#Tequila and seltzer RTD

Text

The High Noon Takeover

High Noon has been a leader in the ready-to-drink market since the category exploded from 2019 to 2022. In the short time since, the brand has only continued to grow in popularity as consumers move away from malt-based hard seltzers. This consumer trend comes as people are looking for healthier alternatives and want more natural-based ingredients. High Noon gave consumers what they wanted as they had created a seltzer using premium spirits, and real fruit juice, with no added sugars. Whereas a vast majority of their competitors do not use real fruit juice, giving them a significant competitive advantage. With the company's newest addition of tequila seltzers, the question arises of what else High Noon can do to further expand its market leadership in the spirit industry?

High Noon seltzers blew up during the RTD (Ready to Drink) popularity boom- and has recently taken over as the top spirit brand in the U.S. market. This comes as a shock to followers of the alcohol market, as Tito’s had previously held the number one spot by a considerable margin. For border context: this change happened quickly. In 2021 the company was not even in the top ten and has now taken over the number one spot.

Speaking to its market dominance, in 2021 the company sold 8.8 million 9-liter cases and increased that number the following year by 85.6% increasing sales by 16.4 million 9-liter cases in 2022. High Noon played a major role in the RTD market popularity increase and now leads that market, as well as the spirit market as a whole. High Noon’s popularity and over-taking of its traditional competitors comes from being one of the first hard seltzers on the market to use real vodka, real fruit juice, and no added sugars in their product. The company prides itself on having just the right amount of flavor while not being overbearing with added sugars and unnatural flavoring.

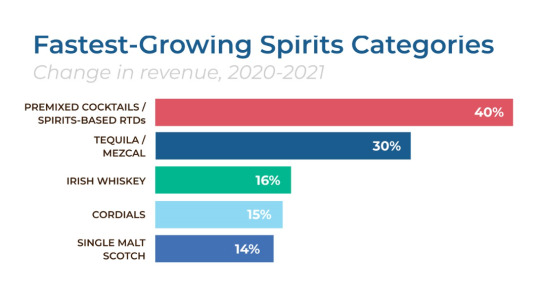

The company has furthered its market penetration by recently adding a new tequila-based seltzer line. This is going to have a massive positive impact on their revenue and will expand their margin as the leading spirit brand. Besides the RTD category (40%) the next fastest-growing spirit revenue comes from tequila (30%). Therefore, was a perfect time to release a tequila-based RTD as they lead the consumer's trends in the spirit categories. While the company was not the first tequila-based RTD the company's GM explains the success of the product by saying “West said that his brand has the first seltzer that simply mixes tequila with juice without added sugar. He described the taste as a ‘fairly light delivery’ without the punchy bite of a typical tequila drink”. Consumers are moving away from sugary fruity drinks and want something that tastes good while also being convenient. High Noon has done an amazing job of capturing the spirit marketplace and the company's revenue and market share show it.”

The release of the tequila seltzer was the first move High Noon had made after taking over as the number-one-selling brand in the market. This leads consumers to ask the question of what the company's next move will be to further their market leadership. The company has become so recognizable/popular and desired that I believe they could continue with just these two lines of RTD’s and still hold the same market share. However, there are ways they can further increase sales and market leadership

Once the numbers come in this year for the company's sales, they will be able to determine the success of adding a new spirit seltzer line. If the tequila line was able to successfully increase the company's revenue, they should investigate adding another line. They can investigate the top-grossing spirit types and determine if the product would market and sell well.

In my opinion, they should expand off their normal vodka-based seltzer line and create a hard iced tea. Vodka and iced tea drinks have recently become very popular local brands notably replacing brands such as Twisted Tea given that they are less sweet. Another main advantage of High Noon yields is using spirit-based versus malt for their beverages, in turn promoting a cleaner flavor. By creating a vodka tea they can attract another demographic of consumers who do not like the typically-offered carbonated drinks. This consumer trend has raised flags to many companies, leading them to also create a non-carbonated RTD that still has great flavor. I believe High Noon can achieve this while still staying true to its brand of using no added sugars and real fruit juice. Adding this product line will only further the company's success and bring them to a whole new level.

High Noon also made an astonishing partnership with Barstool Sports that can't be dismissed while discussing the company’s success. It may have been the brand’s most strategic move to partner with one of our generation's most powerful and influential media outlets of all time. Barstool Sports has taken the world by storm, and they are everywhere involved in almost all sports and other endeavors such as gambling. Barstool has taken over social media and you cannot avoid seeing its content making it one of the most successful brands to market with. Utilizing Barstool’s outspoken founder, Dave Portnoy, as an endorser for High Noon was another major success. People love him as he has a massive following online and is always promoting the company in a fun way. High Noon's success is far from declining as both their brand and their affiliate Barstool Sports are experiencing exponential growth across online and market spaces.

0 notes

Text

Forget Crypto, Rum Seltzer Is The New Talk Of The Town In Miami

Forget Crypto, Rum Seltzer Is The New Talk Of The Town In Miami

Ricardo Sucre is not a fan of beer. He’s a cocktail guy—and more specifically a rum cocktail kind of guy. During the lockdown periods of the pandemic, like many of us, he began turning to the ready-to-drink format to provide escape while many of his favorite local bars in Miami remained closed. The only problem was that most of these RTDs were made with vodka, tequila or even flavored malts. He…

View On WordPress

0 notes

Text

Global Alcoholic RTD Market Entertain New Players for Innovation

Ready-to-Drink (RTD) Alcoholic beverages (Alcopops) are flavored drinks with relatively low alcohol content. These are premixed alcoholic drinks with various fruit flavors and are mainly spirit-based, malt-based, or wine-based. Changing dynamics of the alcohol market, rising consciousness about its consumption, and innovations led to the introduction of such canned bottles RTD and high strength premixes globally. These low-content alcoholic beverages appeal to the young demographics worldwide, pushing the global alcoholic RTD market.

Since its inception in the 1990s, the alcopops drew brows around the world. The first player that launched product in this segment was Barcadi’s Breezer in 1993, followed by Smirnoff Ice, Two dogs, and others. With the changing lifestyles and consumption habits, and the rising interest in low alcohol content drinks, the market is expected to grow at 4.38% of CAGR from 2021 to 2028.

Top manufacturers such as Bacardi Limited, Anheuser Bursch InBev, Suntory Spirits Ltd have strained the competition with massive investments. However, rising consumption of RTD beverages and the industry’s attractiveness will open opportunistic entrance for new players & the market.

Top Ready-To-Drink Alcoholic Beverages with its Brands:

1. Bud light

The malt-based Bud light drinks manufactured by Anheuser Busch InBev is dominating the market, especially in the United States. With the massive success of Bud light Ritas, the company launched Bud Light Mixxtail in 2015. Numerous variants of Bud Lights are significant attractors of the young female population.

2. Ritas Spritz

Rita spritz, another innovation by multinational brewing company Anheuser Busch InBev, initially launched as Lime-A-Rita explicitly targeted the women population. The canned margaritas come in variants like Grape-A-Rita, Orange-0- Rita, and others.

3. Barcardi

Barcadi’s RTD cocktails dominate the market, launched under various product names like Bacardi Limón, Bacardi Pineapple, Bacardi Tangerine, Bacardi Dragonberry, and others. These RTDs are manufactured by the largest spirits company. Bacardi Limited is consumed mainly by the young generation and women globally.

4. Truly Spiked and Sparkling

The light, low alcohol content Truly spiked & Sparkling manufactured by US-based, The Boston Beer Company comes in variants namely, Colima Lime, Grapefruit & Pomelo and others. The company launched this new hard seltzer range in 2016.

5. Smirnoff Pure of Diageo PLC

The Smirnoff Pure, manufactured by multinational beverage company Diageo PLC, grabbed the RTD market globally. This bubbly drink is its first premix to combine vodka and natural fruit ingredients with no added preservatives and artificial ingredients.

6. Austin Cocktails

The vodka-based Austin cocktails come with a mix of natural ingredients and low alcohol content crafted authentic cocktails. The drinks manufactured by a family-owned company, Austin Company, include Bergamot Orange Margarita, Paradise Found, Cucumber Vodka, and Tea Twister.

7. Jack Daniel’s RTDs

Jack Daniel’s ready-to-drink beverage is manufactured by one of America’s largest spirits companies, The Brown-Forman Corporation. The brand grabs a significant share of America’s market and globally. Jack Daniel’s country cocktails are suitable for various occasions with a blend of whiskey and fruity flavor.

8. Sparkling Margaritas

Jose Cuervo, known as the world’s oldest tequila brand, manufactures the ready-to-drink canned sparkling margaritas. The drink is available in flavors, namely classic lime, strawberry, and Paloma, along with its authentic golden margaritas. The company has an operating presence across the globe and holds a significant share in the global alcoholic beverages market.

All in all,

The dominant players are influencing the market by launch of alluring products & capital. Also, with the growing expansion in emerging economies, innovations in packaging, and the presence of new entrants with crafty products, the global alcoholic RTD market has massive opportunities and prospects.

#Alcoholic RTD Market#Ready-To-Drink#Alcoholic#Food and Beverages#Consumer goods and services#inkwood#inkwood research#market research report#market research reports

0 notes

Text

VinePair Podcast: Who Wants to Buy an RTD Brand?

The future of canned cocktails remains to be seen, but for the people and brands that were early to the game, perfecting RTDs has been a pursuit of passion. On today’s episode of the “VinePair Podcast,” featuring a brand new format, hosts Adam Teeter, Joanna Sciarrino, and Zach Geballe reflect on some of the most successful RTD brands they see on the market, and which companies they predict will buy them down the road.

Then, Teeter sits down with one of the people who led the pack in terms of innovation and creativity in the RTD space: Rocco Milano, co-founder of On The Rocks cocktails. Milano talks about why people doubted him when he got into the canned cocktail business five years ago, the brand’s partnerships with airlines and hotels, and what keeps him so enthusiastic about the industry he loves.

Tune in and learn more about On The Rocks cocktails at https://www.ontherockscocktails.com/.

LISTEN ONLINE

Listen on Apple Podcasts

Listen on Spotify

OR CHECK OUT THE CONVERSATION HERE

Adam Teeter: From VinePair’s New York City headquarters, I’m Adam Teeter.

Joanna Sciarrino: And I’m Joanna Sciarrino.

Zach Geballe: And in Seattle, Washington, I’m Zach Geballe.

A: And this is the “VinePair Podcast.” If you’re a regular listener of the “VinePair Podcast,” you might be wondering, why did three voices just pop into my podcast feed?

Z: It IS Friday, we promise.

A: On a Friday? Doesn’t this usually come to my feed on Monday? No, dear listener, you are not confused. That’s because, moving forward, we’re going to be doing — that’s right — two of these a week.

Z: Oh my God.

A: There’s so much demand. But, we’re going to change things up a little bit. So, you might also be used to getting “Next Rounds” in your feed every week. Those are going to come to an end. What we will be replacing the “Next Rounds” with is this episode. Every Friday, you can expect a really awesome conversation between myself, Joanna, and Zach, about a really interesting topic, followed by an interview that one of us is going to conduct with someone who has experience or expertise in the conversation we’ve just had. We’re really excited about this new format. We’ve heard from a lot of you that the conversations that Joanna, Zach, and I have are your favorite part of the podcast. So, that’s why we want to bring you more. We want to give of ourselves as much as we can, because we just love that you love listening. That’s what you’re going to hear from now on. We hope that you enjoy it. We hope that this helps feed the demand.

Z: We’re feeding the beast.

A: Without further ado, let’s get into this Friday’s topic, which is the world of canned cocktails, but with a twist. There’s so many out there. We’ve had the conversation a bunch on the pod. The majority of people who have started businesses in the U.S. recently — especially these kinds of businesses — raise capital. It’s very unlikely that, in this day and age, you go to the bank, get a loan, and open a business. I think our parents’ generation was able to do that. Most people don’t do that anymore. You usually raise angel funding, venture funding, et cetera. Angels and venture funds don’t invest because they like you. They invest because they want a return, which means they want you to sell. When you sell, you hopefully make a profit, and you sell for more than you told them the value of your company was when they invested. Then, they make a profit. I thought we’d have a fun conversation today — before we jump into our interview with Rocco Milano, the co-founder of On The Rocks cocktails — about what canned cocktails that are out there right now we think are the next ones to get bought? Who would buy them and why?

J: We all know that I, and also Adam, love Tip Top cocktails. I don’t know the answer to the second part of this question. I don’t know who’s going to buy them. Guys, come on. I just love them so much. I think they have such a wonderful concept, and they do canned cocktails really well. They’re based out of Atlanta. Who would buy them?

A: I think because they’re a Southern-based brand, if we’re just going to stick to spirits companies, I think the most likely acquirer, for me, will be Sazerac. It’s the company that owns Buffalo Trace. It’s really well known in the spirit space, but they are Southern-based. They’re based in Louisville. They also have offices in New Orleans. This is an Atlanta-based company. It feels like, if Sazerac isn’t paying attention to Tip Top, they probably should be. They make a really good Old Fashioned. It could be interesting to see how that Old Fashioned tastes with one of their whiskeys. Sazerac dabbles in the worlds of tequila, rum, et cetera. It could be interesting to see how their specific spirits play in those drinks, too. What do you think, Zach?

Z: The fascinating thing to me about this category is that you have two possible paths for a company to come in and buy one of these brands. You have the model that you talk about with Rocco in the interview about On The Rocks, where it stems out of a partnership with Beam Suntory, using their product in the canned cocktails. It makes total sense. They already have an established partnership. Eventually, Beam Suntory says, hey, we think what we’re doing here is really working. We want to buy this out. That would fit the Sazerac model, even if there’s not an established partnership. They see a way to get themselves an RTD presence with a brand that has a lot of acclaim. They can feed their product in through that. I wonder if you could see a different model with Tip Top. That’s another Atlanta-based company: Coca-Cola. To me, what’s fascinating here is that we just saw PepsiCo get into beverage alcohol with the Mountain Dew hard seltzer. Prior to that, non-alcoholic soda companies did not touch alcohol. They didn’t co-market. You didn’t get a pre-mixed rum and Coke or something like that. You know Coca-Cola has got to be looking at RTDs and hard seltzers. They know they have the most recognizable beverage brand in the world, so how are they not leveraging this? That leveraging might look like them putting their own stuff out there. But, if they want to be able to get multiple facets of an alcohol distribution business going, to me, that seems like a natural one. As you talk about with Rocco, not to spoil the entire interview, is that, for them, a big part of the business model was placements in hotels, airlines, and arenas. Coca-Cola’s got all of that locked down.

J: Tip-Top is already involved in that as well. It’s the perfect synergy.

A: Yeah, they’re in Delta.

Z: Coca-Cola can take that global. Tip-Top is probably not going to take airlines and stadiums the world over by themselves. But, Coca-Cola can do that. That would be my guess. It’s a little out there.

A: It’s really interesting. I think that’s smart.

J: It’s pretty good.

A: What about you, Zach? What brand would you throw out there, as one that people should be looking at right now that’s in the canned cocktail game?

Z: Well, I think that’s really fascinating. I will freely admit that the first one I thought of that I see a lot is Cutwater. They’re actually owned by AB InBev. So, they’ve already been bought. I was too late on that one. I know you interviewed the founders of Crafthouse. With a brand like that, there isn’t as much of a natural synergy with a local or regional brand. They’re Minneapolis-based, right, Adam?

A: Yes, but there is a synergy. I’ll get there after you talk.

Z: OK. You talk. You did the interview. I’m going to take this conversation a little bit sideways. I apologize. Will you see a brand that is focused on ultra-premium canned cocktails? So far, the price points have been well under what you would pay for a cocktail at a bar or restaurant, typically. What if someone says they want to start making a Manhattan with ultra- premium bourbon. That might not get the same mass market intention as some of these other brands. But, maybe that catches someone’s eye who asks, why wouldn’t someone get a $15 canned cocktail if we could put a product in it that demands that price point? I don’t know. Maybe we can do that. So, tell me about Crafthouse.

A: The natural synergy here is that Charles Joly, who is one of the two founders, has won Diageo World Class. He’s in the family. They clearly know who he is. I also think Diageo could take that brand and do some really interesting things with it. One of the things that I would fix with Crafthouse, a little bit, is some of the branding. I think Diageo is really good at branding and marketing. Crafthouse is really good at having really high-quality liquid in the bottle. That could be really interesting for them to play around with. Crafthouse is doing some interesting things with packaging and stuff. For me, I have one obvious one and a second one. The first is the question of who would ABI buy? ABI loves acquisitions. I think that’s because their acquisitions are pretty obvious. It’s going to be F!ve Drinks. I think F!ve Drinks will get bought pretty soon by ABI, because ZX Ventures is a pretty big investor in F!ve Drinks, and the founder of F!ve Drinks is a former ABI executive. On The Rocks was not founded by a former Beam Suntory executive, but Beam was a minority investor in the drinks pretty early on and then bought it. I think that’s why it’s going to happen. They also have high-quality cocktails in a can. The other one that I think would be interesting for people to be paying attention to is St. Agrestis. Their branding, quality, and their innovation sets them apart. I know that other places have been doing bag-in-box cocktails, but not to the extent that St. Agrestis has in terms of making it actually feel cool. The branding is really good, and the cocktails inside are great. They’re very much Italian-focused. I was thinking about this for a while, and I think a lot of people might be shocked at the company that I would say I think we should be looking at. I think that’s Gallo. The reason that I say Gallo is because they are very quickly becoming the fifth-largest spirits company in the country. They’re Italian-focused. They’re an Italian-American family. They have a lot of amazing Italian wines. They bring in Renato Ratti, Allegrini, et cetera. I think a lot of people aren’t aware that they have a partnership with Montenegro Select, et cetera. It would actually fit very well. I understand that St. Agrestis is also a distillery, which makes it a little bit different from some of the others we’re talking about who are sourcing their spirits from other places to make their canned cocktails. They’re a canned cocktail brand that also owns a distillery. There could be some issues there. Is Gallo going to immediately insert Select into the box of Negronis that St. Agrestis is currently making? Probably not. Part of what makes those cocktails very popular is that they’re using their own Inferno Bitter. But I think it would be really interesting. Gallo is a company that really understands distribution and marketing. They understand that format, too. Gallo has been selling boxed wine forever as one of these skews that they believe in. For them to be the company that gets behind boxed cocktails would be really cool. I think they could do it really well. That would be mine. We have four companies that really seem to fit the mold for why you would be bought and by whom. Is there anyone we missed?

Z: I can’t believe I didn’t think of this before, but I was thinking back on our podcast episodes, and thought of Ramona, which was founded by Jordan Salcito. You can listen to that podcast interview as well, in the archives. They’re already relatively well established, but it’s hard to know in this whole category where the upward growth potential is for some of these brands. Has Ramona reached its natural equilibrium point? It’s available all over the country, at least to some extent. It’s well regarded. But, is there 10x growth in it? I don’t know. Maybe because of its flavor profile and style, it has just capped out where it is. That’s obviously a big part of this. Anyone who’s looking to acquire is looking for something that they can take and grow massively. They want to take it from where it is to a much bigger state. I just think it would be remiss in not mentioning them because they were one of the first.

A: I don’t see it for them, to be honest.

Z: They may not want it. That’s the other thing.

A: I think the brand is cool, but I think it’s almost too “cool kid.” The other issue is that it’s been around for a really long time. Usually what you see with purchases is a brand that gets bought that’s had very quick momentum. You want a company that says, “We know that with the cash that we could funnel in, we could immediately 5x or 6x this growth.” For wine spritzers, I just don’t know how big that market is. I think if Ramona pivoted and they were making spritzes with an Aperol contingent or whatever, that has a huge potential. Then, the question is, what spirits company would purchase and want to go up against what’s coming very quickly to the American market, which is Aperol Spritz as a canned cocktail. Right. That’s going to be a behemoth. We know how much money Campari put behind Aperol in the American market a few years ago. That would be a lot to compete against. I think it would be difficult. But, who knows?

J: I had another one. I was thinking about Lone River, but that was actually already acquired by Diageo in March. Then, I was just thinking of this category of Ranch Waters and tequila-based RTDs. I thought of Onda.

A: Yes, that’s true.

J: I really liked Onda. I would much prefer to drink that than a White Claw or a hard seltzer. I think that has a lot of potential. It’s also just getting very popular now. I don’t know, I could see Bacardi.

A: That would make a lot of sense for Bacardi. Bacardi owns Patrón. They’ve had some of the biggest acquisitions in the past, so that they’ll be really interesting. So, why don’t we get into this conversation I had with Rocco Milano, the co-founder of On The Rocks. We can hear his story about how, only five years ago, they started a bottled cocktail brand when everyone thought they were crazy. They have sold it, already, to Beam Suntory.

A CONVERSATION WITH ROCCO MILANON, CO-FOUNDER OF ON THE ROCKS

A: Today, I’m really excited to be joined by Rocco Milano, the co-founder, brand ambassador, mixologist of On The Rocks cocktails. It’s probably pretty likely that recently, you’ve seen these in your local liquor store, maybe on a plane or in a hotel. These things are everywhere recently. Rocco, thanks so much for joining me.

Rocco Milano: Adam, it is an absolute pleasure to be here. Thank you for having me.

A: We’ve got to get into this. I’m really curious. We’ve talked to a lot of different canned cocktail brands as part of these conversations, but you guys were some of the earliest. When you started, it really felt like there was a huge white space. 2015 was when you launched, right?

R: In 2015, I was being told flat out that I was pissing away my career by getting involved in a ready-to-drink.

A: And now you’re owned by Beam. Six years changes a lot. It is insane how many bottled cocktails the VinePair staff is sent every single week. I’d say everyone has a desire, now, to get into the business. Could you take us back to that beginning in 2015? Tell me a little bit about what you guys saw, what made you decide to do this then, and how you went about it?

R: Sure. It starts at a restaurant, at a bar. I’ve been a bartender for 15 years. My business partner, Patrick Halbert, owned a restaurant that had formerly been known as Private Social and re-concepted as Barter. I stuck around. I was running his beverage program. We tried doing a lot of different things, and we kept getting known for our cocktail program. It was just a really strong one. Private Social, within six weeks of being open, was in the top 10 places in the city to drink. We kept that trend going. We were a cocktail hotspot to the point that, 10 years ago, I had to pull beer from my taps and I was doing cocktails on tap. I couldn’t sell beer to save my life at that place. Everyone came in, and that’s what we were known for.

A: Let’s tell people where you are. You’re talking about Dallas, right?

R: Yes, my apologies. Dallas, Texas.

A: It’s pretty funny that you couldn’t sell beer in Dallas. I think there’s the stereotype of Texans liking their beer. That’s really interesting.

R: Let me take it a step further, brother. I decided to throw in the towel on the Texas versus OU weekend. I could not sell beer to Texans or Oklahomans. I threw in the towel, at that point, for beer. I said, you know what? We’re going to lean into cocktails. We’re going to play to our strengths and we’re really going to push that. Ten years ago, we were doing something that was fun and different. That was the cool part of working with Patrick. Anything I wanted to do, he was always on board with. He got me away from the Mansion on Turtle Creek — which is a five star, five diamond hotel — to go run a bar in uptown Dallas. It was because he used these two magic words that I desperately wanted at that point. It wasn’t more money and it wasn’t better benefits, even though I technically got both. It was creative control. Adam, that was worth its weight in gold to a bartender who’s lost in cocktail books, who’s just reading, who’s going home and sleeping six to eight hours a night because they can’t wait to get back into the kitchen and try doing all these different things. It was so much fun to kind of live in that place of, “Can I be creative?” There’s a great line from “Willy Wonka and the Chocolate Factory”: “pure imagination — living there, you’ll be free if you truly wish to be.” That’s where I was at. It was just such a fun place and time to be able to do all these cool things. I put a cocktail on my menu called Bartender’s Choice. I would ask you four questions, and I’d customize a cocktail for your experience. It was so much fun because it gave me the chance to just wow every single guest I had come into that bar. The highest compliment I’ve ever been paid was when one woman once told me, “You just served me everything I never knew I always wanted.”

A: That’s pretty dope.

R: Right? It was really, really cool. Virgin America, their in-flight team, was doing a big kick-off out of Love Field. I had a number of friends at LSG Sky Chefs. They brought the in-flight crew. Virgin’s just a cool brand to be affiliated with in any way, shape, or form. Their VP of food and beverage came in with the in-flight crew. It was about six people sitting at this one table. I go to the table and do Bartender’s Choice for all six of them. I asked these four questions to all six people. I go back to the bar. I pull different glassware, and I’m doing different spirit types. I’m doing this bitters, this garnish, this fun throwback, this modern twist. I’m changing it up all depending on what they said. I come over, I drop all six drinks down, and I start going through everything. The VP for Virgin turns to me and says, “Would you consider doing an in-flight cocktail menu for Virgin America? We absolutely love this. We think this is so cool.” I talked to Patrick about it. Patrick comes back and says, I’ve got a better idea. What if, instead of just putting together a menu, we found a way to bottle cocktails and see if Virgin America would be interested in buying them? We started trying to target airlines. Any time you’re starting a business, you can’t get enough good advice. There were a number of people who said, “Man, you are pissing away money trying to sell to airlines.” What we found is that we weren’t trying to compete, necessarily, head-to- head with whiskey providers, vodka providers, or distilleries. What we were doing was offering that extra little step of combining the cocktails for you. So, for that in-flight team, all you have to do is pop and pour. There’s five of these poor people on the plane. There’s 300 passengers. Now, we can do a fun, cool cocktail program at 30,000 feet. Unfortunately, Virgin got acquired by Alaska before the program kicked off, but they took the extra step of introducing us to some of their friends. We ended up working with Hawaiian Airlines, which was our first airline partner. Now, to this point — and it’s still a very surreal thought — our Mai Tai flies everywhere that Hawaiian flies around the world. That’s amazing. You can get a cocktail I made from Honolulu to Sydney. It’s mind blowing, brother. Just mind blowing to me.

A: That’s crazy. You took a path that seems like a no-brainer. I was also really impressed that you targeted hotels early on. Even now, it’s something I don’t think a lot of people making canned and bottled cocktails are doing. I think they’re still going after the restaurant or they’re trying to get in at all these different independent wine shops and spirits stores. What you did was ensure that your brand was exposed to every single person that flew. That’s just incredible.

R: Absolutely, Adam. What we started to develop very early on was a philosophy that we are for where the bartender is not. I remember presenting to Omni Hotels and when I first met with their VP of food and beverage, he pointed at the bar behind him and said, “I have a full bar right there. Why do I need you?” I immediately shot back, “Let’s talk about your in-room dining program. Let’s talk about what you’re serving in your golf carts. Let’s talk about your spa program. Let’s talk about your VIP amenities.” I’m a Hilton Diamond member, a Marriott Bonvoy member, and an Omni Black member. Anyone can send red wine or sparkling. That’s not particularly interesting or sexy. Now, I can send you some Old Fashioneds. I can send you some Margaritas. I can send you an actual cocktail basket if you’re hosting your wedding at my property. That’s innovation. That’s showing up in fun, creative ways that nobody else was doing at the time. It’s what made it so much fun, over the past five years, to go to these conferences and present to these people. You could see it in their eyes when the light switch flipped. All of a sudden, they got what I was talking about. They picked it up and ran with it. You’re exactly right, man. We managed to create demand, effectively, by playing in a space that nobody was playing in.

A: First of all, I’ve had the cocktails. They’re very good. I especially enjoy your Mai Tai. Also, I’ve had a lot of founders and people on this podcast; you are insanely excited and a hell of a salesman. That goes a long way. Your enthusiasm for this is very infectious. It’s something people should take into account. Your enthusiasm has to come through. If you’re not enthusiastic about what you’re doing, you’re never going to sell it, or it’s going to be a much harder sell. I can already see you, five years ago, sitting down with some of these beverage directors and convincing them to be as excited about it as you are. A five-year trajectory from start to sell is insane. It’s really insane.

R: It’s completely mind blowing to me. It really is. First of all, thank you so much for the shout-out on the energy. Much love to 5-Hour Energy. I’m on my third for the day, and that’s definitely helped. Beyond that, we’re talking about a subject that I love and that I am passionate about. There was a guy I used to work with in Florida, he was part of the hotel team for our distributor down there. He would always tell me that just hearing my travel itinerary made him nervous. When people would ask me, “Where are you based?” I would always answer the same way. I fly out of American Airlines and I’d say, I’m based at the nearest Admirals Club. I’m forever on the road. But, you want to know why I’m on the hustle? I love what I’m doing and I genuinely believe in what I’m doing. I’m one of those truly blessed people that gets to do what they love. I also have four little boys, ages 13, 8, 6, and 5. Do you know what that means, Adam? Everyone’s hitting college at the exact same time. You better believe I was out there talking to people, going to the shows, going to the meetings, and trying to make it happen.

A: Let’s go back to, how did you make it happen? We’ve jumped very far ahead. Beam ultimately bought On The Rocks in 2020, very recently. So, Virgin comes in, they ask you to make a menu. Your business partner says, “I’m going to do this one better. Let’s try to bottle these.” So, how did you figure it out? One of the other things that has been really difficult in this specific market is that so many of them suck. So many of the bottled cocktails just aren’t that good. How did you go about trying to figure out how to make these cocktails taste good? It’s not as easy as a lot of people think it will be.

R: I couldn’t agree with you more. First and foremost, it took a solid year of R&D. We had to close down the restaurant to start the cocktail journey. One of the things that we had going for us is that I’m not a guy in a lab coat that’s never made a cocktail. I’ve worked with these drinks day in, day out, 15 years, through every kind of bar you can imagine. I knew what these drinks should look like and what they should taste like. Because I was able to approach it as a bartender would, we very quickly established what our tenets were as a brand. We had to be natural. We had to stick with cane sugar. I didn’t want to use fructose, corn syrup, or any of that garbage that’s out there. Any color variations had to be fruit or vegetable juice. We didn’t want to use these inauthentic parts. We wanted to give you that cocktail experience, and that had to start with what we were going to put into the drinks. There was a lot of trial and error. We sent out emails to purveyors for every kind of ingredient you can imagine. Aside from having been a bartender for the past 15 years, I’m a certified spirits specialist, and I’m a spirits professional in the U.S. Bartenders’ Guild. I took a lot of pride in learning about all these different ingredients that I was going to use. For instance, when we first talked about the Mai Tai, we picked rums of different styles, regions, and ages. Consequently, we blended something together. It follows that great Tiki saying that “what one rum can’t do, three rums can.” That does not mean drink three times as much rum, if that’s the first time you’re hearing this. It means, when you blend different styles, techniques, and approaches, you get something so much better than any one of them could be. It’s greater, fuller, and richer. That’s the approach we took to cocktails. There was no right or wrong way to do it. I’ve got cocktails that call for mezcal. I’ve got cocktails that we could make with pisco. I’ve got cocktails that we could make with rum. We ran the gamut of what we thought would work. And one of the things that we always kept in the forefront with what cocktails we were going to produce was that we looked at it as: what would a bar menu look like? Whatever my guest wanted, that’s what I was able to deliver. That was huge for us.

A: When you were making these cocktails, you were thinking about packaging, et cetera. Did you see this as a brand that would be both single-serve and multi-serve? A lot of the cocktails you’re seeing come out now, at least in the last year, are single-serve. The majority of what I’ve seen for you guys is that you bottle in larger formats. Not larger, like 750, but like 375. What was your thought process around what you were going to put this liquid in?

R: So the 100-milliliter was the first thing that we ever started bottling. That was targeting airlines, like I said. Interestingly enough, we learned with our concession partners, our local football club, and eventually some of our NFL partners, that glass bottles are considered projectiles. While it would never occur to me to throw a bottle at a ref’s head, plastic was something that was very important to them. Since we were targeting those areas where the bartender wasn’t, thinking about how somebody could pop and pour a perfect pour was very important. That 100-milliliter, for instance, will perfectly fill a 10-ounce rocks glass once there’s ice in the cup. It’s a single cup I can hand my guest and be done with. Our 200-milliliter was glass. That was designed more for where people were going to be able to touch the bottle. Think about hotel marketplaces and hotel grab and gos, where the guest is going to be able to pick it up, read the label, see what’s on it, and turn it over. We wanted that experience to be glass. The 100-milliliter was a pouring device. The 200-milliliter was the first step into what somebody would pick up and would pour. Fun fact: That will fill a red Solo Cup. Lastly, we launched the 375-milliliter size when we started getting into retail. That was more about shelf presence. Certainly, as we’ve expanded in our retail placement, that’s been what’s been growing the most.

A: One more question for you about the liquid before we get into the business. How important is the proof of the cocktail? Some people have told me that they think another reason that some of these canned cocktails aren’t so great is because the proof is too low. When someone dumps it over ice, it waters down even more. I’m curious what your thoughts are in terms of proof and what the proof should be when you bottle these items.

R: I absolutely love that question. The whole reason we called it On The Rocks is because we factored in for that dilution. Having been a bartender, we ask ourselves, why do we shake? Why do we stir? Why do we do those things? The answer is to add that dilution to the cocktail. That was very important to us. We wanted to have that strength. There’s a reason we didn’t use vodka with everything. I want you to know you’re drinking rum. I want you to know you’re drinking whiskey. I want you to get the agave notes in that tequila. Proof was very important because, once you pour it over ice, if you factor in for that dilution, that guest is going to be able to sit there and sip on their cocktail and not have to slam it. With so many of the other things out there, as soon as you pour it over ice, in two minutes, you’ve got water. We were after a replication of that authentic bar experience, but one that you have on your terms. You’re having it at 30,000 feet. You’re having it on a cruise ship. You’re having it at a hotel.

A: One more question, because you’re really answering all these questions I’ve always wanted to know. A lot of other people with canned cocktails say that another thing that’s hard to get right is citrus. I think you do a pretty good job with the Margarita. What was that process like? You can’t use fresh citrus. It’s not shelf stable. What did it look like to figure out how to really hit those notes? With your Margarita, it really does taste like a Margarita.

R: It’s actually pretty straightforward. It just depends on the lens you’re looking at it through. When we talk about wine, for instance, we talk Brix, pH, and ABV. The exact same thing is true in cocktails. When I first started getting really into cocktails, I had one mentor who said to me that if you blend to where all three of those components are in sync, whatever you’re making is going to be pretty decent. It’s going to be drinkable, at the very least. When something wasn’t too sour, too sweet, too strong, or too weak, I took that with me throughout the rest of my career. Your ability to deliver a balanced cocktail consistently between those three elements is going to be what’s paramount to keeping us in business. If you’re somebody in a lab coat that’s never made a cocktail before in your life, you may not look at the world that way. As a bartender, I know the thought process. I know the feeling. I’ve seen guests light up when they have something that’s balanced and fresh. I’ve converted wine drinkers. One of the questions I would ask with Bartender’s Choice, is whether there are any spirits you love or hate. If you told me you hated gin, there was a 100 percent chance you were going to get a gin cocktail from me. The reason for that is that gin is a beautiful spirit. It’s an amazing spirit. When executed properly — when you can get some of those softer botanicals in there by taking away the bite and harshness from the spirit, allowing the flavor profile to shine through — you have created something amazing. You have delivered something that is truly a culinary experience in a glass to that guest. That’s when you win people over. Because I saw that in person, I wanted to put that in a bottle.

A: That makes a lot of sense. Talk me through the partnership with Beam. It was a partnership before it was an acquisition. How did that happen? Did they come to you? Did you go to them? When did that happen?

R: It was a few years in, when we actually started partnering with them and using spirits. I’d say it was about two or three years. Our COO at the time was very good friends with some of the people at Beam Suntory. He would make sure that they always knew what we were working on. He just kept those back channels open. We started to pick up steam and show that we were in different places. I remember being asked once, “How did you get into five airlines in five years? That just seems like an insurmountable task.” My response was, “Have you ever heard of the In-Flight Service Association? Every industry has a conference. We were the only people who showed up at that conference. Consequently, we got the business.” It was about showing up in those places. It was about playing in those spaces where a company like Beam Suntory really wasn’t playing. I think it drew them to us. Once I was able to say that I was using Knob Creek or Larios gin in a drink, things really started to take off in an interesting way, because we had that assurance of quality. Guests know exactly what they’re going to get because they know Knob Creek. They know it’s stellar whiskey. Not to jump too far ahead, but with everything that’s happened, I think that there’s enough stability within the category that people generally trust what’s coming out of a bottle and what’s coming out of a can. At the time, if you jump back two and a half years ago, it was a complete game changer.

A: I would assume that the acquisition happened naturally. They were with you. They saw the growth. Covid happened, and the market exploded. All of a sudden, everyone wanted to have a canned cocktail brand. You were there at the right time.

R: I swear to God, I look around sometimes and wonder, “What the hell happened here?” They were phenomenal partners in the years while we were just using their brands and they were helping us. Once Covid happened, that was very terrifying for a multitude of reasons. It’s scary as an industry professional. I’m a bartender. My wife’s a waitress. We met at a restaurant. Neither one of us is a corporate person. By the grace of God, this didn’t happen five years ago when I was still behind a bar and she was still waiting tables. From that standpoint, it was very scary. I have a lot of friends who are still in the industry. The first couple of months for them were brutal. Then, people stopped booking hotels, getting on airlines, and cruise lines got shut down. Almost overnight, all of that went away. I’d always really wanted to start seeing cocktails to go because it didn’t make any sense to me that I could get the pizza from you, but not the Margarita. Once cocktails to go started picking up, we started to be able to help out these restaurants with those kinds of options. Plus, liquor delivery. It’s something that, three or four years ago, we wouldn’t have even thought possible. Now, I can have a full bar sent to me. It’s kind of crazy. You’re exactly right. We were very much in the right place at the right time with the product that we had, plus being branded. It gave people that degree of assurance that they needed. To your point from earlier, ABV does play a part, in that you know what you’re getting is bar-quality.

A: Right. Man, this has been awesome talking to you. I could talk to you for 30 more minutes. I have so many more questions for you. One last one is, how many skews do you currently have with On The Rocks, and how many do you plan to release?

R: Phenomenal question. Right now, we have six. Three more are scheduled to be released over the course of the next 12 to 14 months. We have 52 cocktails formulated that we could potentially draw from.

A: 52?

R: Brother, I joke that during that first year, we had more attorneys than employees. I had a lot of time on my hands to tinker around and come up with new things. That first year was just exploration. It was pure imagination, as I said earlier.

A: That’s amazing. Thank you so much again, Rocco, for taking the time to talk to me. This has been awesome to hear the story of On The Rocks and your story. It went from a brand that I was sort of aware of a few years ago to being everywhere. I almost can’t walk into a liquor store now without seeing the brand. That’s a testament to what you guys have built and the importance of being early, being super aggressive, and your passion for the category. Seriously, a massive amount of congratulations. You should be very proud of what you guys have done.

R: I appreciate it tremendously, Adam. I always like to say that we don’t sit in cubicles all day. We’re out there. We’re having fun. It’s got to stay that way. We’ve got to be having a good time with this, because that’s what OTR is all about. It’s that on-premise experience. It’s that bar experience. It’s that restaurant experience. It’s living in a world of “yes.” I never want to lose that.

Thanks so much for listening to the “VinePair Podcast.” If you love this show as much as we love making it, please leave us a rating or review on iTunes, Spotify, Stitcher or wherever it is you get your podcasts. It really helps everyone else discover the show.

Now, for the credits, VinePair is produced and recorded in New York City and Seattle, Washington, by myself and Zach Geballe, who does all the editing and loves to get the credit. Also, I would love to give a special shout-out to my VinePair co-founder, Josh Malin, for helping make all this possible and also to Keith Beavers, VinePair’s tastings director, who is additionally a producer on the show. I also want to, of course, thank every other member of the VinePair team who are instrumental in all of the ideas that go into making the show every week. Thanks so much for listening, and we’ll see you again.

Ed. note: This episode has been edited for length and clarity.

The article VinePair Podcast: Who Wants to Buy an RTD Brand? appeared first on VinePair.

source https://vinepair.com/articles/podcast-rocco-milano-on-the-rocks-rtd/

0 notes

Text

Ready to drink Cocktail

Even if you hear the word cocktail, Cocktail Lover says, the mind is automatically refreshed just like fresh there is no word to explain how you fill it. Cocktail is mixed drinks that have become popular from 20th century. One of the many popular ideas for the birth of the word cocktail is that during the American War of Independence, in 1779, Betsy Flanagan, a Virginia, made chicken and stole it from a British neighbor. She then served the French soldiers with a mixed drink adorned with bird feathers. The cocktail gained popularity and popularity in the USA, especially during the protests. Under pressure from religious and political thinkers, the production, transportation, and sale of alcoholic beverages were banned in the USA from 1920 to 1933. Finding the best cocktail is not always easy and we are always in search of the best cocktail, then we become ponies anywhere. There are hundreds of liberation ideas available, and a variety of places to get a drink. It’s important to find recipes that work for people who want to mix their own drinks at home - for themselves or for a group of friends. They can use a new twist on an old favorite, stick something completely classic or venture out to use a drink. Learn about cocktail brands and product. Then get them delivered straight to your door. We will be the first to say that. Sometimes, the best cocktails are moved by the bartender. Who doesn’t love a tasty spritz in your favorite outdoor patio? Admit it, there are also one or two occasions or even if 10 where you want a little easier. If we tell you that there is a drink that you can buy that provides all the flavors of your favorite cocktail without having to buy at the bar or get the ingredients at home. Ready to drink what you want here. Whether you’re at the beach, tailgating, brunch at home, or just outside the tequila and you don’t go out to get supplies to move cocktails - RTDs are required.

What is Ready to drink Cocktail (RTD)

As per oxford dictionary cocktail is an alcoholic drink consisting spirits ingredient such as fruit juice or cream. Cocktails are made with a variety of alcoholic ingredients brandy, gin, vodka and whiskey. RTDs have grown in popularity recently - and why not? They are portable, tasty and convenient as a hack. Needless to say, you can get all the flavors of a cocktail at home without the hassle of making it. One of the great things about RTDs is that you have the ability to use a new cocktail without the commitment of buying different bottles of beer, wine, liquor or mixer for a new recipe. You think you like cocktails but don't want to commit to buying all the ingredients? RTDs are for you. Want to try a new grape, mango or ginger cocktail without actually buying any product? RTD. Or maybe you’re trying to get into a bloody marriage but don’t want to buy a billion spices. RTDs. As we discussed before - you can get ready to drink a cocktail that contains any alcohol. So go ahead and try a new tequila cocktail, no preparation required. Or maybe you feel summer and need some whiskey and lemonade. RTD has you covered there too.

Popular RTD Brands

1) Fresher’s Island 2) High Noon: High noon is the best and popular RTD brand. There is so many flavors. a) High Noon black cherry seltzer. b) High Noon grape fruit seltzer c) High Noon hard seltzer Variety Pack d) High Noon Peach Seltzer e) High Noon Pineapple Seltzer 3) Cutwater 4) Montebello

Shop popular ready to drink cocktail

1) Skinnygirl Margarita 2) High Noon Watermelon seltzer 3) 1800 Ultimate Peach Margarita 4) Cutwater Whiskey Mule 5) Jose Cuervo Authentic Lite 6) Hornitos Reposado You want to like something else then just go to chrome and type your favorite drink or type liquor store delivery nearby me or online liquor store delivery and order your favorite one and wait for a 30 to 60 min and Boom! Open your door and receive your order and enjoy.

0 notes

Text

GSN Brews News: March 30th 2021 Edition

GSN Brews News: March 30th 2021 Edition

Beam Suntory is targeting the Tequila-based RTD market with Hornitos Tequila Seltzer. The 5% abv cocktails are rolling out now in select markets and come in two flavors, lime and mango. The RTDs are made with Hornitos Plata Tequila and other natural ingredients and do not contain artificial sweeteners. Four-packs of Hornitos Tequila Seltzer will retail for around $12 and will reach national…

View On WordPress

0 notes

Text

Hornitos Tequila Seltzer Is the Newest RTD Cocktail Brand

Hornitos Tequila Seltzer Is the Newest RTD Cocktail Brand

If 2019 was the summer of hard seltzers, 2021 is shaping up to be the summer of ready-to-drink (RTD) cocktails.

Don’t miss The Business of Marketing, a new series featuring leading c-suite executives sharing insights on the importance of leveraging the intersectionality of marketing, finance, technology, HR and the boardroom to drive business growth. Tune in.

Source link

View On WordPress

0 notes

Text

Breakneck Evolution is Compounding the Hard Seltzer Category’s Unprecedented Surge

Hard seltzer is big business, accounting for $2.7 billion in off-premise sales over the 52-week period ending June 13, and posted its biggest week of sales yet over the July 4 holiday, according to Nielsen. But since the category exploded in popularity last summer, it has also garnered a big reputation — one that is both positive and negative. While hard seltzer is now a go-to for consumers across the U.S., it’s also frequently used as the punchline of jokes and targeted in meme culture.

It wasn’t surprising when major alcohol companies rushed to cash in on the hard seltzer category, with brands from Bud Light to Barefoot launching beverages labeled as “hard seltzer” in the first half of 2020. What was surprising was the slew of craft brands — particularly craft breweries — launching hard seltzers. Favorite breweries like Evil Twin, Two Roads, and Solemn Oath, among others, have all added hard seltzers to their lineups alongside geeky double IPAs and hard-to-get imperial stouts.

At the same time, new wine-based hard seltzers like Del Mar Wine Seltzer are following similar formulas to industry-favorite spritzes Ramona and Hoxie, products that have deliberately chosen not to market themselves as hard seltzers. Cocktail enthusiasts looking for spirits-based options can crack open the vodka-based High Noon and Keel Sparkling, or the tequila-based Volley Spiked Seltzer. While these ready-to-drink (RTD) cocktails are not made in the same way as big-brand hard seltzers, they offer the same refreshing, easy-drinking appeal.

As the young hard seltzer category continues to evolve and premiumize at a startling pace, buoyed by mainstream business and craft upstarts alike, its consumer base only seems to broaden, spanning casual imbibers and studious beverage insiders alike. The growth trajectory raises the possibility that this “basic” beverage could serve as the ultimate equalizer, appealing across all consumer demographics (similar to non-alcoholic seltzer).

At a peak moment of sales growth, VinePair reached out to experts across the drinks industry to understand how hard seltzer is carving out an entirely new beverage alcohol category, breaking out of the FMB or RTD categories to which these products have been relegated so far. With product innovation speeding forward at an unprecedented rate, hard seltzer may just be the most dynamic beverage category on the market right now.

The Laws (and Stigmas) of Drinking Claws

Early perceptions and stereotypes of hard seltzers — and the people who drink them — revolve around the three brands that largely introduced the American public to the category: Truly, Bon & Viv, and, primarily, White Claw. These dominant brands established the category style as dry, refreshing, low-calorie, lightly fruity drinks.

Hard seltzer’s target demographic emerged around these brands at the same time. “The typical consumer that comes to mind when you think of hard seltzer is young women,” says Bobbie Burgess, the wine director of Eat Local Starkville in Starkville, Miss., who has sold several brands of hard seltzer in the past. “However, I have seen men and women, younger and older, indulging in these canned beverages.”

The approachable, “better-for-you” appeal of hard seltzer, combined with the canned format’s convenience and portability, has helped the style attract many different kinds of consumers. “Hard seltzer is an anomaly,” adds Brian Miesieski, the VP of marketing and innovation for SweetWater Brewing in Atlanta, which launched the Hydroponics Hard Seltzer in January. “It really blew up what you would perceive to be a typical consumer demographic for seltzer. It struck gold, essentially.”

But while hard seltzer seems to have become an everyman’s and everywoman’s beverage, stigmas still exist. Brands like White Claw and Truly are fixtures on Instagram and have been the subject of viral memes, cementing the category’s association with less serious, millennial consumers.

“There’s the popular saying, ‘There ain’t no laws when you’re drinking Claws,’” jokes Burgess. “If you don’t caption that saying on your social media pictures, did you really drink a White Claw?”

Essentially, all the qualities that attract a broad consumer audience to hard seltzer — large production, simple flavors, mass appeal — also seem to stigmatize it, from an industry perspective. Some liken it to the difference between an independent restaurant and a fast-food chain.

“I don’t judge fast-food fried chicken and I don’t judge people who indulge in hard seltzers,” says Burgess, “but I do hope that after the first one at our bar and building trust, guests are willing to try something different and, dare I say, better.”

While claims of low-calorie, gluten-free, “health-conscious” products have been foundational to early hard seltzer brands’ successes, there has never been a focus on specific ingredients, origins, or production methods — all of which are usually important to serious beverage aficionados. Rather, hard seltzers are often viewed by industry professionals as manufactured, somewhat artificial products made from fermented sugarcane or corn syrup bases.

“Seltzer brands are not currently transparent about their ingredients and practices,” says Jordan Salcito, the founder of wine spritz company Ramona, who points out that the sugar industry often relies on exploitative conditions. “As a potential target consumer, quality and transparency do not currently seem to be part of their value proposition.”

Craft Opportunities

However, it isn’t necessarily hard seltzer’s style that steers serious beverage geeks away from the category. As evidenced by the success of spritzes like Ramona and Hoxie, industry professionals do welcome spritzy, refreshing, less serious canned beverages.

“We launched the same year as White Claw, so clearly the market was ready for a beer alternative,” says Salcito. “I’ve noticed that seltzers often serve as a gateway to spritzes; both are beer alternatives meant for casual moments.”

After all, big-brand, simple beers like PBR and Miller High Life have long been industry favorites for post-shift imbibing. “Sometimes craft consumers want a break from complex beers,” says Miesieski. “Sometimes they just want to cut to the chase and have something that’s refreshing and simple.”

Recently, brands have been recognizing the opportunities in this cross-section of interest and bridging the gap with new, more premium hard seltzer offerings. Craft breweries were some of the first to jump into the premium hard seltzer pool, primarily because it was a natural transition. “The manufacturing process of hard seltzer comes from traditional brewery practices,” says Meg Gill, the founder of both Maha Hard Seltzer, which launched in March in partnership with Anheuser-Busch, and Golden Road Brewing in Los Angeles. “This allows for more breweries to supplement production of their beer products to make hard seltzer.”

However, making hard seltzer is becoming an increasingly necessary venture for breweries as well, since these products are eating away at beer sales. According to Nielsen, hard seltzers have accounted for 10 percent or more of the off-premise beer/FMB/cider sales since the week ending May 23. “Everyone is looking for new categories to drive incremental business,” says Miesieski. “With seltzer stealing share from craft breweries, as a business, it makes sense.”

While hard seltzer doesn’t have a long history like American lagers, for instance, it seems to be following a similar trajectory: After big brands dominated the category and made it popular, craft breweries stepped in to elevate quality by using better ingredients, higher standards, and smaller production processes.

“The craft beer consumer and the craft seltzer consumer overlap greatly, especially when it comes to high flavor appeal and premium ingredient appeal,” says Gill. With Maha Hard Seltzer, she aimed to create flavorful, USDA Certified Organic beverages using high-quality ingredients like cascara, sea salt, and fruit juice.

Though a fan base that is accustomed to lining up for limited releases of hazy IPAs might find craft seltzers to be incongruous with a given brewery’s ethos, Miesieski insists that sticking to the company’s core philosophies allows for experimentation without alienating existing consumers. For SweetWater, this meant staying true to the brewery’s “420 lifestyle” brand and using fruit-based terpenes to get natural-tasting flavors into their Hydroponics hard seltzers.

“The geekier consumers were taken aback at first,” says Miesieski. “But the tide is shifting quite a bit. As long as you’re doing it right, being authentic, and making it a more premium experience, consumers will realize, ‘My favorite brewery is still putting out fantastic beers but doing something different.’”

Disrupting the Formula — and Communicating It

Both new and existing beverage brands are disrupting hard seltzer by proposing new ideas of how these products can be made as well. While hard seltzer is generally classified as a flavored malt beverage (FMB), spirit- and wine-based hard seltzers that are not made from fermented malt or sugar are rapidly emerging.

One of the fastest-growing hard seltzer brands of the summer is High Noon, a vodka-based product billed as both a hard seltzer and a vodka soda. So when it comes to these spirit- and wine-based products, what’s the difference between hard seltzers and spritzy, low-alcohol RTD cocktails — particularly when the latter are typically more accepted by beverage insiders than the former?

“The decision to label a new product as a hard seltzer or RTD spritz is one ultimately made by the marketing department,” says Brie Wohld, the vice president of marketing for Trinchero Family Estates, which launched Del Mar Wine Seltzer in March. “Neither is necessarily better; it comes down to a matter of preference and desired target market.” She notes that market research indicated broad consumer and trade interpretations within both RTD spritz and hard seltzer categories. While wine-based spritzes and wine-based seltzers might be interchangeable, formula-wise, the potential connotation of spritzes as sweet led Del Mar to be labeled as a wine seltzer.

A brand might also decide to label their product as hard seltzer in order to convey that it is appropriate for a more casual occasion. “Currently, the line is very blurred as to what defines a seltzer and an RTD because the category is so new and quickly evolving,” says Chris Wirth, the co-founder and president of Volley Spiked Seltzer. “We felt that this is a product that is meant for a ‘beer moment,’ which is inherently more expansive than a ‘cocktail moment.’ Having a cocktail is a larger psychological commitment.”

The proliferation of spirits- and wine-based hard seltzers could, therefore, drive greater acceptance of the category among those who consider themselves more serious about beverages. Many of these craft hard seltzers — both FMB products and those based on spirits or wine — are also committed to ingredient and production transparency, which also helps with overall category perception.

“Malt-based seltzers with limited ingredient transparency are currently leading the pack, but we anticipate it’s only a matter of time before consumers begin expecting more transparency from their seltzers of choice,” says Wohld. “Stigmas against the larger hard seltzer category don’t necessarily apply to products that prioritize transparency and deliver on what the consumer wants.”

Some brands, like the malt-based Maha and tequila-based Volley, are so committed to transparency that they are printing ingredients on the front label. “At Volley, we believe that transparency within a product is the No. 1 priority,” says Wirth, noting that every Volley uses 100 percent blue agave tequila, sparkling water, and juice.

“Consumers care about what they put in their bodies and they want to understand what’s in it and how it’s made,” says Gill, noting that having a low-calorie option isn’t enough anymore. “That’s why we wanted to create a better hard seltzer option with ingredients you could read about on the label.”

Competition Breeds Innovation

In just a short amount of time, plenty of stereotypes, stigmas, and opinions have emerged around the hard seltzer category. However, this beverage style is in its infancy and is changing rapidly, so it’s important to keep an open mind about hard seltzer as a whole.

“I believe that as talented beverage formulation specialists get involved in the category, perceptions will change,” says Nicholas Greeninger, the CEO of Tolago Hard Seltzer, which is launching in August. “Big beer wants to commoditize the offering, but the consumer will have the final say, as they always do.”

“While there’s incredible diversity within wine and other long-established categories,” says Wohld, “the same cannot be said about the relatively new hard seltzer category.” Therefore, there’s plenty of room for growth and diversification — particularly as new and energetic innovators enter the category and create competition for the handful of dominant brands.

“As long as there’s competition, we’ll all continue to innovate and be creative,” says Miesieski, who notes that SweetWater is creating a new hard seltzer for 2021. “Consumers will demand more premium and higher-quality offerings, just like any other category.” It may seem like everyone and their mother is already drinking hard seltzer, but as new products push the boundaries of quality upward, there are sure to be even more hard seltzer fans ahead, from beverage novices to industry aficionados.

The article Breakneck Evolution is Compounding the Hard Seltzer Category’s Unprecedented Surge appeared first on VinePair.

source https://vinepair.com/articles/evolution-hard-seltzer-category-surge/

source https://vinology1.wordpress.com/2020/08/03/breakneck-evolution-is-compounding-the-hard-seltzer-categorys-unprecedented-surge/

0 notes

Text

9 Things You Should Know About Crafthouse Cocktails

There’s no denying the canned cocktail category’s recent explosion in popularity. Combined with hard seltzer and other ready-to-drink offerings, the category grew 43 percent in 2020 across the globe and is expected to surpass $146 billion in sales by 2030 in the United States alone.

The authenticity of brands like Crafthouse Cocktails — using natural ingredients with recipes crafted by skilled and reputable bartenders — has become a big draw for consumers in the know. Instead of spending unnecessary dollars stocking a home bar to the max, canned cocktails offer a convenient, grab-and-sip alternative.

Let’s break it down with nine things you should know about Crafthouse Cocktails.

Its Co-founder Is a World-Champion Mixologist

If you’re going to try a cocktail in a can, wouldn’t you want it to be made by a world-class bartender? In addition to co-founding the company, Charles Joly created, tweaked, and honed every Crafthouse recipe. He is the only American to ever win World Class by Diageo, one of the industry’s most prestigious bartending competitions. He has also received four James Beard Award nominations and is widely considered one of the most influential bartenders in the country.

Crafthouse Isn’t the Founders’ First Venture Together

After knowing each other through the Chicago hospitality industry since 1999, Matt Lindner and Charles Joly joined forces in 2007 to open the Drawing Room. Located inside the Chicago Athletic Association’s lobby, the establishment focuses on classic and craft cocktails and is the place where the idea to start Crafthouse was born.

Cocktail Coalition

Crafthouse Cocktails doesn’t work alone. Instead of creating its own spirits to use in the recipes, Crafthouse aligns itself with several quality spirit brands to ensure that its canned cocktails are as good as any drinks offered at top bars. The relationships are proudly boasted on the company website, unlike some other canned cocktail brands that don’t disclose what spirits they use. Crafthouse’s Paloma uses La Cofradia Tequila, while its Pineapple Daiquiri includes Plantation Stiggins’ Fancy Pineapple Rum and 5 Years Barbados aged rum. Crafthouse also sources vodka from CH Distillery in Chicago for its Moscow Mule and whiskey from Traverse City in northern Michigan for its Gold Rush.

You Can Drink Crafthouse on the Go

Crafthouse Cocktails are available in nearly every state. However, the three-tier-system and convoluted shipping restrictions regarding spirits in certain states prevent a push to get into every store across the nation. Instead, Crafthouse wants to be available to its consumers who are on the road. It currently has partnerships with Marriott hotels, Amtrak trains, and Virgin Voyage cruise lines.

The Three Rs

Crafthouse uses sustainable packaging for all of its size offerings. Its 200-milliliter bottles are made from 100 percent recyclable aluminum. Its 750-milliliter glass bottles are not only recyclable but also reusable (so keep some on hand for water refills or future cocktail concoctions). The most recent addition to the Crafthouse portfolio, the 1.75-milliliter bag-in-box, is more affordable to make and produces a lower carbon footprint than glass alternatives.

Stumbling Blocks in Montreal

Lindner and Joly recently divulged that, early in their journey, they opened a facility outside Montreal. There, they were urged to take shortcuts to make their recipes faster, more easily, and for less money. This didn’t align with their vision of using authentic ingredients to create proper cocktails, so they moved on.

The Highs and Lows of ABV

Because each Crafthouse cocktail is made as it would be in a bar (only in larger batches), the end result is unique and with varying alcohol levels. This sets Crafthouse apart from other canned cocktail brands, many of which have baseline ABVs across all their products. The Rum Old Fashioned has the highest ABV, with 24.6 percent, while the Moscow Mule and Paloma have the lowest, with 10.1 percent ABV and 10.6 percent ABV, respectively.

Create With Crafthouse

Crafthouse urges its fans to shake up their own cocktails at home. At-home enthusiasts looking to up their mixology games can explore Crafthouse by Fortessa. Available through Fortessa and Pottery Barn, products include everything from glassware and muddlers to ice buckets and smoking cloches.

Adamantly Against Citric Acid

When creating the recipes, Joly was inundated with suggestions to use citric acid instead of real citrus. Not only is it cheaper, but it helps create a shelf-stable product that isn’t as volatile during shipping. But the quality level wasn’t there for Joly — there was no question that he could make it work using real citrus.

The article 9 Things You Should Know About Crafthouse Cocktails appeared first on VinePair.

source https://vinepair.com/articles/ntk-crafthouse-cocktails-rtd-guide/

0 notes

Text

9 Things You Should Know About Crafthouse Cocktails

There’s no denying the canned cocktail category’s recent explosion in popularity. Combined with hard seltzer and other ready-to-drink offerings, the category grew 43 percent in 2020 across the globe and is expected to surpass $146 billion in sales by 2030 in the United States alone.

The authenticity of brands like Crafthouse Cocktails — using natural ingredients with recipes crafted by skilled and reputable bartenders — has become a big draw for consumers in the know. Instead of spending unnecessary dollars stocking a home bar to the max, canned cocktails offer a convenient, grab-and-sip alternative.

Let’s break it down with nine things you should know about Crafthouse Cocktails.

Its Co-founder Is a World-Champion Mixologist

If you’re going to try a cocktail in a can, wouldn’t you want it to be made by a world-class bartender? In addition to co-founding the company, Charles Joly created, tweaked, and honed every Crafthouse recipe. He is the only American to ever win World Class by Diageo, one of the industry’s most prestigious bartending competitions. He has also received four James Beard Award nominations and is widely considered one of the most influential bartenders in the country.

Crafthouse Isn’t the Founders’ First Venture Together

After knowing each other through the Chicago hospitality industry since 1999, Matt Lindner and Charles Joly joined forces in 2007 to open the Drawing Room. Located inside the Chicago Athletic Association’s lobby, the establishment focuses on classic and craft cocktails and is the place where the idea to start Crafthouse was born.

Cocktail Coalition

Crafthouse Cocktails doesn’t work alone. Instead of creating its own spirits to use in the recipes, Crafthouse aligns itself with several quality spirit brands to ensure that its canned cocktails are as good as any drinks offered at top bars. The relationships are proudly boasted on the company website, unlike some other canned cocktail brands that don’t disclose what spirits they use. Crafthouse’s Paloma uses La Cofradia Tequila, while its Pineapple Daiquiri includes Plantation Stiggins’ Fancy Pineapple Rum and 5 Years Barbados aged rum. Crafthouse also sources vodka from CH Distillery in Chicago for its Moscow Mule and whiskey from Traverse City in northern Michigan for its Gold Rush.

You Can Drink Crafthouse on the Go

Crafthouse Cocktails are available in nearly every state. However, the three-tier-system and convoluted shipping restrictions regarding spirits in certain states prevent a push to get into every store across the nation. Instead, Crafthouse wants to be available to its consumers who are on the road. It currently has partnerships with Marriott hotels, Amtrak trains, and Virgin Voyage cruise lines.

The Three Rs

Crafthouse uses sustainable packaging for all of its size offerings. Its 200-milliliter bottles are made from 100 percent recyclable aluminum. Its 750-milliliter glass bottles are not only recyclable but also reusable (so keep some on hand for water refills or future cocktail concoctions). The most recent addition to the Crafthouse portfolio, the 1.75-milliliter bag-in-box, is more affordable to make and produces a lower carbon footprint than glass alternatives.

Stumbling Blocks in Montreal

Lindner and Joly recently divulged that, early in their journey, they opened a facility outside Montreal. There, they were urged to take shortcuts to make their recipes faster, more easily, and for less money. This didn’t align with their vision of using authentic ingredients to create proper cocktails, so they moved on.

The Highs and Lows of ABV

Because each Crafthouse cocktail is made as it would be in a bar (only in larger batches), the end result is unique and with varying alcohol levels. This sets Crafthouse apart from other canned cocktail brands, many of which have baseline ABVs across all their products. The Rum Old Fashioned has the highest ABV, with 24.6 percent, while the Moscow Mule and Paloma have the lowest, with 10.1 percent ABV and 10.6 percent ABV, respectively.

Create With Crafthouse

Crafthouse urges its fans to shake up their own cocktails at home. At-home enthusiasts looking to up their mixology games can explore Crafthouse by Fortessa. Available through Fortessa and Pottery Barn, products include everything from glassware and muddlers to ice buckets and smoking cloches.

Adamantly Against Citric Acid

When creating the recipes, Joly was inundated with suggestions to use citric acid instead of real citrus. Not only is it cheaper, but it helps create a shelf-stable product that isn’t as volatile during shipping. But the quality level wasn’t there for Joly — there was no question that he could make it work using real citrus.

The article 9 Things You Should Know About Crafthouse Cocktails appeared first on VinePair.

Via https://vinepair.com/articles/ntk-crafthouse-cocktails-rtd-guide/

source https://vinology1.weebly.com/blog/9-things-you-should-know-about-crafthouse-cocktails

0 notes

Text

Boston Beer, Beam Suntory Partner for Truly Spirits, Sauza Canned Cocktail Lines