#Loan without cibil verification in Delhi

Explore tagged Tumblr posts

Text

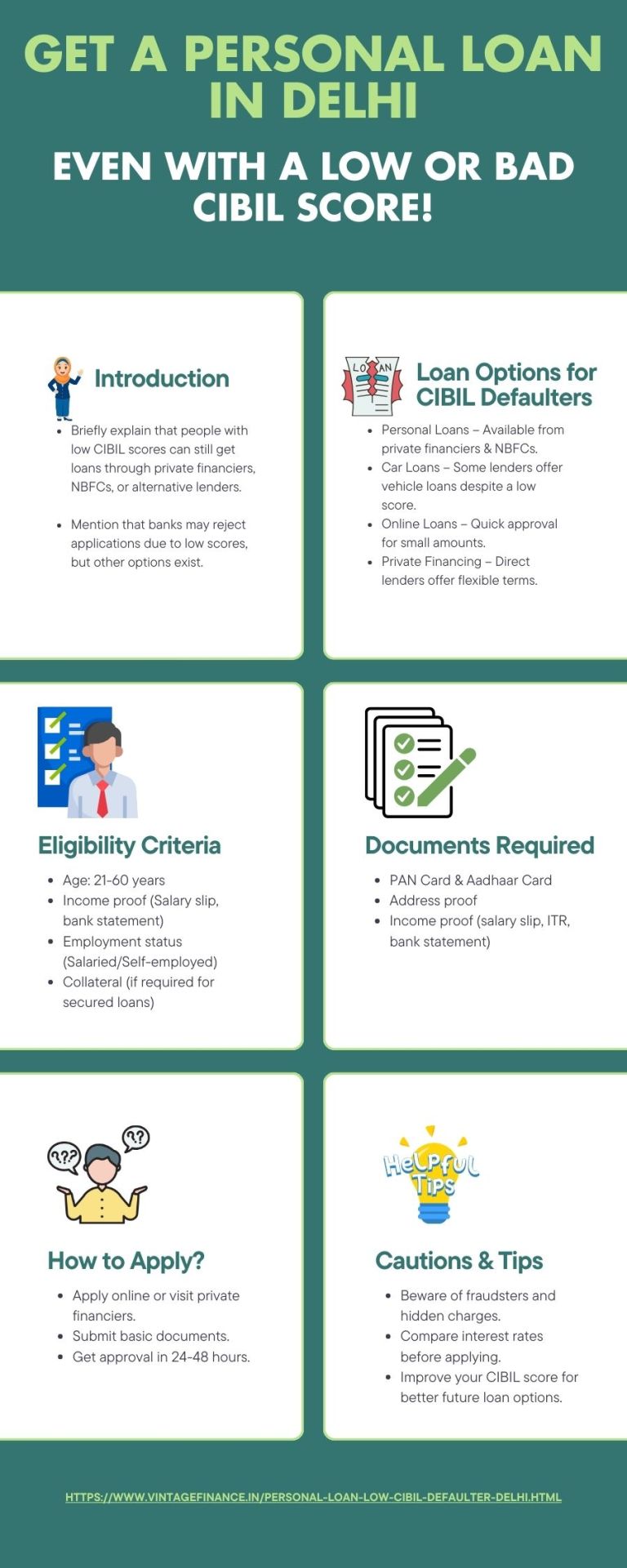

Get an online personal loan in Delhi NCR for bad CIBIL defaulters. No CIBIL verification required, with low-interest rates and flexible repayment options available.

#Personal loan in Delhi without CIBIL check#Personal loan without CIBIL#Loan for cibil defaulters in Delhi#Personal loan for CIBIL defaulter#Personal Loan for low CIBIL score#Loan without cibil check in Delhi#Personal loan for cibil defaulters in Delhi#Private financiers for cibil defaulters in Delhi#Loan without cibil verification in Delhi#Personal loan without cibil in Delhi#Loan without cibil in Delhi#Personal loan for bad cibil score in Delhi#Bad cibil personal loan in Delhi#Loan for bad cibil score in Delhi#Personal loan for cibil defaulters in Delhi NCR#Car loan for cibil defaulters in Delhi#Online loan for CIBIL defaulters#Cibil defaulter personal loan Delhi#online loan for cibil defaulters in Delhi#Low cibil personal loan Delhi

0 notes

Text

No Salary Slip? No Problem! Apply for Instant Loan Online Without Documents in 2025

Struggling to get a loan due to low income, no salary slip, or poor credit score? You’re not alone.

In today’s fast-paced world, financial emergencies don’t wait. Whether it's a medical bill, urgent travel, or rent payment, people often need instant cash loans in 1 hour in India without the hassle of paperwork. However, traditional banks demand documents, proof of income, and a good CIBIL score.

What if we told you that in 2025, there are real solutions to get instant approval loans online without any salary slips, CIBIL checks, or even detailed income proofs?

Let’s explore India’s best no-verification loan apps that are helping thousands of users like you get money in minutes – stress-free.

Why Do People Look for Instant Loans Without Documents?

Many salaried individuals, freelancers, or small business owners often face these challenges:

No salary slip or bank statement

Low or no credit score (CIBIL)

No ITR or formal income proof

Need for urgent funds (within 1 hour)

That’s where instant loans without a salary slip and no-proof personal loan apps step in.

These apps leverage AI-powered credit engines, alternative data, and KYC to offer instant loan disbursal in minutes – even to first-time borrowers with no formal documents.

Who Can Apply?

You can apply personal loan online instantly if you meet the following:

Age: 18+ years

Basic KYC: PAN + Aadhaar

Bank account for loan disbursal

Mobile number linked to Aadhaar

Basic repayment capacity (even gig work/freelancing)

Top No-Verification Loan Apps in India (2025)

Here’s a list of trusted apps where you can get an instant loan without documents or a CIBIL check:

Most of these apps offer quick cash loans without income proof, helping even those with bad credit get personal loan approval.

How to Apply for a Loan Without Income Proof or CIBIL Check?

Here’s a step-by-step guide for an easy personal loan application online in India:

Download the App (Investkraft, KreditBee, CASHe, etc.)

Complete eKYC – Aadhaar + PAN verification

Enter Basic Details – Employment type, monthly income (self-declared)

Bank Account Link – To receive disbursal

Loan Offer & Approval – Instant approval in most cases

Get Funds – Loan disbursal in minutes to your bank or wallet

That’s it! No need to upload salary slips, bank statements, or wait for long approvals.

Real-Life Scenario: How Ramesh Got ₹20,000 in 15 Minutes

I work part-time and earn ₹12,000 monthly. No ITR, no salary slip. I had a sudden health expense and tried KreditBee. I just uploaded my Aadhaar, PAN, and filled in basic info. ₹20,000 was credited to my account in under 15 minutes. Zero paperwork, no credit check!

— Ramesh, 21, Delhi

Is It Safe to Borrow from No-Proof Loan Apps?

Yes, but choose only RBI-registered NBFC-backed apps. Read reviews, verify data encryption policies, and ensure they don’t ask for unnecessary permissions.

Avoid shady apps that:

Demand advance payments

Call your contacts

Threaten legal action

Stick to reputed names like KreditBee, CASHe, and PaySense for a trusted instant loan without a credit score check in India.

Common Myths Busted

Top 5 FAQs – Instant Personal Loans Without Documents in India

1. Can I get a loan without a CIBIL or a salary slip?

Yes. Many apps allow a loan without a salary slip or a bank statement using KYC and alternate data.

2. How fast can I get the loan amount?

You can receive funds within 5 to 30 minutes, depending on the app and verification speed.

3. Is my low CIBIL score a problem?

No. Several platforms specialize in offering loans without a credit score check in India or to low-CIBIL borrowers.

4. Which is the best app for quick cash without income proof?

KreditBee and TrueBalance are top-rated for quick cash loans without income proof.

5. Do I need a job to get a personal loan?

Not always. Some apps offer loans to freelancers, students, and self-declared income earners.

Final Thoughts – Raise Instant Funds Without Hassle in 2025

In 2025, getting instant personal loans without income proof, CIBIL score, or documents is no longer be a dream. With the rise of AI-driven loan platforms, users across India can now meet urgent needs without fear of rejection.

Whether you're looking to apply personal loan online instantly, get an instant cash loan in 1 hour in India, or use a no proof personal loan app, the options are many – and very real.

Choose your app wisely. Stick to trusted names. Borrow only what you need. And enjoy the freedom of instant funds without paperwork.

#Get instant approval loan online#apply personal loan online instantly#instant cash loan in 1 hour in India#insta loan app without salary slip#bad credit personal loan approval guaranteed#loan without salary slip or bank statement#easy personal loan apply online India#instant loan disbursal in minutes#get instant loan without documents#quick cash loan without income proof#no proof personal loan apps#loan without credit score check in India

2 notes

·

View notes

Text

Low-Interest Business Loan in Delhi: A Complete Guide by LoansWala

For any entrepreneur or small business owner, access to affordable credit can be the difference between struggling to survive and thriving with success. In a bustling economic hub like Delhi, businesses—both new and established—need funding solutions that are not only accessible but also cost-effective. That’s where a Low-Interest Business Loan in Delhi becomes a game changer.

In this comprehensive guide brought to you by LoansWala, we’ll explore everything you need to know about securing a Low-Interest Business Loan in Delhi—from eligibility and benefits to the application process and how to choose the right lender.

Why Choose a Low-Interest Business Loan in Delhi?

Delhi, being one of India's major commercial centers, offers countless opportunities for business expansion. However, with opportunity comes competition. In such an environment, maintaining liquidity while reducing financial stress is essential.

A Low-Interest Business Loan in Delhi can provide the capital needed for:

Purchasing inventory

Expanding office space

Hiring skilled staff

Upgrading equipment

Launching marketing campaigns

What makes these loans appealing is that you can access funds without burning a hole in your pocket on high-interest payments. LoansWala understands this need and specializes in offering competitive loan options tailored to businesses in Delhi.

Features of a Low-Interest Business Loan in Delhi

A Low-Interest Business Loan in Delhi comes packed with several features that make it ideal for entrepreneurs:

1. Competitive Interest Rates

As the name suggests, these loans come with reduced interest rates, helping businesses save significantly over the repayment period.

2. Flexible Repayment Tenure

Most loans offer repayment terms ranging from 12 months to 60 months, depending on the business profile and amount borrowed.

3. Minimal Documentation

Thanks to services like LoansWala, the paperwork is simplified, allowing quick and hassle-free processing.

4. No Collateral Required (For Unsecured Loans)

Many Low-Interest Business Loan in Delhi options do not require collateral, which makes it easier for startups and small businesses to qualify.

5. Quick Disbursal

With digital processes and streamlined verification, you can get funds disbursed in as little as 48 hours.

Eligibility Criteria for a Low-Interest Business Loan in Delhi

Each lender may have slightly different eligibility criteria, but the general requirements include:

Business Vintage: A minimum of 1-2 years of business operations

Annual Turnover: Usually a minimum turnover of ₹10 lakhs per annum

Credit Score: A CIBIL score of 650 or above is typically preferred

Age of Applicant: Between 21 to 65 years

At LoansWala, our eligibility checks are flexible, and we help you connect with lenders best suited to your business profile.

Documents Required for a Low-Interest Business Loan in Delhi

Here’s a standard list of documents you may need:

PAN card and Aadhar card of the business owner

Business registration proof (GST certificate, shop act license, etc.)

Bank statements (last 6–12 months)

Income Tax Returns (last 1–2 years)

Profit and Loss Statement

Proof of business address

With LoansWala, most of this documentation can be uploaded digitally, making the application process even smoother.

How LoansWala Helps You Get a Low-Interest Business Loan in Delhi

Finding the right loan at the lowest interest rate can be overwhelming. That's where LoansWala comes in as your financial companion.

Here's how LoansWala simplifies your loan journey:

Loan Comparison: We compare multiple lenders to find the best Low-Interest Business Loan in Delhi for you.

Personalized Support: Our financial advisors offer one-on-one consultations to understand your needs.

Speedy Approvals: We assist in documentation, verification, and follow-ups for quicker approval.

Zero Hidden Charges: With LoansWala, what you see is what you get—no surprise fees.

Benefits of Taking a Low-Interest Business Loan in Delhi Through LoansWala

1. Cost-Efficiency

By opting for a Low-Interest Business Loan in Delhi, your EMI burden is greatly reduced, allowing you to reinvest in your business more efficiently.

2. Improved Cash Flow

These loans help bridge working capital gaps, ensuring smooth daily operations without financial disruptions.

3. Credit Score Boost

Timely repayment of loans through LoansWala also improves your business credit score, making you eligible for larger loans in the future.

4. Custom Loan Solutions

We don’t believe in one-size-fits-all. Whether you’re a trader, manufacturer, or service provider, LoansWala customizes loan plans according to your business model.

Types of Businesses That Can Benefit from a Low-Interest Business Loan in Delhi

Retailers – For inventory purchase and shop expansion.

Wholesalers – To manage bulk orders and improve supply chains.

Startups – For product development and market entry.

Restaurants and Cafes – For new equipment or additional outlets.

Freelancers and Consultants – To set up a dedicated office or hire support staff.

Whatever your business type, LoansWala can help secure the most suitable Low-Interest Business Loan in Delhi.

Mistakes to Avoid While Applying for a Low-Interest Business Loan in Delhi

Even though getting a loan has become simpler, applicants still make errors that lead to delays or rejections.

Common mistakes include:

Incomplete documentation

Applying with a low credit score

Ignoring the fine print in loan agreements

Choosing the wrong loan tenure

Not comparing different lenders

With LoansWala, we help you avoid these pitfalls through step-by-step guidance and expert advice.

How to Apply for a Low-Interest Business Loan in Delhi Through LoansWala

Follow these easy steps:

Visit Our Website: Go to the official LoansWala website.

Fill Out the Loan Form: Provide basic business details and the amount needed.

Upload Documents: Digitally upload the required documents.

Loan Match: Our system finds the most suitable lenders offering a Low-Interest Business Loan in Delhi.

Verification & Approval: Once your documents are verified, loan approval is processed.

Disbursal: Receive the funds directly into your account.

It’s that easy with LoansWala.

Frequently Asked Questions (FAQs)

Q1: Can startups apply for a Low-Interest Business Loan in Delhi?

Yes, startups with a sound business plan and basic documentation can apply. LoansWala helps match startups with lenders who cater to new businesses.

Q2: What is the typical interest rate?

The interest rate for a Low-Interest Business Loan in Delhi varies between 9% to 15%, depending on your credit profile and lender policies.

Q3: Is collateral necessary?

Not always. Many loans through LoansWala are unsecured, which means no collateral is required.

Q4: How long does it take for loan disbursal?

With complete documentation, most loans through LoansWala are disbursed within 48–72 hours.

Real Stories: How LoansWala Helped Businesses Grow in Delhi

Case Study 1: Neha’s Boutique in Lajpat Nagar

Neha wanted to renovate her boutique and needed funds urgently. She approached LoansWala and within 3 days, she had a Low-Interest Business Loan in Delhi sanctioned at just 10.5%. Today, her sales have doubled.

Case Study 2: Ramesh’s Food Delivery Startup

Ramesh needed ₹5 lakhs for tech upgrades. Through LoansWala, he secured the amount with minimal documentation. The loan boosted his business scalability and customer reach.

Conclusion

A Low-Interest Business Loan in Delhi isn’t just a financial product—it’s a growth enabler. It empowers entrepreneurs to take bold steps, expand confidently, and tackle challenges with strength.

Whether you are looking to streamline your working capital, upgrade your operations, or expand into new markets, a Low-Interest Business Loan in Delhi through LoansWala is your gateway to smarter business financing.

Don’t let financial constraints hold you back—explore the possibilities with LoansWala today!

0 notes

Text

Affordable Home Loan in Noida – Turn Your Dream into Reality

The very essence of living life is to have a blissful home in Noida for many. With fabulous infrastructure, rivulets of connectivity, and lush modern amenities, buying a home means the big bucks naturally and, therefore, perhaps the most availing option for many aspiring homeowners could be a home loan.

In search of an enthrallingly cheap Home Loan in Noida, this guide serves you to sate all the needs-to-know-that should be taken into consideration: the benefits, eligibility criteria, and slightly other versions you can lay your hands on in the market.

Why Go Noida for Your Dream House?

Noida remains one of the fastest-developing cities across India that satisfy the need for a sort of mixture between residential and commercial premises. Well-planned sectors, integrated metro and Delhi connectivity: all this made Noida a very sought-after destination for prospective house seekers. It has various types of houses from very low-cost apartments to ultra-luxury villas.

Getting to Know the Home Loan in Noida

Home loan in Noida lets you buy that property of your dreams without putting much strain on your pocket. The financially-interested parties approve a variety of such home loans: ready to occupy, under construction, and for home renovations.

Home Loan Features:

Loan Amount- The loan amount is subject to variation based upon income, credit score, and value of property.

Interest Rates- Top banks and NBFC usually offer competitive interest rates.

Tenure- Keeping your EMIs easy to pay, repayment may extend for a period of 30 years.

Tax Benefits- The borrower can avail of tax benefits by being taxed under the Income Tax Act with sections 80C and 24(b).

Minimal Documentation: The financial institutions have made the application process a half-way to be applied for.

Arena Fincorp-Your Trusted Partner for Home Loans

Finding a financial partner of your choice in a Home Loan in Noida is of utmost importance. Arena Fincorp is a reputed financial service provider that offers a customized home loan solution addressing the varied needs of borrowers. Attractive interest rates, flexible repayment options, and quick approval processes are some features that make Arena Fincorp home financing easier and accessible.

Why Choose Arena Fincorp?

Low Interest Rates: Competitive rates to make home buying affordable.

Fast Processing: Quick approval and disbursal process.

Flexible Tenure: Repayment options worked to suit your financial situation.

Expert Guidance: Financial experts assist you at every step of the loan application process.

Home Loans Eligibility Criteria

These are the criteria that must be fulfilled by borrowers before applying for Home Loan in Noida:

Age: The applicant must stand 21 to 65 years.

Employment Type: Both salaried and self-employed can apply.

Income: The individual is expected to have reliable sources of income as it ensures the loan's repayment.

Credit Score: A good CIBIL score (750 and above) would help you get the loan.

The property's verification: The property should legally be approved for the lender's guidelines.

Documents for Home Loan Application

This is the list of documents that have to be submitted for the home loan application for Arena Fincorp:

Identity Proof (Aadhar, PAN Card, Passport, or Voter ID)

Address Proof (Utility Bills, Rental Agreement, Passport, etc.)

Income Proof (Salary Slips, Bank Stmts, ITR)

Property Documents (Sale Agreements, Title Deeds, Approved Plans, etc).

Home Loan Application in Noida

Simple and hassle-free, comes under this category: getting your home loan in Noida through Arena Fincorp.

Check Eligibility:

Online eligibility calculator would perform the computation to determine the loan amount for which you might be eligible.

Interest Rate Comparison:

By comparing what other lending houses offer in terms of an interest rate, the lowest among such amounts would be fetched.

Submit Application:

Complete the filling process of the application form followed by the submission process and completing the documents required for the application.

Loan Processing and Verification:

The lender will check the documents and assess their creditworthiness.

Disbursing the Loan upon Approval:

Once approved, the loan amount is disbursed to either the seller or builder.

Ways to Get Yourself an Affordable Home Loan

Maintain High Credit Score: If a score is above 750, it helps to acquire the best terms on the loan.

Opt for Longer Tenure: A longer tenure means lower monthly EMI payments.

Compare Lenders: Banks and NBFCs have different interest rates and terms.

Negotiate the Processing Fees: Some lenders may not charge processing fees to eligible borrowers.

Make a Larger Down Payment: A larger down payment will mean a smaller loan amount and lesser interest burden.

Conclusion

Affordable home loans have made it easy for buyers to purchase homes in Noida. It is Arena Fincorp's dedication toward fulfilling your dream of owning a house as it offers a suitable solution that helps you with your best home loan. Owning an affordable home is now possible with respect to low-interest rates, flexible repayment options, and consultancy-based assistance, if one needs to avail a home loan in Noida.

In case you are planning to buy a home, you should visit Arena Fincorp today to take a step towards making your dream house a reality.

0 notes

Text

Unlocking Your Dream Home: Home Loan in Jaipur, Rajasthan

Owning a home is a significant milestone in one's life, symbolizing financial stability and a place to create cherished memories. In Jaipur, Rajasthan, a city renowned for its rich heritage and modern infrastructure, the dream of homeownership is more accessible than ever. With a multitude of financial institutions offering home loan options, prospective buyers can turn their dreams into reality with ease. Why Opt for a Home Loan in Jaipur, Rajasthan? Jaipur, often referred to as the Pink City, is not just a tourist destination but also a booming real estate hub. The city offers a perfect blend of tradition and modernity, making it an ideal place for homebuyers. Here are some reasons why opting for a home loan in Jaipur, Rajasthan, is a wise decision:

Affordable Property Rates: Compared to metropolitan cities like Delhi and Mumbai, Jaipur offers relatively affordable property prices, making it an attractive option for homebuyers.

Growing Infrastructure: With advancements in roadways, metro connectivity, IT parks, and industrial zones, Jaipur is rapidly developing, increasing the demand for residential properties.

Investment Potential: The real estate market in Jaipur is growing steadily, ensuring a profitable return on investment for homeowners.

Diverse Housing Options: Whether you seek a luxurious villa, a modern apartment, or an independent house, Jaipur offers a range of residential options to suit varying budgets. Home Loan Options in Jaipur, Rajasthan Several banks, financial institutions, and housing finance companies provide home loans with competitive interest rates and flexible repayment options. Here are some key features of home loans available in Jaipur: • Loan Amount: Depending on your income and eligibility, you can avail of home loans starting from INR 5 lakhs to several crores. • Interest Rates: Banks offer home loans with interest rates starting from as low as 6.5% per annum. • Tenure: Repayment periods range from 5 years to 30 years, offering flexibility to borrowers. • Processing Fees: Typically, processing charges range from 0.25% to 1% of the loan amount. • Prepayment Charges: Many lenders allow prepayment of loans without extra charges, reducing the overall interest burden. Eligibility Criteria for a Home Loan in Jaipur To avail of a home loan in Jaipur, Rajasthan, applicants must meet certain eligibility criteria set by lenders: • Age Requirement: Applicants must be between 21 to 65 years old. • Income Stability: A steady source of income is required, whether salaried or self-employed. • Credit Score: A CIBIL score of 750 or above increases the chances of loan approval. • Employment Status: Salaried individuals should have at least two years of work experience, while self-employed applicants must demonstrate a stable income. • Property Valuation: The property in question should meet the lender’s legal and technical verification standards. Documents Required for Home Loan Application When applying for a home loan in Jaipur, Rajasthan, ensure you have the necessary documents ready: • Identity Proof (Aadhar Card, PAN Card, Passport, Voter ID) • Address Proof (Utility Bills, Rental Agreement, Passport, Voter ID) • Income Proof (Salary Slips, IT Returns, Bank Statements) • Employment Proof (Appointment Letter, Business Registration Certificate) • Property Documents (Sale Agreement, Approved Building Plan, NOC from Builder) Steps to Apply for a Home Loan in Jaipur Getting a home loan in Jaipur is a straightforward process if you follow these simple steps:

Assess Your Budget: Determine your financial capacity and decide on a loan amount accordingly.

Compare Lenders: Research different banks and NBFCs to find the best interest rates and loan terms.

Check Eligibility: Use online home loan eligibility calculators to estimate the amount you qualify for.

Gather Documents: Ensure you have all the required documents ready before applying.

Submit Application: Apply online or visit the lender’s branch to submit your application.

Verification & Approval: The lender will assess your application, verify documents, and approve the loan.

Loan Disbursement: Upon final approval, the loan amount is disbursed to the seller or builder. Benefits of Taking a Home Loan in Jaipur, Rajasthan Opting for a home loan in Jaipur offers numerous advantages: • Tax Benefits: Home loan borrowers can avail of tax deductions on both principal and interest repayments under Sections 80C and 24(b) of the Income Tax Act. • Long Repayment Tenure: Flexible tenure options make EMI payments more manageable. • High Loan Amount: Banks provide up to 80-90% of the property value as a loan. • Fixed and Floating Interest Rates: Borrowers can choose between fixed or floating interest rates based on their financial planning. • Increase in Property Value: As Jaipur’s real estate market grows, the value of purchased properties is likely to appreciate over time. Top Banks & Financial Institutions Offering Home Loans in Jaipur Several reputed banks and NBFCs provide home loan services in Jaipur, including: • State Bank of India (SBI) • HDFC Bank • ICICI Bank • Axis Bank • Punjab National Bank (PNB) • LIC Housing Finance • Bajaj Finserv • Tata Capital Housing Finance Conclusion A home loan in Jaipur, Rajasthan, is a strategic financial decision that brings you closer to owning your dream home. With affordable property rates, growing infrastructure, and favorable loan options, Jaipur is an ideal city for homebuyers. By understanding the eligibility criteria, loan features, and application process, you can navigate your home loan journey smoothly. Whether you are a first-time homebuyer or an investor, Jaipur’s real estate market offers endless opportunities to secure a valuable asset for the future.

home loan in jaipurrajasthan

0 notes

Text

Top 5 Personal Loan Tips That No One Will Tell You in 2021

As we all know a personal loan is the best option to manage a short-term financial crisis. A personal loan is very helpful in planned and unplanned expenses. Availability of a personal loan is very easy nowadays. Anyone can avail a personal loan easily.

There are lots of financial institutes that offer personal loans for cibil defaulters. Fast approval and quick disbursement make personal loans one of the popular financing options for individuals.

Tip 1: Take a personal loan only when it’s necessary:

The interest rate of personal loans is comparatively high than other types of loans. So we suggest you only apply for a personal loan when it’s necessary. A personal loan helps you to fulfill your short-term requirement but, you will be repaying it for the next few months or years. Hence always ensure that you will be able to repay the loan within your monthly income.

Tip 2: Be careful of extra charges :

Before taking a personal loan you should have to inquire about additional charges and EMI with your bank or lender. Verification charges, GST, the penalty for late payment of EMI, etc. are some of those.

So always consider this point to save your hard-earned money.

Tip 3: Good CIBIL can help you:Tip 4: Go With Short Tenure:

Cibil score is a very important factor in availing any kind of loan. If you have a good cibil score then you can easily avail a personal loan with an attractive interest rate. A good cibil score gives you the edge to negotiate the interest rate with your lenders.

Tip 4: Go With Short Tenure:

As reputed personal loan providers with low cibil scores in Delhi, we suggest you go for a shorter tenure. There are lots of NBFCs and Banks that offer loans at a low-interest rate and longer tenure. Many people think that they are going to save on EMIs. But longer tenure ends up paying more money to banks and NBFCs.

Tip 5: Research before applying:

There are lots of financial institutions in the market that offer personal loans at different interest rates and tenures. To get the best offers, we suggest you go through research work. Compare interest rates, offers, processing fees before taking a personal loan.

If you don’t want to conduct detailed research, and are looking for a trusted personal loan in Delhi without a cibil check then contact vintage finance.

#personal loan for cibil defaulters#personal loan without cibil check#loan without cibil check in delhi#instant personal loan without cibil check

0 notes

Text

How To Make Sure Your Home Loan Won't Be Rejected

In today's growing world, a home is a vital part of an individual's life, and as the world is improving and the stakes are increasing too, it is becoming difficult for an individual to buy or build a right, well-furnished house. Sometimes, it stays as a dream in the shell forever. And to overcome this particular difficulty, people turn to banks for loans. Banks play a crucial role in providing a home loan in Delhi and everywhere at reasonable interest rates. Various banks offer various housing loan interest rates from which an individual can choose a bank, which suits him best.

CIBIL Score

Credit Information Bureau of India Ltd. (CIBIL) is a score (a good score for a home loan is 700) that maintains records of a person who has previously taken a loan or used a credit card. To check for housing loan eligibility, this is a crucial deciding factor. There can be several reasons for a bad CIBIL score. Some of these include dues not paid on time and no payment in EMI. To maintain a good CIBIL score, one should ensure timely payment of dues and avoid taking unsecured loans.

If an applicant has received a loan rejection letter from the bank previously, then he/she might not be able to fulfill the eligibility the loan applicant requires. CIBIL keeps records of every loan application. When the applicant applies for the loan, previous papers from the database will be checked, and the rejection will show up in the credit profile. It is highly advisable one should not keep applying for loans without any reason. Even if you are taking a loan against property, the profile perfection is applicable.

Eligibility And Verification

For a particular applicant who is applying for a home loan in Delhi, it is essential to verify his details. Do the verification with the bank without any inconsistency. To be eligible, all his given identities have to match with the credit report. In case of the applicant changes there any detail, it has to be immediately informed to the lender.

The eligibility criteria for a housing loan in terms of age limit is a minimum of 22-23 years, and the maximum is around 60 years for applicants. If an applicant is near retirement age, the bank would be hesitant to provide the loan as they will have no repayment capacity after a few years.

Make sure your profile is perfect for the loan application. You have to prove the bank that you are in to pay it off. With the same focus, you can as well apply for a

business loan in Delhi

.

0 notes

Text

Get an online personal loan in Delhi NCR for bad CIBIL defaulters. No CIBIL verification required, with low-interest rates and flexible repayment options available.

#Personal loan in Delhi without CIBIL check#Personal loan without CIBIL#Loan for cibil defaulters in Delhi#Personal loan for CIBIL defaulter#Personal Loan for low CIBIL score#Loan without cibil check in Delhi#Personal loan for cibil defaulters in Delhi#Private financiers for cibil defaulters in Delhi#Loan without cibil verification in Delhi#Personal loan without cibil in Delhi#Loan without cibil in Delhi#Personal loan for bad cibil score in Delhi#Bad cibil personal loan in Delhi#Loan for bad cibil score in Delhi#Personal loan for cibil defaulters in Delhi NCR#Car loan for cibil defaulters in Delhi#Online loan for CIBIL defaulters#Cibil defaulter personal loan Delhi#online loan for cibil defaulters in Delhi#Low cibil personal loan Delhi

0 notes

Text

#Personal loan in Delhi without CIBIL check#Personal loan without CIBIL#Loan for cibil defaulters in Delhi#Personal loan for CIBIL defaulter#Personal Loan for low CIBIL score#Loan without cibil check in Delhi#Personal loan for cibil defaulters in Delhi#Private financiers for cibil defaulters in Delhi#Loan without cibil verification in Delhi#Personal loan without cibil in Delhi#Loan without cibil in Delhi#Personal loan for bad cibil score in Delhi#Bad cibil personal loan in Delhi#Loan for bad cibil score in Delhi#Personal loan for cibil defaulters in Delhi NCR#Car loan for cibil defaulters in Delhi#Online loan for CIBIL defaulters#Cibil defaulter personal loan Delhi#online loan for cibil defaulters in Delhi#Low cibil personal loan Delhi

0 notes

Text

Zero Documents, Zero Credit? These 2025 Personal Loan Options Still Approve You!

Are you facing a cash crunch but don’t have the documents or credit score banks usually ask for? You’re not alone. In 2025, thousands of Indians—freelancers, students, homemakers, or people with low income—are searching for ways to secure urgent funds without the hassle of paperwork and credit checks. The good news? You can now get an instant personal loan online in 5 minutes, even without traditional documents or a CIBIL score.

In this guide, we’ll help you discover the top personal loan choices in 2025 that don’t require income proof or credit checks. Whether you're looking for an instant cash loan in 1 hour without documents or want to apply for a personal loan with instant approval, this article has got you covered.

Why Are No-Document & No-CIBIL Personal Loans in High Demand?

Life is unpredictable. Medical emergencies, unexpected bills, or a job loss can throw finances out of balance. But for many, lack of salary slips, low CIBIL scores, or missing bank statements becomes a roadblock.

Thanks to fintech growth, you can now:

Get loan without CIBIL score check instantly

Apply online without visiting a branch

Access emergency funds even with poor credit

Let’s explore the best platforms where you can get a quick loan approval without income documents in 2025.

Top 5 Personal Loan Apps in 2025 Without Documents or Credit Score

Here's a comparison table to help you choose the best option:

How to Get a Personal Loan Without Documents in 2025

You might wonder: “How is it even possible to get a loan without salary slip or bank statement?”

Here’s how lenders make it work:

Alternative Credit Scoring: Apps evaluate mobile usage, digital footprint, and payment history.

PAN + Aadhaar eKYC: Basic documents for identity verification.

Instant decision-making using AI-driven systems.

So yes, you can get personal loan without salary slip or bank statement—especially from these Insta loan app for instant money transfer platforms.

Eligibility for No-Document Personal Loans

Even though you can skip heavy paperwork, you still need to meet a few basic conditions:

Age: 21 to 60 years

Nationality: Indian resident

Basic ID proof: Aadhaar, PAN

Mobile number linked to Aadhaar

Minimal or no credit history accepted

Some apps may also look at:

Regular mobile recharges

UPI/bank transaction frequency

Social profile verification

How to Apply for a Personal Loan with Instant Approval

Follow these simple steps to get approved today:

Download the Loan App – Choose from top apps like KreditBee, Navi, or SmartCoin.

Register & Complete KYC – Use Aadhaar, PAN & selfie verification.

Choose Loan Amount – Select how much you need and the tenure.

Submit Application – No physical documents needed.

Get Disbursal – The Amount reaches your bank account in minutes.

Whether you need ₹2,000 for a weekend fix or ₹50,000 for a medical emergency, the best instant personal loan app in India will cover you.

Real-Life Human Scenarios

I’m a freelancer with irregular income. No bank wanted to give me a loan. But SmartCoin gave me ₹10,000 within 15 minutes without asking for income proof.”

— Ramesh, 27, Pune

After a job loss, my CIBIL score dropped to 520. KreditBee still approved my loan request. I was surprised!”

— Pooja, 33, Delhi

This is the human side of instant lending—serving those the traditional system often ignores.

Things to Watch Out For

Before applying for instant loan in 10 minutes without a credit check, keep this in mind:

Higher Interest Rates: Risk-based lending leads to slightly higher rates (15%–35% APR).

Shorter Tenure: Usually 3–12 months

Late Fee Penalties: Pay on time to avoid heavy charges

Read Terms Carefully: Some apps have hidden charges

Despite these, the easy online application for personal loan process makes it worthwhile when you’re stuck.

Expert Tips to Boost Loan Approval Without Credit Score

Maintain basic bank transactions (₹500–₹1000 per month)

Keep your Aadhaar and PAN linked & updated

Repay small loans on time to build digital trust

Avoid applying to too many lenders at once

Choose NBFC-approved or RBI-regulated apps

Use Cases for No-Document Personal Loans

Medical emergency

Student fees or certification

Freelancer tool or software upgrade

Small business inventory

Credit card repayment or consolidation

Whatever your reason, you can get instant funds for emergency needs today—without the fear of rejections due to low scores.

FAQs – Personal Loan Without Documents or CIBIL in 2025

1. Can I get an instant personal loan online in 5 minutes without a credit score?

Yes, many apps like KreditBee, mPokket, and SmartCoin offer personal loans without checking your CIBIL score.

2. Which app is best for instant cash loan in 1 hour without documents?

Apps like Navi and KreditBee provide fast loans with minimum documentation—just Aadhaar and PAN needed.

3. Is it safe to take a loan without salary slip or bank statement?

Yes, if you're using RBI-registered NBFCs or reputed apps, it's safe. Always check reviews and terms.

4. Will applying without a CIBIL score affect my future credit eligibility?

No, these apps usually do soft checks and help you build a credit history when you repay on time.

5. Can students or housewives apply for these loans?

Absolutely! Platforms like mPokket and SmartCoin are perfect for students, homemakers, and first-time borrowers.

Final Thoughts – Your Approval is Just Minutes Away

In 2025, financial inclusion is not a privilege—it’s a right. Whether you're salaried, unemployed, or self-employed, you can now get loan without CIBIL score check instantly, without feeling helpless or rejected.

Start with a trusted Insta loan app for instant money transfer, and within minutes, you’ll have the funds you need for any emergency.

#Get Instant Personal Loan Online in 5 Minutes#Apply for Personal Loan with Instant Approval#Instant Cash Loan in 1 Hour Without Documents#Insta Loan App for Instant Money Transfer#Loan for Low CIBIL Score Without Rejection#Get Personal Loan Without Salary Slip or Bank Statement#Easy Online Application for Personal Loan#Best Instant Personal Loan App in India#Instant Loan in 10 Minutes Without Credit Check#Get Instant Funds for Emergency Needs#Quick Loan Approval Without Income Documents#Get Loan Without CIBIL Score Check Instantly

1 note

·

View note

Text

Unlocking Your Dream Home: Home Loan in Jaipur, Rajasthan

Owning a home is a significant milestone in one's life, symbolizing financial stability and a place to create cherished memories. In Jaipur, Rajasthan, a city renowned for its rich heritage and modern infrastructure, the dream of homeownership is more accessible than ever. With a multitude of financial institutions offering home loan options, prospective buyers can turn their dreams into reality with ease.

Why Opt for a Home Loan in Jaipur, Rajasthan?

Jaipur, often referred to as the Pink City, is not just a tourist destination but also a booming real estate hub. The city offers a perfect blend of tradition and modernity, making it an ideal place for homebuyers. Here are some reasons why opting for a home loan in Jaipur, Rajasthan, is a wise decision:

Affordable Property Rates: Compared to metropolitan cities like Delhi and Mumbai, Jaipur offers relatively affordable property prices, making it an attractive option for homebuyers.

Growing Infrastructure: With advancements in roadways, metro connectivity, IT parks, and industrial zones, Jaipur is rapidly developing, increasing the demand for residential properties.

Investment Potential: The real estate market in Jaipur is growing steadily, ensuring a profitable return on investment for homeowners.

Diverse Housing Options: Whether you seek a luxurious villa, a modern apartment, or an independent house, Jaipur offers a range of residential options to suit varying budgets.

Home Loan Options in Jaipur, Rajasthan

Several banks, financial institutions, and housing finance companies provide home loans with competitive interest rates and flexible repayment options. Here are some key features of home loans available in Jaipur:

Loan Amount: Depending on your income and eligibility, you can avail of home loans starting from INR 5 lakhs to several crores.

Interest Rates: Banks offer home loans with interest rates starting from as low as 6.5% per annum.

Tenure: Repayment periods range from 5 years to 30 years, offering flexibility to borrowers.

Processing Fees: Typically, processing charges range from 0.25% to 1% of the loan amount.

Prepayment Charges: Many lenders allow prepayment of loans without extra charges, reducing the overall interest burden.

Eligibility Criteria for a Home Loan in Jaipur

To avail of a home loan in Jaipur, Rajasthan, applicants must meet certain eligibility criteria set by lenders:

Age Requirement: Applicants must be between 21 to 65 years old.

Income Stability: A steady source of income is required, whether salaried or self-employed.

Credit Score: A CIBIL score of 750 or above increases the chances of loan approval.

Employment Status: Salaried individuals should have at least two years of work experience, while self-employed applicants must demonstrate a stable income.

Property Valuation: The property in question should meet the lender’s legal and technical verification standards.

Documents Required for Home Loan Application

When applying for a home loan in Jaipur, Rajasthan, ensure you have the necessary documents ready:

Identity Proof (Aadhar Card, PAN Card, Passport, Voter ID)

Address Proof (Utility Bills, Rental Agreement, Passport, Voter ID)

Income Proof (Salary Slips, IT Returns, Bank Statements)

Employment Proof (Appointment Letter, Business Registration Certificate)

Property Documents (Sale Agreement, Approved Building Plan, NOC from Builder)

Steps to Apply for a Home Loan in Jaipur

Getting a home loan in Jaipur is a straightforward process if you follow these simple steps:

Assess Your Budget: Determine your financial capacity and decide on a loan amount accordingly.

Compare Lenders: Research different banks and NBFCs to find the best interest rates and loan terms.

Check Eligibility: Use online home loan eligibility calculators to estimate the amount you qualify for.

Gather Documents: Ensure you have all the required documents ready before applying.

Submit Application: Apply online or visit the lender’s branch to submit your application.

Verification & Approval: The lender will assess your application, verify documents, and approve the loan.

Loan Disbursement: Upon final approval, the loan amount is disbursed to the seller or builder.

Benefits of Taking a Home Loan in Jaipur, Rajasthan

Opting for a home loan in Jaipur offers numerous advantages:

Tax Benefits: Home loan borrowers can avail of tax deductions on both principal and interest repayments under Sections 80C and 24(b) of the Income Tax Act.

Long Repayment Tenure: Flexible tenure options make EMI payments more manageable.

High Loan Amount: Banks provide up to 80-90% of the property value as a loan.

Fixed and Floating Interest Rates: Borrowers can choose between fixed or floating interest rates based on their financial planning.

Increase in Property Value: As Jaipur’s real estate market grows, the value of purchased properties is likely to appreciate over time.

Top Banks & Financial Institutions Offering Home Loans in Jaipur

Several reputed banks and NBFCs provide home loan services in Jaipur, including:

State Bank of India (SBI)

HDFC Bank

ICICI Bank

Axis Bank

Punjab National Bank (PNB)

LIC Housing Finance

Bajaj Finserv

Tata Capital Housing Finance

Conclusion

A home loan in Jaipur, Rajasthan, is a strategic financial decision that brings you closer to owning your dream home. With affordable property rates, growing infrastructure, and favorable loan options, Jaipur is an ideal city for homebuyers. By understanding the eligibility criteria, loan features, and application process, you can navigate your home loan journey smoothly. Whether you are a first-time homebuyer or an investor, Jaipur’s real estate market offers endless opportunities to secure a valuable asset for the future.

CIBIL score check

0 notes

Text

Business Loan in Delhi – Get the Best Financing Options

Starting or expanding a business in Delhi requires sufficient funds. Whether you need working capital, equipment financing, or funds for expansion, a business loan in Delhi can be a perfect solution. At Loans Wala, we provide easy and quick access to loans with low-interest rates and hassle-free approval.

Why Choose a Business Loan in Delhi?

Quick Approval – Get funds without long waiting periods.

Flexible Repayment – Choose a repayment plan that suits your business needs.

Low-Interest Rates – Competitive rates to ease financial burden.

No Collateral Required – Avail unsecured business loans without pledging assets.

Easy Online Process – Apply from anywhere, anytime.

Types of Business Loans Available

1. Unsecured Business Loan

For small businesses or startups that do not have assets to pledge, unsecured business loans are an excellent choice.

2. Working Capital Loan

Businesses in Delhi can get quick working capital loans to manage their day-to-day expenses and maintain cash flow.

3. Machinery & Equipment Loan

If your business requires new machinery, machinery & equipment loans help you finance equipment purchases at low-interest rates.

4. Startup Loan

New businesses can get startup business loans to launch and grow their ventures.

Eligibility Criteria for a Business Loan in Delhi

Applicants should be 21-65 years old.

Business must be operational for at least 1 year.

Minimum monthly revenue criteria must be met.

Good CIBIL score (above 700) preferred.

Documents Required

Identity Proof (Aadhaar, PAN, Voter ID, Passport)

Business Registration Documents

Bank Statements (Last 6 Months)

Financial Statements (ITR, GST Returns, Balance Sheet)

How to Apply for a Business Loan Online?

Visit Loans Wala

Fill Out the Online Form with personal and business details.

Submit Required Documents for verification.

Loan Approval & Disbursal in just a few days.

Why Choose Loans Wala for Business Loans?

✅ Expert Loan Consultation – Our team helps you find the best loan options. ✅ 100% Online & Hassle-Free Process – No need to visit the bank. ✅ Multiple Loan Offers – Get customized plans suited to your business.

Frequently Asked Questions (FAQs)

Q1: What is the minimum loan amount I can apply for?A: Business loans start from ₹50,000 and can go up to ₹50 lakhs.

Q2: How long does loan approval take?A: Approval is usually completed within 24-48 hours if documents are correct.

Q3: Do I need a good credit score for approval?A: Yes, a CIBIL score above 700 increases approval chances, but some lenders offer loans with lower scores.

Q4: Can I get a business loan without collateral?A: Yes, unsecured business loans do not require collateral.

For more details:- https://loanswala.in/

0 notes

Text

Top Nine Points You Should Know About Personal Loan

What are personal loans?

A personal loan is a type of unsecured loan that is offered to the borrower without any collateral against the sum borrowed. The loan amount for which each borrower is eligible varies based on their income and repayment capacity.

Why are personal loans unsecured loans?

Unlike other types of loans that are taken out for a specific purpose such as buying a car or a home, personal loans can be taken to finance any kind of financial goal that one may have. Personal loans can be taken to renovate a house, fund a wedding or international holiday, and even consolidate debt.

What is the maximum amount that can be borrowed?

The loan amount that one is eligible to borrow varies based on their monthly income. When calculating the loan amount, a person’s monthly income and expenses are taken into account. Most banks offer a minimum loan amount of Rs.50,000. However, this amount can be lower in instances where the loan is taken from Non-financial Banking Companies (NBFCs).

Who is eligible to avail a personal loan?

As reputed personal loans from private financiers in delhi at vintage finance salaried and non-salaried individuals are both eligible to take personal loans. To be able to apply for a personal loan, the applicant must be at least 21 years old and cannot be older than 60 years (for salaried individuals). The upper age limit for self-employed individuals is 65 years. With regard to monthly income, the applicant should have a minimum monthly income of Rs.25,000.

How long does it take for processing and disbursal?

One of the advantages of a personal loan is that the processing time is very quick. The loan does not require a lot of documentation. In most cases, the applicant is required to submit their proof of address, proof of identification, and proof of income. A number of banks also pre-approve their customers for personal loans and in these cases, documentation may not even be necessary.

With regard to the disbursal of the loan amount, once the documentation and verification process is complete, the loan amount is disbursed within 48 hours. In some instances, banks provide a few select customers with instant loans that are dispersed within minutes of applying.

How do you repay the amount borrowed?

The repayment process for personal loans takes place in the form of monthly EMIs. The amount to be paid is inclusive of the interest charged on the loan. A number of banks set a standing instruction against the customer’s bank account and the monthly EMI is deducted on a specified date. Additionally, customers can also choose to repay the amount borrowed before the end of the loan tenure. Most banks require customers to complete a total of 12 months of EMI payments before opting to repay the entire loan amount. Banks usually charge a small fee as a foreclosure charge for loans that are repaid before the completion of the loan tenure.

What is the rate of interest charged?

The rate of interest for personal loans are usually a bit higher than those charged for other types of loans. This is because personal loans are unsecured loans. The rate of interest charged on a personal loan can range anywhere between 10.99% and 22% p.a. A number of factors come into play when determining the interest rate for a personal loan. Some of them include the tenure of the loan, the borrower’s credit score and repayment capacity. In general, individuals who choose a longer tenure for their personal loan tend to pay a higher sum as interest. Additionally, borrowers who have a poor credit score and repayment history tend to be charged with higher interest rates.

What is the maximum loan tenure?

As reputed private financers in delhi we know that repayment tenure for a personal loan can range anywhere between 1 year to 5 years. The loan tenure is chosen by the borrower, taking into consideration other financial obligations. As stated in the point above, the amount paid in interest tends to be higher when the borrower chooses a longer loan tenure.

How does your credit score affect your loan approval?

Your credit score or CIBIL score plays a significant role in the approval of a personal loan. Most banks require their loan applicants to have a minimum credit score of 750 or above to be eligible for a personal loan. Furthermore, the CIBIL report also contains comments about missed EMI payments which is also considered when reviewing a loan application. The credit score and repayment track record are taken into account when banks and financial institutions are determining the maximum loan amount and the rate of interest charged.

Can you be a guarantor for a personal loan?

Most banks or financial institutions usually request for a guarantor to a personal loan when they are not entirely sure of the borrower’s repayment capacity. When you sign up to be a guarantor for a loan, you become responsible for making EMI payments of a personal loan in the event that the borrower is unable to do so. One crucial factor that should be kept in mind before agreeing to be a guarantor for a loan is that a missed payment by the borrower also negatively impacts your credit score.

0 notes