#COSO Framework

Explore tagged Tumblr posts

Text

#COSO Framework#Internal Controls#skmc global#Risk Management#Corporate Governance#Compliance#Business Integrity#Enterprise Risk

0 notes

Text

Integrating Risk Management into Corporate Culture in Hong Kong

As regulatory complexity and economic uncertainty continues rising across Hong Kong and mainland China markets, establishing risk-aware cultures has become pivotal for corporations seeking to embed resilience against crises. Beyond building risk monitoring systems, companies today need to drive mindset shifts from the leadership down to infuse vigilance and responsibility towards hazard identification at all levels.

Cultivating Risk Intelligence Starts at the Top

For most organizations, the cultural transformation necessary to view enterprise risk oversight as a shared culture rather than just a compliance activity starts with Asia regional leaders and Hong Kong senior executives. This means not only investment into formal governance through appointing Chief Risk Officers but also having CXOs like Chief Finance, Information and HR Officers spearhead training to their teams around prevailing risk landscapes and vigilance necessary in day-to-day decision making.

Incentivizing Risk Reporting from the Ground Up

Middle managers and frontline analysts will then carry this risk-aware DNA through the organizational bloodstream into daily processes. This demands establishing transparent reporting channels, securing anonymity and anti-retaliation policies to encourage surfacing of suspected risks through what-if questioning or flagging incidents that seemed“off” without fear. Especially around integrity hazards like fraud/bribery, safety hazards like harassment or mental health situations, or regulatory hazards like IP/data transfer violations, removing stigma is key.

Aligning Strategy and Operations with Risk Perspectives

Ultimately, for a risk-informed culture to stick, considerations around financial, reputational and regulatory exposures should drive strategy planning as well as operational enhancements across everything from supply chain design to cybersecurity to financial controls. Key risk indicators must be integrated into dashboards at multiple levels with drilling down to understand root causes. Frameworks like ISO 31000 or COSO provide blueprints here from setup to ongoing assessments into mitigation tracking.

With leadership setting the tone, transparency enabling ground up risk reporting without repercussions, and strategy/operations reflecting risk learnings - global companies can align around managing uncertainty as Hong Kong/China markets, regulations and technologies rapidly evolve. Risk management thereby transforms from restrictive compliance activity to enabler of sustainable advantage and resilience.

#Hong Kong risk culture#Hong Kong corporate culture#Hong Kong leadership#Hong Kong risk governance#Hong Kong risk reporting#Hong Kong risk transparency#Hong Kong risk incentives#Hong Kong risk training#Hong Kong risk attitudes#Hong Kong risk resilience#Hong Kong crisis preparedness#Hong Kong fraud prevention#Hong Kong harassment policies#Hong Kong data policies#Hong Kong compliance culture#Hong Kong strategy alignment#Hong Kong risk dashboards#Hong Kong key risk indicators#ISO 31000 Hong Kong#COSO framework Hong Kong#Hong Kong competitive advantage#Hong Kong sustainability

1 note

·

View note

Text

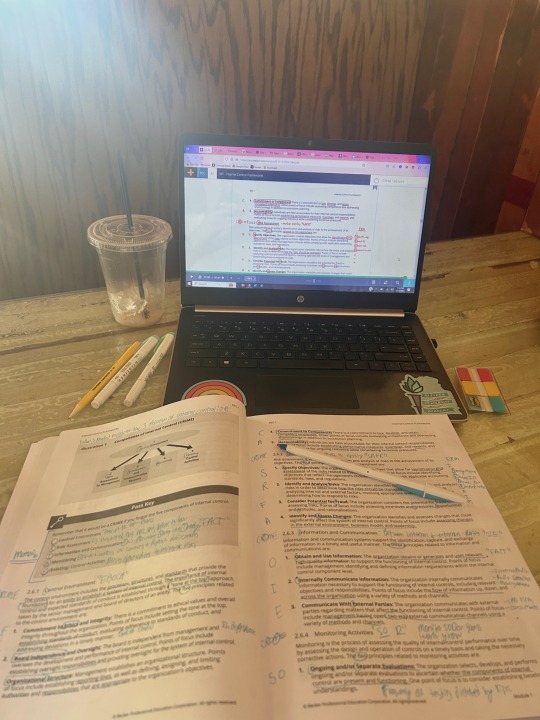

July 24th:

One exam and one beach trip later, I'm back to studying. Now that my Audit exam is over, I'm moving on to Business Environment and Concepts (BEC) which I will take on August 25th, about a month away. When I signed up to take this exam I didn't give myself enough study time for some reason and I don't want to pay the fee to move the exam unless I really really need to. So I'll be cramming this exam in. I did the first module of the first section today in just under four hours. The exam has an essay portion at the end of it so I've also got to work on my writing skills. The writing portion isn't graded on if I'm correct but instead on if I hit all the high points of the topic and how well my grammar and spelling is which is almost worse since I'm out of practice with writing essays. But I'm hoping in this month I can improve on that!

Today's accounting topic: The Committee of Sponsoring Organizations (COSO) issued Internal Control - Integrated Framework which has 17 principles that have been categorized within five major internal control components.

Other activity: I went to a coffee shop an hour away before a doctor's appointment and I got to have one of my favorite coffees! Also got to meet some of my parent's neighbors when I walked my dog this afternoon and they were pretty nice.

#CPA exam review#CPA#cpa exam#business#BEC#Business CPA#studyblr#study inspiration#study hard#study motivation#study blog#study space#studying#student#study#studyspo#heydilli#astudentslifebuoy#heyzainab#juliistudies#inky studies#lookrylie#problematicprocrastinator#mittonstudies#heystardust#notetaeker#mine#I'm working on fixing my sleep schedule since i got so much sleep at the beach lol#so its bed time!

69 notes

·

View notes

Text

Governance, Risk, & Compliance Solutions: Empowering Organizations with Effective GRC in the Middle East

In today’s fast-evolving business environment, organizations face a growing array of regulatory requirements, operational risks, and governance challenges. Particularly in the Middle East, where digital transformation and regulatory reforms are accelerating, effective Governance, Risk, and Compliance (GRC) frameworks are critical to maintaining business resilience and trust.

Paramount stands out as a trusted partner, delivering comprehensive GRC solutions and consulting services tailored to help organizations navigate this complex landscape—ensuring compliance, managing risks, and driving strategic governance.

What Is Governance, Risk, and Compliance (GRC)?

Governance ensures that an organization’s activities align with its objectives, ethical standards, and stakeholder expectations.

Risk management identifies, assesses, and mitigates potential threats to the organization’s operations and reputation.

Compliance involves adhering to applicable laws, regulations, policies, and standards relevant to the business.

A well-integrated GRC framework enables organizations to proactively manage these elements holistically—leading to better decision-making, operational efficiency, and regulatory readiness.

The Middle East’s Unique Regulatory Environment

The Middle East is witnessing a wave of new regulations and standards designed to protect data privacy, enhance cybersecurity, and improve corporate governance. Some examples include:

UAE’s Data Protection Law and Cybersecurity Framework

Saudi Arabia’s Vision 2030 compliance initiatives

Qatar’s Financial Regulatory Authority guidelines

Regional alignment with international standards like ISO 31000, COSO, and GDPR

Paramount’s GRC solutions are designed to address these regional nuances and help organizations build compliance-ready ecosystems.

How Paramount’s GRC Solutions Help You Stay Ahead

✅ Integrated Risk Management

Identify risks across your enterprise, from cybersecurity threats to operational vulnerabilities, and prioritize mitigation efforts based on impact and likelihood.

✅ Regulatory Compliance Management

Track, manage, and demonstrate compliance with multiple regulations and standards through automated workflows and centralized reporting.

✅ Policy and Procedure Management

Develop, update, and enforce policies aligned with regulatory and business requirements, ensuring consistent application across your organization.

✅ Audit and Assurance Services

Conduct internal and external audits to verify controls, identify gaps, and prepare for regulatory inspections.

✅ Training and Awareness Programs

Equip your workforce with the knowledge and skills to adhere to governance policies and manage risks effectively.

✅ Continuous Monitoring and Reporting

Leverage dashboards and analytics to gain real-time visibility into risk exposures, compliance status, and governance effectiveness.

Why Choose Paramount for Your GRC Journey?

🌍 Regional Expertise

Paramount combines deep knowledge of Middle Eastern regulations with global best practices, delivering solutions that are both compliant and culturally relevant.

🔐 Proven Track Record

Trusted by governments, financial institutions, telecom operators, and large enterprises, Paramount has a history of successful GRC implementations.

💡 Tailored Consulting

Our expert consultants work closely with your teams to design GRC frameworks that fit your industry, size, and maturity level.

🤝 Technology-Driven Solutions

We integrate leading GRC platforms and tools to automate workflows, reduce manual effort, and increase accuracy.

Real-World Impact: Building Resilience and Trust

Organizations leveraging Paramount’s GRC solutions benefit from:

Enhanced ability to anticipate and mitigate risks before they escalate

Streamlined compliance processes reducing operational overhead

Improved transparency and accountability across business units

Greater stakeholder confidence, including customers, regulators, and partners

Final Thoughts

In an increasingly regulated and risk-prone world, strong Governance, Risk, and Compliance capabilities are no longer optional—they are essential for sustainable success. Paramount’s comprehensive GRC solutions empower Middle Eastern organizations to not only meet today’s challenges but also prepare for tomorrow’s uncertainties.

0 notes

Text

Level 1 Certification in Enterprise Risk Management – IRM India’s Global Course

Kickstart your career with IRM India’s Level 1 Certification in Enterprise Risk Management—recognized in 140+ countries. Learn ISO & COSO frameworks, risk management processes, and 300+ risk types relevant for entrepreneurs, business leaders, and professionals. Enroll now to build your global risk literacy.

0 notes

Text

Hello, tumblr community!

As we see corporate landscapes grow more complex and regulatory environments tighten, the role of Governance, Risk, and Compliance (GRC) has become more critical than ever. Companies that fail to adapt to effective GRC systems risk falling behind or, worse, facing severe legal and financial consequences. I stumbled upon an interesting GRC course recently, and I thought it might be a great discussion starter here.

The course covers a deep dive into corporate governance, risk management, and compliance, exploring how organizations can implement these critical areas cohesively to ensure long-term success. The course structure is particularly insightful as it doesn’t just touch on theoretical concepts but also provides practical tools for professionals to implement in real-world scenarios.

Key Highlights from the Course:

Comprehensive GRC Framework Learn about the interconnectedness of governance, risk management, and compliance, and how they should work in unison to build a robust organizational structure.

Risk Management According to COSO Guidelines The course dives into the Committee of Sponsoring Organizations of the Treadway Commission (COSO) guidelines, offering valuable insights into effective risk management processes.

Internal Controls and Compliance From the audit committee’s role to implementing internal controls in various business cycles (HR, sales, and finance), understanding these systems is crucial for ensuring a compliant, risk-mitigated environment.

The Role of Corporate Boards and Committees A solid governance system starts with the board. The course explores how boards can ensure effective risk management, transparency, and accountability.

Why is This Relevant Today?

The pace of change in business environments—whether political, economic, or technological—means that organizations must stay proactive in managing their governance structures and risk. The knowledge gained through this course not only enhances your expertise but also provides you with tools to effectively mitigate risks, which is critical for decision-makers at all levels.

It seems to me that more organizations are starting to realize the importance of GRC as an integrated system rather than a series of standalone functions. This holistic view can significantly improve transparency, accountability, and overall organizational performance.

Some Questions for You:

Do you think current corporate boards understand the importance of a cohesive GRC system, or are many still working in silos?

How do you see the role of compliance evolving in the next decade?

What are some of the biggest challenges you face in implementing GRC in your organization, and how do you overcome them?

I’d love to hear your experiences and thoughts on how your companies approach governance, risk, and compliance. Is it something you’re actively working to improve? Or do you think it’s still a "nice-to-have" for many businesses?

Let’s get the discussion going!

GRC #CorporateGovernance #RiskManagement #Compliance #GovernanceFramework #COSO #InternalControls #CorporateBoards #RiskMitigation #BusinessTransparency #OrganizationalPerformance #RiskManagementSystems #AuditCommittee #BusinessRegulations #CorporateAccountability #GRCImplementation #ComplianceProfessionals #CorporateStrategy #DecisionMaking #GovernanceChallenges #BusinessResilience #RegulatoryCompliance

#GRC#CorporateGovernance#RiskManagement#Compliance#GovernanceFramework#COSO#InternalControls#CorporateBoards#RiskMitigation#BusinessTransparency#OrganizationalPerformance#RiskManagementSystems#AuditCommittee#BusinessRegulations#CorporateAccountability#GRCImplementation#ComplianceProfessionals#CorporateStrategy#DecisionMaking#GovernanceChallenges#BusinessResilience#RegulatoryCompliance

0 notes

Text

Internal Auditor Course

Internal auditing is a critical function in ensuring that an organization operates efficiently, effectively, and in compliance with laws and regulations. Internal auditors are responsible for evaluating the internal controls, risk management, and governance processes of an organization. Pursuing an internal auditor course can provide professionals with the skills and knowledge required to excel in this dynamic field. This article explores the significance of internal auditor courses, their benefits, and the key components of the curriculum.

Why Choose an Internal Auditor Course?

An internal auditor course offers an opportunity to gain expertise in the auditing profession, which plays a vital role in improving business operations and protecting organizations from potential risks. These courses provide in-depth knowledge about audit procedures, regulatory frameworks, and risk management strategies, which are essential for ensuring the accuracy and reliability of financial records.

As businesses face increasing scrutiny and regulatory requirements, the demand for skilled internal auditors has risen. Completing an internal auditor course equips individuals with the competencies required to analyze and assess financial systems, identify inefficiencies, and suggest improvements. It is also a great stepping stone for professionals aiming for certifications such as the Certified Internal Auditor (CIA) credential.

Key Components of an Internal Auditor Course

Fundamentals of Internal Auditing: The course typically begins with an introduction to the basics of internal auditing, including its definition, scope, and the role of an internal auditor within an organization. Topics like auditing standards, governance structures, and the ethical considerations of auditing are covered in this section.

Risk Management and Internal Control Systems: A significant part of the course is dedicated to understanding risk management principles and internal control frameworks like COSO (Committee of Sponsoring Organizations of the Treadway Commission). Students learn how to assess risk, identify vulnerabilities in financial and operational processes, and design internal control mechanisms to mitigate these risks.

Audit Planning and Execution: The course will delve into the practical aspects of audit planning, including how to design an audit plan, perform fieldwork, and document audit findings. It will also teach techniques for conducting effective interviews, analyzing financial statements, and preparing audit reports.

Compliance and Regulatory Frameworks: Internal auditors must understand the regulatory environment in which an organization operates. The course includes modules on key compliance issues, such as Sarbanes-Oxley (SOX) compliance, data privacy regulations, and anti-money laundering laws.

Reporting and Communication Skills: One of the key skills an internal auditor must possess is the ability to communicate audit findings clearly and concisely. The course trains students in effective report writing, presenting audit results to stakeholders, and recommending improvements.

Conclusion

An internal auditor course is an essential qualification for anyone looking to build a career in auditing, risk management, or compliance. By providing comprehensive training in audit techniques, risk management, regulatory standards, and ethical practices, these courses help professionals contribute meaningfully to an organization’s financial health and operational efficiency. As businesses continue to prioritize transparency and accountability, the role of internal auditors becomes more crucial, making this course a valuable investment in one’s career growth.

0 notes

Text

Understanding Section 404: Assessment of Internal Control

The Sarbanes-Oxley Act of 2002 introduced significant reforms to corporate governance and financial reporting. One of the key provisions of the act is Section 404, which requires publicly traded companies to assess and report on the effectiveness of their internal controls over financial reporting. In this article, we will delve into the details of Section 404 and its implications for companies.

What is Section 404?

Section 404 of the Sarbanes-Oxley Act requires publicly traded companies to include an internal control report in their annual reports (Form 10-K). This report must contain an assessment of the effectiveness of the company's internal controls over financial reporting. The assessment must be made by the company's management, and it must be accompanied by an attestation report from the company's independent auditor.

What are Internal Controls?

Internal controls refer to the processes, policies, and procedures that a company uses to ensure the accuracy, completeness, and reliability of its financial reporting. These controls can be preventive or detective in nature, and they can be manual or automated. Examples of internal controls include:

Authorization and approval procedures for transactions

Segregation of duties to prevent unauthorized access to financial data

Physical controls to prevent theft or loss of assets

Reconciliation procedures to ensure the accuracy of financial reports

What is the Purpose of Section 404?

The primary purpose of Section 404 is to provide stakeholders with assurance that a company's financial reports are accurate and reliable. By requiring companies to assess and report on their internal controls, Section 404 aims to:

Improve the accuracy and reliability of financial reporting

Enhance investor confidence in the capital markets

Reduce the risk of financial statement errors and fraud

How Does Section 404 Work?

To comply with Section 404, companies must follow a five-step process:

Identify financial reporting risks: Companies must identify the risks that could impact the accuracy and reliability of their financial reporting.

Design and implement internal controls: Companies must design and implement internal controls to mitigate the identified risks.

Assess the effectiveness of internal controls: Companies must assess the effectiveness of their internal controls, using a framework such as the Committee of Sponsoring Organizations (COSO) framework.

Report on internal control effectiveness: Companies must report on the effectiveness of their internal controls in their annual reports (Form 10-K).

Obtain an attestation report: Companies must obtain an attestation report from their independent auditor, which provides an opinion on the effectiveness of the company's internal controls.

Conclusion

Section 404 of the Sarbanes-Oxley Act is a critical component of corporate governance and financial reporting. By requiring companies to assess and report on their internal controls, Section 404 provides stakeholders with assurance that financial reports are accurate and reliable. Companies must follow a structured approach to comply with Section 404, which includes identifying financial reporting risks, designing and implementing internal controls, assessing internal control effectiveness, reporting on internal control effectiveness, and obtaining an attestation report.

0 notes

Text

Risk Management Frameworks: A Foundation for Success

Effective risk management requires a structured approach. This is where risk management frameworks come in. These frameworks provide a standardized method for identifying, assessing, evaluating, and treating risks. Popular frameworks that risk management software often integrates with include:

ISO 31000: Risk Management Guidelines: This international standard provides a comprehensive framework for managing risks across all types of organizations. It emphasizes a continuous risk management process with clear roles and responsibilities. Software can integrate with ISO 31000 by providing tools and functionalities to support each stage of the risk management lifecycle. For example, software might facilitate risk identification workshops, streamline risk assessment scoring, and help generate reports aligned with the ISO 31000 framework.

COSO Enterprise Risk Management (ERM) Framework: Developed by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), this framework emphasizes the importance of integrating risk management into an organization's overall governance, strategy, and operations. Software can integrate with COSO by providing features to map risks to strategic objectives, track risk mitigation activities, and demonstrate compliance with COSO principles.

Other Industry-Specific Frameworks: Many industries have developed their own risk management frameworks tailored to their specific needs. For example, healthcare organizations might utilize the Healthcare Industry Cybersecurity Framework (HCSF), while financial institutions might follow the Federal Financial Institutions Examination Council (FFIEC) Risk Management Framework. Risk management software can integrate with these industry-specific frameworks by providing functionalities that address unique risk profiles and regulatory requirements.

Benefits of Framework Integration

Standardization and Consistency: Frameworks provide a common language for risk management within your organization, ensuring everyone is on the same page. Software that integrates with frameworks helps maintain consistent application of risk management practices across departments.

Improved Risk Identification: Frameworks offer a structured approach to identifying potential risks, ensuring a comprehensive review of all areas of your organization. Software can streamline this process by providing risk identification tools and templates aligned with the framework.

Enhanced Risk Assessment: Frameworks provide guidance on how to assess the likelihood and impact of each risk. Software can integrate with frameworks by offering risk assessment scoring models and risk matrices that are aligned with the chosen framework. This allows for a more objective and consistent evaluation of risks.

Effective Risk Prioritization: Frameworks help you prioritize risks based on their severity. Software can integrate with frameworks by providing tools to visualize risks on a heat map and facilitate informed decision-making on which risks addressing first.

Demonstrated Compliance: Many frameworks are aligned with regulatory requirements. Software that integrates with these frameworks can help generate reports and documentation that demonstrate compliance with relevant regulations.

Choosing the Right Framework

The best risk management framework for your organization depends on your industry, size, and specific risk profile. However, by selecting software that integrates with a well-established framework, you gain a solid foundation for building a robust and effective risk management program.

The Future of Frameworks

Risk management frameworks are constantly evolving to keep pace with the changing business landscape. Emerging trends include:

Integration with Technology: Frameworks will likely become even more technology-driven, leveraging automation and data analytics to enhance risk management processes.

Customization: Frameworks may become more adaptable, allowing organizations to tailor them to their unique needs while still maintaining core principles.

Focus on Emerging Risks: Frameworks will likely place a greater emphasis on identifying and mitigating emerging risks, such as cyber threats and climate change.

Conclusion

Risk management frameworks are essential tools for any organization looking to proactively manage risk. By leveraging software that integrates with these frameworks, you can establish a standardized and consistent approach to risk management, ultimately leading to a more resilient and successful organization.

0 notes

Text

SAP GRC Process Control 12.0

SAP GRC Process Control 12.0: Your Path to Streamlined Compliance

In today’s complex regulatory landscape, ensuring robust compliance across your organization is not just a best practice—it’s imperative. SAP GRC Process Control 12.0 is a powerful solution that helps organizations streamline compliance efforts, reduce risk, and achieve operational efficiency. In this blog, we’ll dive into what it is, key features, and why it matters to your business.

What is SAP GRC Process Control 12.0?

SAP GRC Process Control 12.0 is vital to SAP’s Governance, Risk, and Compliance (GRC) suite. It’s a comprehensive software solution that enables businesses to automate, monitor, and optimize their internal control processes. At its core, SAP Process Control helps you:

Document and Define Controls: Clearly define your business processes and the associated risks and controls.

Assess and Test: Design and execute tests to assess the effectiveness of those controls.

Monitor: Continuously monitor control performance through automated checks and analytics.

Remediate and Report: Identify and address control deficiencies and provide comprehensive reports about your compliance status.

Key FeaturesSAP GRC Process Control 12.0 offers a suite of valuable features for compliance and process management:

Risk and Control Library: This is a pre-built library of risks and controls aligned with common frameworks like COSO and COBIT, saving you significant setup time.

Workflow and Automation: Streamlined workflows to guide compliance activities and automate tasks, improving efficiency.

Surveys and Assessments: User-friendly tools for creating surveys and assessments to test control effectiveness.

Continuous Control Monitoring (CCM): Capabilities for automatic, near real-time monitoring of controls to prevent issues.

Reporting and Analytics Customizable dashboards and reports provide compliance insights to business leaders and stakeholders.

Benefits of SAP GRC Process Control 12.0

Enhanced Compliance: SAP Process Control 12.0 facilitates adherence to industry regulations and internal policies, helping you avoid costly penalties and reputational damage.

Reduced Risk: Proactively identifying and mitigating control weaknesses significantly minimizes risk exposure across your business.

Increased Efficiency: Automation and workflow tools streamline compliance tasks and free employees to focus on higher-value activities.

Improved Visibility: Real-time reporting provides clear insights into your compliance posture and control performance, facilitating data-driven decision-making.

Cost Savings: Reduction of manual compliance work and mitigation of fines and audit penalties translate into long-term cost savings.

Who Needs SAP GRC Process Control 12.0?

Organizations of all sizes operating in regulated industries can significantly benefit from SAP GRC Process Control 12.0. It’s particularly relevant for:

Publicly Traded Companies: Companies subject to Sarbanes-Oxley (SOX) compliance will find it an invaluable tool.

Financial Institutions: Helps address complex banking and finance regulations.

Healthcare and Life Sciences: Critical for adhering to regulations like HIPAA and FDA requirements.

Companies Handling Sensitive Data: This is to ensure proper controls and data privacy.

Getting Started with SAP GRC Process Control 12.0

If you’re looking to get started with SAP Process Control, here are key steps:

Assessment: Assess your current compliance posture, risk areas, and the regulatory landscape in which you operate.

Planning: Define your compliance goals and create a strategic plan aligning with your business objectives.

Implementation: Work with an experienced SAP partner to ensure proper configuration and implementation of Process Control 12.0.

Training: Train your compliance and internal audit teams to utilize the system entirely.

In Conclusion

In the age of ever-increasing regulatory scrutiny, SAP GRC Process Control 12.0 provides a powerful platform to maintain a robust compliance framework. Streamlining processes, automating tasks, and providing real-time insights positions your organization for success in a complex and demanding business environment.

youtube

You can find more information about SAP GRC in this SAP GRC Link

Conclusion:

Unogeeks is the No.1 IT Training Institute for SAP GRC Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on SAP GRC here – SAP GRC Blogs

You can check out our Best In Class SAP GRC Details here – SAP GRC Training

Follow & Connect with us:

———————————-

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeeks

#Unogeeks #training #Unogeekstraining

1 note

·

View note

Text

Navigating Complexity with Confidence: BCT Digital's Enterprise Risk Management Solutions

In today’s rapidly evolving business landscape, managing risk is not just about avoiding potential pitfalls — it’s about seizing opportunities, driving growth, and ensuring long-term success. At the forefront of this mission stands BCT Digital, a leader in innovative Enterprise Risk Management (ERM) solutions designed to help organizations navigate complexities with confidence, agility, and resilience.

A Holistic Approach to Risk Management

Risk is inherent in every aspect of business, from strategic decision-making to day-to-day operations. BCT Digital’s ERM solutions take a holistic approach to risk management, providing organizations with the tools and insights needed to identify, assess, prioritize, and mitigate risks across the enterprise. By integrating risk management into strategic planning and decision-making processes, organizations can proactively address threats, capitalize on opportunities, and drive sustainable growth.

Harnessing Data for Strategic Advantage

In the age of big data and analytics, information is the currency of competitive advantage. BCT Digital’s ERM solutions harness the power of data to provide organizations with actionable insights that drive strategic decision-making. By aggregating, analyzing, and visualizing vast amounts of structured and unstructured data from internal and external sources, organizations gain a comprehensive view of risk exposures, enabling them to make informed decisions that optimize risk-return trade-offs and drive value creation.

Adaptable Solutions for Every Organization

BCT Digital understands that every organization is unique, with its own risk profile, objectives, and constraints. That’s why our ERM solutions are highly adaptable, scalable, and customizable, tailored to meet the specific needs and priorities of each client. Whether it’s developing custom risk frameworks, implementing advanced analytics models, or integrating with existing systems and workflows, BCT Digital works closely with clients to deliver solutions that align with their strategic vision and drive measurable results.

Compliance, Security, and Regulatory Excellence

In today’s regulatory environment, compliance and security are non-negotiable. BCT Digital’s ERM solutions help organizations stay ahead of the curve with robust compliance frameworks and industry best practices. By adhering to regulatory guidelines such as COSO, ISO 31000, and Basel III, organizations can ensure transparency, accountability, and regulatory compliance, mitigating the risk of penalties and reputational damage while enhancing stakeholder trust and confidence.

Empowering Organizations for Future Success

In an era defined by uncertainty and disruption, effective risk management is essential for organizational resilience and success. BCT Digital’s ERM solutions offer organizations a pathway to the future, enabling them to navigate complexities with confidence, agility, and foresight. By embracing innovation, harnessing data, and prioritizing proactive risk management, organizations can position themselves for long-term success and sustainability in an ever-changing world. With BCT Digital as a trusted partner, the future is within reach — navigate complexity with confidence and resilience with BCT Digital’s Enterprise Risk Management solutions.

0 notes

Text

Effective Use of the COSO Framework - In-Person - December 19-20, 2024

Discover the power of the COSO framework at the in-person CPE training event in Scottsdale, AZ. Gain authentic insights into its effective utilization alongside industry experts within a supportive, transparent learning environment. This comprehensive seminar offers a genuine opportunity to enhance your understanding, empowering you to apply the framework with confidence and precision as you navigate the complexities of today's business landscape. For more information please visit https://www.compliance-seminars.com/product-page/effective-use-of-the-coso-framework

0 notes

Text

Test Bank for Core Concepts of Accounting Information Systems, 14th Edition Mark G. Simkin

TABLE OF CONTENTS

Chapter 1 Accounting Information Systems and the Accountant 1 1.1 Introduction: Why Study Accounting Information Systems? 1 1.2 Careers in Accounting Information Systems 2 Traditional Accounting Career Opportunities 2 Systems Consulting 2 Fraud Examiner or Forensic Accountant 3 Information Technology Auditing and Security 4 Predictive Analytics 5 1.3 Accounting and IT 6 Financial Accounting 6 Managerial Accounting 9 Auditing 12 Taxation 14 1.4 What are Accounting Information Systems? 14 Accounting Information Systems 14 The Role of Accounting Information Systems in Organizations 18 1.5 What’s New in Accounting Information Systems? 19 Cloud Computing—Impact for Accountants 19 Corporate Responsibility Reporting 20 Suspicious Activity Reporting 21 Forensic Accounting, Governmental Accountants, and Terrorism 22 Corporate Scandals and Accounting 22 Chapter 2 Accounting on the Internet 32 2.1 Introduction 32 2.2 The Internet and World Wide Web 33 Internet Addresses and Software 33 Intranets and Extranets 34 The World Wide Web, HTML, and IDEA 35 Groupware, Electronic Conferencing, and Blogs 35 Social Media and its Value to Accountants 36 2.3 XBRL—Financial Reporting on the Internet 37 XBRL Instance Documents and Taxonomies 38 The Benefits and Drawbacks of XBRL 38 The Current Status of XBRL 40 2.4 Electronic Business 41 e-Accounting 41 Retail Sales 42 E-Payments, E-Wallets, and Virtual Currencies 43 B2C, B2B, and C2C E-Commerce 46 Electronic Data Interchange 47 Cloud Computing 48 2.5 Privacy and Security on the Internet 51 Identity Theft and Privacy 51 Security 53 Spam, Phishing, Spoofing, and Ransomware 53 Firewalls, Intrusion Detection Systems, Value-Added Networks, and Proxy Servers 54 Data Encryption 57 Digital Signatures and Digital Time Stamping 58 Chapter 3 Information Technology and AISs 69 3.1 Introduction 69 3.2 The Importance of Information Technology to Accountants 70 Six Reasons 70 The Top 10 Information Technologies 71 3.3 Input, Processing, and Output Devices 72 Input Devices 72 Central Processing Units 78 Output Devices 80 3.4 Secondary Storage Devices 81 Magnetic (Hard) Disks 82 CD-ROMs, DVDs, and Blu-Ray Discs 83 Flash Memory 84 Image Processing and Record Management Systems 84 3.5 Data Communications and Networks 85 Communication Channels and Protocols 85 Local and Wide Area Networks 86 Client/Server Computing 89 Wireless Data Communications 90 Cloud Computing 93 3.6 Computer Software 93 Operating Systems 93 Application Software 94 Programming Languages 95 Chapter 4 Accounting and Data Analytics 109 4.1 Introduction 109 4.2 Big Data 110 Volume 110 Velocity 110 Variety 111 Veracity 112 4.3 Analyzing Data 112 Data Procurement 113 Data Provisioning 115 Data Analysis 116 Presentation 117 4.4 Enabling Technologies and Tools 118 Data Access 118 Analysis and Data Visualization Tools 121 4.5 Data Analytics and the Accounting Profession 123 Tax Accounting 123 Managerial Accounting 124 Assurance and Compliance 125 Chapter 5 Integrated Accounting and Enterprise Software 134 5.1 Introduction 134 5.2 Integrated Accounting Software 135 Small Business Accounting Software 136 Mid-Range and Large-Scale Accounting Software 138 Specialized Accounting Information Systems 138 5.3 Enterprise-Wide Information Systems 139 Enterprise System Functionality 140 The Architecture of Enterprise Systems 142 Business Processes and ERP Systems 145 Benefits and Risks of Enterprise Systems 145 5.4 Selecting a Software Package 149 When is a New AIS Needed? 149 Selecting the Right Software 149 Chapter 6 Introduction to Internal Control Systems and Risk Management 163 6.1 Introduction 163 Definition of Internal Control 164 Internal Control Systems 165 6.2 COSO Internal Control—Integrated Framework 165 2013 COSO Report 165 6.3 Enterprise Risk Management 169 COSO ERM Introduction 169 2004 ERM Framework 169 2017 ERM Framework 171 Risk Governance and Culture 172 Risk, Strategy, and Objective Setting 173 Risk in Execution 174 Risk Information, Communication, and Reporting 174 Monitoring Enterprise Risk Management Performance 175 6.4 Examples of Control Activities 175 Good Audit Trail 175 Sound Personnel Policies and Procedures 175 Separation of Duties 177 Physical Protection of Assets 179 6.5 Monitoring Internal Control Systems 183 Reviews of Operating Performance 183 COSO Guidance on Monitoring 183 Operating Performance vs. Monitoring 183 COBIT 5 184 6.6 Types of Controls 186 Preventive Controls 186 Detective Controls 187 Corrective Controls 187 Discerning Between Preventive, Detective, and Corrective Controls 187 6.7 Evaluating Controls 188 Requirements of the Sarbanes–Oxley Act 188 Cost–Benefit Analysis 188 A Risk Matrix 190 Chapter 7 Computer Controls for Organizations and Accounting Information Systems 200 7.1 Introduction 200 7.2 Enterprise-Level Controls 201 Risk Assessment and Security Policies 202 Designing a Security Policy 202 Integrated Security for the Organization 203 7.3 General Controls for Information Technology 204 Access to Data, Hardware, and Software 204 Personnel Policies to Protect Systems and Data 209 Additional Policies to Protect Systems and Data 211 7.4 Application Controls for Transaction Processing 217 Input Controls 218 Processing Controls 221 Output Controls 223 Chapter 8 Accounting Information Systems and Business Processes: Part I 234 8.1 Introduction 234 8.2 Business Process Fundamentals 235 Overview of the Financial Accounting Cycle 235 Coding Systems 236 8.3 Collecting and Reporting Accounting Information 237 Designing Reports 238 From Source Documents to Output Reports 239 8.4 The Sales Process 241 Objectives of the Sales Process 242 Inputs to the Sales Process 243 Outputs of the Sales Process 246 8.5 The Purchasing Process 247 Objectives of the Purchasing Process 247 Inputs to the Purchasing Process 250 Outputs of the Purchasing Process 251 8.6 Current Trends in Business Processes 254 Business Process Outsourcing (BPO) 254 Business Process Management Software 256 Chapter 9 Accounting Information Systems and Business Processes: Part II 266 9.1 Introduction 266 9.2 The Resource Management Process 267 Human Resource Management 267 Fixed-Asset Management 270 9.3 The Production Process 272 Objectives of the Production Process 272 Inputs to the Production Process 277 Outputs of the Production Process 278 9.4 The Financing Process 279 Objectives of the Financing Process 279 Inputs to the Financing Process 281 Outputs of the Financing Process 281 9.5 Business Processes in Special Industries 282 Professional Service Organizations 283 Not-for-Profit Organizations 283 Health Care Organizations 285 9.6 Business Process Reengineering 287 Why Reengineering Sometimes Fails 288 Chapter 10 Cybercrime, Fraud, and Ethics 296 10.1 Introduction 296 10.2 Cybercrime and Fraud 297 Distinguishing between Cybercrime and Fraud 297 Cybercrime Legislation 300 Cybercrime Statistics 303 10.3 Examples of Cybercrime 304 Compromising Valuable Information 304 Hacking 305 Denial of Service 307 10.4 Preventing and Detecting Cybercrime and Fraud 309 Enlist Top-Management Support 309 Increase Employee Awareness and Education 309 Assess Security Policies and Protect Passwords 310 Implement Controls 311 Identify Computer Criminals 312 Maintain Physical Security 313 Recognize the Symptoms of Employee Fraud 314 Use Data-Driven Techniques 316 Employ Forensic Accountants 316 10.5 Ethical Issues, Privacy, and Identity Theft 317 Ethical Issues and Professional Associations 317 Meeting the Ethical Challenges 318 Privacy 319 Company Policies with Respect to Privacy 320 Identity Theft 320 Chapter 11 Information Technology Auditing 329 11.1 Introduction 329 11.2 The Audit Function 330 Internal versus External Auditing 330 Information Technology Auditing 331 Evaluating the Effectiveness of Information Systems Controls 335 11.3 The Information Technology Auditor’s Toolkit 337 Auditing Software 337 People Skills 340 11.4 Auditing Computerized Accounting Information Systems 340 Testing Computer Programs 341 Validating Computer Programs 342 Review of Systems Software 343 Validating Users and Access Privileges 344 Continuous Auditing 345 11.5 Information Technology Auditing Today 347 Information Technology Governance 347 The Sarbanes–Oxley Act of 2002 347 Auditing Standard No. 2201 (AS 2201) 349 ISACA Information Technology Assurance Framework 350 IIA’s Global Technology Audit Guides and Guide to the Assessment of IT Risk series 351 Chapter 12 Documenting Accounting Information Systems 358 12.1 Introduction 358 12.2 Why Documentation is Important 359 12.3 Primary Documentation Tools 362 Data Flow Diagrams 363 Document Flowcharts 368 System Flowcharts 372 12.4 Other Documentation Tools 377 Program Flowcharts 378 Decision Tables and Decision Trees 379 Software Tools for Graphical Documentation and SOX Compliance 381 12.5 End-User Computing and Documentation 383 The Importance of End-User Documentation 383 Policies for End-User Computing and Documentation 385 Chapter 13 Developing and Implementing Effective Accounting Information Systems 398 13.1 Introduction 398 13.2 The Systems Development Life Cycle 399 Four Stages in the Systems Development Life Cycle 399 Systems Studies and Accounting Information Systems 401 13.3 Systems Planning 401 Planning for Success 401 Investigating Current Systems 403 13.4 Systems Analysis 403 Understanding Organizational Goals 403 Systems Survey Work 404 Data Analysis 406 Evaluating System Feasibility 406 13.5 Detailed Systems Design and Acquisition 408 Designing System Outputs, Processes, and Inputs 409 The System Specifications Report 412 Choosing an Accounting Information System 413 Outsourcing 416 13.6 Implementation, Follow-Up, and Maintenance 417 Implementation Activities 417 Managing Implementation Projects 419 Postimplementation Review 421 System Maintenance 422 Chapter 14 Database Design 434 14.1 Introduction 434 14.2 An Overview of Databases 434 What is a Database? 435 Significance of Databases 435 Storing Data in Databases 437 Additional Database Issues 439 14.3 Steps in Developing a Database Using the Resources, Events, and Agents (REA) Approach 442 Step 1—Identify Business and Economic Events 443 Step 2—Identify Entities 444 Step 3—Identify Relationships 444 Step 4—Create Entity–Relationship Diagrams 445 Step 5—Identify Attributes of Entities 446 Step 6—Convert E-R Diagrams into Database Tables 447 14.4 Normalization 449 First Normal Form 449 Second Normal Form 450 Third Normal Form 451 Chapter 15 Organizing and Manipulating the Data in Databases 462 15.1 Introduction 462 15.2 Creating Database Tables in Microsoft Access 463 Database Management Systems 463 Using Microsoft Access 463 Creating Database Tables 464 Creating Relationships 466 15.3 Entering Data in Database Tables 468 Creating Records 468 Ensuring Valid and Accurate Data Entry 469 Tips for Creating Database Tables and Records 472 15.4 Extracting Data from Databases: Data Manipulation Languages (DMLs) 473 Creating Select Queries 473 Creating Action Queries 477 Guidelines for Creating Queries 478 Structured Query Language (SQL) 478 Sorting, Indexing, and Database Programming 479 Chapter 16 Database Forms and Reports 490 16.1 Introduction 490 16.2 Forms 490 Creating Simple Forms 492 Using Forms for Input and Output Tasks 496 Subforms: Showing Data from Multiple Tables 497 Concluding Remarks about Forms 498 16.3 Reports 498 Creating Simple Reports 499 Creating Reports with Calculated Fields 502 Creating Reports with Grouped Data 504 Concluding Remarks about Reports 506 Glossary (Available online at http://www.wiley.com/college/simkin) Index 516 Read the full article

0 notes

Text

IRM Level 1 Examination | Foundation Certificate Course in Enterprise Risk Management Start your career in Enterprise Risk Management (ERM) with IRM’s Global Level 1 Foundation Examination. This certified course, recognized in over 140 countries, equips students and professionals with risk intelligence skills and knowledge on ISO and COSO frameworks, covering 300 types of risks. Ideal for aspiring risk leaders, entrepreneurs, and business professionals. Enroll today!

0 notes

Text

[ad_1] Interview with Lucia Wind, COSO Chair and Strategic Advisory Board Member, IRM India Affiliate Hersh: We’re seeing a collection of shocks and uncertainties throughout the globe and that is solely on the rise with the world getting extra interconnected and complicated. As the brand new Chair of the Committee of Sponsoring Organisations (COSO), that has launched the worldwide framework for enterprise danger administration (ERM), what are your views on ERM and its relevance to enterprise technique, long run survival and organisational resilience? Lucia: I believe that ERM is turning into much more necessary and related and needs to be thought of as a operate and a framework by all group, massive or small, non-public or public. What latest occasions taught us is that consciousness of dangers and readiness to answer altering environments is what's going to differentiate success for firms. Whether or not we take into account readiness to answer a word-wide pandemic, the banking business, or the upcoming environmental/sustainability reporting necessities, firms want to think about the sudden. Taking a deeper take a look at your organization’s technique and linking it to the ERM framework is a vital step within the readiness. Hersh: The ERM definition beneath COSO 2004 is especially near my coronary heart as a result of it places emphasis on ERM being a course of effected by an entity’s board of administrators, administration and different personnel, so known as ‘folks’. How do you see folks (throughout the enterprise) and ofcourse tradition enjoying an necessary position within the implementation of ERM particularly in a post-pandemic world? Lucia: ERM and risk training throughout the varied ranges of a company are crucial. Danger identification if usually the strongest on the decrease ranges of an organization, with the ‘folks’ as you talked about, who are sometimes probably the most related to the mission and its execution based mostly on their position within the firm. The phrase “boots on the bottom” is essential right here for that very cause, they steadily see dangers earlier than they develop into vital. Linking all ranges of a company to danger administration will result in a better-informed danger register, as it is going to merge the massive image boards and senior management see with the tactical and or rising dangers. Hersh: As might know, the IRM’s Global Enterprise Risk Management qualifications / examinations cowl detailed examine of the COSO 2004 and COSO 2017 framework and IRM-certified professionals are rising as ‘champions of change’ at varied organisations by embedding risk-intelligence throughout the worth chain, utilizing these worldwide frameworks and requirements. What’s your recommendation for our budding college students? Lucia: Be inquisitive and produce your studying to apply. The ERM framework offers nice instruments you need to use in your danger administration journey. I'm a powerful believer in asking many questions, possibly that's the auditor in me, however problem your self to grasp the danger universe your group operates in, convey your ERM instruments to the desk and hold asking questions on what may go improper. I really like the title “champions of change,” I believe that drastically describes a real danger skilled. With change usually comes discomfort, but when we don’t problem the comfy state, we won't successfully put together for dangers that will come. Hersh: India is main the way in which in risk-related rules with SEBI, RBI, IRDAI mandating ERM / danger disclosures, board danger administration committees and in some instances even necessary appointment of a Chief Danger Officer. The Ministry of Company Affairs too might come out with a tenet for sure unlisted non-public restricted Firms. But, the appreciation for an ERM operate and risk-based resolution making seems to be low. Any ideas on how danger leaders ought to navigate this and win the arrogance of the Board?

Lucia: Getting a buy-in out of your Board of Administrators is an important step. It actually bridges ERM with the Inner Controls Built-in Framework by COSO (ICIF) by way of the ‘tone on the prime’. I've discovered that bringing actual examples to a dialogue is a really efficient software to help the return-on-investment dialogue associated to ERM. Sadly for a lot of firms however happily for danger professionals battling this problem, we're seeing many latest occasions resembling COVID-post mortems, the banking business eventualities and cybersecurity incidents to be useful in these discussions. Hersh: There’s quite a lot of buzz round rising dangers and situation planning. How ought to Chief Danger Officers (CROs) or Danger Leaders undertake this of their ERM technique? Lucia: As a practitioner, I discovered tabletop train periods very efficient. It isn't a brand new idea however bringing key leaders to a dialog devoted to dangers and having them collaborate and problem one another in areas the place their aims and techniques merge could be very efficient. It usually results in figuring out new dangers, alternatives and eventualities that may simply be missed in particular person conversations. I like to recommend holding such periods on the board degree, govt administration degree but additionally the degrees beneath. It is rather invaluable to check outcomes and assess for themes. Networking with friends is a superb software as properly, we are able to all be taught from one another. Hersh: On a closing notice, what’s your prime three strategic aims as COSO Chair that will profit the enterprise danger administration (ERM) group at massive? Lucia: I'll not have three particular objects because the few priorities I'll talked about will cowl a number of long term aims, however I want to make COSO extra interactive with the skilled communities, ERM included, and we do have a number of initiatives within the works that we hope to launch quickly. As all the time, we're repeatedly evaluating thought management alternatives and I do consider that the subsequent set of initiatives to return might be of nice curiosity to danger professionals. To remain in contact on something COSO, yow will discover extra data on LinkedIn and by following our sponsoring organizations. [ad_2]

0 notes

Text

Becoming an Internal Auditor: A Comprehensive Guide to Internal Auditor Courses

Introduction

In today’s complex business environment, internal auditors play a crucial role in ensuring that organizations operate efficiently, comply with regulations, and manage risks effectively. Internal auditor courses provide the knowledge and skills necessary to perform these critical functions. This guide explores what internal auditor courses entail, the benefits of taking these courses, and how they can advance your career in auditing and compliance.

What is an Internal Auditor?

An internal auditor is a professional who evaluates an organization’s internal controls, risk management processes, and governance practices. They ensure that policies and procedures are followed, assets are safeguarded, and financial information is accurate and reliable. Internal auditors provide insights and recommendations to improve business operations and achieve organizational objectives.

Why Take an Internal Auditor Course?

Knowledge Acquisition: Gain a comprehensive understanding of auditing principles, methodologies, and best practices.

Skill Development: Enhance your ability to assess internal controls, identify risks, and recommend improvements.

Professional Certification: Many courses prepare you for recognized certifications such as the Certified Internal Auditor (CIA) designation.

Career Advancement: Acquire qualifications that can lead to higher positions and increased earning potential.

Regulatory Compliance: Understand regulatory requirements and ensure your organization meets them.

Key Components of Internal Auditor Courses

Auditing Standards and Frameworks: Learn about international auditing standards, such as those from the Institute of Internal Auditors (IIA), and frameworks like COSO (Committee of Sponsoring Organizations).

Risk Management: Study risk assessment techniques and how to apply them in auditing.

Internal Control Systems: Understand the components and importance of effective internal control systems.

Audit Planning and Execution: Learn how to plan and conduct audits, including developing audit plans, gathering evidence, and documenting findings.

Audit Reporting: Gain skills in writing clear, concise, and impactful audit reports.

Ethical Considerations: Study the ethical standards and principles that guide the internal auditing profession.

Types of Internal Auditor Courses

Introductory Courses: Designed for beginners, these courses cover the basics of internal auditing, including fundamental concepts and techniques.

Intermediate Courses: For those with some auditing experience, these courses delve deeper into specific areas such as risk management and advanced audit techniques.

Advanced Courses: Targeted at experienced auditors, these courses cover complex auditing issues, strategic management, and leadership in auditing.

Certification Preparation Courses: Focused on preparing candidates for professional certifications like the CIA, these courses provide in-depth knowledge and exam preparation.

Benefits of Certification

Credibility and Recognition: Certified auditors are recognized as professionals with a high level of expertise and competence.

Career Opportunities: Certifications can open doors to new job opportunities and career advancement.

Professional Network: Join a global community of certified auditors and access valuable networking opportunities.

Continual Learning: Certification often requires ongoing education, ensuring you stay current with industry trends and practices.

Steps to Become a Certified Internal Auditor

Choose the Right Course: Select a course that aligns with your career goals and current level of experience.

Complete the Course: Engage fully in the course, participate in all activities, and complete any assignments or exams.

Gain Practical Experience: Apply the knowledge and skills learned in the course through practical experience in auditing.

Prepare for Certification Exams: Use study guides, practice exams, and review courses to prepare for certification exams.

Apply for Certification: Once you meet the eligibility requirements, apply for certification with the relevant professional body, such as the IIA for the CIA designation.

Maintain Certification: Fulfill any continuing professional education (CPE) requirements to maintain your certification.

Conclusion

Internal auditor course are essential for anyone looking to advance their career in auditing, compliance, and risk management. These courses provide the foundational knowledge and advanced skills needed to excel in the field. By obtaining professional certification, internal auditors can demonstrate their expertise, enhance their career prospects, and contribute significantly to their organizations' success. Whether you are just starting out or looking to deepen your expertise, internal auditor courses offer a valuable pathway to achieving your professional goals.

0 notes