#CPA course syllabus

Explore tagged Tumblr posts

Text

youtube

Wanna Pursue US CPA in 2024 and get hired by Global MNCs

Are you thinking of becoming a certified public accountant? Join us for a free US cpa webinar and learn about the different career paths open to you as a CPA.

#us cpa#usa qualification#certified public accountant#cpa webinar#becker#us cpa course details#us cpa course in india#cpa#commerce students#commerce classes#mcom students#chartered accountant#accountant#accountancy#cpa in india#free us cpa webinar#cpa eligibility#fintram global#cpa course syllabus#cpa course#us cpa jobs in dubai#cpa delhi#cpa course in india#Youtube

0 notes

Text

CPA Jobs in the USA for Indians: The Miles Pathway Advantage

For Indian professionals and students, aspiring to carve out a successful career in accounting, CPA jobs at top accounting firms in the USA represent an exciting opportunity. The US accounting industry is thriving, with a high demand for skilled CPAs across various sectors, including finance, tax, and audit. However, navigating the path to becoming a CPA can be complex, which is where the Miles Education comes into play.

The Miles US Pathway Program is a game-changer for Indian candidates aiming to secure CPA jobs overseas. Through this program, a candidate can complete their MS in accounting in one of the top universities in America, while parallelly preparing for CPA exam. Through this STEM integrated masters program, candidates automatically earn their 3F Visa from the USwhich allows them to work for three years. As you read, there are already 1000s of Miles alumni in US earning an average of $60,000+ salaries (50 Lakhs+)

Additionally, one of the most significant benefits of the Miles US Pathway Program is its comprehensive exam preparation resources. The program offers access to high-quality study materials, one on one sessions, mock tests and interviews, exam-ready study notes and guidance from more than 100 of industry experts. Varun Jain’s (The World's Favorite CPA/CMA Instructor) videos are globally recognised for its expertise in understanding complex topics to even candidates who aren’ aware of the ABCs of accounting.

Moreover, the program assists with job placement, connecting candidates with leading U.S. employers and this support is crucial in a competitive job market where having a strong network and the right credentials can make all the difference.

Indian professionals seeking CPA jobs in the USA will find that the Miles US Pathway Program not only simplifies the certification process but also enhances their career prospects. By leveraging this program, candidates can gain a competitive edge, achieve their dream designation, and embark on a successful career.

#cpa jobs#cpa course#cpa syllabus#cpa course full form#accounting jobs for indians in usa#best cma institute in india

2 notes

·

View notes

Text

Why CMA is the key to your accounting career in India?

The CMA credential, recognized in over 140 countries, opens doors to diverse roles in finance, accounting, and strategy. With a two-part exam and flexible testing, it's a highly sought-after qualification offering attractive salaries and high demand across various sectors. Start your journey to success with Miles! Visit: https://bit.ly/4fRyr7a

0 notes

Text

Are you looking to pursue CPA course in India? Look no further! At IPFC Academy, we are committed to providing you with the best education and resources so that you can excel in your career. Enroll now and start your journey towards becoming a Certified Professional Accountant 💻🎓

Join now : https://www.ifcpltd.com/cpa

Connect with us for more information: 📲+91 9903100338 📧[email protected]

#cpa#cpa exam#cpa course#cpa marketing#cpa course online#cpa course in india#cpa india#career growth#accounting careers#career#cpa syllabus#accountant#accounting professional#cma awards#big4#education#higher education#finance and accounting#finance professionals#online courses#e learning#ipfc

0 notes

Text

CPA Course Exemptions

As a CA, MBA, ACCA, or other professional qualification holder, you might be qualified for CPA exemptions that lighten your exam load and accelerate your CPA certification. This post discusses all exemption categories—academic, professional, and work-based—along with application procedures and advantages.

CPA Exemptions Based on Professional Qualifications

Professional certifications can ease your way to CPA certification through your qualification for exemptions. These are awarded when your previous credentials meet the requirements of the CPA syllabus.

CA (Chartered Accountancy)

CPA exemption for CA is among the most well-known. CAs from India, Australia, and the UK usually receive credit for in-depth knowledge of accounting, auditing, and taxation.

Exemptions may include subjects like Auditing and Financial Reporting.

Some US states recognise Indian CA as fulfilling 120 credit hour requirements.

This CPA exemption saves students time and money and enhances international career prospects.

CMA (Certified Management Accountant)

US CMA holders from IMA are usually exempt from the CPA. CMAs possess deep knowledge in financial planning, performance management, and control of costs.

Are eligible for performance management-related CPA section exemptions.

Lowers the exam load for candidates having managerial accounting experience.

The overlap of subjects in strategic finance makes CMA an excellent stepping point for obtaining CPA certification.

CFA (Chartered Financial Analyst)

While not always formally mentioned, CFA charterholders are occasionally exempt from the CPA due to their qualifications in financial reporting as well as ethics.

Some overlap exists in FAR (Financial Accounting and Reporting) and BEC-equivalent topics.

Having both CPA and CFA enhances finance and auditing employability.

CFA candidates will particularly gain from the financial analysis segment of the CPA syllabus.

CIA (Certified Internal Auditor)

CIA professionals of the IIA are known for their extensive knowledge of auditing.

CIA holders may apply for exemption from the AUD (Auditing and Attestation) section.

Known in jurisdictions where audit-specific certifications are appreciated.

Internal auditors who pursue more general accounting positions gain much from it.

CIMA (Chartered Institute of Management Accountants)

CIMA professionals who are qualified with the CGMA credential can be exempt from sections such as Business Analysis or Financial Management.

Advanced management accounting material is related to CPA material.

It enhances the possibilities for qualifying for the new Evolution 2025 model’s CPAs.

CIMA professionals have international recognition for cost accounting and strategy accounting.

ACCA (Association of Chartered Certified Accountants)

CPA exemption for ACCA is gaining general acceptance, particularly in countries where international financial reporting and taxation skills are in high demand.

Full members of the ACCA can be exempted in several fields.

Exemptions also differ between state boards; certain of them will still have specific papers tested.

The exemption from the CPA for ACCA is particularly beneficial for international professionals who intend to work in the US or multinational corporations.

CPA Exemptions Based on Academic Qualifications

Academic qualifications such as MBA degrees and specialised accounting degrees also make candidates eligible for exemption from CPAs.

MBA

An MBA in finance or accounting is a strong qualifier for exemption from the CPA exam for MBA candidates.

Exemptions can encompass core business environment issues.

MBAs usually satisfy the 150-credit-hour requirement for obtaining the CPA license.

The exemption of MBA holders from the CPA not only removes exam pressure but also simplifies career advancement in management positions.

Other Recognised Degrees and Educational Credits

In some institutions and curricula, other degrees can also be exempt from the CPA under certain circumstances, particularly in the USA and Canada.

Some accepted qualifications include:

Bachelor’s in Accounting/Finance

Master’s in Commerce (M.Com)

BBA with Accounting Major

Postgraduate Diplomas in Accounting

Credits from NAAC-A accredited Indian universities

Degrees evaluated by NACES-recognised agencies

To be qualified for these CPA exemptions, it’s always best to check your eligibility with the state board concerned or a foreign credential evaluation organisation.

Work Experience-Based CPA Exemptions

In certain US jurisdictions or foreign jurisdictions, significant related work experience can help with CPA exemptions.

Experience should typically be in accounting, taxation, or auditing.

May meet educational or ethics requirements.

Needs to be authenticated by a state-licensed CPA supervisor.

These CPA exemptions can significantly help working professionals transition into CPA certification without redundant coursework or exams.

Benefits of CPA Exemptions

Here are key benefits of leveraging CPA exemptions:

Reduced Number of Exams: Fewer examination periods to prepare for.

Time Savings: Accelerate your CPA certification timeline.

Lower Costs: Pay less for course material and exam fees.

Boost Career Growth: Employers prefer CPAs with international and interdisciplinary experiences.

Stress-Free Preparation: Focus only on areas where you lack prior exposure.

Custom Career Path: Choose exam areas that complement your specialisation.

Whether it’s a CPA exemption for MBA, CPA exemption for CA, or CPA exemption for ACCA, these benefits make the journey faster and smarter.

How to Apply for CPA Exemptions

To apply for your CPA exemptions, do the following:

Determine Your Jurisdiction: Each US state board has its own rules.

Get Credentials Evaluated: Utilise agencies such as WES or NASBA International Evaluation Services.

Submit Application: Include transcripts, certificates, and proof of membership.

Wait for Assessment: The board will confirm eligible CPA exemptions.

Plan Your Prep: Focus only on remaining sections after exemptions are granted.

Tip: Double-check the requirements for the CPA exam for the state in which you intend to apply.

Final Thoughts

Gaining the CPA credential is a career highlight in itself, and if you’re exempt from CPAs, then all the better. If you’re in possession of a CA, ACCA, MBA, or some other qualifying credential, then potentially you can bypass duplicative CPA modules and accelerate your success.

Strategic planning is crucial with revised rules in CPA Evolution 2025. Review your history, take advantage of relevant CPA exemptions where possible, and put your efforts where they will have the greatest impact.

FAQs on CPA Course Exemptions

How to get exemption in CPA?

You can receive CPA exemption through qualifications such as CA, ACCA, or MBA, or through experience in related fields. Submit your application to a state board or evaluation authority.

Are there any exemptions for CPA?

Yes, most of the states permit CPAs for candidates with relevant professional or educational qualifications. Exemptions cut down on the number of accounting exam sections needed.

What is the eligibility to study CPA?

Eligibility typically requires a bachelor’s in accounting or equivalent, 120-150 credit hours, and in some cases work experience. Other exemptions are subject to previous credentials.

Can I do CPA in 3 months?

Although tough, it is possible to finish CPA in 3 months in the case of CPA exemptions and concentrating only on remaining sections. Previous experience in accounting and full-time studying are helpful.

0 notes

Text

CPA Course Exemptions

As a CA, MBA, ACCA, or other professional qualification holder, you might be qualified for CPA exemptions that lighten your exam load and accelerate your CPA certification. This post discusses all exemption categories—academic, professional, and work-based—along with application procedures and advantages.

CPA Exemptions Based on Professional Qualifications

Professional certifications can ease your way to CPA certification through your qualification for exemptions. These are awarded when your previous credentials meet the requirements of the CPA syllabus.

CA (Chartered Accountancy)

CPA exemption for CA is among the most well-known. CAs from India, Australia, and the UK usually receive credit for in-depth knowledge of accounting, auditing, and taxation.

Exemptions may include subjects like Auditing and Financial Reporting.

Some US states recognise Indian CA as fulfilling 120 credit hour requirements.

This CPA exemption saves students time and money and enhances international career prospects.

CMA (Certified Management Accountant)

US CMA holders from IMA are usually exempt from the CPA. CMAs possess deep knowledge in financial planning, performance management, and control of costs.

Are eligible for performance management-related CPA section exemptions.

Lowers the exam load for candidates having managerial accounting experience.

The overlap of subjects in strategic finance makes CMA an excellent stepping point for obtaining CPA certification.

CFA (Chartered Financial Analyst)

While not always formally mentioned, CFA charterholders are occasionally exempt from the CPA due to their qualifications in financial reporting as well as ethics.

Some overlap exists in FAR (Financial Accounting and Reporting) and BEC-equivalent topics.

Having both CPA and CFA enhances finance and auditing employability.

CFA candidates will particularly gain from the financial analysis segment of the CPA syllabus.

CIA (Certified Internal Auditor)

CIA professionals of the IIA are known for their extensive knowledge of auditing.

CIA holders may apply for exemption from the AUD (Auditing and Attestation) section.

Known in jurisdictions where audit-specific certifications are appreciated.

Internal auditors who pursue more general accounting positions gain much from it.

CIMA (Chartered Institute of Management Accountants)

CIMA professionals who are qualified with the CGMA credential can be exempt from sections such as Business Analysis or Financial Management.

Advanced management accounting material is related to CPA material.

It enhances the possibilities for qualifying for the new Evolution 2025 model’s CPAs.

CIMA professionals have international recognition for cost accounting and strategy accounting.

ACCA (Association of Chartered Certified Accountants)

CPA exemption for ACCA is gaining general acceptance, particularly in countries where international financial reporting and taxation skills are in high demand.

Full members of the ACCA can be exempted in several fields.

Exemptions also differ between state boards; certain of them will still have specific papers tested.

The exemption from the CPA for ACCA is particularly beneficial for international professionals who intend to work in the US or multinational corporations.

CPA Exemptions Based on Academic Qualifications

Academic qualifications such as MBA degrees and specialised accounting degrees also make candidates eligible for exemption from CPAs.

MBA

An MBA in finance or accounting is a strong qualifier for exemption from the CPA exam for MBA candidates.

Exemptions can encompass core business environment issues.

MBAs usually satisfy the 150-credit-hour requirement for obtaining the CPA license.

The exemption of MBA holders from the CPA not only removes exam pressure but also simplifies career advancement in management positions.

Other Recognised Degrees and Educational Credits

In some institutions and curricula, other degrees can also be exempt from the CPA under certain circumstances, particularly in the USA and Canada.

Some accepted qualifications include:

Bachelor’s in Accounting/Finance

Master’s in Commerce (M.Com)

BBA with Accounting Major

Postgraduate Diplomas in Accounting

Credits from NAAC-A accredited Indian universities

Degrees evaluated by NACES-recognised agencies

To be qualified for these CPA exemptions, it’s always best to check your eligibility with the state board concerned or a foreign credential evaluation organisation.

Work Experience-Based CPA Exemptions

In certain US jurisdictions or foreign jurisdictions, significant related work experience can help with CPA exemptions.

Experience should typically be in accounting, taxation, or auditing.

May meet educational or ethics requirements.

Needs to be authenticated by a state-licensed CPA supervisor.

These CPA exemptions can significantly help working professionals transition into CPA certification without redundant coursework or exams.

Benefits of CPA Exemptions

Here are key benefits of leveraging CPA exemptions:

Reduced Number of Exams: Fewer examination periods to prepare for.

Time Savings: Accelerate your CPA certification timeline.

Lower Costs: Pay less for course material and exam fees.

Boost Career Growth: Employers prefer CPAs with international and interdisciplinary experiences.

Stress-Free Preparation: Focus only on areas where you lack prior exposure.

Custom Career Path: Choose exam areas that complement your specialisation.

Whether it’s a CPA exemption for MBA, CPA exemption for CA, or CPA exemption for ACCA, these benefits make the journey faster and smarter.

How to Apply for CPA Exemptions

To apply for your CPA exemptions, do the following:

Determine Your Jurisdiction: Each US state board has its own rules.

Get Credentials Evaluated: Utilise agencies such as WES or NASBA International Evaluation Services.

Submit Application: Include transcripts, certificates, and proof of membership.

Wait for Assessment: The board will confirm eligible CPA exemptions.

Plan Your Prep: Focus only on remaining sections after exemptions are granted.

Tip: Double-check the requirements for the CPA exam for the state in which you intend to apply.

Final Thoughts

Gaining the CPA credential is a career highlight in itself, and if you’re exempt from CPAs, then all the better. If you’re in possession of a CA, ACCA, MBA, or some other qualifying credential, then potentially you can bypass duplicative CPA modules and accelerate your success.

Strategic planning is crucial with revised rules in CPA Evolution 2025. Review your history, take advantage of relevant CPA exemptions where possible, and put your efforts where they will have the greatest impact.

FAQs on CPA Course Exemptions

How to get exemption in CPA?

You can receive CPA exemption through qualifications such as CA, ACCA, or MBA, or through experience in related fields. Submit your application to a state board or evaluation authority.

Are there any exemptions for CPA?

Yes, most of the states permit CPAs for candidates with relevant professional or educational qualifications. Exemptions cut down on the number of accounting exam sections needed.

What is the eligibility to study CPA?

Eligibility typically requires a bachelor’s in accounting or equivalent, 120-150 credit hours, and in some cases work experience. Other exemptions are subject to previous credentials.

Can I do CPA in 3 months?

Although tough, it is possible to finish CPA in 3 months in the case of CPA exemptions and concentrating only on remaining sections. Previous experience in accounting and full-time studying are helpful.

0 notes

Text

CPA Course Exemptions

As a CA, MBA, ACCA, or other professional qualification holder, you might be qualified for CPA exemptions that lighten your exam load and accelerate your CPA certification. This post discusses all exemption categories—academic, professional, and work-based—along with application procedures and advantages.

CPA Exemptions Based on Professional Qualifications

Professional certifications can ease your way to CPA certification through your qualification for exemptions. These are awarded when your previous credentials meet the requirements of the CPA syllabus.

CA (Chartered Accountancy)

CPA exemption for CA is among the most well-known. CAs from India, Australia, and the UK usually receive credit for in-depth knowledge of accounting, auditing, and taxation.

Exemptions may include subjects like Auditing and Financial Reporting.

Some US states recognise Indian CA as fulfilling 120 credit hour requirements.

This CPA exemption saves students time and money and enhances international career prospects.

CMA (Certified Management Accountant)

US CMA holders from IMA are usually exempt from the CPA. CMAs possess deep knowledge in financial planning, performance management, and control of costs.

Are eligible for performance management-related CPA section exemptions.

Lowers the exam load for candidates having managerial accounting experience.

The overlap of subjects in strategic finance makes CMA an excellent stepping point for obtaining CPA certification.

CFA (Chartered Financial Analyst)

While not always formally mentioned, CFA charterholders are occasionally exempt from the CPA due to their qualifications in financial reporting as well as ethics.

Some overlap exists in FAR (Financial Accounting and Reporting) and BEC-equivalent topics.

Having both CPA and CFA enhances finance and auditing employability.

CFA candidates will particularly gain from the financial analysis segment of the CPA syllabus.

CIA (Certified Internal Auditor)

CIA professionals of the IIA are known for their extensive knowledge of auditing.

CIA holders may apply for exemption from the AUD (Auditing and Attestation) section.

Known in jurisdictions where audit-specific certifications are appreciated.

Internal auditors who pursue more general accounting positions gain much from it.

CIMA (Chartered Institute of Management Accountants)

CIMA professionals who are qualified with the CGMA credential can be exempt from sections such as Business Analysis or Financial Management.

Advanced management accounting material is related to CPA material.

It enhances the possibilities for qualifying for the new Evolution 2025 model’s CPAs.

CIMA professionals have international recognition for cost accounting and strategy accounting.

ACCA (Association of Chartered Certified Accountants)

CPA exemption for ACCA is gaining general acceptance, particularly in countries where international financial reporting and taxation skills are in high demand.

Full members of the ACCA can be exempted in several fields.

Exemptions also differ between state boards; certain of them will still have specific papers tested.

The exemption from the CPA for ACCA is particularly beneficial for international professionals who intend to work in the US or multinational corporations.

CPA Exemptions Based on Academic Qualifications

Academic qualifications such as MBA degrees and specialised accounting degrees also make candidates eligible for exemption from CPAs.

MBA

An MBA in finance or accounting is a strong qualifier for exemption from the CPA exam for MBA candidates.

Exemptions can encompass core business environment issues.

MBAs usually satisfy the 150-credit-hour requirement for obtaining the CPA license.

The exemption of MBA holders from the CPA not only removes exam pressure but also simplifies career advancement in management positions.

Other Recognised Degrees and Educational Credits

In some institutions and curricula, other degrees can also be exempt from the CPA under certain circumstances, particularly in the USA and Canada.

Some accepted qualifications include:

Bachelor’s in Accounting/Finance

Master’s in Commerce (M.Com)

BBA with Accounting Major

Postgraduate Diplomas in Accounting

Credits from NAAC-A accredited Indian universities

Degrees evaluated by NACES-recognised agencies

To be qualified for these CPA exemptions, it’s always best to check your eligibility with the state board concerned or a foreign credential evaluation organisation.

Work Experience-Based CPA Exemptions

In certain US jurisdictions or foreign jurisdictions, significant related work experience can help with CPA exemptions.

Experience should typically be in accounting, taxation, or auditing.

May meet educational or ethics requirements.

Needs to be authenticated by a state-licensed CPA supervisor.

These CPA exemptions can significantly help working professionals transition into CPA certification without redundant coursework or exams.

Benefits of CPA Exemptions

Here are key benefits of leveraging CPA exemptions:

Reduced Number of Exams: Fewer examination periods to prepare for.

Time Savings: Accelerate your CPA certification timeline.

Lower Costs: Pay less for course material and exam fees.

Boost Career Growth: Employers prefer CPAs with international and interdisciplinary experiences.

Stress-Free Preparation: Focus only on areas where you lack prior exposure.

Custom Career Path: Choose exam areas that complement your specialisation.

Whether it’s a CPA exemption for MBA, CPA exemption for CA, or CPA exemption for ACCA, these benefits make the journey faster and smarter.

How to Apply for CPA Exemptions

To apply for your CPA exemptions, do the following:

Determine Your Jurisdiction: Each US state board has its own rules.

Get Credentials Evaluated: Utilise agencies such as WES or NASBA International Evaluation Services.

Submit Application: Include transcripts, certificates, and proof of membership.

Wait for Assessment: The board will confirm eligible CPA exemptions.

Plan Your Prep: Focus only on remaining sections after exemptions are granted.

Tip: Double-check the requirements for the CPA exam for the state in which you intend to apply.

Final Thoughts

Gaining the CPA credential is a career highlight in itself, and if you’re exempt from CPAs, then all the better. If you’re in possession of a CA, ACCA, MBA, or some other qualifying credential, then potentially you can bypass duplicative CPA modules and accelerate your success.

Strategic planning is crucial with revised rules in CPA Evolution 2025. Review your history, take advantage of relevant CPA exemptions where possible, and put your efforts where they will have the greatest impact.

FAQs on CPA Course Exemptions

How to get exemption in CPA?

You can receive CPA exemption through qualifications such as CA, ACCA, or MBA, or through experience in related fields. Submit your application to a state board or evaluation authority.

Are there any exemptions for CPA?

Yes, most of the states permit CPAs for candidates with relevant professional or educational qualifications. Exemptions cut down on the number of accounting exam sections needed.

What is the eligibility to study CPA?

Eligibility typically requires a bachelor’s in accounting or equivalent, 120-150 credit hours, and in some cases work experience. Other exemptions are subject to previous credentials.

Can I do CPA in 3 months?

Although tough, it is possible to finish CPA in 3 months in the case of CPA exemptions and concentrating only on remaining sections. Previous experience in accounting and full-time studying are helpful.

0 notes

Text

US CPA vs Indian CA: Which Path Should You Take in 2025?

In today’s fast-evolving finance industry, choosing between US CPA and Indian CA can be a career-defining decision. With the demand for global finance professionals increasing, many Indian students are wondering: Should I go for CPA or CA?

Let’s break it down—based on syllabus, eligibility, global opportunities, and most importantly, what’s the better fit for your career goals.

🎯 Career Goals & Global Recognition

US CPA is globally recognized, opening doors to top multinational companies, Big 4 accounting firms, and high-paying roles in the US, Canada, and the Middle East.

CA is highly respected in India but has limited global mobility unless combined with another international certification.

💡 Want a deeper dive into the comparison? 👉 Check this CPA vs CA comparison on Blogger

📚 CPA Exam Structure: Less Time, More Value

The CPA consists of 4 papers:

Auditing & Attestation (AUD)

Financial Accounting & Reporting (FAR)

Tax Compliance & Planning (TCP)

Business Analysis & Reporting (BAR)

Unlike CA, which takes 4–5 years, the CPA can be completed in just 12–18 months.

📘 Learn more about the CPA papers here: 👉 CPA Exam Syllabus Breakdown

📝 Eligibility Criteria: Who Can Apply for CPA?

CPA requires:

A Bachelor’s degree in commerce or equivalent

120 to 150 credit hours of education

Some state boards may require work experience

✅ For detailed eligibility info, check: 👉 Eligibility Criteria for CPA

🌍 Can You Become a CPA While Living in India?

Absolutely! You can take the CPA exam right here in India and apply for licensure through a US state board that allows international candidates.

Read the full step-by-step guide: 👉 How to Become a US CPA in India

⚠️ Mistakes Indian Students Often Make with CPA

Many Indian students pick the wrong state board or fail to get their documents evaluated properly. These mistakes delay your CPA journey unnecessarily.

🚫 Don’t fall into the same trap! 👉 Top Mistakes Indian Students Make (Medium blog)

📊 Final Verdict: CPA or CA?

FactorUS CPAIndian CADuration1.5 Years4–5 YearsRecognitionGlobalMostly IndiaExam Structure4 Papers3 Levels (Foundation to Final)Starting Salary (India)₹7–10 LPA₹6–8 LPACareer PathMNCs, Global FirmsIndian Firms, Audit, Tax

Still deciding? Here’s another perspective: 👉 CPA vs CA – Tumblr Post

🏫 The Best CPA Training in India – NorthStar Academy

Choosing the right training partner is crucial. NorthStar Academy provides:

Becker-backed curriculum

Personalized mentorship

State board & evaluation assistance

90%+ pass rate

🎓 Explore the full CPA program details here: 👉 CPA Course Page

🔗 Recap of All Resources

📘 CPA Syllabus Guide

✅ CPA Eligibility

🌏 Become a CPA from India

🚫 CPA Mistakes to Avoid – Medium

📖 CPA vs CA – Blogger

📖 CPA vs CA – Tumblr

🏫 NorthStar Academy Home | CPA Course Page

0 notes

Text

🌍 Why ACCA Is the Ultimate Global Credential for Aspiring Finance Professionals in 2025

Are you dreaming of an international finance career that gives you global recognition, career flexibility, and industry relevance? If yes, then the ACCA (Association of Chartered Certified Accountants) course could be your best bet in 2025.

In this blog, we break down why ACCA stands out among finance certifications and how you can get started with confidence—drawing insights from expert guides and real student experiences.

✅ Why Choose ACCA? Career Scope & Global Relevance

One of the biggest reasons to choose ACCA is its global credibility and job opportunities. Whether you're aiming to work in Big 4 firms or want to explore finance roles in the UK, Middle East, or India, ACCA prepares you for it all.

📘 Why Choose ACCA Course – NorthStar Academy

💡 And here are 5 solid reasons why ACCA is ideal for international careers: 📚 5 Reasons Why ACCA is the Best Choice for a Global Career – Tumblr

🎯 Are You Eligible for ACCA in 2025?

Before you start your ACCA journey, it’s important to understand the eligibility criteria, especially if you’re a 12th commerce student or pursuing B.Com.

📖 ACCA Course Eligibility and Requirements – NorthStar Academy

Also, avoid common pitfalls during your ACCA journey: 📕 Top Mistakes Students Make During ACCA – Blogger

📝 How to Prepare for ACCA Exams – Syllabus & Study Plan

Preparing for ACCA exams is not just about hard work—it's about strategy. Whether you're tackling the Applied Knowledge level or heading toward Strategic Professional, a clear plan is key.

📘 ACCA Exam Preparation & Syllabus Guide – 2025

Need a step-by-step guide to the exam structure and modules? 📘 Understanding the ACCA Exam Structure – WordPress

📌 Bonus: Looking to Explore Other Options Like CPA?

If you're also considering the CPA course, check this detailed course overview: 📘 CPA Course Details – NorthStar Academy

✨ Final Words

ACCA is more than just a certification—it's a global passport to finance careers in audit, taxation, consulting, and management accounting. With the right preparation, mentorship, and resources, your ACCA journey can be both rewarding and transformative.

🔗 Explore. Prepare. Succeed.

0 notes

Text

🎓 CMA USA 2025: Why It’s the Smartest Career Move for Finance Professionals in India

As India’s finance sector continues to globalize, CMA USA has emerged as a powerful certification for those seeking international careers, Big 4 opportunities, and strategic management roles. But in 2025, one question dominates: Should you self-study or go for guided mentorship? And how does CMA USA compare to CPA?

In this blog, we’ll explore how the CMA USA credential is changing career trajectories in India and how NorthStar Academy (NSA) can be your launchpad to success.

🧠 Self-Study vs Mentor Guidance: Which Works Better for CMA USA?

The journey to becoming a Certified Management Accountant (CMA USA) often begins with this crucial choice: Self-study or mentor guidance?

This detailed NorthStar blog dives into both approaches. While self-study offers flexibility, guided mentorship from experts ensures structure, accountability, and fewer chances of burnout.

To dive deeper, check out this complementary Medium post on building a self-study plan for CMA USA.

🧭 Career Pathways: What Can You Do With a CMA USA Certification?

CMA USA isn’t just about passing exams — it's a career-defining qualification that opens doors to strategic finance roles.

This NSA blog on CMA career paths breaks down potential roles in FP&A, corporate strategy, controllership, and beyond. With global demand rising, certified professionals are now seen as high-value strategic assets.

Plus, explore how CMA USA certification increases your chances of landing Big 4 jobs in this insightful WordPress article.

📈 Why Are CMA USA Professionals So Hyped in India?

More students and professionals in India are turning toward CMA USA — and with good reason.

This NSA article explains how multinational corporations are actively recruiting CMA USA holders due to their strategic decision-making capabilities and international compliance knowledge.

⚖️ CMA USA vs CPA USA: Which Should You Choose?

Torn between CMA USA and CPA USA? You’re not alone. Both offer global career potential, but serve different niches.

Read this Blogger article comparing CMA and CPA to understand the key differences in syllabus, job roles, and salary expectations.

If you’re considering the CPA route, check out NorthStar’s CPA Course Details — powered by Becker and guided by India’s top faculty.

🏆 Why NorthStar Academy Is the #1 Choice for CMA USA Prep

Thousands of students choose NorthStar Academy each year for good reason:

✅ Top-rated mentorship from M. Irfat ✅ Flexible learning formats (online + offline) ✅ Becker-backed CPA curriculum ✅ Real-time doubt clearing and placement assistance

Whether you're a student, working professional, or a career switcher, NSA ensures you’re not just exam-ready — you’re career-ready.

✅ Final Words: CMA USA in 2025 Is a Game-Changer

If you’re serious about leveling up your career in finance, CMA USA offers unmatched ROI, international recognition, and fast-track career growth. The key is choosing the right preparation model — and the right mentor.

Let NorthStar Academy guide your journey, and step confidently into a future full of opportunity.

0 notes

Text

youtube

CA vs US CPA | US CPA Qualification

CA vs US CPA | US CPA Qualification | Difference between US CPA and CA | Is CPA better than CA 🔴 CPA Course Details @FinTramGlobal CA & US CPA are two professional qualifications which are very well known in the field of accounting and finance. The key differences between both are explained in this video - Eligibility, Subjects, Exam Pattern, Exam Fees, Total Cost, Jobs in India and many more... Do let us know in the comments if you guys have any doubts! To know more about US CPA Visit: https://fintram.com/us-cpa-course/ Also contact us on: +91-8882677955

#us cpa jobs in usa#us cpa jobs in india#us cpa course#us cpa course details#us cpa course full details#us cpa course material#ca vs cpa in india#ca vs cpa vs acca#cpa vs ca india#difference between ca and cpa qualification#cpa jobs in india#cpa jobs in usa#us gaap#us cpa syllabus#us cpa#cpa or ca#Youtube

0 notes

Text

How much salary does a CPA at a Big 4 company earn in India?

A Certified Public Accountant (CPA) plays a vital role in any organization’s success with their expertise in analyzing the finances, taking ownership of the taxes, maintaining budget reports, and auditing. Other specializations, like forensic accounting and personal financial planning, are also worth mentioning when it comes to financial growth and success. So, what is the average salary of a CPA in India? Is there scope for CPA in the country? Do the Big 4 hire CPAs in India?

To begin with, it is no longer a far-fetched dream to secure a job in one of the Big 4 companies, and definitely not when it comes to earning a 7-figure salary as a CPA in India. This success story is shared with over 55,000 alumni by Miles Education, which has gamified the accountants talent pool accessibility to the companies. Strong tie-ups with more than 220+ companies (75+ Fortune 500 companies) has definitely been the driving force behind the triumph.

Moreover, complex exams like CPA can feel weighing down on the aspirants without the right support and guidance but nothing to worry, we have the world’s favorite CPA instructor! Backed by over 100 global industry experts as faculties, Miles Education shares an impressive 82%+ pass rate.

The CPA program is tailor-made to accommodate full-time working professionals without causing hindrance to their jobs. The CPA exams can be conducted any day of the year, allowing professionals to choose their own timeline. But it is important to remember that all three exams have to be completed within 20 months of passing the first exam. After successful completion, a CPA license is given to the aspirant, enabling him to work in the US and other countries, which is still a dream for many. Presently, the Big 4 companies and MNCs are outsourcing audit and tax jobs from US to India, enabling aspirants to earn 10+ lakhs per year, the average salary of a CPA in India, through the Miles Education CPA program. Enroll to Miles Education today, get trained by the best in the industry, crack the CPA exam and open doors to unlimited possibilities. Live the dream of working in the Big 4!

0 notes

Text

Unlock global career opportunities with the CMA USA course! Master management accounting and financial strategy. Achieve international recognition and expertise. Join our program to advance your career and financial insights. Your path to success starts here. 🌍📊

Apply now at https://www.ifcpltd.com/cma

Connect with us on https://wa.me/919903100338

#cma#cma course#cma usa course online#cma usa#cma usa course#cma syllabus#cma course online#education#career#accountant#higher education#accounting career#cma awards#accounting professional#cpa exam#e learning#finance and accounting#finance professionals

0 notes

Text

B.Com Courses: Best Commerce Programs for a Successful Career

One of the most sought-after undergraduate degrees for students who wish to build a strong foundation in commerce, finance, and business is a Bachelor of Commerce (B.Com). A B.Com degree enables students to gain an in-depth knowledge of accounting, economics, business law, taxation, and management, and hence it is one of the most desired choices for a high-paying job in the corporate world. If you are looking for the best B.Com courses, ACC - Commerce Coaching in Jodhpur provides expert coaching and methodical learning to help students become successful in their academic and professional life. Why B.Com Courses? A B.Com degree is a generalist certification that opens the doors to several career prospects in banking, finance, accounting, taxation, business management, and even entrepreneurship. Some of the key reasons for students opting for B.Com courses are: ✅ Good Career Prospects – A B.Com degree lays down a strong groundwork for careers in finance, accounting, and management. ✅ Professional Course Preparation – It is a good option for CA, CS, CMA, MBA, and other professional exam aspirants. ✅ Multiple Career Opportunities – Students of B.Com can be employed in banks, insurance, tax, audit, and corporate firms. ✅ Specialization and Advanced Studies – M.Com, MBA, CFA, CPA, or any other specializations can be pursued by students after B.Com. Types of B.Com Courses Available There are a number of B.Com courses that have been designed in accordance with various career aspirations. Some of the top B.Com courses are: 1. B.Com (General) It is the most sought-after B.Com course, which provides a general exposure to commerce-related subjects such as accounting, business law, and economics. It is ideal for students who want to maintain career prospects in any field. 2. B.Com (Honours) B.Com (Hons) is a specialized version of the overall B.Com. It provides thorough knowledge in selected subjects like finance, taxation, or accounts. Students seeking specialization and better employment opportunities choose this course. 3. B.Com in Accounting and Finance Specialization here encompasses financial accounting, auditing, and taxation and would be appropriate for students seeking career opportunities in banks, finance companies, and corporate accounts. 4. B.Com in Banking and Insurance A postgraduate B.Com program including subjects like risk management, bank regulations, and insurance policies. It is an excellent chance for students who are interested in finding employment with banks, financial organizations, or insurance companies. 5. B.Com in Taxation The course provides professional training in direct taxes, indirect taxes, GST, and finance legislations. The course is for students who wish to become tax consultants or financial consultants. 6. B.Com in Business Management This is a course designed for students who wish to gain managerial and leadership skills. It equips on subjects like business strategy, entrepreneurship, and corporate governance. Career Options After B.Com Courses There are various career options that come with a B.Com degree, and this cuts across sectors. Some of the most suitable options include: 1. Chartered Accountant (CA) The majority of students prefer taking CA after they have completed studying B.Com as the syllabus is common in CA subjects and it is made simpler to sit for CA Foundation and Intermediate examinations. 2. Company Secretary (CS) Another career option of B.Com students is CS in which one studies corporate law, business policies, and law compliance in companies. 3. Cost and Management Accountant (CMA) CMA is a suitable professional course for students who are interested in cost accounting and financial management. 4. Banking and Finance Careers B.Com graduates can be: - Financial Analysts - Investment Bankers - Accountants - Auditors

5. Government Sector B.Com graduates can appear for government exams like: - UPSC (Civil Services, Indian Revenue Services) - SBI/IBPS Bank PO & Clerk Exams - SSC CGL (For Finance and Audit Departments)

6. Entrepreneurship and Business Administration With B.Com, students learn required business acumen, and hence they are able to venture into their own business or manage family businesses properly. Why Study at ACC for B.Com Courses? At ACC - Commerce Coaching, we provide quality coaching to B.Com students that enables them to excel both academically and in entrance exams. Our B.Com coaching provides: ✔ Experienced Faculty – Highly qualified faculties with deep insight in commerce studies. ✔ Extensive Study Material – Recent notes, reference books, and practice papers. ✔ Frequent Doubt Solving & Mentorship – Personalized mentorship to clarify doubts. ✔ Mock Tests & Performance Analysis – Continuous assessment through test series. ✔ Preparing for Professional Courses – Even B.Com students are prepared for CA, CS, CMA, and other finance examinations.

1 note

·

View note

Text

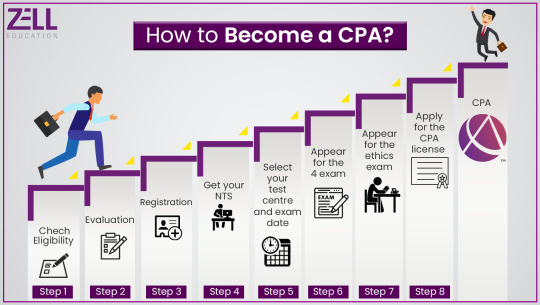

Here’s everything you need to know about the CPA course details, fee structure, syllabus, and eligibility | Zell Education

0 notes

Text

Here’s everything you need to know about the CPA course details, fee structure, syllabus, and eligibility | Zell Education

0 notes