Don't wanna be here? Send us removal request.

Text

Day Trading Mobile App: 5 Must-Know Features for Profits

In today’s fast-paced financial world, a powerful Day Trading Mobile App can be the difference between consistent gains and missed opportunities. As more traders shift from desktops to mobile devices, the need for robust, feature-rich apps has skyrocketed. But with so many options available, which features truly matter? Here are five must-know features every serious trader should look for to stay profitable on the go.

1. Real-Time Market Data When seconds matter, delayed data can cost you. A top-tier Day Trading Mobile App must offer real-time quotes, charts, and market depth. Fast and accurate information helps you make timely decisions and avoid slippage.

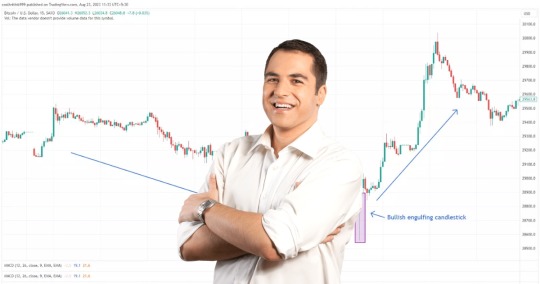

2. Advanced Charting Tools Basic graphs won’t cut it for day traders. Look for apps with customizable charts, technical indicators, and drawing tools. Whether you use moving averages, Bollinger Bands, or RSI, these tools are essential for precise technical analysis.

3. Fast Execution and Low Latency In day trading, timing is everything. Your mobile app should execute orders quickly and reliably, without lag or delays. Many apps offer one-tap trading or swipe-to-execute functions to speed up the process.

4. Risk Management Features Stop-loss, take-profit, and trailing stop functions are essential for managing trades. A reliable Day Trading Mobile App should allow users to set and adjust risk parameters easily within the trading interface.

5. Real-Time Alerts and Notifications Customizable alerts can help you track price movements, breaking news, or technical setups. Push notifications keep you informed without needing to stare at the screen all day.

Choosing the right Day Trading Mobile App means gaining a competitive edge. With these five must-have features, traders can maximize profits and stay agile in a volatile market—anytime, anywhere.

#MobileTradingApp#DayTradeOnTheGo#TradingApp#MobileDayTrading#TradeAnywhere#StockTradingApp#DayTradingTools#AppForTraders#DayTradeMobile

0 notes

Text

Best Crypto Apps for New Traders in 2025

New to crypto and overwhelmed? These beginner-friendly apps in 2025 make trading simple, safe, and kind of fun. 🌐💸

0 notes

Text

Top Crypto Exchanges for Day Trading: A Head-to-Head Breakdown

In the lightning-paced world of crypto trading, every millisecond and move matters. Your choice of exchange isn’t just a preference—it’s a strategic edge. Whether you're capitalizing on quick price swings or leveraging volatility for short-term wins, the right platform can be a game-changer.

Not all exchanges are cut out for the demands of day trading. You need blazing-fast execution, ultra-low fees, and pro-grade tools that keep you a step ahead. From advanced charting suites to intuitive mobile apps, the ideal exchange powers your strategy, not hinders it. But with a sea of platforms vying for your attention, how do you separate the real contenders from the overhyped pretenders?

This in-depth comparison cuts through the clutter to spotlight the top crypto exchanges for day traders—laying out exactly what each one brings to the table (and where they fall short).

Ready to level up your trades with speed, precision, and confidence? Let’s find the best crypto exchange tailored to your trading style.

For more details

0 notes

Text

Must-Have Trading Skills for 2025 and Beyond

🚀 Ready to trade smarter in 2025? Master these essential skills to stay ahead of the curve. Your future success starts today. #TradingSkills #FutureFinance

Must-Have Trading Skills for 2025 and Beyond

In the fast-evolving world of finance, success in trading hinges on much more than gut instinct or outdated strategies. As we move through 2025 and beyond, traders must cultivate a dynamic set of skills to stay competitive and resilient.

1. Advanced Data Analysis With markets increasingly influenced by global news, social media sentiment, and real-time data, the ability to quickly interpret large datasets is crucial. Traders must be comfortable with data visualization tools, algorithmic signals, and even basic coding in languages like Python to keep a competitive edge.

2. Emotional Intelligence Volatility will continue to define the trading landscape. Those who can manage stress, stay patient under pressure, and recognize cognitive biases in decision-making will outperform those who can't. Emotional discipline has become as vital as technical skill.

3. Strategic Adaptability Trading strategies that worked yesterday may fail tomorrow. Flexibility in adjusting approaches, learning new methods, and swiftly incorporating emerging technologies—like AI-driven forecasting—is critical.

4. Risk Management Mastery In 2025’s interconnected markets, small events can trigger major chain reactions. Traders need to sharpen their risk management tactics, using advanced hedging strategies, dynamic stop-loss methods, and diversified asset allocation to protect capital.

5. Global Perspective Markets are no longer isolated. Political shifts, environmental challenges, and technological disruptions halfway around the globe can impact local trades. A broad, global mindset allows traders to anticipate and respond to changes more effectively.

In this new era, trading is less about brute-force speculation and more about intelligent, adaptable decision-making. Those who invest in developing these must-have skills will not only survive but thrive in the marketplace of tomorrow.

Would you also like me to suggest some tags and a caption for posting it on Tumblr?

#Trading#Finance#Investing#StockMarket#Crypto#FinancialFreedom#TradingTips#MarketTrends#RiskManagement#DataAnalysis#EmotionalIntelligence#PersonalGrowth#CareerDevelopment#AI#TechTrends

0 notes

Text

Master the art of Forex with smarter strategies

smartforextactics

Master the art of Forex with smarter strategies designed to boost your wins and sharpen your trading edge.

0 notes

Text

MT4 or MT5 for Crypto Trading: Which Platform is Better for You?

If you're diving into the world of crypto trading, you've probably come across two popular platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). But which one is the right fit for your trading journey?

MT4: Simplicity and Reliability MT4 is known for its user-friendly interface and is a favorite among beginner traders. It offers solid technical analysis tools and a straightforward experience. However, it was originally built for forex trading, so it may lack some advanced features tailored for crypto assets.

MT5: Advanced and Versatile MT5 is a more advanced platform designed to handle a wider range of assets, including cryptocurrencies. It offers more indicators, timeframes, and access to real-time market data. If you're looking to grow and diversify your trading, MT5 gives you the edge.

So, Which One Should You Choose? Go with MT4 if you prefer a simple setup and are just starting out. Choose MT5 if you want more powerful tools and a broader trading experience.

In the end, it all depends on your goals, strategy, and how deep you want to go into the crypto market.

#crypto#cryptotrading#mt4#mt5#metatrader4#metatrader5#forex#tradingplatforms#cryptocurrency#cryptomarket#bitcoin#ethereum#blockchain#cryptotrader#daytrading#technicalanalysis#tradingtools#financialfreedom#investing#tradingstrategies

1 note

·

View note

Text

Crypto Trading Courses 2025

7 Best Crypto Trading Courses to Learn in 2025

If you're looking to dive into the world of crypto trading in 2025, now is the perfect time to level up your skills. Whether you're a complete beginner or looking to sharpen your strategies, these top-rated crypto trading courses will help you trade smarter—not harder.

Crypto Trading Mastery Course – Udemy A comprehensive, beginner-friendly course that covers everything from technical analysis to risk management.

Algorithmic Cryptocurrency Trading – Coursera (University of Nicosia) Ideal if you're into coding and want to build trading bots using real-time market data.

Certified Crypto Trader – Blockchain Council Get certified and gain in-depth knowledge of market trends, strategies, and trading psychology.

Binance Academy – Free Resources Great for self-paced learners. Includes up-to-date lessons on spot, futures, and margin trading.

Crypto Trading for Beginners – Skillshare Short and sweet. Perfect for getting started with the basics in under a few hours.

The Complete Cryptocurrency Investment Course – Udemy Focuses on both trading and long-term investing strategies.

DeFi & Crypto Trading – Moralis Academy Covers the future of finance with insights into decentralized exchanges and yield farming.

No matter your skill level, these courses can help you navigate the volatile crypto market with confidence. Make 2025 the year you master crypto trading!

1 note

·

View note