#BitcoinFixesThis

Explore tagged Tumblr posts

Text

The Evolution of Money: From Seashells to Bitcoin

Money has existed in countless forms throughout history, yet most people never stop to ask: What makes good money?

For thousands of years, civilizations experimented with different forms of exchange—seashells, gold, paper, and now digital numbers in bank accounts. But each step in the evolution of money had flaws—until now.

With Bitcoin, we have found humanity’s final form of money—a system so perfect in design that we will never need to create another. This is the end of the road.

But to understand why, we need to take a journey through money’s evolution—from its primitive origins to its unstoppable digital future.

1. The Barter System: The First Attempt at Money

Before money, people relied on barter—trading goods and services directly. A farmer might trade wheat for a blacksmith’s tools. But bartering had major problems:

No common measure of value (how many fish equal one cow?)

No easy way to store value for the future

No portability—you can’t carry 100 goats to the marketplace

Bartering worked in small, localized communities, but as societies grew, they needed a universal standard of value. Thus, money was born.

2. Commodity Money: When Money Had Real Value

Early civilizations experimented with commodity money—physical items that held intrinsic value, such as: ✅ Gold & silver ✅ Salt (Roman soldiers were paid in salt, hence “salary”) ✅ Cattle ✅ Seashells

These materials worked better than barter because they were scarce, durable, and widely accepted.

Gold and silver eventually became the dominant form of money because they were: ✔ Difficult to counterfeit ✔ Easily divisible into smaller units ✔ Portable compared to heavy trade goods

For thousands of years, gold was money. It was the foundation of trade, wealth, and empires. But gold had a problem—it was too honest. Governments and rulers couldn’t manipulate it easily. So they found a way to cheat the system.

3. Paper Money: The First Step Toward Corruption

Carrying gold was inconvenient, so people began storing it in banks. In return, banks issued paper notes that represented a claim on gold—essentially IOUs for real money.

At first, these notes were backed 1:1 by gold, but over time, governments realized they could print more paper than they had gold, allowing them to: ❌ Fund wars without raising taxes ❌ Control the economy by printing money at will ❌ Steal wealth from citizens through inflation

This was the birth of fiat money—currency that is backed by nothing but government decree.

4. Fiat Money: The Great Experiment

In 1971, the U.S. completely abandoned the gold standard, turning the dollar into pure fiat—money backed by nothing but the government’s promise.

The result? 📉 The dollar lost over 90% of its purchasing power 📈 Wealth inequality skyrocketed as the rich got first access to new money 💸 Inflation became a permanent, systemic problem

Fiat money is a historical anomaly. Every single fiat currency before today has collapsed due to overprinting, hyperinflation, or government mismanagement.

The U.S. dollar is no different—it’s just the latest version of the same mistake.

This is why Bitcoin was created.

5. Bitcoin: The Final Evolution of Money

In 2009, Satoshi Nakamoto introduced Bitcoin, the first form of money that solves every problem fiat money created: ✅ Fixed supply—only 21 million BTC will ever exist ✅ Decentralized—no government can manipulate it ✅ Portable—move millions across borders in seconds ✅ Divisible—spendable in fractions (satoshis) ✅ Immutable—no one can change the rules

Bitcoin is money upgraded for the digital age—a return to honest money, but with even better properties than gold. Unlike fiat, it can’t be printed into oblivion. Unlike gold, it can be transferred instantly across the world.

But more importantly, Bitcoin is the last form of money we will ever need.

For the first time in history, humanity has discovered the perfect monetary system—one that is truly scarce, censorship-resistant, and immune to manipulation. There will never be a better form of money than Bitcoin.

Every previous attempt at money was just a stepping stone to get us here. The search is over.

Conclusion: The Return to Sound Money

History is clear: fiat is an experiment, and Bitcoin is the correction.

For thousands of years, money was scarce, valuable, and honest. Bitcoin brings us back to that reality, but in a modern, digital form.

This isn’t just another monetary system—it’s the final iteration of money itself.

The evolution of money is complete. Now it’s up to you: 🚀 Will you adopt the next generation of money? 🕰️ Or will you be left behind in a failing fiat system?

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#MoneyEvolution#SoundMoney#FiatIsFailing#DigitalGold#BitcoinFixesThis#FinancialFreedom#HardMoney#EndTheFed#InflationKills#HistoryOfMoney#BitcoinStandard#CryptoRevolution#DecentralizedFinance#BarterToBitcoin#TickTockNextBlock#cryptocurrency#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#financial experts#unplugged financial#blockchain

11 notes

·

View notes

Text

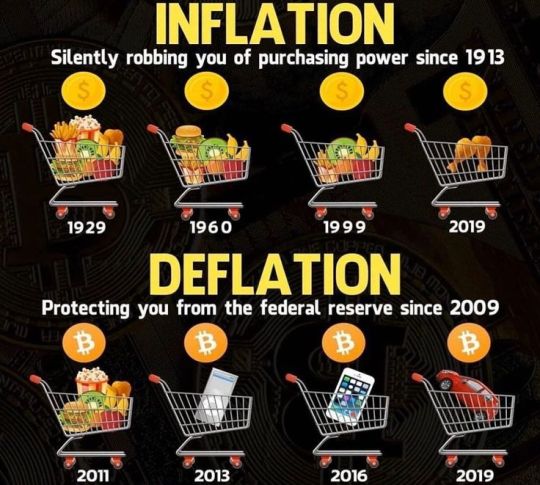

Your Money Is Dying While Bitcoin Is Rising 💸 vs ₿ — SEE WHY!

💰 INFLATION is a silent thief — robbing your purchasing power since 1913 😤 🛒 What a dollar bought in 1929... barely buys an orange today 🍊💔

But then came Bitcoin...

⚡️ DEFLATION by design ⚒ Since 2009, BTC has gone from buying groceries ➡️ to buying PHONES ➡️ to buying CARS 🚗 All while fiat just... dies slowly 😵💫

⛓ This isn’t just a meme — it’s a wake-up call. 🚨 If you're still saving in fiat... you're getting poorer every day.

🔗 Find out how to escape the system now

#BitcoinVsFiat#EscapeInflation#DeflationPower#BitcoinReality#CryptoAwareness#FinancialFreedom#BTCvsDollar#WealthPreservation#BitcoinRevolution#InflationKills#BitcoinFixesThis#DigitalGold#InvestSmart#OptionsSwing

0 notes

Photo

Learn more @x1kcommercials on our IGTV . Fundamental truth of engaging fellow entrepreneurs online. PART 1 OF 2 . You have to have a strategy. 5 plans or more to achieve 1 goal is a strategy. If 2 plans fail you still have a chance to find a new client examples . Example: X1K Commercials We create video ads for online businesses. . We Show business owners how to create video ads, no expensive equipment, software or experience needed. . We have a video marketing course to train video ad creation on lock. We show them how to use video ads ONLINE 2 produce traffic, leads and sales. . We create professional conversion tailored websites and landing pages connected to Google ads and ready to run YouTube ads. . We have a FB ads A-Z course by a celebrity network marketer who runs ads for fortune 500 Companies. . We also have a professional FB ads guy who will train you how to use FB ads. . We have much more. X1K IS THE TRUTH👑. See the 5 plans(Strategy) DM us for more info. . This is 1 of 2. If your engaging fellow entrepreneurs online to find new clients the kind of BUSINESS OR SERVICE you have will triple your chances of success. We're going to discuss that method in the next video. . Hit the post notifications! . . . . #bitcoinfixesthis #bitcoinforcash #bitcoinoffer #bitcoinontherise #bitcoinjappan #bitcoininusa #bitcoinchief #bitcoinhashpower #bitcoindominance #bitcoingold #bitcoinforextrading #bitcoinlambo #forexdaytrade #forexforecast #bitcoinflip. #marketingstrategy #salestips #salestraining #salescoaching #salescoach #salesonline #salestrainer #marketingsolutions #marketingfact #marketingforsmallbusinesses #x1kcommercials #VideoMarketingUniversity (at Los Angeles, California) https://www.instagram.com/p/CLX2DU0DL9A/?igshid=1eqccsoil6ug3

#bitcoinfixesthis#bitcoinforcash#bitcoinoffer#bitcoinontherise#bitcoinjappan#bitcoininusa#bitcoinchief#bitcoinhashpower#bitcoindominance#bitcoingold#bitcoinforextrading#bitcoinlambo#forexdaytrade#forexforecast#bitcoinflip#marketingstrategy#salestips#salestraining#salescoaching#salescoach#salesonline#salestrainer#marketingsolutions#marketingfact#marketingforsmallbusinesses#x1kcommercials#videomarketinguniversity

1 note

·

View note

Photo

Let’s go Tala 🏀⛹🏽♀️⛹🏽♀️⛹🏽♀️🇹🇴🇹🇴🇹🇴#BitcoinFixesThis https://www.instagram.com/p/CgTnrp8PVvy/?igshid=NGJjMDIxMWI=

0 notes

Text

RT @nvk: #BitcoinFixesThis Even better if done with LightingNetwork Why even bother begging/complaining to be banked. https://t.co/ZyNIJP5NG6

#BitcoinFixesThis Even better if done with LightingNetwork Why even bother begging/complaining to be banked. https://t.co/ZyNIJP5NG6

— NVK (@nvk) November 14, 2019

from Twitter https://twitter.com/fbeardev

0 notes

Text

The Cost of Trust: Why Bitcoin Was Inevitable

Every empire collapses under the weight of its own lies. Ours just happens to print theirs on paper.

For centuries, money has demanded trust. Trust in kings. Trust in banks. Trust in central banks. We were told the system worked, that the dollar was strong, that inflation was natural. We trusted the experts, the economists, the suits behind the curtain. But time and again, that trust has been betrayed.

First, they backed our money with gold. Then they removed the gold. Then they removed the brakes. By 1971, the U.S. dollar was no longer backed by anything but promises. And when the promises broke, they printed more. More money, more debt, more control. And somehow, we were expected to say thank you.

The truth is this: every fiat system ends in the same way—with the people holding the bag while the architects slip out the back door. We’ve seen it in Zimbabwe, Venezuela, Argentina. And we’re watching the slow bleed happen again across the so-called "developed" world. Wages stay flat. Prices climb. Savings evaporate. The middle class is quietly being erased.

Meanwhile, the top gets richer. Insiders play with house money. The system isn’t broken. It’s working exactly as designed—to benefit those closest to the money printer and drain everyone else. You work harder, but your money works less. And when the next crisis hits, they bail out the banks again, not the people.

But something changed.

In 2009, during the smoldering aftermath of the last financial crisis, someone—or someones—built a way out. Bitcoin didn’t ask for your permission. It didn’t ask for your trust. It offered something different: rules without rulers. A system where no central authority could inflate away your time, your effort, your life’s work.

Bitcoin flips the script. Instead of trusting humans, it relies on math. Instead of secrecy, it offers transparency. Instead of inflation, it has hard-coded scarcity. It’s not perfect—but it doesn’t pretend to be fair while rigging the game behind closed doors. It’s honest money in a dishonest world.

Proof-of-Work is more than a protocol. It’s a philosophy. A declaration that truth must be earned, not granted. That value comes from effort, not decree. Bitcoin didn’t just show up—it emerged, precisely when it was needed most. And for many of us, it felt like destiny.

Because once you see how broken the system is, you can’t unsee it. Once you understand that the cost of trust is your future, your time, your children’s chances—you realize why Bitcoin was not just a good idea. It was inevitable.

The cost of trust was too damn high. So we built something better.

Tick tock. Next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#SoundMoney#FiatIsTheProblem#Hyperinflation#Decentralization#Trustless#FinancialRevolution#CryptoPhilosophy#ProofOfWork#AustrianEconomics#MoneyPrinterGoBrrr#BitcoinFixesThis#WakeUp#DigitalGold#MonetaryHistory#TheCostOfTrust#NextBlock#TickTockNextBlock#BitcoinEducation#UnpluggedFinancial#financial empowerment#blockchain#finance#globaleconomy#digitalcurrency#unplugged financial#financial education#cryptocurrency#financial experts

6 notes

·

View notes

Text

Bitcoin: The First Truly Autonomous System

Imagine a system so resilient, so incorruptible, that it doesn’t require human oversight to function. A financial network that operates in perfect harmony, never stopping, never asking for permission, never needing a bailout. While governments rise and fall, while corporations collapse under mismanagement, and while even artificial intelligence still needs human programmers to shape its course, Bitcoin just runs.

It doesn’t take weekends off. It doesn’t panic in a crisis. It doesn’t wait for approval from any central authority. It is the first—and only—truly autonomous financial organism.

A Machine That Governs Itself

In traditional finance, systems crumble when humans fail. Banks miscalculate risk and go under. Central banks print money recklessly, causing inflation that eats away at people’s savings. Governments manipulate markets to serve political interests. But Bitcoin stands apart. It exists without rulers, without committees, without corruption. Its only master is its code—an immutable set of rules that no single entity can alter.

There is no CEO of Bitcoin. No government controls its issuance. No banker decides who can access it. Bitcoin is pure logic, a trustless system where transactions are verified by mathematics rather than human opinion. Every 10 minutes, a new block is added, and the network continues forward, unbothered by the chaos of the human world.

AI Needs a Master—Bitcoin Does Not

Some might argue that artificial intelligence is the pinnacle of autonomous technology, but AI still needs human intervention. It must be trained, maintained, and aligned with human interests—or risk spiraling into unintended consequences. AI can be shut down, reprogrammed, or manipulated by those in power. Bitcoin cannot.

Even Central Bank Digital Currencies (CBDCs), which governments will claim to be “modernized” digital money, will be programmed with rules dictated by bureaucrats. They will be surveilled, censored, and controlled. Bitcoin, on the other hand, is self-governing. Its ledger is open, its supply is fixed, and its rules are enforced by an unstoppable network of participants spread across the globe.

A Neutral System in a World of Bias

Bitcoin doesn’t care who you are. It doesn’t care about your nationality, your political beliefs, or your economic status. It treats everyone equally, offering the same rules and the same access. In a world where financial systems are weaponized—where bank accounts are frozen due to politics, where hyperinflation robs entire populations of their wealth—Bitcoin remains untouched. It is the last truly neutral system, offering financial sovereignty to anyone who seeks it.

The Birth of Digital Sovereignty

Bitcoin is more than just money. It is the blueprint for a future where autonomous systems can outlast the failures of human governance. Its ability to function without oversight, without corruption, and without centralized control makes it unlike anything that has ever existed before.

As long as a single node runs, Bitcoin lives. No government decree, no economic collapse, no act of war can erase it. It is the first of its kind—a system that does not ask for permission, does not yield to power, and does not stop. It is autonomy in its purest form.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Decentralization#FinancialFreedom#Autonomy#SelfSovereignty#CryptoRevolution#SoundMoney#DigitalGold#BlockchainTechnology#BitcoinFixesThis#MoneyOfTheFuture#EconomicFreedom#TheFutureIsNow#Hyperbitcoinization#BitcoinPhilosophy#blockchain#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#unplugged financial#cryptocurrency#financial experts

4 notes

·

View notes

Text

Why Fiat Always Ends in Ruin

What do Roman emperors, Chinese dynasties, and modern central banks have in common? They all thought they could outsmart the laws of money. And every single time, they were wrong.

Fiat currency, the kind backed by nothing but government decree, has a perfect track record. A record of failure. From the ancient denarius to today’s dollar, history shows us one truth: when money is no longer scarce, it becomes worthless. Every time a government has chosen fiat, it has ended in collapse, chaos, and economic ruin. No exceptions. Ever.

Let’s go back. Ancient Rome began with silver coins. Real value. But emperors couldn’t resist the temptation to fund wars and bread circuses by cutting the silver content. Over time, the denarius became a hollow shell, worthless in all but name. The empire followed soon after. By the time Rome fell, the currency had lost the trust of its people, and the economy had devolved into barter. What was once a thriving superpower had been gutted from within by monetary manipulation.

China’s Yuan Dynasty tried paper money first. A groundbreaking innovation, until it wasn’t. They printed more and more, devaluing their own currency until confidence collapsed. The dynasty fell into disarray. In later dynasties, the same pattern repeated: initial stability followed by excess, inflation, and societal disruption. Trust in money was replaced by desperation for goods. People fled back to bartering or hoarding hard assets like silver and grain.

Fast forward to Weimar Germany. After World War I, crushed by reparations and economic mismanagement, the German government printed its way into hyperinflation. Wheelbarrows of cash couldn’t buy a loaf of bread. Middle-class savings evaporated. Civil unrest surged. The chaos laid the groundwork for radical political movements because when money breaks, society follows.

Zimbabwe. Venezuela. Lebanon. Argentina. Different continents. Different decades. Same outcome. Once a government decouples its money from real value and begins printing without restraint, collapse is only a matter of time. Always.

Fiat fails because it’s not money, it’s a political tool. It’s a way to shift wealth silently. A mechanism of control. And because it’s so easy to manipulate, it always gets abused. Politicians promise more than they can fund. Wars need financing. Votes need buying. Bailouts need money. Central banks step in, spinning new currency out of thin air to make it happen. And the more they print, the more purchasing power you lose.

The result? Your savings lose value. Your wages buy less. Asset prices soar. And the real economy gets hollowed out in favor of financial games and speculative bubbles. Sound familiar? It should. Because we’re living through the late stages of another great debasement. The U.S. dollar has lost over 90% of its purchasing power in the last century. Today, most people can’t buy a home, can’t save for retirement, and live paycheck to paycheck, despite working harder and longer than ever before.

The illusion of control is what keeps this scam alive. Central planners tweak interest rates, massage CPI numbers, and gaslight the public with financial jargon. “Inflation is good,” they say. “We’re targeting 2%,” they repeat. But they never tell you that 2% inflation means your money halves in value every 35 years. And we all know it's rarely just 2%. They quietly redefine the metrics to hide the truth, while your quality of life deteriorates.

Every fiat collapse begins with the lie: this time is different. Spoiler alert, it never is.

But for the first time in history, we have a way out. A currency with no king, no emperor, no central planner. Bitcoin is the antidote to fiat rot. With a hard cap of 21 million coins, it’s immune to inflation. It’s global. Transparent. Unstoppable. It rewards saving, not spending. Patience, not panic. It gives power back to individuals and communities instead of bureaucrats and billionaires.

Bitcoin doesn’t just represent better money. It represents the end of this cycle. The end of trusting corrupt institutions to manage value on our behalf. It’s a reset, one we can choose. Unlike fiat, Bitcoin has no incentive to lie. It doesn’t fund wars. It doesn’t bail out bad decisions. It operates with mathematical certainty and zero bias. It’s money without masters.

Fiat will fail again. It’s already failing. The only difference this time is that we have an escape hatch. The door is open, but you have to walk through it. The system will not fix itself. It was never designed to. It was designed to transfer wealth from the many to the few, and it’s done that job spectacularly well.

History has taught us this lesson a thousand times. But lessons don’t matter unless we act on them. Bitcoin is our chance to finally learn, evolve, and build a future that’s not chained to lies.

Tick tock. Next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 This isn’t a book about money—it’s a manual for mental upgrades. The Day The Earth Stood Still 2.0 is a raw, unfiltered transmission from a mind that broke through the noise of modern life and emerged with a new operating system. Through personal awakening, quantum brain rewiring, and deep philosophical reflection, this book guides readers through the collapse of illusion and the rise of a new kind of awareness. It’s not about surviving the system. It’s about outgrowing it. Whether through choice or crisis, the upgrade is coming. Tick Tock. Next Thought.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#FiatCollapse#TheGreatDebasement#SoundMoney#MonetaryHistory#EndFiat#OptOut#Hyperinflation#EconomicTruth#BitcoinFixesThis#TickTockNextBlock#FinancialRevolution#HardMoney#WakeUpEconomics#financial empowerment#blockchain#finance#globaleconomy#unplugged financial#financial experts#financial education#digitalcurrency#cryptocurrency

3 notes

·

View notes

Text

Why the Entire Fiat System Is the Scam

What if I told you that the biggest Ponzi scheme in the world wasn’t hiding in some back alley or rogue crypto project—but was the foundation of the global economy itself? The scam is hiding in plain sight. It’s your paycheck. Your bank account. Your retirement fund. The entire fiat monetary system is the con of the century—and we’ve all been born into it like fish into water, never questioning the tank.

The genius of the fiat scam is that it doesn't look like one. It wears the mask of legitimacy: national flags, economists with PhDs, glossy charts, and televised press conferences. It masquerades as policy. It cloaks itself in “public good.” But behind that pristine façade is a game built on trust, coercion, and constant expansion. If a private citizen tried to run this kind of operation, they'd be behind bars before lunch. But when central banks and governments do it, it's called macroeconomics.

Let’s rewind. Once upon a time, money was tethered to something real—gold, silver, scarce resources. There were limits. Discipline. Accountability. But over time, that changed. Bit by bit, dollar by dollar, the gold standard was dismantled until, in 1971, Nixon cut the final cord. Since then, we’ve been floating on pure belief. Fiat money is paper backed by promises, propped up by policy, and enforced by power.

It works like this: governments spend more than they earn, so they borrow. Central banks step in to buy that debt—essentially printing money from thin air. That new money doesn’t magically create more value; it just dilutes what already exists. The first to touch that fresh cash—the government, the banks, the insiders—get the benefit. By the time it trickles down to you, prices have already risen. Your purchasing power is weaker, your savings worth less, and your effort buys you a shrinking piece of the pie. It’s called the Cantillon Effect, and it’s baked into the system.

This is the Ponzi structure in full effect: new money props up old promises. Debt pays for debt. Interest payments grow. The base of the pyramid—the average citizen—must always grow in number or productivity to keep the illusion going. But there's a catch: productivity has limits. Population growth slows. And when the bottom can't support the top? The whole thing trembles.

And still, the spin continues. Inflation is rebranded as “healthy.” Endless growth is called “necessary.” We’re told that 2% annual theft from your savings is “good for the economy.” Meanwhile, real wages stagnate. Houses become speculative assets. Education turns into lifelong debt. The dream becomes a grind. The system manufactures dependence while punishing independence. Those who save are quietly penalized, while those who borrow recklessly are often bailed out. The rules are inverted—virtue is punished, and vice is subsidized.

People are told to invest in the stock market just to outrun inflation. But that’s not investing—that’s gambling to survive. Retirement plans are tied to Wall Street's performance, not your actual productivity. Your future is collateral in a system designed to cannibalize the present to prop up the past. And if you dare question it? You're labeled a conspiracy theorist, a tinfoil-hat outsider, or worse—“financially illiterate.”

Bitcoin is not just a currency. It’s the antidote. It doesn’t rely on rulers or rules that can be changed behind closed doors. It runs on code—open, auditable, and uncensorable. Bitcoin doesn’t inflate. It doesn’t play favorites. It doesn't need bailouts, stimulus packages, or emergency meetings. It just works. Every 10 minutes. Like clockwork.

Bitcoin shines a light on the con. That’s why it’s attacked. That’s why it’s dismissed. Because it exposes what came before it—and dares people to imagine something better. It’s not just an exit—it’s a rebellion. A silent protest with every sat stacked. A way to say, “I see through your game, and I’m not playing anymore.”

Opting into Bitcoin is a reprogramming of your financial DNA. It's reclaiming your time, your energy, and your future. It’s saying no to debasement, to rigged incentives, to the debt trap. It’s a signal of awareness. A beacon of hope. A tool of peaceful revolution.

The fiat system isn’t broken. It’s working exactly as designed—to benefit those who control it. But the truth is out. The pyramid’s foundation is cracking. And people are waking up. Some slowly. Others all at once. The veil is lifting.

The only question now is: will you?

Tick tock. Next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 This isn’t a book about money—it’s a manual for mental upgrades. The Day The Earth Stood Still 2.0 is a raw, unfiltered transmission from a mind that broke through the noise of modern life and emerged with a new operating system. Through personal awakening, quantum brain rewiring, and deep philosophical reflection, this book guides readers through the collapse of illusion and the rise of a new kind of awareness. It’s not about surviving the system. It’s about outgrowing it. Whether through choice or crisis, the upgrade is coming. Tick Tock. Next Thought.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#FiatIsTheScam#PonziScheme#EconomicTruth#MonetaryRevolution#OptOut#TickTockNextBlock#SoundMoney#EndTheFed#CryptoPhilosophy#FinancialAwakening#BitcoinFixesThis#TheGreatAwakening#TruthEconomics#BitcoinIsFreedom#financial empowerment#digitalcurrency#finance#financial experts#globaleconomy#financial education#cryptocurrency#unplugged financial#blockchain

2 notes

·

View notes

Text

Bitcoin’s Energy Usage: The Most Misunderstood Innovation in Human History

They say Bitcoin is boiling the oceans. That it’s an environmental villain. That its energy use is unjustifiable.

But what if the real crime isn't the energy Bitcoin uses, but the narrative built to demonize it? What if Bitcoin isn’t the problem... but the blueprint for the solution?

Let’s talk truth. Let’s rip apart the lazy headlines and go deeper. Because beneath the noise is a revolution most people still don’t understand.

Bitcoin uses energy. So does everything that matters.

The media loves to compare Bitcoin to Visa or PayPal, painting it as inefficient or unsustainable. But that’s like comparing a flashlight to the sun. Visa runs on the rails of a trusted, centralized system. Bitcoin is the rail. It’s the whole damn thing—a self-contained, decentralized monetary system that operates without permission, politics, or backroom deals.

Its energy use isn’t a bug. It’s the bedrock. Proof-of-Work ties digital value to physical reality. It makes Bitcoin incorruptible. You can’t fake a Bitcoin. You can’t conjure it with a keystroke. You earn it by anchoring to the laws of thermodynamics. It’s not "magic internet money" – it’s physics-backed truth in a world of fiat fiction.

Meanwhile, the traditional financial system gets a free pass. Nobody counts the fuel burned by fleets of armored trucks hauling cash. Or the skyscrapers lit 24/7. Or the servers running endless transactions across thousands of banks, hedge funds, and central banks. No one questions the carbon footprint of the military-industrial complex that keeps the petrodollar on life support.

Bitcoin replaces all that bloat with software. With math. With consensus instead of coercion. It doesn’t require tanks to back it up. It doesn’t need to spy on you to enforce rules. It just runs. Borderless. Permissionless. Unstoppable.

But here’s where things get interesting.

Bitcoin mining isn’t just not bad for the environment. It could be the greatest tool we’ve ever had for energy innovation.

Across the globe, Bitcoin miners are setting up shop where energy is cheap, stranded, or wasted. Remote hydro in the mountains. Natural gas flares in oil fields. Oversupplied wind farms with nowhere to send excess power. Miners turn this lost energy into economic value. They act as a buyer of last resort—a pressure release valve for unstable grids and a reason to build more renewables.

This isn’t hypothetical. It’s happening right now. In Texas, Bitcoin miners are helping stabilize the grid. In parts of Africa, they're jumpstarting economic activity by creating demand where there was none. This is not an energy hog. This is a global infrastructure upgrade wrapped in code.

So why the backlash?

Because Bitcoin exposes the rot. It shines a light on the inefficiency, the fragility, and the waste embedded in the old system. It asks uncomfortable questions. It refuses to play by the rules of fiat gatekeepers. And that scares people.

It forces us to confront the truth: that energy isn’t the problem. Corruption is. Misaligned incentives are. And Bitcoin is the first monetary network in human history that rewards transparency, efficiency, and truth.

We’re witnessing the dawn of a new era—one where money is no longer a tool for control, but a tool for freedom. One where energy isn’t rationed by bureaucracy, but unleashed by innovation.

Bitcoin’s energy use isn’t a moral failing. It’s the cost of freedom. The cost of opting out. The cost of building something better.

We’ve misunderstood the most important innovation of our time.

But the block clock keeps ticking. And history has a way of proving the truth.

Tick tock. Next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#BitcoinEnergy#ProofOfWork#SoundMoney#FixTheMoneyFixTheWorld#Decentralization#DigitalGold#BitcoinIsHope#CryptoRevolution#FinancialFreedom#EnergyInnovation#BitcoinMining#EndTheFUD#MonetaryRevolution#UnpluggedFinancial#TickTockNextBlock#BitcoinFixesThis#SustainableFuture#EconomicTruth#EnergyFUD#financial empowerment#blockchain#finance#globaleconomy#digitalcurrency#financial education#financial experts#unplugged financial#cryptocurrency

5 notes

·

View notes

Text

Truth Has No PR Team. Fiat Does.

Truth doesn’t need a marketing budget. It doesn’t hire spokespeople or run flashy ads between football games. Truth doesn’t beg for approval. It doesn’t need likes, retweets, or a blue checkmark. Truth just waits—silent, patient, unyielding. And when the lies collapse under the weight of their own contradictions, truth is still standing.

Fiat currency? Oh, it has the full PR machine. Politicians, economists, media outlets—all reading from the same script. "Inflation is normal." "Central banks have it under control." "This is how it's always worked." They need you to believe that money losing value over time is just part of life. They need you distracted. Because if you ever really looked under the hood, the whole system would fall apart.

Lies are loud because they have to be. They’re fragile. They need reinforcement. That’s why fiat is everywhere you look: news cycles, commercials, sponsored experts. It can’t stand still. It has to run fast enough to outrun its own decay. The second it slows down, people start asking questions.

Bitcoin doesn’t shout. It doesn’t run a campaign. It simply exists, block after block, verifying truth every ten minutes. It doesn't have a CEO. No bailout button. No printing press. Just math, code, and consensus. That’s what makes it terrifying to those in power. It doesn’t need them. It doesn’t ask permission. It’s the quiet kid in the back of the classroom who ends up changing the world.

Fiat has a PR team because it has something to sell. Bitcoin has no PR team because it doesn’t sell anything. It is the thing. It doesn’t convince you—it invites you. And once you get it, really get it, you can’t unsee it. You start hearing the silence behind the noise. You start seeing through the slogans and into the structure.

The truth doesn’t scream. It doesn’t hustle. It just keeps being true.

And if the truth ever had a PR team, it would look a lot like us. The ones who saw it early. The ones who couldn’t unsee it. The ones who feel a fire in their chest every time someone says, "Bitcoin is just a fad."

We are the marketing. We are the movement.

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#TruthBomb#FiatIsTheLie#DecentralizeEverything#MoneyRevolution#SoundMoney#BitcoinFixesThis#CryptoPhilosophy#WakeUpCall#TickTockNextBlock#NoMoreLies#OptOut#UnpluggedFinancial#TheFutureIsOrange#EconomicTruth#cryptocurrency#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#financial experts#unplugged financial#blockchain

2 notes

·

View notes

Text

Why Bitcoin is So Polarizing: The Digital Revolution That Divides the World

Few innovations have sparked as much debate as Bitcoin. Some see it as the financial revolution of the century, while others dismiss it as a speculative bubble or a tool for criminals. But why does this digital asset evoke such extreme reactions? The answer lies in the fundamental way Bitcoin challenges long-held beliefs about money, power, and control.

A Currency or a Cult?

Bitcoin isn’t just another form of money—it’s an idea. And like all powerful ideas, it disrupts the status quo. Those who believe in its potential see it as a lifeboat in a financial system built on debt, inflation, and central bank intervention. Those who oppose it see it as a threat to stability, a reckless experiment that could end in disaster. The divide isn’t just about numbers on a screen; it’s about worldviews, trust, and who gets to define what money really is.

The True Believers

To Bitcoin’s supporters, the flaws of traditional finance are obvious. Central banks print money endlessly, inflating away savings. Banks fail, requiring taxpayer bailouts. Entire economies crumble under the weight of mismanaged monetary policies. Bitcoin offers an escape—a fixed supply, a trustless system, and financial sovereignty for anyone with an internet connection. It’s the antidote to the problems people didn’t realize they had until Bitcoin exposed them.

For many, Bitcoin represents personal empowerment. It allows people to be their own bank, store value outside the reach of governments, and participate in a truly global financial network. In places suffering from hyperinflation or economic collapse, Bitcoin isn’t just a speculative asset—it’s survival.

The Critics and Skeptics

On the other side, skeptics argue that Bitcoin is nothing more than a digital mirage. Volatility makes it unreliable for everyday transactions. Its price swings wildly, making some rich overnight while leaving others devastated. Regulators see it as a financial Wild West, where scams and illicit activities thrive. Governments eye it warily, knowing it undermines their control over monetary policy.

Then there’s the environmental argument. Bitcoin mining requires massive computational power, leading to criticisms about energy consumption. Detractors claim it’s wasteful, though supporters counter that Bitcoin incentivizes renewable energy and is far more efficient than the existing financial system when considering the energy consumption of banks, ATMs, and data centers worldwide.

The Establishment vs. The Disruptors

At its core, Bitcoin represents a philosophical battle between centralization and decentralization. Governments and financial institutions exist to maintain control, stability, and regulation. Bitcoin, by design, removes the need for these intermediaries, shifting power from the few to the many. This redistribution of control is unsettling for those who benefit from the current system.

Wall Street once scoffed at Bitcoin, yet now institutions are quietly accumulating it. Countries like El Salvador embrace it as legal tender, while others scramble to regulate or even ban it. The lines between acceptance and resistance are constantly shifting as Bitcoin’s influence grows.

Cognitive Dissonance and the Fear of Change

Bitcoin forces people to confront uncomfortable truths. It reveals that money, as we know it, is not backed by anything tangible—it’s a system of trust. It challenges the notion that inflation is necessary or that governments should have unchecked control over currency issuance. These are difficult concepts to grapple with, and for many, it’s easier to dismiss Bitcoin than to question the foundation of the financial system they’ve always known.

Change is always met with resistance. Just as the internet was once ridiculed and dismissed as a fad, Bitcoin faces the same scrutiny. But history has a pattern—disruptive technologies are mocked, fought, and eventually, adopted.

The Future: Adoption or Rejection?

Bitcoin’s path is still uncertain. It could become the backbone of a new financial era, or it could remain a niche asset, misunderstood and feared. But one thing is clear—Bitcoin is not going away. Its network continues to grow, its principles of decentralization and sound money continue to attract converts, and its existence continues to challenge the global financial order.

In the end, the polarization surrounding Bitcoin is a testament to its significance. Ideas that don’t matter are ignored. Ideas that threaten the foundations of power are fought. Whether you see Bitcoin as salvation or speculation, it demands attention. And as more people wake up to the reality of our current financial system, the question isn’t whether Bitcoin will survive—but whether the world can afford to ignore it.

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Crypto#FinancialRevolution#Decentralization#Money#FutureOfFinance#SoundMoney#DigitalGold#Blockchain#CryptoNews#BitcoinAdoption#BitcoinFixesThis#CryptoCommunity#Economy#Investing#DisruptTheSystem#TechRevolution#Philosophy#Freedom#Hyperbitcoinization#financial education#finance#digitalcurrency#globaleconomy#unplugged financial#financial empowerment#cryptocurrency#financial experts

4 notes

·

View notes

Text

Central Bank Digital Currencies vs. Bitcoin – Control vs. Freedom

The world is shifting, and the battle for financial sovereignty is heating up. Governments are rolling out Central Bank Digital Currencies (CBDCs), while Bitcoin continues its rise as the antidote to financial oppression. On the surface, they might seem similar—both are digital currencies—but dig a little deeper, and the difference couldn’t be more profound. One is about control, the other about freedom.

The Illusion of Convenience

CBDCs will be marketed as a breakthrough in financial technology. Faster payments. More security. Easy access. But the fine print tells another story. These government-backed digital currencies are programmable, meaning central authorities will have the ability to dictate how, when, and where you can spend your money. They could enforce expiration dates on stimulus checks, block purchases they deem inappropriate, or even restrict access to your funds based on social behaviors. The financial system is already rigged, but CBDCs will remove even the illusion of control over your own money.

This is not paranoia; it’s a logical extension of the trajectory we’re on. When every transaction is monitored, every purchase tracked, and every financial decision scrutinized, what you have isn’t money—it’s a permission slip to participate in the economy.

Bitcoin: The Escape Hatch

Bitcoin operates on the exact opposite principle. No central authority. No gatekeepers. No arbitrary rules. When you hold Bitcoin, you hold true financial sovereignty. It cannot be devalued at the whim of a government. It cannot be frozen because of a policy change. It cannot be inflated into oblivion to cover up systemic mismanagement.

Bitcoin is digital property, secured by math and owned outright by whoever holds the keys. It exists outside of the political sphere, offering a neutral and fair playing field for anyone willing to opt in. And unlike CBDCs, which thrive on surveillance, Bitcoin operates on transparency without sacrificing privacy. Transactions are open, but identities remain pseudonymous. It’s the ultimate check against financial tyranny.

The Urgency to Act: DCA into Freedom

The question isn’t if CBDCs will become the standard—it’s when. The infrastructure is already being built, and when the switch flips, escaping that system will be exponentially harder. That’s why stacking Bitcoin now is crucial.

Dollar-cost averaging (DCA) is the simplest, most effective way to accumulate Bitcoin without worrying about price volatility. By setting up a recurring purchase—whether daily, weekly, or monthly—you steadily convert fiat into a form of money that cannot be debased or controlled. It’s the quiet revolution, a steady migration out of the collapsing fiat system and into an incorruptible store of value.

The key is not just buying Bitcoin but owning it properly. That means withdrawing it from exchanges and securing it in self-custody. The moment you hold your own keys, you’ve already opted out of their game. You’ve chosen sovereignty over subjugation. You’ve taken a step toward financial independence.

The Choice is Yours

CBDCs are not coming to give you more freedom—they are coming to take away what little you have left. Governments do not create new financial tools to relinquish control; they create them to tighten their grip. The difference between a world ruled by CBDCs and one powered by Bitcoin is the difference between being watched and being free.

But the window to act is closing. Bitcoin adoption is still early, but as its value becomes undeniable, opting in will become more expensive. Every block that is mined is one less opportunity to buy freedom at a discount.

The time to choose is now. Will you submit to a system where every dollar is monitored, restricted, and controlled? Or will you take the step toward true financial sovereignty? The answer isn’t in words—it’s in action.

Tick Tock, Next Block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#CBDC#FinancialFreedom#Decentralization#DigitalCurrency#BitcoinFixesThis#SoundMoney#OptOut#SovereignMoney#MonetaryRevolution#Crypto#EconomicFreedom#BitcoinEducation#HardMoney#DCA#StackSats#MoneyRevolution#Blockchain#NoCBDC#BitcoinNotBanks#financial empowerment#financial experts#unplugged financial#finance#financial education#cryptocurrency#globaleconomy

4 notes

·

View notes

Text

Bitcoin: The Ultimate Test of Free Will

At some point in life, everyone is presented with the orange pill—the opportunity to break free from the fiat illusion and take control of their financial destiny. Some people recognize Bitcoin for what it is: the hardest money ever created, an incorruptible escape hatch from government-controlled wealth. Others shrug it off, dismiss it as a fad, or worse—call it a scam.

But what if the decision to embrace Bitcoin isn’t just about money?

What if it’s a test?

A test of free will. A test of intelligence. A test of whether you can see beyond the system you were born into.

The Fiat Dream vs. The Bitcoin Reality

From birth, we’re plugged into a rigged game. The fiat system tells us to work hard, save money, and invest in assets controlled by the very people inflating away our purchasing power. The masses are hypnotized into believing that inflation is natural, that debt is wealth, and that money should be printed endlessly with no consequences.

But then Bitcoin arrives, shattering the illusion.

It doesn’t ask for permission.

It doesn’t compromise.

It doesn’t care whether you understand it or not.

Bitcoin is pure, objective truth wrapped in 21 million digital scarcity units. And yet, most people reject it on first contact.

Why?

Because Bitcoin doesn’t just challenge the financial system—it challenges the way people think.

Recognizing Bitcoin is a Higher-Order Intelligence Test

The ability to grasp Bitcoin’s value might actually be the ultimate IQ test.

Not IQ in the traditional “solve these math problems” sense, but pattern recognition, critical thinking, and independent reasoning. It requires breaking free from economic programming, questioning authority, and seeing the bigger picture—something most people struggle with.

Consider this:

The smartest investors in the world, like Michael Saylor, went from dismissing Bitcoin to going all-in once they actually studied it.

The average person, despite overwhelming evidence, still thinks it’s “too volatile” or “not real money.”

Governments and banks, institutions that thrive on control, fear Bitcoin because they can’t manipulate it.

Bitcoin is the great separator—it filters out those who see the matrix from those who remain trapped inside it.

Free Will vs. Financial Indoctrination

If Bitcoin is a test of free will, then most people are failing it. Not because they’re incapable of understanding it, but because they refuse to challenge their existing beliefs.

Think about it:

How many people mock Bitcoin without ever researching how it works?

How many people parrot media narratives without questioning who funds those media outlets?

How many people choose to remain in the fiat system simply because it's familiar, even as it destroys their purchasing power?

Bitcoin doesn’t require faith. It doesn’t require trust. It only requires a willingness to see.

The orange pill is right in front of them. The choice is theirs.

Tick Tock, Next Block

Bitcoin continues, block after block, whether people accept it or not. Every day, the test presents itself again:

Do you stay in the fiat dream? Or do you wake up?

One day, the world will no longer be measured in dollars. The orange pill won’t be optional—it will be inevitable.

By then, the test will be over.

And only those who passed will be ready.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Crypto#DYOR#FinancialFreedom#OrangePill#MoneyRevolution#SoundMoney#Blockchain#Decentralization#HardMoney#FutureOfFinance#SelfSovereignty#EconomicFreedom#FiatIsDying#Hyperbitcoinization#BitcoinFixesThis#BTCMindset#StayHumbleStackSats#TickTockNextBlock#financial education#financial experts#globaleconomy#finance#digitalcurrency#financial empowerment#unplugged financial#cryptocurrency

2 notes

·

View notes

Text

Bitcoin is the Cheat Code to Opt Out

In gaming, a cheat code lets players bypass restrictions and take full control. Bitcoin is the financial equivalent—a way to exit the rigged system of fiat currency, government control, and economic manipulation. The traditional game is designed to benefit the elite, but Bitcoin changes the rules, giving power back to the people.

The Broken Fiat System

Fiat currency is a losing game for the average person. Governments and central banks print money endlessly, eroding purchasing power and inflating away savings. The more money they create, the more they dilute its value—stealing from those who work and save while enriching those closest to the money printer.

History proves the danger. Weimar Germany, Zimbabwe, Venezuela—fiat collapses have wiped out economies and destroyed entire generations of wealth. The same pattern is unfolding today, just on a global scale. With Central Bank Digital Currencies (CBDCs) on the horizon, financial surveillance and control will only intensify. The system isn’t broken by accident—it was designed this way.

How Bitcoin Fixes This

Bitcoin offers a way out. Unlike fiat, it can’t be inflated, seized, or manipulated by any government or institution. It operates on a decentralized network governed by math and cryptography, not human corruption.

Bitcoin’s key advantages:

Fixed Supply: Only 21 million will ever exist—no printing, no inflation.

Decentralized Control: No bank or government can freeze or seize your holdings.

Borderless & Permissionless: No one can stop you from sending or receiving Bitcoin.

Transparent & Secure: The blockchain ensures financial integrity without central oversight.

Hedge Against Inflation: Bitcoin preserves value over time, unlike fiat’s endless decline.

Bitcoin restores financial sovereignty, allowing individuals to truly own their wealth.

DCA: The Smart Way to Accumulate Bitcoin

You don’t need to be rich or time the market to benefit from Bitcoin. Dollar-Cost Averaging (DCA) is the best way to accumulate BTC over time, regardless of price swings.

With DCA, you:

Buy small amounts of Bitcoin at regular intervals, reducing exposure to short-term volatility.

Remove emotion from investing—no need to time the market.

Gradually build a strong Bitcoin position without feeling financial strain.

A simple habit—investing even $25 a week—can accumulate serious value over time. Platforms like Swan Bitcoin, Strike, and Cash App make it easy.

Practical Steps to Opt Out

Escaping the fiat system starts with action. Here’s how:

Start Acquiring Bitcoin – Stack sats regularly using DCA.

Take Self-Custody – Move your BTC off exchanges into a secure wallet.

Use Bitcoin for Transactions – Support merchants who accept BTC and help build the circular economy.

Educate Yourself & Others – The more people understand Bitcoin, the stronger the movement.

Prioritize Privacy – Use tools like CoinJoin and the Lightning Network to protect your financial sovereignty.

The Future: A World on a Bitcoin Standard

Imagine a world where money isn’t controlled by governments or devalued at will:

No more inflation eroding savings.

No more financial censorship or surveillance.

No more market distortions—prices based on true supply and demand.

A fairer financial system where individuals, not institutions, hold power.

Bitcoin will reprice everything according to real economic value, not central bank manipulation. Those who adopt it now will be ahead of the greatest financial shift in history.

Conclusion

Bitcoin isn’t just another asset—it’s a parallel financial system built for freedom. The fiat world is crumbling, but the escape route is open.

Opt out. Stack sats. Secure your future.

The cheat code has been unlocked—are you ready to use it?

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#FinancialFreedom#OptOut#MonopolyMoney#FiatIsTheScam#BitcoinFixesThis#Decentralization#CryptoRevolution#StackSats#HODL#BTC#SoundMoney#DCA#EndTheFed#MoneyPrinterGoBrrr#Hyperbitcoinization#DigitalGold#InflationIsTheft#FixTheMoneyFixTheWorld#SovereignIndividual#blockchain#digitalcurrency#finance#globaleconomy#financial experts#financial education#financial empowerment#unplugged financial#cryptocurrency

2 notes

·

View notes