#Benefits of Web3

Explore tagged Tumblr posts

Text

Web3 for E-commerce: 5 Must-Know Reasons to Get Started

The digital revolution is here, and Web3 is leading the charge. Discover how your e-commerce business can benefit from this groundbreaking technology.

Web3, also known as Web 3.0, introduces a decentralized internet framework that brings significant advantages to e-commerce businesses. Blockchain technology, a cornerstone of Web3, offers unmatched security with its immutable ledgers and multi-signature wallets, ensuring safe and fraud-resistant transactions. This security is crucial in protecting both businesses and consumers from cyber threats.

Transparency is another hallmark of Web3, enabling customers to verify the authenticity and origin of products through immutable blockchain records. This builds a level of trust and loyalty that traditional e-commerce models struggle to achieve. Additionally, Web3 enhances operational efficiency with smart contracts that automate processes, reduce costs, and eliminate human error, providing a seamless and cost-effective solution for managing supply chains and transactions.

Embrace the future of e-commerce with Web3. Contact Intelisync to learn how our expert solutions in blockchain and decentralized technologies can transform your online store. From security enhancements to operational efficiencies, Intelisync is your partner in pioneering the Learn more....

#5 Reasons Your E-commerce Business#Benefits of Web3#E-commerce Enhanced Customer Experience and Engagement#Future-Proofing Your Business#How can Intelisync assist with integrating Web3 solutions into my e-commerce platform?#How Intelisync Can Help Increased Transparency and Trust#Is Web3 suitable for all types of e-commerce businesses?#Reasons Your E-commerce Business Needs Web3 Streamlined Operations and Cost Savings#Top 5 Reasons Why Your E-commerce Business Should Adopt Web3 Marketing#What are the cost benefits of implementing Web3 in e-commerce#What is Web3 and how does it impact e-commerce?#What is Web3 E-commerce?#What is Web3?#intelisync web3 marketing#intelisync web3 marketing solution.

0 notes

Text

ERC-7231 Has Finally Unlocked The Door To A Truly User-Owned Internet

Introducing ERC-7231: The Future of Digital Identity Management The Ethereum blockchain world has unleashed a host of innovations over the last couple of years, with its switch to a proof-of-stake consensus algorithm through “The Merge” and the adoption of its ERC-721 token standard, which led to the introduction of smart wallets. Now, we’re witnessing yet another monumental change with the introduction and growing adoption of the new ERC-7231 standard, which promises to forever change the way people perceive and manage their digital identities. It’s a potentially revolutionary development that has major implications for non-fungible tokens and soul-bound tokens, representing the latest beacon of progress in blockchain privacy and data ownership. Introducing ERC-7231 The ERC-7231 standard is really just an extension of the popular ERC-721 standard that provides a set of guidelines and rules for minting fungible tokens and NFTs on Ethereum. ERC-721 has become widely known as the “NFT standard”, and has been used to mint millions of NFTs already. With ERC-7231, that standard is evolving to introduce an idea known as “identity binding”, which enables the possibility of numerous individual identities from Web2 and Web3 to be merged. The identities are all linked to the same, unique NFT. In addition, it also allows for those identities to be represented as an SBT, which is a special kind of non-transferable NFT that has emerged as a popular solution for identity applications, proving someone’s credentials, reputation and achievements without revealing their identity.

To Know More- Read the latest Blogs on Cryptocurrencies

#ERC-7231 standard benefits#ERC-7231 digital identity NFTs#CARV Protocol ERC-7231 gaming#ERC-7231 identity binding Web3#ERC-7231 vs ERC-721 comparison#CARV Protocol NFT integration#SBT tokens and ERC-7231#ERC-7231 standard adoption#ERC-7231 gaming profiles#ERC-7231 user data control

0 notes

Text

AI Healthcare App Development In Indiat IT sector and innovative capabilities, has emerged as a hub for AI healthcare app development. This article explores the top five AI healthcare app development companies in India, SigTuple: Redefining Diagnostics with AI, Niramai: Innovative Breast Cancer Screening, Tricog Health: Enhancing Cardiac Care, Qure.ai: Making Radiology More Accessible, Predible Health: Precision Oncology

#AI healthcare app development#custom healthcare app development company#healthcare app development solutions#healthcare app development agency#web3 healthcare app development#ios healthcare app development#benefits of healthcare app development

0 notes

Text

In this blog post, we’ll explore why Web 3.0 has become so critical to success in hospitality as well, as the potential for revolutionizing customer experiences within the hospitality industry. Read More...

#voip technology#business phones#pbx system#voip advantages#voip phone#phonesuite direct#pbx communications#hotel phone system#phonesuite dealers#hotel hospitality#cloud telephony#ip phones#hosted voip#web3.0#Web3 Technology#voiceware#benefits of voip#voip benefits#pstn vs sip#hotel telephone

0 notes

Text

AI and the fatfinger economy

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me at NEW ZEALAND'S UNITY BOOKS in WELLINGTON TODAY (May 3). More tour dates (Pittsburgh, PDX, London, Manchester) here.

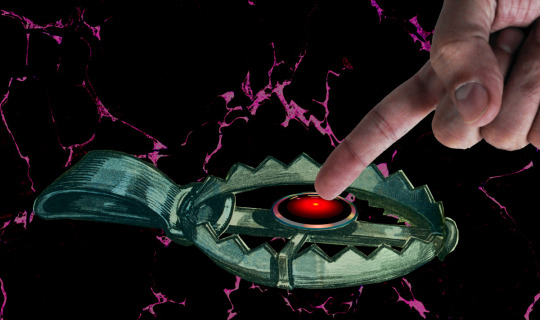

Have you noticed that all the buttons you click most frequently to invoke routine, useful functions in your device have been moved, and their former place is now taken up by a curiously butthole-esque icon that summons an unwanted AI?

https://velvetshark.com/ai-company-logos-that-look-like-buttholes

These traps for the unwary aren't accidental, but neither are they placed there solely because tech companies think that if they can trick you into using their AI, you'll be so impressed that you'll become a regular user. To understand why you find yourself repeatedly fatfingering your way into an unwanted AI interaction – and why those interactions are so hard to exit – you have to understand something about both the macro- and microeconomics of high-growth tech companies.

Growth is a heady advantage for tech companies, and not because of an ideological commitment to "growth at all costs," but because companies with growth stocks enjoy substantial, material benefits. A growth stock trades at a higher "price to earnings ratio" ("P:E") than a "mature" stock. Because of this, there are a lot of actors in the economy who will accept shares in a growing company as though they were cash (indeed, some might prefer shares to cash). This means that a growing company can outbid their rivals when acquiring other companies and/or hiring key personnel, because they can bid with shares (which they get by typing zeroes into a spreadsheet), while their rivals need cash (which they can only get by selling things or borrowing money).

The problem is that all growth ends. Google has a 90% share of the search market. Google isn't going to appreciably increase the number of searchers, short of desperate gambits like raising a billion new humans to maturity and convincing them to become Google users (this is the strategy behind Google Classroom, of course). To continue posting growth, Google needs gimmicks. For example, in 2019, Google intentionally made Search less accurate so that users would have to run multiple queries (and see multiple rounds of ads) to find the answers to their questions:

https://www.wheresyoured.at/the-men-who-killed-google/

Thanks to Google's monopoly, worsening search perversely resulted in increased earnings, and Wall Street rewarded Google by continuing to trade its stock with that prized high P:E. But for Google – and other tech giants – the most enduring and convincing growth stories comes from moving into adjacent lines of business, which is why we've lived through so many hype bubbles: metaverse, web3, cryptocurrency, and now, of course, AI.

For a company like Google, the promise of these bubbles is that it will be able to double or triple in size, by dominating an entirely new sector. With that promise comes peril: growth must eventually stop ("anything that can't go on forever eventually stops"). When that happens, the company's stock instantaneously goes from being a "growth stock" to being a "mature stock" which means that its P:E is way too high. Anyone holding growth stock knows that there will come a day when those stocks will transition, in an eyeblink, from being undervalued to being grossly overvalued, and that when that day comes, there will be a mass sell-off. If you're still holding the stock when that happens, you stand to lose bigtime:

https://pluralistic.net/2025/03/06/privacy-last/#exceptionally-american

So everyone holding a growth stock sleeps with one eye open and their fists poised over the "sell" button. Managers of growth companies know how jittery their investors are, and they do everything they can to keep the growth story alive, as a matter of life and death.

But mass sell-offs aren't just bad for the company – it's also very bad for the company's key employees, that is, anyone who's been given stock in addition to their salary. Those people's portfolios are extremely heavy on their employer's shares, and they stand to disproportionately lose in the event of a selloff. So they are personally motivated to keep the growth story alive.

That's where these growth-at-all-stakes maneuvers bent on capturing an adjacent sector come from. If you remember the Google Plus days, you'll remember that every Google service you interacted with had some important functionality ripped out of it and replaced with a G+-based service. To make sure that happened, Google's bosses decreed that the company's bonuses would be tied to the amount of G+ activity each division generated. In companies where bonuses can amount to 90% of your annual salary or more, this was a powerful motivator. It meant that every product team at Google was fully aligned on a project to cram G+ buttons into their product design. Whether or not these made sense for users, they always made sense for the product team, whose ability to take a fancy Christmas holiday, buy a new car, or pay their kids' private school tuition depended on getting you to use G+.

Once you understand how corporate growth stories are converted to "key performance indicators" that drive product design, many of the annoyances of digital services suddenly make a great deal of sense. You know how it's almost impossible to watch a show on a streaming video service without accidentally tapping a part of the screen that whisks you to a completely different video?

The reason you have to handle your phone like a photonegative while watching a movie – the reason every millimeter of screen real-estate has been boobytrapped with an icon that takes you somewhere else – is that streaming services believe that their customers are apt to leave when they feel like there's nothing new to watch. These bosses have made their product teams' bonuses dependent on successfully "recommending" a show you've never seen or expressed any interest in to you:

https://pluralistic.net/2022/05/15/the-fatfinger-economy/

Of course, bosses understand that their workers will be tempted to game this metric. They want to distinguish between "real" clicks that lead to interest in a new video, and fake fatfinger clicks that you instantaneously regret. The easiest way to distinguish between these two types of click is to measure how long you watch the new show before clicking away.

Of course, this is also entirely gameable: all the product manager has to do is take away the "back" button, so that an accidental click to a new video is extremely hard to cancel. The five seconds you spend figuring out how to get back to your show are enough to count as a successful recommendation, and the product team is that much closer to a luxury ski vacation next Christmas.

So this is why you keep invoking AI by accident, and why the AI that is so easy to invoke is so hard to dispel. Like a demon, a chatbot is much easier to summon than it is to rid yourself of.

Google is an especially grievous offender here. Familiar buttons in Gmail, Gdocs, and the Android message apps have been replaced with AI-summoning fatfinger traps. Android is filled with these pitfalls – for example, the bottom-of-screen swipe gesture used to switch between open apps now summons an AI, while ridding yourself of that AI takes multiple clicks.

This is an entirely material phenomenon. Google doesn't necessarily believe that you will ever want to use AI, but they must convince investors that their AI offerings are "getting traction." Google – like other tech companies – gets to invent metrics to prove this proposition, like "how many times did a user click on the AI button" and "how long did the user spend with the AI after clicking?" The fact that your entire "AI use" consisted of hunting for a way to get rid of the AI doesn't matter – at least, not for the purposes of maintaining Google's growth story.

Goodhart's Law holds that "When a measure becomes a target, it ceases to be a good measure." For Google and other AI narrative-pushers, every measure is designed to be a target, a line that can be made to go up, as managers and product teams align to sell the company's growth story, lest we all sell off the company's shares.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/05/02/kpis-off/#principal-agentic-ai-problem

Image: Pogrebnoj-Alexandroff (modified) https://commons.wikimedia.org/wiki/File:Index_finger_%3D_to_attention.JPG

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

--

Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#kpis#incentives matter#ui#ux#video streaming#google plus#g plus#ai#artificial intelligence#growth stocks#business#big tech

705 notes

·

View notes

Text

Browsing the World Wide Web

Browsing the World Wide Web

One of my favorite passions is creating/finding ways to navigate the web that are healthy, authentic, and fun! Here are some resources I use to guide my internet usage. Some language has been slightly adapted for tone and accessibility. For more in-depth reading, follow the links! (taken with permission from https://yair.garden/browsing). Shared Ideals

MelonKing has an excellent list of shared ideals which I try to keep in mind as I browse the web. It's a great starting point!

Creativity is First: We see the ability to design, decorate, and graffiti digital spaces as essential and powerful.

The Internet is Fun: We want the Web to be a playground that's free to explore and enjoy.

Corporations are Boring: We are tired of the monetization, data abuse, and endless breaches of trust in corporate culture.

The Web is Friendly: We believe the Web should be friendly and supportive; caring is a radical act.

Right to Repair: We value the freedom to make, break, and repair our stuff - tinkering is a form of debate and protest.

One World Wide Web: We want free open knowledge and global connectivity, without paywalls, bubbles, or borders.

Chaotic Effort: We believe that value comes from the time and effort put into projects they love for no reason other than love.

No to Web3: In many (but not all) situations, cryptocurrencies, NFTs, unfairly trained AIs, and buzzword tech are unwelcome and uncool.

Manifesto for a New Web

The YesterWeb is an organization seeking to progressively transform internet culture and beyond. After two years, they created three core commitments and three social behavior guidelines to benefit everyone.

A commitment to social responsibility and partisanship.

A commitment to collective well-being and personal growth.

A commitment to rehumanizing social relations and reversing social alienation.

50 additional manifestos can be found here Social Etiquette

Engage in good faith.

Engage in constructive conflict.

Be mindful of participating in a shared, public space.

Why say no to Web 3.0?

One of the shared ideas of our community of web surfers is to push back against "Web 3.0". Here's why:

It's driven by predatory marketing tactics.

It requires complex technological and financial knowledge to fully understand.

It is actively harming the environment.

It caters to early adopters and whales.

It profits off artificial scarcity.

Investors are banking on Web3, and they really don't want to be wrong.

Personalized Web Surfing Guide

Make your web surfing personal and adventurous, away from corporate influences. Here's a simple guide for a unique browsing experience.

Configure your browser

Remove Ads and Clean up Privacy:

Ublock Origin for removing ads

ClearURLs for removing tracking elements from URLs

SponsorBlock for skipping sponsorships on YouTube

Make it a Safer Space:

ShinigamiEyes for highlighting transphobic/anti-LGBTQ sites

TriggerRemover for removing trigger-inducing content from pages

Clean up UI for Beauty and Minimalism:

CleanerReads for a muted Goodreads experience

Minimal; for a minimal and less attention-grabbing internet

Bonuses for a Cool Experience:

Library Extension: Check book availability at local libraries

Translate Web Pages: Translate pages in real-time

Return YouTube Dislike: Bring back the YouTube dislike feature

How to Browse and Surf the Web

Explore Beyond Corporate Sites: While the internet is vast, the majority of users only see a small fraction dominated by large corporate sites. These sites often prioritize shock value and extreme content, overshadowing the richness of the wider web. Explore alternative avenues to discover the internet's diversity.

Search Engines: Avoid corporate search engines like Google. Instead, consider using alternatives like Kagi, which focuses on privacy and doesn't sell your data. While it costs around $10/month, Kagi offers a diverse mix of web content, making it a worthwhile investment for varied search results. Other niche or non-commercial search engines can also provide unique content. While they may not be sustainable for daily use, they're great for discovering new sites. Find them here.

Webrings: Webrings are collections of websites united by a common theme or topic. They offer a unique way to explore sites created by real people, spanning a wide range of interests. Here are some of my favorite webrings:

Hotline Webring

Retro Webring

Low Tech Webring

Geek Webring

Soft Heart Clinic Mental Health Circle ...and here are some list of webring databases to explore!

Curated List of 64 Webrings

Neocities Webrings

Curated List of Active Webrings

Comprehensive List of 210 Webrings

Cliques/Fanlistings Web Cliques/Cliques are groups which you can join usually if you fulfill a certain task such as choosing an animal or listing your astrological sign. Fanlistings do the same for fans of various topics! You can then be linked on the clique's/fan group's site for further website discovery! Here are some web clique directories:

Project Clique

Cliqued

Fanlistings Network

5. Link Directories

Many sites have smaller link directories of buttons where you can find sites that they are "mutuals" (both creators follow each other) and "friends/neighbors" — sites they follow. It's a great way to build community. There are also larger link directories of sites which someone finds cool, and it's a great way to intentionally explore the web. Here are some of my favorites:

SadGrl Links

Melonland Surf Club

Neocities Sites

Onio.Cafe

Though there are many more! 6. Random Site Generators

Finally, there are random site generators which allow you to randomly stumble upon websites. While not very practical, they are a lot of fun and offer a unique way to discover new corners of the web.

A list can be found here

What now?

The next question you have is probably how can you become an active member/contribute in this world of the underground web? I unfortunately don't have the energy to write a guide right now but it will come soon! In broad strokes, consider making a site on Neocities. If you do make a site, remember to include a robots.txt file to get AI and bots out of there and don't forget to rate your site so we can know who it's for. If you'd like to transition off social media I recommend an RSS Reader such as the one at 32bit.cafe or on Fraidycat (guide on this to come soon as well!). For your twitter-fix you can always post a status at Status Cafe and your mood at imood. There is a whole world out there full of passionate and friendly people who are ready to reclaim the web. Excited to see you there!

69 notes

·

View notes

Video

youtube

비트겟 신규가입 100% 최대 혜택 찬스! 전부 받아가세요!☁☁

"New to Bitget? 🎉 Get 100% sign-up rewards — don’t miss out on maximum benefits! Claim everything now! ☁☁"

#Bitget #CryptoBonus #SignupRewards #CryptoDeals #BitgetPromo #CryptoTrading #EarnCrypto #Web3 #CryptoForAll #CryptoJourney

2 notes

·

View notes

Text

Threshold Network's tBTC is Now live on Sui: Ushering in a new era for Bitcoin DeFi

Texas, United States, July 9th, 2025, Chainwire Key Takeaways: Resolving Bitcoin’s Utility Paradox: tBTC on Sui Eliminates the Choice Between Security and Utility. Web3 Benefits with Web2 Ease: Experience Bitcoin DeFi with 400ms finality and near-zero fees on Sui’s high-performance network. Unprecedented Capital Efficiency: Bitcoin liquidity flows freely across an ecosystem of protocols,…

2 notes

·

View notes

Text

What is the Difference Between a Smart Contract and Blockchain?

In today's digital-first world, terms like blockchain and smart contract are often thrown around, especially in the context of cryptocurrency, decentralized finance (DeFi), and Web3. While these two concepts are closely related, they are not the same. If you’re confused about the difference between a smart contract and blockchain, you’re not alone. In this article, we’ll break down both terms, explain how they relate, and highlight their unique roles in the world of digital technology.

1. Understanding the Basics: Blockchain vs Smart Contract

Before diving into the differences, let’s clarify what each term means.

A blockchain is a decentralized digital ledger that stores data across a network of computers.

A smart contract is a self-executing program that runs on a blockchain and automatically enforces the terms of an agreement.

To put it simply, blockchain is the infrastructure, while smart contracts are applications that run on top of it.

2. What is a Blockchain?

A blockchain is a chain of blocks where each block contains data, a timestamp, and a cryptographic hash of the previous block. This structure makes the blockchain secure, transparent, and immutable.

The key features of blockchain include:

Decentralization – No single authority controls the network.

Transparency – Anyone can verify the data.

Security – Tampering with data is extremely difficult due to cryptographic encryption.

Consensus Mechanisms – Like Proof of Work (PoW) or Proof of Stake (PoS), which ensure agreement on the state of the network.

Blockchains are foundational technologies behind cryptocurrencies like Bitcoin, Ethereum, and many others.

3. What is a Smart Contract?

A smart contract is a piece of code stored on a blockchain that automatically executes when certain predetermined conditions are met. Think of it as a digital vending machine: once you input the right conditions (like inserting a coin), you get the output (like a soda).

Smart contracts are:

Self-executing – They run automatically when conditions are met.

Immutable – Once deployed, they cannot be changed.

Transparent – Code is visible on the blockchain.

Trustless – They remove the need for intermediaries or third parties.

Smart contracts are most commonly used on platforms like Ethereum, Solana, and Cardano.

4. How Smart Contracts Operate on a Blockchain

Smart contracts are deployed on a blockchain, usually via a transaction. Once uploaded, they become part of the blockchain and can't be changed. Users interact with these contracts by sending transactions that trigger specific functions within the code.

For example, in a decentralized exchange (DEX), a smart contract might govern the process of swapping one cryptocurrency for another. The logic of that exchange—calculations, fees, security checks—is all written in the contract's code.

5. Real-World Applications of Blockchain

Blockchains are not limited to cryptocurrencies. Their properties make them ideal for various industries:

Finance – Fast, secure transactions without banks.

Supply Chain – Track goods transparently from origin to destination.

Healthcare – Secure and share patient data without compromising privacy.

Voting Systems – Transparent and tamper-proof elections.

Any situation that requires trust, security, and transparency can potentially benefit from blockchain technology.

6. Real-World Applications of Smart Contracts

Smart contracts shine when you need to automate and enforce agreements. Some notable use cases include:

DeFi (Decentralized Finance) – Lending, borrowing, and trading without banks.

NFTs (Non-Fungible Tokens) – Automatically transferring ownership of digital art.

Gaming – In-game assets with real-world value.

Insurance – Auto-triggered payouts when conditions (like flight delays) are met.

Legal Agreements – Automatically executed contracts based on input conditions.

They’re essentially programmable agreements that remove the need for middlemen.

7. Do Smart Contracts Need Blockchain?

Yes. Smart contracts depend entirely on blockchain technology. Without a blockchain, there's no decentralized, secure, and immutable platform for the smart contract to run on. The blockchain guarantees trust, while the smart contract executes the logic.

8. Which Came First: Blockchain or Smart Contract?

Blockchain came first. The first blockchain, Bitcoin, was introduced in 2009 by the anonymous figure Satoshi Nakamoto. Bitcoin’s blockchain didn’t support smart contracts in the way we know them today. It wasn’t until Ethereum launched in 2015 that smart contracts became programmable on a large scale.

Ethereum introduced the Ethereum Virtual Machine (EVM), enabling developers to build decentralized applications using smart contracts written in Solidity.

9. Common Misconceptions

There are many misunderstandings around these technologies. Let’s clear a few up:

Misconception 1: Blockchain and smart contracts are the same.

Reality: They are separate components that work together.

Misconception 2: All blockchains support smart contracts.

Reality: Not all blockchains are smart contract-enabled. Bitcoin’s blockchain, for example, has limited scripting capabilities.

Misconception 3: Smart contracts are legally binding.

Reality: While they enforce logic, they may not hold legal standing in court unless specifically written to conform to legal standards.

10. Benefits of Using Blockchain and Smart Contracts Together

When used together, blockchain and smart contracts offer powerful advantages:

Security – Combined, they ensure secure automation of processes.

Efficiency – Remove delays caused by manual processing.

Cost Savings – Eliminate middlemen and reduce administrative overhead.

Trustless Interactions – Parties don't need to trust each other, only the code.

This combination is the backbone of decentralized applications (DApps) and the broader Web3 ecosystem.

11. Popular Platforms Supporting Smart Contracts

Several blockchain platforms support smart contracts, with varying degrees of complexity and performance:

Ethereum – The first and most widely used platform.

Solana – Known for speed and low fees.

Cardano – Emphasizes academic research and scalability.

Polkadot – Designed for interoperability.

Binance Smart Chain – Fast and cost-effective for DeFi apps.

Each platform has its own approach to security, scalability, and user experience.

12. The Future of Blockchain and Smart Contracts

The future looks incredibly promising. With the rise of AI, IoT, and 5G, the integration with blockchain and smart contracts could lead to fully automated systems that are transparent, efficient, and autonomous.

We may see:

Global trade systems are using smart contracts to automate customs and tariffs.

Self-driving cars using blockchain to negotiate road usage.

Smart cities are where infrastructure is governed by decentralized protocols.

These are not sci-fi ideas; they are already in development across various industries.

Conclusion: A Powerful Partnership

Understanding the difference between smart contracts and blockchain is essential in today's rapidly evolving digital world. While blockchain provides the secure, decentralized foundation, smart contracts bring it to life by enabling automation and trustless execution.

Think of blockchain as the stage, and smart contracts as the actors that perform on it. Separately, they're impressive. But together, they're revolutionary.

As technology continues to evolve, the synergy between blockchain and smart contracts will redefine industries, reshape economies, and unlock a new era of digital transformation.

#coin#crypto#digital currency#finance#invest#investment#bnbbro#smartcontracts#decentralization#decentralizedfinance#decentralizedapps#decentralizedfuture#cryptocurrency#btc#cryptotrading#usdt

2 notes

·

View notes

Text

Web3 & Decentralized E-Commerce: What It Means for D2C Brands

The e-commerce landscape is evolving, and Web3 is at the forefront of this transformation. As decentralized technologies redefine how businesses operate, Direct-to-Consumer (D2C) brands must prepare for a future where transactions, ownership, and customer relationships are no longer controlled by centralized platforms. But what does this shift mean for the world of online retail?

Understanding Web3 & Decentralized E-Commerce

Web3 refers to the next phase of the internet—powered by blockchain, smart contracts, and decentralized networks. Unlike traditional e-commerce, which relies on intermediaries like marketplaces and payment processors, decentralized e-commerce eliminates middlemen, giving brands direct control over their operations, data, and revenue streams.

How Web3 is Reshaping D2C Brands

Ownership & Control: Web3 empowers brands to own their customer relationships without depending on platforms like Amazon or Shopify.

Decentralized Payments: Cryptocurrency and blockchain-based transactions reduce dependency on banks and lower payment processing fees.

Smart Contracts for Automation: Agreements between buyers and sellers can be self-executing, reducing fraud and ensuring seamless transactions.

Enhanced Data Privacy: Customers have greater control over their data, fostering trust between brands and consumers.

Tokenized Loyalty Programs: Brands can use NFTs and tokens to create exclusive membership benefits, driving deeper engagement and repeat purchases.

Challenges of Web3 in E-Commerce

Adoption Barriers: Many consumers and businesses are still unfamiliar with blockchain and decentralized systems.

Regulatory Uncertainty: Governments worldwide are still developing frameworks to regulate cryptocurrencies and decentralized transactions.

User Experience: While Web3 offers transparency, its technical complexity may create friction for non-tech-savvy consumers.

The Future of D2C in a Web3 World

Decentralized Marketplaces: Platforms like OpenSea and Rarible are paving the way for decentralized product selling.

Metaverse Shopping: Virtual storefronts could redefine the online shopping experience, allowing customers to interact with products in digital spaces.

Community-Led Growth: Web3 enables brands to build loyal communities through decentralized autonomous organizations (DAOs), where customers have a say in brand decisions.

Seamless Global Transactions: Cryptocurrency adoption will allow brands to expand globally without currency conversion hassles.

Is Your Brand Ready for Web3?

While Web3 is still in its early stages, D2C brands that adapt now will gain a competitive edge. Whether through tokenized rewards, decentralized payment systems, or blockchain-backed supply chains, the shift toward decentralized e-commerce is inevitable. The question is: Will your brand lead the change or struggle to catch up?

2 notes

·

View notes

Text

EVM Compatible Blockchain 2025: The Backbone of Web3 Scalability & Innovation

As the Web3 ecosystem matures, 2025 is shaping up to be a transformative year, especially for EVM-compatible blockchains. These Ethereum Virtual Machine (EVM) compatible networks are no longer just Ethereum alternatives; they are becoming the foundation for a more connected, scalable, and user-friendly decentralized internet.

If you’re a developer, investor, or blockchain enthusiast, understanding the rise of EVM-compatible blockchains in 2025 could be the edge you need to stay ahead.

What is an EVM-compatible blockchain?

An EVM compatible blockchain is a blockchain that can run smart contracts and decentralized applications (dApps) originally built for Ethereum. These networks use the same codebase (Solidity or Vyper), making it easier to port or replicate Ethereum-based applications across different chains.

Think of it as the “Android of blockchain” — a flexible operating system that lets developers deploy applications without needing to rebuild from scratch

Why 2025 is the Breakout Year for EVM Compatible Blockchain?

1. Scalability & Speed Are No Longer Optional

In 2025, network congestion and high gas fees are still major pain points on Ethereum. EVM compatible blockchains like Polygon, BNB Chain, Avalanche, Lycan, and the emerging Wave Blockchain are providing faster throughput and significantly lower transaction costs. This allows dApps to scale without compromising performance or user experience.

2. Interoperability Becomes a Standard

Web3 is no longer about isolated blockchains. In 2025, cross-chain bridges and multichain apps are the norm. EVM compatible blockchains are leading this interoperability movement, enabling seamless asset transfers and data sharing between chains — without sacrificing security or decentralization.

3. DeFi, NFTs, and Gaming Demand EVM Compatibility

Whether it’s a DeFi protocol like Uniswap, an NFT marketplace, or a Web3 game, developers want platforms that support quick deployment, lower fees, and a large user base. EVM compatible blockchains offer all three. That’s why platforms like OneWave, a next-gen multichain ecosystem, are being natively built on EVM-compatible infrastructure to unlock full utility across DeFi, NFTs, GameFi, and beyond.

Key Benefits of Using an EVM Compatible Blockchain in 2025

Lower Development Costs: Developers can reuse Ethereum-based code, tools, and libraries.

Wider Audience Reach: Most wallets like MetaMask, and protocols support EVM chains out of the box.

Cross-Platform Utility: Launch on one chain, expand to others seamlessly.

Greater Liquidity & Ecosystem Integration: Easier to tap into existing DeFi liquidity pools and NFT communities.

The Future Outlook: What Comes Next?

As of 2025, the trend is clear: dApps will prefer chains that are fast, cheap, and EVM compatible. Ethereum’s dominance is no longer enough to guarantee loyalty. Instead, flexibility and performance are king.

With the rise of modular architectures, Layer 2s, and zkEVM rollups, the EVM ecosystem is expanding at an unprecedented pace. EVM compatibility isn’t just a feature anymore — it’s a requirement.

For more visit: www.onewave.app

2 notes

·

View notes

Text

2024 Tokenization Boom: A New Era for Real-World Assets

In 2024, the landscape of real-world asset (RWA) tokenization is experiencing a transformative shift, marking a significant milestone in the financial industry. Tokenization converts physical assets like real estate, commodities, and art into digital tokens on a blockchain, enhancing liquidity, accessibility, transparency, and security. This revolutionary technology makes high-value assets more accessible to a broader range of investors. As we explore the current state and future prospects of tokenization, it is clear that this technology is set to reshape the global financial ecosystem significantly.

Tokenization is predicted to be a multi-trillion-dollar opportunity by 2030, with market estimates suggesting it could reach up to $16 trillion. The United States is leading this revolution, followed by countries like Singapore, the United Kingdom, Switzerland, India, and Luxembourg.

The total value locked in tokenized assets has surged to $10.53 billion, with major financial institutions launching tokenized investment products. This signals a major inflection point for the industry, underscoring the significant role tokenization will play in the future of finance.

The benefits of tokenization are extensive. It allows for fractional ownership, increasing liquidity and enabling investors to buy and sell portions of an asset. This democratizes investment opportunities and bridges the gap between traditional and digital financial markets. Tokenization also reduces transaction costs by eliminating intermediaries and automating processes through smart contracts.

As regulatory frameworks evolve and technology advances, tokenization is set to revolutionize the financial industry. Intelisync provides cutting-edge RWA tokenization services to help you navigate and capitalize on this financial Learn more....

#metaverse development company#blockchain development companies#web3 development#blockchain development services#metaverse game development#24/7 Market Access#Access to Real-World Yields#Asset Classes in Tokenization#Benefiting Blockchains#CeFi and DeFi tokenization#CeFi-Based Tokenization Protocols#Commodities#Common Combinations#Credit & Loans#Current Trajectory#DeFi protocols#DeFi-Based Tokenization Protocols#Diverse Asset Classes#Dominance of the U.S.#Emerging Trends#Enhanced Liquidity#Ethereum’s Prominence#Fractional Ownership#Leading Geographies#Leading Geographies in Tokenization#Less Popular Asset Classes#Performance of DeFi Protocols#Popular Asset Classes#Private Credit#Real Estate

1 note

·

View note

Text

Fueling Web3 Innovation: How STON.fi is Empowering Builders on TON

The Web3 space is moving fast, and great ideas alone aren’t enough—you need resources, infrastructure, and the right ecosystem to thrive. This is where STON.fi steps in, providing real support for developers and startups building on The Open Network (TON).

With its Grant Program, STON.fi is actively investing in projects that bring utility, enhance liquidity, and drive user adoption across the TON ecosystem. But this isn’t just another grant program—it’s a launchpad for serious builders who want to scale fast.

Why STON.fi

STON.fi isn’t just the leading decentralized exchange (DEX) on TON—it’s the center of the network’s trading activity. If you’re building on TON, this is where the liquidity is, and the numbers prove it:

🔹 $5.2B+ total trading volume—the highest of any DEX on TON

🔹 4M+ unique wallets, making up 81% of all DEX users on TON

🔹 25,800+ daily active users, with 16,000 making multiple transactions daily

🔹 8,000+ new users joining every day, the fastest-growing DEX on TON

🔹 700+ trading pairs active daily, ensuring deep liquidity

For any DeFi, GameFi, NFT, or Web3 project, these numbers translate into real opportunity—a large active user base, high trading volumes, and a rapidly expanding ecosystem.

What Does the STON.fi Grant Offer

Building a successful Web3 project takes more than just funding—it requires technical support, market exposure, and a strong community. That’s exactly what STON.fi provides through its Grant Program:

✅ Funding up to $10,000 for selected projects

✅ Seamless integration with STON.fi’s infrastructure

✅ Strategic partnerships within the TON ecosystem

✅ Visibility and user adoption through STON.fi’s marketing channels

This program is designed to help projects not just launch—but thrive.

Who’s Already Benefiting

STON.fi has already backed innovative projects that bring real value to the ecosystem. Here are two standout grant recipients:

1️⃣ Farmix – Advanced Yield Farming

Farmix takes yield farming to the next level by introducing leveraged positions on STON.fi’s liquidity pools. This means:

Higher earning potential for liquidity providers

Enhanced liquidity for key trading pairs like STON/USDt, PX/TON, and STORM/TON

More efficient capital deployment for DeFi users

By strengthening STON.fi’s liquidity network, Farmix makes TON’s DeFi landscape more robust and profitable.

2️⃣ TonTickets – Blockchain-Based Prize Gaming

TonTickets is reshaping on-chain prize gaming, allowing users to deposit tokens, earn tickets, and redeem them for rewards. Thanks to STON.fi’s integrated swap feature, winners can instantly convert their rewards into TON.

This creates real liquidity and utility while making blockchain gaming more engaging and rewarding.

Who Should Apply

STON.fi is looking for builders who are serious about scaling in the TON ecosystem. The ideal candidates include:

🔹 DeFi projects focused on trading, lending, or liquidity solutions

🔹 GameFi platforms bringing new gaming mechanics to TON

🔹 NFT projects with strong real-world use cases

🔹 Web3 infrastructure developers enhancing user experience on TON

If your project fits into these categories, this grant could be your launchpad to success.

How to Get Involved

Applying for the STON.fi Grant Program is straightforward:

1️⃣ Submit your project proposal outlining your goals and integration plans.

2️⃣ Demonstrate technical feasibility and how your project adds value to TON.

3️⃣ Present a roadmap detailing your development and user growth strategy.

Approved projects don’t just get funding—they gain access to STON.fi’s technical expertise, liquidity, and marketing support.

Final Thoughts

STON.fi is more than just a DEX—it’s an engine for Web3 growth on TON. By funding and supporting high-potential projects, it’s creating the foundation for a stronger, more dynamic ecosystem.

For any developer looking to scale fast, access liquidity, and reach a massive user base, this is an opportunity you don’t want to miss.

Web3 is evolving—are you ready to build the future on TON

3 notes

·

View notes

Text

STON.fi’s Grant Program: Empowering the Next Wave of Web3 Builders

In the fast-evolving blockchain space, having a groundbreaking idea is just the beginning. The real challenge lies in execution—getting the right resources, building a strong user base, and integrating with a thriving ecosystem.

STON.fi, the leading decentralized exchange (DEX) on The Open Network (TON), is stepping up to fuel this innovation. Through its grant program, STON.fi is actively supporting projects that contribute to the growth of TON’s ecosystem, providing funding, technical support, and market exposure.

This initiative isn’t just about giving out money—it’s about strengthening the TON network by backing projects that bring real-world impact.

Why Build on STON.fi

STON.fi isn’t just another DEX—it’s the backbone of TON’s DeFi landscape, facilitating billions in trading volume and onboarding millions of users. The numbers speak for themselves:

🔹 $5.2 billion+ total trading volume – the highest among all TON-based DEXs.

🔹 4 million+ unique wallets, representing 81% of all DEX users on TON.

🔹 25,800+ daily active users, with 16,000 making multiple transactions daily.

🔹 8,000+ new users joining every day, making STON.fi the fastest-growing DEX on TON.

🔹 700+ trading pairs active daily, ensuring a liquid and diverse market.

For any project looking to scale on TON, these numbers highlight the perfect launch environment—a well-established ecosystem with liquidity, active users, and proven demand.

What Does the Grant Program Offer

STON.fi’s grant program is designed to support Web3 builders in the TON ecosystem by providing:

✅ Funding up to $10,000 to help projects get off the ground.

✅ Integration support with STON.fi’s infrastructure.

✅ Ecosystem partnerships to drive user adoption and growth.

✅ Market exposure through STON.fi’s extensive community.

This isn’t just for DeFi startups—the grant is open to projects in GameFi, NFTs, trading tools, and other Web3 applications that can enhance the TON blockchain.

Recent Grant Recipients

STON.fi has already started backing projects that add value to the ecosystem. Two standout recipients are:

1️⃣ Farmix – Leveraged Yield Farming

Yield farming is a core part of DeFi, but Farmix is taking it a step further by introducing leveraged positions on STON.fi’s liquidity pools. This allows users to earn higher yields while increasing liquidity for key trading pairs such as:

STON/USDt

PX/TON

STORM/TON

By boosting liquidity and user participation, Farmix strengthens STON.fi’s role as the primary trading hub on TON.

2️⃣ TonTickets – Blockchain-Powered Prize Gaming

TonTickets introduces a Web3 prize gaming system where users deposit tokens, earn tickets, and redeem them for rewards. By integrating STON.fi’s swap functionality, winners can instantly convert rewards into TON, enhancing both liquidity and real-world utility.

This isn’t just a game—it’s an engaging way to drive user adoption and on-chain activity, benefiting both TonTickets and the broader STON.fi ecosystem.

Who Should Apply

The STON.fi Grant Program is open to builders who are creating real solutions for the TON network. Ideal applicants include:

🔹 DeFi developers working on liquidity solutions, lending platforms, or trading tools.

🔹 GameFi innovators merging blockchain with gaming mechanics.

🔹 NFT projects that enhance utility beyond digital collectibles.

🔹 Web3 infrastructure builders looking to improve user experience on TON.

If your project aligns with these goals, this grant could be the launchpad you need.

How to Apply

The process is straightforward:

1️⃣ Submit your project proposal, outlining your goals and how they benefit TON.

2️⃣ Show technical feasibility and your plan for integrating with STON.fi.

3️⃣ Present a clear roadmap that details your development and growth plans.

Approved projects not only receive funding but also gain access to STON.fi’s technical resources, user base, and ecosystem support.

Final Thoughts

STON.fi’s grant program isn’t just about funding—it’s about building the future of TON together. By supporting high-potential projects, STON.fi is creating a stronger, more dynamic Web3 ecosystem where developers, traders, and users all benefit.

For any team looking to scale on TON, expand liquidity, and tap into a thriving community, this is an opportunity worth taking.

The next wave of Web3 innovation is happening now. Are you ready to be part of it?

4 notes

·

View notes

Text

STON.fi’s Grant Program: Fueling Innovation on TON

The world of Web3 is constantly evolving, with new ideas shaping the future of decentralized finance, gaming, and blockchain applications. But turning ideas into reality requires more than just passion—it requires resources, funding, and the right ecosystem to thrive.

That’s where STON.fi’s Grant Program comes in. As the most active decentralized exchange (DEX) on The Open Network (TON), STON.fi isn’t just facilitating seamless crypto trading—it’s actively investing in builders who are pushing the boundaries of what’s possible in Web3.

With grants of up to $10,000, developers, founders, and teams working on DeFi, GameFi, and blockchain applications now have a chance to bring their ideas to life with the support of a strong, high-utility ecosystem.

Why STON.fi

STON.fi has established itself as the leading DEX on TON, and the numbers speak for themselves:

$5.2 billion+ total trading volume (the highest among DEXs on TON)

4 million+ unique wallets (representing 81% of all DEX users on TON)

25,800+ daily active users, with 16,000 making multiple transactions daily

8,000+ new users joining each day, making it the fastest-growing DEX on TON

700+ trading pairs active daily, ensuring a dynamic, liquid market

STON.fi isn’t just growing—it’s setting the standard for DeFi activity on TON. The strength of its ecosystem makes it the perfect launchpad for new projects that need exposure, funding, and a strong technical backbone.

What Does the Grant Program Offer

The STON.fi Grant Program is more than just financial support. It’s a strategic boost that provides:

✅ Funding up to $10,000 to build and expand projects

✅ Technical integration support for leveraging STON.fi’s ecosystem

✅ Ecosystem access, ensuring collaboration and visibility

✅ Growth opportunities, including exposure to STON.fi’s vast user base

This isn’t just for DeFi protocols—NFT platforms, Web3 games, and blockchain tools that enhance the TON ecosystem are all eligible. The goal is impactful innovation, with projects that contribute to user growth, activity, and adoption on TON.

Meet the Latest Grant Winners

STON.fi has already begun funding promising projects that align with its mission. Two standout teams recently received grants:

Farmix – Leveraged Yield Farming

Farmix is redefining yield farming by offering leveraged positions on STON.fi’s liquidity pools. This allows users to optimize their farming strategies, maximize returns, and strengthen the liquidity of key pairs, including:

STON/USDt

PX/TON

STORM/TON

The project directly contributes to the growth of STON.fi’s ecosystem, increasing total value locked (TVL) and transaction volume while giving users more ways to earn.

TonTickets – Web3 Prize Gaming

TonTickets is bringing a fresh gamification model to blockchain. Players lock tokens, earn tickets, and redeem them for rewards—adding an interactive layer to Web3 engagement.

By integrating STON.fi’s swap technology, winners can instantly convert rewards into TON, creating real utility and seamless transactions. This initiative doesn’t just benefit TonTickets—it enhances the entire STON.fi ecosystem by increasing activity and liquidity.

Who Can Apply

STON.fi is looking for projects that bring real utility and innovation to the TON ecosystem. Ideal applicants include:

🚀 DeFi builders creating financial tools and liquidity solutions

🎮 GameFi projects integrating blockchain with gaming mechanics

🔗 Web3 infrastructure developers focused on trading tools, NFT utilities, and more

💡 Innovators with unique blockchain applications that strengthen TON’s adoption

STON.fi isn’t just looking for ideas—it’s looking for scalable projects with a clear roadmap and impact potential.

How to Apply

The application process is straightforward:

1️⃣ Submit your proposal, detailing the project’s goal and impact on TON

2️⃣ Show technical feasibility and explain how it integrates with STON.fi

3️⃣ Outline a roadmap that highlights your growth and development strategy

Successful applicants receive not just funding, but also technical and ecosystem support, ensuring their project can thrive within the TON blockchain.

Final Thoughts

STON.fi isn’t just a DEX—it’s a catalyst for Web3 innovation. By supporting builders with funding, infrastructure, and an active user base, it’s ensuring that TON becomes a hub for next-gen blockchain applications.

For developers, founders, and teams looking to launch, scale, and grow, this grant program offers a unique opportunity to gain funding, technical backing, and immediate exposure within a high-utility ecosystem.

The next wave of Web3 innovation is happening now. Will your project be part of it?

4 notes

·

View notes

Text

STON.fi Grant Program: Fueling the Future of Web3

Blockchain innovation thrives on funding and support, and STON.fi is making that happen with its grant program, offering up to $10,000 to Web3 builders. With the TON ecosystem growing rapidly, this initiative is helping projects scale and succeed.

Why STON.fi Stands Out

STON.fi isn’t just another DEX—it’s the backbone of trading on TON, with numbers that prove its dominance:

$5.2 billion+ in total trading volume

4 million+ unique wallets (81% of all TON DEX users)

25,800 daily active users

8,000+ new users every day

700 trading pairs in action daily

The liquidity, user base, and activity make STON.fi the go-to platform for traders and developers alike.

Who’s Benefiting from the Grant Program

Two standout projects recently received funding:

✅ Farmix – A leveraged yield farming protocol built on STON.fi’s liquidity pools, improving TVL and trading efficiency.

✅ TonTickets – A Web3 game allowing users to lock tokens, earn tickets, and win prizes, seamlessly swapping rewards for TON using STON.fi’s SDK.

How to Get Involved

Developers building DeFi, GameFi, or Web3 tools can apply for funding. STON.fi provides technical support, ecosystem access, and financial backing to help projects succeed.

With the TON blockchain evolving, now is the time to build. The STON.fi Grant Program is open—apply and secure your funding today.

4 notes

·

View notes