iTechGRC, a part of iTechUS, Inc., empowers businesses with risk management, compliance, and audit solutions. Our cutting-edge technology enhances security, flexibility, and cost efficiency. With over 20 years of expertise, we have transformed 500+ businesses across industries. We specialize in integrated risk management tailored to your unique needs. Led by CEO Kishore Khandavalli, we ensure performance-driven solutions. Discover more about our GRC solutions today.

Don't wanna be here? Send us removal request.

Text

Maximizing Business Value: Calculating the ROI of GRC Software

In today’s complex risk landscape, Governance, Risk, and Compliance (GRC) software is no longer a luxury—it’s a necessity. But how do organizations justify the investment?

This comprehensive guide by iTechGRC breaks down how to calculate the ROI of GRC software, factoring in reduced compliance costs, improved decision-making, and time savings from automation. Whether you're building a business case or optimizing your current GRC tools, understanding ROI is crucial for strategic planning.

From risk mitigation to audit readiness, the benefits are measurable—and this article shows you how.

Is your GRC investment paying off? 📈 Discover how to measure and maximize ROI with iTechGRC’s expert guide.

👉 Calculating the ROI of GRC Software

#GRC #RiskManagement #Compliance #ROICalculation #EnterpriseRisk #Governance #TechROI #iTechGRC

0 notes

Text

GenAI’s Game-Changing Impact on Risk & Compliance in Banking

Generative AI (GenAI) is rapidly transforming how banks manage risk and compliance—bringing speed, intelligence, and automation to traditionally manual and fragmented processes.

From virtual regulatory assistants that decode complex rules to intelligent surveillance systems that flag suspicious activities in real time, GenAI is empowering risk teams to respond faster, more accurately, and with greater confidence. It’s also streamlining legacy system modernization, enhancing ESG and cyber risk management, and enabling real-time compliance insights across functions.

But innovation comes with responsibility. The adoption of GenAI in risk functions must include robust governance—bias testing, human-in-the-loop controls, and alignment with regulations like the EU AI Act and GDPR.

iTech GRC’s latest ebook, “GenAI Impact: Risk & Compliance in Banking,” provides a practical roadmap for financial institutions. It covers high-impact use cases, risk-specific GenAI strategies, and how banks can move from pilot to scale—without compromising oversight or control.

👉 Download the full ebook here: GenAI Impact – Risk and Compliance in Banking

0 notes

Text

Stay Ahead of Regulatory Risk with Smart Compliance Technology

In today's fast-evolving regulatory environment, staying compliant isn't just about avoiding penalties—it's about building trust, resilience, and long-term success.

At ITechGRC, our Regulatory Compliance Management Software helps businesses streamline their compliance processes, reduce manual efforts, and stay audit-ready at all times.

✅ Centralized regulatory repository ✅ Automated compliance workflows ✅ Real-time risk assessments ✅ Custom alerts and dashboards ✅ Easy integration with existing systems

Our solution empowers compliance teams to stay proactive, adapt to regulatory changes quickly, and drive efficiency across governance, risk, and compliance (GRC) programs.

🔗 Learn more: https://itechgrc.com/regulatory-compliance-management-software

0 notes

Text

IBM OpenPages Has the Most User-Friendly Interface—Here’s Why

IBM OpenPages Wins Best User Interface Innovation at Risk Market Technology Awards

At iTech, we’re thrilled to share that IBM OpenPages with Watson has been recognized once again as a leader in the GRC space. In the February edition of the prestigious Risk Market Technology Awards, OpenPages was named the winner in the Best User Interface Innovation category.

These awards, a key part of the globally respected Risk Awards, celebrate excellence across technology vendors, trading platforms, legal firms, clearinghouses, and more. As the longest-running and most distinguished honors in the risk management and derivatives markets, this recognition highlights IBM OpenPages’ continued innovation and leadership in delivering powerful, user-friendly GRC solutions.

Simplifying Risk Management: The OpenPages Approach

When you take a closer look at how risk and compliance processes are carried out in most organizations, it becomes clear that many of the people involved are not risk or compliance experts. Yet, these responsibilities still affect their day-to-day work. That’s why governance, risk, and compliance (GRC)—also known as Integrated Risk Management (IRM)—should involve every employee, not just the specialists.

Through extensive research, the IBM OpenPages team found that non-expert users often see GRC tasks as overly time-consuming. Worse, the systems used to manage these tasks typically require training that can interrupt their regular responsibilities. In many cases, employees abandon training altogether due to how infrequently they use the GRC platform.

To solve this challenge, the OpenPages team went back to the drawing board. Their mission: redesign the user experience to make it faster, simpler, and more intuitive for everyone—from beginners to advanced users.

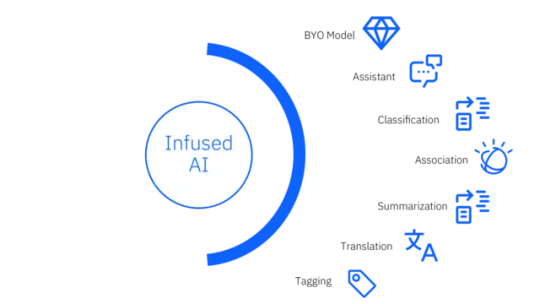

The result? A zero-training approach. The design team reimagined the platform with a user-centric interface that makes onboarding almost effortless and significantly boosts productivity. They also streamlined a large portion of the training materials by integrating natural language processing (NLP) and Watson Assistant, allowing users to get help in plain language, when and where they need it.

With this update, OpenPages proves that effective GRC doesn’t have to be complex—it just has to be accessible.

OpenPages’ Game-Changing “Watson Moment”

To enhance the user experience even further, the OpenPages design team integrated what IBM calls a “Watson Moment.” This feature—already used across IBM Cloud and Data Platform products—appears as cards, modals, drawers, or highlighted content to deliver smart, contextual assistance.

In OpenPages, the Watson Moment analyzes a user’s written description of the risks they want to assess. It then intelligently recommends the most relevant information or controls that should be reviewed. By guiding users in real-time, this feature helps streamline decision-making and ensures a more accurate, focused risk assessment process.

0 notes

Text

Supply Chain Risk Management

o stay resilient, businesses must proactively manage supplier risks with a strategic, data-driven approach.

#supply chain risk management#supply chain resilience#supply chain risk assessment#supply chain monitoring

0 notes

Text

Why Understanding Business Continuity and Disaster Recovery Is Critical in 2025

In today’s high-risk business climate, understanding the difference between business continuity and disaster recovery is essential. This blog breaks down their key distinctions, highlights real-world impacts of disruptions, and explains why both strategies are critical for building long-term resilience.

Key Differences Between Business Continuity and Disaster Recovery

To build a resilient business, it’s essential to understand the distinct roles business continuity and disaster recovery play during a disruption. While they work hand-in-hand, they serve different functions—each critical in maintaining stability when a crisis strikes.

How Each Plan Supports Operations in a Crisis

Business Continuity Plan (BCP): A BCP ensures essential business functions continue during disruptions.

Example: In a regional power outage, your BCP might enable remote work, provide backup generators, or relocate operations—keeping customer service online and operations running.

Disaster Recovery Plan (DRP): A DRP focuses on recovering IT systems and data after an incident.

Example: After a cyberattack, your DRP guides IT to restore data from backups, secure systems, and bring critical technology back online quickly.

Proactive vs. Reactive Planning

BCP – Proactive Approach: Anticipates disruptions and outlines preventative strategies.

Example: A BCP might include alternate suppliers to avoid product shortages during a supply chain disruption.

DRP – Reactive Approach: Activates after a crisis occurs, specifically IT-related incidents.

Example: Following a ransomware attack, your DRP helps recover encrypted data and secure your systems.

Scope of Impact

BCP Covers Broad Business Functions:

Communication protocols

Employee roles and responsibilities

Alternate workflows for departments like sales, operations, and customer support

DRP Focuses on IT Infrastructure:

Data recovery

System restoration

Cybersecurity measures

Primary Goals

BCP:

Minimize downtime during disruptions

Maintain customer-facing services

Preserve revenue and reputation

DRP:

Fully restore IT systems and data

Resume digital operations with minimal data loss or delay

Employee Safety & Communication

BCP:

Includes emergency procedures, evacuation plans, and clear communication protocols

Keeps employees safe and informed during events like natural disasters or facility closures

DRP:

While it doesn’t focus on physical safety, it restores internal communication systems like email or chat platforms after an IT outage

Customer Trust & Brand Protection

BCP:

Helps maintain service delivery, even during crises

Example: Activating alternate suppliers during disruptions to avoid missed deliveries or delays

DRP:

Secures customer data post-breach

Demonstrates your commitment to data protection and regulatory compliance

Regulatory Compliance

BCP:

Supports operational continuity to meet industry regulations (e.g., HIPAA, SOX, ISO 22301)

Especially vital in finance, healthcare, and manufacturing

DRP:

Ensures data privacy and security compliance (e.g., GDPR, HIPAA)

Helps avoid fines and legal repercussions following cyber incidents

Testing and Maintenance

BCP:

Should be regularly tested with drills and updated based on lessons learned

Example: Remote work simulations or disaster drills ensure preparedness

DRP:

Requires frequent IT recovery simulations

Ensures backup systems and data restoration processes are current and functional

To conclude, two plans, one Goal—Business Resilience

Business continuity and disaster recovery may overlap, but they are not interchangeable. Together, they create a strong defense against disruption—keeping your business operational, your data secure, and your customers confident.

Check the following link for more detail

0 notes

Text

#Business Continuity, # Disaster Recovery, # Business Continuity vs Disaster Recovery

0 notes

Text

Mastering Operational Risk: The 4 Ps Framework with IBM OpenPages & ITech GRC

Discover how the 4 Ps of Operational Risk Management—Predict, Prevent, Prepare, and Protect—empower organizations to manage risk effectively. Learn how IBM OpenPages, with support from ITech GRC, provides smart tools, real-time monitoring, and expert services to safeguard your business.

Operational risk can emerge from anywhere—cyber threats, system failures, or regulatory changes. A strong Operational Risk Management (ORM) strategy requires more than just reacting to issues; it means being proactive. The 4 Ps framework—Predict, Prevent, Prepare, and Protect—offers a comprehensive approach to managing risk effectively.

With IBM OpenPages, organizations gain access to advanced tools that support every phase of the risk lifecycle:

Predict future threats through scenario analysis and centralized risk modelling using past data trends.

Prevent issues before they escalate with integrated controls, loss event tracking, and intuitive workflows.

Prepare for potential disruptions by creating emergency plans, assigning resources, and monitoring readiness with real-time dashboards.

Protect critical operations through live risk monitoring, automated alerts, and efficient incident response management.

Whether you're in finance, healthcare, manufacturing, or retail, IBM OpenPages, combined with expert implementation from ITech GRC, enables a proactive, unified, and resilient approach to risk management.

ITech GRC helps you put the “4 Ps” into action. To know more details check at:

https://itechgrc.com/mastering-operational-risk-management-with-ibm-openpages-a-simple-approach/

0 notes

Text

Download the Complete Guide to Enterprise Risk Management (ERM)

Are you looking to strengthen your organization’s risk strategy? Our free eBook, "The Complete Guide to Enterprise Risk Management," is your go-to resource for building a proactive and resilient risk management framework.

This comprehensive guide walks you through:

The fundamentals of ERM

Proven frameworks and models

Best practices for implementation

Tips on integrating risk with business strategy

Whether you're a compliance officer, risk manager, or business leader, this eBook provides valuable insights to help you navigate today’s complex risk landscape with confidence.

👉 Download Now and take control of your enterprise risk strategy.

#ERM #EnterpriseRiskManagement #RiskManagement #Governance #Compliance #BusinessStrategy #RiskFramework #RiskAssessment #FreeEbook

0 notes

Text

How AI Is Transforming GRC and Risk Management in 2025

In today’s complex regulatory landscape, organizations are under increasing pressure to stay compliant while managing a growing web of risks. Artificial Intelligence (AI) is emerging as a game-changer in Governance, Risk, and Compliance (GRC), offering smarter, faster, and more accurate ways to monitor and mitigate risk.

From predictive analytics that forecast potential threats to automated compliance tracking, AI is helping businesses transition from reactive to proactive risk management strategies. The integration of AI in GRC not only enhances decision-making but also reduces human error and boosts operational efficiency.

To explore how AI is reshaping the future of GRC and risk management, check out this insightful guide by iTechGRC: 👉 https://itechgrc.com/ai-in-grc-and-risk-management/

#AIinGRC#RiskManagement#Compliance#ArtificialIntelligence#GRCtools#EnterpriseRisk#DigitalTransformation#RegTech#CyberRisk#AIforBusiness

0 notes

Text

Why Enterprise Policy Management is Essential for Modern Risk and Compliance Programs

In today’s rapidly evolving regulatory environment, organizations face mounting pressure to keep policies current and aligned with global standards. iTechGRC’s Enterprise Policy Management solution, powered by IBM OpenPages, helps businesses automate and streamline the full lifecycle of policies — from creation and review to approval and attestation. With AI-driven insights, centralized document repositories, and advanced compliance mapping, companies can reduce redundancy, identify regulatory gaps, and minimize risks effectively. A comprehensive governance, risk, and compliance (GRC) framework is no longer optional — it’s a strategic necessity.

Discover how iTechGRC transforms policy management for smarter, agile enterprises: Enterprise Policy Management Services

0 notes

Text

Strengthen Your Business with Smart Financial Controls

In today’s fast-paced business environment, effective financial controls are essential for maintaining stability and ensuring long-term growth. Financial controls help businesses track their income and expenses, minimize financial risks, and maintain compliance with regulations.

If you’re looking to enhance your company’s financial management processes, check out the Financial Controls Management services at iTechGRC. Their expert solutions help businesses implement robust financial systems, improve operational efficiency, and safeguard against financial inconsistencies.

By integrating advanced financial controls, organizations can make informed decisions, reduce operational risks, and secure their financial future.

0 notes

Text

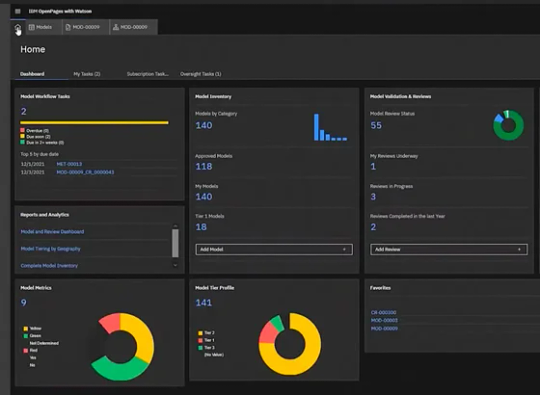

Strengthen Your Financial Institution with Robust Model Risk Governance

In today’s fast-paced regulatory environment, financial institutions rely heavily on models to drive decisions—from credit scoring to market risk assessments. However, with great reliance comes significant risk. Without a proper governance framework, these models can become sources of compliance issues and financial loss.

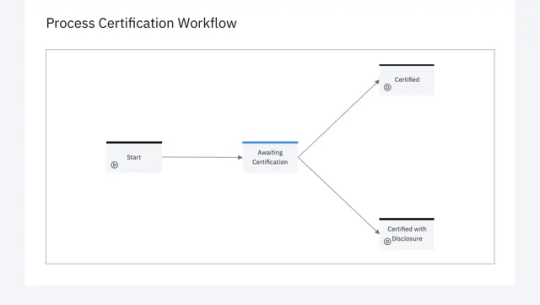

Model Risk Governance is essential for ensuring that models are accurate, transparent, and aligned with regulatory expectations. It involves the validation, documentation, oversight, and lifecycle management of every model in use.

iTechGRC offers a streamlined approach to model risk governance, helping organizations establish robust policies, monitor model performance, and stay audit-ready at all times. Whether you're managing a handful of models or an enterprise-wide portfolio, iTechGRC's solution adapts to your needs with ease and efficiency.

✅ Ready to take control of your model risk? Explore iTechGRC’s Model Risk Governance Solution and start building a stronger, safer compliance framework today.

0 notes

Text

🔹 Operational Risk Management with iTech 🔹

Managing risks effectively is crucial for business success. iTech’s Operational Risk Management framework ensures a structured approach to identifying, assessing, and mitigating risks.

📌 Key Steps in Risk Management:

✅ Identify Risk – Recognizing potential threats that may impact business operations.

✅ Plan Assessment – Evaluating risks and preparing strategic action plans.

✅ Measure Risk – Analyzing risk severity and likelihood to prioritize mitigation.

✅ Assign Mitigation & Controls – Implementing strategies to minimize or eliminate risks.

✅ Report Risk – Documenting risks for transparency and regulatory compliance.

✅ Manage Performance – Continuously monitoring and improving risk controls.

🚀 Stay ahead of operational challenges with iTech’s structured risk management approach!

🔗 Learn more: https://itechgrc.com/operational-risk-management/

0 notes

Text

Understanding Environmental, Social, and Governance (ESG) Frameworks

Environmental, Social, and Governance (ESG) frameworks are essential tools that help organizations assess and manage their impact on the world. These frameworks guide businesses in evaluating risks and opportunities related to environmental sustainability, social responsibility, and governance practices.

For more insights on ESG frameworks and how they can benefit your organization, visit iTechGRC’s ESG Page. 🚀

0 notes

Text

Streamline Compliance Effortlessly with iTechGRC’s Regulatory Compliance Management Solution

In today’s complex business environment, regulatory compliance is a major challenge for organizations. With ever-evolving regulations, managing compliance efficiently can be time-consuming and overwhelming. iTechGRC offers a powerful Regulatory Compliance Management (RCM) solution powered by IBM OpenPages , enabling businesses to simplify compliance processes and stay ahead of regulatory changes.

Why Regulatory Compliance Management Matters Non-compliance can result in heavy penalties, reputational damage, and operational disruptions. Businesses must continuously monitor regulatory updates, classify obligations, and manage risks effectively. A robust compliance management system like iTechGRC’s IBM OpenPages RCM ensures that organizations can centralize their compliance efforts, reducing manual errors and improving efficiency.

Key Features of iTechGRC’s Compliance Management Solution

Centralized Repository – Store all regulatory obligations in one place for better accessibility and classification.

Automated Regulatory Updates – Stay informed about changing regulations and automate compliance tracking.

Risk Mapping and Analysis – Align regulatory requirements with internal risk data to make informed decisions.

Efficient Data Processing – Handle large volumes of compliance data without delays.

Proactive Compliance Management – Get timely alerts and ensure regulatory adherence without last-minute surprises.

Benefits of Using iTechGRC for Compliance Management

Reduced Compliance Risks – Automates monitoring and reduces the risk of non-compliance.

Improved Efficiency – Eliminates manual compliance tasks, saving time and resources.

Regulatory Change Alerts – Notifies businesses of relevant changes, ensuring proactive compliance.

Seamless Integration – Easily connects with existing risk management frameworks and business operations.

Stay Ahead with iTechGRC’s IBM OpenPages RCM Managing regulatory compliance doesn’t have to be a burden. With iTechGRC’s IBM OpenPages Regulatory Compliance Management solution , businesses can streamline their compliance processes, reduce risks, and focus on growth.

Want to simplify your regulatory compliance strategy? Explore iTechGRC’s solution today!

0 notes

Text

Third-Party vs. Vendor Risk Assessment: Key Differences Explained

In today's interconnected business environment, organizations frequently collaborate with external entities to enhance operations and drive growth. However, these partnerships introduce various risks that necessitate thorough assessments. Two primary evaluations in this context are third-party risk assessments and vendor risk assessments. While they may seem similar, understanding their distinctions is crucial for effective risk management.

Key Differences Between Third-Party and Vendor Risk Assessments

🔹 Third-Party Risk Assessment: Evaluates risks associated with all external entities interacting with an organization, including suppliers, partners, contractors, and service providers. The goal is to mitigate potential threats to operations, data security, compliance, and reputation.

🔹 Vendor Risk Assessment: A subset of third-party risk management, focusing specifically on vendors supplying goods or services. This assessment examines financial stability, regulatory compliance, cybersecurity measures, and operational reliability.

🔹 Main Distinction: While vendor risk assessments focus on direct suppliers, third-party risk assessments cover a broader range of external partnerships, ensuring comprehensive risk mitigation.

To learn more, read the full article here: Difference Between Third-Party Risk Assessment and Vendor Risk Assessment

0 notes