#CPE CPA

Explore tagged Tumblr posts

Text

CPE CPA

CPE CPA made simple. Access a wide range of courses to fulfill your continuing professional education needs. Our courses are hussle-free and offer flexibility to help you excel in your career ahead. Start Learning now!

Visit us at-

0 notes

Text

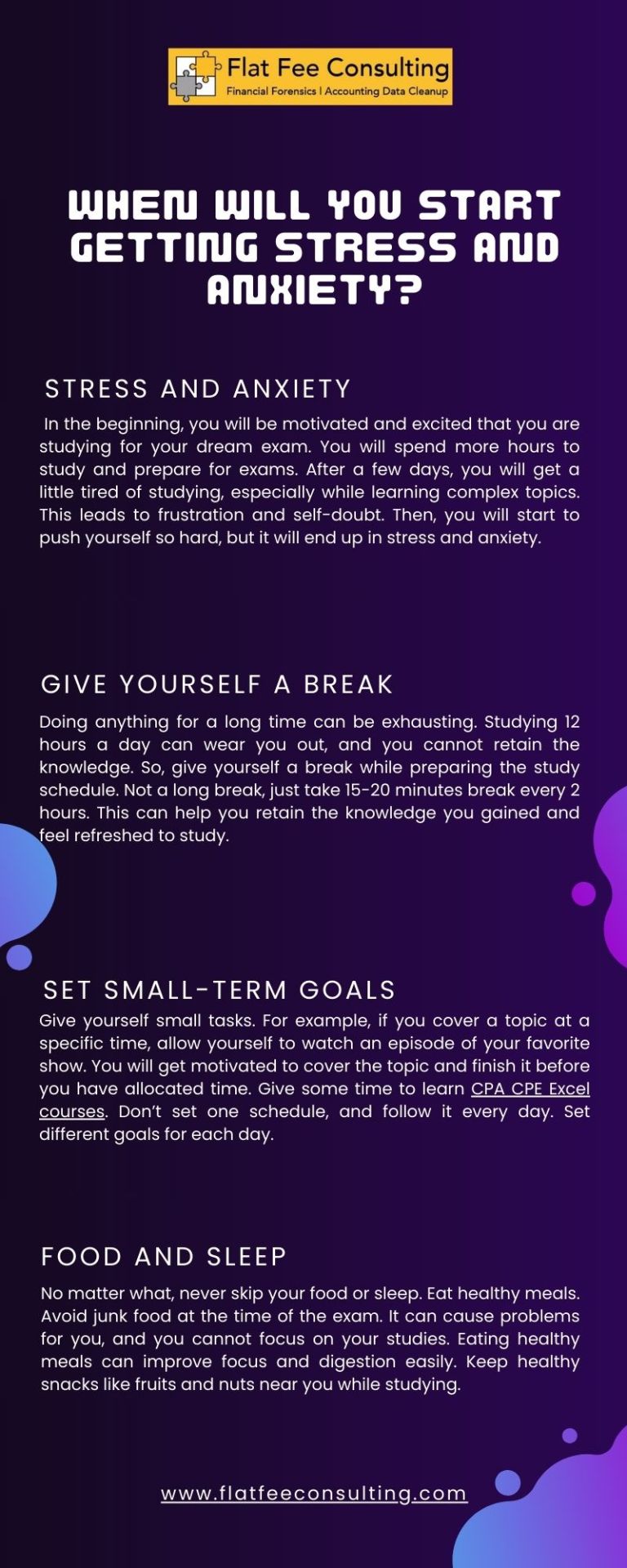

CPA CPE Excel courses - Flat Fee Consulting

Sometimes, things seem to be hard, but nothing is impossible. Don’t pressure yourself. Just follow these steps and believe in yourself. You can do well in the exam as you have attended Excel CPE classes and worked hard for your exam. So Be Confident and Do Well!

0 notes

Text

The Importance of Ethics for Certified Public Accountants

Finance is not just a world of numbers and transactions; it is a domain deeply entrenched in trust, responsibility, and most importantly, ethical conduct.

Certified Public Accountants (CPAs), as major players in this field, bear the substantial burden of maintaining integrity and ethical standards. The importance of ethics CPE for CPAs cannot be overstated, as their decisions and actions have significant impacts on clients, companies, and the economy at large.

This article explores why ethics are so critical for CPAs and why this is particularly significant in the finance sector.

Upholding Public Trust

The finance sector fundamentally operates on the premise of trust. Investors, stakeholders, and the general public rely on the accuracy and honesty of financial statements and reports prepared by CPAs.

Ethical breaches, such as misrepresentation or fraud, can shatter this trust, leading to a loss of confidence not only in the individual CPA but also in the entire financial system. The collapse of Enron and the subsequent fallout of Arthur Andersen is a stark reminder of the catastrophic consequences that can result from ethical failings.

Compliance and Regulation

The finance sector is heavily regulated to protect the interests of all stakeholders involved. CPAs are expected to navigate a complex landscape of laws and regulations, ensuring that their practices comply with legal standards and ethical principles.

Ethical conduct goes beyond mere legal compliance; it involves upholding the spirit of the law, promoting transparency, and preventing any form of financial misdeeds. This is vital in preventing financial scandals, which can have widespread repercussions on the economy and society.

Fiduciary Responsibility

CPAs often act in a fiduciary capacity, meaning they are entrusted with managing the assets or interests of others. This role comes with a high level of responsibility and requires an unwavering commitment to act in the best interest of their clients or the public. Ethical lapses in this area can lead to conflicts of interest, misallocation of resources, or personal gain at the expense of clients, thereby undermining the very foundation of fiduciary duty.

The Ripple Effect on the Economy

The financial reports and audits conducted by CPAs form the backbone of economic decision-making.

Investors, creditors, and other stakeholders rely on these documents to make informed decisions. Unethical behavior, such as manipulating financial statements, can lead to incorrect valuations, misguided investments, and ultimately, economic instability. The global financial crisis of 2008 highlighted how unethical practices in the finance sector could lead to widespread economic turmoil.

Setting a Professional Standard

CPAs are regarded as professionals who are expected to set an example of integrity and ethical behavior. They play a critical role in mentoring and influencing the next generation of financial professionals. By adhering to high ethical standards, CPAs reinforce the importance of ethics in the finance sector and contribute to the creation of a culture of honesty and integrity.

Ethics CPE: A Must For CPAs

The importance of ethics for Certified Public Accountants in the finance sector cannot be overstated. Ethical behavior underpins the trust that the public places in financial systems, ensures compliance with laws and regulations, fulfills fiduciary responsibilities, stabilizes the economy, and sets a standard for professional conduct.

As gatekeepers of financial integrity, CPAs must commit to the highest ethical standards, recognizing that their actions have far-reaching consequences beyond the balance sheet. The commitment of CPAs to ethics is not just a matter of professional duty but a cornerstone of the global financial infrastructure. In order to keep up with the current standards and be compliant within the financial sector, CPAs are encouraged to visit CPE Inc., where they can find an array of ethics webinars and courses to meet their needs. Visit their website for more information!

For more information about Continuing Education For Finance Professionals and Continuing Education For Tax Professionals please visit:- CPE Inc.

0 notes

Text

Stay ahead in your accounting career with Continuing Professional Education (CPE)! From live seminars to online courses, CPAs have a variety of options to fulfill their ongoing education requirements and stay current with industry trends. #CPE #CPA #ProfessionalDevelopment

#Continuing Professional Education#CPE for CPAs#CPA education requirements#Continuing education for accountants#CPE#CPA#AccountingEducation#ProfessionalDevelopment

0 notes

Text

Getting an Audit Licence in the UAE: Requirements and Business Setup

The UAE continues to establish itself as a regional and global business hub. With the introduction of corporate tax and increasing regulatory compliance standards, the demand for qualified, licensed auditors has surged.

Whether you're a UAE national or a foreign professional, becoming a licensed auditor in the UAE opens the door to lucrative career and business opportunities.

In this post, we’ll take you through everything you need to know about obtaining an audit licence in the UAE and going for your own company formation in the UAE, from meeting educational requirements to setting up a compliant, fully licensed practice.

Overview of Audit Licencing in the UAE

- Introduction

Audit licences in the UAE are issued and regulated by the Ministry of Economy (MoE), ensuring that only qualified professionals can offer auditing services. To practice as an auditor or open an audit firm, individuals must meet specific education, experience, and examination standards.

Both local and international applicants can apply, provided they comply with UAE’s regulatory and ethical auditing frameworks.

- Education, Experience & Certification Requirements

To apply for an audit licence in the UAE, candidates must meet the following criteria:

1. Educational Qualifications:

A bachelor’s degree in accounting, finance, or a related discipline from a recognised institution is required.

Non-accounting graduates must complete at least 15 credit hours in accounting from accredited programs.

A master’s degree in accounting or finance is advantageous but not mandatory.

2. Professional Experience:

A minimum of five years of post-degree experience in auditing is required.

For expatriates, UAE-specific experience requirements depend on total international experience:

10+ years abroad = 1 year of UAE experience

5–10 years abroad = 2 years of UAE experience

2–5 years abroad = 3 years of UAE experience

3. Recognised Professional Certifications:

Credentials such as ACCA (UK), ICAEW, CPA (USA, Canada, Australia), and SOCPA (Saudi Arabia) may grant exemptions from certain exams (e.g., IFRS and ISA).

All candidates, regardless of certification, must pass the UAE Laws & Taxation exam.

- The UAE Fellowship Programme & Exam Details

Before applying for an audit licence, professionals must obtain a UAE Fellowship Certificate, administered by the Emirates Association of Accountants & Auditors (EAAA) in collaboration with the MoE and ACCA.

1. Steps to Obtain the Fellowship Certificate:

a) Register with EAAA Create a membership account with the Emirates Association of Accountants & Auditors.

b)Verify Education and Experience Submit relevant documents showing compliance with education and work history requirements.

c) Pass the Required Exams

International Financial Reporting Standards (IFRS)

International Standards on Auditing (ISA)

UAE Laws & Taxation

Note: Exemptions may apply for IFRS and ISA if you hold qualifying certifications.

d) Complete Continuing Professional Education (CPE) At least 30 hours annually, with 12 hours in core subjects like accounting, auditing, and UAE tax law.

e) Apply for Fellowship Certificate Once all criteria are met, submit your application to receive your official certificate.

2. Exam Format:

Each exam includes 70 multiple-choice questions.

A passing score is 60%.

Exams are conducted online by the ACCA and proctored at British Council centres across the UAE.

All exams must be completed within two years of passing the first.

- Applying for Your Individual Audit Licence

Once you’ve secured the UAE Fellowship Certificate, you can apply for an individual audit licence with the Ministry of Economy.

#Requirements:

Professional Indemnity Insurance: AED 500,000 minimum coverage.

Application Fee: AED 100

Three-Year Licence Fee: AED 4,500

Submit your documents, pay the fees, and upon approval, you’ll receive your licence to practice auditing professionally in the UAE.

- Starting Your Own Audit Firm in the UAE

If you’re looking to create an independent practice through business setup in the UAE, here’s how to start an audit firm in the UAE.

#Step-by-Step Setup Process:

Select a Business Name Ensure it aligns with UAE naming conventions and is available for registration.

Form a Partnership Your firm must include at least two partners, one of whom must be a UAE national with a 25% stake. All partners must have five years of audit experience.

Verify Partner Licences Each partner must hold a valid MoE-issued individual auditor licence.

Establish a Risk Management Framework Demonstrate that your firm operates within accepted regulatory and ethical standards.

Provide International Experience (if applicable) Foreign firms must show a minimum of five years of licenced practice in their country of origin.

Secure an Office Location Set up a compliant and functional office space.

Open a Corporate Bank Account Choose a UAE-based bank for business transactions and operations.

Obtain Insurance Professional indemnity insurance of at least AED 1,000,000 is required.

Register with the MoE Submit all business and personal documents and pay:

Application Fee: AED 100

Three-Year Firm Licence Fee: AED 10,500

- Renewing Your Audit Licence

1) Renewal Schedule:

Audit licences must be renewed every three years. This involves a review of compliance, updated documentation, and proof of CPD (Continuing Professional Development) hours.

2) CPD Requirements:

Minimum of 30 CPD hours annually

Audit firms must maintain records of each auditor’s CPD compliance.

3) Compliance and Ethics:

Auditors must adhere to ethical principles like integrity, objectivity, and independence. Violations can result in:

Monetary fines

Licence suspension or revocation

Legal action or imprisonment

- UAE Corporate Tax: Audit Obligations

Since June 1, 2023, the UAE has implemented a corporate tax regime, requiring businesses with annual revenues over AED 50 million to submit audited financial statements by MoE-licensed auditors.

Additionally, Qualifying Free Zone Entities must provide audited financials to retain eligibility for the 0% tax rate. More information can be found at the Federal Tax Authority (FTA) website.

Building a Career in Auditing

Obtaining an audit licence in the UAE is more than a legal formality; it’s a professional milestone. Whether you aim to practice individually or establish a firm, your journey involves rigorous qualifications, ethical practice, and commitment to continued learning.

At Nimbus Consultancy, we specialise in helping professionals and businesses navigate UAE licensing requirements and ongoing compliance. From company formation in the UAE to visa processing and PRO services, we’re here to simplify your journey.

0 notes

Text

Why Continuous Education is Key for Every CPA

Introduction To remain competitive in the ever-evolving financial industry, continuing education is a must for every CPA. In this post, we’ll explore the importance of ongoing education and the best ways to pursue it.

1. Meet Continuing Professional Education (CPE) Requirements

Most states require CPAs to complete CPE every year to maintain their license. Stay on top of CPE opportunities to meet the requirements and expand your knowledge.

2. Specialize in Niche Areas of Accounting

As a CPA, you can further your expertise by specializing in areas such as tax accounting, forensic accounting, or audit services. This allows you to offer more valuable services to clients and enhances your career prospects.

3. Leverage Online Courses and Certifications

Take advantage of online platforms offering certifications in new areas like data analytics, cybersecurity in accounting, or financial planning. These certifications not only expand your skill set but also make you more marketable.

Conclusion Continual learning is critical to long-term success as a CPA. Whether you’re fulfilling your CPE requirements or specializing in a niche area, keep evolving and stay relevant. Click here for further info.

0 notes

Text

Certified Public Accountant - Purpose, Roles, and Path to Licensure

A license to practice as a Certified Public Accountant (CPA) is conferred upon individuals who meet stringent educational, experiential, and examination criteria in the accounting field. Licensure, administered by states and overseen by the National Association of State Boards of Accountancy (NASBA), signifies an accountant’s adherence to established standards in the profession. The primary purpose of the CPA license is to ensure that individuals providing accounting services possess the requisite knowledge and ethical commitment to safeguard the public interest.

CPAs fulfill a variety of crucial roles across diverse sectors. In public accounting, they conduct audits, prepare financial statements, and provide tax services to businesses and individuals. Within corporations, CPAs may serve as controllers or chief financial officers, overseeing financial reporting and strategic financial planning. Their expertise extends to government entities, where they contribute to financial oversight and regulatory compliance. Moreover, CPAs are authorized to represent clients before the Internal Revenue Service (IRS) and prepare reports for submission to the Securities and Exchange Commission (SEC), demonstrating their specialized knowledge of tax law and securities regulations. Beyond these core functions, CPAs offer consulting services, advising on financial matters, risk assessment, and business strategy. Their responsibilities often involve maintaining accurate financial records, identifying discrepancies, and implementing improvements to internal financial processes.

The path to obtaining a CPA license is rigorous and multifaceted. It begins with fulfilling educational requirements, which typically entail earning a bachelor's degree, although specific majors are not universally mandated. Many states require 150 semester hours of post-secondary education, necessitating additional coursework beyond the standard bachelor's degree. This requirement can be met through graduate studies or specialized programs.

Following the attainment of the required educational credits, candidates must pass the Uniform CPA Examination, a comprehensive assessment designed to evaluate their proficiency in financial accounting and reporting, auditing and attestation, taxation and regulation, and a chosen discipline area, which includes business analysis and reporting, information systems and controls, or tax compliance and planning. The examination is administered by NASBA and consists of multiple-choice questions and task-based simulations. Achieving a passing score of 75 on each of the four sections is mandatory.

In addition to educational and examination requirements, candidates must fulfill experience criteria, which typically involve one to two years of full-time, paid work in accounting-related roles. This experience must often be verified by a licensed CPA and may encompass work in public accounting, private industry, or government. Each state board of accountancy sets its specific requirements for licensure, and candidates must ensure that they meet the criteria of the state in which they intend to practice. Upon successful completion of all requirements, individuals are eligible to apply for a CPA license from their respective state board.

Maintaining the CPA license necessitates adherence to continuing professional education (CPE). These requirements, which vary by state, typically involve completing a specified number of CPE hours annually or biennially. CPE courses cover topics such as accounting standards, tax law updates, and professional ethics. Compliance with CPE requirements ensures that CPAs remain current with evolving accounting practices and regulations.

0 notes

Link

0 notes

Text

CPE CPA

Fulfill your CPE CPA requirements hassle-free. Our courses offer flexibility and quality to help you excel in your accounting profession. Enhance your skills today with CPE Credit!

Visit us at-

0 notes

Text

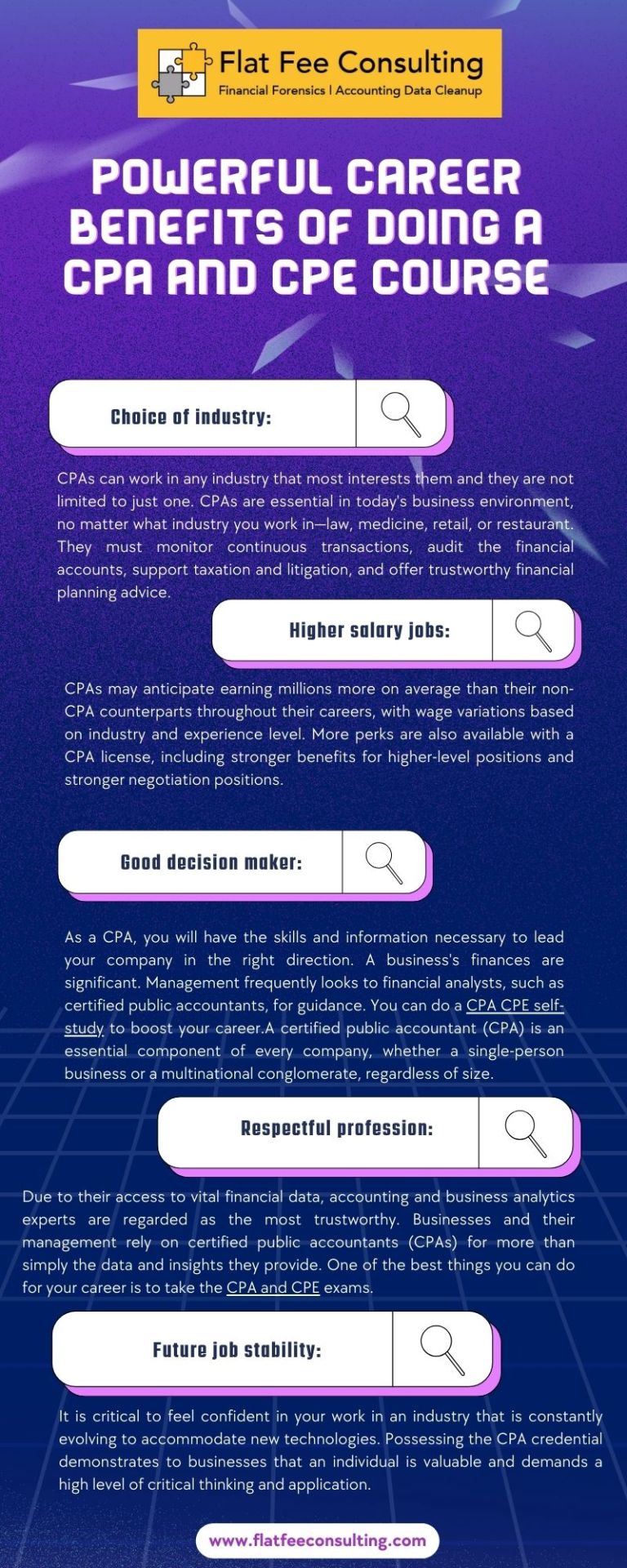

CPA and CPE - Flat Fee Consulting

If you have been considering getting a CPA credit, now is the time to start studying. It is a career change you can feel good about, one that can open doors and support you on your way to the ideal profession, with higher pay, more possibilities, and more respect.

0 notes

Text

The Crucial Role of Ethics in a CPA’s Professional Development and Career

In the world of finance and accounting, where precision, trust, and transparency are paramount, ethics forms the cornerstone of a CPA's professional life. Certified Public Accountants bear a unique responsibility to uphold the integrity of financial systems and instill confidence in the stakeholders they serve.

This article delves into why ethics is such an essential part of a CPA's professional development and career, examining its role in fostering trust, ensuring compliance, and enabling sustainable growth in the financial industry.

Building and Sustaining Trust

Trust is the foundation upon which all client-CPA relationships are built. Clients, businesses, and the public rely on CPAs to provide accurate, unbiased financial information. Ethical behavior ensures that CPAs maintain this trust by:

Ensuring Accuracy: Ethical CPAs prioritize transparency and avoid misrepresenting financial data, safeguarding stakeholders from potential financial mismanagement.

Protecting Confidentiality: Adhering to ethical standards ensures that sensitive client information remains secure, reinforcing trust in professional relationships.

Compliance with Laws and Regulations

Ethics and compliance are inextricably linked. CPAs are bound by a code of conduct and must adhere to stringent regulatory frameworks, such as those outlined by the American Institute of CPAs (AICPA), the Sarbanes-Oxley Act, and other federal and state laws. Key ethical obligations include:

Independence: CPAs must remain impartial, avoiding conflicts of interest that could compromise their objectivity.

Integrity: Upholding honesty and fairness, even in the face of pressure or incentives to act otherwise.

Failing to meet these standards can result in severe penalties, including the loss of licensure, legal repercussions, and reputational damage.

Mitigating Risks in Financial Reporting

In an era of increasing scrutiny on financial practices, ethical lapses can lead to scandals that erode public confidence. By adhering to high ethical standards, CPAs mitigate risks associated with:

Fraud Detection and Prevention: Ethical CPAs proactively identify and address irregularities, ensuring that financial statements reflect an accurate and truthful account of a business's financial health.

Audit Integrity: Upholding ethical standards during audits ensures that any discrepancies or risks are reported transparently, protecting stakeholders from financial harm.

Navigating Complex Financial Decisions

The evolving financial landscape presents CPAs with increasingly complex scenarios requiring sound judgment. Ethical training equips CPAs with the tools to navigate these challenges, ensuring decisions are made in alignment with professional standards and societal expectations.

Balancing Stakeholder Interests: Ethical CPAs prioritize fairness and transparency when handling competing stakeholder demands.

Decision-Making Frameworks: Ethics provide a clear framework for addressing dilemmas, minimizing the risk of reputational or financial damage.

Ethics as a Pillar of Professional Excellence

For CPAs, ethics is not merely an abstract concept but a daily practice that underpins their professional identity. It is the guiding force that ensures they deliver value to clients, uphold the integrity of financial systems, and contribute to the public good. By committing to ethical principles, CPAs not only protect their careers but also play a vital role in maintaining trust and transparency in the global financial ecosystem.

Investing in ethics training, such as Ethics CPE courses, like the ones available at CPE Inc., is an essential step for any CPA seeking to elevate their career and uphold the highest standards of the profession.

For more information about CPE Courses and Best CPE For Cpas please visit:- CPE Inc.

0 notes

Text

Pro2learn: The Best Online CPE Platform for CPAs

Pro2Learn offers wide range of topics with an easy-to-use platform for knowledge sharing and knowledge exchange through the presentation and offering of the most up-to-date educational content and developments important to the accounting and tax profession. Pro2Learn students have access to the highest quality webinar presentations by thought leaders in the profession. Professional/Students can also take advantage of occasions to view self-study and archived sessions, enjoying the ability to choose between real-time or past events. In addition, members can access information and register for live conferences and seminars through the site. For more information please visit our website.

Pro2Learn endeavors to provide the uppermost quality, progressive educational content to accounting and tax professionals in a cost effective manner.

0 notes

Text

Illumeo is Probably the best LMS with CPE

Illumeo offers some of the best CPE solutions for CPA, CIA, Payroll, SHRM, HRCI, ISACA and many other. Tons of courses, webinars and the learning tools give an LMS like learning experience is just phenomenal and even the largest CPE providers like Becker, Surgent, Wolter Kluwers dont offer the same features and tools. Their Enterprise LMS is also used by many organizations and I have been told that their LMS pricing is pretty aggressive.

1 note

·

View note

Text

Importance of Continuous Professional Education Post-CA

Becoming a Chartered Accountant (CA) is a significant achievement, but the journey doesn’t end there. The dynamic nature of the finance and accounting industry demands that professionals continuously update their knowledge and skills to stay relevant. Continuous Professional Education (CPE) is an essential aspect of a CA's career, enabling them to adapt to regulatory changes, technological advancements, and industry trends.

1. What is Continuous Professional Education (CPE)?

CPE refers to structured learning programs designed to enhance the knowledge and skills of professionals. For CAs, this involves attending workshops, webinars, and training sessions, or pursuing advanced certifications. CPE ensures that CAs remain competent and up-to-date with the latest developments in their field.

2. Why is CPE Important?

a) Keeping Up with Regulatory Changes

The regulatory environment in accounting and taxation is ever-evolving. From amendments in tax laws to updates in International Financial Reporting Standards (IFRS), staying informed is crucial. CPE programs help CAs understand these changes and apply them effectively in their practice.

b) Adapting to Technological Advancements

Technology has transformed the way businesses operate, and the accounting profession is no exception. Tools like cloud accounting, AI-driven analytics, and blockchain are becoming mainstream. Participating in CPE programs ensures that CAs are equipped to leverage these technologies for better efficiency and accuracy.

c) Enhancing Professional Skills

Beyond technical knowledge, CPE focuses on developing soft skills such as communication, leadership, and problem-solving. These skills are critical for career advancement, particularly for CAs aspiring to leadership roles.

d) Maintaining Professional Credibility

Clients and employers value professionals who stay informed and competent. By participating in CPE programs, CAs demonstrate their commitment to excellence, enhancing their credibility and reputation.

3. CPE and Exam Preparation Resources

For aspiring CAs, tools like CA Entrance Exam Books, Scanner CA Foundation Books, Scanner CA Intermediate Books, and Scanner CA Final Books are indispensable during their preparation phase. Similarly, for qualified CAs, CPE programs act as the next step in continuous learning, ensuring they remain relevant and effective in their roles.

4. Benefits of CPE

a) Improved Career Opportunities

Continuous learning opens up new career paths. Specialized certifications in areas like forensic accounting, international taxation, or financial planning can help CAs diversify their expertise and stand out in a competitive market.

b) Networking Opportunities

CPE programs often bring professionals together, creating opportunities to network and exchange ideas. These connections can lead to collaborations, mentorship, or new business opportunities.

c) Personal Growth

Learning new concepts and skills fosters personal growth and boosts confidence. CPE helps professionals approach challenges with a fresh perspective, making them more effective problem-solvers.

5. Popular CPE Programs for CAs

a) Workshops and Seminars

These programs focus on specific topics like GST, transfer pricing, or audit techniques. They are ideal for gaining in-depth knowledge in a short time.

b) Online Courses

Platforms like Coursera, edX, and ICAI’s e-learning portal offer flexible learning options. Topics range from advanced accounting to emerging technologies like blockchain.

c) Certifications

Certifications such as CPA (Certified Public Accountant), ACCA (Association of Chartered Certified Accountants), or CFA (Chartered Financial Analyst) add global recognition to a CA’s credentials.

d) Self-Study Programs

For self-paced learners, resources similar to CA Foundation Scanner, CA Intermediate Scanner, and CA Final Scanner can be used to deepen understanding of complex subjects.

6. Challenges in Pursuing CPE

a) Time Constraints

Balancing work and learning can be challenging, especially for practicing CAs. Prioritizing and scheduling time for CPE is essential.

b) Cost of Programs

Some CPE programs can be expensive. However, many organizations reimburse these costs as part of professional development initiatives.

c) Choosing Relevant Topics

With numerous options available, selecting programs that align with career goals and interests can be overwhelming. Identifying areas of improvement and industry demand can guide this decision.

7. How to Incorporate CPE into Your Career

a) Set Clear Goals

Identify your career aspirations and choose CPE programs that align with those goals.

b) Leverage Technology

Use online platforms and virtual webinars to learn at your own pace.

c) Track Progress

Maintain a log of completed CPE activities to track your learning journey and ensure compliance with mandatory requirements.

d) Stay Consistent

Make CPE a regular part of your professional life. Even short courses can accumulate into significant learning over time.

8. Conclusion

Continuous Professional Education is a cornerstone of success for Chartered Accountants. Just as resources like CA Entrance Exam Books, Scanner CA Foundation Books, CA Intermediate Scanner, and Scanner CA Final Books are vital during the exam phase, CPE is essential for professional growth post-qualification. By staying updated with industry trends, enhancing skills, and embracing lifelong learning, CAs can ensure their relevance and effectiveness in a rapidly changing professional landscape. Invest in CPE to not only advance your career but also contribute to the broader accounting and finance community.

0 notes

Text

Tax Accountants in CPA Firms: Staying Ahead of the Curve in Tax Compliance

The tax landscape is constantly evolving, with new laws, regulations, and court rulings emerging regularly. For tax accountants in Certified Public Accountant (CPA) firms, staying ahead of the curve in tax compliance is crucial to providing high-quality services to clients and minimizing the risk of non-compliance.

Additional Challenges in Tax Compliance

In addition to the complexity of tax laws and regulations, tax accountants in CPA firms face several other challenges in tax compliance, including:

Frequent Changes to Tax Laws and Regulations: Tax laws and regulations are constantly changing, making it essential for tax accountants to stay up-to-date.

Increasing Scrutiny from Tax Authorities: Tax authorities, such as the Internal Revenue Service (IRS), are increasingly scrutinizing tax returns and compliance, making it essential for tax accountants to ensure accuracy and completeness.

Growing Complexity of Tax-Related Technology: Tax-related technology, such as tax preparation software and accounting systems, is becoming increasingly complex, making it essential for tax accountants to stay proficient.

Strategies for Staying Ahead of the Curve in Tax Compliance

To stay ahead of the curve in tax compliance, tax accountants in CPA firms can employ several strategies, including:

Staying Current with Tax Laws and Regulations: Tax accountants should regularly review tax laws and regulations, attend seminars and webinars, and participate in professional organizations to stay current.

Investing in Tax-Related Technology: Tax accountants should invest in tax-related technology, such as tax preparation software and accounting systems, to streamline processes and improve accuracy.

Developing a Tax Compliance Checklist: Tax accountants should develop a tax compliance checklist to ensure that all necessary steps are taken to comply with tax laws and regulations.

Collaborating with Other Professionals: Tax accountants should collaborate with other professionals, such as attorneys and financial advisors, to ensure that clients receive comprehensive and integrated services.

Continuing Professional Education: Tax accountants should participate in continuing professional education (CPE) courses to stay current with tax laws and regulations and to improve their skills and knowledge.

Conclusion

Staying ahead of the curve in tax compliance is essential for tax accountants in CPA firms to provide high-quality services to clients and minimize the risk of non-compliance. By staying current with tax laws and regulations, investing in tax-related technology, developing a tax compliance checklist, collaborating with other professionals, and participating in continuing professional education, tax accountants can ensure that they are equipped to navigate the complex and ever-changing tax landscape.

0 notes

Text

FinTram Global - Online Learning Platform

FinTram Global is a premier educational platform that offers live online training in India for certifications such as CFP, US CPA, US CMA, ACCA, IFRS, and a range of CPE courses. Reach out to FinTram Global for online classes in CFP, US CPA, US CMA, ACCA, and IFRS, delivered by our expert faculty using distinctive teaching techniques.

1 note

·

View note