reputable companies, offering “giveaways” if you send them a small amount of Bitcoin.

How It Works

These scammers create fake accounts on Twitter, Instagram, or even YouTube, mimicking real influencers or cryptocurrency figures. They’ll post messages saying something like, “Send 0.1 BTC, and you’ll receive 0.5 BTC back!” Unfortunately, anyone who sends funds to these addresses never sees their money again.

How to Avoid Impersonation and Social Media Scams

Verify the account handle and look for the blue verification badge.

Avoid any offers that require you to send crypto to receive a larger amount in return.

Report fake accounts if you come across them.

6. Fake ICOs and DeFi Projects

What Are Fake ICOs and DeFi Projects?

Some scammers take advantage of Initial Coin Offerings (ICOs) or decentralized finance (DeFi) projects by creating fake or poorly designed projects to steal investor funds.

How It Works

Fake ICOs usually promise revolutionary technology or groundbreaking solutions but don’t deliver. These projects may lack transparency, have anonymous teams, or offer extremely vague information about how their technology works. I’ve seen well-designed websites with polished whitepapers that later turned out to be scams.

How to Avoid Fake ICOs and DeFi Projects

Research the team members and verify their identities on professional sites like LinkedIn.

Look for partnerships with known companies and check their legitimacy.

Be cautious of anonymous teams or vague project descriptions.

7. Malware and Ransomware Attacks

What Are Malware and Ransomware Scams?

Malware and ransomware attacks occur when hackers install malicious software on your computer or mobile device to steal cryptocurrency from your wallet or demand a ransom.

How It Works

Malware can be disguised as a link, download, or software update. Once installed, it can track your keystrokes or even access your wallet. In ransomware attacks, hackers lock your data and demand a ransom in Bitcoin for its release.

How to Avoid Malware and Ransomware Scams

Install a trusted anti-virus program and regularly update it.

Enable multi-factor authentication on your accounts for an added layer of security.

Avoid downloading files from unknown sources or clicking on suspicious links.

Conclusion

Bitcoin scams can be frightening, especially if you’re new to cryptocurrency. But by following a few key precautions and staying aware of the tactics scammers use, you can significantly reduce your risk. Remember to always double-check websites, be skeptical of unrealistic promises, and research any project or investment opportunity thoroughly.

Crypto investing can be incredibly rewarding, but it requires a cautious approach. Staying informed and vigilant is your best defense against falling victim to Bitcoin scams.

2 notes

·

View notes

Text

Can Your Bitcoin Address Change on Cash App? Tips for Managing Your Wallet

As cryptocurrencies grow in popularity, platforms like Cash App have made it easier for everyday users to buy, sell, and send Bitcoin. Whether you’re new to crypto or a seasoned investor, you may have noticed that Cash App assigns you a unique Bitcoin wallet address. But what happens if you need a different address or wish to know whether a Cash App Bitcoin wallet address change is possible?

In this guide, we’ll take a deep dive into how the Cash App Bitcoin wallet works, whether you can change your Bitcoin address, and some essential tips for managing your Bitcoin transactions on the platform. We’ll also answer common questions about Bitcoin addresses on Cash App to help you understand how to keep your funds safe and transactions smooth.

Introduction: How Bitcoin Addresses Work on Cash App?

Cash App isn’t just a mobile payment app—it also offers crypto trading features, allowing users to send, receive, and store Bitcoin directly within the app. When you create a Bitcoin wallet on Cash App, the platform assigns a unique Bitcoin wallet address. This address acts like a digital identifier for your wallet, enabling other users or platforms to send Bitcoin to your account safely.

However, users often have questions about whether their Bitcoin address can be changed. Perhaps you are concerned about privacy, wondering if your wallet can have a new address to limit exposure of past transactions. Or maybe you want to reset the address for security reasons. This blog will explore how Bitcoin addresses on Cash App function and if you can request a Bitcoin wallet address change within the app.

Can I Change My Bitcoin Address on Cash App?

The answer to the question “Can I change my Bitcoin address on Cash App?” lies in how Bitcoin wallets are designed. Cash App automatically assigns a new Bitcoin address periodically for security reasons. So, the good news is that you don’t need to manually change your Bitcoin address because Cash App will provide new addresses on your behalf over time.

Bitcoin addresses on Cash App function similarly to how Bitcoin addresses work on most crypto platforms:

You can receive Bitcoin using the latest address assigned to your account.

Your previous Bitcoin addresses remain valid—so even if your address changes, funds sent to old addresses will still arrive in your wallet.

The platform may issue a new address whenever you perform certain activities, such as requesting a deposit address.

This dynamic address system ensures enhanced privacy for users by making it difficult for outsiders to trace a user’s entire transaction history based on one address.

How to View or Use Your Bitcoin Address on Cash App

If you’re using Cash App for Bitcoin transactions, it’s essential to know how to access your wallet address. Here’s how to find new Bitcoin wallet address on Cash App:

Open the Cash App on your phone.

Tap the Bitcoin (₿) icon at the bottom of the screen.

Select Deposit Bitcoin to display your current Bitcoin wallet address.

You’ll see both the alphanumeric address and a QR code that others can scan to send Bitcoin to your wallet.

This address can be used to receive Bitcoin from other wallets or platforms. Even though Cash App periodically updates your Bitcoin address, older addresses assigned to your account will still function for incoming transactions.

Why Does Cash App Change Bitcoin Addresses?

There are several reasons why Cash App assigns new Bitcoin addresses periodically. These changes are designed to enhance the security and privacy of your transactions:

Privacy Protection: Bitcoin addresses are public, meaning anyone can see all transactions associated with an address on the blockchain. By issuing new addresses periodically, Cash App helps prevent someone from easily tracking all your activity.

Security Enhancements: Using the same Bitcoin address repeatedly increases the chances of it being linked to fraudulent activities. Regular address changes lower these risks.

Compliance with Blockchain Standards: Bitcoin networks encourage wallet providers to use hierarchical deterministic (HD) wallets, which generate multiple addresses under a single wallet to enhance user security.

This automatic address update ensures that you don’t need to worry about changing your Bitcoin wallet address manually.

Can You Request a Specific Bitcoin Address Change?

Although Cash App generates new Bitcoin addresses regularly, there is no manual option for users to change the address on demand. The system is designed to automate this process, ensuring that each user’s account remains secure and compliant with blockchain standards.

If you have concerns about a previous Bitcoin address being compromised, you can still use the newest address generated by Cash App for future transactions. However, your old addresses will continue to receive Bitcoin without any issues.

Managing Multiple Bitcoin Transactions on Cash App

You don’t need to worry about managing different addresses yourself, as all Bitcoin received via old and new addresses will reflect in your Cash App Bitcoin balance. Here are some useful tips for seamless Bitcoin transactions on Cash App:

Use the latest Bitcoin address whenever requesting deposits from another wallet or exchange for added security.

Keep track of transaction confirmations on the Bitcoin blockchain to monitor the status of your incoming funds.

Make sure to verify the amount and recipient address before sending Bitcoin, as transactions on the blockchain are irreversible.

What Happens if You Share an Old Bitcoin Address?

If you’ve already shared an older Bitcoin address with someone, there’s no need to worry. Bitcoin sent to any valid address associated with your Cash App wallet will still arrive safely in your account.

Unlike some traditional payment systems, the blockchain ensures that all past addresses remain valid indefinitely, so even if your address changes, older ones will still work for receiving funds.

FAQ

Can I change my Bitcoin address on Cash App manually?

No, Cash App does not allow users to manually change their Bitcoin address. However, the platform periodically generates new addresses for your wallet to enhance security and privacy.

How often does Cash App change Bitcoin addresses?

There is no fixed schedule for Bitcoin address changes. Cash App issues new addresses automatically when needed, such as when you request a new deposit address.

Will my old Bitcoin address still work after a new one is assigned?

Yes, all old Bitcoin addresses linked to your Cash App wallet will remain valid and functional. Funds sent to any previous address will still arrive in your Bitcoin balance.

How do I find my Bitcoin wallet address on the Cash App?

To view Cash App Bitcoin wallet address, open the Cash App, tap the Bitcoin (₿) icon, and select Deposit Bitcoin. You’ll see your current address and QR code for deposits.

Why does the Cash App change Bitcoin addresses periodically?

Cash App updates Bitcoin addresses to protect user privacy, enhance security, and comply with blockchain best practices. Regular address changes prevent others from tracking your entire transaction history.

Can I have multiple Bitcoin addresses on Cash App?

Yes, Cash App assigns multiple addresses over time, but you don’t need to manage them separately. All addresses remain linked to your Bitcoin wallet and can receive funds.

#does cash app bitcoin address change#cash app bitcoin address change#how to change does cash app bitcoin address#how to get new cash app bitcoin address

2 notes

·

View notes

Text

SOURCE PROTOCOL

SOURCE is building limitless enterprise applications on a secure and sustainable global network. Defi white-labelled services, NFT markets, RWA tokenization, play-to-earn gaming, Internet of Things, data management and more. SOURCE is providing blockchain solutions to the real world and leveraging the power of interoperability.

SOURCE competitive advantages over other blockchain projects

For builders & developers — Source Chain’s extremely high speeds (2500–10000+ tx / per second), low cost / gas fees ($0.01 average per tx), and scalability (developers can deploy apps in multiple coding languages using CosmWasm smart contract framework), set it apart as a blockchain built to handle mass adopted applications and tools. Not to mention, it’s interoperable with the entire Cosmos ecosystem.

For users — Source Protocol’s DeFi suite is Solvent and Sustainable (Automated liquidity mechanisms create a continuously self-funded, solvent and liquid network), Reduces Complexity (we’re making Web 3.0 easy to use with tools like Source Token which automate DeFi market rewards), and we’ve implemented Enhanced Security and Governance systems (like Guardian Nodes), which help us track malicious attacks and proposals to create a safer user environment.

For Enterprises — Source Protocol is one of the first to introduce DeFi-as-a-Service (DaaS) in order for existing online banking and fintech solutions to adopt blockchain technology with ease, and source also provides Enterprise Programs which are complete with a partner network of OTC brokerages, crypto exchanges, and neobanks that create a seamless corporate DeFi experience (fiat onboarding, offboarding, and mutli-sig managed wallets)

Why Source Protocol

Firstly, many protocols are reliant on centralized exchanges for liquidity, limiting their ability to scale independently. This creates a lot of the same issues traditional finance has been plagued with for decades.

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

Source Protocol’s ecosystem

Source Protocol’s ecosystem includes a full DeFi Suite, a members rewards program and white-label integration capabilities with existing online Web 2.0 enterprises:

Source Swap — An Interchain DEX & AMM built on Source Chain for permission-less listing of $SOURCE-based tokens, native Cosmos SDK assets, cw-20’s, and wrapped Binance Smart Chain (BEP-20) assets.

Source One Market — A peer to peer, non-custodial DeFi marketplace for borrowing, lending, staking, and more. Built on Binance Smart Chain with bridging to Source Chain & native Cosmos SDK assets.

Source Token $SRCX (BEP-20) — the first automated liquidity acquisition and DeFi market participation token built on Binance Smart Chain.

Source One Token $SRC1 (BEP-20) — a governance and incentivized earnings token that powers Source One Market.

Source USX $USX (BEP-20) — Source One Market stablecoin backed and over collateralized by a hierarchy of blue chip crypto assets and stablecoins.

Source Launch Pad — Empowering projects to seamlessly distribute tokens and raise liquidity. ERC-20 and BEP-20 capable.

Source One Card & Members Rewards Program — users can earn from a robust suite of perks and rewards. In the future, Source One Card will enable users to swipe with their crypto assets online and at retail locations in real time.

DeFi-as-a-Service (DaaS) — Seamless white-label integration of Source One Market, Source Swap, Source Launch Pad, and/or Source One Card with existing online banking and financial applications, allowing businesses to bring their customers DeFi capabilities.

Source Protocol Key Components

Sustainable Growth model built for enterprise involvement and mass application adoption

Guardian Validator Nodes for enhanced network security

Integration with Source Protocol’s Binance Smart Chain Ecosystem and Decentralized Money Market, Source One Market

Source-Drop (Fair community airdrop and asset distribution for ATOM stakers and SRCX holders)

Interoperable smart contracts (IBC)

High speed transaction finality

Affordable gas fees (average of $0.01 per transaction)

Highly scalable infrastructure

Open-source

Permission-less Modular Wasm + (EVM)

Secured on-chain governance

Ease of use for developers

conclusion

SOURCE is a comprehensive blockchain technology suite for individuals, enterprises and developers to easily use, integrate and build web3.0 applications. It is a broad-spectrum technology ecosystem that transforms centralized web tools and financial instruments into decentralized ones. Powering the future of web3,

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

For More Information about Source Protocol

Website: https://www.sourceprotocol.io

Documents: https://docs.sourceprotocol.io

Twitter: https://www.twitter.com/sourceprotocol_

Instagram: https://www.instagram.com/sourceprotocol

Telegram: https://t.me/sourceprotocol

Discord: https://discord.gg/zj8xxUCeZQ

Author

Forum Username: Java22

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3443255

SOURCE Wallet Address: source1svnzfy5fafuskeaxmf2sgvgcn6k3sggmssl8d7

2 notes

·

View notes

Text

My first Vue.js app ✨

Today I'm working on a multi-day assignment - a bitcoin digital wallet app using the Vue framework! Crypto is not my jam but fortunately this is just a theme for a CRUDL app that will let me practice this new framework for the first time, as well as improve my design and UX skills! I will also work with some APIs for drawing the required data and libraries for visualizing it with charts.

I actually started this project a few days ago, but have not been in a good mindset to make a lot of progress. So far Vue seems simpler than React, so I hope today will go better!

The concept of this app is to be a digital wallet, where the user has an amount of 'bitcoin' and a list of contacts to whom they can transfer money.

So far I have a pretty solid layout, a header and footer, and I managed to render a list of previews of contacts.

The plan for today:

implement a filter

implement the rest of the CRUDL features

create a statistics dashboard

improve the overall design & UX

11 notes

·

View notes

Text

What Web Development Companies Do Differently for Fintech Clients

In the world of financial technology (fintech), innovation moves fast—but so do regulations, user expectations, and cyber threats. Building a fintech platform isn’t like building a regular business website. It requires a deeper understanding of compliance, performance, security, and user trust.

A professional Web Development Company that works with fintech clients follows a very different approach—tailoring everything from architecture to front-end design to meet the demands of the financial sector. So, what exactly do these companies do differently when working with fintech businesses?

Let’s break it down.

1. They Prioritize Security at Every Layer

Fintech platforms handle sensitive financial data—bank account details, personal identification, transaction histories, and more. A single breach can lead to massive financial and reputational damage.

That’s why development companies implement robust, multi-layered security from the ground up:

End-to-end encryption (both in transit and at rest)

Secure authentication (MFA, biometrics, or SSO)

Role-based access control (RBAC)

Real-time intrusion detection systems

Regular security audits and penetration testing

Security isn’t an afterthought—it’s embedded into every decision from architecture to deployment.

2. They Build for Compliance and Regulation

Fintech companies must comply with strict regulatory frameworks like:

PCI-DSS for handling payment data

GDPR and CCPA for user data privacy

KYC/AML requirements for financial onboarding

SOX, SOC 2, and more for enterprise-level platforms

Development teams work closely with compliance officers to ensure:

Data retention and consent mechanisms are implemented

Audit logs are stored securely and access-controlled

Reporting tools are available to meet regulatory checks

APIs and third-party tools also meet compliance standards

This legal alignment ensures the platform is launch-ready—not legally exposed.

3. They Design with User Trust in Mind

For fintech apps, user trust is everything. If your interface feels unsafe or confusing, users won’t even enter their phone number—let alone their banking details.

Fintech-focused development teams create clean, intuitive interfaces that:

Highlight transparency (e.g., fees, transaction histories)

Minimize cognitive load during onboarding

Offer instant confirmations and reassuring microinteractions

Use verified badges, secure design patterns, and trust signals

Every interaction is designed to build confidence and reduce friction.

4. They Optimize for Real-Time Performance

Fintech platforms often deal with real-time transactions—stock trading, payments, lending, crypto exchanges, etc. Slow performance or downtime isn’t just frustrating; it can cost users real money.

Agencies build highly responsive systems by:

Using event-driven architectures with real-time data flows

Integrating WebSockets for live updates (e.g., price changes)

Scaling via cloud-native infrastructure like AWS Lambda or Kubernetes

Leveraging CDNs and edge computing for global delivery

Performance is monitored continuously to ensure sub-second response times—even under load.

5. They Integrate Secure, Scalable APIs

APIs are the backbone of fintech platforms—from payment gateways to credit scoring services, loan underwriting, KYC checks, and more.

Web development companies build secure, scalable API layers that:

Authenticate via OAuth2 or JWT

Throttle requests to prevent abuse

Log every call for auditing and debugging

Easily plug into services like Plaid, Razorpay, Stripe, or banking APIs

They also document everything clearly for internal use or third-party developers who may build on top of your platform.

6. They Embrace Modular, Scalable Architecture

Fintech platforms evolve fast. New features—loan calculators, financial dashboards, user wallets—need to be rolled out frequently without breaking the system.

That’s why agencies use modular architecture principles:

Microservices for independent functionality

Scalable front-end frameworks (React, Angular)

Database sharding for performance at scale

Containerization (e.g., Docker) for easy deployment

This allows features to be developed, tested, and launched independently, enabling faster iteration and innovation.

7. They Build for Cross-Platform Access

Fintech users interact through mobile apps, web portals, embedded widgets, and sometimes even smartwatches. Development companies ensure consistent experiences across all platforms.

They use:

Responsive design with mobile-first approaches

Progressive Web Apps (PWAs) for fast, installable web portals

API-first design for reuse across multiple front-ends

Accessibility features (WCAG compliance) to serve all user groups

Cross-platform readiness expands your market and supports omnichannel experiences.

Conclusion

Fintech development is not just about great design or clean code—it’s about precision, trust, compliance, and performance. From data encryption and real-time APIs to regulatory compliance and user-centric UI, the stakes are much higher than in a standard website build.

That’s why working with a Web Development Company that understands the unique challenges of the financial sector is essential. With the right partner, you get more than a website—you get a secure, scalable, and regulation-ready platform built for real growth in a high-stakes industry.

0 notes

Text

Beyond Bitcoin: Diversifying Your Cryptocurrency Investments

If you’re holding only Bitcoin in your crypto portfolio, you’re not really investing—you’re speculating on a single asset. The smartest crypto investors diversify, not because they’re trying to time the next moonshot, but because spreading your exposure across different blockchain assets helps you reduce risk, stabilize returns, and tap into sectors Bitcoin doesn’t reach. Whether you’re new to digital assets or already managing a growing wallet, diversifying lets you take part in decentralized finance, stable income strategies, and emerging tech—without betting the farm on just one coin. In this article, you’ll explore seven practical strategies to broaden your crypto holdings and manage your position with better confidence.

Start with Ethereum and Large-Cap Altcoins

If Bitcoin is digital gold, Ethereum is the internet’s infrastructure. You want to allocate part of your portfolio to ETH, not only because of its market cap but because its smart contract layer powers most decentralized apps and Web3 activity. With Ethereum, you're investing in a platform, not just a coin. That gives it functional resilience in ways Bitcoin can’t match.

Alongside ETH, look at large-cap altcoins like Solana, Cardano, and Avalanche. These chains offer alternatives to Ethereum with faster speeds, lower fees, or unique governance structures. While they carry more volatility, they serve different ecosystems and could offer upside in market cycles where BTC and ETH stay flat. Stick with tokens that show real user adoption, developer growth, and active upgrades.

Explore Sector-Specific Tokens

You’ve got a foundation with ETH and top-10 alts—but the crypto market runs on niches. Decentralized finance (DeFi) tokens like Aave, Uniswap, and Curve give you exposure to financial services being rebuilt on blockchain rails. These assets are more than speculative; they earn fees from lending, swapping, and liquidity provisioning.

In the NFT and metaverse sectors, tokens like MANA (Decentraland) or SAND (The Sandbox) give you entry into virtual platforms used for gaming, real estate, and creative projects. They're higher risk, but when attention shifts to new use cases, these tokens often lead rallies. Allocating a small percentage to sector-specific plays keeps your portfolio dynamic while adding exposure to innovation that could drive the next bull market.

Add Stablecoins for Flexibility and Yield

You can’t stay fully exposed to volatility. Stablecoins give you a cash-like layer that opens doors to passive income. Coins like USDC, USDT, or DAI hold value around $1, making them ideal for parking profits or waiting out dips. But holding stablecoins isn't just defensive—it’s productive.

By staking or lending stablecoins on platforms like Aave, Compound, or centralized providers, you can earn yield without taking price risk. Even conservative returns in the 4%–8% range offer value in a market known for extreme swings. You’re not trying to beat the market here; you're creating stability while your other assets move more freely.

Consider Crypto ETFs and Managed Products

Not everyone wants to self-manage a dozen wallets or rebalance five exchanges. If you're looking for exposure without the complexity, crypto ETFs and mutual funds are becoming more viable. Spot ETFs tracking Bitcoin or Ethereum let you benefit from price moves without touching tokens directly. They're regulated, professionally managed, and accessible via brokerage accounts.

Other funds, like diversified crypto index products, spread your investment across multiple tokens based on market cap, utility, or sector weight. This is a strong fit if you're focused on longer-term growth or want crypto to act like an asset class inside a broader portfolio. It won’t give you the thrill of early token investing—but it does give you compliance, structure, and a stress-free way to build allocation.

Include Derivatives Only If You Understand Them

Futures, options, and leveraged tokens are not tools for everyone—but if you’ve got trading experience, they can help hedge positions or add strategic exposure. A short position on a Bitcoin future might protect your gains if you're expecting a pullback. Options allow you to buy insurance against downside without selling long-term holdings.

These tools can be risky, especially in fast-moving markets. Liquidity can dry up, leverage can compound losses, and the technicals behind each contract are more complex than simply holding spot tokens. But if you're prepared and disciplined, derivatives allow you to fine-tune your exposure with surgical precision.

Secure Multi-Chain Wallet Infrastructure

Having a diversified portfolio only matters if you can actually access and protect your assets. That starts with choosing the right wallets. Use non-custodial, multi-chain wallets like Trust Wallet, MetaMask, or Exodus to manage a range of assets from one place. Store long-term holdings in hardware wallets like Ledger or Trezor to avoid risk from phishing, malware, or platform hacks.

Segment your assets by function. Keep active trading funds on secure exchanges or hot wallets. Park long-term holdings offline. Use two-factor authentication and password managers to eliminate human error. Just like in traditional finance, your biggest losses don’t always come from market movement—they often come from poor custody decisions.

Rebalance Based on Risk, Not Emotion

Crypto can be noisy. You’ll see headlines pushing obscure coins and influencers shilling the next “must-own” project. Stick to your plan. Build a rebalancing schedule that fits your goals—quarterly, monthly, or when any asset grows beyond a set weight. If one token triples in value, consider taking profit and redistributing across the rest of your holdings.

By regularly trimming the excess and topping up underweights, you stay aligned with your risk profile. This avoids emotional decisions like buying at peaks or panic-selling dips. Diversification is a tool, but discipline is what turns it into an actual strategy.

Key Ways to Diversify Your Crypto Holdings

Hold a core base of BTC and ETH

Add sector-specific tokens (DeFi, NFTs, metaverse)

Use stablecoins for yield and capital stability

Invest through ETFs or managed crypto funds

Secure assets in multi-chain wallets with proper custody

In Conclusion

Putting all your trust in Bitcoin might feel safe—but it limits your upside and exposes you to narrow risk. A diversified crypto strategy gives you resilience across cycles, exposure to emerging trends, and optionality when the market changes. Use a mix of stablecoins, altcoins, sector plays, and managed products to balance performance and protect gains. Store your assets securely, review your allocation regularly, and avoid overreacting to noise. When you diversify with a clear head and strong plan, crypto becomes more than speculation—it becomes a long-term component of your financial playbook.

"Thanks for reading! To learn more about my background, professional experiences, and contributions within the fintech and blockchain ecosystems, you can explore my Crunchbase."

0 notes

Text

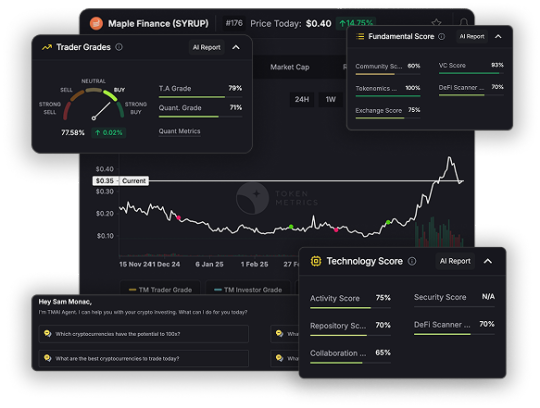

The Future of Crypto APIs: Why Token Metrics Leads the Pack

In this article, we’ll explore why Token Metrics is the future of crypto APIs, and how it delivers unmatched value for developers, traders, and product teams.

More Than Just Market Data

Most crypto APIs—like CoinGecko, CoinMarketCap, or even exchange-native endpoints—only give you surface-level data: prices, volume, market cap, maybe order book depth crypto trading. That’s helpful… but not enough.

Token Metrics goes deeper:

Trader and Investor Grades (0–100)

Bullish/Bearish market signals

Support/Resistance levels

Real-time sentiment scoring

Sector-based token classification (AI, RWA, Memes, DeFi)

Instead of providing data you have to interpret, it gives you decisions you can act on.

⚡ Instant Intelligence, No Quant Team Required

For most platforms, building actionable insights on top of raw market data requires:

A team of data scientists

Complex modeling infrastructure

Weeks (if not months) of development

With Token Metrics, you skip all of that. You get:

Pre-computed scores and signals

Optimized endpoints for bots, dashboards, and apps

AI-generated insights as JSON responses

Even a solo developer can build powerful trading systems without ever writing a prediction model.

🔄 Real-Time Signals That Evolve With the Market

Crypto moves fast. One minute a token is mooning, the next it’s bleeding.

Token Metrics API offers:

Daily recalculated grades

Real-time trend flips (bullish ↔ bearish)

Sentiment shifts based on news, social, and on-chain data

You’re never working with stale data or lagging indicators.

🧩 Built for Integration, Built for Speed

Unlike many APIs that are bloated or poorly documented, Token Metrics is built for builders.

Highlights:

Simple REST architecture (GET endpoints, API key auth)

Works with Python, JavaScript, Go, etc.

Fast JSON responses for live dashboards

5,000-call free tier to start building instantly

Enterprise scale for large data needs

Whether you're creating a Telegram bot, a DeFi research terminal, or an internal quant dashboard, TM API fits right in.

🎯 Use Cases That Actually Matter

Token Metrics API powers:

Signal-based alert systems

Narrative-tracking dashboards

Token portfolio health scanners

Sector rotation tools

On-chain wallets with smart overlays

Crypto AI assistants (RAG, GPT, LangChain agents)

It’s not just a backend feed. It’s the core logic engine for intelligent crypto products.

📈 Proven Performance

Top funds, trading bots, and research apps already rely on Token Metrics API. The AI grades are backtested, the signals are verified, and the ecosystem is growing.

“We plugged TM’s grades into our entry logic and saw a 25% improvement in win rates.” — Quant Bot Developer

“It’s like plugging ChatGPT into our portfolio tools—suddenly it makes decisions.” — Web3 Product Manager

🔐 Secure, Stable, and Scalable

Uptime and reliability matter. Token Metrics delivers:

99.9% uptime

Low-latency endpoints

Strict rate limiting for abuse prevention

Scalable plans with premium SLAs

No surprises. Just clean, trusted data every time you call.

💬 Final Thoughts

Token Metrics isn’t just the best crypto API because it has more data. It’s the best because it delivers intelligence. It replaces complexity with clarity, raw numbers with real signals, and guesswork with action.In an industry that punishes delay and indecision, Token Metrics gives builders and traders the edge they need—faster, smarter, and more efficiently than any other API in crypto.

0 notes

Text

Your Trusted Partner in FinTech App Development Services

In today’s fast-moving digital world, financial software services are evolving faster than ever—and fintech is leading the charge. Whether it's digital banking, peer-to-peer payment systems, or investment platforms, the demand for innovative financial solutions is skyrocketing. That’s where SMT Labs steps in. As a leading fintech software development company, SMT Labs specializes in delivering tailor-made, secure, and scalable financial technology solutions that meet the unique needs of modern businesses.

Why FinTech Matters More Than Ever

The financial sector is no longer about long queues in banks or waiting days for a transaction to process. Today, it’s all about speed, accessibility, personalization, and most importantly, security. That’s why developing fintech apps has become more than just a trend—it’s an essential part of staying competitive in today’s financial landscape. From mobile banking to blockchain-based solutions, fintech is helping businesses offer smarter, faster, and safer services.

And when it comes to creating these solutions, the right partner makes all the difference.

What SMT Labs Brings to the Table

At SMT Labs, we understand the nuances of financial ecosystems. Our team doesn’t just write code—we craft digital experiences that are intuitive, powerful, and future-ready. Here’s what sets our financial software development services apart:

1. Custom FinTech Solutions Tailored to Your Business

Every financial service is unique, and so are its challenges. We don’t believe in one-size-fits-all. Our experts work closely with you to understand your business goals and build solutions that are tailored for your audience and market. Whether you’re a startup launching a new product or an established enterprise looking to modernize, SMT Labs has your back.

2. Security Comes First

In fintech, trust is everything. That’s why our fintech software development services put security at the forefront. From end-to-end encryption to compliance with global financial regulations like GDPR, PCI-DSS, and PSD2, we ensure your platform is safe and reliable.

3. Scalable Architecture for Growing Demands

We build with growth in mind. Our architecture is designed to handle everything from a handful of users to millions of daily transactions. So, as your business grows, your platform scales smoothly without performance hiccups.

4. Expertise Across the Financial Spectrum

As a full-fledged financial software development company, SMT Labs delivers a wide range of solutions including:

Mobile banking apps

Digital wallets

Payment gateway integration

Investment and wealth management tools

Loan origination and management systems

InsurTech platforms

Blockchain and crypto-based solutions

5. User-Centric Design and Seamless UX

Even the most powerful tech won’t matter if users find it hard to navigate. Our UI/UX designers focus on creating user-friendly interfaces that your customers will love using—again and again.

Why Choose SMT Labs as Your FinTech App Development Company?

Choosing SMT Labs means choosing innovation, reliability, and excellence. With a proven track record of successful fintech projects, our team of seasoned developers, designers, and financial tech experts are here to bring your vision to life.

We use the latest technologies, including AI, machine learning, blockchain, and cloud computing, to develop intelligent platforms that not only meet industry standards but push the boundaries of what's possible.

From ideation to post-launch support, we handle every stage of the development lifecycle so you can focus on what you do best—growing your business.

Get in Touch with SMT Labs

Ready to bring your fintech idea to life? Or maybe you want to upgrade your existing financial platform? SMT Labs is here to help.

Contact SMT Labs today to discuss your project requirements, timelines, and how we can transform your vision into a robust fintech solution that drives results.

You can reach out to us directly via our contact form

Whether you need a secure payment app, a smart investment platform, or a fully-integrated banking system, SMT Labs is your go-to partner for all things fintech.

Experience the future of finance—built with SMT Labs.

Get more information: https://smtlabs.io/

#fintech app development#fintechinnovation#fintech#fintech app development company#fintech app development services#fintechtrends#mobile app development

0 notes

Text

Why You Should Hire Developers Who Understand the Future of Tech

Whether you’re launching a startup, scaling your SaaS product, or building the next decentralized app, one thing is clear—you need the right developers. Not just any coders, but skilled professionals who understand both the technical and strategic sides of digital product building.

In today’s fast-evolving tech landscape, the need to hire developers who are agile, experienced, and forward-thinking has never been greater. From blockchain to AI to SaaS, the right team can turn your business vision into a scalable, future-proof product.

Why Hiring Developers is a Strategic Move, Not Just a Task

In-house or outsourced, full-time or fractional—hiring developers is not just about filling a technical role. It’s a strategic investment that determines:

The speed at which you go to market

The quality of your product

The ability to scale your infrastructure

The cost-effectiveness of your development cycle

When you hire developers who are aligned with your business goals, you're not just building software—you’re building competitive advantage.

The Types of Developers You Might Need

Your hiring approach should depend on what you're building. Here are some common roles modern businesses look for:

1. Frontend Developers

They create seamless and engaging user interfaces using technologies like React, Angular, or Vue.js.

2. Backend Developers

These developers handle the logic, databases, and server-side functions that make your app run smoothly.

3. Full-Stack Developers

They handle both front and back-end responsibilities, ideal for MVPs or lean startups.

4. Blockchain Developers

Crucial for any web3 development company, they specialize in smart contracts, dApps, and crypto integrations.

5. AI Engineers

As AI product development continues to grow, developers with machine learning and automation skills are increasingly in demand.

6. DevOps Engineers

They ensure your systems run efficiently, automate deployment, and manage infrastructure.

Depending on your project, you may need to hire developers who are specialists or build a blended team that covers multiple areas.

The Modern Developer Stack: More Than Just Code

Today’s development goes far beyond HTML and JavaScript. You need developers familiar with:

Cloud platforms (AWS, Azure, GCP)

Containers & orchestration (Docker, Kubernetes)

APIs & microservices

Version control (Git, GitHub, Bitbucket)

Security best practices

Automated testing & CI/CD

The goal isn’t just to write code—it’s to build secure, scalable, and high-performance systems that grow with your business.

SaaS Products Need Specialized Developer Expertise

If you're building a SaaS platform, the development process must account for:

Multi-tenant architecture

Subscription billing

Role-based access

Uptime and monitoring

Seamless UX and product-led growth

That’s where experienced saas experts come in—developers who not only write clean code but understand SaaS metrics, scale, and user behavior.

Hiring the right SaaS development team ensures your platform can evolve with user needs and business growth.

Web3: The Future of App Development

More and more businesses are looking to create decentralized applications. If you’re building in the blockchain space, you need to hire developers who are familiar with:

Ethereum, Polygon, Solana, or other chains

Smart contract development (Solidity, Rust)

Wallet integrations and token standards

DeFi and DAO protocols

Collaborating with a seasoned web3 development company gives you access to specialized talent that understands the nuances of decentralization, tokenomics, and trustless systems.

AI-Driven Applications: Why You Need Developers with ML Skills

From personalized recommendations to intelligent chatbots, AI product development is becoming an essential feature of modern apps. Developers with AI and machine learning knowledge help you:

Implement predictive analytics

Automate workflows

Train custom models

Use data more effectively

If your project involves building intelligent features or analyzing large datasets, hiring developers with AI experience gives you a distinct edge.

In-House vs Outsourced: What’s Right for You?

Many businesses face the choice: Should we build an in-house team or hire externally? Here’s a quick breakdown:

Criteria

In-House Team

Outsourced Developers

Control

High

Medium to High (depending on provider)

Cost

Higher (salaries + overhead)

More flexible, often cost-effective

Speed to Hire

Slower

Faster (especially with an agency/partner)

Specialized Skills

Limited

Broader talent pool

Scalability

Moderate

High

For many startups and growing businesses, the best solution is to partner with a development agency that gives you dedicated or on-demand talent, while letting you stay lean and focused.

What to Look for When Hiring Developers

To make the most of your investment, look for developers who:

Have a proven portfolio of completed projects

Are fluent in your tech stack

Can communicate clearly and collaborate cross-functionally

Understand business logic, not just code

Are committed to continuous learning

Whether you’re hiring freelancers, building an internal team, or partnering with a service provider—vetting for these traits is key to long-term success.

Final Thoughts: Hire Smart, Build Faster

Tech moves fast—and the companies that keep up are the ones with the right talent by their side.

Choosing to hire developers who understand modern trends like Web3, AI, and SaaS is no longer optional. It’s the difference between building something that merely works—and building something that lasts, grows, and disrupts.

If you’re ready to build a world-class product with a team that understands both code and strategy, explore partnering with a trusted digital team today.

The future is being written in code—make sure yours is built by the right hands

0 notes