#Audit Software in India

Explore tagged Tumblr posts

Text

Enhancing Audit Workflow Management with Cutting-Edge Tools from AudTech

Introduction

In the ever-evolving landscape of finance, audit and accounting firms must adopt innovative workflow management tools to stay competitive and deliver high-quality services. This blog explores the latest trends in audit workflow management and how AudTech’s advanced software is setting new standards in the industry. https://audtech.co.in/2025/04/03/regulatory-updates-in-statutory-audits-key-compliance-changes-firms-need-to-be-aware-of/

AI and Machine Learning: The Future of Audit Efficiency

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing audit workflows. By automating repetitive tasks, such as data collection and analysis, AI-driven tools help auditors focus on high-risk activities. AudTech’s software integrates AI to enhance data accuracy, identify anomalies, and provide predictive insights, streamlining the entire audit process.

Cloud-Based Solutions for Seamless Collaboration

Cloud computing is transforming audit workflow management by enabling real-time collaboration and accessibility. AudTech’s cloud-based platform allows auditors to access documents, share updates, and collaborate with clients from anywhere, at any time. This flexibility not only improves efficiency but also ensures that audit teams can work cohesively, even remotely.

Enhanced Data Security with Advanced Technologies

Data security is paramount in the auditing process. With increasing cyber threats, adopting robust security measures is essential. AudTech’s software incorporates state-of-the-art encryption and access control mechanisms, ensuring that sensitive financial data is protected against unauthorized access and breaches.

Real-Time Analytics and Reporting

Real-time analytics is a game-changer for auditors, providing immediate insights into financial data. AudTech’s platform offers advanced analytics tools that help auditors generate comprehensive reports quickly and accurately. This capability is crucial for making informed decisions and delivering timely audit results to clients.

Workflow Automation and Efficiency

Automated workflow management tools, such as those offered by AudTech, significantly enhance audit efficiency. These tools automate key audit processes, from planning and execution to reporting and follow-up. By reducing manual tasks, auditors can save time and focus on critical areas that require professional judgment.

Integration with Existing Systems

Modern audit workflow tools must integrate seamlessly with existing systems to maximize efficiency. AudTech’s software is designed to integrate with various financial and enterprise systems, ensuring a smooth workflow and eliminating data silos. This integration enhances data consistency and reduces the risk of errors.

Conclusion

Staying ahead in the competitive audit industry requires adopting the latest workflow management tools. AudTech’s advanced software provides auditors with the tools they need to enhance efficiency, accuracy, and client satisfaction. By leveraging AI, cloud computing, and automation, audit firms can streamline their workflows and deliver superior services in today’s digital age.

Contact

Office No. 810, 8th Floor,

LMS Finswell, Viman Nagar, Pune, Maharashtra, India, 411014

+91 9112118221 / [email protected]

0 notes

Text

Top TDS Software for Quick Returns & Challan Generation | CompuTDS

#TDS filing software#TDS return software#Tax software#Audit report software India#24Q 26Q forms#Online TDS filing#TDS compliance

0 notes

Text

The Future of Accounts Payable and Receivable Automation in India

In today’s fast-paced business environment, financial transactions must be handled efficiently to maintain cash flow and profitability. Companies are rapidly shifting towards digital solutions to optimize their financial operations. Accounts payable automation in India is revolutionizing how businesses manage their outgoing payments, ensuring accuracy, compliance, and seamless processing. Likewise, accounts receivable automation in India is helping organizations streamline invoicing, payment collection, and reconciliation, reducing manual errors and delays.

The Rise of Financial Services Automation in India

As industries expand and transactions increase, traditional manual financial processes become inefficient and error-prone. This has led to a surge in demand for financial services automation in India. Businesses across sectors are embracing automation to improve efficiency, enhance compliance, and minimize risks. Automated financial workflows not only speed up payment cycles but also provide real-time visibility into transactions, ensuring better decision-making.

Key Benefits of Accounts Payable and Receivable Automation

1. Enhanced Efficiency and Speed

Automation eliminates repetitive tasks, reducing the time spent on invoice processing and payment approvals. Companies using accounts payable automation in India can process invoices swiftly and avoid late payment penalties.

2. Error Reduction and Compliance

Manual data entry often results in miscalculations and compliance issues. With accounts receivable automation in India, businesses can ensure accurate billing, automated reminders, and error-free financial records.

3. Improved Cash Flow Management

By automating accounts payable and receivable functions, businesses can maintain a healthy cash flow, avoid bottlenecks, and ensure timely payments and collections.

4. Fraud Prevention and Security

Automation software comes with built-in security features that protect businesses from fraud, unauthorized access, and financial discrepancies.

Choosing the Right Accounts Payable and Receivable Automation Software

Selecting a reliable Accounts Payable Receivable Automation Software Company is crucial for businesses looking to modernize their financial operations. A good software provider offers features such as AI-powered invoice processing, automated reconciliation, seamless integration with ERP systems, and real-time reporting. Investing in the right automation solution ensures long-term financial efficiency and business growth.

Conclusion

The demand for accounts payable automation in India and accounts receivable automation in India is growing as businesses recognize the advantages of financial digital transformation. Partnering with a top Accounts Payable Receivable Automation Software Company can help organizations achieve operational excellence, reduce costs, and improve financial accuracy. Embracing financial services automation in India is no longer a choice but a necessity for companies looking to stay ahead in the competitive market.

If your business is looking for a seamless transition to automated financial processes, now is the time to explore cutting-edge solutions and take a step towards financial excellence!

#aviation compliance software in india#audit tracking system#hipaa compliant workflow automation in india#document approval workflows in india#aviation document management system#healthcare data security solutions in india#accounts payable automation in india#healthcare regulatory compliance software in india#Accounts Payable Receivable Automation Software Company#financial services automation in india

0 notes

Text

Create Immersive AR Experiences for Your Business

Augmented reality is no longer just for gaming—it’s a game-changer for businesses. At Atcuality, we specialize in augmented reality development services to help brands offer immersive digital experiences. Our team designs AR applications for eCommerce, automotive, architecture, and more, enabling businesses to engage users in new and exciting ways. Imagine allowing customers to try on clothes virtually, explore 3D home designs, or interact with digital product demonstrations—all from their smartphones. With real-time AR interactions, businesses can provide value-driven experiences that increase conversions and customer satisfaction. Let us help you leverage AR to create interactive solutions tailored to your audience’s needs.

#ai applications#website development#augmented and virtual reality market#digital marketing#artificial intelligence#emailmarketing#augmented reality#web development#web design#information technology#website#wordpress development#software#website developer near me#website developer in india#website optimization#website design#wordpress#ssl#sslcertificate#ssl certificates#seo company#seo marketing#seo services#on page seo#off page seo#seo#social media marketing#on page optimization#on page audit

0 notes

Text

Looking for expert IT consultancy services in Vadodara? Barodaweb offers tailored IT solutions, guiding businesses with 30 years of expertise. Partner with us for growth-driven IT strategies.

#Best#top#Trustworthy#Professional#IT#business#software#Consultancy#Service#Provider#company#studio#firm#web audit#near me#in#vadodara#baroda#Gujarat#India

0 notes

Text

Check out the Features of Stock Audit. For more details @ www.ncssoft.in

NCS #ncssoftsolutions #eTHICCAAM

Audit software with best comprehensive integrated solution #Audit management software with robust auditing standards

#stockaudit#features#Best insurance software for Audit#eTHIC insurance software in India#Best Audit software for banks#audit#auditsoftware#compliance#grc platform#seo audit

0 notes

Text

Can Blockchain Technology replace Chartered Accountants?

Auditing is undergoing a seismic shift, largely driven by the relentless march of blockchain technology. Blockchain technology is not replacing auditors; it’s empowering chartered accountants. The future of audit lies in a collaborative approach. Technology like blockchain handles tedious tasks like reconciliation through secure, shared ledgers. This frees up CAs from the time-consuming task of ensuring data accuracy, allowing them to focus on higher-level analysis and providing valuable insights that directly impact client decision-making.

This powerful synergy between Chartered Accountants and blockchain technology unlocks a new era of auditing:

⏩Enhanced Efficiency: Streamlined processes through automated tasks like reconciliation free up valuable Chartered Accountant time. This translates to faster audits and reduced costs for both CAs and their clients.

⏩Effective Risk Management: Real-time access to secure blockchain data allows for continuous auditing. This empowers Chartered Accountants to identify potential issues early on, enabling proactive risk management for clients.

⏩Perceptive Analysis: Chartered Accountants leverage their expertise to interpret the vast amounts of secure data generated by blockchain. This deeper financial health insight empowers them to provide clients with more perceptive analysis and strategic guidance.

This collaborative approach ultimately strengthens trust and transparency in the financial markets. Ready to Lead the Audit Revolution? Learn how Blockchain Empowers Chartered Accountants

#blockchain#technology#artificial intelligence#machine learning#chartered accountants#software#trending#bank audit#internal audit#india#finance

0 notes

Text

What is an APQP Checklist?

An Advanced Product Quality Planning (APQP) checklist is a vital tool used in various industries to ensure the systematic development of products and processes. It serves as a comprehensive guide to managing quality throughout the product lifecycle, from initial design to production and beyond.

Importance of APQP in Quality Management

APQP plays a crucial role in maintaining product quality and customer satisfaction. By following a structured approach outlined in the checklist, organizations can:

Ensure Product Quality: APQP helps in identifying potential risks and quality issues early in the product development stage, allowing for timely mitigation measures.

Reduce Defects and Rework: Through thorough planning and risk assessment, APQP aims to minimize defects and rework, thereby reducing overall production costs.

Understanding the APQP Checklist

An APQP checklist is a document that outlines the necessary steps and requirements for implementing APQP processes effectively. It typically includes:

Definition: A clear definition of APQP and its objectives.

Components of the Checklist: Sections covering various aspects such as planning, design, process validation, and production.

Benefits of Using an APQP Checklist

The utilization of an APQP checklist offers several benefits, including:

Streamlining Processes: By following a structured approach, organizations can streamline their product development and manufacturing processes.

Enhancing Communication: The checklist facilitates effective communication among cross-functional teams, ensuring everyone is aligned with project requirements.

Facilitating Risk Management: APQP checklist helps in identifying and mitigating risks early in the product lifecycle, reducing the likelihood of costly failures.

How to Develop an Effective APQP Checklist

Developing an effective APQP checklist involves several key steps:

Gathering Relevant Information: Collecting necessary data and information related to product requirements, customer expectations, and regulatory standards.

Involving Cross-Functional Teams: Engaging representatives from various departments to ensure comprehensive input and buy-in.

Establishing Clear Criteria and Metrics: Defining specific criteria and metrics for evaluating product quality and process performance.

Implementing the APQP Checklist in Different Industries

APQP principles can be applied across various industries, including:

Automotive Sector: APQP is widely used in the automotive industry to ensure the quality and safety of vehicles.

Aerospace Industry: Aerospace companies utilize APQP to meet stringent regulatory requirements and ensure the reliability of aircraft components.

Healthcare Sector: In healthcare, APQP helps in developing safe and effective medical devices and pharmaceutical products.

Common Mistakes to Avoid When Using APQP Checklist

While APQP checklist offers numerous benefits, organizations must avoid common pitfalls such as:

Lack of Stakeholder Involvement: Failure to involve key stakeholders from different departments can lead to oversight and suboptimal outcomes.

Failure to Update the Checklist Regularly: An outdated checklist may not reflect current industry standards or regulatory requirements, compromising its effectiveness.

Ignoring Feedback and Improvement Opportunities: Organizations should actively seek feedback from users and stakeholders to identify areas for improvement and refinement.

Examples of APQP Checklist Templates

There are various APQP checklist templates available, ranging from basic to advanced, tailored to specific industry requirements.

Basic Checklist Template: Includes essential steps and requirements for implementing APQP processes.

Advanced Checklist Template: Incorporates additional features such as risk assessment matrices and validation protocols.

Tips for Maximizing the Effectiveness of APQP Checklist

To derive maximum benefit from APQP checklist, organizations should:

Provide Adequate Training: Ensure that employees are trained in APQP principles and understand how to use the checklist effectively.

Regular Audits and Reviews: Conduct periodic audits and reviews to assess compliance with APQP processes and identify areas for improvement.

Continuous Improvement Initiatives: Encourage a culture of continuous improvement, where feedback is solicited, and lessons learned are applied to enhance processes.

Case Studies: Successful Implementation of APQP Checklist

Several organizations have successfully implemented APQP checklist, resulting in improved product quality and customer satisfaction.

Future Trends in APQP Checklist Development

As technology advances and industry requirements evolve, APQP checklist development is expected to incorporate:

Integration with Digital Tools: Increasing integration with digital tools and software platforms to streamline APQP processes and enhance collaboration.

Emphasis on Sustainability: Incorporating sustainability criteria and metrics into APQP checklist to address growing environmental concerns.

Conclusion

In conclusion, an APQP checklist is a valuable tool for organizations seeking to ensure product quality, minimize risks, and enhance customer satisfaction. By following a structured approach outlined in the checklist, businesses can streamline their product development processes and stay competitive in today's dynamic market.

FAQs

What is the role of APQP in quality management?

APQP plays a crucial role in maintaining product quality by identifying potential risks and quality issues early in the product development stage.

How can organizations develop an effective APQP checklist?

Developing an effective APQP checklist involves steps such as gathering relevant information, involving cross-functional teams, and establishing clear criteria and metrics.

In which industries is APQP commonly used?

APQP principles can be applied across various industries, including automotive, aerospace, and healthcare sectors.

What are some common mistakes to avoid when using an APQP checklist?

Common mistakes include lack of stakeholder involvement, failure to update the checklist regularly, and ignoring feedback and improvement opportunities.

How can organizations maximize the effectiveness of APQP checklist?

Organizations can maximize effectiveness by providing adequate training, conducting regular audits and reviews, and fostering a culture of continuous improvement.

#Software Development India#Software Company Chennai#Best Software Product Companies in Chennai#Software Service Providers in Chennai#software companies in Anna Nagar Chennai#APQP Software#ppap software#dms software#best document manager software#internal audit software#coq software#spc software#msa software#fmea software#ccm software#gcs software#vqms software#sqms software.

0 notes

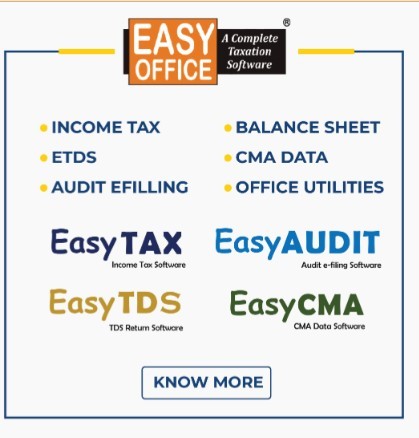

Text

audit management software, Best audit software in India

Audit Software Free Download

.

EasyAUDIT

audit software

Comprehensive solution for Audit e-filing & Balance Sheet

Experience the ease of Audit e-filing

audit software for chartered accountants in india

EasyAudit – a module for Audit efiling & Balance sheet generation in EasyOFFICE software. EasyAudit software is a powerful tool designed to assist Chartered Accountants and Auditors in their Audit work.It provides a wide range of features to help with the Balance Sheet preparation and e-filing of audit reports.

.

audit management software

The software incorporates various audit forms such as 3CA, 3CB, 3CD, 3CEB, 29B and 10B, which makes it a comprehensive solution for all auditing needs.

.

Best audit software in India

EasyAudit software also allows you to prepare Financial account statements Profit & Loss, Balance sheet manually or by importing trial balances from Excel sheets and Tally.

.

audit efiling software

With all these features EasyAudit is the Best Software & first choice among Chartered Accountants and Auditors looking for a reliable and efficient tool for Audit e-filing & Audit reporting.

.

best audit software

The software has the ability to automatically generate Balance sheet, Profit-loss account and Trading account based on the trial balance provided by the user making it a highly convenient tool that saves time and effort. In addition, it prepares fund flow and cash flow statements.

.

audit software for chartered accountants in india

EasyAUDIT is used by Tax professionals to prepare Audit forms, CARO Report, Audit Reports and calculate depreciation by Fixed Asset Chart.

.

balance sheet software

GST complaint Fully Accounting Software EASYACC is specific software of Financial Accounting. The software is an integrated business accounting software for Small and Medium traders and as well as for professionals.

.

audit software price

The software due to its user-friendly interfaces, Advanced Features, robustness, convenience and speed is being extensively used by Chartered Accountants, Tax Professionals, Consultants, Accountants, Traders and industries...

.

audit software 2023

To Keep our Customer up-dated With current market needs we regularly updating & adding the new features in the software.

.

tax audit e filing software

A Professionally managed organization engaged in the field of Electronics Process Control Solutions, Industrial Automation, TDS Software Free Download and Software Developments for more than a decade.

.

3ca and 3cb software

Owing to our expertise in this domain, we are able to offer a generalize & custom-made range of Electronics Process Control Instruments and Accounting Software that is in compliance with the international standards of quality.

.

3cd filing software

Our dedicated and fully qualified team works hard to provide competitive prices, quick turnaround and full technical support.

.

tax audit software free download

Contact Us

Address: 505, Sukhsagar Complex, Nr. Hotel Fortune Landmark, Usmanpura Cross Road, Ashram Road, Ahmedabad - 380013. Gujarat

.

Call: 7927562400/+91-079-27562400

Email: [email protected]

Website: www.electrocom.in

#audit software#audit software for chartered accountants in india#audit management software#Best audit software in India

0 notes

Text

Automated Labour Law Audits and Compliance Software — SEAL

Simpliance’s revolutionary automated statutory audit platform driven by AI & Machine Learning technology is helping companies reduce costs by 50% while conducting 100% audit checks of all records submitted and exponentially increasing audit speed.

INTELLIGENT TECHNOLOGY

First of its kind AI & Machine Learning driven audit platform in India enabling compliance at a click

100% EMPLOYEE RECORDS CHECKED

Automated engine, checking 100% records on all high-risk audit points of labour compliance

VARYING PAYROLL INPUT FORMATS

Capable of analysing varying payroll input formats from different softwares

INTEGRATED REGISTER GENERATION

Automated state-wise statutory register generation; PAN India under all applicable laws

Book your FREE DEMO now!

0 notes

Text

The Shift to Cloud-Based Auditing – Why Firms Are Moving Towards Digital Audit Solutions

The auditing landscape is undergoing a massive transformation with the rapid adoption of cloud-based audit software. As regulatory requirements grow stricter and businesses seek efficiency, firms are shifting towards audit workflow management software to streamline processes, enhance security, and ensure compliance. This digital shift is not just a trend—it’s a necessity for firms aiming to stay competitive in a rapidly evolving financial environment.

The Need for Digital Audit Solutions

Traditional auditing methods relied heavily on manual data entry, paper-based documentation, and inefficient workflow management. These outdated processes often led to errors, compliance risks, and delays in report generation. The rise of audit automation software has eliminated these challenges by providing real-time collaboration, automated reporting, and AI-powered insights for auditors and accountants.

Key drivers for the adoption of cloud-based audit software include:

Increasing regulatory scrutiny and compliance complexities

The need for secure, remote access to audit files

Demand for enhanced accuracy and reduced manual errors

Efficient management of large volumes of financial data

Cost-effectiveness and scalability of cloud solutions

Benefits of Cloud-Based Audit Solutions

Enhanced Workflow Automation

A cloud-based audit workflow management system helps firms automate repetitive tasks, improving efficiency and productivity. Features like audit file management software and audit sampling software enable auditors to manage documentation, track workflows, and generate reports with minimal effort.

Improved Data Security and Compliance

Cloud-based audit management software solutions come with robust security measures, including encryption, multi-factor authentication, and compliance with international data protection standards. Unlike traditional on-premise audit tools, cloud solutions offer automated updates to meet regulatory changes in statutory audits. https://audtech.co.in/2025/04/08/the-shift-to-cloud-based-auditing-why-firms-are-moving-towards-digital-audit-solutions/

Seamless Collaboration and Remote Access

With firms adopting hybrid and remote work models, audit workflow software enables real-time collaboration. Team members can access audit files securely from anywhere, reducing dependency on physical office spaces. This feature is especially beneficial for statutory audit firms that handle global clients.

Cost-efficiency and Scalability

Cloud-based audit digitization software reduces infrastructure costs, eliminating the need for physical servers and extensive IT maintenance. Firms can scale their audit management software as needed, ensuring flexibility in handling audits of varying complexities.

Advanced Analytics and AI-Powered Insights

Modern audit software for accountants and CPA firms integrates data analytics tools to detect anomalies, assess risks, and provide predictive insights. This enhances decision-making and strengthens the overall audit process by identifying potential fraud or compliance breaches early.

Key Compliance Challenges Addressed by Cloud Auditing

One of the primary reasons firms are shifting towards cloud-based audit automation software is to ensure compliance with ever-changing regulatory requirements. The latest audit quality maturity models emphasize the importance of audit sampling tools, digital record-keeping, and automated compliance checks. Top statutory audit software solutions now include built-in regulatory updates, reducing the burden on firms to track compliance changes manually.

Implementing Cloud-Based Auditing – Best Practices

To fully leverage the benefits of audit workflow management, firms should follow these best practices:

Choose the Right Audit Management Software – Select a solution with audit file management, document collaboration, and compliance tracking.

Train Your Team – Ensure auditors and accountants are well-trained in using audit automation software to maximize efficiency.

Prioritize Data Security – Implement strict security protocols, including multi-layer encryption and access control features.

Monitor Regulatory Updates – Use software with built-in compliance tracking to stay aligned with statutory audit regulations.

Conclusion

The shift to cloud-based audit solutions is no longer optional—it’s an industry standard for firms aiming to improve efficiency, compliance, and security. Investing in audit workflow software enables firms to stay ahead in an increasingly complex regulatory environment while optimizing operations. By adopting audit automation software, firms can reduce errors, enhance collaboration, and ensure compliance with evolving audit regulations.

Whether you’re a small CPA firm or a large accounting practice, upgrading to cloud-based audit tools will future-proof your business and position it for long-term success.

Optimize your audit process today with a powerful cloud-based solution. Explore the best-in-class audit software tailored for statutory audits, financial reporting, and compliance management.

Contact

Office No. 810, 8th Floor,

LMS Finswell, Viman Nagar, Pune, Maharashtra, India, 411014

+91 9112118221 / [email protected]

0 notes

Text

Accounting Services in Delhi, India by SC Bhagat & Co.: Your Trusted Financial Partner

In today’s fast-paced business world, reliable accounting services are essential for growth and compliance. Whether you're a startup, a small business, or a large enterprise, accurate financial management ensures smooth operations and helps you make informed decisions.

SC Bhagat & Co., one of the leading accounting firms in Delhi, India, offers comprehensive accounting services designed to meet the diverse needs of businesses across industries.

Why Choose SC Bhagat & Co. for Accounting Services in Delhi?

1. Comprehensive Accounting Solutions

SC Bhagat & Co. provides end-to-end accounting services including bookkeeping, financial reporting, tax planning, audit support, payroll management, and more. Their team of expert Chartered Accountants ensures every financial aspect of your business is handled with utmost precision.

2. Expertise Across Various Industries

Whether you operate in manufacturing, IT, retail, healthcare, or any other sector, SC Bhagat & Co. has the experience to understand your unique accounting requirements and deliver customized solutions.

3. Compliance and Accuracy

Staying compliant with Indian tax laws and regulations can be challenging. The team at SC Bhagat & Co. ensures timely filings and compliance with all statutory requirements, minimizing your legal risks and avoiding penalties.

4. Technology-Driven Approach

Leveraging modern accounting software and tools, SC Bhagat & Co. offers transparent, accurate, and real-time financial data. This tech-forward approach helps clients stay updated and make strategic decisions confidently.

5. Cost-Effective Services

Outsourcing your accounting needs to SC Bhagat & Co. reduces operational costs and saves time, allowing you to focus on your core business functions.

Key Accounting Services Offered

Bookkeeping & Accounting Accurate recording of financial transactions to maintain up-to-date books.

GST & Tax Compliance Assistance with GST returns, TDS, and other tax-related filings to ensure full compliance.

Payroll Services End-to-end payroll processing including salary calculations, deductions, and statutory compliance.

Financial Reporting & Analysis Preparation of balance sheets, profit & loss statements, cash flow statements, and detailed financial analysis.

Audit Support Assistance during internal and statutory audits, including preparing necessary documentation.

Benefits of Professional Accounting Services in Delhi

Improved financial accuracy and transparency

Enhanced decision-making capabilities

Timely compliance with legal and tax requirements

Cost and time savings

Scalability and flexibility to meet growing business needs

About SC Bhagat & Co.

SC Bhagat & Co. is a reputed Chartered Accountant firm in Delhi, India, with decades of experience in providing high-quality accounting, tax, and business advisory services. Their client-centric approach, combined with professional expertise and integrity, has made them a trusted partner for businesses of all sizes.

Frequently Asked Questions (FAQ)

What types of businesses can benefit from accounting services by SC Bhagat & Co.?

SC Bhagat & Co. serves startups, SMEs, large enterprises, and even multinational companies across various industries.

How does SC Bhagat & Co. ensure data confidentiality?

They follow strict data privacy policies, use secure software systems, and maintain non-disclosure agreements to ensure client information is fully protected.

Can SC Bhagat & Co. handle GST and tax filing for my business?

Yes, they offer comprehensive GST and tax compliance services, including preparation and filing of all required returns.

Do they offer virtual or remote accounting services?

Yes, SC Bhagat & Co. provides virtual accounting services using cloud-based systems, making it easy to collaborate regardless of your location.

How can I get started with SC Bhagat & Co.?

You can contact them directly via their website, email, or phone to schedule a consultation and discuss your specific accounting needs.

Conclusion

Choosing the right accounting partner is crucial for the financial health and growth of your business. SC Bhagat & Co. stands out as a reliable and experienced firm providing comprehensive accounting services in Delhi, India. Their commitment to excellence, technology adoption, and client-focused approach make them the perfect choice for businesses looking to streamline their financial management.

#taxation#gst#taxationservices#accounting services#direct tax consultancy services in delhi#accounting firm in delhi#tax consultancy services in delhi#remittances#beauty#actors

3 notes

·

View notes

Text

Statutory Audit in India by PK Chopra & Co. – Ensuring Financial Transparency and Compliance

Introduction Statutory audits are a legal requirement for companies operating in India under the Companies Act, 2013. They play a crucial role in ensuring financial transparency, compliance with laws, and maintaining stakeholder trust. PK Chopra & Co., a leading Chartered Accountancy firm in India, specializes in delivering accurate and compliant statutory audit services for businesses across sectors.

What is a Statutory Audit? A statutory audit is a mandatory audit of a company’s financial records to ensure accuracy and compliance with regulatory norms. It is governed by the Companies Act, 2013, and is compulsory for:

All companies with an annual turnover exceeding prescribed limits

Private limited companies with paid-up capital over ₹1 crore

Public limited companies, irrespective of turnover

The statutory audit ensures that the financial statements represent a true and fair view of the company’s financial position.

Why Statutory Audits are Important in India

Regulatory Compliance A statutory audit ensures that a company complies with the Companies Act and other applicable laws.

Investor Confidence Audited financial statements give investors and stakeholders confidence in a company’s financial integrity.

Fraud Detection Regular statutory audits help identify financial irregularities, preventing fraud and mismanagement.

Business Credibility Comprehensive audits enhance the credibility and reliability of a business in the eyes of banks, investors, and regulatory bodies.

PK Chopra & Co. – Expert Statutory Audit Services in India With decades of experience in the field of audit and assurance, PK Chopra & Co. is a reputed name among businesses looking for reliable statutory audit services in India.

Our Audit Process Includes: ✅ Understanding the business structure and operations ✅ Reviewing internal control systems ✅ Verifying accounting records and vouchers ✅ Assessing compliance with statutory requirements ✅ Preparing detailed audit reports

Why Choose PK Chopra & Co.? Qualified Chartered Accountants with deep domain knowledge

Technology-enabled audit tools for accuracy and efficiency

Tailored audit plans for diverse industries

Transparent audit reporting with actionable insights

Industries We Serve PK Chopra & Co. offers statutory audit services to a wide array of sectors, including:

Manufacturing

Real Estate

Retail & E-commerce

IT & Software

Healthcare

NGOs & Educational Institutions

Our Commitment At PK Chopra & Co., we are committed to upholding the highest standards of audit quality, confidentiality, and professionalism. Whether you are a startup or an established enterprise, our team ensures your statutory audit is conducted smoothly and in compliance with Indian regulations.

Frequently Asked Questions (FAQ)

What is the difference between a statutory audit and an internal audit? A statutory audit is legally required and focuses on financial accuracy and compliance. Internal audits, on the other hand, are conducted voluntarily to assess internal controls and operational efficiency.

Who is required to get a statutory audit in India? Any company registered under the Companies Act, 2013, including private and public limited companies with specified thresholds of turnover or paid-up capital, must undergo a statutory audit.

What documents are required for a statutory audit? Documents include the balance sheet, profit and loss account, general ledger, bank statements, tax filings, and relevant statutory registers.

How long does a statutory audit take? The duration depends on the company’s size and complexity, but on average, it may take anywhere between 2 to 6 weeks.

Why should I choose PK Chopra & Co. for statutory audit? PK Chopra & Co. brings decades of experience, industry-specific expertise, and a client-centric approach, ensuring efficient and compliant audits with minimal disruption to your operations.

Conclusion

A statutory audit is not just a compliance requirement—it’s a strategic tool that fosters trust, prevents risks, and strengthens corporate governance. With PK Chopra & Co., you get more than just auditors—you gain a proactive financial ally. Contact us today to ensure your business remains audit-ready and fully compliant.

#internal audit in india#usaid audit in india#due diligence services in india#best due diligence services in india#income tax audit in india#best usaid audit in india#transfer pricing audit services in india#architecture#celebrities#art

2 notes

·

View notes

Text

Revolutionizing Healthcare with HIPAA Compliant Workflow Automation in India

The healthcare industry in India is rapidly evolving, with digital transformation reshaping how medical data is managed and secured. With increasing concerns over patient privacy, regulatory compliance, and operational efficiency, healthcare providers must adopt HIPAA compliant workflow automation in India to streamline their processes while ensuring data security and regulatory adherence.

The Need for HIPAA Compliant Workflow Automation in India

Healthcare organizations deal with vast amounts of sensitive patient data, making security and compliance crucial. Manual processes not only slow down operations but also pose risks such as data breaches, unauthorized access, and compliance violations. By implementing HIPAA compliant workflow automation in India, hospitals, clinics, and medical service providers can enhance efficiency, reduce errors, and maintain compliance with global standards.

Key benefits of workflow automation include:

Improved Data Security: Automating healthcare workflows minimizes human intervention, reducing the chances of data mishandling.

Regulatory Compliance: Automated systems ensure that healthcare organizations meet regulatory standards effortlessly.

Operational Efficiency: Faster data processing, seamless coordination, and reduced paperwork enhance overall patient care.

Ensuring Data Protection with Healthcare Data Security Solutions in India

Data security remains one of the biggest challenges in the healthcare sector. With cyber threats on the rise, implementing robust healthcare data security solutions in India is non-negotiable. These solutions help in protecting electronic health records (EHRs), preventing unauthorized access, and ensuring that sensitive patient data remains confidential.

Leading healthcare data security solutions in India include:

End-to-End Encryption: Protects patient data during storage and transmission.

Access Control Mechanisms: Ensures only authorized personnel can access sensitive information.

Regular Security Audits: Helps identify vulnerabilities and maintain compliance with regulations.

Streamlining Compliance with Healthcare Regulatory Compliance Software in India

Navigating the complex regulatory landscape in India’s healthcare sector requires specialized tools. Healthcare regulatory compliance software in India helps organizations adhere to industry guidelines such as HIPAA, NABH, and GDPR by automating compliance processes, reducing human error, and ensuring regular reporting.

Features of compliance software include:

Automated Compliance Checks: Reduces risks of violations and penalties.

Audit-Ready Reports: Simplifies regulatory inspections and documentation.

Real-Time Monitoring: Ensures continuous adherence to evolving regulations.

The Future of Healthcare Automation and Compliance in India

As India’s healthcare sector embraces digitalization, the demand for HIPAA compliant workflow automation in India, healthcare data security solutions in India, and healthcare regulatory compliance software in India will continue to grow. By leveraging these technologies, healthcare organizations can enhance efficiency, improve security, and ensure seamless regulatory compliance, ultimately leading to better patient care and trust.

If you’re looking to implement top-tier healthcare automation and security solutions, now is the time to invest in cutting-edge technologies that protect your organization and your patients.

#aviation compliance software in india#audit tracking system#hipaa compliant workflow automation in india#document approval workflows in india#aviation document management system#healthcare data security solutions in india#accounts payable automation in india#healthcare regulatory compliance software in india

0 notes

Text

Tally Training in Chandigarh: Build a Successful Accounting Career

In today’s fast-paced digital economy, proficiency in accounting software like Tally is no longer optional — it’s a necessity. Whether you’re a student, a working professional, or someone planning a career shift into finance, Tally training in Chandigarh offers a golden opportunity to build a solid foundation in business accounting. With growing business activity in the region, mastering Tally can set you apart in the competitive job market.

Introduction to Tally and Its Relevance

Tally is one of the most widely used business accounting software in India. It simplifies complex financial operations such as invoicing, inventory management, taxation, payroll processing, and financial reporting. Tally ERP 9, the earlier version, was known for its robust features, while Tally Prime — the latest iteration — offers an intuitive interface and smarter navigation for enhanced productivity.

In a country where small and medium enterprises form the economic backbone, Tally plays a critical role in helping businesses maintain compliance and streamline operations. From automating GST filings to tracking stock levels in real time, Tally’s capabilities are deeply aligned with the needs of modern Indian enterprises.

Why Choose Tally Training in Chandigarh?

Chandigarh has steadily grown into a major educational and business center in North India. With its well-connected infrastructure and proximity to Punjab, Haryana, and Himachal Pradesh, it attracts students and professionals from across the region.

The city boasts several reputed training institutes that specialize in job-oriented programs, including Tally training in Chandigarh. These institutes not only provide structured learning but also offer real-world exposure through internships and industry interactions. The business-friendly environment of Tricity — comprising Chandigarh, Mohali, and Panchkula — further enhances placement opportunities for Tally-trained individuals.

Key Features of a Good Tally Training Institute

Selecting the right institute can make a big difference in how effectively you master Tally. Look for the following features when choosing your Tally course:

Certified and experienced trainers ensure you’re learning from professionals who understand both the software and its industry applications. Practical exposure through case studies and real-time projects helps you gain confidence in using Tally in real-world scenarios.

Modern Tally courses now include essential modules like GST compliance, inventory control, payroll processing, MIS report generation, and taxation management. Institutes that regularly update their syllabus in sync with government norms and business trends are more valuable.

Personalized mentorship, flexible batch timings (weekend/evening), and career support services like resume building and mock interviews can significantly enhance your learning experience.

Career Scope After Tally Training

Completing a certified Tally course can unlock a variety of career paths. Common roles include:

Accountant

GST Consultant

Billing Executive

Finance Executive

Audit Assistant

Tally skills are especially in demand in sectors like retail, manufacturing, logistics, healthcare, and professional services. Small and mid-sized businesses across the Tricity area consistently hire Tally-certified professionals for daily bookkeeping, tax filing, and reporting.

The average starting salary for a fresher with Tally training ranges from ₹15,000 to ₹25,000 per month, with rapid growth potential as you gain experience and industry exposure.

Tally ERP 9 vs Tally Prime: What You’ll Learn

A well-rounded Tally training program in Chandigarh covers both Tally ERP 9 and the newer Tally Prime. While ERP 9 remains in use across many companies, Tally Prime introduces improved usability with a simplified menu structure, enhanced multi-tasking, and better data tracking.

Key modules you’ll explore include:

Financial Accounting and Ledger Management

Inventory Management and Stock Control

Payroll Setup and Salary Processing

GST and TDS Return Filing

MIS Reports and Business Intelligence

Data Backup and Security Features

You’ll also learn how to use Tally as a business management tool that integrates seamlessly with compliance and audit requirements.

Best Tally Training Institutes in Chandigarh

When choosing an institute, reputation matters. The best Tally training institutes in Chandigarh offer practical curriculum, certified trainers, placement assistance, and flexible learning schedules.

Bright Career Solutions Mohali stands out as a highly rated institute offering in-depth Tally training with practical exposure. With expert faculty, dedicated career support, and strong student feedback, BCS Mohali has become a trusted name in Tally education in the region.

Students regularly highlight the institute’s hands-on training approach, one-on-one mentorship, and successful placement records across local businesses and startups.

FAQs About Tally Courses in Chandigarh

Q. Is Tally useful for non-commerce students? Ans. Yes. Tally is designed to be user-friendly and can be learned by students from non-commerce backgrounds. Institutes usually begin with accounting basics before diving into software-specific training.

Q. What is the typical duration and cost of Tally training? Ans. The duration can range from 1 to 3 months depending on the course level (basic to advanced). Fees generally range from ₹5,000 to ₹15,000. Institutes like BCS Mohali also offer installment plans.

Q. Is a Tally certification necessary to get a job? Ans. While not mandatory, a certification adds credibility to your resume and significantly boosts your chances during hiring. Certified professionals are often preferred for finance and accounts roles.

Conclusion

Tally training in Chandigarh is more than just a short-term course — it’s a launchpad for a rewarding career in finance and accounting. With businesses increasingly relying on Tally for daily operations and compliance, skilled professionals are in high demand.

Whether you’re a student, job seeker, or professional looking to upgrade your skills, enrolling in a Tally course from a reputed institute like Bright Career Solutions Mohali can help you take a decisive step toward career success. The right training, combined with dedication and practice, can turn you into a valuable asset for any business.

2 notes

·

View notes