#CIBIL Defaulter

Explore tagged Tumblr posts

Text

Does Taking a Personal Loan Reduce Your Credit Utilization Ratio?

A personal loan is one of the most flexible financial tools available, helping borrowers cover expenses such as medical bills, home renovations, education, or even debt consolidation. However, before taking out a personal loan, it’s essential to understand its impact on your credit utilization ratio and overall credit score.

Your credit utilization ratio is a crucial factor in determining your credit score. It measures how much credit you’re using compared to your available credit limit. Many borrowers wonder: Does taking a personal loan reduce your credit utilization ratio? The answer depends on how the loan interacts with your credit profile. In this guide, we’ll explore the relationship between personal loans and credit utilization and offer strategies to maintain a healthy credit score.

1. Understanding Credit Utilization Ratio

The credit utilization ratio is the percentage of your available revolving credit that you are currently using. It primarily applies to credit cards and lines of credit but does not include installment loans like personal loans or auto loans.

How is Credit Utilization Calculated?

The formula for calculating your credit utilization ratio is:

For example:

If your total credit card limit is ₹5,00,000, and your outstanding balance is ₹1,50,000, your credit utilization ratio is 30%.

A lower ratio (below 30%) is ideal for maintaining a high credit score.

Since personal loans are installment credit (not revolving credit), they do not directly factor into your credit utilization ratio. However, they can still impact your credit score in various ways.

2. Does Taking a Personal Loan Reduce Credit Utilization?

Taking a personal loan does not directly lower your credit utilization ratio because credit bureaus do not include installment loans when calculating credit utilization. However, a personal loan can indirectly help improve this ratio, depending on how it is used.

A. Using a Personal Loan to Pay Off Credit Card Debt

If you take a personal loan to consolidate high-interest credit card debt, it can reduce your credit utilization ratio significantly.

✅ Example:

You have ₹3,00,000 in credit card debt across multiple cards, and your total credit limit is ₹5,00,000.

Your credit utilization is 60%, which is too high and negatively affects your credit score.

If you take a personal loan of ₹3,00,000 and use it to pay off your credit card debt, your credit utilization drops to 0% while your credit card limits remain intact.

This improves your credit score over time.

B. Adding a Personal Loan Without Paying Off Credit Card Debt

If you take a personal loan but do not use it to pay off existing credit card balances, it will not change your credit utilization ratio. However, it will increase your total debt obligations.

🚨 Example:

Your credit card utilization is 40%, and you take a personal loan for a different purpose.

Your overall debt increases, but your credit utilization ratio remains unchanged.

This may impact your debt-to-income ratio (DTI), which lenders consider when assessing loan applications.

3. How a Personal Loan Affects Your Credit Score?

While credit utilization is a significant factor in credit scoring, a personal loan influences your credit score in multiple ways.

A. Positive Effects of a Personal Loan

✅ Credit Mix Improvement – A personal loan adds installment credit to your profile, diversifying your credit mix, which can boost your score. ✅ Timely Payments Improve Score – Making regular EMI payments enhances your payment history (which accounts for 35% of your credit score). ✅ Debt Consolidation Benefits – If used wisely, a personal loan can replace high-interest credit card debt, reducing financial stress.

B. Negative Effects of a Personal Loan

❌ Increases Total Debt – Adding a personal loan increases your total liabilities, affecting your debt-to-income ratio. ❌ Temporary Credit Score Dip – Taking a new loan triggers a hard inquiry, which may cause a temporary dip in your credit score. ❌ Missed Payments Can Hurt Score – Failing to make timely EMI payments can lead to defaults and negatively impact your credit history.

4. When Should You Consider Taking a Personal Loan to Reduce Credit Utilization?

A personal loan can be a strategic tool to improve your credit score, but it should be used wisely. Here’s when it makes sense:

✅ If Your Credit Utilization is Above 30% – High credit card balances hurt your credit score. A personal loan can help pay off those balances and reduce utilization. ✅ If You Want to Lower Interest Costs – Credit card interest rates can exceed 30% annually, while a personal loan typically has rates between 10-18%. ✅ If You Can Afford EMI Payments – Only take a personal loan if you can comfortably handle the monthly repayments. ✅ If You Need a Credit Score Boost – If you plan to apply for a home loan or car loan, reducing credit utilization before applying can improve approval chances.

5. How to Use a Personal Loan Responsibly to Improve Credit Health?

If you decide to take a personal loan to improve your credit standing, follow these best practices:

✔️ Choose a Loan with a Low Interest Rate – Compare lenders to find the best terms. ✔️ Pay Off Credit Card Debt First – If reducing credit utilization is your goal, prioritize paying off high-interest debt. ✔️ Make Timely EMI Payments – A missed personal loan payment will damage your credit score. ✔️ Avoid Taking Unnecessary Loans – Do not take a personal loan unless you truly need it. ✔️ Monitor Your Credit Report – Regularly check your CIBIL score to track improvements and correct any errors.

Conclusion

A personal loan does not directly reduce your credit utilization ratio because installment loans are not included in the calculation. However, if used to pay off credit card debt, a personal loan can significantly lower your utilization ratio and improve your credit score.

While a personal loan can be a valuable tool for managing debt, it is important to use it wisely. Always consider factors such as interest rates, repayment terms, and total debt obligations before taking a loan. Maintaining a strong financial strategy will help you improve your credit health, lower your credit utilization, and achieve financial stability.

#personal loan#personal loan online#nbfc personal loan#fincrif#loan apps#bank#personal laon#loan services#personal loans#finance#Personal loan#Personal loan restructuring#Loan restructuring impact on credit score#Credit score after loan restructuring#Does loan restructuring affect credit score#Personal loan modification and credit score#How to restructure a personal loan#Loan restructuring vs loan settlement#Personal loan repayment changes#Benefits of restructuring a personal loan#Personal loan restructuring process#How to improve credit score after loan restructuring#Personal loan EMI restructuring#Does restructuring affect future loans#Impact of restructuring on CIBIL score#How banks restructure personal loans#Personal loan repayment flexibility#Loan restructuring eligibility criteria#Loan restructuring vs refinancing#Personal loan default vs restructuring

1 note

·

View note

Text

Customer Credit Behaviour has become a mandatory check before further lending for all kinds of Loans and Credit Cards. Every time an individual applies for credit, the financer sends an enquiry to a credit bureau—the primary ones include Equifax, Experian, Transunion CIBIL, or CRIF Highmark—to retrieve an individual’s score and history.

#CIBIL Score#Transunion Credit Score#Check Your Credit Score#CIBIL Score Check Online#Urgent Loan for CIBIL Defaulters#Low CIBIL Score Personal Loan

0 notes

Text

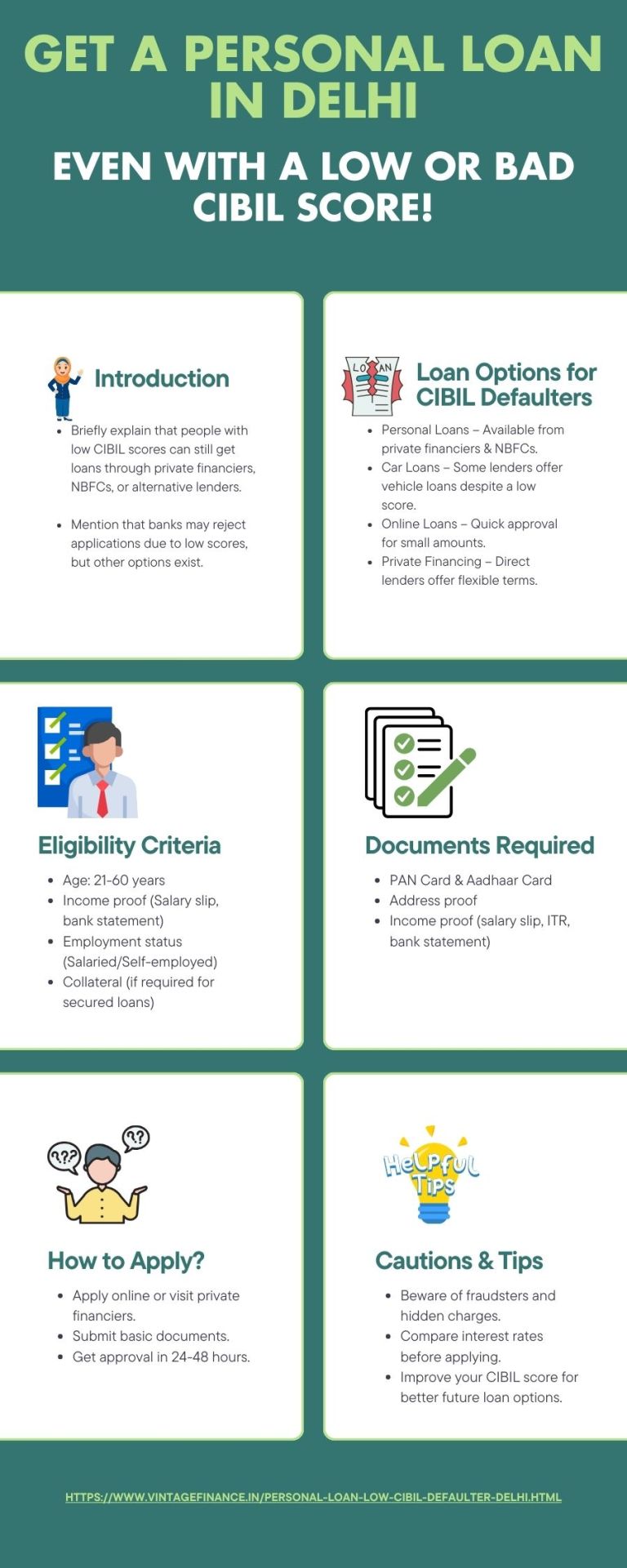

Get an online personal loan in Delhi NCR for bad CIBIL defaulters. No CIBIL verification required, with low-interest rates and flexible repayment options available.

#Personal loan in Delhi without CIBIL check#Personal loan without CIBIL#Loan for cibil defaulters in Delhi#Personal loan for CIBIL defaulter#Personal Loan for low CIBIL score#Loan without cibil check in Delhi#Personal loan for cibil defaulters in Delhi#Private financiers for cibil defaulters in Delhi#Loan without cibil verification in Delhi#Personal loan without cibil in Delhi#Loan without cibil in Delhi#Personal loan for bad cibil score in Delhi#Bad cibil personal loan in Delhi#Loan for bad cibil score in Delhi#Personal loan for cibil defaulters in Delhi NCR#Car loan for cibil defaulters in Delhi#Online loan for CIBIL defaulters#Cibil defaulter personal loan Delhi#online loan for cibil defaulters in Delhi#Low cibil personal loan Delhi

0 notes

Text

Urgent Loan for CIBIL Defaulters

For those with a low credit score, getting an urgent loan for CIBIL defaulters may seem difficult, but it's not impossible. Many lenders offer secured loans or private lending options specifically for those with poor credit. Although the interest rates might be higher, these loans are designed to provide quick financial relief. With collateral or a guarantor, CIBIL defaulters can secure urgent loans to manage their immediate expenses.

0 notes

Text

How to Get Urgent Loan for CIBIL Defaulters?

Facing financial difficulties is daunting, especially for individuals with a less-than-perfect credit history. If you find yourself labeled as a CIBIL defaulter, securing urgent financial assistance might seem like an insurmountable challenge. However, despite the setbacks, there are still avenues available for those in need. Here's a guide on how to get an urgent loan for CIBIL defaulters:

Understand Your Credit Situation: Begin by obtaining a copy of your credit report from CIBIL or any other credit bureau. Review the report carefully to understand the factors contributing to your defaulter status. Identify any discrepancies and work towards rectifying them to improve your credit score.

Explore Alternative Lending Options: Traditional banks and financial institutions may be hesitant to extend credit to CIBIL defaulters. However, there are alternative lenders, such as online lending platforms and peer-to-peer lending networks, that specialize in providing loans to individuals with imperfect credit histories.

Consider Collateral-Based Loans: If you're struggling to secure an unsecured loan due to your CIBIL default status, consider applying for a secured loan instead. Collateral-based loans, such as gold loans or loans against property or securities, provide lenders with added security, making them more willing to lend to CIBIL defaulters.

Demonstrate Repayment Capacity: When applying for an urgent loan, emphasize your ability to repay the borrowed amount despite your CIBIL defaulter status. Provide documentation of stable income, employment stability, and any additional assets or savings that can serve as repayment assurance.

Opt for Smaller Loan Amounts: While you may need a significant sum urgently, consider applying for smaller loan amounts initially. Lenders may be more willing to extend credit for lower amounts to mitigate their risk associated with CIBIL defaulters.

Seek Assistance from Financial Advisors: If you're unsure where to begin or feel overwhelmed by the process, consider seeking guidance from financial advisors or credit counselors. They can provide personalized advice and help you navigate the complexities of securing a loan as a CIBIL defaulter.

Be Prepared for Higher Interest Rates: Due to the increased risk associated with lending to CIBIL defaulters, lenders may charge higher interest rates on loans. Be prepared to negotiate terms and compare offers from multiple lenders to ensure you're getting the most favorable terms possible.

Stay Diligent and Persistent: Securing an urgent loan for CIBIL defaulter may require patience and perseverance. Don't be discouraged by initial rejections and continue exploring different lending options until you find a suitable solution.

Conclusion

While being labeled as a CIBIL defaulter presents challenges, it's not impossible to secure urgent financial assistance when needed. By understanding your credit situation, exploring alternative lending options, and demonstrating repayment capacity, you can increase your chances of obtaining an urgent loan even with a less-than-perfect credit history. Remember to stay diligent, be open to alternative solutions, and seek assistance when needed to navigate the process successfully.

0 notes

Text

Understanding Loan Against Property Interest Rates

Loan Against Property (LAP) is a popular financing option that allows individuals to leverage their property to secure funds for various needs. One of the most critical aspects to consider when opting for a LAP loan is the interest rate, as it directly impacts the overall cost of borrowing. In this article, we will delve into the factors influencing Loan Against Property Interest Rates and explore how to make informed decisions when applying for such loans.

What is Loan Against Property?

A Loan Against Property is a secured loan where you pledge your residential, commercial, or industrial property as collateral. This type of loan can be utilized for purposes such as business expansion, education, medical emergencies, or debt consolidation. With competitive interest rates and high loan amounts, LAP loans are an attractive choice for many borrowers.

Factors Affecting Loan Against Property Interest Rates

Credit Score: A high credit score demonstrates financial responsibility and can help you secure lower interest rates. On the other hand, a poor credit score might lead to higher rates or even rejection of your application.

Loan Amount and Tenure: The loan amount and repayment tenure also influence the interest rate. Longer tenures may have slightly higher rates due to the increased risk to lenders.

Type of Property: The nature and location of the property being pledged can impact the interest rate. Properties in prime locations or with high market value may attract better rates.

Income Proof and Stability: Providing adequate income proof assures lenders of your repayment capacity. However, some lenders offer Loan Against Property Without Income Proof, albeit at higher interest rates.

Lender Policies: Different financial institutions have varying policies and benchmarks for determining LAP loan interest rates. Comparing multiple lenders can help you find the best deal.

How to Use a Loan Against Property Interest Rate Calculator

A Loan Against Property Interest Rate Calculator is a valuable tool that helps you estimate your monthly EMI and overall repayment amount. By inputting details such as the loan amount, tenure, and interest rate, you can assess the affordability of the loan and plan your finances accordingly.

Loan Against Property for CIBIL Defaulters

If you have a history of CIBIL defaults, obtaining a Loan Against Property might be challenging but not impossible. Some lenders specialize in offering loans to individuals with poor credit histories, although the interest rates might be higher. Improving your credit score and demonstrating consistent income can improve your chances.

Benefits of Loan Against Property

Lower Interest Rates: Compared to unsecured loans, LAP loans usually have lower interest rates due to the security provided by the property.

Flexible Usage: The funds can be used for various purposes without restrictions.

Higher Loan Amount: You can avail a significant loan amount depending on the property's value.

How to Apply for Loan Against Property

Applying for a Loan Against Property is a straightforward process:

Research and shortlist lenders based on their interest rates and policies.

Use a Loan Against Property Interest Rate Calculator to evaluate EMI affordability.

Gather necessary documents such as property papers, identity proof, and income proof.

Understanding Loan Against Property Interest Rates. await approval and disbursement after property evaluation and verification.

Conclusion

Apply Loan Against Property is crucial for making a sound financial decision. By comparing different lenders, using tools like interest rate calculators, and being mindful of factors like credit scores and property value, you can secure a LAP loan that aligns with your needs and repayment capacity. Whether you’re looking for a Loan Against Property Without Income Proof or need options for CIBIL defaulters, careful planning and research can help you achieve your financial goals.

1 note

·

View note

Text

Common Mistakes to Avoid When Applying for an MSME Business Loan

For many entrepreneurs, access to timely funding can determine the success or stagnation of their business. An MSME Business Loan is designed specifically to support micro, small, and medium enterprises in meeting working capital needs, buying machinery, expanding operations, or covering day-to-day business expenses. However, many applicants fall into common traps that lead to delays, rejections, or unfavorable loan terms.

To help you navigate the loan process smoothly and increase your chances of approval, here are the common mistakes to avoid when applying for an MSME Business Loan.

1. Inadequate Documentation

One of the most frequent reasons for MSME loan rejection is incomplete or incorrect documentation. Financial institutions require a standard set of documents to verify identity, business registration, income, and repayment capacity.

What to avoid:

Submitting outdated or expired documents

Missing key papers like GST returns, bank statements, or audited financials

Failing to provide business proof like Udyam Registration or trade licenses

Tip: Always double-check the lender’s checklist and prepare both physical and digital copies in advance.

2. Poor Credit History

Your creditworthiness is one of the first things lenders check. A low CIBIL score or history of missed EMIs signals risk, reducing your chances of getting an MSME Business Loan approved—or resulting in a higher interest rate.

What to avoid:

Ignoring past defaults or outstanding credit card dues

Applying without reviewing your credit report

Submitting applications to multiple lenders simultaneously, which may lower your credit score

Tip: Aim for a credit score of 700 or above and clear pending dues before applying.

3. Not Knowing the Exact Loan Requirement

Many business owners apply for vague or unrealistic loan amounts without understanding their actual financial needs. This creates confusion during assessment and may indicate poor planning.

What to avoid:

Applying for a loan without a business plan or usage breakdown

Requesting an amount disproportionate to your annual revenue

Tip: Evaluate your business needs clearly—whether it’s for equipment, inventory, marketing, or working capital—and back your request with data.

4. Ignoring the Terms and Conditions

Not reading the fine print of an MSME Business Loan agreement can lead to unexpected charges, repayment issues, or penalties down the line.

What to avoid:

Overlooking clauses related to interest rate type (fixed vs floating), prepayment charges, or processing fees

Signing documents without understanding the terms

Tip: Ask for a detailed loan offer letter and clarify any doubts with the loan officer before committing.

5. Choosing the Wrong Lender

Not all lenders offer the same terms or understand the needs of MSMEs. Choosing the wrong institution may lead to high EMIs, poor customer service, or hidden fees.

What to avoid:

Picking a lender just because of fast disbursal promises

Not comparing interest rates, tenure options, or collateral requirements

Tip: Use online comparison tools or consult a financial advisor to find the best loan provider for your business type and size.

6. Ignoring Eligibility Criteria

Each lender has specific eligibility requirements related to turnover, years of operation, credit score, and industry. Applying blindly without checking these may waste time and hurt your credit score.

What to avoid:

Applying for a loan without checking minimum business vintage or turnover requirements

Assuming all MSMEs qualify for government-backed schemes

Tip: Review the eligibility criteria in detail before applying and ensure you meet all minimum requirements.

Conclusion

An MSME Business Loan can be a powerful tool to fuel growth, manage cash flow, or scale operations—but only when approached with preparation and caution. Avoiding these common mistakes can increase your chances of approval, reduce financial stress, and help you get the most out of your loan.

Always treat the loan application as a professional financial transaction. Plan thoroughly, read carefully, and choose wisely—your business depends on it.

0 notes

Text

Rejected by Banks? Here’s How to Get a Personal Loan with Low CIBIL Score – No More Waiting!

Think your low CIBIL score means the end of your financial journey? Think again. While traditional banks slam the door on applicants with poor credit, platforms like FinCrif open new paths. Whether you're dealing with past defaults or limited credit history, you can still get a personal loan with bad CIBIL score—if you know where to look and how to approach it smartly.

Let’s cut the fluff. Here’s your no-nonsense guide to securing a personal loan with low CIBIL score, and why FinCrif might just be the game-changer you need.

Why CIBIL Score Matters—But Shouldn’t Define You

Your CIBIL score is a 3-digit number ranging from 300 to 900 that reflects your creditworthiness. Ideally, scores above 750 are considered "safe" by banks. But life happens. One missed EMI, a job loss, or a medical emergency—and your score takes a hit.

Most lenders don’t look beyond the number. But FinCrif partners with NBFCs and digital lenders who understand that your past doesn’t define your present.

Bad CIBIL? Here’s What It Could Look Like:

Below 600: Considered high-risk

600–700: Average to fair credit

Above 700: Favorable for traditional loans

Can You Get a Loan with a Low CIBIL Score?

Yes, absolutely.

With the rise of alternative lenders, low CIBIL score loan approvals are more common than ever. These lenders don’t just assess your score—they evaluate your income, job stability, repayment capacity, and intent.

FinCrif makes it easier by:

Connecting you to the right lender

Helping you apply for personal loan with low CIBIL online

Ensuring documentation and application support

Offering competitive interest rates even on riskier profiles

Top Strategies to Get Personal Loan Approval with Low CIBIL Score

1. Go NBFC Instead of Banks

Banks are rigid. NBFCs (Non-Banking Financial Companies), available through FinCrif, are flexible and evaluate your whole profile.

2. Opt for a Lower Amount First

Want ₹10 lakh? Start with ₹50,000 or ₹1 lakh. Build your repayment credibility again.

3. Add a Co-Applicant or Guarantor

Having a co-borrower with a good score can boost your approval chances significantly.

4. Show Income Proof

Steady salary, business income, or even rental income can help lenders look past your CIBIL.

5. Secure Your Loan

If you have assets—like FD, insurance, or gold—use them to get a secured loan with lower interest.

Loan Options for Low CIBIL Borrowers on FinCrif

Here are some of the types of low CIBIL score personal loan options available:

Instant small-ticket loans (₹10,000 to ₹1 lakh)

Collateral-backed loans

Salary advance loans

Peer-to-peer lending

These options come with different terms, but all of them help you rebuild your credit score while addressing urgent cash needs.

Personal Loan Approval with Low CIBIL – Eligibility Checklist

FinCrif evaluates your application on broader terms, like:

Monthly income: ₹15,000 and above

Job status: Salaried or stable self-employed

Age: Between 21 and 58 years

Location: Serviceable cities across India

Supporting documents: ID, address proof, salary slips/bank statements

Even with bad credit, if your profile shows promise, FinCrif ensures you're not ignored.

Interest Rates on Low CIBIL Score Loan

Rates vary, but here’s a breakdown:

Standard Rate: 10.49% – 24% (depending on lender and risk)

Loan Tenure: 3 months to 5 years

Processing Fee: 1% – 3%

Prepayment Options: Available after 6–12 months

Yes, the rate might be slightly higher, but you’re buying time and trust. And once your repayments begin, your CIBIL score improves automatically.

The FinCrif Advantage – Why Choose Us?

FinCrif is your smart alternative to old-school rejection. Here's why:

Access to NBFCs open to low-CIBIL borrowers

No collateral required in most cases

Transparent process with zero hidden charges

Fast approval – sometimes in as little as 24 hours

Digital journey from start to disbursal

Why waste time on dead ends when FinCrif gives you a chance to win?

Quick Steps to Apply Personal Loan with Low CIBIL Score

Visit FinCrif’s platform

Enter basic details and your CIBIL score (if known)

Use our smart match tool to find a lender fit for low CIBIL profiles

Upload documents

Get approved and receive funds in your bank

Everything is done online. No branch visits. No questions asked.

Mistakes to Avoid if You Have a Low CIBIL Score

Don’t apply to too many lenders—hurts your score more

Don’t hide your financial issues—transparency earns trust

Don’t default again—this is your second chance

Don’t overborrow—take what you can repay comfortably

Success Story: Ravi from Pune

Ravi had a CIBIL score of 580 after missing a few EMIs during COVID. Traditional banks refused him. Through FinCrif, he received a ₹1.5 lakh personal loan at 16% interest from an NBFC. After repaying it in 12 months, his score jumped to 701—and today, he qualifies for a home loan.

Conclusion: Don’t Let Low CIBIL Stop You

Bad credit doesn’t make you a bad borrower. It makes you someone who needs a chance to reset. Whether it’s medical urgency, business recovery, or day-to-day survival, you deserve access to funding. FinCrif is the platform that gives you that shot.

If you're tired of hearing “No,” this is your chance to finally get a “Yes.” Apply today for a personal loan with low CIBIL score—and take control of your finances again.

0 notes

Text

How Your Credit Score Affects Your Car Loan Approval

Buying a car is a milestone moment—whether it’s your very first vehicle, a much-needed upgrade, or even a second family car. But before you take that exciting step into the showroom or browse your favorite car loan offers online, there’s one important number that quietly influences everything behind the scenes: your credit score.

It might not be something you think about daily, but your credit score plays a major role in how banks and lenders decide whether to approve your car loan—and what kind of terms they’ll offer you. In this blog, we’ll explore why your credit score matters, how it impacts your car loan approval, and what you can do if your score isn’t where you want it to be.

What Is a Credit Score, Really?

Let’s start simple. Your credit score is a three-digit number that represents your creditworthiness—or in plain terms, how reliably you’ve handled debt in the past. In India, scores typically range from 300 to 900, with anything above 750 considered excellent.

Credit bureaus like CIBIL, Experian, Equifax, and CRIF High Mark calculate your score based on factors such as:

Your repayment history (on credit cards, loans, EMIs)

Credit utilization (how much of your credit limit you use)

Length of your credit history

Types of credit accounts (secured vs. unsecured)

Number of recent credit inquiries

Think of it as your financial reputation. And just like in life, a good reputation opens doors.

How Credit Score Impacts Your Car Loan

✅ Loan Approval

The most direct impact of your credit score is on the loan approval decision. When you apply for a car loan, the lender checks your credit report to assess your risk level. A high score (750 or above) signals that you’re responsible with credit, making lenders more likely to approve your application without hesitation.

A low score (below 650), on the other hand, raises red flags. It tells lenders you may have missed EMIs or defaulted in the past. This could result in:

Loan rejection

Higher scrutiny during the approval process

The need for a guarantor or co-applicant

✅ Interest Rate Offered

Even if you do get approved with a lower score, it might come at a cost—a higher interest rate. For example, someone with a good credit score might get a car loan at 8% interest, while someone with a weaker score might be offered 11% or higher for the same loan amount. Over time, that adds up to a significant difference in total repayment.

A good credit score = cheaper loan. It’s as simple as that.

✅ Loan Amount and Tenure

With a higher credit score, you’re more likely to qualify for a larger loan amount and have more flexibility in choosing your repayment tenure—whether it’s 3 years, 5 years, or more. Lenders trust that you can manage your EMIs responsibly, so they’re more comfortable with bigger commitments.

Lower scores, however, may limit your eligibility to lower loan amounts and shorter tenures, increasing your monthly EMI burden.

✅ Loan Processing Speed

Believe it or not, your credit score can even impact how quickly your loan is processed. Applicants with excellent scores often get pre-approved offers or faster approvals, especially from digital-first lenders or banks you already have a relationship with.

Meanwhile, low-score applicants may face delays due to extra document checks, verifications, or the need for additional approvals.

What to Do If Your Score Is Low?

Don’t worry—your credit score is not set in stone. If it’s lower than ideal, there are concrete steps you can take to improve it, even before applying for a car loan.

🧾 1. Check Your Credit Report

Start by checking your report from a bureau like CIBIL. Look for errors, outdated entries, or signs of fraud. Disputing and correcting errors can boost your score.

💳 2. Clear Outstanding Dues

Pay off overdue EMIs, credit card bills, or other pending loans. Even clearing a few missed payments can help improve your score over time.

📈 3. Lower Your Credit Utilization

If you're using over 50% of your credit card limit, try to bring it down. A lower credit utilization ratio is viewed positively by lenders.

🧠 4. Avoid Multiple Loan Applications

Every time you apply for a loan, an inquiry is made on your credit file. Too many inquiries can lower your score. Be selective and apply only when you're confident.

🤝 5. Add a Co-Applicant

If your score is low but your spouse or family member has a strong credit history, consider applying jointly. This increases your chances of approval.

Final Thoughts

In the end, your credit score is more than just a number—it’s a reflection of your financial behavior over time. When it comes to buying a car, a high score can unlock better interest rates, easier approvals, and a smoother experience overall. But even if your score needs some work, don’t be discouraged.

The key is being proactive. Understand your current score, work toward improving it, and explore car loan options that suit your financial reality.

Remember: a car loan should make your life easier, not more stressful. So treat your credit score as a tool—not a roadblock—and use it to drive your financial goals forward.

0 notes

Text

Best Credit Cards for Low CIBIL Score Rebuild Your Credit Smartly

Having a low CIBIL score can make it challenging to access financial products, especially credit cards.However,rebuilding your credit is possible with the right tools starting with the best credit cards designed specifically for low credit scores.These cards, often secured or specially curated for credit recovery,offer a stepping stone toward improving your credit history. By using them wisely maintaining low balances and paying on time you can gradually boost your score and regain financial credibility. In this blog, we explore the best credit card options for individuals with low CIBIL scores and how they can help you rebuild your credit smartly.

Understanding the Impact of a Low CIBIL Score

A low credit card for low cibil score,typically below 650, indicates poor credit health and can limit your access to financial products, especially unsecured credit cards. This score reflects past payment delays, defaults, or high credit utilization. Lenders view it as a risk, which makes approval difficult. However, it’s important to know that this is not the end of the road. With disciplined financial behavior and the right credit tools, such as secured or low-limit cards, you can gradually repair your credit profile. Understanding why your score dropped is the first step in choosing a card that supports your recovery journey.

What Are Secured Credit Cards and How Do They Work?

Secured credit cards are designed specifically for individuals with poor or no credit history. These cards require a refundable security deposit, usually equal to your credit limit, which acts as collateral for the bank. Since the risk to the issuer is reduced, approval chances are much higher even with a low CIBIL score.These cards function like regular credit cards and report to credit bureaus. By using them responsibly paying dues on time and keeping utilization low you can steadily improve your credit score. Secured cards are a practical, low-risk way to rebuild financial trust and unlock future credit opportunities.

Top Indian Banks Offering Credit Cards for Low CIBIL Scores

Several Indian banks and NBFCs offer credit cards tailored for people with low CIBIL scores. Notable examples include SBI’s SimplySAVE Secured Card, ICICI Bank’s Coral Credit Card against Fixed Deposit, and Axis Bank’s Insta Easy Card. These are usually secured cards backed by a fixed deposit, making approval easier. These cards often come with basic benefits such as reward points, fuel surcharge waivers, and online banking access. Choosing the right card from a reputed bank ensures transparency, reliability, and a smoother path to credit improvement. Compare terms like deposit requirements, annual fees, and interest rates before applying.

How to Use Credit Cards Responsibly to Rebuild Credit?

Rebuilding your credit with a card starts with responsible usage.Always pay your bills on or before the due date this alone significantly impacts your CIBIL score.Try to keep your credit utilization ratio below 30% of your credit limit.Avoid applying for multiple credit cards at once, as frequent hard inquiries can further lower your score. Monitor your statements for errors and track your credit report regularly to measure progress. Over time, consistent financial behavior will reflect positively in your credit profile, and you’ll become eligible for better credit products with enhanced limits and rewards.

Key Features to Look for in a Credit Card for Poor Credit

When selecting a credit card for a low CIBIL score, prioritize features that align with credit rebuilding goals. Look for cards that report to all major credit bureaus, offer low or no annual fees, and come with reasonable interest rates. A secured credit card backed by a fixed deposit is ideal, as it provides easier approval and flexibility. Also, ensure there are no hidden charges and the bank offers digital access for easy account tracking. Some cards even provide upgrade options after timely payments. These features make it easier to manage debt and steadily regain creditworthiness.

Mistakes to Avoid When Using a Credit Card with Low Credit Score

Using a credit card irresponsibly when already dealing with a low CIBIL score can make things worse. Avoid making only minimum payments, as it leads to accumulating interest and a negative credit impression. Never miss payment deadlines it can trigger penalty charges and further drop your score. Refrain from maxing out your credit limit or applying for multiple cards simultaneously. Also, avoid withdrawing cash using your credit card, as it incurs high fees. The goal is to demonstrate financial discipline to credit bureaus, so every transaction should reflect responsible usage and repayment capacity.

How Long Does It Take to Improve Your Credit with the Right Card?

Rebuilding your credit score is a gradual process and depends on your financial behavior. With consistent on-time payments, low credit utilization, and avoiding new debt, you may start seeing improvements within 3–6 months. However, a noticeable increase in your CIBIL score generally takes 6–12 months of disciplined use. The credit card you choose should support this journey with reliable reporting to credit bureaus and transparent terms. Over time, your improved credit profile can qualify you for better financial products, including unsecured credit cards, loans, and even lower interest rates making your efforts toward recovery truly worthwhile.

Conclusion

Rebuilding your credit with the right credit card is not only possible but also a smart financial move. For individuals with a low CIBIL score, secured credit cards and specialized products offer a practical way to regain creditworthiness. By choosing the right card, maintaining timely payments, and using credit wisely, you can steadily improve your score over time. These cards act as stepping stones toward better financial health and open doors to more rewarding credit opportunities in the future. With patience, discipline, and the right tools, your low CIBIL score doesn't have to hold you back from achieving financial freedom.

0 notes

Text

How to Remove a Personal Loan Default Record from Your Credit Report?

A personal loan can be a great financial tool for handling emergencies, consolidating debt, or funding major expenses. However, missing payments or defaulting on a personal loan can leave a negative mark on your credit report, affecting your ability to secure future loans or credit cards. A loan default record lowers your credit score and can remain on your credit report for up to seven years, making financial recovery difficult.

The good news is that there are ways to remove or rectify a personal loan default record from your credit report. In this guide, we will explore the steps to clear a loan default, how it impacts your financial future, and strategies to improve your creditworthiness.

1. What Happens When You Default on a Personal Loan?

A personal loan default occurs when a borrower fails to repay EMIs (Equated Monthly Installments) for an extended period, usually 90 days or more. Once the default is recorded, the lender reports it to credit bureaus like CIBIL, Experian, or Equifax, leading to a significant drop in the borrower’s credit score.

Consequences of a Personal Loan Default:

Credit Score Drop – A default can lower your credit score by 100 to 150 points.

Loan Rejection – Future loan applications may be denied due to the poor credit history.

Legal Action – In extreme cases, lenders may initiate legal proceedings to recover the outstanding amount.

Difficulty in Renting or Employment – Some landlords and employers check credit reports before approval.

If you have defaulted on a personal loan, taking corrective action immediately can help you recover financially.

2. Steps to Remove a Personal Loan Default Record from Your Credit Report

If you want to remove a personal loan default record, follow these steps:

A. Get a Copy of Your Credit Report

Obtain your credit report from CIBIL, Experian, Equifax, or CRIF Highmark.

Check for errors, incorrect late payments, or discrepancies in your loan default record.

Identify the lender who reported the default and confirm the outstanding balance.

B. Clear Outstanding Dues

If the default is genuine, contact your lender and repay the outstanding balance.

Request a loan settlement or restructuring if you are unable to pay in full.

Obtain a No Objection Certificate (NOC) after full repayment.

C. Negotiate a Loan Settlement with the Lender

Some lenders allow a one-time settlement where you can pay a reduced amount.

Ensure the settlement is reported as “Closed” in your credit report.

Avoid “Settled” status, as it still impacts your credit score negatively.

D. Request the Lender to Update Your Credit Report

Once you clear the dues, ask the lender to update your payment status with credit bureaus.

It takes 30-45 days for the updated report to reflect the changes.

E. Dispute Errors in the Credit Report

If your report contains inaccurate default records, raise a dispute with the credit bureau.

Submit supporting documents such as payment receipts, NOC, and bank statements.

The credit bureau will investigate and correct errors within 30-45 days.

By following these steps, you can improve your credit score and remove the negative impact of a personal loan default.

3. How Long Does a Personal Loan Default Stay on Your Credit Report?

A loan default remains on your credit report for up to 7 years. However, you can speed up the recovery process by:

Repaying outstanding dues and requesting report updates.

Raising disputes for incorrect default records.

Using credit-building strategies to improve your score over time.

If you take corrective action, the impact of a personal loan default can be minimized much sooner.

4. Alternative Ways to Improve Your Credit Score After Default

If a personal loan default has affected your credit score, follow these strategies to rebuild your creditworthiness:

A. Pay Bills and EMIs on Time

Set up auto-debit for loan repayments to avoid future defaults.

Maintain a 100% payment track record to show creditworthiness.

B. Use a Secured Credit Card

Opt for a secured credit card against a fixed deposit to rebuild your score.

Make small purchases and pay bills in full and on time.

C. Reduce Your Credit Utilization Ratio

Keep your credit card usage below 30% of your credit limit.

Paying off existing debts improves your credit profile.

D. Increase Your Credit Mix

Having a mix of secured (home, auto loans) and unsecured loans shows creditworthiness.

Avoid taking multiple personal loans in a short span.

E. Limit Hard Inquiries

Do not apply for multiple loans or credit cards simultaneously.

Hard inquiries lower your score; space out loan applications.

By following these methods, your credit score will gradually improve, increasing your chances of loan approvals in the future.

5. How to Prevent a Personal Loan Default in the Future?

To avoid defaulting on a personal loan, follow these proactive measures:

A. Borrow Only What You Can Repay

Assess your financial capacity before taking a loan.

Use a personal loan EMI calculator to determine affordable repayment amounts.

B. Maintain an Emergency Fund

Save at least 3-6 months’ worth of expenses to cover unexpected financial setbacks.

C. Choose a Longer Loan Tenure for Lower EMIs

If repayment is challenging, opt for a longer tenure to reduce EMI burden.

D. Prioritize Debt Payments

Always pay loans and credit card bills first before discretionary spending.

E. Communicate with Your Lender

If facing financial difficulties, contact your lender early to explore restructuring options.

Taking these precautions will help you avoid personal loan defaults and maintain a healthy credit profile.

Conclusion

A personal loan default can significantly impact your creditworthiness, but it is possible to remove or rectify it with the right approach. The first step is to clear outstanding dues, negotiate with the lender, and request a credit report update. If errors exist, disputing them with the credit bureau can help remove incorrect defaults.

Additionally, rebuilding your credit score through timely payments, secured credit cards, and low credit utilization is crucial for financial recovery. By adopting smart borrowing habits, you can prevent future defaults and regain your financial stability.

If you’re struggling with a personal loan default, take action today to improve your credit score and restore your financial health.

#personal loan#personal loan online#fincrif#bank#personal loans#loan services#nbfc personal loan#finance#loan apps#personal laon#Personal loan#Personal loan default#Remove loan default record#How to fix loan default#Improve credit score after default#Loan default impact on credit score#Credit report loan default removal#Personal loan repayment issues#How to clear personal loan default#Loan default settlement process#Credit bureau loan default dispute#Personal loan default negotiation#How long does a loan default stay on credit report#Steps to fix credit score after default#Loan restructuring after default#CIBIL report loan default removal#Best way to handle personal loan default#How to improve credit score after loan default#Defaulted loan clearance process#Personal loan EMI default solution

1 note

·

View note

Text

What Is a Collateral Loan on Property? A Beginner’s Guide

In today’s financial landscape, having access to quick and sizable funds can be a game-changer—especially when you're planning to start a business, cover medical expenses, or consolidate debt. While personal loans are common, they often come with high-interest rates and limited loan amounts. This is where Collateral Loans on Property emerge as a smart, cost-effective solution.

Whether you're a salaried individual, self-employed professional, or business owner, understanding how property-based loans work can help you unlock the full value of your real estate assets. In this beginner’s guide, we’ll break down what collateral loans on property are, how they work, and why they may be the right choice for you.

What Is a Collateral Loan on Property?

A collateral loan on property (also called loan against property or LAP) is a secured loan offered by banks or NBFCs where the borrower pledges a residential, commercial, or industrial property as security to avail funds. This loan allows you to retain ownership and continue using the property while leveraging its market value to access high loan amounts at lower interest rates.

Key Features of Collateral Loans on Property

Secured Loan: The property acts as a guarantee to the lender, reducing their risk and thereby offering you better interest rates.

High Loan Amount: You can get anywhere from ₹5 lakhs to ₹5 crores or more, depending on your property's market value.

Lower Interest Rates: Typically ranges from 8% to 13%, significantly lower than unsecured personal loans.

Longer Tenure: Repayment tenure can range from 5 to 20 years, easing monthly EMI burden.

Ownership Retained: You continue to use the property as before—only the title is held as security.

How Do Collateral Loans on Property Work?

Here’s a step-by-step look at how these loans function:

Loan Application: You apply with basic KYC documents, income proof, and property papers.

Property Valuation: The lender evaluates the market value of your property.

Loan Amount Decided: Based on the Loan-to-Value (LTV) ratio—usually 50% to 70% of the property’s market value.

Loan Disbursement: Once approved, the loan amount is credited to your account.

Repayment: You repay through monthly EMIs over the agreed loan tenure.

Types of Properties Accepted as Collateral

Lenders usually accept the following property types:

Residential Property: Self-occupied or rented homes.

Commercial Property: Shops, office spaces, etc.

Industrial Property: Factories or warehouses (depending on lender policy).

Land: Some lenders accept non-agricultural land in urban areas.

Who Can Apply?

Collateral loans on property are open to:

Salaried individuals

Self-employed professionals

Business owners

Partnership firms or companies (for business expansion)

Advantages of Collateral Loans on Property

✅ Lower EMIs due to long tenure and low interest

✅ Higher loan eligibility

✅ Funds can be used for any purpose—business, education, wedding, or emergencies

✅ Faster processing for salaried and high-CIBIL applicants

Things to Consider Before Applying

While collateral loans on property are attractive, they do carry certain risks:

Risk of Losing Property: Defaulting on payments can lead to legal action or auction of the property.

Processing Time: May take longer than personal loans due to property evaluation and legal checks.

Documentation Load: Involves thorough verification of property ownership and marketability.

Final Thoughts

If you own a residential or commercial property and need a substantial loan amount at a low interest rate, Collateral Loans on Property can be an excellent financing option. They provide financial flexibility without liquidating your real estate assets.

However, it’s essential to evaluate your repayment ability and compare offers from multiple lenders before making a decision. With proper planning and responsible borrowing, this type of secured loan can open the door to long-term financial freedom.

0 notes

Text

Get an online personal loan in Delhi NCR for bad CIBIL defaulters. No CIBIL verification required, with low-interest rates and flexible repayment options available.

#Personal loan in Delhi without CIBIL check#Personal loan without CIBIL#Loan for cibil defaulters in Delhi#Personal loan for CIBIL defaulter#Personal Loan for low CIBIL score#Loan without cibil check in Delhi#Personal loan for cibil defaulters in Delhi#Private financiers for cibil defaulters in Delhi#Loan without cibil verification in Delhi#Personal loan without cibil in Delhi#Loan without cibil in Delhi#Personal loan for bad cibil score in Delhi#Bad cibil personal loan in Delhi#Loan for bad cibil score in Delhi#Personal loan for cibil defaulters in Delhi NCR#Car loan for cibil defaulters in Delhi#Online loan for CIBIL defaulters#Cibil defaulter personal loan Delhi#online loan for cibil defaulters in Delhi#Low cibil personal loan Delhi

0 notes

Text

Here’s why a Good CIBIL Score is Key to Getting a Personal Loan Quickly!

Are you thinking about taking a personal loan in India? We all know the basic eligibility criteria you must fulfill for a quick personal loan. CIBIL score is the main factor when you are applying for personal loans. Personal loans are usually unsecured loans where you do not need to submit any collateral. Hence, the CIBIL score is the score that represents your financial attitude to your lender.

This blog will make you understand exactly why a good credit score is key to getting a personal loan quickly!

What is a CIBIL Score?

CIBIL score is a three-digit number derived by TransUnion CIBIL Limited for each profile. CIBIL score is prepared based on the data enclosed in the Credit Information Report(CIR).

In simple words, a credit score reflects personal financial behaviour a person is cultivating towards financial responsibilities such as timely repayments, credit mix and credit utilization.

The score helps lenders analyze your creditworthiness.

Credit score ranges are as given below:

800–850 - Excellent 740–799 - Very good 670–739 - Good 580–669 - Fair 300–579 - Poor

How is your credit score determined?

Payment History: Making your repayments on time gives your credit score a great boost. While defaults downgrade your credit score.

Credit Mix: Two major types of credit are secured and unsecured borrowing. The balance you create between both of these types in your profiles is called credit mix. A good credit mix reflects positively on your credit.

Credit Utilization: If you have utilised a high percentage of your credit limit, it shows that you are dependent on credit which negatively impacts your credit score.

How To Get A Personal Loan Without a CIBIL Score?

In case of a bad credit score, you can still get the loan with collateral. The purpose of your credit score is to prove your obedient financial behaviour. A Credit score is a must when you are choosing an unsecured loan that comes without collateral.

While secured loans do not require a good credit score. You can go for a secured loan by keeping your property such as land, a house you own or a commercial property, as collateral and receive your loan amount.

How To Build A Good Credit Score?

Pay Your Bills on Time: Around 35% of your credit score is dependent on your on-time repayment frequency. Hence, you are highly likely to positively boost your credit with on-time payments.

Keep Monitoring Your Credit Score: Checking your credit score on a regular basis helps you build strategies to push your credit score higher. On some websites, you can even check the next predicted score based on how much outstanding amount you wish to clear while making the next repayment.

Limit Credit Inquiries: Each time you apply for a loan or a credit card, the lender will access your credit score. A high number of credit scores being accessed shows a bad impact on your credit report.

Set Auto Payment: You can talk to your lender and set up automatic payment. You can choose the date when you want to repay your credit. You will no longer need to manually pay your EMI. Also, you will be free from the worry of making on-time payments.

Make Advance Payments: Making advance payments would keep you ahead in this game. Also, when you have already paid your future EMIs, you save yourself from penalties for paying late in case of late payments. The good thing is that you also completed your repayment sooner than expected.

Benefits You Can Get With a Good Credit Score While Applying for a Personal Loan

Good Credit Score, No Need for Collateral While you are applying for an unsecured loan, your credit score is going to prove your responsible financial behavior to the lender. Hence, only with the support of good credit, you can get a personal loan with ease.

Better Interest Rates A good credit score automatically opens the door for you to better interest rates.

Credit Cards with Exciting Benefits Borrowers with good credit scores can apply for a credit card that offers exciting benefits.

Easy Loan Approvals Lenders prioritize loan profiles with good credit scores because these borrowers are highly likely to repay on time with their excellent financial behaviour. It gives security to the lender who is offering you financial support.

Longer Loan Tenure Approvals Borrower profiles with good credit scores can also apply for a loan with a longer repayment tenure.

Higher Loan Amounts As we know, a good credit score is an opportunity to receive many exciting benefits. You can also get quick approval for higher loan amounts with good credit scores.

Conclusion

In conclusion, you should never ignore the impact your credit score can have on your future loan inquiries. Definitely, financial needs can arise anytime without asking. But, if you have always worked hard towards your credit score in your good days, it will be your saviour in your bad days.

Lenditt personal loan app is the top choice of Indians for quick personal loans. With basic criteria such as a good credit score, a stable source of income and age between 21 and 60, you are eligible for Rs. 2 lakh personal loan.

We understand the emergencies that happen without prior notification and your urgent financial needs. Hence, we offer quick loan approval under 15 minutes to our customers. Also, quick loan approval followed by quick loan disbursal is a cherry on top!

Until we meet in our next blog, keep monitoring your credit score!

Source Link:Good CIBIL Score is Key to Getting a Personal Loan Quickly

0 notes

Text

Step-by-Step Guide to the Takeover of NBFC in India

Introduction

The takeover of an NBFC refers to the acquisition of a controlling interest (either through shareholding or management control) in a registered NBFC by another entity. This process is strictly regulated by the Reserve Bank of India (RBI) to ensure transparency, financial stability, and protection of stakeholders’ interests.

Key Regulatory Framework

Reserve Bank of India (RBI) Guidelines: RBI is the primary regulatory authority overseeing the takeover of NBFCs in India. Any change in control, management, or shareholding beyond prescribed limits requires prior approval from the RBI.

Companies Act, 2013: Governs corporate actions, board meetings, and documentation.

Ministry of Corporate Affairs (MCA): Compliance for changes in company structure, directors, and shareholders.

Step-by-Step Process for the Takeover of NBFC

Signing the Memorandum of Understanding (MoU)

Both the acquirer and target NBFC sign an MoU, outlining intent, responsibilities, and initial terms.

The acquirer typically pays a token amount to the target company at this stage.

Convening Board Meetings

Both companies hold separate board meetings to approve the takeover proposal and authorize further actions.

The board also sets the date for an Extraordinary General Meeting (EGM) to seek shareholder approval.

Due Diligence and Valuation

Comprehensive due diligence is conducted on the target NBFC, covering financials, compliance, assets, and liabilities.

Valuation is performed using methods like the Discounted Cash Flow (DCF) to determine the fair price.

Share Transfer Agreement

Upon satisfactory due diligence, a formal Share Purchase/Transfer Agreement is executed between the parties.

The remaining consideration is paid in accordance with the agreement.

Application to RBI for Prior Approval

A detailed application is filed with the RBI’s regional office, seeking approval for the proposed takeover of the NBFC.

The application includes all supporting documents, agreements, and compliance certificates.

No Objection Certificate (NOC) from Creditors

The target NBFC obtains a No Objection Certificate (NOC) from its creditors, confirming that they have no objections to the proposed takeover.

RBI Review and Approval

RBI scrutinizes the application and may raise queries. Prompt and complete responses are crucial.

Only after receiving the RBI’s No Objection Certificate (NOC) can the process proceed.

Public Notice

Within 30 days of RBI approval, a public notice must be published in two newspapers (one English and one regional language), inviting objections from the public.

Transfer of Assets and Liabilities

The acquirer transfers the agreed funds to the target NBFC’s account.

Assets and liabilities are transferred as per the agreement, and the takeover is executed.

Statutory Filings and Compliance

File necessary forms with the Ministry of Corporate Affairs (MCA) for any changes in company name, directors, or shareholding.

Intimate RBI and other regulators about post-takeover changes.

RBI Approval: The Cornerstone of the Takeover of NBFC

When is RBI Approval Required?

Change in shareholding of 26% or more.

Change in management of 30% or more.

Sale or transfer of NBFC.

Key RBI Conditions:

Minimum net owned funds of INR 2 crores.

Clean track record: No defaults or disputes in the last 24 months.

Submission of the previous three years’ income tax returns.

Minimum CIBIL score of 700+.

Documentation Required

Memorandum of Association (MOA) and Articles of Association (AOA)

Certificate of Incorporation

Board and Shareholder Resolutions

MoU and Share Purchase Agreement

No Objection Certificate from Creditors

Valuation Report by a Chartered Accountant

RBI Application and supporting documents

Post-Takeover Compliance and Reporting

Update statutory registers and records.

File post-takeover returns with RBI and MCA.

Ensure continued compliance with RBI’s prudential norms and reporting requirements.

Regularly inform the RBI of any subsequent changes in management or shareholding.

Common Challenges and Solutions

Regulatory Delays: Proactively respond to RBI queries and provide complete documentation to avoid delays.

Due Diligence Issues: Conduct thorough due diligence to uncover hidden liabilities or compliance gaps.

Stakeholder Objections: Transparent communication with creditors and the publication of public notices helps mitigate objections.

Conclusion

The takeover of NBFCs in India is a complex yet rewarding process that requires meticulous planning, strict regulatory compliance, and strategic execution. By following the step-by-step process outlined above, acquirers can ensure a smooth transition, safeguard stakeholder interests, and unlock new growth opportunities in the dynamic non-banking financial company (NBFC) sector.

Key Takeaways:

Always prioritize RBI compliance for a successful takeover of an NBFC.

Thorough due diligence and transparent communication are critical.

Engage professionals for legal, financial, and regulatory guidance throughout the process.

By adhering to these best practices, stakeholders can navigate the takeover of NBFC with confidence and achieve sustainable business growth.

0 notes

Text

Rebuild Your Credit Card for Low CIBIL Score

Rebuilding your credit can feel overwhelming, especially if you have a credit card for low cibil score.However, the right credit card can be a powerful tool to help you improve your financial standing. Designed specifically for individuals with poor or limited credit history, credit cards for low CIBIL scores offer accessible approval criteria and features that support responsible usage. By making timely payments and maintaining a low credit utilization ratio, you can gradually boost your score over time. In this blog, we’ll explore how these credit cards work, the best options available, and tips to use them wisely for rebuilding your credit.

Understanding the Impact of a Credit Card for Low CIBIL Score

A credit card for low CIBIL score can limit your access to financial products, especially credit cards and loans. Lenders use your score to evaluate risk, and a score below 650 often signals poor credit habits or past defaults. This can lead to higher interest rates or outright rejections. However, a low score doesn’t mean the end of your financial journey—it’s a wake-up call to make better credit decisions. Understanding how your score affects your borrowing power is the first step toward rebuilding. With the right tools and mindset, you can repair your credit history and regain financial credibility over time.

Why Credit Card for Low CIBIL Score Can Help Rebuild Your Score?

Many view credit card for low CIBIL score as a trap, but when used wisely, they can actually be a lifeline for those with low CIBIL scores. By making small purchases and paying them off in full and on time, you create a positive repayment history. This consistent behavior signals to credit bureaus that you’re a responsible borrower. Some credit cards even report activity monthly, which helps accelerate score improvements. Rebuilding with a credit card is about strategy and discipline not spending more, but spending smart. Over time, this responsible usage can significantly boost your CIBIL score and open doors to better financial products.

Types of Credit Cards Available for Credit Card for Low CIBIL Scores

People with lcredit card for low CIBIL score may not qualify for standard credit cards, but several options are still available. Secured credit cards, backed by a fixed deposit, are the most accessible and often don’t require a high score. Some banks also offer special cards designed for those with limited or damaged credit, sometimes called "credit builder cards." These usually come with lower credit limits and fewer rewards but are ideal for rebuilding. Some fintech companies also provide credit lines with flexible terms. Exploring these tailored card options gives you a starting point on your journey to rebuild and improve your credit.

Choosing the Right Card to Rebuild Credit Card for Low CIBIL Scores

When selecting a credit card for low CIBIL score to rebuild your score, look for one with simple approval requirements, low fees, and monthly reporting to credit bureaus. Avoid cards with high annual charges or hidden terms. A secured credit card is often the best starting point backed by your deposit, it reduces the bank’s risk while allowing you to build credit responsibly. Also, check if the issuer provides credit monitoring or educational tools. Prioritize cards that help you track your spending and payment behavior. Choosing the right card is crucial; it sets the foundation for improving your financial reputation over time.

Using Your Credit Card for Low CIBIL Scores Wisely to Boost Your Score

Once you’re approved, the key to rebuilding lies in responsible usage. Keep your credit card for low CIBIL score utilization below 30% of your limit, pay your full bill before the due date, and never miss a payment. Avoid cash withdrawals, as they often come with high interest and fees. Set reminders or automate payments to maintain consistency. Even small monthly purchases like fuel or groceries can help build a good history when repaid promptly. Your goal isn’t to spend more but to build trust with lenders. Over time, consistent, smart use will reflect positively on your credit report and raise your CIBIL score gradually.

Common Mistakes to Avoid When Rebuilding Credit Card for Low CIBIL Scores

Rebuilding credit card for low CIBIL score requires patience and discipline, but some missteps can set you back. Avoid applying for multiple credit cards at once, as each hard inquiry lowers your score slightly. Don’t max out your limit or miss payments these actions can further damage your credit profile. Also, steer clear of predatory cards with excessive fees or misleading terms. Resist the temptation to close old accounts, as long credit histories benefit your score. Lastly, don’t expect immediate results; credit repair takes time. Avoiding these mistakes will ensure that your efforts to rebuild with a credit card yield positive long-term outcomes.

Tracking Progress and Knowing When to Upgrade Credit Card for Low CIBIL Scores

As your credit habits improve, so will your credit card for low CIBIL score.Keep a regular check on your score through free online tools or reports from credit bureaus. Monitor changes in your credit utilization and payment history. Once your score crosses a healthy threshold usually above 700 you may qualify for better credit cards with higher limits and more benefits. At this point, consider upgrading to an unsecured card or switching to one with rewards and cashback. However, continue your responsible usage habits. Rebuilding credit isn’t just a one-time fix; it’s a long-term commitment to financial health and stability.

Conclusion

Rebuilding your credit card for low CIBIL score may seem challenging, but with the right credit card and disciplined financial habits, it's entirely achievable. Choosing a suitable card, making timely payments, and maintaining low credit utilization are key steps toward improving your credit profile. Avoiding common pitfalls and tracking your progress will help you stay on course. Remember, rebuilding credit is a gradual process, but every responsible move brings you closer to financial stability. With patience and persistence, you can restore your creditworthiness and unlock better financial opportunities in the future. Start today your improved credit score is within reach.

0 notes