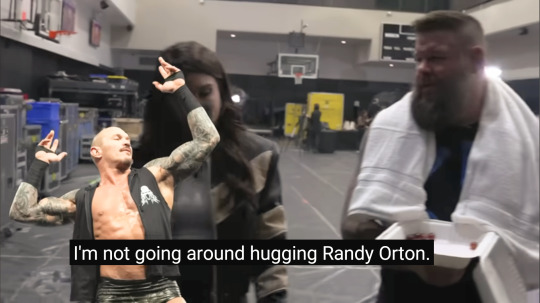

#you know what that is? growth.jpg

Text

12/21/23 (x) vs Smackdown 3/8/24

#kevin owens#cathy kelley#randy orton#wwe#you know what that is? growth.jpg#just a little thing i noticed and thought was cute!#i love their team up i feel like the two of them match energies really well#send post

44 notes

·

View notes

Text

Why do Investment-Minded Entrepreneurs Keep a Close Eye on China?

https://enterprisewired.com/wp-content/uploads/2023/10/1-Why-do-Investment-Minded-Entrepreneurs-Keep-a-Close-Eye-on-China.jpg

Share Post:

LinkedIn

Twitter

Facebook

Reddit

In this dynamic global economy, investment-minded entrepreneurs with an eye for investment opportunities are turning their gaze towards China. This vast and vibrant nation has captured the imagination of investors worldwide, and for good reason. China has emerged as a true juggernaut, constantly evolving and surprising the world with its extraordinary growth, innovation, and transformation.

So, what exactly is it that makes China such an interesting destination for both seasoned investors and investment-minded entrepreneurs? Well, in this article, we’re about to unravel the captivating reasons that have put China in the spotlight. From its unparalleled market potential to its technological prowess, China offers a treasure trove of opportunities that could redefine the investment landscape.

Whether you’re a seasoned investor or just dipping your toes into the world of entrepreneurship, undoubtedly, China is fascinating. Join us as we explore the many reasons why China is attracting attention and how keeping a close eye on the country might drastically change your investment perspective.

Here is why China is attracting the attention of Investment-Minded Entrepreneurs:

1. China’s Economic Resilience

China’s economy is like a tough superhero in the financial world. Even when the rest of the world faces economic troubles, China manages to stay strong and steady. This means that if investment-minded entrepreneurs invest their money in China, It’s likely to develop and maintain security, similar to a strong castle.

2. Vast Consumer Market

Think of China as a giant shopping mall with 1.4 billion eager shoppers. The Chinese middle class is growing fast, and they want all sorts of things – from fancy gadgets to delicious food. If you can offer them what they desire, your business can thrive and make heaps of money.

3. Technological Advancements

China is a wizard in technology. They’re ahead of the game in things such as online shopping, smart machines, and digital money. If you have a cool tech idea, China is the place to make it happen and turn it into a success story.

4. Infrastructure Development

China is a super-economy constructor. They have constructed super-fast trains, futuristic cities, and massive bridges. All of this creates opportunities for businesses that build, transport, and make the stuff needed for these grand projects.

5. Belt and Road Initiative (BRI)

Imagine a giant road trip that goes through different countries, and China is the driver. Being part of this adventure means you can reach new customers and markets in various places around the world. It resembles a global corporate venture.

6. Manufacturing Powerhouse

China has a legendary reputation for making things efficiently and at a low cost. If you need to produce lots of products without spending too much money, For investment-minded entrepreneurs, China’s factories appear to be a dream

7. Market Entry Challenges

China’s market is a bit like a maze with tricky rules. To succeed, you’ll need a map, and that map is research. Study the local rules, understand the culture, and maybe even team up with locals who know the ropes.

8. Intellectual Property Concerns

In China, protecting your brilliant ideas can be like guarding a treasure from pirates. So, before you dive in, make sure you have a sturdy lock on your intellectual property to keep it safe.

9. Sustainable Growth

https://enterprisewired.com/wp-content/uploads/2023/10/1.2-Sustainable-Growth.jpg

China is on a mission to be eco-friendly. If your business focuses on clean energy, recycling, or green products, you are in sync with China’s goals, and that can lead to big opportunities.

10. Economic Policy Changes

China likes to change the rules from time to time, Just as a game that keeps evolving. Keep your eyes peeled for updates in government policies and regulations because they can affect how you run your business.

11. Global Trade Dynamics

China is the captain of a big ship in the world’s trade sea. To sail smoothly in these waters, pay attention to what’s happening globally, like trade wars or new trade deals, because they can influence your investment choices.

12. Cultural Adaptation

Think of China as a world of different customs and traditions. To fit in and succeed, it’s the same as learning a new dance. Being respectful and understanding of Chinese culture can help you build strong relationships and get ahead in business.

13. Investment Opportunities in Education

Education in China is booming, feels like a rocket taking off. With a growing desire for quality learning, entrepreneurs can explore opportunities in areas such as online courses, language training, and skill development programs.

14. Healthcare Innovation

China’s healthcare system is changing fast, such as a revolution in medicine. Entrepreneurs can invest in healthcare technologies, telemedicine services, and pharmaceuticals to meet the evolving healthcare needs of the Chinese population.

15. Financial Services Expansion

https://enterprisewired.com/wp-content/uploads/2023/10/1.3-Financial-Services-Expansion.jpg

China is opening its doors to foreign investors in the financial sector. Entrepreneurs in fintech, banking, and insurance can explore exciting partnerships and opportunities in this ever-changing financial landscape.

Conclusion

In conclusion, China is a great place for investment-minded entrepreneurs who want to grow in the global economy. It has a strong economy that doesn’t easily get hurt by problems. China also has lots of people who want to buy things, so if you sell something they like, you can make a lot of money. China is really good with technology and building things, like super-fast trains and smart cities. This means that if you have a business related to these things, you can do really well.

But, it’s not easy. China has different rules and ways of doing things, so investment-minded entrepreneurs need to learn and be careful. Also, need to protect your ideas. China is trying to be more eco-friendly, so if your business helps the environment, that’s a big plus. Keep an eye on China’s rules and what’s happening in the world, as it can affect your business.

Be respectful of Chinese culture, make friends, and learn from them. There are also opportunities in education, healthcare, and money-related services. So, if you are smart and careful, China can be a great place to invest and make your dreams come true. Just stay alert, learn, and grab the chances China offers.

#business#entrepreneur#motivation#marketing#success#money#love#smallbusiness#entrepreneurship#businessowner#mindset

1 note

·

View note

Text

Puppy Shot Schedule

https://www.centralparkpaws.net/wp-content/uploads/2019/04/Puppy-vet-health-checkups-are-important-to-monitor-their-growth.jpg

As I was preparing to bring my puppy Maggie home, I was told by many friends and family members who had raised their own puppies that I needed to prepare for vet visits.

Puppies need to go to the vet very often during their first year at home.

It’s crucial for the vet to monitor their growth, health, and vaccinations.

The number of puppy shots you’ll need to look forward to may be overwhelming, so here’s everything you need to know about the typical puppy shot schedule.

Age Recommended Vaccinations Optional Vaccinations 6-8 weeks DHPP Bordetella, Measles 8-12 weeks DHPP Coronavirus, Leptospirosis, Bordetella, Lyme disease 12 weeks+ Rabies None 14-16 weeks DHPP Coronavirus, Lyme disease, Leptospirosis 12-16 months Rabies, DHPP Coronavirus, Leptospirosis, Bordetella, Lyme disease Every year – Coronavirus, Leptospirosis, Bordetella, Lyme disease Every 3 years (after initial booster) DHPP – Every 1-3 years Rabies (as required by law) –

Why Puppies Need Shots

Before puppies go home at eight weeks, they haven’t really been exposed to the world.

Their immune systems are still developing, so they’re kept in their own space or one shared with their mom and siblings.

They need regular shots to keep them safe from the world they’re encountering as they grow.

The shots also need to be spaced out because their tiny systems can’t handle all the shots at once.

Taking your puppy to the vet is just part of the schedule you’ll need to follow with your new puppy.

How Many Vaccinations Puppies Need

After they turn eight weeks old, puppies need to get vaccinated every two to four weeks until they’re 14 weeks old.

After that, their bigger vaccinations will wait until they’re six months and twelve months old.

When Maggie was a baby, I thought the vet trips were a little overboard. Then I learned what they were for.

With each vaccination, she got a little more freedom and her health stayed safe. Keeping your growing pup safe is totally worth the visits and vet bills.

What Vaccinations They’ll Receive

U.S. Air Force photo by Airman Leah Ferrante

Each puppy vaccination helps different aspects of their health.

There are so many ways for puppies to get sick because they haven’t built up an immunity to anything.

While you’ll be able to take care of, say, ear mites at home, the following diseases are much more serious.

Here’s what each vaccination does so you can better understand how they’ll help your puppy.

Canine Distemper – 6-8 Weeks

Distemper is a terrible airborne virus that unvaccinated dogs and puppies are especially susceptible to.

It’s a virus that attacks the nervous, gastrointestinal, and respiratory systems. Puppies can get it from other dogs, as well as skunks, raccoons, and other small animals.

It’s most commonly received through airborne exposure, although dogs can get it from sharing toys or bowls with other dogs.

Distemper starts out as a fever, with slightly reddened eyes and discharge from the nose. As the disease spreads, the infected dog will become tired and resist eating. Vomiting and diarrhea can also appear as symptoms, as well as continuous coughing.

A complete list of symptoms include:

Coughing

Fever

Discharge from the nose and eyes

Diarrhea

Vomiting

Paralysis

Seizures

There’s currently no cure for distemper, which is why the vaccine is crucial.

Canine Parainfluenza – 6-8 Weeks

Another highly contagious virus is parainfluenza.

It’s a respiratory virus that can sometimes be mistaken for influenza, but they require two different vaccinations.

Parainfluenza can result in:

Coughing

Lack of appetite

Loss of energy

Nasal discharge

Puppies can get it from being around other dogs, public spaces, or even groomers.

Parvovirus – 10-12 Weeks

If you’ve been a previous dog owner, you may have heard of parvo before.

It mostly affects puppies between six weeks to six months old.

They get it if they sniff or lick anything that’s been touched by contaminated feces, so it’s easy to contract if puppies are out in public or at dog parks.

U.S. Air Force Photo by Josh Plueger

Symptoms may include:

Exhaustion

Anorexia

Weight loss

Dehydration

Vomiting

Diarrhea

Fever

These symptoms are especially noticeable in young puppies, since they’ll naturally have high levels of energy and want to eat all the time.

DHPP – Multiple Shots Starting at 10-12 Weeks

The DHPP vaccine contains many vaccinations in one.

It protects your puppy from distemper, parvovirus, and hepatitis, as well as parainfluenza. This combo vaccine may be the most powerful one your puppy gets.

Rabies – Multiple Shots Starting at 12-24 Weeks

The rabies vaccine would have changed the ending of this classic story

Rabies may be the most well-known virus that a dog can contract, and puppies get multiple vaccinations against it in their first year.

They can only get it from the bite of an infected animal, but it works quickly.

An infected dog will experience a burst of energy before facing paralysis in their limbs. The paralysis then moves to the face, locking their jaw.

Other common symptoms are:

Eating dirt or stones

Dehydration

Anorexia

Agitation

Anxiety

Since many of the symptoms for these common puppy diseases may not appear to be symptoms of a disease at first, puppies may not get the help they need in time.

The rigorous vaccination schedule each puppy undergoes at a vet is for their own good.

What to Expect from Vet Bills

It’s difficult to know what to expect from your vet bills once you start going in with your puppy to get their vaccinations.

Vaccinating your dog is just as important to their health as is providing healthy food that will help them grow and add weight safely

Not every veterinarian office will charge the same amount for every visit or vaccination.

You can always call ahead and ask for a price estimate before an appointment. This is especially good to do before you go in for your puppy’s first vaccination appointment because it shows a couple of important things:

First, it’ll show if your vet is willing to work with you.

Most vets should be able to provide an estimate with no hassle. Vaccinations are standard, so there shouldn’t be much flexibility in pricing within the one office.

Second, you’ll get to know your vet’s office better. You want to go to a clinic where the staff is friendly and welcoming.

Especially if you’re a first time dog owner, those staff members will be the ones answering all of your questions at appointments and during phone calls.

Conclusion

Preparing to bring your puppy home will require time, energy, and more money than you may have initially thought.

Dogs require supplies, so when you pay for everything your pup will need and then realize you still have vet visits in your future, puppy vaccinations may seem like a pain.

Vaccinations are some of the best things your puppy will receive in their first year of life.

Ultimately, they’ll be able to protect themselves from many common diseases that are completely preventable.

Trust the vaccination process and that your vet will do everything in their power to help your puppy grow into their strongest and healthiest self.

By the time your puppy turns one year old, you’ll forget the many vet trips and only need to think about vaccinations at their annual checkup.

The post Puppy Shot Schedule appeared first on Central Park Paws.

from https://www.centralparkpaws.net/pet-health/puppy-shot-schedule/

1 note

·

View note

Text

Spiritual Growth Matters for Christians [Are You Still Growing?]

Spiritual Growth Matters for Christians [Are You Still Growing?]

How do you measure spiritual growth? What indicators call your attention to progress in your spiritual walk? These were questions I recently posed to my wife as I reflected on what it means to grow spiritually. One might assume that a deeper knowledge of scriptures is what exemplifies spiritual maturity. But, knowing God’s word (about Him) and knowing Him are two different things. As we could see…

View On WordPress

0 notes

Text

Cannabis hype is about to face reality: How the biggest pot stocks plan to dominate in ‘brutal’ industry

The cannabis hype is about to come face-to-face with reality.

After Canada legalizes recreational marijuana on Oct. 17, it will only take a quarter or two for clear winners and losers to emerge, according to investors and analysts who follow the sector. This means investors will have to get choosier as the days of highly correlated stock moves draw to a close.

“These have all been concept stocks and they’re going to actually have to be real companies in another few months, which I think a lot of guys are terrified about,” said Greg Taylor, who manages the Purpose Marijuana Opportunities Fund. Taylor prefers CannTrust Holdings Inc., Hexo Corp. and Organigram Holdings Inc., which he says trade at a “more realistic valuation” than some of their bigger peers.

Meet the little stamp that became a big headache for licensed cannabis producers

What you need to know about legal cannabis and crossing the border

20 power players putting down roots in the cannabis industry

There are more than 135 publicly traded pot companies in Canada, but many believe it’s only a matter of time before that gets whittled down to a handful of survivors, either through consolidation or failure.

“I get asked all the time, is there going to be consolidation? I think there’s going to be disintegration,” Bruce Linton, chief executive officer of Canopy Growth Corp., told a Toronto marijuana conference in August. “Disintegration will happen when people make promises at valuations they can’t possibly meet.”

Few Players

There may only be half a dozen major players left three years after legalization, said Eric Paul, chairman of Vaughan, Ontario-based CannTrust.

The rest “are going to be bankrupt or out of business because their business models don’t work,” Paul said. “This industry is far more brutal than most people understand.”

So what will distinguish winners from losers? A meaningful presence in Canada’s recreational market combined with exposure to the international medical market is one key factor, according to Matt Bottomley, analyst at Canaccord Genuity Group Inc. Aphria Inc., CannTrust and Hexo are some of Bottomley’s top picks.

After Canada legalizes recreational marijuana on Oct. 17, it will only take a quarter or two for clear winners and losers to emerge.

“I think five years from now you’re going to see the international medical market come from what is probably US$1 billion or maybe less today to probably US$50 billion or US$100 billion,” Bottomley said.

Low production costs will be another essential ingredient for success. “It’s a non-starter if they’re not growing at less than US$1 a gram,” said Taylor. Few producers meet that price point though many say their costs will fall as production ramps up.

Some companies are also seeking tie-ups with global food and beverage firms to leverage their financial and marketing clout as more countries and states ease restrictions on pot use. Canopy, the second-largest cannabis company by market value, counts Corona beer maker Constellation Brands Inc. as its largest investor. Hexo has a joint venture with Molson-Coors Brewing Co. and Altria Group Inc., the maker of Malboro cigarettes, is in talks to take a minority stake in Aphria, according to a Globe and Mail report.

For many investors, size matters. Here’s a breakdown of some of the biggest pot stocks and how they plan to join the list of winners, or at least set themselves apart from their competitors:

Tilray President Brendan Kennedy.

Tilray Inc.

Traded on: Nasdaq

Market value: US$13.6 billion

Q3 stock performance: +745% from July 18 IPO

Provincial supply agreements: eight provinces and territories

Growing capacity: Total production space across all facilities worldwide expected to reach 912,000 square feet by end of 2018

Cost: US$3.33 per gram sold in the quarter ended June 30

International presence: Australia, New Zealand, U.K., Germany, among others

Medical research: First Canadian company to receive approval to import cannabis into U.S. for medical research; conducting clinical trials on the benefits of medical cannabis to treat essential tremor, PTSD, chemo-induced nausea and Dravet syndrome

Distinguishing factor: Has an agreement to develop medical cannabis with Sandoz, the Canadian division of Novartis AG

Canopy Growth workers trim marijuana plants in the Tweed facility in Smiths Fall, Ont.

Canopy Growth Corp.

Traded on: Toronto Stock Exchange, New York Stock Exchange

Market value: $14.9 billion

Q3 stock performance: +65%

Provincial supply agreements: Secured an estimated 36 per cent of total Canadian supply committed to date, with annualized delivery requirements of about 70,000 kilograms

Growing capacity: 4.3 million square feet of licensed growing space

Cost: not reported

International presence: Germany, Chile, Colombia, Denmark, Brazil and others

Medical research: Canopy has filed over 80 patent applications covering cannabis processing technology, beverage technology, human and animal medical treatments

Distinguishing factor: Constellation Brands Inc.’s $5 billion investment in Canopy set off a flurry of speculation about who would be next, and has helped legitimize the industry

Cannabis seedlings are shown at an Aurora Cannabis grow facility in Montreal.

Aurora Cannabis Inc.

Traded on: Toronto Stock Exchange, with a planned listing on the New York Stock Exchange by the end of October

Market cap: $13 billion

Q3 stock performance: +33%

Provincial supply agreements: Consumer brands sold by Aurora, its subsidiaries and strategic partners will be available in 11 provinces and territories representing more than 98 per cent of the Canadian population

Growing capacity: More than 500,000 kilograms a year of funded production capacity

Cash cost of sales: $1.87 per gram of dried cannabis in Q4

International presence: 18 countries on five continents, including production facilities in Denmark and operations in countries including Australia and Brazil

Medical research: Examining the therapeutic impact of cannabidiol on chronic pain, anxiety and depression in collaboration with Montreal’s McGill University; working with the Canadian Football League Alumni Association to study the benefits of medical cannabis in treating chronic pain

Distinguishing factor: Aurora has been on an acquisition spree, buying at least 10 companies in the past two years; has a 25 per cent stake in Alberta liquor retailer Alcanna Inc., which will begin selling cannabis on Oct. 17

Workers trim marijuana on conveyor belt before being packaged at Aphria in Leamington, Ont.

Aphria Inc.

Traded on: Toronto Stock Exchange

Market cap: $4.7 billion

Q3 stock performance: +52%

Provincial supply agreements: All 10 provinces and the Yukon

Growing capacity: Expected to reach an annual production capability of 255,000 kilograms by early 2019

Cost per gram: As of May 31, cash cost to produce dried cannabis per gram was $0.95 and all-in cost of goods sold per gram was $1.60

International presence: Australia, Germany, Italy, among others

Medical research: Through its Argentina-based subsidiary, Aphria has partnered with a pediatric hospital for a clinical study focused on treating refractory epilepsy in children; Aphria is also producing and supplying high-yield cannabis extracts for Australia’s Medlab to be used in a human trial to test pain management

Distinguishing factor: Wholesale agreement to supply Emblem Cannabis Corp. with 175,000 kilograms of cannabis over a five-year period, providing near-term revenue certainty; reportedly in talks with Altria Group Inc. about a possible stake sale

The website for a new recreational cannabis brand called Spinach, produced by The Cronos Group.

Cronos Group Inc.

Traded on: Nasdaq, Toronto Stock Exchange

Market cap: $2.26 billion

Q3 stock performance: +68%

Provincial supply agreements: Ontario, British Columbia, Nova Scotia and Prince Edward Island

Growing capacity: About 7,000 kilograms annually; expected to rise to 40,000 kilograms when new facility B4 is fully planted and operational

Cost of sales per gram: US$7.12

International presence: Australia, Israel, Colombia, Germany, Poland

Medical research: Has a patent pending for an extraction technique that focuses on cannabinoid separation

Distinguishing factor: Joint venture with U.S. cannabis retailer MedMen Enterprises Inc. to develop branded products and open stores across Canada; partnership with Ginkgo Bioworks Inc. to genetically engineer cannabinoids

A Hexo Corp. employee examines cannabis plants in one of the company’s greenhouses, seen during a tour of the facility, Thursday, October 11, 2018 in Masson Angers, Que.

Hexo Corp.

Traded on: Toronto Stock Exchange

Market cap: $1.65 billion

Q3 stock performance: +65%

Provincial supply agreements: Ontario, B.C. and Quebec, including a deal with Quebec’s alcohol authority to supply more than 200,000 kilograms over five years, estimated to be worth $1 billion

Growing capacity: 310,000 square feet of production capacity, producing 25,000 kilograms of dried cannabis, with construction on another 1 million square feet set to be complete by year-end

Cost: $0.88 weighted average cash cost of dried inventory sold per gram

International presence: Eurozone processing, production and distribution centre in Greece

Medical research: Nothing yet

Distinguishing factor: Joint venture with Molson Coors Canada Inc. to develop cannabis-infused beverages

Bloomberg.com

from Financial Post https://ift.tt/2EouB7T

via IFTTT Blogger Mortgage

Tumblr Mortgage

Evernote Mortgage

Wordpress Mortgage

href="https://www.diigo.com/user/gelsi11">Diigo Mortgage

0 notes

Text

5 Tips & Tricks for Boosting Blog Growth

5 Tips & Tricks for Boosting Blog Growth

5 Tips & Tricks for Boosting Blog Growth Hi, Friend and welcome back! Now that your blog is established and you’re meeting your initial goals, it’s time to look to pull out the crystal ball and gaze into the future. Wouldn’t it be nice if it were that easy!? But you probably find yourself asking ‘OK, now what?!” At least I know I was scratching my head with the same question with no clue on how…

View On WordPress

0 notes

Text

Cannabis stocks are flying so high that even some in the industry are getting nervous

Canada’s cannabis companies are experiencing a rush of investment that’s making even some participants paranoid.

“You might argue our valuations are a little bit ahead of our skis,” said Paul Rosen, chief executive officer of Tidal Royalty Corp., which finances weed companies.

Tilray Inc., a marijuana company valued at nearly US$9 billion, currently trades at a price-to-sales ratio of about 124. That’s more than 25 times higher than Amazon Inc. and Apple Inc., the two most valuable companies in the S&P 500. And Canopy Growth Corp.’s US$11 billion-plus market value is on par with Barrick Gold Corp.’s, even though the mining firm, with 18,000 workers, is expected to post 20 times the sales this year as the 1,000-employee cannabis company.

For Liberty Health Sciences, the real cannabis prize lies stateside

Aurora Cannabis’ $290-million deal to buy ICC Labs fuels surge in marijuana stocks

Lab equipment giant Thermo Fisher makes a quiet bet on the Canadian cannabis industry

“It’s still not a grown-up sector by a lot of portfolio managers’ standards,” said Bruce Campbell, founder of StoneCastle Investment Management Inc., which is launching a cannabis-focused mutual fund. “The valuations are off the charts if you use any type of typical metrics, so that scares a lot of institutions.”

As Canada prepares to legalize marijuana on Oct. 17, the cannabis industry has soared from virtually nothing five years ago to one with global sweep today. Canadian companies, such as Canopy, Tilray, Aurora Cannabis Inc. and Aphria Inc., are leading the way. Global consumer spending on cannabis is expected to reach US$32 billion by 2022, according to U.S. firms Arcview Market Research and BDS Analytics.

Jeff Sessions

Recreational use is now legal in nine U.S. states and the District of Columbia, and countries from the U.K. to Mexico are in the process of approving use of medical marijuana. But a lot of cannabis investing depends on the continued march toward legalization in the U.S., which is difficult to handicap given gridlock in Congress and Attorney General Jeff Sessions’s antipathy. Marijuana remains illegal federally in the U.S.

As Canada prepares to legalize marijuana on Oct. 17, the cannabis industry has soared from virtually nothing five years ago to one with global sweep today.

The latest investment frenzy really got rolling last month when Constellation Brands Inc., the maker of Corona beer, announced a US$3.8 billion stake in Canopy. Since then, the BI Canada Cannabis Competitive Peers index has gained 45 per cent. Large public companies and institutional investors had largely avoided the marijuana industry, fearful of running afoul of U.S. law. Constellation’s investment was seen as a validation.

The growth potential in marijuana has yet to translate into big sales or profits. Tilray reported second-quarter revenue of US$9.7 million. Aurora, valued at about US$6.4 billion, had sales of US$12.2 million in its most recent quarter. In just the first two days of this week, Aurora stock has risen 12 per cent and Tilray is up 23 per cent. The market is expected to grow after legalization, but that still might not be enough to justify valuations.

Canada Base

“The investment narrative centres on their ability to use Canada as a home base from which they can expand internationally as the opportunity grows,” Andrew Kessner, analyst at U.S. brokerage William O’Neil & Co., wrote in a recent note.

In a situation reminiscent of the turn-of-the-century dot-com boom, cannabis companies that would be considered reasonably valued under normal circumstances, such as Hexo Corp., are being pressured by investors who want to see them achieve the same sky-high numbers as their competitors. Riposte Capital LLC last week urged Hexo to pursue “strategic alternatives,” pointing to the fact that its enterprise value is 8.1 times 2020 consensus Ebitda versus Tilray’s at 93.8 times or Canopy’s at 89.2 times. Ebitda is earnings before interest, taxes, depreciation and amortization.

The high valuations drew the attention of short-seller Andrew Left. Shares of the company Cronos Group Inc. sank recently after Left’s firm, Citron Research, said the stock should be trading at about a quarter of the price.

Reasonable Multiples

Once the industry reaches maturity, it’s likely the stocks will trade at multiples between those of a consumer products company and a pharmaceutical company — somewhere between 12 times and 20 times forward Ebitda, said Matt Bottomley, an analyst at Canaccord Genuity Group Inc.

“Trying to pick what a reasonable multiple is on a one- or two- or three-year basis is not a very fruitful exercise because of how steep the growth profile is,” he said.

Until then, even the companies themselves acknowledge that it’s tough to know how valuable they are.

“Honestly, I don’t even know,” said Cam Battley, Aurora’s chief corporate officer. “Our CFO and I, we talk about this all the time. But nobody’s done this before.”

–With assistance from Anne Riley Moffat.

Bloomberg.com

from Financial Post https://ift.tt/2QmIMMF

via IFTTT Blogger Mortgage

Tumblr Mortgage

Evernote Mortgage

Wordpress Mortgage

href="https://www.diigo.com/user/gelsi11">Diigo Mortgage

0 notes