#Personal loan without CIBIL

Explore tagged Tumblr posts

Text

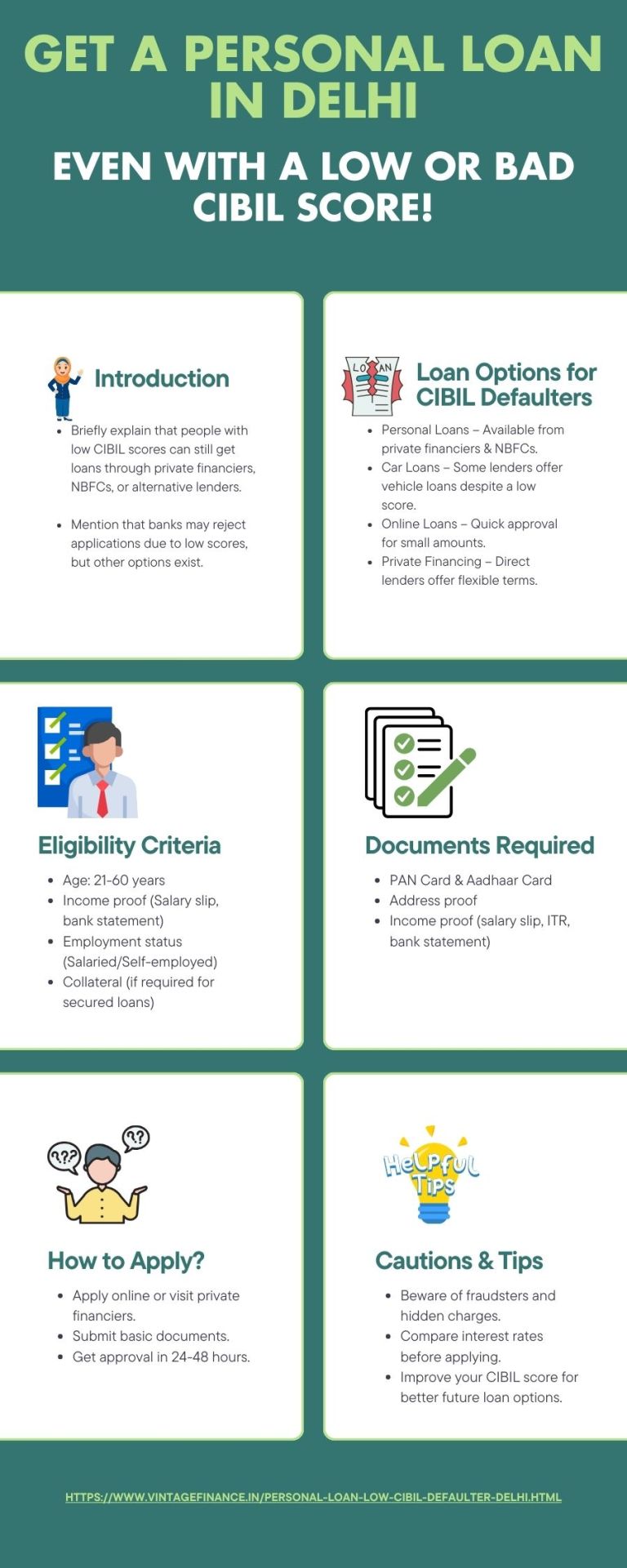

Get an online personal loan in Delhi NCR for bad CIBIL defaulters. No CIBIL verification required, with low-interest rates and flexible repayment options available.

#Personal loan in Delhi without CIBIL check#Personal loan without CIBIL#Loan for cibil defaulters in Delhi#Personal loan for CIBIL defaulter#Personal Loan for low CIBIL score#Loan without cibil check in Delhi#Personal loan for cibil defaulters in Delhi#Private financiers for cibil defaulters in Delhi#Loan without cibil verification in Delhi#Personal loan without cibil in Delhi#Loan without cibil in Delhi#Personal loan for bad cibil score in Delhi#Bad cibil personal loan in Delhi#Loan for bad cibil score in Delhi#Personal loan for cibil defaulters in Delhi NCR#Car loan for cibil defaulters in Delhi#Online loan for CIBIL defaulters#Cibil defaulter personal loan Delhi#online loan for cibil defaulters in Delhi#Low cibil personal loan Delhi

0 notes

Text

How to Get a Personal Loan If You Have No Credit History?

A personal loan can be a great financial tool to cover unexpected expenses, medical bills, home improvements, or even fund a vacation. However, getting approved for a personal loan without a credit history can be challenging. Lenders rely on credit scores and credit reports to assess an applicant’s creditworthiness, and having no credit history means they have no past records to evaluate your repayment behavior.

But don’t worry! If you have no credit history, you can still secure a personal loan by following the right strategies. This article explores how you can get a loan without a credit score, alternative ways to prove your eligibility, and lenders that might be willing to offer you credit.

Why Do Lenders Check Credit History for a Personal Loan?

A credit history is a record of your past financial activities, including loan repayments, credit card usage, and payment behavior. It helps lenders determine:

✔ Your repayment capacity – Whether you can handle debt responsibly. ✔ Your financial discipline – If you make timely payments or default. ✔ Your creditworthiness – How much risk is involved in lending to you.

When you apply for a personal loan, lenders usually check your credit score (CIBIL, Experian, or Equifax) before approving your application. But if you have never taken a loan or used a credit card, you may not have a credit score, making it harder for lenders to assess your reliability.

Can You Get a Personal Loan with No Credit History?

Yes, you can! Even if you don’t have a credit score, many lenders provide personal loans based on income stability, employment status, and alternative creditworthiness factors. Here’s how you can qualify:

1. Apply for a Loan from an NBFC or Digital Lender

Traditional banks have strict eligibility criteria, but NBFCs (Non-Banking Financial Companies) and fintech lenders offer personal loans to individuals with no credit history.

🔹 NBFCs and digital lenders use alternative credit evaluation methods, such as income, employment stability, and transaction history, instead of relying only on credit scores. 🔹 Many digital lenders provide instant personal loans through mobile apps, requiring only basic KYC verification.

Examples of NBFCs and fintech lenders that offer personal loans to individuals with no credit history: ✔ Bajaj Finserv ✔ MoneyTap ✔ PaySense ✔ Navi ✔ EarlySalary

2. Opt for a Secured Personal Loan

If lenders are hesitant to approve your loan due to no credit history, applying for a secured personal loan can improve your chances.

✔ What is a secured loan? – A secured loan requires collateral such as a fixed deposit (FD), gold, or assets to back the loan. ✔ Why does it help? – Since the loan is secured against an asset, the lender takes on less risk and may approve your application even without a credit score.

Examples of secured personal loans:

Loan against FD – If you have a fixed deposit, banks like SBI, HDFC, and ICICI offer personal loans up to 90% of the FD value.

Gold loan – Pledging gold as collateral can help you get a personal loan at a lower interest rate.

3. Show Proof of Stable Income

Lenders are more likely to approve a personal loan if you have a stable job with a consistent monthly income.

✅ Salaried individuals – If you work in a reputed company or government sector, lenders may approve your loan based on salary slips, bank statements, and employment proof. ✅ Self-employed individuals – If you run a business or work as a freelancer, bank statements, tax filings, and business records can strengthen your application.

Tip: Many lenders require a minimum monthly income of ₹15,000 - ₹25,000 to approve a personal loan for applicants with no credit history.

4. Apply for a Loan with a Co-Applicant or Guarantor

If you’re finding it difficult to get a personal loan due to no credit history, adding a co-applicant or guarantor can increase approval chances.

✔ Who can be a co-applicant? – Your spouse, parent, or sibling with a stable income and good credit history. ✔ Why does this help? – Lenders consider the co-applicant’s credit score and income, making it easier to qualify. ✔ What is a guarantor? – A person who agrees to take responsibility for loan repayment if the borrower defaults.

Example: If your father has a strong credit score and stable income, adding him as a co-applicant can improve your approval chances.

5. Start Building Credit Before Applying for a Personal Loan

If you don’t need a personal loan immediately, consider building a credit history first.

✔ Get a secured credit card – Many banks offer credit cards against a fixed deposit, which can help establish a credit score. ✔ Use a credit builder loan – Some financial institutions provide small credit builder loans, where repayments are reported to credit bureaus. ✔ Apply for a low-limit credit card – Even if it has a small limit, responsible usage and timely repayments will help create a credit profile.

Tip: Regularly using a credit card and paying the bill on time can generate a CIBIL score within 3-6 months, making it easier to get a personal loan later.

6. Choose a Lower Loan Amount and Shorter Tenure

If you’re applying for a personal loan with no credit history, requesting a high loan amount may lead to rejection.

✔ Why choose a lower amount? – Lenders are more likely to approve a smaller loan amount since it involves lower risk. ✔ Opt for a shorter tenure – A loan tenure of 1-2 years may have a higher approval rate than long-term loans.

7. Maintain a Healthy Bank Balance and Transaction History

Since you don’t have a credit history, lenders may evaluate your bank statements and spending habits.

✔ Ensure regular salary deposits – A stable monthly income in your bank account increases approval chances. ✔ Avoid frequent overdrafts or bounced cheques – These indicate financial instability and can lead to rejection. ✔ Keep a minimum balance – Maintaining a decent bank balance shows financial responsibility.

Which Lenders Offer Personal Loans Without a Credit History?

Here are some popular financial institutions that provide personal loans to individuals with no credit score:

🔹 State Bank of India (SBI) – Offers loans to first-time borrowers with stable employment. 🔹 HDFC Bank – Provides loans to salaried employees with salary accounts in the bank. 🔹 Bajaj Finserv – NBFC offering flexible loan options without strict credit history requirements. 🔹 MoneyTap & PaySense – Fintech lenders with quick approval for new borrowers. 🔹 Navi & KreditBee – Digital lending apps that use alternative data for credit assessment.

Final Thoughts: How to Get a Personal Loan Without a Credit History

Getting a personal loan with no credit score is challenging but not impossible. Lenders consider other factors like income, employment stability, alternative credit proof, and co-applicants before approving the loan.

If you’re unable to get a personal loan immediately, consider building a credit history through secured credit cards or small credit-builder loans. Additionally, NBFCs and digital lenders provide better opportunities for first-time borrowers.

With the right approach, financial discipline, and smart planning, you can secure a personal loan even without a credit history and gradually build a strong credit profile for future financial needs.

#personal loan online#nbfc personal loan#fincrif#bank#finance#loan apps#personal loan#personal loans#loan services#personal laon#Personal loan#No credit history loan#Loan without credit score#First-time borrower loan#Personal loan approval#Loan for new borrowers#No credit check loan#Bad credit personal loan#Loan without CIBIL score#Low credit score loan#Alternative credit history#Secured personal loan#Unsecured personal loan#Loan for salaried employees#Loan for self-employed#Digital lender loan#NBFC personal loan#Loan from fintech companies#Instant personal loan#Low-income personal loan

1 note

·

View note

Text

Get an Instant ₹20000 Personal Loan @15k Minimum Salary, Apply Now

“Need 20000 rupees loan urgently”? To meet your financial needs, like electricity bills, school fees, bike repair, medical bills, etc. You can get an instant Rs 20000 personal loan with a 100% digital process, lower interest rate, and flexible tenure. Apply Now Today! Get a personal loan of ₹20000 that comes with multiple repayment options, minimal documentation, and a hassle-free process,…

#20000 loan for 12 months#20000 loan for 12 months in india#20000 loan on Aadhar card online#20000 loan without CIBIL score#20000 loan without income proof#emergency loan 20000 online#I need 20000 rupees loan urgently in india#I need 20000 rupees loan urgently without salary#Personal Loan of 20000

0 notes

Text

Are Personal Loans Worth Taking? Eligibility, EMI & Benefits Explained!

💸 क्या पर्सनल लोन लेना फायदेमंद है? (Are Personal Loans Worth It?) आजकल आप हर जगह पर्सनल लोन के ऑफर देखते होंगे – मोब��इल ऐप्स, बैंक कॉल्स, SMS और सोशल मीडिया पर भी।लेकिन क्या ये लोन आपके लिए सही हैं? आइए जानें पर्सनल लोन लेने से पहले किन बातों का ध्यान रखना चाहिए, और आप इसके लिए कितने योग्य (eligible) हैं। 📌 पर्सनल लोन क्या होता है? Personal Loan एक unsecured loan होता है, यानी आपको इसके लिए…

#best personal loan#CIBIL score#compare loan offers#EMI calculator#Financial Planning#instant personal loan#interest rates India#loan eligibility#loan repayment#loan without collateral#monthly EMI#personal finance tips#Personal Loan#personal loan in India#unsecured loan

0 notes

Text

Instant Personal Loan Without Documents – No Income Proof or CIBIL Needed in 2025

Are you tired of hearing "No" from banks just because of a low salary or poor credit score? You're not alone. Thousands of hardworking individuals across India face the same rejection every day. But here's the good news: In 2025, getting an Instant Personal Loan, even with low income or bad CIBIL, is not only possible but also effortless, thanks to a growing digital lending ecosystem.

In this guide, we'll show you exactly how to get instant funds online without stepping into a bank, uploading heavy documents, or worrying about your past credit mistakes.

Who Can Benefit from This Guide?

If you're someone who:

Earns less than ₹10,000 per month

Has a low or no CIBIL score

Needs urgent cash loans or instant money loan

Is self-employed without income proof

Wants quick loan approval online without the headache of paperwork

This article is tailor-made for you.

Why Traditional Banks Say No

Banks typically reject personal loan applications for these reasons:

Low salary threshold not met

CIBIL score below 650

No formal income proof like salary slips or ITRs

Lack of collateral or banking history

But fintech platforms have changed the game by offering Insta Loan solutions based on your alternative data like mobile usage, UPI activity, bank SMS, and more.

The Digital Lending Revolution: Your Shortcut to Instant Loans

With the rise of technology, you can now apply for a personal loan online with just your phone and Aadhaar card. Whether you need instant cash loans, quick personal loans, or even a personal loan without visiting a bank, everything is now accessible via apps and digital platforms.

Top Features of Instant Personal Loan Online

Top 5 Personal Loan Apps in India for Bad CIBIL & Low Salary (2025)

These apps are changing the way Insta Loans are given — with easy steps, low documents, and zero judgment on your past.

Real Case Example: How Rahul Got ₹50,000 in 20 Minutes

Rahul, a freelancer from Lucknow, had no CIBIL and only earned around ₹11,000/month. He got rejected by banks twice. Then he tried a digital app (KreditBee), uploaded Aadhaar + PAN, verified bank SMS, and got instant approval for ₹50,000 within 20 minutes — no calls, no branch visit, no salary slip.

This is not luck. It’s fintech power in your pocket.

How to Apply for a Personal Loan Online (Step-by-Step)

Download the best personal loan app (like KreditBee, Nira, PaySense, etc.)

Complete KYC with Aadhaar + PAN or Voter ID

Enter your income source (salary, freelance, small business)

Submit your mobile-linked bank account

Get Personal Loan Instant Approval within minutes

Receive Instant Funds in your bank account

Smart Tips to Boost Instant Personal Loan Approval

Use the same mobile number linked to UPI & bank

Don’t fake income — apps verify through bank SMS

Enable auto KYC to speed up the process

Repay small loans first to unlock higher limits

Link Aadhaar to your phone for OTP-based access

Key Benefits

No Income Proof Needed

No CIBIL? No problem!

Apply Anytime, Anywhere

Instant Disbursement

No Bank Visit Required

Trusted by Salaried & Small Business Owners

Whether you're from Delhi NCR, Lucknow, Indore, Nagpur, or Guwahati, you can apply from your mobile right now.

FAQs: Instant Personal Loan in India

1. Can I get an instant loan online with a low CIBIL score?

Yes. Many fintech lenders offer instant personal loans without a CIBIL check or accept scores below 600.

2. Is income proof mandatory for online loan approval?

No. You can get a personal loan without income proof using bank SMS or UPI data.

3. How fast can I receive funds after applying?

Most apps offer to get a personal loan in 5 minutes or within 1 hour after approval.

4. Are these platforms available in smaller cities like Indore or Guwahati?

Yes. You can get a quick personal loan in Indore, apply for a personal loan in Guwahati, and many other Tier 2 cities.

5. Is PAN or Aadhaar mandatory?

Most platforms need at least one for KYC, but some offer a personal loan without PAN or Aadhaar on special terms.

Final Word: No Documents? No Problem Anymore

We understand that life isn’t always financially smooth. That’s why 2025 is all about freedom from paperwork, no CIBIL roadblocks, and instant online loan disbursement from the comfort of your phone.

Whether you’re in Delhi NCR, Nagpur, Indore, or Guwahati, you no longer need to stand in queues or beg the bank manager.

Just tap, verify, and get funded. Because your dreams shouldn’t wait for a credit score.

Ready to Apply? Your Loan is 5 Minutes Away

Choose a trusted app

Upload Aadhaar or PAN

Enter your basic details

Get funds in your account — instantly!

#Personal Loan#Instant Loan#Instant Personal Loan#Personal Loan Apply Online#Personal Loan Online Apply#Personal Loan Apply#Instant Loan Online#Cash Loans#Personal Loan Online#Instant Personal Loan Online#Instant Cash Loans#Instant Money Loan#Insta Loan#Personal Loan Instant Approval#Quick Loans Online#Get Instant Personal Loan#Quick Personal Loans#Quick Money Loans#Personal Loan India#Insta Personal Loan#personal loan for low cibil score#instant funds#Instant Personal Loan without income proof#Instant Personal Loan without cibil#Personal loan for self-employed without proof#Personal loan with ₹10#000 salary#Loan without bank statement or salary slip#Personal loan for small business owners#Easy loan approval without CIBIL check

0 notes

Text

2025 में बिना इनकम प्रूफ और कम CIBIL स्कोर पर पाएं इंस्टेंट लोन – जानिए कैसे!

भारत में 2025 की शुरुआत के साथ ही डिजिटल लोन की दुनिया में एक नया बदलाव आया है। अब लोन लेने के लिए न तो बैंक की लंबी लाइन में लगने की जरूरत है, न ही ढेर सारे दस्तावेज़ जमा करने की। अगर आपके पास इनकम प्रूफ नहीं है, या फिर आपका CIBIL स्कोर बहुत अच्छा नहीं है, तब भी आप आसानी से इंस्टेंट लोन ले सकते हैं। आजकल कई फिनटेक कंपनियां ऐसे लोन ऐप्स लेकर आई हैं जो केवल आधार कार्ड और पैन कार्ड के आधार पर लोन…

#instant loan app 2025#instant loan without income proof#loan without salary slip#no cibil loan app#personal loan without documents

0 notes

Text

The tenure or repayment term for a Personal Loan is the time allotted to a customer to return the loan amount. The tenure allotted for a Personal Loan is from a minimum of 12 months to a maximum of 72 months, whereas an applicant can repay a mortgage or home loan for up to 30 years. Before taking a loan, consider an appropriate tenure per the key points above our EMI Calculator will help you choose a suitable tenure.

#Online Instant Personal Loan#Personal Loan Near Me#Personal Loan From Private Bank#Personal Loan Without Cibil Score#Eligibility Criteria for Personal Loan

0 notes

Text

Get Instant Personal Loan Online – Fast & Easy Approval Apply for an instant personal loan online with quick approval and minimal paperwork. Get fast funds for any need with flexible repayment options.

0 notes

Text

Why CIBIL Score is Important for Getting a Personal Loan

Your CIBIL score is more than just a number; it’s a crucial factor in determining your eligibility for a personal loan. Whether you’re planning to consolidate debt, fund a wedding, or address an emergency, understanding the importance of your CIBIL score can make the borrowing process smoother and more efficient. For those exploring alternatives, some lenders offer a personal loan without a CIBIL score check, though it often comes with higher interest rates and stricter terms. In this article, we’ll explore why the CIBIL score plays a pivotal role in personal loan applications and how it impacts your borrowing experience.

What is a CIBIL Score?

The CIBIL score, ranging from 300 to 900, is a three-digit number that reflects your creditworthiness. It is generated by the Credit Information Bureau (India) Limited (CIBIL) based on your credit history, repayment behavior, and financial habits.

Here’s how the score is typically categorized:

750-900: Excellent—Indicates a high level of creditworthiness.

650-749: Good—Suggests moderate risk for lenders.

550-649: Fair—Lenders may approve loans but at higher interest rates.

300-549: Poor—High risk, and loan approvals are unlikely.

Why is the CIBIL Score Important for Personal Loans?

Primary Indicator of Creditworthiness: Lenders use your CIBIL score as the first filter to assess your reliability as a borrower. A high score indicates that you’ve managed credit responsibly in the past, increasing your chances of loan approval. Conversely, a low score suggests potential risk, making lenders hesitant to approve your loan application.

Determines Loan Eligibility: Most lenders have a minimum CIBIL score requirement for personal loans, typically around 750. If your score meets or exceeds this threshold, you’re more likely to qualify for the loan. Falling below this benchmark could result in your application being rejected or additional conditions being imposed, such as higher collateral or a guarantor.

Influences Interest Rates: Your CIBIL score directly impacts the interest rate you’ll be offered on a personal loan. Borrowers with higher scores usually enjoy lower interest rates, which can significantly reduce the overall cost of the loan. On the other hand, a low score might result in higher interest rates to compensate for the perceived risk.

Affects Loan Amount Approval: Lenders are more likely to approve larger loan amounts for borrowers with strong credit scores. A high score assures the lender that you can handle the financial responsibility of repaying a substantial loan. Conversely, a low score might restrict your borrowing capacity.

Simplifies Approval Process: A high CIBIL score not only boosts your chances of approval but also speeds up the loan approval process. Lenders are more confident in extending credit to borrowers with a proven track record of responsible credit management, making the verification process quicker and more straightforward.

How is the CIBIL Score Calculated?

The CIBIL score is calculated based on the following factors:

Repayment History (35%): Timely payment of EMIs and credit card bills is the most significant factor influencing your score.

Credit Utilization Ratio (30%): The amount of credit you use compared to your total credit limit. A low utilization ratio (below 30%) is ideal.

Length of Credit History (15%): A longer credit history demonstrates sustained responsible borrowing behavior.

Credit Mix (10%): A balanced mix of secured (e.g., home loans) and unsecured (e.g., personal loans) credit is beneficial.

Number of Hard Inquiries (10%): Frequent loan applications and credit checks can lower your score, as they indicate financial strain.

Benefits of a High CIBIL Score

Negotiating Power: A strong CIBIL score gives you leverage to negotiate better loan terms, such as lower interest rates, higher loan amounts, or longer repayment tenures.

Access to Pre-Approved Loans: Many banks and financial institutions offer pre-approved loans to customers with excellent CIBIL scores, providing quick access to funds without extensive documentation.

Reduced Financial Stress: With a high score, you’re less likely to face loan rejections or unfavorable terms, making the borrowing process more predictable and stress-free.

Tips to Improve Your CIBIL Score

If your score is less than ideal, here are steps to improve it:

Pay EMIs and Bills on Time: Timely payments are crucial to building and maintaining a good score.

Limit Credit Utilization: Keep your credit card usage below 30% of the total limit.

Check Your Credit Report Regularly: Review your report for errors or discrepancies and report them for correction.

Avoid Multiple Loan Applications: Too many hard inquiries can negatively impact your score.

Diversify Your Credit Portfolio: Maintain a healthy mix of secured and unsecured loans.

Close Unused Credit Accounts: Too many open accounts can hurt your creditworthiness.

Conclusion

Your CIBIL score is a key determinant of your ability to secure a personal loan on favorable terms. It acts as a reflection of your financial discipline and credit behavior, influencing not just your eligibility but also the cost of borrowing. A good score can open doors to better opportunities, while a low score can make borrowing expensive and challenging.

For those with less-than-ideal scores, focusing on building and maintaining a strong credit profile is essential. Responsible credit management, timely repayments, and financial planning can help you improve your score over time, ensuring you’re well-positioned to meet your financial goals. Ultimately, a strong CIBIL score empowers you to access credit when you need it most, giving you greater control over your financial future. Platforms like Lending Plate simplify the process further by offering user-friendly services and competitive loan options.

0 notes

Text

Personal Loan for Low CIBIL Score: A Comprehensive Guide

A low CIBIL score can feel like a significant obstacle when applying for a personal loan, but the reality is that it doesn’t have to stand in the way of your financial goals. Even if you have a less-than-ideal credit history, options are still available to secure a personal loan in India. In this comprehensive guide, we’ll explore how a low CIBIL score impacts personal loan applications, the steps you can take to improve your chances of approval, and how Kreditbazar can assist you in accessing funds, even with a low credit score.

What is a CIBIL Score and Why Does It Matter?

Your CIBIL score is a three-digit number ranging from 300 to 900, generated by the Credit Information Bureau (India) Limited (CIBIL), which reflects your creditworthiness. It is based on your financial history, borrowing behaviour, repayment patterns, and outstanding debts. A higher score indicates that you are a low-risk borrower, while a lower score suggests a higher risk, which can make lenders cautious about approving your loan applications.

Here’s a quick breakdown of CIBIL score ranges and what they indicate:

750 – 900: Excellent credit score, low risk, high chances of loan approval with favourable terms.

650 – 749: Good credit score, moderate risk, fairly good chance of approval.

550 – 649: Average credit score, higher risk, chances of approval reduced significantly.

300 – 549: Poor credit score, high risk, very limited loan options, if any.

For most banks and financial institutions in India, a score of 750 and above is ideal for quick and easy personal loan approvals. However, if your score falls below this, especially below 650, your loan application may either get rejected or be subject to higher interest rates and stricter terms.

But a low CIBIL score doesn’t mean you're out of options. Many alternative lenders, including Kreditbazar, offer personal loans to individuals with lower credit scores, though certain factors may influence your loan approval.

Can You Get a Personal Loan with a Low CIBIL Score?

The short answer is yes, but there are some trade-offs. Lenders may view you as a higher risk if you have a low CIBIL score, but they can still offer loans under specific circumstances. These could include charging higher interest rates, reducing the loan amount, or requiring additional guarantees like collateral or a guarantor. Some lenders, particularly NBFCs (Non-Banking Financial Companies), are more flexible with their credit requirements compared to traditional banks.

At Kreditbazar, we understand that not everyone has a perfect credit history. This is why we work with a network of lending partners, including NBFCs, to offer personal loans for low CIBIL score borrowers. While the terms may vary, our goal is to ensure that those in need of financial assistance have access to it, regardless of their credit background.

Factors That Lenders Consider Besides CIBIL Score

When evaluating a personal loan application from someone with a low CIBIL score, lenders consider several factors to assess the borrower’s repayment capacity. These include:

1. Income Stability

Lenders often look at your monthly income and job stability. If you have a steady and reliable source of income, especially from a reputed employer, this can offset the risk posed by a low CIBIL score. A higher income gives lenders the confidence that you will be able to meet your repayment obligations, even if your credit history isn’t stellar.

2. Loan Amount

Requesting a smaller loan amount may increase your chances of approval. A lower loan amount reduces the risk for the lender, making it easier for them to accommodate borrowers with low credit scores. If you don’t need a large sum immediately, opting for a smaller loan can be a smart move.

3. Existing Debt

Lenders will check your current debt load. If you are already overburdened with other loans and credit card balances, they may hesitate to extend another loan. However, if you have a manageable debt load and can demonstrate a consistent repayment history for existing obligations, it can help improve your case.

4. Collateral or Guarantor

Some lenders may ask for collateral or a guarantor if your CIBIL score is low. This provides them with extra security and reduces their risk. Offering assets like property or a fixed deposit as collateral can increase the likelihood of approval, as can having a co-applicant or guarantor with a strong credit score.

5. Relationship with the Lender

If you have an existing relationship with a lender—such as a savings account, credit card, or another financial product—they may be more willing to approve your loan despite a low CIBIL score. Having a history of responsible financial behaviour with the same lender works in your favour.

Steps to Get a Personal Loan with a Low CIBIL Score

If your CIBIL score is below the preferred threshold, here are some steps you can take to improve your chances of getting a personal loan:

1. Look for Lenders that Cater to Low CIBIL Scores

Not all lenders are focused on offering loans to high-credit-score borrowers. Some specialize in providing loans to individuals with lower scores. At Kreditbazar, we work with lending partners who understand that a low CIBIL score doesn’t necessarily reflect your current financial standing. We help connect you with loan options that match your needs, even if your credit score is less than ideal.

2. Improve Your CIBIL Score

If your loan isn’t an immediate necessity, taking a few months to improve your credit score can greatly enhance your loan prospects. Here’s how:

Timely repayments: Ensure that all your current loans, EMIs, and credit card payments are made on time.

Reduce credit utilization: Try to keep your credit utilization below 30% of your total credit limit.

Avoid applying for multiple loans/credit cards: Each application results in a hard inquiry, which can further lower your score.

Check your credit report for errors: Dispute any inaccuracies that may be negatively affecting your score.

3. Opt for a Co-Applicant or Guarantor

Adding a co-applicant or guarantor with a high CIBIL score can boost your chances of loan approval. This provides the lender with added assurance, as they have another individual to fall back on in case of default.

4. Apply for a Secured Loan

If you have assets like property, gold, or fixed deposits, consider applying for a secured loan. Secured loans often come with lower interest rates and are easier to obtain for borrowers with low CIBIL scores, as the lender has collateral to fall back on if you default.

5. Demonstrate Income Stability

Highlight your steady income and job stability in your loan application. If you have a good track record with your current employer or a strong business background (if self-employed), lenders may be more lenient regarding your low CIBIL score.

Understanding the Drawbacks: Higher Interest Rates for Low CIBIL Scores

One of the most significant drawbacks of securing a personal loan with a low CIBIL score is the higher interest rate. Lenders compensate for the increased risk by charging higher rates than they would for borrowers with good credit. This means that although you can get a loan, you may end up paying more in interest over time.

For instance, a borrower with a high CIBIL score may get a personal loan with interest rates as low as 10% to 12%, while a borrower with a low CIBIL score might be offered rates ranging from 14% to 20% or higher. It's essential to factor this into your decision and ensure that the repayment terms are manageable.

How Kreditbazar Can Help

At Kreditbazar, we understand the challenges that come with a low CIBIL score. Our mission is to ensure that financial setbacks don’t stand in the way of your future. We’ve partnered with leading NBFCs to provide personal loans for low CIBIL score borrowers, offering tailored solutions that meet your needs without adding unnecessary complexity to the process.

By applying for a personal loan through Kreditbazar, you can expect:

Quick and easy online application

Minimal documentation requirements

Personalized loan offers

Fast approvals and disbursements

Whether you're facing an emergency, planning for personal expenses, or consolidating existing debt, Kreditbazar can help you find the right loan option—even if your CIBIL score isn’t perfect.

Conclusion: Don’t Let a Low CIBIL Score Hold You Back

Having a low CIBIL score may make it more challenging to secure a personal loan, but it doesn’t mean you’re out of options. By exploring alternative lenders, improving your credit profile, and applying for manageable loan amounts, you can still access the funds you need.

Ready to apply for a personal loan despite your low CIBIL score? Explore your options with Kreditbazar today, and take the first step towards financial freedom.

#low interest personal loans#personal loans#same day loans online#loans for small business#small business funding#small business#small business loans#loans for small industry business#personal loans without car title#student loans#low cibil score#cibil score#low credit score#credit score#Low credit Score Loans#loans#lowest interest rates business loans#interest rates

0 notes

Text

Get an online personal loan in Delhi NCR for bad CIBIL defaulters. No CIBIL verification required, with low-interest rates and flexible repayment options available.

#Personal loan in Delhi without CIBIL check#Personal loan without CIBIL#Loan for cibil defaulters in Delhi#Personal loan for CIBIL defaulter#Personal Loan for low CIBIL score#Loan without cibil check in Delhi#Personal loan for cibil defaulters in Delhi#Private financiers for cibil defaulters in Delhi#Loan without cibil verification in Delhi#Personal loan without cibil in Delhi#Loan without cibil in Delhi#Personal loan for bad cibil score in Delhi#Bad cibil personal loan in Delhi#Loan for bad cibil score in Delhi#Personal loan for cibil defaulters in Delhi NCR#Car loan for cibil defaulters in Delhi#Online loan for CIBIL defaulters#Cibil defaulter personal loan Delhi#online loan for cibil defaulters in Delhi#Low cibil personal loan Delhi

0 notes

Text

Get Your ₹10000 Personal Loan Now: Apply Instantly for Fast Cash!

Struggling with unexpected expenses like electricity bills, car or bike repairs, school fees, or mobile fixes? A quick ₹10,000 Personal Loan can be your lifeline—no documents, no collateral needed. Get an instant Personal Loan of ₹10000 with low interest rates, flexible tenure, multiple repayment options, and a hassle-free process with no paperwork. Fast cash loan approval within 6 minutes and…

#10000 loan on aadhar card#10000 loan urgent without cibil score#10000 personal loan on aadhar card without documents#10000 personal loan on aadhar card without salary#I need 10000 rupees loan urgently in india#I need 10000 rupees loan urgently online#I need 10000 rupees loan urgently without salary#i need 10000 rupees urgently student#mini loan 10000#pan card loan 10000#PM Aadhar Card Loan#Small cash loan on Aadhar card

0 notes

Text

Apply for an instant personal loan

Rupee112 is an instant personal loan service provided by our customers. It is very reliable for instant loans. Those are quick service providers and easy ways. For more information visit our site.

#apply online for emergency loan Ghaziabad#Short Term Loans Online gurgaon#instant payday loan noida#Same Day Loan for Salaried Employees Bengaluru#Short term loan without CIBIL kolkata#short term loan for salaried employees Hyderabad#instant emergency loan Ghaziabad#Payday Loans for Salaried Employees faridabad#emergency loan online noida#Short Term Personal Loan in Gurgaon#instant personal loan for low cibil score noida#instant payday loan gurgaon

0 notes

Text

Get Approved in Minutes! India’s Fastest Instant Loan Platforms Ranked for 2025

Let’s face it — when you need money urgently, waiting for days or even weeks for a loan approval feels like forever. Imagine applying and getting approved for a personal loan within 10 minutes, right from your phone, without tons of paperwork or credit checks. Sounds too good to be true? Well, it’s not!

In this article, I’ll walk you through the fastest instant loan platforms available in India that offer quick approval personal loans, instant online personal loan application forms, and emergency instant cash loan online — all with minimal hassle. Whether you have a low CIBIL score, no income proof, or simply want a paperless process, these apps have you covered.

Why Instant Loans Are a Game-Changer

Life is unpredictable. Sometimes you face unexpected expenses like medical emergencies, car repairs, or urgent travel. Traditional bank loans require piles of documents, lengthy verification, and often turn down applications because of strict credit checks or income proof demands.

That’s where instant loan apps come in. They provide:

Quick approval personal loan within minutes

Simple instant online personal loan application form

Options for no-income-verification personal loans

Loans for people with bad credit, personal loan India options

Same-day personal loan disbursal directly to your bank account

Completely paperless instant loan India processes

Basically, they take the pain out of getting money when you need it the most.

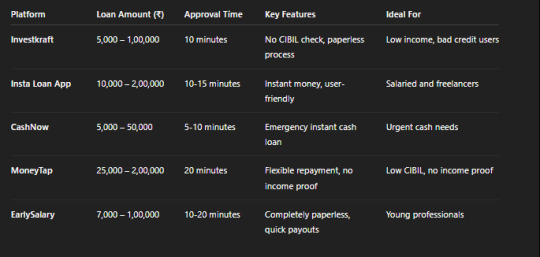

Top 5 Fastest Instant Loan Platforms in India (2025)

Here’s a comparison of the fastest apps that have changed the instant loan game:

How To Get Your Instant Loan Approved in 10 Minutes

Getting a loan in just 10 minutes might sound futuristic, but thanks to technology and smart algorithms, it’s very much possible. Here's how:

Step 1: Download the Instant Loans App

Search for a trusted app like Investkraft or Insta Loan App on Google Play or App Store and install it.

Step 2: Fill out the Instant Online Personal Loan Application Form

Provide basic details like your name, contact info, and bank details. Most apps ask for minimum documents, sometimes just Aadhaar and PAN.

Step 3: Upload Minimal Documents

Most platforms require KYC documents — Aadhaar card, PAN card, and sometimes bank statements. No bulky paperwork!

Step 4: Automated Verification and Instant Loan Approval in Minutes

AI-powered systems verify your details instantly and approve your loan, often within 10 minutes.

Step 5: Receive Same Day Personal Loan Disbursal

Once approved, the loan amount is directly transferred to your bank account — no waiting, no stress.

Common Problems Users Face & How These Apps Solve Them

Problem: Low or No CIBIL Score? Many traditional lenders reject applications if your credit score is low. But the no CIBIL check loan approval feature in apps like Investkraft means you can still get funds quickly.

Problem: No Income Proof? If you’re self-employed or don’t have formal income documents, these platforms offer no-income-verification personal loans.

Problem: Emergency Need for Cash? Apps like CashNow specialize in emergency instant cash loans online with super-fast approvals.

Problem: Paperwork and Delays? Forget all that! These apps offer paperless instant loan India processes with just digital document uploads.

What Makes These Instant Loan Apps Reliable?

Safety & Security: Licensed by RBI or partnered with NBFCs, these apps use bank-level encryption to keep your data safe.

User-Friendly Interface: The instant loans app download process is quick, and the apps are designed to be easy to navigate even for first-time users.

Transparency: No hidden charges, clear terms for interest rates, and repayment schedules.

Flexible Repayment: Options to repay in EMIs or lump sum, depending on your comfort.

Real User Experience: Instant Money When You Need It Most

Meet Anjali, a freelancer from Mumbai:

Last month, I had an urgent dental surgery, but no savings. I downloaded the Investkraft app, filled a simple form, and got instant approval within 10 minutes. The money was in my account the same day! No stressful paperwork or long waits.

Important Tips for Applying for Instant Loans

Check the App’s Credibility: Always choose apps with good user reviews and RBI registration or NBFC partnership.

Understand the Interest Rates: Instant loans may have slightly higher interest than banks, but the speed and convenience compensate for it.

Avoid Over-Borrowing: Only take what you really need, to keep repayments manageable.

Use the Loan Responsibly: Pay on time to avoid penalties and improve your credit score for future loans.

Frequently Asked Questions (FAQs)

1. Can I get an instant loan without income proof? Yes! Many instant loan platforms provide no-income-verification personal loans, especially for freelancers and self-employed individuals.

2. Is my bad credit score a barrier? Not always. Apps like Investkraft offer bad credit personal loan options without checking your CIBIL score.

3. How fast is the approval process? Some platforms offer instant loan approval in minutes, as fast as 10 minutes after application.

4. Are these instant loans safe? Absolutely, as long as you use verified apps and read the terms carefully. Your data is secure, and transactions are encrypted.

5. What documents do I need to apply for? Typically, Aadhaar, PAN, and sometimes bank statements. The process is mostly paperless, instant loan India style.

Final Thoughts: The Future of Instant Funds is Here

The days of waiting in long bank queues and submitting piles of documents are over. With these instant loan apps, you can get instant funds without paperwork, be approved within 10 minutes, and disbursed the same day. It’s time to embrace this digital revolution and take control of your financial emergencies smartly.

Remember, while these platforms provide convenience and speed, responsible borrowing is the key. Always read the terms, understand the interest rates, and plan your repayments.

Ready to get your instant money loan? Download your preferred instant loan app now and apply for a personal loan online today!

#Quick approval personal loan#Instant Online personal loan application form#Emergency instant cash loan online#Instant loans app download#Bad credit personal loan India#No-income-verification personal loan#Apply now for personal loan#Same day personal loan disbursal#Instant loan approval in minutes#Get Instant funds without paperwork#Paperless instant loan India#No CIBIL check loan approval#insta loan#investkraft#instant money#instant loan website#instant money loan#online instant loan#instant fund app

1 note

·

View note

Text

"Get the Best Home, Personal, Doctors, Car, and Business Loans with SD Financial"

SD Financial offers a wide range of loan options for both individuals and businesses. Get affordable home loans, personal loans, doctors loans, car loans, and business loans against property with SD Financial. Our team of experts will help you choose the best loan option for you and your business. We offer competitive interest rates and flexible repayment terms that can be tailored to meet your specific needs. With our experienced team, you can be sure you are getting the best financial solution for your needs. Don't hesitate to contact us today to learn more about our loan options and how we can help you get the financing you need.

#New Car Loan in basti#best small business loans in basti#Used Car Loan in basti#restaurant business loans in basti#Construction Equipment Loan in basti#Commercial Vehicle Loan in basti#Personal Loan in basti#Doctors Loan in basti#Business Loan in basti#Home Loan in basti#loan without cibil in basti

0 notes

Text

Financial Liquidity Unlocked: Instant Loans Against Mutual Funds

In the dynamic landscape of personal finance, individuals often find themselves in need of quick and accessible sources of funding. An innovative solution gaining prominence is the option of obtaining instant loans against mutual funds. This financial instrument not only addresses the immediate liquidity requirements of investors but also leverages the value of their existing mutual fund investments. In this article, we delve into the concept of instant loans against mutual funds, exploring the benefits, considerations, and the overall impact on personal financial management.

Understanding Instant Loans Against Mutual Funds:

Instant loans against mutual funds operate on a simple premise: investors can pledge their mutual fund units to financial institutions or lending platforms in exchange for a loan amount. The loan amount is determined based on the net asset value (NAV) of the mutual fund units being pledged. This allows investors to unlock the value of their investments without the need to liquidate their mutual fund holdings.

Benefits:

Quick Access to Funds: One of the primary advantages of opting for instant loans against mutual funds is the speed at which funds can be accessed. Traditional loan approval processes can be time-consuming, but leveraging mutual fund units as collateral allows for a swift approval and disbursement of funds.

Retaining Investment Portfolio: Unlike selling mutual fund units to meet financial needs, opting for a loan against these investments enables individuals to retain their portfolio. This is particularly advantageous in situations where investors believe in the long-term growth potential of their mutual funds and wish to avoid disrupting their investment strategy.

Flexible Repayment Options: Instant loans against mutual funds typically come with flexible repayment options. Borrowers can choose from various tenures and repayment structures, allowing them to tailor the loan to their financial circumstances and goals.

Market Upside Participation: By opting for a loan against mutual funds instead of selling them, investors retain the opportunity to benefit from any potential upside in the market. If the value of the mutual fund units increases during the loan tenure, borrowers can still enjoy the appreciation.

Considerations:

Risk of NAV Fluctuations: The value of mutual fund units is subject to market fluctuations, and as such, the net asset value (NAV) can vary. Borrowers should be aware that if the NAV decreases, they might need to pledge additional units or repay part of the loan to maintain the agreed-upon loan-to-value ratio.

Interest Rates and Charges: While instant loans against mutual funds provide quick access to funds, borrowers should carefully review the interest rates and associated charges. Different lenders may offer varying terms, and it's crucial to assess the overall cost of the loan to make an informed decision.

Loan-to-Value Ratio: Financial institutions typically determine the loan amount based on a loan-to-value (LTV) ratio. Investors should understand the LTV ratio applicable to their loan and be prepared to provide additional collateral if the value of the mutual fund units falls.

Conclusion:

Instant loans against mutual funds represent a financial tool that empowers individuals to meet their immediate liquidity needs without sacrificing their long-term investment goals. By leveraging the value of mutual fund holdings, investors can access quick and flexible financing solutions. However, it is essential for borrowers to carefully weigh the benefits and considerations, considering the dynamic nature of the financial markets and the specific terms offered by lending institutions. As with any financial decision, a thorough understanding of the terms, risks, and potential rewards is key to making informed choices that align with individual financial objectives.

For more details, visit us :

online personal finance app

loan against securities lowest interest rate

Insta Loan Against Mutual Funds Online

0 notes