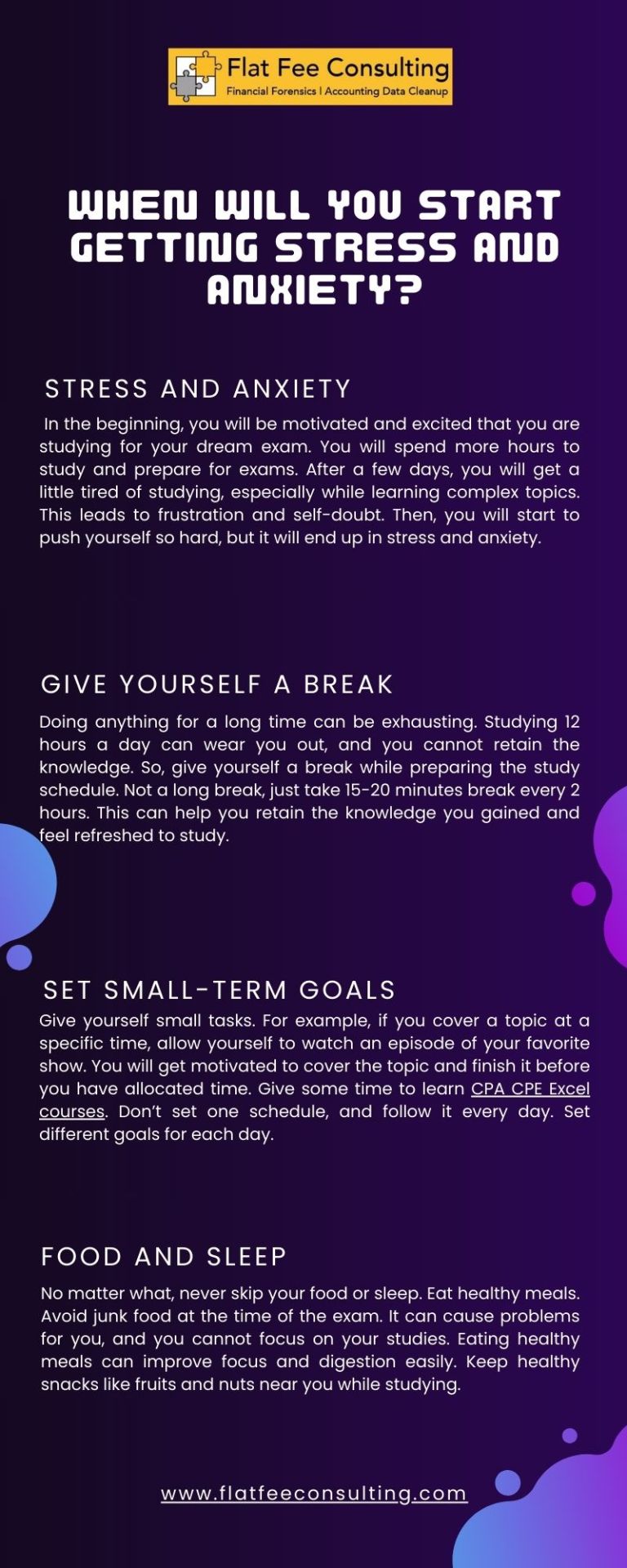

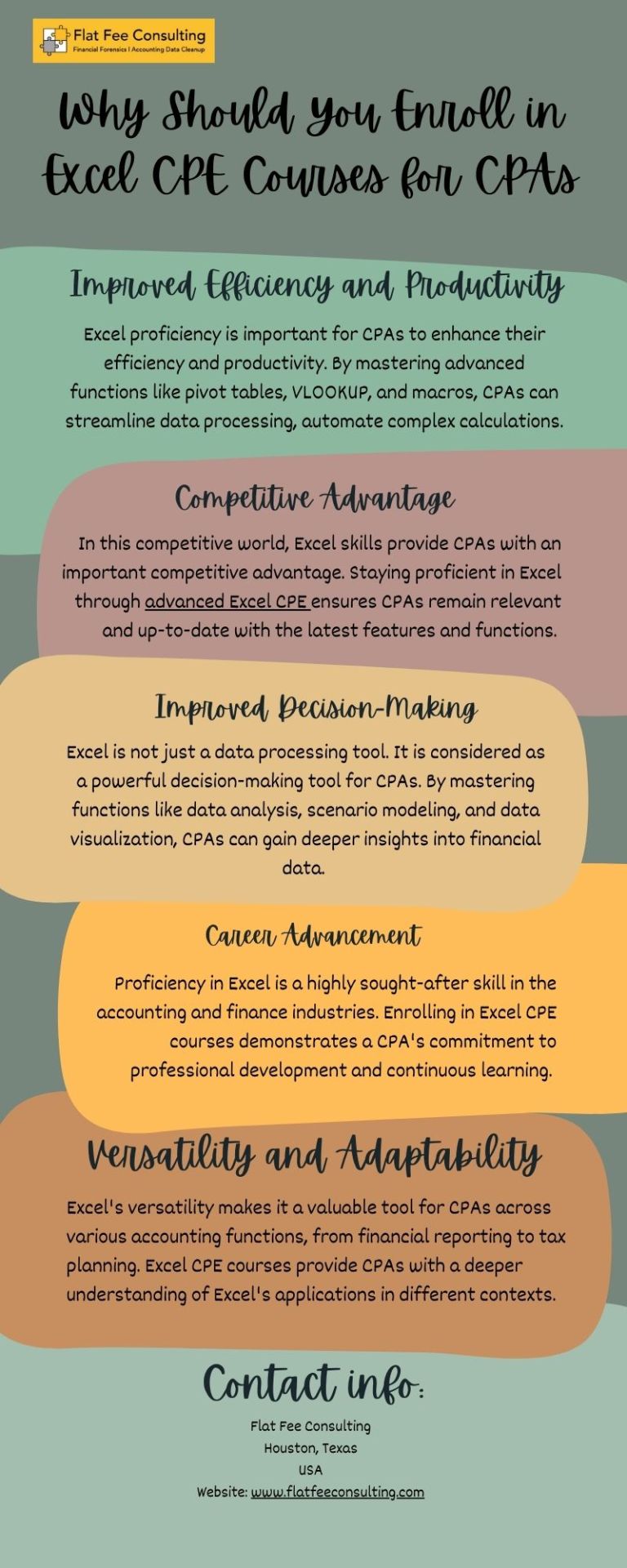

#CPA CPE Excel courses

Explore tagged Tumblr posts

Text

CPA CPE Excel courses - Flat Fee Consulting

Sometimes, things seem to be hard, but nothing is impossible. Don’t pressure yourself. Just follow these steps and believe in yourself. You can do well in the exam as you have attended Excel CPE classes and worked hard for your exam. So Be Confident and Do Well!

0 notes

Text

The Crucial Role of Ethics in a CPA’s Professional Development and Career

In the world of finance and accounting, where precision, trust, and transparency are paramount, ethics forms the cornerstone of a CPA's professional life. Certified Public Accountants bear a unique responsibility to uphold the integrity of financial systems and instill confidence in the stakeholders they serve.

This article delves into why ethics is such an essential part of a CPA's professional development and career, examining its role in fostering trust, ensuring compliance, and enabling sustainable growth in the financial industry.

Building and Sustaining Trust

Trust is the foundation upon which all client-CPA relationships are built. Clients, businesses, and the public rely on CPAs to provide accurate, unbiased financial information. Ethical behavior ensures that CPAs maintain this trust by:

Ensuring Accuracy: Ethical CPAs prioritize transparency and avoid misrepresenting financial data, safeguarding stakeholders from potential financial mismanagement.

Protecting Confidentiality: Adhering to ethical standards ensures that sensitive client information remains secure, reinforcing trust in professional relationships.

Compliance with Laws and Regulations

Ethics and compliance are inextricably linked. CPAs are bound by a code of conduct and must adhere to stringent regulatory frameworks, such as those outlined by the American Institute of CPAs (AICPA), the Sarbanes-Oxley Act, and other federal and state laws. Key ethical obligations include:

Independence: CPAs must remain impartial, avoiding conflicts of interest that could compromise their objectivity.

Integrity: Upholding honesty and fairness, even in the face of pressure or incentives to act otherwise.

Failing to meet these standards can result in severe penalties, including the loss of licensure, legal repercussions, and reputational damage.

Mitigating Risks in Financial Reporting

In an era of increasing scrutiny on financial practices, ethical lapses can lead to scandals that erode public confidence. By adhering to high ethical standards, CPAs mitigate risks associated with:

Fraud Detection and Prevention: Ethical CPAs proactively identify and address irregularities, ensuring that financial statements reflect an accurate and truthful account of a business's financial health.

Audit Integrity: Upholding ethical standards during audits ensures that any discrepancies or risks are reported transparently, protecting stakeholders from financial harm.

Navigating Complex Financial Decisions

The evolving financial landscape presents CPAs with increasingly complex scenarios requiring sound judgment. Ethical training equips CPAs with the tools to navigate these challenges, ensuring decisions are made in alignment with professional standards and societal expectations.

Balancing Stakeholder Interests: Ethical CPAs prioritize fairness and transparency when handling competing stakeholder demands.

Decision-Making Frameworks: Ethics provide a clear framework for addressing dilemmas, minimizing the risk of reputational or financial damage.

Ethics as a Pillar of Professional Excellence

For CPAs, ethics is not merely an abstract concept but a daily practice that underpins their professional identity. It is the guiding force that ensures they deliver value to clients, uphold the integrity of financial systems, and contribute to the public good. By committing to ethical principles, CPAs not only protect their careers but also play a vital role in maintaining trust and transparency in the global financial ecosystem.

Investing in ethics training, such as Ethics CPE courses, like the ones available at CPE Inc., is an essential step for any CPA seeking to elevate their career and uphold the highest standards of the profession.

For more information about CPE Courses and Best CPE For Cpas please visit:- CPE Inc.

0 notes

Text

Importance of Continuous Professional Education Post-CA

Becoming a Chartered Accountant (CA) is a significant achievement, but the journey doesn’t end there. The dynamic nature of the finance and accounting industry demands that professionals continuously update their knowledge and skills to stay relevant. Continuous Professional Education (CPE) is an essential aspect of a CA's career, enabling them to adapt to regulatory changes, technological advancements, and industry trends.

1. What is Continuous Professional Education (CPE)?

CPE refers to structured learning programs designed to enhance the knowledge and skills of professionals. For CAs, this involves attending workshops, webinars, and training sessions, or pursuing advanced certifications. CPE ensures that CAs remain competent and up-to-date with the latest developments in their field.

2. Why is CPE Important?

a) Keeping Up with Regulatory Changes

The regulatory environment in accounting and taxation is ever-evolving. From amendments in tax laws to updates in International Financial Reporting Standards (IFRS), staying informed is crucial. CPE programs help CAs understand these changes and apply them effectively in their practice.

b) Adapting to Technological Advancements

Technology has transformed the way businesses operate, and the accounting profession is no exception. Tools like cloud accounting, AI-driven analytics, and blockchain are becoming mainstream. Participating in CPE programs ensures that CAs are equipped to leverage these technologies for better efficiency and accuracy.

c) Enhancing Professional Skills

Beyond technical knowledge, CPE focuses on developing soft skills such as communication, leadership, and problem-solving. These skills are critical for career advancement, particularly for CAs aspiring to leadership roles.

d) Maintaining Professional Credibility

Clients and employers value professionals who stay informed and competent. By participating in CPE programs, CAs demonstrate their commitment to excellence, enhancing their credibility and reputation.

3. CPE and Exam Preparation Resources

For aspiring CAs, tools like CA Entrance Exam Books, Scanner CA Foundation Books, Scanner CA Intermediate Books, and Scanner CA Final Books are indispensable during their preparation phase. Similarly, for qualified CAs, CPE programs act as the next step in continuous learning, ensuring they remain relevant and effective in their roles.

4. Benefits of CPE

a) Improved Career Opportunities

Continuous learning opens up new career paths. Specialized certifications in areas like forensic accounting, international taxation, or financial planning can help CAs diversify their expertise and stand out in a competitive market.

b) Networking Opportunities

CPE programs often bring professionals together, creating opportunities to network and exchange ideas. These connections can lead to collaborations, mentorship, or new business opportunities.

c) Personal Growth

Learning new concepts and skills fosters personal growth and boosts confidence. CPE helps professionals approach challenges with a fresh perspective, making them more effective problem-solvers.

5. Popular CPE Programs for CAs

a) Workshops and Seminars

These programs focus on specific topics like GST, transfer pricing, or audit techniques. They are ideal for gaining in-depth knowledge in a short time.

b) Online Courses

Platforms like Coursera, edX, and ICAI’s e-learning portal offer flexible learning options. Topics range from advanced accounting to emerging technologies like blockchain.

c) Certifications

Certifications such as CPA (Certified Public Accountant), ACCA (Association of Chartered Certified Accountants), or CFA (Chartered Financial Analyst) add global recognition to a CA’s credentials.

d) Self-Study Programs

For self-paced learners, resources similar to CA Foundation Scanner, CA Intermediate Scanner, and CA Final Scanner can be used to deepen understanding of complex subjects.

6. Challenges in Pursuing CPE

a) Time Constraints

Balancing work and learning can be challenging, especially for practicing CAs. Prioritizing and scheduling time for CPE is essential.

b) Cost of Programs

Some CPE programs can be expensive. However, many organizations reimburse these costs as part of professional development initiatives.

c) Choosing Relevant Topics

With numerous options available, selecting programs that align with career goals and interests can be overwhelming. Identifying areas of improvement and industry demand can guide this decision.

7. How to Incorporate CPE into Your Career

a) Set Clear Goals

Identify your career aspirations and choose CPE programs that align with those goals.

b) Leverage Technology

Use online platforms and virtual webinars to learn at your own pace.

c) Track Progress

Maintain a log of completed CPE activities to track your learning journey and ensure compliance with mandatory requirements.

d) Stay Consistent

Make CPE a regular part of your professional life. Even short courses can accumulate into significant learning over time.

8. Conclusion

Continuous Professional Education is a cornerstone of success for Chartered Accountants. Just as resources like CA Entrance Exam Books, Scanner CA Foundation Books, CA Intermediate Scanner, and Scanner CA Final Books are vital during the exam phase, CPE is essential for professional growth post-qualification. By staying updated with industry trends, enhancing skills, and embracing lifelong learning, CAs can ensure their relevance and effectiveness in a rapidly changing professional landscape. Invest in CPE to not only advance your career but also contribute to the broader accounting and finance community.

0 notes

Text

CPE CPA

CPE CPA made simple. Access a wide range of courses to fulfill your continuing professional education needs. Our courses are hussle-free and offer flexibility to help you excel in your career ahead. Start Learning now!

Visit us at-

0 notes

Text

Understanding the Certified Public Accountant (CPA) Course: A Complete Guide

The Certified Public Accountant (CPA) course is a prestigious professional certification designed for individuals aspiring to become licensed accountants in the United States. Renowned for its rigor and comprehensiveness, the CPA course prepares candidates to excel in various critical areas such as accounting, auditing, taxation, and business law.

Whether you are considering CPA coaching in Chandigarh or elsewhere, it is essential to understand the course structure, eligibility, and requirements to successfully navigate the path toward certification.

Education Requirements for the CPA Course

To begin your journey toward CPA certification, a foundational step is meeting the education eligibility criteria. Most states require candidates to hold at least a bachelor’s degree from an accredited college or university. This degree must include a specified number of credit hours in accounting and related business subjects.

While the total required credit hours vary by state, many require around 150 credit hours to qualify for the CPA exam. These coursework requirements ensure that candidates possess a solid grounding in essential accounting principles and business knowledge before moving forward.

The CPA Exam: Four Critical Sections

The Uniform CPA Examination is a pivotal part of the certification process, designed to comprehensively test candidates’ proficiency across four distinct sections:

Auditing and Attestation (AUD): This section evaluates knowledge of auditing standards, procedures, and attestation engagements. Candidates must understand how to prepare, compile, and review financial statements according to professional standards.

Business Environment and Concepts (BEC): BEC focuses on business-related concepts, including economics, financial management, information technology, and business law. This section tests candidates on their understanding of the broader business environment affecting accounting practices.

Financial Accounting and Reporting (FAR): FAR covers financial accounting principles and the preparation of financial statements for various entities. Candidates are tested on topics such as accounting standards and financial reporting frameworks.

Regulation (REG): REG assesses candidates on federal taxation, business law, ethics, and professional responsibilities. It ensures candidates understand regulatory frameworks governing the accounting profession.

Candidates are required to pass all four sections within a state-specific timeframe, highlighting the importance of thorough preparation and time management.

Work Experience: Gaining Practical Accounting Skills

In addition to education and examination requirements, relevant work experience is crucial for CPA certification. Most states mandate candidates to accumulate one to two years of professional accounting experience under the supervision of a licensed CPA.

This hands-on experience helps candidates apply theoretical knowledge in real-world settings, building critical skills that enhance their competence and readiness for professional practice.

Ethics Exam: Upholding Professional Integrity

Many states require candidates to pass an ethics exam as part of the CPA certification process. This exam covers ethical standards and professional conduct expected of CPAs, emphasizing the importance of integrity, objectivity, and responsibility in accounting practice.

The ethics requirement reinforces the commitment of CPAs to uphold public trust and maintain the profession’s reputation.

Continuing Education: Lifelong Learning for CPAs

Becoming a CPA is not the final step; maintaining the license involves ongoing continuing professional education (CPE). CPAs must regularly update their knowledge of evolving accounting standards, regulations, and best practices to remain competent and effective in their roles.

CPE requirements vary by state but generally include completing a specified number of education hours every licensing period to ensure continuous professional development.

State-Specific Requirements: Importance of Local Guidelines

While the core components of the CPA course are consistent, state-specific variations exist regarding eligibility, exam administration, experience, and fees. Each state’s Board of Accountancy establishes its own rules, so candidates must consult their local board to understand precise requirements.

For those seeking CPA coaching in Chandigarh or other locations, it’s important to align preparation with the regulations of the state where certification is pursued.

Conclusion

The CPA course offers a robust pathway for aspiring accountants to develop expert knowledge and gain licensure to practice professionally. Understanding the education prerequisites, exam structure, work experience, ethics, and continuing education requirements is key to successfully earning and maintaining the CPA designation.

By choosing the right coaching, committing to disciplined study, and adhering to state-specific guidelines, candidates can confidently achieve their CPA goals and open doors to rewarding careers in accounting and finance.

0 notes

Text

🔊Ethics and Conducts for Kansas CPAs

➡️myCPE presents an enlightening Ethics CPE course that delves into the ethical standards that every CPA in Kansas should uphold. Regardless of whether you work in public, governmental, or private accounting practices, this course is designed to equip you with the necessary knowledge to navigate the complex landscape of ethical decision-making.

➡️Our course is rooted in the AICPA Code of Professional Conduct, which sets the gold standard for CPAs.

➡️This ethics course, sheds light on some of the most critical points, including: Integrity: The backbone of ethical conduct. Objectivity and Independence: Crucial elements for maintaining trust. The SEC's Auditor Independence Requirements: Understanding the expectations. Alternative Practice Structures (APS): Expanding horizons and exploring new possibilities. Professional due care: Elevating your commitment to excellence. Applicability of AICPA Code of Ethics: Understanding how it impacts your daily work.

➡️Stay up to date with the latest developments, tackle ethical dilemmas, and enhance your decision-making skills.

➡️Subscribe today to myCPE for the comprehensive packages and unlock the full potential of CPE packages for Kansas CPAs and complete your requirements in one go. Embrace ethics as the guiding force for a successful and trusted CPA career. Enroll in our Ethics and Conducts for Kansas CPAs course today! #CPAethics #KansasAccountants #EthicsMatters #ProfessionalExcellenceSee less

0 notes

Text

US CPA Career: 9 Top Skills that Certified Public Accountants Need

Becoming a Certified Public Accountant (CPA) can be a significant achievement in one's career. It opens up various challenging job opportunities and leadership roles, including internal auditors, IT managers, tax accountants, financial advisors, chief financial officers, and CEOs of major corporations, both for entry-level and experienced professionals.

To play a more substantial role in a company's financial success, employers expect CPAs to possess additional skills and attributes, especially when hiring them for management positions. Passing the CPA exam is crucial for CPAs to establish their credibility and expertise in finance and accounting. However, to thrive in this industry, CPAs must possess the ability to handle complex tasks with speed and accuracy, continuously develop their CPA skills, and acquire new ones.

Therefore, CPAs need to acquire nine essential skills to succeed in their careers amidst the increasing demand for financial and accounting professions.

These skills are:

Up-to-date tax knowledgeStaying informed about tax laws and mandates is essential for accounting professionals to provide effective services to clients and organizations. To do so, everyone from financial planners to payroll administrators and tax accountants should participate in continuing professional education (CPE) courses related to federal and state taxation, as tax regulations frequently change. Business awareness

Having a strong understanding of a business's profile and staying informed about economic and financial events that can affect the organization is crucial for CPAs. Possessing business awareness skills allows CPAs to comprehend the inner workings and relationships among different departments within the company, which can enhance their overall effectiveness and success. FlexibilityBeing adaptable is a vital quality for accounting professionals to provide excellent service to their clients. They should be capable of meeting deadlines while being open to change, whether it is due to the introduction of new software, a change in tax policy, or a transition in upper management. Accounting professionals should prepare themselves as much as possible for potential changes within their workplace. Leadership skills CPAs working in large firms often hold key mid to upper-level management positions that require them to be accountable for the organization's success. It is essential for these professionals to exhibit strong leadership qualities, demonstrating the ability to manage and motivate others while maintaining focus on business objectives, whether working for a public or private company. Therefore, developing leadership skills is critical for CPAs who wish to excel in their roles. Technical abilitiesAccounting and financial professionals must keep up with the rapid technological changes in their workplaces, as automation and other technology trends are revolutionizing the accounting and finance industries. Thus, CPAs need to be proficient in advanced Excel and modeling techniques, as well as familiar with ERP tools and query languages (e.g., SQL) to effectively utilize these technological advancements. Additional auditing training While auditing is one of the four sections of the CPA exam, having a strong understanding of this area is critical for accountants seeking to assist companies in evaluating their performance. As companies look to internal auditors to enhance efficiency, manage risks, and evaluate IT systems, accountants may want to consider pursuing additional auditing training to meet these demands effectively. Data AnalyticsCloud computing has made it possible for accountants to access financial information in real time, which underscores the importance of data analytics skills. By enhancing their ability to analyze data, CPAs can provide clients with valuable insights into their financial information, gain a better understanding of the company's overall financial outlook, reduce risk, and enhance business processes. Time management skillsGood time management skills are crucial for CPAs to achieve success in their work. These skills include effective prioritization, organization, scheduling of meetings and tasks, managing interruptions, and delegating tasks to optimize productivity and output in the long run.

How to gain new skills as a CPA?

To enhance your skills as a CPA, it's essential to identify professional development opportunities provided by your employer and inquire if they offer financial support or flexibility to pursue additional training. If the skills you acquire align with your employer's needs, they may be willing to provide the necessary resources.

In addition to technical accounting skills, it's crucial to develop managerial and business acumen to advance in your CPA career. Improving decision-making abilities and cultivating self-awareness are excellent ways to expand your skillset and increase job satisfaction. Hence, accounting professionals need more than just qualifications and certifications to excel in their roles.

To learn more about the CPA course and the skills required to succeed, you can contact Miles Education or email them at [email protected].

0 notes

Text

How to Become a CPA

You are probably wondering how to become a CPA. This article will show you the basics. Once you've graduated from accounting school, you can apply to join various firms that specialize in tax, audit, accounting, and financial services. As you're studying, keep in mind that some jurisdictions will allow you to bring your calculator to the exam, so make sure yours is in good condition and is fully charged. Ultimately, a CPA license is an emblem of excellence, a mark of achievement, and can lead to larger opportunities. Just be sure to take action, work hard, and believe you can become a CPA.

You can take a CPA exam to obtain your license. This exam is similar to a college-level exam but more difficult. While studying for the CPA Exam is a full-time job, you can still find time to complete a review course. CPA review courses are essentially a library of information aimed at helping you pass the CPA Exam. In addition to a study manual, you can purchase a textbook that describes the ethical duties and responsibilities of a CPA. It is not required in all states, but it is common.

To become a CPA, you need to meet your state's educational and experience requirements. State boards issue CPA licenses and the requirements for taking the CPA exam and becoming licensed vary from state to state. In Ohio, for example, you must complete four college accounting semesters. You should also check the residency, experience, and education requirements in your state. In addition to this, you should check with your state board for the CPA examination.

You should get your bachelor's degree before applying for the CPA exam. The degree is an opportunity to build a foundational business, finance, and computer concepts. Undergraduate accounting programs also teach you various other useful skills, including microeconomics, business law, and marketing principles. These skills are necessary for CPAs in any field and will help you stand out among your competition. So, how do you prepare to become a CPA?

Generally, a CPA license requires one to two years of full-time employment under a licensed CPA before the exam is taken. You can choose to complete this experience part-time or full-time, depending on your availability. Once you're licensed, you must earn 40 hours of CPE credits every year. However, the time it takes to become a CPA depends on your skills and how fast you learn. You should also take time to prepare for the CPA exam.

You can spend two to seven years studying to become a CPA, though it will probably take longer. As of this writing, you'll need at least a bachelor's degree and up to one to two years of work experience. However, you can also opt to study while completing your master's degree. Depending on your situation, the total time for your CPA exam study can range from a few months to two years.

You can choose to attend a college or university that offers a rigorous accounting program. FGCU emphasizes advanced technical study, effective accounting technologies, and communication skills. FGCU also offers an optional concentration in Analytics. Regardless of the program you choose, all students complete core courses, advanced accounting, and nine credit hours of electives. It is a good idea to join an association while studying to make your dream a reality.

Once you pursue a CPA, you'll need to raise your funds. Besides the college or university fees, you'll need to purchase the review course materials and take the exams. The entire process can cost anywhere from thirty to sixty thousand dollars. Therefore, the additional expense of a review course may be around US$3,000. You'll also need to pay for a license to practice and a continuing education course.

Ultimately, becoming a CPA requires you to pass an important professional exam, and it's also an excellent career choice. Certified public accountants typically earn above-average salaries and are in high demand. They can pursue a wide variety of professional roles and earn more money. You should plan on taking a challenging CPA exam once you're ready. These exams are essential for anyone who wants to work in the field.

0 notes

Text

Advanced Excel CPE - Flat Fee Consulting

In a CPA's hectic schedule, investing valuable time in useless classes and courses spread over several platforms is simply inefficient. So, avoid the time-consuming search! Investing your time and money in Excel CPE classes is worthwhile because it promotes job advancement. Join the best Excel CPE course and take your career to the next level in the ever-evolving accounting profession.

0 notes

Text

What Are CPE Credits for CPAs and How Do You Earn Them?

Continuing Professional Education (CPE) credits are essential for Certified Public Accountants to maintain their licenses and stay up to date with industry developments.

Whether you're a newly certified CPA or a seasoned professional, understanding how to earn and manage CPE credits is crucial for maintaining compliance with state board regulations and professional organizations.

Understanding CPE Credits

CPE credits are units of measurement used to quantify professional education and training for CPAs. These credits help accountants remain knowledgeable about tax laws, financial reporting standards, ethical considerations, and other relevant topics in the accounting industry. Most CPAs are required to earn a specific number of CPE credits within a defined reporting period, usually one to three years, depending on state regulations and professional membership requirements.

Why Are CPE Credits Important?

Regulatory Compliance: State boards of accountancy require CPAs to earn CPE credits to maintain their licenses.

Professional Growth: Continuing education helps CPAs stay informed about changes in accounting standards, tax laws, and technology.

Career Advancement: Keeping up with CPE requirements ensures CPAs remain competitive in the job market.

Ethical Responsibilities: Many CPE programs include ethics courses that reinforce the importance of professional integrity and ethical decision-making.

How to Earn CPE Credits

CPAs can earn CPE credits through various methods, including online courses, live seminars, webinars, and self-study programs. Below are the most common ways to earn CPE credits:

Online CPE Courses

Online CPE courses provide a flexible and convenient way for CPAs to earn credits from anywhere. Providers like CPE Inc. offer a wide range of courses covering essential topics such as:

Taxation

Auditing

Financial Reporting

Business Law

Ethics

Technology in Accounting

Many online courses are self-paced, allowing CPAs to learn at their own convenience and complete courses based on their schedules.

Live Webinars and Virtual Conferences

Attending live webinars and virtual conferences allows CPAs to interact with industry experts, ask questions, and participate in discussions. Many organizations, including CPE Inc. offer live CPE events that provide up-to-date information on regulatory changes and accounting best practices.

In-Person Seminars and Workshops

For CPAs who prefer a traditional classroom setting, in-person seminars and workshops offer structured learning environments. These events are often conducted by professional organizations and accounting firms to provide deep insights into specific accounting and financial topics.

Professional Conferences

Accounting and finance conferences often feature keynote speakers, panel discussions, and specialized training sessions that qualify for CPE credit. These events provide an excellent opportunity for networking while earning required credits.

On-the-Job Training and Firm-Sponsored Programs

Some employers provide in-house training programs that qualify for CPE credit. These programs cover company-specific policies, financial regulations, and industry trends that help CPAs enhance their expertise.

CPE Credit Requirements

CPE credit requirements vary by state and professional organization. CPAs should check with their state board of accountancy and other relevant institutions to ensure compliance. Here are some general guidelines:

Annual or Biennial Reporting Periods: Most states require CPAs to complete CPE credits within a one-to-three-year reporting cycle.

Minimum Credit Requirements: The total number of required credits typically ranges from 40 to 120 hours per cycle.

Ethics Requirement: Many states mandate that CPAs complete ethics training as part of their CPE credits.

Technical and Non-Technical CPE: Some state boards differentiate between technical courses (e.g., accounting, auditing, tax) and non-technical courses (e.g., leadership, communication skills).

Earn Your CPE Credits Today

CPE credits are a fundamental requirement for CPAs to maintain their professional licenses and stay ahead in the evolving field of accounting.

By utilizing resources such as CPE Inc., CPAs can conveniently earn credits through online courses, webinars, and self-study programs. Understanding CPE requirements and taking proactive steps to complete courses ensures CPAs remain compliant, knowledgeable, and competitive in their profession.

To explore high-quality CPE courses, visit CPE Inc. and start earning your credits today!

For more information about Ethics CPE Webinar and Accounting CPE please visit:- CPE Inc.

0 notes

Text

US CPA Career: 9 Top Skills that Certified Public Accountant Need

US CPA Career 9 Top Chops that Certified Public Accountant Need Getting a Certified Public Accountant (CPA) can be an essential corner in your career path. With CPA credentials, there are numerous grueling jobs and leadership places for both entry- position and endured. For illustration, moment’s CPAs are working as internal adjudicators, IT directors, duty accountants, fiscal counsels, principal fiscal officers, and CEOs of major pots.

Businesses also want their CPAs to play a more significant part in their fiscal success and make moxie to come more fiscal counsels. Thus, when hiring CPAs, especially for operation positions, employers will look for fresh chops and attributes. Passing the CPA test, CPAs have acquired credibility and moxie to work in finance and account. Of course, numerous factors help in the success of a CPA career. One of them is the capability to handle complex tasks with speed and delicacy. So, they must also continually develop necessary CPA chops, as well as acquire new chops.

What are the top chops demanded by CPAs in this adding demand for fiscal or counting careers? Following are nine chops that CPA professionals need to acquire to succeed in their careers. Up to date duty knowledge Successful account professionals stay streamlined with duty laws and authorizations, which change constantly. To help the guests and associations, everyone from payroll directors to duty accountants and fiscal itineraries should take continuing professional education (CPE) courses in civil and state taxation.

Business mindfulness Know the business profile and be well apprehensive of the profitable and fiscal events that impact the business. Hence, business mindfulness is a must- have skill for CPAs. The better you understand how an association’s colorful departments operate and interact, the more successful you are.

Inflexibility To give better services to guests, counting professionals must be flexible in their work and meet deadlines. The change could be related to new software, a new duty policy, or a shift in top operation. Prepare yourself as much as you can for the changes about to roll out in a plant.

Leadership chops Certified Public Accountants (CPAs) who work in large enterprises tend to lead medial to upper- position operation positions. They need to maintain compass, responsibility, and passion in business operation, whether they handle a public or private company. Therefore, CPA professionals must develop their leadership chops. Communication Chops A CPA must be professed in their profession and communicate effectively with their guests and give them the right advice. In addition, a CPA must have strong communication chops to convey information and sapience into their work product, whether it's fiscal statements, duty returns, or other documents.

Specialized capacities It’s getting decreasingly important for fiscal and account professionals to abide by the technological changes in their plant. Accounting robotization and other technology trends are revolutionizing all the account and finance work. For this reason, CPAs need to learn about advanced excel and modeling ways, ERP tools, and query languages (Eg SQL).

Fresh auditing training Utmost CPAs have good knowledge of auditing since it's one of the four sections of the CPA test. But, accountants who want to help companies and estimate the company’s performance should pursue fresh training in auditing. This is because businesses want internal adjudicators to increase effectiveness, manage threat and estimate IT systems.

Data analytics Pall computing allows accountants to have fiscal information streamlined in real- time. Perfecting data analytics chops helps Certified Public Accountants give guests more precious perceptivity into their data. They will also have a deeper understanding of the overall fiscal outlook, reduce threat, and ameliorate business processes. Time operation chops To be a successful CPA, it's essential to have good time operation chops to prioritize their work more. Time operation chops include prioritization, getting organized, cataloging meetings and tasks, handling interruptions, and delegating tasks to help CPAs produce a better affair in the long run.

How to gain new chops as a CPA? You can gain new chops or expand your chops by knowing what professional development openings are presently handed by your employer. Ask your director if the business would be willing to give fiscal support or offer you the inflexibility to pursue fresh training. Still, there's a chance the company will be helping you gain those chops by furnishing the coffers, If the chops you want to earn can profit your employer.

Of course, not all CPA chops can be tutored. To learn directorial chops or ameliorate your business knowledge, consider strengthening your decision- making chops and cultivating tone- mindfulness.. These fresh chops can help you reach the CPA career chart you have set and increase your job satisfaction. In this way, account professionals need further than just qualifications or instruments to do a better job for career success. Now it's your time to ace the chops to make your CPA career everything you want it to be. For further information on the CPA course and its required chops, please feel free to Communicate Simandhar Education@ 91778027338 8 or post us [email protected].

0 notes

Text

US CPA Career: 9 Top Skills that Certified Public Accountant Need

US CPA Career: 9 Top Skills that Certified Public Accountant Need

NOVEMBER 22, 2021

Becoming a Certified Public Accountant (CPA) can be an essential milestone in your career path. With CPA credentials, there are many challenging jobs and leadership roles for both entry-level and experienced. For example, today’s CPAs is working as internal auditors, IT managers, tax accountants, financial advisors, chief financial officers, and CEOs of major corporations.

Businesses also want their CPAs to play a more significant role in their financial success and build expertise to become better financial advisors. Therefore, when hiring CPAs, especially for management positions, employers will look for additional skills and attributes.

Passing the CPA exam, CPAs have acquired credibility and expertise to work in finance and accounting. Of course, many factors help in the success of a CPA career. One of them is the ability to handle complex tasks with speed and accuracy. So, they must also continually develop necessary CPA skills, as well as acquire new skills.

What are the top skills needed by CPAs in this increasing demand for financial or accounting careers? Following are nine skills that CPA professionals need to acquire to succeed in their careers.

· Up to date tax knowledge

Successful accounting professionals stay updated with tax laws and mandates, which change frequently. To help the clients and organizations, everyone from payroll administrators to tax accountants and financial planners should take continuing professional education (CPE) courses in federal and state taxation.

· Business awareness

Know the business profile and be well aware of the economic and financial events that impact the business. Hence, business awareness is a must-have skill for CPAs. The better you understand how an organization’s various departments operate and interact, the more successful you are.

· Flexibility

To provide better services to clients, accounting professionals must be flexible in their work and meet deadlines. The change could be related to new software, a new tax policy, or a shift in top management. Prepare yourself as much as you can for the changes about to roll out in a workplace.

· Leadership skills

Certified Public Accountants (CPAs) who work in large firms tend to lead mid to upper-level management positions. They need to maintain scope, accountability, and passion in business management, whether they handle a public or private company. Thus, CPA professionals must develop their leadership skills.

· Communication skills

A CPA must be skilled in their profession and communicate effectively with their clients and give them the right advice. In addition, a CPA must have strong communication skills to convey information and insight into their work product, whether it is financial statements, tax returns, or other documents.

· Technical abilities

It’s becoming increasingly important for financial and accounting professionals to abide by the technological changes in their workplace. Accounting automation and other technology trends are revolutionizing all the accounting and finance work. For this reason, CPAs need to learn about advanced excel and modeling techniques, ERP tools, and query languages (Eg: SQL).

· Additional auditing training

Most CPAs have good knowledge of auditing since it is one of the four sections of the CPA exam. But accountants who want to help companies and evaluate the company’s performance should pursue additional training in auditing. This is because businesses want internal auditors to increase efficiency, manage risk and evaluate IT systems.

· Data analytics

Cloud computing allows accountants to have financial information updated in real-time. Improving data analytics skills helps Certified Public Accountants give clients more valuable insights into their data. They will also have a deeper understanding of the overall financial outlook, reduce risk, and improve business processes.

· Time management skills

To be a successful CPA, it is essential to have good time management skills to prioritize their work better. Time management skills include prioritization, getting organized, scheduling meetings and tasks, handling interruptions, and delegating tasks to help CPAs create a better output in the long run.

Now it is your time to ace the skills to make your CPA career everything you want it to be. For more information on the CPA course and its required skills, please feel free to Contact Simandhar Education @ +91 7780273388 or mail us at [email protected].

0 notes

Text

CPE CPA

Fulfill your CPE CPA requirements hassle-free. Our courses offer flexibility and quality to help you excel in your accounting profession. Enhance your skills today with CPE Credit!

Visit us at-

0 notes

Link

Well, this is a difficult question. CPE courses for CPAs are all desirable but of course this varies according to the feasibility of an accountant and his accessibility. CPE courses for CPAs are so much helpful and none of them is unimportant or unworthy. It is just the matter of an accountant’s preferences and his level of knowledge. Accounting CPE courses and CPE webinars are of great value because they induce excellence in accountants.

#Cpe Solutions#Cpe Online#Cpe Courses For Cpa#Online Cpe#Best Online Cpe Courses#Cpe Courses Online#Cpe Online Courses#Cpe Webinars#Online Cpe Courses#Accounting Seminars#Cpe Self Study

0 notes

Text

CPA USA: Course details, Eligibility, Benefits and Fee structure

CPA USA

CPA USA (Certified Public Accountant) is the highest standard of competence in the field of Accountancy across the globe. The exam is administered by the American Institute of Certified Public Accountants (AICPA), which is the world’s largest accounting body. If you ever consider a career in accounting and want an illustrious career, CPA USA Course is the best option for you. CPAs are globally recognized as premier accountants and are hired across industries throughout the world.

What is CPA USA?

Certified Public Accountant (CPA) is the title of qualified accountants in numerous countries in the English-speaking world. In the United States, the CPA is a license to provide accounting services to the public. It is awarded by each of the 50 states for practice in that state. Additionally, almost every state (49 out of 50) has passed mobility laws to allow CPAs from other countries to practice in their state. State licensing requirements vary, but the minimum standard requirements include passing the Uniform Certified Public Accountant Examination, 150-semester units of college education, and one year of accounting related experience.

Continuing professional education (CPE) is also required to maintain licensure. Individuals who have been awarded the CPA but have lapsed in the fulfillment of the required CPE or who have requested conversion to inactive status are permitted to use the designation "CPA Inactive" or an equivalent phrase in many states. In most U.S. states, only CPAs are legally able to provide attestation (including auditing) opinions on financial statements. Many CPAs are members of the American Institute of Certified Public Accountants and their state CPA society.

State laws vary widely regarding whether a non-CPA is even allowed to use the title "accountant." For example, Texas prohibits the use of the designations "accountant" and "auditor" by a person not certified as a Texas CPA, unless that person is a CPA in another state, is a non-resident of Texas, and otherwise meets the requirements for practice in Texas by out-of-state CPA firms and practitioners.

Many other countries also use the title CPA to designate local public accountants.

CPA USA Course Eligibility

To appear for the CPA USA Examination, the candidates must have any of the below qualifications

· Member of the Institute of Chartered Accountants of India.

· Member of the Institute of Cost and Works Accountants in India.

· Member of the Company Secretaries in India.

· Master of Commerce

· MBAs

Quite a few states also accept Indian CA's with B.Com in the U.S. However. The exact criteria will vary from State to State. You can get in touch with EduPristine CPA USA Course, a recognized training provider in association with Becker for further details.

CPA USA Exam application process and fees

Sometimes, the most tedious part of writing an exam is not the study but the application process! Application for the CPA USA exam is a different process from applying for a CPA license. Once you have cleared the uniform CPA USA exam with a minimum passing score of 75, you are eligible for a license as a CPA and can start the application process for a CPA license.

Once you have analyzed the minimum eligibility criteria for the jurisdiction you wish to apply for, you need to pay the CPA USA application and examination fees. The CPA application fees should be submitted with the application and the other required documents.

CPA USA Course Syllabus

The CPA USA exam syllabus is broken down into four sections. Each of these sections has their syllabus and exam which you need to be proficient in. The four parts of the CPA USA exam are as follows:

· Auditing and Attestation (AUD),

· Financial Accounting and Reporting (FAR)

· Regulation (REG),

· Business Environment Concepts (BEC)

Here are the direct links to download the AICPA revised new syllabus 2019. Huge number of aspirants are preparing for the Certified Public Accountant (CPA) in various countries. The CPA USA exam question paper covers multiple-choice questions, written communication and task-based simulations. Candidates need to concentrate more on exam content provided by Becker to score more marks in the examination.

CPA Course Exam and pass rates

The CPA USA exam scoring is done on an independent basis for every candidate. With this kind of scoring pattern, the candidate is adjudged on the grounds of knowledge levels, skills, and analytic approach. Over the years, the number of CPAs has been on the rise. Here's a table that gives overall CPA USA Exam pass rates section-wise, for section-wise analysis go to

(CPA Exam pass rates for the year 2015)

The difficulties and challenges you face to be a CPA are all paid off once it is attained. CPAs are in demand in every industry because of the extensive knowledge and high professional standards that a CPA has to maintain.

C.A v. US CPA

CPA USA Course Benefits

The CPA USA course is considered as the ultimate qualification that has unlimited possibilities to show your potential in the accounting field. Listed below are the specific benefits of CPA USA course.

International Recognition: Excellent opportunity for C.A., ICWA, C.S., LLB, MBA (Finance), M.com and Commerce Graduates who aspire for an International Certification. The exam is administered by the AICPA, which is the world's largest accounting body.

Careers Opportunities: After passing the CPA exam candidates start their career with accounting & Auditing Firms, Research firms, Investments banks, Hedge Funds, Private equity firms, Commercial banks, Mutual funds, Merger & Acquisition etc.

Flexibility & Ease: It's a Single Level Online exam with just 4 Papers; one can quickly clear the exams in less than a year.

Must do for CA, M.Com and Commerce Graduates: There are very few International certifications that you can give along with our job and get such high job potential.

Academic Excellence: A CPA qualification is similar to the Indian CA qualification. In addition to the C.A. qualification, a CPA will know US GAAP, GAAS and U.S. federal taxation and business laws. This gives a great advantage to a CPA when working with U.S. Based Financial firms or Indian firms working for U.S. clients.

CPA USA Exam Fees

How much is the CPA USA Exam fee? Well, we can only answer that question by reviewing a series of CPA USA exam costs.

When you apply to take the CPA USA Exam, you must pay an application fee and an examination fee. Depending on your state, you may also have to pay a registration fee at some point. The boards can charge whatever they want for these fees, but 50 out of 55 adhere to NASBA’s examination fee schedule.

CPA Exam Application Fee

You must pay an initial application fee to your state board. To give you a sense of how much this fee will cost, I’ll discuss some examples.

Of the jurisdictions that follow NASBA's fee schedule example, the application fee ranges from a mere $10 (thank you, West Virginia) to a monstrous $245 (no thank you, Montana). Of the jurisdictions that developed their fee schedule, the lowest application fee is $150 (a tie between Oregon and the U.S. Virgin Islands). And though their application fees may be high, some of these rogue state boards charge lower examination fees than their NASBA-influenced counterparts.

And then, there's Wisconsin, which is in a league of its own. Wisconsin has combined its application and examination fee to charge $412.40 for one section (slightly less than Montana) and $1,106.60 for all four parts (that's entering good CPA review course territory).

This is a one-time fee, but you’ll have to pay it again if your state board rejects your application or if you let your Authorization to Test Notice (ATT) expire.

Some common FAQs asked by the students-

1. Is there any value for CPA USA?

US CPA course gives you in-depth knowledge on areas related to US GAAP, U.S. Tax, U.S. Audit. It will help you all to increase your work areas, and you will be able to deal with more and more clients.

2. How to become a CPA USA?

Becoming a CPA might be the smartest career decision of your life, but it's not an easy one. Even if you're already a working accountant, also if you have your bachelor's degree in business or accounting, you've still got a few hurdles to leap before you can hang your state license on the wall of your own private, public accounting practice. You need to understand how the CPA requirements by state differ, so you can know the steps to becoming a CPA in your home state.

3. How many questions are on the CPA USA Exam?

You will see that each section has a large number of Multiple-choice questions divided into two tests. Test number 1 in the Auditing and Attestation section has 36 Multiple-choice questions, and test number 2 in the same division has another 36 Multiple-choice questions.

4. How many hours to study for the CPA USA Exam?

In general, it's recommended that CPA candidates study for 300-400 hours for the CPA exam in total to ensure they pass. Essentially, this equates to about 80-100 hours of CPA study hours for each exam section.

5. Is CPA considered as a master's study?

No, CPA is not a masters degree. CPA is an abbreviated form for Certified Public Accountants. It is a designation given to those who pass the CPA exam and meet the experience requirements.

We'd love to call it a journey, or an adventure, but you're not returning the One Ring to Mount Doom; you've got to dot your I's, cross your T's, and make sure you have met all the requirements, because the National Association of State Boards of Accountancy (NASBA), and the state boards themselves, don't fool around. They are your gatekeepers to a career as a CPA.

STEPS TO BECOMING A CPA: THE 3 E'S

CPA USA requirements boil down to the 3 E's: Education, Exam, and Experience. You must be crystal clear about a couple of things regarding the 3 E's.

Conclusion

If you have a master's degree in the relevant field, I encourage you to take the CPA exam right now, as you are lucky few who can get qualified for this exam in your country.

For BCOM + CA candidates, although I don't have a solution for you, Leslie-Anne Roger at CPA excel may still be able to help, depending on your situation. She has been assisting BCOM + CA candidates primarily over the years to sit for the exam. Leslie-Anne charges a fee in the form of a CPA excel course, but there is a 95% refund should the application is declined. Please find below my interview with her, or you can reach her directly.

Good luck!

0 notes