#MoneyEvolution

Explore tagged Tumblr posts

Text

The Evolution of Money: From Seashells to Bitcoin

Money has existed in countless forms throughout history, yet most people never stop to ask: What makes good money?

For thousands of years, civilizations experimented with different forms of exchange—seashells, gold, paper, and now digital numbers in bank accounts. But each step in the evolution of money had flaws—until now.

With Bitcoin, we have found humanity’s final form of money—a system so perfect in design that we will never need to create another. This is the end of the road.

But to understand why, we need to take a journey through money’s evolution—from its primitive origins to its unstoppable digital future.

1. The Barter System: The First Attempt at Money

Before money, people relied on barter—trading goods and services directly. A farmer might trade wheat for a blacksmith’s tools. But bartering had major problems:

No common measure of value (how many fish equal one cow?)

No easy way to store value for the future

No portability—you can’t carry 100 goats to the marketplace

Bartering worked in small, localized communities, but as societies grew, they needed a universal standard of value. Thus, money was born.

2. Commodity Money: When Money Had Real Value

Early civilizations experimented with commodity money—physical items that held intrinsic value, such as: ✅ Gold & silver ✅ Salt (Roman soldiers were paid in salt, hence “salary”) ✅ Cattle ✅ Seashells

These materials worked better than barter because they were scarce, durable, and widely accepted.

Gold and silver eventually became the dominant form of money because they were: ✔ Difficult to counterfeit ✔ Easily divisible into smaller units ✔ Portable compared to heavy trade goods

For thousands of years, gold was money. It was the foundation of trade, wealth, and empires. But gold had a problem—it was too honest. Governments and rulers couldn’t manipulate it easily. So they found a way to cheat the system.

3. Paper Money: The First Step Toward Corruption

Carrying gold was inconvenient, so people began storing it in banks. In return, banks issued paper notes that represented a claim on gold—essentially IOUs for real money.

At first, these notes were backed 1:1 by gold, but over time, governments realized they could print more paper than they had gold, allowing them to: ❌ Fund wars without raising taxes ❌ Control the economy by printing money at will ❌ Steal wealth from citizens through inflation

This was the birth of fiat money—currency that is backed by nothing but government decree.

4. Fiat Money: The Great Experiment

In 1971, the U.S. completely abandoned the gold standard, turning the dollar into pure fiat—money backed by nothing but the government’s promise.

The result? 📉 The dollar lost over 90% of its purchasing power 📈 Wealth inequality skyrocketed as the rich got first access to new money 💸 Inflation became a permanent, systemic problem

Fiat money is a historical anomaly. Every single fiat currency before today has collapsed due to overprinting, hyperinflation, or government mismanagement.

The U.S. dollar is no different—it’s just the latest version of the same mistake.

This is why Bitcoin was created.

5. Bitcoin: The Final Evolution of Money

In 2009, Satoshi Nakamoto introduced Bitcoin, the first form of money that solves every problem fiat money created: ✅ Fixed supply—only 21 million BTC will ever exist ✅ Decentralized—no government can manipulate it ✅ Portable—move millions across borders in seconds ✅ Divisible—spendable in fractions (satoshis) ✅ Immutable—no one can change the rules

Bitcoin is money upgraded for the digital age—a return to honest money, but with even better properties than gold. Unlike fiat, it can’t be printed into oblivion. Unlike gold, it can be transferred instantly across the world.

But more importantly, Bitcoin is the last form of money we will ever need.

For the first time in history, humanity has discovered the perfect monetary system—one that is truly scarce, censorship-resistant, and immune to manipulation. There will never be a better form of money than Bitcoin.

Every previous attempt at money was just a stepping stone to get us here. The search is over.

Conclusion: The Return to Sound Money

History is clear: fiat is an experiment, and Bitcoin is the correction.

For thousands of years, money was scarce, valuable, and honest. Bitcoin brings us back to that reality, but in a modern, digital form.

This isn’t just another monetary system—it’s the final iteration of money itself.

The evolution of money is complete. Now it’s up to you: 🚀 Will you adopt the next generation of money? 🕰️ Or will you be left behind in a failing fiat system?

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#MoneyEvolution#SoundMoney#FiatIsFailing#DigitalGold#BitcoinFixesThis#FinancialFreedom#HardMoney#EndTheFed#InflationKills#HistoryOfMoney#BitcoinStandard#CryptoRevolution#DecentralizedFinance#BarterToBitcoin#TickTockNextBlock#cryptocurrency#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#financial experts#unplugged financial#blockchain

11 notes

·

View notes

Text

🚀 Unlock the Future of Finance: Your Ultimate Bitcoin Starter Guide! 💰

Ever wondered how to dive into the world of Bitcoin but felt overwhelmed? 🤔 Your journey begins NOW! This incredible guide simplifies everything you need to know about getting started with Bitcoin – from setting up your secure wallet to sending and receiving your first digital coins. ✨

No more guesswork! We break down the essentials:

Downloading a Wallet: Your personal vault for digital wealth. 🔒

Saving Your Private Key: The secret to your Bitcoin's safety. 🔑

Receiving Bitcoin: Get ready to accept digital payments. 📥

Sending Bitcoin: Learn to transact with ease. 📤

This isn't just information; it's your roadmap to financial evolution! Don't miss out on understanding the currency of tomorrow. Ready to empower yourself with knowledge? 👇

Click here for the full guide and more insightful cryptocurrency tutorials! 👉 https://t.co/Ttddedmvoc

Let's revolutionize your understanding of money, together! 🚀

#Bitcoin#Cryptocurrency#Crypto#Blockchain#MoneyEvolution#DigitalCurrency#FinTech#InvestInYourself#FinancialFreedom#GetStarted#BeginnersGuide#LearnCrypto#SatoshiLibrary#FutureOfMoney#HODL

0 notes

Text

🚀 Crypto Is the Currency of the Future—Don’t Get Left Behind 🔮💰

The world is changing faster than ever—and so is money. Crypto isn’t just a new asset, it’s a new era. Transparent, borderless, and built for the digital age. Early adopters aren’t just ahead—they’re rewriting the rules. So ask yourself: will you lead the change or chase it later? ⏳💡 Click this link : https://tinyurl.com/y9exyz7b

#crypto#cryptocurrency#futureofmoney#dontgetleftbehind#blockchain#decentralizedfinance#defi#web3#digitalcurrency#bitcoin#ethereum#cryptoadoption#financialfreedom#cryptomovement#cryptotruth#newmoney#fintechrevolution#tumblrcrypto#cryptoera#nextgenfinance#moneyevolution

0 notes

Photo

#crytocurrency #cryptoinvestor #cryptoexchange #cryptomarket #moneyevolution 🌍 time has come for you to take part in money evolution, if you will be successful then begin to invest today...... https://www.instagram.com/p/BuX8qn7AfRF/?utm_source=ig_tumblr_share&igshid=1pdxdgmwe633e

0 notes

Text

MicroStrategy & Corporate Bitcoin Adoption: Is This the Start of a Trend?

When MicroStrategy made its first Bitcoin purchase in August 2020, many dismissed it as an eccentric move by its outspoken CEO, Michael Saylor. Fast forward to today, and the company has become the largest publicly traded holder of Bitcoin, with billions of dollars converted from cash reserves into digital gold. What started as an outlier decision now looks more like the beginning of a broader shift in corporate finance.

But why are big companies buying Bitcoin, and what does this signal for the future of business and finance?

Why Corporations Are Buying Bitcoin

Historically, companies have held cash reserves in banks, government bonds, or other low-risk assets. This strategy worked well when inflation was low, and the dollar remained relatively stable. But over the past few years, the financial landscape has changed dramatically. Governments worldwide have ramped up money printing, leading to concerns over currency debasement. With inflation eating away at purchasing power, sitting on cash has become an increasingly bad idea.

Bitcoin presents an alternative. Unlike fiat currencies, which can be endlessly printed, Bitcoin has a fixed supply of 21 million coins. This scarcity makes it a hedge against inflation and currency devaluation, much like gold but with superior portability, liquidity, and security.

For MicroStrategy, the logic was simple: keeping cash in dollars meant losing value over time, while holding Bitcoin offered long-term appreciation potential. Their gamble paid off, with the company's Bitcoin holdings significantly appreciating, boosting their overall market valuation.

The Ripple Effect: Who’s Following MicroStrategy’s Lead?

MicroStrategy’s aggressive Bitcoin strategy has influenced other corporations to take notice. Tesla, led by Elon Musk, briefly bought Bitcoin for its balance sheet, though it later sold a portion. Block (formerly Square), owned by Jack Dorsey, has also been a strong advocate, integrating Bitcoin into its business model.

Now, we’re seeing institutional adoption growing beyond just tech companies. Major financial firms like BlackRock and Fidelity have started offering Bitcoin-related investment products, and traditional banks are scrambling to provide crypto services to high-net-worth clients.

Even Microsoft, one of the world’s largest companies, is facing internal shareholder pressure to consider adding Bitcoin to its reserves. While not all businesses will go as far as MicroStrategy, the idea of holding Bitcoin as a treasury asset is becoming less radical by the day.

What This Signals for the Future

MicroStrategy’s moves have sparked a crucial conversation about how companies manage their financial reserves. If more corporations adopt Bitcoin, it could significantly change global finance:

New Standard for Treasury Reserves – If Bitcoin becomes a widely accepted reserve asset, businesses will no longer be tied to the traditional financial system’s limitations.

Increased Stability and Legitimacy for Bitcoin – Corporate adoption reduces volatility and strengthens Bitcoin’s position as a reliable asset.

Pressure on Governments and Regulators – The more companies hold Bitcoin, the harder it becomes for governments to ignore or attempt to ban it.

Some argue that Bitcoin’s volatility makes it a risky bet for corporations. However, volatility is a feature of any emerging asset. As adoption increases, the market will likely stabilize, making Bitcoin even more attractive for long-term holding.

Conclusion

What started as MicroStrategy’s bold experiment is now looking more like the early stages of a financial transformation. More companies are recognizing that Bitcoin isn’t just a speculative asset—it’s a long-term hedge against a failing fiat system. If this trend continues, we could see a future where holding Bitcoin on the balance sheet isn’t just an option for corporations—it’s a necessity.

The question is no longer if more companies will follow MicroStrategy’s lead, but when.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#MicroStrategy#CorporateFinance#CryptoAdoption#FinancialRevolution#BitcoinTreasury#HODL#DigitalGold#InflationHedge#CryptoInvesting#SoundMoney#FutureOfFinance#Blockchain#FiatCollapse#BTC#BitcoinNews#MoneyEvolution#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#financial experts#unplugged financial#cryptocurrency

3 notes

·

View notes

Text

From Seashells to Satoshis: The Evolution of Money

Picture an ancient marketplace, where the currency jingling in your pouch might not be coins at all, but seashells. For centuries, cowrie shells were prized for their shiny appeal and rarity, transforming them into one of humanity’s earliest forms of money. Over time, these shells gave way to metals—iron, copper, silver, and gold—that gleamed with an unmistakable allure. Soon enough, our ancestors decided that lugging heavy gold and silver everywhere was a bit too cumbersome, so they started stamping metals into more convenient coins. This was the moment rulers realized something fundamental: whoever controls the mint, controls the economy. It wasn’t long before some couldn’t resist the temptation to mix cheaper metals in, keeping the gold for themselves. Those sneaky tactics brought about a new kind of challenge—trust.

Civilizations continued to experiment with what they could use as a medium of exchange, but ultimately, the golden standard took hold in many parts of the world. Gold’s scarcity, durability, and shiny mystique made it perfect for coins. That system thrived, yet society yearned for the next innovative step: paper currency. People quickly discovered that thin, foldable, and easy-to-carry notes were far superior to a pocketful of metal, and so governments printed paper money backed by vaults of precious metal. With the rise of fiat currency, the day came when the promise that these notes could be traded for gold or silver fizzled out entirely. Suddenly, many currencies were worth something simply because a central authority claimed so, and people believed it—or at least went along with the collective delusion. This arrangement flourished as economies globalized, but it also planted the seeds of modern financial headaches, like inflation and incessant money printing.

Still, the convenience of paper money was unmatched—until credit cards and online banking arrived. With a simple swipe or a tap on an app, individuals could pay for things in a purely digital sense. Transactions happened at lightspeed, all orchestrated by a network of banks and payment processors. Yet that centralization, which at first looked efficient, also created single points of failure. If banks had technical issues or simply felt your transaction was “suspicious,” access to your funds could vanish faster than you could say “insufficient funds.”

Enter Bitcoin, launched by the mysterious Satoshi Nakamoto. The idea behind Bitcoin was to create a system that didn’t require permission or trust in any single authority. Think of it as the next stage in the evolution of money—just like going from shells to gold, gold to paper, and paper to digital banking, the concept of decentralized digital coins felt like a natural leap. Here, the currency isn’t printed arbitrarily by a central bank; it’s “mined” through solving cryptographic puzzles. More importantly, every transaction is recorded on a public ledger called the blockchain, ensuring transparency, security, and an unwavering limit on the total supply.

Some critics argue that cryptocurrencies are too volatile or still too complex for mainstream adoption. Others worry about the energy consumed in mining. Yet, even those skeptics acknowledge that Bitcoin and other digital assets have ignited a global conversation. The very fact that governments and big financial institutions are grappling with how to regulate or incorporate crypto is proof that we’ve reached a tipping point. Humanity has always been restless when it comes to improving its systems, especially the system of money.

From shells in the marketplace to cryptographic tokens on the internet, the thread connecting us across history is innovation. We are constantly reimagining how to store and exchange value. The real question is not whether money will evolve once more—it’s how quickly this new chapter will redefine our personal freedoms, our economic structures, and the ways we trust one another. Will we cling to old traditions until they crumble, or embrace a future where blockchains, decentralized finance, and digital currencies reshape how we think about worth itself?

In the grand tapestry of civilization, money isn’t just coins and notes; it’s a story we tell ourselves about trust, power, and possibility. As we move ever closer to a world shaped by digital networks, the ancient shells on a faraway beach remind us that the idea of value is never fixed—it’s created, adapted, and refined. And now, in the age of Bitcoin, we’re just beginning to write the next chapter.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#MoneyEvolution#Blockchain#DigitalCurrency#FinancialRevolution#BitcoinEducation#CryptoHistory#FutureOfFinance#Decentralization#BitcoinFixesThis#SeashellsToSatoshis#MoneyMatters#EconomicFreedom#Hyperbitcoinization#SoundMoney#Finance#MoneyTalks#CryptoMindset#FiatVsBitcoin#financial experts#unplugged financial#financial empowerment#financial education#globaleconomy

3 notes

·

View notes

Text

Bitcoin: More Than Money—A Revolution in the Making

Imagine living in a world where your financial freedom is dictated by a handful of powerful entities, where corruption erodes trust, and inflation chips away at your hard-earned wealth. Now, picture a solution so revolutionary that it challenges these systems at their core. Bitcoin isn’t just a currency; it’s a movement that’s reshaping the way we think about money and power. Throughout history, revolutions have emerged to challenge entrenched systems and offer a better alternative. The American Revolution fought for independence. The Industrial Revolution brought technological innovation and economic transformation. Now, Bitcoin is leading a financial revolution—breaking free from the constraints of centralized control to deliver freedom, transparency, and sovereignty to individuals.

The spark for this revolution was ignited in 2008 with the release of Satoshi Nakamoto’s white paper. In a world reeling from financial collapse, Bitcoin offered a glimmer of hope: a decentralized system immune to corruption and inflation.

At its core, Bitcoin embodies the ideals of freedom, fairness, and transparency. It operates without a central authority, allowing individuals to transact directly with one another. Unlike fiat currencies, Bitcoin is trustless—no need to rely on governments or banks to validate its value. This philosophy of decentralization is reminiscent of historical movements that challenged central powers. Just as the printing press democratized access to knowledge, Bitcoin democratizes access to financial tools. It provides an alternative to systems that have long prioritized the few at the expense of the many.

The legacy financial system is rife with flaws. Inflation erodes wealth. Centralization concentrates power in the hands of a few. A lack of transparency breeds corruption. For billions of people, access to basic banking services remains a distant dream. Bitcoin offers a way out. Its deflationary model preserves value over time. Its blockchain ledger ensures transparency, making corruption and manipulation nearly impossible. And its borderless nature allows anyone, anywhere, to participate in the global economy. In countries like Venezuela and Nigeria, Bitcoin has become a lifeline, empowering individuals to escape the clutches of failing fiat currencies and oppressive regimes.

Bitcoin isn’t just a financial tool; it’s a cultural phenomenon. The “Bitcoin rabbit hole” draws people into a world of new ideas about money, value, and freedom. Its community—bound by memes, innovation, and shared ideals—represents a grassroots movement for change. On a technological level, Bitcoin mining has sparked innovation in renewable energy. Miners are incentivized to seek out the cheapest and most sustainable power sources, potentially accelerating the transition to green energy. This dual role as a disruptor and innovator underscores Bitcoin’s revolutionary impact.

Revolutions are never easy. Governments, banks, and legacy institutions view Bitcoin as a threat to their dominance. They criticize it for its volatility, energy usage, and potential for misuse. Yet, these critiques often mirror the resistance faced by other transformative technologies in their early days. Consider the internet—once dismissed as a novelty for hobbyists, now an indispensable part of life. Bitcoin, too, faces skepticism and backlash. But history teaches us that revolutionary ideas eventually prevail.

What does the next decade hold for Bitcoin? As adoption grows, its potential to reshape the financial landscape becomes clearer. Financial inclusion, wealth preservation, and a fairer global economy are within reach. Picture a world where people no longer depend on unstable fiat currencies. A world where transactions are borderless, instant, and secure. Bitcoin’s revolutionary promise is not just about money; it’s about creating a better, more equitable system for all.

The revolution is here. The question is, will you be part of it? To join this movement, start by educating yourself. Read, learn, and engage with the Bitcoin community. Take small steps: buy a fraction of Bitcoin, secure it, and understand its value. Resources like this blog, documentaries, and books such as The Bitcoin Standard can guide you on your journey. Every revolution begins with individuals making a choice. Bitcoin offers an opportunity to not just observe history but to actively shape it.

Bitcoin is more than a currency; it’s a transformative force that challenges the status quo and offers a vision of a freer, fairer future. As with any revolution, the road ahead will be fraught with challenges. But those who embrace it today will be the architects of tomorrow.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#CryptoRevolution#FinancialFreedom#Decentralization#Blockchain#Cryptocurrency#DigitalGold#BitcoinCommunity#FutureOfMoney#FreedomAndTransparency#EconomicChange#TechInnovation#SatoshiNakamoto#DigitalRevolution#DeflationaryMoney#SustainableFinance#BitcoinMining#BorderlessEconomy#MoneyEvolution#TickTockNextBlock#financial empowerment#globaleconomy#unplugged financial#digitalcurrency#financial experts#financial education#finance

2 notes

·

View notes

Text

Embrace Change: Why Learning About New Technologies, Like Bitcoin, Is Essential for the Future

Change can be intimidating. I remember when smartphones first started to take off—many people, myself included, were skeptical. We didn't quite understand why we'd need a computer in our pocket. Now, it’s hard to imagine life without one. This kind of skepticism is natural, and it’s the same hesitation we see today with new technologies like Bitcoin.

New technologies often challenge our comfort zones, and while it’s easy to resist them, doing so can mean missing out on major opportunities. Bitcoin is a perfect example. It’s still widely misunderstood, but just like smartphones and the internet, it’s poised to become an integral part of our future.

1. The Power of Staying Ahead The world around us is in a constant state of evolution, and those who stay ahead stay relevant. Think about the early days of the internet or smartphones—people who adopted these technologies early gained a major advantage. They not only benefited financially but also understood and influenced the direction these innovations would take.

Take, for example, the adoption of social media. Those who embraced it early found new ways to connect, build businesses, and create influence. Early adoption isn’t just about financial gain; it’s about positioning yourself at the forefront of a shift that can redefine how we live and interact.

2. Fear of Change and Its Cost Why do so many resist new technologies? Fear plays a big role—fear of complexity, fear of the unknown, and fear of failure. It’s easy to dismiss something unfamiliar because it feels overwhelming. But the cost of staying comfortable can be high. By not adopting the internet when it was new, many businesses lost their edge. Blockbuster famously missed the transition to streaming, and we all know how that turned out.

The same is true for individuals. Failing to learn about Bitcoin now could mean missing out on financial opportunities and the chance to take control of your own assets. It could mean lagging behind as the world transitions to a more decentralized, transparent form of finance.

3. Bitcoin: The Current Frontier Bitcoin is the current frontier—a technology that’s still in its early stages but has incredible potential. Many misunderstand Bitcoin, seeing it as just another form of money or a speculative asset. In reality, Bitcoin represents far more than just financial sovereignty. It is a tool for promoting transparency, a decentralized infrastructure that challenges traditional power dynamics, and a means to build a fairer, more inclusive global financial system—a way for individuals to control their wealth without relying on banks or centralized institutions.

If we look at the history of disruptive technologies, Bitcoin fits the pattern. When the internet first emerged, people struggled to understand its potential. It seemed confusing, abstract, and risky. Today, we can't live without it. Bitcoin has a similar trajectory. It’s not just about digital currency; it’s about creating a more transparent, decentralized, and fair global financial system.

4. MicroStrategy: Adopting a Bitcoin Standard A powerful example of how adopting Bitcoin can transform a company is MicroStrategy. In 2020, MicroStrategy made headlines by adopting a Bitcoin standard, using Bitcoin as its primary treasury reserve asset. This bold move was driven by a belief in Bitcoin’s potential as a store of value, especially in a world where traditional currencies are being devalued through inflation.

Since adopting Bitcoin, MicroStrategy has seen dramatic changes. Not only has the company's value increased, but it has also positioned itself as a leader in the adoption of digital assets. MicroStrategy's CEO, Michael Saylor, has been vocal about the benefits of Bitcoin, emphasizing its potential to preserve wealth and hedge against currency devaluation. This move has also inspired other companies to consider Bitcoin as part of their financial strategy.

MicroStrategy’s story serves as a real-world example of how embracing new technologies like Bitcoin can yield substantial rewards, both in terms of financial gain and strategic positioning. It underscores the importance of staying ahead and being willing to take calculated risks to benefit from emerging opportunities.

5. Embracing Learning: A Mindset Shift Learning about something new doesn’t have to be daunting. It’s all about the mindset. See learning as a journey, not a destination. Start small—read articles, watch videos, listen to podcasts. Follow credible sources, and don’t be afraid to ask questions.

The important thing is to take that first step. You don’t have to understand Bitcoin completely on day one. Even the experts were beginners once. What matters is progress, not perfection. The more you learn, the more empowered you become.

6. Benefits of Embracing New Technologies There are real benefits to embracing new technologies like Bitcoin. Staying informed means you’re part of a movement that’s reshaping how we interact with money. It means taking control of your own financial future and being empowered to make decisions without needing to rely on centralized entities.

There’s also a strong community aspect. Learning about Bitcoin isn’t something you have to do alone. There are countless forums, groups, and communities where people share knowledge and support each other. Together, we can grow, learn, and shape the future of finance.

7. Call to Action The best way to overcome hesitation is to take action. I challenge you to take that first step—do some research, watch a video, or even buy a small amount of Bitcoin to understand how it works. It doesn’t have to be a big investment; the goal is to learn and experience.

Be proactive rather than reactive. The future is coming, whether we’re ready or not. By choosing to learn now, you’re choosing to be ready.

Conclusion Change is inevitable, but how we respond to it is a personal choice. You can ignore new technologies and risk falling behind, or you can choose to embrace them, learn, and grow. Staying ahead means staying empowered, and learning about Bitcoin today could be the key to thriving in the future.

The world is changing, and by learning, you can be part of that change, ensuring you’re not just surviving but thriving in the new landscape.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#FinancialRevolution#NewTechnologies#Blockchain#TechAdoption#FutureFinance#DigitalCurrency#EmbraceChange#FinancialSovereignty#DecentralizedFuture#LearnBitcoin#MicroStrategy#TechnologicalAdvancement#Innovation#FinancialIndependence#DisruptiveTechnology#MoneyEvolution#DigitalAssets#StayAhead#financial experts#finance#globaleconomy#financial education#financial empowerment#unplugged financial

2 notes

·

View notes

Text

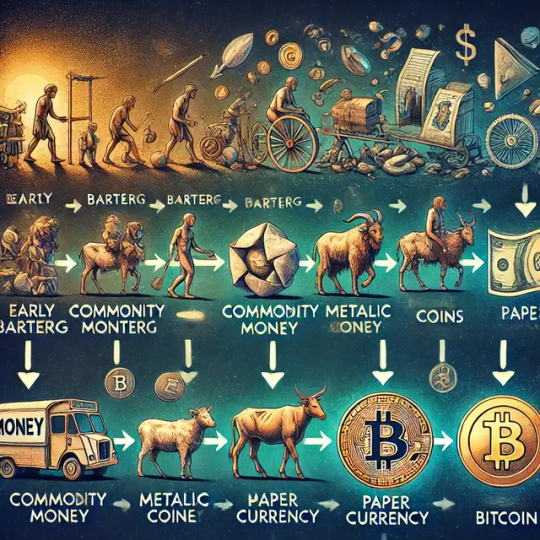

The Evolution of Money: From Barter to Bitcoin

Money has always been an essential part of human society, serving as a tool for exchange, value storage, and facilitating trade. From the early days of barter systems to the modern era of digital currencies, money has evolved in fascinating ways. In this post, we will explore the history of money—from the simple barter systems to the rise of Bitcoin as a potential solution for today's monetary challenges.

1. Barter System In the earliest days of human society, people used a barter system to trade goods and services directly. If someone had surplus grain and needed a tool, they would find someone who had that tool and was in need of grain. While this system worked on a small scale, it had significant limitations. The "coincidence of wants" problem made it impractical—both parties had to want what the other had, and this was often not the case. As societies grew more complex, a more efficient system was needed.

2. Emergence of Commodity Money To overcome the inefficiencies of barter, societies began using commodity money—items that had intrinsic value and were widely accepted in trade. Items like shells, cattle, and metals became mediums of exchange. Commodity money solved the "coincidence of wants" issue and allowed for more standardized trade. However, challenges persisted, such as portability, divisibility, and the ability to assess value consistently.

3. Metallic Coins and Standardization The introduction of metallic coins marked a significant leap forward. Coins made from precious metals like gold, silver, and copper had inherent value and could be easily transported and traded. Standardization played a key role—authorities like kings and governments minted coins to certify their value, providing public trust in the monetary system. Metallic coins facilitated commerce and expanded trade networks, but they also required oversight and protection from debasement or counterfeiting.

4. Paper Money and Government Backing To address the practicality of carrying large quantities of coins, societies transitioned to using paper money. Initially, these paper notes acted as promissory notes that represented a claim on a specific amount of gold or silver stored by a bank. Central banking systems were established to manage these reserves, and eventually, governments began issuing paper currency backed by their promise of value. This emergence of government-backed fiat currency allowed for much greater flexibility and convenience in managing the money supply.

5. The Gold Standard and Its Demise For much of the 19th and early 20th centuries, many countries adhered to the gold standard, where paper money was directly linked to a fixed amount of gold. This system aimed to stabilize currencies and prevent excessive inflation. However, during the Great Depression in 1933, the U.S. government made owning significant amounts of gold illegal and confiscated gold holdings from citizens to stabilize the economy and provide more control over the money supply. By the early 1970s, the gold standard was completely abandoned, and fiat currency—money not backed by any physical commodity—became the global norm.

6. The Fiat Era and Modern Challenges Fiat currency, backed solely by the trust and authority of governments, allowed countries to control their monetary policies and react to economic challenges. However, there are notable downsides. Governments can print more money to fund expenditures, leading to inflation. In recent years, countries worldwide have been printing money at an unprecedented rate, leading to a compounding effect that reduces the purchasing power of their currencies. This widespread money printing not only creates inflation but also contributes to economic instability. Due to the interconnected nature of the global economy, these actions often have ripple effects, creating financial uncertainty and challenges for individuals worldwide.

7. The Advent of Bitcoin Bitcoin emerged in 2009 as a response to the perceived failings of the traditional monetary system. It introduced a digital, decentralized alternative to traditional forms of money. Bitcoin is built on a peer-to-peer network that operates without the need for intermediaries like banks. Its limited supply of 21 million coins ensures scarcity, and its transparent, decentralized ledger—the blockchain—addresses many of the issues related to trust and inflation. Bitcoin represents a bold step forward in the evolution of money, one that resists censorship, preserves value, and operates independently of centralized authorities.

8. Comparison: Bitcoin vs. Fiat Currency Bitcoin offers key advantages over fiat currency. Unlike fiat, which can be printed at will, Bitcoin's supply is fixed and predictable. Its decentralized nature makes it resistant to censorship and government intervention. While fiat currency benefits governments by allowing them to control economic policy, Bitcoin's transparent and decentralized framework empowers individuals and offers a new level of financial sovereignty.

Conclusion The evolution of money has been shaped by humanity's ongoing quest for convenience, fairness, and stability. From barter systems to commodity money, metallic coins, paper currency, and now digital assets, each stage reflects our changing needs. Bitcoin represents the next step in this evolution, offering a solution to the challenges of fiat currency—such as inflation, centralization, and lack of transparency. As the world continues to change, it's worth considering whether Bitcoin might be the foundation for a more resilient and fair financial system in the future.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#EvolutionOfMoney#HistoryOfMoney#BarterToBitcoin#Bitcoin#Cryptocurrency#FinancialHistory#DigitalCurrency#MoneyMatters#EconomicHistory#FiatCurrency#GoldStandard#CommodityMoney#FutureOfMoney#Blockchain#FinancialEducation#Decentralization#MoneyEvolution#BitcoinRevolution#SoundMoney#UnpluggedFinancial#financial experts#finance#financial empowerment#financial education#globaleconomy#unplugged financial

3 notes

·

View notes

Text

Bitcoin: The Renaissance of Money

I. Introduction Bitcoin is more than just a digital currency; it is a revolutionary force, akin to the great cultural movements in history like the Renaissance. Just as the Renaissance transformed art, science, and human perspective, Bitcoin is reshaping the very fabric of money, finance, and trust. This transformation challenges the status quo and introduces a paradigm shift in how we think about value and freedom.

II. The Historical Context of Money Throughout history, money has continually evolved. From the early barter systems, to the use of precious metals as coins, and eventually the introduction of paper money, the story of money is one of constant change. Each shift has responded to the needs and technologies of its time, but these systems have always relied on central authorities. With the advent of Bitcoin, a new chapter in the history of money is being written—one that removes the need for centralized control and hands power back to individuals.

III. Bitcoin: A New Dawn Bitcoin represents a new dawn in the evolution of money. It is decentralized, meaning that no single entity, government, or organization has control over it. This is in stark contrast to traditional fiat currencies, which are controlled by central banks and governments, subject to manipulation and inflation. Bitcoin offers an alternative: a peer-to-peer network that is open, secure, and verifiable by anyone, providing a financial system that belongs to everyone.

IV. Cultural Movement of Bitcoin Bitcoin is more than just a currency; it is a cultural movement. It embodies the ideals of freedom, sovereignty, and the democratization of wealth. For many, Bitcoin represents the ability to take back control of their finances—away from banks and traditional financial institutions that often operate without transparency. It aligns with values of fairness and empowerment, giving people the opportunity to participate in a global economy without intermediaries or unnecessary barriers.

V. Financial Sovereignty and Trust One of the core promises of Bitcoin is financial sovereignty. By holding Bitcoin, individuals gain full control over their money, free from the risks of bank failures, currency devaluation, or government interference. The blockchain, Bitcoin’s underlying technology, plays a key role in building this trust. Every transaction is recorded on a public ledger that is immutable and transparent, ensuring that the system remains trustworthy and accountable.

VI. Inducing a Moral Shift Bitcoin’s principles of sound money have the power to induce a moral shift in society. When money is fair, transparent, and unmanipulated, people’s behavior changes in response. Bitcoin encourages values such as delayed gratification, responsibility, and the creation of real value. By moving away from an inflationary fiat system—prone to manipulation and benefitting a select few—Bitcoin inspires a societal shift towards greater honesty, accountability, and long-term thinking. It fosters an environment where hard work and responsible stewardship of resources are rewarded, rather than undermined by inflation and financial manipulation.

VII. Blockchain: A Foundation for Honesty and Transparency The blockchain technology that underpins Bitcoin extends beyond currency—it is a foundation for honesty and transparency in numerous sectors. Blockchain can be applied to industries like supply chain management, where it provides end-to-end visibility and ensures the authenticity of goods. It can also be used for decentralized data management and verifiable public records, eliminating the need for blind trust in opaque institutions. At a time when public confidence in traditional systems is at an all-time low, blockchain offers a powerful solution for transparency and integrity, allowing individuals to verify information for themselves.

VIII. Breaking the Chains of Traditional Finance The traditional banking system is riddled with inefficiencies, high fees, and a lack of transparency. It often operates to the benefit of a few, leaving many underserved. Bitcoin addresses these issues by offering faster, cheaper, and more transparent transactions. It removes intermediaries, reduces costs, and creates a more inclusive financial environment. Bitcoin empowers individuals to take control of their financial destiny, bypassing the limitations and bureaucracy of traditional finance.

IX. Impact on the Future Looking ahead, Bitcoin has the potential to play a significant role in a more sustainable, fair, and decentralized economy. The integration of Bitcoin with clean energy solutions can create a harmonious relationship between financial innovation and environmental stewardship. Bitcoin mining can drive investments in renewable energy, transforming how we produce and consume power. A future built on Bitcoin is one where financial systems are fairer, more transparent, and aligned with sustainable practices.

X. Conclusion Bitcoin is more than a technological innovation; it is a transformative movement that has the power to reshape our understanding of money, value, and trust. Just as the Renaissance challenged old paradigms and ignited new possibilities, Bitcoin is doing the same for the financial world. It invites us to rethink what is possible and to be part of a revolution that champions fairness, transparency, and individual empowerment. Join the movement and help shape the future of money.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#CryptoRevolution#MoneyEvolution#FinancialFreedom#BlockchainTechnology#SoundMoney#DecentralizedFuture#DigitalRenaissance#EconomicSovereignty#TransparencyMatters#CryptoCulture#FutureOfFinance#BitcoinMovement#FinancialInnovation#BlockchainRevolution#financial empowerment#digitalcurrency#finance#blockchain#globaleconomy#financial experts#cryptocurrency#financial education#unplugged financial

2 notes

·

View notes

Text

A New Dawn: Transitioning to a Bitcoin Future

Money is not just a medium of exchange; it's a psychotechnology, as integral to human communication as language itself. Today, we're living in unprecedented times with the potential to peacefully transition to a new financial system growing right alongside the current one. In this post, we'll explore how Bitcoin is enabling this transformation and what it means for our future.

The Current Financial Landscape

The flaws and instability of the fiat currency system are becoming increasingly apparent. Inflation, excessive money printing, and economic uncertainty are driving individuals and institutions to seek alternatives. The traditional financial system, burdened by debt and centralization, is showing signs of strain. Over the past few years, central banks worldwide have printed unprecedented amounts of money to stimulate economies. This has led to inflation, eroding the purchasing power of savings and causing widespread financial insecurity. Governments and corporations are drowning in debt, and the centralized nature of the current financial system leaves it vulnerable to corruption and mismanagement. Global events, from pandemics to geopolitical tensions, add to the unpredictability of fiat currencies. Enter Bitcoin, a decentralized digital currency offering a new kind of financial freedom.

The Role of Bitcoin

Bitcoin is not just another financial asset; it's a revolutionary technology that grows alongside our existing financial system. Its decentralized nature, security, and limited supply make it a viable alternative to traditional currencies, promising stability and independence. Unlike traditional currencies controlled by central banks, Bitcoin operates on a decentralized network of computers, ensuring no single entity can manipulate its value. Bitcoin's blockchain technology provides unparalleled security, making it nearly impossible to counterfeit or manipulate. With a capped supply of 21 million bitcoins, Bitcoin is inherently deflationary, protecting against inflation and preserving value over time. Bitcoin offers a form of money that is transparent, secure, and resistant to the whims of central authorities.

Historical Context

Throughout history, major economic transitions have often been marked by turmoil and conflict. From the shift from barter to coinage to the adoption of paper money, each transition has reshaped society. However, for the first time, we have the opportunity to transition peacefully to a new system with Bitcoin. The move from barter systems to coinage revolutionized trade and economic interaction but was often accompanied by social upheaval. The adoption of paper money brought convenience but also led to centralization and control by governments. Now, in the digital age, Bitcoin represents the next step in the evolution of money, offering a decentralized and democratized form of value exchange. Unlike past transitions, Bitcoin's integration can be gradual and voluntary, allowing individuals and institutions to adopt it at their own pace.

The Peaceful Transition

Bitcoin offers a non-violent alternative to traditional financial upheaval. Its gradual adoption process allows people and institutions to adapt without the chaos that typically accompanies such transitions. This peaceful integration could pave the way for a more stable and equitable financial future. Bitcoin's adoption is growing organically, driven by individual choice and market forces rather than imposed by authorities. It can operate alongside existing financial systems, providing a safety net and alternative without causing immediate disruption. By giving individuals control over their own finances, Bitcoin empowers people to take charge of their economic future.

Real-World Examples

Consider the case of MicroStrategy, a company that has invested billions into Bitcoin, treating it as a core part of their strategy. Led by Michael Saylor, MicroStrategy has transformed its balance sheet by converting cash reserves into Bitcoin, demonstrating confidence in its long-term value. Government proposals, like those from Senator Cynthia Lummis, highlight the growing trust and interest in Bitcoin. Senator Lummis has proposed treating Bitcoin like gold, advocating for its inclusion in national reserves and regulatory frameworks. Influential figures such as Robert F. Kennedy Jr. and Donald Trump have spoken about Bitcoin's potential to revolutionize the financial system, adding legitimacy and interest from a broader audience. These examples illustrate the growing acceptance and integration of Bitcoin into mainstream financial and political discourse.

The Psychological Shift

Understanding and adopting Bitcoin can lead to a profound change in how we perceive value and money. My journey with Bitcoin has reshaped my mindset, providing a new perspective on financial freedom and stability. This psychological shift is as important as the technological and economic changes. Bitcoin challenges traditional notions of value, prompting us to rethink what money is and how it should function. Owning Bitcoin gives individuals direct control over their wealth, reducing reliance on banks and financial intermediaries. Learning about Bitcoin often leads to a deeper understanding of economics, monetary policy, and personal finance. Sharing my personal journey, from discovering Bitcoin to embracing its potential, highlights the transformative power of this technology.

Conclusion

We stand at the brink of a new era. The peaceful transition to a Bitcoin-based financial system is not just a possibility; it's a growing reality. By embracing this change, we can look forward to a more stable, secure, and equitable financial future. Bitcoin offers a path to financial independence and stability, free from the flaws of the fiat system. As more people and institutions recognize Bitcoin's potential, we can collectively work towards a better economic system.

Call to Action

Subscribe to my blog for more insights into the evolving financial landscape. Follow my YouTube channel and social media for the latest updates and discussions on Bitcoin and its potential to revolutionize our world.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#CryptoRevolution#FinancialFreedom#FutureOfFinance#BitcoinFuture#DigitalCurrency#EconomicTransition#NewEra#CryptoCommunity#BlockchainTechnology#BitcoinAdoption#Cryptocurrency#FinancialInnovation#DecentralizedFinance#FiatCollapse#MoneyEvolution#CryptoJourney#EconomicFreedom#DigitalGold#BitcoinHodl#blockchain#globaleconomy#unplugged financial#financial empowerment#financial education#financial experts#finance

2 notes

·

View notes

Text

#Bitcoin#Crypto#FinancialFreedom#MoneyEvolution#Investing#Blockchain#MichaelSaylor#FutureOfMoney#Cryptocurrency#DigitalCurrency#Finance#WealthBuilding#CryptoCommunity#BitcoinRevolution#financial experts#financial empowerment#financial education#globaleconomy#unplugged financial

3 notes

·

View notes

Text

youtube

The Evolution of Money: From Barter to Bitcoin

Description:

Are you ready to explore the fascinating journey of money? In this video, we delve deep into the history of money, tracing its evolution from ancient barter systems to the cutting-edge world of Bitcoin. 🌍💰

🔍 What You'll Learn:

Barter Systems: Discover how early civilizations exchanged goods and services before the invention of money.

Commodity Money: Understand the role of items like gold, silver, and other commodities in trade and their intrinsic value.

The Birth of Coins: Learn about the first coins, their origins, and how they revolutionized trade and commerce.

The Rise of Paper Money: Explore the transition from metal coins to paper currency and the impact on economies worldwide.

Fiat Currency: Dive into the concept of fiat money, its advantages, and its role in modern economies.

The Digital Revolution: Uncover the emergence of digital currencies, the rise of Bitcoin, and how they are reshaping the financial landscape.

✨ Why Watch This Video?

Gain a comprehensive understanding of the history of money.

Learn about the key milestones that have shaped our current financial systems.

Discover how Bitcoin and other cryptocurrencies are poised to transform the future of money.

Join us on this enlightening journey through time and witness the remarkable evolution of money! Don't forget to like, subscribe, and hit the notification bell to stay updated with all our latest content. 🚀

#MoneyEvolution#HistoryOfMoney#Bitcoin#Cryptocurrency#FinancialRevolution#FiatCurrency#DigitalCurrency#EconomicHistory#BarterSystem#GoldStandard#PaperMoney#CryptoEducation#FinancialFreedom#UnpluggedFinancial#MoneyMatters#FinancialLiteracy#financial experts#globaleconomy#unplugged financial#blockchain#financial empowerment#financial education#finance#Youtube

3 notes

·

View notes

Text

The Role of Bitcoin in Financial Independence

In today’s rapidly evolving world, where financial systems are increasingly centralized and controlled, the concept of financial independence has never been more vital. Many are turning to Bitcoin as a path to achieve this independence. But how exactly can Bitcoin help us break free from traditional financial constraints? Let’s dive into the key ways Bitcoin can empower us and why it might be the revolutionary choice you need.

1. Decentralization and Control

Imagine a world where your money is truly your own. One of Bitcoin’s most revolutionary aspects is its decentralized nature. Unlike traditional currencies, which are controlled by central banks and governments, Bitcoin operates on a peer-to-peer network. No single entity has control over the Bitcoin network, making it resilient to censorship and manipulation.

For you, this decentralization means more control over your finances. You’re no longer reliant on banks or financial institutions to access or transfer your money. This autonomy ensures your assets are safeguarded from institutional failures, government interventions, or political instability. It’s financial freedom in its purest form.

2. Protection Against Inflation

Inflation is a silent thief, eroding the purchasing power of your hard-earned money over time. With central banks worldwide printing money at unprecedented rates, the risk of inflation looms large.

Bitcoin, with its fixed supply of 21 million coins, offers a robust hedge against inflation. Its scarcity ensures it cannot be devalued by government actions. Unlike fiat currencies, which can be inflated away, Bitcoin’s value is preserved by its limited supply. This makes it an attractive store of value in an era of rampant money printing and economic uncertainty.

3. Borderless Transactions

Imagine being able to send money to anyone, anywhere, without the usual hassles. Traditional financial systems are often hindered by borders, regulations, and intermediaries. International transfers can be slow and costly, involving multiple parties and high fees.

Bitcoin, however, allows for seamless, borderless transactions. Whether sending money to family abroad or paying for services from global vendors, Bitcoin facilitates quick and inexpensive transfers. This is especially beneficial for those in countries with restrictive financial regulations or unstable currencies.

4. Financial Inclusion

A significant portion of the world’s population remains unbanked or underbanked, lacking access to traditional financial services. This exclusion limits economic opportunities and perpetuates poverty.

Bitcoin can bridge this gap by providing a simple, accessible means of storing and transferring value. All you need is an internet connection and a digital wallet, empowering millions to participate in the global economy. For people in developing countries or areas with limited banking infrastructure, Bitcoin offers a lifeline to financial services that were previously out of reach.

5. Transparency and Security

Trust is built on transparency. Bitcoin transactions are recorded on a public ledger known as the blockchain. This transparency ensures transactions can be verified by anyone, reducing the risk of fraud.

Additionally, Bitcoin’s cryptographic security makes it extremely difficult for unauthorized parties to alter transaction data or access funds without the owner’s private keys. This security model is a stark contrast to traditional banking systems, where breaches and fraud are more common. By holding your own private keys, you have full control and responsibility over your assets, providing peace of mind in the digital age.

6. Autonomy and Privacy

In a world where financial privacy is becoming increasingly rare, Bitcoin offers a degree of anonymity. While transactions are transparent, the identities of the parties involved are not easily traceable.

This privacy can protect you from intrusive surveillance and potential misuse of personal financial data. It ensures your financial activities remain your own, free from prying eyes. This level of financial privacy is particularly important for those living under oppressive regimes or in environments where financial freedom is restricted.

7. Life-Changing Investment Potential

Incorporating Bitcoin into your investment strategy can produce life-changing results. As a relatively new and rapidly evolving asset class, Bitcoin has demonstrated substantial growth and potential for significant returns.

Early adopters of Bitcoin have seen remarkable gains, and while past performance is not indicative of future results, the continued development and adoption of Bitcoin suggest it still holds significant investment potential. By diversifying your investment portfolio with Bitcoin, you can achieve greater financial gains and secure your financial future. This potential for high returns, combined with its other benefits, makes Bitcoin an attractive addition to any investment strategy.

Conclusion

Bitcoin is more than just a digital currency; it represents a paradigm shift towards financial independence and empowerment. By offering decentralization, protection against inflation, borderless transactions, financial inclusion, transparency, security, privacy, and substantial investment potential, Bitcoin can play a crucial role in achieving financial freedom. As the world continues to evolve, embracing Bitcoin might be the key to securing your financial future in an increasingly uncertain economic landscape.

So, as you ponder your financial future, consider the revolutionary potential of Bitcoin. It might just be the game-changer you need.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Let’s learn about the Bitcoin Revolution together. Your financial freedom starts now!

#Bitcoin#FinancialIndependence#CryptoRevolution#Decentralization#DigitalCurrency#InflationHedge#BorderlessTransactions#FinancialInclusion#BlockchainTechnology#CryptoSecurity#PrivacyInFinance#InvestmentStrategy#CryptoInvesting#FutureOfFinance#UnpluggedFinancial#MoneyEvolution#CryptoEducation#FinancialFreedom#CryptoCommunity#DigitalAssets#financial education#financial empowerment#financial experts#cryptocurrency#blockchain#finance#unplugged financial#globaleconomy

3 notes

·

View notes

Text

Understanding the Shift to Paper Money: The Portability Problem of Gold

Throughout history, money has taken various forms, from bartering goods to trading gold and silver. However, one pivotal innovation transformed how we conduct trade: paper money. But why did this shift occur? Why did society abandon gold, the precious metal that had backed economies for centuries? It all comes down to one crucial issue: portability.

The Gold Standard: Advantages and Challenges

Gold has been used for thousands of years as a reliable store of value and medium of exchange. Its rarity and desirability made it universally accepted, while its physical properties allowed for minting durable coins. However, gold had its limitations—primarily in the context of portability. Carrying significant quantities of gold was cumbersome, risky, and impractical, especially for long-distance trade or high-value transactions. These challenges prompted the search for a more efficient way to facilitate commerce while retaining the intrinsic value and trust associated with gold.

The Emergence of Paper Money

The need for a more convenient monetary system eventually led to the rise of promissory notes representing gold or silver holdings. These paper instruments allowed holders to claim a specific amount of precious metals from a trusted entity, usually a bank. People could trade these notes for goods and services, confident in the promise of gold backing. This shift to paper money provided a more portable means of exchange, solving the portability problem of gold.

Gradually, these promissory notes became the standard method for everyday transactions, with gold remaining primarily in vaults. The efficiency of paper currency made it the preferred choice in commerce, laying the groundwork for today's financial system.

Transition to Fiat Money

Over time, the connection between paper money and gold weakened. Governments began issuing paper money not as promissory notes but as fiat currency, relying on public trust and government stability rather than a direct tie to precious metals. The gold standard was abandoned, leaving behind a system where paper currency held value by government decree.

While this transition allowed governments to maintain greater control over monetary policy, it also shifted the perception of money. Trust and value became abstract concepts tied to the authority backing the currency rather than a tangible asset.

Modern Implications and Bitcoin

Today, the challenges of fiat money have opened the door to a new form of currency: Bitcoin. Digital, decentralized, and immune to government manipulation, Bitcoin is often seen as an augmentation to both gold and fiat currency. It provides portability, scarcity, and the security of blockchain technology while addressing the limitations of traditional forms of money.

Bitcoin holds the potential to change how we perceive and use currency. It is a natural evolution from the portability issues that gold faced and the trust challenges inherent in fiat systems.

Conclusion

The evolution from gold to paper money represents a pivotal moment in financial history, rooted in solving the problem of portability. Today's innovations, such as Bitcoin, offer new solutions to old problems, giving us a glimpse into the potential future of money. Understanding this journey helps us appreciate the importance of adaptation in our quest for a better financial system and illuminates how technology will continue to shape the world of finance.

#bitcoin#financial education#financial empowerment#financial experts#finance#blockchain#cryptocurrency#digitalcurrency#globaleconomy#unplugged financial#PaperMoney#GoldStandard#FiatCurrency#Portability#Bitcoin#DigitalCurrency#FinancialHistory#MoneyEvolution#Blockchain#MonetarySystem#financial freedom#financialfreedom#financialplanning#financial dominance#financialnews

3 notes

·

View notes

Text

How Money is Created: A Free Market Phenomenon, Not a Government Invention

In today’s world, many believe that money is something governments created and control, but this is far from the truth. While governments play a significant role in issuing and regulating money today, the creation of money itself is deeply rooted in the free market. Money wasn't invented by governments—it evolved naturally as a solution to the inefficiencies of barter and trade. And in today's rapidly changing financial landscape, we're witnessing a return to those market-driven principles with Bitcoin.

Let’s dive into the evolution of money, how it's a product of the free market, and why Bitcoin is the modern revival of sound money.

The Origins of Money in Free Markets

Before money as we know it existed, people relied on barter to trade goods and services. If you had wheat but needed livestock, you had to find someone with livestock who also wanted wheat. This problem—known as the "double coincidence of wants"—was inefficient and made trade cumbersome.

To solve this, markets began to gravitate towards certain commodities that held intrinsic value and were widely accepted. Livestock, grain, and eventually precious metals like gold and silver became preferred mediums of exchange. These commodities were durable, divisible, and scarce—qualities that made them useful as a standard form of money. This was not the result of any government decree, but rather the organic outcome of market participants searching for the most efficient way to trade and store value.

Money as the Product of Free Market Dynamics

The selection of money was not arbitrary. The free market chose the best forms of money through a process of natural selection. The qualities that made commodities like gold and silver attractive—durability, divisibility, portability, and scarcity—became the foundation for what we recognize as "money."

In this way, money is an emergent property of the market. Its creation is the result of human interaction in trade and commerce. It was not invented but discovered through the market’s need for a more efficient medium of exchange.

This dynamic process illustrates that money’s true value comes from its utility in the market—not from government mandates or laws. Trust and acceptance of a medium of exchange arise organically in a free market, based on what people perceive to hold value. Governments only stepped in later to formalize and control this process.

Government’s Role in Co-opting Money

While governments did not create money, they quickly saw the advantages of controlling it. By taking control of the money supply, governments could finance wars, fund projects, and manage economies—but at the cost of market dynamics.

One of the earliest forms of government control over money was the adoption of fiat currency. Instead of money being backed by physical commodities like gold or silver, fiat money derives its value solely from government decree. Governments declared that their currency would be legal tender for all debts, public and private, and thus fiat money was born.