#Personal Loans in Nigeria

Text

0 notes

Text

Things Biden and the Democrats did, this week #19

May 17-24 2024

President Biden wiped out the student loan debt of 160,000 more Americans. This debt cancellation of 7.7 billion dollars brings the total student loan debt relieved by the Biden Administration to $167 billion. The Administration has canceled student loan debt for 4.75 million Americans so far. The 160,000 borrowers forgiven this week owned an average of $35,000 each and are now debt free. The Administration announced plans last month to bring debt forgiveness to 30 million Americans with student loans coming this fall.

The Department of Justice announced it is suing Ticketmaster for being a monopoly. DoJ is suing Ticketmaster and its parent company Live Nation for monopolistic practices. Ticketmaster controls 70% of the live show ticket market leading to skyrocketing prices, hidden fees and last minute cancellation. The Justice Department is seeking to break up Live Nation and help bring competition back into the market. This is one of a number of monopoly law suits brought by the Biden administration against Apple in March and Amazon in September 2023.

The EPA announced $225 million in new funding to improve drinking and wastewater for tribal communities. The money will go to tribes in the mainland US as well as Alaska Native Villages. It'll help with testing for forever chemicals, and replacing of lead pipes as well as sustainability projects.

The EPA announced $300 million in grants to clean up former industrial sites. Known as "Brownfield" sites these former industrial sites are to be cleaned and redeveloped into community assets. The money will fund 200 projects across 178 communities. One such project will transform a former oil station in Philadelphia’s Kingsessing neighborhood, currently polluted with lead and other toxins into a waterfront bike trail.

The Department of Agriculture announced a historic expansion of its program to feed low income kids over the summer holidays. Since the 1960s the SUN Meals have served in person meals at schools and community centers during the summer holidays to low income children. This Year the Biden administration is rolling out SUN Bucks, a $120 per child grocery benefit. This benefit has been rejected by many Republican governors but in the states that will take part 21 million kids will benefit. Last year the Biden administration introduced SUN Meals To-Go, offering pick-up and delivery options expanding SUN's reach into rural communities. These expansions are part of the Biden administration's plan to end hunger and reduce diet-related disease by 2030.

Vice-President Harris builds on her work in Africa to announce a plan to give 80% of Africa internet access by 2030, up from just 40% today. This push builds off efforts Harris has spearheaded since her trip to Africa in 2023, including $7 billion in climate adaptation, resilience, and mitigation, and $1 billion to empower women. The public-private partnership between the African Development Bank Group and Mastercard plans to bring internet access to 3 million farmers in Kenya, Tanzania, and Nigeria, before expanding to Uganda, Ethiopia, and Ghana, and then the rest of the continent, bring internet to 100 million people and businesses over the next 10 years. This is together with the work of Partnership for Digital Access in Africa which is hoping to bring internet access to 80% of Africans by 2030, up from 40% now, and just 30% of women on the continent. The Vice-President also announced $1 billion for the Women in the Digital Economy Fund to assure women in Africa have meaningful access to the internet and its economic opportunities.

The Senate approved Seth Aframe to be a Judge on the US Court of Appeals for the First Circuit, it also approved Krissa Lanham, and Angela Martinez to district Judgeships in Arizona, as well as Dena Coggins to a district court seat in California. Bring the total number of judges appointed by President Biden to 201. Biden's Judges have been historically diverse. 64% of them are women and 62% of them are people of color. President Biden has appointed more black women to federal judgeships, more Hispanic judges and more Asian American judges and more LGBT judges than any other President, including Obama's full 8 years in office. President Biden has also focused on backgrounds appointing a record breaking number of former public defenders to judgeships, as well as labor and civil rights lawyers.

#Thanks Biden#Joe Biden#kamala harris#student loans#student loan forgiveness#ticketmaster#Africa#free lunch#hunger#poverty#internet#judges#politics#us politics#american politics

2K notes

·

View notes

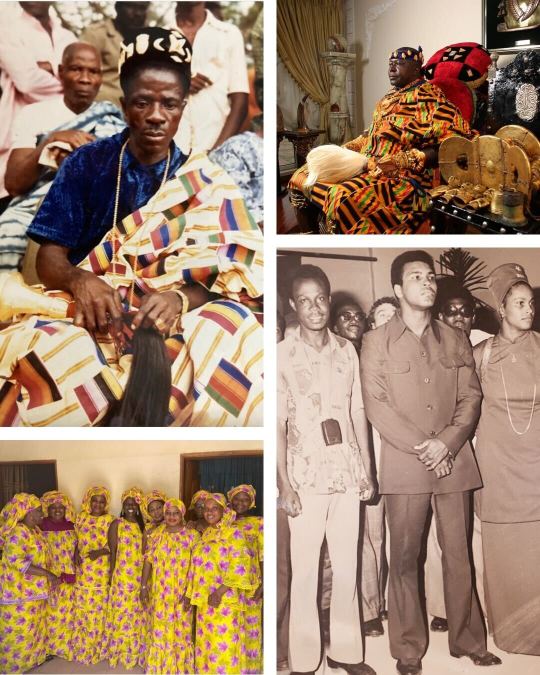

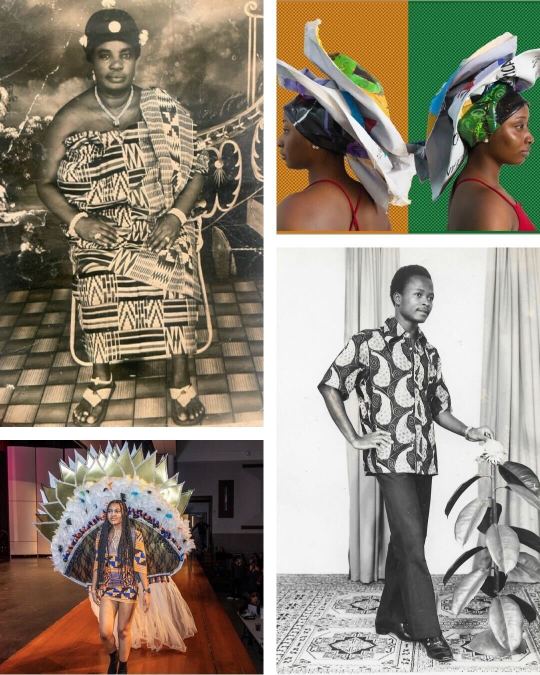

Photo

How would you describe your own style?

As part of #AfricaFashion, In Our Own Style presents personal photography as a window into past and present styles and fashion attitudes. These self-submitted photographs illuminate an intergenerational understanding of identity and family, which spans the African continent and diaspora.

View more photographs in Africa Fashion, loaned to the Brooklyn Museum by individuals with ties to Côte d'Ivoire, the Democratic Republic of the Congo, Ghana, Liberia, Niger, Nigeria, Togo, and Uganda.

Thank you to all who submitted! Continue to share your photos and videos from your family’s archive with #AfricaFashionBkM.

📷 Joshua Woods, Diane G. Degry, Chester Higgins, Marame Gueye, Liz Kimbulu, Ama Kateena, David Palacios, J.J. Thornberry and April Levack, Addoley Dzegede, Zamarianne Bradley, Jamel Shabazz, Jennifer Nnamani, Hannah Traore

92 notes

·

View notes

Text

who is jamie fucking tartt, anyways? // a guide to the public's knowledge on richmond's #9, divided into three sections: non-football watcher, casual watcher, football fan

for the non-football watcher //

• you'd probably know of jamie as a footballer the way people would know of haaland or kane or saka. he's not beckham-level famous [ yet ] but he is a big deal in english football and very talented

• if you're a reality tv watcher, your primary exposure to jamie would be his stint on the uk's number one show, lust conquers all. on lust, jamie very much played up a prick attitude, very much the smug sort of guy who knows he's sexy and will talk about it. he cheated on amy [ who he'd proposed to in a bathroom ] with denise by having jacuzzi sex, leading to his elimination from the show.

• if you're from manchester, there's drama around him - he left man city two weeks into the 2020-21 season to do lust conquers all. united fans already disliked him, but jamie's abandonment of city led to pretty widespread dislike of him in his hometown.

• if nothing else, if you find yourself around richmond with no knowledge of the team/jamie, he's loud, bubbly, bright - a very different person than he was on lust conquers all. you might see him kicking a ball around with kids on the richmond green, or chasing around a dog to wear it down for their owner, or training with roy kent [ who is a beckham-level big deal. you would know of roy kent ] and talking his ear off while he does

names you'd know - roy kent [ current richmond manager, very fucking famous ], zava [ formerly of many teams, a striker, very fucking famous. played in america his last season (2022-23), with lafc ].

casual football watcher //

everything up ^^ there, plus...

• jamie tartt is richmond's #9. he played striker while on loan with richmond in 2019-20 and is now a midfielder. he's from manchester and grew up in the manchester city academy system, making his premier league debut young. he plays for england and has begun to make himself a regular in the three lions' xi.

• he played under pep guardiola for multiple years, and was a part of the premier league winning teams in 2017-18 and 2018-19.

• he left manchester city to do lust conquers all, and was not welcome back to city. he rejoined the world of football with richmond while they were in the championship. they earned their promotion that season and returned to the premier league.

• they were not expected to do well in the premier league, but after a shift of strategy after zava's departure from the club in 2021, richmond ended the season on a long win streak to finish second in the premier league, qualifying for richmond's first-ever run in the champions league.

• jamie has won premier league player of the month twice and goal of the month three times.

• jamie's got something going on with roy kent. he never fails to lavish praise on his manager when he's given the opportunity, despite kent's stubborn demeanor.

• if you're an american, you may know ted lasso, richmond's former manager. he went viral for dancing in the locker room after leading his division ii wichita state shockers to the d2 championship game and winning the division

• subnote to that^^ even more intense d1 college football watchers would probably only know him as the meme. d2 college football is not widely consumed in america - i'm an avid cfb watcher, and i couldn't tell you without googling who won d2 last year.

names you'd know - sam obisanya [ richmond midfielder & nigeria international ] // isaac mcadoo [ richmond captain & centre back ] // dani rojas [ richmond striker & mexico international ]

football fan //

everything up there ^^ plus...

• jamie has a lifelong hatred of manchester united. he will play harder in those matches, and he scored a hat trick against them at richmond in early 2023.

• jamie grew up on a council estate, and was recruited for man city's academy when he was 8, starting with them when he was 9.

• jamie wore 51 at city for all of the years he played there.

• jamie's city senior debut was in 2015, when he was 17 years old, and he played with them from 2015 through 2020, when he left to do lust conquers all.

• jamie was loaned to afc richmond for the 2019-20 season, where he made a name for himself. his chant is sung to the tune of baby shark. he scored 11 goals for richmond, keeping them solidly mid-table, until ted lasso's arrival.

• his loan was cut short in february 2020, and he returned to city to play the rest of the season with his home club.

• richmond was relegated to the championship after the 2019-20 season when jamie made an assist in stoppage time with man city to end the match 2-1, city.

• jamie's return to richmond was not without controversy - he was hotheaded and kept the ball more often than he passed it while he was on loan. his relationship with his teammates was tumultuous at best, downright bad at worst. on the first match day of his return, afc richmond mounted a protest against their main sponsor, dubaiair. richmond lost that match, leading to the end of an 8-week tie streak.

• jamie has publicly been very supportive of his teammates since then, especially in more recent years. he frequently ends games with an assist or more to his name, and is widely regarded as the central cog of richmond's team.

• jamie wears 24 when he isn't starting for england, a tribute to sam obisanya.

• jamie grew up a roy kent fan, and many of his plays mimic roy's from roy's prime.

• jamie's england debut was in 2022, at age 24.

• jamie is transitioning into playing more midfield for england, though their gaffer has commented in the past that jamie 'doesn't have the skillset to play centrally for england'. when in the xi, jamie typically wears the 7 or 8, though he has worn the 11 a handful of times, too - showing his dynamic ability to play just about any spot on the pitch.

• as of october 2023, jamie has three assists and one goal for england, and is on the hunt for more.

• jamie is a player with a mind for the game unlike most others', regularly seeing the game two to three passes ahead of where it is. he can play box-to-box incredibly efficiently, and has saved more than one goal from going in. he's a hard worker and always seems to be enjoying himself on the pitch during hard-fought games, though he has been publicly dismayed at hard losses before, such as a 5-0 loss to city in the fa cup semifinal in 2021.

• he has a summer football camp in manchester named after him that he sponsors, providing free boots, shin guards, and other equipment to the kids who grew up like he did, without many resources but with a love of the game, and helps them get in front of academy recruiters. jamie is frequently seen training with these kids during his summer break.

• as of present day, it's public record that jamie donates money to domestic violence, sexual abuse, and women's charities, as well as the nhs

names you'd know - ted lasso [ former richmond gaffer ] // nathan shelley [ former west ham gaffer, current richmond assistant ] // the rest of richmond's regular starting xi, listed on my carrd // paddy o'gara [ former manchester city centre back, a mentor of jamie's ]

#headcanons !#i have brainrot can you tell yet#if you ever want more knowledge than this feel free to ask !!! i will expound !!!!

9 notes

·

View notes

Text

A Comprehensive Guide to Personal Loans and Smart Borrowing.

Personal loans can be a valuable financial tool for various needs, from covering unexpected expenses to consolidating debt. Here’s a detailed guide to understanding the different types of personal loans and their benefits.

Types of Personal Loans

1. Unsecured Personal Loans

Description: These loans do not require collateral, meaning you don’t have to pledge any assets to secure the loan.

Benefits:

No Collateral Required: Reduces the risk of losing personal assets.

Quick Approval: Often faster to process since no asset valuation is needed.

Flexible Use: Can be used for various purposes, such as medical expenses, education, or travel.

2. Secured Personal Loans

Description: These loans are backed by collateral, such as a car or property. Benefits:

Lower Interest Rates: Typically offer lower interest rates due to reduced risk for the lender.

Higher Loan Amounts: Can borrow larger sums compared to unsecured loans.

Improved Approval Chances: Easier to qualify for if you have valuable assets.

3. Fixed-Rate Loans

Description: These loans have a fixed interest rate that remains the same throughout the loan term. Benefits:

Predictable Payments: Easier to budget with consistent monthly payments.

Protection Against Rate Increases: Shielded from rising interest rates.

4. Variable-Rate Loans

Description: These loans have an interest rate that can fluctuate based on market conditions. Benefits:

Potential for Lower Rates: May start with a lower interest rate compared to fixed-rate loans.

Flexibility: Can benefit from decreasing interest rates.

5. Debt Consolidation Loans

Description: These loans are used to combine multiple debts into a single loan with one monthly payment. Benefits:

Simplified Payments: Easier to manage one payment instead of multiple.

Lower Interest Rates: Can reduce overall interest costs if the new loan has a lower rate.

Top 10 Tips For Choosing The Right Insurance Policy You Need To Know

10 Best Seniors Auto Insurance Options for 2024/2025

How To Reduce Your Gas And Electricity Bills: Top 10 Tips You Need To Know

Benefits of Personal Loans

Access to Quick Funds: Provides immediate cash for emergencies or planned expenses.

Flexible Use: Can be used for a wide range of purposes, from home improvements to medical bills.

Fixed Repayment Schedule: Helps with budgeting and financial planning.

Improves Credit Score: Timely repayments can boost your credit score.

How to Secure a Business Loan in Nigeria

Securing a business loan in Nigeria can be challenging, but with the right approach, you can increase your chances of success. Here’s a step-by-step guide to help small business owners secure funding.

1. Develop a Solid Business Plan

A comprehensive business plan is crucial. It should outline your business model, market analysis, financial projections, and how you plan to use the loan. A well-prepared plan demonstrates your business’s potential to lenders.

2. Determine the Loan Amount

Calculate the exact amount of money you need for your business. Be specific about how the funds will be used, whether for purchasing equipment, expanding operations, or covering operational costs.

3. Choose the Right Type of Loan

Different types of business loans are available, including:

Term Loans: Lump sum repaid over a fixed period.

Lines of Credit: Flexible borrowing up to a certain limit.

Microloans: Small loans for startups and small businesses.

Equipment Financing: Loans specifically for purchasing equipment

4. Meet Eligibility Requirements

Lenders have specific criteria, such as:

Business Registration: Ensure your business is legally registered.

Credit Score: Maintain a good credit score.

Financial Statements: Provide audited financial statements for the past two years.

Collateral: Be prepared to offer collateral if required.

5. Prepare Financial Documents

Gather all necessary financial documents, including:

Income Statements

Balance Sheets

Cash Flow Statements

Tax Returns

6. Research Lenders

Identify potential lenders, such as banks, microfinance institutions, and online lenders. Compare their interest rates, loan terms, and eligibility requirements.

7. Apply for the Loan

Submit your loan application along with the required documents. Be prepared to answer questions about your business and financials during the review process.

8. Follow Up

Stay in touch with the lender throughout the application process. Promptly provide any additional information they request to avoid delays.

9. Utilize the Funds Wisely

Once approved, use the loan funds as outlined in your business plan. Proper utilization of the loan can help grow your business and improve your chances of securing future funding.

10. Repay on Time

Ensure timely repayment of the loan to maintain a good relationship with the lender and improve your creditworthiness for future loans.

5 Essential tips for Smart Borrowing.

Here are five essential tips for smart borrowing to help you manage your finances effectively:

1. Know Your Numbers

Before applying for any loan, it’s crucial to understand your financial situation. Check your credit score and debt-to-income ratio. A higher credit score can help you secure better loan terms, while a manageable debt-to-income ratio ensures you can handle additional debt without financial strain.

2. Differentiate Between Good and Bad Debt

Not all debt is created equal. Good debt, such as student loans or mortgages, can help you build wealth over time. On the other hand, bad debt, like high-interest credit card debt, can be financially draining. Focus on borrowing for investments that will appreciate in value or improve your financial situation.

3. Shop Around for the Best Rates

Don’t settle for the first loan offer you receive. Compare rates from multiple lenders to find the best deal. Look for transparent terms and conditions, and consider both traditional banks and online lenders to ensure you’re getting the most favorable terms.

4. Understand the Terms of the Loan

Read the fine print before signing any loan agreement. Make sure you understand the interest rate, repayment schedule, fees, and any penalties for early repayment. Knowing these details can help you avoid unexpected costs and manage your loan more effectively.

5. Create a Repayment Plan

Have a clear plan for repaying your loan. Budget for your monthly payments and consider setting up automatic payments to avoid missing due dates. Paying off your loan on time can improve your credit score and make it easier to borrow in the future.

By understanding the different types of personal loans and following the steps to secure a business loan, you can make informed financial decisions that support your personal and business goals. Whether you're looking to cover unexpected expenses or expand your business, the right loan can provide the financial boost you need. Remember to borrow responsibly and manage your debt effectively to ensure long-term financial stability

0 notes

Text

Keeping Up with Banking and Finance News in Nigeria

Staying informed about the latest developments in the world of banking and finance is crucial, especially in a dynamic and rapidly evolving economy like Nigeria. Today brings a mix of updates that have a significant impact on the financial landscape of the country.

1. Central Bank’s Monetary Policy Announcement

In a much-anticipated move, the Central Bank of Nigeria (CBN) released its latest monetary policy decisions. The key highlight is a slight adjustment in the benchmark interest rate, aimed at balancing economic growth and inflation control. This decision comes as a response to the changing domestic and global economic conditions. Experts are closely analyzing the potential implications of this adjustment on borrowing costs, investment, and overall economic activity.

2. Fintech Startup Secures Funding

In a sign of the growing importance of the fintech sector, a Nigerian fintech startup successfully raised a substantial amount of funding in its latest investment round. The startup, focused on providing innovative digital payment solutions, attracted interest from both local and international investors. This infusion of capital is expected to fuel the company’s expansion plans and contribute to the modernization of the financial services industry in Nigeria.

3. Foreign Investment in Nigerian Bonds

Nigeria’s sovereign bonds continue to attract attention from foreign investors. Today, it was announced that a major international investment firm has increased its holdings of Nigerian government bonds. This move reflects growing confidence in Nigeria’s economic prospects and the steps taken to enhance fiscal discipline. The increased foreign investment not only strengthens Nigeria’s external reserves but also signals positive sentiment toward the country’s financial stability.

4. Digital Transformation of Banking Services

In line with the global trend of digital transformation, several Nigerian banks announced new initiatives to enhance their digital banking services. These initiatives include the rollout of advanced mobile banking apps, the expansion of online customer support, and the introduction of personalized financial management tools. The aim is to provide customers with more convenient and efficient ways to manage their finances, while also adapting to changing consumer preferences.

5. Non-Performing Loan Recovery Efforts

Efforts to address non-performing loans (NPLs) in Nigeria’s banking sector continue to make progress. The Asset Management Corporation of Nigeria (AMCON) reported a significant milestone in its ongoing efforts to recover NPLs from various financial institutions. This development contributes to the overall health of the banking industry by reducing financial risks and improving the availability of credit for productive economic activities.

Well, today’s banking and finance news in Nigeria showcases the diverse range of activities shaping the financial landscape. From monetary policy adjustments to fintech innovation and international investments, these developments collectively contribute to the growth and stability of Nigeria’s economy. As the nation progresses on its financial journey, staying attuned to these updates remains a valuable practice for individuals, businesses, and investors alike.

0 notes

Text

Central Financial institution Electronic digital Currency exchange (CBDC): Changing the landscape of Monetary Landscaping

Nowadays, the actual economical planet possesses witnessed your developing fascination with Central Financial institution Electronic digital Stock markets (CBDCs). These kinds of electric sorts of sovereign forex, granted plus managed simply by central banking institutions, stand for a large development around fiscal techniques worldwide. Not like cryptocurrencies like Bitcoin and also Ethereum, that happen to be decentralized nigeria cbdc plus perform at home from a central specialist, CBDCs tend to be common plus take care of the backing plus stability of any countrywide government and also central bank.

Understanding CBDCs

CBDCs tend to be effectively electric variants with fiat currency. People are manufactured plus issued by central banking institutions using blockchain and also related technological know-how, giving an electronic reflection of any country'ohydrates actual currency. Not like funds, which is perceptible and desires actual handling, CBDCs are available just around electric variety, facilitating more rapidly orders plus empowering imaginative economical services.

Types of CBDCs

CBDCs can be grouped directly into a couple most important types: retail store CBDCs plus wholesale CBDCs.

Retail CBDCs: These are generally open to everyone plus can be used day-to-day orders, much like actual funds and also present electric settlement methods. Retail CBDCs intention to increase economical add-on by providing secure, low-cost settlement options to folks plus businesses.

Below wholesale CBDCs: Designed for loan companies plus large-scale orders, wholesale CBDCs help interbank pay outs plus orders involving economical entities. They give you efficiency benefits around clearing plus negotiation processes, perhaps lessening fees plus detailed risks from the economical system.

Motivations for CBDCs

Several components travel a persons vision plus ownership with CBDCs simply by central banking institutions:

0 notes

Text

Fixed Income Funds

In today’s dynamic financial landscape, investors are constantly seeking avenues for stable and lucrative returns. Fixed Income Funds are a beacon of reliability, offering investors a secure path to wealth, growth and accumulation. At the forefront of this financial revolution stands FBNQuest, Nigeria’s premier merchant and investment bank, committed to empowering individuals worldwide with unparalleled investment opportunities.

Fixed Income Funds are all about stability. They give you a reliable income, even when the financial market is unpredictable. They pay you a fixed interest amount or dividend until the maturity date. When the Fixed income matures, investors are repaid the principal amount they had invested. Also, investors know the exact amount of the returns they will get ahead. Government and corporate bonds are the most common types of fixed-income products.

Types of Fixed Income

FBNQuest’s Fixed Income Funds are made up of different kinds of investments, like government bonds and corporate loans. This mix helps to keep your money safe while still making it grow over time.

Treasury bills (T-bills)

Treasury bonds (T-bonds)

Treasury Inflation-Protected Securities (TIPS)

Corporate bonds

High-yield bonds

Certificate of deposit

Fixed Income Pros and Cons

Pros

Steady income stream of fixed returns

More stable returns than stocks

Higher claim to the assets in bankruptcies

Government and FDIC backing on some

Cons

Returns are often lower than other investments

Credit and default risk exposure

Vulnerable to interest rate fluctuations.

Sensitive to Inflationary risk

Explore Stability of Fixed Income Funds With FBNQuest

Fixed Income Funds represent a cornerstone of conservative investment strategies, providing investors with a steady stream of income while minimizing exposure to market volatility. At FBNQuest, we recognise the importance of stability in uncertain times, and our Fixed Income Funds are meticulously curated to deliver consistent returns, irrespective of market fluctuations. With a diverse portfolio comprising government securities, corporate bonds, and money market instruments, our funds offer a compelling blend of security and growth potential.

Unparalleled Expertise and Insight

What sets FBNQuest apart is our unwavering commitment to excellence and expertise in navigating the intricacies of the financial market. With a team of seasoned professionals at the helm, we leverage our deep-rooted industry knowledge and market insights to tailor Fixed Income Funds that align with our clients’ investment goals and risk appetite. Whether you’re a seasoned investor or a novice exploring investment opportunities, our personalized approach ensures that your financial aspirations are realized with precision and confidence.

In conclusion, Fixed Income Funds stand as a testament to stability and prosperity in an ever-evolving financial landscape. At FBNQuest, we invite you to embark on a transformative journey towards financial empowerment and wealth growth. With our comprehensive suite of Fixed Income Funds, backed by unrivaled expertise and a legacy of trust, we position ourselves as the premier choice for investors seeking to unlock the full potential of their financial portfolios. Invest with FBNQuest today and embark on a path towards enduring financial success.

In crafting your financial future, contact FBNQuest—the epitome of excellence in investment banking.

Contact Us :

Call us at : 01-2801340-4

Email Us at : [email protected]

Address : Lagos

16 Keffi Street, Off Awolowo Road, S.W. Ikoyi, Lagos, Nigeria

0 notes

Text

How Do I Stop Loan App From Accessing My Contacts?

How do I stop loan app from accessing my contacts? There have been problems with loan apps getting access to people's contact lists and sending defamatory messages to their contact lists when people don't pay back their loans when they're supposed to. This only happens with fake loan apps that say their shortest loan repayment period is 61 days and then start to threaten you after seven days. So, most Nigerians want to know, "How do I stop the loan app from accessing my contacts?"

How do I stop loan app from accessing my contacts?

The best way to stop loan apps from accessing your contacts is to not download the apps at all. If you already have them on your phone, don't borrow money from them because that would let them see your list of contacts.

If none of those work, follow these steps to stop loan apps from accessing your contacts:

- Step 1: Go to your phone's settings: The look of the menu might be different from what we show here, but the steps are the same.

- Step 2: Open Apps under settings

- Step 3: Click Permissions: This will open the permission manager so you can see which app is using a certain permission.

- Step 4: Choose Contacts from the list of permissions

- Step 5: Choose the loan app you want to turn off and take permissions away from.

You can repeat the same steps to take away location permission, etc. But the truth is that you can't stop a loan app from accessing your contacts when you borrow from them. When you use a loan app to borrow money, your contacts are often used as a guarantee that you will pay back the loan. It just acts as your security.

After you take out a loan from them, your personal information, such as your name, passport photo, BVN, and phone number, is uploaded to an external database. This is done as soon as you give them your contact information. The truth is that you are still at their mercy even if you delete or uninstall the app after borrowing from them because they already have access to your contacts.

But if you act quickly enough, you can stop them from getting any more information from your phone. You have to take away the permission you gave them. To do this, go to your phone's settings, scroll down to "permission," and stop the loan app from accessing your phone's storage, gallery, contacts, or SMS. For this to work, you have to be very quick. In this case, they only have your name and phone number, so they only deal with you.

You can also stop loan apps from accessing your contacts by paying back the loan when it's due and removing the app from your phone. So you must first pay up before you can delete the app. This way, they can't hold you any longer.

How to stop loan apps from sending messages to my contacts?

The best way to stop loan apps from sending messages to your contacts is to never take out a loan from them. If you don't buy from them, they won't be able to get your contact information. Don't send them messages.

When you don't pay on time, loan apps only send messages to the people on your contact list. Most of the time, these messages are dangerous and hurtful. Please keep in mind that this only works for fake loan apps, which we've already talked about in this article.

This is not what original loan apps are known for. Sometimes they even call the people on your list of contacts and tell them to warm you up. You've probably heard that fake loan apps have ruined people's reputations by sending threatening messages to their contact lists.

If you need to borrow money, please only use real loan apps. Fake loan apps will only make you look bad. This post is about how loan apps are sending a lot of messages to people in Nigeria. I hope that our guide will help you out.

How do I stop an app from getting to my information?

It's very easy to stop an app from getting to your information. Please do these things to stop an app from getting access to your information.

Option 1: Don't let the app do anything.

First, you need to know that not all apps should be allowed to access your information. Some of them should just be installed, and you should never give them access to your private information like your contacts, messages, and so on.

Option 2: Go to Settings and take away permissions

If you gave the app permission to access your info, that's fine. You can still remove the permissions by going to your phone's settings, selecting the app, and then removing the permission. The app would no longer be able to see your information after that.

In some cases, these apps might download a copy of your information that is already on their server (database), and it would only take an employee to remove it. Try to read the app's terms of service before you download it so you know what information they will be collecting about you.

Option 3: Get rid of it.

You could also get rid of the app from your phone completely. If you remove an app from your phone after permitting it, it will stop collecting your information.

Can a loan app still see my contacts after I delete it?

When you uninstall the loan app, it usually can't get to your contacts or send messages to them.

Once you uninstall the app, it will no longer be able to do anything on your phone.

When you uninstall the loan app, it can only access your contacts if it has downloaded and saved your contacts' information, like your friends' WhatsApp and phone numbers. In this case, they will keep calling and texting you until you pay your Department.

If you've already paid off your loan but the app keeps calling your friends and family, you can file a complaint with the FCCPC Act.

What happens if you don't pay back an online loan?

If you get a loan from one of these apps and don't pay it back when it's due, the app will be able to use your BVN and bank information to take out the amount you owe plus any interest.

This loan app will do everything it can to get you to pay back the money, even if you didn't put in your bank information or if the money in your account wasn't enough to cover the loan.

If the way they treated you and how they bothered you didn't make you pay them the money, blogging your BVN could mark you as a fraud.

If you don't pay back your loan, your BVN may mark you as a fraud, which could make it harder for you to get a visa to travel outside of the country.

If you try to trick the app and they can prove it, they might sue you in court, depending on how bad it is.

Conclusion - How Do I Stop Loan App From Accessing My Contacts?

Fake loan apps have been known to access your contacts and send them threatening messages when you don't pay back the loan after a ridiculously long period. The best way to avoid all of this is to never take out one of these fake loans. Check out "How to Apply for a CBN Non-Interest Loan?".

Read the full article

0 notes

Text

The Nigerian banking sector is on a digital transformation. With customers increasingly relying on mobile apps and online platforms for their financial needs, there is a growing need for convenient and accessible communication. Enter JejeChat, the WhatsApp chatbot solution designed for Nigerian businesses. JejeChat bridges the gap between traditional banking and the mobile-first world, offering a seamless and personalized communication experience for banks and their customers.

Revolutionizing Customer Service:

24/7 Availability: JejeChat provides round-the-clock customer support, allowing customers to access basic banking services at any time through the familiar platform of WhatsApp.

Improved Accessibility: Customers in remote areas or with busy schedules can easily access banking services at their convenience, eliminating the need for phone calls or long waits in queues.

Multilingual Support: JejeChat can be tailored to support various Nigerian languages, promoting financial inclusion in a diverse country like Nigeria.

Beyond Basic Inquiries:

Streamlined Transactions: JejeChat enables simple transactions such as airtime recharge, bill payments, and money transfers within the bank or to registered recipients, reducing the reliance on physical branches and ATMs.

Personalized Financial Assistance: JejeChat can provide personalized answers about specific accounts, loan options, or investment products, as well as offer relevant financial services based on customer profiles and needs.

Promoting Financial Literacy: JejeChat can be used to teach educational content on financial literacy topics, empowering customers to make informed financial decisions.

Benefits for Banks:

Increased Efficiency: JejeChat automates repetitive tasks, freeing up bank staff to focus on more complex customer interactions and providing personalized financial advice.

Reduced Operational Costs: Chatbots offer a cost-effective way to handle customer inquiries compared to traditional call centers.

Enhanced Customer Satisfaction: Faster response times, 24/7 availability, and personalized communication lead to a more positive customer experience, ultimately boosting customer loyalty.

Valuable Customer Data: JejeChat gathers data from customer’s interactions, enabling banks to analyze customer’s behavior and preferences to refine marketing campaigns, develop new products, and improve overall customer service strategies.

JejeChat WhatsApp Banking: The Future of Banking Communication

By integrating JejeChat with their existing systems, Nigerian banks can unlock a world of communication possibilities. JejeChat offers a user-friendly experience for customers, improves financial accessibility, and ultimately fosters a more efficient and customer-centric banking experience in Nigeria.

Ready to transform your bank's communication strategy? Sign Up for a free trial with JejeChat today and experience the power of Conversational AI in the Nigerian financial sector! JejeChat can be the key to enhancing customer service, streamlining operations, and driving growth for your bank.

0 notes

Text

Fixed Income Funds

In today’s dynamic financial landscape, investors are constantly seeking avenues for stable and lucrative returns. Fixed Income Funds are a beacon of reliability, offering investors a secure path to wealth, growth and accumulation. At the forefront of this financial revolution stands FBNQuest, Nigeria’s premier merchant and investment bank, committed to empowering individuals worldwide wit

h unparalleled investment opportunities.

Fixed Income Funds are all about stability. They give you a reliable income, even when the financial market is unpredictable. They pay you a fixed interest amount or dividend until the maturity date. When the Fixed income matures, investors are repaid the principal amount they had invested. Also, investors know the exact amount of the returns they will get ahead. Government and corporate bonds are the most common types of fixed-income products.

Types of Fixed Income

FBNQuest’s Fixed Income Funds are made up of different kinds of investments, like government bonds and corporate loans. This mix helps to keep your money safe while still making it grow over time.

Treasury bills (T-bills)

Treasury bonds (T-bonds)

Treasury Inflation-Protected Securities (TIPS)

Corporate bonds

High-yield bonds

Certificate of deposit

Fixed Income Pros and Cons

Pros

Steady income stream of fixed returns

More stable returns than stocks

Higher claim to the assets in bankruptcies

Government and FDIC backing on some

Cons

Returns are often lower than other investments

Credit and default risk exposure

Vulnerable to interest rate fluctuations.

Sensitive to Inflationary risk

Explore Stability of Fixed Income Funds With FBNQuest

Fixed Income Funds represent a cornerstone of conservative investment strategies, providing investors with a steady stream of income while minimizing exposure to market volatility. At FBNQuest, we recognise the importance of stability in uncertain times, and our Fixed Income Funds are meticulously curated to deliver consistent returns, irrespective of market fluctuations. With a diverse portfolio comprising government securities, corporate bonds, and money market instruments, our funds offer a compelling blend of security and growth potential.

Unparalleled Expertise and Insight

What sets FBNQuest apart is our unwavering commitment to excellence and expertise in navigating the intricacies of the financial market. With a team of seasoned professionals at the helm, we leverage our deep-rooted industry knowledge and market insights to tailor Fixed Income Funds that align with our clients’ investment goals and risk appetite. Whether you’re a seasoned investor or a novice exploring investment opportunities, our personalized approach ensures that your financial aspirations are realized with precision and confidence.

In conclusion, Fixed Income Funds stand as a testament to stability and prosperity in an ever-evolving financial landscape. At FBNQuest, we invite you to embark on a transformative journey towards financial empowerment and wealth growth. With our comprehensive suite of Fixed Income Funds, backed by unrivaled expertise and a legacy of trust, we position ourselves as the premier choice for investors seeking to unlock the full potential of their financial portfolios. Invest with FBNQuest today and embark on a path towards enduring financial success.

In crafting your financial future, contact FBNQuest—the epitome of excellence in investment banking.

Contact Us :

Call us at : 01-2801340-4

Email Us at : [email protected]

Address : Lagos

16 Keffi Street, Off Awolowo Road, S.W. Ikoyi, Lagos, Nigeria

0 notes

Text

factors that could affect financing your start-up

Beyond the humble $50 investment that kickstarted our endeavour, I recognize the critical importance of securing additional funding to scale our operations and realize our vision of transforming the landscape of Naija shopping drop shipping in Nigeria. In this blog post, I will delve into the financial sources we are considering for the future of Naija Shopper's drop shipping business. a good business strategy. When you diversify your financing sources, you also have a better chance of getting the appropriate financing that meets your specific needs. Keep in mind that bankers don’t see themselves as your sole source of funds. And showing that you've sought or used various financing alternatives demonstrates to lenders that you're a proactive entrepreneur.

1. Personal Investment: As an entrepreneur deeply committed to the success of my venture, I recognize the value of personal investment. Beyond the initial $50, I am willing to invest additional resources—whether in the form of cash or collateral—demonstrating my long-term commitment to the project. Personal investment not only showcases my dedication but also instills confidence in potential investors and lenders, highlighting my unwavering belief in the business's potential for success.

2. Your Professional Profile: Leveraging my professional background and expertise is crucial in establishing credibility with lenders. As a proactive entrepreneur, I understand the importance of showcasing my industry knowledge, relevant work experience, and thorough research to mitigate risks and drive sustainable growth. By articulating a compelling case for the venture and demonstrating diligence in planning and execution, I strengthen my position in securing financing for future business endeavours.

3. Your Guarantee: While banks may typically require a personal guarantee for startup businesses, I view this as an opportunity to showcase my commitment and confidence in the venture. Assuming personal responsibility for the loan underscores my dedication to the business's success and reinforces my accountability to stakeholders. By providing a guarantee, I demonstrate my willingness to take calculated risks and stand behind the venture's growth trajectory.

In navigating the complexities of startup financing, I am guided by a strategic approach that prioritizes diversification of funding sources and meticulous planning. By combining personal investment with a strong professional profile and a willingness to provide guarantees, I position myself for success in securing the financing needed to fuel future business ventures.

In conclusion, as I continue to chart the course for Naija Shopper's drop shipping growth and expansion, I am committed to leveraging these financial sources to unlock new opportunities and drive innovation in the e-commerce landscape. By embracing a proactive mindset and strategic financial planning, I am confident in our ability to realize our vision and make a meaningful impact on the drop shipping experience in Nigeria. while each entrepreneur's journey is unique, a strategic approach to financing that combines personal investment, a strong professional profile, and a willingness to provide guarantees lays the foundation for sustainable growth and success.

Source:

Business Development Bank of Canada (BDC). (n.d.). Start-up financing: 4 factors affecting start-up financing. Retrieved from https://www.bdc.ca/en/articles-tools/start-buy-business/start-business/4-factors-affecting-start-up-financing?type=C&order=4

#StartupFunding#Entrepreneurship#BusinessFinancing#NaijaShopper#DropShipping#FinancialStrategy#PersonalInvestment#ProfessionalProfile#Guarantee#Ecommerce#NigeriaEconomy

1 note

·

View note

Text

Top 10 Tips to Help You Pick the Right Insurance Policy.

Choosing the right insurance policy can be overwhelming with so many options available. Whether it’s health, auto, home, or life insurance, making an informed decision is very crucial in picking the right insurance policy. Here are the top 10 tips to help you choose the right insurance policy:

1. Assess Your Needs

Before you start shopping for insurance, take a moment to assess your needs. Consider factors such as your age, health, lifestyle, and financial situation. For instance, a young, healthy individual might prioritize different coverage than someone with a family and a mortgage.

2. Understand the Types of Insurance

Familiarize yourself with the different types of insurance available. This will help you identify which policies are essential for your situation. (More on this in the next section!)

3. Compare Multiple Quotes

Don’t settle for the first policy you come across. Obtain quotes from multiple insurance providers to compare coverage options and premiums. This will help you find the best deal.

10 Best older people Auto Insurance Options for 2024/2025

Best Car Insurance Companies, best car insurers And All You Need To Know

Top ten Auto Insurance companies in USA

Top 10 Best Apps to Get Instant Loan In Nigeria

4. Check the Insurer’s Reputation

Research the insurance company’s reputation. Look for reviews and ratings from current and past customers. A company with a strong track record of customer service and claims handling is preferable.

5. Read the Fine Print

Carefully read the policy documents to understand what is covered and what is not. Pay attention to exclusions, limitations, and any additional costs that may apply.

6. Consider the Premiums and Deductibles

Evaluate the premiums and deductibles associated with the policy. A lower premium might seem attractive, but it could come with higher deductibles, which means more out-of-pocket expenses when you file a claim.

7. Look for Discounts

Many insurance companies offer discounts for various reasons, such as bundling multiple policies, having a good driving record, or installing safety features in your home. Ask about available discounts to reduce your premiums.

8. Evaluate the Coverage Limits

Ensure that the policy provides adequate coverage limits for your needs. Underinsuring can leave you vulnerable, while overinsuring can lead to unnecessary expenses.

9. Seek Professional Advice

If you’re unsure about which policy to choose, consider seeking advice from an insurance broker or financial advisor. They can provide personalized recommendations based on your specific needs.

10. Review and Update Your Policy Regularly

Your insurance needs may change over time. Regularly review your policy to ensure it still meets your requirements and make adjustments as necessary.

Understanding Different Types of Insurance

Insurance is a broad field with various types of policies designed to protect different aspects of your life. Here’s a breakdown of the most common types of insurance:

Health Insurance

Purpose: Covers medical expenses, including doctor visits, hospital stays, surgeries, and prescription medications. Types:

Individual Health Insurance: Purchased by individuals or families.

Group Health Insurance: Provided by employers to their employees.

Government Health Insurance: Programs like Medicare and Medicaid.

Auto Insurance

Purpose: Protects against financial loss in case of accidents, theft, or damage to your vehicle. Types:

Liability Coverage: Covers damages to others if you’re at fault in an accident.

Collision Coverage: Covers damages to your vehicle from a collision.

Comprehensive Coverage: Covers non-collision-related damages, such as theft or natural disasters.

Home Insurance

Purpose: Protects your home and personal belongings against damage or loss. Types:

Homeowners Insurance: Covers the structure of your home and personal property.

Renters Insurance: Covers personal property for renters.

Condo Insurance: Covers personal property and interior structures for condo owners.

Life Insurance

Purpose: Provides financial support to your beneficiaries in the event of your death. Types:

Term Life Insurance: Provides coverage for a specific period.

Whole Life Insurance: Provides lifelong coverage with a savings component.

Universal Life Insurance: Offers flexible premiums and death benefits with a savings component.

Disability Insurance

Purpose: Provides income replacement if you become unable to work due to illness or injury. Types:

Short-Term Disability Insurance: Covers a portion of your income for a short period.

Long-Term Disability Insurance: Covers a portion of your income for an extended period.

Travel Insurance

Purpose: Covers unexpected events during travel, such as trip cancellations, medical emergencies, and lost luggage. Types:

Trip Cancellation Insurance: Reimburses non-refundable travel expenses if you need to cancel your trip.

Travel Medical Insurance: Covers medical expenses incurred while traveling.

Baggage Insurance: Covers lost or damaged luggage.

By understanding the different types of insurance and following these tips, you can make informed decisions that provide the protection you need. Remember, the key is to assess your needs, compare options, and choose a policy that offers the best value and coverage for your situation.

0 notes

Text

Central Bank of Nigeria Directs Banks to Notify Customers Before Debt Recovery Initiative

The Central Bank of Nigeria (CBN) has directed banks to provide customers with prior notices of outstanding obligations before commencing debt recovery processes.

The move aims to ensure a transparent, courteous, and fair debt recovery process for consumers.

Released on Thursday via its website, the CBN's document titled "Revised Consumer Protection Regulations" underscores the importance of adhering to consumer protection principles within financial institutions.

Key highlights from the regulations include guidelines on consumer rights, aiming for improved outcomes and enhanced access to financial services.

According to the document, foreclosure actions should be considered only as a last resort after exhausting all other avenues of debt recovery.

Foreclosure, the legal process wherein ownership transfers to the bank or lender in the event of loan default, should be preceded by offering customers the option of a private sale. Customers must be provided with this option within a 30-day timeframe unless explicitly waived.

Furthermore, financial service providers are mandated to allocate net proceeds from foreclosures to the respective loan accounts and inform customers of any remaining balances.

Banks are also required to furnish customers with detailed reports on collateral sales, including processes, expenses, and net proceeds.

The CBN emphasizes that banks hold accountability for the actions of debt collection agents. Moreover, the document outlines restrictions for loan providers concerning communication with individuals associated with the customer, barring unauthorized disclosures of personal data without express consent.

Additionally, financial service providers are tasked with implementing measures to safeguard customers' assets, including automated transaction monitoring and fraud detection mechanisms.

Consumers are to be educated on fraud threats, with clear procedures established for reporting suspicious activities or unauthorized transactions.

To enhance digital financial services, banks must offer secure and user-friendly interfaces, while ensuring the privacy and confidentiality of consumer data.

The CBN underscores the importance of obtaining written consent for data collection and processing, with clear opt-in and opt-out mechanisms for data sharing.

The apex bank's revision of the 2019 Consumer Protection Regulations aims to safeguard consumer interests amidst the evolving financial services landscape.

Read the full article

0 notes

Text

Does Migo Loan Send Messages To Contacts?

Understanding Migo’s Policy for Contacting References if Loan Payments Are Missed

Migo, a fintech platform offering quick, unsecured loans in Nigeria, requires borrowers to provide personal references during the application process. Some people have concerns about Migo contacting their references if they default or miss payments on their loan.

This comprehensive article examines Migo’s policies…

View On WordPress

0 notes

Text

HOW TO INCORPORATE BUSINESS IN NIGERIA

By: Gloria NK Okeke

BENEFITS OF INCORPORATING YOUR BUSINESS IN NIGERIA

Benefits of Incorporating Your Business in Nigeria: Incorporating a business in Nigeria can be a daunting task, but the benefits far outweigh the challenges. Nigeria is the largest economy in Africa and has a rapidly growing market, making it an attractive destination for businesses looking to expand. In this article, we will discuss the benefits of incorporating your business in Nigeria and how it can help your company thrive in this dynamic market.

One of the main benefits of incorporating your business in Nigeria is the limited liability protection it offers. When you register your business as a limited liability company (LLC), your personal assets are protected from any liabilities or debts incurred by the company. This means that in the event of a lawsuit or bankruptcy, your personal assets such as your home, car, or savings will not be at risk. This is a crucial advantage for business owners, as it provides a safety net and allows them to take risks without fear of losing everything.

Incorporating your business also gives it a more professional image and credibility. In Nigeria, many customers and investors prefer to do business with registered companies rather than sole proprietorships or partnerships. By incorporating your business, you are showing potential clients and investors that you are serious about your business and are committed to its success. This can help attract more customers and investors, leading to increased growth and profitability.

Another benefit of incorporating your business in Nigeria is the ease of raising capital. As a registered company, you have access to various sources of funding such as bank loans, venture capital, and angel investors. These sources of capital are more likely to invest in a registered company as it provides them with a sense of security and legitimacy. Additionally, as your business grows and becomes more successful, you can issue shares to raise capital, which is not possible for sole proprietorships or partnerships.

Incorporating your business also offers tax benefits. In Nigeria, registered companies are subject to a lower corporate tax rate compared to sole proprietorships and partnerships. This means that you can save a significant amount of money on taxes, allowing you to reinvest it back into your business. Additionally, registered companies are eligible for tax incentives and exemptions, which can further reduce their tax burden. This can be a significant advantage for businesses looking to maximize their profits and minimize their expenses.

Furthermore, incorporating your business in Nigeria can also help you attract and retain top talent. As a registered company, you can offer your employees benefits such as health insurance, retirement plans, and stock options. These benefits are highly valued by employees and can help you attract and retain the best talent in the market. This, in turn, can lead to increased productivity, innovation, and overall success for your business.

Incorporating your business in Nigeria also provides you with a clear legal structure and governance framework. As a registered company, you are required to have a board of directors, hold annual general meetings, and keep proper financial records. This ensures transparency and accountability within the company, which is essential for its long-term success. Additionally, having a clear legal structure can also protect your business from internal conflicts and disputes.

In conclusion, incorporating your business in Nigeria offers numerous benefits that can help your company thrive in this dynamic market. From limited liability protection to tax benefits and access to funding, registering your business as a limited liability company can provide a solid foundation for growth and success. It is important to seek professional advice and assistance when incorporating your business to ensure that you comply with all legal requirements and maximize the benefits of incorporation. With the right approach, incorporating your business in Nigeria can be a game-changer for your company.

STEP BY STEP GUIDE TO INCORPORATING YOUR BUSINESS IN NIGERIA

Step-by-Step Guide to Incorporating Your Business in Nigeria: Incorporating a business in Nigeria can be a daunting task, especially for those who are not familiar with the country's laws and regulations. However, with the right guidance and knowledge, the process can be smooth and successful. In this article, we will provide a step-by-step guide on how to incorporate your business in Nigeria.

Step 1: Choose a Business Structure

The first step in incorporating your business in Nigeria is to choose a suitable business structure. The most common types of business structures in Nigeria are sole proprietorship, partnership, and limited liability company (LLC). Each structure has its own advantages and disadvantages, so it is important to carefully consider which one best suits your business needs.

A sole proprietorship is the simplest and most common form of business structure in Nigeria. It is owned and operated by one person, and the owner is personally liable for all business debts and obligations. A partnership, on the other hand, is a business owned and operated by two or more individuals who share profits and losses. In a partnership, each partner is personally liable for the business's debts and obligations.

An LLC, also known as a private limited company, is a separate legal entity from its owners. This means that the company's liabilities are limited to its assets, and the owners are not personally liable for the company's debts and obligations. An LLC is the most preferred business structure in Nigeria, as it offers limited liability protection and is relatively easy to set up.

Step 2: Choose a Business Name

Once you have decided on a business structure, the next step is to choose a business name. The name should be unique and not already registered by another company in Nigeria. You can check the availability of your desired business name on the Corporate Affairs Commission (CAC) website. It is also important to ensure that the name does not violate any trademarks or copyrights.

Step 3: Prepare the Required Documents

To incorporate your business in Nigeria, you will need to prepare the necessary documents, which include a memorandum and articles of association, a statement of share capital, and a notice of registered address. These documents will outline the company's objectives, share structure, and registered address. You will also need to provide copies of the directors' and shareholders' identification documents, such as passports or national identity cards.

Step 4: Register with the Corporate Affairs Commission (CAC)

The next step is to register your business with the CAC. This can be done online through the CAC website or in person at one of their offices. You will need to submit the required documents and pay the necessary fees. The CAC will then review your application and issue a certificate of incorporation if everything is in order.

Step 5: Obtain Necessary Permits and Licenses

Depending on the nature of your business, you may need to obtain additional permits and licenses from other government agencies. For example, if you are starting a food business, you will need to obtain a food handling permit from the National Agency for Food and Drug Administration and Control (NAFDAC). It is important to research and identify all the necessary permits and licenses for your business to avoid any legal issues in the future.

Step 6: Open a Business Bank Account

Once your business is registered and all necessary permits and licenses are obtained, you can open a business bank account. This will help you keep your personal and business finances separate, which is important for tax purposes and liability protection.

In conclusion, incorporating a business in Nigeria may seem like a complex process, but by following these steps, you can successfully register your business and start operating legally. It is important to seek professional advice and ensure that all legal requirements are met to avoid any complications in the future. With the right approach and knowledge, you can establish a successful and thriving business in Nigeria.

TYPES OF BUSINESS ENTITIES IN NIGERIA WHICH ONE IS RIGHT FOR YOU

Types of Business Entities in Nigeria: Which One is Right for You? Nigeria is a country with a thriving economy and a growing business sector. With its large population and abundant natural resources, it presents a great opportunity for entrepreneurs and investors to establish their businesses. However, before starting a business in Nigeria, it is important to understand the different types of business entities available and choose the one that best suits your needs.

The most common types of business entities in Nigeria are sole proprietorship, partnership, limited liability company (LLC), and corporation. Each of these entities has its own advantages and disadvantages, and it is crucial to carefully consider them before making a decision.

Sole proprietorship is the simplest and most common form of business entity in Nigeria. It is owned and operated by one person, who is solely responsible for all the business's profits and losses. This type of business is easy to set up and requires minimal paperwork and legal formalities. However, the owner has unlimited liability, which means that their personal assets can be used to settle any business debts or obligations.

Partnership is a business entity owned and operated by two or more individuals. It is similar to sole proprietorship in terms of ease of formation and minimal legal formalities. However, in a partnership, the owners share the profits and losses of the business. This type of business entity also has unlimited liability, which means that each partner is personally responsible for the business's debts and obligations.

Limited liability company (LLC) is a hybrid business entity that combines the features of a corporation and a partnership. It offers the owners limited liability protection, meaning that their personal assets are not at risk in case of business debts or obligations. LLCs are also relatively easy to set up and have fewer legal formalities compared to corporations. However, they require more paperwork and have higher registration fees.

Corporation is a separate legal entity from its owners, and it is owned by shareholders. It offers the most significant level of liability protection to its owners, as their personal assets are not at risk in case of business debts or obligations. Corporations also have a perpetual existence, meaning that they can continue to exist even after the death of its owners. However, corporations are more complex and expensive to set up, and they require more legal formalities and paperwork.

When deciding which type of business entity is right for you, it is essential to consider factors such as liability protection, ease of formation, tax implications, and the nature of your business. For instance, if you are a small business owner with limited resources and want to have full control over your business, a sole proprietorship or partnership may be the best option for you. On the other hand, if you are planning to start a large business with multiple owners and want to protect your personal assets, a corporation or LLC may be a better choice.

It is also crucial to seek professional advice from a lawyer or an accountant before incorporating your business in Nigeria. They can guide you through the legal requirements and help you choose the most suitable business entity for your specific needs.

In conclusion, Nigeria offers a conducive environment for businesses to thrive, and choosing the right type of business entity is crucial for success. Whether you decide to go for a sole proprietorship, partnership, LLC, or corporation, it is essential to carefully consider the advantages and disadvantages of each and seek professional advice before making a decision. With the right business entity, you can set your business up for success and contribute to the growth of Nigeria's economy.

Read the full article

0 notes