#CA Intermediate syllabus

Explore tagged Tumblr posts

Text

🎉 SPC 14th Anniversary – Special Offer Alert! 🎉

💥 Get 14% OFF on all Pendrive, Google Drive, and Live Streaming courses! 📅 Offer valid till 31st Dec 2024!

🔐 Don’t miss out – Celebrate with us and grab your discount now! 📞 Call: +91 89830 87140 🌐 Website: www.swapnilpatni.com 💻 Inquiry Link - https://bit.ly/3ykcSe1

#ca classes in india#ca coaching classes#ca inter classes#online ca course in india#CA Intermediate syllabus#Best CA Inter Online Classes#CA Inter Eligibility#Online lectures for CA Inter#ca inter online classes

0 notes

Text

The Best Faculty and SFM Classes for CA Final and CA Inter in India

The journey to becoming a Chartered Accountant (CA) in India is both challenging and rewarding. One of the pivotal stages in this journey is mastering the Strategic Financial Management (SFM) for the CA Final and choosing the best faculty for CA Intermediate (CA Inter). Here’s a detailed look at why selecting the right SFM classes for CA Final and the best faculty for CA Inter is crucial for aspiring CAs.

SFM Classes for CA Final

Strategic Financial Management (SFM) is a crucial subject in the CA Final exam, requiring a deep understanding of financial concepts, strategic decision-making, and analytical skills. To excel in this subject, choosing the right SFM classes for CA final is essential. Here’s why:

Comprehensive Coverage: The right SFM classes will cover the entire syllabus comprehensively, ensuring that students grasp all necessary concepts.

Expert Guidance: Experienced faculty can break down complex topics into easily understandable segments, making learning more effective.

Practical Approach: Quality SFM classes incorporate practical examples and case studies, helping students apply theoretical knowledge to real-world scenarios.

Updated Material: The financial world is constantly evolving. Good SFM classes offer updated study materials reflecting the latest trends and practices.

Interactive Learning: Engaging teaching methods, including interactive sessions, doubt-clearing forums, and peer discussions, enhance the learning experience.

CA Inter: Best Faculty

The CA Intermediate level serves as a bridge between the foundational knowledge and the advanced concepts in the CA curriculum. Having the best faculty for CA Inter can make a significant difference in a student’s performance. Here’s what to look for in the best CA Inter faculty:

Expertise and Experience: The best faculty possess extensive knowledge and years of teaching experience, allowing them to deliver content effectively.

Innovative Teaching Methods: They use innovative teaching methods to simplify complex topics, making them easier for students to understand and retain.

Personalized Attention: Great teachers recognize that each student learns differently and provide personalized guidance to address individual learning needs.

Strong Communication Skills: Effective communication helps in clearly conveying concepts and engaging students, fostering a better learning environment.

Success Record: Faculty with a proven track record of producing successful students can instill confidence and motivation in their pupils.

Conclusion

Excelling in the CA exams requires dedication, hard work, and the right guidance. Selecting the best SFM classes for CA Final and the CA intern best faculty can significantly impact your preparation and success. By choosing wisely, you equip yourself with the knowledge and skills necessary to navigate the complexities of the CA curriculum and achieve your goal of becoming a Chartered Accountant.

Investing in quality education and expert guidance is a step toward a successful CA career. Choose the best, and let your journey to becoming a Chartered Accountant be smooth and rewarding.

0 notes

Text

Unlocking Success: A Comprehensive Guide to Preparing for the CA Inter Exam

Are you gearing up for the CA Inter Exam? This pivotal moment in your academic and professional journey demands meticulous preparation and a strategic approach. Whether you’re a first-time taker or aiming for a top rank, mastering the art of preparation is key. Here’s a comprehensive guide to help you unlock success in the CA Inter Exam.

Understanding the CA Inter Exam: The CA Inter Exam, conducted by the Institute of Chartered Accountants of India (ICAI), is a stepping stone towards becoming a Chartered Accountant. It consists of eight papers divided into two groups, covering topics such as Accounting, Corporate and Other Laws, Cost and Management Accounting, Taxation, and more.

Creating a Study Plan: Effective time management is crucial for exam preparation. Create a study plan that allocates sufficient time to cover each subject thoroughly. Break down your study sessions into manageable segments, focusing on understanding concepts, practicing problems, and revising regularly.

Utilizing Study Material: ICAI provides study material and practice manuals for each subject. These resources are invaluable for exam preparation, as they are curated by experts and align with the exam syllabus. Make sure to supplement your studies with additional reference books and online resources for a holistic understanding of the topics.

Mock Tests and Previous Years’ Papers: Practice makes perfect, and this holds true for the CA Inter Exam as well. Solve mock tests and previous years’ papers to familiarize yourself with the exam pattern, time management, and question types. Analyze your performance to identify weak areas and work on improving them.

Seeking Guidance: Don’t hesitate to seek guidance from experienced professionals, teachers, or mentors. Joining a coaching institute or online classes can provide structured guidance and help clarify doubts. Engage in group study sessions to gain different perspectives and enhance your learning experience.

Maintaining a Healthy Lifestyle: A healthy body supports a healthy mind. Ensure you get enough rest, eat nutritious meals, and exercise regularly. Avoid stress and burnout by taking breaks and indulging in hobbies or activities that relax you.

Staying Positive and Motivated: The journey to becoming a Chartered Accountant is challenging, but maintaining a positive attitude and staying motivated is key to success. Visualize your goals, stay focused, and believe in your abilities.

Conclusion: The CA Inter Exam is not just a test of knowledge but also a test of determination and perseverance. By following this comprehensive guide, you can prepare effectively and increase your chances of acing the exam. Stay committed to your goals, and success will be yours. Best of luck!

Original Source: CA Intermediate Course

#ca inter exam#ca inter#ca intermediate#ca intermediate course#ca inter subjects#ca inter syllabus#ca intermediate syllabus#ca inter group 1 subjects#ca inter group 2 subjects#ca inter accounts

0 notes

Text

CA Intermediate Nov 2023 Exam Preparation strategy

Practice, Practice, and Practice is the main mantra to prepare for CA intermediate Nov. 2023 exam. You must have a well-defined strategy, especially for difficult exams such as the CA Intermediate. This article will provide you with detailed and effective approaches to each subject covered by the CA Intermediate syllabus.

If you want to read more click here

0 notes

Text

https://justpaste.it/e98la

0 notes

Text

#CA Inter FM New Syllabus#CA Inter FM#best faculty for ca inter fm#CA Intermediate FM#CA Intermediate#CA Inter

0 notes

Text

#ca inter fm#CA Intermediate FM#best faculty for ca inter fm#ca inter fm new syllabus#CA Inter FM Pendrive#CA Inter EFF & FM Pendrive

0 notes

Text

ICAI New Scheme for CA Intermediate Syllabus and Subjects 2024

On July 1, 2023, the ICAI notified the CA Intermediate syllabus under the new plan of education and training. The first CA Intermediate exam based on the new CA Intermediate syllabus will be held in May 2024.

Read More: https://ksacademy.co.in/blogs/ca-intermediate-new-syllabus-and-subjects/

CA Intermediate New Syllabus, CA Intermediate New Syllabus 2024, CA Inter New Syllabus, CA Inter New Syllabus 2024

#CA Intermediate New Syllabus#CA Intermediate New Syllabus 2024#CA Inter New Syllabus 2024#CA Inter New Syllabus

0 notes

Text

From Numbers to Notebooks: The Journey of a CA Aspirant

Choosing to become a Chartered Accountant is more than just choosing a career. It's about stepping up into one of the most respected and challenging careers in the financial industry. Each CA aspirant begins with a dream. This is often motivated by a passion for numbers, the desire to develop financial expertise or the ambition of gaining professional recognition. Between the initial spark of interest and the prestigious prefix "CA", there is a long journey that involves dedication, failures, growth and transformation.

In this challenging process, the role of a good mentor is crucial. Finding the right guidance is important for students who want to establish a solid foundation, particularly in competitive hubs such as Rajasthan. CA Coaching in Jaipur is important because it can help students turn their goals into reality.

Take a closer view of this journey, from the initial curiosity up to certification.

Stage One: The Spark of Interest

Often, the journey begins at school when students develop an interest in commerce or accountancy. It could be that they enjoy solving balance sheet problems, analyzing profits and losses, or just feel a natural affinity for structured, logical thought. Families, mentors or older students may influence the decision.

The real understanding of the course comes after the student has enrolled. Students are introduced to the depth and volume of content at the beginning of CA Foundation. The complexity of concepts that were simple at school begins to emerge. Aspirants soon realize that curiosity is just the beginning--commitment will be the real key.

Stage Two: Structured Learning and Discipline

Aspirants should plan their lives to include preparation once they have enrolled. The syllabus is extensive, and each level - Foundation, Intermediate and Final - brings new challenges.

Foundation focuses on basics like accounting, business law, and quantitative aptitude.

Intermediate introduces core subjects such as corporate law, advanced accounting, taxation, and auditing.

Final elevates the complexity, demanding deep understanding and case-based application in subjects like strategic financial management and international taxation.

Students must develop a disciplined routine of study to manage the academic load. The time becomes a valuable resource. Weekends are not for recreation but rather for revisions and practice tests. Early on, the typical aspirant begins to learn how to prioritize. They choose concepts over distractions and consistency over comfort.

Stage Three: Learning to Handle Pressure

Emotional endurance is one of the aspects of CA students' journey that are often overlooked. Many students fail before they succeed, as the pass rates for CA exams is low. This can lead to frustration, anxiety, and self-doubt. Those who persevere begin to mature emotionally.

Students are trained to perform well under pressure through mock exams, peer-to-peer comparisons and time-pressed revisions. These experiences also build resilience, which is a vital skill for future success as a finance professional.

Students start to realize that persistence is more important than talent. They become more strategic in their preparation--identifying weak areas, allocating study hours based on performance, and seeking targeted support.

Stage Four: From Student to Professional Thinker

When students reach the CA Final level something transformative occurs. Students no longer just study to pass exams, but begin to think as professionals. They begin to approach questions as though they were solving real-world problems.

This is a significant shift. This shows that the student has the necessary skills to succeed in the corporate world, not just on the academic level but also mentally and practically. It becomes second nature to make decisions, analyze, and communicate in a structured way.

Mentorship is even more important at this stage. They need more than academic coaching. They also require guidance in how to write logically and present themselves like chartered accountants. Only seasoned mentors in structured coaching environments are able to deliver these skills.

Stage Five: Preparing for the Finish Line

The final lap can be both exciting and challenging. Aspirants start to think beyond the exam, and begin visualizing their future. Some aspirants may want to work in audit firms. Others might aim for finance departments at MNCs or start their own business.

The most intensive phase of preparation comes before. The students revise and re-revise as well as take many mock tests. They learn how to stay focused, manage fatigue and optimize performance for long periods of time. The support of peers, teachers and families is invaluable.

After years of hard work, when the results are achieved, the prefix “CA” becomes more than a title. It becomes a symbol for grit and endurance.

Conclusion

It is not an easy or short journey to go from numbers to a notebook, from a student interested in mathematics to a certified professional. It requires more than just academic intelligence. Focus, time management and emotional stability are required. The right coaching institute will make your journey more efficient, goal-driven, and structured.

Gyan Sagar classes Jaipur provides expert-led CA Coaching to aspirants in Jaipur in both online and off-line modes. They offer a focused curriculum, experienced teachers, and performance-driven instruction to help students become capable finance professionals.

0 notes

Text

CA Foundation September 2025: Important Chapters & Weightage Analysis

If you’re preparing for the CA Foundation September 2025 exam, you already know the competition is intense. To score well and crack the exam on your first attempt, smart preparation is essential — and that starts with understanding important chapters and subject-wise weightage.

At Vishwas CA, an Online CA coaching institute known for delivering the Best CA Coaching Online, we help students break down the syllabus strategically. This blog covers the key topics, chapter-wise weightage, and smart tips to help you prepare efficiently through our CA Foundation online classes.

Subject-Wise Chapter Importance & Weightage

The CA Foundation exam comprises four papers:

Paper 1: Principles and Practice of Accounting

Paper 2: Business Laws

Paper 3: Quantitative Proficiency in Business Mathematics, Statistics, and Logical Reasoning

Paper 4: Business Economics

Let’s look at the important chapters and expected weightage based on past trends and ICAI guidelines:

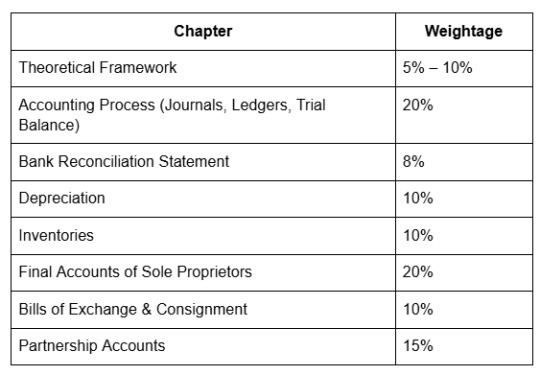

✅ Paper 1: Principles and Practice of Accounting

Focus Tip: Practice solving final accounts and partnership problems. These are scoring chapters in our CA classes online.

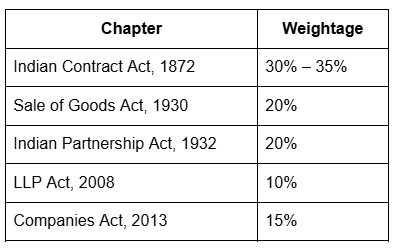

✅ Paper 2: Business Laws

Focus Tip: Learn legal terminologies and their practical applications. Our Online coaching for CA Foundation offers simplified law lectures.

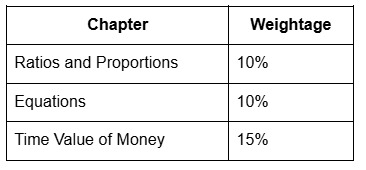

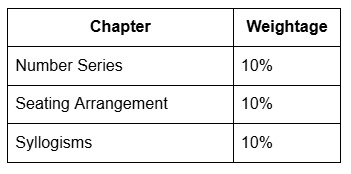

✅ Paper 3: Quantitative Aptitude

(A) Business Mathematics

(B) Logical Reasoning

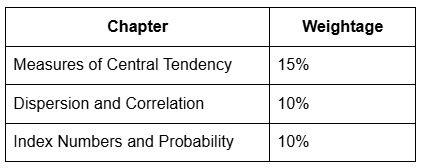

(C) Statistics

Focus Tip: Practice regularly from mock papers available in our Best online CA classes in India platform.

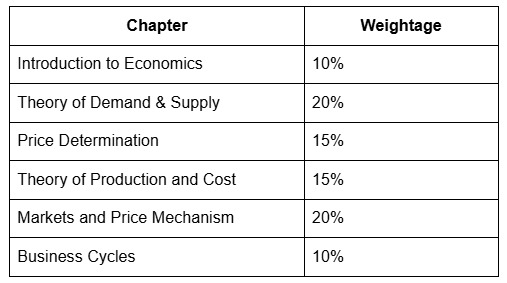

✅ Paper 4: Business Economics

Focus Tip: Concept clarity is key. Our CA Foundation online classes use visual and real-world examples for better understanding.

Why Weightage Analysis Matters

Knowing which chapters carry more marks helps you:

Prioritize your study schedule

Maximize output in less time

Avoid spending too much time on low-weight chapters

Practice high-impact questions through CA coaching classes online

Conclusion: Prepare Smartly with Vishwas CA

Mastering the CA Foundation exam is all about strategic preparation. Knowing the important chapters and their weightage allows you to focus your energy where it matters most. At Vishwas CA, we provide the Best CA coaching online with chapter-wise mock tests, expert guidance, and doubt-solving sessions. Whether you're looking for CA Foundation online classes or Online coaching for CA Intermediate, we’ve got your back.

Join the Best online CA classes in India and experience Online CA coaching in India that’s tailored for success. Get started today with Vishwas CA – your trusted Online CA coaching institute.

#CA Classes in India#Online CA Coaching#Best CA Classes In India#CA Foundation Classes#CA Intermediate Classes#CA Online Classes#Best CA Coaching In India#CA Foundation online classes#CA Intermediate online classes#CA classes online#CA coaching classes online#Online CA coaching in India#Best online CA classes in India#Best CA coaching online

0 notes

Text

🎓 Top 10 Facts About CA Day, Course Details & Trusted Education Portals in 2025

Every year on July 1st, India celebrates "CA Day" (Chartered Accountants Day), a proud recognition of the formation of the Institute of Chartered Accountants of India (ICAI) in 1949. From brilliant minds shaping India’s economic backbone to students dreaming of becoming financial leaders, CA Day reminds us of how essential and inspiring this profession truly is. Whether you're a curious student, a passionate aspirant, or a proud parent, understanding the top 10 facts about the CA journey, current education systems, and trusted info portals can make all the difference in your success path. In today’s fast-changing digital age, knowing where to find reliable information about the CA course is just as important as preparing for the exams. With increasing fake news and unverified platforms, learners must stay alert and connected to authentic portals, guidance sources, and official updates. At top10answer.com, we’ve compiled everything you need in one powerful, easy-to-read guide — packed with emotion, facts, and a vision for your future.

1️⃣ 🔥 What is CA Day & Why July 1st is Celebrated Every Year?

CA Day (July 1st) is the birthday of the ICAI — the second-largest accounting body in the world. It symbolizes integrity, accuracy, and India’s economic power. 🧠 "Finance is not just about numbers, it’s about responsibility" – Warren Buffett ICAI has been guiding lakhs of students in building a career of respect, power, and unmatched contribution. It's a dream for many, and CA Day is the celebration of that dream becoming reality for thousands each year.

2️⃣ 📚 Top 10 Course Levels Every Aspiring CA Must Know

Embarking on a CA journey? Here are the top 10 steps that shape every CA’s path: 📌 Level📘 Description1.CA Foundation Course (Entry level)2.CA Intermediate (2 groups)3.3-Year Articleship Training4.CA Final Exam5.ICAI Registration6.Orientation Program7.Information Technology Training (ITT)8.Advanced ICITSS9.Practical Exam Skillsets🔟Certificate of Practice (COP) ✅ Advantages: Strong foundation, industry-respected career, and international opportunities 🚫 Disadvantages: Long study duration, pressure handling, strict discipline

3️⃣ 🧠 Top 10 Skills Every CA Student Should Develop

To succeed in CA, you need more than textbooks. Focus on these top 10 must-have skills: - 💼 Analytical thinking - 🕰️ Time management - 🗂️ Attention to detail - 📊 Financial reporting knowledge - 🧮 Tax and Audit skills - 🤝 Communication skills - 🔍 Investigation & forensic mindset - 🧘 Stress management - 💻 Tech-savviness (Excel, Power BI, etc.) - 🌍 Global outlook 🧠 "Success usually comes to those who are too busy to be looking for it." — Henry David Thoreau

4️⃣ 🌐 Top 10 Trusted Education Portals for CA Preparation in 2025

Here are the most trusted and current websites you should bookmark today: PortalWhy It's Reliable📘 ICAI.orgOfficial site with syllabus, notifications📕 BOS PortalICAI’s official student education portal📗 Edu91Popular CA coaching channel📘 UnacademyCA courses from verified educators📙 CAclubindiaForum + Resources + Doubt clearing📕 ICAI Digital Learning HubOnline learning support📗 TaxGuruRegular updates on GST, income tax📘 SuperProfsTest prep & mock support📙 IndigoLearnAnimated video lessons📕 top10answer.comExpert tips, Top 10 lists & CA insights 🎯

5️⃣ 💧 Top 10 Myths vs Facts About the CA Profession

MythRealityCA is only for toppersAnyone with dedication can become a CA ✅CA means no personal lifeWith time mgmt., balance is possible 🌈It’s impossible to clear in the first attemptMany do! Right planning is key 🎯Only boys take CAGirls are excelling too! 👩🎓CA has no global reachIndian CAs are in demand in UAE, UK, etc. 🌍 ⚠️ Precaution: Always follow official sites for updates — not WhatsApp forwards!

6️⃣ 🧭 Top 10 Benefits of Choosing CA as a Career

- 💼 High-paying job or independent practice - 🇮🇳 Huge national and international demand - 🧾 Expertise in taxation, audits, and finance - 🧠 Continuous learning environment - 💪 Respected title and authority - 🏆 CA firms, corporates, government roles - 🌐 Ability to work abroad - 📈 Business startup readiness - 🧩 Logical mindset development - 💖 Social contribution via financial transparency 🎬 “A dream doesn’t become reality through magic; it takes sweat, determination, and hard work.” – Colin Powell

7️⃣ 📊 Top 10 Stats About CA Course in India (2025 Edition)

MetricValueTotal CA Members (India)3.9 LakhsTotal CA Students7.8 LakhsAverage CA Salary₹8-10 LPA (starting)Top Hiring CitiesMumbai, Delhi, BengaluruFemale CAsOver 1 Lakh 👩💼ICAI Centers166+ in IndiaGlobal CA Recognition40+ countriesICAI MoUsUK, Australia, Canada 🌍Online Classes70% shift to hybrid learningPass Percentage (2024 Final)Group I: 11.2%, Group II: 17.3%

8️⃣ 📖 Famous Personalities Who Studied CA or Promoted Finance 💡

NameContributionKumar Mangalam Birla 🏢Industrialist & CA backgroundNaina Lal Kidwai 💼First Indian woman CA with Harvard MBAMrunal Thakur 🎬Actress who studied CA before film careerSundar Pichai 💼Advocates financial education (Google CEO)Chetan Bhagat 📚Ex-banker turned author, promotes CA careers

9️⃣ 📌 Top 10 Tips to Succeed in CA Journey (2025 Version)

- ✅ Start early and plan study hours - ✅ Focus more on conceptual clarity - ✅ Join a good mentorship group - ✅ Solve past papers & mock exams - ✅ Maintain your physical/mental health 🧘 - ✅ Don’t skip ICAI’s BOS lectures - ✅ Revise regularly and create summary sheets - ✅ Join telegram or Discord CA groups carefully - ✅ Avoid burnout: Balance with hobbies - ✅ Follow top10answer.com for fresh tips! 🌟

🔟 🎯 Why Visit top10answer.com for CA Day & Education Articles?

- 🎓 Expert-written “Top 10” articles for clear decision-making - 🔍 Researched updates, student-friendly formats - 📱 Latest portal links, career insights, trend analysis - 🧭 Emotional support for students and families - ✨ Join thousands who trust top10answer.com for powerful, simplified guidance!

✨ Conclusion: CA – A Path That Builds Nations and Dreams 🌍

Becoming a Chartered Accountant isn’t just a career; it’s a commitment to integrity, excellence, and social transformation. From CA Day on July 1st to your first step into Foundation, the journey is magical, challenging, and life-changing. As we salute the tireless work of Indian CAs, remember — you could be next. Explore, prepare, and take charge of your dreams. Stay updated with top10answer.com, your partner in career growth, clarity, and confidence. 🚀💖 Read the full article

0 notes

Text

Eligibility, Fees, Duration, Syllabus & Salary – Complete Guide 2025

CA Course: CA का पूरा नाम (Full Form) Chartered Accountant है। यह भारत के सबसे प्रतिष्ठित और चुनौतीपूर्ण कोर्सों में से एक प्रोफेशनल कोर्स है, जिसे Institute of Chartered Accountants of India (ICAI) द्वारा करवाया जाता है। CA कोर्स को आप 12वीं के बाद कभी भी कर सकते हैं। इसे करने के लिए BBA, B.Com, M.Com जैसे कोर्स जरुरी नहीं है। पर आप इन कोर्स के बाद सीधे CA Intermediate में एडमिशन ले सकते हैं। यह…

0 notes

Text

Best Study Timetable for CA Intermediate Students Who Are Preparing for the Sept 2025 Exams

Are you a CA Intermediate student setting your sights on the September 2025 exams? Feeling the weight of the vast syllabus and wondering how to conquer it effectively? You’re not alone! The CA Intermediate examination is a significant challenge, but with the right strategy and, more importantly, a well-structured study timetable, you can navigate the journey successfully.

Passing the CA Inter exams requires not just hard work, but smart work. And the foundation of smart work is a realistic, achievable, and comprehensive study plan tailored to your needs. This blog post will guide you through creating the best study timetable for CA Intermediate September 2025 attempt under the New Scheme, along with essential tips to stick to it.

Why is a Study Timetable Your Best Friend for CA Inter?

Embarking on CA studies without a timetable is like sailing without a compass. You might eventually reach your destination, but it will likely take longer, be more stressful, and you might miss crucial points along the way. Here’s why a dedicated study timetable is indispensable:

Structured Approach: It breaks down the enormous syllabus into manageable daily and weekly tasks.

Effective Time Management: It ensures you allocate adequate time to all subjects, preventing last-minute cramming or neglecting certain areas.

Reduces Stress & Anxiety: Knowing exactly what you need to study each day brings clarity and reduces the overwhelm.

Tracks Progress: A timetable helps you monitor your completion rate and identify if you are on track.

Builds Discipline: Adhering to a schedule builds the self-discipline crucial for the CA course.

Understanding the CA Intermediate Syllabus (New Scheme)

The September 2025 exams will be held under the New Scheme of Education and Training. Familiarize yourself with the subjects in both groups:

Group 1:

Paper 1: Advanced Accounting

Paper 2: Corporate and Other Laws

Paper 3: Taxation (Income Tax Law & GST)

Group 2:

Paper 4: Cost and Management Accounting

Paper 5: Auditing and Ethics

Paper 6: Financial Management and Strategic Management 1

Each paper demands dedicated attention. Some are practical, others theoretical, and some a mix. Your timetable must reflect this diversity.

Crafting Your Personalized CA Inter Study Timetable

There’s no one-size-fits-all timetable. The “best” timetable is one that you can realistically follow. Here are the key principles to consider when creating yours:

1. Assess Your Starting Point:

Are you attempting one group or both?

How much of the syllabus have you already covered?

Which subjects/topics do you find challenging?

How much time do you have available daily (considering articleship, classes, etc.)?

2. Determine Your Study Hours:

CA Inter requires significant dedication. Aim for 8-12 hours of focused study per day, depending on your capacity and the number of groups.

Identify your most productive hours – are you a morning person or a night owl? Schedule your toughest or most concentration-demanding subjects during these peak hours.

3. Balance Practical and Theory:

Avoid studying only practical or only theory subjects back-to-back.

Mix them up throughout the day to keep your mind engaged and prevent monotony. For example, pair a practical subject like Advanced Accounting or Costing with a theory subject like Law or Auditing.

4. Allocate Time Based on Weightage and Difficulty:

Give more time to subjects or topics that have higher weightage in the exams or those you find difficult.

Don’t neglect the “easier” subjects, but optimize your time allocation.

5. Include Buffer Time:

Life happens! Don’t jam-pack every minute. Include small buffers for unexpected delays or to extend a study session if you’re in flow.

6. Schedule Regular Revision:

Revision is NON-NEGOTIABLE. Allocate dedicated slots daily, weekly, and monthly for revising previously studied topics. Spaced repetition is key to retention.

7. Integrate Mock Tests:

Solving mock tests is crucial to evaluate your preparation level, practice time management under exam conditions, and get familiar with the paper pattern. Schedule mock tests regularly, especially in the last 1-2 months.

8. Prioritize Breaks and Rest:

Burnout is real and counterproductive. Include short breaks (10-15 minutes) between study sessions and longer breaks (30-60 minutes) for meals.

Ensure you get 7-8 hours of quality sleep each night. A fresh mind grasps concepts better.

Sample Timetable Structure (Adaptable)

Here’s a possible daily structure you can adapt. Remember to customize subject slots based on your preference and coaching class timings (if applicable).

Morning Slot (e.g., 6:00 AM – 9:00 AM): Practical Subject (e.g., Advanced Accounting / Costing) – Your mind is fresh, ideal for problem-solving.

Break (9:00 AM – 10:00 AM): Breakfast, freshen up.

Late Morning Slot (e.g., 10:00 AM – 1:00 PM): Theory Subject (e.g., Corporate and Other Laws / Auditing and Ethics) – Focus on understanding concepts, reading provisions.

Lunch Break (1:00 PM – 2:00 PM)

Afternoon Slot (e.g., 2:00 PM – 5:00 PM): Another Subject (e.g., Taxation / Financial Management & SM) – Could be practical or theory depending on your mix.

Tea/Short Break (5:00 PM – 5:30 PM)

Evening Slot (e.g., 5:30 PM – 8:00 PM): Practice/Revision/Theory Reading – Solve problems, revise topics from the day, or read theory chapters again.

Dinner Break (8:00 PM – 9:00 PM)

Night Slot (e.g., 9:00 PM – 10:30 PM): Revision / Law Reading / Light Subject – Quick revision of formulas, sections, or reading relatively lighter theory topics.

Beyond 10:30 PM: Wind down, prepare for the next day, ensure sufficient sleep.

Note: The above is just an example. You might have longer study blocks, different start/end times, or choose to focus on fewer subjects per day. Flexibility is key.

Phase-wise Preparation Strategy Leading to Sept 2025

Consider dividing your preparation into phases:

1. Phase 1: Conceptual Clarity & Syllabus Completion (May – July 2025)

Focus on attending classes (if any) and understanding each concept thoroughly from the ICAI Study Material.

Make concise notes, especially for theory subjects and important practical concepts/formulas.

Aim to complete the initial coverage of the entire syllabus (or your chosen group’s syllabus).

2. Phase 2: Practice & First Revision (August 2025)

Start solving questions from the ICAI Study Material, RTPs (Revision Test Papers), and MTPs (Mock Test Papers).

Begin your first full revision of all subjects. Focus on applying the concepts you learned.

Identify your weak areas and dedicate extra time to them.

3. Phase 3: Intensive Revision & Mock Tests (September 2025 onwards till exams)

This is the most critical phase. Aim for multiple revisions (at least 2-3).

Solve past exam papers under timed conditions.

Take full-syllabus mock tests to simulate the exam environment and work on speed and accuracy.

Refine your answer writing skills for theory papers.

Tips for Sticking to Your CA Inter Study Timetable

Creating the timetable is only half the battle; adhering to it is the real challenge.

Be Realistic: Don’t create an overly ambitious plan you can’t sustain.

Find Your Ideal Study Environment: Choose a quiet place free from distractions.

Minimize Distractions: Keep your phone away during study sessions.

Track Your Progress: Tick off topics as you complete them. This gives a sense of accomplishment.

Stay Consistent: Even short, consistent study sessions are more effective than erratic long ones.

Don’t Be Afraid to Adjust: If a topic takes longer than planned, adjust your schedule for the following days. Don’t let one setback derail your entire plan.

Stay Healthy: Eat nutritious food, exercise regularly, and get enough sleep. Physical and mental well-being are crucial for focus and performance.

Stay Positive: The CA course is challenging, but your effort will pay off. Stay motivated and believe in yourself.

Conclusion

Preparing for the CA Intermediate September 2025 exams requires dedication, strategic planning, and a disciplined approach. A well-thought-out study timetable is your roadmap to success. Personalize the structure provided here based on your strengths, weaknesses, and available time. Stick to your plan, revise consistently, practice diligently, and don’t forget to take care of your physical and mental health.

Start planning today and take the first concrete step towards clearing your CA Inter exams in September 2025!

0 notes

Text

0 notes

Text

#CA Inter FM#CA Inter FM (New Syllabus) Live Batch May'24#CA Intermediate#CA Inter#ca inter fm eco#best faculty for ca inter fm#CA Inter EFF & FM Pendrive

0 notes

Text

0 notes