#CommonStock

Explore tagged Tumblr posts

Text

What is Common Stock? Different Types vs Preferred Stock In 2025

Investing in the stock market can be a complex endeavor, particularly when it comes to understanding the various types of stocks available. Among the most important distinctions to understand is the difference between common stock and preferred stock. This article will delve into about common stock, explore various types of common stock, and highlight how it differs from preferred stock. By the end, you’ll have a clearer understanding of these investment vehicles and how they can fit into your portfolio.

What is Common Stock: Meaning and Basics

Common stock represents ownership in a corporation. When you buy common stock, you are purchasing a piece of the company, which entitles you to a portion of the profits (through dividends) and a vote in major corporate decisions, typically at the annual shareholders’ meeting. Common stockholders have the potential for high returns through price appreciation, but they also face higher risks compared to preferred stockholders.

Key Characteristics of Common Stock

Ownership Rights: Common stockholders are partial owners of the company and their ownership is represented by the number of shares they hold.

Voting Rights: Most common stocks provide voting rights, typically one vote per share, allowing shareholders to vote on important matters like electing the board of directors.

Dividends: Dividends on common stocks are not guaranteed and can vary based on the company’s profitability and discretion of the board of directors.

Capital Appreciation: Common stocks offer significant potential for price appreciation, which can result in high returns for investors.

Residual Claim: In the event of liquidation, common shareholders have the last claim on the company’s assets, after creditors and preferred shareholders are paid.

Types of Common Stock

Common stock can be further categorized into different types, each with its own characteristics:

Blue-Chip Stocks: These are shares of large, well-established, and financially sound companies with a history of reliable performance and dividends. Examples include companies like Apple, Microsoft, and Johnson & Johnson.

Growth Stocks: These stocks belong to companies that are expected to grow at an above-average rate compared to other companies. They typically reinvest their earnings into the business, so they may not pay dividends. Examples include tech companies like Amazon and Tesla.

Income Stocks: These stocks are known for paying consistent and high dividends. They are typically from stable, mature companies. Utility companies often fall into this category.

Value Stocks: These stocks are considered undervalued based on fundamental analysis. They have lower price-to-earnings ratios and are believed to have intrinsic value higher than their current market price.

Penny Stocks: These are very low-priced stocks, typically trading below $5 per share. They are highly speculative and can be very volatile. They are not typically listed on major exchanges.

What is Preferred Stock?

Preferred stock is a type of equity that has characteristics of both stocks and bonds. Preferred stockholders have a higher claim on assets and earnings than common stockholders, often receiving dividends before common shareholders. These dividends are usually fixed and can be a steady source of income. However, preferred stock typically does not carry voting rights.

Key Characteristics of Preferred Stock

Fixed Dividends: Preferred stocks usually pay fixed dividends, making them more stable in terms of income compared to common stocks.

Priority Over Common Stock: In the event of liquidation, preferred shareholders are paid before common shareholders but after debt holders.

Limited or No Voting Rights: Preferred shareholders generally do not have voting rights, or their voting rights are restricted.

Callable Feature: Preferred stocks can be callable, meaning the issuing company can buy them back at a predetermined price after a certain date.

Convertible Options: Some preferred stocks can be converted into a specified number of common shares, offering potential for capital appreciation.

Common Stock vs Preferred Stock: Key Differences

Understanding the differences between common and preferred stocks is crucial for making informed investment decisions. Common stocks offer the potential for high returns and voting rights but come with higher risk. Preferred stocks, on the other hand, provide stable income through fixed dividends and have a higher claim on assets, making them a safer investment option with limited growth potential.

Choosing between common and preferred stock depends on your investment goals, risk tolerance, and preference for income stability versus growth potential. Both types of stocks can play a vital role in a diversified investment portfolio.

Why Choose Common Stock?

Growth Potential: Common stocks have the potential for significant capital appreciation, offering higher returns compared to preferred stocks.

Voting Rights: Shareholders have a say in corporate governance, influencing decisions like mergers, acquisitions, and election of the board of directors.

Liquidity: Common stocks are typically more liquid, with more shares traded on major exchanges daily, making it easier to buy and sell.

Dividend Growth: While not guaranteed, dividends for common stocks can grow over time as the company’s profitability increases.

Why Choose Preferred Stock?

Stable Income: Preferred stocks provide fixed dividends, offering a reliable source of income, which is attractive to income-focused investors.

Lower Risk: With a higher claim on assets and earnings, preferred stocks are less risky compared to common stocks.

Convertible Feature: The option to convert preferred stocks into common stocks provides an opportunity for capital appreciation if the company performs well.

Priority in Dividends: Preferred shareholders are paid dividends before common shareholders, ensuring a more consistent return.

Common Stock and Uncommon Profits

“Common Stocks and Uncommon Profits” by Philip Fisher

Philip Fisher’s “Common Stocks and Uncommon Profits” is a seminal work that offers a comprehensive approach to stock investing. Fisher’s philosophy focuses on thorough research, understanding the company’s business, and long-term investment horizons. Here are some key principles from the book:

Scuttlebutt Method:

Fisher emphasizes gathering information from various sources, including competitors, suppliers, and customers, to gain a deep understanding of a company’s prospects.

Quality of Management:

Assessing the quality and integrity of a company’s management is crucial. Fisher looks for innovative leaders who prioritize long-term growth and shareholder value.

Growth Potential:

Fisher advises investing in companies with strong growth potential. This includes analyzing the company’s products, market position, and future prospects.

Financial Health:

A company’s financial health, including its balance sheet, cash flow, and profit margins, is a critical factor in Fisher’s investment strategy.

Long-Term Perspective:

Fisher advocates for a long-term investment approach. He believes that holding onto high-quality stocks over many years can yield substantial returns.

Achieving Uncommon Profits

Fisher’s strategies aim to help investors achieve uncommon profits through a disciplined and research-driven approach. Here are some steps to follow based on his principles:

Conduct In-Depth Research:

Use the scuttlebutt method to gather comprehensive information about the company from various sources.

Evaluate Management:

Assess the leadership team’s track record, vision, and commitment to innovation and growth.

Identify Growth Opportunities:

Look for companies with products or services that have significant growth potential and a competitive edge in the market.

Analyze Financials:

Examine the company’s financial statements to ensure it has a strong balance sheet, healthy cash flow, and robust profit margins.

Invest for the Long Term:

Focus on long-term investments in high-quality companies, allowing time for the company’s value to appreciate.

CONCLUSION

Understanding the nuances between common stock and preferred stock is crucial for making informed investment decisions. Common stocks offer the potential for high returns and voting rights but come with higher risks and no guaranteed dividends. Preferred stocks, on the other hand, provide a more stable income with fixed dividends and lower risk but typically lack voting rights and significant growth potential.

Investors should consider their financial goals, risk tolerance, and income needs when deciding between common and preferred stocks. A diversified portfolio that includes both types of stocks can provide a balanced approach, leveraging the growth potential of common stocks and the stability of preferred stocks.

By gaining a comprehensive understanding of these investment vehicles, you can better navigate the stock market and make choices that align with your long-term financial objectives. Whether you are looking for growth, stability, or a combination of both, knowing the difference between common stock and preferred stock is essential for building a robust investment strategy.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#commonstock#preferredstock#stockinvesting#financialliteracy#investment101#equityinvesting#personalfinance#typesofstock#stocks2025#howtoinvest#beginnerinvesting#financeblog#learninvesting#stockmarketbasics#moneymatters

0 notes

Text

youtube

#AIInvesting#StockMarket#InvestWithAI#CommonStock#PreferredStock#StockTrading#BestStockApps#SmartInvesting#AIStockTrading#FinanceTips#Youtube

0 notes

Link

#commonandpreferredstock#commonstock#commonstockandpreferredstock#commonstockvspreferredstock#commonstockvspreferredstockinhindi#commonvspreferredstock#differencebetweencommonandpreferredstock#differencebetweencommonstockandpreferredstock#preferredstock#preferredstockdividends#preferredstockvscommonstock#preferredvscommonstock#stockmarket#whatiscommonstockandpreferredstock

0 notes

Text

Trutankless Announces Spin-Off of Wholly-Owned Subsidiary, Tankless365

Streamlined Process and Stockholder Benefits PHOENIX - Trutankless, Inc. made a significant announcement today, revealing its plans to spin off its wholly-owned subsidiary, Tankless365, Inc. Shareholders of Trutankless, Inc. will receive shares of Tankless365, Inc. based on a pro-rata distribution ratio of 4:1. On a date to be determined by the Board of Directors, known as the "Distribution Date," each shareholder holding common stock as of that date will be entitled to receive one share of Tankless365, Inc. common stock for every four shares of Trutankless, Inc. common stock owned. This distribution will result in the shareholders collectively owning 100% of the outstanding common stock of Tankless365, Inc. Remarkably, Trutankless, Inc. stockholders need not take any action to participate in the distribution and receive their shares of Tankless365, Inc.'s common stock.

Trutankless, Inc.: Pioneering Home Automation and Efficiency Systems

Energy-efficient Water Heaters Driving Environmental Sustainability Trutankless is a technology-driven company specializing in accessible, next-generation home automation and efficiency systems. The company's primary product line consists of electric tankless water heaters, which outperform traditional tank water heaters in terms of energy efficiency, output, dependability, and environmental sustainability. With a customer base comprising plumbing wholesale distributors and dealers nationwide, Trutankless, Inc. has established itself as a leading provider of innovative home solutions since its inception in 2008. The company's headquarters are located in Scottsdale, Arizona.

Tankless365, Inc.: Revolutionizing Lead Generation in Home Services

Enhancing Trade Professionals' Efficiency in Lead Capture and Monetization Tankless365, Inc., incorporated as a Nevada corporation on October 21st, 2021, operates as a wholly-owned subsidiary of Trutankless, Inc. Focusing on the mission to innovate lead generation within the home services industry, Tankless365 aims to augment the efficiency with which trade professionals capture and monetize leads in real-time. To support its operations, Tankless365, Inc. has enlisted the services of Pacific Stock Transfer as its transfer agent. With a streamlined process and the opportunity for stockholders to benefit from their ownership in both Trutankless, Inc. and Tankless365, Inc., this spin-off represents an exciting development for investors and stakeholders alike. The strategic move enables Trutankless, Inc. to further concentrate on advancing its technology-driven home automation and efficiency systems, while Tankless365, Inc. positions itself as a leading force in revolutionizing lead generation within the home services sector.

More About Trutankless

Trutankless, Inc., founded in 2008 and headquartered in Scottsdale, Arizona, has established itself as a technology-driven developer of accessible, next-generation home automation and efficiency systems. The company's primary focus lies in the production and distribution of a line of electric tankless water heaters, which surpass traditional tank water heaters in terms of energy efficiency, output, dependability, and environmental sustainability. Trutankless, Inc. has built strong business connections with plumbing wholesale distributors and dealers throughout the United States, positioning itself as a trusted provider of innovative home solutions. Under the guidance of its dedicated management team, Trutankless, Inc. has achieved notable success in the industry, constantly striving to push boundaries and drive advancements in home automation and efficiency technology. Sources: THX News & Trutankless Inc. Read the full article

#Commonstock#DistributionDate#Energyefficiency#Homeautomation#Next-generation#Prorataratio#Shareholders#Spin-off#Tankless365#Trutankless

0 notes

Photo

Watch the Interview! #AHRF #theapartmentlady #tav1 #investing #commonstock #evictionprevention #5daynotice @evictionprevention https://player.vimeo.com/video/431169792 https://www.instagram.com/p/CCJ7UU4jJ_W/?igshid=w2i3g4z36d68

1 note

·

View note

Photo

#Stocks #REALESTATE #Business #cryptocurrency #Bitcoin $Gbtc $Btsc #Blockchain $Riot $Bcii $Hog $x #Steel $Rgr $mjna $Qqq $Dogs $UAE $Spy $Dia $phot #Wallstreet #Traders #Pinksheets #Pennystocks #REALESTATE #Reit #Housingbubble #Doddfrank #Dowjones #Commonstock $Fb $Goog $Amzn $Brk.b #mmj #Bearmarket📉 https://www.instagram.com/p/B4a3PJWDWBk/?igshid=1j7xjrcxmo3ng

#stocks#realestate#business#cryptocurrency#bitcoin#blockchain#steel#wallstreet#traders#pinksheets#pennystocks#reit#housingbubble#doddfrank#dowjones#commonstock#mmj#bearmarket📉

1 note

·

View note

Photo

This will be my last monthly update on Instagram. ⠀ Seeing it as useless at this point, with more cons then pros ⠀ I’m active on @twitter @commonstock and @substackinc under from100kto1m ⠀ Check out www.from100kto1m.com and subscribe it’s free! ⠀ #from100kto1m #from100k #millionaire #million #substack #subscribe #checkitout #twitter #commonstock #investing #longterm #stocks #dividends #options #stockmarket #usa #international #screenshots #money #mindset #journey #links #free #subscription #equities #wealth #learning #finance #insta #instagram (at New York, New York) https://www.instagram.com/p/Ckn8GhCOpu3/?igshid=NGJjMDIxMWI=

#from100kto1m#from100k#millionaire#million#substack#subscribe#checkitout#twitter#commonstock#investing#longterm#stocks#dividends#options#stockmarket#usa#international#screenshots#money#mindset#journey#links#free#subscription#equities#wealth#learning#finance#insta#instagram

0 notes

Text

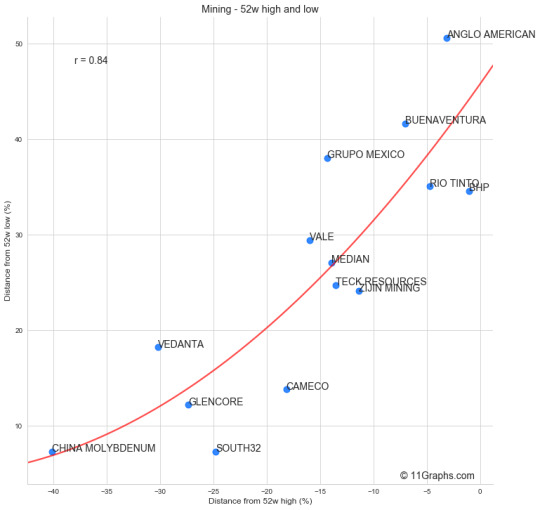

$NGLOY and $BVN are near their 52w high within the mining industry.

$CMCLF is near its 52w low with a 40% decrease from its highest price.

#Mining#Analysis#Chart#Charts#ChinaUS#CommonStock#Equities#Finance#Financial#FinancialInvestment#FinancialMarket#FundamentalAnalysis#Graphs#Invest#Investing#Investment#Investor#LongTermInvestment#Stock#StockAnalysis#StockMarket#StockPicks#Stocks#Valuation#ValueInvesting

0 notes

Photo

99 Alternatives – Common Stocks Common stocks represent ownership as a security within a corporation. Holders of a common stock use control by selecting a board of director and voting on a corporate policy. Common stockholders tend to be at the bottom of the priority ladder for ownership structure, in the case of liquidation, common shareholders have the rights to a company’s assets after bondholders. Other preferred shareholders and debtholders are paid in full. For more information, log onto – https://www.99alternatives.com/sub-alternatives/common-stocks.html

#AlternativeInvestments#alternativeassets#investment#investmentalternatives#invest#whattoinvestin#99alternatives#commonstocks#shares

1 note

·

View note

Photo

Are you interested in Stock Investments, but fear of Loss? Let us help you with this. Get constant earnings without loss through applying these tricks: · Use stop-loss orders for safe investment · Employ trailing stops for better understanding · Going against the grain shall help you · Have a hedging strategy · Hold cash reserves for later times · Sell and switch - have dynamic approach · Have Diversified alternatives · Consider the zero-cost collar and many more. This stuff will definitely help you. To know more of such Stock Secrets, connect with us @ Jayanistockadvices.com or Reach Our +91 9550645959 Join On Telegram: https://lnkd.in/gVgkCdDb

0 notes

Link

0 notes

Photo

Beef Entertainment Corporation #Business #Blackwallstreet #Bitcoin #cryptocurrency #Realtor $Fnma #Broker #Powerbroker #Currencies #Ethereum #Blockchain #equitieoptions #Futures #Options #Fiducuary #Commonstocks #Volatility #Bearmarket📉 #Socialjustice #Socialmedia #Socialism #Capitalism #Cashflow #Passiveincome #Liquidity #Privateequity #Venturecapitalist https://www.instagram.com/p/Byz3QFhjMaA/?igshid=uckyjbo4l5gl

#business#blackwallstreet#bitcoin#cryptocurrency#realtor#broker#powerbroker#currencies#ethereum#blockchain#equitieoptions#futures#options#fiducuary#commonstocks#volatility#bearmarket📉#socialjustice#socialmedia#socialism#capitalism#cashflow#passiveincome#liquidity#privateequity#venturecapitalist

0 notes

Photo

Here is how I have done up until now (6/2/2022) ⠀ @webullglobal has added some more extra stuff, loving using their app! ⠀ I’ll be working on my substack probably over the weekends so if you haven’t yet check it out at www.from100kto1m.com ⠀ How’s everyone else been doing in this market? I must say I feel more relaxed doing this on monthly rather then weekly … less stressful and weekly doesn’t really do much. ⠀ DMs are open and follow me on here, there, and everywhere ⠀ Til next month, peace ✌️ ⠀ #from100kto1m #investing #mrzaye #substack #money #twitter #instagram #mindset #followme #millionaire #wallst #millionairemindset #commonstock #value #growth #screenshots #invest #time #options #stocks #stockmarket #longterm #buying #selling #holding #dividends #100k #onemillion #brooklyn #consistency (at New York City, N.Y.) https://www.instagram.com/p/CeUcG3FgMme/?igshid=NGJjMDIxMWI=

#from100kto1m#investing#mrzaye#substack#money#twitter#instagram#mindset#followme#millionaire#wallst#millionairemindset#commonstock#value#growth#screenshots#invest#time#options#stocks#stockmarket#longterm#buying#selling#holding#dividends#100k#onemillion#brooklyn#consistency

0 notes

Text

Voxels 'Crypto-To-Equity' 交易所現在Glance的VR即將到來_

Promoting一種加密代幣raise現金為公司是很少新的,但是利用加密代幣獲得一個公平在組織是另一個扭曲.現在主要數字真相(VR)環境建設者和市場 Voxelus,共同成立由連續企業家Halsey 無足輕重指導CNET和Salesforce.com的後方,是為了允許使用他們的in-娛樂加密令牌,體素(VOX),到購買公平在私人持有的Voxelus Inc. Voxelus,2015年成立,其平台允許終端用戶開發虛擬現實在線遊戲,遭遇和數字空間沒有創作一行代碼,宣布今年12月,他們將為您提供最多33.3%股權在特拉華州註冊的corporationVoxelus Inc.,在exchange為15%的Voxel 外匯(股票代碼:VOX)即目前發行和優秀在部門。 transfer代表初始ever公平就是存在兌換公司外匯,特別體素。 作為比賽加密貨幣,體素電力所有銷售額和電子商務被描述為“革命性的區塊鏈新產品”。它結合完全'工作證明'穩定性在後面比特幣具有例外檢查站服務器,停止可能��擊 社區。 需要所有活躍交易的代幣transform,然後代幣持有者合作在交易所轉換將擁有第三股份公司,預定發生在初期季度開始。 |一個人}次供應為體素持有者。 大多數VR組織與種類創業譜系在後面Voxelus不可用日常|日常|每天|每天|日常|日常}交易者,因為他們被管理企業資本家,估值為 high如$三億百萬(m)或更多。 Whilstvirtual真相是繼續青少年 作為利基技術訣竅在相當多西方國家,VR作為形式主流娛樂在台灣蓬勃發展。 城鎮遍及地區,給一個VR體驗關於率一部電影門票。分析師希望虛擬現實商業在台灣到2020年將增加到8.5十億美元。 一個年輕台灣男孩戴著虛擬事實(VR)眼鏡,他站在購物中心的模擬器中。 . [+] 2016年11月27日,台灣台北,哪裡VR正在蓬勃發展。 (Photo by Kevin Frayer/Getty Photographs). 2016年3月31日開始買賣的Voxels加密貨幣,現在以號交易交換substitute加密貨幣 - Bittrex, Poloniex and ShapeShift - 並有overall market 大寫around $342,068 截至今天 - 等於到440比特幣(BTC)。這個比起market cap of a just around $two.6m 以前這個公曆年在七月中旬。 現在$一個購買大約九十二體素 (VOX)。 Voxelus系統組成,3D風格應用程序為電腦和Mac Voxelus Viewer,在台式電腦,Oculus Rift和三星VR 設備上有效 和,Voxelus Market,使創作者市場和消費者 獲得VR素材和遊戲標題為Voxelus生態系統,就業體素in-體育加密貨幣。 更多比一百,000指標向上到日期,它是開始由企業家Halsey Small,誰成立CNET,是谷歌語音的聯合創始人、Salesforce.com、GrandCentral(現為谷歌語音)、OpenDNS、Uphold和Rhapsody,以及布宜諾斯艾利斯的crewbuilders由阿根廷計算機軟件領導行業資深Martin Repetto,CEO兼聯合創始人。 Repetto 事先製造首選大型多人在線在線休閒(MMOG),Atmosphir,電影電子遊戲創作設備那個結束在TechCruch502008年再次。MMOG是���能力支持重要數字玩家,一般從數百到數不勝數,同時在非常相同 地球aroundan萬維網關係。 在加入Voxelus之前,Repetto是Slight Studios的CEO 運行一個團隊二十開發者在development的Atmosphir。作為聯合創始人,Repetto和Slight加入了Maximo Radice,在軟件包市場為14很長一段時間和主要集中關於進步視頻遊戲。 Equity Stake 33.3%公平股權,相當於31.5百萬VOX,將之後 exchange程序完成在Q1next{公曆年.還有,考慮到一個人想要以購買體素在交易,他們將定義必須出現來自加密貨幣觀眾 . 至於為什麼公司做出決定揀出在此加密到公平的轉換路線,Repetto,Voxelus CEO 主要在布宜諾斯艾利斯,定義:“我們堅定相信在長期,但是希望給予那些分享我們的視力又一個 參與成就組織。” Given表示組織也擁有重要數量體素,使用區塊鏈來保留 監控,其價格標籤導致從更大稀缺如需求在市場上升應該增加價值企業。 增加到企業容量到sellVoxels topurase 購買信息也會幫助提高其價格。使用區塊鏈也幫助製造接受和發送價值直率。 作為一家公司Voxelus有組織發展和廣告在美國洛杉磯,although進步和專業操作做工作是定位在城鎮位於布宜諾斯艾利斯西北約三百公里(186英里)的羅薩里奧。 整體員工是目前經營對挑戰。 兌換幣轉股權 Repetto 附加:“我們已經做出決定到提供這個1次替代他們的現金為公平在公司”。 公司功能禮物這個只有一個-時間解決方案為體素持有者transform他們的幣變成股權在公司,也允許任何人以獲得優勢機會以擁有公平在什麼被吹捧為“有前途的VR 平台以有吸引力估值。” 企業將在2017年初規定{minimum|minimal|bare minimum|Least|minimum他們揭開更多細節,但是無論什麼原來是可以給一個前景和展望在未來在數字現實和網絡遊戲房間。 在線種類&錢包 獨家,Voxelus將供應在網絡上kind和錢包tackle以fairness在foundation的33.33%的company 為卓越31.5m體素或任何部分。 Supplementalinformation為所有這些買家希望參與在貿易將建造可用 供應。 持有者沒有義務交易他們的體素,因為他們將繼續在Bittrex,Poloniex和ShapeShift上進行交易-如有效其他兩個更緊湊交換。這些交流會繼續繼續存在唯一系統的購買VR財產,遊戲名稱和Voxelus 市場上的世界。 ShapeShift 是 Voxels 的早期 交易者,並促成了其 $500,000 的眾籌,於 2015 年 12 月結束。數量 獲得additional and more c.$500,000已部署在建設多平台VR世界建設者。 (注意:是Erik Voorhees,ShapeShift的首席執行官和美國/巴拿馬開始-up創始人,負責用於命名in-活動加密貨幣令牌Voxel)。 在terms of content VR assets可能是一切從漫畫電子書環境贊助品牌汽車比賽賽道。 “我們有基本物理around其中幾個虛擬現實世界可以創造,“說 Repetto。 “我們已經有幾個獨特形式文章包各種種類世界。”其中一些可以注意到通過他們的網頁下面“市場”。 交易所換算等級 cypto-to-公平貿易計劃將運行月並在設置費用1.058%企業為差不多每一個1,000,000 體素 - 無關的售價的加密外匯在日。 那些體素重新獲得由Voxelus將應用為它的後續球面金額無更多比1,000,000 Voxels for eachmonth,表示少少一個人-50%1%了不起體素(6%per日曆年)。 關於後續round的資金,公司將有能力到“賣一個最小選擇體素”根據到Repetto,他將額外將使用進行操作和“購買品牌內容就像樂高積木與品牌樂高包一樣”。 公平在Voxelus的股權將在commonstock考慮到這一點沒有chosenstock發出,所有人合作 “將在玩主題與創始人,早期投資者和員工”,業務表示。 新技術舉措 “我們會用這些資金去建立on我們早期的領導在VR書面內容部門,”解釋重複。他包括:“我們有品種新專業舉措將進一步大大增強我們的人界面,如nicely為品牌 content discounts, teed up to be introduced in the coming weeks and months. ” Talking from Argentina he discovered that they will soon reveal “exciting new features" to the Voxelus software package platform. On forthcoming announcements related to the company's engineering prepare in the in the vicinity of future, Repetto stated: “We count on lots of releases from the corporation amongst now and the conversion”. That stated, he declined to mention precise specifics when canvassed. As to the use of cryptocurrency and its adoption when it arrives to the VR place, products and solutions and in-activity cryptocurrency tokens - be it Voxelus or many others - the Argentinian ventured: “Our perception is that 2017 is going to mark the commencing of the VR industry. Most game titles have in game forex. Only the Voxel can be taken out of the video game and still have value. This we hope to be broadly copied more than time.”

0 notes

Text

0 notes

Text

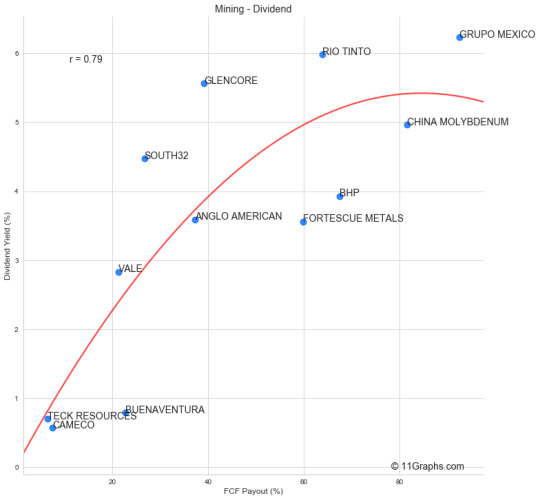

$GMBXF and $RIO have the highest dividend yield within the mining industry.

$CCJ, $TECK and $BVN have the lowest.

#Mining#Analysis#Chart#Charts#CommonStock#Equities#Finance#Financial#FinancialInvestment#FinancialMarket#FundamentalAnalysis#Graphs#Invest#Investing#Investment#Investor#LongTermInvestment#Stock#StockAnalysis#StockMarket#StockPicks#Stocks#TradeWar#Valuation#ValueInvesting

0 notes