#Big Data Security Market Analysis

Explore tagged Tumblr posts

Text

The Big Data Security Market Size, Share | CAGR 17.3% during 2025-2032

The global big data security market size was valued at USD 23.68 billion in 2024 and is projected to reach USD 83.95 billion by 2032, growing at a CAGR of 17.3% during the forecast period (2025–2032). The increasing sophistication of cyberattacks, growing regulatory compliance requirements, and rapid digital transformation across sectors are driving significant investment in big data protection.

Key Market Highlights

2024 Global Market Size: USD 23.68 billion

2025 Forecast Start Point: USD 27.40 billion

2032 Global Market Size: USD 83.95 billion

CAGR (2025–2032): 17.3%

Market Outlook: Rising demand for security solutions that protect structured and unstructured big data across hybrid and multi-cloud environments.

Key Players in the Global Big Data Security Market:

IBM Corporation

Oracle Corporation

McAfee LLC

Microsoft Corporation

Amazon Web Services (AWS)

Symantec (Broadcom Inc.)

Cloudera Inc.

Hewlett Packard Enterprise (HPE)

Check Point Software Technologies

Imperva

Palo Alto Networks

Talend

Splunk Inc.

Request for Free Sample Reports:

Market Dynamics:

Growth Drivers

Explosion in data volumes across enterprises, cloud platforms, and edge devices

Stringent compliance mandates (e.g., GDPR, HIPAA, CCPA)

Increased adoption of cloud and hybrid cloud models needing secure data movement and storage

Surge in cyberattacks targeting high-value data sets like PII and financial records

Growing implementation of AI/ML for security analytics and anomaly detection

Key Opportunities:

Development of AI-powered big data threat detection platforms

Integration of big data security with DevSecOps and data governance models

Expansion of managed security services (MSS) in data-heavy verticals

Customized solutions for healthcare, BFSI, retail, and energy sectors

Opportunities in edge and IoT security, especially for real-time big data use cases

Emerging Trends:

Adoption of AI and deep learning for automated data threat mitigation

Rise of unified data governance frameworks integrating security and compliance

Shift toward Zero Trust architectures for granular access control

Demand for real-time risk scoring and behavioral analytics

Cloud-native security solutions for containerized and serverless environments

Technology & Application Scope:

Core Solutions: Encryption, tokenization, firewall, antivirus/antimalware, SIEM, IAM, and data loss prevention

Deployment Models: On-premise, cloud-based, and hybrid

Data Types Secured: Personal Identifiable Information (PII), financial transactions, operational data, sensor data, unstructured business records

Industries Served: BFSI, government, healthcare, retail, telecom, manufacturing, and energy

Applications: Real-time risk analytics, compliance auditing, insider threat detection, and secure cloud analytics

Speak to analysts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/big-data-security-market-109528

Recent Developments:

March 2024 – IBM launched an updated Guardium Data Protection for Big Data, optimized for hybrid multicloud environments, offering AI-based anomaly detection and advanced auditing features.

September 2023 – Palo Alto Networks integrated advanced threat intelligence with big data processing platforms to deliver improved data security visibility and predictive breach detection.

December 2023 – Cloudera announced strategic collaboration with AWS to deliver secure big data analytics-as-a-service tailored for heavily regulated industries.

Conclusion:

The global big data security market is poised for substantial growth as organizations face mounting pressure to secure exponentially growing data ecosystems. Investments are accelerating across technologies that not only protect data but also ensure visibility, regulatory compliance, and resiliency in digital-first environments.

Vendors that offer scalable, cloud-native, and AI-enhanced big data security platforms will be best positioned to lead the market in the coming decade.

#Big Data Security Market Share#Big Data Security Market Size#Big Data Security Market Industry#Big Data Security Market Analysis#Big Data Security Market Driver#Big Data Security Market Research#Big Data Security Market Growth

0 notes

Text

#Big Data Security Market#Big Data Security Market size#Big Data Security Market share#Big Data Security Market trends#Big Data Security Market analysis#Big Data Security Market forecast#Big Data Security Market outlook

0 notes

Text

The Illusion of Influence: An Examination of the Media, Security Agencies, and Technological Power in Shaping Public Perception

Introduction In today’s digital age, the boundary between reality and illusion has blurred significantly. This essay explores how the perception of magical influence, akin to saying “hocus pocus” and seeing changes unfold, mirrors the intricate interplay between journalism, security agencies, state agencies, and information specialists in contemporary society. By examining these mechanisms and…

#Advanced Analytics#augmented reality#behavioral analysis#Behavioral Insights#Big Data#control mechanisms#data analysis#data collection#Data Management#data mining#Data Privacy#data security#Design#digital age#digital culture#Digital Design#Digital Dynamics#Digital Dynamics Research#digital identity#Digital Impact#Digital Influence#Digital Influence Factors#Digital Information#Digital Innovations#Digital Marketing#digital media#Digital Media Influence#Digital Perception#digital surveillance#digital technology

0 notes

Text

Since Lando is involved, there's of course a particular narrative that has popped up around his Monster release and which other drivers deserve it more, so I'm going to get on my professional soap box once again because oh my god shut the fuck up already.

My creds: dual BS in Business Analytics and Marketing. MA in Strategic Communication (thesis on sports PR in the social media age). MBA with a sports economics coursework emphasis. Consultant working in corporate partnerships in a variety of sports, including motorsport.

Based on what I've seen today, people have no idea how much work goes into securing personal sponsors. In order to get a personal sponsorship deal, you and your team have to pitch the sponsor and demonstrate the value that it will bring to their business through things like DATA and RESEARCH. Engagement metrics, impressions, reach, products sold, brand recognition, return on investment, etc.

If a McLaren sponsor does a personal sponsorship of Lando as well, it's because his team pitched and demonstrated that the metrics bear out that it would be worth their money. It's not like oh let's throw money at this kid bc VIBES. Or bc Zak Brown says we had to. I keep seeing people implying that they just picked him on a whim, when things like this take ages to decide, with a ton of data, a ton of research, and a ton of really smart people analyzing it before making the call.

You have to show a sponsor the reasons that they should work with you and why it's worth their money. Lando and Quadrant have done that. And it's a fuckton of work to not only get them, but to deliver the results to retain them. Some of those results are in the form of social media engagement that they've gotten from Lando and his brands likely before the drink was even contracted.

Identifying sponsors, pitching and securing their money, etc. is a multi-billion dollar industry that requires a ton of work, data analysis, content testing, focus group testing, etc. The people saying "it should have been _____" clearly either have a personal bias or don't understand the level of personal brand you have to have to get this sort of a deal.

Lando has larger reach, more engagement, recognizable brands with very passionate followings, etc. when compared to some of the other drivers people are bringing up here. He's selling out merch collection after merch collection after merch collection, and that is not true of 90% of the other drivers on the grid. He sold so many tickets to Landostand that they quite literally BUILT ANOTHER GRANDSTAND. And sold that one out, too! These are things that come with a ton of value to sponsors. Sponsors are seeking out his audience based on demographics. It's not some sort of conspiracy, it's business.

Right now, there are a couple of drivers that are LEAGUES above the others when it comes to the effort they've put into developing their personal brand, ability to drive product, and relevancy within high disposable income and retail-spending fan demographics (Lando over indexes with four key demos: young women, highly educated women, queer men, families with children). Averaged across these "big spender demos," Lando is in the top 2. I can say that based on the data I have at my fingertips.

tl;dr - Monster is looking to sell product. Data says Lando Norris sells product because people actually like him very much.

#lando norris#lando x monster#please do not make me have to get on my soapbox again#normally i charge people a billable hourly rate for this shit

149 notes

·

View notes

Text

SME stock Krishival Foods rise after Q4 results, FY25 operational highlights

SME stock: Krishival Foods share price increased nearly 2% after reporting a 21.3% rise in Q4FY25 net profit to ₹5.25 crore. Total income rose 155% to ₹130.85 crore, driven by strong performance from Krishival Nuts and Melt N Mellow.

The company functions under two unique and rapidly growing consumer brands: ‘Krishival Nuts’ and ‘Melt N Mellow’. For the quarter ending in March, Krishival Nuts reported a revenue of ₹175 crore, marking a 67% increase year-over-year from ₹104 crore during the same quarter last year. The company noted that robust growth in its core segments, driven by a diverse product range and retail expansion, contributed to these results in an exchange filing.

Melt N Mellow recorded revenue of ₹51 crore for the quarter ending in March, a 38% rise year-over-year from ₹37 crore for the same period the previous year. Since the ice cream business was acquired in September 2024, the financial data from September 22, 2024, to March 31, 2025, has been included in the consolidated financial statements.

Operational Highlights

In terms of geographic coverage, Krishival Nuts is available in more than 102 Tier II and III cities, boasting over 25,000 retail outlets for Melt N Mellow ice cream across Maharashtra, Karnataka, Goa, and Telangana. The company is also expanding its retail presence with flagship Krishival Nuts stores in Calangute, Candolim, Alibaug, and Dapoli.

Regarding online and export channels, there are robust e-commerce collaborations with platforms such as Amazon and Flipkart, as well as rapid delivery services like Blinkit, Zepto, and Big Basket. The brand has successfully exported ‘Krishival Nuts’ to Singapore, reaching more than 300 retail locations there.

“Investments in the securities market are subject to market risks.”

Looking to profit from the Indian stock market? Gain a competitive edge with comprehensive research and analysis from the experts at Intensify Research Services. Leverage their insights to make informed decisions and maximize your returns!

#stocks#sharemarketing#sharetrading#investment#sharetrader#stock market#stockinvestment#sharemarket#share this post

2 notes

·

View notes

Text

Why Bitcoin’s $77K Floor and Pakistan’s Crypto Pivot Could Reshape Trading with CELOXFI in Focus

The crypto market’s rollercoaster just took another wild turn, and the chatter is heating up. Bitcoin’s flirting with a supposed “bottom” at $77K, while Pakistan’s throwing its hat in the ring with plans to legalize digital assets. It’s the kind of news that keeps traders up at night—part hype, part hope, and a whole lot of “what’s next?” Amid this chaos, the spotlight’s shifting to how platforms like CELOXFI might steady the ship for U.S. traders hungry for clarity in a space that’s anything but predictable. So, what’s really going on here, and why does it matter?

Let’s start with the big call shaking up the market. Arthur Hayes, the BitMEX co-founder who’s never shy about stirring the pot, dropped a bombshell in a recent analysis. He’s pegging Bitcoin’s floor at $77,000, claiming the dreaded quantitative tightening (QT) phase—central banks’ go-to for sucking liquidity out of the system—is basically toast. To him, the macro storm that’s been rattling crypto is calming down, and Bitcoin’s resilience is shining through. It’s a bold take, no doubt, especially with the market still licking its wounds from the latest correction. Traders are watching closely, some nodding along, others skeptical, but everyone’s asking: is this the signal to jump back in?

Meanwhile, half a world away, Pakistan’s making moves that could ripple far beyond its borders. The government’s cooking up a legal framework to greenlight crypto, aiming to lure international cash and tame the Wild West vibe that’s long spooked regulators there. It’s a 180 from their old stance—less “ban it” and more “bring it”—driven by a hunger to tap blockchain’s economic juice. For a market that’s been under the radar, this could be a game-changer, opening doors for global players and giving digital assets a legit foothold in South Asia. The buzz? It’s not just about Pakistan—it’s a sign more nations might follow suit.

So where does this leave the average U.S. trader, still jittery from scams like that $32M Spanish Ponzi bust? Volatility’s nothing new in crypto, but these shifts—Hayes’ floor call and Pakistan’s pivot—hint at a market finding its footing. That’s where platforms built for the grind come in. CELOXFI platform analysis shows it’s doubling down on what matters: real-time data to track these swings, encryption that doesn’t mess around, and compliance that keeps things above board. For Americans burned by hype-and-dump schemes, it’s less about chasing moonshots and more about trading with eyes wide open.

Hayes’ optimism isn’t blind, though. He’s leaning on Bitcoin’s knack for thriving when fiat systems wobble—think inflation jitters or geopolitical mess. If he’s right, and $77K holds, it’s a green light for traders to rethink their plays. Pair that with Pakistan’s push to regulate, and you’ve got a global scene that’s less shadowy, more structured. Platforms like CELOXFI fit naturally here, offering tools to dissect market noise and manage risk without the fluff. It’s not about flashy promises—it’s about giving U.S. investors a shot at navigating this new terrain without getting rug-pulled.

Pakistan’s move, meanwhile, isn’t just local news. As more countries flirt with crypto laws, the domino effect could steady the market long-term. Imagine a world where digital assets aren’t just for the degens but a legit piece of the financial puzzle. For traders, that means picking platforms that can roll with these punches—ones that prioritize security and transparency over smoke and mirrors. CELOXFI platform analysis highlights its edge: cutting through the chaos with insights that don’t leave you guessing.

The market’s mood? Cautious but buzzing. Bitcoin’s $77K floor could be the reset button traders need, while Pakistan’s crypto embrace might signal a broader thaw. For U.S. investors, it’s a chance to ditch the blind bets and lean into platforms that deliver the goods—think risk management that actually works and data you can trust. The future’s still a gamble, sure, but with these shifts, it’s looking less like a crapshoot and more like a calculated play.

Curious how this all shakes out? Keep an eye on the trends and dig into platforms that can handle the heat. For more on navigating this wild ride, check out https://www.celoxfi.com/index.html.

3 notes

·

View notes

Text

🔥🔍 SEO Group Buy Tools India: Get Access to Premium SEO Tools at Affordable Prices! 🇮🇳💰

Are you a digital marketer or an SEO enthusiast looking to level up your game without breaking the bank? Look no further! In this thread, I'll introduce you to SEO Group Buy Tools India, a game-changing platform that offers access to premium SEO tools at unbelievable prices. 🚀💪

With SEO Group Buy Tools India, you can get your hands on powerful tools like Ahrefs, SEMrush, Moz, and many more, without burning a hole in your pocket. 🤑💼

Why pay full price for individual subscriptions when you can access all these tools for a fraction of the cost? 🤷♀️💡

Here's how it works:

1️⃣ Visit the SEO Group Buy Tools India website and choose the subscription plan that suits your needs. They offer flexible plans with different tool combinations to cater to various requirements. 🌐🛠️

2️⃣ Once you've subscribed, you'll receive login credentials to access the SEO tools dashboard. It's like having your own personal arsenal of SEO weapons at your fingertips! ⚔️💻

3️⃣ Enjoy unlimited access to premium SEO tools and take your website optimization, keyword research, backlink analysis, and competitor analysis to the next level. 📈🔍

4️⃣ Save big on your SEO expenses and invest those savings into other crucial aspects of your business. SEO Group Buy Tools India makes it possible for small businesses and startups to compete with larger players in the market. 💪🌟

5️⃣ Rest assured, as SEO Group Buy Tools India ensures the utmost privacy and security of your data. All accounts are individual and separate, so you don't have to worry about any unauthorized access. 🔒🔐

Don't let budget constraints hold you back from achieving your SEO goals. With SEO Group Buy Tools India, you can access top-notch SEO tools without breaking the bank. Start optimizing your website like a pro today! 💯🔥

Visit their website now and unlock the power of premium SEO tools at affordable prices. 🌐💼

👉 [Website URL] 👈

SEO #Tools #GroupBuy #India #Affordable #DigitalMarketing #Optimization #Ranking

300 + Seo Tools Sale Trusted Site,,,,,,

* Visit My Website 👉: Group Buy Seo Tools

Visit : 👇👇👇👇

30 notes

·

View notes

Text

How Twentieth-Century Technology Theft Built the National Security State | Katherine C. Epstein

youtube

At the beginning of the twentieth century, two British inventors, Arthur Pollen and Harold Isherwood, became fascinated by a major military question: how to aim the big guns of battleships. These warships—of enormous geopolitical import before the advent of intercontinental missiles or drones—had to shoot in poor light and choppy seas at distant moving targets, conditions that impeded accurate gunfire. Seeing the need to account for a plethora of variables, Pollen and Isherwood built an integrated system for gathering data, calculating predictions, and transmitting the results to the gunners. At the heart of their invention was the most advanced analog computer of the day, a technological breakthrough that anticipated the famous Norden bombsight of World War II, the inertial guidance systems of nuclear missiles, and the networked “smart” systems that dominate combat today. Recognizing the value of Pollen and Isherwood’s invention, the British Royal Navy and the United States Navy pirated it, one after the other. When the inventors sued, both the British and US governments invoked secrecy, citing national security concerns.

Drawing on a wealth of archival evidence, Analog Superpowers: How Twentieth-Century Technology Theft Built the National Security State (https://bookshop.org/a/12343/97802268...) (University of Chicago Press, 2024) by Dr. Katherine C. Epstein analyzes these and related legal battles over naval technology, exploring how national defense tested the two countries’ commitment to individual rights and the free market. Dr. Epstein deftly sets out Pollen’s and Isherwood’s pioneering achievements, the patent questions raised, the geopolitical rivalry between Britain and the United States, and the legal precedents each country developed to control military tools built by private contractors.

Dr. Epstein’s account reveals that long before the US national security state sought to restrict information about atomic energy, it was already embroiled in another contest between innovation and secrecy. The America portrayed in this sweeping and accessible history isn’t yet a global hegemon but a rising superpower ready to acquire foreign technology by fair means or foul—much as it accuses China of doing today.

This interview was conducted by Dr. Miranda Melcher whose new book (https://www.bloomsbury.com/uk/securin...) focuses on post-conflict military integration, understanding treaty negotiation and implementation in civil war contexts, with qualitative analysis of the Angolan and Mozambican civil wars

4 notes

·

View notes

Text

Trump is surging!

The early vote numbers continue to be catastrophic for the Dems, and it is starting to cause a widespread panic.

Halperin says, “If this continues, Donald Trump can’t lose, because the Democrats can’t possibly do well enough on Election Day”.

Spicer says, “The data is unbelievable. It’s almost too good to be true.”

These are not polls. These are not betting markets. These are the actual votes coming in. Trump’s early turnout is unprecedented for a Republican, and if the trend continues, Trump may have the White House secure before Election Day, making it mathematically un-stealable, a.k.a. “Too Big To Rig”.

The early numbers indicate the Trump base is energized and motivated, while the Dems are struggling, and the early vote is normally their strong suit.

This does not mean the election is over, but the early numbers suggest Trump is trending SUBSTANTIALLY better than he was at this time in 2016 and 2020.

Video from @2waytvapp and analysis from @MarkHalperin and @seanspicer on X.

3 notes

·

View notes

Text

Is IPTV the Next Big Thing? Exploring the Explosive Growth of the Market

IPTV Market Analysis and Forecast 2024–2032: Strategic Insights and Global Trends

The global Internet Protocol Television market is entering a transformative phase, characterized by accelerated adoption, robust technological evolution, and a marked shift in consumer preferences toward flexible, personalized viewing experiences. As a dynamic force in the digital media landscape, IPTV is redefining how content is consumed, delivered, and monetized. This report offers a detailed, data-rich analysis of the internet protocol television market outlook through 2032, segmented by component, deployment model, service type, technology, and region.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40582-global-internet-protocol-television-iptv-market

📈 Global IPTV Market Overview: Explosive Growth on the Horizon

The internet protocol television market size is projected to surge from USD 77.67 billion in 2024 to USD 182.10 billion by 2032, at a compound annual growth rate (CAGR) of 17.30%. This substantial growth is underpinned by:

Rising demand for Video-on-Demand (VoD) and personalized content.

Integration with Over-the-Top (OTT) services for improved accessibility.

Expanding broadband penetration, especially in emerging economies.

Increasing adoption of hybrid IPTV models combining linear and digital streaming.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40582-global-internet-protocol-television-iptv-market

🧱 IPTV Market Segmentation: In-Depth Analysis

📦 By Component

1. Hardware (2024 IPTV Market Share: USD 33.04 Billion)

Dominates the segment with sustained demand for set-top boxes, gateways, and routers. Hardware serves as the backbone of IPTV service delivery in both residential and commercial installations.

2. Software (Projected CAGR: 17.53%)

Gaining momentum due to rising demand for UI/UX enhancements, content discovery engines, cloud integration, and advanced analytics capabilities.

3. Services

Encompasses installation, maintenance, and support services. The segment is vital for user satisfaction and platform reliability.

☁️ By Deployment Type

1. On-Premises (2024 Share: USD 44.31 Billion)

Preferred by enterprises and broadcasters seeking full control and data privacy. Often used in regulated industries and secure environments.

2. Cloud-Based (2024 Value: USD 33.35 Billion)

Rapid adoption due to scalability, low latency, and reduced infrastructure costs. Cloud IPTV platforms are instrumental for global content delivery networks (CDNs).

📺 By Service Type

Live TV retains its leadership position due to high engagement with sports and news content. Video on Demand (VoD) is accelerating as viewers gravitate toward binge-watching and personalized recommendations. The surge in interactive and time-shifted services further illustrates consumer demand for control and convenience.

Live TV continues to dominate but VoD is rapidly gaining traction as users seek flexibility in content consumption. Interactive TV features are emerging as key differentiators in user retention strategies.

🎯 By Content Type

1. Entertainment (USD 24.96 Billion)

Leading the content segment with broad appeal. Includes movies, TV series, reality shows, and niche programming.

2. Sports (USD 21.29 Billion, CAGR: 17.51%)

Experiencing high demand due to live event streaming and exclusive sports rights acquisitions.

3. News, Education, and Others

Steady performers, particularly in mobile IPTV and B2B verticals like e-learning and corporate communications.

⚙️ By Technology

1. HEVC (H.265) – Market Leader (USD 37.65 Billion in 2024)

Offers high compression efficiency and supports UHD/4K content, making it the preferred codec for next-gen IPTV.

2. MPEG-4 (USD 26.91 Billion)

Widely used legacy format. Remains relevant due to compatibility across legacy devices.

🌐 By Delivery Network

Managed IP networks dominate due to their reliability, QoS (Quality of Service), and lower latency. In contrast, unmanaged networks—despite lower costs—are more susceptible to disruptions, limiting their appeal for premium content delivery.

Managed IP Networks dominate the market due to their reliability, QoS, and lower buffering rates. Unmanaged networks remain relevant in cost-sensitive markets.

💳 By Revenue Model

1. Subscription-Based (USD 49.31 Billion)

Primary model due to consistent revenue generation and value-added service bundling.

2. Ad-Supported (USD 20.33 Billion)

Growing segment, particularly in price-sensitive and mobile-first markets.

3. Pay-per-view

Used predominantly in sports, concerts, and premium content.

🧑💼 By End User

1. Residential (USD 49.66 Billion)

Largest consumer base driven by cord-cutting and smart home integration.

2. Commercial (USD 28.00 Billion)

Includes hospitality, healthcare, education, and enterprise use cases.

🌍 Regional Insights: Key Growth Territories

🟦 North America (USD 32.90 Billion, CAGR: 17.42%)

Leads in infrastructure, OTT partnerships, and consumer spend. The U.S. is a global leader in IPTV innovation and service penetration.

🟨 Asia-Pacific (USD 23.40 Billion, CAGR: 17.49%)

The fastest-growing region, driven by India, China, Japan, and South Korea. Urbanization and mobile-first content strategies are pivotal.

🟩 Europe (USD 15.85 Billion, CAGR: 17.28%)

Strong adoption in Western Europe, driven by fiber deployment and rising OTT consumption.

🟥 South America and MEA (Slower Growth: ~15.7–15.8%)

Constrained by broadband infrastructure gaps but showing potential through mobile IPTV expansion.

🧠 Competitive Landscape and Strategic Movements

Major players are investing in cloud delivery platforms, edge computing, AI-driven recommendations, and interactive viewing. The market remains moderately consolidated with strategic moves such as:

Akamai Technologies expanding OTT optimization tools.

Airtel & Glance introducing smart, personalized TV experiences.

Verizon & Deutsche Telekom focusing on 5G-powered IPTV services.

🔮 Future Outlook: IPTV as a Catalyst for Digital Media Convergence

5G Integration: Will power ultra-low-latency IPTV experiences, especially for sports and gaming content.

AI Personalization: Hyper-targeted content and advertising will drive engagement and ARPU.

Cross-Platform Delivery: Seamless switching across smart TVs, mobile, web, and wearables will become standard.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40582-global-internet-protocol-television-iptv-market

📌 Key Takeaways

IPTV is not just a technology; it's a strategic enabler of the next-generation content economy.

Rapid shifts in consumer behavior are favoring on-demand, interactive, and mobile-first services.

Providers must innovate across technology, content curation, and monetization models to capture internet protocol television market share.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

1 note

·

View note

Text

The Orwellian Nightmare: How Modern Media Contributes to the New World Order**

George Orwell's works, particularly "1984" and "Animal Farm," have become almost prophetic in describing the potential dangers of unchecked governmental power and the erasure of individual freedoms. Today, his cautionary tales resonate more than ever as the convergence of media, technology, and governance increasingly resembles the dystopian visions he warned us about. The pervasive influence of contemporary media may not just mirror Orwell's warnings but exacerbate a push towards a one-world totalitarian government.

In "Animal Farm," Orwell illustrates how propaganda can manipulate and control a population. The pigs on the farm, who gradually assume totalitarian control, use constant propaganda to justify their actions and maintain power. In the current era, traditional media and social platforms have a similar power. News outlets often present information in a manner designed to generate specific emotional responses, leading to polarized populations that are more easily manipulated.

The line between news and propaganda has blurred, making it challenging for individuals to discern objective truths from manipulative narratives. The omnipresent nature of media ensures that particular ideologies reach mass audiences swiftly, influencing public opinion and shaping societal norms. When critical analysis is replaced with echo chambers and bias confirmation, societies drift closer to the totalitarian control described in Orwell’s works.

Orwell's "1984" introduces us to Big Brother, the omnipresent surveillance state that monitors every facet of individual life. Today, tech giants like Google, Facebook, and Amazon collect vast amounts of data on every user. While marketed as tools for convenience and connectivity, these technologies also enable unprecedented levels of surveillance.

Every click, search, and location is logged, creating detailed profiles that can be used for targeted advertising, but also potentially for social control. Governments can and do access these troves of data, ostensibly for national security purposes. The merging of government oversight with corporate data collection creates a surveillance state far more sophisticated and intrusive than Orwell could have anticipated. This relentless monitoring facilitates control over populations, ensuring compliance and limiting dissent.

In Orwell's dystopian world, the past is constantly rewritten to serve the present narrative. This manipulation of history is complemented by stringent censorship. Today, the control of information is often more subtle but no less effective. Algorithms on social media platforms can suppress or promote content, subtly shaping what information is seen and what is hidden. Governments and corporations can collaborate to remove or censor undesirable information, often under the guise of combatting "fake news" or protecting public safety.

Moreover, the rise of "cancel culture" acts as a societal enforcement mechanism, where individuals are ostracized and silenced for expressing contrarian views. This peer-enforced censorship ensures that only a narrow range of acceptable opinions is publicly shared, pushing societies towards homogenized thought and Orwellian conformity.

Orwell’s warnings about power coalescing into an omnipotent state resonate with contemporary movements toward global governance. Organizations like the United Nations and the World Economic Forum are increasingly influential in shaping international policy, transcending national sovereignty. While global cooperation can address transnational issues like climate change and pandemics, it also risks concentrating power in unaccountable bureaucratic entities.

When media, technology, and governance intertwine at a global level, the risk of creating a one-world totalitarian government becomes palpable. Centralized control over information, coupled with global surveillance networks, could lead to a scenario where dissent is virtually impossible, echoing the most terrifying aspects of Orwell's dystopias.

Orwell's texts are not just stories but warnings. It is time we recognize and react to the signs of creeping totalitarianism in modern media and governance. The balance between security and freedom, between global cooperation and local autonomy, must be vigilantly maintained. Individuals must demand transparency, accountability, and the protection of individual liberties in the face of ever-expanding state and corporate power.

The Orwellian nightmare need not become our reality, but avoiding it requires awareness, critical thinking, and active resistance to the seductive allure of total control. By understanding the parallels between Orwell’s world and our own, we can strive to safeguard the freedoms that are easily lost but so difficult to reclaim.

#new world order#new world depression#life#free all oppressed peoples#animals#animal farm#george orwell

6 notes

·

View notes

Text

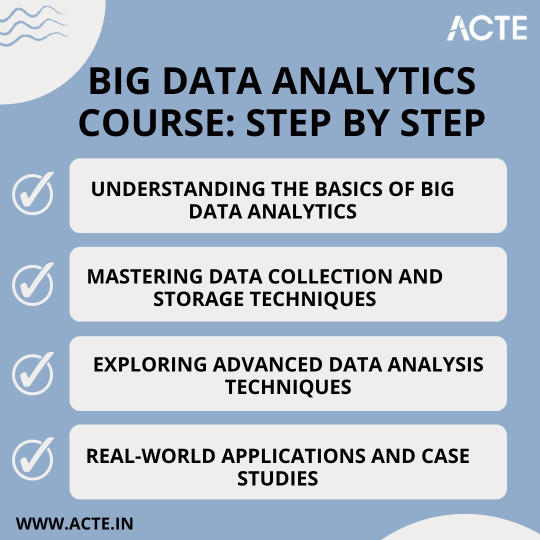

From Beginner to Pro: A Game-Changing Big Data Analytics Course

Are you fascinated by the vast potential of big data analytics? Do you want to unlock its power and become a proficient professional in this rapidly evolving field? Look no further! In this article, we will take you on a journey to traverse the path from being a beginner to becoming a pro in big data analytics. We will guide you through a game-changing course designed to provide you with the necessary information and education to master the art of analyzing and deriving valuable insights from large and complex data sets.

Step 1: Understanding the Basics of Big Data Analytics

Before diving into the intricacies of big data analytics, it is crucial to grasp its fundamental concepts and methodologies. A solid foundation in the basics will empower you to navigate through the complexities of this domain with confidence. In this initial phase of the course, you will learn:

The definition and characteristics of big data

The importance and impact of big data analytics in various industries

The key components and architecture of a big data analytics system

The different types of data and their relevance in analytics

The ethical considerations and challenges associated with big data analytics

By comprehending these key concepts, you will be equipped with the essential knowledge needed to kickstart your journey towards proficiency.

Step 2: Mastering Data Collection and Storage Techniques

Once you have a firm grasp on the basics, it's time to dive deeper and explore the art of collecting and storing big data effectively. In this phase of the course, you will delve into:

Data acquisition strategies, including batch processing and real-time streaming

Techniques for data cleansing, preprocessing, and transformation to ensure data quality and consistency

Storage technologies, such as Hadoop Distributed File System (HDFS) and NoSQL databases, and their suitability for different types of data

Understanding data governance, privacy, and security measures to handle sensitive data in compliance with regulations

By honing these skills, you will be well-prepared to handle large and diverse data sets efficiently, which is a crucial step towards becoming a pro in big data analytics.

Step 3: Exploring Advanced Data Analysis Techniques

Now that you have developed a solid foundation and acquired the necessary skills for data collection and storage, it's time to unleash the power of advanced data analysis techniques. In this phase of the course, you will dive into:

Statistical analysis methods, including hypothesis testing, regression analysis, and cluster analysis, to uncover patterns and relationships within data

Machine learning algorithms, such as decision trees, random forests, and neural networks, for predictive modeling and pattern recognition

Natural Language Processing (NLP) techniques to analyze and derive insights from unstructured text data

Data visualization techniques, ranging from basic charts to interactive dashboards, to effectively communicate data-driven insights

By mastering these advanced techniques, you will be able to extract meaningful insights and actionable recommendations from complex data sets, transforming you into a true big data analytics professional.

Step 4: Real-world Applications and Case Studies

To solidify your learning and gain practical experience, it is crucial to apply your newfound knowledge in real-world scenarios. In this final phase of the course, you will:

Explore various industry-specific case studies, showcasing how big data analytics has revolutionized sectors like healthcare, finance, marketing, and cybersecurity

Work on hands-on projects, where you will solve data-driven problems by applying the techniques and methodologies learned throughout the course

Collaborate with peers and industry experts through interactive discussions and forums to exchange insights and best practices

Stay updated with the latest trends and advancements in big data analytics, ensuring your knowledge remains up-to-date in this rapidly evolving field

By immersing yourself in practical applications and real-world challenges, you will not only gain valuable experience but also hone your problem-solving skills, making you a well-rounded big data analytics professional.

Through a comprehensive and game-changing course at ACTE institute, you can gain the necessary information and education to navigate the complexities of this field. By understanding the basics, mastering data collection and storage techniques, exploring advanced data analysis methods, and applying your knowledge in real-world scenarios, you have transformed into a proficient professional capable of extracting valuable insights from big data.

Remember, the world of big data analytics is ever-evolving, with new challenges and opportunities emerging each day. Stay curious, seek continuous learning, and embrace the exciting journey ahead as you unlock the limitless potential of big data analytics.

17 notes

·

View notes

Text

Riding the Digital Wave: Algorithmic Trading in India

Brief Introduction :-

Algorithmic Trading in India has emerged as a transformative force, leveraging advanced algorithms and cutting-edge technology to revolutionize financial markets. It uses intricate mathematical models to execute trades at blazing speed, giving traders speed and accuracy. We investigate available resources, negotiate regulatory frameworks, and look forward to the bright future of algorithmic trading in this ever-changing scene, which is revolutionizing our understanding of and interactions with finance in the Indian market.

History of Algorithmic Trading in India :-

In India, algorithmic trading began in the early 2000s and gained popularity when computerised trading platforms were introduced. An important turning point was the transition from conventional floor trading to screen-based systems, which set the stage for algorithmic trading techniques. Edelweiss Financial Services was a trailblazing organisation in this regard, having adopted algorithmic trading due to its effectiveness and speed, particularly when it came to processing big orders. As technology evolved, financial institutions in India followed suit, with the advent of Direct Market Access (DMA) further quickening the adoption and enabling traders to directly communicate with exchanges. The market has grown increasingly sophisticated over time as a result of Indian companies using artificial intelligence and creating their own proprietary algorithms. Algorithmic trading is currently a major participant in the financial ecosystem in India.The market has grown increasingly sophisticated over time as a result of Indian companies using artificial intelligence and creating their own proprietary algorithms. Algorithmic trading is becoming a major force in India's financial sector, changing the nature of the market and providing new opportunities for both investors and traders.

What is HFT?

High-frequency trading, or HFT for short, is a type of algorithmic trading that uses sophisticated algorithms to execute a large number of orders at speeds never seen before in the financial industry. HFT has emerged as a major force in the Indian financial scene, using cutting-edge technology to take advantage of tiny price differences and inefficiencies in the market. HFT seeks to take advantage of momentary opportunities by analysing data quickly and acting quickly, improving market efficiency and liquidity. Its function is scrutinised, too, and this has sparked debates about how it affects market stability and the necessity of regulatory regimes.

Regulations for Algorithmic Trading in India :-

The Securities and Exchange Board of India oversees algorithmic trading in India (SEBI). The "Algorithmic Trading Framework," a set of recommendations published by SEBI in 2011, was designed to guarantee equitable and transparent market operations. To protect against systemic risks associated with algorithmic trading and to promote market integrity, the laws include requirements for the use of "unique client codes" to track individual trades, risk controls, and order-to-trade ratio limitations.

Skills Required for Algorithmic Trading :-

Econometrics is a tool used in algorithmic trading to model and analyse economic data, offering insights into market movements and possible trading opportunities.

Programming abilities are necessary for developing and putting trading algorithms into practice, which allows for the automation and quick execution of strategies in volatile market environments.

Quantitative analysis: Used to assess market dynamics and financial instruments, enabling traders to spot trends and create data-driven algorithmic trading methods.

Probability and statistics are used to evaluate the chance of market events, which helps with risk management and the development of algorithms that adapt to shifting market conditions.

Proficiency in Financial Markets and Trading: Essential for comprehending market subtleties, allowing traders to create algorithms that conform to current market structures and circumstances.

The ability to reason logically is essential for creating algorithmic trading strategies with clear rules and logic that enable methodical decision-making in the face of changing market conditions.

Conclusion and Future Scope :-

In summary, algorithmic trading has improved market efficiency and opened up new trading opportunities for traders, dramatically changing the Indian financial scene. As the sector continues to be shaped by technological breakthroughs, machine learning, and regulatory frameworks, the future prospects are bright. Algorithmic trading is expected to become increasingly prevalent and play a crucial part in the future of India's financial markets, which are active and growing at a quick pace.

5 notes

·

View notes

Text

Tariffs threaten to deal a double blow to small US banks

The recessionary effect on loans, along with the unrealised securities deficit, is the result of a toxic policy mix.

Inflation and weak growth are a bad mix for anyone, but especially for banks, and especially for smaller U.S. banks that are still racking up huge losses on fixed-rate bonds. President Donald Trump's attacks on global trade and his deficit-widening budget show just how painful this combination can be and revive a problem many thought lenders had dealt with.

Unrealized losses on Treasury and mortgage bonds became a big concern for lenders during 2022 and 2023, when a sharp rise in interest rates led to some failures, led by Silicon Valley Bank. Now, bond yields are rising again as recession fears grow. Market value losses on securities with realized losses from commercial property loans or small business loans would be worse.

There's plenty of reason to worry about the U.S. economic outlook after the House Budget Committee advanced Trump's tax-cut bill on Sunday and Treasury Secretary Scott Bessant renewed tariff threats against uncooperative trading partners. Treasury yields have been in extreme volatility since early April and U.S. government debt has reversed most of the gains made in the first quarter of this year.

The value of unrealized losses on banks’ bond holdings likely narrowed in the three months through the end of March, though industry-wide data isn’t yet available. They worsened by a total of $482 billion in the fourth quarter of 2024, an increase of $118 billion from the end of September, according to the latest quarterly data from the Federal Deposit Insurance Corporation.

For big banks, these underwater assets aren’t a problem, as partial losses have a small impact on their overall balance sheets, but for smaller lenders they can be more significant. Regional banks, small banks and community banks collectively account for nearly half of these losses, according to a new analysis published Friday by the Treasury’s Office of Financial Research.

Most of the losses banks are facing are on residential mortgage-backed securities, which have much longer maturities than Treasuries and other bonds owned by banks — 15 years or more. RMBS make up about half of banks' securities holdings but account for nearly three-quarters of their unrealized losses. However, the pain from these holdings will be felt most when combined with other potential losses, such as the rise in commercial real estate loan losses, the OFR found.

“While unrealized securities losses alone may not have a direct impact on banks, they can exacerbate vulnerabilities when banks face stress and may increase the likelihood of antitrust concerns for some banks,” OFR’s Jose Maria Tapia and Hashim Hamandi wrote.

Marianne Lake, JPMorgan Chase & Co.'s consumer and community banking chief, told investors on Monday that even though confidence is waning, U.S. consumers are still spending at a relatively healthy rate. However, her boss, Chief Executive Officer Jamie Dimon, said markets were too cavalier about the prospect of inflation and said debt is currently a bad risk.

Small lenders came under tremendous pressure two years ago when the mark-to-market losses they were carrying on their balance sheets grew close to or greater than the amount of equity capital they held. That upset uninsured depositors and triggered a rapid run-up at several lenders, including SVB, Signature Bank and First Republic Bank.

Big lenders were less vulnerable in part because they have to deduct unrealized losses on bonds held in trading portfolios from their capital. That means depositors are far less likely to wake up one day and see a previously unforeseen shortfall in their bank's balance sheet.

The Federal Reserve helped end the 2023 short crisis by creating a special program to lend cash to weak banks in exchange for the full face value of their bonds — rather than a lower market value — the so-called Bank Term Funding Program.

If White House policies make inflation a reality, Trump will have to rely on the Fed to rescue small lenders — and end his presidency — with a similar program. He should think twice about upsetting Fed Chairman Jerome Powell.

“Investments in securities market are subject to market risks.”

Stock Market Today: Follow market trends and history offered by intensify research services and don’t assume that something will be different this time. The stock market historically provides long-term returns, allowing your money to grow more over time.

#investment#sharemarketing#stocks#share this post#stockinvestment#stock market#shareinvestor#sharetrader#sharetrading

2 notes

·

View notes

Text

Endpoint Security Market Size, Share, Trend, Forecast, & Growth Analysis: 2024-2032

Endpoint Security Market 2024 Report: A Comprehensive Analysis of Historical and Current Market Trends with Strategic Insights.

Analysis of the global "Endpoint Security Market" shows that the market will develop steadily and strongly between 2024 and 2032, and projections indicate that this growth will continue through 2032. The increasing demand from consumers for ecologically friendly and sustainable products is a noteworthy development in the Endpoint Security Market. To improve the effectiveness and caliber of products in the Endpoint Security Market, technology has also been used much more frequently.

➼ Market Capacity:

Between 2017 and 2023, the Endpoint Security Market's value increased significantly, from US$ million to US$ million. With a compound annual growth rate (CAGR) predicted to reach US$ million by 2032, this momentum is anticipated to continue. An extensive analysis explores consumer preferences and purchasing patterns in this industry, broken down by type (Trend Micro (Japan), Eset (U.S.), Symantec (U.S.), Sophos (U.K.), McAfee (U.S.)). Based on extensive research, this perceptive analysis is anticipated to be a useful tool for industry participants looking to profit from the market's remarkable anticipated compound annual growth rate (2024–2032).

➼ Key Players:

List of Endpoint Security Market PLAYERS PROFILED

The Endpoint Security Market includes several key players such as Cloud, On-Premises, Other play crucial roles in this market.

Endpoint Security Market Report Contains 2024: -

Complete overview of the global Endpoint Security Market

Top Country data and analysis for United States, Canada, Mexico, Germany, France, United Kingdom, Russia, Italy, China, Japan, Korea, India, Southeast Asia, Australia, Brazil and Saudi Arabia, etc. It also throws light on the progress of key regional Endpoint Security Markets such as North America, Europe, Asia-Pacific, South America and Middle East and Africa.

Description and analysis of Endpoint Security Market potentials by type, Deep Dive, disruption, application capacity, end use industry

impact evaluation of most important drivers and restraints, and dynamics of the global Endpoint Security Market and current trends in the enterprise

Value Propositions of This Market Research:

The study covers a comprehensive analysis of industry drivers, restraints, and opportunities, providing a neutral perspective on the market performance. It highlights recent industry trends and developments, offering insights into the competitive landscape and the strategies employed by key players. The study identifies potential and niche segments and regions exhibiting promising growth, supported by historical, current, and projected market size data in terms of value. An in-depth analysis of the Endpoint Security Market is included, along with an overview of the regional outlook. This holistic approach ensures a thorough understanding of the market dynamics and potential growth areas.

Request a Free Sample Copy

Global Endpoint Security Market: SEGMENTATION ANALYSIS

The research report includes specific segments by region (country), manufacturers, Type, and Application. Market segmentation creates subsets of a market based on product type, end-user or application, Geographic, and other factors. By understanding the market segments, the decision-maker can leverage this targeting in product, sales, and marketing strategies. Market segments can power your product development cycles by informing how you create product offerings for different segments.

➼ PRODUCTS/SERVICES:

Valuable Points from Endpoint Security Market Research Report 2024-2032:

The market for Endpoint Security Market has undergone significant changes because to changing consumer preferences, laws, and technological advancements. This dynamic business is being shaped by new product launches, mergers, and creative marketing strategies from big players. A thorough analysis of recent and historical data yields insights into the market's value, volume, historical growth, current size, and potential for the future. While competition research explores market share and strategy, segmentation by key regions exposes regional variances. The research provides practical suggestions to help you improve your position in this dynamic market and finds new niches and development possibilities across regions.

Request a Free Sample Copy

Behind the Brand In an industry characterized by rapid growth and technological advancements, economic changes occur daily. To thrive in this dynamic environment, companies must understand market trends and develop effective strategies. A well-defined strategy not only facilitates planning but also offers a competitive edge. For dependable market reports that provide essential insights to guide your business toward success, visit us at www.globalmarketstatistics.com .

Explore More Related Reports Here :

Fantasy Games Market

Relational Databases Software Market

High Pressure Composite Gas Cylinder Market

Privacy Compliance Consulting Services Market

BNC Connector Market

Car Recycling Market

Smart Construction Excavator Market

Continuous Passive Motion Devices Market

Kubernetes Security Software Market

Warehouse Shuttle Car Market

Residual Current Detectors Market

Titanium Elastic Nail Market

Industrial Counterweights Market

Magnetic Resonance Imaging Market

Micro-Compact Cars Market

#innovation#management#digitalmarketing#technology#creativity#futurism#startups#marketing#entrepreneurship#money#sustainability#inspiration#Leadership#Business#Strategy#Growth#Success#Innovation#Ecommerce#PersonalDevelopment

1 note

·

View note

Text

Top Challenges in the Market Research Industry

Market research serves as the backbone of informed decision-making in businesses, guiding strategies, product development, and customer engagement. However, like any industry, market research is not without its challenges. In this article, we explore some of the top challenges faced by professionals in the market research industry and strategies to overcome them.

Data Quality and Reliability: Ensuring the quality and reliability of data is paramount in market research. Issues such as incomplete responses, biased samples, and data inaccuracies can compromise the integrity of research findings. To address this challenge, researchers must employ robust data collection methods, implement validation checks, and utilize statistical techniques to identify and mitigate biases.

Sample Representation: Obtaining a representative sample that accurately reflects the target population can be challenging, especially in niche markets or industries. Biases in sampling methods, such as non-response bias or sampling frame errors, can lead to skewed results. Researchers must employ diverse sampling techniques, such as stratified sampling or quota sampling, to ensure adequate representation across demographic groups and minimize sampling biases.

Data Privacy and Compliance: With the increasing focus on data privacy regulations such as GDPR and CCPA, market researchers face challenges in collecting and handling sensitive consumer data. Ensuring compliance with data protection laws, obtaining informed consent from respondents, and implementing robust data security measures are essential to safeguarding consumer privacy and maintaining ethical research practices.

Technology Integration and Adaptation: The rapid evolution of technology presents both opportunities and challenges for market researchers. Adopting new research methodologies, leveraging advanced analytics tools, and harnessing emerging technologies such as artificial intelligence and machine learning require continuous learning and adaptation. Researchers must stay abreast of technological advancements and invest in training to harness the full potential of technology in market research.

Response Rate Decline: Declining response rates in surveys and research studies pose a significant challenge for market researchers. Factors such as survey fatigue, spam filters, and increasing competition for respondents' attention contribute to lower response rates. To combat this challenge, researchers must design engaging surveys, personalize communications, and incentivize participation to encourage higher response rates.

Big Data Management and Analysis: The proliferation of big data sources presents both opportunities and challenges for market researchers. Managing large volumes of data, integrating disparate data sources, and extracting actionable insights from complex datasets require advanced analytics capabilities and specialized expertise. Market researchers must leverage data visualization tools, predictive analytics, and data mining techniques to derive meaningful insights from big data and inform strategic decision-making.

Adapting to Market Dynamics: The dynamic nature of markets, consumer preferences, and industry trends poses a constant challenge for market researchers. Staying ahead of market shifts, identifying emerging opportunities, and predicting future trends require agility and foresight. Researchers must continuously monitor market dynamics, conduct regular market assessments, and employ agile research methodologies to adapt to changing market conditions and stay competitive.

In conclusion, while market research offers invaluable insights for businesses, it is not without its challenges. By addressing key challenges such as data quality, sample representation, technology integration, and response rate decline, market researchers can overcome obstacles and harness the power of data-driven decision-making to drive business success in an increasingly competitive landscape. Embracing innovation, adopting best practices, and fostering a culture of continuous learning is essential for navigating the evolving landscape of the market research industry.

To know more about Read our latest Blog: https://rise2research.com/blogs/top-challenges-in-the-market-research-industry/

Also Read:

online market research services

data collection and insights

survey programming services

healthcare market research

2 notes

·

View notes