#itechgrc

Explore tagged Tumblr posts

Text

Mastering Compliance with the Modern-Day Three Lines of Defense Framework

In today’s rapidly evolving regulatory environment, organizations must adopt robust risk and compliance strategies to remain resilient. One of the most effective and time-tested approaches is the Three Lines of Defense (3LoD) model. iTechGRC’s latest free eBook sheds light on how this framework has evolved to meet modern compliance challenges.

The 3LoD model is more than a theoretical structure—it’s a practical strategy for ensuring accountability, transparency, and effectiveness across all layers of governance. The eBook explores:

The evolution of the Three Lines model in a post-pandemic, digital-first world

How to align compliance, risk, audit, and business units under a unified framework

Real-world examples of integrating 3LoD in modern enterprises

Tools and technologies enhancing the effectiveness of each "line"

Whether you're a compliance officer, risk manager, internal auditor, or business leader, this guide provides practical insights into implementing a cohesive risk management system.

Download the full eBook here → iTechGRC eBook: Modern-Day Three Lines of Defense

Empower your organization with a smarter approach to risk, governance, and control.

0 notes

Text

1 note

·

View note

Text

Maximizing Business Value: Calculating the ROI of GRC Software

In today’s complex risk landscape, Governance, Risk, and Compliance (GRC) software is no longer a luxury—it’s a necessity. But how do organizations justify the investment?

This comprehensive guide by iTechGRC breaks down how to calculate the ROI of GRC software, factoring in reduced compliance costs, improved decision-making, and time savings from automation. Whether you're building a business case or optimizing your current GRC tools, understanding ROI is crucial for strategic planning.

From risk mitigation to audit readiness, the benefits are measurable—and this article shows you how.

Is your GRC investment paying off? 📈 Discover how to measure and maximize ROI with iTechGRC’s expert guide.

👉 Calculating the ROI of GRC Software

#GRC #RiskManagement #Compliance #ROICalculation #EnterpriseRisk #Governance #TechROI #iTechGRC

0 notes

Text

Top Telecom and Network Regulatory Compliance Risks to Watch in 2024

In 2024, the telecom sector is navigating an increasingly complex regulatory landscape. Landmark regulations like net neutrality, Truth-in-Billing, and robocall guidelines highlight the importance of managing risk and compliance. With the rise of GenAI, telecom companies face additional challenges related to data governance, ethics, and security. Below are the key compliance risks telecom companies must watch out for:

1. Macroeconomic Risks

High Demand for Data: Increasing demand for data-driven services, like video streaming, puts pressure on telecom providers to deliver high-speed, high-availability networks.

Cost-of-Living Crisis: Consumers are cutting back on premium services, shrinking profit margins for telecom companies.

Delayed Tech Investments: With reduced revenue, investments in 5G and fiber-optic networks may slow down.

Talent Crisis: Many telecom companies are facing hiring freezes and retention challenges while adapting to remote work preferences.

Sustainability: A lack of climate-related financial disclosures and net-zero goals hinders the industry’s progress in addressing sustainability concerns.

2. Technological Risks

GenAI Adoption: While beneficial, GenAI poses risks in algorithmic biases and security vulnerabilities, demanding rigorous testing and monitoring.

5G & 6G: The expansion of 5G and exploration of 6G technologies add financial strain, requiring telecom companies to balance network investments and operational costs.

Security Threats: The telecom industry is a prime target for cyberattacks. Data breaches, DDoS attacks, and insider threats highlight the need for robust security measures.

3. Regulatory Risks

Data Privacy & Security: Compliance with GDPR and CCPA is critical to avoid penalties related to customer data mishandling.

Net Neutrality: The restored net neutrality rules require ISPs to provide fair, transparent internet access without blocking or slowing down competitors' content.

Robocall and Texting Rules: Updated regulations on robocalls and text messaging demand stricter consent and blocking of illegal messages.

Broadband Labels: Providers must disclose broadband prices and speed information at the point of sale, ensuring transparency for consumers.

4. Political Risks

U.S. Elections: Telecom policies will be influenced by the election outcome, affecting net neutrality, privacy laws, and antitrust regulations.

U.S.-China Relations: Restrictions on Chinese telecom hardware, like Huawei and ZTE, create challenges in sourcing affordable equipment.

Supply Chain Issues: Global disruptions in the supply chain continue to delay network hardware delivery and slow the rollout of 5G networks.

Conclusion Telecom companies must stay vigilant, proactively managing risks to comply with regulations while maintaining their competitive edge. With solutions like OpenPages Policy and Compliance Management, telecom providers can streamline risk management processes and ensure compliance with evolving regulatory mandates.

For more guidance on navigating telecom compliance risks, contact iTech GRC’s risk and compliance advisory team today.

Learn more: Top Telecom and Network Regulatory Compliance Risks to Watch in 2024

0 notes

Text

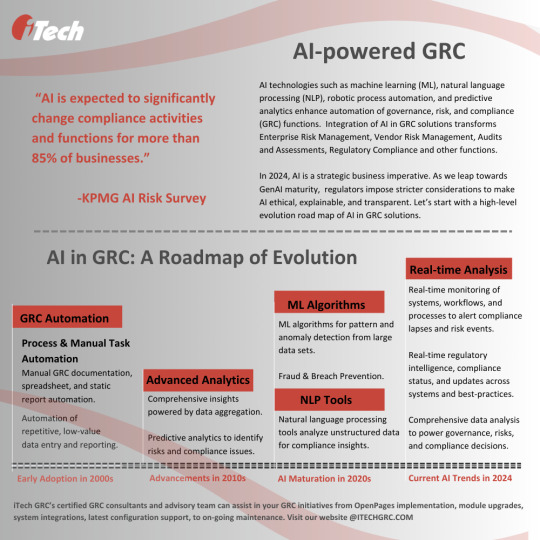

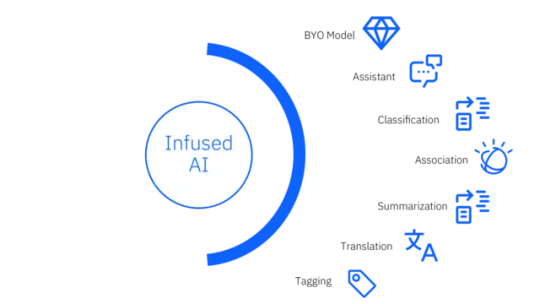

AI & GRC: Current Trends AI maturity is governance, risk, and compliance (GRC) management is directly dependent on AI advisory teams and enterprise leaders who play a major role in testing its safety, compliance, and ethics. GenAI use cases are also advancing in risk management and regulatory compliance. But how long is the journey to reach the desired level of innovation? Check our post.

0 notes

Text

Partnering for Success: Risk Consultants as an Extension of Your Team

At iTechGRC, we're more than just service providers—we're your partners! Our goal is to reduce your exposure to data breaches and non-compliance through comprehensive risk management solutions. We believe that navigating risk and compliance shouldn't be chaotic. That’s why we offer personalized support with dedicated advisory analysts.

Our Approach In an ever-evolving risk landscape, it's essential to stay ahead. We provide tailored business advice and industry best practices to help you build resilience and reduce vulnerabilities. By offering solutions like heat maps and out-of-the-box workflows, we streamline risk management, allowing you to focus on growth.

Our Services From implementation and advisory to installation and cognitive analytics, our services are designed to enhance your risk capabilities. Our managed services help you optimize resources, while our reporting tools offer insightful data for decision-making. Whether you need help installing IBM modules or want to leverage AI for better insights, iTechGRC has the expertise to guide your business.

For more information, explore our Integrated Risk Management Services.

Why iTechGRC? We help you tailor risk management strategies, ensure smooth technology adoption, and proactively manage vendor risks. With our extensive knowledge of integrated risk management, we turn challenges into opportunities, building a secure and compliant future for your organization.

0 notes

Text

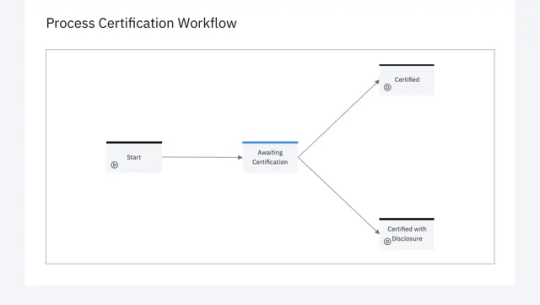

Simplifying Global Financial Compliance: IBM OpenPages in Action

Simplify Financial Reporting Compliance

Centralized Financial Controls Data: IBM OpenPages Financial Controls Management offers a unified source for financial controls data, ensuring that decision-makers can access up-to-date information for business continuity and impact analyses. This centralization supports seamless integration with other modules and secure, role-based access to relevant records.

Enhanced Business Intelligence: The platform provides executive management with visibility into compliance status through rich, interactive dashboards and dynamic reports. These user-friendly, configurable dashboards deliver insightful visuals of data relationships, planning activities, and daily tasks, aiding informed decision-making.

Unified Compliance Process: OpenPages automates the testing, review, certification, and remediation processes, facilitating the fulfillment of financial compliance obligations. It also supports gap analyses to identify and address weaknesses, helping organizations enhance their compliance strategies.

Benefits of IBM OpenPages for Financial Controls Management

Streamlined Compliance: OpenPages helps organizations efficiently comply with global financial reporting regulations like Sarbanes-Oxley, reducing the complexity and cost of maintaining multiple solutions.

Transparency and Confidence: The platform provides transparency into the state of financial controls, instilling confidence in decision-makers that compliance requirements are being met effectively.

Improved Data Quality: With a configurable user interface, OpenPages enhances data quality and supports informed decision-making, ensuring that organizations can confidently navigate the complexities of financial compliance.

For more details, visit iTech's Financial Controls Management.

0 notes

Text

AI-Powered Compliance: Navigating the Complexities of Regulatory Requirements

Introduction:

In the rapidly evolving landscape of Governance, Risk, and Compliance (GRC), technological advancements play a pivotal role in enhancing efficiency, accuracy, and overall effectiveness. Among the cutting-edge technologies making waves in the GRC space, Artificial Intelligence (AI) stands out as a game-changer. In this blog post, we'll explore the integration of AI in GRC and shed light on how iTech GRC is harnessing this technology to redefine the way organizations manage their governance, risk, and compliance processes.

I. Understanding the Role of AI in GRC:

Automated Risk Assessment:

AI algorithms enable iTech GRC to automate the risk assessment process, analyzing vast datasets to identify potential risks and vulnerabilities.

Real-time risk monitoring allows organizations to stay proactive in addressing emerging threats, reducing the likelihood of compliance breaches.

Predictive Analytics for Compliance:

iTech GRC leverages AI-driven predictive analytics to forecast compliance trends and anticipate regulatory changes.

This foresight empowers organizations to adapt their compliance strategies in advance, ensuring a proactive approach to regulatory requirements.

Enhanced Fraud Detection:

AI algorithms in iTech GRC are designed to detect anomalies and patterns indicative of fraudulent activities.

Real-time monitoring helps organizations combat fraud effectively, safeguarding their assets and maintaining trust with stakeholders.

II. iTech GRC: Transforming GRC with AI:

Intelligent Data Analysis:

iTech GRC's AI capabilities facilitate intelligent data analysis, extracting valuable insights from vast datasets.

This enhances decision-making processes, enabling organizations to make informed choices based on comprehensive and accurate information.

Adaptive Compliance Frameworks:

The dynamic nature of regulatory environments requires flexible and adaptive compliance frameworks.

iTech GRC utilizes AI to create compliance frameworks that evolve in response to regulatory changes, ensuring ongoing alignment with industry standards.

User-Friendly AI Interfaces:

iTech GRC prioritizes user experience by integrating AI features seamlessly into user interfaces.

Intuitive AI interfaces make it easier for GRC professionals to navigate complex datasets and leverage AI insights without the need for extensive technical expertise.

III. Future Prospects of AI in GRC:

Continuous Evolution of AI Algorithms:

iTech GRC commits to staying at the forefront of technological advancements by continuously evolving its AI algorithms.

Regular updates ensure that organizations using iTech GRC benefit from the latest AI capabilities for GRC optimization.

Collaborative AI Solutions:

The future of GRC involves collaborative AI solutions that facilitate cross-functional teamwork.

iTech GRC aims to enhance collaboration by integrating AI tools that streamline communication and information sharing among different GRC stakeholders.

Conclusion:

As organizations navigate the complex landscape of GRC, iTech GRC emerges as a trailblazer in harnessing the power of AI. By automating processes, providing predictive insights, and adapting to regulatory changes, iTech GRC ensures that GRC professionals can focus on strategic decision-making with confidence. The integration of AI in GRC is not just a technological advancement but a paradigm shift in how organizations manage governance, risk, and compliance in the digital age.

0 notes

Text

Stay Ahead of Regulatory Risk with Smart Compliance Technology

In today's fast-evolving regulatory environment, staying compliant isn't just about avoiding penalties—it's about building trust, resilience, and long-term success.

At ITechGRC, our Regulatory Compliance Management Software helps businesses streamline their compliance processes, reduce manual efforts, and stay audit-ready at all times.

✅ Centralized regulatory repository ✅ Automated compliance workflows ✅ Real-time risk assessments ✅ Custom alerts and dashboards ✅ Easy integration with existing systems

Our solution empowers compliance teams to stay proactive, adapt to regulatory changes quickly, and drive efficiency across governance, risk, and compliance (GRC) programs.

🔗 Learn more: https://itechgrc.com/regulatory-compliance-management-software

0 notes

Text

How AI Is Transforming GRC and Risk Management in 2025

In today’s complex regulatory landscape, organizations are under increasing pressure to stay compliant while managing a growing web of risks. Artificial Intelligence (AI) is emerging as a game-changer in Governance, Risk, and Compliance (GRC), offering smarter, faster, and more accurate ways to monitor and mitigate risk.

From predictive analytics that forecast potential threats to automated compliance tracking, AI is helping businesses transition from reactive to proactive risk management strategies. The integration of AI in GRC not only enhances decision-making but also reduces human error and boosts operational efficiency.

To explore how AI is reshaping the future of GRC and risk management, check out this insightful guide by iTechGRC: 👉 https://itechgrc.com/ai-in-grc-and-risk-management/

#AIinGRC#RiskManagement#Compliance#ArtificialIntelligence#GRCtools#EnterpriseRisk#DigitalTransformation#RegTech#CyberRisk#AIforBusiness

0 notes

Text

Why Enterprise Policy Management is Essential for Modern Risk and Compliance Programs

In today’s rapidly evolving regulatory environment, organizations face mounting pressure to keep policies current and aligned with global standards. iTechGRC’s Enterprise Policy Management solution, powered by IBM OpenPages, helps businesses automate and streamline the full lifecycle of policies — from creation and review to approval and attestation. With AI-driven insights, centralized document repositories, and advanced compliance mapping, companies can reduce redundancy, identify regulatory gaps, and minimize risks effectively. A comprehensive governance, risk, and compliance (GRC) framework is no longer optional — it’s a strategic necessity.

Discover how iTechGRC transforms policy management for smarter, agile enterprises: Enterprise Policy Management Services

0 notes

Text

Strengthen Your Business with Smart Financial Controls

In today’s fast-paced business environment, effective financial controls are essential for maintaining stability and ensuring long-term growth. Financial controls help businesses track their income and expenses, minimize financial risks, and maintain compliance with regulations.

If you’re looking to enhance your company’s financial management processes, check out the Financial Controls Management services at iTechGRC. Their expert solutions help businesses implement robust financial systems, improve operational efficiency, and safeguard against financial inconsistencies.

By integrating advanced financial controls, organizations can make informed decisions, reduce operational risks, and secure their financial future.

0 notes

Text

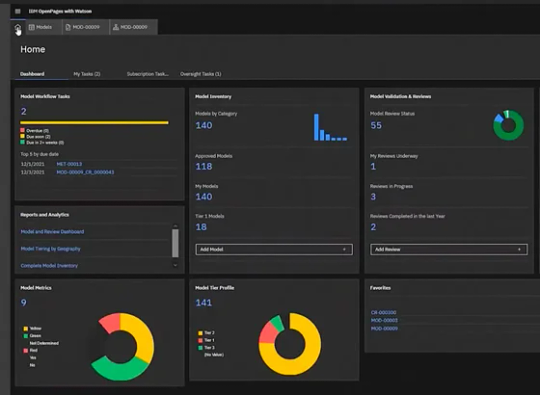

Strengthen Your Financial Institution with Robust Model Risk Governance

In today’s fast-paced regulatory environment, financial institutions rely heavily on models to drive decisions—from credit scoring to market risk assessments. However, with great reliance comes significant risk. Without a proper governance framework, these models can become sources of compliance issues and financial loss.

Model Risk Governance is essential for ensuring that models are accurate, transparent, and aligned with regulatory expectations. It involves the validation, documentation, oversight, and lifecycle management of every model in use.

iTechGRC offers a streamlined approach to model risk governance, helping organizations establish robust policies, monitor model performance, and stay audit-ready at all times. Whether you're managing a handful of models or an enterprise-wide portfolio, iTechGRC's solution adapts to your needs with ease and efficiency.

✅ Ready to take control of your model risk? Explore iTechGRC’s Model Risk Governance Solution and start building a stronger, safer compliance framework today.

0 notes

Text

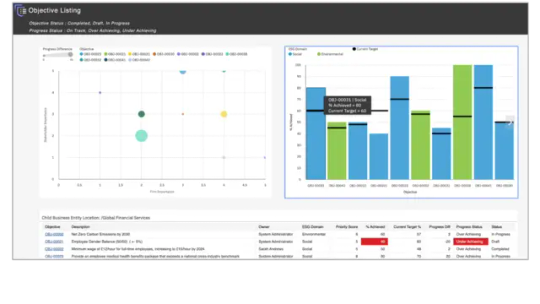

Understanding Environmental, Social, and Governance (ESG) Frameworks

Environmental, Social, and Governance (ESG) frameworks are essential tools that help organizations assess and manage their impact on the world. These frameworks guide businesses in evaluating risks and opportunities related to environmental sustainability, social responsibility, and governance practices.

For more insights on ESG frameworks and how they can benefit your organization, visit iTechGRC’s ESG Page. 🚀

0 notes