Don't wanna be here? Send us removal request.

Text

InstaLegal - Arriving This June

Something new Very reliable Millions of Legal data coming your way this June

Click Here to get notified and receive launch offers

0 notes

Text

Forensic Auditors Notify SC Over 9.5k Crore Can be Retrieved from Amrapali Group

Highlights

Forensic auditors have informed the Supreme Court that INR 9,590 crore can be retrieved from Amrapali Group

The Supreme Court also ordered attachment of private properties of the CMD, Anil Sharma and directors — Shiv Priya and Ajay Kumar

The court also appointed a valuer to calculate the accurate value of 5,229 unsold flats including those booked by Amrapali for mere INR 1, 11 and 12.

Forensic auditors have informed the Supreme Court that INR 9,590 crore can be retrieved from Amrapali Group. The Group known to be redirected INR 3,523 crore of home buyers money. Out of which INR 455 crore can be recovered from individuals including the directors of the realty firm and individuals holding key managerial position.

Forensic auditors — Pawan Agarwal and Ravi Bhatia informed a bench of Justices that firm sold 5,856 flats at a relatively cheap price and INR 321.31 crore can be retrieved considering the current market value.

It was also said that INR 3,487 crore is recoverable from buyers of the flats and taken the possession in 14 Amrapali projects.

The auditors created 8-volume report which was submitted to the court said that so far they have identified INR 152.24 crore which the company’s directors and their family members have utilized to pay income taxes, advances for share purchases and under other heads.

The report also observed that out of 35 group companies, individuals holding key managerial positions including directors siphoned off INR 69.36 crore, that was cash in hand with the companies.

“Amounts given as advances without any business transactions which have not been adjusted along with the amount received/paid for the non-genuine transactions amount to Rs 234.31 crores and should be recovered from the management of the Amrapali Group of companies,” the report said, which included only the companies audited by Bhatia.

The auditors also said that there were 5,229 flats remain unsold in 11 different projects and can be sold for INR 1,958.82 crore.

The auditors pointed out that fake purchases amounted to about INR 1,446.68 crore and Amrapali Group has a liability of INR 6,004.06 crore due towards Noida and Greater Noida Authority.

The apex court has observed and accepted reports by the auditors and has sought clarification from the group and its associates.

On February 28, the Supreme Court allowed Delhi Police to arrest CMD Anil Sharma and 2 directors from Amrapali Group on the basis of home-buyers complaint that they were deceived and duped of their funds.

The Supreme Court also ordered attachment of private properties of the CMD, Anil Sharma and directors — Shiv Priya and Ajay Kumar.

The alleged culprits were under detention of Uttar Pradesh Police and kept in a hotel in Noida since October 9, 2018, for not complying with Supreme Court orders. It came in as a shock when the court ordered the arrest on an appeal by the Economic Offence Wing (EOW) of Delhi Police.

The court also appointed a valuer to calculate the accurate value of 5,229 unsold flats including those booked by Amrapali for mere INR 1, 11 and 12.

For more updates on Indian Registered Companies, visit www.InstaFinancials.com

0 notes

Text

Free Director Profile Page with 5 Key Benefits

Highlights

Be aware of your peers (Directors)

Beware of offending Directors, keep tabs on integrity of Directors

Evaluate and know your competitors better

Examine the active status of Directors of your clients and vendors

Conduct Director recruitment or executive search in a much savvy manner.

Avail all these key benefits with latest, accurate, and unique information for FREE!

After days of working on this much-awaited feature of “Director Profile Page”, we have finally rolled-out and are ready to give you a unique experience like never before.

Know your competitors much better and have a competitive edge over your peers with our new and improved feature on “Director Profile”.

How to access Director Profile Page in just 3 simple steps

Visit InstaFinancials.com

Type any company name on InstaFinancials search console

Scroll down and look for “Directors Detail” section and click on any Director name to view his profile for FREE

We believe there has to be key benefits when you roll-out a new feature and some of them I have jotted down for you below.

Key Benefits of Director Profile Page Feature

Be aware of your peers (Directors)

Beware of offending Directors, keep tabs on integrity of Directors

Evaluate and know your competitors better

Examine the active status of Directors of your clients and vendors

Conduct Director recruitment or executive search in a much savvy manner.

These benefits come with the latest, accurate, unique information related to Directors and is absolutely FREE.

Well, there is no point of learning benefits until and unless we are aware of how to utilize this feature. Let me guide you on using these features below.

With these 3 simple steps you can evaluate your fellow Directors by understanding and analyzing their profile. Let us know if you’ve got any specific feature in your mind that you want us to implement.

0 notes

Link

Now, you can view the latest, accurate and unique information about all the directors absolutely for FREE!

0 notes

Text

5 Smart Ways to Use the Small Business Loan

You finally secured a small business loan — after months of preparation, formalities and waiting. This boost of cash can help your business in a number of ways. But you need to be smart about how you invest the money.

5 Smart Ways to Use the Small Business Loan

Hire New Staff or Training Equipment

If you are looking to expand your team, using the small business loan for hiring would be a good idea. If hiring a full-time team still proves to be expensive, consider outsourcing.

Hiring remote workers or part-time staff can help you create a better workforce. If you are happy with the current staff, invest in creating better training programs.

Purchase, Lease, or Repair Equipment

Every business needs equipment — be it computers, construction equipment or even cooking equipment in a restaurant.

This equipment can break down unexpectedly or they might need upgrades. If you don’t have money to repair or purchase new equipment, the business will suffer.

This is where a personal line of credit for businessmen can come into use. You can utilize it to purchase or lease new equipment. You can even invest the funds in getting the equipment repaired.

Having properly functioning equipment will ensure that your business operations run smoothly.

Business Expansion

If you think it is a good time to expand the business, use the loan to do so.

There are many ways to expand business:

You can open another office in a different physical location

You can set up an online store to sell your products

You can expand the products or services you offer

Hiring extra staff

A small business loan can help take your business to the next level and grow by great strides.

Effective Marketing

Every business benefits from marketing — whether it is online marketing or using traditional ways of offline marketing.

Use the small loan to invest in increasing the internal marketing capacity by hiring new staff. You can even use it to invest in marketing software and systems.

Investing in marketing helps in increasing brand visibility and gives better marketing insights. It also increases the chances of generating a higher return on investment.

Buying Additional Inventory

Seasonal needs may require you to buy an additional inventory. So would a sudden rise in demand. Not having the inventory at such times means lost revenue.

A small business loan provides the cash flow to buy the extra inventory or replenish the existing stock. Investing in inventory is one of the most common reasons business owners seek funding. Having enough inventory will help you keep up with consumer demands.

Moreover, having an up-to-date inventory will broaden the reach and appeal of your product range. This helps in attracting new customers.

In Conclusion

Focus on aspects that will help in the expansion and growth of the business. Making wise financial decisions will lead to greater ROI. Using the loan ineffectively will lead you to borrow more money in the future. Lastly, if you have a bad credit score, you can still apply for a loan.

0 notes

Text

Companies that Claimed Over 95% Input Tax Credit Under Radar

Highlights:

Tax authorities have dropped emails looking for answers from companies which paid over 95% of their tax liability by claiming Input Tax Credit.

The questions have arisen due to a big change in turnover reported by the companies, the decline in growth of central GST liability.

The Institute of Chartered Accountants of India (ICAI) western regional council has written and questioned the tax authorities practice in dealing with such cases.

Companies that used Input Tax Credit for paying most of its Goods and Services Tax (GST) liability or the companies that reported a drastic change in the turnover are being questioned by the tax officials.

Tax authorities have dropped emails looking for answers from companies which paid over 95% of their tax liability by claiming Input Tax Credit. Tax officials want to ascertain the crucial aspects responsible for such low amount of GST collections.

The questions have raised due to the big change in turnover reported by the companies, decline in growth of central GST liability and a huge gap in Input Tax Credit between GSTR 2A and GSTR 3B. In some places, companies have been asked to furnish tax payment challans. GSTR 2A and GSTR 3B are tax return forms.

GSTR 2A is a tax return related to purchases and is automatically generated by the GST portal. It includes all the information on goods and services purchased from the seller. GSTR 3B is a simple tax return introduced by the Central Board of Excise and Customs, it has to be filed by everyone who is registered under GST.

“It will be good if the government looks into this issue and comes up with clear guidelines in terms of information which should be sought from businesses and the manner in which it would be used,” said Pratik Jain, National Leader, Indirect Taxes, PwC.

The estimated revised budget for FY 2019, the government fixed GST revenue at INR 6.43 lakh crore, INR 1 lakh crore fewer than it was projected first. GST secured a collection of INR 92,427 crore in February. The collection of February month is much lower due to lesser days, however, it seems to increase in March.

Companies are feeling pressure due to tax authorities not giving them enough time to reply to the queries, tax officials are also sending frequent emails for seeking information to the queries.

“There is an increasing trend by the department to conduct such inquiries over an email, more so with revenue pressures at the end of the financial year,” said Bipin Sapra, partner, EY. “This needs to be avoided as there are proper mechanisms in law like annual returns and GST audit reports which are yet to be filed and which will provide the complete details being sought by the department.”

0 notes

Text

Quikr to Acquire an E-commerce Company into Buying and Selling of Refurbished Products Zefo

Highlights

Quikr to acquire Zefo in an all-stock deal worth INR 200 crore.

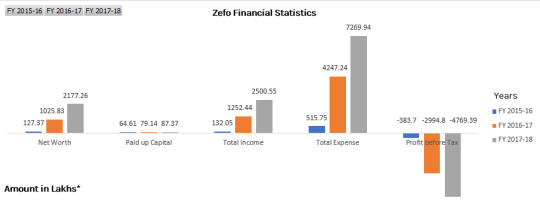

Financial statistics of Zefo from the year 2015–2018.

Quikr is also pushing to create its own payments and logistics services for the used or second-hand products.

Quikr, a renowned Indian classified advertising platform said to be acquiring Zefo soon. Zefo is an Indian e-commerce platform for buying and selling refurbished or second-hand products.

It has been understood that Quikr is in advanced talks to acquire Sequoia-backed refurbished products marketplace Zefo for INR 200 crore in an all-stock deal.

After the acquisition of Zefo, supported by Sequoia Capital, Helion Venture Partners and others, will go on to operate independently. Zefo was incorporated on 2nd July 2015 by Arjit Gupta, Himesh Joshi, Karan Gupta, and Rohit Ramasubramanian.

Zefo has raised an estimated INR 2.8 crore from investors thus far. This online portal specializes in quality check, repairs, and refurbishment of products like furniture, electronic appliances, and mobile phones.

We have rounded up financial statistics of Zefo, let’s see how well the company has fared from the year 2015 to 2018.

The above financial statistics of Zefo from the year 2015–2018 shows us different financial parameters which involve Net Worth, Paid up Capital, Total Income, Total Expense and Profit before Tax.

A person who is known to be aware of the deal said: “This aligns with Quikr’s philosophy of moving to a transaction-based business model, and strengthens its position in the second-hand and refurbished goods space.” Zefo is going to help Quikr by enabling access to repair and refurbishing of products it has lacked. Quikr is also pushing to create its own payments and logistics services for the used or second-hand products.

“Zefo will benefit from Quikr’s customer base, while Quikr will be able to leverage the operational capabilities that Zefo has built around refurbishment and logistics” said by another person who is directly aware of this deal striking soon.

A Quikr spokesperson told that the company does not want to make any statement on speculation that Quikr to acquire Zefo. Last year in August e-commerce big player Flipkart introduced its own market for refurbished products called 2GUD, supported by its acquisition of mobile repair services company called F1 Info Solutions.

2GUD has its focus on the refurbished smartphones and laptops market so far. The company has said that it would expand into refurbished furniture and appliances markets as well, competing with companies like Zefo.

0 notes

Text

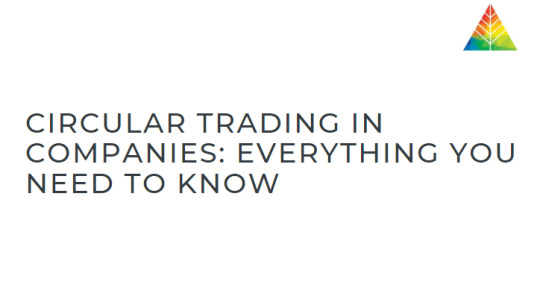

Circular Trading in Companies: Everything You Need to Know

Circular Trading has been ever existing in the Indian Market, but many tend to believe that it only takes place in the stock market. However, that is not the case, Circular Trading can also take place into companies or trading businesses. Before we further get into the depth and analysis of circular trading, let’s start with the basics and try to understand the following aspects.

What is Circular Trading in Companies?

Circular Trading is a type of scam that takes place when a company tries to create a flow of fake sales transaction with its collusioned parties by producing fake invoices. Now, we all wonder, why do they do that? What is the illegal advantage of it?

Circular Trading: It’s illegal Advantages

This type of scam basically creates a huge financial impact on companies’ accounts. This approach of fraud helps companies to inflate their turnover, gain larger loans from financial institutions or banks and also avail GST credits on every lap of transactions done, ultimately raising the black money.

How Circulation Trading takes place in companies? (With example)

We have got a fine example to illustrate how Circular Trading takes place. For instance, there are 3 companies, Company A, Company B, and Company C.

Let’s say Company A is into steel supplies, the Company A sells goods to Company B and Company B sells the same goods to Company C and finally, Company A purchases the exact goods from Company C, hence completing the cycle. But in reality the goods are not moved from one company to another, it’s just the illegitimate transactions created through fabricated invoices which are produced between the companies. Here, Company A, B, and C all are collusioned and involved in the conspiracy.

Generally, this is not the desired pattern for the flow of goods if the transactions are authentic. However, the cycle becomes much more complicated to analyze with the involvement of more than 3 dealers.

Understanding Input Tax Credit

In February, 2019, The Indirect Tax Department raided several suspected companies from different states involved in circulation trading. It is said to be these companies prepared doctored invoices of INR 25,000 crore to avail advantage of GST credit or input tax credit.

Input Tax Credit is a mechanism where a company at the time of paying tax on output, can claim the tax that have already paid on inputs. For instance, a manufacturing company has a tax payable on output (Final product) is INR 500 and tax paid on inputs (Purchases) is INR 300. Here, this manufacturing company can claim input credit of INR 300 and will be taxed only the difference amount that is INR 200.

Consequences

Circulation trading is a serious offense as it is non-bailable and cognizable offense, where a police department has the authority to arrest without a warrant and can begin an investigation without any permission of a court if the amount surpasses beyond INR 5 crore.

0 notes

Text

Tax Officials Raid Companies Involved in Circular Trading

Highlights

The Indirect Tax Department targets raid over several promoters of companies involved in circular trading.

Companies also prepared counterfeit invoices of INR 25,000 crore which was issued by the small and medium companies.

The Indirect Tax Department has raided several states like West Bengal, Punjab, Rajasthan, Punjab, Haryana, Maharashtra, and New Delhi.

Circular trading is a type of securities fraud that can take place in stock markets, causing price manipulation and often related to pump and dump schemes.

Tax officials begin to go after companies that tried to fend off Goods and Services Tax (GST) and are involved in circular trading. Officials claim to have arrested various promoters of such companies.

Many suspects that circular trading may be used to increase turnover or perhaps an approach to bringing black money in the system. Tax experts believe due to this approach genuine companies are facing trouble.

Experts, however, argue that circular trading has been an old trick for several businesses, and in itself doesn’t necessarily result in tax evasion.

In February 2019, The Indirect Tax Department authorities issued notices and raided a number of companies which were involved in inflating their company’s turnover by selling goods from one company to another. They also prepared counterfeit invoices of INR 25,000 crore which were issued by the small and medium companies across India to take advantage of GST credit.

Experts say that approach towards circular trading has been a conventional trick for several companies and that does not necessarily result in tax evasion.

Tax Lawyers plan on to file habeas corpus against the tax department’s arrests. Tax lawyers claim that in the majority of cases no duplicate invoices were issued and tax department did not occur any loss due to tax lawyers.

“While many companies may indulge in circular trading, it doesn’t necessarily mean a case of fake invoices with related evasion of taxes,” said by Abhishek A Rastogi, a partner at Khaitan & Co, who is arguing bail application in some such cases. “The judicial custody has been ordered in few cases and this is a clear case to file a writ of habeas corpus in these situations.”

A person, known to be quite familiar with the development of circular trading illustrated an example of a Mumbai-based company. This Mumbai based company is into trading of plastic supplies. The company sold goods to a Pune based company which sold the exact goods to another company from Bengaluru. While all this was happening, goods were stored safely at a warehouse in Mumbai and GST credits were availed on every lap of the transaction. So, the goods were sold to a number of traders before landing with the original seller, just to pump up the turnover and receive larger valuations and loans.

The input tax credit is a mechanism whereby a company can set off the GST paid by them on purchases against future tax liabilities. Industry trackers said that in many cases the promoters of such companies have landed in jail.

The Indirect Tax Department issued notices to a number of suspected companies seeking the proof of all the sale and purchase transactions and also submit the invoices.

The Indirect Tax Department suspects that such companies purchase the fake bills which help them claim the input tax credit and in actuality, there is no buying and selling of goods is taking occurrence.

The Indirect Tax Department has raided several states like West Bengal, Punjab, Rajasthan, Punjab, Haryana, Maharashtra, and New Delhi. More than 500 people have been booked under the raids.

“Logically it would not make sense to buy own goods at a higher value unless there are reasons beyond the realm of normal transactions,” said by Suresh Nair, the partner at EY India. “There could be scrupulous elements who seek to benefit therefrom for reasons beyond GST. Similar instances could prevail in cross-border transactions as well, and could be fodder for investigative agencies as clearly there could be more to this than meets the eye.”

Circular trading frequently comes into play for getting black money in the system. Importers import goods and then export those same goods. On several occasions, in the past, The Indirect Tax Department has also arrested suspected individuals involved in circular trading.

0 notes

Text

Nifty 50 Non-Executive and Independent Directors Received an Average Sitting Fee of Rs 60 Lakh

Highlights

The Nifty 50 group of companies paid an average sitting fee of INR 60 Lakh to non-executive directors.

The profit-linked commission received by non-executive directors was even higher.

UltraTech Cements topped the list with a payout of INR 21.25 Crore to its non-executive directors.

Companies like Dr Reddy’s, Infosys, Bharti Infratel etc. do not pay sitting fees but pay a commission based on profits earned.

The Nifty 50 group of companies paid an average sitting fee of INR 60 Lakh to non-executive directors, including the independent directors during FY 2017–18 (Ranging from a cumulative payout of INR 11 lakh to INR 195 lakh). Profit-linked commission received by non-executive directors was even higher. The average commission paid by Nifty 50 was estimated INR 505 Lakh (Ranging between INR 31 Lakh and INR 21 Crore).

One of the several companies which fall under Nifty 50 is Axis Bank, which ranked at the top with the highest sitting fee payout of INR 195 Lakh during FY 2018. According to The Companies Act, it permits a maximum remuneration of INR 1 Lakh per meeting to each director as a sitting fee.

In addition to Axis Bank, its peers from the financial sector which paid the maximum permissible sitting fee of INR 1 Lakh were Yes bank, IndusInd Bank, ICICI and HDFC Bank. These banks were the most generous regarding payment of sitting fees to non-executive directors as banks are restricted to pay commission to their non-executive directors. Mahindra & Mahindra, Sun Pharma, Hero MotoCorp, ITC, Bharti Airtel, Vedanta, and Bajaj Auto were among the other companies which paid the maximum sitting fee of INR 1 Lakh for each meeting.

An employee stock ownership plan (ESOP) cannot be issued to independent directors. However, The Companies Act allows them profit-linked commission to be paid, as approved by shareholders. Speaking of commission payout to non-executive directors, UltraTech Cements topped the list with a payout of INR 21.25 Crore.

There are few companies which do not pay sitting fees to its directors for attending board and committee meetings. Companies such as Dr Reddy’s, Infosys, Bharti Infratel and Tech Mahindra do not pay the sitting fee. These companies, however, pay a commission based on profits earned. Tech Mahindra and Infosys paid a commission of INR 868 Lakh and 871 Lakh respectively, during FY 2018.

On the other hand, public sector companies that fall under Nifty 50 with the likes of Coal India, Bharat Petroleum, Indian Oil, Gail, ONGC, Power Grid Corporation, and SBI did not pay any commission to its non-executive directors.

You can also find the list of directors of the above-mentioned companies and companies related information on InstaFinancials.

#nifty 50#sitting fee#directors#non-executive directors#instafinancials#finance#companies#ultratech cements#axis bank#hero motocorp#infosys

0 notes

Text

GST Evasion of INR 20,000 Crores Detected by Government

Highlights:

Rs. 20,000 crores of tax evasion happened during the fiscal year April-Feb FY’19

The tax officers have detected fake invoice of Rs. 1,500 crores

Central Board of Indirect Taxes and Customs department will have a meeting with the representatives of the real estate sector

Rs. 10,000 crores GST evasion has been recovered

The Indian Government has detected that around Rs. 20,000 crores of tax evasion happened during the fiscal year April-Feb FY’19. The Central Board of Indirect Taxes and Customs — the department will have a meeting with the representatives of the real estate sector to understand the hurdles they have post reduction in Goods and Services Tax (GST) rates.

The Council of GST Chairman, Finance Minister Arun Jaitley and comprising state counterparts had decided to cut tax rates on the under — construction apartments and affordable housing to 5% and 1% respectively, but the builders will not be able to claim for the taxes paid on inputs like steel, cement, etc. Earlier GST rates on under-construction apartments were 12% and on affordable housing was 8% with the input tax credit.

The Real Estate sector demanded giving relief to builders of under — construction flats that are already built to move in but are not yet sold to buyers. On this, the Central Board of Indirect Taxes and Customs member John Joseph added that they need to raise this issue with the urban development ministry.

The GST evasion that was detected between April 2018 — February 2019 worth Rs. 20,000 crores of that Rs. 10,000 crores have been recovered. The tax officers have detected fake invoice of Rs. 1,500 crore that was used for illegally claiming GST credit worth Rs. 75 crores. The team has recovered Rs. 25 crores out of it and rest investigation is going on it.

The government will take more steps and precautions to check frauds and will increase compliance because only 5–10 % of the businesses are ‘black sheep’ and is a disgrace that brings a bad name to the real estate industry for which the genuine businesses do not have to suffer.

The government has been increasing compliance for 1.2 crores registered businesses and trying to be dynamic in justifying tax rates since the time GST had been rolled out on July 1, 2017.

At present, GST has 4 — tier slab of 5, 12, 18 and 28 percent, while the essential is zero-rated.

0 notes

Text

India with the Lowest AAA cos Rating Amongst Emerging Markets: Crisil

Highlights

There is only 0.85% of AAA rated companies in India out of globally rated companies.

India out of globally rated companies, which is far behind the ratings projected by countries like China, Taiwan, Thailand, and South Korea.

If 32,500 AAA rated Indian companies were to be assessed on the global scale, their ratings will be boxed on a far narrow bound between BBB category and D on the global scale — Crisil

The amount of AAA rated companies in India is amongst the lowest as compared to the other companies in the emerging markets. Crisil believes even the companies which are rated AAA in India cannot be compared with other AAA-rated companies around the world.

It is astonishing to believe that there is only 0.85% of AAA rated companies in India out of globally rated companies, which is far behind the statistics projected by the countries like China, Taiwan, Thailand, and South Korea after analyzing the national rating data from these countries.

Korea Ratings (Credit rating agency) from South Korea rates 68% of the companies in the country, which has rated 17% of the companies portfolio as AAA. Another credit rating agency Korea Investor Services has rated 13% of its rating portfolio at AAA, while China also has 13% of all the credit ratings at AAA. Taiwan stands at 9% and Thailand at 5%.

Crisil said domestic companies which are rated AAA cannot be compared with the global ratings at the same level “A national rating scale affords granular benchmarking of domestic issuers on a 20-point scale (AAA to D) and the sovereign, which has the flexibility to print local currency, is pegged at AAA on this scale,” Crisil.

“If around 32,500 AAA rated Indian companies were to be assessed on the global scale, their ratings will be boxed on a far narrow bound between BBB category and D on the global scale because India’s sovereign rating (in the BBB category) will usually serve as a ceiling,” Crisil said.

Globally too there has been a gradual decline in the amount of AAA rated companies. At S&P Global Ratings, it has gone down from 89 a decade ago to 9 as of January 1, 2018.

In 2017, AAA-rated companies in the U.S accounted for less than 5% of bond issuances. A and BBB firms accounted for over 60% and speculative grade near 20%.

“Over the past decade or more, companies in the developed economies have relied more on debt in their quest to increase shareholder value. When reliance on debt increases, financial risk also rises leading to a lowering of credit ratings. The width and depth of the corporate bond markets in these geographies and ultra-low borrowing costs over the past decade have also encouraged the shift to debt-driven growth,” said by Gurpreet Chhatwal, President, Crisil Ratings.

0 notes

Text

Lakshmi Vilas Bank Limited Credit Ratings Slashed Under Regulation 30 (LODR)

Highlights

Tamil Nadu based Lakshmi Vilas Bank Credit Ratings have been cut down from BBB+ to BBB-

Brickwork Ratings considered Lakshmi Vilas Bank’s financial results up to Q3/9M FY19, publicly available information and other information provided by the bank.

Influential downgrading factors like the the decrease in business both in advances and deposits, operating loss incurred in Q3 FY 19, higher net loss for 9MFY 19 etc. played a huge part.

The Karur (Tamil Nadu) based Lakshmi Vilas Bank introduced itself as ‘Scheduled Commercial Bank’ in August 1958. The bank’s corporate office is located at Guindy, Chennai. The bank started expanding its branches out of Tamil Nadu. As of September 30, 2018, the bank had 569 branches with 1048 ATMs throughout 18 states and 1 Union Territory of India. Majority of branches are held in Southern states of India like Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, and Kerala.

In compliance with SEBI Listing Obligations and Disclosure Requirement(LODR) Regulations, 2015, Brickwork Ratings India Pvt. Ltd has downgraded the credit rating of Lakshmi Vilas Bank from BWR BBB+ to BWR BBB- for Unsecured Redeemable Non-Convertible Subordinated Lower Tier II Bonds — Series VII of INR 50.50 Crores.

Brickwork Ratings considered Lakshmi Vilas Bank’s financial results up to Q3/9M FY19, publicly available information and other information provided by the bank.

Various factors played in downgrading the ratings like continued weak performance of the bank in terms of decrease in business both in advances and deposits, operating loss incurred in Q3 FY 19, higher net loss for 9MFY 19 as compared to full-year FY 18 net loss, weakening asset quality reflected through increased Gross NPA and Net NPA, higher provisions leading to the net loss and impacting the capital adequacy.

The Capital to Risk Weighted Assets Ratio (CRAR) as of December 31, 2018, is below that of March 31, 2018, and the capital adequacy ratio as of March 31, 2018, was below the regulatory requirement. Generating profit and maintaining CRAR as per regulatory requirement shall be the key rating sensitivities.

Key Rating Drivers

Credit Strengths of Lakshmi Vilas Bank

The bank has its existence in Southern states of Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, and Kerala.

The bank’s Current and Savings Account Ratio (CSAR) has hiked up from 21.06% in FY 18 to 22.85% in 9MFY19.

Experienced Board Members and senior management team are the spines of this bank. The Board has 2 nominee director from RBI.

Credit Risks of Lakshmi Vilas Bank

A string of weak performances in terms of business, earnings and asset quality since FY 18.

Business declined by 9% with a decrease in advances by 11% and deposits by 8% during 9M FY 19.

The bank suffered an operating loss in Q3 FY 19 since the operating loss in Q4 FY 18. For 9M FY 19, the bank made provisions of INR 798 Cr (FY 18: Rs.1306 Cr) and incurred a net loss of INR 705Cr (FY 18 net loss of Rs.585 Cr).

Gross Non-Performing Asset (GNPA) has increased to INR 3364 Crores as of 9M FY 19 (FY 18: INR 2962 Crores) and Net NPA increased to INR 1716 Crores (FY 18 INR 1458 Crores), Put-Call Ratio (PCR) is 55.93% (FY 18: 55.07%).

As of December 31, 2018 capital adequacy ratios of CRAR @ 7.57% and Tier I @ 5.57% is below the ratios as of March 31, 2018, which had CRAR of 9.81% and Tier I of 8.05%. The capital adequacy ratio of the Bank as of March 31, 2018, had declined below statutory requirement.

Here’s the enclosed official Rating Review Letter provided by the rating agency for downward revision of rating of Lakshmi Vilas Bank.

Pdf: Official Letter by BrickWork Ratings describing Credit Ratings Slashed Under Regulation 30 (LODR) for Lakshmi Vilas Bank

0 notes

Text

FAQs on e-Form ACTIVE (INC – 22A)

1. Which are the Companies that need to file e-Form ACTIVE (Active Company Tagging Identities And Verification) (INC-22A)?

Every active company in India that is incorporated on or before 31st December 2017 needs to file particulars of the company in e-Form ACTIVE(Active Company Tagging Identities and Verification) on or before 25th April 2019 as notified by the Ministry of Corporate Affairs in Companies (Incorporation) Amendment Rules, 2019.

2. Is it mandatory to file the e-Form ACTIVE for those companies that incorporated after 31 Dec 2017?

Companies incorporated after 31st December 2017 do not need to file e-Form ACTIVE( INC — 22A).

3. What is the last date for filing e-Form ACTIVE (INC-22A)?

The last date for filing the e-Form ACTIVE is 25th April 2019.

4. What is the name of the e-Form required by Active Companies to file for MCA’s mandate on Companies (Incorporation) Amendment Rules, 2019?

The e-Form is Active Company Tagging Identities and Verification (ACTIVE) — Form INC 22A.

5. Which active companies in India need to file e-Form ACTIVE (INC-22A)?

All Active Companies under :

Public Company(whether listed or not)

Private Company

Government Company

One Person Company

Limited Liability Partnership

6. Which type of companies are not required to file the e-Form ACTIVE (INC-22A)?

Companies which have been struck off

Company under the process of striking off

Company under liquidation

Amalgamated or dissolved companies

7. Which are the Companies restricted to file e-form ACTIVE (INC-22A)?

The companies that have not filed its due financial statements under section 137 (AOC-4) or due annual returns under section 92 (MGT-7) or both with the Registrar shall not be allowed to fill e-Form ACTIVE unless these companies are under some management dispute and the dispute is registered by the Registrar in the register.

8. How much penalty or late fee is charged by the Ministry of Corporate Affairs after the due date of filing?

A fee of Ten Thousand Rupees (Rs.10,000) will be charged by MCA to companies who do not file e-Form ACTIVE by the given due date i.e. on or before 25th April 2019.

9. Which documents are mandatory to attach in e-Form ACTIVE (INC-22A)?

The documents that are mandatory are :

Photo of Registered office with external building & inside office pictures showing at least one Director(s)/ KMP in the picture who has affixed his Digital Signature Certificate to the e-Form ACTIVE.

10. What are the details mandatory to fill in the INC-22A Form?

Number of the Directors as on the date of filing

Email ID of the Company — OTP verification shall be done

Details of Statutory Auditor

Details of the Cost Auditor if Applicable

Details include DIN no, Name and Designation of CEO, Manager and Whole Time Director (before filing the e-Form, please make sure that DIN of all the directors are not disqualified or deactivated due to non-filing of DIR- 3 KYC)

Details include Pan, Name and Membership Number of Company Secretary if Applicable.

Details of CFO if applicable

SRN number of AOC-4/MGT-7 for FY 2017–2018

11. Who will be certifying e-Form ACTIVE (INC-22A)?

The form shall be Certified by the following individuals:

In the case of OPC- One Director

In the case of Other Companies: Two Directors or One Director and KMP

Certified by the Company Secretary/Cost Accountant/Cost and Works Accountant in Practice.

12. What happens if a company doesn’t comply with the mandate and does not file the e-Form ACTIVE (INC-22A)?

The company who does not comply with Companies (Incorporation) Amendment Rules, 2019 cannot request for recording the following event-based information or changes of the company in Registrar of Companies like:

SH-07 (Change in Authorized Share Capital)

PAS-03 (Change in Paid-up Capital)

DIR- 12 (Changes in Director, except cessation)

INC-22 (Change in Registered Office)

INC-28 (Amalgamation de-merger)

The Registrar will not accept such companies marked as “ACTIVE non-compliant” unless these companies file ” e-Form ACTIVE”

13. Where is the e-Form ACTIVE available?

It is available in the Ministry of Corporate Affairs — Company Forms Download page.

The Link is:

http://www.mca.gov.in/MCA21/dca/downloadeforms/eformTemplates/NCA/Form_INC-22A_help.zip

0 notes

Text

MCA Mandates All Active Companies in India to Submit This Form Before 26th Apr 2019

The Ministry of Corporate Affairs has amended Section 469 of the Companies Act, 2013.

The Amended Rules are :

These rules may be called the Companies (Incorporation) Amendment Rules, 2019.

These rules will come into force with effect from 25th February 2019.

The form needed to file for Companies (Incorporation) Amendment Rules, 2019 is e- Form ACTIVE (FORM NO. INC.22A).

Key Highlight of Amendment

Every company that is incorporated on or before the 31st December 2017 shall file particulars of its company and its registered office in e- Form ACTIVE (Active Company Tagging Identities and Verification) on or before 25th April 2019.

Who are Restricted from Filing?

Cases where Companies cannot file e- Form ACTIVE (FORM NO. INC.22A)

Any company that has not filed its due Financials Statements under Section 137 or due Annual Returns under Section 92 or both with the Registrar shall be barred from filing e-Form ACTIVE.

If these companies are under some management dispute and the Registrar has records of the dispute recorded in the register then they will be allowed to file e- Form ACTIVE.

2. Companies that are recorded in the register as struck off or are under the process of striking off or liquidation or amalgamated or dissolved are not required to file e- Form ACTIVE.

What happens, if Companies Don’t Comply?

Companies who do not intimate these said particulars to the Registrar, these companies will be marked as “ACTlVE-non-compliant” on or after 26th April 2019 and will be liable for action.

The “ACTlVE-non-compliant” companies cannot request for recording the following event-based information or changes like :

Change in Authorized Capital

Change in Paid-up Capital

Changes in Director, except cessation

Change in Registered Office

Amalgamation, De-merger

The Registrar will not accept such companies marked as “ACTIVE non-compliant” unless these companies file ” e-Form ACTIVE”.

Late Fee for Not Filing within Due Date

Companies that file e-Form ACTIVE on or after 26th April 2019 with a late payment fee of Rs 10,000 (Ten Thousand Rupees), these companies shall be marked “ACTIVE Compliant” by Registrar.

Documents That are Needed Handy before Filing e-Form ACTIVE

Photo of Registered office (external building & inside office) showing therein at least one Director(s)/ KMP who has affixed his DSC to the Form

Email ID of the Company — OTP verification shall be done

Details of Auditor i.e. Category, Name, PAN, Membership No. of Auditor or Firm Registration No.

Details of Cost Accountant, if applicable — same as Auditor

SRN of Form AOC -4/AOCXBRL & MGT — 7 of FY 2017–18

Note:

The Form is required to be signed by 1 Director in case of OPC and 1 Director & 1 KMP or Directors in case of other Companies, along with certification by practicing professional.

The DIN status of Directors of Companies must be Approved before the filing of this form.

0 notes

Text

Govt Eases Conditions and Investment Limit for Angel Tax concession to Startups

Highlights

Government increases the limit from 10 crores to 25 crores for availing income tax concessions.

A startup will be defined as an entity which has been involved in operations for up to ten years from its date of registration instead of seven years.

The investments made by the listed companies with a net worth of INR 100 crores or turnover of INR 250 crores into a startup shall be exempted.

Any amount raised by startups in excess of its market value would be considered as income from other sources and would be levied tax rate of 30%.

Government increases the limit from 10 crores to 25 crores for availing income tax concessions.

A startup will be defined as an entity which has been involved in operations for up to ten years from its date of registration instead of seven years.

The investments made by the listed companies with a net worth of INR 100 crores or turnover of INR 250 crores into a startup shall be exempted.

Any amount raised by startups in excess of its market value would be considered as income from other sources and would be levied tax rate of 30%.

Government increases the limit from 10 crores to 25 crores for availing income tax concessions.

A startup will be defined as an entity which has been involved in operations for up to ten years from its date of registration instead of seven years.

The investments made by the listed companies with a net worth of INR 100 crores or turnover of INR 250 crores into a startup shall be exempted.

Any amount raised by startups in excess of its market value would be considered as income from other sources and would be levied tax rate of 30%.

The government has made a decision to relax Angel Tax norms and increase the investment limit to INR 25 crores for availing Income Tax concessions by startups. This has come as a huge relief to startups.

In the current scenario, startups can benefit of tax concession only if total investment, including from Angel Investors do not go beyond INR 10 crores.

A notification related to simplifying the process for startups to get exemptions on investments under section 56(2)(viib) of Income Tax Act, 1961, will be issued shortly.

The definition of startups has been amplified. Soon, the startup will be defined as an entity which has been involved in operations for up to ten years from its date of registration instead of seven years.

“An entity shall be considered as a startup if its turnover for any of the financial year, since its incorporation or registration, has not exceeded Rs 100 crore instead of the existing Rs 25 crores,” the official said.

The investments made by the listed companies with a net worth of INR 100 crore or turnover of INR 250 crores into a startup shall be exempted from the section 56 (2) (viib) of the Income Tax Act, exceeding the INR 25 crores limit. Non-residents who have invested into startups shall also be exempted under this section, beyond the limit of INR 25 crores.

“Considerations of shares received by eligible startups for shares issued or proposed to be issued by all investors shall be exempt up to an aggregate limit of Rs 25 crores,” the official added.

“For being eligible for exemption under Section 56(2)(viib), a startup should not be investing in immovable property, transport vehicles above Rs 10 Lakh, loans and advances, capital contribution to other entities and some other assets except in the ordinary course of its business,” the official said.

A startup shall also be exempted if its a private limited company recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) and is not investing in specified asset classes. The eligible startups have to file a duly signed self-declaration with DPIIT to avail exemption. DPIIT shall forward these declarations to Central Board of Direct Taxes.

Several startups have claimed to receive Angel Tax notices and have raised concerns regarding these notices that how it is impacting their businesses under the Section 56 of Income Tax Act to pay taxes on angel funds received by them.

Section 56(2)(viib) of the Income Tax Act says that any amount raised by startups in excess of its market value would be considered as income from other sources and would be levied tax rate of 30%.

Note: Angel tax is a term used to refer to the income tax payable on capital raised by unlisted companies via issue of shares where the share price is seen in excess of the fair market value of the shares sold. The excess realisation is treated as income and taxed accordingly.

Visit InstaFinancials we provide Financial Insights of all companies in India along with providing financial reports and crucial public documents of any company in India. Visit our blog https://blog.instafinancials.com/to get the latest updates and news on the Indian Corporate.

0 notes

Text

MCA notifies norms for appointment of Chairperson & members of NFRA

G.S.R. 125(E). — Ministry of Corporate Affairs hereby amends the National Financial Reporting Authority (Manner of Appointment and other Terms and Conditions of Service of Chairperson and Members) Rules 2018.

Under sub-section (3) of section 132 of the Companies Act, 2013, the following rule that is amended is, in rule 4, in sub-rule (5), for the words “within a period not exceeding one hundred and twenty days” shall be from now on substituted by “within a reasonable period of time”.

This means, the search-cum-selection committee shall make its recommendation to the Central Govt. for the appointment of the Chairperson or Members of the National Financial Reporting Authority, as the case may be within a reasonable period of time.

This rule may be called the National Financial Reporting Authority (Manner of Appointment and other Terms and Conditions of Service of Chairperson and Members) Amendment Rules, 2019 and has come to force on 18th February 2019 after it has been published in the official Gazette.

Note: The principal rules were published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R.262 (E), dated the 21st March 2018.

Visit InstaFinancials and reach out to us. We provide Financial Insights of all companies in India along with providing financial reports and crucial public documents of any company in India. Visit our blog https://blog.instafinancials.com/to get the latest updates and news on the Indian Corporate.

0 notes