#AccountingTips

Explore tagged Tumblr posts

Text

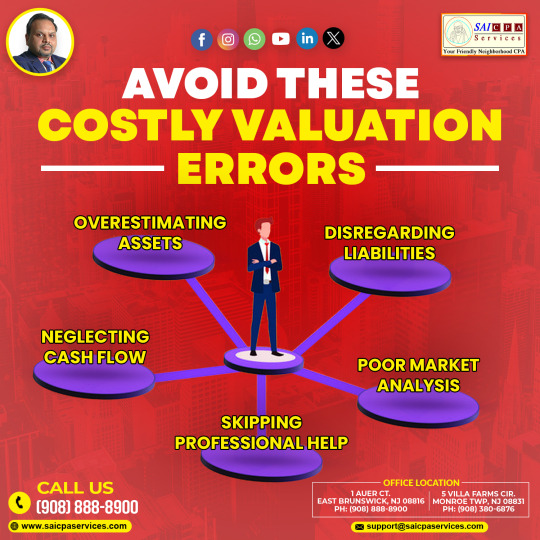

Get Valuation Right with SAI CPA Services

When it comes to business valuation, there’s no room for error. Whether you’re planning a sale, seeking investors, managing estate planning, or navigating a merger, an accurate valuation is critical. Even small mistakes can lead to major financial setbacks, tax issues, or missed opportunities. That’s where SAI CPA Services comes in—we help you avoid costly valuation errors and get it right the first time.

✅ Why Precise Valuation Matters

Smart Financial Decisions: A reliable valuation gives you a clear picture of your business’s worth, enabling confident decision-making.

Tax & Legal Compliance: Accurate valuations are essential for IRS reporting, estate planning, and legal proceedings. Errors can lead to audits, penalties, or disputes.

Attracting Buyers or Investors: A well-supported valuation builds credibility, trust, and negotiation power.

🚫 Common Mistakes to Avoid

Overlooking Market Trends: Ignoring industry shifts or economic conditions can distort value.

One-Size-Fits-All Methods: Using generic formulas may not reflect your business’s true position or potential.

Neglecting Intangibles: Key assets like brand equity, customer relationships, or intellectual property are often undervalued or missed.

Weak Documentation: Poorly organized or incomplete financial data can raise red flags during review.

✅ How SAI CPA Services Helps

At SAI CPA, we bring a strategic, personalized approach to every valuation:

Expert Guidance: Our experienced professionals use proven methodologies—income-based, market-based, and asset-based—to ensure accuracy.

Tailored Analysis: We factor in industry benchmarks, market trends, and internal performance metrics unique to your business.

Clear, Defensible Reports: Our valuations are detailed, well-documented, and ready for review by investors, lenders, or regulatory bodies.

A well-executed valuation is more than a number—it’s a roadmap for growth, investment, and long-term planning. Don’t leave it to chance. Partner with SAI CPA Services to ensure your business is valued correctly—right from the start.

Facebook: AjayKCPA Instagram: sai_cpa_services Twitter: SaiCPA LinkedIn: Sai CPA Services WhatsApp: Sai CPA Channel Phone: (908) 380-6876

(908) 888-8900

1 Auer Ct, East Brunswick, NJ 08816

#SaiCPAService#BusinessValuation#AccountingTips#FinancialClarity#SmallBusinessSupport#ValuationMatters#AvoidCostlyMistakes#SmartFinance

0 notes

Text

eCommerce Year-End? Let’s Talk Platform Problems

Selling on Amazon, Shopify, eBay, or WooCommerce? Then you know year-end isn’t just paperwork—it’s untangling fees, refunds, random VAT chaos, and making sense of messy reports.

We just dropped a blog that breaks it all down: 👉 What messes up your tax return 👉 Why your platform reports aren’t enough 👉 And how to finally get your numbers actually sorted

📦 Whether you're shipping socks or selling digital art—don’t let your finances fall apart. 📘 Read the blog and find out how platform-specific eCommerce accounting can seriously save your sanity.

💬 DM us or Contact E2E for help that actually makes sense.

#ecommerce#yearend#smallbusiness#accountingtips#ukbiz#shopify#amazon#ebay#woocommercelife#tumblrbusiness

0 notes

Text

GST Reconciliation: A Must-Know for 2025

Stay ahead in tax compliance with GST Reconciliation: A Detailed Guide for 2025 by Aone outsourcing ca. This guide simplifies the process of matching GST records, ensuring accuracy and avoiding penalties. Whether you're a business owner or accountant, get essential insights to streamline your GST filing.

#GSTReconciliation#TaxCompliance#GSTFiling#AoneOutsourcingCA#BusinessFinance#AccountingTips#GSTGuide2025#TaxUpdates#FinancialAccuracy#SmallBusinessTax

1 note

·

View note

Text

Getting your end of year payroll right (End of year special for Australian Businesses)

youtube

In this video Neha walks you through process on getting your end of year payroll right. PLEASE WATCH THIS ENLARGED AS EXCEL LOOKS SMALL. Its important to ensure that your staff's end of year payroll information is intact and finalised STP gets lodged correctly.

0 notes

Text

It’s Finally Happening Today!! What makes INDEX and MATCH a more versatile alternative to VLOOKUP and HLOOKUP in spreadsheet lookups? Be part of our online session, “Excel for Accountants & Payroll: Advanced 2025 Guide”, guided by acclaimed Microsoft Excel expert David H. Ringstrom, who will resolve the intricacies revolving around the ways to improve the integrity of your spreadsheets. This session will highlight the following key areas: • Adding fields to a blank pivot table to create instant reports. • Contrasting the INDEX and MATCH combination to VLOOKUP or HLOOKUP. • Creating a pivot table to transform lists of data into on-screen reports. Date: May 22, 2025 Time: 9:30 AM PT | 12:30 PM ET This session is crafted for finance and tax experts—accountants, CPAs, CFOs, controllers, enrolled agents, and preparers. Apply code CM40 at checkout for an instant $40 savings. Reserve your seat today: https://www.courseministry.com/product/excel-for-accountants-payroll-advanced-2025-guide/ Have questions? We're here to help: [email protected]

#ExcelTraining#FinanceProfessionals#CPALife#SpreadsheetSkills#PivotTables#VLOOKUP#INDEXMATCH#ExcelForAccountants#ContinuingEducation#AccountingTips

0 notes

Text

10 Common Accounting Mistakes to Avoid

Messy books can silently drain your business. Whether you're just starting out or running a growing company, avoiding these common bookkeeping and accounting mistakes is a must:

Mixing personal & business expenses

Skipping bank reconciliations

Ignoring small receipts

Misclassifying expenses

Delaying data entry

Not backing up financial data

Forgetting tax deadlines

Overlooking accounts receivable

Relying solely on spreadsheets

Not hiring a professional

Each mistake might seem small, but over time, they can cause serious headaches—and even legal trouble.

✅ Want peace of mind and clean books? Get expert help in bookkeeping and accounting today. Your future self will thank you!

0 notes

Text

📊 Understanding Financial Statements for US Small Businesses: A Simple Guide 💼

Running a small biz means juggling a lot — customers, operations, growth plans. But there’s one thing you can’t skip: understanding your financial health. Financial statements are like your business’s GPS, showing you where you are and what your next move should be.

Not a numbers person? No worries — here’s a simple breakdown of the 3 main financial statements every US small business owner should know:

1️⃣ Income Statement (Profit & Loss)

Think of this as your biz’s report card. It shows:

💰 Revenue: Money you make from sales

📉 Cost of Goods Sold (COGS): What it costs to make your product or service

💸 Operating Expenses: Rent, salaries, marketing, etc.

📈 Net Income/Loss: Profit or loss after everything

Why it matters? It tells you if you’re making money or not — and where to tweak if things aren’t looking good.

2️⃣ Balance Sheet

This is a snapshot of your business’s financial health right now:

🏦 Assets: What you own (cash, inventory, equipment)

💳 Liabilities: What you owe (loans, bills)

📊 Equity: What’s left after subtracting liabilities from assets

Why it matters? It shows if your business is stable and able to cover debts and obligations.

3️⃣ Cash Flow Statement

Cash flow = your business’s lifeline. Even if you’re profitable, no cash means trouble. This shows:

🔄 Operating Activities: Cash from daily operations

🛠️ Investing Activities: Cash spent or earned from buying/selling assets

💵 Financing Activities: Cash from loans, repayments, or investments

Why it matters? Positive cash flow means you can pay bills and invest in growth. Keep an eye on this to avoid surprises.

How They Work Together

Income Statement = Are you profitable?

Balance Sheet = What do you own vs. owe?

Cash Flow = Can you cover your bills today?

For example, you could be profitable but have negative cash flow if customers pay late — so watch all three!

🔗 For more tips and guides, learn more here.

#SmallBusiness#FinancialStatements#AccountingTips#CashFlow#ProfitAndLoss#BalanceSheet#BizGrowth#EntrepreneurLife#accounting#united states#bookkeeping#business#small business#Counto

1 note

·

View note

Text

New Jersey Corporate Business Tax: What Small Businesses Need to Know

If you're a small business operating in New Jersey, understanding the Corporate Business Tax (CBT) is key to staying compliant and avoiding penalties. 📊 Whether you’re a C corporation or certain S corporations, the CBT applies to your operations. Here's a quick guide on what it is and how it affects you. 👇

What is the New Jersey CBT? The Corporate Business Tax (CBT) is a tax imposed on corporations doing business in New Jersey. It applies if your business earns income or conducts activities in the state. 🏢💼

Tax Rates & Minimum Tax

6.5% on income up to $50,000

9% on income over $50,000 (after 2023)

2.5% surtax on income over $10 million

Minimum tax based on gross receipts (even if no profit):

Under $100,000: $500

$100,000-$250,000: $750

$250,000-$500,000: $1,000

$500,000-$1,000,000: $1,500

Over $1,000,000: $2,000

Filing & Deadlines

File electronically using CBT-100 for C corporations, or CBT-100S for S corporations.

File by the 15th day of the 4th month after your fiscal year ends (usually April 15 for calendar-year businesses).

Quarterly estimated payments due:

April 15, June 15, September 15, December 15

Economic Nexus Even if you don’t have a physical presence in NJ, you may still owe CBT if:

You earn $100,000 or more in receipts from NJ OR

You have 200+ transactions with NJ customers

Why Professional Accounting Services Matter The CBT rules can be complex, and missing deadlines or filing incorrectly can lead to penalties. 🧾 That's why working with a professional accountant in New Jersey can help ensure everything is filed correctly and on time. 📅💼

Summary Managing your New Jersey Corporate Business Tax (CBT) doesn’t have to be overwhelming. With the right tax guidance and accounting support, your small business can stay compliant and focus on what matters most: growth. 🌱

Need help navigating CBT

#accounting services#tax#accounting#bookkeeping#small business#NJCBT#SmallBusinessTax#CorporateTax#TaxCompliance#NJBusiness#AccountingTips#SmallBusinessGrowth#TaxHelp#BusinessOwner#Counto

1 note

·

View note

Text

The Importance of Non-Disclosure Agreements (NDAs) for CA Firms in India

🔒 NDAs in Accounting: More Than Just Paperwork! 🧾💼

In the accounting world, you're not just crunching numbers—you’re handling confidential gold. ✨

That’s where an NDA (Non-Disclosure Agreement) steps in like a superhero! 🦸♂️

💡 Why it matters?

Because safeguarding client data isn't just ethical—it's essential. From employees to vendors, everyone should know: what's shared here, stays here. 🤐

📌 NDAs help protect:

✔️ Client financial details

✔️ Internal processes

✔️ Sensitive reports

✔️ Strategic insights

💬 Bonus? Clients trust you more when you show them you're serious about security.

It’s not just compliance—it’s commitment. 💯

⚠️ In a world full of digital risks, an NDA isn’t optional—it’s your first defense against breaches, misunderstandings, and legal messes. 🛡️

👀 Want to know what clauses matter and how to create one that actually works?👇

Read the full blog here 👉 https://www.suvit.io/post/importance-of-nda

0 notes

Text

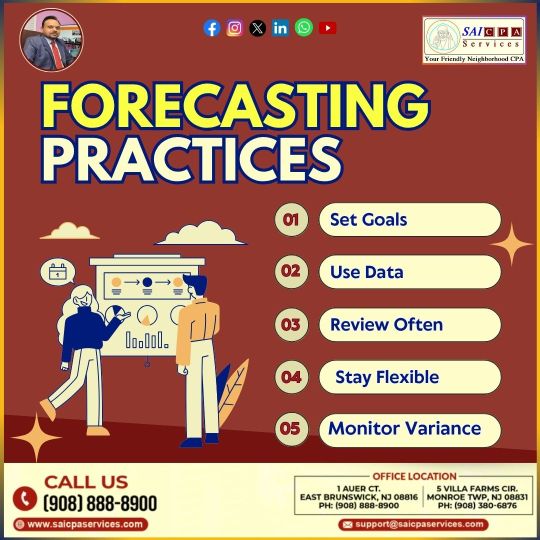

Smart Forecasting with Sai CPA Services

Financial forecasting is a vital tool for any business looking to grow and succeed. At Sai CPA Services, we offer expert forecasting solutions to help you plan with confidence and make informed decisions about your future.

What is Financial Forecasting? Financial forecasting is the process of estimating future income, expenses, and cash flow. It helps business owners set realistic goals, allocate resources effectively, and prepare for both opportunities and challenges.

Why It Matters With accurate forecasts, you can anticipate future trends, avoid cash shortages, and make smart investment decisions. Whether you're launching a new product or expanding operations, forecasting gives you a clear financial roadmap.

How Sai CPA Services Helps Our experienced team uses historical data, industry trends, and your business insights to create reliable financial projections. We provide:

Sales Forecasting

Cash Flow Projections

Budget Planning

Break-even Analysis

Profit and Loss Forecasts

Tailored to Your Business Every business is unique. At Sai CPA Services, we customize your forecasts to align with your goals and industry, giving you the clarity needed to grow strategically.

Let Sai CPA Services guide your business with trusted financial forecasting—so you can move forward with confidence and clarity.

Facebook: AjayKCPA Instagram: sai_cpa_services Twitter: SaiCPA LinkedIn: Sai CPA Services WhatsApp: Sai CPA Channel Phone: (908) 380-6876

(908) 888-8900

1 Auer Ct, East Brunswick, NJ 08816

#SaiCPAService#FinancialForecasting#BusinessPlanning#AccountingTips#CashFlowManagement#SmallBusinessFinance#CPAInsights#SaiCPA

0 notes

Text

Accounting Data Disasters: Common Mistakes and How to Avoid Them

Ever feel like you're drowning in spreadsheets? You're not alone. As financial data grows more complex, even seasoned accountants make critical errors that can ripple through an entire business.

The Data Danger Zone: 5 Common Accounting Mistakes

1. Trusting Data Without Verification

We recently worked with a London retailer who based an entire quarter's strategy on sales projections from unreconciled data. The result? A £45,000 inventory mistake that could have been prevented with basic data validation.

Quick Fix: Implement a "trust but verify" protocol—cross-reference data from multiple sources before making significant decisions. At Flexi Consultancy, we always triangulate data from at least three sources before presenting insights to clients.

2. Excel as Your Only Tool

Excel is brilliant, but it's not designed to be your only data analysis tool when working with large datasets. Its limitations become dangerous when handling complex financial information.

Quick Fix: Supplement Excel with specialized data tools like Power BI, Tableau, or industry-specific financial analytics platforms. Even basic SQL knowledge can transform how you handle large datasets.

3. Ignoring Data Visualization

Numbers tell stories, but only if you can see the patterns. Too many accountants remain stuck in endless rows and columns when visual representation could instantly reveal insights.

Quick Fix: Learn basic data visualization principles and create dashboard summaries for all major reports. Your clients will thank you for making complex data digestible.

4. Overlooking Metadata

The context around your data matters just as much as the numbers themselves. When was it collected? Who entered it? What methodology was used?

Quick Fix: Create standardized metadata documentation for all financial datasets. Something as simple as "last modified" timestamps can prevent major reporting errors.

5. Manual Data Entry (Still!)

We're shocked by how many London accounting firms still manually transfer data between systems. Beyond being inefficient, this practice introduces errors at an alarming rate.

Quick Fix: Invest in proper API connections and automated data transfer protocols between your accounting systems. The upfront cost is nothing compared to the errors you'll prevent.

The Real Cost of Data Mistakes

These aren't just technical issues—they're business killers. One of our clients came to us after their previous accountant's data analysis error led to a six-figure tax miscalculation. Another lost investor confidence due to inconsistent financial reporting stemming from poor data management.

Beyond immediate financial implications, data mistakes erode trust, which is the currency of accounting.

Beyond Fixing: Building a Data-Strong Accounting Practice

Creating reliable financial insights from large datasets requires more than avoiding mistakes—it demands a systematic approach:

Document your data journey: Track every transformation from raw data to final report

Create repeatable processes: Standardize data handling procedures across your practice

Build data literacy: Ensure everyone touching financial information understands basic data principles

Implement peer reviews: Fresh eyes catch mistakes others miss

Need Help Navigating Your Data Challenges?

If you're struggling with financial data management or want to elevate your approach, reach out to our team. We specialize in helping London businesses transform financial data from a headache into a strategic asset.

This post was brought to you by the data nerds at Flexi Consultancy who believe financial insights should be both accurate AND actionable. Follow us for more practical accounting and financial management tips for London SMEs and startups.

0 notes

Text

Financial statement are critical tool to help you make an informed decision about your business.Learn about the financial statements to improve your business profitability. Click the link here to read more!

0 notes

Text

Unlock Cash Flow Fast: Proven Inventory Management System That Saves You Thousands!

youtube

Struggling with tight cash flow despite strong sales? You might be sitting on "wealth on the shelf." 🧾 In this eye-opening video, Cash Flow Mike breaks down a real business turnaround that unlocked $420K in 90 days—without borrowing a dime! 💸

🔥 Unlock Financial Clarity with Cash Flow Mike! 🔥

💡 Your clients need better financial guidance. Are you ready to deliver it? Cash Flow Mike helps accountants, bookkeepers, financial advisors, and CAS professionals transform financial data into meaningful, action-driven conversations that help business owners grow, profit, and thrive.

🚀 Start Here – FREE Resources:

📅 Let Us Help! → https://bit.ly/cash-flow-mike

📞 Meet Mike Mike → https://bit.ly/cash-flow-mike

🎥 Subscribe to Cash Flow Mike on YouTube!

🔗 Subscribe Now → / @cashflowmikemilan

📲 Connect with Cash Flow Mike

📌 Website: https://www.cashflowmike.com/

📌 Facebook: / thecashflowmike

📌 LinkedIn: / mikemilan

📌 Instagram: / thecashflowmike

#ClientAdvisory#AccountingAdvisory#cashflow#BusinessAdvisory#SmallBusinessFinance#ProfitFirst#Bookkeepers#FinancialCoaching#AccountingTips#CashFlowMike#Youtube

1 note

·

View note

Text

How to Check Payroll Audit History: See Who Made Changes & When

youtube

Want to know who made changes in your payroll and when? In this video, Neha walks you through how to access and understand your Payroll Audit History, including user actions and timestamp details. Perfect for payroll admins, accountants, and business owners who need to stay on top of payroll compliance and accuracy.

0 notes

Text

IAS 38 Made Simple: Intangible Asset Recognition for ACCA DipIFR Students

Learn how to easily understand and apply IAS 38 for recognizing intangible assets. A simplified guide by Finpro Consulting designed for ACCA DipIFR students and IFRS learners.

Target URL:-https://finproconsulting.in/blog/intangible-assets-recognition/

#IAS38#IntangibleAssets#ACCADipIFR#IFRS#AccountingTips#FinproConsulting#IFRSStandards#FinancialReporting#AccountingStudents

0 notes

Text

Top accounting tips for small business owners to manage finances, track expenses, and ensure tax compliance with tools like Tririd Biz Accounting Software.

0 notes