#100 - Age Equity Allocation

Explore tagged Tumblr posts

Text

100-Age Rule | Asset Allocation Rule

The ‘100 minus your age’ rule is another asset allocation rule. 100 minus your age gives you the percentage in equities with the balance going into low-risk bond assets.

For example, At age 30 you need 70% equity and 30% bonds. For age 50, equity comes out at 50% and bonds 50%.

The idea is that as you get older you move out of equities and into lower risk bonds. Advisors call this de-risking or life styling. Received wisdom is that in later life having a high proportion of equities creates a hazard to income, if the short term value of the portfolio suddenly moves up or down in value as a fund can’t recover.

#100-Age Rule#100 minus age rule#100 minus age rule investing#Equity Allocation Rule#100 Minus Age Equity#Hundred Minus Age Rule#100 - Age thumb Rule#100 - Age Equity Allocation#100 Minus Age Investment Allocation#100 minus age rule in investing#Risk Management In Equity Allocation Rule#Beware of the 100 Minus Age Rule#asset allocation#multi asset allocation fund#asset allocation portfolio#equity#portfolio investment#asset yogi#risk management trading

0 notes

Text

From Side Hustles to Stocks: How Gen Z is Building Wealth Young

In a world of instant gratification and TikTok trends, Gen Z is redefining what it means to be financially savvy. Born between the mid-1990s and early 2010s, this generation is more digitally native, socially aware, and entrepreneurial than any before. And as 2025 unfolds, the concept of financial independence is no longer a distant milestone—it's a goal being actively pursued in their 20s, or even late teens.

But how does one actually become financially independent in today’s volatile economy? The answer lies in smart investment strategies, a deeper understanding of financial tools, and continuous upskilling—especially through avenues like an online investment banking course that gives Gen Z the knowledge edge they crave.

Let’s decode the financial game plan Gen Z is following in 2025—and how you can join the movement.

Why Financial Independence Matters More Than Ever

For Gen Z, financial independence isn’t just about early retirement or flashy wealth. It’s about freedom—freedom to choose meaningful work, travel, build businesses, or simply live without financial anxiety.

Several factors fuel this drive:

Economic uncertainty post-pandemic and global recessions

The gig economy, offering both flexibility and instability

Student loan debts and high costs of living

Social media influence, glamorizing financial freedom and side hustles

In short, Gen Z wants control over their financial future—and they’re not waiting till 40 to get it.

1. Start with Financial Literacy: Know the Basics

You can’t manage what you don’t understand. That’s why the smartest Gen Zers are prioritizing financial literacy.

This includes understanding:

Budgeting and saving

Debt management

Compound interest

Risk vs. return

Inflation and its impact on wealth

Free resources like YouTube, finance podcasts, and beginner-friendly investment apps are helping bridge the knowledge gap. But for a serious leap in understanding financial markets and tools, many are enrolling in an online investment banking course that offers structured knowledge with real-world relevance.

2. The Rise of DIY Investing

Gone are the days when investing was reserved for Wall Street professionals. With the rise of apps like Zerodha, Robinhood, and Groww, Gen Z has democratized investing.

They’re investing in:

Mutual Funds – SIPs starting from as low as ₹100

Direct Stock Market Investments

ETFs (Exchange Traded Funds) – Offering diversification with low fees

REITs (Real Estate Investment Trusts) – Allowing property investment without owning physical real estate

And while FOMO-driven investing (hello, Dogecoin) still tempts many, there’s a noticeable shift toward long-term wealth building.

3. Diversification: Don’t Put All Your Eggs in One Basket

Smart investors know that putting all your money into one type of asset is risky. Gen Z is increasingly learning the importance of diversification.

A diversified portfolio in 2025 may include:

Equities

Debt instruments (like bonds or PPFs)

Real estate or REITs

Commodities like gold

Crypto (in limited, educated proportions)

Taking an online investment banking course can teach you the logic behind asset allocation and portfolio balancing—a crucial skill in today’s fast-changing financial landscape.

4. Learning from Mistakes: The Crypto Wake-Up Call

Let’s be real: Gen Z jumped into the crypto craze with wild enthusiasm—and many got burned.

While Bitcoin and Ethereum remain part of modern portfolios, the 2022–2023 crypto crash taught a hard lesson: speculative assets should never dominate your investments.

The upside? This experience has made young investors more cautious, analytical, and strategy-focused, with many seeking formal financial training to make better decisions going forward.

5. Upskilling: Learning the Language of Finance

In the age of AI and digital transformation, Gen Z knows the value of upskilling. But it's not just about tech anymore—finance is the next big thing.

Courses in investment banking, financial analytics, and stock market fundamentals are booming. What makes an online investment banking course so appealing?

Flexibility: Learn at your own pace, from anywhere

Practical application: Case studies, simulations, and live market insights

Career boost: Opens doors to high-paying finance roles or entrepreneurial ventures

One such program, offered by reputed institutes like the Boston Institute of Analytics, helps Gen Zers not just understand investment banking—but live it.

6. Building Passive Income Streams

To achieve true financial independence, it’s not enough to save—you need to build passive income.

Popular Gen Z passive income sources in 2025 include:

Dividend-yielding stocks

Freelance skills turned into online courses

YouTube channels, blogs, or social media pages that earn ad revenue

Digital product sales (eBooks, templates, NFTs)

Affiliate marketing or dropshipping businesses

These passive income streams provide a cushion and help accelerate financial independence goals.

7. Financial Planning Tools & Tech

Gen Z loves tech—and fintech tools are their best friends.

From Robo-advisors that automate investing to budgeting apps like Walnut, Mint, and YNAB, this generation is harnessing technology to manage money smarter.

AI-powered tools now suggest customized investment portfolios based on your goals, risk tolerance, and timeline—helping even novice investors build wealth confidently.

Conclusion: Gen Z Is Changing the Investment Game

Financial independence is no longer a dream for the distant future—it’s a plan, actively unfolding in 2025.

Through a mix of self-education, digital tools, calculated risks, and formal upskilling via programs like an online investment banking course, Gen Z is rewriting the rulebook on wealth-building.

They’re not just earning money. They’re learning how to make money work for them.

Whether you're a Gen Z just starting out or someone older looking to catch up, the takeaway is clear: The earlier you start, the better. And with the right knowledge and strategy, financial independence isn’t just possible—it’s inevitable.

0 notes

Text

Australia's Health And Hospital Reform FASHIONING a FUTURE HEALTHCARE SYSTEM Australia's Recent National Health and Hospital Reform The National Health Reform Plan The goal of this Plan is to deliver landmark reforms on Australia's health and hospital system in order to build the foundations of the country's future health system (NHHN, 2010). These major structural reforms will bring certain changes about. They will make the Commonwealth Government the majority financier of public hospitals. It will assume funding and policy responsibility for general practice and primary health care services. It allocates a third of annual Goods and Services Taxes to state and territory governments. It changes the way hospitals are operated as it assumes control from central bureaucracies and turning it over to local hospital networks. It also changes the funding mode in hospitals by paying local hospital networks directly for services instead of by a block grant from the Commonwealth to the states (NHHN). These reforms will endeavor to achieve the goals by improve public hospital and primary health care services (NHHN, 2010). They will draw from the strengths of the present health system, which already provides primary health care through Medicare, and free public hospital treatment for the public. They will also keep these foundations sustainable. Most of all, it will utilize the skills, experience and ingenuity of the citizens at the frontline of the health and hospital system. The Reform Plan will build on the achievements of Government's major health reforms, including record funding for public hospitals, increased volumes of elective surgery procedures, relieving emergency departments of pressures, and record investment in the training of more doctors and nurses (NHHN). Reforms are a must in delivering high-quality health care (NHHN, 2010). The fragmented state of the present health care system has produced sore consequences. It has added to cost shifting among the different levels of government. It has incurred much waste. And it has resulted in long patient wait times. It furthermore faces looming challenges. The population is both growing and ageing. Unprecedented technological advancements are likely to raise health costs. And the burden of chronic disease is also likely to grow. The one consolation is that Australia's rates of hospital admission are higher than those of other countries. This implies better chances at keeping the community healthy (NHHN). But these are hardly achievable without appropriate and major reforms (NHHN, 2010). The nation's finances must be reformed. In order to implement reforms, the government must continue performing the role of private hospitals and healthcare providers to insure acceptable health outcomes. This reform package evolved from the recommendations of the National Health and Hospitals Reform Commission as well as from the more than 100 dialogues between the government and health professionals and the community. This represents the position of the government presented to the states at the Council of Australian Governments (NHHN). The Principles The design principles of the entire health and aged are what citizens and potential patients seek (NHHRC, 2008). People and family-centeredness in being tailor-made for individuals, families and communities as close to home as possible. Equity in that is accessible to all on the basis of health needs rather than the ability to pay. Shared responsibility in that health and the success of the health system depend on the citizens it serves. It is participative. Strengthening prevention and wellness in that is a comprehensive and holistic approach in organizing and funding health services with the end-view of improving the health of the entire nation. Comprehensive as it covers multiple and changing health needs and built on strong primary health care services foundation. Value for money as it requires justifiable local flexibility in financing, staffing and infrastructure in delivering appropriate, timely and effective care. Providing for future generations, this system teaches and trains future generations of health professionals on changes in health care and roles and other adaptations in response to changes. The system recognizes broader environmental influences on health in the global scene, the physical and built environment and the socio-economic environment (NHHRC). Governance principles focus on how the health system will work (NHHRC, 2008). It takes a long-term view in acting strategically and assuming and a responsible forward-looking stance. It assures safety and quality of clinical governance at all levels of the system in learning from mistakes and improving in all aspects. It commits transparency and accountability in clearly delineating and reporting funding details to all. Public voice allows public participation at multiple levels to assure a viable, responsive and effective healthcare system. A respectful and ethical system is pledged with the highest ethical standards and which recognizes the worth and dignity of the entire person. The system observes responsible spending on health in that it assures effective flow of resources to the front line of care and minimal wastage. Funding systems will promote continuity of care according to common eligibility and access requirements. Both public and private resources will effectively and equitably used in cost-effective ways. Information and communication technologies will improve access in rural and remote areas. And it fosters a culture of reflective improvement and innovation, research and sharing of effective practices to improve specific services and the health of all Australians (NHHRC). Factors Influencing the Reforms The first is a system that is unprepared to confront future challenges (NHHN, 2010). These include an ageing population from 14% in 2010 to 23% in 2050; a growing population from 22 million at present to 36 million by 2050; increasing burden of chronic disease; increased and further increasing health costs from today's 15% of government spending to 26% by 2050; and workforce shortages, particularly in the regions and the rural areas. The second factor is too much blame and fragmentation between governments. Patients are, as a consequence, confused as to which level of government can be held accountable for their care. The third factor consists of gaps and poor coordination in needed health services. Primary health care is difficult to access in the rural areas and in the regions or out-of-hours general practice services. Access is also difficult for those in highly disadvantaged areas where health outcomes are poor. Too much pressure on public hospitals and health professionals is the fourth factor. The public hospital system reels under continuously increasing patient demand and drained budgets. Waiting time for surgery and emergency treatment has been longer for more than half a decade. This pressure and other strains are a daily experience to healthcare professionals. The fifth factor is an unsustainable funding model. State government revenue growth has not been able to cope with the continued increase in healthcare costs. Public hospital expenditures grew by 10% from 2003-2008. Health spending alone is projected to cost more than all the state and local government revenue. The sixth factor consists of too much inefficiency and waste. Some public hospitals may be operating less efficiently than best practice at up to 20%, according to the Productivity Commission. Despite improved funding through block grants, transparency remains relatively limited. This lack of transparency prohibits taxpayers and government from making comparisons among states on the matter of efficiency. Too centralized and bureaucratic administrative setups in some states account for part of the problem. These practices discourage efficiency among local clinicians and managers. And the seventh and last factor is inadequate local or clini8cal engagement. Many clinicians and citizens have no adequate involvement in decision-making in the delivery of health services. They fail to make full use of available expertise and commitment of the workforce. Moreover, their services are not suited to the needs of the community (NHHN). A "Road Test" of the Reforms A Simulation was held in June 2011 by the Australian Healthcare and Hospital Association or AHHA (2012) for a dry-run of the new healthcare environment and for comments. The participants recognized the prime importance of changed mind-sets for the success of the new ideas. The backing of governments through a common commitment to the entire change process was a common expressed need. Improving clinical services and consumer experience, a foremost goal of the reforms, will largely depend on the close coordination between the Medicare Locals and the Local Hospital Networks for the proposed delivery of integrated patient services. The participants also found the new Commonwealth-State financing arrangements as a main feature of the reforms. They likewise found the new "efficient price" for hospital services controversial. These two features should be refined or adjusted to provide incentives to patient care in the most appropriate settings. The participants, however, warned that efforts to achieve financial efficiency should not sacrifice quality and safety (AHHA). One of the Reform Plan's major elements is to preview the role of existing and planned national data collection and performing reporting agencies (AHHA, 2012). These agencies should work together to uplift health services instead of hiking red tape and increasing reporting burden for health services. The consumer participants, for their part, found the Simulation useful. But they also confronted their lack of understanding about how to get involved in planning, design, monitoring and evaluation of health care as equal partners. These insights from the Simulation were meant to be a valuable contribution and reference for the effective implementation of Australia's health reform agenda, according to AHHA director Prue Power (AHHA). Implications on the Medical Devices Industry The Reform Plan may also trigger a series of swift market changes for this industry (MedicExchange, 2010). A Frost and Sullivan consultant projected that the U.S.$2.3-billion medical devices market would grow at an estimated 9% between 2009 and 2012. Approximately U.S.$98 billion was spent on healthcare goods and services in 2009 alone. . Government funding for healthcare steadily increased to respond to the need for better services especially to the ageing population and increasing rates of chronic disease. The consultant predicted that the Reform Plan would open many new growth opportunities for medical device companies. He foresaw the market achieving roughly U.S.$3 billion by this year. The Reform Plan will invest in primary and sub-acute care to reduce preventable hospital admissions, increase health awareness, improve healthcare infrastructure and improve access to emergency departments. About U.S.$530 million of the total budget has been reserved for the purchase of medical equipment, machines, the hiring of more physicians, adding more beds, providing more training and the like in order to reduce waiting time for elective surgery for four years. Other factors like increasing healthcare costs, the ageing population, high prevalence of chronic disease, rising need for personalized care and technological advances will fuel the growth the medical devices industry. Healthcare expenditures for those 65 years and older will be seven times today's level 40 years from now. The Commonwealth's health spending should rise to more than 200 Australian dollars by 2050 (MedicExchange). Expansion in exports will also power the growth of the medical devices industry, which is extremely trade-oriented (MedicExchange, 2010). More than 90% of the country's domestic demands for medical devices is met by both imports and exports of 90% of products manufactured in Australia. Two such companies are Cochlear and ResMed with their niche products and innovativeness. The development of biotechnology and nanotechnology will lead to new materials and devices for medical and diagnostic use. The industry has high levels of research and development expenditure and tight collaboration with the health and medical systems, educational and health institutions. Increasing healthcare costs, landmark healthcare reforms since Medicare, billowing exports and technological advances will altogether accrue to the sustainable growth of the industry. At the same time, these will create opportunities for the creation of cardiovascular devices, surgical equipment and devices, point-of-care diagnostics, and homecare and non-hospital devices, the consultant added (MediExchange). Advantages and Disadvantages Publicly-funded healthcare delivery systems are universal healthcare systems (Mission, 2012). Opponents call them socialized medicine systems but proponents call them national healthcare service systems. Such a system provides health care for all citizens of a given political entity. A universal healthcare system, as the name implies, is supplied and operated by a government. But in some, the health care may be publicly funded but private firms extend most of the medical services. Otherwise, the healthcare system allows private providers to offer their resources so that the individual may have the choice between private and public care. But this does not exempt private customers from paying taxes and other costs for spending for public health care (Mission). Funds in universal health care systems are accumulated differently (Mission, 2012). In the case of Australia, funding comes from general government revenues. Coverage also varies in countries. While Canada covers all hospital care expenses, Japan patients pay 10-30% of the costs; Belgium shoulders the majority of eye and dental costs, while Australia does not cover either. Most industrialized nations have some kind of publicly funded health care systems, which cover most if not the total population. Australia is one of these countries (Mission). Universal health care systems are lauded for their equality (Mission, 2012). But countries with these systems allow corresponding private health care providers to create a two-part healthcare system: one for wealthy citizens who pay for private and higher-costing quality care. The other is for those who receive public care. Opponents say that the system's cost-efficiency produces lower quality and less than responsive care. Doctors hired by the system are also paid less. The result is a decrease in medical innovativeness and inventiveness (Mission). BIBLIOGRAPHY AHHA (2012). National health reforms simulated in ground-breaking event. Australian Healthcare and Hospitals Association. Retrieved on April 13, 2012 from http://www.ahha.asn.au/news/national-health-reforms-siulated-ground-breaking-event-0 Mission, C. (2012). Universal healthcare facts. eHow: Demand Media, Inc. Retrieved on April 13, 2012 from http://www.ehow.com/about_567591-universal-healthcare.html MedicExchange (2010). Australia's healthcare reforms: medical devices industry outlook. MedicExchange.com. Retrieved on April 13, 2012 from http://www.mediexchange.com/Healthcare-Reform/australia-healthcare-reforms-medical-devices-industry-outlook.html NHHN (2010). A national health and hospitals network for Australia's future. National Health and Hospitals Network: Commonwealth of Australia. Retrieved on April 13, NHHRC (2009). Principles for Australia's health system. National Health and Hospitals Reform Commission: Commonwealth of Australia. Retrieved on April 12, 2012 from http://www.health.gov.au/internet/nhhrc/publishing.nsf/Content/principles-lp Read the full article

0 notes

Text

Succeed in Your Financial Planning with These 6 Thumb Rules

Financial planning doesn’t have to be rocket science. With these 6 simple thumb rules, you can take charge of your finances and achieve your goals with ease

Save 30% of Your Income

Aim to save at least 30% of your monthly take-home income. Start by automating savings—set up automatic transfers to a savings account or invest in SIPs. Can’t hit 30% every month? No worries, just make it up in the following months. Small, consistent savings can grow exponentially through the power of compounding.

Build a 12-Month Emergency Fund

Life is unpredictable—secure yourself with an emergency fund that covers 12 months of essential expenses like rent, groceries, utilities, and loans. This safety net ensures you’re prepared for any financial hiccup without touching your long-term investments.

Limit Debt to <40% of Income

Your total monthly debt repayments should not exceed 40% of your gross income. Consolidate high-interest loans to reduce your repayment burden and keep your finances stress-free.

Buy a Home at 2x Annual Income

When buying a home, aim for a value that’s no more than 2-3 times your annual family income. Ensure your mortgage payments fit comfortably within your budget and don’t overshadow your savings goals.

Strategic Asset Allocation

Follow this age-old strategy: 100 minus your age in equities. For instance, if you’re 30, allocate 70% to equities and 30% to bonds. Adjust as you age to ensure a balance between risk and security.

Automate Financial Habits

Automating savings and investments makes sticking to your financial plan effortless. Use SIPs, recurring deposits, or other tools to stay consistent with your financial goals.

💡 Our Take

Financial planning doesn’t have to be overwhelming. Start with these thumb rules, and once you're on track, tweak them to suit your unique needs.

Need personalized advice? Book a free 15-minute call with JJ Tax’s expert CAs today! We’ll help you design a financial plan tailored to your goals and secure your future.

www.jjfintax.com.

Download JJ TAX APP

0 notes

Photo

Are you a financial aspirant or a recent graduate in business? Are you trying to find the best professional courses in finance and accounting for a flying career? Well, your search ends here because we’ve put together a list of the top 6 finance certifications for professionals and students. Any business, whether it is an established corporation or a startup, depends on finance. The financial health of a firm affects every aspect of corporate operations, from investing in assets and raw materials to funding projects. For any organization, controlling finances becomes essential. Finance professionals are hired by companies worldwide, and this demand is only rising. However, how can you train for a lucrative profession in finance? If you know what to do, how to do it, and where to do it, you can start a career in finance at any age. This guide will take you step-by-step through all of the best certifications and courses in finance and accounting. Professional Courses in Finance and Accounting ACCA Certification ACCA is another one of the top professional courses in finance and accounting. It is offered by the UK body ACCA and offers you 360-degree knowledge of the accounting domain that includes business accounting, Corporate Accounting, Financial Accounting and Management, Business Law, Taxation, Performance Management and Analysis, auditing, and Financial Reporting. The unique part about this ACCA course is that it has the lowest eligibility criteria compared to others, which lets you pursue ACCA even before your Graduation. The duration of this certification course is 2 years, and the passing rate is more than 50%. CFA Certification When it comes to the top professional courses in Finance and Accounting, CFA, or Chartered Financial Analyst, is one of the most sought-after finance certifications. This certification is a preferred choice, especially for those candidates who have successfully qualified for the CFA exam through the CFA Institute. What makes it unique is that CFA certification is globally recognized and accepted by the major MNCs and global investment firms. CFA allows you to become a financial analyst and also go for the option of becoming an independent financial advisor. There is an extended scope for CFA; it covers all the major sectors, including banking, financial markets, IT, and more. If you wish to flourish in business, here is the 10-step guide to starting a business. Financial Modeling and Valuation Analyst (FMVA)® Certification Getting a financial modeling certification from a company like aCFI is a brand-new and quickly becoming more popular alternative for corporate finance professionals. Using real-world Excel applications, the course covers everything from how to create a financial model to sophisticated valuation methods and sensitivity analysis. Starting at $497, the entire Financial Modeling and Valuation Analyst Program (FMVA)® at CFI offers more than 24 courses and more than 100 hours of video training. The FMVATM test has a pass rate of roughly 70%. When it comes to the best Professional Courses in Finance and Accounting, this certification is a must. Chartered Alternative Investment Analyst (CAIA) Designation Professionals working in the asset management and hedge fund sectors are the target audience for the CAIA certification, which focuses on alternative investments. Ethics, hedge funds, private equity, real assets, structured products, asset allocation, and risk management are the key subjects covered in the CAIA. One of the best certifications in finance is CAIA. There are two levels in the CAIA financial certification program. About 70% of students pass the exam. For specialized areas of finance, such as managing alternative investments (such as private equity, real assets, and hedge funds), the CAIA curriculum is excellent. On average, it only requires 12–18 months to finish. Certified Management Accounting (CMA) A prestigious professional certification course in finance, CMA, is another option that has gained global acceptance. This is an ideal course option for students who have a deep interest in planning, budgeting, and forecasting decisions for enterprises. CIMA is conducted by the UK-based Chartered Institute, while CMA is offered in the US. The total duration of the course is 6–9 months. The eligibility criteria for this financial certification are a bachelor’s degree from a renowned college or an IMA-approved professional certification. If you are a new mom like me and juggling between your work and family, get my secret formulas on maintain a work life balance. Financial Risk Manager Certification The Global Association of Risk Professionals (GARP) administers the Financial Risk Manager (FRM®) exam. FRM Part 1 and FRM Part 2 are the two components that make up the entire exam. In May and November of each year, exams are given. Let’s talk about FRM Parts 1 and 2 individually now. FRM Part 1 Basic risk management subjects are c overed in FRM Part 1 including quantitative principles, derivatives, value at risk (Vary), fundamentals of risk management, etc. FRM Part 2 Advanced risk management subjects like Credit Risk, Market Risk, Operational Risk, Portfolio and Integrated Risk Management, and Current Issues are covered in FRM Part 2. Last Verdict on Professional Courses in Finance and Accounting It’s not a piece of cake to land your desired job at your dream firm. But if you have the necessary skill sets and the appropriate degree, certification, or recognition, it’s not that difficult either. Choose the best finance course from the above list, and you are all set to fly. For professional support, consider enrollin the Mirchawala’s Hub of Accountancy. That’s it for now. What do you think? What are the top courses in finance and accounting you are interested in obtaining? Do you have any questions about any of the accounting or finance courses we’ve added to the list? Let us know in the comment section below. Source link

0 notes

Text

How to Build a Portfolio That Supports Your Retirement Life

Retirement planning goes beyond just saving money; it requires a well-structured portfolio that can generate the necessary income to support your lifestyle during your golden years. Building a retirement portfolio involves careful selection of investment assets that align with your financial goals, risk tolerance, and time horizon. Here's how you can construct a portfolio designed to sustain and support your retirement life.

Adopt the Financial Independence, Retire Early (FIRE) Approach

The FIRE movement—short for Financial Independence, Retire Early—has been gaining traction in India, particularly among young professionals in metropolitan cities. The goal is to save and invest actively during your professional life so that you may attain financial independence far before the typical retirement age.

For Indians, this might involve maximizing your savings rate by living below your means, investing in high-growth assets like equities, and cutting unnecessary expenses. Even if early retirement isn’t your goal, incorporating FIRE principles can help you build a robust retirement corpus, giving you the flexibility to retire comfortably or even pursue a second career or passion project later in life.

Balanced Risk Approach

As you approach retirement, your risk tolerance naturally decreases. It’s essential to strike a balance between growth and preservation of capital. Typically, younger investors can afford to take on more risk by allocating a higher percentage of their portfolio to equities. However, as you near retirement, gradually shifting towards more conservative investments like bonds, fixed deposits, and dividend-paying stocks can help protect your capital.

A common strategy is the "100 minus age" rule, where you subtract your age from 100 to determine the percentage of your portfolio to allocate to equities. For example, if you’re 40, you might consider keeping 60% in equities and 40% in safer assets. Adjust this rule based on your risk appetite, financial situation, and market conditions.

Integrate Sustainable and Ethical Investing

In India, the focus on ethical and sustainable investing is growing as investors become more socially and environmentally conscious. Sustainable investment planning, often referred to as ESG (Environmental, Social, and Governance) investing, involves selecting companies that adhere to ethical practices, focus on sustainability, and contribute positively to society.

Several Indian mutual funds now offer ESG-focused schemes, allowing you to invest in companies that align with your values. This not only supports responsible businesses but also offers the potential for strong financial returns, as companies with good governance and sustainable practices are often better positioned for long-term growth.

Focus on Dividend Growth Stocks

In India, dividend-paying stocks are a popular choice for generating regular income during retirement. However, focusing on dividend growth stocks—companies that consistently increase their dividends over time—can offer even greater benefits.

Investing in established Indian companies with a history of dividend growth can provide a reliable income stream, helping you maintain your lifestyle without needing to sell your investments. Over time, as these dividends grow, they can significantly bolster your retirement income, especially when reinvested during the accumulation phase.

Prioritize Flexibility and Liquidity

Given India’s dynamic economic environment and increasing life expectancy, it’s important to maintain flexibility in your retirement portfolio. This means including assets that can be easily liquidated or adjusted based on changing circumstances, such as unexpected expenses or shifts in financial goals.

Bucket Strategy: Divide your portfolio into short-term, medium-term, and long-term buckets. Short-term buckets can hold liquid assets like savings accounts or short-term fixed deposits for immediate needs, while long-term buckets can invest in growth-oriented assets like equities.

Cash Reserve: Maintain a cash reserve or an emergency fund to cover unforeseen expenses without needing to sell off long-term investments. This is particularly important in India, where medical emergencies or family obligations can arise unexpectedly.

Hybrid Annuities: Consider hybrid annuities that offer a mix of guaranteed income and market-linked returns, providing both security and growth potential. These products are becoming increasingly available in the Indian market and can add an element of stability to your retirement income.

Conclusion

Building a retirement portfolio that supports your life after work requires a blend of traditional wisdom and innovative strategies. By embracing principles like the FIRE approach, sustainable investing, global diversification, and leveraging India’s technological growth, you can create a portfolio that not only sustains you financially but also empowers you to enjoy a fulfilling retirement.

Remember, a successful retirement portfolio in India should be adaptable, tax-efficient, and aligned with your long-term goals. By staying informed and proactive, you can navigate your retirement years with financial security and peace of mind, enjoying the fruits of your hard work.

1 note

·

View note

Text

Learn Investing: How to Create a Balanced Portfolio

Learn investing wisely is crucial for achieving financial goals and securing your future. One of the fundamental principles of successful investing is creating a balanced portfolio. In this guide, we'll explore what a balanced portfolio is, why it's important, and how you can build one to optimize your investments effectively.

Understanding a Balanced Portfolio

A balanced portfolio is a strategic mix of different investments that aims to deliver the highest possible return for a given level of risk. The key idea behind a balanced portfolio is diversification, spreading your investments across various asset classes such as stocks, bonds, real estate, and cash equivalents. This diversification helps reduce the overall risk because different asset classes tend to perform differently under different market conditions.

Importance of a Balanced Portfolio

The primary benefit of a balanced portfolio is risk management. By diversifying your investments, you reduce the impact of volatility in any single asset class. For example, if the stock market experiences a downturn, the bonds or real estate in your portfolio may provide stability or even growth, thereby cushioning the overall impact on your investment returns.

Another advantage of a balanced portfolio is that it can align with your financial goals and risk tolerance. Younger investors with a longer time horizon might have a higher allocation to stocks for growth potential, while older investors or those nearing retirement might lean more towards bonds and stable income-generating assets to preserve capital.

Steps to Create a Balanced Portfolio

1. Assess Your Risk Tolerance

Before you start building your portfolio, it's essential to evaluate your risk tolerance. This assessment helps determine the mix of investments that you'll be comfortable with during market fluctuations. Risk tolerance typically depends on factors such as your age, financial goals, and investment experience.

2. Define Your Investment Goals

Clearly define your investment objectives. Are you investing for retirement, education, or wealth accumulation? Your goals will influence the allocation of assets in your portfolio. For long-term goals, you might have a higher proportion of equities, while short-term goals may warrant a more conservative approach.

3. Allocate Assets Strategically

Based on your risk tolerance and investment goals, allocate your assets across different asset classes. A common rule of thumb is the "100 minus your age" rule, where you subtract your age from 100 to determine the percentage of your portfolio that should be invested in stocks. The remainder can be allocated to bonds and other asset classes.

4. Diversify Within Asset Classes

Within each asset class, further diversify your investments. For stocks, consider diversifying across industries and geographies. Similarly, within bonds, diversify between government, corporate, and municipal bonds. This diversification helps mitigate specific risks associated with individual securities or sectors.

5. Monitor and Rebalance Regularly

Financial markets are dynamic, and asset values can change over time. Regularly monitor your portfolio's performance and rebalance it periodically to maintain the desired asset allocation. Rebalancing involves selling over-performing assets and buying under-performing ones to bring your portfolio back to its target mix.

Conclusion

In conclusion, creating a balanced portfolio is a cornerstone of successful learn investing. By diversifying across asset classes, assessing your risk tolerance, and aligning with your financial goals, you can build a portfolio that maximizes returns while managing risks effectively. Remember, investing is a long-term endeavor that requires patience and discipline.

Start building your balanced portfolio today with guidance from experts at mysmartcousin. Whether you're a novice investor or looking to refine your strategy, understanding how to create a balanced portfolio will set you on the path to financial success. Invest wisely and secure your future with a well-balanced investment approach.

By incorporating these strategies into your investment plan, you can enhance your chances of achieving your financial objectives while navigating the complexities of the market. Embrace the power of a balanced portfolio and watch your investments grow over time.

For more insights and personalized advice on creating a balanced portfolio, contact mysmartcousin today. Start your journey towards financial freedom with a solid investment strategy tailored to your needs.

Remember, mastering how to create a balanced portfolio is key to building wealth and achieving your financial dreams.

0 notes

Text

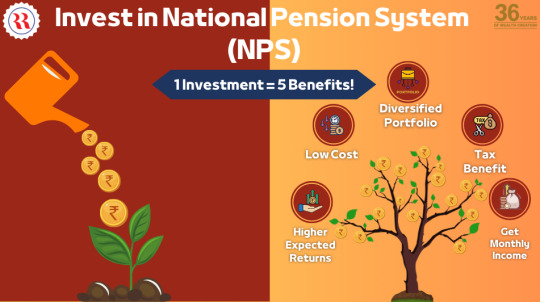

Invest in the National Pension System (NPS)

Unlocking Future Financial Security: The Importance of Early National Pension System Investment

The National Pension System(NPS)stands as a beacon of financial security, offering Indian citizens a voluntary and contributory pension scheme to ensure a comfortable retirement. Launched by the Government of India, NPS aims to provide retirement income by allowing individuals to contribute regularly during their working years. Upon retirement, subscribers receive either a lump sum or periodic payments, known as a pension, based on their contributions and investment returns. Regulated by the Pension Fund Regulatory and Development Authority (PFRDA), NPS offers a range of investment options, providing flexibility to contributors to choose between various asset classes such as equities, government bonds, and corporate debt. Available to citizens across all sectors, including public, private, and unorganized, as well as self-employed individuals, National Pension System offers tax benefits under Section 80CCD of the Income Tax Act, making it an attractive long-term savings avenue for retirement planning. The National Pension System details are given below.

Selecting the Right Mix : Asset Allocation in National Pension System

When it comes to planning for retirement through NPS, selecting the appropriate mix of asset classes and Pension Fund Manager (PFM) is crucial. NPS offers four primary asset classes under a single PFM, each with its unique characteristics and risk-return profiles:

Asset Class E – Equity and Related Instruments : Subscribers have the flexibility to allocate up to 75% of their Tier-I investment and 100% of their Tier-II investment to Equity, providing potential for higher returns over the long term.

Asset Class C – Corporate Debt and Related Instruments : This option allows subscribers to allocate a portion of their portfolio to corporate debt, enhancing stability and generating income.

Asset Class G – Government Bonds and Related Instruments : Subscribers can allocate a portion of their portfolio to government bonds, ensuring capital preservation while providing safety and stability.

Asset Class A - Alternative Investment Funds : Including instruments like CMBS, MBS, REITs, and AIFs, Alternative Investment Funds offer diversification and potential for higher returns. However, the allocation to Alternative Investment Funds cannot exceed 5% of the total portfolio value.

Exclusive Tax Benefits for NPS Subscribers -

NPS offers exclusive tax benefits to all subscribers under subsection 80CCD (1B) of the Income Tax Act, 1961. Subscribers can avail an additional deduction for investment up to Rs. 50,000 in NPS (Tier I account), over and above the deduction of Rs. 1.5 lakh available under section 80C. This makes NPS a tax-efficient investment avenue, providing an opportunity to save on taxes while building wealth for retirement.

The following are the benefits of NPS:

Investing in NPS at an early stage of life offers a multitude of benefits that can significantly impact one's financial future :

Harnessing the Power of Compounding : Early investment allows for maximum benefit from compounding, leading to substantial wealth accumulation over the long term.

Building a Sizeable Retirement Corpus : Starting NPS investments at a young age enables subscribers to build a sizeable retirement corpus through regular contributions and long-term investment growth, ensuring financial security during retirement

Availing Tax Benefits : NPS offers attractive tax benefits, including deductions under Section 80C, making it a tax-efficient investment avenue.

Flexibility and Portability : NPS offers flexibility and portability, allowing subscribers to choose their investment options and adapt their strategy as their financial circumstances evolve over time.

Long-Term Investment Horizon : NPS is designed for the long term, allowing subscribers to take advantage of the long investment horizon and potential market upswings over time.

In conclusion, the national pension system benefits the investor by providing a secure and tax-efficient avenue for retirement planning, with early investment providing numerous benefits, including harnessing the power of compounding, building a sizeable retirement corpus, and availing tax benefits. Therefore, starting National Pension System investments early is essential for securing a financially stable retirement future. For additional investment opportunities, kindly explore: https://www.rrfinance.com/

0 notes

Text

Thomas Bartley on Leadership - Process vs Purpose (1)

Leadership is more than directing a team to achieve a set of objectives; it's about inspiring individuals to realize their full potential and guiding them on a journey of growth and development. Thomas Bartley, a seasoned leader in the retail industry, embodies this philosophy in every aspect of his career.

Bartley, hailing from Chicago and now residing in Naperville, offers a diverse portfolio of professional experiences, from leading Google’s Specialty Retail practice, advising large retailers on digital adoption, to managing leading branded consumer products and durables businesses at Fortune 100 companies. Each role has equipped him with a unique set of skills—building global brand management, new product development, P&L management, and retail strategy—formulating a holistic approach to leadership.

Thomas Bartley Naperville

At Google, Thomas Bartley distinguished himself as a transformational leader, spearheading the digital revolution among a host of retail clients. His pivotal role involved capitalizing on Google's cutting-edge technology and superior human resources to drive a significant upsurge in eComm revenue and profitability. Bartley's expertise extended to enhancing the user experience (UX) for customers, a crucial aspect of retail success in the digital age.

Attuned to the significance of website loading times on user engagement, Bartley zeroed in on the critical threshold of under five seconds for mobile site speed. He recognized the fact that a slow-loading site could deter potential customers, impacting conversion rates and, subsequently, revenue. Bartley, therefore, initiated comprehensive assessments to identify bottlenecks and areas for improvement in site performance.

His proactive stance on this matter was complemented by arranging for the allocation of requisite technical resources. He assembled a team of capable professionals, leveraging their skills to optimize mobile site performance. Their collective efforts resulted in substantial improvements in Customer UX, fulfilling the demand for quick, seamless access to site content.

In essence, Bartley's tenure at Google was defined by his shrewd leadership and strategic direction. He understood the intricacies of the digital retail landscape and maneuvered effectively, ensuring that Google’s retail clients were equipped to thrive in an increasingly competitive market. His contributions have significantly enhanced the digital presence and profitability of numerous retail clients, underscoring his role as a key player in retail digital transformation.

Before Google, Bartley played crucial roles at Warner-Lambert, Schering-Plough Healthcare, Kellogg’s, Whirlpool, ConAgra, and Sears Holdings. His tenure at Sears Holdings Corporation, where he served as General Manager of Craftsman and later as Chief Marketing Officer, saw significant gains in market share and profitable growth for the Kenmore brand.

Bartley attributes his success to his ability to rally people towards a vision that may seem out of reach but is achievable. This leadership style has been highly effective, particularly in his role as a non-executive board member for a leading Private Equity owned enterprise for the past four years.

His interests outside of work, such as home-brewing, boating, vegetable gardening, and carpentry, reflect his curious mind and commitment to continuous learning. These hobbies allow him to explore the blend of art and science, mirroring his leadership style that marries process and purpose.

In essence, Thomas Bartley's leadership journey illustrates that the balance between process and purpose is critical. It's about understanding the "how" and "why" and creating an environment where people can find their own answers. He firmly believes that leadership is about developing people and helping them see their own potential, thus fostering a culture of growth and continuous improvement.

Bartley's extensive experience in the retail sector and unique leadership style continue to be a source of inspiration for others. He is an evangelist for continuous learning, believing that this will provide the foundation for success, no matter what the challenge is. As he says, "the real benefit of learning new skills comes from not only knowing how to do something but also why it's important." This philosophy has enabled him to lead teams on an upward trajectory, inspiring them to develop and grow—on both a personal and professional level. With his continued guidance and mentorship, Bartley has no doubt made a lasting impact in the retail industry.

Bartley is eager to see where technology will take us as we move into the future, believing that innovation is key to staying competitive in today's retail landscape. His commitment to collaboration, exploration, and continuous learning will no doubt help shape a better tomorrow for businesses everywhere.

It is clear that Bartley has an unwavering passion for leadership and technology. He continues to be a trailblazer in the retail industry, inspiring others to pursue their own vision with a balance of process and purpose. With his continued guidance, retail businesses everywhere can look forward to a bright future.

As Thomas Bartley has said, "The key to success in the ever-changing world of retail is embracing innovation while continuing to learn new skills and strategies." It is this approach that will keep us on the cutting edge of retail, creating a brighter future for all involved.

By combining process and purpose, Bartley has been able to tap into his full potential as a leader—inspiring others to do the same. He continues to be an invaluable asset in both the business world and beyond, proving that leadership is about more than just achieving objectives—it's about empowering people to realize their full potential. Now more than ever, we need leaders like Thomas Bartley to show us how to succeed in the ever-evolving world of retail. With his guidance and expertise, businesses everywhere can look forward to a brighter tomorrow.

0 notes

Text

100-Age Rule | Asset Allocation Rule

The ‘100 minus your age’ rule is another asset allocation rule. 100 minus your age gives you the percentage in equities with the balance going into low-risk bond assets. For example, At age 30 you need 70% equity and 30% bonds. For age 50, equity comes out at 50% and bonds 50%. The idea is that as you get older you move out of equities and into lower risk bonds. Advisors call this de-risking or life styling. Received wisdom is that in later life having a high proportion of equities creates a hazard to income, if the short term value of the portfolio suddenly moves up or down in value as a fund can’t recover.

0 notes

Text

Building a Long-Term Investment Portfolio for Financial Success

In today's ever-changing economic landscape, securing your financial future has become a top priority for many individuals. One of the most effective ways to achieve this is by building a long-term investment portfolio. A well-structured investment portfolio can provide financial stability, generate wealth, and help you reach your long-term financial goals. This article will guide you through the process of creating a robust long-term investment portfolio.

1. Set Clear Financial Goals

The foundation of any successful long-term investment portfolio is setting clear financial goals. Whether you aim to retire comfortably, fund your child's education, or buy a dream home, understanding your objectives will dictate your investment strategy. These goals will determine your risk tolerance, time horizon, and asset allocation.

2. Diversification Is Key

Diversification is the golden rule of investing. It involves spreading your investments across different asset classes such as stocks, bonds, real estate, and alternative investments. Diversification helps manage risk. When one asset class underperforms, another may outperform, balancing your overall returns.

3. Understand Your Risk Tolerance

Your risk tolerance is a critical factor in building your investment portfolio. It determines the proportion of your investments allocated to riskier assets like stocks versus safer assets like bonds. Assess your willingness and ability to endure market fluctuations, and tailor your portfolio accordingly.

4. Choose Your Investment Vehicles

When building a long-term investment portfolio, consider the various investment vehicles available:

Stocks: Equities offer the metatrader potential for high returns but come with higher volatility. Investing in individual stocks or exchange-traded funds (ETFs) can be a way to capitalize on the growth potential of the stock market.

Bonds: Bonds are considered safer and more stable investments. They provide regular interest payments and return of principal upon maturity. They are a great choice for income-focused investors.

Real Estate: Real estate can provide diversification and potential for rental income and property appreciation. Real estate investment trusts (REITs) allow you to invest in real estate without owning physical properties.

Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management.

Alternative Investments: These include assets like commodities, hedge funds, and private equity. They can add diversity to your portfolio, but they often come with higher fees and less liquidity.

5. Asset Allocation

The key to successful long-term investing is finding the right balance of assets. Your asset allocation should reflect your financial goals and risk tolerance. A common rule of thumb is the "100 minus your age" guideline. Subtract your age from 100 to determine the percentage of your portfolio that should be in stocks. The rest can be allocated to bonds and other assets.

6. Regularly Rebalance Your Portfolio

Over time, your portfolio's asset allocation may drift due to the varying performance of different investments. To maintain your desired risk level, it's essential to periodically rebalance your portfolio. This involves selling assets that have performed well and reinvesting in underperforming ones.

7. Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This approach can reduce the impact of market volatility and potentially lower your average cost per share over time.

8. Stay Informed

The world of finance is constantly evolving. To make informed investment decisions, you must stay informed about market trends, economic indicators, and any changes in your financial situation. Consider consulting with a financial advisor who can provide personalized guidance.

9. Patience Is a Virtue

Building a long-term investment portfolio requires patience. Market fluctuations are inevitable, but if you've done your homework, diversified your portfolio, and set clear goals, you should stay focused on the long term. Avoid making impulsive decisions based on short-term market movements.

10. Monitor and Adjust

Regularly monitor your investment portfolio's performance and adjust your strategy as needed. Life circumstances change, and so should your investment plan. Keep an eye on your financial goals and make changes when necessary.

In conclusion, building a long-term investment portfolio is a crucial step toward achieving financial success. It involves setting clear goals, diversifying your assets, understanding your risk tolerance, and staying informed. With careful planning, patience, and discipline, you can create a portfolio that provides financial security and helps you reach your long-term objectives. Remember, investing is a journey, not a destination, and it's a journey well worth embarking upon.

0 notes

Text

An Easy Way to Assess Your Risk Profile

Some of the most popular questions asked by our investors especially during the current crisis are -

"Should I continue my SIP in Equity funds?"

"Should I invest in Debt funds rather than a Bank FD?"

"Can Gold save me from the current crisis?"

"Are Hybrid Funds good for long term investments?"

These questions are valid.

We have always answered them in one way or another.

But what really determines your portfolio "well-being?"

Your Risk bearing capacity. Your Risk Appetite....

In times of economic uncertainty, it's important to re-strategize your investment portfolio.

Since almost everything around us has changed.

It makes total sense to re-evaluate your risk appetite. Not just to ensure there is no further damage to your investment portfolio, but also to make the most of the hidden opportunities amidst turmoil.

A risk profile is important for determining a proper asset allocation for your investment portfolio.

In this article we aim to help you understand your attitude towards risk, and how your tolerance to risk translates into your portfolio construction.

You see, every asset class has a risk-return trait suitable for a certain level of personal risk appetite, investment objectives, financial goals, and the time horizon to achieve them.

Let us look at 9 factors that determine Asset Allocation by Risk Profile -

1. Your age

Have your heard of the 100 rule?

It's by far the easiest and most interesting way to determine risk by your age.

It simply states that you should take the number 100 and subtract your age. The result should be the percentage of your portfolio that you dedicate to equity mutual funds.

If you're 25, this rule suggests you should invest 75% of your money in equity mutual funds. And if you're 75, you should invest 25% in equity mutual funds.

In other words, the basic principle behind age-based asset allocation is that your exposure to portfolio risk needs to reduce with age.

2. Your annual income

Given the expenses, the higher the income, the higher could be your risk appetite.

Of course things might have changed now a little bit, that's why, dear investor, re-evaluating risk becomes more important.

3. Your existing assets

Are you a young investor starting your wealth creation journey?

Or Are you a seasoned investor with high-value assets and well-diversified.

This will determine a lot on your risk bearing capacity.

4. Current financial liabilities

As said above, let's assume you are a seasoned investor or a high income individual.

Your risk appetite could be low if your current liabilities are high.

Also if your income is low but with no current liabilities you are free to take more risk.

5. Your knowledge of financial markets

This could be your game changer!

If you know well enough about the financial markets, you can aim for prudent asset allocation.

For instance, this can help you understand that equities are very risky if you are investing for a short tenure; but the same equities could offer a very attractive risk adjusted return when you are holding for a long period of time.

Thus increasing your chance to make the most out of your portfolio. Eventually earning higher risk adjusted returns.

6. Monthly investible surplus

No matter if you fall under the high income bracket or not. Monthly investible surplus depends upon your financial responsibilities.

So, once all your monthly expenses are taken care of. You have paid your monthly EMIs, bills, SIPs etc.

Is there any surplus amount left for you to further invest?

If your proportion of investible surplus is high, your risk-taking ability could also be high.

7. Investment time horizon

This is very common.

We have several times discussed this when it comes to long term investment in equity mutual funds.

The longer time horizon for investment, the greater risk-taking capacity.

If you need your money in short period of time, you are not recommended to take undue risk with your money.

8. Broader investment objective of the investor

If your investment objective is capital appreciation over a long period of time, usually the propensity to take on risk is usually higher.

You are one of those investors who seek a significant level of returns.

These investors could take on higher risk over a long period. More aggressive strategies that may offer higher potential risk adjusted long term returns.

9. Degree of loss the investor can endure

"If you are not willing to risk the unusual, you will have to settle for the ordinary - Jim Rohn"

Last but not the least, if you are one of those who believe taking risk to achieve the extraordinary is the way to go, you have a high risk appetite.

Higher the degree of loss you can bear, higher is the risk endurance.

The Bottom Line

Yes, all investors are not the same.

Some prefer less risk. While some might prefer higher risk than even the higher net worth individuals.

It is important for you to understand the idea of risk and how it applies to YOUR investment portfolio.

Thus helping you make an informed investment decision.

Let us make it easy for you. Try your personal asset allocator to check your risk profile NOW. Just click here.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

0 notes

Text

7 Reasons Why Cryptocurrency Belongs In Your Retirement Portfolio

Across the world, governments are faced with the reality that most households aren’t saving enough for retirement.

Sadly, the era of company-sponsored pension plans is long gone and both Millennials and Boomers are bombarded with the high costs of basic priorities such as housing, education and healthcare that compete directly with investment plans and retirement savings.

According to a recent study carried out by Ramsey Solutions, about half of Americans are not saving for retirement, and the few who do save aren’t saving enough. Folks, that’s a crisis.

In another survey, only 3 in 5 households headed by someone between the ages of 45 and 54 had a retirement account with an average value of $83,000, and 13% of people in their 40s had absolutely no retirement savings.

Apparently, 56% of Gen X folks have no clue how much they will need for retirement. This is according to a new study conducted by Bankrate. In addition, nearly half of working households will experience lower living standards during retirement, as revealed by the Center for Retirement Research at Boston College.

Save for Your Retirement By Investing in Crypto

It’s never too late to start planning or saving for your retirement. Its a fact that most people dread putting their money in risky (read: liquid and volatile) areas such as cryptocurrencies.

We will tell you for free that any viable future financial plan should include Bitcoin and other cryptocurrencies which will provide a secure hedge against existing shaky financial systems.

Today, many people are searching for opportunities that deliver high ROI within a short time frame, possibly through options like private equity funds, venture capital, real-estate investment trusts and lately cryptocurrency.

And there are many people that continue with the struggle to max out their 401(k) contributions, stashing money in traditional IRA or mutual funds.

Of course that’s crucial, but since the majority of retirement plans adhere to the “contribute and coast” rhetoric, ensuring smooth operations and optimal earnings, they eventually demand rebalancing of your finances as the global financial landscape evolves.

Keep in mind that cryptocurrency is one of the biggest and most disruptive technologies in the financial arena in recent tim

Cryptocurrency is coming into the broader market as a new asset class. The puzzling price swings in Bitcoin are luring millennials into pouring their money into risky investments. Interestingly, even the IRS has approved cryptocurrency IRAs.

At this juncture, people are wondering which crypto asset class belongs to the retirement accounts, which crypto and retirement portfolios can feature in their investment strategy and if buying crypto is a great idea for long-term investing?

Why Cryptocurrency Has Become Such a Big Deal?

Well, it’s the next big thing. Ask Wall Street fund managers — they say it is the future!

Don’t be surprised when your friends and family start channeling their retirement dollars into cryptocurrency sooner rather than later. And don’t be startled when you see the cryptocurrency index or exchange-traded funds start to appear on the New York Stock Exchange.

While the crypto space is susceptible to volatility, there are numerous indications that point to Bitcoin and blockchain as being a strong bull ideal for building exchange-traded funds as well as other instruments that are great for retirement savings. You too should be bullish on blockchain, Bitcoin and other cryptos.

Rafael Carmona Toscano, a private investor and scholar of cryptocurrency who has been accumulating Bitcoin since 2013, notes that Bitcoin has a bright future. Rafael boasts hands-on experience with cryptos as he started out mining Bitcoin, and later purchased it.

“Bitcoin is a bank for the unbankable,” he says, while stating that many people in the world have no bank accounts and hence cryptocurrency would solve a huge problem for those folks.

Digital assets represent a new, fundamental asset class — one that is being considered carefully by investors. The main reason for this can be illustrated by Real Estate Investment Trusts, abbreviated as REITs.

The underlying concept of REIT was first introduced as an asset class designed for legal investment in 1960. The investment grew gradually in subsequent decades, but did not gain momentum until the 1990s. In short, the early investors profited incredibly.

Similarly, Bitcoin and other cryptocurrencies are probably the fastest growing asset class in the financial space. But do they qualify to be in your retirement account? Many experts believe so.

Here are 7 reasons why you should include a cryptocurrency IRA (individual retirement account) in your retirement portfolio.

#1: Diversification

The rule of thumb is never put all your eggs in one basket! Did you know that diversification is one of the strategies used to minimize exposure to a single asset class while still ensuring its growth? When it comes to retirement planning, one of the most effective ways to diversify is to put your savings in multiple mutual funds for different reasons such as income, growth, investing etc. Thereafter, you may need to re-balance your portfolio to ensure any rapidly growing segments of your portfolio do not skew your intended allocation.

In traditional financial markets, most of the available tax-deferred retirement accounts restrict diversification to only two classes — bonds and stocks. But, as much as diversification involves spreading the risk across different asset classes, this should extend beyond bonds and stocks to include real estate, cryptocurrency and precious metals, among others. Since cryptocurrency is a promising new asset class with exciting upside potential, it is worth considering as a retirement plan alternative for your diversified portfolios.

#2: Government Hedge

No government can directly control cryptocurrency. This is one of the reasons that has fueled its growth as an alternative currency. However, government regulations and policies do impact the bond market or Wall Street. In addition, central banks debase traditional currencies such as the U.S Dollar with evolving approaches to exchange and monetary policies. In contrast, digital assets like Bitcoin are immune to the effects of changing governmental directives. As such, we can consider cryptocurrency as an asset class capable of shifting in the opposite direction to dominant markets. This gives more credence to its diversification potential.

#3. Long-Term Growth Opportunities

Keep in mind that while cryptocurrency is proving to be an ideal long-term investment, it is also volatile. And just like any other volatile investment, what skyrockets today can plummet tomorrow and that can be bad for your health!

But do you know what other investments can be volatile? Stocks! That’s right. We all remember the Great Recession that happened from 2007–2009 where the U.S equities lost about 50% of their value in less than 18 months.

But we’re not talking about day-to-day transactions. Retirement planning is a long term horizon where individuals count on accruing tax deferred benefits for several decades in order to achieve a given milestone. It’s this long term view that got those who saved for retirement out of the muddy waters of the Great Recession.

Remember the lowest level for the Dow Jones Industrial Average during the crunch? It was at 6,547. Most notably, its highest level before the crash was at 14,164. A decade later, and the market has drastically risen over those points of the Great Recession.

Similarly, while the price of cryptocurrency and particularly Bitcoin is significantly low at the moment, it is obviously higher when compared to early 2017. I bet that anyone would be quite happy with the returns, with the coin price having increased beyond double from its value of about $2,000 in May 2017 to the current November 2018 prices of around $4,000.

#4. Cryptocurrency is Still Cheap

Is the current price tag of Bitcoin turning you away? Well, think again and remember even if Bitcoin’s not cheap, other cryptocurrencies are.

The most important question is not whether or not cryptocurrency is cheap, but will it have appreciated in value a decade later?

If you believe Bitcoin’s price will be in the range of $10,000, $100,000 or $1 million, then the coin is damn cheap today!

While you may not be that guy who spent $100 in 2010 and now has a net worth of $7.4 million, you can still take the advice provided by Wences Casare, PayPal board member that you “put 1 percent of your income into Bitcoin and forget about it for ten years.”

#5. Bitcoin Is Highly Resilient

Bitcoin is huge and the news of its death as highlighted in the 2013 smug LA Times article was premature, given that the coin is aging well.

While the Bitcoin market has faced some tumultuous times, like earlier in the decade when it lost about 70 per cent of its value overnight, the coin has recovered — along with other cryptocurrencies. Realistically, the thought of Bitcoin fading away is impossible as long as the concept of cryptocurrency still exists.

#6. Crypto Is Going Mainstream

You can use cryptocurrency on the online ecommerce marketplace, Overstock. Restaurants in Kenya and Silicon Valley will accept and give you a discount for using it. You can also buy your Sacramento Kings tickets with it.

Some of the biggest companies on the planet like Microsoft, Dell, Tesla and Virgin Galactic are accepting Bitcoin. And why not? Its price is likely to be more tomorrow than it is today.

BitPay, a global payment company is already working with over 125,000 merchants across the globe that accept Bitcoin as a medium of exchange. The company goes a notch higher to allow Bitcoin users to hold a Bitcoin Visa credit card which enables users to transact anywhere this Visa is accepted.

In essence, the fiction that “you can’t use Bitcoin to buy anything” is a fallacy, not a fact. Of course, We don’t expect you to hit your grocery store with it now, but you might be interested in knowing that a guy purchased a house with Bitcoin and made a $1.3 million return on the deal.

#7. Supporting Technology

The world of technology is evolving so rapidly and its successful integration into crypto and retirement portfolios will depend on how fast its functionality will allow holders to quickly and smoothly trade coins and exchange cryptocurrency for fiat currency or non-tokenized assets in their portfolios, while ensuring complete automation, transparency and record-keeping. This will reduce the need for having “middlemen” that drive up charges and cost layers.

The maturation of technologies that support trading in crypto is poised to increase its value, while pushing it into becoming mainstream.

Ideally, the emergence of more retirement platforms that support the technological characteristics of cryptocurrency exchange and portfolio integration have the power to increase crypto gains for the early adopters.

One example of a supporting retirement platform is Dacxi, an innovative platform that empowers new customers looking to hold on to their assets for the long-term. The company’s Dacxi Bundle is a first-of-its kind, combining the major coins by market capitalisation with an emerging coin with rapid growth potential. Ultimately, this helps new customers to spread their risk across four crypto assets automatically and at zero transaction fees!

Tokens or bundles purchased by users are kept safely in 2FA, secure wallets. Users are able to rebalance amounts and adjust their portfolio as they choose.

Take The Plunge

So, why be a statistic among people whose biggest regret is not saving enough for retirement?

How much do you plan to spend when you finally take the plunge? The answer to this question is — as much you can afford. Only you know your own risk tolerance and capability to save or spend.

Dacxi is proud to support people on a path to prosperity with crypto. If you would like to find out more then please join us at dacxi.com. We’re here to help.

1 note

·

View note

Photo

Here Are The Two Key Reasons America Has Improved Its Retirement Score

Credit increased savings is something that doesn’t get talked about enough for American investors who want to be better prepared financially for retirement.

In fact, according to Fidelity Investments’ latest biennial Retirement Savings Assessment, the typical American household is on track to have 83 percent of the income they’ll need over the course of their expected retirement years – with about half in even better shape than that. To put this into perspective, fifteen years ago, when the assessment was first conducted, the projected figure was a bleaker 62 percent.

“It’s a testament to the hard work many families have made in taking control of their finances,” says Melissa Ridolfi, vice president of retirement and college leadership at Fidelity.

The study is based on a comprehensive national survey of 3,234 people identified as saving for retirement, age 25 to 74 in households earning at least $20,000 annually, and looked at assets such as retirement accounts, home equity, inheritances, and current or expected pensions and Social Security benefits. The one disheartening finding: Twenty-eight percent of respondents might just as well be walking around with bright red warning signs if they don’t take significant steps to make up their current shortfall.

Fidelity actually used color-coded indicators to give a fuller picture of households’ ability to cover their estimated expenses in a down market during those later years: