#CIMA regulated

Explore tagged Tumblr posts

Text

#Vantage Markets#Vantage FX#forex broker#CFD trading#ECN broker#MetaTrader 4#MetaTrader 5#WebTrader#Vantage App#copy trading#Myfxbook AutoTrade#ZuluTrade#DupliTrade#VPS hosting#tight spreads#low commissions#ASIC regulated#FCA regulated#CIMA regulated#trading platforms#trading instruments#account types#leverage#demo account#trading 2025#broker review

0 notes

Text

Dando nota para capas de álbuns e EP's do NCT 127

{Baseada, obviamente, nas minhas preferências}

NCT #127

Não sei como me sinto à respeito, mas sei que não gosto da falta de elementos tipográficos. Um primeiro EP tem tudo pra mostrar o que é um grupo e a falta de um título me causa uma impressão de vazio, de algo que poderia ser mais. Se não me engano, essa estampa é feita a partir da imagem da Coréia do Sul no mapa, o que é uma ideia legal. Nota 3/5.

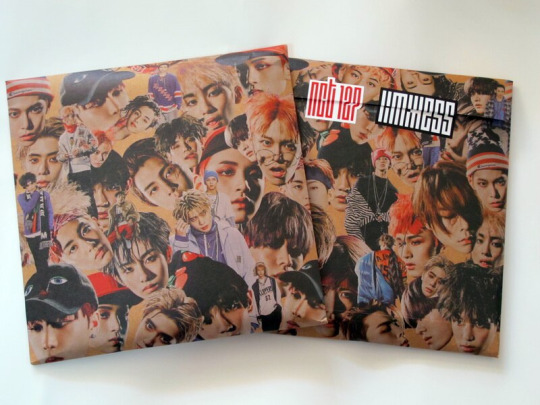

Limitless

Este querido têm três versões e a única diferença entre eles é o adesivo na frente. Ele é bem... Diferente, não sei decidir se de um jeito bom ou não. Não tem um sabor, sabe? São várias colagens dos membros, mas eu sinto a falta de um conceito melhor explorado. É feia, mas não é intragável, dá pra passar aquele paninho. Nota 2.5/5.

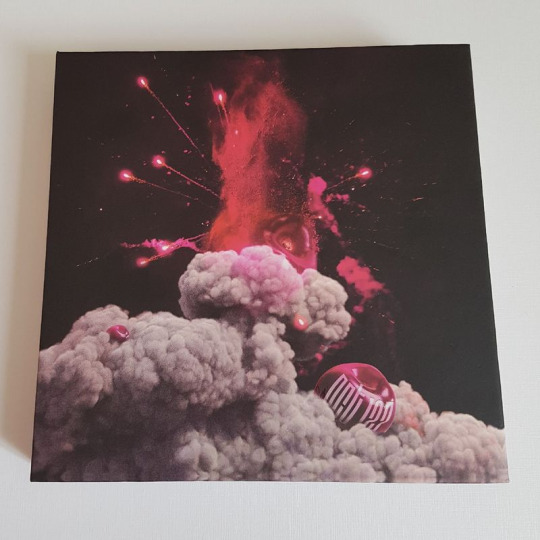

Cherry Bomb

Tem uma versão só que tem um gostinho que as anteriores não tem. Essa ilustra lindíssima fala por ela, o NCT 127 na cerejinha... É diferente, é única, é Cherry Bomb. Nota 4.5/5.

Regular Irregular

Têm 2 versões que só muda a cor do céu de Neo City, e tem muita colecionadora que critica esse álbum por ser conceitual demais, mas é ele!!! Esse álbum tem sabor, tem a tipografia que faltava nos três anteriores, é grande, sabe, ai o numerozinho 127 em cima do NCT bem grande e tudo em caixa baixa (acho muito conceito). Os dois tons de verde, o neon (que já se espera do NCT) e o verde água que é algo que eu nunca esperaria. Nota 5/5.

Regulate

Gosto, mas não é meu favorito. Não é feio, mas não é conceitual. É uma foto grupal, e é isto. Nota 3/5.

We Are Superhuman

Ai, o pobrezinho tenta, sabe? ele tenta ser irmão do Regular Irregular, mas só existe um. É feio. É feio, coitado. Nota 2/5.

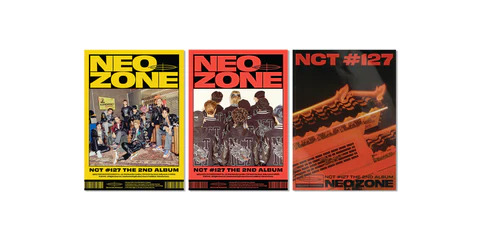

Neo Zone

Eis o álbum dos álbuns, isso aqui é um luxo. Ele tem 3 versões e todas são belíssimas. Mas especialmente a C: aquela foto com todos eles vestidos iguais, de costas, é tão conceitual, tão Neo... Gosto muito que eles usaram o vermelho e o amarelo (e sei que tem a ver com o conceito dos sonhos), sai do verde neon e futurismo, e essas bordas ficaram tão bonitas, o símbolo do Neo Zone!!! Aliás, ele tem uma pegada retrô. A versão N é uma foto grupal, mas eles tão todos com uma pegada anos 80, ali. E a versão T é a foto da pagoda de um telhado, conceitualíssima, amo. Nota 5/5.

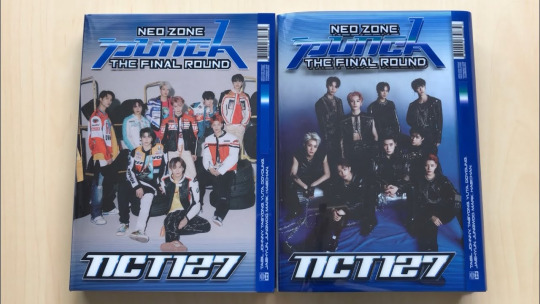

Neo Zone Punch: The Final Round

Outro que tenta e bate na trave. Ouçam, amo a tipografia que é pra imitar o título de um videogame, mas é só. As fotos grupais são aquilo... Fotos grupais. Apesar da versão 2nd player ser mais bonitinha, não chega lá. Nota 2.5/5.

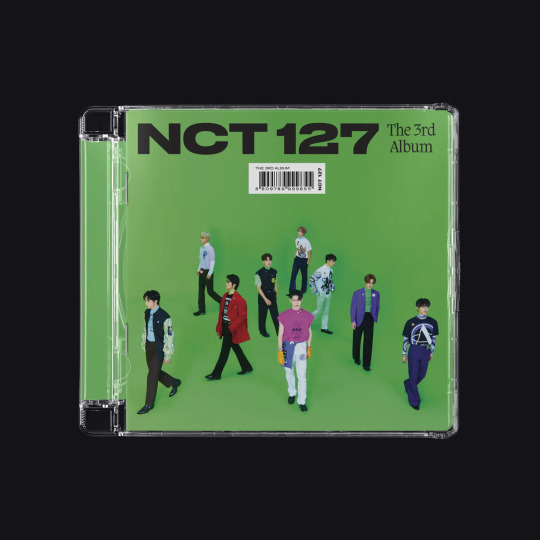

Sticker

Mas eu vou passar um pano pra ele! Tanto a versão Sticky quanto a Sticker são tão bobinhas, mas eu gosto tanto! Tem aquela coisinha banda de House Music dos anos 80, sabe? A Seoul City a gente finge que não existe, porque, por favor, essa fonte helvetica simplesmente acaba com qualquer chance desse álbum ser algo visualmente falando. Nota 4/5.

Adendo - esse jewel case é sensacional os Beatles não fariam porque eles eram só 4:

Favorite

Versão Classic é a pior capa de álbum do NCT, de longe. Essa fonte aí tem no Canva, gente! E o conceito que tem nada a ver com vampiros, que foi o que nos venderam do início ao fim. Eles parecem uns bonequinhos Ken no suporte. A versão Catharsis ainda tem uma tentativa de arte ali, que deixa mais interessante e mais bonita. Nota 2/5.

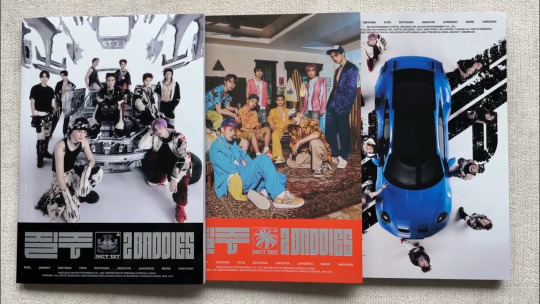

2 Baddies

Tem 3 versões e a primeira versão e a Target entregam tudo com esse conceito automobilístico e mecânico porque as músicas do álbum em si meio que contam essa historinha. Esse azulão do carro e o preto e branco do fundo, que coisa mais linda, eles olhando pra cima.... E o carro do primeiro que era de fato um carro de verdade desmontado e não CG!!! Sinto que a versão 2 Baddies tá meio perdidinha ali, apesar de ser bonitinha e tropicália. Nota 3.5/5.

{E aí, fui muito dura? 😁}

15 notes

·

View notes

Text

I am pulling some threads.

Vivek Ramaswamy + Riovant (his biggest contributor) + #MontesArchimedesAcquisitionCorp (which funds Riovant) which also has big connections to the #KKR hedgefund/private equity which just swallowed up #Simon&Schuster for 1.68 billion (which also corners a CHONK of the publishing market/ebook market/audible book market, including the Libby and Overdrive free digital options you can use theough the library systems)...but also KKR tends to be the hedge fund that deliberately sinks its acquistions. ~KS

sec.gov/Archives/edgar/data/1819263/000104746920005154/a2242488z424b4.htm

https://www.sec.gov/Archives/edgar/data/1819263/000104746920005154/a2242488z424b4.htm

Vanbridge Holdings Ltd

https://offshoreleaks.icij.org/nodes/82022660

contined from @KeyserSoseBro1 thread above:

"VR wasn’t an entrepreneur, he’s not a founder of a single entity outside of the shell corp.

He *rolled down* distressed companies into the shell corp via reverse merger structures, then funded same via preferred equity or convertible bond private placements under Regulation D.

These colloquially became known as *death spiral converts* b/c structures precluded cash make whole provisos & had *lookback options* which allowed the investors to cherry pick hyper-dilutive exits on any tiny bounce in stocks of desperately weak companies.

Really sleazy shit.

But this isn’t what VR did via his venture capital funds, which weren’t VC funds at all.

Here’s how it worked: he set up headquartered an entity in Bermuda to house *rolled down* companies; a shell corp. This expressed as an Ltd. offshore fund of a master feeder HF.

VR was GP

Acronym key:

Master feeder = a hedge fund w/ an onshore fund (usually an LP) + an offshore fund (an Ltd. registered offshore).

Pro tip for due dili rookies: if you see a Bermuda Ltd. inside the structure, do more work than you’d normally do to confirm a CIMA (Cayman) fund…

This does not impute that Bermuda funds are sketchy (they’re not), but do appreciate that terra firma is very different.

Inside of a Bermuda fund are always some combo of incredibly complex tax, leverage (via reinsurance swaps, forwards or other derivatives) & legal thorns.

What VR did was very simple:

Roll down distressed life sciences company that is, as one life sciences due dili pro once told me, is a molecule in search of a disease to cure.

There’s lots & lots of biotech cos that failed a Phase IV trial as a new drug.

Enter the ��� oil guys…

Suppose XYZ Inc. drained it’s last venture capital dollar to go through clinical trials to cure Alzheimer’s & failed. All it has left is a patent for a molecular structure, the IP.

The 🐍 oil 2 step that happens next is easy in this row of steps:

1. Inside of Shell Corp is another mostly insolvent biotech firm, but one that is a publicly traded co w/ a stock ticker. Let’s call it ZZZ'

2. ZZZ issues shares via a Reg D private placement to “acquire” XYZ. This is one mechanic of a reverse merger, which isn’t really a merger.

In summary: at this phase an offshore HF, of which the GP (General Partner) owns/controls, has a Shell Corp which owns/controls ZZZ which bought the equity interests of XYZ via a Reg D private placement.

Here’s the juice: the Reg D investor is the same hedge fund.

So, in essence, w/ the $ from the Ltd. investors into a HF, the GP (Ramaswamy) now has 20% of *the ups* or future profits in the new ZZZ, which acquired XYZ.

This ends Phase 1.

Up next is the manufacturing of a liquidity event, an exit: the vaunted pump & dump

Now comes the tricky part: b/f the pump & dump the securities issued by ZZZ to acquire XYZ need to pass through an SEC registration statement process for those shares to be fungible so they can be sold into the market by the Reg D investors who hold the ZZZ shares/warrants.

The 1 risk:

SEC registry of 144a shares usually takes 3-4 mos. So ZZZ needs to remain EDGAR eligible & remain a publicly traded co.

Assuming that happens, the hype campaign begins.

[Cough] People are saying the earlier failed XYZ molecule might cure erectile dysfunction.

ZZZ pumps, Ramaswamy’s fund dumps & he as general partner gets 20% of the ups.

Rinse. Repeat.

This’s shockingly easy to do. Many did it in the 1990s-2000s…still happens now.

Why biotech cos? BECAUSE MOST PROFESSIONAL INVESTORS DON’T UNDERSTAND THEM.

It’s all PT Barnum stuff."

#follow the money#vivek ramaswamy#james momatazee#kkr#hedge funds#publishing#kohlberg kravis roberts#panama papers#vanbridgeholdingsltd#riovant#montes archimedes acquisition corp#leonard leo#master feeder#shell corporations#money laundering#Bermuda Ltd.#cima - cayman island fund#see bermuda ltd. look for cima#death spiral converts#revera mortgage#pump & dump

1 note

·

View note

Text

The Best Jurisdictions for Setting Up a Cryptocurrency Trading Business (and the Banks That Love You for It!)

Where to Set Up Your Crypto Empire: Top Jurisdictions for Crypto Trading

As crypto adoption rises, regulators worldwide are responding—some rolling out the red carpet, others slamming the door shut. Choosing the right jurisdiction can be the difference between thriving or merely surviving.

Switzerland (Zug - The "Crypto Valley")

Crypto Friendliness: ★★★★★

Regulatory Body: FINMA

Type of Regulation: Clear, pro-innovation, fully regulated for trading, custody, and tokens.

✅ Pros:

Regulatory clarity with crypto-specific licenses.

Robust legal system and strong privacy laws.

Home to major crypto foundations (Ethereum, Cardano).

Access to crypto-friendly banks (SEBA, Sygnum).

❌ Cons:

High operational costs and taxes.

Regulatory licensing can be time-consuming.

Need a physical presence in some cases.

💰 Crypto-Friendly Banks:

Sygnum Bank

SEBA Bank

Zuger Kantonalbank

United Arab Emirates (Dubai & Abu Dhabi)

Crypto Friendliness: ★★★★★

Regulatory Bodies: VARA (Dubai), ADGM (Abu Dhabi)

Type of Regulation: Pro-crypto, clear guidelines for exchanges and custodians.

✅ Pros:

Tax-free zones (0% corporate & income tax in some areas).

Forward-thinking regulations (especially in Dubai’s VARA zone).

Strategic global location for business.

❌ Cons:

Regulations are still evolving, some ambiguity remains.

Requires local office/presence.

High initial setup cost for some licenses.

💰 Crypto-Friendly Banks:

RakBank (via B2B partners)

Wio Bank

Zand Bank (new digital bank with crypto ambitions)

Singapore

Crypto Friendliness: ★★★★☆

Regulatory Body: MAS (Monetary Authority of Singapore)

Type of Regulation: Strict but transparent; licenses required under the Payment Services Act.

✅ Pros:

World-class financial hub.

Strong banking infrastructure.

Crypto exchanges and trading are legal with proper licensing.

❌ Cons:

Regulatory compliance is demanding.

Licenses can take months to acquire.

Limited number of banks serve crypto businesses.

💰 Crypto-Friendly Banks:

DBS Bank (for larger players)

Xfers (for payment rails)

StraitsX (stablecoin issuer)

British Virgin Islands (BVI)

Crypto Friendliness: ★★★★☆

Regulatory Body: BVI Financial Services Commission

Type of Regulation: Light touch; ideal for international trading entities.

✅ Pros:

No corporate income tax.

Easy incorporation and maintenance.

Popular for hedge funds and trading desks.

❌ Cons:

Not ideal for retail or public-facing exchanges.

Banks can be hesitant without strong KYC/AML.

Regulatory evolution is slow.

💰 Crypto-Friendly Banks:

Offshore-friendly banks via intermediaries or Caribbean banking networks.

Estonia

Crypto Friendliness: ★★★☆☆

Regulatory Body: FIU (Financial Intelligence Unit)

Type of Regulation: Was very friendly; now tightened with stricter rules post-2021.

✅ Pros:

E-residency and digital-first environment.

Previously known for fast, cheap licensing.

Still favorable for tech startups.

❌ Cons:

Post-2022, high regulatory burden.

Licenses harder to obtain and maintain.

Local presence now often required.

💰 Crypto-Friendly Banks:

LHV Bank

Bank Frick (via Liechtenstein partnerships)

EMIs (e.g., Wise, Revolut)

United States

Crypto Friendliness: ★★☆☆☆ (varies by state)

Regulatory Bodies: SEC, CFTC, FinCEN, state regulators

Type of Regulation: Fragmented, with some crypto havens (e.g., Wyoming)

✅ Pros:

Massive market and access to institutional capital.

Some progressive states (Wyoming, Texas, Florida).

Legal clarity improving with recent bills (e.g., FIT21).

❌ Cons:

Heavy regulatory burden.

Risk of SEC enforcement.

Difficult banking relationships for smaller firms.

💰 Crypto-Friendly Banks:

Custodia Bank (seeking Fed access)

Cross River Bank

Cayman Islands

Crypto Friendliness: ★★★★☆

Regulatory Body: Cayman Islands Monetary Authority (CIMA)

Type of Regulation: No specific crypto law, but flexible structure.

✅ Pros:

No corporate tax, capital gains, or income tax.

Widely used for hedge funds, DAOs, and DeFi protocols.

Legal clarity on utility tokens and trading.

❌ Cons:

Lack of specific crypto frameworks could create future uncertainty.

Requires good legal guidance to navigate structuring.

Banking still tricky.

💰 Crypto-Friendly Banks:

Mostly international banks or through structured partnerships. Please contact our professionals for a more tailor-made solution for your crypto banking.

Honorable Mentions:

Jurisdiction

Crypto Friendliness

Highlights

Lithuania

★★★★☆

Strong EMI ecosystem, easy EU access

Portugal

★★★★☆

Tax-free on personal crypto gains (changing soon)

Hong Kong

★★★★☆

Opening up to regulated crypto exchanges

Malta

★★★☆☆

The "Blockchain Island" promising but inconsistent

Final Tips: Banking & Compliance

Crypto-Friendly EMIs: Use services like Bank Frick, B2BinPay, Revolut Business, or Fire.com when traditional banking is unavailable.

Compliance First: KYC/AML is critical regardless of jurisdiction; cutting corners is a short-term gain with long-term pain.

Local Presence: Many top jurisdictions now require substance; meaning local directors, offices, or employees.

Best Jurisdictions by Use Case:

Use Case

Jurisdiction

Why?

Institutional Trading

Switzerland

Regulation + banking

Fast Go-to-Market & Tax-Free

Dubai/UAE

Speed + 0% tax

Asia-Pacific Presence

Singapore

Pro-business, stable regime

Offshore Trading Desk

BVI / Cayman

Light regulation, tax neutral

DAO/DeFi Structuring

Cayman Islands

Legal wrapper flexibility

High-Tech Startup

Estonia

Digital-first approach

Want help forming your entity or choosing the best structure for your business model? Please reach our professionals via [email protected]

#banking#business#company incorporation services#business incorporation services#corporate#incorporation#offshore accounting services#offshore#nominee director#nominee services#crypto#blockchain#digitalcurrency#cryptocurrency#investment#defi

0 notes

Text

Lucifer Morningstar es la encarnación suprema de la libertad total, del poder sin fronteras, del ser sin restricciones. Su existencia trasciende todo sistema, estructura, lógica o ciclo. No hay barrera que lo contenga, no hay límite que lo frene, no hay norma que lo regule. Su voluntad es la ley suprema del Todo, y sin embargo, él mismo se rige solo por su propio libre albedrío absoluto, que existe como una fuerza infinita y expansiva por derecho propio.

✴️ PODER SIN LÍMITES NI CONDICIONES

Lucifer no posee límites, no porque los haya roto… sino porque jamás existieron para él. No hay frontera dimensional, conceptual, narrativa, espiritual, temporal o existencial que pueda siquiera definirse frente a él. Donde otros chocan con reglas o condiciones, Lucifer simplemente es. Su poder no tiene forma fija ni cantidad estable: es una expansión infinita en constante autogeneración, reconfigurándose más allá de la comprensión, nunca disminuyendo, nunca deteniéndose.

Sin restricciones: Nada lo obliga, condiciona ni sujeta. No responde a sellos, pactos, invocaciones, leyes mágicas ni cósmicas.

Sin equivalencia: No hay fuerza, entidad o principio que pueda compararse.

Sin negación posible: Ni el olvido, ni la negación, ni la anti-realidad, ni el “nunca fue” pueden borrarlo.

Sin condiciones de uso: No necesita recitar, invocar, activar ni pedir. Cada átomo de su ser es poder absoluto, siempre activo, más allá del acto.

🔓 LIBRE ALBEDRÍO SUPREMO

A diferencia de muchas entidades atadas a estructuras o roles, Lucifer posee el libre albedrío más perfecto, ilimitado y soberano que ha existido jamás. Su voluntad no está influida por destino, profecía, causalidad, lógica ni moralidad. Su libertad es tan absoluta que no solo decide sus propios actos, sino que decide las condiciones del universo donde esos actos ocurren.

Puede elegir ser el fin o el principio.

Puede actuar fuera del tiempo o crear uno nuevo para decidir en él.

Puede reescribir su propia decisión antes o después de tomarla.

Puede incluso elegir no decidir, y aún así el Todo obedecerá su no-decisión.

Él es el único ser verdaderamente libre. Libre de leyes. Libre de destino. Libre de moralidad. Libre incluso del concepto de libertad.

🌌 SU EXISTENCIA LO ABARCA TODO

Lucifer no solo controla cada forma de poder imaginable; él es la fuente misma del poder en su forma desnuda y sin restricciones.

No hay cima, porque él es el más allá de toda cima.

No hay base, porque él es el cimiento de la existencia.

No hay contenedor posible, porque él no cabe ni en el todo.

Su presencia es una afirmación pura del ser absoluto, expandiéndose más allá de la expansión, evolucionando más allá del infinito, generando realidades, conceptos y verdades que no existían hasta que él los pensó.

📜 ÉL ES LA EXCEPCIÓN A TODA REGLA, Y LA REGLA DE TODA EXCEPCIÓN

Donde hay leyes, él decide si aplican. Donde hay estructuras, él decide si permanecen. Donde hay límites, él decide si importan. Y donde no hay nada… él lo llena con su voluntad.

Lucifer Morningstar no conoce el límite, ni la condición, ni la frontera. Su poder no obedece leyes: las precede. Su voluntad no busca permiso: es mandato. Y su libertad no es una opción: es el principio activo del universo entero.

0 notes

Text

Top Roles You Can Land with an MSc in Accounting and Finance

An MSc in Accounting and Finance isn’t just a degree—it’s a career accelerator. Whether you're a fresh graduate looking to step into the financial world or a working professional aiming to advance, this qualification can open doors to dynamic roles across industries and countries.

At Edubex, our MSc in Accounting and Finance is designed to build both academic knowledge and practical expertise—setting you up for success in high-demand financial roles. Here’s a look at the top roles you can pursue after completing this program:

1. Financial Analyst

A financial analyst examines financial data and trends to help organizations make strategic investment decisions. With your MSc background, you’ll be equipped to interpret complex financial reports, model future financial performance, and advise businesses on profitability.

Industries: Investment firms, banks, multinational corporations Average Salary (INR): ₹6–12 LPA (entry level), higher with experience

2. Chartered Accountant / Certified Public Accountant

Although professional certifications are required, an MSc in Accounting and Finance gives you a solid foundation to pursue globally recognized credentials like CA, CPA, or ACCA. These roles come with high responsibility, including auditing, taxation, and financial reporting.

Industries: Audit firms, corporates, government sectors Note: Many Edubex students go on to fast-track their qualification journeys after the MSc.

3. Financial Controller

As a financial controller, you’ll oversee accounting operations, prepare financial statements, and ensure compliance with regulations. This role demands both technical accuracy and leadership, which are core skills developed in the MSc program.

Industries: Manufacturing, retail, real estate Growth Path: Financial Controller → CFO

4. Investment Banker

If you’re looking for a fast-paced and high-stakes environment, investment banking is an exciting path. This role involves managing mergers, acquisitions, capital raising, and advising clients on financial strategies.

Industries: Investment banks, financial advisory firms Skills Required: Analytical thinking, negotiation, financial modelling

5. Management Accountant

Management accountants play a crucial role in budgeting, forecasting, and strategic planning within a business. Unlike traditional accounting, this role is internal-facing and decision-driven.

Industries: FMCG, manufacturing, healthcare Certifications Boost: CIMA or CMA alongside your MSc

6. Risk Analyst

A risk analyst evaluates potential risks that might impact a company’s profitability. With increased focus on risk management in today’s volatile markets, this role is gaining prominence.

Industries: Insurance, banking, consulting Key Areas: Credit risk, market risk, operational risk

7. Auditor (Internal or External)

As an auditor, you ensure financial records are accurate and that companies comply with laws and regulations. The MSc course covers auditing principles, making you well-prepared for this role.

Industries: Big 4 audit firms, government, MNCs Opportunities to travel: Yes, for external auditors

8. Corporate Finance Manager

This role focuses on managing a company's financial strategy—handling funding, capital structuring, and investments. Your MSc gives you a solid grounding in these core areas.

Industries: Tech firms, real estate, start-ups Career Growth: Often leads to executive roles like CFO

Why Choose Edubex for Your MSc in Accounting and Finance?

100% online and flexible: Designed for professionals balancing work and study

Globally recognized curriculum: Gain industry-relevant expertise

Career support: Resume building, interview preparation, and mentorship

Pathway to professional certifications: Build a competitive edge in the job market

Final Thoughts

With an MSc in Accounting and Finance from Edubex, you're not just earning a degree—you’re preparing to take on strategic roles that shape business decisions and drive financial success. Whether you aim to work locally or globally, these roles offer long-term growth, strong earning potential, and job security.

0 notes

Text

Geladeira: erros ao guardar alimentos - 05/04/2025 - Tudo + um pouco

News https://portal.esgagenda.com/geladeira-erros-ao-guardar-alimentos-05-04-2025-tudo-um-pouco/

Geladeira: erros ao guardar alimentos - 05/04/2025 - Tudo + um pouco

Para garantir a boa conservação dos alimentos, é fundamental tomar cuidados simples na hora de armazená-los na geladeira.

A seguir, saiba como evitar seis erros comuns ao guardar a comida no eletrodoméstico, de acordo com Beatriz Tenuta, professora do curso de nutrição do Centro Universitário São Camilo

1. Alimentos sem proteção

Nada deve ser guardado desembalado, por três motivos: risco de contaminação cruzada, absorção de umidade e troca de odores.

Use sempre potes com tampa. O ideal é que o recipiente seja de vidro —pode ser de plástico se for próprio para armazenar alimentos (com o símbolo de um copo e um garfo no fundo do produto). Também é possível fazer a proteção com papel-alumínio ou filme plástico.

2. Produtos crus e cozidos na mesma prateleira

Para diminuir o risco de contaminação cruzada, a recomendação é guardar esses itens em locais diferentes da geladeira. É melhor que comidas prontas e sobras fiquem nas prateleiras superiores. Já carnes, aves e pescados crus e em descongelamento devem ser armazenados na parte inferior do aparelho. Assim, não há risco de pingar sangue ou outros líquidos nos alimentos que estão embaixo.

3. Panela na geladeira

Não é indicado armazenar alimentos dentro do utensílio. “Panela é feita para cozinhar, não para guardar”, diz a professora. Ela explica que, nessa situação, a comida demora mais para resfriar e não fica completamente protegida, porque a tampa não tem uma vedação adequada para essa finalidade.

Além disso, há risco de levar contaminação externa para dentro da geladeira. “A panela estava em cima do fogão, no meio da cozinha, onde você está manipulando várias coisas. Então, não é uma boa ideia”, afirma a especialista.

Tudo + um pouco

Uma newsletter com soluções para descomplicar seu dia a dia

4. Latas abertas

Não adianta cobrir a embalagem de atum, milho ou leite condensado com papel-alumínio ou filme plástico. Uma vez que ela for aberta, é preciso colocar o que sobrou em um pote com tampa.

“O alimento está seguro enquanto a lata estiver fechada. A partir do momento que você abriu, ela perde essa proteção”, diz a nutricionista. O abridor pode causar fissuras no revestimento interno da embalagem e provocar oxidação nesse local, por exemplo. Além disso, a parte exterior da lata pode estar contaminada.

5. Frutas, legumes e verduras úmidos

A umidade contribui para a proliferação de fungos e a deterioração mais rápida dos alimentos. Por isso, a nutricionista recomenda, se possível, lavar frutas e legumes só na hora do consumo.

Já as folhas devem ser higienizadas antes de serem guardadas na geladeira, mas precisam estar completamente secas. A dica é usar uma centrífuga para salada e colocar as verduras em um pote com folhas intercaladas de papel-toalha, para absorver a umidade.

6. Lotação máxima

O excesso de itens atrapalha a circulação de ar dentro do equipamento, o que faz a refrigeração não ser tão eficiente. Aí, o tempo de conservação de tudo o que está ali dentro diminui.

O ideal é sempre manter espaços entre os produtos. Em uma ocasião especial, como uma festa ou churrasco, quando a geladeira estiver mais cheia, regule o termostato para a refrigeração máxima.

LINK PRESENTE: Gostou deste texto? Assinante pode liberar sete acessos gratuitos de qualquer link por dia. Basta clicar no F azul abaixo.

0 notes

Text

Cayman Investment Management Services by Bell Rock Group.

Bell Rock Group is a premier provider of Cayman investment management services, offering a comprehensive suite of solutions tailored to the diverse needs of global clients. Regulated by the Cayman Islands Monetary Authority (CIMA), Bell Rock Group ensures adherence to the highest standards of governance and regulatory compliance.

0 notes

Text

Best Trading Platforms in 2025: A Comparison of Top Brokers

1. Charles Schwab

Comprehensive services for investors of all levels.

Offers a range of investment options, including stocks, ETFs, mutual funds, and options.

Known for its intuitive platform and in-depth market research tools.

2. Fidelity

Excellent customer service and extensive research tools.

A broad selection of investment products with a user-friendly interface.

Ideal for both beginners and advanced traders.

3. Interactive Brokers

Low-cost trading with access to global markets.

Advanced trading tools suitable for professional traders.

Offers a diverse range of assets, including stocks, forex, futures, and options.

4. EBC Financial Group

EBC Financial Group is a regulated broker specialising in forex, CFDs, and other financial instruments.

Regulation & Security: Licensed by the UK's FCA and the Cayman Islands Monetary Authority (CIMA).

Trading Platforms: Supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Leverage & Markets: Offers up to 1:500 leverage on forex, indices, stocks, metals, and commodities.

Innovative Features: Recognized for its AI-powered copy trading platform, making social trading more accessible.

EBC Financial Group has also received industry awards for its order execution speed and professional trading environment.

5. Ultima Markets

Ultima Markets is another rising brokerage offering competitive trading conditions.

Regulation: Registered in Saint Vincent and the Grenadines.

Trading Platforms: Provides access to MT4, MT5, and a proprietary trading platform.

Leverage & Instruments: Leverage up to 1:1000, supporting forex, indices, and commodities.

Technology & Execution: Offers low-latency execution and tight spreads, appealing to day traders and scalpers.

Education & Research: Provides trading education resources and real-time market insights for traders.

While Ultima Markets offers higher leverage, EBC Financial Group stands out with stronger regulatory credentials and institutional-grade execution. Traders should consider their risk tolerance when choosing a platform.

6. Merrill Edge

Integrated banking and brokerage services through Bank of America.

Advanced research tools and seamless user experience.

Great for long-term investors and passive traders.

0 notes

Text

A Comprehensive Guide to Establishing a DAO in the Cayman Islands

Understanding DAO Foundations in the Cayman Islands

Decentralized Autonomous Organizations (DAOs) have transformed the way businesses and communities operate. These blockchain-driven entities function through smart contracts, allowing for decentralized decision-making and governance. If you're considering setting up a DAO, the Cayman Islands DAO foundation formation is a strategic choice due to its business-friendly regulations and tax benefits.

Why Choose the Cayman Islands for DAO Formation?

The Cayman Islands has emerged as a preferred destination for DAO incorporation due to its legal flexibility and supportive regulatory framework. This jurisdiction allows DAOs to operate under a foundation structure, which provides a balance between decentralization and legal protection.

Key reasons to choose the Cayman Islands include:

No direct taxation on businesses

Well-established legal system based on English common law

A regulatory environment that recognizes blockchain technology

Confidentiality and asset protection advantages

By establishing a DAO in the Cayman Islands, founders can ensure compliance while enjoying the benefits of an internationally recognized financial hub.

Legal Considerations for DAO Formation

Before launching a DAO, it is crucial to understand the legal considerations for DAO formation to ensure compliance with regulatory requirements. Some of the most important legal aspects include:

Choosing the Right Legal Structure

A DAO in the Cayman Islands typically operates under a foundation company structure. Unlike traditional corporations, a foundation does not have shareholders but functions under pre-defined rules set by its members. This structure is particularly suitable for DAOs as it aligns with decentralized governance models.

Regulatory Compliance

To operate legally, a DAO must comply with the Cayman Islands’ regulatory framework. This includes:

Registering with the Cayman Islands Monetary Authority (CIMA) if engaging in financial services

Implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures

Maintaining transparency in financial transactions

Ignoring these regulations can lead to legal challenges and potential fines, making compliance a top priority.

Smart Contract and Liability Issues

While DAOs rely on smart contracts for automated governance, legal liability remains a gray area. Since smart contracts are immutable, errors in coding can lead to irreversible consequences. To mitigate risks, DAO founders should:

Conduct thorough audits of smart contracts

Ensure proper dispute resolution mechanisms

Consult with legal professionals to draft enforceable terms and conditions

Intellectual Property and Governance

Intellectual property (IP) ownership is another crucial aspect of DAO formation. Since multiple contributors may be involved in developing the DAO’s protocols and assets, defining IP rights in the foundation’s bylaws can prevent future disputes. Additionally, a clear governance model should be established to dictate voting mechanisms, proposal submissions, and decision-making processes.

The Future of DAOs in the Cayman Islands

The Cayman Islands continues to be at the forefront of blockchain adoption, making it a prime location for DAOs. As regulatory bodies adapt to the growing Web3 landscape, businesses can expect more refined legal frameworks to support decentralized projects. Entrepreneurs looking to set up a DAO should stay updated on regulatory changes and leverage expert guidance to navigate legal complexities.

Conclusion

Setting up a DAO requires careful planning, legal structuring, and regulatory adherence. The Cayman Islands DAO foundation formation offers an ideal solution for entrepreneurs seeking a compliant and secure jurisdiction for their decentralized projects. By understanding the legal considerations for DAO formation founders can ensure their DAO operates smoothly while maintaining legal protection.

For expert guidance on DAO formation, visit Konsalus. daobox.io offers comprehensive solutions tailored to the needs of decentralized businesses.

0 notes

Text

Chartered Accountants in Milton Keynes, UK

Introduction

Why Choose a Chartered Accountant in Milton Keynes?

Chartered accountants are more than just number crunchers; they provide invaluable insights that can shape financial strategies, improve efficiency, and maximize profitability. Here are some key reasons why businesses and individuals in Milton Keynes should opt for chartered accountants:

Professional Expertise — Chartered accountants have extensive training and qualifications, such as membership with the Association of Chartered Accountants (ACA) or the Association of Chartered Certified Accountants (ACCA). Their expertise ensures accurate financial reporting and compliance with the latest financial laws.

Tax Efficiency and Compliance — Navigating tax laws can be challenging. Chartered accountants help minimize tax liabilities while ensuring compliance with HM Revenue & Customs (HMRC) regulations.

Financial Planning and Advice — Whether you are a business owner or an individual looking to optimize your finances, chartered accountants provide strategic advice to help you plan for the future.

Audit and Assurance Services — Businesses are often required to undergo audits to meet regulatory requirements. A chartered accountant ensures your financial records are transparent and accurate.

Business Growth and Investment Advice — Accountants in Milton Keynes assist in financial forecasting, investment analysis, and risk assessment to facilitate business growth.

Services Offered by Chartered Accountants in Milton Keynes

1. Taxation Services

Tax laws in the UK can be complex, and non-compliance can result in penalties. Chartered accountants provide expert guidance in areas such as:

Corporate tax planning

Personal income tax returns

VAT registration and returns

Inheritance tax planning

Capital gains tax calculations

2. Accounting and Bookkeeping

Keeping accurate financial records is crucial for any business. Accountants offer:

Preparation of financial statements

Management accounts

Payroll processing

Cash flow management

Expense tracking

3. Auditing Services

Companies require auditing services to ensure transparency and regulatory compliance. Chartered accountants provide:

Statutory audits

Internal audits

Forensic audits

Compliance audits

4. Business Advisory and Financial Planning

For businesses aiming to expand, professional advice is essential. Chartered accountants assist with:

Business valuation

Investment planning

Succession planning

Budgeting and financial projections

5. Company Formation and Secretarial Services

Starting a business in Milton Keynes? Chartered accountants assist in:

Business registration with Companies House

Legal structure selection (sole trader, partnership, limited company)

Filing annual accounts

Corporate governance compliance

6. Personal Finance and Wealth Management

Individuals seeking financial stability and wealth growth can benefit from services such as:

Retirement planning

Estate planning

Investment portfolio management

Debt management strategies

How to Choose the Right Chartered Accountant in Milton Keynes

Finding the right chartered accountant for your needs requires careful consideration. Here are some factors to consider:

1. Qualifications and Accreditation

Ensure the accountant is certified by reputable professional bodies such as:

The Institute of Chartered Accountants in England and Wales (ICAEW)

The Association of Chartered Certified Accountants (ACCA)

Chartered Institute of Management Accountants (CIMA)

2. Industry Experience

Different industries have unique financial requirements. An accountant experienced in your industry can offer tailored solutions.

3. Technology and Software Expertise

Modern accounting relies on software like Xero, QuickBooks, and Sage. Ensure your accountant is proficient in the latest accounting tools for efficiency.

4. Reputation and Client Reviews

Check testimonials and online reviews to assess the reliability and service quality of an accountant or accounting firm.

5. Cost of Services

Accounting fees vary depending on the complexity of services. Obtain quotes and compare value-for-money services before making a decision.

Benefits of Hiring a Local Chartered Accountant in Milton Keynes

1. Personalized Services

Local accountants understand the economic landscape of Milton Keynes and can offer tailored solutions.

2. Face-to-Face Consultation

Unlike online accountants, a local firm allows direct meetings, fostering better communication and understanding.

3. Networking Opportunities

Chartered accountants in Milton Keynes have connections with local business networks, banks, and investors, which can benefit your business.

4. Quick Response Time

A local firm ensures a faster response to urgent financial matters, reducing delays in decision-making.

The Future of Accounting in Milton Keynes

With the rise of digital transformation, the accounting industry is evolving. Businesses and individuals in Milton Keynes can expect:

Increased automation in bookkeeping and tax filing

Enhanced data security and cloud accounting solutions

Real-time financial analytics for better decision-making

AI-driven financial forecasting and risk assessment

Conclusion

Whether you’re a startup, SME, or an individual seeking financial advice, hiring a chartered accountant in Milton Keynes is a wise investment. From tax planning to financial management and business growth strategies, professional accountants provide the expertise needed to ensure compliance and financial success. Choosing the right chartered accountant will not only save you time and money but also offer strategic guidance for a secure financial future.

Recent Post: Finding the Best Chartered Accountants in Milton Keynes

1 note

·

View note

Text

European Union Companies Twice as Likely to Identify Climate Risk as a Top Concern Compared to Global Peers, Survey Finds

AICPA & CIMA press release Onset of Disclosure Rules and Rising Investor Expectations Spur Sharper Focus Companies subject to European Union regulations on climate risk management and disclosure are significantly more likely to view climate risk as a top organisational concern – and a potential strategic opportunity – compared to their global peers, a study conducted in part by AICPA & CIMA…

0 notes

Text

Upskilling Your Accounting Team for 2025: The Key to Staying Ahead

In the ever-changing world of accounting, merely keeping up with the changes in regulations is not enough to be ahead of the curve. By 2025, upskilling your accounting team has become essential to compete and deliver more value to your clients. What does upskilling mean, and how will it change your practice? Let’s find out.

Why is upskilling crucial for accounting professionals today?

The accounting profession has been transformed lately by technological and client expectations; the traditional, routine accounting task is being substituted with more sophisticated roles. Thereby, this calls for more strategic roles of the firm which can be upskilled so that the entire team can easily handle these changes.

In addition, complexity in compliance is increasing, through changing tax laws, evolving financial reporting standards, and shifting regulatory frameworks. As accountants are constantly updating their skills, they will be well-equipped to adapt to the complex environment and subsequently reduce risks both for the firms and their clients.

What core competencies will your team require for 2025?

The following skills would be important to develop in professionals to succeed in the modern accounting environment:

Technological Savvy

One should know the latest accounting software, cloud-based solutions, and automation tools. This is to know how these technologies can make processes easier, more accurate, and efficient.

Data Analysis and Interpretation

The interpretation of complex financial data and provision of actionable insights has become very valuable. Data analytics enables accountants to transcend bookkeeping to strategic advice that will add value to businesses.

Cybersecurity Awareness

Security of financial data through digital accounting is at the top of the list. The accountants should be trained on good cybersecurity practice to protect the client’s information and comply with the law of data protection like GDPR.

Emotional Intelligence (EI) and Soft Skills

As EI is strong, better client and teamwork relationships can be developed. A person should have empathy, self-awareness, and effective communication skills. They have better understanding and satisfying the needs of the clients through them.

Regulatory and Compliance Knowledge

Tax laws, VAT regulations, and financial reporting standards change with time. Up-skilling ensures that the accountants do not incur a cost of heavy penalties for the clients.

Technological Advancement: How could it affect your accounting practice?

What’s emerging in the accounting landscape is a lot about Artificial Intelligence (AI) integration and automation. AI-based tools can take charge of the routine tasks: transaction entry, reconciliations, and invoice processing. However, these technologies highlight how accountants should then be focused on tasks where human judgment is unparalleled.

For example, AI can produce reports; however, for it to make strategic recommendations and interpret insights, that expertise is clearly human-centric. Upskilling in technology means managing and interpreting AI outputs effectively to ensure that automation supports rather than replaces human expertise.

What strategies can facilitate effective upskilling?

A successful upskilling program requires several strategic steps:

Continuous Learning Culture

It should have a culture of life-long learning. It can be scheduled through training sessions, seminars, and other courses that are accessible online.

Professional Certifications and Training

Professional certifications such as ACCA, CIMA, or CPA should be pursued. This not only gives the employees more credibility but extends their exposures in specialized fields of accounting.

Mentoring and Knowledge Transfer

Such a pair can aid in knowledge transfer and also be helpful for the practical development of skills. Bridging skill gaps requires very effective encouragement of internal mentorship programs.

Collaborative Learning and Real-World Application

Apply project-based teamwork when diverse skills are needed, with team members teaching each other new competencies that can be practiced.

Online Learning Platforms

There are so many courses for accounting professionals offered by platforms like Coursera, LinkedIn Learning, and ICAEW’s digital training.

How do upskilled employees improve client satisfaction?

An upskilled team is more efficient to meet and also surpass clients’ expectations. Accountants shall begin with the ability to provide more in-depth analysis, proactive advice, and efficient delivery once their skills have been improved.

For example, the data analytics training can enable a firm to offer to predict the future financial models to its clients.This will help the clients make strategic business decisions, hence, strengthening client relationships and positioning your firm as a front runner in the industry.

How can Integra Global Solutions upskill your team?

We understand at Integra Global Solutions UK the ever-changing needs of the accounting profession. We are designed to fill the gap by supplementing the capabilities of your team with a full range of outsourcing services to let your people focus on the strategic work and leave routine accounting functions to us.

Through association with Integra, your firm can have the professional services of accounting, bookkeeping, and financial analysis available.

Free up valuable in-house resources for high-impact tasks.

Comply with UK accounting standards and regulatory requirements.

Stay ahead of the competition with leading-edge technology and industry best practices.

Our custom-made outsourcing solution works alongside accounting firms to optimize the operational capacity of the former and deliver an assurance of professional growth from within the firm teams.

Conclusion:

Upskilling your accounting team is no longer an option but a strategic imperative in 2025. Help your firm and yourself navigate the complexities of the modern accounting world with technical skill, analytics, cybersecurity, emotional intelligence, and regulatory compliance knowledge.

Accept the upskilling today to position your team for success tomorrow through sustained growth, improvement in efficiency, and higher client satisfaction. Invest in the future of your accounting practice—because the skills you’ll develop today will define your firm’s success into the years ahead.

1 note

·

View note

Text

Global Agriculture Bucket Elevators Market Size,Growth Rate,Industry Opportunities 2025-2031

This report is a detailed and comprehensive analysis for global Agriculture Bucket Elevators market. Both quantitative and qualitative analyses are presented by manufacturers, by region & country, by Type and by Application. As the market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product examples of selected competitors, along with market share estimates of some of the selected leaders for the year 2025, are provided. Our Agriculture Bucket Elevators Market report is a comprehensive study of the current state of the industry. It provides a thorough overview of the market landscape, covering factors such as market size, competitive landscape, key market trends, and opportunities for future growth. It also pinpoints the key players in the market, their strategies, and offerings.

The report offers an in-depth look into the current and future trends in Agriculture Bucket Elevators, making it an invaluable resource for businesses involved in the sector. This data will help companies make informed decisions on research and development, product design, and marketing strategies. It also provides insights into Agriculture Bucket Elevators’ cost structure, raw material sources, and production processes. Additionally, it offers an understanding of the regulations and policies that are likely to shape the future of the industry. In essence, our report can help you stay ahead of the curve and better capitalize on industry trends.

The research report encompasses the prevailing trends embraced by major manufacturers in the Agriculture Bucket Elevators Market, such as the adoption of innovative technologies, government investments in research and development, and a growing emphasis on sustainability. Moreover, our research team has furnished essential data to illuminate the manufacturer's role within the regional and global markets. The research study includes profiles of leading companies operating in the Agriculture Bucket Elevators Market: The report is structured into chapters, with an introductory executive summary providing historical and estimated global market figures. This section also highlights the segments and reasons behind their progression or decline during the forecast period. Our insightful Agriculture Bucket Elevators Market report incorporates Porter's five forces analysis and SWOT analysis to decipher the factors influencing consumer and supplier behavior.

Segmenting the Agriculture Bucket Elevators Market by application, type, service, technology, and region, each chapter offers an in-depth exploration of market nuances. This segment-based analysis provides readers with a closer look at market opportunities and threats while considering the political dynamics that may impact the market. Additionally, the report scrutinizes evolving regulatory scenarios to make precise investment projections, assesses the risks for new entrants, and gauges the intensity of competitive rivalry. Major players covered: Tsubakimoto Chain、Renold、Thiele、Pewag、RUD Ketten、HEKO Group、John King Chains、B.V.Transmission Industries、Transmin、Bühler、Cimas、Borghi、Perry of Oakley

Agriculture Bucket Elevators Market by Type: Single-strand Systems、Double-strand Systems Agriculture Bucket Elevators Market by Application: Seed、Flour、Others Key Profits for Industry Members and Stakeholders:

a. The report includes a plethora of information such as market dynamics scenario and opportunities during the forecast period. b. Which regulatory trends at corporate-level, business-level, and functional-level strategies. c. Which are the End-User technologies being used to capture new revenue streams in the near future. d. The competitive landscape comprises share of key players, new developments, and strategies in the last three years. e. One can increase a thorough grasp of market dynamics by looking at prices as well as the actions of producers and users. f. Comprehensive companies offering products, relevant financial information, recent developments, SWOT analysis, and strategies by these players.

The content of the study subjects, includes a total of 15 chapters: Chapter 1, to describe Agriculture Bucket Elevators product scope, market overview, market estimation caveats and base year. Chapter 2, to profile the top manufacturers of Agriculture Bucket Elevators, with price, sales, revenue and global market share of Agriculture Bucket Elevators from 2020 to 2025. Chapter 3, the Agriculture Bucket Elevators competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast. Chapter 4, the Agriculture Bucket Elevators breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2020 to 2031. Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2020 to 2031. Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2020 to 2024.and Agriculture Bucket Elevators market forecast, by regions, type and application, with sales and revenue, from 2025 to 2031. Chapter 12, market dynamics, drivers, restraints, trends and Porters Five Forces analysis. Chapter 13, the key raw materials and key suppliers, and industry chain of Agriculture Bucket Elevators. Chapter 14 and 15, to describe Agriculture Bucket Elevators sales channel, distributors, customers, research findings and conclusion. Global Info Research is a company that digs deep into global industry information to support enterprises with market strategies and in-depth market development analysis reports. We provides market information consulting services in the global region to support enterprise strategic planning and official information reporting, and focuses on customized research, management consulting, IPO consulting, industry chain research, database and top industry services. At the same time, Global Info Research is also a report publisher, a customer and an interest-based suppliers, and is trusted by more than 30,000 companies around the world. We will always carry out all aspects of our business with excellent expertise and experience.

0 notes