Web TT is a complete online money transfer solution built on the latest technology. It is one of the most convenient and cost-effective modes of sending money online. Once signed up with the service, customers can log on to the portal at any time and send money online through bank accounts, debit or credit cards.

Don't wanna be here? Send us removal request.

Text

Effortless Money Transfers in Abu Dhabi with GCC Exchange

Abu Dhabi, the vibrant capital of the UAE, is a global hub where expatriates, businesses, and travelers converge, creating a high demand for reliable money transfer services. Whether you're sending funds to family overseas, paying international vendors, or managing personal finances, finding a secure and cost-effective remittance solution is essential. GCC Exchange, through its innovative WebTT platform, offers a seamless way to handle money transfers in Abu Dhabi. This guest blog explores how GCC Exchange simplifies international remittances, making it the top choice for residents seeking convenience and value. Visit https://ae.gccexchange.com/ to get started.

The Need for Money Transfers in Abu Dhabi

Home to a diverse expatriate community, Abu Dhabi sees constant demand for international money transfers. From Filipino workers sending remittances home to Indian professionals supporting families, or businesses settling cross-border invoices, the city’s financial landscape is dynamic. Traditional methods like bank transfers or exchange houses often involve high fees, delays, and cumbersome processes. GCC Exchange addresses these challenges with WebTT, a modern online platform designed to meet the unique needs of Abu Dhabi’s residents, offering speed, transparency, and affordability.

What is WebTT?

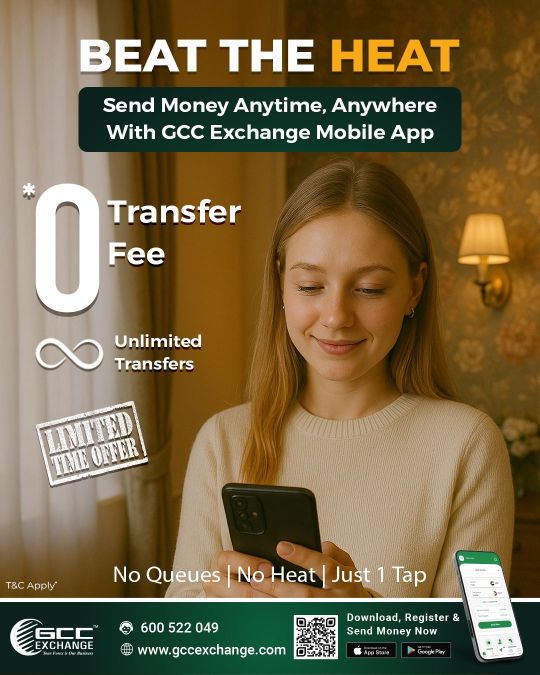

WebTT, GCC Exchange’s online money transfer solution, combines cutting-edge technology with user-friendly features to deliver a superior remittance experience. Accessible via https://ae.gccexchange.com/ or the GCC Exchange mobile app, WebTT allows users to send money globally using bank accounts, debit, or credit cards. With competitive exchange rates (e.g., 1 AED = 23.72 INR, indicative rate), quick processing, and exceptional customer support, WebTT is transforming how Abu Dhabi residents manage international transfers.

Standout Features of WebTT

Quick Registration: Sign up in just one minute, enabling instant access to transfer services.

Transparent Pricing: No hidden charges ensure you know exactly what you’re paying.

Robust Security: Encrypted software guarantees 100% protection for your transactions.

24/7 Accessibility: Send money anytime, anywhere, from your smartphone or computer.

Competitive Rates: Maximize the value of your transfers with favorable exchange rates.

Flexible Transfer Options for Every Need

GCC Exchange recognizes that no two money transfers are the same. WebTT offers a range of options tailored to Abu Dhabi’s diverse population:

Cash to Account: Transfer funds directly to any bank account worldwide, ideal for regular remittances or business payments.

Cash Pickup: Beneficiaries can collect cash from authorized payout partners globally, perfect for urgent situations.

Cash to Home: Send money straight to your loved ones’ doorstep, offering unparalleled convenience.

Cash to Mobile: Deposit funds into mobile wallets for uses like shopping, utility payments, or ATM withdrawals.

These versatile options ensure WebTT meets the needs of everyone in Abu Dhabi, from individuals sending small amounts to families to businesses handling large transactions.

Why GCC Exchange Stands Out in Abu Dhabi

With numerous remittance providers in the market, GCC Exchange distinguishes itself through its customer-focused approach and local expertise:

Exceptional Support: Rated 100% for customer service, the team is always ready to assist.

Regional Knowledge: Operating across the UAE, GCC Exchange understands Abu Dhabi’s unique financial needs.

Mobile App Convenience: The GCC Exchange app allows users to track transfers, set rate alerts, and manage transactions on the go.

Trusted Team: Professionals like Shentil Anand and Ismayil Karutharayuil ensure reliable service delivery.

Advantages of Online Money Transfers with WebTT

Choosing WebTT over traditional methods offers significant benefits for Abu Dhabi residents:

Time Efficiency: Complete transfers in minutes without visiting a branch.

Cost Savings: Enjoy competitive rates and no hidden fees, ensuring more money reaches your recipient.

Global Network: WebTT’s extensive payout partnerships ensure funds reach even remote destinations.

Peace of Mind: Real-time tracking and top-tier security keep your transactions safe.

Getting Started with WebTT in Abu Dhabi

Ready to simplify your money transfers? Follow these easy steps:

Access the Platform: Visit https://ae.gccexchange.com/ or download the GCC Exchange app.

Register: Complete the one-minute sign-up process.

Select Transfer Type: Choose cash to account, pickup, home delivery, or mobile wallet.

Enter Details: Provide recipient information and transfer amount.

Send Funds: Pay securely using your bank account, debit, or credit card.

After initiating the transfer, you can monitor its progress and set rate alerts to optimize future transactions.

Tips for Smart Money Transfers in Abu Dhabi

To make the most of your remittances with GCC Exchange:

Monitor Exchange Rates: Use WebTT’s rate alert feature to transfer when rates are favorable.

Verify Recipient Details: Double-check bank or wallet information to avoid delays.

Leverage the App: The mobile app offers real-time updates and easy access to support.

Plan Ahead: For regular transfers, schedule payments to ensure timely delivery.

Conclusion

For Abu Dhabi residents seeking a fast, secure, and affordable way to send money internationally, GCC Exchange’s WebTT platform is unmatched. With its intuitive interface, diverse transfer options, and commitment to transparency, WebTT empowers users to manage remittances effortlessly. Whether you’re supporting family in Asia, paying suppliers in Europe, or sending funds to Africa, GCC Exchange delivers a world-class experience. Visit https://ae.gccexchange.com/ or download the app today to discover a smarter way to handle money transfers in Abu Dhabi.

#uae money transfer app#money transfer app in uae#money transfer app from uae to india#best app to transfer money from uae to india#online money transfer

0 notes

Text

How to Start Forex Trading in Dubai: A Guide to Licensed Accounts and CFD vs Forex for UAE Investors

Dubai, with its thriving financial ecosystem and investor-friendly regulations, has become a hub for retail traders seeking opportunities in the forex market. If you are a UAE resident or expat interested in entering this fast-paced world of currency trading, understanding the basics—starting from getting a licensed trading account in Dubai to choosing between Forex vs CFD trading—is essential.

How to Start Forex Trading in Dubai

The first step to begin your trading journey in Dubai is to choose a broker licensed by the Securities and Commodities Authority (SCA) or Dubai Financial Services Authority (DFSA). These regulatory bodies ensure that brokers follow strict compliance protocols, protecting your funds and personal data.

Here’s how to get started:

Choose a Licensed Broker: Look for an SCA or DFSA-approved broker. These entities offer investor protection, transparent pricing, and local customer support.

Open a Licensed Trading Account in Dubai: Complete your KYC process by submitting Emirates ID, passport, visa copy, and proof of address. Make sure the account you open is labeled as a "licensed trading account" with regulatory backing.

Fund Your Account: Use local bank transfers or credit cards to deposit funds securely.

Select Your Trading Platform: MetaTrader 4, MetaTrader 5, and cTrader are popular platforms that offer live charts, market orders, and expert advisor (EA) support.

Start with a Demo Account: Before risking real money, practice on a demo account to understand market dynamics.

Forex vs CFD Trading Explained for UAE Investors

Both Forex (foreign exchange) and CFD (contract for difference) trading are popular in the UAE, but they differ in structure, instruments, and risk levels.

Forex Trading

Forex trading involves buying one currency while selling another. For example, trading EUR/USD means you're speculating whether the Euro will rise or fall against the US dollar. It operates 24 hours a day and offers high liquidity and leverage. It’s ideal for traders focused solely on currencies.

CFD Trading

CFDs, on the other hand, are derivative contracts that allow you to trade a wide range of assets—stocks, indices, commodities, and even cryptocurrencies—without owning the underlying asset. You profit from the price difference between entry and exit points. CFDs offer greater diversification but may involve higher fees or overnight charges.

Key Differences for UAE Investors:

Regulation: Forex and CFDs are both regulated by the SCA and DFSA in Dubai. Ensure the broker offers a licensed trading account in Dubai for both instruments.

Leverage: Forex typically offers higher leverage than CFDs, but that also means higher risk.

Market Access: CFDs give broader access to global markets, while forex is more focused.

Conclusion

If you’re exploring how to start forex trading in Dubai, begin by choosing a DFSA-licensed broker and opening a licensed trading account. Then, decide whether you want to stick with forex pairs or explore CFDs for broader exposure. Understanding the Forex vs CFD trading differences is crucial for informed decision-making and risk management. With the right tools, education, and regulation, Dubai offers a secure environment for your trading journey.

#money transfer app in uae#best app to transfer money from uae to india#dubai to india money transfer app#money transfer app from uae to india

0 notes

Text

UAE Exchange money transfer is a trusted and convenient solution for sending money internationally, especially from the UAE to countries like India, Pakistan, the Philippines, and more. With a strong presence across the UAE, UAE Exchange offers competitive exchange rates, low transfer fees, and fast processing times. Whether you're using their branches or digital platform, you can expect secure and efficient remittance services. The company is regulated by UAE financial authorities, ensuring complete safety of your transactions. For millions of expats, UAE Exchange remains a go-to option for reliable, hassle-free money transfers both online and offline.

#money transfer app in uae#dubai to india money transfer app#best app to transfer money from uae to india#uae money transfer app#online money transfer app in uae

0 notes

Text

The Best Dubai to India Money Transfer App – Fast, Secure, and Reliable with GCC Exchange

Sending money from Dubai to India has never been easier, thanks to the rise of mobile remittance platforms. In a digital-first world, expatriates no longer have to wait in queues or visit branches to send funds home. Whether it's for family support, investments, or emergency needs, having access to a trustworthy Dubai to India money transfer app can make all the difference.

This is where GCC Exchange stands out—with a feature-rich, user-friendly platform designed to simplify international money transfers. Accessible via https://ae.gccexchange.com, GCC Exchange is your one-stop solution for fast, secure, and affordable cross-border remittance.

Why GCC Exchange Is the Best Dubai Money Transfer App

GCC Exchange is a well-established name in the UAE’s financial services sector, offering currency exchange and global remittance services trusted by millions. Their mobile app is widely recognized as one of the top-rated Dubai money transfer apps—and for good reason:

Key Features:

Competitive Exchange Rates: Get the most value for every dirham sent to India.

Quick Transfers: Most transactions are completed within minutes.

Bank-Level Security: Your data and funds are protected with end-to-end encryption.

Easy-to-Use Interface: Clean design and intuitive navigation.

Real-Time Tracking: Monitor the status of your transfer in real-time.

24/7 Access: Send money anytime, from anywhere in the UAE.

Whether you're a working professional or a business owner, GCC Exchange simplifies your cross-border transactions like no other online money transfer app in UAE.

Dubai to India Money Transfer – Seamless and Instant

The UAE is home to over 3 million Indian expatriates, most of whom send money back home regularly. The GCC Exchange app makes Dubai to India money transfer quick and stress-free. With just a few taps, you can:

Add your recipient’s Indian bank details.

Enter the amount you wish to send.

Confirm the exchange rate and make payment.

Track your transfer until it’s completed.

Funds can be sent directly to Indian bank accounts or made available for cash pickup, depending on your preference.

Why GCC Exchange Is the Best Online Money Transfer App in UAE

What makes GCC Exchange the preferred choice among countless expats is its focus on speed, safety, and simplicity. The app supports multi-language features, works across Android and iOS, and offers a seamless experience whether you're transferring small or large amounts.

Unlike many platforms, GCC Exchange is licensed and regulated by UAE financial authorities, offering peace of mind with every transaction.

Final Thoughts

If you’re looking for the most reliable Dubai money transfer app, or a powerful online money transfer app in UAE, look no further than GCC Exchange. Whether you're sending money to support your family or manage investments, GCC Exchange ensures your funds arrive quickly and securely.

Visit https://ae.gccexchange.com or download the app today—and experience the smartest way to send money from Dubai to India.

#best app to transfer money from uae to india#money transfer app in uae#uae money transfer app#online money transfer

0 notes

Text

Currency Exchange & Money Transfer Company in UAE | GCC Exchange

Best App for Money Exchange - Compare Your Options

Money exchange apps have transformed international transfers. The best platforms offer competitive rates, low fees, and fast processing. Consider apps with transparent pricing, multiple payment options, and strong security features. Read user reviews and compare rates before choosing your preferred platform.

GCC Exchange provides the best money exchange experience with competitive rates, secure transactions, and exceptional customer support for all your international transfer requirements.

Visit: https://www.gccexchange.com/

#money transfer app in uae#best app to transfer money from uae to india#dubai to india money transfer app

0 notes

Text

Currency Exchange & Money Transfer Company in UAE | GCC Exchange

India to Dubai Money Transfer - Reverse Remittances Made Easy

Reverse remittances from India to Dubai are increasingly common for investments and business purposes. Choose reliable platforms offering competitive rates and secure transfers. The best apps provide transparent pricing, fast processing, and multiple transfer options for your convenience.

GCC Exchange facilitates seamless India to Dubai transfers with competitive rates, secure processing, and dedicated customer support for all your international money transfer needs.

#money transfer app in uae#uae to india money transfer app#money transfer app from uae to india#uae money transfer app

0 notes

Text

UAE to India Money Transfer Apps

The specific corridor between UAE and India represents one of the world's largest remittance flows, driving innovation in uae to india money transfer app development. Understanding the unique features and advantages of specialized applications helps expatriates make informed decisions about their international transfer needs.

A dedicated uae to india money transfer app typically offers specialized features tailored to this popular corridor, including optimized exchange rates, streamlined verification processes for Indian bank accounts, and integration with popular Indian payment systems. These specialized features can provide significant advantages over generic international transfer applications.

Competitive exchange rates are often a primary consideration when selecting a uae to india money transfer app. Applications specializing in this corridor may offer preferential rates due to volume advantages and market expertise. Real-time rate comparisons and historical rate charts help users monitor market trends and optimize transfer timing.

Processing speed for UAE to India transfers has improved dramatically with specialized applications. Many uae to india money transfer app options now offer near-instant transfers to major Indian banks, with funds availability within minutes rather than days. This speed advantage is particularly valuable for urgent transfers or emergency situations.

Indian banking integration is a key differentiator among various applications. Advanced uae to india money transfer app solutions provide seamless connectivity with major Indian banks, enabling direct account credits, real-time status updates, and automated beneficiary verification. This integration improves reliability and user experience significantly.

Verification processes for UAE to India transfers are often streamlined in specialized applications, with pre-configured document requirements and automated verification systems. This efficiency reduces the time required for account setup and transaction approval, improving overall user satisfaction.

Regulatory compliance for UAE to India transfers involves both UAE and Indian financial regulations. Quality applications ensure adherence to all applicable requirements, including Reserve Bank of India guidelines and UAE Central Bank regulations. This compliance provides security and legitimacy for users' transactions.

Customer support for specialized corridor applications often includes language support in Hindi, Arabic, and English, reflecting the diverse user base. Dedicated support teams familiar with common transfer scenarios provide more effective assistance compared to generic international services.

Loyalty programs and volume discounts are common features in uae to india money transfer app solutions, recognizing the regular remittance patterns of expatriate users. These programs can provide significant cost savings for frequent users.

Discover specialized uae to india money transfer app services at GCC Exchange, where corridor expertise meets innovative technology for optimal transfer experiences.

0 notes

Text

Top Money Transfer Apps in UAE

The proliferation of smartphone technology has revolutionized international money transfers, with numerous money transfer app in uae options now available to residents and businesses. Selecting the right application requires understanding key features, security measures, and service quality factors that impact user experience.

A quality money transfer app in uae should provide intuitive user interface design, making navigation simple for users regardless of their technical expertise. Key features include easy account setup, straightforward transfer initiation, real-time rate displays, and comprehensive transaction history. The best applications balance functionality with simplicity, ensuring efficient user experiences.

Security features are paramount in any financial application. Leading money transfer app in uae options employ advanced encryption, biometric authentication, and multi-factor verification to protect user data and funds. Regular security updates and compliance with financial regulations provide additional layers of protection against fraud and unauthorized access.

Exchange rate competitiveness varies significantly among different applications. Some apps provide rates comparable to traditional exchange houses, while others may apply substantial markups. Rate transparency, real-time updates, and comparison tools help users identify the most favorable options for their transfers.

Processing speed capabilities differ among various applications, with some offering instant transfers while others require several hours or days for completion. Understanding these timeframes helps users select appropriate service levels based on their urgency requirements and recipient needs.

Customer support quality can significantly impact user satisfaction, especially when dealing with transfer issues or questions. Look for applications offering multiple support channels, including in-app chat, phone support, and email assistance. Multilingual support is particularly valuable in the diverse UAE market.

Transfer limits and fee structures should align with user needs and transfer patterns. Some applications excel for small, frequent transfers, while others provide better value for larger amounts. Understanding fee structures, including fixed charges and percentage-based commissions, helps identify cost-effective options.

User reviews and ratings provide valuable insights into application performance, reliability, and customer service quality. Reading recent reviews helps understand current service levels and identify any recurring issues or concerns.

Explore advanced money transfer app solutions at GCC Exchange, where cutting-edge mobile technology delivers exceptional transfer experiences.

0 notes

Text

WebTT - Send Money Online from UAE | GCC Exchange

Choosing the Right Money Transfer App for Different Transfer Amounts

Selecting the optimal money transfer app in UAE depends significantly on your typical transfer amounts, as different platforms offer varying advantages based on transaction size and frequency.

Small Transfers (AED 100-500) For smaller amounts, focus on UAE to India money transfer apps with low fixed fees rather than percentage-based charges. Some platforms offer free transfers for first-time users or small amounts, making them ideal for occasional remittances. Apps with instant transfer capabilities are particularly valuable for urgent small payments.

Medium Transfers (AED 500-2000) Medium-sized transfers benefit from apps offering competitive exchange rates with reasonable fees. Many money transfer apps in UAE provide their best rates for this range, balancing profitability with customer satisfaction. Look for platforms with loyalty programs that reduce fees for regular users.

Large Transfers (AED 2000+) Larger transfers require careful consideration of both fees and exchange rates. Apps offering tiered pricing often provide better value for substantial amounts. Security features become crucial for large transfers, so prioritize platforms with robust fraud protection and insurance coverage.

Frequency Considerations Regular senders should prioritize apps with subscription models or loyalty programs. Monthly fee structures can be more economical than per-transaction charges for frequent users. Some UAE to India money transfer apps offer premium memberships with enhanced exchange rates and reduced fees.

Speed Requirements Express services typically cost more but may be justified for urgent transfers regardless of amount. Standard services offer better value for routine remittances where speed isn't critical.

Recipient Preferences Consider how recipients prefer to receive funds. Some apps excel at bank deposits, while others offer superior cash pickup networks or mobile wallet integration.

Transfer Purpose Emergency transfers may warrant premium services, while regular family support can use standard options. Investment-related transfers might benefit from apps with better exchange rate tracking and timing features.

Matching your transfer patterns with appropriate money transfer apps in UAE ensures optimal value and service quality.

0 notes

Text

The Future of Digital Remittances: UAE Money Transfer App Innovations

The landscape of digital remittances is evolving rapidly, with money transfer apps in UAE leading technological innovations that promise to revolutionize how expatriates send money home to India and other destinations.

Artificial Intelligence integration is transforming user experiences. Modern UAE to India money transfer apps employ AI to predict optimal transfer times based on exchange rate patterns, helping users maximize their transfer value. Machine learning algorithms also enhance fraud detection, providing superior security without compromising transaction speed.

Blockchain technology is emerging as a game-changer for transparency and security. Several platforms are exploring blockchain-based solutions that provide immutable transaction records and potentially reduce transfer costs by eliminating intermediaries.

Biometric authentication is replacing traditional password systems. Fingerprint scanning, facial recognition, and voice authentication are becoming standard features, offering enhanced security while simplifying the user experience.

Real-time cross-border payments are becoming reality. Advanced money transfer apps in UAE are implementing instant settlement systems that complete transfers within seconds rather than hours or days, particularly beneficial for emergency situations.

Integration with digital wallets and cryptocurrencies is expanding payment options. Some platforms now support popular Indian digital wallets as payout methods, while others are experimenting with cryptocurrency-backed transfers for faster, cheaper transactions.

Predictive analytics help users make informed decisions. Apps now provide historical exchange rate data, trend analysis, and rate forecasts, enabling users to time their transfers strategically.

Enhanced customer support through chatbots and virtual assistants ensures 24/7 availability. These AI-powered systems can handle routine inquiries, process simple transactions, and escalate complex issues to human agents when necessary.

As these innovations mature, UAE to India money transfer apps will become more efficient, secure, and user-friendly, making international remittances seamless and cost-effective for millions of expatriates.

0 notes

Text

Troubleshooting Common Issues with UAE Money Transfer Apps

Even the best money transfer app in UAE can encounter occasional issues. Understanding common problems and their solutions ensures smooth transfer experiences and quick resolution of any difficulties.

Transfer Delays Delays often result from incomplete documentation or compliance checks. Ensure all required documents are uploaded clearly and completely. Contact customer support if delays exceed stated timeframes, as additional verification may be required.

Failed Transactions Transaction failures typically occur due to insufficient funds, incorrect beneficiary details, or technical issues. Verify account balance and recipient information accuracy. Most UAE to India money transfer apps automatically refund failed transfers within 24-48 hours.

Exchange Rate Disputes Rate fluctuations can cause confusion when transfer amounts differ from initial quotes. Apps typically lock rates for limited periods, after which new rates apply. Complete transfers quickly after rate confirmation to avoid unexpected changes.

Account Verification Issues Document rejection often stems from poor image quality or expired documents. Ensure photos are clear, well-lit, and show all document details. Use current documents and avoid partial or blurred images.

Beneficiary Problems Recipients may face issues collecting funds due to bank processing delays or incorrect details. Verify beneficiary information thoroughly and ensure recipient banks support the chosen transfer method.

App Performance Issues Slow loading or crashes may indicate app updates or server maintenance. Restart the app, check for updates, or try again later. Persistent issues warrant customer support contact.

Customer Service Challenges Long response times can frustrate users needing immediate assistance. Use multiple contact methods including chat, email, and phone. Document your issue clearly with transaction numbers and screenshots.

Security Concerns Unusual account activity or suspected fraud requires immediate action. Change passwords, enable additional security features, and report concerns to customer support immediately.

Understanding these common issues helps users navigate money transfer apps in UAE more effectively, ensuring reliable service for all remittance needs.

0 notes

Text

Understanding Regulatory Compliance for Money Transfer Apps in UAE

Regulatory compliance ensures your chosen money transfer app in UAE operates legally and safely. Understanding these regulations helps users select legitimate platforms while avoiding potential legal issues.

The UAE Central Bank regulates all money transfer services, including digital platforms. Licensed UAE to India money transfer apps must comply with strict anti-money laundering (AML) and know-your-customer (KYC) requirements, ensuring transaction legitimacy.

AML regulations require comprehensive transaction monitoring. Licensed apps implement sophisticated systems to detect suspicious activities, protecting users from involvement in illegal financial activities. These measures may occasionally delay transfers for additional verification.

KYC compliance mandates thorough customer identification. Users must provide extensive documentation including Emirates ID, passport, visa, and proof of address. This verification process, while sometimes lengthy, ensures platform security and regulatory adherence.

Transfer limits reflect regulatory requirements. Most money transfer apps in UAE impose daily, monthly, and annual transfer limits based on customer verification levels. Higher limits typically require additional documentation and approval processes.

Record-keeping obligations protect both users and service providers. Regulated apps maintain detailed transaction histories for specified periods, enabling authorities to investigate suspicious activities while providing users with comprehensive transfer records.

Cross-border regulations involve both UAE and Indian authorities. Legitimate apps coordinate with Reserve Bank of India requirements, ensuring seamless transfers while maintaining compliance with both jurisdictions' regulations.

Regular audits ensure ongoing compliance. Licensed platforms undergo periodic regulatory reviews, maintaining their operational licenses and ensuring continued service reliability.

Choosing regulated UAE to India money transfer apps provides legal protection and service reliability. These platforms invest heavily in compliance infrastructure, offering users peace of mind regarding transaction security and regulatory adherence.

Always verify app licensing through official UAE Central Bank channels before trusting any platform with your financial transactions.

0 notes

Text

Step-by-Step Guide to Your First Money Transfer Using UAE Apps

Making your first transfer through a money transfer app in UAE can seem daunting, but following these simple steps ensures a smooth, secure experience sending money to India.

Step 1: Download and Registration Choose a reputable UAE to India money transfer app from official app stores. Complete registration using your Emirates ID, passport, and UAE residence visa. Most apps require phone number verification for security purposes.

Step 2: Identity Verification Upload clear photos of required documents including passport, Emirates ID, and visa. Some apps may request a selfie for biometric verification. This process typically takes 24-48 hours for approval.

Step 3: Add Beneficiary Details Enter recipient information including full name, address, and bank account details. Double-check all information for accuracy, as incorrect details can delay transfers or result in additional fees.

Step 4: Choose Transfer Method Select your preferred funding method - bank account, debit card, or credit card. Each option has different processing times and fees, so choose based on your urgency and cost preferences.

Step 5: Enter Transfer Amount Specify the amount in AED you wish to send. The app will display the equivalent INR amount after deducting fees and applying exchange rates. Review all details carefully before proceeding.

Step 6: Review and Confirm Verify all transfer details including recipient information, transfer amount, fees, and expected delivery time. Most money transfer apps in UAE provide detailed transaction summaries before final confirmation.

Step 7: Complete Payment Authorize payment using your chosen method. Save the transaction reference number for tracking purposes.

Step 8: Track Your Transfer Monitor transfer status through the app's tracking feature. You'll receive notifications when funds are delivered to your beneficiary.

Following these steps ensures your first UAE to India money transfer app experience is successful and secure.

0 notes

Text

Comparing Fees and Exchange Rates Across UAE Money Transfer Apps

Understanding fee structures and exchange rates is crucial when selecting a money transfer app in UAE. These factors directly impact the amount your beneficiaries receive, making comparison essential for maximizing transfer value.

Most UAE to India money transfer apps employ different fee models. Some charge fixed fees regardless of transfer amount, while others use percentage-based structures. Fixed fees benefit larger transfers, while percentage-based systems may favor smaller amounts.

Exchange rate margins significantly affect your transfer value. Apps typically offer rates slightly below market rates, with the difference representing their profit. Compare live exchange rates across multiple platforms to identify the most competitive options.

Hidden fees can erode transfer value unexpectedly. Some apps advertise low upfront fees but compensate through poor exchange rates. Calculate the total cost by considering both fees and exchange rate differences from market rates.

Transfer speed often correlates with cost. Express services commanding premium fees may be worthwhile for urgent transfers, while standard services offer better value for routine remittances.

Promotional offers can provide substantial savings. Many money transfer apps in UAE offer introductory rates, loyalty bonuses, or limited-time promotions that significantly reduce transfer costs.

Transfer amount tiers influence pricing. Some apps offer better rates for larger transfers, while others maintain consistent pricing regardless of amount. Choose apps aligning with your typical transfer patterns.

Payment method affects costs too. Bank transfers often incur lower fees than debit card payments, while credit card funding may attract additional charges.

Regular comparison ensures optimal value. Exchange rates fluctuate daily, and promotional offers change frequently. Monitoring multiple UAE to India money transfer apps helps identify the best deals for each transfer, maximizing the funds reaching your loved ones.

0 notes

Text

Security Best Practices When Using Money Transfer Apps in UAE

Security remains paramount when using any money transfer app in UAE, especially given the substantial amounts typically transferred from the UAE to India. Understanding and implementing proper security measures protects both your funds and personal information.

Start with strong authentication practices. Enable two-factor authentication whenever available and use unique, complex passwords for your UAE to India money transfer app. Avoid using public Wi-Fi networks for financial transactions, as these connections may be vulnerable to interception.

Verify app authenticity before downloading. Only download money transfer apps from official app stores and check developer credentials. Fraudulent apps often mimic legitimate services to steal user credentials and funds.

Keep your app updated with the latest security patches. Developers regularly release updates that address security vulnerabilities and enhance protection features. Enable automatic updates to ensure you're always using the most secure version.

Monitor your transaction history regularly. Most money transfer apps in UAE provide detailed transaction logs. Review these records frequently to identify any unauthorized activity immediately.

Be cautious with personal information sharing. Legitimate apps will never ask for sensitive details like full bank account numbers or passwords through email or text messages. Always verify requests through official customer service channels.

Use secure networks and devices for transfers. Ensure your smartphone has updated security software and avoid using shared or public devices for financial transactions.

Report suspicious activity immediately. If you notice unusual account behavior or unauthorized transactions, contact customer support instantly. Quick response can prevent significant losses.

Understanding these security practices ensures your UAE to India money transfer app experience remains safe and reliable, protecting your financial interests while maintaining seamless remittance capabilities.

0 notes

Text

How UAE to India Money Transfer Apps Are Revolutionizing Remittances

The remittance landscape between UAE and India has transformed dramatically with the introduction of sophisticated UAE to India money transfer apps. These digital platforms have revolutionized how expatriates send money home, offering unprecedented convenience and efficiency.

Traditional money transfer methods often involved long queues, limited operating hours, and complex documentation. Modern money transfer apps in UAE have eliminated these barriers by providing 24/7 accessibility from your smartphone. Users can initiate transfers anytime, anywhere, without visiting physical locations.

Cost-effectiveness represents another revolutionary aspect. Digital platforms typically offer better exchange rates compared to traditional money changers, saving users significant amounts on large transfers. Many apps also provide rate alerts, helping users time their transfers for maximum value.

The speed of transactions has improved remarkably. While traditional methods could take days, contemporary UAE to India money transfer apps often complete transfers within hours. Some premium services offer instant transfers, crucial for urgent financial needs.

Enhanced transparency builds user confidence. These apps provide real-time tracking, allowing users to monitor their transfer status from initiation to completion. Recipients receive instant notifications when funds arrive, eliminating uncertainty about transaction timing.

Security features have evolved to meet international standards. Advanced encryption, biometric authentication, and regulatory compliance ensure transfer safety. Many apps also offer transaction history and receipt generation for record-keeping purposes.

The integration of multiple payout options has expanded recipient convenience. Whether through bank deposits, mobile wallets, or cash pickup locations, recipients can choose their preferred method of receiving funds.

As technology continues advancing, money transfer apps in UAE are introducing features like AI-powered fraud detection, blockchain integration, and enhanced customer support through chatbots, making remittances more secure and user-friendly than ever before.

0 notes

Text

Maximizing Value: How to Get the Best Exchange Rates Using Money Transfer Apps from UAE to India

Exchange rates play a crucial role in determining the value recipients receive when using a money transfer app from UAE to India, making it essential for users to understand how rates work and how to optimize their transfers for maximum value. GCC Exchange provides users with the tools and knowledge needed to make informed decisions about their international remittances.

Understanding exchange rate fundamentals is the first step in maximizing value through any online money transfer app in UAE. Exchange rates fluctuate constantly based on economic conditions, political events, and market sentiment in both the UAE and India. These fluctuations can significantly impact the amount recipients receive, making timing an important factor in transfer decisions.

GCC Exchange's dubai to india money transfer app provides real-time exchange rate information that helps users monitor AED to INR conversion rates throughout the day. The app displays current rates, historical trends, and market analysis that enable users to identify favorable conditions for their transfers. This transparency allows users to make educated decisions about when to send money.

Rate alert systems are a valuable feature of the money transfer app from UAE to India that help users optimize their transfers. Users can set preferred exchange rates and receive notifications when these rates become available. This feature is particularly useful for users who transfer money regularly and want to maximize the value of their remittances over time.

The online money transfer app in UAE includes comparison tools that show how GCC Exchange rates compare to other providers in the market. This transparency helps users understand the value they're receiving and makes it easier to evaluate different transfer options. The app also provides calculators that show exactly how much recipients will receive in Indian Rupees for any given transfer amount.

Timing strategies can significantly impact the value received through a dubai to india money transfer app. Economic announcements, policy changes, and market events can create favorable exchange rate conditions. GCC Exchange provides market insights and analysis that help users understand these patterns and time their transfers accordingly.

The money transfer app from UAE to India offers different service tiers that balance speed and cost, allowing users to choose options that best meet their needs. Express transfers typically offer convenience at a premium rate, while standard transfers may provide better exchange rates for users who can wait longer for fund delivery.

Promotional offers and loyalty programs through the online money transfer app in UAE can provide additional value for regular users. GCC Exchange frequently offers special rates, reduced fees, and bonus promotions that help users save money on their transfers. The app notifies users of these opportunities and automatically applies eligible discounts.

Volume considerations can affect the rates available through a dubai to india money transfer app. Larger transfers may qualify for preferential rates, while smaller transfers might be subject to standard pricing. Understanding these thresholds helps users optimize their transfer amounts for better value.

The money transfer app from UAE to India includes features that help users track their transfer costs over time, providing insights into spending patterns and opportunities for optimization. Historical data shows users how much they've sent, what rates they've received, and how their transfer costs have changed over time.

Market volatility can create both opportunities and challenges for users of the online money transfer app in UAE. The app provides volatility indicators and market commentary that help users understand current conditions and make informed decisions about whether to transfer immediately or wait for better rates.

Long-term strategies for using the dubai to india money transfer app include regular monitoring of exchange trends, setting up automatic transfers during favorable conditions, and taking advantage of seasonal patterns that may affect AED to INR rates. These strategies help users maximize value consistently over time.

#money transfer app from uae to india#dubai to india money transfer app#online money transfer app in uae

0 notes