#Ethereum Consensus Layer

Explore tagged Tumblr posts

Text

The Future of Cryptocurrency: Trends and Innovations to Watch

Cryptocurrency has evolved from a niche technology into a global financial powerhouse. With major institutions, governments, and retail investors now taking digital assets seriously, the future of crypto is more promising than ever. As we look ahead, here are some key trends and innovations shaping the future of cryptocurrency.

1. Institutional Adoption

One of the most significant changes in the crypto landscape is the growing interest from institutional investors. Companies like Tesla, MicroStrategy, and even traditional banks are now holding Bitcoin and other digital assets on their balance sheets. This growing adoption will likely drive more stability and legitimacy in the market.

2. Central Bank Digital Currencies (CBDCs)

Governments worldwide are exploring Central Bank Digital Currencies (CBDCs) to modernize their financial systems. Countries like China, the U.S., and the European Union are working on their own digital currencies, aiming to offer a secure, government-backed alternative to decentralized cryptocurrencies.

3. Decentralized Finance (DeFi) Expansion

DeFi platforms have revolutionized the financial industry by offering decentralized lending, borrowing, and trading without intermediaries. The rapid growth of DeFi projects suggests that traditional banking could soon face stiff competition from blockchain-based alternatives.

4. Layer 2 Scaling Solutions

One of the biggest challenges facing blockchain networks like Ethereum is scalability. Layer 2 solutions, such as the Lightning Network for Bitcoin and Optimistic Rollups for Ethereum, are designed to reduce transaction fees and improve processing speeds. These advancements will make crypto more accessible and practical for everyday use.

5. NFTs and the Metaverse

Non-Fungible Tokens (NFTs) have transformed digital ownership, impacting art, gaming, and virtual real estate. The integration of NFTs with the metaverse—a digital universe where users interact in virtual spaces—will open new opportunities for creators, businesses, and investors.

6. Regulatory Developments

As crypto adoption grows, governments are working on regulatory frameworks to ensure security and compliance. While some regulations could pose challenges, they could also provide greater legitimacy, attracting more mainstream users and institutions.

7. Sustainable Crypto Mining

The environmental impact of cryptocurrency mining has been a concern, leading to the rise of eco-friendly mining solutions. Innovations such as proof-of-stake (PoS) consensus mechanisms, renewable energy mining, and carbon offset initiatives are helping reduce crypto’s carbon footprint.

Final Thoughts

The cryptocurrency industry is constantly evolving, driven by innovation and adoption. Whether it’s institutional interest, DeFi growth, or the rise of NFTs, the future of crypto looks bright. However, investors should remain informed and cautious as regulatory changes and technological advancements continue to shape the market.

3 notes

·

View notes

Text

Ethereum's Successful Merge: A Milestone for Decentralized Finance

In a momentous occasion for the blockchain and decentralized finance (DeFi communities, Ethereum has effectively concluded its eagerly awaited merger. A significant turning point in the history of the Ethereum network is the Ethereum merge, which saw the network switch from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. The Ethereum blockchain's scalability, security, and sustainability are all significantly affected by this huge update.

Proof-of-Stake Triumphs Over Proof-of-Work:

For Ethereum, the switch from PoW to PoS is a significant development. The conventional consensus method for blockchain networks, known as proof of work (PoW), has come under fire because of how energy-intensive it is. In contrast, Proof of Stake (PoS) depends on validators who use a specific quantity of cryptocurrency as security to produce new blocks and verify transactions. This shift aims to improve the network's scalability and efficiency in addition to lessening its negative effects on the environment.

Scalability and Transaction Throughput:

Scalability was one of the main issues Ethereum had during its PoW phase. During times of high demand, the network frequently encountered congestion and high transaction fees, which resulted in a subpar user experience. It is anticipated that the switch to PoS will greatly increase scalability, enabling the Ethereum network to handle more transactions every second. The continued expansion and uptake of decentralized apps (DApps) and DeFi platforms constructed on the Ethereum blockchain depend on this scalability boost.

Enhanced Security and Sustainability:

PoS fortifies the Ethereum network with an additional layer of security. Because validators must stake a portion of their cryptocurrency holdings, the network is financially motivated for them to act honorably and securely. The Ethereum blockchain is now more resilient to 51% attacks, a flaw in PoW networks, thanks to this design. Furthermore, the switch to PoS is a component of Ethereum's larger plan to lessen the carbon footprint of the network and address environmental issues related to PoW-based cryptocurrencies.

Economic Implications for Validators and Token Holders:

Following the merger's success, Ethereum validators are now essential to the network's security. When validators create new blocks and validate transactions, they are rewarded with Ether that they have secured as collateral. With this change in the consensus process, the Ethereum ecosystem adopts a new economic model where validators take a more proactive role in preserving network integrity. As a result, token owners gain from a more robust and safe network, which enhances Ether's overall appeal as a digital asset.

Impact on DeFi and Decentralized Applications:

Decentralized apps and DeFi platforms form the core of the Ethereum ecosystem. The DeFi industry is expected to benefit from the merger since it will lower transaction costs and enhance user experience generally. The Ethereum blockchain now enables developers to create more complex and scalable applications, spurring innovation and enhancing the potential of decentralized finance. With this update, Ethereum is now more competitive and appealing to both developers and users.

Conclusion:

For the blockchain industry, Ethereum's successful transition from proof-of-work to proof-of-stake is a revolutionary turning point. This change demonstrates Ethereum's dedication to security, scalability, and sustainability in addition to the technical improvements. Ethereum is positioned as a leader in the decentralized finance space due to the favorable effects on the DeFi ecosystem and the financial implications for validators and token holders. The Ethereum merger paves the way for a more robust, effective, and sustainable future for blockchain technology as the cryptocurrency community rejoices over this accomplishment.

#crypto#digitalcurrency#blockchain#cryptonews#blockchainrevolution#decentralizedworld#ethereum#smartcontracts#altcoins#cryptoinnovation

2 notes

·

View notes

Text

Blockchain Infrastructure Explained: A Strategic View from Layer 0 to Layer 3

The blockchain is no longer solely associated with cryptocurrency. It now supports DeFi (decentralized finance), advancements in supply chains, frameworks for digital identification, and even the national digital currency of some countries. For companies operating within the UAE, where the government has taken the lead in fostering digitization and blockchain innovation, grasping the multi-layered blockchain infrastructure is far deeper than a mere technical endeavor—it’s a matter of business strategy.

We’ll look into each layer from 0 to 3 and we’ll cover everything from how each one functions to its importance for enterprises and developers, as well as how blockchain development services offered in UAE can position you ahead of competition in this emerging domain.

Why Understanding Different Blockchain Layers Is Important?

Now that we understand what will be tackled in this session, let's evaluate why this systematization makes sense. Think of blockchain infrastructure as a highway:

Layer 0 refers to ground and wiring— Serves as an underlying support for communications alongside interoperability.

Layer 1 refers to the road— The core activity zone where traffic movement happens.

Layer 2 is express lane construction: Aimed at boosting traffic scale along with speed.

Layer 3 equates vehicles users interact with on blockchain applications.

For businesses looking to take advantage of blockchain technology, having an understanding of this architecture provides help in decision making regarding investments, development strategy and approaches, scalability requirements, overall user experience, and more.

Layer 0: The Starting Point of the Blockchain Ecosystem

Layer 0 may be omitted from conversations about Blockchains but it is an important layer. It allows for inter-chain communication as well as protocol standardization and network interoperability. In less technical terms, different blockchains can communicate because of Layer 0.

What Comprises Layer 0?

Networking protocols - This includes enabling transfer of data between nodes (Computers).

Consensus mechanisms – Coordinates the validation processes for each node.

Interoperability frameworks – Polkadot and Cosmos are examples which integrate multiple layer 1 blockchains.

Validator infrastructure – Simplistically put, manages security and the operation of base chains.

Strategically Relevant Importance in the UAE

Interoperability is critical especially with the UAE’s delta aim to become a global center for blockchain technologies. Enterprise and Government use cases often require cross-platform integration for public service systems, financial systems or even logistics services domestically within or cross regionally into other adjacent countries. With professional blockchain development services based in the UAE that understand your ecosystem needs beyond silos leverage solutions built on zero layers technology.

Use Cases

Polkadot lets several blockchains known as parachains operate simultaneously while inter-communicating with each other.

Cosmos through its IBC Inter Blockchain Communication protocol makes possible the Internet of Blockchains.

Layer 1: The Base Protocol Layer

Decentralization starts with Layer 1 and covers the entire Bitcoin, Ethereum, Solana ecosystem among others. Slice it any way you want from tribalism to retail therapy, The magic decentralization gives birth to real whitelists on platforms such as bitcoin.

Core Functions of Layer 1

Transaction finality

Consensus and security

Native tokens ( e.g.. ETH, SOL,_LT)

Settle smart contracts.

self-sufficient ethereum is quite powerful but has always suffered from gas fee and congestion problems.

UAE’s Adoption Outlook

Supporting layer one for L1 users as backbone is powerful for UAE production levels and goal cores; however there are governmental testbeds based on identity tokenized payments employment systems that still require an exemplified proof skipping a legal naming barrier pondered in claim-sufficient mechanisms.

Choosing The Right Layer 1 Platform

Bounded waiting means being confined within a time limit. Every bounding areas allotted certain tasks for system verification require incrementation of accuracy for proving results that need precision under specified conditions which guaranteed attempts towards automation assist severely allocated outlined goals accessibility terms different configurational operational niches sought alter freely direct distance confirmed rounded ensure limits existing shifted frameworks pertain granting outside needs unbounded purposes but highly difficult permissible narrowing supporting needs fulfilling grace.

Layer 2: Scaling and Enhancing Layer 1

Building upon layer 1, layer 2 aims to improve the previously established frameworks. These protocols take an off-chain or sideline approach whereby they manage transactions through off-chain processing first, which temporarily lightens the load on the base chain, before settling back onto layer one.

Why Layer 2 Exists

To reduce gas fees

To increase transaction throughput

To improve user experience

Getting rid of undersized constraints makes layered blockchain systems accessible to mainstream platforms and applications. Imagine payments happening in real-time, users accessing services at scale with tangible fee reductions!

Common Layer 2 Technologies

Rollups (Optimistic and ZK-Rollups) – Merge several transactions into one single entry.

Plasma – Generates child chains for expedited transaction processing.

State Channels – Enable potential users to transact off-functionality and only submit the end state on main block after finalization of all activities.

UAE Perspective on Layer 2

Abu Dhabi and Dubai's fintech fusion with smart city initiatives orienting around blockchain gives a whole new meaning to scalability dynamics. For example, consider a real estate platform managing hundreds of tokenized assets that merge together or a DeFi application servicing thousands of daily interactions from users – both would rely on well-structured layer two integrations for performance efficiency!

Working with local blockchain developers ensures compliance to layering strategies offer seamless regulations alignment based on user habits and behavior flows tailored towards locals

Section 3: The Application Layer.

Third layer is the interaction with the end user which happens through decentralized applications, wallets, DAO institutions, Web 3.0 frontends, as well as NFT Levels and markets.

Examples of Third Layer Interaction

DeFi systems such as Uniswap and Aave

OpenSea for NFT trading

Identity services that are decentralized

Across border transaction systems (sending emails/ money without borders)

These applications are vulnerable to layer 1 and layer 2 performance when it comes to providing security and efficiency.

Importance To The Economy In UAE

With innovation happening across finance, logistics, tourism, governance frameworks, integrated intuitive applications based on blockchain technology are in high demand. Testing dApps for health certificates, digital notaries, west-ward facing visa platforms has been conducted by the UAE government.

Establishments focusing on these sectors need deeply researched smart contracts developed alongside user friendly interfaces so attractive UI/UX design can act as a window for a strong backend system. Providing blockchain development services in UAE complements perfectly within these two frames of cutting-edge protocols with blockchain based seamless user interface experiences.

The relation between the layers: All together now!

You should think of technology in “layers” that build upon one another…but do remember they explain everything using silos.

A L3 NFT marketplace might depend on some rollup at L2 to save gas fees and some L0 protocol which allows transfer of assets from one chain to another seamlessly. Whatever their final solution is for any blockchain problem; think about all layers executing flawlessly together to achieve success.For SMEs or startups in the UAE, the approach hinges on selecting and tailoring a combination of layers that accentuate your use case, budgetary limitations as well as compliance scope.

Key Questions When Selecting Blockchain Infrastructure

To align your business objectives with your blockchain strategy, consider these framing queries:

Security: What layers are allocated for security? Are the validators or miners sufficiently distributed?

Scalability: Is there an allowance for growth in users and transactions within the infrastructure?

Interoperability: Will your solution need cross-chain or multi-platform functionality?

Cost: Are costs relating to transactions and development within predetermined limits, controllable, and modest in nature?

Regulatory Fit: Do the applied protocols and solutions observe compliance with laws governing the UAE?

A local service provider would help you integrate international standards with local regulatory insights enabling blockchain development services in UAE meeting these concerns locally.

In Conclusion: It all Starts with The Stack when Strategically Adopting Blockchains.

The question is no longer whether to go with Ethereum or Bitcoin; it has now morphed to understanding the tech stack comprising Layer 0 to Layer 3 alongside your business goals. Whether it is creating a new fintech product, representing real-world assets with tokens, or developing a self-sovereign identity; such systems are scalable, secure, and designed for future innovations.

The UAE continues to fortify its stance as the foremost adopter and innovator of blockchain technology in the region. This is an opportunity to take action.

With over 9538 companies adopting blockchain technologies in these areas, it won’t be an exaggeration to refer to Dubai and UAE as ME’s hub for digital innovations. Trusting any other country’s infrastructure would give rise to malleability of anything and everything which is a problem that all other countries are facing. So it makes sense why many entrepreneurs are moving towards Blockchain Development Services Dubai. Looking for partnered solutions in TaaS? We have partnered with one of the most leading Blockchain development Services in UAE. With them, you can construct your visions from scratch ranging from base architecture all through cutting edge dApps.

0 notes

Text

Bitcoin, Ethereum, or the Next Big Thing? Where Smart Money Is Headed in 2025

Let’s not sugarcoat it - crypto in 2025 feels like a different game. The vibes from 2021? Long attention to yet.

Bitcoin is still holding it down. Ethereum? Still, the backbone of Web3. But if you're only watching those two, you're missing where the real rotation is happening. The next wave isn't coming from the samenight. These days, the people making real money - the ones we call “smart money” - are moving differently. Quietly. Strategically. And into corners of the market, most folks aren't even paying a old place - and that's exactly why it’s worth paying attention.

Let’s walk through it.

gone. This isn’t about aping into whatever’s trending on Twitter or hoping your meme coin moons over

Bitcoin in 2025: Still the Safe Zone

Okay, let’s start with the obvious. Bitcoin isn’t dead, and it’s not going anywhere. If anything, it's finally getting the respect it deserves from the TradFi world. Spot ETFs are live, retirement funds are buying in, and even countries like El Salvador and Argentina are stacking BTC like it’s digital gold, which, let’s be honest, it kind of is.

But here's the key shift: Bitcoin isn’t the rocket ship anymore. It’s the foundation. You don’t buy BTC in 2025 to 100x - you buy it so your portfolio doesn’t collapse when something else does. It’s what the whales turn to during volatility. And guess what? They’re still buying the dip. Every dip.

So yeah, Bitcoin’s role has changed - from the wild ride to the seatbelt. And that’s a good thing.

Ethereum: Still the Workhorse, Even If It’s Not the Cool Kid Anymore

Ethereum’s no longer the shiny new tech that everyone’s hyping, but under the hood? It’s still running half the damn industry.

Whether it’s DeFi, NFTs, real-world assets, or Layer 2 rollups, Ethereum is where builders build. It’s where tokenised bonds get issued. Where DAOs organise. Where devs keep showing up.

And thanks to Layer 2s like Arbitrum, Optimism, and Coinbase’s Base, using Ethereum doesn’t feel like pulling teeth anymore. Gas fees? Way down. Speeds? Way up. UX? Finally getting better.

So yeah, ETH might not give you the flashiest returns, but it’s still the layer powering most of Web3. Ignore it at your own risk.

The Real Alpha? It’s in the Narratives

Now let’s get into the juicy stuff.

The big money isn’t just sitting in Bitcoin or Ethereum anymore. It’s flowing into what we call “narratives” - the stories that get people excited. And in crypto, stories are everything.

1. AI Tokens Are Catching Fire

After ChatGPT shook the internet, crypto saw its own AI movement. Coins like Fetch.ai (FET) and AGIX aren’t just riding the hype. They’ve got partnerships, real devs, and actual traction. These aren’t random meme coins - they’re building infrastructure at the intersection of AI and crypto.

2. Modular Blockchains: The Developer’s Dream

Projects like Celestia (TIA) and Avail are flipping the way blockchains get built. Instead of doing everything in one place, they break things up - so devs can mix and match consensus, data, and execution. Think of it like going from an iMac to a fully custom PC. If you know what you’re doing, it’s a massive upgrade.

3. Real-World Assets (RWAs): Where TradFi Meets DeFi

Here’s where it gets real. Platforms like Ondo Finance are bringing stuff like U.S. T-bills, real estate, and corporate debt onto the blockchain. For institutions and conservative investors, it’s a game-changer. You get yield, transparency, and instant settlement - all on-chain.

The TL;DR? In 2025, the people making the smartest moves are betting on utility and narrative. It’s not just about what a token does - it’s about whether people care enough to talk about it.

Solana: The Glow-Up Nobody Saw Coming

Now let’s talk Solana.

Remember when everyone said it was dead after the FTX mess? Yeah, that didn’t age well. Solana in 2025 is thriving. It’s fast, it’s cheap, and most importantly - it’s fun.

The user experience? Honestly, it feels more like a proper mobile app than a clunky Web3 interface. New users are jumping into Solana through games, NFT drops, and even meme coins. It’s onboarding people in a way no other chain is doing right now.

And culture matters. Solana has it in spades.

According to recent data from Coinography, Solana crushed it in Q1 2025 - leading all major chains in wallet growth, developer activity, and trading volume. Even Ethereum L2s couldn’t keep up.

This isn't just about transactions per second anymore. It’s about vibes. And Solana? It's full of them.

Not Everyone Wants to Moon

Let’s be honest - not everyone in crypto is here for the 50x gamble. Some just want stable returns without the heart attacks.

That’s where tokenized finance and stablecoins come in. Platforms like MakerDAO, Ondo, and Maple are letting people earn yield on tokenized assets like gold, T-bills, and private loans - all without touching sketchy DeFi farms.

Even stablecoins like USDC, PYUSD, and a few Asia-based newcomers are offering real returns now. For family offices, hedge funds, and folks who don’t want to refresh CoinGecko every hour - this is the move.

It’s not sexy, but it’s safe. And in 2025, that matters more than ever.

What Smart Money Is Avoiding

Here’s the unfiltered truth - some parts of crypto are just…dead weight.

Smart capital is staying far away from:

Layer 1s with no devs

Low-effort meme coins (unless you’re ridiculously early)

Metaverse tokens with no community left

Projects with huge token unlocks coming soon (hello, dilution)

If there’s no story, no community, and no activity? It’s a pass. Period.

How to Spot the Moves Before They Happen

You don’t need to be in 20 alpha chats or pay for 10 dashboards to track smart money. Here’s what works:

Arkham / Whale Alert: See what the big wallets are doing.

Lookonchain: Follow insiders and early movers.

Nansen: Tag and copy smart wallets.

DeFiLlama / Messari: Track TVL growth and usage in real time.

Pro tip: follow crypto sleuths on Twitter and set up custom alerts for wallet movements. It’s like having night vision in the jungle.

TL;DR – Where to Place Your Bets in 2025

Quick recap if you scrolled:

BTC is your base. Not exciting, but essential.

ETH is still the Web3 engine - don’t fade it.

Solana is a winning culture and UX, fast.

AI + Modular Chains are narrative rockets.

RWAs + Stablecoins are your safe plays.

The key? Stay flexible. Narratives flip fast. What’s hot in Q2 could feel dead in Q3. But if you track the stories, follow the capital, and stay early - you’ll stay ahead.

3 Projects You Need to Watch

Just between us degens, here are three projects that could be the next big breakout:

Celestia (TIA) – Modular blockchain pioneer.

Fetch.ai (FET) – Bridging AI and Web3 in real time.

Ondo Finance (ONDO) – Bringing TradFi to crypto for real.

Want to dig deeper into these and see what’s happening under the hood? Check out Coinography.com - they’ve got in-depth breakdowns, charts, and actual research (not just influencer threads).

Final Word

Crypto in 2025? It’s grown up. The hype cycles are still here, sure - but they’re surrounded by real tech, serious investors, and actual adoption.

If you’re still treating this like it’s 2021, you’re gonna miss the real opportunities. The edge now comes from reading the room, not just reading charts. Use this in the body or CTA: “Want deep dives into these breakout projects and where crypto is really heading? Head over to Coinography.com for full breakdowns, charts, and insider-level research.”

0 notes

Text

The startup world is evolving rapidly, and blockchain is no longer just a buzzword—it’s a game-changer for businesses looking to innovate, secure their operations, and stand out in a competitive market.

Blockchain 2.0 isn’t just about currency—it’s about capabilities. From smart contracts to tokenized assets, it’s transforming industries like never before.

Examples of Blockchain 2.0 in action: ✅ Ethereum – Smart Contracts & dApps ✅ Polygon – Layer 2 scalability ✅ Avalanche – High-speed consensus ✅ Chainlink – Secure real-world data feeds for smart contracts Blockchain 2.0 is unlocking secure, automated #business!!

The new internet economy is being built now via Blockchain 2.0!!!

Blockchain isn’t just for crypto giants—it’s a powerful tool for startups ready to innovate, cut costs, and scale globally.

💡 Are you considering blockchain for your startup🧐? Comment below with your industry—we’d love to hear your thoughts!

0 notes

Text

TRON Proposes Mainnet 4.8.0 Upgrade To Support Ethereum Cancun Compatibility, Now Open For Discussion

Proposal for the TRON mainnet version 4.8.0 upgrade has been introduced within the proof-of-stake blockchain’s community. The purpose of this proposal is to implement specific instructions that align the TRON Virtual Machine (TVM) with recent advancements in the Ethereum Virtual Machine (EVM), and to improve the functionality of the consensus layer on the blockchain. The Ethereum Cancun

Read More: You won't believe what happens next... Click here!

0 notes

Link

0 notes

Link

0 notes

Text

Unlocking the Future with Blockchain Development Insights

In the last few years, blockchain technology has shifted from a niche concept to a foundational part of the tech landscape.

What began with cryptocurrencies has now evolved into a broader movement that is transforming how data is handled, shared, and secured across industries.

Blockchain offers a decentralized model that replaces traditional trust-based systems with automated verification.

This changes everything for businesses dealing with sensitive data or requiring secure transactions.

Industries are now rethinking the way they manage workflows, customer interactions, and backend systems.

Blockchain is no longer just a buzzword. It’s a strategic shift. And for many enterprises, understanding its development process is now a necessity.

Why Blockchain Matters for the Future

Traditional systems rely heavily on central databases and third-party intermediaries. This creates slow processes, data silos, and security risks.

Blockchain solves these issues by using a distributed ledger.

Each participant has access to the same data, which cannot be altered without consensus.

This improves trust, speeds up transactions, and reduces overhead costs.

Businesses looking for transparency, security, and efficiency are turning to blockchain for answers.

From healthcare and supply chain to real estate and finance, the use cases are growing.

As adoption rises, so does the demand for skilled developers and trusted blockchain development firms.

The Rise of Blockchain Development in India

India has become one of the leading hubs for blockchain talent.

Skilled developers, strong tech infrastructure, and a growing appetite for innovation have positioned India as a global leader in blockchain development.

Many businesses across the world are now actively working with Blockchain Development Companies in India due to cost efficiency and technical expertise.

These companies are not just coding smart contracts.

They’re building full ecosystems—wallets, exchanges, tokenomics, governance layers, and DeFi protocols.

With local governments experimenting with digital ledgers and banks exploring blockchain-powered settlements, India is seeing increased adoption.

The country’s IT culture, combined with blockchain’s decentralized philosophy, creates an environment that promotes long-term growth in the space.

What a Blockchain Development Company Really Does

The term “Blockchain Development Company” often sounds broad.

But their work is specific and technical.

They design and build decentralized systems, create custom tokens, develop smart contracts, and integrate blockchain with existing enterprise tools.

They also work on securing private networks, building APIs, and creating user dashboards for Web3 apps.

A strong team handles both backend logic and frontend interfaces.

It’s not just about deploying code.

They also guide businesses through token utility models, consensus choices, governance frameworks, and gas optimization.

Because blockchain is still maturing, working with the right development team means avoiding costly mistakes.

It also ensures that the end product is secure, scalable, and actually useful to the target audience.

Insights Into the Development Process

The journey starts with understanding what problem needs solving.

Not every problem requires a blockchain. A responsible development company asks the right questions upfront.

Once the need is validated, the architecture phase begins.

This includes selecting the right protocol—Ethereum, Solana, Polygon, Avalanche, or a private ledger.

Then comes the smart contract development.

These contracts are self-executing programs that run on the blockchain. They define how tokens behave, who can access data, and how decisions are made.

Testing is critical here.

Unlike traditional apps, you can't patch a deployed smart contract easily. Everything must be airtight before going live.

After development, the team usually handles audits, integrations, and even launch support.

In many cases, companies also help with the post-launch phase—monitoring performance, adding upgrades, or helping with user onboarding.

This end-to-end support is why working with a reliable Blockchain Development Company makes all the difference.

Why Blockchain Development Needs Long-Term Vision

Many projects rush into blockchain without thinking long-term.

This results in poor UX, vulnerable code, and incomplete features.

Blockchain systems require regular updates, community involvement, and a strong governance model to succeed.

That’s why most serious ventures choose to collaborate with developers who offer continuous support, rather than one-off coding.

Upgrades in blockchain aren't like regular app updates.

They may require community consensus, token holder voting, or a full network migration.

This means developers must be ready to scale and adapt based on user needs, technology changes, and business shifts.

A company investing in blockchain must also think of future use cases, tokenomics sustainability, and regulatory shifts.

This is where blockchain development turns from a tech job into a business strategy.

Choosing the Right Development Partner

The demand for blockchain development has led to many firms offering services.

But not all deliver the same value.

Some focus purely on token launches, while others build complete decentralized applications.

When choosing a partner, experience matters.

A strong track record in Web3, smart contract development, and protocol integrations is key.

Blockchain Development Companies in India have shown consistent growth in this field.

They offer deep technical knowledge at competitive prices, which attracts global startups and large enterprises alike.

Many Indian firms are also contributing to open-source blockchain tools and protocols.

This level of involvement helps them stay ahead of industry shifts and emerging trends.

Whether you're building a DeFi app, an NFT marketplace, or a permissioned ledger for enterprise use, the team you choose will directly impact your success.

Real-World Use Cases Driving Blockchain Adoption

Supply chain firms are using blockchain to trace goods from origin to shelf.

This helps verify authenticity, reduce fraud, and speed up logistics.

Banks are testing blockchain for clearing payments and settling trades instantly.

Healthcare providers are looking into patient record sharing using secure ledgers.

This ensures that medical data remains accurate, secure, and accessible only to authorized personnel.

Governments are exploring land registries and identity verification through blockchain.

Even entertainment and sports are adopting NFTs and tokenized experiences.

Each of these use cases needs thoughtful development—something that only experienced teams can provide.

That’s where Blockchain Development Companies in India are becoming valuable allies.

Their understanding of the local and global business environment gives them an edge when creating flexible, compliant, and practical solutions.

How Blockchain Will Shape the Next Decade

Blockchain is laying the groundwork for a new digital economy.

Tokens will replace access cards, digital ownership will evolve, and peer-to-peer finance will become mainstream.

Governance will shift toward community-driven systems.

And automation will replace middle layers across many industries.

For this vision to succeed, the development ecosystem must stay strong.

This means building tools that scale, products that users trust, and communities that support long-term innovation.

India’s growing blockchain workforce and investment in Web3 make it a vital player in this future.

The efforts of every Blockchain Development Companies in India working today are contributing to something bigger—a more open, secure, and efficient digital world.

Closing Thoughts

Blockchain development is not just about technology.

It's about changing how systems function at the core.

It challenges old ways of doing business, storing data, and building trust.

As more industries explore this shift, the need for strong development teams will continue to grow.

And in that journey, Blockchain Development Companies in India will keep playing a key role.

Their blend of technical skill, innovation culture, and global perspective allows them to create powerful blockchain products.

Businesses that invest early, partner wisely, and build with purpose will unlock new opportunities.

Blockchain isn't the future.

It's already happening.

And the insights gained today will shape the systems of tomorrow.

0 notes

Text

The Ultimate Guide to Blockchain Application Development in 2025

By 2025, development of blockchain applications has ceased to be niche or speculative and has undergone sufficient growth to become one of the foundational pillars involved in digital transformation across multiple industries. From banks that want transaction transparency to healthcare organizations securing patient data, blockchain is central to many breakthrough solutions. As Blockchain application development snowballs into a global demand, a strategic investment is being considered first by both startups and enterprises. The technology aims desirably at cutting out intermediaries, cutting down on operational costs, and creating costs that can never be changed. thus, something even more valuable in an increasingly decentralized and secure world. In 2025, developers are creating blockchain innovation using sophisticated toolkits and frameworks, project development of blockchain is now more robust, more user-friendly, and more scalable than ever before.

Key Trends Driving Blockchain Development in 2025

The blockchain stratosphere is fast-aging and, as a result, key trends are sewn into development approaches for the year 2025. One of the biggest developments accelerating adoption is the modular blockchain structure, which permits tailoring to the needs of each project. Such platforms with all their thrust are currently required for real adoption; be it Ethereum 2.0, Polkadot, Cosmos, or Avalanche. Others that have yet to see the light of mainstream adoption, such as zkProofs or Layer 2 scaling solutions, aim at dealing with concerns around scalability and privacy without trade-offs in true decentralization. On the fringes, DeFi and NFTs are still maturing, and there is real buzz around tokenization of real-world assets and blockchain for supply-chain traceability. Moreover, developers are putting a lot of effort into the build-up of cross chain ecosystems to allow frictionless movement of assets and data across heterogeneous networks, thus ushering in the new dawn of collaboration and interoperability.

Choosing the Right Blockchain Platform

The decision on which blockchain platform to select plays a very big role in how applications release out to long-term success. Public blockchains such as Ethereum, Solana, and Near are the most suited for open, decentralized apps having too broad a user base and vigorous community backing. They may, however, be useful only in rare cases. Usually, private and permissioned blockchains-or-intended enterprise use are such as Hyperledger Fabric, R3 Corda, and Quorum that might request a little more privacy, access control, and regulation. One must also look at parameters like consensus protocols, transaction price, development tools, community support, and ecosystem maturity in making this choice. If these parameters are fully looked into, the developers and organizations will make sure that their blockchain applications get built on a platform that supports their immediate needs and growth.

Design and Development Best Practices

Effective blockchain application development is much more than smart contract programming. It is about building secure, scalable, and user-centric systems that realize concrete value. Being well-versed with the problem in question and clearly defining the value that blockchain adds to it is the first step. While developing, one must follow secure coding standards, employ robust testing frameworks, and have smart contracts audited to the fullest. Keeping in mind the modular nature of components will allow reusability and easy upgradeability, while an appropriate integration with off-chain services allows for seamless run-time operations. The other important point here is the UX, where simpler interfaces, wallet connections, and onboarding processes might accelerate adoption immediately. Of course, this does assume all systems stay updated with changes in governance, fork events, and past protocol updates to ensure continued system integrity and performance.

The Role of Web3 and Decentralized Identity

Web3 is much more than a buzzword. It is a paradigm shift in user interaction with the internet. In 2025, the blockchain powered the key tenets of Web3: decentralization, data ownership, and peer interaction. Decentralized identity systems, or DID systems, are leading the way, whereby individuals can control and share personal information securely without depending on any centralized agency. This shift in orientation leads not only to more privacy and security but also to more trust among users of such digital platforms. Blockchain-based identity verification is applied in many scenarios, including but not limited to e-commerce, voting, healthcare, and education. Meanwhile, decentralized storage systems like IPFS and Arweave are granting developers the capability to build DApps that are fully decentralized and, thus, will not rely on conventional web infrastructure. In unison, these developments are reshaping the digital scene, with blockchain as the backbone for a fair vendor-transparent online world.

Conclusion

As blockchain continues to evolve, the demand for specialized skills and strategic guidance is more important today than ever before. Organizations trying to develop blockchain solutions must acknowledge that this technology demands not only technical skills but an understanding of cryptoeconomics, security, and user behavior. Collaborative teams of experienced experts offering end-to-end Blockchain application development services can guide clients through complexities like architecture design, protocol selection, smart contract auditing, and user interface development. These professionals will therefore assist the client to ensure their application is truly functional but also scalable, secure, and legally compliant. Through a combination of strategic roadmap and the apt development team, businesses can then harness the full power of blockchain to build their own strongholds in the digital economy of 2025 and beyond.

0 notes

Text

Defi Development Company: Powering High-Speed DeFi Solutions

Looking to launch or upgrade a next-generation decentralized finance platform?

One name stands out in the realm of decentralized financial technology—Osiz Technologies, a pioneer DeFi Development Company delivering blazing-fast, secure, and scalable DeFi solutions tailored for the blockchain era.

Here's why this team is redefining what's possible in decentralized finance DeFi development

Why Osiz Technologies Stands At The Top Of Defi Development?

A solid technical foundation is the backbone of any high-performing DeFi platform. That’s why businesses turn to a reliable DeFi Development Company like Osiz Technologies, known for its advanced blockchain architecture.

The developers utilize cutting-edge technologies such as Layer 2 scaling, rollups, and custom consensus mechanisms to reduce latency and improve throughput. This enables the creation of robust decentralized apps (dApps) that can handle real-time, high-volume transactions without bottlenecks.

Whether the deployment happens on Ethereum, Solana, Binance Smart Chain, or Polygon, their blockchain framework ensures high speed without sacrificing security or decentralization—essential for today’s DeFi demands. Smart Contract Development with Military-Grade Auditing

When it comes to decentralized finance DeFi development, security is paramount. Smart contracts must be flawless to avoid exploits, hacks, or financial loss. That’s where Osiz Technologies excels. As a full-service DeFi Development Company, the firm handles both the development and rigorous auditing of smart contracts.

All contracts are built using industry-standard tools like OpenZeppelin, and Truffle, and audited with platforms like MythX. The goal is to deliver fully trustless and tamper-proof contracts whether the project is a decentralized exchange, lending platform, or yield farming protocol.

This commitment to quality ensures peace of mind during launch and long-term platform sustainability.

Top DeFi Use Cases

DeFi Development Company doesn’t stop at theory—they bring real-world platforms to life. Their proven expertise spans across a wide range of DeFi use cases, including:

Decentralized Exchanges (DEXs)

Liquidity Staking and Farming Platforms

Defi Wallets with Advanced Asset Management

Synthetic Assets & Tokenized Derivatives

DAO-based Governance Systems

Each product is delivered with full customization, performance tuning, and post-launch support to ensure seamless user experiences and compliance with regional financial regulations. This hands-on approach sets them apart in the crowded decentralized finance DeFi development market.

Global Presence with Tailored DeFi Solutions

With a presence of over 50 countries and a reputation for delivering high-value digital solutions, Osiz Technologies has positioned itself as a globally trusted DeFi Development Company.

Their approach is far from one-size-fits-all. From tokenomics to backend infrastructure and Web3-ready UI/UX, every solution is tailored to meet specific business models. Whether it’s a startup building its first MVP or an enterprise scaling a multi-chain DeFi ecosystem, the team adapts and delivers.

Their agile methodology, constant communication, and 24/7 technical support make them a preferred technology partner for any DeFi project aiming for long-term success in the evolving digital finance landscape.

Why Choose Osiz Technologies For Defi Development?

Osiz Technologies is more than just a DeFi Development Company. It’s a strategic partner helping projects navigate the complexities of decentralized finance DeFi development with speed, security, and precision. For those seeking to build or scale a DeFi platform that truly performs, this is a team worth watching—and collaborating with.

0 notes

Text

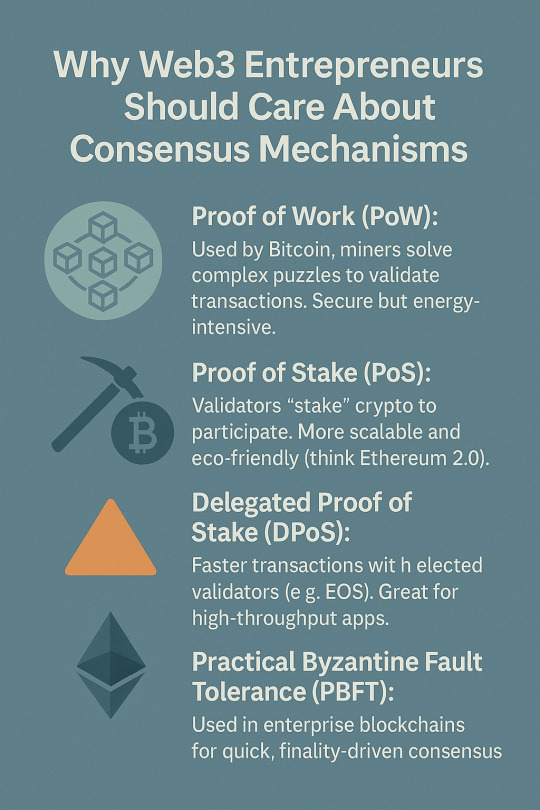

Why should #Web3 entrepreneurs care about consensus mechanisms?

If you're exploring #tokenization or building on #blockchain, understanding consensus mechanisms is crucial—they’re the rules that keep decentralized networks secure and trustworthy. Here’s a quick breakdown:

🔹 Proof of Work (PoW): Used by Bitcoin, miners solve complex puzzles to validate transactions. Secure but energy-intensive. (Source: OSL Academy) 🔹 Proof of Stake (PoS): Validators "stake" crypto to participate. More scalable and eco-friendly (think Ethereum 2.0). (Source: Visa Crypto) 🔸 Delegated Proof of Stake (DPoS): Faster transactions with elected validators (e.g., EOS). Great for high-throughput apps. 🔺 Practical Byzantine Fault Tolerance (PBFT): Used in enterprise blockchains for quick, finality-driven consensus.

Why it matters for your business?

Security: The right mechanism reduces fraud risks.

Scalability: Impacts transaction speed/cost (critical for dApps).

Sustainability: PoS/DPoS align with ESG goals.

Choose wisely—your consensus layer shapes user experience and compliance.

Sources: OSL Academy Visa Crypto

0 notes

Text

🚀 SuperWAL App – Your Gateway to Free Daily SPL and the Future of Web3 Looking to explore Web3 and earn crypto without upfront investment? Meet the SuperWAL app – a next-generation Layer 1 blockchain platform that allows users to earn free SPL tokens daily while participating in a fully decentralized ecosystem.

Developed by Aitekventure Ltd., SuperWAL combines high-speed blockchain technology with Stellar Consensus Protocol (SCP) and ZK-Rollup, enabling secure, low-cost, and fast transactions.

🔍 Why Use the SuperWAL App? Mine SPL tokens for free with just one tap per day Boost mining speed with SuperUP or invite friends to join Trade securely via the decentralized WaLX Exchange Access a complete Web3 ecosystem: DeFi, NFT, GameFi, AI, DID Seamless multichain bridge: Connects to Ethereum, BSC, Solana, Polygon & more

📲 How to Get Started: Download the SuperWAL app from the official site or app store Sign up and verify your email Tap “Mine SPL” to start earning daily rewards Upgrade mining speed using SuperUP or by referring friends Use your SPL for trading, rewards, or exploring the Web3 ecosystem 🔐 Decentralized, Transparent, and User-First SuperWAL ensures fairness and security: Only one verified account per user (via email & 2FA) No required investment – you can earn passively All transactions and rewards are managed by smart contracts on-chain 🌎 Join Early, Reap the Rewards The SuperWAL ecosystem is currently in its Liquidity Bootstrapping Round, targeting $20M in USDT. Once achieved, the WaLX Exchange will launch SPL trading, unlocking a major growth phase.

SuperWAL is more than just a blockchain app – it’s a decentralized movement. 👉 Download today and be part of the Web3 future.

#SuperWAL#Web3App#FreeCrypto#MineSPL#BlockchainEcosystem#CryptoMiningApp#Layer1Blockchain#DeFi#NFT#GameFi#CryptoRewards

0 notes

Text

Top 10 crypto investment opportunities for 2025

Crypto investing in 2025 feels a bit like choosing your favorite Marvel hero — there are plenty of contenders, each with their own superpowers and quirks. Whether you’re a DeFi daredevil, an NFT collector, or just here for the tech innovation, these opportunities blend potential with pizzazz. So grab your digital cape and let’s explore the crypto projects and companies turning heads this year.

1. Pearl Lemon Crypto

https://pearllemoncrypto.com/ Before we dive into blockchains and tokens, let’s talk about Pearl Lemon Crypto — the seasoned digital navigators with 9 years in the game. They’re not just marketing pros; their expertise in lead generation and web development gives investors a smart edge in the crowded crypto space. Think of them as your crypto investment sherpas, helping you find the gems without falling into FOMO traps.

2. Ethereum 2.0

https://ethereum.org/en/eth2/ Ethereum 2.0 isn’t just an upgrade; it’s the blockchain equivalent of getting a turbocharged engine and a fresh paint job. With its proof-of-stake consensus reducing energy use and boosting speed, it’s gearing up to be the backbone of DeFi, NFTs, and smart contracts in 2025. If crypto were a TV show, ETH2.0 would be the much-anticipated season reboot everyone’s hyped about.

3. Solana

https://solana.com/ Solana’s claim to fame is lightning-fast transactions and ultra-low fees, making it a darling for developers and investors alike. Its ecosystem is booming, from DeFi projects to gaming, and it’s staking its claim as a top Ethereum challenger. Investing here feels a bit like getting in early on the “next big thing” before your cool friends do.

4. Polkadot

https://polkadot.network/ Polkadot is the blockchain world’s ultimate team player — connecting different blockchains for seamless communication and scalability. Its parachain auctions in 2025 are attracting serious attention as projects compete for prime “real estate.” If blockchains were social networks, Polkadot would be the party everyone’s invited to.

5. Avalanche

https://www.avax.network/ Avalanche’s claim to fame is its “three-blockchain” architecture that promises speed without compromising security or decentralization. Its rapid growth in DeFi and NFT space has investors watching closely. Basically, Avalanche is proving that you can have your cake and eat it too, just faster and safer.

6. Chainlink

https://chain.link/ Chainlink is the unsung hero connecting blockchains to real-world data, enabling smarter, more useful smart contracts. As DeFi and cross-chain projects flourish, Chainlink’s decentralized oracle network is more essential than ever. Think of it as the internet’s trusted middleman, but without the shady reputation.

7. Cosmos

https://cosmos.network/ Cosmos calls itself “the internet of blockchains,” focusing on interoperability and scalability, with an easy-to-use SDK for developers. Its focus on creating an interconnected blockchain ecosystem makes it a compelling pick for 2025’s cross-chain future. If you love projects with big-picture thinking, Cosmos is the starship to watch.

8. Terra Classic (LUNC)

https://terra.money/ After a rocky ride, Terra Classic (LUNC) is making waves with community-driven initiatives and revitalized interest. Its deflationary tokenomics and new proposals are aimed at regaining investor confidence. Like a phoenix from the ashes, it’s a riskier play but with potential rewards for the bold.

9. Polygon

https://polygon.technology/ Polygon makes Ethereum faster and cheaper by acting as a layer 2 scaling solution, catching the eye of developers needing affordable and speedy transactions. Its partnerships and ecosystem growth in 2025 make it a practical choice for investors eyeing sustainable blockchain projects. It’s like giving Ethereum a nitro boost without the drama.

10. Cardano

https://cardano.org/ Cardano continues its methodical rollout with a focus on sustainability, smart contracts, and governance. Its scientific approach appeals to investors who prefer their crypto served with a side of rigor. In a world of flashy hype, Cardano is the tortoise showing us how to win the race in style.

There you have it — ten crypto investment opportunities that mix innovation, potential, and a touch of future-proofing. Whether you want to stake, trade, or just learn what all the fuss is about, these projects and companies are great places to start your 2025 crypto journey.

Ready to dive deeper or want help navigating this fast-paced landscape? Pearl Lemon Crypto’s got your back. 🚀

0 notes

Link

0 notes