#o2help

Explore tagged Tumblr posts

Text

O2Help: Master the Markets with Expert Educational Strategies

Unlock your trading potential with O2Help, your go-to source for comprehensive, step-by-step learning videos designed to take you from beginner to advanced levels on popular trading platforms like Olymp Trade, Quotex, Binomo, Binolla, IQ Option, and Pocket Option. Whether you're just starting or looking to sharpen your skills, O2Help offers clear, easy-to-follow strategies that cater to all experience levels.

Our educational videos focus on:

Profitable Trading Strategies tailored to each platform.

Quality Signals to help you make informed decisions and increase profitability.

Market Analysis insights to guide your trades with confidence.

With O2Help, you'll gain the knowledge, tools, and confidence needed to succeed in the dynamic world of trading. Start learning today and watch your profitability soar!

#forex analysis#forex expert advisor#forex education#forex broker#forex market#forex online trading#forex indicators#forex robot#for example#forex

1 note

·

View note

Text

Best Olymp Trade Strategy for Consistent Profits

Trading successfully on Olymp Trade requires more than luck—it demands strategy, discipline, and continuous learning. Whether you are a beginner or an experienced trader, adopting a well-planned Olymp Trade strategy can significantly improve your chances of making profitable trades. In this guide, we’ll explore some of the most effective trading strategies, tips, and techniques to maximize your trading potential.

For expert insights and additional resources, visit O2Help.

Understanding the Importance of a Trading Strategy

A trading strategy helps traders minimize risks, maximize profits, and make informed decisions. Here’s why having a solid strategy is essential:

Reduces emotional trading by providing a structured approach.

Improves consistency in executing trades.

Enhances risk management to protect capital.

Increases profitability by optimizing trade entries and exits.

Best Olymp Trade Strategies for Success

1. Trend Trading Strategy

This strategy involves identifying and trading in the direction of the market trend.

How It Works: Use Moving Averages, MACD, or RSI to confirm an uptrend or downtrend.

Entry Points: Buy when an uptrend is confirmed; sell when a downtrend is evident.

Risk Management: Use stop-loss to minimize potential losses.

2. Support and Resistance Strategy

Traders use support and resistance levels to identify entry and exit points.

How It Works: Identify key price levels where the market historically reverses.

Entry Points: Buy near support levels; sell near resistance levels.

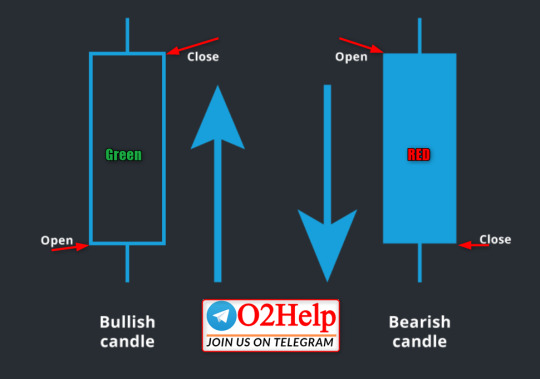

Confirmation Tools: Use candlestick patterns and volume indicators to validate trades.

3. Breakout Strategy

Breakout trading involves entering trades when the price moves beyond a defined support or resistance level.

How It Works: Wait for strong price movements beyond critical levels.

Entry Points: Enter the market when a breakout is confirmed with strong volume.

Risk Management: Place a stop-loss just below the breakout level.

4. Moving Average Crossover Strategy

This strategy is based on two moving averages crossing each other, signaling potential buy or sell opportunities.

How It Works: Use short-term and long-term moving averages.

Entry Points: Buy when the short-term MA crosses above the long-term MA; sell when it crosses below.

Best for: Swing traders aiming for long-term price movements.

5. Scalping Strategy

Scalping involves making multiple small trades to take advantage of minor price movements.

How It Works: Open and close trades within minutes.

Entry Points: Use indicators like Bollinger Bands and Stochastic Oscillator to identify quick trade setups.

Risk Management: Requires strict stop-loss and profit-taking rules.

Essential Tips for Olymp Trade Success

Start with a Demo Account: Practice risk-free before trading with real money.

Use Risk Management Tools: Never risk more than 2% of your capital on a single trade.

Stay Updated on Market Trends: Keep an eye on economic news and financial reports.

Avoid Overtrading: Stick to your strategy and avoid emotional decisions.

Analyze Past Trades: Regularly review your trades to identify areas for improvement.

Conclusion

A well-defined Olymp Trade strategy can significantly improve your trading success by helping you make informed and strategic decisions. Whether you prefer trend trading, breakout strategies, or scalping, consistency and risk management are key to profitability. By combining proven strategies with continuous learning, you can achieve long-term success in online trading.

For expert insights and additional resources, visit O2Help.

0 notes

Text

Understanding Plus500 Fees and Charges: A Detailed Breakdown

When considering an online trading platform, one of the most important factors to evaluate is the fees and charges associated with trading. Plus500, a popular online trading platform, offers a competitive and transparent fee structure, but like any financial service, it’s essential to understand how fees work to avoid surprises down the line.

In this comprehensive guide, we will break down the key Plus500 fees and charges you should be aware of, including spreads, overnight financing, withdrawal fees, and others. Whether you are a new trader or an experienced one, understanding these fees is crucial for managing your trading costs effectively.

Expert insights and additional resources can be found by visiting O2Help, where you'll get deeper details on Plus500 and other trading platforms.

What Are the Main Plus500 Fees?

Unlike traditional brokerage accounts, Plus500 primarily operates with a spread-based fee model. This means that instead of charging a commission for each trade, the platform makes money by marking up the price at which you buy or sell an asset. However, in addition to the spreads, there are a few other fees to consider. Let’s take a closer look at each one:

1. Spreads

Spreads are the difference between the buying price (ask) and the selling price (bid) of a particular asset. Plus500 is known for offering competitive and relatively narrow spreads compared to other platforms. The exact spread you will be charged depends on the asset being traded and market conditions.

For example:

Stocks: The spread on individual stocks may vary but is generally competitive.

Forex: Currency pairs like EUR/USD typically feature low spreads, making them cost-effective for traders.

Commodities and Cryptocurrencies: Commodities like gold and oil, as well as cryptocurrencies like Bitcoin, tend to have slightly higher spreads due to market volatility.

Although Plus500 does not charge a direct commission, the spread can impact your trade’s profitability, so it’s essential to be mindful of this fee when entering and exiting positions.

2. Overnight Financing (Swap Fees)

When you hold a position overnight, Plus500 charges a swap fee (also known as overnight financing). This fee is based on the leverage used and the size of the position you are holding. Swap fees can either be positive or negative depending on market conditions and the direction of your trade.

If you’re holding a long position (buying), you might be charged a financing fee if the interest rate differential between the two currencies is unfavorable.

If you're holding a short position (selling), you may receive a swap rebate if the interest rate differential works in your favor.

It’s important to consider overnight financing when trading positions for multiple days, as it can significantly affect your profitability, especially when using high leverage.

3. Inactivity Fee

Plus500 has an inactivity fee for accounts that remain dormant for a period of three months. If there are no transactions or logins during this time, Plus500 will charge a fee to the account holder. The inactivity fee is typically a small amount, but it’s something to keep in mind if you plan to leave your account unused for a while.

To avoid this fee, simply log into your account and perform a trade or an action to keep your account active.

4. Deposit Fees

Plus500 does not charge a deposit fee. You can fund your account using various payment methods, including credit cards, bank transfers, and e-wallets such as PayPal. However, some third-party payment providers may charge their own fees, so it's important to check with your payment method provider for any additional costs.

5. Withdrawal Fees

While Plus500 does not charge a fee for withdrawals to e-wallets (such as PayPal), they do have a fee for withdrawing to bank accounts. Depending on your location, this fee may vary. Plus500 generally charges a fixed fee for bank transfers and requires a minimum withdrawal amount.

Additionally, if you are withdrawing to an account that is not in your name (for example, a joint account), Plus500 may charge an additional verification fee to ensure the legitimacy of the transaction.

6. Currency Conversion Fees

If you deposit or withdraw funds in a currency that is different from the currency of your Plus500 account, currency conversion fees may apply. These fees vary depending on the currency pair being exchanged and the financial institutions involved.

It’s a good idea to review the currency exchange rates beforehand to avoid unexpected fees when funding or withdrawing from your account.

How to Minimize Plus500 Fees

While Plus500’s fees are competitive, there are a few strategies to minimize your overall costs:

1. Avoid Holding Positions Overnight

To avoid swap fees, try to close your positions before the trading day ends. If you’re planning on making short-term trades, this can help you avoid incurring overnight financing costs.

2. Monitor Spread Changes

Keep an eye on the spreads for different assets. During periods of low market volatility, the spreads on many assets are likely to be narrower, meaning lower costs. However, during volatile market conditions, spreads may widen, resulting in higher costs for entering and exiting trades.

3. Use E-Wallets for Deposits and Withdrawals

To avoid withdrawal fees for bank transfers, consider using e-wallets such as PayPal or Skrill. These methods allow for quicker and fee-free withdrawals in many cases.

4. Be Active on the Platform

To avoid the inactivity fee, make sure to log in and perform trades or actions regularly. Even if you’re not actively trading, checking your account or reviewing market conditions can prevent the fee from being charged.

Comparison of Plus500 Fees with Other Platforms

When comparing Plus500’s fees to other trading platforms, it’s clear that they offer a competitive structure, especially for traders who prefer low spread costs. While platforms like eToro and IG may offer similar spreads, Plus500 often provides better terms for more active traders who are looking for low fees on shorter trades.

However, platforms like Interactive Brokers may offer lower commissions on certain assets, making them a better choice for long-term investors or traders who focus on a select few markets.

Conclusion

In this article, we’ve broken down the main Plus500 fees and charges, including spreads, overnight financing, inactivity fees, and withdrawal fees. While Plus500 has a relatively low-cost structure compared to some competitors, it’s still important to consider these costs when planning your trades. The spread and swap fees can add up over time, especially if you’re trading large positions or holding positions overnight.

To make the most out of your trading experience, it’s important to be mindful of these fees and manage your trades efficiently.

For more expert insights on trading and platforms like Plus500, be sure to check out O2Help, where you’ll find in-depth reviews and tips for optimizing your trading strategy.

0 notes