Don't wanna be here? Send us removal request.

Text

Evolution of Document Processing with GenAI

Introduction:

Document processing has been steadily evolving over the last few years, along with a significant increase in its importance for several industries.

From the days of manual data entry to today’s intelligent document processing, it has been a long journey, marking the growth of this segment into a separate industry in itself.

While in the past, companies had no choice but to rely on handwritten notes and manual data extraction for their business decisions, it was time consuming and error-prone. This led to the advent of sophisticated technologies like optical character recognition (OCR) software in the late 20th century. Combining these features of OCR and utilizing deep learning, today’s intelligent document processing harnesses the power of Gen AI for detecting text from over 200 languages, recognizing handwriting, and extracting layout characteristics such as paragraphs, lines, and symbols with speed and accuracy.

In this blog, we will explore this journey, first by highlighting the importance of document processing in today’s industries and then shed some light on how the latest generation of AI technology is providing document processing with a cutting edge.

Challenges in Document Processing Evolution:

Early days of evolution

During the initial days, document processing served as a reliable business function, wherein it provided several benefits that laid the foundation for its growth. Here are some of those functions described in detail:

Adding Clarity in Communication Document processing led to a clear-cut understanding of the objectives, roles, and outcome requirements of several business areas by documenting functional, quality, and usability requirements.

Defining Project Management Requirements When it came to project management, document processing helped identify project boundaries, defining what problems needed to be addressed and the constraints that had to be overcome for successful project execution.

Aiding in Business Collaboration Document processing helped foster collaboration between different stakeholders by providing the required information to arrive at a consensus over any business decision.

Identifying Risks Document processing provided the scope for identifying potential risks and dependencies, enabling the formulation of proactive measures.

Enabling Benchmarking Document processing provided the basis for benchmarks for any new project requirements, ensuring deliverables met business objectives and stakeholder interests.

Challenges faced in manual document processing :

As document complexities increased, manual processing became challenging, especially in document-heavy industries like mortgages. This spurred a shift towards automating document processing for competitive advantage and improved customer experiences. *As per a recent survey published by Harvard Business Review, more than 80% of the surveyed workforce considered automation behind their increase in productivity, while 85% attributed automation as the source of better collaboration.

Given these findings and the limitations of human processing, there is an increasing need for enhanced document processing solutions.

Here are a few such limitations described further :

Increased errors Manual processing seemed manageable when the volume was low. However, with formats and volume changing quickly as businesses started to grow, it became increasingly difficult to bring efficiency to business processes that required document processing.

Decreased security Securing sensitive documents and their data while being complained about by regulatory bodies became a far cry with increased volumes.

Lack of speed When it comes to manually processing documents for data extraction, large volumes of physical documents create a scenario where a faster turnaround is almost impossible.

Increased cost The need for physical storage and maintenance of large volumes of documents required resource deployment and increased the cost with scale-up requirements.

Accessibility issues Accessing large volumes of documents often poses challenges both in organizing them as well as extracting data whenever required. This led to the need for a technology that can mine and extract data in an orderly manner.

Solution:

The new technology on the horizon:

Document processing evolved significantly with character recognition technology, starting in the 1920s with numeric recognition, and advancing to full character recognition in the 1950s. The introduction of digital OCR in the 1970s improved accuracy, but limitations remained, such as the inability to interpret meanings, dependency on document quality, and lack of learning from errors, highlighted the need for further improvements, sparking a new era in document processing innovation.

The advent of the AI revolution:

The limitations of OCR technology created room for further improvements and the need for a better and superior technology that would be smart enough to handle the modern-day requirements of document processing across different industry sectors.

The rapid digitization of the late 20th century and the need for easy storage and rapid retrieval of documents for handling large volumes of data gave birth to an entirely new form of document processing called intelligent document processing commonly called IDP.

The integration of artificial intelligence (AI) and machine learning (ML) gave rise to this new technology that utilizes natural language processing (NLP) and computer vision to enhance accuracy and efficiency in handling large volumes of documents.

Digital transformation with GenAI technology—unraveling the tech behind the game changer

It is undeniable that the introduction of GenAI technology has completely transformed the field of document processing.

The combination of various components of GenAI technology has created a phenomenal IDP solution such as DocVu.AI.

For example, the combination of positional OCR with the regression locator algorithm is providing cutting-edge solutions for the mortgage industry.

Let us look deeper into this by analyzing some use cases:

Enhanced data extraction with better accuracy: With positional OCR, lenders can identify key data points wiring mortgage documents, such as loan amounts and borrower details. The regression locator algorithm is particularly useful for unstructured data sets, wherein the IDP solution can adapt to various document layouts, ensuring accurate extraction.

Improved accuracy in handwritten text recognition: The regression locator algorithm, when combined with advanced machine learning technology, enhances the accuracy of handwritten text recognition in mortgage documents. This is an important feature for extracting data from handwritten annotations and signatures, which traditional OCR fails to perform.

Dynamic adaptability across diverse document structures and formats: By utilizing machine learning techniques, the regression locator algorithm learns from diverse document examples, improving the ability of IDP solutions such as DocVu.AI to recognize patterns and features across different formats. This continuous learning ability enhances extraction abilities over time.

Robust processing technology: Advanced Gen AI technology features like a regression locator algorithm enhance the image quality of the scanned output of any OCR. It substantially reduces noise along with alignment corrections. This feature eliminates the hindrance of data extraction from a poor quality document format.

Cost-effectiveness with increased efficiency: Positional OCR plays a key role in minimizing human intervention in document processing workflows. As a result, organizations can scale up easily without the need for proportional human resource increases. This leads to significant cost savings while having better efficiency.

Conclusion:

In document processing, where traditional OCR technology frequently falls short, generative AI’s revolutionary powers bring about a radical shift. This is further highlighted by the fact that GenAI-powered products, like DocVu.AI, automate repetitive operations and improve workflows, allowing organizations to increase productivity and accuracy. Advanced GenAI models, such as regression locator algorithms, further emphasize this. DocVu.AI helps businesses find new ways to collaborate and grow by optimizing document workflows in the mortgage sector. This helps them stay competitive in a market that is changing quickly while also saving mortgage lenders a lot of money.

Connect with DocVu.AI

0 notes

Text

Effortless Accounts Payable Solution with AI

Finance teams across different industry verticals have largely overlooked the substantial potential of AI and ML to enhance productivity in accounts payable, despite acknowledging the power of digital transformation.

1* Reports show that AP automation with AI can reduce processing costs by 81%, accelerate processing times by 73%, and cut human errors by up to 40%.

These AI and ML-driven digital transformation solutions not only boost productivity but also eliminate human errors and detect fraud. In this blog, we will explore the transformative power of these technologies and their impact on addressing challenges in accounts payable.

Challenges in Manual Accounts Payable: High Costs, Inefficiencies, and Profitability Risks

Over the years, it has been recognized that the manual accounts payable process presents issues such as high operational and storage overheads, which result in increasing expenses. Furthermore, manual processing of accounts payable can result in repeated payments, late fines, and missed discounts, highlighting the inherent inefficiencies of such systems.

High Costs and Storage Overheads

Manual accounts payable (AP) processing can be costly due to higher operational and storage overheads. Handling and storing paper documents requires significant resources, driving up expenses and occupying valuable physical and digital space.

Inefficiency and Profitability Challenges

The manual accounts payable process often faces issues like errors and delays, leading to:

Duplicate payments

Late payment of fees

Missing out on early discounts

As a result of these operational inefficiencies, organizations suffer impaired profitability and financial losses.

The two most significant disadvantages of the manual accounts payable process are: – Lack of control – Lack of management visibility

Aside from these, the two other significant obstacles preventing effective decision -making and operational efficiencies are:

Limited ability to track AP workflows.

Ability to analyze AP workflows.

As a result, firms run the risk of fraud and noncompliance with financial requirements.

Scalability and Flexibility Issues

With the gradual growth and expansion of any business entity, a variety of requirements emerge that an accounts payable process must support, namely:

Business expansion,

Mergers,

New location setups.

In such cases, traditional manual accounts payable encounter problems in the form of –

Adaptability

Flexibility

As a result, the manual accounts payable process becomes more difficult and costly to handle.

Strained Supplier Relationships

The principal causes of strained supplier relationships originate from two key shortcomings in the typical accounts payable process:

Payments are delayed and inaccurate.

Communication gaps

This frequently leads to a plethora of challenges springing up in supplier relationship management, including:

Trust and dependability difficulties

Suppliers’ payment terms are poor

Discounts are limited.

As a result, there is a significant impact on the organization’s total supply chain management.

Revolutionizing Accounts Payable with AI: The Power of Intelligent Document Processing (IDP)

AI revolutionizes manual accounts payable (AP) processes by powering intelligent document processing (IDP). Through AI, document handling is automated, costs are reduced, accuracy is ensured, and efficiency is enhanced. This solution provides real- time tracking, improves control, and scales effortlessly with business growth, leading to stronger supplier relationships.

Reducing Costs and Storage Overheads

Manual accounts payable (AP) processing is often burdened with high operational and storage costs. Intelligent document processing (IDP) streamlines these tasks by automating the handling and storage of paper documents, significantly reducing expenses. By digitizing invoices and related documents, businesses can cut down on physical storage needs, freeing up valuable space and resources.

2. Enhancing Efficiency and Profitability

Inefficiencies in manual AP processing frequently lead to duplicate payments, late payment fees, and missed early payment discounts, negatively affecting profitability. IDP ensures accuracy and timeliness, eliminating these costly errors. Automated systems promptly process invoices and payments, maximizing early payment discounts and avoiding late fees, thus enhancing overall efficiency and profitability.

3. Improving Control and Visibility

A major drawback of manual AP processes is the lack of control and visibility, hindering informed decision making. IDP provides real time tracking and detailed insights into the AP workflow, enabling better management decisions and improved operational efficiency. Enhanced visibility also reduces the risk of fraud and ensures compliance with financial regulations.

4. Scalability and Flexibility

As businesses grow, manual AP processes become increasingly cumbersome and expensive to manage. IDP scales effortlessly with business expansion, mergers, and new locations, ensuring the AP system remains efficient and cost-effective. This flexibility allows businesses to adapt their AP processes seamlessly to changing needs and complexities.

5. Strengthening Supplier Relationships

IDP facilitates faster and more accurate payments, improving relationships with suppliers. Timely payments and accurate updates build trust and reliability, fostering stronger business partnerships. Improved supplier relationships can lead to better terms and discounts, enhancing the overall efficiency of the supply chain.

In conclusion, the power of AI helps IDP streamline AP, resulting in the following outcomes:

Accuracy and Profitability IDP ensures accuracy, eliminates errors, and boosts efficiency and profitability.

Real-time Insights IDP provides real-time tracking for better decisions and improved efficiency.

Scalability and Relationships IDP scales seamlessly, fostering stronger relationships through accurate payments.

To experience ‘Intelligent Automation’ transforming accounts payable through the use of intelligent document processing, connect with DocVu.AI at : www.docvu.ai

Source : 1* https://www.forbes.com/sites/forbesfinancecouncil/2023/01/23/accounts-payable-automation-and-succeeding-with-its-implementation/

0 notes

Text

Effective Supplier Relationship Management Through Automated Invoice Processing

Effective supplier relationship management is vital for business success, but manual invoice processing often poses significant challenges. What are these challenges and how can organizations overcome them? Let us discuss it!

Traditional methods of handling invoices are fraught with challenges, including human errors, delays, and inefficiencies. These issues can strain supplier relationships, leading to payment disputes, missed discounts, and ultimately, a disruption in the supply chain.

Enter intelligent document processing (IDP) as a part of automated invoice processing. This advanced technology automates the extraction and processing of invoice data, dramatically reducing the time and effort required.

This blog will explore how by leveraging Intelligent Document Processing (IDP), businesses can achieve automated invoice processing leading to :

Addressing the pain points of manual methods

Paving the way for a more streamlined approach

Enhancing operational efficiency

Ensuring accurate, timely payments

Fostering stronger, more reliable relationships with suppliers

The Truth About Traditional Manual Invoice Processing

Manual invoice processing can significantly strain supplier relationships, hampering productive collaboration and shared growth. Here are some key issues that arise:

Incorrect Data Entry: Manual processes often result in errors.

Lost Invoices: Misplaced invoices can cause significant delays.

Duplicate Payments: Paying twice for the same invoice leads to financial discrepancies.

These issues lead to disputes and mistrust between suppliers and buyers. Additionally, suppliers face:

Frequent Payment Delays: Inaccuracies cause delays, disrupting cash flow.

Operational Inefficiencies: Delayed payments hinder the smooth running of operations.

Financial Strain: Cash flow issues lead to financial instability.

Overall, these challenges affect suppliers’ ability to deliver goods and services promptly and compromise their business stability.

Enhancing Supplier Trust with Real-Time Invoice Transparency to Reduce Costs:

Moreover, the lack of visibility and transparency inherent in manual processes can create a communication gap between buyers and suppliers. Without real-time updates and easy access to invoice status, suppliers are left in the dark about payment timelines, leading to frustration and dissatisfaction. This uncertainty can erode the trust that is crucial for a strong supplier relationship. Inconsistent and delayed payments may prompt suppliers to seek more reliable partners, or worse, impose stricter credit terms and higher prices to mitigate their risks, further escalating costs for the buyer.

Streamline Accounts Payable to Enhance Supplier Relationships and Reduced Costs:

The administrative burden on accounts payable teams is another critical factor. Manual invoice processing requires considerable time and effort, diverting resources from strategic activities that could enhance supplier relationships. This inefficiency not only increases operational costs but also reduces the agility of the procurement process. Consequently, the organization might miss out on early payment discounts and other financial incentives offered by suppliers, impacting its bottom line.

Scale Business Growth: Automate Invoice Processing to Avoid Bottlenecks and Errors:

Furthermore, manual processes lack the scalability needed to support business growth. As companies expand, the volume of invoices increases, exacerbating the existing inefficiencies and compounding the risk of errors. This can lead to bottlenecks and backlogs, further delaying payments and damaging supplier relationships. In a competitive market, where timely and accurate payments are a hallmark of reliability, such inefficiencies can tarnish the buyer’s reputation, making it less attractive to top-tier suppliers.

Alternate Ways To Efficient Invoice Processing

Intelligent document processing as a component of automated invoice processing significantly enhances supplier relationship management. IDP helps build a reliable and efficient financial interaction framework by ensuring accuracy, speed, transparency, and scalability. This not only streamlines operations but also cultivates stronger, more resilient partnerships, positioning businesses for sustained success in their supplier relationships.

Transforming Supplier Relationship Management with Intelligent Document Processing

Intelligent document processing (IDP) plays a crucial role in transforming automated invoice processing, significantly enhancing supplier relationship management. By leveraging technologies such as optical character recognition (OCR), machine learning (ML), and artificial intelligence (AI), IDP automates the extraction, validation, and processing of invoice data with remarkable accuracy and efficiency. This automation eliminates the common pitfalls of manual invoice processing, such as human errors, delays, and inconsistencies, thereby fostering a more reliable and transparent financial interaction between buyers and suppliers.

Real-Time Invoice Tracking Boosts Supplier Confidence and Collaboration:

One of the primary benefits of IDP in automated invoice processing is the substantial reduction in errors. IDP systems can accurately capture and interpret data from various invoice formats and layouts, ensuring that critical information such as invoice numbers, dates, amounts, and supplier details are correctly recorded. This accuracy minimizes discrepancies that could otherwise lead to payment delays and disputes. Suppliers appreciate the reliability of timely and accurate payments, which helps maintain their cash flow and operational stability, thereby strengthening their trust and loyalty towards the buyer.

Optimizing Invoice Processing Workflow for Enhanced Visibility and Communication:

Moreover, IDP enhances the visibility and transparency of the invoice processing workflow. Suppliers can track the status of their invoices in real time through integrated supplier portals, reducing uncertainty and enhancing communication. This transparency reassures suppliers about the predictability of payments, alleviating their concerns and fostering a more collaborative relationship. Buyers can demonstrate their commitment to efficiency and reliability by providing clear and consistent updates, further solidifying their reputation as dependable partners.

Enhancing Accounts Payable Efficiency: Shifting Focus to Strategic Tasks for Improved Supplier Relationships:

The efficiency gained through IDP also allows accounts payable teams to shift their focus from manual data entry and error resolution to more strategic tasks, such as optimizing payment schedules and negotiating better terms with suppliers. This strategic shift improves internal operations and creates opportunities for value-added interactions with suppliers. For instance, buyers can leverage the time saved to explore early payment discounts or bulk purchasing agreements, benefiting both parties financially and strengthening the partnership.

Scalable Invoice Processing Systems: Ensuring Efficiency and Trust in Business Growth:

Additionally, IDP systems are highly scalable and capable of handling increasing volumes of invoices as businesses grow. This scalability ensures that the automated processes remain efficient and effective, even during periods of expansion. Suppliers experience consistent and prompt payments regardless of the transaction volume, which is crucial for maintaining their trust and engagement over the long term.

Conclusion

In conclusion, automated invoice processing powered by Intelligent Document Processing (IDP) stands as a transformative force in supplier relationship management by providing a plethora of benefits namely :

Elimination of Manual Challenges: IDP eliminates manual processing challenges, ensuring precision, speed, and transparency in invoice processing.

Fostering Trust and Collaboration: IDP fosters trust and collaboration with suppliers, leading to resilient and mutually beneficial relationships.

Prioritizing Accuracy and Speed: Businesses embracing IDP prioritize accuracy, speed, and transparency in financial transactions.

Optimizing Processes: Leveraging IDP optimizes processes, enhances operational efficiency, and builds stronger partnerships with suppliers.

Now you can experience this ‘Intelligent Automation’ with DocVu.AI’s intelligent document processing at: www.DocVu.AI

0 notes

Text

Exploring Two-Way, Three-Way, Four-Way Invoice Matching in Account Payable

Introduction to Invoice Matching in Accounts Payable

Invoice matching is a vital process in accounts payable that maintains correct and timely vendor payments. When it comes to invoice matching, there are three types: two-way, three-way, and four-way.

Looking deeper into each of them we find that the ‘Two-Way Invoice Matching’ is the easiest way, which involves the accounts payable team checking vendor’s invoices against the original purchase order. This helps to confirm invoice accuracy and prevents overpayments.

Next comes ‘Three-way matching’; which extends this process to compare the invoice with a goods receipt or service confirmation. This ensures that the company is billed only for goods and services that were both received, as well as accepted.

Finally comes the best method which is ‘Four-way invoice matching. Under this, aside from the purchase order and goods or service verification, the AP team also analyzes invoices to contract /service agreements. The last step makes sure that the payment sticks to what is told.

In this blog, we look into each of these above-mentioned invoice matching procedures and then delve deeper into them for a better understanding of how their appropriate implementation can affect the overall performance and efficiency of your accounts and finance department.

What is invoice matching?

Invoice processing is a key accounts and finance department process managed by the accounts payable team. It starts with the initial receipt of the invoices from the vendor/supplier till the final payment is made and involves managing the entire lifecycle of these vendor/supplier invoices.

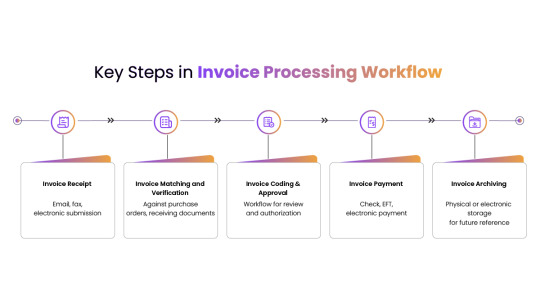

Let us look a bit closely into the key steps in the invoice processing workflow:

– Invoice Receipt: After a purchase is made, invoices are received from vendors/suppliers through either email, fax, or electronic invoice submission procedure. Once an invoice is received, the accounts payable team needs to capture the invoice data about vendor details, invoice date, invoice number, description, amount due, and so on.

– Invoice Matching and Verification: The invoice details are matched against purchase orders, receiving documents, and other supporting documents to verify accuracy and legitimacy. All differences between the invoice and supporting documentation should be resolved before processing.

– Invoicing Coding & Approval: The invoice is coded with the appropriate general ledger account, cost center, and any other accounting information that you should provide to get reimbursed. The document is then forwarded through an approval workflow for review by a person who has the authority to approve the request and trigger its payment.

– Invoice Payment: Once approved, the invoice is scheduled for payment based on the vendor’s payment terms. Usually, payments are made and accepted via check, electronic fund transfer (EFT), or other electronic payment types.

Need of invoice matching

Vendor invoice management and tracking are necessary for the company to handle vendors’ invoices and keep correct records. Below are the key facts on why the processing of invoices is of significance.

Payment accuracy: Properly planned and implemented invoice processing facilitates decreases in the possibilities of overpayments, underpayments, delayed payments or even making payments to the wrong payee. Make sure that the companies’ invoices are received, approved, and paid for correctly.

Improve vendor relations: Timely and efficient processing of invoices is known to enhance the relationship between a business and its vendors/suppliers. This helps the suppliers understand that your business is creditworthy and will pay promptly.

Cash management: The features of working with invoice software include the real-time tracking of the amount of money owed, the amount of money due, the orders, etc. This makes it possible to monitor cash flow in a better and consecutively more predictable manner.

Streamlined workflow: Most importantly, automated invoice processing does not require input of data manually by the personnel, hence eliminating the chances of making mistakes and at the same time, is much faster. It releases account-paying employees; they are now less bogged down with other activities that are not related to strategy making.

Compliance mechanisms and accounting mechanisms: A proper invoicing system is both logical and easier to follow every financial transaction that is made, while at the same time paving the way for a clear way of ensuring that every financial transaction is made following the set accounting standards and recognized tax laws.

Here are the various types of invoice-matching

Accounts payable automation uses three forms of matching: two-way, three-way, and four- way.

– Two-way invoice matching: This happens when a third-party invoice is matched with a purchase order, tolerances are met, and the invoice is saved in a database.

– Three-way invoice match: This occurs when an invoice is matched with a purchase order, a receipt for goods, and a supplier invoice. All three components must be within agreed- upon tolerances. The information is subsequently entered into the AP system.

Tolerances and Holds in Invoice Processing

The tolerance and holds are used in efficient invoice processing to produce an accurate and compliant end product. Let us now explain their mechanisms and role in financial activities.

The Role of Tolerances Tolerances are set values that confirm if the invoice amount is correct or not regarding the PO details. This step can be done to ensure that there are no disparities in the information given or to keep things organized. Hence, when an invoice meets these tolerances, it is a sign that the transaction details correspond with the PO.

Managing Invoice Holds An invoice hold is raised in circumstances where there is a failure to match the PO with the invoice or goods cannot be validated to have been received. They protect instances whereby one has provided his/her money to pay for goods or services that have not been recorded or delivered.

Types of Deviations

– Quantity Deviation: This takes place when the quantity stated on the invoice differs from the quantity stated on the purchase order and or the received goods. It is useful in avoiding the consistency of charging more than is required or the receipt of less than is due.

– Price Deviation: This may occur when the price that has been arrived at during the purchase order is different from the price on the invoice. Price variations prevent fleecing of the consumer by charging high amounts or on the other extreme, charging very low amounts.

The Software and Company Policy factors:

The ability to manage tolerances and holds mainly depends on the specific software employed and corporate standards. Thus, while doing the approval, there may be a certain level of flexibility for faster decision making about certain discrepancies. Nevertheless, all invoices might not adhere to planned and specified tolerances for data review. That is if an invoice is not processed to these criteria, its payment will be suspended till when it is corrected or released through an exceptions list.

To sum up, the need for the proper control of constant tolerance checks and handling of invoices plays a large part in the accurate calculation of the financial data and reduces occurrences of possible disruptions.

The importance of Two-way / Three-way & Four-way Invoice matching

Ensuring Accurate Billing using two-way, three-way, and four-way invoice matching and their importance

– Accurate Billing Verification Two-way, Three-way, and Four-way match, in the case of AP, ensures that firms are being billed the correct price for the quantity ordered according to their contract. These methods check the order, receipt, and invoice to avoid overcharging and identity mismatches.

– Protection Against Errors When specifying the match, if vendors have sent more or supplied at a cheaper price, this will not be a problem. But only if they have sent less or charged more than they had agreed upon, then a discrepancy occurs. This process of checking the errors transfers the responsibility to the vendor regarding the agreed terms which are very easy to ascertain when it comes to delivery-based manufacturing.

What is manual invoice matching?

The traditional AP method of matching invoices means that a member of the accounts payable team looks for documents relevant to an invoice for comparison and checks the consistency of every figure in the documents and the invoice. Ideally, it may take days to complete this process, more so when the invoices received are many.

Many organizations still employ traditional methods of invoice processing manually, despite the availability of technologies to perform the same.

While it may seem quite convenient and straightforward to process invoices, in reality, it is time consuming and prone to errors, leading to inefficiency.

Let us look into these detriments of manual matching of invoices more closely:

Manual data entry of invoice details: One of the biggest drawbacks of manual invoice processing is the manual data entry of invoice details. This is not only a lengthy and time- consuming process, but also human errors in recording correct data can lead to financial discrepancies, leading to losses and strained supplier relations.

Challenges of tracking duplicate invoices: In the case of vendors sending duplicate invoices with the same or different invoice numbers and details, it becomes difficult to track them when invoice processing is done manually. This situation gets aggravated at times of partial payments or corrected invoices. Without a systematic process of automatically tracking such duplications, there is every possibility of confusion leading to payment issues.

Manual exception management challenges: When invoice processing discrepancies occur, manual exception management becomes challenging. During such times, accounts payable team members have to physically verify multiple documents from different departments and obtain the necessary authorization before invoices are processed. This leads to a longer billing cycle, resulting in payment delays and vendor relationship issues. Moreover, during financial audits, these discrepancies tend to be serious issues due to the lack of a proper formal invoice tracking mechanism.

Process visibility challenges due to a lack of transparency: In manual invoice processing, often it is difficult to ascertain the processing status of different invoices or find out which invoices are cleared for payments, which invoices are approaching payment deadlines, and which invoices are stuck up in the processing workflow due to some issues. This aspect of lack of visibility puts added pressure on the accounts payable team while prioritizing tasks in the face of missed deadlines.

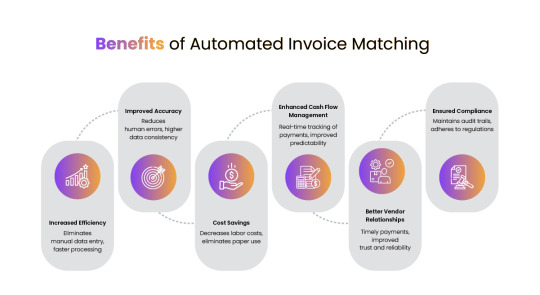

What is automated invoice matching?

It is possible to automate the integration of invoice matching processes into a digital AP automation solution and create a touchless AP system. Today’s AP solutions have an intelligent matching engine based on machine learning and artificial intelligence, addressing all those tasks and helping the accounts payable team to save time.

Introduction to AI for automating the process of Invoice Matching

AI applied to automate invoice matching involves using algorithms to match data that is entered on an invoice to the records of a company. Automated tools like machine learning algorithms help in analyzing two sets of data and comparing them for anomalies.

How Does it Work: Understanding the Functioning of AI Automated Invoice Matching?

AI and machine learning algorithms allow for invoice matching by automating a process that involves comparing invoices, POs, and receipts. Here’s a step by-step breakdown:

Invoice Capture: This is followed by the recognition of the data found on the invoices through the use of OCR technology that extracts printed or handwritten text and translates it into data.

Data Extraction: Invoices are parsed to extract invoice no., date, supplier name, items, and amounts by AI algorithms. These machine learning models are also developed to extract data from different formats for the invoices.

Data Retrieval: It acquires linked data of purchase orders and receipt records including the PO numbers, quantity, and price.

Data Matching: AI powered algorithms check for similarities or gaps based on a comparison of PO/receipt data and invoice data. Additionally, It also allows one to specify whether one wants tight or lax matching rules.

Exception Handling: Whenever the system identifies data anomalies it informs the related stakeholders and users to review and resolve the issues by following a predefined workflow that also includes timely notifications and escalation for speedy redressal.

Automatic Approval: When the probability of a match is high, the system can approve the invoices for payments without a lot of intervention hence being able to fasten the payment process.

Continuous Learning: In the long run, it becomes more effective since it contains features that make it progressively more competent at understanding the users’ input and previous experience.

Reporting and Integration: Automated invoice matching systems implemented with the use of advanced technologies such as AI provide strong capabilities of reporting and analytics that enable identifying the degree of matching accuracy as well as revealing possible exceptions. They can also work with most of the accounting and ERP applications for billing and updating changes that will lead to payments.

In conclusion, AI-automated invoice matching applies the concept of machine learning and other developed rules to check the compatibility of data from invoices, POs, and receipts, thereby improving the efficiency of matching.

Making use of Automated Invoice Matching:

As we can see in the contemporary business environment costs have become critical in running an organization and therefore its operations have to be efficient and accurate. Automating preparation and reconciliation of the invoices is an essential tool within these processes.

Here’s an overview of the significant benefits automated invoice matching brings to organizations:

1. Eliminate Paperwork and Other Time-Consuming Procedures: The first and probably one of the most significant benefits that businesses can gain from the automation of invoices is the elimination of manual data rekeying. The typical task in invoice management is manual data entry, which is rather long and accompanied by a high risk of mistakes. Thus, the automation of this process is very beneficial for finance teams – they can have free time, which is spent on repetitive tasks, and pour it into improved business development and the achievement of strategic goals.

2. Submits Faster Approvals: It helps to dispose of invoices much faster due to the option of automatic invoice approvals. This technology ensures the avoidance of many possible errors and guarantees smooth cooperation between different systems, thus making the approvals of invoices fast. Thus, approvals made in less time promote sound financial management, and in particular, assist in providing a continuous cash flow.

3. Improves Workflows: The manual AP processes are always characterized by chaos in terms of time consumption and possible mistakes. Automation helps to avoid such restrictions because it optimizes the processing of invoices. Automated systems help to reduce the time and resources spent on corrections for errors made by people, thus improving the financial operation processes.

4. Prompt Payments: The approved invoices are automatically put through for payments on time through the process of automated invoice matching. This plays a vital role in sustaining good relationships with vendors and suppliers. This way, payments that are made on time and are accurate assist in the creation of trust and reliability to foster long-lasting business relationships.

5. Augment Cash Management: Managing cash is one of the critical activities of any organization, and automation is an essential issue here. Reducing overall delays as well as other penalty charges that are usually accompanied with the original amount to be paid, go a long way in cutting down the overall expenses incurred by an organization, affecting cash flows. This helps to minimize the likelihood of a business facing a cash crunch when they least expect it.

6. Ensure Compliance: As with any organization engaged in business operations, regulation and audit requirements are one of the most important components of financial management. The automated systems for invoice processing keep records and provide a fully tracked audit trail where all operations correspond to compliance requirements. They reduce the chances of getting to the wrong side of the law or finding yourself answerable in a court of law.

Conclusion

In conclusion, automatic matching of invoices is not only an evolution in tools but it is a valuable evolution in an organization’s system approach to its finances. Deloitte UK has also echoed the same saying that by adopting automation In the business world, B pains achieve increased efficiency of working, accuracy as well and compliance, all of which act as promoters of growth as well as sustainability.

0 notes

Text

Invoice Processing in 2024: A Streamlined Journey from Receipt to Payment

Think back, have you ever felt stressed when the due date of an invoice gets nearer? Although customers cannot directly see it, it is essential for the company to always meet invoice deadlines and make accurate entries in the accounts. This blog post is all about invoices starting with an analysis of the process and going through the need for automation and the possible effects on the business in 2024.

What is Invoice Processing?

Invoice processing refers to the step-by-step handling of invoices from when they get into your organization to payment and documentation. They are the bedrock of accurate financial operations because they allow the organization’s managers to provide accurate vendor payments while offering clear records.

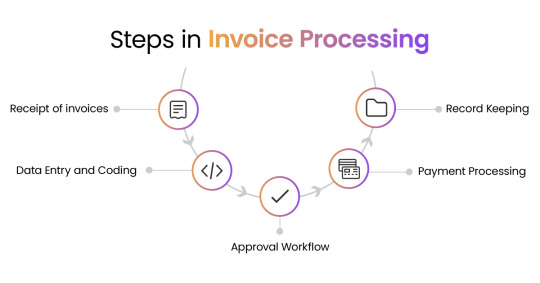

Here are the five Key Steps of Invoice Processing:

Step 1: First, invoices may be received through physical mail, email attachments, and electronic data interchange (EDI).

Step 2: The next stage is ‘Data Entry and Coding’ where information such as an invoice number, the amount paid to the vendor, and line items on the invoice are compiled. This information is then input into the accounting system and structure for accurate recording (for example; stationery, and advertisement expenses).

Step 3: After that comes ‘Approval Workflow’. Depending on the size of the invoice, authorized people check it for accuracy and alignment with purchase orders, contracts, or receiving reports. This phase prevents duplicate payments and assures compliance with business policies.

Step 4: The next is ‘Payment Processing’. Once approved, the invoice is then due for payment at the agreed time frame (for instance, net 30 days). This involves making a payment and an adjustment of the records in the form of a check or electronic transfer.

Step 5: After this comes ‘Record Keeping’. Paid invoices are securely saved for future reference and audits. Digital copies provide for easy retrieval and disaster recover

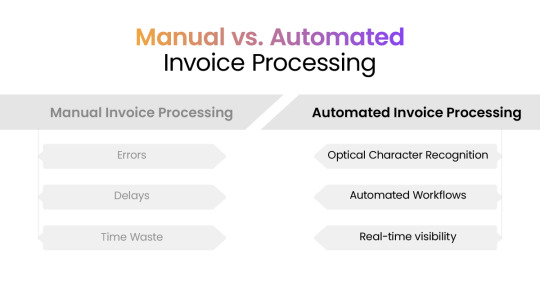

Manual vs. Automated Invoice Processing: A World of Difference

To put it into perspective, manual and automated processing of invoices has several differences. Traditionally, invoice processing involved manual paperwork on invoices or simple data entry programs.

This manual method is prone to:

Errors (data entry mistakes, misplaced invoices),

Delays (waiting for approvals),

Wastages of important employee time.

Enter automation! Modern invoice processing software that uses unique features such as:

Optical Character Recognition (OCR): Captures data from bills that have been scanned or even in PDF formats, thus greatly reducing the time spent on data entry and less chance of making errors.

Automated Workflows: Automates the approval process by identifying persons for every bill and processing the bills according to set procedures.

Real-time visibility: Offers the tracking of the invoice status from all the stages to ensure that timely payments are made hence avoiding late fees.

Advantages of Automating Your Invoice Processing:

Increased Efficiency: Enables your team to spend more time on strategic initiatives.

Improved Accuracy: Reduces human errors and standardizes data.

Faster Processing: Organizes workflows to expedite approvals and payments.

Cost savings: Cuts on expenses incurred on manual labor while, at the same time eliminating the use of paper.

Enhanced cash flow control: Enhances the cash flow’s efficiency because one can get real-time information about upcoming payments.

Industries Leading in Automated Invoice Processing:

The beauty of automation is its adaptability. Here are just a few industries that get the maximum benefits from such automation

Mortgage: Automate the large volume of invoices related to loan processing, appraisals, and origination to ensure timely payments to multiple vendors.

Fintech: Improve the client experience by streamlining recurring bills for services such as software subscriptions and expediting payments.

Insurance: Automate claim processing by gathering data from bills filed for repairs or medical treatments, resulting in speedier payouts to policyholders.

Intelligent Document Processing Is Transforming Invoice Processing with a Plethora of Benefits :

Improved data capture and conversion.

Intelligent document processing (IDP) transforms accounts payable by processing a variety of invoice formats, including pictures, PDFs, and email text. These technologies locate, extract, and transform data into a structured format, simplifying the first phases of accounts payable automation. This includes matching invoices to purchase orders, receiving documents, and routing them for approval before payment.

Efficiency and Accuracy for Data Entry

IDP has quickly automated the initial stage of data entry and verification, which was previously time-consuming and error-prone. IDP takes data in less than 60 seconds, but rules-based software might take two to five minutes for each invoice. This huge increase in speed is accompanied by greater accuracy; whereas human data input accuracy is roughly 80%, IDP can achieve up to 98 percent accuracy.

Continuous Improvement through Machine Learning.

One of the most notable qualities of IDP is its capacity to learn and improve over time. IDP’s machine learning component means that it not only begins with a high level of accuracy but also continuously improves its performance, lowering errors and processing times. This revolution in invoice processing enables businesses to manage accounts payable more efficiently and precisely than ever before.

IDP from DocVu.AI Is Your Key to Seamless Invoice Processing:

DocVu.AI, an AI-powered IDP platform, is here to revolutionize invoice processing.DocVu.AI goes beyond basic automation, offering:

Intelligent data extraction: Extracts data with high accuracy, even from complex invoices with different formats.

Workflows Based on Machine Learning: Adapts to your approval processes, resulting in smoother routing and speedier approvals.

Real-time Analytics: Present intelligent dashboards for tracking key performance indicators, trends, and patterns, and making sound financial decisions.

Are you ready to have an efficient system of invoice processing instead of wasting much time and effort?

Then contact us today to see how DocVu.AI can help your team increase your bottom line at www.docvu.ai

Also watch out for our upcoming blog series, in which we will answer your most often-asked questions about invoice processing.

0 notes

Text

Meeting Mortgage Challenges With Data Integration

In the ever-evolving landscape of mortgage lending, challenges can feel overwhelming. Yet, data integration stands as a powerful remedy to streamline these processes. By leveraging robust data integration strategies, lenders can vastly improve operational efficiency and resource management, paving the way for portfolio growth. This becomes especially vital during the application and onboarding stages, where seamless data integration minimizes errors, speeds up decision-making, and boosts customer satisfaction. In this blog, we delve into how embracing data integration can help mortgage lenders tackle underwriting challenges and achieve business success.

Roadblocks in Efficient Data Integration

Data integration in the mortgage industry presents numerous challenges due to the complexity and diversity of data sources

Data Silos: Data silos are a prevalent issue in the mortgage industry. Information is often stored in disparate systems and formats, making it difficult to consolidate and analyze comprehensively. This fragmentation hinders seamless data flow, leading to inefficiencies and potential errors.

Data Quality: Maintaining high data quality is another significant challenge. Inaccurate or incomplete data can stem from manual entry errors, outdated information, or discrepancies across sources. Ensuring reliable data requires rigorous validation and cleansing processes, which are resource-intensive.

Legacy Systems: Many mortgage companies rely on outdated technology that lacks compatibility with modern systems. These legacy systems create barriers to efficient data integration and increase the risk of data loss or corruption during migration.

Regulatory Compliance: Adhering to strict data governance and privacy regulations, such as GDPR and CCPA, adds complexity to data integration. Mortgage companies must ensure compliance while integrating data from multiple sources, necessitating robust security measures and meticulous documentation.

Data Volume: The sheer volume of data generated in the mortgage process, from application to closing, poses another challenge. Managing and integrating this vast amount of data requires scalable and efficient solutions. Implementing advanced technologies like AI and machine learning can help address these issues but demands significant investment and expertise.

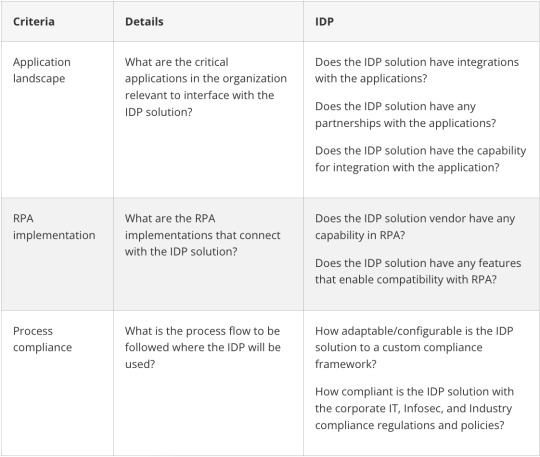

Overcoming Data Integration Challenges with Intelligent Document Processing

Intelligent Document Processing (IDP) revolutionizes data integration in the mortgage industry by addressing critical challenges such as data silos, quality, legacy systems, regulatory compliance, and data volume. By leveraging advanced technologies like AI and machine learning, IDP streamlines data consolidation, enhances accuracy, modernizes outdated systems, ensures compliance, and efficiently manages vast amounts of data.

Addressing Data Silos: Intelligent document processing (IDP) effectively tackles data silos by consolidating information from various systems and formats into a unified database. Through advanced technologies like optical character recognition (OCR) and machine learning, IDP enables seamless extraction, transformation, and loading (ETL) of data. This integration enhances data flow, reduces inefficiencies, and minimizes the risk of errors.

Enhancing Data Quality: IDP significantly improves data quality by automating validation and cleansing processes. By leveraging AI algorithms, IDP can detect and correct inaccuracies, fill in missing information, and ensure consistency across data sources. This automated approach not only enhances the reliability of the data but also reduces the resource-intensive nature of manual data validation.

Modernizing Legacy Systems : IDP aids in modernizing legacy systems by facilitating the integration of outdated technologies with contemporary platforms. This integration minimizes the risk of data loss or corruption during migration and enhances overall system compatibility. Consequently, mortgage companies can achieve more efficient and secure data integration processes.

Ensuring Regulatory Compliance: With stringent data governance and privacy regulations, IDP provides robust security measures and meticulous documentation capabilities. IDP ensures that data integration processes adhere to regulations such as GDPR and CCPA, safeguarding sensitive information and maintaining compliance across all data sources.

Managing Data Volume: The vast amount of data generated in the mortgage process can be overwhelming. IDP offers scalable and efficient solutions to manage and integrate this data. By utilizing AI and machine learning, IDP can handle large volumes of data, streamlining the mortgage process from application to closing.

In conclusion, we can say by adopting IDP, mortgage companies can streamline their operations and achieve a more efficient data integration process that results in –

– Streamlining Data Consolidation: Intelligent Document Processing (IDP) addresses data integration challenges by breaking down silos and consolidating information, ensuring seamless data flow and enhancing efficiency. Additionally, DocVu’s in-built Document Management System integrates OCR and Non-OCR workstreams effectively and helping manage data seamlessly.

– Enhancing Accuracy and Compliance: Leveraging AI and machine learning, IDP improves data accuracy and quality, ensures regulatory compliance, and manages large data volumes, leading to improved customer service and operational excellence.

To experience this ‘intelligent automation’ in data integration with intelligent document processing, connect with DocVu.AI at: www.docvu.ai

0 notes

Text

Meeting Customer Expectations in the Mortgage Industry Through Improvement in Service Offerings

In today’s competitive mortgage industry, meeting customer expectations is paramount. With a plethora of options available, borrowers are no longer just looking for the best rates—they seek exceptional service that simplifies the complex mortgage process. As customer expectations evolve, so must the service offerings of mortgage providers. This blog explores how enhancing service quality, leveraging advanced technologies, and adopting a customer-centric approach can help mortgage companies not only meet but exceed customer expectations, fostering loyalty and driving growth in an increasingly demanding market.

Hurdles Faced in Improving Service Quality for Mortgage Industry Players

Improving mortgage service offerings to meet customer expectations presents a multifaceted challenge for the industry. Addressing these challenges is key to enhancing service offerings and meeting customer expectations in the mortgage industry.

One of the primary obstacles is the complexity and length of the mortgage application process, which can be daunting and time-consuming for customers. Streamlining this process without compromising thoroughness and compliance is a significant hurdle. Additionally, there is the challenge of integrating advanced technology while ensuring data security and privacy, which is crucial given the sensitive nature of financial information.

Another challenge is addressing the diverse needs and expectations of customers. With a wide range of borrowers, from first time homebuyers to seasoned investors, tailoring services to meet individual requirements is essential but complex. This includes offering personalized advice and support, which requires a deep understanding of each customer’s financial situation and goals.

Moreover, the industry faces regulatory changes and market fluctuations that can impact service offerings. Staying agile and adaptable while maintaining high service standards is critical. Lastly, there is the issue of customer communication. Ensuring clear, consistent, and timely communication throughout the mortgage process is vital for building trust and satisfaction but can be difficult to achieve consistently.

Addressing Key Challenges by Adding Intelligent Automation for Improving Service Offerings

In the competitive landscape of the mortgage industry, enhancing service offerings is crucial to meet rising customer expectations. Intelligent automation emerges as a powerful solution, addressing key challenges through innovative technologies. Central to this transformation is intelligent document processing (IDP), which streamlines and automates the handling of vast amounts of paperwork. By leveraging IDP, mortgage providers can significantly reduce manual errors, accelerate processing times, and ensure compliance. This not only enhances operational efficiency but also delivers a seamless, faster, and more accurate service experience for customers, ultimately boosting satisfaction and trust in the mortgage process.

Intelligent Document Processing (IDP) is a crucial component of Intelligent Automation that significantly enhances mortgage service offerings by addressing key challenges in the industry. IDP leverages AI, machine learning, and natural language processing to automate the extraction, classification, and validation of data from various mortgage-related documents. This advanced technology streamlines the traditionally manual, error prone processes, leading to increased accuracy and efficiency.

One of the primary challenges in the mortgage industry is the sheer volume of paperwork involved, which often results in delays and errors. IDP mitigates these issues by quickly and accurately processing large quantities of documents, ensuring that critical information is captured correctly and reducing the risk of human error. This acceleration in document handling speeds up the mortgage approval process, enhancing customer satisfaction by providing quicker responses and reducing the waiting period.

Furthermore, IDP improves compliance with regulatory requirements by ensuring that all necessary documentation is accurately processed and easily retrievable. This reduces the risk of non-compliance penalties and builds trust with customers who expect a secure and reliable service.

By integrating IDP into their processes, mortgage providers can offer a more efficient, accurate, and customer-centric service, meeting and exceeding customer expectations in an increasingly competitive market.

In conclusion, intelligent automation has emerged as a powerful solution to the myriad challenges facing the mortgage industry in its quest to improve service offerings and meet customer expectations. By integrating intelligent document processing (IDP), mortgage lenders can streamline the traditionally cumbersome and error-prone task of handling vast amounts of paperwork. IDP leverages technologies such as optical character recognition (OCR) and machine learning to accurately extract, classify, and validate data from various document types. This not only accelerates the loan processing time but also significantly reduces the risk of human error, ensuring higher accuracy and compliance. Moreover, the automation of routine tasks frees up valuable time for mortgage professionals, allowing them to focus on delivering personalized customer service. As a result, customers experience faster turnaround times, greater transparency, and improved satisfaction. Intelligent automation, with its ability to transform document-centric processes, is not just an enhancement but a fundamental shift towards a more efficient, customer-centric mortgage industry. This transformation ultimately positions lenders to better meet the evolving needs and expectations of their clients, fostering trust and long-term loyalty in an increasingly competitive market.

Connect with DocVu.AI to experience intelligent document processing solutions.

0 notes

Text

Make data-driven decisions using DocVu.AI to improve business efficiency

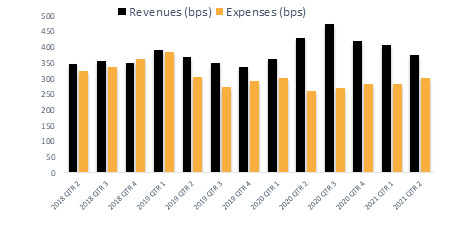

As revenue growth for the last three quarters is slowing, it becomes essential to revisit past strategies and align with today’s market scenarios. Organizations need to be more competitive to maintain their market share. The focus should be on how you can increase your mortgage product’s value proposition.

You can leverage operations to improve your mortgage product value proposition, impacting your top line and margins. The key difference that operations can make to mortgage is

Qualify more applicants

Increase applicant buying power

Offer the most competitive rate

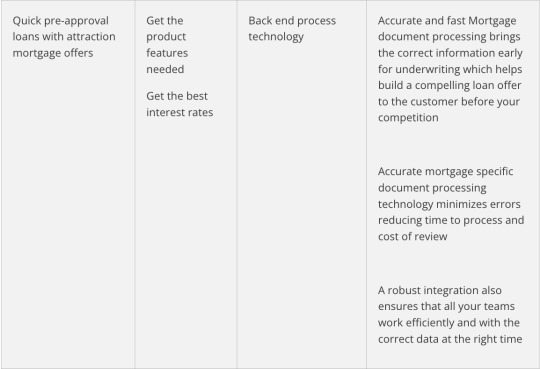

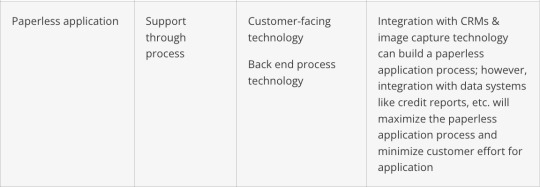

So let’s look at this from the lends of a Customer, Broker and the organization and arrive at key areas that can bring growth.

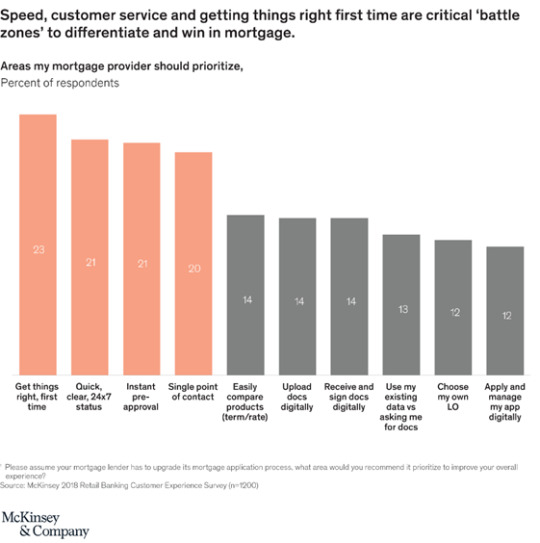

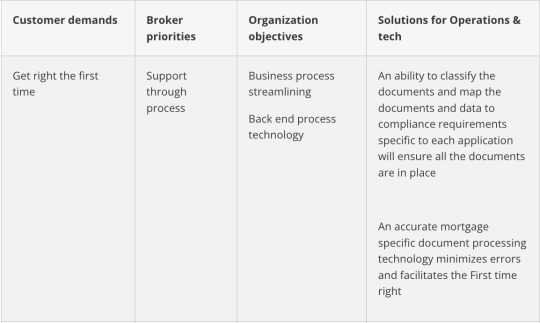

Customer’s priorities

Get things right the first time — Customers want to sit once and finish the process of loan applications. While the mortgage application is a complicated process, it is essential to get all the required information at the beginning.

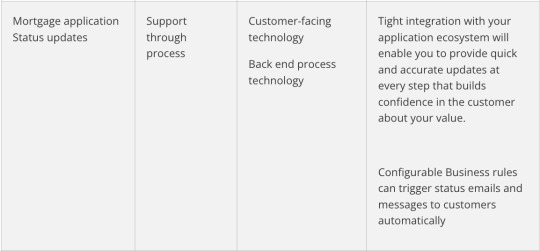

Mortgage application Status updates — Customers want to know the detailed status of the application

Quick pre-approval loans (with attraction mortgage offers)– Getting quick pre-approval is vital as this enables a customer to explore options to choose the right offer. So really, it should be a fast pre-approval with an attractive loan offer

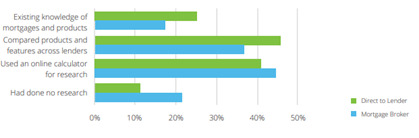

Paperless application — The percent of respondents who reported a paperless online mortgage process being important in choosing a mortgage lender or broker remained relatively high and unchanged from 2018 to 2019 (40 percent for home-purchase mortgages and 44 percent for refinances).

Brokers value

The importance of brokers is rising.

The percentage of NMP survey respondents who applied for mortgage loans through brokers increased

42% in 2018 to 46% in 2019 for home-purchase mortgages

30% in 2018 to 38% in 2019 for refinances

2. The percentage of NMP survey respondents who applied for mortgage loans directly through a bank or credit union decreased

54% in 2018 to 49% in 2019 for home-purchase mortgages

67% in 2018 to 61% in 2019 for refinances

The primary factors that lead to customers choosing brokers are: –

fewer customers are aware of the mortgage processes

fewer customers are aware of mortgage products or comparisons done

customers have a personal or prior relationship with a broker

During the mortgage process, brokers add value to a customer in: –

Getting the best interest rates

Getting the product features needed

Support through process

Organization

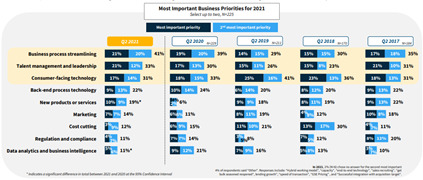

A survey responded by top executives in mortgage banks shows a story that mirrors the findings of the surveys for brokers and customers.

The top 4 priorities for mortgage organizations are: –

Business process streamlining

Talent management and leadership

Customer-facing technology

Back end process technology

Mapping it all together

0 notes

Text

Document Automation and the Future of Non-QM Loans with IDP solutions

As margins thin out, lenders are faced with the task of reconfiguring their existing cost structures while looking for alternate revenue streams. The non-QM market is emerging as a lucrative and practical solution for many. COVID-19 halted the boom of non-QM due to the liquidity constraint, however, it regained its market share and finished 2021 with 25 billion worth of originations and is anticipated to double in 2022.

What is a Non-QM Loan?

A loan which has any one of the criteria below will be considered non-QM:

Debt-to-Income greater than 43%

Blemish on FICO credit due to unforeseen circumstances

Self-employed for less than two years

Low income on tax returns

A non-qualified mortgage doesn’t conform to the consumer protection provisions of the Dodd-Frank Act.

For example, if you have a DTI of more than 43% or have erratic income and don’t meet the income verification requirements set out in the Dodd-Frank Act or by most lenders, you are not eligible for a qualified mortgage and may be offered a non-qualified mortgage instead.

How Do Lenders Verify Income for Non-QM Loans?

Non-QM loans don’t adhere to the standards required for QM loans, but that doesn’t mean they are low-quality loans. A study conducted in 2018 shows that the differences in credit score and loan-to-value ratio between non-QM borrowers and QM borrowers are minimal. However, non-QM borrows on average do have a higher DTI ratio.

Non-QM loans provide flexibility for lenders to offer mortgages to people not eligible for QM loans. Nevertheless, lenders still need to substantiate the documents provided, including income sources. They may also want to verify assets or any other information that assures them the borrower will be able to repay the loan. Non-QM loans are not insured, guaranteed, or backed by FHA, VA, Fannie Mae, or Freddie Mac.

The Evolution of the Mortgage Market

The non-QM market shows promise for the future due to the below factors:

Stricter Regulations

Regulatory bodies, Fannie Mae, and Freddie Mac have made stricter restrictions to reduce possible risks by limiting the percentage of qualified loans offered. This has resulted in a smaller government box, isolating a large section of borrowers who do not conform with the GSE. Moreover, with bank lending restrictions also becoming stricter, this aided non-QM loans to become a more accommodative alternative for loan seekers.

2. Evolving Borrower Profile

There has been a radical change in employment profiles across the country triggered by the COVID-19 pandemic. Entrepreneurship is on the up with a significant percentage of salaried individuals starting their own business due to loss of jobs.

According to statistics, the growth of start-up businesses in the country has risen by 24% from 2019 to 2020. A Forbes report published in 2019 estimated that nearly 30% of Americans are self-employed. This opens the non-QM market to a large number of individuals who become natural candidates for non-QM loans as Fannie Mae and Freddie Mac primarily favor the salaried class.

3. Soaring Home Prices

Home prices over the past few years have seen a gradual rise. The mortgage market is generally shifting away from refinances, which made up over 50% of the market in the last 12 months, to a purchase driven market. The demand for large-sized loans has increased – mostly in the form of Non-QM, as the GSE guidelines around investment properties have been disqualifying most candidates for agency loans.

Key Challenges Faced by Lenders in the Non-QM Space

While interest in the market is on the rise, there are challenges for Non-QM loans. Despite the growing interest, the sector does face some basic functional challenges that lenders are required to overcome. The key ones are detailed below-

Managing Error-Prone Manual Processes

Manual processing of Non-QM can lead to errors, longer timelines and higher costs. Non-QM products do tend to be a bit diverse. This makes the requirement of proper technology to streamline tasks and improve efficiency levels across the organization quite a pressing one. Though there are many generic automation solutions available in the market, Non-QM loans require specialized solutions to get the domain intelligence into the system.

2. Mitigating Risks of Frauds

Mortgage fraud has been rising steadily in the last decade. Due to a relaxation in DTI ratio and other criteria, it becomes critical for Non-QM providers to have a robust risk and fraud mitigation mechanism.

3. Dealing with the Changing Cost Structures

When looking at the total number of mortgage units over the last 10 years, the market has fluctuated up or down by up to 50% each year. It’s clear that mortgage is an industry that is subject to high fluctuations. Due to this ambiguity, increasing fixed costs by investing in additional capacity can be a risk.

The pivotal role of specialized document automation technology in overcoming functional challenges

Specialized solutions can help to overcome functional challenges faced in disbursing Non-Qualified Mortgages. Document automation involves using advanced technology such as AI to simplify the lengthy tasks pertaining to disbursing a typical non-QM loan – right from onboarding, processing, underwriting, pricing, packaging, and closing in a cost-effective way.

DocVu.AI – the most innovative AI/ML solution for BFSI* is designed to be workflow-driven and follows the same set of rules that is adhered to when tasks are manually executed. With the use of intelligent algorithms, the solution significantly increases the pace of execution and reduces the probability of costly human errors.

As a result, Non-QM Mortgage lenders gain increased freedom to take on additional workload due to the automation introduced at several points without worrying about capacity constraints. This empowers the lenders to place their undivided focus on core areas for sustainable growth.

*As per IBS Intelligence 2021 ratings

0 notes

Text

How to Streamline Mortgage Operations with Template-Free Document Processing

“Liberty, when it begins to take root, is a plant of rapid growth.” — George Washington.

The same can be said about data these days. Today businesses have to transform with changes in the market dynamically and thus cannot afford to spend time extracting data and insights from unstructured bulk documents. Freedom from manual and time-consuming tasks such as document processing can give businesses the bandwidth to focus on their core business functions. Across industry verticals, technologies such as OCR are recognized to accelerate growth.

Being independent and liberal means that each data can have its characteristic format. While there are solutions to reduce manual efforts — the technology still requires human intervention to extract and process all the available data in prescribed formats, hence making it largely complicated

Template-based OCR: Time-consuming way to process documents.

Earlier document-processing workflows mirrored paper-based workflows. Document images were captured and stored digitally, but any processing such as data extraction and indexing remained manual. The next generation of solutions relied on templates to locate and extract required data. While this provided huge productivity gains, these types of applications worked well for structured documents like forms or semi-structured documents such as statements and invoices, where the required data elements remain in the exact location on the page. Though templates provide a high level of accuracy, the problem with this approach is that if the format of a document changes, a new template has to be created every time. Templates limit the scope of extracting valuable insights from data. The task of creating and maintaining templates for multiple document types is manual, time-consuming, and not scalable with the possibility of manual errors.

Template-Free OCR: A democratic solution to process documents.

Unlike the traditional template-based approach, template-free OCR understands the context of documents to optimize data extraction. The technology combines the traditional OCR with Deep Learning, computer vision and neural networks to scan and dynamically process data from the documents in structured or unstructured form. It identifies multiple document types in a multi-page document and automatically splits it into single pages along with classification. This speeds up the process and reduces continuous manual intervention, giving document processing freedom and independence from the clutches of template-based OCR. DocVu.AI can also accurately distinguish between real image detail and noise. The solution leverages noise reduction technology to eliminate noise and extract the required information.

In the context of the mortgage industry, Intelligent Document Processing Solutions leverage the template-free approach to expedite loan processing from end-to-end to shorten closing cycles with greater accuracy and cost efficiency. With AI/ML at its core, template-free OCR solutions accelerate the straight-through processing (STP) percentage through continuous learning.

The key advantages of the template-free approach are:

A higher degree of information accountability and visibility.

Improved responses of enterprises to customers.

Faster and better decision-making compared to paper-based workflows.

Reduction in costs.

Speedy extraction of unstructured data from documents.

Increased productivity and efficiency.

Better employee management hence better TAT and customer satisfaction.

Case Study — How Automating Document Processing proved beneficial for a large US bank providing residential mortgages.

A top bank in the US, offering residential mortgage services across 50 states, can have innumerable templates for some of their mortgage offerings. The template-based approach still made the process highly manual and the technology wasn’t scalable, thus limiting the scope of extracting insightful data and increasing the turnaround time for the customers. DocVu.AI with its speedy extraction of unstructured data from documents and democratized automation with its “Template-Free” approach increased the productivity and efficiency of the processing of the loans. As a result, the bank saved up to 53% in 6 months and had an annualized savings of 99.2%.

About DocVu.AI: Ushering Freedom from the Template-Based Approach.

DocVu.AI is a cloud-based open, robust, and enterprise-grade Intelligent Document Processing solution that improves quality, reduces manual effort, and shortens the closing cycle. Having processed over 10 million loans with over 350 different templates, DocVu.AI leverages the power of template-free OCR technology to increase STP percentage. Enhance your revenues by cutting up to 30% of the cost of processing every mortgage package by harnessing the power of DocVu.AI.

“We have more details that let you explore how DocVu.AI helps you to make your operations more efficient with the following article.”

0 notes

Text

Automation: Key to Streamlining Mortgage Document Processing in a competitive market

“Things get done only if the data we gather can inform and inspire those in a position to make [a] difference.”

– Mike Schmoker, Education Writer, Speaker.

Data is the fuel that powers businesses to make informed decisions, but the critical question remains, “Is the data relevant?” For Data to be relevant, enterprises need solutions that intuitively process structured and unstructured documents and cull out appropriate insights.

To make the data relevant, Intelligent Document Processing (IDP) solutions function as the ‘Third Eye’, a symbol of intuitive capabilities. IDP Solutions, powered by the cognitive and intuitive abilities of AI/ML, takes data beyond just mundane document processing. They meticulously extract key data insights, identify gaps, and offer customized reports that otherwise cannot be achieved seamlessly through manual processes.

As a case in point, one of the largest mortgage service providers in the world improved its bulk loan processing capability with the help of a robust and enterprise-grade Intelligent Document Processing solution. Some of the challenges earlier faced by this Mortgage Service provider were:

High volumes of loans and variability in demand leading to unpredictable outcomes such as quality, readability, etc.

Loans coming from various sellers were not in a uniform format, resulting in an increased processing time.

Absence of an automated system requiring manual processing of loans.

The above establishes that technology as a Third Eye is essential not only for data extraction but also for data validation and security. With the adoption of an intuitive IDP platform powered by OCR, the service provider could seamlessly achieve:

Easy processing of diverse loans

Reduction of manual effort to process the loans

Accuracy and speed in the data processing

DocVu.AI – the ‘Third Eye’ in today’s era

“Any sufficiently advanced technology is equal to magic.” – Sir Arthur C Clarke.

We have already discussed the attributes of AI/ML-based technology as a Third Eye and why these were needed. With strong domain expertise, DocVu.AI helps improve the end-to-end processing of loans starting from origination and going on to application, approval, closing, servicing, and securitization. The solution with its robust technology not only focuses on growth but also on ease, efficiency, and accuracy.

DocVu.AI is an enterprise-grade Intelligent Document Processing solution. Its OCR technology helps identify text within a digital image, extracts the data, and converts it into machine-comprehensible text, thereby increasing the scalability of the loans processed without any scope of data error or documents being missed out. It is backed by effective implementation in terms of security controls in Access Management, Change Management, Incident Management, Risk and Vulnerability Management, and Business Continuity Management. DocVu.AI is also certified by Veracode to comply with the highest standards of security risk prevention which is essential for any data-driven solution these days.

As a result, DocVu.AI stands strong as the Third Eye in the mortgage industry as it leverages various technologies to deliver value with timely validated quality data that is structured and compliant with data privacy norms. The Third Eye is in a way Democratizing Automation and making the Data ‘Relevant’.

We have more details that let you explore how DocVu.AI helps you to make your operations more efficient with the following article.

0 notes

Text

Maximize business returns with Intelligent document processing

‘A Dream Home’, one’s lifetime ambition is most often fueled by mortgage companies. Lenders ensure all checks and balances are done when processing documents, enabling the home seekers to inch closer to their dreams.

The US mortgage industry is under the constant influence of macroeconomic parameters viz. interest rates, inflation, economic policies, and geopolitical stability. These external factors have a huge impact on the financial health of mortgage companies.