#AdvocacyGroups

Explore tagged Tumblr posts

Text

The Undying Wish of Alfons Scholing: A Journey of Love and Self-Discovery

Part 1: The Quest for Love and Family In the heart of a bustling studio where creativity flows, Alfons Scholing, a man of passion and purpose, serves as an inspiration to many. His unwavering dedication to the youth and his deep-rooted desire for a family have shaped not only his life but also the lives of those who have had the privilege of knowing him. Alfons’s journey is one marked by love,…

View On WordPress

#AdvocacyGroups#Alfons Scholing#Allyship#Assisted Reproductive Technologies#Authenticity In Love#AwarenessCampaigns#Breaking Stereotypes#Building Loving Families#Challenging Stereotypes#ChangeMakers#CollaborativeEfforts#CommunitySupport#Complexity of Choices#Comprehensive Growth.#Creating Safe Spaces#Diverse Family Structures#Dutch Society Relations#EducationForChange#Embracing Diversity#Emotional Resilience#empathy#EmpathyNetwork#Empowerment#EmpowermentPartners#Equality In Love#Equality Matters#Equality Struggles#EqualityAdvocates#Family Aspirations#Family Building Challenges

0 notes

Text

Political Movements Need Strong Names

taxrepeal.com is direct and impactful—ideal for advocacy campaigns or political platforms. https://www.godaddy.com/en-uk/domainsearch/find?domainToCheck=taxrepeal.com

0 notes

Photo

#iuniversepublishing #iUniverse #ColleenStan #TheSimpleGiftsOfLife #JimBGreen #TheGirlInTheBox #TheSexSlave #SlaveK #TrueCrimeBooks #TrueCrime #FormerVictims #VictimAdvocates #sextraffickingawareness #sextraffickingisreal #AdvocacyGroups #TrueCrimeAwareness #CrimeAwareness #VictimsOfCrime https://www.instagram.com/p/CjhxsZbur0FVcJoC-Tn9wX0IqmoO0PK1hwZuFg0/?igshid=NGJjMDIxMWI=

#iuniversepublishing#iuniverse#colleenstan#thesimplegiftsoflife#jimbgreen#thegirlinthebox#thesexslave#slavek#truecrimebooks#truecrime#formervictims#victimadvocates#sextraffickingawareness#sextraffickingisreal#advocacygroups#truecrimeawareness#crimeawareness#victimsofcrime

0 notes

Link

USCHAG offer a selection of lifestyle brands that range from CBD and luxury bath products to helping children overcome fears of the dark.

0 notes

Photo

ICYMI: Baltimore, MD,Monday July 24th,2017 (AMNGLOBAL) Calling all #artists #poets #designers #salons #nonprofits #contractors #politicalorganizations #advocacygroups #communityassociations #bands #creatives. We've got 250 free tickets waiting for you to grab right now for the #BIYF. http://fb.me/6wCnAZOCy

#advocacygroups#bands#biyf#salons#poets#designers#contractors#politicalorganizations#creatives#nonprofits#communityassociations#artists

0 notes

Photo

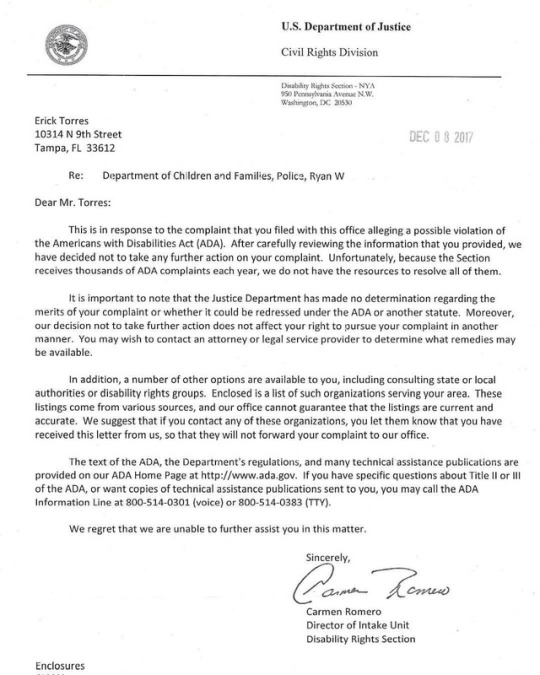

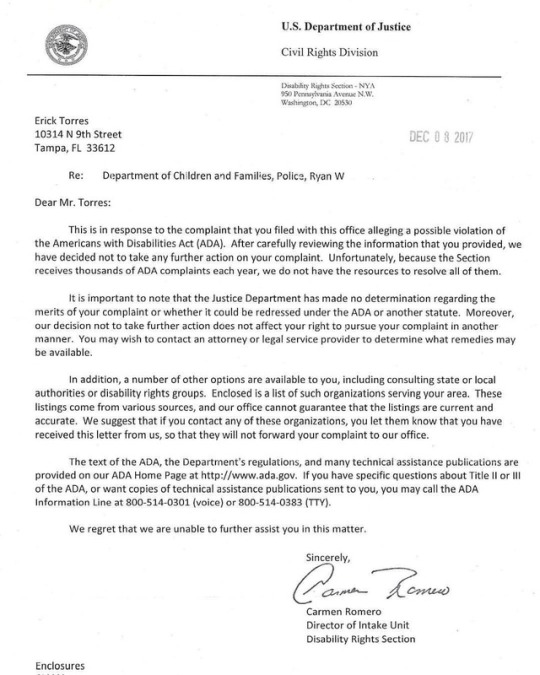

#tiftprweallresist People assume ,,he’s an angry person, dismissive , walk by. You try to speaklife speakup #speakforthevoiceless yet due to ignoranceisbliss they rather judge, then perhaps give a moments thought, something is not right. See #polarized #doublestandards and #dividednation it is often the ones who are least #advocated #communitysupport that tent to feel the worst of the #indifference and it’s pains. #advocacygroups #governmentagencies #hud justicedepartment as I was #wheelchairlife my ability to #defendtheland was not the same and I have known #hunger #homelessness #indifference and all this time I have fought primarily in silence. Why speak, conclusions made. #disablityrights have turned into #survivalskills for #agencies sometimes take weeks to respond, you are denied #legalaid if not #povertyline so when all avenues exhausted, #titlevii and #legalprecedent dictate it is @thejusticedept that is at federal level as civicservice dutiesandresponsibilities to to ensure #equalprotection for #civilrights and do not blame Republicans, some of the few that have listened were not Democrats, but in a nation where who can be cruelest wins, what is a right, becomes a struggle and there is no worse feeling in the world, needing to overcome and rise to walk, cope and that people who were supposed to be #Inclusion matters advocacy could care less, and as some of you if not a #prettypicture you don’t read, there is truly a #taleoftwocities where many who are sick or truly in need are attacked and further #nodignity for it’s hard to see and accept that people, simply dont wish to see it. I am no victim or less, I have endured cruelties that civilization would deem barbaric to the silence of those that DO See, you do not do a good job of faking. I sent tons of #evidencebased information documented, the (at United States)

#taleoftwocities#wheelchairlife#homelessness#legalprecedent#inclusion#nodignity#equalprotection#governmentagencies#titlevii#dividednation#povertyline#polarized#evidencebased#prettypicture#legalaid#communitysupport#speakforthevoiceless#disablityrights#civilrights#hud#survivalskills#advocacygroups#hunger#indifference#tiftprweallresist#doublestandards#advocated#agencies#defendtheland

0 notes

Text

Allied Interstate

Debt collectors like Allied Interstate cannot harass you over a debt. You have rights under the law. We will stop the harassment once and for all.

THE BEST PART IS…

If Allied Interstate violated the law, you will get money damages and Allied Interstate will pay our fees and costs. You will not pay us a penny for our time. Plus, some of our clients also receive debt relief and cleaned up credit reports. You have nothing to lose! Call us today at 888-572-0176 for a free consultation.

Who is Allied Interstate?

Allied Interstate is a large third party collection agency, headquartered in Columbus, Ohio. Allied Interstate provides account receivable services to companies from many industries and collect on numerous types of accounts including credit card debt, student loans, healthcare, and many more. They are a subsidiary of a large out-sourcing company, IQor Holdings, Inc. According to Bloomberg Business, Allied Interstate was founded in 1954 and employs over 10,000 people. They are listed as a Limited Liability Company.

If you are getting calls from Allied Interstate but do not believe you have a debt in collections, they may be calling you by mistake. This is not uncommon with Allied Interstate, who was ordered to pay the Federal Trade Commission a settlement of $1.75 million in 2010 for failing to remove consumers from their call lists after being notified they had called the wrong party.

Allied Interstate Address, Phone Number, and Contact Information

Allied Interstate is located at P.O. Box 361477 Columbus, OH 43236. The main telephone numbers for Allied Interstate are 800-811-4214 and 952-546-6600. These are just two of many Allied Interstate contact numbers.

Allied Interstate website is http://www.allied-interstate.com Allied Interstate’s e-mail address is [email protected]

Phone Numbers Used By Allied Interstate

Allied Interstate likely has dozens, if not over 100, phone numbers it calls from. Here are a few phone numbers Allied Interstate may be calling you from:

800-447-2934

800-811-4214

877-478-7645

800-863-1562

952-595-2311

800-806-3342

866-310-3882

952-546-6600

877-488-1792

Allied Interstate Lawsuits

If you want to know just how unhappy consumers are with Allied Interstate take a look at the number of lawsuits filed against Allied Interstate on the Public Access to Court Electronic Records (“PACER”). PACER is the federal docket throughout the country that lists federal complaints filed against Allied Interstate When you do a search for Allied Interstate there are over 1000 lawsuits filed against Allied Interstate. Most of these lawsuits involve consumer rights’ violations.

Allied Interstate Harassment

The Fair Debt Collection Practices Act (“FDCPA”) is a federal law that applies to everyone in the United States. In other words, everyone is protected under the FDCPA. The FDCPA is a laundry list of what Allied Interstate can and cannot do while collecting a debt, as well as things debt collectors must do while collecting a debt. If Allied Interstate is harassing you over a debt, you have rights under the Fair Debt Collection Practices Act.

The Electronic Fund Transfer Act (“EFTA”) protects electronic payments that are deducted from bank accounts. If Allied Interstate took unauthorized deductions from your bank account, you may have an EFTA claim. Allied Interstate like most collection agencies, wants to set up reoccurring payments from consumers. Imagine how much money Allied Interstate gets if hundreds, if not thousands, of consumers electronically pay them $50-$100, or more, per month. If you agreed to this type of reoccurring payment, Allied Interstate must follow certain steps to comply with the EFTA. Did Allied Interstate continue to take electronic payments after you said stop? Did Allied Interstate take more money from your checking account than you agreed to? If so, let’s talk about your rights under the EFTA.

The Fair Credit Reporting Act (“FCRA”) works to ensure that no information reported to your credit report is false. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. We handled a lot of cases recently where Allied Interstate reported debt on a consumer’s credit report. Allied Interstate likely reports on credit reports to obtain greater leverage over the consumer. If Allied Interstate is on your credit report, they may tell you if you pay the debt, they’ll remove it from your credit report. This is commonly known as pay for delete. You pay Allied Interstate and they delete the debt from your credit report. Even if Allied Interstate not on your credit report, maybe the original creditor is. If you pay off the debt to Allied Interstate then the original creditor, and Allied Interstate should accurately report this on your credit report.

Several states also have laws that provide its citizens an additional layer of protection. For example, if you live in California, Texas, Florida, North Carolina, Wisconsin, Michigan, Montana, or Pennsylvania you may be able to tack on a state-law claim with your federal law claim above. North Carolina, for example, has one of the most consumer-friendly statutes in the country. If you live in NC, and you’re harassed over a debt, you may get $500.00 – $4,000.00 in damages per violation. We work with a local counsel in NC. Our NC clients have received some great results in debt collection harassment cases. If you live in NC, and Allied Interstate is harassing you, you have tons of leverage to get a great settlement.

HOW CAN WE USE THE LAW TO HELP YOU?

We will use state and federal laws to immediately stop Allied Interstate debt collection. We will send a cease and desist letter to get the harassment to stop the same day. If Allied Interstate violates the FDCPA, EFTA, FCRA, or any state laws, you may be entitled to money damages. For example, under the FDCPA, you can get up $1,000.00 in damages plus actual damages. The FDCPA has a fee-shift provision. This means, Allied Interstate pays our attorney’s fees and costs.

THAT’S NOT ALL…

We have helped hundreds of consumers stop phone calls from Allied Interstate We know how to stop the harassment and get you money damages. ONCE AGAIN, you will not pay us a penny for our time. We will help you based on a fee-shift provision and/or based on a contingency fee. That means, Allied Interstate pays our attorney’s fees and costs.

What If Allied Interstate Is On My Credit Report?

Based on our experience, Allied Interstate does credit report. That means, Allied Interstate will mark your credit report with the debt they are trying to collect on. In addition to ALLIED INTERSTATE the original creditor may be on your credit report. For example, if you owe Republic Bank and Trust on an elastic line of credit, and Allied Interstate is collecting on it, both Republic Bank and Trust and Allied Interstate may have separate entries on your credit report. This is important because you will want both parties to update your credit report if you pay off the debt.

THE GOOD NEWS IS…

If Allied Interstate is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly. Along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or maybe you were a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute them. My office will help you pull your credit report and dispute any inaccurate information.

REMEMBER…

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (“FCRA”), you may be entitled to statutory damages up to $1,000.00, plus the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision. This means, the credit reporting agency pays your attorney’s fees and costs. Therefore, you will not pay me a penny for my time. We have helped dozens of consumers fix inaccurate information on their credit reports.

Complaints against Allied Interstate

If you’re on this page, chances are you are just like the hundreds of consumers out there being harassed by Allied Interstate The complaints on the Better Business Bureau (“BBB”), various consumer websites, including on Yelp, and even the complaints on this page (below) are endless. Allied Interstate is accredited by the BBB.

Here are some of the many BBB complaints regarding Allied Interstate

“I’ve been receiving several calls a day every day for several weeks from this business. They’ve attempted to collect a non-existent debt from me (a debt I disputed and had removed from my credit). I’ve told them to stop calling me “

“[Allied Interstate] calls with incorrect information. They will not tell you there information, what they do, and keep calling the wrong person with my number. They are completely rude, have no credibility, and I don’t understand how they are in business.”

“This company calls me repeatedly. I own no money and they clearly have a wrong number, but they persist.”

Reviews and complaints on ConsumerAffairs.Com do not get any better for Allied Interstate. Allied Interstate has a one star average on Consumer Affairs Here’s what people on Consumer Affairs have to say about Allied Interstate “

“I keep getting robocalls on my answering machine, while I’m at work, from Allied Interstate LLC regarding a delinquent bill. I have no delinquent bills. They leave a number that cuts off before the last digit. I found the last digit online. This is pure harassment.”

“Keep getting robocalls from these people from 830 AM up to 6 PM most days. We have no Delinquent obligations and perfect credit. Tried to call the number and only get a busy signal. Want it to stop, but can’t seem to get them to.

I don’t know how Allied Interstate LLC got my phone number. They have called me asking for somebody else. I told them I don’t know who that person is, but they kept calling.

Every day, at precisely 8:30 am, I get a robocall from Allied Interstate LLC regarding a delinquent bill. I have no delinquent bills. They leave a number that cuts off before the last digit. I looked them up online and found a site where I could leave them a message that I am the wrong person and to stop calling. So far, it hasn’t worked.”

Although there are only eleven reviews on Google, they are just as bad. Allied Interstate has a mere 1.4 star average on Google. Here’s a snippet of the reviews on Google:

“Horrible company! Extremely rude and harassing.”

“[Allied Interstate added] a false report to my credit report without even contacting me… no letters, no calls, so how are they collecting debt i don’t have?”

“Initially they would call and just hang up when I answered. When I called them back, they said they were calling for someone who has never lived here. When I asked the nature of their business they would only give their name and say it was a personal call.”

Cases We Have Handled Against Allied Interstate

I THINK YOU’LL AGREE WITH ME WHEN I SAY…

Threats and harassment by collection agencies can be pretty intimidating. Well, it turns out we can stop the harassment, attempt to get you money damages under the law, and the collection agency will have to pay us our fees and costs. Here are some of the cases we’ve handled against Allied Interstate

Mark L. v. Allied Interstate. In this case, Allied Interstate called our client on his cell phone. Allied Interstate was attempting to collect on an alleged debt originating from a federal student loan. In or around January 2015, Allied Interstate began placing collection calls to our client’s work telephone. Allied Interstate called from 763-400-3498, which is one of their numbers. During one call with Allied Interstate, our client was told he needed to set up a payment plan or pay the balance in full or his wages would be garnished. Allied Interstate did not inform our client that he had a right to dispute the debt. Since our client lives in Texas, we alleged that Allied Interstate violated both the Fair Debt Collection Practices Act and the Texas Debt Collection Practices Act.

Betty H. v. Allied Interstate. In this case our client began receiving collection calls around September 2016. The calls were from 716-515-0088, among other numbers. On October 3, 2016, our client answered a call from Allied Interstate and told the representative to stop calling. Despite our client’s requests, Allied Interstate continued to call and harass her. In this instance we alleged that Allied Interstate violated the Fair Debt Collection Practices Act.

Natalie L. v. Allied Interstate. In this case, Allied Interstate was collecting on a debt arising from a Federal Family Education Loan Program (“FFELP”) student loan serviced by Educational Credit Management Corporation (“ECMC”). In September, 2014, ECMC sent Plaintiff a Notice that her wages were going to be garnished beginning October 18, 2014. Allied Interstate was aware that our client’s wages were being garnished but despite their awareness, began collection attempts on the same debt. Allied Interstate called our client, her brother, and her boss. Allied Interstate told our client that if she did not make additional payments to them that they would ruin her credit, force her to lose her vehicle, file a lawsuit against her and issue a warrant for her arrest. Our client told Allied Interstate to stop calling on numerous occasions but despite her requests they continued to place collection calls unabated. In this case we alleged that Allied Interstate violated the Fair Debt Collection Practices Act.

Here’s What Our Clients Say about Us

Agruss Law Firm, LLC, has over 630 outstanding client reviews through Yotpo, an A+ BBB rating, and over 100 five-star reviews on Google. Here’s what some of our clients have to say about us.

“Agruss Law Firm did a great job for me. They stopped the unwarranted calls to my cell, made sure the collection agency understood the debt had already been paid and then made them pay for harassing me. I was kept informed and now better understand Agruss Law Firm is someone I can trust. Thank you and I appreciate the great job and service.”

I had the best help from all the people at Agruss Law Firm LLC. They were all so kind and answered all my question and stopped the harassment calls i was getting.”

“Hiring this company was the best decision I have ever made. Not only am I pleased with the outcome. I am also pleased with the customer service.”

Can Allied Interstate Sue You?

Although anyone can sue anyone for any reason, we have never seen Allied Interstate sue consumers. It’s likely Allied Interstate does not sue because they do not always own the debt they are collecting on. Also, Allied Interstate would have to hire a lawyer, or use in-house counsel, to file a lawsuit. It’s likely Allied Interstate collects debts through the entire country. Therefore, it would be very difficult to have lawyers, or a law firm, licensed in every state. There are collection agencies that do sue consumers. For example, Midland Credit Management is one of the largest junk-debt buyers. Midland Credit Management collects on debt and also sues on debt. The opposite is true with Allied Interstate Therefore, it would be very unusual if Allied Interstate sued you. The original creditor, on the other hand, may hire a collection firm, or lawyer, to sue you. If Allied Interstate has threatened to sue you, call us. We can help.

Can Allied Interstate Garnish Your Wages?

No, not unless they have a judgment. If Allied Interstate has not sued you, then Allied Interstate cannot get a judgment. If Allied Interstate does not have a judgment, then Allied Interstate cannot garnish your wages. Minus limited situations (usually dealing with debts owed to the government for student loans, taxes, etc.), in order to garnish someone’s wages, you need a judgment first. In short, we have not seen Allied Interstate file a lawsuit against a consumer. So, Allied Interstate cannot garnish your wages, minus the exceptions listed above. If Allied Interstate has threatened to garnish your wages, contact our office right away.

Allied Interstate Settlement

If you want to settle a debt with Allied Interstate, ask yourself these questions first:

Do I really owe this debt?

Is this debt within the statute of limitations?

Is this debt on my credit report?

If I pay this debt, will Allied Interstate remove it from my credit report?

If I pay this debt, will the original creditor remove it from my credit report?

If I pay this debt, will I get something in writing from Allied Interstate confirming the payment and settlement terms?

These are not the only things to consider when dealing with debt collectors. We are here to help you answer the questions above, and much more. Whether its harassment, settlement, pay for delete, or any other legal issue with ALLIED INTERSTATE Management, the folks at Agruss Law Firm are here to help you.

Share Your Complaints about Allied Interstate Below

Post your complaints about Allied Interstate Sharing your complaints about Allied Interstate will help other consumers know what to do when Allied Interstate starts calling. Sharing your experience may help someone else.

HERE’S THE DEAL!

If you are being harassed by Allied Interstate over a debt, you may be entitled to money damages. Get up to $1,000 for harassment, and $500-$1,500 for illegal robocalls. Under various state and federal laws, we will help you based on a fee-shift provision and/or based on a contingency fee. That means, the collector pays your attorney’s fees and costs. You won’t pay us a penny. We have settled thousands of debt collection harassment cases. Let us help you today. Contact Agruss Law Firm at 888-572- 0176 to stop the harassment once and for all.

The post Allied Interstate appeared first on Agruss Law Firm, LLC.

Allied Interstate published first on https://agrusslawfirmllc.tumblr.com

0 notes

Text

Allied Interstate

Debt collectors like Allied Interstate cannot harass you over a debt. You have rights under the law. We will stop the harassment once and for all.

THE BEST PART IS…

If Allied Interstate violated the law, you will get money damages and Allied Interstate will pay our fees and costs. You will not pay us a penny for our time. Plus, some of our clients also receive debt relief and cleaned up credit reports. You have nothing to lose! Call us today at 888-572-0176 for a free consultation.

Who is Allied Interstate?

Allied Interstate is a large third party collection agency, headquartered in Columbus, Ohio. Allied Interstate provides account receivable services to companies from many industries and collect on numerous types of accounts including credit card debt, student loans, healthcare, and many more. They are a subsidiary of a large out-sourcing company, IQor Holdings, Inc. According to Bloomberg Business, Allied Interstate was founded in 1954 and employs over 10,000 people. They are listed as a Limited Liability Company.

If you are getting calls from Allied Interstate but do not believe you have a debt in collections, they may be calling you by mistake. This is not uncommon with Allied Interstate, who was ordered to pay the Federal Trade Commission a settlement of $1.75 million in 2010 for failing to remove consumers from their call lists after being notified they had called the wrong party.

Allied Interstate Address, Phone Number, and Contact Information

Allied Interstate is located at P.O. Box 361477 Columbus, OH 43236. The main telephone numbers for Allied Interstate are 800-811-4214 and 952-546-6600. These are just two of many Allied Interstate contact numbers.

Allied Interstate website is http://www.allied-interstate.com Allied Interstate’s e-mail address is [email protected]

Phone Numbers Used By Allied Interstate

Allied Interstate likely has dozens, if not over 100, phone numbers it calls from. Here are a few phone numbers Allied Interstate may be calling you from:

800-447-2934

800-811-4214

877-478-7645

800-863-1562

952-595-2311

800-806-3342

866-310-3882

952-546-6600

877-488-1792

Allied Interstate Lawsuits

If you want to know just how unhappy consumers are with Allied Interstate take a look at the number of lawsuits filed against Allied Interstate on the Public Access to Court Electronic Records (“PACER”). PACER is the federal docket throughout the country that lists federal complaints filed against Allied Interstate When you do a search for Allied Interstate there are over 1000 lawsuits filed against Allied Interstate. Most of these lawsuits involve consumer rights’ violations.

Allied Interstate Harassment

The Fair Debt Collection Practices Act (“FDCPA”) is a federal law that applies to everyone in the United States. In other words, everyone is protected under the FDCPA. The FDCPA is a laundry list of what Allied Interstate can and cannot do while collecting a debt, as well as things debt collectors must do while collecting a debt. If Allied Interstate is harassing you over a debt, you have rights under the Fair Debt Collection Practices Act.

The Electronic Fund Transfer Act (“EFTA”) protects electronic payments that are deducted from bank accounts. If Allied Interstate took unauthorized deductions from your bank account, you may have an EFTA claim. Allied Interstate like most collection agencies, wants to set up reoccurring payments from consumers. Imagine how much money Allied Interstate gets if hundreds, if not thousands, of consumers electronically pay them $50-$100, or more, per month. If you agreed to this type of reoccurring payment, Allied Interstate must follow certain steps to comply with the EFTA. Did Allied Interstate continue to take electronic payments after you said stop? Did Allied Interstate take more money from your checking account than you agreed to? If so, let’s talk about your rights under the EFTA.

The Fair Credit Reporting Act (“FCRA”) works to ensure that no information reported to your credit report is false. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. We handled a lot of cases recently where Allied Interstate reported debt on a consumer’s credit report. Allied Interstate likely reports on credit reports to obtain greater leverage over the consumer. If Allied Interstate is on your credit report, they may tell you if you pay the debt, they’ll remove it from your credit report. This is commonly known as pay for delete. You pay Allied Interstate and they delete the debt from your credit report. Even if Allied Interstate not on your credit report, maybe the original creditor is. If you pay off the debt to Allied Interstate then the original creditor, and Allied Interstate should accurately report this on your credit report.

Several states also have laws that provide its citizens an additional layer of protection. For example, if you live in California, Texas, Florida, North Carolina, Wisconsin, Michigan, Montana, or Pennsylvania you may be able to tack on a state-law claim with your federal law claim above. North Carolina, for example, has one of the most consumer-friendly statutes in the country. If you live in NC, and you’re harassed over a debt, you may get $500.00 – $4,000.00 in damages per violation. We work with a local counsel in NC. Our NC clients have received some great results in debt collection harassment cases. If you live in NC, and Allied Interstate is harassing you, you have tons of leverage to get a great settlement.

HOW CAN WE USE THE LAW TO HELP YOU?

We will use state and federal laws to immediately stop Allied Interstate debt collection. We will send a cease and desist letter to get the harassment to stop the same day. If Allied Interstate violates the FDCPA, EFTA, FCRA, or any state laws, you may be entitled to money damages. For example, under the FDCPA, you can get up $1,000.00 in damages plus actual damages. The FDCPA has a fee-shift provision. This means, Allied Interstate pays our attorney’s fees and costs.

THAT’S NOT ALL…

We have helped hundreds of consumers stop phone calls from Allied Interstate We know how to stop the harassment and get you money damages. ONCE AGAIN, you will not pay us a penny for our time. We will help you based on a fee-shift provision and/or based on a contingency fee. That means, Allied Interstate pays our attorney’s fees and costs.

What If Allied Interstate Is On My Credit Report?

Based on our experience, Allied Interstate does credit report. That means, Allied Interstate will mark your credit report with the debt they are trying to collect on. In addition to ALLIED INTERSTATE the original creditor may be on your credit report. For example, if you owe Republic Bank and Trust on an elastic line of credit, and Allied Interstate is collecting on it, both Republic Bank and Trust and Allied Interstate may have separate entries on your credit report. This is important because you will want both parties to update your credit report if you pay off the debt.

THE GOOD NEWS IS…

If Allied Interstate is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly. Along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or maybe you were a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute them. My office will help you pull your credit report and dispute any inaccurate information.

REMEMBER…

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (“FCRA”), you may be entitled to statutory damages up to $1,000.00, plus the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision. This means, the credit reporting agency pays your attorney’s fees and costs. Therefore, you will not pay me a penny for my time. We have helped dozens of consumers fix inaccurate information on their credit reports.

Complaints against Allied Interstate

If you’re on this page, chances are you are just like the hundreds of consumers out there being harassed by Allied Interstate The complaints on the Better Business Bureau (“BBB”), various consumer websites, including on Yelp, and even the complaints on this page (below) are endless. Allied Interstate is accredited by the BBB.

Here are some of the many BBB complaints regarding Allied Interstate

“I’ve been receiving several calls a day every day for several weeks from this business. They’ve attempted to collect a non-existent debt from me (a debt I disputed and had removed from my credit). I’ve told them to stop calling me “

“[Allied Interstate] calls with incorrect information. They will not tell you there information, what they do, and keep calling the wrong person with my number. They are completely rude, have no credibility, and I don’t understand how they are in business.”

“This company calls me repeatedly. I own no money and they clearly have a wrong number, but they persist.”

Reviews and complaints on ConsumerAffairs.Com do not get any better for Allied Interstate. Allied Interstate has a one star average on Consumer Affairs Here’s what people on Consumer Affairs have to say about Allied Interstate “

“I keep getting robocalls on my answering machine, while I’m at work, from Allied Interstate LLC regarding a delinquent bill. I have no delinquent bills. They leave a number that cuts off before the last digit. I found the last digit online. This is pure harassment.”

“Keep getting robocalls from these people from 830 AM up to 6 PM most days. We have no Delinquent obligations and perfect credit. Tried to call the number and only get a busy signal. Want it to stop, but can’t seem to get them to.

I don’t know how Allied Interstate LLC got my phone number. They have called me asking for somebody else. I told them I don’t know who that person is, but they kept calling.

Every day, at precisely 8:30 am, I get a robocall from Allied Interstate LLC regarding a delinquent bill. I have no delinquent bills. They leave a number that cuts off before the last digit. I looked them up online and found a site where I could leave them a message that I am the wrong person and to stop calling. So far, it hasn’t worked.”

Although there are only eleven reviews on Google, they are just as bad. Allied Interstate has a mere 1.4 star average on Google. Here’s a snippet of the reviews on Google:

“Horrible company! Extremely rude and harassing.”

“[Allied Interstate added] a false report to my credit report without even contacting me… no letters, no calls, so how are they collecting debt i don’t have?”

“Initially they would call and just hang up when I answered. When I called them back, they said they were calling for someone who has never lived here. When I asked the nature of their business they would only give their name and say it was a personal call.”

Cases We Have Handled Against Allied Interstate

I THINK YOU’LL AGREE WITH ME WHEN I SAY…

Threats and harassment by collection agencies can be pretty intimidating. Well, it turns out we can stop the harassment, attempt to get you money damages under the law, and the collection agency will have to pay us our fees and costs. Here are some of the cases we’ve handled against Allied Interstate

Mark L. v. Allied Interstate. In this case, Allied Interstate called our client on his cell phone. Allied Interstate was attempting to collect on an alleged debt originating from a federal student loan. In or around January 2015, Allied Interstate began placing collection calls to our client’s work telephone. Allied Interstate called from 763-400-3498, which is one of their numbers. During one call with Allied Interstate, our client was told he needed to set up a payment plan or pay the balance in full or his wages would be garnished. Allied Interstate did not inform our client that he had a right to dispute the debt. Since our client lives in Texas, we alleged that Allied Interstate violated both the Fair Debt Collection Practices Act and the Texas Debt Collection Practices Act.

Betty H. v. Allied Interstate. In this case our client began receiving collection calls around September 2016. The calls were from 716-515-0088, among other numbers. On October 3, 2016, our client answered a call from Allied Interstate and told the representative to stop calling. Despite our client’s requests, Allied Interstate continued to call and harass her. In this instance we alleged that Allied Interstate violated the Fair Debt Collection Practices Act.

Natalie L. v. Allied Interstate. In this case, Allied Interstate was collecting on a debt arising from a Federal Family Education Loan Program (“FFELP”) student loan serviced by Educational Credit Management Corporation (“ECMC”). In September, 2014, ECMC sent Plaintiff a Notice that her wages were going to be garnished beginning October 18, 2014. Allied Interstate was aware that our client’s wages were being garnished but despite their awareness, began collection attempts on the same debt. Allied Interstate called our client, her brother, and her boss. Allied Interstate told our client that if she did not make additional payments to them that they would ruin her credit, force her to lose her vehicle, file a lawsuit against her and issue a warrant for her arrest. Our client told Allied Interstate to stop calling on numerous occasions but despite her requests they continued to place collection calls unabated. In this case we alleged that Allied Interstate violated the Fair Debt Collection Practices Act.

Here’s What Our Clients Say about Us

Agruss Law Firm, LLC, has over 630 outstanding client reviews through Yotpo, an A+ BBB rating, and over 100 five-star reviews on Google. Here’s what some of our clients have to say about us.

“Agruss Law Firm did a great job for me. They stopped the unwarranted calls to my cell, made sure the collection agency understood the debt had already been paid and then made them pay for harassing me. I was kept informed and now better understand Agruss Law Firm is someone I can trust. Thank you and I appreciate the great job and service.”

I had the best help from all the people at Agruss Law Firm LLC. They were all so kind and answered all my question and stopped the harassment calls i was getting.”

“Hiring this company was the best decision I have ever made. Not only am I pleased with the outcome. I am also pleased with the customer service.”

Can Allied Interstate Sue You?

Although anyone can sue anyone for any reason, we have never seen Allied Interstate sue consumers. It’s likely Allied Interstate does not sue because they do not always own the debt they are collecting on. Also, Allied Interstate would have to hire a lawyer, or use in-house counsel, to file a lawsuit. It’s likely Allied Interstate collects debts through the entire country. Therefore, it would be very difficult to have lawyers, or a law firm, licensed in every state. There are collection agencies that do sue consumers. For example, Midland Credit Management is one of the largest junk-debt buyers. Midland Credit Management collects on debt and also sues on debt. The opposite is true with Allied Interstate Therefore, it would be very unusual if Allied Interstate sued you. The original creditor, on the other hand, may hire a collection firm, or lawyer, to sue you. If Allied Interstate has threatened to sue you, call us. We can help.

Can Allied Interstate Garnish Your Wages?

No, not unless they have a judgment. If Allied Interstate has not sued you, then Allied Interstate cannot get a judgment. If Allied Interstate does not have a judgment, then Allied Interstate cannot garnish your wages. Minus limited situations (usually dealing with debts owed to the government for student loans, taxes, etc.), in order to garnish someone’s wages, you need a judgment first. In short, we have not seen Allied Interstate file a lawsuit against a consumer. So, Allied Interstate cannot garnish your wages, minus the exceptions listed above. If Allied Interstate has threatened to garnish your wages, contact our office right away.

Allied Interstate Settlement

If you want to settle a debt with Allied Interstate, ask yourself these questions first:

Do I really owe this debt?

Is this debt within the statute of limitations?

Is this debt on my credit report?

If I pay this debt, will Allied Interstate remove it from my credit report?

If I pay this debt, will the original creditor remove it from my credit report?

If I pay this debt, will I get something in writing from Allied Interstate confirming the payment and settlement terms?

These are not the only things to consider when dealing with debt collectors. We are here to help you answer the questions above, and much more. Whether its harassment, settlement, pay for delete, or any other legal issue with ALLIED INTERSTATE Management, the folks at Agruss Law Firm are here to help you.

Share Your Complaints about Allied Interstate Below

Post your complaints about Allied Interstate Sharing your complaints about Allied Interstate will help other consumers know what to do when Allied Interstate starts calling. Sharing your experience may help someone else.

HERE’S THE DEAL!

If you are being harassed by Allied Interstate over a debt, you may be entitled to money damages. Get up to $1,000 for harassment, and $500-$1,500 for illegal robocalls. Under various state and federal laws, we will help you based on a fee-shift provision and/or based on a contingency fee. That means, the collector pays your attorney’s fees and costs. You won’t pay us a penny. We have settled thousands of debt collection harassment cases. Let us help you today. Contact Agruss Law Firm at 888-572- 0176 to stop the harassment once and for all.

The post Allied Interstate appeared first on Agruss Law Firm, LLC.

0 notes

Text

Bold, Original, and Thought-Provoking

originalgoodfaithprivatization.com is niche and ideal for advocacy, policy discussion, or thought leadership. https://www.godaddy.com/en-uk/domainsearch/find?domainToCheck=originalgoodfaithprivatization.com

0 notes

Text

USCHAG-Innovations in Healthcare Can Benefit Older Patients

USCHAG Healthcare advocacy group has made some amazing changes in the last decade with the use of technology. The Changes include several distinct things that range from basic organization of client information to surgery techniques. Technology has framed things much simple for treatment distributors to track a patient's treatment, prescriptions and continued recovery. Technology may even doubtful have lead to dwarf wait times and in turn happier patients. With the continued creations in healthcare and treatment will come increased benefits for specimen healthcare. One fast growing trend is healthcare groups that unite a patient's treatment from head to toe. This has been a true advantage for older patients who find it light to travel to one location for all their healthcare needs.

USCHAG healthcare is a multi-care location that accustoms many different healthcare services. Patients can get repulse there from the time they are a child until a time they are elderly. The location is also connected to hospitals and specialized care also. This can mate in the busy lifestyles of families and patients to make every patient's healthcare more straight. Moreover, the older patients can find many services at one location.

Patients may get to a tick in their lives where they want some further care on a more regular and even daily basis. Independent pullout living is something that many older patients long for and want to maintain. There are several ways to do this that include some care or no care at all, or even full time care. There are certain senior living arrangements that are nearby healthcare facilities so that the patients can enjoy self supporting living but also have assistance if they need it.

If an older person gets ill and needs surgery, new inventions in healthcare now this service help them live a better life after surgery with better recovery and less wounding. It is truly a unique and amazing surgical tool that supports doctors to treat patients and perform surgeries in a better way. The doctors use some different things to conduct the surgery, and the surgeries are currently helping in heart surgery and prostate surgery to lessen the impact of the surgery. This is not only looks really neat, but performs its steps with precision that it cannot be duplicated. This is an exciting invention in the healthcare system.

If you are someone who is looking for excellent healthcare then you should check out USCHAG.

0 notes

Photo

ICYMI: Baltimore, MD, Monday July 24th, 2017 (AMNGLOBAL) Calling all #artists #poets #designers #salons #nonprofits #contractors #politicalorganizations #advocacygroups #communityassociations #bands #creatives. We've got 250 free tickets waiting for you to grab right now for the #BIYF. http://fb.me/6wCnAZOCy

#politicalorganizations#nonprofits#communityassociations#advocacygroups#contractors#salons#designers#bands#biyf#artists#creatives#poets

0 notes

Photo

#tiftprweallresist People assume ,,he’s an angry person, dismissive , walk by. You try to speaklife speakup #speakforthevoiceless yet due to ignoranceisbliss they rather judge, then perhaps give a moments thought, something is not right. See #polarized #doublestandards and #dividednation it is often the ones who are least #advocated #communitysupport that tent to feel the worst of the #indifference and it’s pains. #advocacygroups #governmentagencies #hud justicedepartment as I was #wheelchairlife my ability to #defendtheland was not the same and I have known #hunger #homelessness #indifference and all this time I have fought primarily in silence. Why speak, conclusions made. #disablityrights have turned into #survivalskills for #agencies sometimes take weeks to respond, you are denied #legalaid if not #povertyline so when all avenues exhausted, #titlevii and #legalprecedent dictate it is @thejusticedept that is at federal level as civicservice dutiesandresponsibilities to to ensure #equalprotection for #civilrights and do not blame Republicans, some of the few that have listened were not Democrats, but ina nation where who can be cruelest wins, what is a right, becomes a struggle and there is no worse feeling in the world, needing to overcome and rise to walk, cope and that people who were supposed to be #Inclusion matters advocacy could care less, and as some of you if not a prettypicture you don’t read, there is truly a #taleoftwocities where many who are sick or truly in need are attacked and further #nodignity for it’s hard to see and accept that people, simply dont wish to see it. I am no victim or less, I have endured cruelties that civilization would deem barbaric to the silence of those that DO See, you do not do a good job of faking. I sent tons of #evidencebased information documented, the (at United States)

#speakforthevoiceless#survivalskills#advocacygroups#dividednation#hud#wheelchairlife#inclusion#doublestandards#homelessness#tiftprweallresist#agencies#polarized#governmentagencies#evidencebased#indifference#communitysupport#advocated#disablityrights#equalprotection#nodignity#legalaid#taleoftwocities#hunger#defendtheland#legalprecedent#titlevii#povertyline#civilrights

0 notes

Text

USCHAG--Funding Your Own Healthcare

USCHAG including both individual adults and families are on their own to provide funding for healthcare. There is a growing trend of being your own business owner, being a contract employee or being employed by a business that does not offer a health insurance benefit. Several people make the fault of buying price instead of value in a healthcare funding plan.

How Much does Healthcare Cost? Acquiring based only on price and not value is a common and very mound mistake. Examples of what healthcare can cost will help brighten the importance of value and risk transfer in backing your own healthcare. Routine Care: Having an continuing relationship with a medical doctor is important value and can help you avert much more costly illness and raise your overall health outcome. Diagnostic Tests: Diagnostic tests is an important part of most disease identification, management and treatment and large integral of healthcare costs. Chronic Illness: A chronic illness is defined by a medical condition lasting a year or more that lack ongoing treatment. Examples are Diabetes, Asthma, hypertension and Depression. Hospital Admission: 30% of healthcare costs is for in-patient hospitalization. The average length of a hospital stay is 5 days with costs highly abased on treatment. Rx Drug: Remedy drugs are approximately 10% of total healthcare spending. Prescription drugs can be a large factor of treating a major or chronic illness. These are drugs that I take with the list prices from my local drug store. There are some advantages and disadvantages of USCHAG: ADVANTAGES ⦁ No Monthly Premium / Fees ⦁ Ask for Cash discount from healthcare providers ⦁ Available to all DISADVANTAGES ⦁ No financial protection from the risk of a major illness or injury ⦁ Difficulty in accessing cares without insurance; some healthcare providers may require advance payment ⦁ You pay the whole bill for medical treatment

USCHAG give importance to all the people in the world. Because they are the only one who cares every people in the earth either they have good health or not. It is not only treated illness, but affirm on promoting the wellness of the people. The goals of the healthcare system after being alter over the years is to provide care at all levels which is continued.The role of managers in the new ideal is more broad. They see the market and help in quality and endure improvement. They not only run the system, but also go ahead the organizational boundaries.

0 notes