#How does QuickBooks Enterprise work?

Explore tagged Tumblr posts

Text

AI-Powered Automation: The Competitive Advantage for Small Businesses

What is AI-powered automation, and how does it work?

AI-powered automation is when machines use artificial intelligence (AI) to do tasks that normally need human thinking. These tasks include answering customer questions, managing emails, creating reports, scheduling meetings, and even making smart business decisions.

It combines machine learning, natural language processing, and data analytics to automate both simple and complex business processes. For small businesses, this means they can operate faster, smarter, and with fewer resources.

Why should small businesses care about AI automation?

Because AI helps small businesses do more with less. Here’s how:

Time savings: AI can reduce time spent on repetitive tasks by up to 80% (McKinsey & Company).

Cost efficiency: A study by Accenture found AI can lower operating costs by up to 30%.

Growth: Businesses that adopt AI grow revenue 50% faster than those that don’t (Forrester Research).

Competitive edge: In a crowded market, speed and precision matter. AI gives smaller companies tools that used to be available only to large enterprises.

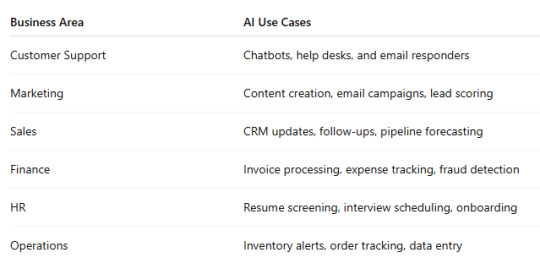

What areas of business can AI automate?

What are the benefits of using AI for small businesses?

Here’s how AI changes the game:

Saves time and resources

Automates repetitive tasks like data entry, scheduling, and follow-ups

Lets your team focus on work that requires real thinking

2. Improves customer service

Chatbots like Tidio or Drift respond 24/7

Personalizes responses based on customer history

3. Boosts marketing performance

AI tools like Mailchimp and ActiveCampaign send smarter emails

Tracks customer behavior and adjusts campaigns in real-time

4. Makes better decisions faster

AI tools can analyze data and show trends that humans might miss

Helps with forecasting sales or choosing the right products to promote

5. Scales with your business

AI doesn’t need a lunch break. As your business grows, it grows with you.

How much does AI automation cost for small businesses?

Good news — it’s more affordable than you think.

AI chatbots like Tidio start at around $29/month

AI email marketing tools like MailerLite start free, then scale up

AI scheduling tools like Calendly offer free tiers for solo users

AI bookkeeping software like QuickBooks with AI features start at $25/month

Even platforms like HubSpot and Zoho CRM have built-in AI tools now, often included in their base plans.

How do I get started with AI automation?

Step 1: Identify repetitive tasks Start with things you or your team do daily: sending emails, answering the same customer questions, or pulling reports.

Step 2: Choose the right tools Here are a few to consider:

CRM automation: Zoho CRM, HubSpot, Salesforce

Marketing AI: Mailchimp, Jasper, Copy.ai

Finance AI: QuickBooks, Xero, FreshBooks

Operations: Zapier, Make, Monday.com

Step 3: Start small Automate one task, track the results, and build from there. For example, use an AI chatbot to handle FAQs, then expand to email automation.

Step 4: Train your team Make sure your team understands the tools and knows how to use them. Choose platforms with good customer support or training videos.

Step 5: Monitor and adjust Check how automation affects your time, customer satisfaction, and budget. Tweak your system as needed.

Are there real-world examples of small businesses using AI?

Yes. Many small businesses are already using AI to succeed:

Coffee shop in Chicago used AI-powered email marketing and saw a 35% increase in repeat customers.

Online craft store in Texas used AI chatbots and reduced customer support response time by 70%.

Digital marketing agency in Florida automated lead scoring with Zoho CRM and boosted conversion rates by 25%.

These are simple use cases with big impact. None of them required full-time IT staff.

What are the risks or downsides of using AI for small businesses?

Like any tool, AI comes with challenges:

Over-automation: Customers still want to talk to humans sometimes.

Data privacy: You need to make sure the tools you use are secure and follow data laws.

Learning curve: Some tools require time to learn or train properly.

Wrong expectations: AI helps — but it doesn’t solve every problem magically.

The key is to use AI where it makes sense, not everywhere.

What should I look for in an AI solution provider?

When choosing a tool or consultant, make sure they:

Understand your industry and business size

Offer setup, support, and training

Work with trusted AI platforms

Can show real examples and results

Help you integrate with tools you already use

Don’t just pick the tool with the flashiest features. Choose the one that solves your problems best.

Final thoughts: Is AI automation worth it for small businesses?

Yes. AI-powered automation is no longer just for big companies. It’s for any business that wants to:

Save time

Lower costs

Serve customers better

Grow smarter

By starting with small changes — like chatbots, email automation, or CRM updates — you can see big returns quickly. And as the tools grow smarter and more affordable, the benefits will only increase.

If you’re unsure where to begin or want expert guidance, AeyeCRM offers personalized support to help small businesses get started with cloud-based AI tools that drive real results.

1 note

·

View note

Text

Top Reasons to Trust Accounting Lane’s Online Accounting Experts for Your Business

With today's dynamic digital world, companies require effective and trustworthy financial management more than ever. With the assistance of reputed Online Accounting Experts, your company can change how it manages accounting, bookkeeping, and planning. Accounting Lane is a first-rate option for businesses that need convenient and precise financial services when it comes to reliable and advanced accounting solutions.

Following are the most important reasons why you should rely on Accounting Lane's Online Accounting Experts for your business requirements.

Proficiency with Online Accounting Applications

One of the biggest benefits of hiring Accounting Lane is their extensive experience in numerous Online Accounting Applications. With real-time access to your financial information, accuracy and transparency are guaranteed in your accounts. From well-known systems such as Xero and QuickBooks to bespoke accounting software, Accounting Lane's Online Accounting Specialists are skilled in merging and managing multiple systems that meet your individual business needs.

With sophisticated Online Accounting Applications, they automate bookkeeping, invoicing, payroll, and tax preparation tasks. Not only does this save time, but it also minimizes errors, allowing your business to remain compliant and financially sound.

Remote Accessibility and Convenience

With remote work and cloud technologies on the increase, it's important to have access to accounting services anytime, anywhere. Online Accounting Experts at Accounting Lane use cloud technology to offer you instant access to your financial information wherever you are. This ease makes business owners and managers able to make timely decisions based on current information without having to wait for physical copies or on-site inspections.

The convenience of being able to view your books over the web translates into the ability to monitor expense, handle invoices, and analyze financial performance using your PC or mobile device — ideal for entrepreneurs always on the move.

Tailored Solutions for Any Business

No two businesses are the same, and Accounting Lane understands that one-size-fits-all solutions rarely work. Their team of Online Accounting Experts takes the time to understand your business model, goals, and challenges to tailor accounting solutions that best fit your needs.

Whether you are a small startup, expanding small business, or mature enterprise, Accounting Lane provides scalable services that evolve with your firm. In addition to bookkeeping, they offer strategic financial planning, budgeting, and forecasting aimed at driving your long-term success.

Cost-Effective Financial Management

It can be costly to employ a full-time in-house accounting staff, particularly for small and medium-sized companies. Outsourcing your accounting requirements to Accounting Lane's Online Accounting Experts enables you to enjoy professional services without bearing the additional costs of salaries, benefits, and office space.

By using Online Accounting Applications, the team minimizes most mundane procedures, with less manual effort and decreasing the total expense of accounting services. Being cost-saving, you receive professional financial handling while keeping resources free to use elsewhere in your business.

Better Data Security and Compliance

Handling financial data online naturally raises concerns about security and privacy. Rest assured, Accounting Lane prioritizes data protection by using secure cloud platforms and stringent security protocols. Their Online Accounting Experts ensure that your financial information is encrypted, backed up, and safeguarded from unauthorized access.

Additionally, maintaining compliance with changing tax laws and money regulations is essential. The Accounting Lane team remains current on the most recent compliance mandates, ensuring you do not incur expensive penalties and audits. With their professional advice, your company is always compliant and audit-ready.

Real-Time Reporting and Insights

One of the major advantages of adopting Online Accounting Applications is having access to instant reports. Accounting Lane's Online Accounting Specialists grant you precise, accurate, and timely financial statements and information. This transparency enables you to track cash flow, profitability, and other key measures at any time.

With real-time data at your fingertips, you can make better decisions quicker, whether it's deciding where to invest next, keeping track of expenses, or getting ready for tax season. These actionable insights have the potential to be the difference-maker in keeping and expanding your business.

Expert Help and Dedicated Support

Working with Accounting Lane is more than contracting the services of an accountant; it's employing a valued advisor. Their Online Accounting Experts are on hand at all times to respond to questions, fix problems, and provide specialist guidance that is specific to the difficulties your business is facing.

No matter whether you require tax filing assistance, accuracy in books, or financial planning, Accounting Lane's specialists offer customized service that really matters. This connection is more than crunching numbers — it is about nurturing your business success every step of the way.

Conclusion

Selecting the proper accounting partner is essential to your business's financial well-being and success. From Accounting Lane's Online Accounting Experts, you receive a combination of technology-enabled solutions, one-on-one service, and professional financial advice. Their expertise in Online Accounting Applications guarantees that you receive safe, effective, and easily accessible financial management specific to your business.

By trusting Accounting Lane, you’re choosing a partner dedicated to helping your business succeed with reliable, cost-effective, and innovative accounting solutions. Ready to take your business to the next level? Connect with Accounting Lane’s Online Accounting Experts and experience the future of accounting today.

0 notes

Text

How Oracle HCM Solutions Helped Us Discover What Was Broken in Our Onboarding Process

At first glance, our hiring process at Avion Technology seemed to work just fine. We could attract talent, conduct interviews, and send out offer letters quickly. But as we began to scale, it became clear: our onboarding process had cracks we hadn’t even noticed.

While no single step was “broken,” the system was far from efficient. New hires were left waiting. HR was swamped. IT processes lagged. The result? A disjointed employee experience that impacted productivity and morale.

That’s when we turned to Oracle HCM Solutions—and everything changed.

What Wasn’t Working (That We Didn’t See Coming)

We weren’t short on talent. We were short on tools and structure. Here are just a few friction points we faced:

Paper-based onboarding documents

Manually triggered IT setups

Multiple systems for HR, payroll, and benefits

Repetitive data entry for every new hire

Delays in communication and inconsistent onboarding timelines

Individually, these issues were small. Together, they formed a major bottleneck.

The Shift to Oracle HCM Cloud

Switching to Oracle HCM Solutions was more than a tech upgrade—it was a strategic move. Here's what changed for the better:

Automated workflows drastically reduced onboarding time

E-signature tools removed paper-based delays

Employee self-service portals handled most new hire questions

Integrated systems connected HR, IT, and leadership in real time

The result? Faster onboarding, less HR stress, and a confident start for every employee.

Key Features That Make Oracle HCM Solutions Stand Out

Whether you're leading a mid-sized business or scaling a larger enterprise, Oracle HCM Cloud comes with a full suite of tools that make onboarding and HR management more intelligent:

Core HR: Unified employee records, global compliance

Talent Management: Smart recruiting, goal-setting, and performance tracking

Workforce Rewards: Compensation and benefits tools

Workforce Management: Time tracking, scheduling, leave requests

Employee Experience: Personalized onboarding journeys and AI-powered HR help desks

Analytics & Payroll Integration: Real-time data visibility and predictive insights

Why Hybrid Teams Need HCM More Than Ever

In hybrid and remote work models, smooth onboarding is no longer optional—it’s essential.

Oracle HCM Solutions are built to support distributed teams with:

Remote completion of onboarding tasks

Automated IT and HR coordination

Unified access to company policies, welcome kits, and team intros

Mobile-first design for anytime, anywhere accessibility

Manager dashboards to track onboarding progress

For companies managing multiple locations or remote employees, this centralized approach removes friction and creates consistency.

How We Help Others Do the Same

At Avion Technology, we’re not just users of Oracle HCM—we help other businesses implement it too. Our team offers:

Full implementation and configuration

Custom system integrations (ERP, payroll, CRM)

Workflow automation and employee portals

Post-launch support, training, and optimization

From our base in Schaumburg, Illinois, we help growing businesses across the U.S. modernize their HR and onboarding operations.

Frequently Asked Questions (FAQs)

1. Is Oracle HCM Cloud a good fit for small businesses? It works best for mid-size to large enterprises, especially those with complex workflows or distributed teams.

2. How long does it take to implement? Typical implementation takes 8–16 weeks, depending on customization and modules selected.

3. Can Oracle HCM integrate with payroll or CRM platforms? Yes. It integrates with popular systems like QuickBooks, ADP, and NetSuite.

4. What support is available post-implementation? Ongoing support includes training, user adoption, and continuous system optimization.

5. What makes Oracle HCM ideal for remote teams? Self-service onboarding, mobile access, and cloud-based tools ensure a smooth experience from any location.

Hiring is just the beginning. Let us help you deliver a seamless onboarding experience that retains top talent, boosts productivity, and scales effortlessly.

Get a Free HCM Readiness Assessment Let’s discover what’s slowing your onboarding down—and how Oracle HCM can fix it.

Contact Avion Technology today to get started.

#OracleHCM#HCMsolutions#DigitalOnboarding#HRTech#EmployeeExperience#HRTransformation#RemoteOnboarding#CloudHR#FutureOfWork#OraclePartner#TalentManagement#EmployeeSuccess#Avion Technology

0 notes

Text

Finding the Best ERP for Small Businesses: Expert Insights

Choosing the right ERP (Enterprise Resource Planning) system can be a game-changer for small businesses. When done right, it simplifies operations, boosts productivity, and creates a solid foundation for scale. But with so many ERP platforms in the market—each offering its own bells and whistles—the selection process can quickly become overwhelming. Here’s what to know before you commit.

What is ERP and Why Does It Matter?

ERP software centralizes core business operations—think finance, HR, sales, supply chain, inventory, and customer management—into a single, integrated system. It eliminates data silos, improves communication, and helps small businesses run smarter, not harder.

For smaller organizations, ERP can:

Reduce manual work by automating routine tasks

Deliver real-time insights that support faster, better decisions

Create operational consistency across departments

Scale easily as the business grows and evolves

How to Choose the Best ERP for Your Small Business

There’s no one-size-fits-all ERP solution. What works for a logistics startup might be overkill (or underwhelming) for a retail brand. When evaluating your options, keep these priorities top-of-mind:

Affordability: Look for flexible pricing models, especially SaaS or cloud-based ERPs with monthly subscriptions.

User Experience: An intuitive interface ensures your team actually uses the system.

Integration: The best ERP solutions play nicely with your existing tools—think QuickBooks, Shopify, Salesforce, etc.

Customization: Your business is unique. Your ERP should adapt to your workflows, not the other way around.

Scalability: Choose a system that won’t choke once your team, inventory, or data volume doubles.

Why Aptimized?

Aptimized, specializes in guiding small businesses demystify ERP and make decisions with confidence:

What sets Aptimized apart?

They take a business-first approach—focusing on your pain points before recommending tech.

Their experts work across industries and ERP platforms (NetSuite, SAP, Odoo, Microsoft Dynamics, and more).

They offer everything from ERP selection and implementation to post-launch support.

In short, they’re not here to push a product—they’re here to build solutions that work for you.

Ready to Find the Right ERP?

If your business is growing and your spreadsheets are groaning under the pressure, it’s probably time to level up. ERP doesn't have to be overwhelming—and you don't have to go it alone.

👉 Reach out to Aptimized for expert ERP guidance tailored to small businesses. Whether you're just starting the search or need help optimizing an existing setup, they’re ready to roll up their sleeves and help you win.

1 note

·

View note

Text

Discover the Best Timekeeping Software to Boost Accuracy and Productivity

Unlocking Efficiency: A Deep Dive Into the Best Timekeeping Software for 2025

In today's fast-paced digital work environment, the ability to track time accurately is not just a convenience—it’s a necessity. Whether you're managing a remote workforce, running a small business, or overseeing a large enterprise, the need for precise, real-time time tracking has made the search for the best timekeeping software more critical than ever. But with so many options on the market, how do you know which tool truly stands out?

Why Timekeeping Software Matters

Timekeeping software has evolved significantly over the years. Gone are the days of manual punch cards and spreadsheets. Today’s solutions are cloud-based, AI-enabled, and packed with features that not only record time but also help analyze productivity, allocate resources, and integrate seamlessly with other essential business tools.

The best timekeeping software does more than just track hours worked. It ensures labor law compliance, supports invoicing, enhances payroll accuracy, and gives insights into how teams spend their time. For businesses striving to improve operational efficiency and cut down on unnecessary costs, adopting a reliable timekeeping system is a game-changer.

Key Features to Look for in the Best Timekeeping Software

When evaluating your options, here are some crucial features to look for:

1. User-Friendly Interface

The best timekeeping software is easy for everyone to use, from tech-savvy professionals to those with limited technical experience. A clean, intuitive interface reduces training time and ensures quick adoption across your team.

2. Real-Time Tracking

Real-time tracking lets users clock in and out from any device, monitor task progress, and adjust workflows on the fly. This feature is especially beneficial for remote teams or businesses with mobile workforces.

3. Project and Task Management

Top-rated timekeeping tools offer integrated project management features. This allows teams to assign tasks, set deadlines, and track how much time is spent on each project or client.

4. Integration with Payroll and Accounting Software

One of the most valuable features of the best timekeeping software is its ability to integrate with tools like QuickBooks, Xero, Gusto, and others. This streamlines payroll processing and eliminates manual data entry errors.

5. Automated Reporting and Analytics

The ability to generate detailed reports and visual analytics gives business owners and managers the insights they need to make informed decisions. Whether it’s identifying bottlenecks or improving resource allocation, reporting tools are indispensable.

6. Cloud Accessibility and Mobile Support

With remote work on the rise, having cloud-based timekeeping software with mobile app support is no longer optional. Users should be able to track time from anywhere, anytime.

7. Compliance and Security

The best timekeeping software includes built-in compliance tools that help businesses follow labor laws, manage overtime, and handle break requirements. Additionally, secure data encryption and user access controls ensure sensitive information is protected.

Who Can Benefit From Timekeeping Software?

Small Businesses: Get better visibility into employee performance and reduce time theft.

Freelancers & Contractors: Accurately bill clients and manage multiple projects efficiently.

Enterprises: Improve resource planning, budget forecasting, and employee accountability.

Remote Teams: Stay connected, aligned, and productive with real-time collaboration tools.

Top Picks for the Best Timekeeping Software in 2025

While preferences will vary based on company size and needs, here are a few standout platforms that consistently rank among the best:

Clockify: A free, cloud-based timekeeping tool ideal for freelancers and small teams.

Toggl Track: Known for its beautiful interface and strong reporting features.

TSheets by QuickBooks: Great for businesses that already use QuickBooks and need seamless integration.

Hubstaff: Combines time tracking with employee monitoring and productivity analysis.

Harvest: Offers powerful invoicing and project budgeting features.

Each of these platforms excels in different areas, so it’s worth testing a few to determine which best matches your workflow and goals.

0 notes

Text

Discover the Best Timekeeping Software to Boost Accuracy and Productivity

Unlocking Efficiency: A Deep Dive Into the Best Timekeeping Software for 2025

In today's fast-paced digital work environment, the ability to track time accurately is not just a convenience—it’s a necessity. Whether you're managing a remote workforce, running a small business, or overseeing a large enterprise, the need for precise, real-time time tracking has made the search for the best timekeeping software more critical than ever. But with so many options on the market, how do you know which tool truly stands out?

Why Timekeeping Software Matters

Timekeeping software has evolved significantly over the years. Gone are the days of manual punch cards and spreadsheets. Today’s solutions are cloud-based, AI-enabled, and packed with features that not only record time but also help analyze productivity, allocate resources, and integrate seamlessly with other essential business tools.

The best timekeeping software does more than just track hours worked. It ensures labor law compliance, supports invoicing, enhances payroll accuracy, and gives insights into how teams spend their time. For businesses striving to improve operational efficiency and cut down on unnecessary costs, adopting a reliable timekeeping system is a game-changer.

Key Features to Look for in the Best Timekeeping Software

When evaluating your options, here are some crucial features to look for:

1. User-Friendly Interface

The best timekeeping software is easy for everyone to use, from tech-savvy professionals to those with limited technical experience. A clean, intuitive interface reduces training time and ensures quick adoption across your team.

2. Real-Time Tracking

Real-time tracking lets users clock in and out from any device, monitor task progress, and adjust workflows on the fly. This feature is especially beneficial for remote teams or businesses with mobile workforces.

3. Project and Task Management

Top-rated timekeeping tools offer integrated project management features. This allows teams to assign tasks, set deadlines, and track how much time is spent on each project or client.

4. Integration with Payroll and Accounting Software

One of the most valuable features of the best timekeeping software is its ability to integrate with tools like QuickBooks, Xero, Gusto, and others. This streamlines payroll processing and eliminates manual data entry errors.

5. Automated Reporting and Analytics

The ability to generate detailed reports and visual analytics gives business owners and managers the insights they need to make informed decisions. Whether it’s identifying bottlenecks or improving resource allocation, reporting tools are indispensable.

6. Cloud Accessibility and Mobile Support

With remote work on the rise, having cloud-based timekeeping software with mobile app support is no longer optional. Users should be able to track time from anywhere, anytime.

7. Compliance and Security

The best timekeeping software includes built-in compliance tools that help businesses follow labor laws, manage overtime, and handle break requirements. Additionally, secure data encryption and user access controls ensure sensitive information is protected.

Who Can Benefit From Timekeeping Software?

Small Businesses: Get better visibility into employee performance and reduce time theft.

Freelancers & Contractors: Accurately bill clients and manage multiple projects efficiently.

Enterprises: Improve resource planning, budget forecasting, and employee accountability.

Remote Teams: Stay connected, aligned, and productive with real-time collaboration tools.

Top Picks for the Best Timekeeping Software in 2025

While preferences will vary based on company size and needs, here are a few standout platforms that consistently rank among the best:

Clockify: A free, cloud-based timekeeping tool ideal for freelancers and small teams.

Toggl Track: Known for its beautiful interface and strong reporting features.

TSheets by QuickBooks: Great for businesses that already use QuickBooks and need seamless integration.

Hubstaff: Combines time tracking with employee monitoring and productivity analysis.

Harvest: Offers powerful invoicing and project budgeting features.

Each of these platforms excels in different areas, so it’s worth testing a few to determine which best matches your workflow and goals.

0 notes

Text

How to Choose the Right Accounting Software in 2025

Introduction

Let's face it, accounting is not the most interesting part of running any business. However, having a clunky and out-of-the-date accounting software makes it even harder. There are numerous smart, efficient tools in the market in the year 2025-the feat is choosing a right one.

Importance of Choosing Right Software

Financial Accuracy

A good accounting tool always ensures that your numbers are spot-on, and the best ways to avoid expensive accidents are to minimize such events.

Efficiency in Time

The time spent on bookkeeping by spending hours on the work can be leveraged by adopting automation.

Tax Compliance

Keeping up with tax laws is less stressful when the software does all the compliance automatically for the user, be it GST or VAT.

Key Features Required in 2025

Cloud-Based Access

Remote working is here to stay. Use software you could access anytime, anywhere.

Automation Capabilities

From automatic invoices to repetitive payments, automation is time saving.

Real-time Reporting

Faster reporting means better decisions.

Integration with Other Tools

Your accounting software should integrate with CRM, payroll, and e-commerce platforms.

User-Friendly Interface

Even if you are not an adept ''numbers'' person, however, surfing through the software would not be a lengthy mission but an easy and straightforward process.

Know Your Business Need

Business Size and Industry

Same features will not be fit to small business enterprises as compared to large organizations. So, choose accordingly.

Number of Users

Let the entire team get access without any overburden of licenses.

Customization Needs

Special report or industry feature? Look for a customizable dashboard and workflow.

Budget Considerations

One-Time Versus Subscription Pricing

Both have their advantages and disadvantages, just be sure it fits into your cash flow model.

Hidden Costs

Beware of paying extra for updates, support, or integrations.

Security and Compliance

Data Encryption

Your financial data deserves to be Fort Knox tight.

GDPR & Local Tax Compliance

Make sure the software adheres to the rules and regulations of your country.

Customer Support and Training

For questions, you want quick and happpy answers and resources for getting started.

Scalability for Future Growth

Choose software that grows with you-because staying static chairs isn't really the plan.

Reviews and Recommendations

Don't just trust the ads. Read reviews of real users and ask for peer recommendations.

Free Trials and Demos

Most reputed tools offer at least a 14-day free trial, but before you pay, have a test drive.

Popular Accounting Software Options in 2025

Tririd Biz

QuickBooks Online

Zoho Books

Xero

FreshBooks

Common Mistakes

Neglecting to check if it is scalable

Not checking integration options

Paying too much for features rarely used

Choosing solely on price

Final Checklist Before Buying

It supports your business size

Within the budget

Automation and integrations

Security and compliance

User-friendly and scalable

Conclusion

Choosing your accounting software for 2025 need not be an insurmountable task. Simply take the time to evaluate your needs and try out the tools before deciding on the option that really fits your business. Think of it as the hunt for the right pair of road-running shoes—the more fitting they are, the less difficult the race will become.

Visit Our Website: The Powerful & Handy Accounting software

FAQs

1. What is the best accounting software for small businesses in 2025?

Tririd Biz, Zoho Books, and QuickBooks Online are the top picks for small to medium enterprises.

2. Should I choose online or offline accounting software?

Cloud-based is more flexible and accessible—great for remote teams and modern businesses.

3. How much should I budget for accounting software?

Prices vary according to the software's sophistication, but expect subscription fees of US$10-70 per month; always check for hidden fees.

4. Can accounting software help with filing taxes?

Yes! Modern tools usually offer automation features to help in tax compliance and filing.

5. What if I don’t know the first thing about accounting?

Don’t worry—most programs have been designed for the beginner in mind and will provide tutorials, FAQs, and support teams.

#Best Accounting Software in 2025#Small Business Accounting Software#Business Financial Management#Tririd Biz Accounting Software#Best accounting software in india

0 notes

Text

Every business owner wants to see their business succeed. With the right strategy, the business could grow and achieve the set targets. However, without proper planning, it could go bankrupt within the first year. One of the reasons a business fails is not having their finances right. Monitoring how money is coming in and out is equally as important as hiring the right people for your company. The right accounting software helps in tracking expenses, invoicing, reconciliation and so much more. Choosing the best accounting software can be challenging because each has a set of different features and pricing. Here are some things to consider when sourcing for one: The usability- how many users can use the software? Does it have a mobile version? Is it cloud-based or desktop software? Costs- this should not be the primary determinant. Do you need one with has extra features or just simple accounting software? Features-What features are you looking for? One that has simple to basic functions or a comprehensive one? Do you need it also to track inventory? Do you need an all-in-one package? Project management, time tracking, invoicing and such? Review of some of the top accounting software 1. QuickBooks Online QuickBooks apps have been the number one choice of CPA`s and Bookkeepers when it comes to ease of use. Most of the Bookkeepers prefer using QuickBooks Enterprise Hosting on their cloud Citrix XenDesktop to work remotely from anywhere on any device in a multi-user environment. This software is ideal for small businesses. Some of its features include: Bookkeeping: It lets you connect your bank and credit accounts for your automatic downloads. Tracking expenses: Once you’ve connected the accounts, QuickBooks helps you import and categorizes the expenses for you. You can as well save photos of receipts, and the software will help assign the costs to the right account. Managing bills: The software comes with an in-built bill pay organizer. In most cases, there are bills you don’t pay as soon as you get them. QuickBooks helps you track them and their due dates all in one place which makes it easier to pay on time and avoid accruing penalty fees. Receipt scanner: The QuickBooks app has an in-built receipt scanner which lets you take a photo of the receipt and the software saves the scanned receipt for documentation purposes as well as attaching it to the expenses section. Pricing: The most basic plan is $10/month. When installing QuickBooks, sometimes a compatibility error can occur, and it’s important to know how to deal with it. Sometimes, you try downloading it from your browser, and it brings a DNS error. It is important to know How to Fix the Google Chrome DNS as it could be what prevents you from downloading the software. 2. FreshBooks Invoicing: FreshBooks helps you create professional invoices by letting you add your logo. Credit card payment: It allows your clients to pay you for work rendered and online and you receive the money up to 11 days faster. You can automate your business in a way the software follows up on your behalf about payment. It is easier to choose your currency and invoice from anywhere as there is a mobile app. You can add invoice due dates and offer discounts easily. There is no need to calculate your sales tax as FreshBooks will do it for you automatically. There is also time tracking where you can bill for tracked hours. FreshBooks is a great project management software as well. You can add team members for a particular project to keep communication active and make sure the project is completed. Pricing: The most basic plan starts at $7.50/month 3. Sage Business Cloud Accounting Sage Business Cloud Accounting is suitable for both small and medium-sized businesses. The software is specifically for qualified bookkeepers and accountants. Features: Bank integration and reconciliation: it links clients’ bank accounts to the business to save on time and reduce errors. The software makes bank reconciliation more error-free.

It is easy to use and is cloud: based hence no backups or updates needed. Invoicing-Sage helps you customize invoices and lets you record when you get paid for them. Generating statements: Generating statements such as balance sheets is possible with this software, and you can even create IRS 1099 forms for employees. Sage can also issue clients' credit notes for any returned items. There is also an unlimited user collaboration. 4. Zoho Books Zoho Books is a cloud: based which makes it easy to use from anywhere. Bill generation- Zoho Books allows you to create and send client bills online and it automatically adjusts the stock level when clients receive goods. Expense management: Zoho allows you to track any expenses incurred to help you make financial decisions. There is an auto-scan feature that captures any critical information on the document scanned and uploads it directly for easy access and reporting. Other features include: customizing invoices, keeping track of your taxes and scheduling reports. Pricing: the basic plan starts at $9/month. Investing in accounting software requires you to know your business needs. Do you want something that is scalable and can grow with your business or not? Purchase wisely as this has the potential of helping you realize your profits sooner than you thought you would. Article Updates Article updated on October 2019 - Minor content updates and links fixed.

0 notes

Text

Inventory tracking method : The crucial to Effective Inventory Management

In moment's fast- paced business terrain, Inventory tracking method are essential for icing that businesses can manage their stock efficiently and meet client demands. With a well- enforced system, businesses can minimize losses, ameliorate cash inflow, and increase overall productivity. In this blog, we will explore the different Inventory tracking method available, their benefits, and how businesses can work them for success.

What Are Inventory Tracking styles?

Inventory tracking method relate to the processes or systems businesses use to cover, manage, and track the volume and position of their stock. These styles insure that the business always has the right quantum of products at the right time, precluding stockouts or overstocking. Effective force shadowing is a crucial element of force chain operation, impacting everything from order fulfillment to cash inflow.

Types of Inventory Tracking styles

When it comes to Inventory tracking method, there are colorful approaches that businesses can choose from grounded on their requirements. Each system has its pros and cons, and the stylish choice depends on the type of products, deals volume, and available coffers.

1. Barcode Inventory Tracking

One of the most common Inventory tracking method is barcode scanning. In this system, each product is assigned a unique barcode. When an point is vended or entered, the barcode is scrutinized, and the force system automatically updates the stock situations. Barcode tracking systems are effective and accurate, making them ideal for businesses that need real- time visibility into force situations.

Benefits of Barcode Inventory Tracking

Accuracy Reduces mortal crimes in force operation.

pets Speed up the process of force updates and shadowing.

Real- time Updates Instant updates make it easier to manage force across multiple locales.

2. Radio frequence Identification( RFID)

RFID is another advanced force shadowing system. It uses radio swells to transmit information about a product's position and status. RFID markers, unlike barcodes, do n't bear direct line- of- sight to be scrutinized. This system is particularly salutary for businesses with high- value particulars or large amounts of stock, as it can track multiple particulars contemporaneously.

Benefits of RFID force Tracking:

Enhanced effectiveness Track large volumes of force in real- time.

No Need for Line- of- Sight Unlike barcode systems, RFID does not bear visual contact with the point.

Reduced Labor Costs The robotization of force counting and streamlining reduces the need for homemade labor.

3. Homemade force Tracking

For lower businesses or those with limited coffers, homemade force shadowing might be the go- to system. This system involves physically counting force on a regular base and recording the data in a spreadsheet or a paper tally. While this system is low- cost, it can be time- consuming and prone to mortal error.

Benefits of Homemade force Tracking:

Low- Cost No need for advanced technology or software.

Simple Easy to apply for small- scale operations.

Inflexibility Can be customized to suit specific business requirements.

4. Inventory Management Software

For larger businesses or those with complex force requirements, force operation software provides a more robust result. These systems integrate colorful shadowing styles( like barcodes or RFID) with data analysis tools, helping businesses track stock situations, reorder points, and deals trends. Popular software includes SAP, Oracle, and QuickBooks.

Benefits of Inventory Management Software:

robotization Reduces homemade labor and crimes by automating numerous tasks.

Data Analytics Provides precious perceptivity into deals trends and force performance.

Scalability Suitable for businesses of all sizes, from small startups to large enterprises.

5. Just- by- Time( JIT) Inventory Tracking

Just- by- Time( JIT) is an force shadowing system that focuses on keeping minimum stock situations and ordering force only when demanded. This approach minimizes storehouse costs and the threat of overstocking. JIT requires precise demand soothsaying and a strong relationship with suppliers to insure timely deliveries.

Benefits of JIT Inventory Tracking:

Cost Savings Reduces force holding costs by maintaining low stock situations.

Streamlined Operations Encourages effective product and ordering processes.

Inflexibility Allows businesses to acclimate snappily to changing request demands.

6. Periodic Inventory System

Under the periodic force system, force is counted at specific intervals, similar as daily, yearly, or annually. Unlike the perpetual system, which continuously tracks force, periodic systems update stock situations only after a physical count. This system is generally used by small businesses with lower deals volumes.

Benefits of Periodic force Tracking:

Lower Costs Less investment in technology and systems compared to perpetual systems.

Simple to Implement Ideal for small businesses with smaller force particulars.

Easy to Manage Requires lower time for diurnal shadowing compared to real- time systems.

How to Choose the Right force Tracking Method

Choosing the right force shadowing system depends on several factors, including the type of business, budget, and functional complexity. Businesses with high deals volume or a wide range of products may profit from advanced systems like RFID or barcode scanning. On the other hand, lower businesses with smaller products may find homemade shadowing or a periodic system sufficient.

Consider these crucial factors when choosing an force shadowing system

Deals Volume Advanced volumes frequently bear automated systems like barcode or RFID shadowing.

Budget lower businesses may conclude for low- cost styles like homemade shadowing or periodic systems.

Product Complexity Businesses with complex products or multiple variants may need a more sophisticated system, like force operation software.

The Benefits of Effective force Tracking

enforcing an effective force shadowing system can offer a range of benefits for businesses

Improved Cash Flow By maintaining optimal force situations, businesses can free up cash that would else be tied up in redundant stock.

Reduced Stockouts and Overstocking Accurate shadowing ensures businesses have the right quantum of stock at the right time.

More Decision- Making Real- time data allows for further informed purchasing and product opinions.

Conclusion

In conclusion, opting the right force shadowing system is pivotal for effective force operation. Whether you choose barcode scanning, RFID, force operation software, or a homemade system, the thing is to streamline force processes, reduce crimes, and insure that your business can meet client demands. By understanding the different Inventory tracking method and their benefits, you can choose the stylish approach for your business’s requirements.

FAQs

1. What are the most common force shadowing system?

The most common Inventory tracking method include barcode scanning, RFID, homemade shadowing, force operation software, and periodic force systems.

2. Which force shadowing system is stylish for small businesses?

For small businesses, homemade shadowing or periodic force systems may be the most cost-effective and straightforward styles. As the business grows, they may consider transitioning to barcode scanning or force operation software.

3. Can Inventory tracking method help reduce losses?

Yes, effective Inventory tracking method can minimize losses by icing accurate stock situations, reducing theft or corruption, and precluding overstocking or stockouts.

4. What's RFID, and how does it work in force shadowing?

RFID( Radio frequence Identification) is an advanced force shadowing system that uses radio swells to track products automatically without demanding a direct line of sight. RFID markers transmit data to RFID compendiums , which modernize force situations in real- time.

5. How does an force shadowing system ameliorate decision- making?

By furnishing real- time and accurate data, an force shadowing system enables businesses to make further informed opinions about stock situations, reorder points, and copping strategies, leading to more effective operations.

With these Inventory tracking method, businesses can optimize their force processes, ameliorate profitability, and insure client satisfaction. Choosing the right system is crucial to staying competitive in moment’s request.

0 notes

Text

A Complete Guide to SaaS Integration Platforms

If you're juggling too many apps and still struggling to keep things streamlined, you're not alone. SaaS apps are lifesavers, but if they're not talking to each other, they're just more hassle. The solution? SaaS integration platforms. This guide will walk you through everything you need to know, step by step.

What Exactly is a SaaS Integration Platform?

A SaaS integration platform lets your cloud-based apps share data effortlessly. Think of it as the glue holding your apps together, ensuring smooth, automatic communication without any manual hassle.

Why Do You Need SaaS Integrations?

Let's keep it simple. Without integrations:

You manually enter data repeatedly.

Errors pile up quickly.

Processes slow down.

Your team becomes frustrated.

With integrations, apps sync automatically, workflows are smooth, and life becomes much easier.

Key Benefits of Using SaaS Integration Platforms

Here’s how integration platforms change your business:

Saves You Time

By automating repetitive tasks, integration platforms let your team focus on bigger things—like growing your business.

Keeps Data Clean

No more duplicates or inconsistencies. Data flows smoothly between platforms, always staying accurate and updated.

Boosts Productivity

With fewer manual tasks, productivity skyrockets. Your team is happier and more efficient.

Cost-Effective

Cutting down manual tasks reduces labor costs. Your budget, thank you.

Different Types of SaaS Integrations

Let’s look at three common integration types:

App-to-App Integration

Connecting two apps directly for instance, linking Salesforce to Slack, so your sales team instantly gets notifications about new leads.

Data Integration

Synchronizes data between platforms. Imagine your CRM data always matching your marketing database—no effort required.

Workflow Automation

Automates complete business processes. A customer fills a form, triggering automatic actions like CRM updates, email campaigns, and billing.

Common Use Cases for SaaS Integration

Here are the scenarios businesses most often use integrations for:

CRM Integration: Connect Salesforce or HubSpot with email marketing apps for automatic follow-ups.

Billing Automation: Automatically link Stripe with accounting apps like QuickBooks or Xero.

Customer Support: Sync Zendesk with your CRM to track customer interactions seamlessly.

How SaaS Integration Platforms Actually Work

APIs

APIs let software communicate. SaaS platforms use APIs to send and receive data automatically.

Triggers and Actions

Something happens in one app (trigger), prompting another app to respond automatically (action).

Middleware

Middleware translates information between apps, ensuring smooth communication even when apps aren’t designed to work together.

Top SaaS Integration Platforms in 2025

Some integration platforms are game-changers. Here’s a quick rundown:

Zapier: Easy to use, perfect for small businesses.

Workato: Ideal for larger teams needing advanced integrations.

Konnectify: Great for embedding integrations directly into your app.

Tray.io: Offers extensive customization with low coding effort.

MuleSoft: Robust platform for enterprises requiring complex integrations.

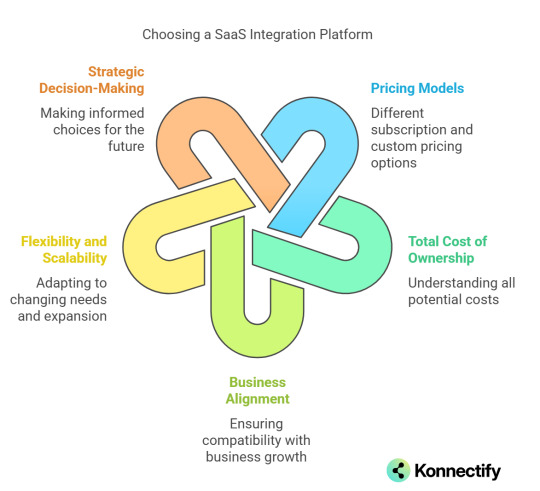

Choosing the Best SaaS Integration Platform

When picking a platform, ask yourself these questions:

Ease of use: Can non-tech folks use it?

Scalability: Will it grow with your business?

Security: Does it meet standards like GDPR or HIPAA?

Cost: Does it fit your budget?

Steps to Implement SaaS Integrations

Ready to get started? Follow these easy steps:

Identify Your Needs: List your apps and figure out what you want to automate.

Choose Your Platform: Pick the integration tool that fits your needs.

Configure the Integration: Set up triggers and actions clearly.

Test and Launch: Test thoroughly, then roll it out to your team.

Common Challenges (and How to Avoid Them)

Integrations aren’t always perfect. Watch out for:

Limited APIs: Some apps might restrict access.

Data Issues: Different formats can create chaos.

Security Concerns: Always pick secure platforms.

Scalability Problems: Make sure your chosen platform can grow alongside you.

Best Practices for Smooth SaaS Integration

Keep things smooth by:

Clearly defining what you need.

Regularly updating and maintaining your integrations.

Monitoring your integrations frequently to catch issues early.

How to Measure the Success of Integrations

Look at these metrics:

Reduction in manual workload

Data accuracy improvements

Productivity boosts

Decreased error rates

Using analytics tools (like Google Analytics) helps you track these changes clearly.

The Future of SaaS Integrations

Integration platforms are constantly evolving. Here’s what's coming next:

AI-driven Integrations: AI will soon predict your integration needs.

Low-code/no-code Solutions: Platforms anyone can use, even without coding skills.

Hybrid Integrations: Seamless links between cloud and traditional on-premise software.

Real-Life Examples of Successful SaaS Integrations

Real-world companies doing integrations right:

Uber: Integrates payment systems, maps, and user ratings effortlessly.

Netflix: Connects billing, user data, and recommendations flawlessly.

Conclusion

SaaS integration platforms aren't just convenient—they're essential. They transform your business from scattered apps into one streamlined, efficient machine. Ready to get started?

FAQs

1. Is SaaS integration expensive? Not always. Pricing varies widely—small businesses have affordable, scalable options.

2. Do integrations require coding knowledge? No! Most modern platforms require minimal to zero coding knowledge.

3. Can integrations improve my customer experience? Definitely. Faster responses and accurate data sharing mean happier customers.

4. How secure are integrations? Leading platforms have robust security measures, so pick a trusted provider.

5. Can SaaS integration platforms scale with my business? Yes—most quality platforms offer flexible, scalable plans suitable for growth.

Please don’t forget to leave a review.

#it services#saas#saas development company#saas platform#information technology#software#b2b saas#saas technology#software development#ipaas

1 note

·

View note

Text

Top 10 Time Tracking Apps for Remote Workers Across Different Countries

Remote work is becoming the new norm across the world, making Time Tracking Apps essential for businesses to monitor productivity and ensure fair compensation. Whether it’s for freelancers, small businesses, or large enterprises, time tracking helps in efficient work management. Among the top solutions, Desktrack Demo provides an insightful look into how tracking software can improve workflows. Additionally, Clock-In Clock-Out Apps are crucial for maintaining accurate work records.

In this article, we explore the top 10 Time Tracking Apps used by remote workers globally.

1. Desktrack

Why Choose Desktrack?

Automated time tracking and activity monitoring

Real-time application and website tracking

Desktrack Demo available for testing features before purchase

Screenshot capturing for transparency

Payroll and invoice generation integration

Desktrack is ideal for businesses looking for a detailed monitoring system to improve productivity and optimize workflows.

2. Toggl Track

Key Features:

One-click time tracking

Intuitive and simple UI

Detailed reports and analytics

Works across multiple devices

Toggl Track is a great choice for freelancers and teams that need flexible time tracking with minimal manual input.

Read More: Top 16 Free & User-Friendly Timer Apps for Windows in 2025

3. Clockify

Key Features:

Unlimited users for free

Clock-in and clock-out tracking

Project and task tracking

Integration with multiple work tools

Clockify is perfect for businesses seeking a cost-effective solution with unlimited tracking features.

4. Hubstaff

Key Features:

GPS tracking for remote teams

Screenshot monitoring

Payroll and invoice generation

Productivity measurement tools

Hubstaff is best suited for companies managing large remote teams that require real-time monitoring.

5. Time Doctor

Key Features:

Focused on productivity tracking

Website and application usage monitoring

Automated time tracking

Distraction alerts

Time Doctor is perfect for organizations that want to prevent time wastage and maximize employee efficiency.

6. Harvest

Key Features:

Time and expense tracking

Seamless invoicing features

Integration with project management tools

Easy-to-read reporting dashboards

Harvest is a great tool for freelancers and consultants who need to track both billable hours and expenses.

7. RescueTime

Key Features:

Automatic activity tracking

Productivity analysis

Goal-setting for better time management

Focus mode for distraction-free work

RescueTime is best for individuals and professionals looking to enhance focus and time management.

8. Timely

Key Features:

AI-powered time tracking

Calendar-based tracking system

Easy integrations with work tools

Automatic timesheet generation

Timely is ideal for businesses that need minimal manual intervention and AI-driven tracking for improved accuracy.

9. Everhour

Key Features:

Team collaboration features

Task and project tracking

Works within project management tools

Budgeting and forecasting tools

Everhour is best for teams that need seamless integration with project management software.

10. QuickBooks Time (formerly TSheets)

Key Features:

GPS-based tracking

Clock-in and clock-out options

Payroll and invoicing integration

Mobile-friendly interface

QuickBooks Time is a great choice for businesses needing accurate time tracking and seamless payroll integration.

Read More: 15 Best Computer Tracking Software in India for 2025

How to Choose the Right Time Tracking App?

When selecting a Time Tracking App, consider the following factors:

Ease of Use – Is the app user-friendly?

Features – Does it offer time tracking, invoicing, and reporting?

Integration – Can it integrate with your existing work tools?

Pricing – Is it budget-friendly?

Demo Availability – Try the Desktrack Demo before purchasing to test features.

Conclusion

Time tracking is essential for remote workers and businesses to maintain productivity and ensure accurate billing. From AI-powered solutions like Timely to manual options like Clockify, there is a variety of Clock-In and Clock-Out Apps available to suit different needs. Whether you opt for Desktrack for its advanced tracking features or QuickBooks Time for payroll integration, choosing the right app can significantly impact work efficiency. Start with a demo version to find the best fit for your business!

0 notes

Text

What is the Difference Between Manual Accounting and e-Accounting?

Introduction

Accounting has been the backbone of businesses for centuries, evolving from traditional bookkeeping methods to modern digital solutions. In today’s fast-paced world, e-Accounting is revolutionizing how financial records are managed, making processes more efficient and error-free. But how does it compare to manual accounting? Let’s explore the key differences between the two and understand why e-Accounting is becoming the preferred choice for businesses and professionals.

Understanding Manual Accounting

Manual accounting is the conventional practice of recording transactions on paper with the help of physical registers, ledgers, and journals. It involves accountants doing arithmetic calculations, keeping records, and making financial statements manually. Manual accounting has been practiced for centuries and is popular among small businesses that have a small scale of operations.

Characteristics of Manual Accounting:

Transactions are recorded manually in books and ledgers.

Requires human labor for calculations and financial statements.

Time-consuming and susceptible to human mistakes.

No automation, making data retrieval challenging.

No access to real-time data; updates need manual inputs.

Understanding e-Accounting

With advancements in technology, e-Accounting has emerged as a modern approach to financial management. It involves using accounting software and cloud-based platforms to maintain financial records digitally. This method is widely used in corporate businesses, small enterprises, and even startups due to its efficiency, accuracy, and automation.

Key Features of e-Accounting:

Transactions are recorded digitally using accounting software.

Automated calculations minimize human errors.

Provides real-time access to financial data.

Cloud storage allows remote access to data.

Quicker processing and report creation.

Key Differences Between Manual Accounting and e-Accounting

Factors

Manual Accounting

e-Accounting

Recording Transactions

Handmade using ledgers and journals.

Electronic through software such as Tally, QuickBooks, and SAP.

Possibility of Errors

High likelihood of errors in calculations and human mistakes.

Less possibility of errors through automated calculations.

Data Security

Susceptible to damage, loss, or theft.

Safe through cloud storage and password protection.

Time Consumption

Takes a lot of time in calculations and report generation.

Quicker processing with automation and real-time report generation.

Cost Effectiveness

Lower in cost initially but involves extra expenditure on storage and maintenance.

Economical in the long term, saving paper and labor charges.

Data Accessibility

Restricted accessibility; physical presence is needed.

Accessible at all times, any place with an internet connection.

Why Businesses Are Moving to e-Accounting

The change in financial management through digital technology has prompted enterprises to move toward e-Accounting because it is efficient and reliable. Listed below are a few important reasons why e-Accounting has become the preference:

1. Real-Time Data Access

Unlike manual accounting, where accounts are updated periodically, e-Accounting offers instant access to data. Companies can monitor their financial position in real time, resulting in improved decision-making.

2. Accuracy and Error Minimization

Manual calculations tend to result in errors, which may lead to financial inconsistencies. With e-Accounting, automated processes guarantee accuracy, minimizing the chances of errors in financial reporting.

3. Time and Cost Savings

Traditional accounting takes hours of work to prepare financial statements. e-Accounting automates most processes, conserving precious time and minimizing costs related to paper records, storage, and manpower.

4. Safe Data Storage and Backup

Paper records are susceptible to loss, destruction, or theft. e-Accounting systems provide cloud-based storage, which secures data, provides automatic backup, and has limited access for authorized personnel.

5. Compliance with Tax Regulations

Most e-Accounting systems have in-built tax compliance functions, allowing for easy, error-free filing of GST, TDS management, and financial reporting. This keeps a company legally compliant without extra efforts.

Should You Learn e-Accounting?

For students and working professionals who want to pursue a career in accounting, learning e-Accounting is necessary. Since more and more businesses are depending on computerized accounting software, knowing e-Accounting tools such as Tally, QuickBooks, SAP, and Excel can provide job opportunities that can earn you a good income. If you are looking to become an accountant, tax advisor, or financial analyst, possessing e-Accounting skills can make you stand out in the employment market.

Conclusion

Though manual accounting has been a reliable practice for years, e-Accounting is the way forward for financial management. Its capacity to provide speed, accuracy, security, and accessibility makes it the first choice for companies and professionals. By embracing digital accounting tools, students and future accountants can improve their skills and remain competitive in the finance sector.

If you are in search of an institute to study e-Accounting with hands-on training, register yourself with a well-known accounting institution that provides practical learning on Tally, GST, and financial reporting. A well-structured course can lay a solid foundation and equip you with expertise in contemporary accounting practices. Visit us:

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

#e accounting#gst course#tally course#tally prime#finance#tally course in yamuna vihar#tally software#tally course in uttam nagar#tally course academy#tally institute#GST course in yamuna nagar#GST course in uttam nagar

0 notes

Text

Does Odoo integrate with QuickBooks?

Yes, Odoo can seamlessly integrate with QuickBooks, providing businesses with an efficient way to manage accounting and ERP functions in a unified platform. With Odoo Integration, you can synchronize data between these two powerful tools, ensuring that your financial and operational workflows are streamlined.

Why Integrate Odoo with QuickBooks?

Combining Odoo’s robust ERP capabilities with QuickBooks’ accounting excellence offers several benefits:

Centralized Data Management Integrating Odoo with QuickBooks ensures that all financial data, such as invoices, payments, and expenses, is automatically synchronized across platforms.

Enhanced Financial Reporting Access real-time reports and analytics with synchronized data, making it easier to track financial performance and make data-driven decisions.

Streamlined Workflow Automate data transfer between Odoo and QuickBooks, eliminating the need for manual entry and reducing the risk of errors.

Improved Tax Compliance Synchronizing Odoo’s sales data with QuickBooks’ accounting tools makes it easier to track tax obligations and generate accurate reports during tax season.

Time and Cost Efficiency Automating accounting processes through integration saves time and resources, allowing businesses to focus on growth.

How Does Odoo-QuickBooks Integration Work?

Through APIs or specialized connectors, Odoo and QuickBooks can work together seamlessly. Here’s how the integration functions:

Invoice Sync: Sales orders and invoices generated in Odoo are automatically reflected in QuickBooks.

Payment Records: Payments processed in QuickBooks are updated in Odoo for consistent records.

Expense Tracking: Expenses recorded in QuickBooks are synced with Odoo to provide a complete financial overview.

Customer and Vendor Data: Keep customer and vendor profiles updated across both platforms for accurate CRM and procurement.

Inventory and COGS: Inventory adjustments and Cost of Goods Sold (COGS) calculations are automated between the two systems.

Benefits of Entrivis Tech’s Odoo Integration Services

Entrivis Tech Pvt Ltd offers customized Odoo Integration solutions, ensuring a smooth and effective connection between Odoo and QuickBooks. Key advantages include:

Custom Solutions: Tailored integrations to meet your business requirements.

Error-Free Implementation: Reliable syncing of financial data without disruptions.

Scalable Options: Designed to grow alongside your business needs.

Ongoing Support: Comprehensive technical support to address any challenges.

Who Should Consider This Integration?

Small Businesses: Simplify accounting and ERP processes to save time and resources.

Growing Enterprises: Scale operations efficiently with real-time data synchronization.

E-Commerce Businesses: Manage inventory, sales, and finances effortlessly.

Final Thoughts

Odoo and QuickBooks are powerful tools on their own, but their integration creates a comprehensive solution for managing business operations and finances. Whether you’re looking to simplify processes or improve financial accuracy, this integration is worth exploring.

Entrivis Tech Pvt Ltd specializes in providing top-notch Odoo Integration services. Contact them today to discover how they can help you achieve a seamless connection between Odoo and QuickBooks!

0 notes

Text

Bookkeeper South Jersey

Bookkeeper South Jersey: Why You Should Hire a Professional Keeping your finances organized is essential for the success of any business, whether you’re a small local shop or a growing enterprise in South Jersey. However, managing books is no small task. From tracking daily transactions to preparing financial reports, bookkeeping requires attention to detail, time, and a good understanding of accounting principles. If you’ve been considering handling your business’s bookkeeping yourself or delegating it to someone inexperienced, it’s worth taking a step back. Hiring a professional bookkeeper in South Jersey can save you time, reduce stress, and improve the accuracy of your financial records. Here’s why working with an expert is a smart investment.

What Does a Bookkeeper Do? Bookkeepers play a critical role in maintaining accurate financial records for a business. Their responsibilities typically include recording daily transactions, reconciling bank statements, managing accounts payable and receivable, preparing invoices, and assisting with payroll. Unlike an accountant who focuses on broader financial strategies and tax filings, a bookkeeper ensures your day-to-day finances are in order. They create the foundation upon which accountants and financial planners can build strategic insights.

The Benefits of Hiring a Bookkeeper

Expertise and Accuracy Professional bookkeepers are trained to handle financial records with precision. They understand how to properly categorize transactions, track expenses, and ensure that your books are balanced. Mistakes in bookkeeping can lead to cash flow issues, missed tax deductions, and even legal trouble. By hiring a qualified bookkeeper in South Jersey, you reduce the risk of errors and gain peace of mind knowing your financial records are accurate and up to date.

Time Savings Running a business is demanding, and managing your books can quickly become a time-consuming task. By outsourcing your bookkeeping, you free up valuable time to focus on other aspects of your business, such as serving customers, managing employees, or planning growth strategies. A professional bookkeeper can handle your financial records efficiently, allowing you to spend your time where it’s needed most.

Better Financial Insights When your books are well-organized, you gain a clearer picture of your business’s financial health. A professional bookkeeper can provide reports that help you understand your cash flow, track profitability, and identify trends or areas of concern. These insights are invaluable for making informed decisions about your business’s future.

Why DIY Bookkeeping is Risky Many business owners in South Jersey consider managing their own bookkeeping to save money. While this approach may seem cost-effective initially, it often leads to costly mistakes. Without proper training and tools, it’s easy to misclassify transactions, overlook deductions, or fail to reconcile accounts. Additionally, bookkeeping software like QuickBooks or Xero requires a learning curve. If you’re not experienced with these platforms, you may spend countless hours trying to figure out how to use them effectively. This time could be better spent growing your business or improving your services. Finally, DIY bookkeeping doesn’t provide the same level of expertise as a professional. A bookkeeper can identify potential issues early, offer advice on improving financial practices, and ensure compliance with tax laws and regulations.

How a Professional Bookkeeper Adds Value Tax Preparation Made Easy Tax season can be stressful for business owners, especially if financial records are incomplete or disorganized. A professional bookkeeper ensures your records are accurate and ready for tax filing, making the process smoother and more efficient. They also help you track deductible expenses throughout the year, potentially saving you money on your tax bill. Scalability for Growing Businesses As your business grows, your financial needs become more complex. A professional bookkeeper can adapt to your evolving needs, whether it’s managing a higher volume of transactions, preparing for audits, or providing financial reports for potential investors. Their expertise ensures your financial records can keep up with your business’s growth. Compliance with Regulations Financial regulations can be complicated, and non-compliance can lead to penalties or legal trouble. Bookkeepers are familiar with local, state, and federal requirements and ensure that your business adheres to these rules. By staying compliant, you avoid unnecessary fines and maintain your reputation. Support During Financial Audits In the event of an audit, having a professional bookkeeper on your side is invaluable. They can provide organized records, clarify transactions, and assist with any questions or concerns raised by auditors. Their support can make the audit process less intimidating and more manageable.

Finding the Right Bookkeeper in South Jersey When searching for a bookkeeper in South Jersey, look for someone with experience in your industry and a strong track record of reliability. Consider their certifications, such as being a Certified Bookkeeper or having experience with popular accounting software. A good bookkeeper should also be transparent, communicative, and willing to work closely with you to meet your business’s unique needs.

Conclusion Bookkeeping is the backbone of any successful business, ensuring that financial records are accurate, organized, and compliant with regulations. While it may be tempting to manage your books yourself, hiring a professional bookkeeper in South Jersey offers numerous benefits, from saving time to improving financial insights. By entrusting your bookkeeping to an expert, you can focus on running and growing your business with confidence, knowing that your finances are in capable hands. So, if you’ve been searching for “Bookkeeper South Jersey,” take the next step and hire a professional who can help your business thrive.

bookkeeper #bookkeeping #accounting #accountant #smallbusiness #bookkeepingservices #taxes #accountingservices #newjersey #nj #newyork #nyc #california #usa #jerseyshore #newyorkcity #jersey #brooklyn

1 note

·

View note

Text

Discover the Best Timekeeping Software to Boost Accuracy and Productivity

Unlocking Efficiency: A Deep Dive Into the Best Timekeeping Software for 2025

In today's fast-paced digital work environment, the ability to track time accurately is not just a convenience—it’s a necessity. Whether you're managing a remote workforce, running a small business, or overseeing a large enterprise, the need for precise, real-time time tracking has made the search for the best timekeeping software more critical than ever. But with so many options on the market, how do you know which tool truly stands out?

Why Timekeeping Software Matters

Timekeeping software has evolved significantly over the years. Gone are the days of manual punch cards and spreadsheets. Today’s solutions are cloud-based, AI-enabled, and packed with features that not only record time but also help analyze productivity, allocate resources, and integrate seamlessly with other essential business tools.

The best timekeeping software does more than just track hours worked. It ensures labor law compliance, supports invoicing, enhances payroll accuracy, and gives insights into how teams spend their time. For businesses striving to improve operational efficiency and cut down on unnecessary costs, adopting a reliable timekeeping system is a game-changer.

Key Features to Look for in the Best Timekeeping Software

When evaluating your options, here are some crucial features to look for:

1. User-Friendly Interface

The best timekeeping software is easy for everyone to use, from tech-savvy professionals to those with limited technical experience. A clean, intuitive interface reduces training time and ensures quick adoption across your team.

2. Real-Time Tracking

Real-time tracking lets users clock in and out from any device, monitor task progress, and adjust workflows on the fly. This feature is especially beneficial for remote teams or businesses with mobile workforces.

3. Project and Task Management

Top-rated timekeeping tools offer integrated project management features. This allows teams to assign tasks, set deadlines, and track how much time is spent on each project or client.

4. Integration with Payroll and Accounting Software

One of the most valuable features of the best timekeeping software is its ability to integrate with tools like QuickBooks, Xero, Gusto, and others. This streamlines payroll processing and eliminates manual data entry errors.

5. Automated Reporting and Analytics

The ability to generate detailed reports and visual analytics gives business owners and managers the insights they need to make informed decisions. Whether it’s identifying bottlenecks or improving resource allocation, reporting tools are indispensable.

6. Cloud Accessibility and Mobile Support

With remote work on the rise, having cloud-based timekeeping software with mobile app support is no longer optional. Users should be able to track time from anywhere, anytime.

7. Compliance and Security

The best timekeeping software includes built-in compliance tools that help businesses follow labor laws, manage overtime, and handle break requirements. Additionally, secure data encryption and user access controls ensure sensitive information is protected.

Who Can Benefit From Timekeeping Software?

Small Businesses: Get better visibility into employee performance and reduce time theft.