#buy us payday loan leads online

Note

Please explain how to write out a personal ledger like I’m 5 (my budget is getting tighter and I always pay my bills before any other spending but I’m tired of passively spending and wondering where 50 bucks went at the end of the month)

OK

I have a five year old and if I explained this to you like you were five it would not be useful to you in your mid twenties

I do mine on the computer, I have a file in Microsoft Excel because I have Excel, but any spreadsheet program would work I'm sure, you could probably use Google sheets or whatever it’s called

warning: if you follow this method you will know how you spend your money

So what I do is this

I have a sheet set up as follows:

Column A is "Date," which is the date I spent the money

Column B is "Date Posted," which is the date the transaction actually clears my bank

Column C is "Amount," or the amount spent/moved/deposited. This will be a positive or negative number depending on whether you are adding or subtracting money from the account

Column D is "Category," which is very important for making this data useful for a budget. Categories will probably be subjective but the ones that I mainly use are:

Bill - this is for a regular monthly expense necessary to live, like car insurance, electricity, the mortgage, phone, etc.

Debt - this is for money I flush down the toilet. I used to have a separate category for "Medical Debt" but now it's all just Debt. Credit card payments and student loans. And medical debt.

Gas - when I buy gasoline it gets its own category

Groceries - as the name implies this is when I buy food from a grocery store, as distinct from:

Takeout - this is when I eat out, have delivery, fast food, etc., unhealthy sodium-saturated food prepared by someone else for immediate consumption

Misc - this is the useless category in which all other spending is absorbed, including my irresponsible purchases.

I also have the following categories:

Deposit - for when money goes in

Transfer - for when money is moved to or from another account

Withdrawal - for when I remove cash

Obviously you could have other categories for expenses you want to track more closely. Clothing might warrant its own category, or books, or snacks, which are sort of between takeout and groceries, or whatever.

Column E is "Location," which is where I spent the money. I usually try to write this how it appears on my ledger, which is not always where I remember physically spending it. For example, my wife's Old Navy card shows up as Barclay Card on the ledger, which has been the object of much confusion, leading to

Column F is "Notes," where I elaborate when Column E doesn't make very much sense. What is Barclay Card? Oh, the Old Navy card.

One place in which Columns E and F work together most regularly is on paydays, when E gives the name of the employer and F gives whose payday it is.

Column G just says "Balance," which I leave in cell G1 permanently, and then Column H / cell H1 is a running balance, which you can see above I let Excel calculate using a simple formula that takes the sum of all additions and subtractions in column C

Now, these features might be exclusive to Excel but I'm sure you could find equivalents in other spreadsheet programs. I have Row 1 / Top Row "Frozen" so that I can always see the column names and the balance as I scroll down. I also have columns A through F set to "filter," which is why they have the little drop-down arrow on the right-hand side, and this, as the name implies, lets me filter. So if you want to look at a specific category, or specific place, or something. I most often use this to filter out all but the current month in Column A, and to keep my transactions in the right chronological order.

Once its set up, and this is the painful part, you need to keep track of every single penny you spend. You can do this in the old-school way by keeping receipts or if you have online banking and they're pretty on top of things you can look at your bank ledger at the end of the day and add the day's transactions then. But if you let it sit more than a day or two you will have unpleasantness and it will only get worse the longer it sits. This is where having a Date and Date Posted column comes into play. There are some bills I have that take several days to post. My mortgage for example, which is my largest single bill, takes about four days to clear. My wife's student loans, the second largest bill, take about a week to go through. So I put those on my ledger the day I submit the payment and then they show up in the bank ledger a few days later and I note that as well. PayPal transactions also tend to take several days to go through. The other reason having a Date and a Date Posted column is nice is when you have to self-audit because there's a discrepancy between your balance and the bank’s, you can use the sort/filter function to sort your transactions by the date posted which makes it easier to compare your ledger to your bank.

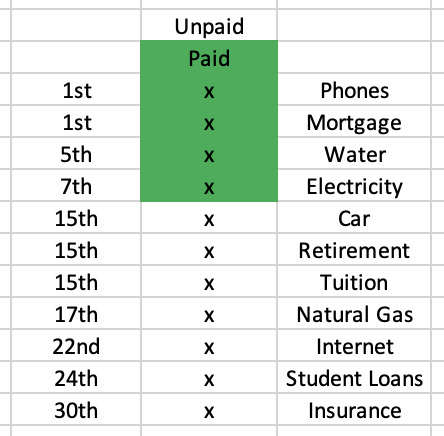

The other thing I do is I have a little portion of the spreadsheet off to the side where I keep all of my fixed bills and their due dates and keep track of when I pay them in a month. The Unpaid / Paid cells at the top are so I can copy and paste the format of those cells as the month goes on. As the months go on I have to cut and paste this to keep it close to the end of the ledger. You don't really need to have this but I do, it helps me decide which paycheck pays which bills and when every month.

The other thing is I have a different sheet for every year, because I don't want a spreadsheet with 10,000+ rows. You could have a different sheet for every month or whatever, I don't know. I did it by year.

If you keep on top of this you will know better than your bank how much money you have at all times.

30 notes

·

View notes

Text

https://www.kingsresearch.com/payday-loans-market-533

Global Payday Loans Market Report: Trends, Drivers, and Future Growth Prospects

Kings Research has recently published its report on the global Payday Loans market, which finds that the market revenue is expected to reach US$ 45.86 Billion by 2031 from US$ 32.70 Billion in 2022, with a remarkable 4.39% CAGR over the forecast period from 2023 to 2031.

This comprehensive research study on the global Payday Loans market gives detailed insights into the sector, offering a detailed analysis of market trends, prominent drivers, and future growth prospects. In order to make wise business decisions, it gives readers an extensive understanding of the market environment. Furthermore, the report covers several aspects, such as estimated market sizing, strategies employed by leading companies, restraining factors, and challenges faced by market participants.

Gain expert insights and supercharge your growth strategies. Request our market overview sample now

Market Forecast and Trends

The report's precise market forecasts and identification of emerging trends will allow readers to foresee the industry’s future and outline their tactics for the following years accordingly. Understanding market trends can help in gaining a competitive edge and staying ahead in a fast-paced business environment.

Regional and Segment Analysis

The study on the global Payday Loans market will aid industry participants find high-growth regions and profitable market segments through region-specific and segment-by-segment analysis. This information helps in implementing better marketing strategies and product lineups to meet the preferences and needs of various target audiences. The major regions covered in this comprehensive analysis include North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Investment and Expansion Opportunities

The research report supports strategic decision-making by revealing prospective areas for investment and business growth in the global Payday Loans market. This report is a great tool for finding markets that are foreseen to grow substantially for aiding readers who want to expand into new and untapped markets or launch new products.

Competitive Analysis

The research report comprises an in-depth competitive analysis, which profiles major market competitors and evaluates their tactics, weaknesses, and market shares. These key players employ top business strategies, such as partnerships, alliances, mergers, acquisitions, product innovations, and product development, to establish a competitive advantage. Industry participants may use this information to measure their business against rivals and develop winning strategies for distinguishing themselves in the market.

Why Buy This Report?

Obtain an in-depth understanding of market trends and growth catalysts.

Utilize precise market forecasts for informed decision-making.

Outperform competitors through extensive competitive analysis.

Identify and leverage profitable regional and segment prospects.

Strategically plan investments and expansions in the global Payday Loans market

The major players in the Payday Loans Market are:

Cash America International

Check `n Go

MoneyGram

CashNetUSA

Check City Online

Moneytree, Inc.

Advance Financial

TMG Loan Processing, LLC

EZ Money

LENDUP.com

1 note

·

View note

Text

Exploring Credit Resources : A Detailed Guide

Credit is an important financial instrument that plays a vital role in the lives of individuals and businesses alike. It allows persons to gain access to resources for numerous applications, from buying a home or vehicle to starting a company or managing sudden expenses. To steer the planet of credit properly, it's important to understand the different credit resources available and how they work. In that comprehensive guide, we'll search in to the different types of credit resources , their advantages and disadvantages, and how exactly to use them wisely Debt help.

Conventional Banks and Credit Unions

Old-fashioned economic institutions like banks and credit unions are among the most common sources of credit. They give you a wide selection of credit products and services, including:

Credit Cards: Bank cards allow you to produce purchases on credit up to and including predetermined limit. They can be quite a easy way to control daily expenses and construct your credit history. Nevertheless, or even used responsibly, they can lead to high-interest debt.

Personal Loans: Personal loans are generally unsecured loans that may be used for different purposes, such as for instance debt consolidation, do-it-yourself, or medical expenses. Fascination charges vary predicated on creditworthiness.

Mortgages: Mortgages are long-term loans used to get homes. They usually have decrease interest costs compared to other types of credit but require a considerable down payment.

Auto Loans: These loans are designed for getting vehicles. They may be attached (with the car as collateral) or unsecured, with various fascination rates.

Professionals: Standard banks and credit unions offer competitive curiosity charges and a wide range of credit options.

Cons: Eligibility conditions could be rigid, and the application process might be time-consuming.

Online Lenders

With the development of the web, on line lenders have acquired acceptance as substitute sources of credit. They provide:

Peer-to-Peer (P2P) Loans: P2P systems connect borrowers with personal investors. Borrowers can often protected loans with more variable terms, and investors may earn higher results compared to old-fashioned savings accounts.

On line Personal Loans: They're much like conventional personal loans but often have faster acceptance processes and might be offered to people who have various credit scores.

Payday Loans and Money Developments: These short-term, high-interest loans are intended for emergencies. They should be applied modestly for their high cost.

Professionals: On the web lenders often have streamlined request techniques, which makes it simpler to acquire credit quickly.

Drawbacks: Fascination prices can be greater than those offered by traditional banks, and there may be less regulatory oversight.

Credit Cards

Credit cards deserve a unique mention since they are a trusted type of rotating credit. There are various types of credit cards, including:

Secured Credit Cards: These cards involve a protection deposit and are well suited for those looking to construct or rebuild their credit.

Reward Credit Cards: These cards present cashback, travel returns, or other incentives to make purchases. They could be helpful if used wisely.

Store Credit Cards: They are particular to specific retailers and often present discounts on store purchases.

Advantages: Charge cards give convenience, security, and the ability to create credit when applied responsibly.

Drawbacks: Misusing bank cards can result in high-interest debt and harm to your credit score.

Credit Resources for Corporations

Corporations also provide usage of different credit resources , including:

Organization Credit Cards: They are just like personal bank cards but designed for company expenses. They are able to help split up personal and business finances.

Little Company Loans: These loans offer money for business growth, gear purchases, or detailed expenses. They may be attached or unsecured.

Lines of Credit: Companies may secure spinning lines of credit, providing them with access to funds as needed.

Professionals: Organization credit resources might help gas growth and manage income movement effectively.

Negatives: Eligibility needs for company credit may be stringent, and curiosity charges may vary widely.

Credit Studies and Scores

Credit resources also contain methods for monitoring and managing your credit health:

Credit Studies: These documents summarize your credit history, including your cost record, credit employment, and outstanding debts. You are able to acquire a free annual credit record from all the three significant credit bureaus.

Credit Scores: FICO and VantageScore are both most common credit rating models. Your credit rating, predicated on information from your own credit report, is a crucial factor in obtaining credit and determining interest rates.

Credit Checking Solutions: These solutions monitor improvements in your credit record and provide alerts for potential identification robbery or fraudulent activity.

Benefits: Monitoring your credit can assist you to find and resolve errors or identity theft and keep a wholesome credit profile.

Negatives: Credit monitoring services might include membership fees.

Credit resources are crucial instruments that inspire persons and organizations to accomplish their financial goals. Understanding the many forms of credit available, their benefits and drawbacks, and just how to utilize them wisely is crucial for economic success. By leveraging credit responsibly and sustaining a solid credit profile, you are able to accessibility the assets you need to construct a safe financial future while steering clear of the pitfalls of exorbitant debt.

0 notes

Text

How to Apply Quick Cash Loans from ATD Money

Getting instant cash loans online has never been easier. ATD Money is a leading micro-finance company in India that offers hassle-free mini-cash loans to salaried individuals. They offer a convenient online application process and top-notch customer service.

You can even get a personal loan with low CIBIL score! Here are a few tips to help you out.

Payday Loans

A payday loan is a short-term loan designed to help you meet your immediate financial needs. However, these loans can be costly if not used responsibly. Moreover, they may lead to an escalating cycle of debt and can impact your credit score negatively. In order to avoid these pitfalls, you should always borrow only what you can afford to pay back on time. Besides, you should shop around for the best rates and fees available. Additionally, you should never borrow from a lender that is not licensed in your state.

ATD Money is a new microfinance platform that offers hassle-free instant cash loans for salaried employees. It has partnered with several NBFCs to offer these loans and is accessible via a free mobile app. Unlike payday loans, ATD Money’s loans are regulated and do not carry high interest rates. The company also works within Indian law to safeguard customers’ data.

Another option for getting quick cash is to borrow from friends or family members. This can be an effective way to help out a loved one in need without the stress of repaying a large sum of money. However, this option is not suitable for everyone and you should carefully consider the pros and cons before taking out a debt-based loan.

You can also try to renegotiate with your existing lenders. If you have significant debt from credit cards or student loans, many lenders are willing to work with you to establish a monthly repayment plan that will help you manage your budget. You can also ask your employer for an advance on your paycheck, which will allow you to avoid paying exorbitant fees and interest to payday lenders.

Lastly, you can apply for a personal loan from a local bank or credit union. These loans are usually less expensive than payday loans and can provide you with the funds you need in an emergency. Typically, you will need to have good credit and an income to qualify for a personal loan. In addition, you should shop around for the best rates available and read the fine print of any loan agreement before signing it.

Personal Loans

A personal loan is a great option for people who need money to cover unexpected expenses. These loans can be used to pay bills, buy a new car, or take a vacation. However, it is important to know how these loans work before applying. You should read the terms and conditions carefully, and make sure you understand what fees and charges are associated with a personal loan. Also, you should always use a trusted website that is backed by a recognized banking institution. In addition, a trustworthy website will always display an address that starts with “https,” which protects your information from cybercriminals.

When you apply for a personal loan, the lender will ask you for information about your income and credit history. This will determine whether you qualify for a loan and how much you can borrow. A good lender will have reasonable rates and terms and will offer a variety of repayment options. You should also look for a lender that does not report late payments to the credit bureaus.

Some lenders offer payday loans with very high-interest rates, so it is essential to research your options before choosing a lender. In addition, you should be aware of the penalties for repaying a payday loan. If you are not able to repay the loan on time, it could result in a negative impact on your credit score.

If you need a quick cash loan, you can download an app that allows you to get approved in minutes. This app will help you avoid scams and find a lender that is right for you. It will also help you save time and money. You can also use the app to track your loan progress and repayment history.

If you have a low CIBIL score, you can still apply for a loan through ATD Money. The application process is completely online and takes only a few minutes. This company is a leading microfinance solution provider and offers advanced salary advances, zip loans, and payday loans to salaried workers in India.

Business Loans

Getting a business loan is an important step in growing your company. You can use it to invest in equipment, hire employees, or pay for other expenses that help your business grow. However, many lenders have stringent eligibility requirements and long wait times. It’s best to apply with a lender that offers online applications and fast approvals. Some lenders may also report late payments to credit bureaus, so it’s important to understand these risks before applying.

ATD Money is a leading microfinance solutions provider that’s dedicated to transforming lives by simplifying the loan application process for salaried individuals. The app lets you request a loan of up to Rs 15,000, and the approval process is quick and easy. You can even defer the loan for a maximum of 365 days, so you don’t have to worry about repaying it in a short time.

There are several different types of business loans available, including working capital loans, which are used to cover operational expenses, equipment loans, invoice factoring (which involves selling unpaid invoices to a third party in exchange for a fee), and real estate business loans (which use commercial property as collateral). Many lenders offer business loan calculators on their websites to help you determine how much you can afford to borrow. Once you’ve found a lender that offers the type of business loan you need, be sure to review all of their terms and conditions before applying.

It’s important to know how long it will take for your lender to process your loan application and send the funds to your bank account. Some lenders have instant approvals, while others can take up to a week to approve your application and provide the funds. The best-unsecured business loan providers have the fastest processing times and can get you the cash you need quickly.

Unsecured Loans

An unsecured loan is a type of personal loan that is not secured by any asset. These loans are usually available from financial institutions such as credit unions and banks. They are typically based on an individual's creditworthiness and income. Those with poor or fair credit are likely to face higher rates and difficulty in getting approved for an unsecured loan.

While unsecured loans are often available to anyone, it's important to understand the terms and conditions of each loan before applying. Some lenders may require that you provide proof of income in the form of pay stubs or W-2 forms. You may also be asked to provide your bank's routing number and account number. This information will be used to direct your loan payments to your bank account. It's also a good idea to discuss your options with multiple lenders before choosing one.

Unsecured loans are a great way to cover unexpected expenses, but they should only be taken out when you can afford to pay them back on time. If you find that you're having trouble keeping up with your repayment schedule, consider renegotiating the terms of your loan or trying to save up money to make up the difference. It's important to remember that if you can't pay your unsecured loan on time, it will be reported to the credit bureau and could damage your credit score.

ATD Money is a microfinance solutions provider that offers hassle-free mini-cash loans for salaried individuals. Its mobile app is available on Android devices, and the application process is fast and simple. The company has partnered with several NBFCs to offer payday loans, and its customers enjoy top-notch customer service. The company's goal is to help working-class people avoid financial crises and meet their day-to-day needs.

The ATD Money app is free to download, and it can be used by anyone in India who has a smartphone and internet connection. The application process is simple, and the company has a dedicated team to help you with any questions or concerns. It's an excellent choice for anyone who's in need of quick cash, and it's a great alternative to payday loans, which can carry high interest rates and are difficult to repay.

0 notes

Text

Daily Habits That Erode Your Financial Well-being

Daily Habits That Erode Your Financial Well-being

In the hustle and bustle of daily life, it's easy to fall into habits that, over time, can wreak havoc on your financial stability. These seemingly innocuous routines, when left unchecked, can act as slow poison for your finances. Let's delve into some of these habits, shedding light on the financial pitfalls they create.

- Impulse Spending: One of the most insidious financial habits is impulse spending. Those small, unplanned purchases may seem harmless at the moment, but they add up over time, draining your bank account.

- Neglecting Budgeting: Failing to budget is like sailing without a map. Without a clear plan for your finances, you're likely to overspend and lose track of your financial goals.

- Ignoring Savings: Saving should be a non-negotiable part of your financial routine. Neglecting to save regularly can leave you unprepared for emergencies or future financial goals.

- High Credit Card Balances: Racking up high credit card balances and only paying the minimum due can lead to a never-ending cycle of debt with high-interest rates.

- Frequent Dining Out: Eating out too frequently, whether it's takeout or dining at restaurants, can drain your wallet faster than you realize.

- Not Investing: Letting your money sit idly in a savings account without exploring investment options means missing out on potential returns that could secure your financial future.

- Ignoring Financial Literacy: Lack of financial knowledge can lead to poor decision-making. Investing time in understanding financial concepts can save you from costly mistakes.

- Procrastinating Bills: Delaying bill payments can result in late fees and a negative impact on your credit score, which can affect your ability to secure loans or favorable interest rates.

- Retail Therapy: Using shopping as a coping mechanism for stress or emotional issues can lead to overspending and financial strain.

- Ignoring Insurance: Neglecting insurance coverage, whether it's health, life, or property insurance, can leave you vulnerable to unexpected financial burdens.

- Failing to Negotiate: Not negotiating for better deals on services like insurance, internet, or cable means you might be overpaying for these essential expenses.

- Keeping Up With Others: Trying to match the lifestyle of friends or neighbors, even if it's beyond your means, can lead to financial stress and debt.

- Excessive Online Shopping: The convenience of online shopping can be a double-edged sword. It's easy to overspend when you're just a click away from making a purchase.

- No Emergency Fund: Not having an emergency fund can leave you financially vulnerable when unexpected expenses arise, forcing you to rely on loans or credit cards.

- Avoiding Retirement Planning: Delaying retirement planning can result in insufficient savings for your golden years, leading to financial struggles in retirement.

- Overextending in Housing: Renting or buying a home that stretches your budget to the limit can leave little room for other essential expenses and savings.

- Ignoring Tax Planning: Failing to optimize your tax strategy can result in missed opportunities for deductions and savings.

- Overusing Loans: Depending too heavily on loans, whether personal loans, payday loans, or credit lines, can trap you in a cycle of debt.

- Not Tracking Expenses: Keeping tabs on your expenses is essential for understanding where your money goes. Without this insight, it's challenging to make informed financial decisions.

- Living Without a Financial Goal: Not setting financial goals can lead to a lack of direction, making it easy to fritter away money without purpose.

These daily habits might seem trivial individually, but their cumulative effect can be detrimental to your financial health. Recognizing and addressing these habits is the first step toward achieving financial stability and securing your financial future. By making conscious choices and developing healthier financial routines, you can break free from these slow-poisoning habits and set yourself on the path to financial well-being.

Read the full article

0 notes

Text

ATD Money Online Payday Loan Application in India

ATD Money is a leading loan provider that aims to transform the lives of people through their easy and instant process of loan approval. This company offers a wide range of services that include personal loans, automobile loans, business loans, etc.

National Conventions are held biennially. The national officers work together to organize these events. They are also responsible for the finances and public relations of the Fraternity.

Benefits

Unlike other payday loan companies in India, ATD Money offers low-interest rates and fast processing. They also do not charge a monthly fee. In addition, their application process is simple and easy to understand. The company has a large network of branches across the country. Those who wish to apply for a loan with ATD should be aware of their credit history. To qualify for a loan, applicants should have a good credit score and sufficient income.

ATD Money is a leading micro-finance service provider in India. The company provides loans to salaried employees who need financial help. They offer a variety of personal loans, including instant cash loans and small retail loans. The company also offers unsecured business loans and payday loans to qualified customers. The company's loans are available to residents of all ages and ethnic backgrounds.

Fitch expects ATD to generate solid funds from operations (FFO) over the next several years as a result of stronger end-market demand and lower operating expenses. The company's current FFO margin is 0.5%, and Fitch forecasts it to rise slightly to 1.0% in 2021. The company has a strong balance sheet with $29 million of consolidated cash and cash equivalents as of April 3, 2021.

Lease-adjusted gross EBITDA leverage is currently 7.3x but will decline towards the mid-5x range over the next few years as a result of higher EBITDAR and debt reduction. Fitch also expects fixed charge coverage to improve toward 1.5x by YE 2021 from 1.2x in 2020.

Brands increasingly are demanding more transparency from agencies around fees, commissions and the cost of media. This has led to some brands taking their ad buying in-house. Other firms have been forced to rethink their models or go out of business. VIA's ill-fated streetcar project is a classic example of government arrogance and waste. Voters approved a one-fourth-cent sales tax for the district. Still, city leaders diverted its proceeds to this single rail project, cannibalizing bus replacement accounts and taking "unused" bond funds from street projects.

Application Process

Whether You use the Website on Your own behalf or on behalf of an entity, You are solely responsible for maintaining the confidentiality of Your username and password. If You use the Website on behalf of an entity, You must notify the entity of any loss or theft of Your user name and password, and you must promptly request that such information be changed. You must also promptly notify ATD if You become aware of any unauthorized use of Your user name and password.

ATD may disclose Your personal information to third parties without Your consent to comply with court orders or subpoenas, respond to requests for assistance from law enforcement agencies, or protect its rights and property. You may review the personal information that ATD maintains about You by visiting its Privacy Notice.

ATD reserves the right to limit Your access to the Website or any portion of it at any time. ATD also reserves the right to modify the information, software, and materials presented on or through this Website at any time.

In addition, by providing content, information, or a work of authorship to any Forum, You automatically grant ATD a royalty-free, perpetual, irrevocable, non-exclusive right and license to copy, publish, translate, create derivative works from, distribute, transmit, display, or otherwise use such Postings (in whole or in part) worldwide and/or incorporate them into other works in any form, media, or technology now known or later developed for the full term of any rights that may exist in such content.

You may not download, reproduce, or otherwise copy any of the information, software, or materials on this Website for commercial use without the written permission of ATD. This includes, but is not limited to, text, graphics, headers, icons, images, sound clips, audio or video files, computer code (including HTML, CSS, XML, and JavaScript code), programs, products, information, and documentation as well as the design, structure, selection, coordination, expression, "look and feel", and arrangement of such information, software, and materials.

ATD, its officers, employees, agents, licensors, and successors in interest are firmly committed to the highest standards of honesty, integrity, and fairness in all of its business activities. Any breach of these standards, including any misrepresentation, fraud, or other unfair dealing, shall be a material breach of this TOU and grounds for immediate termination of Your right to use this Website.

Customer Service

ATD Money provides its customers with top-notch customer service that is available through phone or email. The company also offers a convenient online process for applying for and getting a loan approved. This helps save time and allows customers to get the help they need quickly and easily.

The company understands that many people struggle with financial problems at some point in their lives. This is why they offer a variety of loans and services to help you manage your finances. They also offer low-interest rates and flexible repayment terms.

ATD Money is a mobile application that provides instant cash loans to salaried individuals in India. The app is easy to use and can be downloaded from Google Play. Once the application is completed, the loan can be approved within a few minutes and will be disbursed shortly after. The app is free to download, and there are no hidden fees or charges. It is a great way to get the money you need without having to ask friends or family for money. The app can be used for a variety of purposes, including paying bills, buying a new vehicle, or covering unexpected expenses.

Interest Rates

If you are looking for a company offering loans at the lowest interest rates, you should check out ATD Money. It is one of the leading micro-finance companies in India that has made a huge impact on the lives of millions of people by providing them with loans that they can afford to pay back. They also provide fast approval and minimal documentation. In addition, they offer the best customer service in the industry. They also offer the best interest rate on personal loans for students and professionals.

You may link to the Website, but you must not frame or mirror it or its content or use any other means to infringe ATD's intellectual property rights. The Website contains links to other websites on the World Wide Web, which are maintained by third parties over which ATD exercises no control. These links are provided only for Your convenience and are not intended to imply any endorsement by ATD of the products or services offered on those sites or the content, materials, or information presented therein.

By submitting content or information to a Forum, You automatically grant ATD a royalty-free, perpetual, irrevocable, non-exclusive right and license to reproduce, modify, publish, translate, create derivative works from, distribute, transmit, sublicense (or further authorize), sell, and/or display such content or information (in whole or in part) worldwide and/or to incorporate it in other works in any form, media, or technology now known or later developed for the full term of any rights that may exist in such content or information.

ATD makes no representations or warranties, express or implied, about the suitability, accuracy, completeness, timeliness, or legality of the Services, Materials, and Information available on the Website for any purpose. Furthermore, ATD disclaims (to the fullest extent permitted by law) all warranties, expressed or implied, including any implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

Limitation of Liability

ATD shall not be liable for any damages whatsoever arising out of Your use of the Website, whether direct, indirect, special, incidental, or consequential, including lost profits, even if ATD has been advised of the possibility of such damage. This includes but is not limited to, any claims for lost revenue, lost profits, loss of data, or failure of equipment.

#cash loans#instant loan#loan app in india#payday loans in india#personal loans#quick cash loans#payday loans#fast cash loans online#advance salary loan#loan apps

0 notes

Text

What Is Direct Lending?

Finding money to fund unexpected expenses can be tough when you don’t know where to turn. Thankfully, there are direct lenders that allow you to borrow cash quickly and easily.

When you need emergency funding fast, MaxLend offers installment loans up to $3,750 after a quick approval decision. Choose a direct lender like MaxLend and you could get same-day funding.*

What Is Direct Lending?

In the online lending world, a direct lender is a company that loans money directly to people who apply and qualify for a loan.

Also online, there are loan lead generators, companies that have websites where you can submit your information for a loan application. You may have applied through a lead generator in the past, maybe without realizing it.

When you submit your information for a loan application to lead generators, they offer your information to third-parties — middlemen, agents and direct lenders — who may buy it as a lead on a loan. You have no control over which company purchases your information — and you’ll receive whatever offer that lender wants to make. When your information is purchased as a loan lead, you’re redirected to the website of the lender who purchased it.

What Are Direct Lending Companies?

Direct lending companies provide loans personally to clients. They may also buy leads from lead generators. When you apply with a direct lending company, you know which company you’ll be working with, rather than going through a third-party.

Advantages of Working With a Direct Lender

When you apply with a direct lender rather than going through lead generators, you have the freedom to choose which lender you’d like to work with — and can choose the one that suits your needs best. Direct lending companies like MaxLend loan money directly to those who need it.

One reason customers choose to apply directly with a lender is because with a direct lender, they know the perks and benefits they’ll get. If the direct lender offers a loan loyalty rewards program, like MaxLend does, borrowers also know the loan they obtain will count toward their rewards. With MaxLend, you know you’re working one-on-one with your quick loan experts.

When you choose to work with a direct lender like MaxLend, you can expect convenience, flexibility, good customer service, fast cash release, and the benefits of our installment loan rewards program.

MaxLend — A Direct Lender for Installment Loans

MaxLend is proud to be a direct lender for cash loans in the form of installment loans, a payday loan alternative for emergency funding. You can apply for cash online with MaxLend to get approved for an installment loan up to $3,750.

If you’re seeking an alternative solution to payday loans from a direct lender, look no further than MaxLend. Upon approval, you can get funds in your bank account as soon as today.* For more information on direct lending, contact us today at 877–936–4336. Call us anytime, 24/7, to answer your questions.

Source:

*Same Day Funding is available on business days where pre-approval, eSignature of the loan agreement and completion of the confirmation call, if a call is required, have occurred by 11:45 a.m. Eastern Time and a customer elects ACH as payment method. Customers who complete this process by 1:30 p.m. Eastern on business days may still receive funds on the same day, but some banks may not disburse the funds until the next business day. Other restrictions may apply. Certain financial institutions do not support same day funded transactions. When Same Day Funding is not available, funding will occur the next business day.

The content on this site is for informational purposes only and is not professional financial advice. MaxLend does not assume responsibility for information given. All information should be weighed against your own abilities and circumstances and applied accordingly. It is up to readers to determine if this information is safe and suitable for their own situations.

MaxLend, is a sovereign enterprise, an economic development arm and instrumentality of, and wholly-owned and controlled by, the Mandan, Hidatsa, and Arikara Nation, a federally-recognized sovereign American Indian Tribe. (the “Tribe”). This means that MaxLend’s loan products are provided by a sovereign government and the proceeds of our business fund governmental services for Tribe citizens. This also means that MaxLend is not subject to suit or service of process. Rather, MaxLend is regulated by the Tribe. If you do business with MaxLend, your potential forums for dispute resolution will be limited to those available under Tribal law and your loan agreement. As more specifically set forth in MaxLend’s contracts, these forums include an informal but affordable and efficient Tribal dispute resolution, or individual arbitration before a neutral arbitrator. Otherwise, MaxLend is not subject to suit or service of process. Nothing in this website is intended to waive or otherwise prejudice MaxLend’s entitlement to these protections. Neither MaxLend nor the Tribe has waived its sovereign immunity in connection with any claims relative to use of this website. If you are not comfortable doing business with sovereign instrumentality that cannot be sued in court, you should discontinue use of this website.

0 notes

Text

ATD Money - Apply for Microfinance Loans Online

ATD Money is a leading micro-finance lender in India, providing loan approval with easy process and minimal documentation. ATD Money offers a variety of products, including the best salary advance loan and unsecured business loan.

Payday Loan

ATD Money is a micro financial solution provider that offers a range of advance cash loans to salaried individuals. Its services include payday loans, same day loan, and unsecured business loan. The company’s main goal is to help customers solve their financial problems and ease their financial burden.

The company’s online payday loan application process is fast and easy. All you need to do is provide a few basic details and submit some documents. Then, you’ll be notified of the status of your application. If you’re approved, the lender will deposit the funds directly into your bank account.

Once you’ve received the funds, you can use them to cover any emergency expenses. This includes medical bills, school fees, or even a new car. If you’re not able to pay back the loan on time, it may be possible to roll over the repayment term. However, be aware that payday loans typically have high interest rates and are not recommended for long-term financing.

ATD Money offers a variety of personal loans to salaried employees in India. These loans can be used to fund a wide range of expenses, including home repairs, debt consolidation, or buying a new car. To apply, simply log in to the ATD Money website or download the mobile app. Once your information is verified, you’ll be able to receive the loan amount within 24 hours. The best part is that you won’t have to wait in a queue or pay any processing charges. Plus, you can easily repay the loan with a flexible schedule and a low interest rate. This makes it an ideal choice for people who need a quick cash loan.

Advance Salary Loan

When you find yourself in a money crunch, it can be challenging to decide the best way to fill the gap. Should you borrow from friends or family? Charge it to a credit card? Or take out a payday loan? Whatever you choose, there are some important things to consider.

Unlike payday loans, an advance salary loan is an open-end, variable rate financial product that lets you borrow as much or as little as you need. You can also use it to pay bills, start a savings plan or get access to financial counseling. And you can repay the full balance and accrued interest with a funds transfer from an LGFCU share or deposit account on your next pay date.

However, be aware that your employer may not approve a salary advance request if it would reduce your hourly minimum wage below the legal amount. And if your employer agrees to an advance, be sure you have a written agreement that clearly outlines the terms and conditions of the loan.

ATD Money is a leading online micro finance solution provider, offering mini cash loans for salaried individuals. These loans are of a small amount and have an affordable interest rate. You can easily apply for these loans by filling in the necessary details on the website. If your application is approved, the loan amount will be credited to your bank account within 24 hours. The company offers various other micro finance solutions as well, including payday loans, zip loans, instant personal loan and unsecured business loan.

Unsecured Business Loan

Many small businesses need access to extra funding at some point – whether it’s to cover working capital or take the business to the next level. There are many ways to get funding for a business, including secured or unsecured loans. However, each type of financing has its own pros and cons. Secured loans are typically more cost-effective and offer lower interest rates than unsecured ones. However, it’s important to weigh up the risks before applying for a secured loan.

Unsecured loans are ideal for SMEs because they don’t require any property to be used as collateral. This means that personal assets like a home or car will not be at risk if the business fails to repay the debt. Moreover, unsecured loans are easier to get than secured loans because the lender does not need to appraise the value of assets or the borrower’s creditworthiness. This makes it faster to obtain a loan than secured options, but it’s important to consider the terms and rates carefully before applying.

There are many different lenders who offer unsecured business loans, including high street banks, peer-to-peer lenders and specialist business finance companies. It is important to find a lender that offers competitive rates and has the experience to assess your business’s financial position. It’s also important to choose a lender that reports to each of the major business credit bureaus to help you build your business’s credit score.

While there are several benefits of unsecured business loans, they are not without their own downsides. For one, they are often more expensive than secured loans because the lender is taking a higher risk with this type of lending. Additionally, unsecured loans may be discharged in bankruptcy, so they are not as protected as secured loans. In addition, it’s important to remember that unsecured business loans are not a permanent solution to your cash flow problems. Eventually, you will need to pay back the loan, and if you fail to do so, the lender may seek to repossess your business’s assets.

Mini Cash Loan

If you are facing a financial crisis, and need immediate cash then a mini loan can be your saving grace. These small loans are easy to get and do not require any lengthy documentation. In fact, you can even borrow such loans if you have a low credit score. These loans are also much more affordable than personal loans from banks. These loans can help you cover your urgent expenses and improve your credit score at the same time. The best part about these loans is that they are easily available online.

ATD Money is a fast-growing microfinance company that offers quick loans to salaried professionals in India. Its range of services includes payday loans, instant loans, zip loans, and advance salary. Its loan approval process is entirely web-based and takes less than 24 hours. Moreover, it does not conduct any surveillance on the applicant’s credit history.

This loan app provides instant and hassle-free loans to salaried employees, who need cash during the month. Its loans are based on the average monthly take-home salary of the employee. This app is a great way to solve financial emergencies and meet the short-term financial needs of working class people. Its customer service is also excellent and it can help you through the entire application process.

Often, the salaried class faces financial crunch in the middle of the month due to unexpected expense. These expenses may include bills, car repair, or other emergency costs. To help them in this situation, ATD Money has launched an innovative app called “Payday Loan”. This app helps the employees of the corporate sector during the financial crunch by extending short-term financial support on their monthly income basis.

Unlike other lending institutions, ATD Money does not run credit checks on the applicant’s credit report and does not demand collateral or guarantee. The loan amounts offered by ATD are usually up to Rs. 1 lakh. The loan terms can vary from a few months to a year. However, it is important to remember that the amount of the loan must be repaid on time. If not, you may be charged additional interest and could even be placed on the blacklist of defaulters.

0 notes

Text

ATD Money -Best Payday Loans Online With No Credit Check

When you are facing a financial emergency, you may need some extra cash. A payday loan can be a quick way to get a small amount of money.

However, it is important to know what to expect before taking out a payday loan. You should also make sure you can afford to repay it.

Easy Loan

If you’re looking for a quick loan, ATD Money is an excellent choice. They offer an easy application process, and they can disburse the funds to your bank account in less than 30 minutes after you apply.

They are a trusted lender that works within the law. They also work with a network of NBFC partners to help you get the money you need. They have a strong online presence, and they offer loans to people from all walks of life.

These loans are a great way to cover unexpected expenses or fund personal projects. They are easy to get and have low-interest rates, so you can pay them back over time.

Another benefit of these loans is that they can be used without a guarantor. This means that you can borrow more than you would with a traditional loan. However, it is important to remember that these loans are short-term and should only be used for emergencies.

Whether you need to pay for an emergency or buy a new car, ATD Money can help you meet your financial needs. They offer both unsecured and secured loans at competitive rates, and they have a fast application process.

You can apply for an Easy Loan from ATD Money on their website or mobile app. Once you submit your information, a loan expert will contact you to discuss your options.

ATD Money is a microfinance company that provides a variety of short-term loans to Indian citizens. These loans don’t require a guarantor or credit check and can be used to pay off debt or start a business.

They are available at retail locations or through an NBFC partner, and they have low rates and flexible payment plans. You can also defer payments, which makes them a great option for people who need to pay bills but don’t have the money.

ATD Money is an emerging and rapidly growing microfinance solution provider agency that offers a range of online mini-cash loans for salaried employees and those with a monthly income. The company’s easy-to-use mobile app makes it quick and easy to apply for a loan.

Easy Application

ATD Money is an online microfinance service that offers a variety of loan products. It is a convenient option for salaried individuals who need instant cash. Its application process is fast and simple, and it has a great customer support team. It is also available to any citizen of India, making it a good choice for people with bad credit.

Salaried employees who earn between $15K and $250K a month can apply for salary loans through ATD Money. These loans can help you cover unexpected expenses, such as a car repair or vacation. The company’s mobile app makes it easy to get a loan, and the results are typically available in minutes.

Payday lenders are another popular way to obtain quick cash, but they can be risky for some people. Because payday loans are due on your next paycheck, they can be difficult to manage. They can also be expensive, so they should be used as a last resort.

Another option for getting quick cash is to ask your employer for a paycheck advance. These loans aren’t as fast as personal loans, but they are less expensive and easier to manage. They can also be a useful tool for people who have a limited budget and don’t want to use their bank account.

You can also find a payday lender online or at a retail location. These lenders are often affiliated with NBFC partners, which means they work within the law and have a strong reputation.

ATD Money is a leading microfinance service provider that offers a variety of loan products to customers across the world. Its website and mobile apps make it easy to apply for a loan, submit documents, and track your progress.

Unlike payday loans, ATD Money does not require a guarantor or credit check. The company also charges a low-interest rate and works within the law to ensure that its customers are treated fairly.

ATD Money is a leading online microfinance company that provides small loans to consumers. It has a large customer base and offers a variety of financial solutions, including mobile banking and digital payments. It is based in Delhi and has offices throughout India.

Easy Repayment

If you are in need of some extra cash to cover unexpected expenses, a payday loan is an easy option. They are quick to approve and disburse, and some lenders can even pay the money directly into your bank account. They are an excellent choice for short-term needs, but if you have bad credit or need to borrow a larger amount of cash, you might want to consider an alternative option.

ATD Money offers a range of different loans, from installment loans to personal lines of credit. Each type of loan has its own set of benefits and features, and some may be more appropriate for your particular situation than others.

Installment loans typically have longer repayment terms and fixed interest rates, but they can be a good choice if you need to pay off a large purchase or need access to more cash over time. These types of loans often require a valid ID, proof of income, and a checking account to apply.

Personal lines of credit offer more flexible terms and can be used to pay off a wide variety of expenses, including emergency repairs or vacations. They can also be useful for larger purchases or to manage a monthly budget.

These types of loans usually have lower interest rates than other types of financing, but you must be sure to check out your options before making a decision. Some personal lines of credit charge fees for ATM withdrawals, so it is important to check out these fees before applying.

You can also try a no-credit-check option, which is an easy way to get access to the funds you need without undergoing a lengthy application process. These options are available through many banks and credit unions, and they can be an excellent solution for emergencies or short-term financial needs.

The biggest advantage of this option is that it can be used for almost any purpose, so it can be a great way to finance a new car, help with home repairs, or take that long-awaited vacation you’ve always wanted. Unlike payday loans, these options don’t require a guarantor or credit check.

Easy Credit Check

If you need quick cash, ATD Money is an easy way to get a loan. Their loans don’t require a guarantor or credit check, and you can use them for anything from unexpected bills to personal projects.

Another way to get a loan is with a credit card. These cards typically have PINs that you can use to access cash. However, be sure to read the fine print. Many card issuers limit the amount of cash you can withdraw from an ATM. It’s also important to know that these loans can negatively impact your credit score if you’re not paying them back on time.

For instance, missing just one payment on a credit card can drop your credit score by 100 points or more. It’s best to avoid these types of high-interest, short-term loans as much as possible and instead save up for emergencies with a savings account.

Alternatively, you can use an online marketplace to compare direct lenders. VivaLoans and 100Lenders are two such sites that allow you to compare a number of payday loan providers and choose the best one for you.

Payday loans are a common way to get a small, emergency loan, but they can come with a lot of fees and high-interest rates. A bad credit score can make it even more difficult to obtain a payday loan, so it’s essential to shop around for the best option.

A payday loan is a short-term loan that’s generally due on your next payday. You can apply for these loans at any bank or credit union, but it’s a good idea to shop around before making your final decision.

You can also look for payday loans that offer a no-credit-check feature. These are usually more affordable than traditional payday loans, but they can be risky because they often trap you in debt.

Finally, if you’re looking for a more budget-friendly alternative to a payday loan, consider Afterpay. This app splits your purchases from $200 to $2,000 into four equal payments.

These loans are a great option for people with low credit scores, but it’s important to choose the right lender to ensure you don’t pay too much interest or end up trapped in debt.

0 notes

Text

Just how to Discover the Right Online Loan

When looking to find the best on the web loans accessible, you must research your options in order that you'll know exactly what to anticipate on the web lenders to be searching for whenever you demand a loan. Clearly, the very best on the web loans won't be the easiest to obtain; to get the very best interest rates and terms, you must take the time to thoroughly check out numerous on line lenders. Your collateral must be worth significantly more compared to the loan required and you will need to understand in advance that when you have bad credit you will likely be paying a greater interest rate than somebody who has lån med betalingsanmerkning . That is just the price that has to be compensated in order to enhance your credit score.

In the event that you make an effort to carefully contemplate all your choices and pick a loan centered that'll fit your preferences, it's more than likely that you'll have an optimistic experience together with your on line financing.

Guaranteed loans will probably have probably the most desirable payback terms... the reason being the lender is guaranteed in full repayment by the collateral therefore they are ready to provide interest costs and loan terms that wouldn't be probable if the loan was unsecured. Lenders tend to be more comfortable that they may be compensated right back if the loan is secured by your property. Online to provide their services occasionally limits the kinds of collateral which will be accepted. This really is because of the paperwork that is involved.

It may also be possible to use the piece that you're financing to protected the loan... this is particularly so if you are buying a home loan or a vehicle loan. However, you're probably going to require a down payment. Once the applying is done you will know how much cash you will need for the down payment.

Some on line lenders won't improve loans for buying something. They tend to lead more toward consolidating your debts or increasing your credit. These lenders will usually accept high-value home equity as the ideal choice of collateral because it is easier to handle and they do not need space for storage as they do for bodily homes like vehicles. It is simple to transfer the control because the specific property isn't involved. It's just a matter of paper work.

These types of loans don't need a credit check always, unlike the bank or even a large lending company. With an Instant Online Loan you can have a nearly immediate acceptance, and the cash may be delivered right to your bank. The only thing is that these Instant On line Loans do need that you've a job. Together with a couple of references and a bank-account that's in excellent standings. Your program can just take a few seconds to inform you of how much cash you have been permitted for. Nevertheless there are always a several issues that you have to know about. You do not want to be late in paying the Quick On the web Loan back, as there are sever penalties for being late together with your payments. These Quick On the web Loans do demand a top interest charge, and this is seen in the late penalties, as every time you're late you must pay back more and more money. Therefore you intend to ensure that you pay the loan straight back on your next payday or two, in order to avoid these large penalties.

Many individuals believe they are carrying out a great work spending their costs, but, only once you think you are likely to have only a little added spending money, anything arises; it might be that you suddenly have to truly have a new portion for your vehicle or because for some reason it wouldn't start, which means you finished up contacting anyone to pull your car to the shop. That is only an illustration, the idea it this could cost you a bundle that you probably do not need available. The matter could possibly be any issue that needed income quickly to pay an urgent bill. Therefore an Immediate Online Loan might be researched.

The same as any other economic purchase, the very best on the web loans may have some repayment terms which is agreeable for both the lender and the borrower. That is essential. A lot of on line lenders present automatic payments from the customer's bank account. This is a simple way of payment and the borrower won't your investment deadline or have to create and send checks. Many customers will find a choice on the internet site so they can select to use a wire move or spend online. If you prefer, you are able to send your payment to the physical address.

0 notes

Text

What Are Cheapest Online Loans?

When seeking to find the best on the web loans accessible, you need to do your research to ensure that you'll know exactly what to expect on the web lenders to be looking for when you demand a loan. Clearly, the most effective on the web loans won't be the simplest to obtain; to get the very best fascination rates and terms, you should take the time to carefully check out numerous on the web lenders. Your collateral will need to be worth substantially more compared to the loan requested and you artikkelen de skrev at the start that when you yourself have poor credit you will likely be paying an increased interest charge than anyone who has great credit. That is only the cost that has to be compensated in order to improve your credit score.

If you make an effort to carefully consider all your possibilities and select a loan based which will fit your needs, it's more than likely that you'll have a confident experience with your on the web financing.

Attached loans will most likely have the most desirable payback terms... the reason being the lender is guaranteed repayment by the collateral so they are willing to provide fascination rates and loan terms that wouldn't be possible if the loan was unsecured. Lenders tend to be more comfortable that they can be paid right back if the loan is guaranteed by your property. Using the internet to provide their companies often limits the forms of collateral which will be accepted. This really is because of the paperwork that is involved.

It may also be probable to use the product that you're financing to secure the loan... this is particularly true if you should be buying a house loan or a vehicle loan. Nevertheless, you are probably going to desire a down payment. After the application is completed you'll know how significantly money you will need for the down payment.

Some on the web lenders won't advance loans for buying something. They have a tendency to lead more toward consolidating your debts or improving your credit. These lenders will most likely take high-value house equity as the ideal choice of collateral since it is easier to deal with and they don't require space for storage because they do for physical qualities like vehicles. It is simple to move the ownership because the particular home isn't involved. It is merely a matter of paper work.

These kind of loans do not require a credit always check, unlike the bank or even a big financing company. With an Quick Online Loan you could have a nearly immediate approval, and the money may be delivered straight to your bank. The thing is why these Immediate On line Loans do involve that you have a job. Together with a few sources and a bank-account that is in excellent standings. Your program can just take a couple of seconds to see you of how much cash you've been accepted for. However there are a few things that you need to know about. You do not desire to be late in paying the Instant On line Loan right back, as you will find sever penalties for being late together with your payments. These Immediate On the web Loans do demand a high fascination charge, and this is observed in the late penalties, as every time you're late you must repay more and more money. So you intend to make sure that you pay the loan back on your following payday or two, to be able to prevent these high penalties.

Lots of people believe they are performing a great job spending their expenses, however, just once you think you are going to have only a little added paying income, something pops up; it may be that you suddenly have to have a new part for your car or because for whatever reason it would not begin, so you finished up calling anyone to pull your car to the shop. This is only a good example, the purpose it this could cost you a fortune that you truly do not need available. The matter could possibly be any issue that needed income quickly to pay surprise bill. So an Immediate Online Loan could possibly be researched.

Exactly like any financial transaction, the best on the web loans could have some repayment phrases that'll be agreeable for the lender and the borrower. This is essential. A lot of on the web lenders provide automatic payments from the customer's bank account. This really is an easy way of cost and the borrower will not forget the due date or have to publish and send checks. Several consumers may find a choice on the internet site for them to choose to employ a cable move or pay online. If you like, you can mail your payment to the physical address.

0 notes

Text

The best ways to get free money

No one knows how to get free money like a pro. Whether you’re looking for ways to start your own business, or you just want to get by on a little bit of free money, there are plenty of ways to do it. Here are five easy ways to get free money:

How to Get Free Money.

There are many ways to get free money through investing. One way is to invest in stocks. You can buy stocks online, in a mutual fund, or through an investment advisor. If you’re new to investing, it’s best to start with a small amount of money and work your way up.

How to Get Free Money through the Job Market

Another way to get free money is through the job market. You can find jobs that are available for free or at low cost by checking out job boards or Indeed.com. You can also search for part-time or full-time jobs on websites like Indeed and Craigslist.

How to Get Free Money through Coupons and Deals

If you want to get paid for your work, there are several ways you can do this. One way is by getting a coupon or deal from a store, restaurant, or other establishment. Another option is by signing up for newsletters or email newsletters that offer cash bonuses for subscribing (these are often called “gift cards”). Finally, you could also sign up for paypal payments and receive payments directly from companies instead of waiting for wageschecks mailed back home.

The best way to get free money is to find ways to use it. By using the tips in this article, you’ll be on your way to getting free money that you can use for fun or emergencies.

How to Get Free Money.

The quickest and most common way to get free money is through credit cards. You can get free money by paying off your card in full, or by using Reward Points. reward points are earned when you make purchases with your credit card, and can be redeemed for a variety of discounts and rewards.

To get started, start by reading the terms and conditions of your credit card company’s website carefully. Many companies offer promotions and deals that you may not know about. For example, American Express sometimes offers free travel when you make a purchase of $50 or more in one visit. And Chase Freedom sometimes offers a $25 statement credit for just signing up for a approved account).

If you have low credit score or are not able to afford high-deductible cards, there are also several other ways to get free money through your bank account. You can often earn rewards points by depositing money into your bank account on time, making responsible financial decisions, and spending below your average monthly expenses.

You can also explore the various applications available from banks that offer free checking or savings accounts with no minimum balance requirements. This will allow you to save up until you want to use the account, which could lead to some pretty valuable discounts and benefits!

How to Get Free Money through Loans

There are many different ways to get free money through loans. Some people try payday loans or student loan consolidation, while others take out smaller loans or get a car loan without needing collateral. The best way to find out which option is best for you is to speak with a lender representative who will be able to help answer all of your questions about getting paid back on time and keeping your payments under control.

And finally, if you need emergency financing for something urgent – like buying an airline ticket without notice – don’t hesitate to call an overnight borrowing service like Wells Fargovernight Loans at 1-800-242-6227! They will help get you the cash needed fast so you can enjoy your trip!

How to Get Free Money.

Working514 is a website that provides users with information on how to get free money. They offer a variety of ways to get free money, from working for free in various industries to finding deals on groceries and other items. Working514 also offers a number of resources and tools to help users find work and receive free money.

How to Get Free Money through a Sale

Some people try to sell products or services for free in order to receive money in return. This can be done through online ads, social media, or even in-person sales encounters. In some cases, the seller may not require any payment until the product or service is completed. Other times, the seller may require payment before starting the sale process. When working with sellers who require payment before beginning transactions, it is important to be aware of any potential financial troubles that could arise should the deal not go through as planned.

Subsection 3.3 How to Get Free Money through Free House.

Not all houses are available for rent without paying an fee first. Sometimes homes that are available for rent for a low price but have some restrictions (like no pets) are offered as part of a “free house” program. These houses usually have open floorspace and often come with some sort of amenity package such as breakfast or wifi access. By taking advantage of this program, you can save on housing costs while still enjoying the benefits of living in a free home!

Conclusion

There are many ways to get free money. You can get free money through investments, job opportunities, coupon codes and deals, or by working out. It's important to take a look at all of the different ways to get free money so you can find the best way for your business. By exploring different options and finding the best way to get free money for your company, you'll be able to reach a larger audience and boost sales.

0 notes

Text

Top 5 Salaried Loan App in India

Are You Searching for Fast Loan Applications in India? ATD Money claims to offer fast loans for salaried employees across India.

Customers can easily check their eligibility online and if approved, funds should arrive to them within one to three days.

ATD Money

ATD Money Salary & Payday Loan is a convenient and safe mobile app designed to provide salaried employees with quick cash loans in emergency situations. This app carefully verifies social and creditworthiness of each applicant as well as their employer’s credibility before accepting them as customers.

Benefits of this loan app include no paperwork, no fees and an impressive approval rate. Furthermore, all your information remains strictly confidential — making this loan app one of the top rated loan apps in India. Another advantage is its convenient nature for quick loans for any purpose — download this loan app to access your account from anywhere!

Additionally, this app is user-friendly and offers superior customer support from company representatives who are always available to answer any queries about service usage or any other matters that arise. In addition to offering assistance and providing advice for saving money and improving credit scores, they also offer advice on saving money and increasing them.

This Android application is free to download and use with an intuitive user interface. Simply create an account, provide basic personal details and choose from several loan options available based on your needs — upload scanned documents for faster approval if desired! Once complete, your loan could arrive as soon as within minutes!

Upwards

Upwards is a quick personal loan app that makes applying for loans easy and fast, all from your smartphone. The application process is completely digital and can be completed at home in minutes; minimal paperwork is needed and borrowing money through Upwards is safe — even short-term borrowing if needed! You can borrow small amounts over an extended period and pay it back later!

Loans designed specifically for salaried professionals can help professionals meet any unexpected financial emergencies with flexible repayment terms and low-interest rates, making managing expenses simpler. Although multiple loans or credit cards may affect your credit score negatively, EMI payments should aim to remain below 40% of take-home salary for optimal success.

Another advantage of taking out this loan is that it can help you build up a healthy credit profile, increasing the odds of getting a mortgage in the future. To do so successfully, regularly monitor your credit report while also paying your EMIs on time to avoid damaging your score.

Lendingkart’s acquisition of Upwards is a strategic move designed to address Tier 2/3/4 markets’ significant credit gaps while capitalizing on Upwards’ advanced technology and expertise for streamlining loan application and underwriting processes.

Upwards offers an assortment of personal finance products, such as personal loans and credit cards. As a registered non-bank financial company (NBFC), this lender adheres to RBI guidelines. Apply for your loan within 3 minutes with Upwards!

ZestMoney

ZestMoney is an instant loan app designed for salaried individuals that allows them to make purchases on installments over an EMI repayment schedule. Free and instant loan approval make ZestMoney ideal for purchasing electronics, healthcare items, fashion accessories or courses from Udacity, UpGrad Edureka SimpliLearn.

Zest Money has partnered with more than 3, 000 leading e-commerce merchants to provide its users with buy now pay later credit limits and automated repayment of monthly EMIs. While this service may save time and hassle, users should be mindful that it does have some limitations.

At first glance, this company is unregulated by the RBI — this means they do not need to follow strict customer privacy and security regulations. Furthermore, fees and charges remain opaque and some customers have complained about using personal data for marketing purposes by the company.

Though financial emergencies may force us to make quick decisions, it’s still wise to do your research prior to applying for a buy now pay later loan. Otherwise, you could fall into an expensive debt trap. Check terms and conditions carefully so as to avoid unexpected fees; also think carefully if ZestMoney loans are right for you; especially if your credit history is poor — in which case it may be best avoided altogether; but if applying anyway make sure payments are timely in order to prevent falling into another debt trap.

CASHe

CASHe is an instant loan app that makes borrowing money effortless and paperless. Users only have to upload documents online when applying, with free download and use available to anyone with a smartphone — the app even asks users for selfie verification to authenticate identity!

CASHe stands out from other lenders by providing short-term loans specifically targeted towards young professionals. These loans can be used for various purposes, from paying an unexpected bill or planning a trip, to purchasing items on e-commerce websites. Furthermore, this company utilizes an alternative credit scoring algorithm which assesses customer risk; thus providing loans even when users have low CIBIL scores.