#ACCA Classes

Explore tagged Tumblr posts

Text

Why ACCA is the Best Choice for Aspiring Accountants

The Association of Certified Accountants (ACCA) is among the most sought-after accounting certifications in the world. If you are a professional accountant looking to establish an enjoyable and long-lasting career in accounting and finance, ACCA Coaching from Sranjan International School of Finance stands as the most suitable path. This article explains the main reasons why becoming an ACCA is the best most effective way to go.

Global Recognition and Prestige

One of the main benefits when you become an ACCA professional is the widespread recognition. Recognition and acceptance in more than 180 countries, ACCA certification opens doors to a variety of opportunities across the globe without the need for additional qualifications local to each country that is visited. Employers also value this accreditation as a sign of the highest standards of ethics, competence, and professionalism which employers are highly discerning about.

Its ACCA program is intended to provide students with an extensive understanding of accounting, finance as well as business administration. It covers a range of subjects, such as financial reporting assurance and audit services, tax laws and compliance issues as well as business law regulation strategies for performance management as well as business leadership. This ensures that participants of ACCA are prepared to face the issues in the finance and accounting industries.

Flexibility in Learning

ACCA gives students the most flexibility in studying options and exam schedules. Students can choose between enrolling in accredited institution classes and online classes or combining both. This allows accountants in the future to personalize their education to meet their specific requirements and needs whether they are full-time students, professionals in the workforce, or looking to change careers. ACCA gives you the help you require to manage your studies while juggling other commitments.

Requirement for Practical Experience

ACCA recognizes the importance of practical experience in forming knowledgeable accountants. To be eligible for membership, candidates must also satisfy a practical requirement for experience (PER) which ensures that they can acquire theoretical knowledge and real-world accounting experiences through real-world situations. This PER obligation aims to equip graduates with the knowledge and skills that will allow them to excel in their profession and gain job opportunities following the completion of their studies.

Ethical and Professional Standards of Practice for Companies

Professionalism and ethics are at the foundation of the ACCA certification. It is a fact that the ACCA Institute places great emphasis on ethical conduct, integrity as well as professionalism. Students who take an ethics and professional skill section as part of their learning must finish the course and adhere to the highest standards of conduct, which makes ACCA members trusted advisers in the financial industry.

There are a variety of career Opportunities Available To You

An ACCA qualification offers many career options across a range of industries. Candidates with this qualification could explore opportunities in the public sector, corporate finance audit and assurance, management positions, or taxation consultancy for non-profit or business organizations In fact, there are a lot of possibilities with the ACCA qualification that graduates can pursue different routes until they discover the best one to suit their goals and interests.

Learning Environment Supporters

The ACCA Institute is dedicated to helping students through their education journey. There are a variety of resources accessible to them to prepare for their exams and the development of professional skills; These include study guides and webinars, practice tests, and forums in which they can connect and share experiences. Accredited institutions also provide additional support through coaching programs that are designed specifically for students to help them achieve their goals.

Networking Opportunities

Joining the ACCA community gives you unbeatable networking opportunities. Members have access to an international community of professionals, which can be valuable in advancing their careers and personal achievements. Events, seminars, and networking conferences hosted by ACCA allow members to connect with colleagues as well as experts from the industry and potential employers to discuss potential collaborations or opportunities for employment, in addition to an insight into trends in the industry and the best methods.

Cost-Effective Qualification for Commercial Real Estate Projects

In comparison to other accounting professional certifications, ACCA is generally more economical. With online courses and flexible learning options via ACCA members, students can better manage their costs and earn substantial returns on their investments. ACCA members typically earn higher salaries and better job prospects than non-certified professionals.

Continuous professional development.

The ACCA Institute promotes continuing professional development (CPD) to ensure members stay informed of developments in the industry and to maintain their professional expertise. Members must take part in CPD annual activities to stay relevant in the ever-changing business environment, thereby ensuring that they are equipped with the necessary skills and knowledge for a successful career.

Conclusion

In the end, ACCA stands out as the top accounting certification because of its worldwide recognition, extensive program, flexibility, requirements for experience, strong emphasis on ethics, wide choices of career opportunities, supportive learning environment, networking opportunities, cost-effectiveness, and dedication to ongoing professional growth. Being an ACCA member is an exciting process that can set you up for a lengthy and rewarding career in finance and accounting. Our ACCA classes provide comprehensive training with expert instructors, practical resources, and a supportive community, ensuring you are well-prepared for the ACCA exams and your future career.

1 note

·

View note

Text

Build an International Finance Career with Expert ACCA Classes

If you're aiming for a successful international career in accounting and finance, the ACCA qualification should be on your radar. The Association of Chartered Certified Accountants (ACCA) is a globally recognized certification that opens doors to career opportunities in over 180 countries. Whether you're a student, graduate, or working professional, enrolling in the right Acca Classes and following a structured Acca Course can put you on the fast track to career success.

Why ACCA?

ACCA is more than just a qualification—it's a global standard. It equips you with the skills to manage accounting systems, understand international financial reporting standards, and make strategic business decisions. With the growing demand for finance professionals worldwide, ACCA gives you an edge in a competitive job market.

Expert ACCA Classes at Unique Global Education

Enrolling in expert-led ACCA classes is the first step toward clearing your exams and building a strong foundation in the subject. At Unique Global Education, these classes are designed to provide more than just textbook knowledge. They prepare students for real-world financial roles with hands-on problem-solving, case studies, and personalized guidance.

Here’s what you can expect from their ACCA CLASSES :

Live and Recorded Sessions: Attend classes in real-time or watch recorded videos at your convenience.

Qualified Instructors: Learn from ACCA-certified professionals with teaching and industry experience.

Interactive Learning: Small batch sizes and personalized doubt-clearing sessions ensure student success.

Mock Exams: Regular assessments and mock tests to measure progress and build exam confidence.

Flexible Timings: Weekend and weekday batches available to suit working professionals and students alike.

Comprehensive ACCA Course Structure

The Acca Course at Unique Global Education covers all 13 ACCA papers across three levels—Applied Knowledge, Applied Skills, and Strategic Professional. Each level is taught with a mix of academic rigor and practical application, ensuring you're job-ready upon completion.

Features of the ACCA Course include:

Complete syllabus coverage

Real-time exam strategies

Guidance on ethics and professionalism

Career support and placement assistance

Who Should Enroll?

The Acca Course and Acca Classes are ideal for:

12th pass students with a commerce background

B.Com or M.Com graduates

CA or CMA aspirants

Working professionals in finance or accounting

Start Your Journey Today

Investing in the right education is the first step toward a future-proof career. With flexible learning, expert faculty, and a global curriculum, Unique Global Education offers everything you need to succeed. Enroll in their Acca Classes and take advantage of a globally respected Acca Course that opens up worldwide opportunities.

0 notes

Text

ACCA vs CA: Which Accounting Qualification Should You Choose?

Introduction When it comes to accounting certifications, ACCA and CA (Chartered Accountant) are two of the most respected qualifications. Both offer extensive career opportunities, but they cater to different paths. So, which one should you pursue? Let's compare these two certifications and see which is the best fit for you.

ACCA vs CA: Key Differences

Global Recognition: ACCA is recognized globally, while CA is primarily recognized in India and a few other countries.

Curriculum: ACCA’s curriculum is more flexible and includes a broader range of financial services compared to CA’s more specialized focus on accounting and auditing.

Entry Requirements: The eligibility for CA is stricter compared to ACCA, which has a more flexible entry point for students from various educational backgrounds.

Job Prospects: Both offer lucrative career options. However, ACCA opens doors to international job opportunities, while CA is more popular within India.

Which is Right for You? If you aspire to work internationally or in diverse finance roles, ACCA is your best choice. On the other hand, if you want to specialize in accounting or auditing within India, CA may be the right fit.

Conclusion Both ACCA and CA provide excellent career prospects. Consider your long-term goals, preferred work environments, and career paths when making your decision.

For a more detailed blog, click Here.

0 notes

Text

ACCA Careers and How a BBA Can Help You Get There

Thinking of acca careers after graduation? A BBA degree lays the groundwork for a successful accounting career. Explore how bba subjects align with the acca syllabus. Learn about career options and roles after completing ACCA. Set yourself up for success in global finance and accounting.

#bba subjects#top bba colleges in india#acca careers#bba colleges#bba syllabus#bba colleges in bangalore#acca subjects#best bba colleges in bangalore#bba colleges in india#bba specialization#bba subjects list#bba duration#bba eligibility#bba honours#top 10 bba colleges in india#acca eligibility#best university for bba in india#top 5 bba colleges in india#acca duration#bba hons subjects#top bba colleges#top bba colleges in bangalore#acca fee structure#acca fees in india#acca india#acca institutes in bangalore#top 10 bba colleges in bangalore#acca classes#bba in bangalore#bba in management

1 note

·

View note

Text

0 notes

Text

The ACCA program gives you extensive expertise in accounting, finance, and business management and is a worldwide recognized qualification. The ACCA programme equips you for leadership positions in the finance sector by covering important topics like taxation, auditing, and financial reporting. ACCA provides global reputation, flexible education alternatives, and access to interesting employment prospects.

#ACCA#ACCA COURSE#ACCA EXAM#ACCA FEES#ACCA GLOBAL#ACCA IN INDIA#ACCA SYLLABUS#ACCA ELIGIBILITY#ACCA EXEMPTIONS#ACCA SALARY#ACCA CERTIFICATION#ACCA CLASSES

0 notes

Text

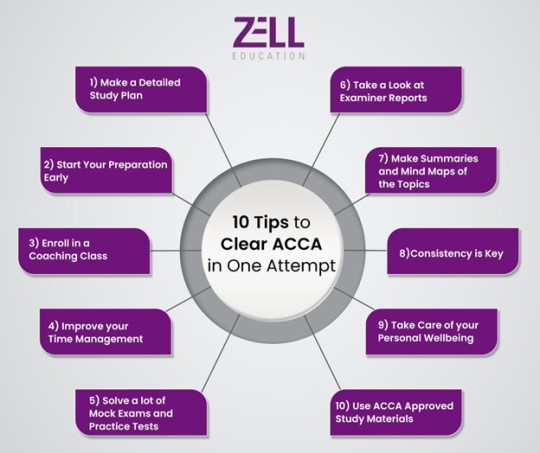

Learn the top 10 ACCA study methods to confidently ace your examinations. These professional pointers can help you navigate the intricacies of ACCA, from understanding exam formats to managing your time effectively and grasping essential study approaches and utilizing useful resources. Use these doable success methods to improve your performance, maintain focus, and ramp up your preparation.

#ACCA#ACCA COURSE#ACCA EXAM#acca fees#ACCA GLOBAL#ACCA IN INDIA#acca eligibility#acca exemptions#accastudy#acca classes#acca certification

0 notes

Text

Don’t Get Stuck – Choose ACCA for Flexibility and Global Careers!

Don't limit yourself if you want to pursue a dynamic career in finance! With the unmatched flexibility that the ACCA course provides, you can manage your studies and other responsibilities. Gaining access to international career opportunities in more than 180 countries is possible with an ACCA certificate. Zell Education offers you the direction and assistance you require to be successful, regardless of whether you are getting ready for the ACCA exam or are just getting started. With ACCA, you can advance your career and discover endless opportunities!

0 notes

Text

CMA USA Subjects

CMA USA Subjects and The CMA (Certified Management Accountant) USA certification covers a comprehensive range of subjects essential for expertise in management accounting and financial management. The CMA exam is divided into two parts. Part 1 focuses on Financial Planning, Performance, and Analytics, encompassing topics such as external financial reporting decisions, planning, budgeting, forecasting, performance management, cost management, and internal controls. Part 2 covers Strategic Financial Management, including financial statement analysis, corporate finance, decision analysis, risk management, investment decisions, and professional ethics. These subjects collectively ensure that CMA professionals possess the analytical skills and strategic insight necessary for effective financial decision-making and leadership in today's dynamic business environment.

0 notes

Text

ACCA Course

The ACCA (Association of Chartered Certified Accountants) qualification is a top-tier credential in the world of accounting and finance. It's globally recognized and is often seen as a gold standard for professionals in these fields. Whether you're aiming for a career in auditing, taxation, financial management, or any other area of finance, the ACCA equips you with the essential skills and knowledge to succeed.

Why Pursue the ACCA Qualification?

The ACCA qualification is more than just a credential; it’s a ticket to a world of opportunities. The global recognition of ACCA opens doors to diverse career paths in finance and accounting. Whether you’re looking to work in multinational corporations, government agencies, or public accounting firms, ACCA provides the foundation you need.

Global Recognition: ACCA is acknowledged in over 180 countries, making it a truly global qualification. This recognition ensures that ACCA professionals are in demand across different regions, giving you the flexibility to work anywhere in the world.

Diverse Career Opportunities: With ACCA, you can explore various roles, including financial analyst, auditor, tax consultant, and more. The versatility of the ACCA qualification means you’re not limited to one career path but can branch out into different areas of finance and accounting.

Comprehensive Curriculum: The ACCA syllabus is designed to cover all aspects of accounting and finance. From financial reporting to business analysis, the curriculum ensures you develop a broad understanding of the financial landscape.

ACCA Eligibility Criteria

One of the great things about ACCA is its accessibility. Whether you’re a recent high school graduate or a working professional, you can pursue ACCA.

Who Can Apply? ACCA is open to anyone with a passion for finance and accounting. You don’t need a degree in accounting to start; however, certain academic qualifications can give you exemptions from some exams.

Academic Requirements: Typically, you’ll need a minimum of two A-levels and three GCSEs (or their equivalent) to start the ACCA course. However, even if you don’t meet these requirements, there are alternative entry routes available.

Professional Experience Requirements: While you can start studying for ACCA without prior work experience, you’ll need to complete three years of relevant professional experience to qualify fully. This ensures that ACCA professionals have both the knowledge and practical skills required in the industry.

Career Opportunities After ACCA

Once you’ve completed the ACCA qualification, a world of career opportunities awaits.

Potential Job Roles: ACCA professionals can work in various roles, including financial analyst, auditor, tax consultant, management accountant, and more. The versatility of the ACCA qualification means you’re not limited to one career path.

Industries That Value ACCA Qualification: ACCA is recognized across multiple industries, including banking, consulting, manufacturing, and government. Whether you want to work in the private sector or public sector, ACCA gives you the credibility you need.

Global Job Market Trends for ACCA Professionals: As businesses continue to globalize, the demand for ACCA professionals is growing. Companies are looking for accountants who can navigate international financial regulations and standards, making ACCA a valuable qualification in today’s job market

Conclusion

The ACCA qualification is a powerful tool for anyone looking to build a successful career in finance and accounting. With its global recognition, comprehensive curriculum, and diverse career opportunities, ACCA offers a solid foundation for your professional journey. Choosing the right institution to pursue ACCA is crucial, and Zell Education stands out as a top choice. With its exceptional faculty, personalized support, and proven track record, Zell Education provides everything you need to succeed in your ACCA journey.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in touch

0 notes

Text

ACCA Course

The ACCA (Association of Chartered Certified Accountants) qualification is a top-tier credential in the world of accounting and finance. It's globally recognized and is often seen as a gold standard for professionals in these fields. Whether you're aiming for a career in auditing, taxation, financial management, or any other area of finance, the ACCA equips you with the essential skills and knowledge to succeed.

Why Pursue the ACCA Qualification?

The ACCA qualification is more than just a credential; it’s a ticket to a world of opportunities. The global recognition of ACCA opens doors to diverse career paths in finance and accounting. Whether you’re looking to work in multinational corporations, government agencies, or public accounting firms, ACCA provides the foundation you need.

Global Recognition: ACCA is acknowledged in over 180 countries, making it a truly global qualification. This recognition ensures that ACCA professionals are in demand across different regions, giving you the flexibility to work anywhere in the world.

Diverse Career Opportunities: With ACCA, you can explore various roles, including financial analyst, auditor, tax consultant, and more. The versatility of the ACCA qualification means you’re not limited to one career path but can branch out into different areas of finance and accounting.

Comprehensive Curriculum: The ACCA syllabus is designed to cover all aspects of accounting and finance. From financial reporting to business analysis, the curriculum ensures you develop a broad understanding of the financial landscape.

ACCA Eligibility Criteria

One of the great things about ACCA is its accessibility. Whether you’re a recent high school graduate or a working professional, you can pursue ACCA.

Who Can Apply? ACCA is open to anyone with a passion for finance and accounting. You don’t need a degree in accounting to start; however, certain academic qualifications can give you exemptions from some exams.

Academic Requirements: Typically, you’ll need a minimum of two A-levels and three GCSEs (or their equivalent) to start the ACCA course. However, even if you don’t meet these requirements, there are alternative entry routes available.

Professional Experience Requirements: While you can start studying for ACCA without prior work experience, you’ll need to complete three years of relevant professional experience to qualify fully. This ensures that ACCA professionals have both the knowledge and practical skills required in the industry.

Career Opportunities After ACCA

Once you’ve completed the ACCA qualification, a world of career opportunities awaits.

Potential Job Roles: ACCA professionals can work in various roles, including financial analyst, auditor, tax consultant, management accountant, and more. The versatility of the ACCA qualification means you’re not limited to one career path.

Industries That Value ACCA Qualification: ACCA is recognized across multiple industries, including banking, consulting, manufacturing, and government. Whether you want to work in the private sector or public sector, ACCA gives you the credibility you need.

Global Job Market Trends for ACCA Professionals: As businesses continue to globalize, the demand for ACCA professionals is growing. Companies are looking for accountants who can navigate international financial regulations and standards, making ACCA a valuable qualification in today’s job market

Conclusion

The ACCA qualification is a powerful tool for anyone looking to build a successful career in finance and accounting. With its global recognition, comprehensive curriculum, and diverse career opportunities, ACCA offers a solid foundation for your professional journey. Choosing the right institution to pursue ACCA is crucial, and Zell Education stands out as a top choice. With its exceptional faculty, personalized support, and proven track record, Zell Education provides everything you need to succeed in your ACCA journey.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in touch

1 note

·

View note

Text

How US CMA Classes in Indore Are Changing Students' Lives

Why Choose US CMA Classes in Indore?

Indore has become a rising hub for finance and accounting education, especially for US CMA aspirants. The growing demand for globally recognized certifications has led many students to choose US CMA classes in Indore. These classes offer a perfect blend of theoretical knowledge and practical skills essential for today's finance professionals.

Srajan International School of Finance, one of the leading institutes, has designed its US CMA coaching to meet international standards, ensuring students are fully equipped to succeed.

Globally recognized curriculum

Industry-relevant case studies

Personalized mentorship

Advanced study resources

Top Benefits of Pursuing US CMA in Indore

Students enrolling in US CMA programs in Indore gain multiple advantages. The city offers quality education combined with affordable living costs, making it a prime destination for professional courses.

Access to experienced faculty with global exposure

Availability of mock tests and simulation exams

Networking opportunities with finance professionals

Support for internship and placement opportunities

Additionally, many students also explore ACCA classes in Indore to broaden their international accounting credentials alongside US CMA.

Career Opportunities After US CMA Certification

The US CMA certification opens doors to numerous career paths globally. Certified professionals are highly sought after in sectors like financial planning, analysis, auditing, and consulting.

Financial Analyst

Cost Accountant

Internal Auditor

Finance Manager

Budget Analyst

Indore's top institutes help students tap into these opportunities by offering placement assistance and career counseling, much like the options available through ACCA Coaching in Indore.

How US CMA Coaching in Indore Prepares You for Global Careers

Global career readiness is a key focus of US CMA coaching in Indore. The curriculum is structured to match the standards set by the Institute of Management Accountants (IMA) USA.

Real-world financial scenarios and case studies

Practical applications of management accounting

Soft skills training for international workplaces

Access to global alumni networks

With the right training, students from Indore are landing jobs not just in India but across the world, similar to the global opportunities provided by the ACCA Institute in Indore.

Success Stories of US CMA Students from Indore

Several students from Indore have successfully transitioned into rewarding finance careers after completing their US CMA certification.

Ankit Jain, now a Financial Analyst at a multinational corporation

Priya Mehta, promoted to Senior Accountant within a year of certification

Rahul Sharma, working as a Cost Accountant in Dubai

These success stories are a testament to the quality education provided by institutes like Srajan International School of Finance.

Experienced Faculty and Expert Guidance in Indore

Quality education is directly linked to the expertise of the faculty. Indore's US CMA coaching institutes employ seasoned professionals who bring real-world experience into the classroom.

Faculty with years of industry and teaching experience

Personalized doubt-clearing sessions

Regular feedback and performance tracking

Guest lectures by industry leaders

Many students also benefit from faculty who have experience teaching CMA coaching in Indore, providing a holistic learning experience.

Affordable Fee Structure for US CMA Coaching in Indore

Unlike major metro cities, Indore offers high-quality coaching at much more affordable rates. This makes US CMA education accessible to a broader group of students.

Flexible payment options

Scholarship opportunities for deserving students

Cost-effective study material and resources

Lower cost of living compared to big cities

This affordability allows many students to also consider enrolling in CMA classes in Indore to enhance their qualifications further.

Flexible Online and Offline US CMA Classes in Indore

Flexibility in learning modes is one of the strongest points of US CMA coaching in Indore. Students can choose between online and offline classes based on their convenience.

Interactive online classes with live sessions

Classroom training with personalized attention

Recorded lectures for revision

Weekend and evening batches for working professionals

This hybrid learning model has made it easier for students to balance their studies with internships or jobs.

International Exposure Through US CMA in Indore

The US CMA qualification itself provides a strong international credential. Indore's coaching centers further enhance this by offering global exposure through:

International webinars and workshops

Collaboration with foreign faculty

Participation in global finance forums

Preparation for international job interviews

Students gain confidence to apply for roles in the US, Middle East, and Europe, making them truly global professionals.

How US CMA Certification Boosts Your Salary and Growth

One of the most significant reasons students opt for US CMA is the substantial salary boost and career growth it offers.

Average salary increase of 30-50% post-certification

Faster promotions into managerial roles

Higher job stability and demand

Increased credibility with employers

With proper guidance from institutes like Srajan International School of Finance, students witness tremendous career growth soon after completing their US CMA.

Conclusion

US CMA classes in Indore, especially at Srajan International School of Finance, are truly transforming students' lives. With expert faculty, global exposure, affordable fees, and flexible learning modes, students are well-equipped to achieve international careers in finance and accounting.

Whether you're aiming for your first job or looking to switch to a global finance role, enrolling in US CMA classes in Indore could be your game-changing decision.

FAQs

Q1. Is US CMA coaching in Indore suitable for working professionals? Yes, most institutes offer flexible weekend and evening batches to accommodate working professionals.

Q2. What is the average duration of US CMA coaching in Indore? Typically, it takes 6-12 months to complete US CMA coaching, depending on the student's pace.

Q3. Can I pursue US CMA along with my college degree? Absolutely! Many students start their US CMA journey during their undergraduate studies.

Q4. How is Srajan International School of Finance different from others? Srajan offers personalized mentorship, expert faculty, affordable fees, and global exposure, making it a preferred choice.Q5. Are placement services available after completing US CMA? Yes, most reputed institutes, including Srajan International School of Finance, offer placement assistance to their students.

#acca institute#acca classes#acca classes in indore#us cma offline classes#acca coaching in indore#us cma classes in rajasthan#acca institute in indore#acca coaching#us-cma coaching#us cma online classes

0 notes

Text

ACCA Course

The ACCA (Association of Chartered Certified Accountants) qualification is a top-tier credential in the world of accounting and finance. It's globally recognized and is often seen as a gold standard for professionals in these fields. Whether you're aiming for a career in auditing, taxation, financial management, or any other area of finance, the ACCA equips you with the essential skills and knowledge to succeed.

Why Pursue the ACCA Qualification?

The ACCA qualification is more than just a credential; it’s a ticket to a world of opportunities. The global recognition of ACCA opens doors to diverse career paths in finance and accounting. Whether you’re looking to work in multinational corporations, government agencies, or public accounting firms, ACCA provides the foundation you need.

Global Recognition: ACCA is acknowledged in over 180 countries, making it a truly global qualification. This recognition ensures that ACCA professionals are in demand across different regions, giving you the flexibility to work anywhere in the world.

Diverse Career Opportunities: With ACCA, you can explore various roles, including financial analyst, auditor, tax consultant, and more. The versatility of the ACCA qualification means you’re not limited to one career path but can branch out into different areas of finance and accounting.

Comprehensive Curriculum: The ACCA syllabus is designed to cover all aspects of accounting and finance. From financial reporting to business analysis, the curriculum ensures you develop a broad understanding of the financial landscape.

ACCA Eligibility Criteria

One of the great things about ACCA is its accessibility. Whether you’re a recent high school graduate or a working professional, you can pursue ACCA.

Who Can Apply? ACCA is open to anyone with a passion for finance and accounting. You don’t need a degree in accounting to start; however, certain academic qualifications can give you exemptions from some exams.

Academic Requirements: Typically, you’ll need a minimum of two A-levels and three GCSEs (or their equivalent) to start the ACCA course. However, even if you don’t meet these requirements, there are alternative entry routes available.

Professional Experience Requirements: While you can start studying for ACCA without prior work experience, you’ll need to complete three years of relevant professional experience to qualify fully. This ensures that ACCA professionals have both the knowledge and practical skills required in the industry.

Career Opportunities After ACCA

Once you’ve completed the ACCA qualification, a world of career opportunities awaits.

Potential Job Roles: ACCA professionals can work in various roles, including financial analyst, auditor, tax consultant, management accountant, and more. The versatility of the ACCA qualification means you’re not limited to one career path.

Industries That Value ACCA Qualification: ACCA is recognized across multiple industries, including banking, consulting, manufacturing, and government. Whether you want to work in the private sector or public sector, ACCA gives you the credibility you need.

Global Job Market Trends for ACCA Professionals: As businesses continue to globalize, the demand for ACCA professionals is growing. Companies are looking for accountants who can navigate international financial regulations and standards, making ACCA a valuable qualification in today’s job market

Conclusion

The ACCA qualification is a powerful tool for anyone looking to build a successful career in finance and accounting. With its global recognition, comprehensive curriculum, and diverse career opportunities, ACCA offers a solid foundation for your professional journey. Choosing the right institution to pursue ACCA is crucial, and Zell Education stands out as a top choice. With its exceptional faculty, personalized support, and proven track record, Zell Education provides everything you need to succeed in your ACCA journey.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in touch

0 notes

Text

How to Fast-Track Your ACCA Qualification in India

Introduction: Dreaming of completing your ACCA faster and stepping into your dream job? The ACCA journey doesn’t have to drag on for years. With the right strategies, you can fast-track your certification while keeping your work-life balance intact. Here's your action plan!

1. Choose the Right Learning Partner

The first and most crucial step is enrolling with an Approved Learning Partner (ALP).

Look for:

Platinum or Gold ALP status

Flexible batch timings (weekend/evening classes)

Experienced ACCA faculty

Strong student success rates

Pro Tip: Some ALPs even offer "accelerator" programs that help you clear multiple papers within a single exam window.

2. Plan Your Papers Smartly

ACCA allows flexible exam scheduling. Use this to your advantage.

How to do it:

Attempt 2–3 papers per session if possible

Group similar subjects together (e.g., FR + AA)

Prioritize tougher papers earlier when your energy is higher

Example paper grouping for speed:

First window: Business and Technology (BT), Management Accounting (MA), Financial Accounting (FA)

Second window: Corporate and Business Law (LW), Performance Management (PM)

3. Stay Exam-Ready Year Round

Consistency beats cramming.

Daily Study Habits:

Study 1–2 hours every day

Weekly mock tests from past papers

Join online doubt-clearing sessions

Remember: ACCA exams are application-based. Practicing case studies with high quality ACCA study materials is key.

4. Claim Exemptions If Eligible

If you have a B.Com, CA Inter, or MBA background, you might be eligible for ACCA exemptions!

Possible exemptions:

Up to 9 papers from Applied Knowledge and Applied Skills levels

Warning: Only claim exemptions if you're confident about the skipped content, otherwise you might struggle with the higher-level Strategic Professional exams.

Conclusion

Fast-tracking ACCA in India isn’t about rushing — it’s about strategic planning and disciplined execution. With the right institute, smart scheduling, and consistent efforts, you can become ACCA-qualified faster than you ever thought possible.

For a more detailed blog, click Here.

0 notes

Text

ACCA Course

The ACCA (Association of Chartered Certified Accountants) qualification is a top-tier credential in the world of accounting and finance. It's globally recognized and is often seen as a gold standard for professionals in these fields. Whether you're aiming for a career in auditing, taxation, financial management, or any other area of finance, the ACCA equips you with the essential skills and knowledge to succeed.

Why Pursue the ACCA Qualification?

The ACCA qualification is more than just a credential; it’s a ticket to a world of opportunities. The global recognition of ACCA opens doors to diverse career paths in finance and accounting. Whether you’re looking to work in multinational corporations, government agencies, or public accounting firms, ACCA provides the foundation you need.

Global Recognition: ACCA is acknowledged in over 180 countries, making it a truly global qualification. This recognition ensures that ACCA professionals are in demand across different regions, giving you the flexibility to work anywhere in the world.

Diverse Career Opportunities: With ACCA, you can explore various roles, including financial analyst, auditor, tax consultant, and more. The versatility of the ACCA qualification means you’re not limited to one career path but can branch out into different areas of finance and accounting.

Comprehensive Curriculum: The ACCA syllabus is designed to cover all aspects of accounting and finance. From financial reporting to business analysis, the curriculum ensures you develop a broad understanding of the financial landscape.

ACCA Eligibility Criteria

One of the great things about ACCA is its accessibility. Whether you’re a recent high school graduate or a working professional, you can pursue ACCA.

Who Can Apply? ACCA is open to anyone with a passion for finance and accounting. You don’t need a degree in accounting to start; however, certain academic qualifications can give you exemptions from some exams.

Academic Requirements: Typically, you’ll need a minimum of two A-levels and three GCSEs (or their equivalent) to start the ACCA course. However, even if you don’t meet these requirements, there are alternative entry routes available.

Professional Experience Requirements: While you can start studying for ACCA without prior work experience, you’ll need to complete three years of relevant professional experience to qualify fully. This ensures that ACCA professionals have both the knowledge and practical skills required in the industry.

Career Opportunities After ACCA

Once you’ve completed the ACCA qualification, a world of career opportunities awaits.

Potential Job Roles: ACCA professionals can work in various roles, including financial analyst, auditor, tax consultant, management accountant, and more. The versatility of the ACCA qualification means you’re not limited to one career path.

Industries That Value ACCA Qualification: ACCA is recognized across multiple industries, including banking, consulting, manufacturing, and government. Whether you want to work in the private sector or public sector, ACCA gives you the credibility you need.

Global Job Market Trends for ACCA Professionals: As businesses continue to globalize, the demand for ACCA professionals is growing. Companies are looking for accountants who can navigate international financial regulations and standards, making ACCA a valuable qualification in today’s job market

Conclusion

The ACCA qualification is a powerful tool for anyone looking to build a successful career in finance and accounting. With its global recognition, comprehensive curriculum, and diverse career opportunities, ACCA offers a solid foundation for your professional journey. Choosing the right institution to pursue ACCA is crucial, and Zell Education stands out as a top choice. With its exceptional faculty, personalized support, and proven track record, Zell Education provides everything you need to succeed in your ACCA journey.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in touch

0 notes

Text

ACCA Mentorship Program

0 notes