#ADAS

Explore tagged Tumblr posts

Text

youtube

Learn more at: What is ADAS AEB Automatic Emergency Braking

2 notes

·

View notes

Text

Just some nice Pictures and a Video of the BRP Miguel Malvar (FFG-06) Guided Missile Corvette of the Philippine Navy (PN), the latest Missile-armed Vessel of the Service during the Arrival Ceremony given to it in Subic recently.

MY NOTES: Just some of the Things I noticed about the Ship from the Pictures and Video, aside from the installed Vertical Launch System (VLS) Cells: The Gokdeniz Close In Weapons System (CIWS) is a LOT bigger than I thought it would be, you can clearly see its Size from the Picture with the PN Personnel standing next to it.

It easily is around 3-4 meters tall, or 9-12 feet for you who are used to the United States (US) Standard of Measurement. I didn’t expect it to be that big, I thought it would be a bit smaller based on what I thought were the Full Scale Mock Ups (FSMU) that I saw at the Asian Defense and Security (ADAS) Events.

Also noticeable is that Screen Mesh over the opening for the Rigid Hull Inflatable Boats (RHIB), and the Cover over the Torpedo Launchers that can be lowered or raised as needed. Both of these help enhance the Stealth Characteristics of the Ship.

Among other Things, the Malvar-class Corvettes will be the first Vessels of the PN that are armed with VLS and Gun-based CIWS. The Contract for these Vessels was signed in December of 2021 under the Administration of former President Rodrigo Duterte.

SOURCES:

Department of National Defense – Philippines Facebook Page Post, 04/08/25 – 1354H {Archived Link}

Philippine Navy Facebook Page Post, 04/09/25 – 0805H {Archived Link}

#brpmiguelmalvar#ffg06#guidedmissile#corvette#philippinenavy#arrivalceremony#subic#verticallaunchsystem#vls#gokdeniz#closeinweaponssystem#ciws#unitedstates#fullscalemockups#fsmu#asiandefenseandsecurity#adas#torpedolauncher#rigidhullinflatableboats#rhib

2 notes

·

View notes

Text

I hate when people find out I'm a girl who likes Star Wars they immediately go like "Oh oh so your favorite character is Rey." Like no bro. It's Adas!

7 notes

·

View notes

Text

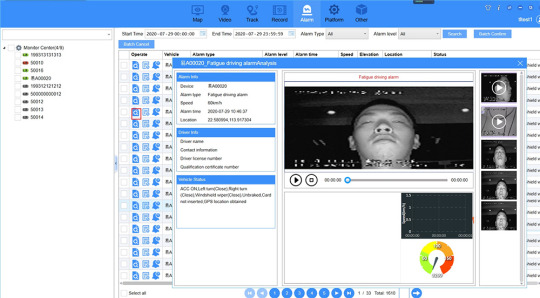

Why Do We Need AI-MDVR with ADAS & DSM in Vehicle Monitoring?

For long-distance truck drivers, a reliable partner on the road is essential. Ai-MDVR not only assists drivers but also provides fleet management companies with satisfactory reports. Advanced features like ADAS and DSM alert drivers to avoid unfavorable behaviors, generating valuable big data reports. By analyzing these reports, fleet management companies can monitor driving habits, gather evidence of poor behavior, and promote good driving practices, ultimately enhancing road traffic safety.

youtube

Making Phone Calls Detection & Distraction Detection.

News reports often highlight the dangers of drivers using their smartphones while driving, a leading cause of traffic accidents. Relying solely on driver awareness is insufficient to prevent this issue. The DSM system addresses this problem by warning drivers to stop using their phones and capturing evidence of phone use, which is then saved on a server for further action.

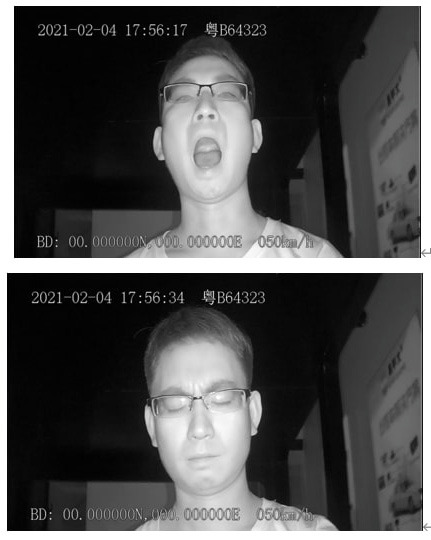

Yawning Detection & Eyes Closing Detection :

Fatigued driving is a common issue for long-distance transport vehicle drivers, characterized by frequent yawning and blinking. The DSM system detects this and immediately warns the driver to take a break, preventing potential accidents. When alerted, the driver should stop at a safe location to rest before continuing, as a moment's distraction can lead to a devastating crash.

Smoking Detection & Driver Absence Detection:

Smoking in a vehicle, especially those carrying gasoline or transporting passengers, is a serious safety risk. Prohibiting drivers from smoking is a crucial policy, particularly for tank trucks and buses. If a driver is caught smoking, the DSM system will issue a stern warning, "Stop Smoking please!", and capture evidence, which is then sent to the fleet administrator, ensuring a swift response to prevent potential disasters.

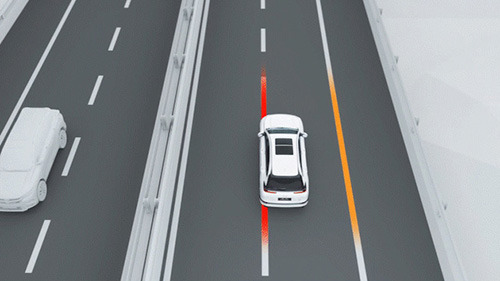

Lane Departure Warning & Safe Distance Warning :

A good driver cultivates safe habits, especially in adverse weather conditions like rain or fog, where visibility is reduced. In such situations, the ADAS system's lane departure and safety distance warnings provide crucial assistance, helping the driver maintain a safe distance from the vehicle ahead and avoid frequent lane changes. By doing so, the risk of accidents is significantly reduced, making highway driving safer.

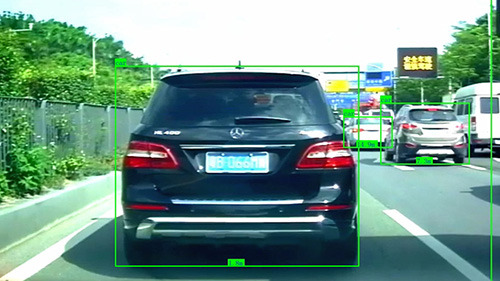

Pedestrian Collision Warning & Forward-collision-warning:

Even experienced taxi drivers can miss pedestrians in their blind spots. The pedestrian collision detection function provides an extra layer of protection, particularly for those who may not be visible or are not paying attention when crossing the road. This feature is especially crucial for novice drivers, who may struggle to accurately judge pedestrian movements, helping to prevent accidents and ensure safer roads.

You will receive a comprehensive report detailing all DSM and ADAS alarm information.

Big data will drive future decision-making, and the Intelligent Vehicle Monitoring System (IVMS) client enables remote access to ADAS and DSM reports, streamlining fleet management. By analyzing these reports, managers can identify common bad driving behaviors, pinpoint drivers who exhibit them, and take targeted action. Additionally, Ai-MDVR provides a proactive solution to prevent accidents by allowing administrators to receive real-time alerts and intervene promptly, notifying drivers to correct hazardous behaviors through the remote platform.

Sourse

ICARVISIONS WEB

1 note

·

View note

Text

💪 Start the week off strong with with a 14 day free trial of Mitchell 1 ProDemand! No obligation. No credit card. No risk. It's 100% FREE! 🔗 https://www.m1repair.com/mitchell1prodemand

Get everything you need with our industry-leading auto repair information. From our powerful 1Search Plus search engine, exclusive real-world knowledge from SureTrack, advanced interactive wiring diagrams, labor times, OEM parts pricing, scheduled maintenance up to 300,000 miles, and ADAS repair information, we've got you covered!

#mitchell1#mitchell 1#prodemand#ondemand#auto repair#car repair#vehicle repair information#prodemand free#automotive#check engine light#auto mechanic#mechanic#ADAS#labor times#maintenence#parts#suretrack#wiring diagrams

2 notes

·

View notes

Text

Upgrading Your Vehicle's BCM: Worth the Investment?

The Body Control Module (BCM) in a vehicle is a critical component that controls various electrical and electronic systems. Over the years, automotive technology has advanced significantly, and newer vehicles come equipped with more sophisticated BCMs. This article delves into the question of whether upgrading your vehicle's BCM is a worthwhile investment, exploring the potential benefits and considerations involved. U.S. Mobile Calibrations, a trusted authority in vehicle electronic systems, aims to provide valuable insights to help you make an informed decision.

Understanding the Role of the BCM

a. What Does a BCM Do?

The BCM manages and controls various electrical systems in a vehicle, such as lighting, power windows, central locking, and more. It acts as a centralized control hub.

b. Importance of an Efficient BCM:

A well-functioning BCM is crucial for seamless operation of electronic systems, contributing to the overall comfort, safety, and efficiency of the vehicle.

Potential Benefits of Upgrading Your Vehicle's BCM

a. Enhanced Functionality:

Newer BCMs often come with additional features and improved capabilities, providing enhanced functionality compared to older models.

b. Improved Efficiency:

Advanced BCMs may optimize the vehicle's electrical systems, potentially improving fuel efficiency and overall performance.

c. Integration with Modern Technology:

Upgrading the BCM allows integration with the latest technologies, enhancing connectivity, security, and entertainment features.

d. Customization and Personalization:

Some upgraded BCMs offer customization options, enabling you to tailor settings to your preferences for a more personalized driving experience.

Considerations Before Upgrading Your Vehicle's BCM

a. Compatibility:

Ensure that the upgraded BCM is compatible with your vehicle's make, model, and year to avoid any compatibility issues.

b. Professional Installation:

Upgrading the BCM requires precise installation. It's advisable to have a professional automotive technician handle the installation to ensure it's done accurately.

c. Cost-Benefit Analysis:

Evaluate the cost of upgrading the BCM against the potential benefits it offers. Consider factors like improved functionality, efficiency, and convenience.

The decision to upgrade your vehicle's BCM is contingent upon various factors, including the model and age of your vehicle, your specific needs, and the potential advantages an upgraded BCM can provide. Consult with professionals and consider the potential benefits and costs before making the final decision.

U.S. Mobile Calibrations is dedicated to guiding you through this decision-making process, ensuring that your vehicle's electronic systems meet your expectations and contribute to an enhanced driving experience.

(FAQs) About Upgrading Your Vehicle's BCM

1. What is a Body Control Module (BCM)?

A Body Control Module (BCM) is an essential electronic component in a vehicle that controls various electrical systems, such as lighting, power windows, and central locking.

2. Why should I consider upgrading my vehicle's BCM?

Upgrading your vehicle's BCM can provide enhanced functionality, improved efficiency, integration with modern technology, and customization options, contributing to an upgraded driving experience.

3. How do I know if my vehicle's BCM needs an upgrade?

Consider an upgrade if you're looking for added features, better efficiency, or integration with modern devices. Consulting with a professional can help determine if an upgrade is suitable for your vehicle.

4. Is upgrading the BCM a complex process?

While upgrading a BCM requires precision, it is not overly complex. However, it's crucial to have a professional automotive technician handle the installation to ensure it's done accurately.

5. Can an upgraded BCM improve fuel efficiency?

Yes, an upgraded BCM may optimize the electrical systems in your vehicle, potentially leading to improved fuel efficiency and overall performance.

6. What are some features I can expect from an upgraded BCM?

An upgraded BCM may offer enhanced functionality, better connectivity, improved security features, customization options, and integration with advanced entertainment systems.

7. Are there BCM upgrades compatible with all vehicle types?

BCM upgrades are often specific to vehicle makes, models, and years. It's essential to ensure that the upgraded BCM is compatible with your specific vehicle to avoid any compatibility issues.

8. Can I install an upgraded BCM myself?

While it's possible to install an upgraded BCM yourself, it's recommended to have a professional automotive technician handle the installation to guarantee accurate and safe installation.

9. What is the typical cost of upgrading a vehicle's BCM?

The cost of upgrading a BCM can vary based on the make and model of your vehicle and the specific features of the upgraded BCM. It's advisable to consult with professionals for an accurate cost estimate.

#usmobilecalibrations#adas#ecm#bcm#electroniccontrolmodules#advancedriverasistance#bodycontrolmodule

2 notes

·

View notes

Text

Wrong: Ada Lovelace invented computer science and immediately tried to use it to cheat at gambling because she was Lord Byron's daughter.

Right: Ada Lovelace invented computer science and immediately tried to use it to cheat at gambling because that was the closest you could get in 1850 to being a Super Mario 64 speedrunner.

#history#computers#computer science#ada lovelace#memes#gaming#video games#super mario 64#speedrunning

67K notes

·

View notes

Text

ADAS, #AdvancedDriverAssistanceSystems, #AutomotiveTechnology, #SensorFusion, #AutonomousDriving, #VehicleSafety, #ADASMarket, #RadarSensors, #CameraSystems, #CollisionAvoidance, #LaneDepartureWarning, #BlindSpotDetection, #AdaptiveCruiseControl, #AutomotiveElectronics, #DriverAssistance

#ADAS#AdvancedDriverAssistanceSystems#AutomotiveTechnology#SensorFusion#AutonomousDriving#VehicleSafety#ADASMarket#RadarSensors#CameraSystems#CollisionAvoidance#LaneDepartureWarning#BlindSpotDetection#AdaptiveCruiseControl#AutomotiveElectronics#DriverAssistance

0 notes

Text

ADAS Market Size Share and Industry Forecast

Meticulous Research®—a leading global market research company, published a research report titled, ‘ADAS Market by Type (Blind Spot Detection Systems, Automatic Emergency Braking Systems), Automation (Level 1, 2, and 3), Component (Vision Camera Systems, Sensors), Vehicle, End Use (Passenger, Commercial), and Geography - Global Forecast to 2031.’

According to the latest publication from Meticulous Research®, the ADAS market is projected to reach $122.86 billion by 2031, at a CAGR of 14.6% during the forecast period 2024–2031. The growth of the ADAS market is driven by stringent vehicle safety regulations, the rising demand for luxury cars, and the increasing integration of safety and comfort features in high-end vehicles. However, the lack of supporting infrastructure in developing countries restrains the growth of this market.

Moreover, the emergence of autonomous vehicles, increasing developments in the autonomous shared mobility space, and the rising adoption of electric vehicles are expected to generate market growth opportunities. However, environmental and data security risks and the high costs of implementing ADAS are major challenges for the players operating in this market.

The global ADAS market is segmented based on system type (adaptive cruise control systems, blind spot detection systems, automatic parking systems, pedestrian detection systems, traffic jam assistance systems, lane departure warning systems, tire pressure monitoring systems, automatic emergency braking systems, adaptive front-lighting systems, traffic sign recognition systems, forward collision warning systems, driver monitoring systems, and night vision systems), level of automation (level 1, level 2, and level 3), component (vision camera systems, sensors, ECU, software, and actuators), vehicle type (internal combustion engine, hybrid, and electric vehicles), end use (passenger vehicles and commercial vehicles), and geography. The study also evaluates industry competitors and analyses the regional and country-level markets.

Based on system type, the ADAS market is broadly segmented into adaptive cruise control systems, blind spot detection systems, automatic parking systems, pedestrian detection systems, traffic jam assistance systems, lane departure warning systems, tire pressure monitoring systems, automatic emergency braking systems, adaptive front-lighting systems, traffic sign recognition systems, forward collision warning systems, driver monitoring systems, and night vision systems. In 2024, the adaptive cruise control systems segment is expected to account for the largest share of the market. The growth of this segment is mainly attributed to the need to maintain a comfortable driving experience, supportive government regulations, and advancements in adaptive cruise control systems.

However, the blind spot detection systems segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the expanding e-commerce and logistics sector, the increasing adoption of BSD systems in vehicles, and the rising use of complementary metal oxide semiconductors (CMOS) image sensors.

Based on level of automation, the ADAS market is broadly segmented into level 1, level 2, and level 3. In 2024, the level 1 segment is expected to account for the largest share of the market. The growth of this segment is attributed to the growing investments in vehicle electrification, the rising demand for driver assistance systems, and the increasing number of Level 1 vehicles on the road.

However, the level 3 segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the rising demand for self-driving vehicles and the increasing initiatives by major market players aimed at launching advanced Level 3 autonomous cars.

Based on component, the ADAS market is broadly segmented into vision camera systems, sensors, ECU, software, and actuators. In 2024, the sensors segment is expected to account for the largest share of the market. However, the sensors segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the rising need to reduce greenhouse gas emissions and the increasing demand for sensors in hybrid powertrains.

Also, this segment is projected to register the highest CAGR during the forecast period.

Based on vehicle type, the ADAS market is broadly segmented into internal combustion engine, hybrid, and electric vehicles. In 2024, the internal combustion engine vehicles segment is expected to account for the largest share of the market. Internal combustion engine (ICE) vehicles are automobiles that use an internal combustion engine (ICE) to power the vehicle. ICEs are typically powered by fossil fuels such as gasoline or diesel, but they can also be powered by alternative fuels such as ethanol or compressed natural gas. ICE vehicles have been the dominant form of transportation for the past century.

However, the electric vehicles segment is projected to register the highest CAGR during the forecast period. The supportive government policies and regulations, increasing investments by leading automotive OEMs, rising environmental concerns, decreasing prices of batteries, and advancements in charging technologies are the key factors driving the growth of electric vehicles in the ADAS market.

Based on end use, the ADAS market is broadly segmented into passenger and commercial vehicles. In 2024, the passenger vehicles segment is expected to account for the larger share of the ADAS market. The growth of this segment is attributed to the growing awareness regarding the hazards associated with greenhouse gas emissions and environmental pollution, stringent emission norms, and demand for premium cars among consumers.

However, the commercial vehicles segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the increase in fuel prices and stringent emission norms set by governments, the growing adoption of autonomous delivery vehicles, and the increasing adoption of electric buses and trucks.

Based on geography, the ADAS market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of the ADAS market. The growth of ADAS in APAC is attributed to the growing automotive manufacturing sector in countries such as Japan, China, India, and South Korea, supportive government regulations, and the rising popularity of Electric Vehicles (EVs).

However, Europe is expected to command the highest CAGR of the global ADAS market. The market growth in the region is attributed to the huge presence of component manufacturers, the growth of the overall automotive sector, and the high demand for sensors for automated vehicle prototypes.

Key Players:

The key players profiled in the global ADAS market study include Continental AG (Germany), Valeo SA (France), Robert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), and Aptiv PLC (Ireland), Autoliv, Inc. (Sweden), Denso Corporation (Japan), Garmin Ltd. (U.S.), Infineon Technologies AG (Germany), Magna International Inc. (Canada), Mobileye B.V. (Israel), Huawei Technologies Co., Ltd. (China), Qualcomm Technologies, Inc. (U.S.), Microsoft (U.S.), and NXP Semiconductors N.V. (Netherlands).

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5377

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#ADAS#AdvancedDriverAssistanceSystems#AutomotiveTechnology#SensorFusion#AutonomousDriving#VehicleSafety#ADASMarket#RadarSensors#CameraSystems#CollisionAvoidance#LaneDepartureWarning#BlindSpotDetection#AdaptiveCruiseControl#AutomotiveElectronics#DriverAssistance

0 notes

Text

ADAS Market Size Share and Industry Forecast

Meticulous Research®—a leading global market research company, published a research report titled, ‘ADAS Market by Type (Blind Spot Detection Systems, Automatic Emergency Braking Systems), Automation (Level 1, 2, and 3), Component (Vision Camera Systems, Sensors), Vehicle, End Use (Passenger, Commercial), and Geography - Global Forecast to 2031.’

According to the latest publication from Meticulous Research®, the ADAS market is projected to reach $122.86 billion by 2031, at a CAGR of 14.6% during the forecast period 2024–2031. The growth of the ADAS market is driven by stringent vehicle safety regulations, the rising demand for luxury cars, and the increasing integration of safety and comfort features in high-end vehicles. However, the lack of supporting infrastructure in developing countries restrains the growth of this market.

Moreover, the emergence of autonomous vehicles, increasing developments in the autonomous shared mobility space, and the rising adoption of electric vehicles are expected to generate market growth opportunities. However, environmental and data security risks and the high costs of implementing ADAS are major challenges for the players operating in this market.

The global ADAS market is segmented based on system type (adaptive cruise control systems, blind spot detection systems, automatic parking systems, pedestrian detection systems, traffic jam assistance systems, lane departure warning systems, tire pressure monitoring systems, automatic emergency braking systems, adaptive front-lighting systems, traffic sign recognition systems, forward collision warning systems, driver monitoring systems, and night vision systems), level of automation (level 1, level 2, and level 3), component (vision camera systems, sensors, ECU, software, and actuators), vehicle type (internal combustion engine, hybrid, and electric vehicles), end use (passenger vehicles and commercial vehicles), and geography. The study also evaluates industry competitors and analyses the regional and country-level markets.

Based on system type, the ADAS market is broadly segmented into adaptive cruise control systems, blind spot detection systems, automatic parking systems, pedestrian detection systems, traffic jam assistance systems, lane departure warning systems, tire pressure monitoring systems, automatic emergency braking systems, adaptive front-lighting systems, traffic sign recognition systems, forward collision warning systems, driver monitoring systems, and night vision systems. In 2024, the adaptive cruise control systems segment is expected to account for the largest share of the market. The growth of this segment is mainly attributed to the need to maintain a comfortable driving experience, supportive government regulations, and advancements in adaptive cruise control systems.

However, the blind spot detection systems segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the expanding e-commerce and logistics sector, the increasing adoption of BSD systems in vehicles, and the rising use of complementary metal oxide semiconductors (CMOS) image sensors.

Based on level of automation, the ADAS market is broadly segmented into level 1, level 2, and level 3. In 2024, the level 1 segment is expected to account for the largest share of the market. The growth of this segment is attributed to the growing investments in vehicle electrification, the rising demand for driver assistance systems, and the increasing number of Level 1 vehicles on the road.

However, the level 3 segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the rising demand for self-driving vehicles and the increasing initiatives by major market players aimed at launching advanced Level 3 autonomous cars.

Based on component, the ADAS market is broadly segmented into vision camera systems, sensors, ECU, software, and actuators. In 2024, the sensors segment is expected to account for the largest share of the market. However, the sensors segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the rising need to reduce greenhouse gas emissions and the increasing demand for sensors in hybrid powertrains.

Also, this segment is projected to register the highest CAGR during the forecast period.

Based on vehicle type, the ADAS market is broadly segmented into internal combustion engine, hybrid, and electric vehicles. In 2024, the internal combustion engine vehicles segment is expected to account for the largest share of the market. Internal combustion engine (ICE) vehicles are automobiles that use an internal combustion engine (ICE) to power the vehicle. ICEs are typically powered by fossil fuels such as gasoline or diesel, but they can also be powered by alternative fuels such as ethanol or compressed natural gas. ICE vehicles have been the dominant form of transportation for the past century.

However, the electric vehicles segment is projected to register the highest CAGR during the forecast period. The supportive government policies and regulations, increasing investments by leading automotive OEMs, rising environmental concerns, decreasing prices of batteries, and advancements in charging technologies are the key factors driving the growth of electric vehicles in the ADAS market.

Based on end use, the ADAS market is broadly segmented into passenger and commercial vehicles. In 2024, the passenger vehicles segment is expected to account for the larger share of the ADAS market. The growth of this segment is attributed to the growing awareness regarding the hazards associated with greenhouse gas emissions and environmental pollution, stringent emission norms, and demand for premium cars among consumers.

However, the commercial vehicles segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the increase in fuel prices and stringent emission norms set by governments, the growing adoption of autonomous delivery vehicles, and the increasing adoption of electric buses and trucks.

Based on geography, the ADAS market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of the ADAS market. The growth of ADAS in APAC is attributed to the growing automotive manufacturing sector in countries such as Japan, China, India, and South Korea, supportive government regulations, and the rising popularity of Electric Vehicles (EVs).

However, Europe is expected to command the highest CAGR of the global ADAS market. The market growth in the region is attributed to the huge presence of component manufacturers, the growth of the overall automotive sector, and the high demand for sensors for automated vehicle prototypes.

Key Players:

The key players profiled in the global ADAS market study include Continental AG (Germany), Valeo SA (France), Robert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), and Aptiv PLC (Ireland), Autoliv, Inc. (Sweden), Denso Corporation (Japan), Garmin Ltd. (U.S.), Infineon Technologies AG (Germany), Magna International Inc. (Canada), Mobileye B.V. (Israel), Huawei Technologies Co., Ltd. (China), Qualcomm Technologies, Inc. (U.S.), Microsoft (U.S.), and NXP Semiconductors N.V. (Netherlands).

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5377

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#ADAS#AdvancedDriverAssistanceSystems#AutomotiveTechnology#SensorFusion#AutonomousDriving#VehicleSafety#ADASMarket#RadarSensors#CameraSystems#CollisionAvoidance#LaneDepartureWarning#BlindSpotDetection#AdaptiveCruiseControl#AutomotiveElectronics#DriverAssistance

0 notes

Text

youtube

Windshield Replacement - What About It? Windshields have not always been "shatter proof". In 1890's auto glass was ordinary glass, and in the event of impact the glass would shatter into sharp fragments causing sever injuries and death.

In 1905, Eduardo Benedictus introduced laminated glass which consists of two layers of glass with a layer of polyvinyl butyral (PVB) sandwiched in between.

Windshield replacement has become more difficult as there are ADAS cameras, lasers and sensors that have be calibrated. OEM auto glass is still preferred by all major insurance companies.

For more information about Motor Vehicles, please visit: Auto Glass Education, Automotive Documents, Auto Glass, Auto Repair and Car Detailing Health Benefits, Auto Glass Arizona, Arizona Auto Glass, Arizona Auto Repair Shop, News Trends Forecasts, History of Kia Vehicles, Importance of Auto Repair Shop and Maintaining Your Vehicle, How to Be an Effective Auto Glass Salesman, Evolution of Auto Glass Technology, Difference Between Regular Glass and Auto Glass, How to Avoid Auto Repair Shop Fraud, History of Car Dealerships, Car Insurance and Windshield Damage, Safelite Auto Glass, Auto Glass Rates for Insurance, Car Detailing, History of Rail Car, Windshield Wipers AZ, Information on Windshield Replacement and Auto Glass, Service Tech Auto Glass Windshield Replacement, Windshield Replacement Mesa AZ, Phoenix Auto Glass Tint, Perfect Touch Auto Glass, Right Windshield Auto Glass

#information#front windshield#windshield replacement#rear windshield#auto glass replacement#auto glass arizona#auto glass education#oee auto glass#oem auto glass#adas#advanced driver assistance systems#laminated glass#Windshields#Youtube

3 notes

·

View notes

Text

#Dylect#SmartDashcam#VehicleSafety#RoadSurveillance#AutoTech#ADAS#ConnectedVehicles#InnovationInMobility#electricvehiclesnews#evtimes#autoevtimes#evbusines

0 notes

Text

Maximizing Road Safety Through Reliable ADAS Sensor Calibration Services in the USA

The evolution of vehicle safety technology has drastically changed the driving experience in recent years. With the integration of Advanced Driver Assistance Systems (ADAS), modern vehicles are smarter, more responsive, and equipped to reduce human error on the road. However, the effectiveness of these systems heavily depends on one critical process—accurate ADAS sensor calibration. Without proper alignment and setup, even the most advanced safety features may fail to function as intended.

As cars increasingly rely on automated assistance, maintaining the precision of ADAS components is essential. Sensors, radars, and cameras must work in perfect harmony to detect vehicles, pedestrians, and lane markings in real time. Any misalignment caused by a collision, windshield replacement, or suspension work can disrupt these systems, making calibration not just important—but absolutely necessary for safe driving.

What Does ADAS Include?

ADAS is a comprehensive suite of technologies that assist drivers in avoiding collisions, maintaining safe driving habits, and improving overall control of the vehicle. Common ADAS features include:

Automatic Emergency Braking (AEB)

Lane Departure Warning (LDW)

Adaptive Cruise Control (ACC)

Blind Spot Monitoring (BSM)

Parking Assist Systems

Traffic Sign Recognition

Each of these features depends on accurate input from external sensors and internal processors. When properly calibrated, ADAS works seamlessly to support the driver and enhance road safety.

The Need for Recalibration

ADAS components are sensitive and must be aligned precisely according to manufacturer specifications. Calibration is required whenever the position or orientation of a sensor changes. Some common instances include:

After a windshield replacement (as forward-facing cameras are usually mounted near or behind the glass)

Following a front or rear collision, even if it appears minor

After suspension or steering system repairs

When wheels are realigned or tires are replaced

If ADAS components such as radar units or cameras are repaired or replaced

Skipping recalibration can lead to incorrect system responses, posing serious safety risks for drivers, passengers, and others on the road.

Static vs. Dynamic Calibration: What’s the Difference?

ADAS calibration is typically performed in one of two ways:

Static Calibration

Static calibration is done indoors in a controlled environment. It involves placing specific calibration targets around the vehicle at precise angles and distances. This procedure is commonly used for vehicles with front-view cameras or radar sensors. It requires:

Certified, level flooring

Controlled lighting conditions

OEM-specified targets and tools

Specialized scan equipment

Dynamic Calibration

Dynamic calibration is carried out while the vehicle is driven on well-marked roads at specific speeds. The system uses real-time road data to align sensors and ensure that ADAS functions operate correctly. Technicians follow precise driving patterns, and calibration is monitored through diagnostic tools.

Both methods may be required depending on the vehicle manufacturer and the ADAS components involved.

Why OEM Compliance Is Critical

ADAS systems are developed with strict guidelines by automakers, and each brand may use different sensor positions, angles, and technologies. Performing calibration without adhering to Original Equipment Manufacturer (OEM) standards can lead to unreliable or inaccurate results.

Professional facilities use:

OEM-compliant software and diagnostic tools

Factory-approved targets and mounting equipment

Environmental controls to maintain calibration integrity

Accurate pre- and post-calibration scans

Using OEM-certified equipment ensures the calibration is valid, safe, and in full compliance with manufacturer requirements.

The Calibration Environment: Precision Matters

Accurate calibration requires much more than just the right tools—it needs the right environment. Top-tier diagnostic centers maintain:

Laser-leveled service bays to prevent misalignment

Even, shadow-free lighting to eliminate target distortion

Designated, interference-free calibration zones

Climate-controlled settings for sensor stability

These factors create a precise and repeatable environment where sensors and cameras can be aligned to exact specifications, ensuring each safety feature functions as intended.

Risks of Inaccurate or Missed Calibration

Improper or skipped calibration can have serious consequences:

Incorrect driver alerts or system disengagement

Delayed emergency responses such as braking or lane correction

Failure of critical features like adaptive cruise control

Compromised vehicle safety, increasing risk of collisions

Insurance and liability issues if involved in an accident

Even small changes—like a slight bump or a few degrees of misalignment—can affect system accuracy. That’s why regular checks and timely recalibration are essential parts of safe vehicle maintenance.

How the Process Works at a Professional Facility

The calibration process at a certified diagnostic center is both thorough and precise. It typically includes:

Initial inspection of the ADAS components and verification of sensor placement

Pre-scan diagnostics to identify existing errors or faults in the system

Setup of calibration tools, targets, and environmental controls

Execution of either static or dynamic calibration (or both, depending on OEM requirements)

Post-scan diagnostics to confirm calibration success and feature accuracy

Documentation for customer records, insurers, or compliance checks

This end-to-end process guarantees not just accuracy—but peace of mind for the driver.

The Role of Trained Technicians

ADAS calibration is not a DIY task—it requires in-depth knowledge of modern vehicle systems. Certified technicians stay up-to-date with evolving vehicle technologies, calibration techniques, and OEM protocols. They are trained to:

Interpret complex diagnostic codes

Select and set up appropriate calibration targets

Execute manufacturer-specific procedures

Identify underlying sensor faults or installation errors

Document results and provide quality assurance

Without skilled professionals, even the best tools may not achieve reliable results.

Documentation and Compliance Assurance

Proper documentation is a crucial part of professional ADAS calibration. Leading centers provide:

Before-and-after calibration reports

Photos of the calibration setup

OEM scan tool logs

Detailed explanation of procedures performed

This documentation is vital for insurance claims, warranty coverage, and compliance with repair standards.

Conclusion

As ADAS features become more sophisticated, proper calibration is no longer optional—it is essential for the safe operation of any modern vehicle. Whether you’ve replaced a windshield, had a minor accident, or undergone suspension repair, your ADAS system must be recalibrated to ensure every component functions accurately.

Precision, compliance, and expertise are non-negotiable when it comes to ADAS sensor calibration. The stakes are too high to take shortcuts. By working with a professional diagnostic center that uses factory-approved tools, level calibration bays, and trained technicians, you safeguard your vehicle’s safety systems and protect those inside and around your vehicle.

For expertly performed ADAS calibration that meets all OEM standards, trust the professionals at Abel Diagnostic Centers—your safety is our mission.

#ADAS#ADASCalibration#ADASsensorcalibration#VehicleSafety#OEMCompliant#AutoRepairUSA#WindshieldCalibration#CollisionRepair#AbelDiagnosticCenters

1 note

·

View note

Text

ICARVISIONS AI: Drive Smarter, Drive Safer

Revolutionizing Vehicle Safety Through Artificial Intelligence

ICARVISIONS, one of the leading manufacturers of MDVR technology, presents our new generation AI-MDVR system. Built on a decade of expertise and customer insights, our solution transforms everyday driving into a safer, smarter experience.

Smart Technology for Smarter Driving

Our AI-MDVR system combines advanced cameras, sensors, and real-time processing to create a comprehensive safety ecosystem. The system actively monitors your vehicle's environment, providing instant alerts and actionable insights through:

Real-time video analysis

Audio warnings

Cloud-based data transmission via 3G/4G/5G networks

Complete fleet telematics integration

Core Safety Features

ADAS (Advanced Driver Assistance System)

Transform your vehicle into an intelligent safety companion with features designed to prevent accidents before they happen:

Lane Departure Warning: Alerts drivers when vehicle unintentionally drifts from lane, keeping you safely on track.

Safe Distance Warning: Monitors and maintains optimal distance between vehicles based on your speed.

Pedestrian Collision Warning: Detects pedestrians in vehicle's path and provides instant alerts.

Forward Collision Warning: Prevents rear-end collisions through early warning of sudden braking or slowing vehicles ahead.

DSM (Driver Status Monitor)

The Driver Monitoring System (DSM) helps evaluate driver behavior and enhance fleet efficiency by analyzing alarm data to identify top-performing drivers. Our comprehensive monitoring features include:

Driver Authentication: Facial recognition ensures only authorized drivers operate vehicles

Fatigue Detection:

Monitors yawning patterns

Tracks eye movement and closure

Detects driver distraction and absence

Safety Compliance Monitoring:

Smoking detection

Phone usage detection

Camera obstruction detection

BSD (Blind Spot Detection)

Experience complete situational awareness with our advanced blind spot monitoring system:

Sound and light-based object detection

Seamless integration with video monitoring

I/O linkage for comprehensive vehicle control

Why Choose ICARVISIONS AI-MDVR?

Proactive Safety: Prevents accidents through early warning systems

Comprehensive Coverage: Monitors both external threats and driver behavior

Fleet Optimization: Improves driver performance and reduces operational risks

Future-Ready: Leverages cutting-edge AI technology for continuous improvement

Smart Features for Every Journey

Our AI-MDVR system doesn't just record - it actively protects. By analyzing real-time data and providing immediate feedback, we help:

Reduce accident rates

Improve driver behavior

Enhance fleet efficiency

Ensure regulatory compliance

Protect your investment

Source

ICARVISIONS WEB AI

1 note

·

View note

Text

I finally decided to release the Pictures and Videos of the Offshore Patrol Vessel (OPV) of the Philippine Navy (PN) which I took during the Asian Defense and Security (ADAS) Event in Pasay last Year in October of 2024.

I intended to release these much earlier, but it just got buried due to one Reason or another. I’m releasing them now since I intend to discuss more about these Ships at another time soon. Anyway, the first time I saw their Scale Models at the Booth of the Hyundai Heavy Industries (HHI), I really admired how it looked, it looks fantastic and really modern.

The Ships are based on HHI’s HDP-2200 Design, is 94.5 meters long, has a Displacement of 2,450 tonnes and a maximum Speed of 41 kilometers per hour.

However, as I got to examine it closer, I was a bit disappointed mainly because it totally lacked Anti Submarine Warfare (ASW) Capabilities. It has no Torpedo Launchers, and also doesn’t have a Hull Mounted Sonar (HMS).

This means that the Ship lacks the ability to detect Submarines on its own, nor does it have the ability to attack them when they are submerged. Also its Anti Surface Warfare (AsuW) and Anti-Air Capability is limited as it will rely mainly on its Cannons, namely its 76 millimeter caliber Main Gun and two 30 millimeter caliber Guns mounted on Remote Weapons Station (RWS).

Its Simbad-Remote Control or RC Missile System, the same ones being used on the Jose Rizal class Frigates, will be mainly used against Aerial Targets, but it does have a secondary capability for use against Ships also.

It has no Anti-Ship Missile (AShM) Weapons of its own, I asked the HHI Representatives then if the Vessel has any Fitted For But Not With (FFBNW) Features, but they said no.

This means that fitting AShMs, Torpedo Launchers and Sonars may not be easy since those have Space, Electrical, etc. Requirements that are not there in Place, which I think is a big loss of Opportunity as these will be some of our most Modern Ships once they go into Service.

It’s possible those Weapons and Equipment may be fitted later, but I have some doubts about that because the PN doesn’t exactly have a great Track Record when it comes to doing that with its Ships. Our Del Pilar Class Vessels have been in Service for around one and a half Decades now, and they are still the Gunboats that they were when the United States (US) transferred them to us.

The Tarlac class Landing Docks still have nothing more than Heavy Machine Guns (HMG) for their Armament up to now, almost a Decade since its Lead Ship went into Service.

#philippinenavy#offshorepatrolvessel#opv#asiandefenseandsecurity#adas#pasay#hyundaiheavyindustries#hhi#hdp2200#antisubmarinewarfare#asw#antisurfacewarfare#asuw#hullmountedsonar#hms#remoteweaponsstation#rws#simbadrc#simbadremotecontrol#joserizalclass#antishipmissile#fittedforbutnotwith#ffbnw

0 notes