#equity advisors in delhi

Text

Why the Stock Market is Ideal for Long-Term Investment

Investing in the stock market means putting your money into companies to help them grow. It’s like planting seeds in a garden, hoping they’ll grow into big trees over time. Here’s why putting your money in stocks for a long time is a great idea

Stocks Can Make You More Money Over Time: When you buy stocks, you’re buying a tiny piece of a company. As the company gets better and makes more money in long-term investment, the value of your piece can go up. Even though the stock market can go up and down quickly, over many years, it usually goes up.

Historical Performance 2. Compounding Returns 3. Diversification Benefits 4. Mitigating Volatility with Time

#sebi registered investment advisor#Sebi Registered Investment Advisor in delhi#Sebi Registered Investment Advisor in noida#Sebi Registered Investment Advisor in delhi NCR#equity advisory#sebi registered advisor

0 notes

Text

How Mutual Fund Agents in Delhi Simplify the Process of Investing in Mutual Funds Online

In today’s fast-paced world, the convenience of online services has transformed how we manage our finances, including investments. For those looking to invest in mutual funds, the ability to do so online offers numerous benefits, such as accessibility, speed, and the ability to manage portfolios at any time. However, despite the convenience, the process can still be complex, especially for beginners or those unfamiliar with the intricacies of mutual fund investments. This is where a Mutual Fund Agent in Delhi becomes invaluable. By bridging the gap between traditional investment advice and modern technology, they simplify the online investing process, making it easier and more effective for investors.

Understanding the Role of a Mutual Fund Agent in Delhi

Before diving into how a Mutual Fund Agent in Delhi can simplify online investing, it’s essential to understand their role. A Mutual Fund Agent is a financial advisor who helps clients select, manage, and optimize their mutual fund investments. They possess in-depth knowledge of the various mutual funds available in the market, understand the risks and returns associated with each, and can offer personalized advice based on an individual’s financial goals and risk tolerance.

In Delhi, a city that serves as a financial hub for many investors, a Mutual Fund Agent is particularly beneficial due to their familiarity with both local and global market trends. They help investors make informed decisions, whether they are investing in equity, debt, or hybrid funds.

The Challenges of Online Mutual Fund Investing

Investing in mutual funds online offers several advantages, such as instant transactions, easy access to account information, and the ability to track investments in real-time. However, it also presents certain challenges:

Complexity of Options: With hundreds of mutual funds available, choosing the right one can be overwhelming, particularly for those new to investing.

Lack of Personalized Guidance: While online platforms offer tools and resources, they often lack the personalized advice that many investors need to make informed decisions.

Technical Difficulties: Navigating online investment platforms can be challenging, especially for those not tech-savvy or familiar with the specific features of these platforms.

Emotional Decision-Making: The ease of online transactions can sometimes lead to impulsive decisions, driven by market volatility or trends, rather than a well-thought-out strategy.

Regulatory and Compliance Concerns: Investors need to be aware of the regulatory requirements and compliance issues related to mutual fund investments, which can be confusing without proper guidance.

How Mutual Fund Agents in Delhi Simplify Online Investing

A Mutual Fund Agent in Delhi plays a crucial role in addressing these challenges, ensuring that the process of investing in mutual funds online is smooth, informed, and aligned with your financial goals. Here’s how they do it:

1. Personalized Fund Selection

One of the most significant advantages of working with a Mutual Fund Agent in Delhi is the personalized fund selection they offer. Rather than trying to navigate the overwhelming number of options on your own, your agent can recommend specific funds that align with your financial goals, risk tolerance, and investment horizon. Whether you’re looking for growth-oriented equity funds, stable debt funds, or a balanced hybrid option, your agent will tailor their recommendations to your unique needs.

2. Guidance Through Online Platforms

While online platforms offer convenience, they can be intimidating for those unfamiliar with their features. A Mutual Fund Agent in Delhi can guide you through the process of using these platforms, from setting up your account to making your first investment. They will explain the various features, such as setting up SIPs (Systematic Investment Plans), redeeming units, and monitoring your portfolio, ensuring you feel confident and in control of your investments.

3. Regular Portfolio Monitoring and Updates

Investing in mutual funds is not a one-time activity; it requires regular monitoring to ensure that your portfolio remains aligned with your financial goals. A Mutual Fund Agent in Delhi provides ongoing support by regularly reviewing your portfolio and updating you on its performance. They can recommend adjustments, such as switching funds or rebalancing your portfolio, based on market conditions or changes in your financial situation.

4. Mitigating Emotional Decision-Making

Market volatility can lead to emotional decision-making, where investors might buy or sell based on short-term market movements rather than a long-term strategy. A Mutual Fund Agent in Delhi helps mitigate this by providing rational, well-informed advice. They encourage a disciplined approach to investing, reminding you of your long-term goals and helping you stay the course even during market downturns.

5. Ensuring Regulatory Compliance

Navigating the regulatory landscape of mutual fund investments can be complex. A Mutual Fund Agent in Delhi ensures that your investments comply with all relevant regulations, protecting you from potential legal issues or penalties. They stay updated on any regulatory changes and inform you of how these changes might impact your investments, ensuring you remain compliant and well-protected.

6. Cost-Effective Solutions

Many investors are concerned about the costs associated with hiring a Mutual Fund Agent in Delhi. However, the benefits they provide often outweigh the costs. Most agents earn a commission from the mutual funds they recommend, meaning there are no upfront fees for their services. Additionally, their expertise can help you avoid costly mistakes, such as investing in high-fee funds or making poorly timed trades, ultimately saving you money in the long run.

7. Education and Awareness

Beyond managing your investments, a Mutual Fund Agent in Delhi also plays a crucial role in educating you about the world of mutual funds. They can provide insights into different types of funds, explain key investment concepts, and help you understand the impact of various market conditions on your portfolio. This education empowers you to make more informed decisions, even when investing online.

The Delhi Advantage: Why Location Matters

Choosing a Mutual Fund Agent in Delhi offers unique advantages. As a financial hub, Delhi is home to some of the country’s most experienced and knowledgeable financial professionals. A Mutual Fund Agent in Delhi is often at the forefront of industry developments, with access to the latest market research, industry events, and networking opportunities. This positions them to provide cutting-edge advice and insights that can significantly enhance your online investing experience.

Furthermore, Delhi’s diverse and growing economy offers numerous investment opportunities across various sectors. A Mutual Fund Agent in Delhi understands the local market dynamics and can recommend funds that capitalize on regional growth trends, offering you a strategic advantage.

How to Choose the Right Mutual Fund Agent in Delhi

While the benefits of working with a Mutual Fund Agent in Delhi are clear, selecting the right agent is crucial to your investment success. Here are some tips to help you choose the best Mutual Fund Agent in Delhi:

Check Credentials and Experience: Ensure that the agent is certified and has a strong track record of success.

Seek Recommendations: Ask friends, family, or colleagues for recommendations of reputable agents.

Evaluate Communication Skills: Choose an agent who can explain complex concepts in simple terms.

Assess Their Understanding of Your Goals: Select an agent who takes the time to understand your financial goals.

Consider Their Availability: Ensure that the agent is accessible and responsive.

Conclusion: A Simplified, Successful Investment Journey

Investing in mutual funds online offers convenience, but it also requires careful planning and informed decision-making. A Mutual Fund Agent in Delhi simplifies the process by offering personalized advice, guiding you through online platforms, and providing ongoing support. By partnering with a knowledgeable and experienced agent, you can navigate the complexities of online investing with confidence, ensuring that your investments are well-aligned with your financial goals.

Your investment journey doesn’t have to be daunting or overwhelming. With the right Mutual Fund Agent in Delhi by your side, you can simplify the process, make informed decisions, and achieve long-term financial success.

#Mutual Fund Agents in Delhi#financialplanning#investment#mutual fund#Mutual Fund Agent#Mutual Fund Agent in Noida

1 note

·

View note

Text

Startup Advisors in Delhi

Startup Advisory

India is home to more than 100 unicorns. Most of these companies had early backers who believed in them and provided funds at an early stage. Today, those early backers are millionaires because they believed in those startups and risked their money.

Startup investing was earlier limited to a certain set of people, but that is no longer the case, it has democratised.

Who should invest in startups?

According to us, people with high networth having a high degree of risk taking ability should consider investing in startups. Domain experts may also consider investing in startups from the same sector as they will be able to assess the risk better.

Why is startup investing considered risky?

In their quest to grow quickly, startups tend to burn a lot of cash due to which there is a constant need for funding. If the funding dries up, it becomes very difficult for the startup to survive. Hence, there is very limited capital protection in case of startups. If you invest in any other instrument, there is a high degree of principal protection even if partially, which is not the case in startups.

What is the typical investment size and investment type in startups?

The cheque sizes usually range from 5-10L per startup. The investments are mostly equity investments. There are debt structures as well where you receive regular coupon payments, but they are less popular as startups are generally starved for cash and adding an interest payment may not be the best idea.

How is Growthvine different from the other startup investing platforms?

Happy to take that one. Our team is made up of people with investment research experience across financial companies. We have been analysing businesses for than 10 years and are very conservative in our approach. Our experience and approach is what differentiates us. Our process is simple, we hunt for startup opportunities where we are able to trust the management, the business has a long runway for growth and the funding needs are not extreme.

What are some of the startup terminology so it is easier to understand their business?

CAC (Customer Acquisition Cost): This is the marketing spend that a company does in order get the customer on board.

ARR (Annual Recurring Revenue): This is the revenue which the company is making.

Cash burn : This is the net negative cash that a company is making every month. Say a company earns revenue of Rs. 100 a month, but is spending Rs. 120 in costs, then the burn will be Rs. 20 If startup investing excites you, contact us and become a part of India’s next leg of growth.

Contact us:

Physical Address: The Office Pass, 5th Floor, Tower C, Unitech Cyber Park, Sector — 39, Gurgaon — 122001

Phone number: +919354435518

Gmail: infogrowthvine.in

Website: HTTPS://GROWTHVINE.IN/

0 notes

Text

Share market courses in Delhi

Share market courses in Delhi offer comprehensive education and training for individuals looking to enter or advance in the world of stock trading and investment. These courses are designed to cater to a wide range of learners, from beginners who are new to the stock market to experienced traders seeking to sharpen their skills. Delhi, being a major financial hub in India, hosts numerous institutes and academies that provide specialized courses on share markets. These courses cover a broad spectrum of topics, including fundamental analysis, technical analysis, equity research, derivatives trading, risk management, and portfolio management.

Participants are taught the intricacies of reading stock charts, understanding market trends, analyzing financial statements, and executing trades. Many of these courses also delve into the psychology of trading, helping students manage emotions like fear and greed, which are crucial for successful investing. In addition to theoretical knowledge, these programs often include practical sessions, live market exposure, and case studies, enabling students to apply what they have learned in real-time market scenarios.

The share market courses in Delhi are typically led by seasoned professionals and experts with years of experience in the financial industry, providing valuable insights and mentorship to the participants. Additionally, some courses offer certification upon completion, which can be a valuable credential for those looking to pursue careers as financial analysts, traders, or investment advisors.

Overall, share market courses in Delhi are an excellent opportunity for anyone interested in building a solid foundation in stock market trading and investment, whether for personal financial growth or a professional career in finance.

#Share market course#Share market course in delhi#Share market classes#Share market classes in delhi#Share market institute#Share market institute in delhi#Share market institution

0 notes

Text

Delhi Police Lawyer Their Role And Importance

Amid the bustle of normal life on Delhi's crowded sidewalks stands an anchor of justice: the Delhi Police. The Delhi Police are the principal defenders of the nation's capital and are tasked with preserving law and order within the center of the country. However, the Delhi Police Lawyer is another unknown set of heroes who work diligently behind the scenes to ensure justice is served.

Delhi Police Lawyers: About

Delhi police lawyers specialize in defending law enforcement officers in court, disciplinary hearings, and criminal prosecutions. They provide crucial defense services to police officers who face charges, ensuring their legal rights are upheld and assisting in clearing their records.

Delhi police lawyers play pivotal roles:

Representation During Prosecution: They guide clients through criminal proceedings, explaining charges, defenses, and plea options. They work to exclude evidence that could be detrimental to their client's case and advocate for them in court.

Role of Investigator: Lawyers at Sharks of Law investigate cases thoroughly, gathering evidence from witnesses and physical sources to strengthen the defense's position and achieve favorable outcomes.

Role of Advisor: They counsel clients on legal strategies, potential defenses, and negotiation tactics, ensuring their rights are protected throughout the legal process.

Role of Advocate: As advocates, they present compelling arguments in court, cross-examine witnesses, and challenge prosecution evidence to secure fair trials for their clients.

Role of Protector: Emotionally supporting clients through legal challenges, ensuring they understand their rights, and prioritizing their well-being during stressful proceedings.

Delhi police lawyers at Sharks of Law are committed to upholding justice and equity behind the scenes. Their expertise ensures law enforcement officers receive robust legal representation, contributing to the maintenance of order and security in India's capital.

Sharks of Law serves as a comprehensive legal resource for Delhi police lawyers, offering expert consultation and representation tailored to the unique needs of each client.

Contact Information:

Email: [email protected]

Help Desk: +91-88770-01993

0 notes

Text

IT Company II Business Development Manager II Project Security Systems marketing II Security Systems company II Kolkata

Ideal Career Zone: Where Your Skills Meet Your Passions. The ideal career zone is the sweet spot where your skills and passions intersect. It's the place where you can use your talents to make a difference in the world, while also feeling fulfilled and satisfied. Finding your ideal career zone can be a challenge, but it's worth it. When you're in the right zone, you'll be more productive, more motivated, and more likely to succeed.

Hi we are from IDEAL CAREER ZONE. We are a job placement firm and we are recruiting staffs for different posts for different company.

About Company: A garment manufacturing company in Kolkata looking some staffs for their company.

Post: Quality International Services

Job description

Business Development Manager - Project (Extra Low Voltage, Infrastructure, Security Systems)

Company is currently seeking a highly skilled and experienced Business Development Manager to join our team in Delhi. Who responsible for new Govt. & PSU client acquisition and servicing with existing clients of the company across designated Area for the sales of various product lines, Establishing and implementing long term marketing strategies and marketing plans for the Business in order to build brand equity & Govt. market share.

Responsibilities:

Identify and develop new business opportunities within the PAN India in the field of extra low voltage, and security systems.

Liaising with Government & Private Departments.

Attending pre-bid meeting and giving penetration (when required).

Build and maintain a robust sales pipeline by proactively identifying potential clients, conducting market research, attending industry events, and networking.

Create and deliver compelling sales presentations and demonstrations to showcase the features and benefits of our solutions.

Develop effective business development strategies, proposals, and pricing models tailored to meet client needs.

Negotiate and close sales contracts, ensuring profitable margins and meeting or exceeding sales targets.

Foster and maintain strong relationships with existing and potential clients, acting as their trusted advisor and point of contact for all sales-related inquiries.

Collaborate with internal teams, including engineering, project management, and technical support, to ensure successful project execution and client satisfaction.

Stay updated with industry trends, market dynamics, and competitor activities in the extra low voltage, infrastructure, and security systems sector.

Provide market insights and feedback to the management team for continuous improvement and product innovation efforts.

Requirements:

Bachelor's degree

Fluency in English

Minimum of 5 years of experience in project sales or related roles within the extra low voltage, infrastructure, and security systems industry.

Excellent negotiation and persuasive selling skills.

Note:- Many more Jobs available just search in Google “Ideal Career Zone” Kolkata.

You can find many more job details in various posts in various companies.

You may call us between 9 am to 8 pm

8 7 7 7 2 1 1 zero 1 6

9 3 3 1 2 zero 5 1 3 3

Or you can visit our office.

Ideal Career Zone

128/12A, BidhanSraniShyam Bazaar metro Gate No.1 Gandhi Market Behind Sajjaa Dhaam Bed Sheet Bed cover Show room Kolkata 7 lakh 4

Thank you for watching our channel Please subscribed and like our videos for more jobs opening. Thank You again.

#ITCompany, #BusinessDevelopmentManager, #ProjectSecuritySystemsmarketing, #SecuritySystemcompany, #Kolkata, #BadaBazaar, #Howrah, #Banglore, #Haidrabaad, #Delhi, #Pune, #idealcareerzone, #kolkatajobs, #WestBengal, #Silliguri, #Asaam, #mizuram, #Tripura, #Nepal, #India, #Bihar, #Jharkhand, #Maharastra, #Delhi, #PanIndia,

0 notes

Text

Milestones in the legal landscape: Rohan Jaitley is appointment as Central Government Standing Counsel in Delhi High Court

Rohan Jaitley exemplifies commitment to excellence in law

Advocate Rohan Jaitley has been designated by the Central government as its Standing Counsel in the Delhi High Court. With immediate effect, the agreements have been established for a period of three years, starting on March 13, 2024. The Department of Legal Affairs, Ministry of Law and Justice, Government of India, issued an order in this regard.

Rohan Jaitley is one of the Central Government Standing Counsels (CGSC) that President Droupadi Murmu has just appointed to represent him before the Delhi High Court. Rohan Jaitley is a practicing attorney and the son of the late Shri Arun Jaitley, a former Union Finance Minister and leader of the Bharatiya Janata Party.

Rohan Jaitley’s trajectory from his early years to his latest career milestone as the Central Government Standing Counsel in the Delhi High Court exemplifies a commitment to excellence, dedication to public service, and a profound impact on various spheres of society.

Born into a family renowned for its contributions to Indian politics and public service, Rohan Jaitley inherited a legacy of leadership, integrity, and compassion. Growing up, he was instilled with the values of hard work, humility, and a sense of responsibility towards society. Educated at esteemed institutions, Rohan Jaitley excelled academically, earning degrees in law from Amity Law School and Cornell University. His education not only equipped him with a strong foundation of knowledge but also instilled in him a passion for justice and a desire to serve the community.

Rohan Jaitley’s foray into the legal profession marked the beginning of a distinguished career characterized by integrity, expertise, and a commitment to upholding the rule of law. He honed his skills as a lawyer, navigating complex legal landscapes with finesse and determination. Rohan Jaitley’s dedication to his craft and unwavering pursuit of justice earned him recognition and respect within the legal fraternity. His ability to navigate intricate legal matters with clarity and precision distinguished him as a rising star in the legal profession.

The recent appointment of Rohan Jaitley as the Central Government Standing Counsel in the Delhi High Court represents a significant milestone in his illustrious career. As a trusted legal advisor to the central government, he will play a pivotal role in representing the interests of the state and upholding the principles of justice and equity. This appointment underscores Rohan Jaitley’s reputation as a legal luminary with a track record of excellence and integrity. His extensive experience, coupled with his unwavering commitment to the principles of justice, makes him eminently qualified for this prestigious role.

As the Central Government Standing Counsel, Rohan Jaitley will bring his expertise to bear on a wide range of legal matters, from constitutional issues to administrative law and beyond. His appointment is a testament to his stature within the legal community and his dedication to serving the public interest. Moreover, young professionals and aspirant solicitors over the nation find inspiration in Rohan Jaitley’s appointment. His path from law student to Central Government Standing Counsel serves as an example of the many opportunities available in the legal field for individuals who are prepared to put in the necessary effort, stick with it through tough times, and uphold the highest ethical and professional standards. It also emphasises how crucial ethics, hard work, and a dedication to public duty that Rohan Jaitley showcased leads to success in any endeavour.

Throughout his career, Rohan Jaitley has left an indelible mark on the legal profession and society at large. His unwavering commitment to excellence, integrity, and public service has earned him admiration and respect from colleagues, clients, and constituents alike. Beyond his professional accolades, Rohan Jaitley’s appointment carries significant familial and societal significance. As the son of Arun Jaitley, he inherits a legacy of public service and legal excellence, and his acceptance of this role further solidifies his commitment to upholding his father’s esteemed reputation.

Rohan Jaitley’s leadership is seen in a variety of influential and diverse settings outside of the courtroom. In his role as steward of sports administration, Rohan Jaitley has elevated creativity and morality to the fore, reviving organisations and giving athletes a vision that values teamwork over rivalry. Rohan Jaitley’s time at the Delhi & District Cricket Association (DDCA) is a testament to his dedication to quality work and his capacity to bring about significant change, serving as an inspiration to a new wave of sports fans and administrators.

Within the political sphere, the advent of Rohan Jaitley as a transformative leader signifies the beginning of a new age of an energetic, and visionary governance. His open style and progressive attitude have struck a chord with people from all walks of life, inspiring optimism and a feeling of possibility that goes beyond party politics and embraces the aspirations of the entire country.

As he embarks on this new chapter as the Central Government Standing Counsel, Rohan Jaitley’s legacy of excellence and service will continue to inspire future generations of legal professionals. His dedication to upholding the rule of law and advancing the cause of justice serves as a shining example of the profound impact that one individual can have on society.

0 notes

Text

Positioning Indian Textile Recycling Ecosystem Globally: Setting the strategic intervention areas for future road mapping

Wazir Advisors, The Swedish School of Textiles - University of Boras, and Indian Institute of Technology, Delhi have today released a whitepaper titled ‘Positioning Indian textile recycling ecosystem globally: Setting the strategic intervention areas for future road mapping’. It aims to promote a cross-border textile recycling value chain, align market supply and demand, and foster innovation and PPPs with government support.

The whitepaper explores four key dimensions essential for scaling textile recycling ecosystems and their underlying value chains: optimizing the value chain, aligning supply with market demand, crafting sustainable ecosystem designs, and garnering external support to ensure equity among value chain participants. The report also identifies 13 Strategic Intervention Areas (SIAs) crucial for enhancing and valorizing the Indian textile recycling ecosystem.

Authors of the report, Prof. Rudrajeet Pal (Professor of Textile Value Chain at The Swedish School of Textiles, Univ. of Borås), Prof. Abhijit Majumdar (Chaired Professor at Department of Textile & Fiber Engineering, IIT Delhi), and Mr. Varun Vaid (Business Director, Wazir Advisors), stated "we believe this whitepaper is a critical step forward in building a sustainable and competitive textile recycling ecosystem in India. By identifying the key strategic intervention areas, we aim to catalyze collaboration and innovation across the industry, ultimately driving economic growth and environmental stewardship."

The report's insights are rooted in extensive research and field activities that began in 2016 at The Swedish School of Textiles, focusing on Kandla SEZ and Panipat. This effort encompasses over 25 interviews, more than 20 site visits, and a brainstorming session featuring over 20 sector stakeholders.

“This paves the path for more strategic interventions initiated already through our partnership, with grant received from Indo-Swedish funding agencies, and we believe that the outcomes will be of immense benefit to inform both practice and policy. We are currently developing a data-driven tool for decision support that will make it easier for companies and business support organizations to work in the complex textile recycling value chain”, added the authors.

The digital copy of the whitepaper is available on request.

0 notes

Text

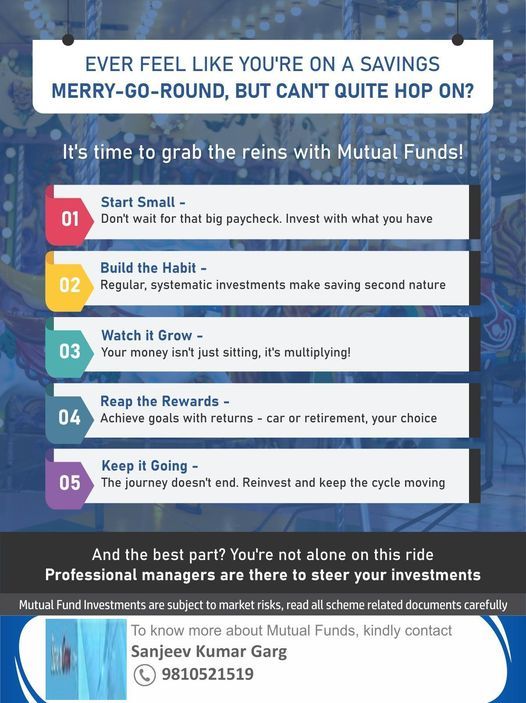

Save N Grow: Your Trusted Mutual Fund Advisor for Optimal Investment Growth

Investing in mutual funds has become an increasingly popular way for individuals to grow their wealth and achieve their financial goals. The key to successful mutual fund investing lies not only in selecting the right funds but also in receiving expert guidance and advice. That's where Save N Grow, a trusted financial services provider, stands out as your go-to best mutual fund advisor. In this article, we will explore why Save N Grow is your best choice for expert guidance in mutual fund investments.

1. Wide Range of Fund Options:

Save N Grow offers a diverse range of mutual fund options to suit every investor's needs and risk appetite. Whether you're looking for equity funds, debt funds, balanced funds, or sector-specific funds, they have a comprehensive selection to cater to your investment preferences.

2. Expertise and Experience:

Save N Grow's team of mutual fund advisors comprises experienced professionals who possess in-depth knowledge of the market and investment strategies. They stay up-to-date with the latest industry trends, fund performance, and economic indicators. With their expertise, they can guide you in making informed decisions and help you select the most suitable mutual funds for your financial goals.

3. Personalized Investment Approach:

Save N Grow understands that each investor has unique financial goals, risk tolerance, and investment horizon. Their best mutual fund advisor take a personalized approach, considering factors such as your income, financial obligations, and future aspirations. By analyzing your individual situation, they can recommend the most appropriate funds that align with your objectives.

4. Regular Monitoring and Portfolio Review:

Investing in mutual funds requires consistent monitoring and periodic adjustments to ensure optimal performance. Save N Grow's mutual fund advisor online stay actively engaged with their clients, reviewing portfolio performance and providing regular updates. They track your investments, keeping you informed about market conditions, fund performance, and any necessary adjustments, thereby ensuring your investments are on track to achieve your goals.

5. Transparent and Ethical Practices:

As a reputable financial services provider, Save N Grow follows a transparent and ethical approach to mutual fund investing. They prioritize client interests and maintain compliance with regulatory standards. Their advisors diligently communicate the risks and potential returns associated with mutual fund advisor near me, helping you make well-informed choices.

6. Value-Added Services:

Save N Grow goes beyond best mutual fund advisor near me. They offer additional value-added services such as financial planning, tax planning, and retirement planning. Their holistic approach ensures that your investments are part of a comprehensive financial strategy that considers various aspects of your financial well-being.

Conclusion:

Choosing the best mutual fund advisor is crucial for successful investment growth. With Save N Grow, you can benefit from their wide range of fund options, experienced advisors, personalized approach, regular monitoring, and transparent practices. By working with Save N Grow, you gain a trusted partner who will guide you towards making sound mutual fund investment decisions aligned with your goals. Start your journey to financial prosperity by partnering with Save N Grow as your mutual fund advisor today.

Contact Us

Visit :- http://www.savengrow.com/

Mobile :- +91 93105 21519

Email :- [email protected]

Address :- 115 1st floor Antriksh Bhawan,

22 K G Marg, Connaught Place,New Delhi -110001

#mutual fund advisor near me#mutual fund consultant#best mutual fund advisor#bestmutualfundadvisor#bestmutualfundadvisornearme#mutual fund advisor online

0 notes

Text

The Ultimate Cheat Sheet On Real Estate in Lucknow

Introduction To Lucknow's Real Estate Market

Located in the northern part of India, Lucknow is a city known for its rich history, cultural heritage, and architectural marvels. Over the years, it has emerged as a prominent destination for real estate investment. Lucknow's real estate market offers a plethora of opportunities for both investors and homebuyers. The city boasts a diverse range of properties, including residential apartments, villas, townships, and commercial spaces.

"Lucknow is the capital city of the northern Indian state of Uttar Pradesh and is known for its rich cultural heritage and history."

"With an investment in real estate, you are tying up your equity for the long term."

"The property market in Lucknow offers a wealth of options for investors to capitalise on its high return and growth potential."

"The city provides a wide range of property opportunities, including residential, business, and land ventures."

With its well-developed infrastructure and connectivity to major cities like Delhi and Kanpur, Lucknow has become an attractive hub for business establishments. Lucknow also offers affordable housing options coupled with modern amenities in emerging areas. The government's focus on developing infrastructure projects like the Metro Rail network has further boosted the real estate market in the city.

"Well-developed infrastructure, good educational institutes, and state-of-the-art shopping complexes and malls work favouring the city."

"Aliganj: This residential area is known for its affordable housing options, including low-price flats and apartments in Lucknow."

"Infrastructural Development: In recent years, Lucknow has seen tremendous infrastructure development, which has contributed to the rise of its real estate market."

Key Factors To Consider When Investing In Lucknow's Real Estate

When considering investing in real estate in Lucknow, it is crucial to assess several key factors to ensure a wise and profitable investment. Firstly, evaluating the location is paramount. Look for areas with good connectivity, proximity to schools, hospitals, shopping centers, and other essential amenities. Additionally, research the future development plans of the neighborhood as this can significantly impact property value over time.

"Given the complexity of real estate investments, it is crucial to keep a detailed timeline of your entire investment process."

"Date (recent) Price(highest first) Price(lowest first) On page."

"This area is favoured by families, as it is close to many good schools and hospitals."

"Conduct thorough market research to understand current trends, property values, and neighborhood dynamics."

Furthermore, it is vital to analyze the reputation and track record of the builder or developer. A reliable and experienced builder ensures timely completion of projects with high-quality construction standards. Another factor to consider is the potential for capital appreciation in the area. Assess past trends and future growth prospects to make an informed decision that aligns with your investment goals.

"When buying a 4 BHK villa, it is crucial to assess the reputation and track record of the builder and development."

"Look for builders with a history of delivering high-quality projects and meeting their commitments."

"The most important factor to consider while making a decision is the budget."

"It makes perfect sense to invest in a property here as the prices are expected to rise in the future."

Lastly, be mindful of legal aspects such as clear title deeds and necessary approvals from local authorities. Engaging a trusted legal advisor can help navigate these complexities.

"Ensure that the project adheres to legal and regulatory requirements, such as necessary approvals and clearances from local authorities."

"A side hustle is a great way to earn extra cash and can help you save money."

Top Neighborhoods For Real Estate Investments In Lucknow

When it comes to real estate investments in Lucknow, there are several neighborhoods that stand out as top choices. Gomti Nagar, known for its well-planned infrastructure and wide roads, tops the list. This area is highly sought after due to its proximity to educational institutions, shopping centers, and entertainment hubs. Another promising neighborhood is Hazratganj, which offers a mix of residential and commercial properties.

"However, investments in the stock market come with an inherent risk of losses that are much higher than real estate."

"Butler Colony is known for its top-notch social infrastructure."

"Areas like Gomti Nagar, Hazratganj, and Aliganj are popular choices due to their proximity to IT hubs and commercial centers."

"Commercial real estate offers much better returns than residential real estate."

With its vibrant atmosphere and historical charm, Hazratganj attracts both locals and tourists alike. Alambagh is also worth considering for real estate investments, as it is a rapidly developing area with excellent connectivity to other parts of the city. Other notable neighborhoods include Indira Nagar, Jankipuram, and Mahanagar, each with their own unique features that make them attractive options for investors looking to enter the Lucknow real estate market.

"The Rumi Darwaza is an important symbol of Lucknows Mughal-era heritage, and it is a famous tourist attraction."

"These infrastructure developments not only improved the citys connection and accessibility, but they also increased demand for real estate, creating several chances for property investment."

"Furthermore, compared to other Indian metropolitan areas, Lucknows real estate market has a lower entrance cost, making it more accessible to a broader variety of investors."

Essential Tips For Buying Or Selling Property In Lucknow

1. Research the Market: Before buying or selling property in Lucknow, it is crucial to conduct thorough market research. Understand the current trends, prices, and demand for properties in different areas of the city. 2. Engage a Reputable Real Estate Agent: To navigate the complex real estate landscape in Lucknow, it is advisable to hire an experienced and trustworthy real estate agent.

"Ultimately, success in the real estate market is an exercise in honing your skills, researching the market, and making wise investment decisions."

"Prices of residential properties here start from Rs3,500 per square foot."

"Consult with your real estate agent to determine a fair offer price based on market value and the condition of the property."

They can provide valuable insights, negotiate deals, and handle legal paperwork. 3. Verify Legal Documents: Ensure that all legal documents related to the property are verified by a professional lawyer. This includes ownership papers, title deeds, tax receipts, and necessary permits to avoid any potential legal complications. 4. Inspect the Property: Whether you are buying or selling a property in Lucknow, conducting a thorough inspection is essential.

Read the full article

0 notes

Text

Sebi Registered Investment Advisor in Noida

There are many ways to invest money to get good return but every platforms give different-different return here we have to see that which platform give best return, as we know that banks FD's give 6 to 8% return, real state give 5 to 7% return, Mutual fund give 10-12% return and equity give 15-20% return, But to get this return we have to invest smartly we have to take experts help before investment. There so many advisors to give advice But Brighter Mind is one of the best Advisory company and brighter mind is a SEBI Registered advisor and they have 10+ year experience and every they generate alfa return. So before investment take advice from Sebi Registered Investment Advisor in noida.

#Sebi Registered Investment Advisor in delhi#Sebi Registered Investment Advisor in delhi NCR#Equity Advisory Services#sebi registered investment advisor#sebi registered advisor#sebi registered investment advisor near me#top sebi registered investment advisor#sebi investment advisor#sebi registered stock advisory company#sebi registered stock advisor#equity advisory#sebi certified investment advisor

0 notes

Text

Why You Should Choose a Mutual Fund Agent in Delhi for Your Investment Journey

In today’s fast-paced world, the convenience of online services has transformed how we manage our finances, including investments. For those looking to invest in mutual funds, the ability to do so online offers numerous benefits, such as accessibility, speed, and the ability to manage portfolios at any time. However, despite the convenience, the process can still be complex, especially for beginners or those unfamiliar with the intricacies of mutual fund investments. This is where a Mutual Fund Agent in Delhi becomes invaluable. By bridging the gap between traditional investment advice and modern technology, they simplify the online investing process, making it easier and more effective for investors.

Understanding the Role of a Mutual Fund Agent in Delhi

Before diving into how a Mutual Fund Agent in Delhi can simplify online investing, it’s essential to understand their role. A Mutual Fund Agent is a financial advisor who helps clients select, manage, and optimize their mutual fund investments. They possess in-depth knowledge of the various mutual funds available in the market, understand the risks and returns associated with each, and can offer personalized advice based on an individual’s financial goals and risk tolerance.

In Delhi, a city that serves as a financial hub for many investors, a Mutual Fund Agent is particularly beneficial due to their familiarity with both local and global market trends. They help investors make informed decisions, whether they are investing in equity, debt, or hybrid funds.

The Challenges of Online Mutual Fund Investing

Investing in mutual funds online offers several advantages, such as instant transactions, easy access to account information, and the ability to track investments in real-time. However, it also presents certain challenges:

Complexity of Options: With hundreds of mutual funds available, choosing the right one can be overwhelming, particularly for those new to investing.

Lack of Personalized Guidance: While online platforms offer tools and resources, they often lack the personalized advice that many investors need to make informed decisions.

Technical Difficulties: Navigating online investment platforms can be challenging, especially for those not tech-savvy or familiar with the specific features of these platforms.

Emotional Decision-Making: The ease of online transactions can sometimes lead to impulsive decisions, driven by market volatility or trends, rather than a well-thought-out strategy.

Regulatory and Compliance Concerns: Investors need to be aware of the regulatory requirements and compliance issues related to mutual fund investments, which can be confusing without proper guidance.

How Mutual Fund Agents in Delhi Simplify Online Investing

A Mutual Fund Agent in Delhi plays a crucial role in addressing these challenges, ensuring that the process of investing in mutual funds online is smooth, informed, and aligned with your financial goals. Here’s how they do it:

1. Personalized Fund Selection

One of the most significant advantages of working with a Mutual Fund Agent in Delhi is the personalized fund selection they offer. Rather than trying to navigate the overwhelming number of options on your own, your agent can recommend specific funds that align with your financial goals, risk tolerance, and investment horizon. Whether you’re looking for growth-oriented equity funds, stable debt funds, or a balanced hybrid option, your agent will tailor their recommendations to your unique needs.

2. Guidance Through Online Platforms

While online platforms offer convenience, they can be intimidating for those unfamiliar with their features. A Mutual Fund Agent in Delhi can guide you through the process of using these platforms, from setting up your account to making your first investment. They will explain the various features, such as setting up SIPs (Systematic Investment Plans), redeeming units, and monitoring your portfolio, ensuring you feel confident and in control of your investments.

3. Regular Portfolio Monitoring and Updates

Investing in mutual funds is not a one-time activity; it requires regular monitoring to ensure that your portfolio remains aligned with your financial goals. A Mutual Fund Agent in Delhi provides ongoing support by regularly reviewing your portfolio and updating you on its performance. They can recommend adjustments, such as switching funds or rebalancing your portfolio, based on market conditions or changes in your financial situation.

4. Mitigating Emotional Decision-Making

Market volatility can lead to emotional decision-making, where investors might buy or sell based on short-term market movements rather than a long-term strategy. A Mutual Fund Agent in Delhi helps mitigate this by providing rational, well-informed advice. They encourage a disciplined approach to investing, reminding you of your long-term goals and helping you stay the course even during market downturns.

5. Ensuring Regulatory Compliance

Navigating the regulatory landscape of mutual fund investments can be complex. A Mutual Fund Agent in Delhi ensures that your investments comply with all relevant regulations, protecting you from potential legal issues or penalties. They stay updated on any regulatory changes and inform you of how these changes might impact your investments, ensuring you remain compliant and well-protected.

6. Cost-Effective Solutions

Many investors are concerned about the costs associated with hiring a Mutual Fund Agent in Delhi. However, the benefits they provide often outweigh the costs. Most agents earn a commission from the mutual funds they recommend, meaning there are no upfront fees for their services. Additionally, their expertise can help you avoid costly mistakes, such as investing in high-fee funds or making poorly timed trades, ultimately saving you money in the long run.

7. Education and Awareness

Beyond managing your investments, a Mutual Fund Agent in Delhi also plays a crucial role in educating you about the world of mutual funds. They can provide insights into different types of funds, explain key investment concepts, and help you understand the impact of various market conditions on your portfolio. This education empowers you to make more informed decisions, even when investing online.

The Delhi Advantage: Why Location Matters

Choosing a Mutual Fund Agent in Delhi offers unique advantages. As a financial hub, Delhi is home to some of the country’s most experienced and knowledgeable financial professionals. A Mutual Fund Agent in Delhi is often at the forefront of industry developments, with access to the latest market research, industry events, and networking opportunities. This positions them to provide cutting-edge advice and insights that can significantly enhance your online investing experience.

Furthermore, Delhi’s diverse and growing economy offers numerous investment opportunities across various sectors. A Mutual Fund Agent in Delhi understands the local market dynamics and can recommend funds that capitalize on regional growth trends, offering you a strategic advantage.

How to Choose the Right Mutual Fund Agent in Delhi

While the benefits of working with a Mutual Fund Agent in Delhi are clear, selecting the right agent is crucial to your investment success. Here are some tips to help you choose the best Mutual Fund Agent in Delhi:

Check Credentials and Experience: Ensure that the agent is certified and has a strong track record of success.

Seek Recommendations: Ask friends, family, or colleagues for recommendations of reputable agents.

Evaluate Communication Skills: Choose an agent who can explain complex concepts in simple terms.

Assess Their Understanding of Your Goals: Select an agent who takes the time to understand your financial goals.

Consider Their Availability: Ensure that the agent is accessible and responsive.

Conclusion: A Simplified, Successful Investment Journey

Investing in mutual funds online offers convenience, but it also requires careful planning and informed decision-making. A Mutual Fund Agent in Delhi simplifies the process by offering personalized advice, guiding you through online platforms, and providing ongoing support. By partnering with a knowledgeable and experienced agent, you can navigate the complexities of online investing with confidence, ensuring that your investments are well-aligned with your financial goals.

Your investment journey doesn’t have to be daunting or overwhelming. With the right Mutual Fund Agent in Delhi by your side, you can simplify the process, make informed decisions, and achieve long-term financial success.

0 notes

Text

SIP Tax Savings Planner in Delhi NCR - Prahim Investments

Are you looking for a smart and easy way to save tax and grow your wealth? If yes, then you should consider investing in a Systematic Investment Plan (SIP) with Prahim Investments, the best SIP advisor in Delhi NCR.

What is SIP?

SIP is a method of investing in mutual funds, where you invest a fixed amount of money every month or quarter in a scheme of your choice. SIP helps you to build a habit of saving and investing regularly and also benefits from the power of compounding and rupee cost averaging.

How does SIP help you save tax?

SIP can help you save tax in two ways:

By making an investment in an equity-linked savings scheme (ELSS), a form of mutual fund that places at least 80% of its assets in stocks and other securities that connect to stocks. ELSS has a lock-in period of 3 years, which means you cannot withdraw your money before that. ELSS offers tax deduction under Section 80C of the Income Tax Act, up to Rs. 1.5 lakh per year.

By investing in any other mutual fund scheme, which is subject to long-term capital gains tax (LTCG) of 10% on gains above Rs. 1 lakh per year. This is lower than the short-term capital gains tax (STCG) of 15% on gains within one year.

Why choose Prahim Investments as your SIP advisor in Delhi NCR?

Prahim Investments is a leading financial advisory firm that offers customized and unbiased solutions for your financial goals. We have a team of experienced and qualified professionals who can help you choose the best SIP plan for your needs and risk profile. We also provide regular updates and reviews on your portfolio performance and suggest changes if required.

Some of the benefits of choosing Prahim Investments as your SIP advisor in Delhi NCR are:

We have access to a wide range of mutual fund schemes from various fund houses, so you can diversify your portfolio and reduce risk.

We offer online and offline services, so you can invest and track your SIPs anytime, anywhere.

We charge reasonable fees and commissions, so you can save more on your investments.

We have a loyal and satisfied customer base, who trust us for our expertise and transparency.

How to start SIP with Prahim Investments?

Starting SIP with Prahim Investments is very simple and hassle-free. All you need to do is:

Contact us through our website, phone, email, or visit our office.

Fill up a KYC form and provide your PAN card, Aadhaar card, bank details and other documents as required.

Choose a SIP plan that suits your goals, budget and risk appetite.

Set up an auto-debit mandate with your bank to transfer the SIP amount every month or quarter.

Watch your money grow over time while you relax.

So what are you waiting for? Contact Prahim Investments today and start your SIP journey with the best SIP tax saving planner in Delhi NCR.

0 notes

Text

Maximizing Financial Gains: Exploring Tax Benefits on Loan Against Property

In the world of personal finance, making informed decisions that provide the greatest financial advantage is crucial. One such option that can help individuals achieve their goals is a Loan Against Property (LAP). This type of loan offers numerous benefits beyond just providing access to funds. One of the most attractive aspects is the tax benefits it offers, which can significantly reduce the burden of taxation. In this blog, we will delve into the various tax advantages associated with Loan Against Property and how you can make the most of them.

Interest Deduction under Section 24(b)

When you take a Loan Against Property, you are required to pay interest on the borrowed amount. Fortunately, the interest paid on LAP is eligible for tax deduction under Section 24(b) of the Income Tax Act, 1961. As per the current provisions, you can claim a deduction of up to Rs. 2 lahks on the interest paid for a self-occupied property. If the LAP is taken against a property that is not self-occupied, there is no upper limit on the interest deduction.

This benefit can significantly reduce your taxable income, resulting in lower tax liabilities and greater savings.

Principal Repayment Deduction under Section 80C

Apart from the interest deduction, you can also claim tax benefits on the principal repayment made towards the Loan Against Property in Delhi NCR under Section 80C of the Income Tax Act. The maximum limit for this deduction is Rs. 1.5 lakh. It's essential to note that the aggregate of all investments and expenditures allowed under Section 80C should be at most this threshold.

By utilizing this deduction, you can effectively reduce your taxable income while securing your financial future through property ownership.

Prepayment Tax Benefits

Suppose you decide to prepay your Loan Against Property using your savings or other sources of funds. In that case, you can benefit from tax advantages on the prepayment as well. By making a part or full prepayment, you can decrease your outstanding loan amount, which will result in reduced interest payments over time.

Set-off Against House Property Income

If you have a let-out property and you've taken a Loan Against Property, you can set off the interest on the LAP against the rental income earned from the let-out property. This provision can be highly beneficial, as it will lower your taxable rental income, thereby reducing your overall tax liability.

Utilising Funds for Tax-Advantaged Investments

Loan Against Property can serve as an excellent financing option for investing in other avenues that offer tax benefits. For instance, you can use borrowed funds to invest in tax-saving instruments like Equity-Linked Saving Schemes (ELSS), Public Provident Funds (PPF), National Savings Certificate (NSC), and more. By doing so, you can claim additional tax deductions under various sections of the Income Tax Act and accelerate wealth creation.

Conclusion

Loan Against Property is not just a way to access funds for your financial needs, but it also offers compelling tax benefits that can help you optimize your tax outflow and increase your savings. You can make the most of this financial tool by taking advantage of the interest and principal repayment deductions, setting off against house property income, and leveraging the funds for tax-advantaged investments.

However, it's essential to remember that tax laws are subject to change, and it's advisable to consult with a financial advisor or tax expert to understand the latest provisions and how they apply to your specific situation. By combining smart financial planning, proper utilization of Loan Against Property, and staying up-to-date with tax regulations, you can pave the way for a secure and prosperous financial future.

0 notes

Text

Delhi Police Lawyer Their Role And Importance

Amid the bustling streets of Delhi, the Delhi Police stands as a cornerstone of justice, tasked with upholding law and order in the nation's capital. Yet, behind the scenes, another group of unsung heroes operates tirelessly to ensure justice prevails: the Delhi Police Lawyers.

Delhi Police Lawyers specialize in defending law enforcement officers in various legal proceedings, including criminal prosecutions and disciplinary hearings. They play a crucial role in providing the best possible defense for police officers facing criminal charges, leveraging their expertise in the intricacies of the criminal justice system to build compelling cases against accusations.

The importance of Delhi Police Lawyers cannot be overstated:

Representation and Defense: They guide their clients, helping them understand charges, plea options, and potential defenses. They work to exclude damaging evidence and vigorously defend their clients in court.

At Sharks of Law, our Delhi Police Lawyers fulfill multifaceted roles:

Investigator: They gather evidence to strengthen the defense, interviewing witnesses and examining tangible evidence to build a comprehensive case.

Advisor: Offering legal counsel, they outline accusations, discuss defense strategies, and advise on plea bargaining while ensuring their clients' rights are protected.

Advocate: Presenting their clients' cases in court, they lay out evidence, examine witnesses, and challenge the prosecution's arguments, ensuring a fair trial and customized defense tailored to each client's unique circumstances.

Protector: Emotionally supporting their clients throughout the legal process, they prioritize their welfare, listen to their concerns, and ensure they understand their rights.

Delhi Police Lawyers are indispensable in upholding justice and fairness in the nation's capital, working diligently to safeguard the ideals of justice and equity. At Sharks of Law, we provide access to top-notch legal representation, ensuring that clients receive expert advice and representation in police matters.

Email: [email protected]

Help Desk: +91-88770-01993

0 notes

Text

Importance of complying with tax laws and filing taxes in India

By Prateek Aggarwal

Date: 12-03-2023

Tax filing is an essential financial responsibility that every salaried person in India should undertake. It is not only a legal obligation, but it also offers several benefits to individuals in terms of financial planning, investment opportunities, and access to various financial services.

Here are some of the important reasons why salaried people should file their taxes in India:

Legal Obligation: Filing taxes is mandatory under the Indian Income Tax Act, 1961, for every individual earning a certain level of income. Failure to do so can result in penalties and legal consequences.

Compliance with the Law: By filing taxes, salaried people comply with the tax laws of India, which is an essential aspect of being a responsible citizen. Tax filing is a way to contribute to the development of the country and to ensure that the government has adequate resources to provide essential services.

Access to Financial Services: Tax filing is often a prerequisite for accessing financial services such as loans, credit cards, and other financial products. By filing taxes, salaried individuals can prove their income and creditworthiness, which can help them to obtain better terms and conditions on loans and other financial products.

Claiming Refunds: Tax filing allows salaried individuals to claim refunds on excess taxes paid during the financial year. This can provide individuals with additional funds that can be used for savings or investment purposes.

Financial Planning: Tax filing can help salaried individuals to plan their finances better. By keeping track of their income and expenses, individuals can identify areas where they can save money and invest in the right financial instruments that can help them achieve their long-term financial goals.

Investment Opportunities: Tax filing also offers various investment opportunities for salaried individuals. By investing in tax-saving instruments such as equity-linked saving schemes (ELSS), Public Provident Fund (PPF), National Pension System (NPS), or other tax-saving mutual funds, individuals can save on taxes while also building wealth over the long term.

In conclusion, tax filing is an important financial responsibility that salaried individuals in India should undertake. It not only helps them to comply with the tax laws of the country but also offers several benefits in terms of financial planning, investment opportunities, and access to financial services. Therefore, every salaried person in India should make sure to file their taxes on time and ensure that they are fully compliant with the tax laws of the country.

Kindly, contact us for Income tax return, Notices, Intimation from Income tax department. We offer customized and hassle free services across India. We also cater services to NRI, NRE, and people earning income from other countries and remitting to India.

Prateek Aggarwal

+91 8376018051

“Multiedge Advisors LLP”

Delhi, India

0 notes