Don't wanna be here? Send us removal request.

Text

Options Trading Tick : Trading Tick Call vs Put Advanced Strategies 2025

Options Trading Tick is a versatile and sophisticated investment strategy that allows traders to speculate on the future direction of a stock, bond, or other underlying asset. Unlike traditional stock trading tick, where traders simply buy or sell shares of an asset, trading tick call vs put involves the buying or selling of contracts that give the holder the right, but not the obligation, to buy or sell the underlying asset at a specified price (strike price) by a certain date (expiration date).

WHAT IS OPTIONS TRADING TICK CALL VS PUT?

An option tick is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. The options trading tick specified price is called the strike price, and the date on which the options trading tick expires is called the expiration date.

Types Of Options Trading Tick Call Vs Put

A call options gives the buyer the right to buy an underlying asset at the strike price. A put options tick gives the buyer the right to sell an underlying asset at the strike price.

Let’s delve into each type and understand how they function in the market.

Calls:

A call option gives the buyer the right, but not the obligation, to buy an underlying asset at a specified price (strike price) within a predetermined period (expiration date). When an investor purchases a call option, they are essentially betting that the price of the underlying asset will rise above the strike price before the option expires. If the price surpasses the strike price, the buyer can exercise the option and buy the asset at the lower predetermined price, thereby realizing a profit.

Key Points about Calls:

Bullish Outlook: Call options are typically used when investors have a bullish outlook on the underlying asset’s price.

Limited Risk: The maximum loss for the buyer of a call option is the premium paid for the option contract.

Unlimited Profit Potential: The profit potential for the buyer of a call option is theoretically unlimited, as the asset’s price can rise indefinitely.

Puts:

On the other hand, a put option grants the buyer the right, but not the obligation, to sell an underlying asset at a predetermined price (strike price) within a specified period (expiration date). Investors typically purchase put options when they anticipate that the price of the underlying asset will decline below the strike price before the option expires. If the price drops below the strike price, the buyer can exercise the option and sell the asset at the higher predetermined price, thereby profiting from the price decrease.

Key Points about Puts:

Bearish Outlook: Put options are commonly used when investors have a bearish outlook on the underlying asset’s price.

Limited Risk: Similar to call options, the maximum loss for the buyer of a put option is the premium paid for the option contract.

Profit Potential: The profit potential for the buyer of a put option is limited to the difference between the strike price and the asset’s price at expiration, minus the premium paid.

Why Trading Tick Call Vs Put?

Options trading tick can be used for a variety of purposes, including:

* Generating income: Options Trading Tick can be used to generate income by selling covered calls or cash-secured puts.

* Hedging against risk: Options Trading Tick can be used to hedge against risk by purchasing protective puts or calls.

* Speculating on the direction of a stock or other underlying asset: Options Trading Tick can be used to speculate on the direction of a stock or other underlying asset by purchasing calls or puts.

ADVANCED OPTIONS TRADING TICK CALL VS PUT STRATEGIES

There are many different advanced options trading tick strategies that can be used to achieve specific investment goals. Some of the most common advanced options trading tick call vs put strategies include:

Straddles and strangles: A straddle is an option trading tick strategy that involves purchasing both a call and a put option trading on the same underlying asset with the same strike price and expiration date. A strangle is similar to a straddle, but the strike prices of the call and put options trading are different.

Vertical spreads: A vertical spread is an option trading strategy that involves purchasing one option trading tick and selling another option trading tick with the same underlying asset but different strike prices and/or expiration dates.

Butterfly spreads: A butterfly spread is an option trading strategy that involves purchasing one option trading and selling two other options trading with the same underlying asset but different strike prices and/or expiration dates.

Condor spreads: A condor spread is an options trading strategy that involves purchasing two options trading and selling two other options trading tick with the same underlying asset but different strike prices and/or expiration dates.

RISKS OF OPTIONS TRADING TICK CALL VS PUT

Options trading tick can be a risky investment. The buyer of an option trading tick can lose the entire amount of money invested if the option trading tick expires worthless. The seller of an option trading tick can lose more money than the amount of the premium received if the option trading tick is exercised.

BEFORE YOU START OPTIONS TRADING TICK CALL VS PUT

Before you start options trading, it is important to understand the risks involved. You should also make sure that you have a good understanding of options trading pricing and greeks. Greeks are measures of the sensitivity of an option’s trading tick price to changes in various factors, such as the underlying asset’s price, volatility, interest rates, and time to expiration.

You can learn more about options trading tick by reading books, taking courses, and practicing with a simulated trading account.

Options Trading Course Empower Your Investing Journey With Us

Aspiring investors seeking to navigate the complexities of the stock market often find themselves drawn to the world of options trading course. This sophisticated investment strategy offers the potential for enhanced returns and risk management, but it also demands a deeper understanding of market dynamics and options trading course pricing models. To master this intricate realm, enrolling in an options trading course is a wise decision.

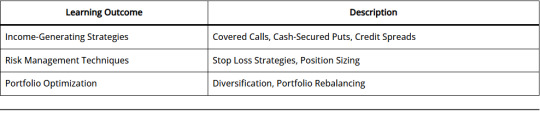

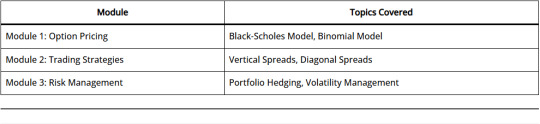

These comprehensive options trading courses provide a structured learning environment, guiding you through the fundamental concepts of options trading course, from basic terminology to advanced options trading course strategies. You’ll gain insights into call options trading course, put options trading course, Greeks, and the impact of various market factors on options trading courses pricing.

Under the guidance of experienced instructors, you’ll delve into various options trading courses strategies, including covered calls, cash-secured puts, straddles, and iron condors. You’ll learn how to analyze market conditions, identify potential options trading courses opportunities, and execute trades with confidence.

Options trading course also emphasize risk management techniques, equipping you with the knowledge to mitigate potential losses and protect your capital. You’ll learn about risk-reward ratios, hedging strategies, and position sizing techniques.

Whether you’re a novice investor seeking an introduction to options trading courses or an experienced trader aiming to refine your skills, an options trading courses offers a valuable pathway to success. By investing in your knowledge, you’ll gain the confidence and expertise to navigate the dynamic world of options trading courses and unlock its potential for enhanced returns.

CONCLUSION

Options trading tick call vs put can be a powerful tool for investors who understand the risks involved. By using advanced options trading tick strategies, investors can generate income, hedge against risk, and speculate on the direction of stocks and other assets.

Note: This is not financial advice. You should always consult with a qualified financial advisor before making any investment decisions.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#OptionsTrading#AdvancedTradingStrategies#CallVsPut#OptionsStrategies2025#StockMarketEducation#TradingTips#FinancialMarkets#DerivativesTrading#OptionsTickAnalysis#TradingStrategies2025#MarketInsights#InvestmentStrategy#TechnicalAnalysis#StockMarket2025#FinanceProfessionals#optionstrading#tradingstrategies#callvsput#advancedtrading#2025tradingtips#ticktrading#stockmarkettalk#derivativetrading#marketanalysis#daytradingtips#financiallearning#investsmart#tradingtechniques#optionstrading2025#putcallstrategy

0 notes

Text

Paper Trading by TradingView 2025: A Breakthrough Illusion

Paper Trading by TradingView has emerged as a powerful, risk-free tool for both beginners and experienced investors in the fast-evolving world of financial markets, where volatility is constant and FOMO (Fear of Missing Out) often drives impulsive decisions. Particularly in paper trade India, where retail participation has surged since 2020, paper trading has become an essential practice ground for learning, testing strategies, and gaining confidence without risking real capital. Paper trading by TradingView isn’t just a tool—it’s your virtual mentor, strategic playground, and confidence engine.

In this detailed guide, we will explore: * What is paper trade? * The functionality and benefits of paper trading by TradingView * The rising trend of paper trade India * How to use TradingView paper trade feature step-by-step * The psychology behind paper trading and FOMO meaning in Hindi * Tips for turning your paper trading journey into real profits Let’s dive into it.

What is Paper Trade?

Before exploring the benefits of paper trading by TradingView, it’s important to answer the fundamental question: what is paper trade?

Paper trade is the practice of simulating buying and selling financial instruments—such as stocks, commodities, forex, or crypto—without using real money. The term “paper” stems from traditional days when traders would manually record their hypothetical trades on paper to track how they would perform.

A paper trade is a simulated trading process in which individuals can practice buying and selling financial instruments without using real money. It’s like playing a video game of the stock market—where every move is real-time and data-driven but without the financial risk.

The term originates from the days when people would write their hypothetical trades on paper to evaluate strategy performance. With modern technology, platforms like TradingView paper trade have digitized and enhanced this process.

Today, modern paper trading happens digitally through platforms like TradingView, which provide live market data and realistic order execution without any actual financial risk.

Why Paper Trade Matters?

Because most new traders lose money in their early days due to poor planning, emotional decisions, or lack of understanding of market mechanics. Paper trading by TradingView allows them to develop skills, test strategies, and gain confidence—without the stress of losing capital.

Understanding what is paper trade is crucial for new investors and aspiring traders. In real-world trading, emotions like fear, greed, overconfidence, or FOMO can affect decision-making. With paper trading, you’re able to:

* Practice and refine strategies in a risk-free environment * Understand order types (market, limit, stop-loss, etc.) * Learn portfolio and risk management * Develop emotional control and trading discipline * Gain confidence before transitioning to live markets

Think of it as using a flight simulator before flying an actual plane. It doesn’t guarantee success, but it gives you invaluable experience and knowledge.

For Example: Suppose you want to buy Reliance Industries shares on the NSE but are unsure about market timing. Instead of risking real capital, you open a paper trade India position using TradingView. You “buy” at ₹2,800 with a target of ₹3,000 and stop-loss at ₹2,750. You monitor the trade just like in real life. Over time, you analyze whether your setup worked and why.

This repetitive cycle builds habits and a trading framework without financial risk.

Understanding Paper Trading by TradingView

Now that we know what is paper trade, let’s focus on paper trade TradingView���one of the most user-friendly and feature-rich platforms for simulated trading.

TradingView, a leading charting and trading platform, offers a built-in paper trading module that mirrors real market conditions. With live data, multiple indicators, and order execution simulations, it enables traders to:

* Practice technical and fundamental strategies * Understand risk management and position sizing * Analyze results with historical data * Learn discipline without fear of losing money

What is Paper Trade TradingView?

Paper trade TradingView refers to the simulated trading feature provided by TradingView, one of the world’s most popular charting and analysis platforms. With this feature, users can create virtual trades across various markets like equities, indices, forex, and crypto using real-time data—without any monetary exposure.

This makes paper trading by TradingView one of the most effective tools for both novice and professional traders to test, learn, and improve their trading performance.

How Paper Trade TradingView Works

When you activate the TradingView paper trade feature, you are allocated a virtual portfolio (default is $100,000). You can place trades in the same way as you would on a live account:

* Use Buy or Sell options based on market or limit orders * Set your stop-loss and take-profit points * View all open positions, order history, and P&L statements * Track your performance over time and analyze your mistakes

Unlike demo accounts offered by brokers, which often have fixed instruments or unrealistic execution, paper trade TradingView supports multiple asset classes with global charts and customized strategy backtesting.

Key Functional Benefits

How It Helps in Paper Trade India Ecosystem

India has seen a massive increase in retail investors post-2020. However, a significant chunk of new traders lose capital within the first 6–12 months due to lack of education, impulsive trading, and overexposure.

The paper trade TradingView module plays a transformative role in paper trade India by enabling:

* College students to practice before entering real markets * Working professionals to backtest strategies in their spare time * Trainers and mentors to guide students using live market simulations * Investors to experiment with intraday, swing, and positional setups

Especially in a market like India, where FOMO meaning in Hindi resonates deeply (कहीं कोई बड़ा मौका छूट न जाए), having a zero-risk practice platform is the perfect psychological buffer.

Real-World Use Case:

Imagine you’ve just learned about technical indicators like RSI and MACD. You’re curious if a crossover strategy can help you identify trends.

Using paper trade TradingView, you: * Open Nifty 50 charts * Place long trades based on MACD bullish crossover * Set 1:2 risk-reward ratio * Track over 50 such trades across 2 months

At the end, your paper trading history will show whether this strategy is profitable, consistent, and worth going live with. That’s how valuable paper trading by TradingView becomes—not just in theory, but in action.

Features of Paper Trading by TradingView:

* Real-time Market Data: All trades in TradingView paper trade are based on real-time prices, offering a realistic experience. * One-Click Trading: You can buy/sell directly from charts using the simulated trading panel. * Custom Order Types: Place limit, market, stop-loss, or take-profit orders to test different strategies. * Performance Reports: Analyze your win-loss ratio, average returns, and risk metrics. * Multi-Asset Support: Trade across stocks, indices, forex, crypto, and more in a risk-free environment.

Paper Trade India: A Rising Trend Among Aspiring Traders

The concept of paper trade India is witnessing rapid adoption as more Indians enter the financial markets with a desire to learn and earn. While India has traditionally been a savings-driven economy, the rise of fintech platforms, social media, and financial literacy campaigns has sparked a new wave of interest in trading—especially among Gen Z and millennials.

Why is Paper Trade India Booming?

There are several socioeconomic and technological reasons behind the popularity of paper trading by TradingView and other platforms in India:

1. Growth of Retail Participation in Stock Markets: Since the pandemic, India has added over 10 crore new demat accounts, with Tier-2 and Tier-3 cities contributing significantly. However, many of these investors lack practical trading knowledge. Here, paper trade India becomes the bridge between theory and real markets.

2. High Financial Risks in Real Trading: Trading involves risk, and most retail traders lose money due to emotional decisions, overtrading, and poor strategy. Paper trading by TradingView provides a zero-risk sandbox for Indian traders to develop and test their strategies.

3. Rise of Online Stock Market Education: Edtech platforms like Zerodha Varsity, Elearnmarkets, and NSE Academy now include modules on paper trade India. They recommend that learners simulate trades before entering live markets.

4. Accessibility Through Technology: TradingView and similar platforms have made paper trade India possible even from mobile devices. A student in Varanasi or a homemaker in Surat can now practice stock trading from their phones using real market data.

5. Support from Trading Communities: Telegram groups, YouTube channels, and Instagram influencers now create challenges like “30 Days of Paper Trading” or “Paper Trading Leaderboards” to motivate young traders to learn without risking capital.

How Indians Are Using TradingView Paper Trade in Real Life

Here are a few examples that show how paper trade India is changing the trading landscape:

Case 1: College Students: Engineering and commerce students in cities like Pune, Bengaluru, and Ahmedabad are using paper trading by TradingView to practice intraday and swing trading. It has even become part of classroom assignments in many stock market institutes.

Case 2: Working Professionals: Mid-career professionals are using their free time to practice trading with TradingView paper trade, often during lunch breaks or weekends. Some test intraday strategies in Indian stocks and then evaluate performance before going live.

Case 3: Retired Individuals: Retired individuals with savings are now using paper trade India to test portfolio management strategies. It gives them peace of mind that they can learn without putting their retirement corpus at risk.

Benefits of Paper Trade India for Aspiring Traders

Recommended Indian Assets to Paper Trade on TradingView

If you’re using paper trading by TradingView, here are some popular Indian instruments to practice on:

Note: You can use NSE/BSE tickers in TradingView and practice trades as if you’re trading live on Indian markets.

Checklist for Serious Paper Traders in India

To make the most of paper trade India, follow this structured approach:

1. Set a Daily Trading Routine: Simulate trading during actual Indian market hours: 9:15 AM to 3:30 PM IST 2. Use a Trading Journal: Record every paper trade with reason, setup, entry, exit, and result 3. Start with ₹1 Lakh Virtual Capital: Simulate the capital you plan to use in real life 4. Trade Indian Instruments: Don’t trade US or global stocks unless you plan to trade them later 5. Focus on Consistency: Aim for 3–4% monthly returns consistently over 3+ months

Transitioning from Paper Trade to Live Trade in India

While paper trade India is crucial for learning, the eventual goal is to move to real capital. Here’s a basic transition plan:

Step 1: Start with ₹1 Lakh paper trading account and test your strategy. Step 2: Maintain consistent performance (win rate, risk-reward) for 60-90 days. Step 3: Open a demat account with brokers like Zerodha, Upstox, or Angel One. Step 4: Start live trading with ₹10,000–₹25,000, using the same strategy. Step 5: Gradually scale up as confidence and skill grow.

Warning: Don’t Skip Paper Trading

Skipping paper trading is like driving a car without learning to steer. Many new Indian traders lose lakhs because they follow others, suffer from FOMO, and enter blindly. Always treat paper trade India as a non-negotiable first step.

Why Paper Trade India is Gaining Momentum

In recent years, paper trade India has become a buzzword among young investors. Here’s why:

Democratization of Trading With platforms like Zerodha, Upstox, and Angel One reducing brokerage fees, the Indian retail market has exploded. But without proper education, this has also led to major losses.

Education-First Approach Institutions and coaching centers are integrating paper trading by TradingView into their stock market courses.

Rise of Social Media Traders Many new traders suffer from FOMO. They follow influencers who post screenshots of profits, prompting beginners to jump in blindly. FOMO meaning in Hindi is “कहीं कुछ छूट न जाए का डर”, which drives impulsive decisions. Paper trading by TradingView offers a safe way to channel this urge productively.

SEBI and Regulatory Push Even regulatory bodies in India encourage investor education and risk-free training—making paper trade India a part of awareness campaigns.

FOMO Meaning in Hindi and Its Impact on Trading

One of the biggest psychological barriers in trading is FOMO. Let’s understand FOMO meaning in Hindi and how it connects to paper trading.

FOMO Meaning in Hindi: FOMO का हिंदी में अर्थ है – “कुछ महत्वपूर्ण खो देने का डर” या “कहीं हम कुछ बड़ा अवसर न चूक जाएं”।In the context of trading, it means entering a trade impulsively because others are profiting, without proper analysis.

Examples include: * Buying a stock after it has already gone up significantly * Jumping into crypto or penny stocks because of hype * Selling in panic during a small dip

Paper trading by TradingView allows you to simulate these emotional trades and learn from the outcomes—without financial loss. Over time, it helps you build emotional discipline and strategic patience.

How to Start Paper Trading by TradingView: Step-by-Step

If you’re wondering how to begin your journey with tradingview paper trade, follow this beginner-friendly guide:

Step 1: Create a TradingView Account: Go to TradingView.com and sign up for a free or paid plan.

Step 2: Launch a Chart: Once logged in, click on “Chart” at the top. Choose your preferred stock, forex pair, or crypto.

Step 3: Connect to Paper Trading Account: At the bottom panel, click on “Trading Panel.” Choose “Paper Trading by TradingView” and connect.

Step 4: Set Your Initial Balance: TradingView gives you $100,000 virtual cash by default. You can reset or adjust this as per your preference.

Step 5: Start Trading: Use the “Buy” and “Sell” buttons on the chart to place trades. Customize order types, set stop-loss and target levels.

Step 6: Monitor Performance: View all positions in the “Orders and Positions” window. Analyze your trade history, win rate, and P&L.

Benefits of TradingView Paper Trade Over Other Platforms

Zero Risk, Maximum Learning Ideal for beginners who want to avoid real-money losses. Global Community Support Access public strategies, community scripts, and trading ideas to learn from others. Backtesting and Forward Testing You can backtest historical data and then use paper trading by TradingView to validate the results live. Web-Based Platform No downloads needed. Seamless access across mobile, desktop, and browser.

Common Mistakes in Paper Trade TradingView and How to Avoid Them

While paper trading by TradingView is incredibly useful, many beginners misuse it. Here are some common mistakes:

Avoiding these mistakes will make your paper trade TradingView experience more productive.

How Long Should You Paper Trade Before Going Live?

This is a common question from those doing paper trade India. The answer depends on: * Your consistency (not just one lucky trade) * Your strategy success rate over 100+ trades * Your emotional readiness to lose real money

Generally, a 2–3 month period with consistent positive results on TradingView paper trade is a good benchmark before switching to live trading.

Case Study: Ravi’s Journey from Paper to Profit

Ravi, a 25-year-old student from Delhi, began learning stock trading during the COVID-19 lockdown. Tempted by social media traders flaunting profits, he often wondered about FOMO meaning in Hindi and felt he was missing out.

Instead of rushing, he started paper trading by TradingView with ₹0. Over six months, he practiced with over 300 trades, refined his strategy, and journaled every loss.

Today, he trades with real money and credits TradingView paper trade for saving him from early mistakes and emotional pitfalls.

CONCLUSION

Absolutely. As the markets grow more complex and investor participation continues to rise in paper trade India, learning through simulation is no longer optional—it’s essential.

Paper trading by TradingView is not just a tool, it’s a mentor, a practice ground, and a confidence builder. Whether you’re new to trading or an experienced investor testing new strategies, this platform offers everything you need—minus the risk.

Key Takeaways: * Understand what is paper trade before entering real markets * Use TradingView paper trade to build skills and discipline * Beat emotional trading and understand FOMO meaning in Hindi * Transition slowly from paper to real trades based on consistent performance

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#papertrading#tradingview#stockmarket2025#tradinglife#tradingcommunity#investingblog#fintechtrends#illusionorbreakthrough#financeaesthetic#marketmindset#ismtinstitute#learnfromismt#ismt#PaperTrading#TradingView2025#StockMarketTrends#TradingStrategies#InvestingInsights#TradingInnovation#Fintech#StockMarketEducation#AlgoTrading#FinancialMarkets

0 notes

Text

What is IPO Cycle in Stock Market 2025

In this blog we will discuss What is IPO Cycle, 2024, the stock market continues to see fluctuations and innovations in Initial Public Offerings (IPOs). IPO allotment refers to the process by which shares are allocated to investors, often in cases where demand exceeds supply, requiring a lottery or proportionate distribution system. In the context of trading, an IPO provides a new security that traders can buy and sell on the stock exchange, which may see price volatility as the market establishes its perceived value. From an investment perspective, an IPO offers early entry into a company’s public journey, with potential for both high returns and risks, as the company’s growth trajectory post-IPO may vary significantly.

Understanding what is IPO cycle is essential for investors, whether they are experienced traders or new to the world of stock investments. This guide will dive deep into what is IPO, explore the types of IPO, explaintion of what is IPO cycle, what is IPO allotment, and what is IPO trading and investment.

What is IPO?

An Initial Public Offering (IPO) is the process by which a private company offers its shares to the public for the first time, allowing it to become publicly traded on a stock exchange. This transition from private to public ownership opens up new opportunities for the company to raise capital, increase visibility, and achieve various strategic objectives. For investors, an IPO offers a chance to invest in a company at the earliest stage of its public journey, often with the potential for long-term growth.

This guide will break down the IPO process, its benefits and risks, and how it impacts both the company and the stock market.

Why Do Companies Go Public?

There are several reasons companies choose to go public:

Raising Capital: IPOs allow companies to access substantial funding from a wide pool of investors. This capital is often used for scaling operations, launching new products, or entering new markets.

Increasing Credibility and Brand Awareness: Going public enhances a company’s visibility and reputation. A publicly listed company may find it easier to attract customers, partners, and talented employees.

Providing Liquidity for Existing Investors: Early investors, founders, and employees often have shares in the company. An IPO provides them with a means to cash out some or all of their holdings, generating returns on their initial investment.

Using Stock as a Currency: Once public, companies can use their stock as currency, whether as employee compensation or to acquire other businesses.

What is IPO Process

The IPO process involves several stages, with each step critical to a successful public listing.

Preparation and Due Diligence: The company prepares by conducting internal audits, financial analysis, and refining its growth strategies. The board of directors evaluates the company’s readiness to go public.

Hiring Underwriters: The company appoints investment banks or underwriters to guide the IPO process. These underwriters are responsible for helping set the IPO price, marketing the IPO, and ensuring compliance with regulatory requirements.

Filing with Regulatory Authorities: In the U.S., companies must file a registration statement (Form S-1) with the Securities and Exchange Commission (SEC). This document includes extensive information about the company’s financials, risks, and operations.

Marketing the IPO (Roadshow): The company and its underwriters conduct a “roadshow,” where they present the company’s business model, financial health, and growth potential to prospective investors. The goal is to generate interest in the IPO.

Pricing and Allotment: After the roadshow, the company sets a final IPO price based on investor interest. The shares are then allotted to institutional and retail investors who have subscribed to the IPO.

Listing on the Exchange: The IPO is launched, and the company’s shares are officially listed on the stock exchange. Investors can start trading shares as soon as the stock market opens.

Post-IPO Obligations: Once public, the company must meet certain financial reporting and compliance standards, such as quarterly earnings reports, transparency with shareholders, and regulatory disclosures.

How & What is IPO Impact the Stock Market

An IPO has several immediate and long-term effects on the stock market:

Market Sentiment and Volatility: IPOs can generate significant market interest, particularly for high-profile companies. This initial excitement can lead to heightened volatility in the company’s stock price during the first few days or weeks of trading.

Price Discovery: During an IPO, the market determines the fair value of a company’s stock based on demand from investors. This price discovery process is crucial as it sets the baseline for future trading.

Sector Impact: If a well-known company in a specific sector goes public, it can impact the entire industry’s stocks. For example, the IPO of a major tech company might boost investor interest in other tech stocks.

Liquidity Increase: An IPO increases the stock’s liquidity, making it easier for shareholders to buy and sell shares. This improved liquidity can attract more investors and lead to a more stable long-term stock price.

Influence on Indexes: Some IPOs are large enough to eventually be included in major stock indexes (like the S&P 500), influencing the performance of these indexes and potentially drawing in more institutional investors.

Benefits and Risks of IPO

Benefits for the Company:

Access to Capital: IPOs can provide significant funding to fuel growth initiatives.

Enhanced Public Image: A publicly traded company can attract better talent, improve customer trust, and strengthen its brand.

Equity as Currency: Once public, companies can use stock for employee compensation or acquisitions, expanding growth possibilities.

Risks for the Company:

Regulatory Compliance Costs: Public companies must comply with strict regulations and reporting standards, which can be costly and time-consuming.

Pressure from Shareholders: Public companies face pressure to meet quarterly earnings expectations, potentially impacting long-term strategy.

Market Scrutiny: Increased visibility also means more scrutiny from analysts, media, and investors, which can add pressure to the company’s leadership.

Benefits for Investors:

Early Growth Opportunities: IPOs allow investors to buy shares at the early stages of a company’s public life, offering the potential for substantial returns if the company grows successfully.

Liquidity: IPOs provide liquidity to existing shareholders and give retail investors access to new investment opportunities.

Risks for Investors:

Volatility: IPO stocks are often highly volatile, particularly during the first days or months of trading.

Potential Overpricing: Companies might set high IPO prices based on demand during the roadshow, leading to a decline in value post-listing if market sentiment changes.

Lock-Up Periods: Early investors and insiders are often subject to lock-up periods, restricting their ability to sell shares for a set time. This can lead to sudden price drops once the lock-up period expires.

How to Participate in an IPO

If you’re considering investing in an IPO, here are the steps:

Research the Company: Learn about the company’s business model, financials, growth potential, and industry position.

Select a Brokerage: Most online brokers offer access to IPOs, although some may have requirements for IPO participation.

Submit an Application: Apply to buy shares through your brokerage, indicating how many shares you’d like and the price range if it’s a book-building IPO.

Wait for Allotment: Based on demand and the company’s allotment policy, you’ll either receive the shares or be informed if your application was unsuccessful.

Track the Stock’s Performance: IPO stocks can be volatile. Monitor the company’s performance and set an investment strategy aligned with your risk tolerance.

Why Do Companies Opt for an IPO?

Companies choose to go public for several reasons, including raising capital for expansion, reducing debt, improving credibility, and providing an exit strategy for early investors. In 2024, the IPO market remains a dynamic avenue for companies aiming to unlock growth potential and gain public trust.

What is IPO Cycle?

The IPO cycle is the series of stages that a company undergoes from its private beginnings to its public launch. Here’s a breakdown of the key stages in what is IPO cycle:

Preparation Phase: This involves assessing the company’s readiness to go public. During this phase, companies conduct internal audits, financial analysis, and strategic planning. It is also the time to choose investment banks to underwrite the IPO and determine the share structure.

Filing and Approval Phase: Companies must file for an IPO with regulatory bodies like the Securities and Exchange Commission (SEC) in the U.S. They provide comprehensive details about the company, financials, and intended share offerings. Once approved, the IPO enters the marketing phase.

Marketing and Roadshow: The company and its underwriters present the company’s value to potential investors, usually through roadshows. During these events, they highlight the company’s growth prospects, business model, and value proposition to attract institutional investors.

Pricing and Allotment Phase: After gauging investor interest, the company sets a final IPO price. Pricing is crucial since it impacts both the company’s funding goals and investor interest. The shares are then allotted to investors based on demand and availability.

Listing and Trading: Finally, the company’s shares are listed on a public exchange, marking the official IPO. Trading begins as soon as the market opens, giving the public and institutional investors access to buy and sell shares.

Post-IPO Phase: After going public, the company must meet specific financial reporting and regulatory requirements. The performance of its shares also impacts investor sentiment and may affect future stock issuance.

The IPO cycle can take several months to over a year, depending on market conditions and regulatory processes. Understanding this cycle is essential for both investors and companies aiming to maximize value from an IPO.

Types of IPO

In the world of IPOs, companies have different methods for pricing and offering their shares to investors. The types of IPO primarily include the Fixed Price Offering and the Book Building Offering. Each type has its unique features, advantages, and strategies that can appeal to various types of IPO investors and cater to different company goals.

1. Fixed Price Offering

A Fixed Price Offering is one of the types of IPO where the issuing company, in collaboration with underwriters, sets a fixed price per share before the IPO is launched. This means that potential investors know the exact price they will be paying for each share at the time of application.

Key Characteristics of Fixed Price Offering:

Set Price in Advance: The company announces the price at which shares will be issued well in advance of the types of IPO. This price is based on evaluations conducted by the company and its underwriters, often taking into account factors like the company’s financials, growth prospects, and market trends.

Lower Visibility on Demand: In a fixed price offering, demand isn’t as visible to the company until after the subscription period closes. Investors have to decide whether to participate based on the set price alone.

Simplicity for Investors: Since the price is pre-determined, investors don’t need to speculate about the final price. This simplicity makes it more accessible for retail investors who may prefer clarity over the potential price fluctuations seen in other types of IPO.

Advantages and Disadvantages of Fixed Price Offering:

Advantages:

Predictability: Both the company and the investors know the exact pricing structure, which makes planning and budgeting more straightforward.

Attractiveness to Small Investors: Because of the fixed price, smaller investors may feel more comfortable participating, knowing they will pay exactly what is quoted.

Disadvantages:

Underpricing or Overpricing Risks: Since the company sets a fixed price without fully knowing demand, there’s a risk of setting a price too high (leading to low demand) or too low (leading to under-subscription and lower proceeds).

Limited Insight on Demand: Unlike book building, where demand is gauged in real-time, fixed price offerings don’t allow companies to adjust based on investor interest.

2. Book Building Offering

A Book Building Offering is another types of IPO which has more dynamic pricing method where the price of shares is determined based on demand from institutional and individual investors. Here, the company and its underwriters set a price range (often with a minimum and maximum price), and investors bid within this range.

Key Characteristics of Book Building Offering:

Price Discovery Mechanism: Unlike a fixed price IPO, this types of IPO has the final offer price is set based on the demand seen during the IPO subscription period. Investors place bids within a range, and the highest bids generally determine the final price.

Investor Bidding: Investors specify both the quantity of shares they wish to purchase and the price within the set range they are willing to pay. This bidding process provides insight into the demand for shares.

Transparency and Demand Insight: Companies get real-time feedback on investor interest, which helps in setting an accurate market-based price. This insight can help prevent significant price fluctuations after the shares start trading on the market.

Advantages and Disadvantages of Book Building Offering:

Advantages:

Accurate Market-Based Pricing: By assessing demand, the company can set a price that better reflects investor interest and market conditions, often leading to a more accurate valuation.

Attracts Large Investors: Institutional investors are often more inclined to participate in book building IPOs, as they can secure significant allocations at preferred prices.

Disadvantages:

Complexity: The process is more complex and may not be as easily understood by retail investors, as the final price is not known until after the book-building period.

Fluctuating Prices: Price discovery can lead to wide fluctuations, which may deter some risk-averse investors.

Other Types of IPO Offerings (Less Common)

While fixed price and book building are the most common, there are additional types of IPO structures that some companies might use depending on their goals and market conditions.

Dutch Auction Offering:

In a Dutch auction, investors bid on the shares by indicating both the price they are willing to pay and the quantity of shares they want to buy.

The final IPO price is determined by the lowest price at which all the offered shares can be sold.

This approach allows all successful bidders to pay the same price, which can encourage broader participation but is rarely used due to its complexity.

Direct Listing:

In a direct listing, a company lists its shares on a public exchange without raising new capital or working with underwriters to price the shares.

This type of listing is often chosen by companies that do not need additional funds but want to provide liquidity to their existing shareholders.

Notably used by companies like Spotify and Slack, direct listings avoid underwriting fees and provide a market-driven share price on the first trading day.

Special Purpose Acquisition Company (SPAC):

A SPAC is a company formed with the sole purpose of raising funds through an IPO to acquire a private company and bring it public.

This “alternative IPO” method has gained popularity in recent years, especially for companies that want a faster, less regulated way to go public.

SPACs offer flexibility and can be more attractive for companies in volatile or rapidly evolving sectors.

What is IPO Allotment?

IPO allotment is the process through which shares are distributed to investors who have applied for the IPO. Demand often surpasses supply, leading to oversubscription. In this case, shares are allocated based on a pre-defined basis, such as lottery or proportional allotment. Here’s a simplified look at what is IPO allotment:

Retail Allotment: Small investors are given priority, typically through a lottery system when demand is high.

Institutional Allotment: A significant portion of shares is reserved for institutional investors, who often receive a guaranteed allotment based on their order size.

Employee Allotment: Some IPOs set aside shares for employees, allowing them to benefit from the company’s growth.

The allotment process can be competitive, especially in high-demand IPOs, and often leads to disappointment among retail investors. For an investor, securing an IPO allotment is a crucial step to benefiting from potential initial price surges.

What is IPO in Trading?

In trading, an IPO represents a fresh investment opportunity, bringing new stock to the market. IPO stocks can be volatile, with prices often spiking or dropping within days of listing. Many traders aim to capitalize on these price movements, engaging in what is IPO in trading strategies.

Pre-market Trading: Some IPOs allow for pre-market trading, enabling investors to buy shares before they are officially listed.

Day Trading: IPOs are popular among day traders who aim to profit from short-term price fluctuations, capitalizing on the initial volatility that follows an IPO.

Swing Trading: Swing traders, who hold stocks for a few days to weeks, may find IPOs attractive due to the potential for substantial movements within a short timeframe.

IPO trading offers high-reward opportunities, but it also involves significant risk. For example, a highly anticipated IPO could underperform if the market sentiment is weaker than expected, resulting in rapid declines in stock prices.

CONCLUSION

The IPO cycle is an integral part of the stock market, offering a pathway for private companies to access public capital and for investors to participate in early-stage growth. From understanding what is IPO is to exploring what are the type of IPO, what is IPO allotment, what is IPO in trading, and investment strategies, this guide has covered the essentials of the IPO process in 2024. With careful research and a strategic approach, IPOs can offer unique opportunities for both traders and long-term investors. For companies, selecting the right type of IPO depends on factors like the desired level of transparency, potential investor base, and the stability of the stock market at the time of listing.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#IPOCycle#StockMarket2025#IPO2025#InitialPublicOffering#StockMarketEducation#InvestmentStrategies#FinancialMarkets#StockMarketInsights#MarketTrends2025#IPOGuide#ipoexplained#whatisipo#ipocycle#stockmarket2025#investingtips#stockmarketeducation#tradingguide#financeblog#personalfinance#investmenteducation#ismt#learnfromismt#ismtinstitute

0 notes

Text

Understanding the Basics of Investing & How To Start Investing In 2025

What Is Investing?

Investing is the process of allocating your money into assets, such as stocks, mutual funds, or bonds, to grow it over time. Unlike saving, investing involves some risk but offers potentially higher returns.

Why Invest with ₹5000?

Affordability: ₹5000 is an accessible amount for most people.

Low Risk Entry: Starting small minimizes financial risk.

Foundation Building: It helps you learn how to start investing effectively.

How Start Investing with ₹5000

1. Set Clear Financial Goals: Before diving into investing, define your objectives. Are you saving for retirement, a vacation, or an emergency fund? Knowing your goals will guide your investment choices.

2. Choose the Right Investment Options: Even with a modest ₹5000, there are multiple avenues to explore:

a. Start Investing in Stocks The stock market is a popular choice for beginners. Platforms like Zerodha, Upstox, and Groww allow you to start investing with low initial amounts. Look for blue-chip stocks or Exchange Traded Funds (ETFs) that offer diversification and stability.

b. Mutual Funds For those wary of directly investing in stocks, mutual funds are an excellent option. SIPs (Systematic Investment Plans) allow you to invest as little as ₹500 monthly. Equity-based mutual funds provide good returns over time.

c. Digital Gold Digital gold is a great way to diversify your portfolio with a small amount. Platforms like Paytm and PhonePe let you invest in gold with as little as ₹100.

d. Fixed Deposits (FDs) and Recurring Deposits (RDs) While not as lucrative as stocks, FDs and RDs are secure options for risk-averse investors.

3. Start Small and Stay Consistent: Consistency is key when you start investing. Regular contributions, even small ones, can compound into substantial wealth over time.

4. Leverage Technology: Online platforms and apps have made it incredibly easy to start investing stocks. Many apps provide user-friendly interfaces, investment tips, and analytics to help beginners make informed decisions.

5. Educate Yourself: Investing isn’t a one-time activity. Continuously learning about market trends, new investment options, and risk management will help you grow as an investor.

Tips for Success in the Stock Market

1. Research Before Investing: Study company fundamentals, market trends, and sector performance before buying stocks.

2. Diversify Your Portfolio: Avoid putting all your eggs in one basket. Spread your ₹5000 across multiple investment options to mitigate risks.

3. Keep Emotions in Check: Market fluctuations are normal. Avoid panic selling during downturns.

4. Reinvest Returns: Reinvesting dividends or profits helps in compounding your investments.

How to Manage Risks When Starting Small

Every investment carries some risk. Here’s how you can minimize it:

Start with Low-Risk Options: Invest in large-cap stocks or mutual funds.

Set Stop-Loss Limits: Protect your investments from significant losses by setting stop-loss limits in the stock market.

Stay Informed: Regularly track your investments and make adjustments as needed.

#investing#investmenttips#howtostartinvesting#investingforbeginners#stockmarket2025#personalfinance#financialgoals#financialfreedom#moneytips#wealthmindset#investingtips2025#newinvestor#moneygoals#financeblog#budgetingtips#ismtinstitute#learnfromismt#ismt

0 notes

Text

Tips for Traders in Young Age 2025

Tips for Traders have never been more crucial than in today’s fast-paced financial markets, where young minds are making bold and informed moves. With technology advancing, information more accessible, and trading platforms becoming increasingly user-friendly, a growing number of young traders are entering the world of stocks, options, and commodities. Whether you’re in your twenties or even a teenager with a passion for finance, this blog is tailored for you. We’ll dive into the most effective tips for traders—especially young ones—and lay out a clear roadmap for long-term trading success in 2025.

Tips for Traders in 2025: Mindset & Preparation

Success in trading is as much about psychology as it is about strategy. Here are essential tips for traders focused on mental preparation:

Have a Clear Purpose: Before entering any trade, ask yourself- * Am I doing this based on strategy or emotion? * Is this aligned with my long-term goals?

Avoid the “Get Rich Quick” Trap: One of the most important traders tips is to remain grounded. Trading is not a shortcut to wealth—it’s a skill that requires consistent learning and discipline.

Create a Trading Journal: Document your trades, reasons behind them, emotions during the trade, and outcomes. This forms a vital part of your trading routine.

Why Start Trading at a Young Age?

Starting early offers several advantages: * Compounding Growth: Early investments have more time to grow. * High Risk Tolerance: Younger people can afford to take higher risks. * Tech-Savviness: Young traders are often more comfortable with trading apps and platforms.

By following solid traders tips, young individuals can avoid common pitfalls and build a rewarding trading journey from the start.

Tips for Trade: Practical Guidance for Beginners

The following tips for trade will help young traders build solid foundations:

Start Small, Think Big: * Begin with a small capital, maybe ₹5,000–₹20,000. * Focus on gaining experience instead of profits.

Understand the Asset You Trade: Whether it’s equities, derivatives, or cryptocurrencies, know the basics. Learn about- * How markets move * Technical vs. fundamental analysis * News impact

Use a Demo Account First: Many platforms offer simulated environments. This is an excellent space for young traders to test tip for trade without risking real money.

Tips for Trading Options: 2025 Outlook

Options trading is one of the most exciting yet complex arenas in the financial market. For young traders in 2025, the appeal of limited risk and high potential return has made options increasingly popular. However, this segment demands more knowledge and discipline than regular stock trading.

Here are actionable tip for trading options every beginner and young trader must understand:

Understand the Basics First: Before placing your first options trade, master the foundational concepts- * Call Option: Right to buy an asset at a set price (strike price). * Put Option: Right to sell an asset at a set price. * Strike Price, Expiry, Premium: Understand these key terms. * In the Money (ITM), At the Money (ATM), Out of the Money (OTM): Know how to classify options. 📌 Traders tip: Use tools like Zerodha Varsity or Sensibull to understand real-world examples.

Don’t Start with Weekly Expiry Options: Weekly options may seem attractive because of their low cost, but they decay quickly due to time value (Theta). 📌 Tips for traders: Begin with monthly expiry options for better control and lower time pressure.

Always Use a Defined Risk Strategy: Options can magnify gains—and losses. Protect your capital by using strategies that cap your losses. Some safe starter strategies for young traders: * Debit Spreads (Bull Call, Bear Put) – Limited loss and profit. * Iron Condors – Low risk, good for range-bound markets. 📌 Tips for trading options: Avoid naked options selling unless you’re highly experienced and capitalized.

Respect the Greeks: Options pricing is influenced by five “Greeks”: Delta, Theta, Gamma, Vega, Rho. * Delta: Measures how much option price changes with stock price. * Theta: Time decay—options lose value as expiry nears. * Vega: Measures sensitivity to volatility changes. 📌 Traders tip: Focus on Delta and Theta initially. They impact your P&L the most.

Always Trade with a Stop-Loss and Target: One of the biggest mistakes young traders make is not cutting their losses early. 📌 Tips for traders: Define your entry, stop-loss, and target before executing the trade. Tools like Opstra and TradingView can help.

Monitor Implied Volatility (IV): Implied Volatility tells you how expensive or cheap options are. High IV means options are expensive; low IV means cheaper premiums. 📌 Tips for trading options: Avoid buying options in very high IV periods unless expecting a major move (like earnings or budget day).

Stay Away from Tips and Telegram Groups: It’s tempting to follow someone’s trade blindly, but options trading requires context and timing. A good setup at 10:15 AM may fail at 11:30 AM. 📌 Traders tip: Learn to build your own conviction through study and paper trading.

Practice with Virtual Trading Platforms: Platforms like Sensibull and Opstra offer paper trading tools. Use them to practice option strategies without risking capital. 📌 Tips for trade: Simulated trading helps you build confidence and recognize mistakes early.

Track Your Option Trades: Keep a trade diary where you write- * What strategy you used * Why you chose that strike * How you managed the position * What you learned from the trade 📌 Traders tip: Reviewing your own mistakes is more powerful than reading others’ success stories.

Focus on Learning, Not Just Earning

Options trading can make you feel smart when a single trade gives 2x returns. But consistency is the real goal.

📌 Special suggestion for young traders: Aim to become a skilled options trader first—profits will naturally follow.

Key Tips for Trading Options: * Know the Greeks: Understand Delta, Gamma, Theta, and Vega. * Start with Buying, Not Writing: Selling options requires large margins and more expertise. * Avoid Weekly Expiries at First: These are high-risk and high-volatility instruments. * Use Stop-Loss Always: One of the golden tip for trading options is to always define your risk.

Don’t Chase Lottery-Type Returns: Focus on consistency. An option trade with a 20–30% return is still a great win.

Trading Routine: Habits That Build Success

Your trading routine can make or break your performance. Discipline is key for success, and that starts with habits. Stay consistent with your trading routines, invest in learning, and keep upgrading your skillset.

Morning Routine: * Read news from financial websites (Moneycontrol, Bloomberg, ET Markets). * Check global market trends (SGX Nifty, Dow Futures). * Mark key support/resistance levels.

During Market Hours: * Stick to your strategy. * Don’t overtrade. * Avoid checking your P&L continuously.

Evening Routine: * Review your trades. * Update your journal. * Learn from mistakes or wins. Having a structured trading routines improves emotional control and leads to consistent improvement.

Special Suggestion for Young Trader in 2025

Being a young trader in today’s rapidly evolving market is both a privilege and a responsibility. You have time on your side, access to modern tools, and the flexibility to learn and adapt faster than ever. But with these advantages also come unique challenges—like information overload, emotional volatility, and the pressure to succeed quickly.

So here’s a special suggestion for young trader that can set the tone for long-term success:

“Focus More on Process, Less on Profit.” Yes, you read that right. The number one traders tip for anyone under 30 is to prioritize building strong habits, strategies, and a learning mindset over obsessing about quick profits.

Learn Before You Earn: Don’t rush into complex derivatives or high-frequency trading just because others are doing it. Instead: * Take free courses on Zerodha Varsity, Coursera, or Investopedia. * Learn technical analysis, risk management, and basic economics. * Read books like “Trading in the Zone” or “The Psychology of Money”. 📌 Tips for trade: Your real capital at this stage is your time and curiosity.

Protect Capital Like It’s Your Future: Most young trader blow up their accounts early due to overconfidence and overtrading. Instead: * Use small position sizes. * Apply stop-loss on every trade. * Never trade money you can’t afford to lose. 📌 Traders tip: Treat capital protection as a survival skill, not a conservative approach.

Avoid Social Media FOMO: Scrolling through screenshots of ₹1 lakh profits on Instagram or Telegram can be misleading. Remember, nobody posts their losses. * Focus on your growth, not others’ highlights. * Join communities for learning, not copying trades. 📌 Special suggestion for young traders: Comparison is the thief of consistency.

Build a Strong Trading Routine: A professional approach beats a random approach every time. Build a personalized trading routines: * Morning prep (news, levels, pre-market) * Market hours (planned trades only) * Post-market (review, journal, learn) 📌 Tips for traders: A routine turns your emotions into a system—and systems win.

Set Realistic Expectations: You’re not in a race. Even a consistent monthly return of 3–5% can outperform most mutual funds. * Forget doubling money every month. * Aim for small, consistent wins and gradual skill-building. 📌 Tips for trading options: Avoid dreaming of turning ₹10,000 into ₹1 lakh overnight with weekly expiry trades. Think sustainability.

Embrace the Power of Compounding: Start SIPs, invest long-term, and combine that with trading profits. Let trading be your cash flow, not your only wealth engine. 📌 Special suggestion: Learn investing along with trading. That’s how you build freedom, not just funds.

Top Young Traders in India: Who’s Making Waves?

Stories of Inspiration for New-Age Market Enthusiasts

India’s financial markets have witnessed a wave of energetic, tech-savvy, and disciplined young traders who are reshaping the landscape. These individuals have not only demonstrated skill and courage but have also become role models for thousands of aspiring traders.

In this section, we highlight some of the top young trader in India making a mark in 2025, along with what you can learn from their journeys.

1. Subhasish Pani – Power of Discipline and Strategy * Age: Early 30s * Known For: Options trading, mentorship, and YouTube education * Why Follow Him: Founder of Power of Stocks, Subhasish is popular for his logical approach to price action and options strategy. He also emphasizes emotional control and risk management.

📌 Traders tip: Focus on capital protection, not just high returns. Learn and backtest your setups before using real money.

2. Sharique Samsudheen – Clarity in Complexity * Age: 30s * Known For: Simplifying market concepts for F&O traders * YouTube: “The Free Trader” * Why Follow Him: Sharique breaks down complex derivatives strategies into understandable language and promotes consistency over hype.

📌 Tips for trading options: Learn from his breakdowns of iron condors, spreads, and hedging techniques.

3. Rachana Ranade – Educator, Not Just a Trader * Age: 30s * Background: Chartered Accountant * Known For: Financial literacy and technical analysis training * Why Follow Her: She has empowered lakhs of youth through courses and YouTube, especially in equity, technical analysis, and long-term investing.

📌 Tips for traders: Build your basics strong before diving into advanced strategies.

4. Shivansh Bhasin – The Swing Trade Specialist * Age: Late 20s to early 30s * Known For: Swing trading setups, Telegram/YouTube signals * Why Follow Him: His focus is on price action with clearly defined entries, stop-losses, and targets. His disciplined alerts and trading system have built strong credibility.

📌 Tips for trader: Stay consistent with one style of trading that suits your psychology.

5. Neha Nagar – Influencer with a Purpose * Age: 20s * Background: Finance influencer and entrepreneur * Known For: Educating on basics of investing, taxation, and mutual funds * Why Follow Her: While not a trader in the conventional sense, she has brought massive awareness to financial literacy among the youth.

📌 Special suggestion for young traders: Start with knowledge—trading is a subset of a larger wealth journey.

What You Can Learn from These Top Young Traders in India

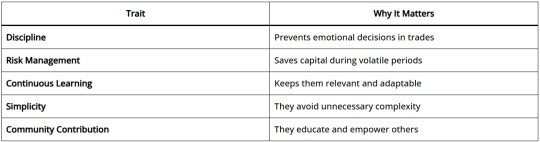

All of these top young trader in India share a few key traits:

These young market stars are building more than personal wealth—they’re shaping a culture of financial literacy, responsible trading, and early financial independence.

Want to Be One of the Top Young Traders?

If you’re just starting, take inspiration from these individuals. Their journeys weren’t built in a day. Start small, learn continuously, stick to a trading routines, and treat every trade as a learning opportunity.

One day, your story might feature in the list of top young trader in India.

Final Word on Trading Options

For young traders in 2025, options trading presents both a challenge and an opportunity. By following these tips for trading options, you can: * Minimize losses * Improve strategy execution * Develop emotional discipline * Avoid common beginner traps Stay consistent with your trading routines, invest in learning, and keep upgrading your skillset.

These top young trader in India prove that age is no barrier if you have the knowledge, strategy, and mindset.

Traders Tips: Avoiding Common Mistakes

Let’s now cover trader tips focused on common pitfalls to avoid:

❌ Overleveraging: Using too much margin can lead to large losses. Use leverage responsibly.

❌ Copying Others Blindly: Understand the logic behind a trade before copying someone’s position.

❌ Trading Without a Stop Loss: This can quickly blow up your account. One of the core tips for traders is always defining your risk.

❌ Ignoring Risk-Reward Ratio: Always aim for at least a 1:2 risk-reward ratio.

Creating a Young Trader’s Portfolio in 2025

While trading can be rewarding, diversification is important. A balanced young trader’s portfolio could look like: * 50% Equity Long-Term (Mutual Funds/Stocks) * 20% Trading Capital (Intraday/Options) * 20% Emergency Fund * 10% Gold or Digital Gold This keeps you protected while still allowing you to learn from markets.

Future Trends: Where Are the Opportunities for Young Trader?

In 2025, several new avenues are opening up for young trader: * Algo Trading: Automated strategies using Python. * Crypto Derivatives: Still risky but maturing. * Sustainable Stocks: ESG-based companies gaining attention. * AI Tools in Trading: Platforms are using AI for signal generation and analysis.

Keeping up with these innovations will provide young trader with an edge.

Top Apps and Platforms for Young Trader in India

Your tools matter. Here are some of the most trusted platforms:

Make sure to pick a platform that suits your trading routines and instrument preference.

Final Tips for Young Traders in 2025

Let’s wrap up with a summary of actionable tips for traders and traders tips you can implement right away:

🔹 Start small, but stay consistent. 🔹 Focus on process, not just profits. 🔹 Build a daily trading routine. 🔹 Follow and learn from top young traders in India. 🔹 Embrace technology and innovation. 🔹 Always define risk and reward in every trade. 🔹 Never stop learning.

The journey is long, but the earlier you start, the more time you have to improve, adapt, and grow.

CONCLUSION

In 2025, the world of trading is more accessible than ever. Young traders have the tools, platforms, and resources to become successful if they approach it wisely. With the right tips for trade, disciplined trading routine, and a learner’s mindset, your age can become your biggest advantage.

Whether you’re trading stocks, learning tips for trading options, or just observing the strategies of top young traders in India, the important thing is to start—and stay consistent.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#tradingtips#youngtrader#stockmarket2025#financialindependence#moneytalks#investearly#financeblog#millennialmoney#genzfinance#tradingmotivation#tradinggoals#stockmarketlife#younginvestorjourney#wealthmindset#tradingforbeginners#financialliteracy#financeinspiration#sidehustle2025#tradingtips2025#financialfreedom#startyoung#genzinvesting#investing101#buildwealth#stockmarket#learntrading#financialgoals#tradinglife#sidehustle#moneytips

0 notes

Text

New York Stock Market Index in 2025

The New York Stock Market Index, one of the world’s leading financial markets, plays a pivotal role in global economics. Its indices, such as the Dow Jones Industrial Average (DJIA), S&P 500, and NASDAQ Composite, serve as barometers of the financial health and investor sentiment in the United States. In 2024, the performance and dynamics of these indices have garnered significant attention, not only within the U.S. but also globally, including their impact on the Indian market. This comprehensive overview explores the current state of the New York Stock Market, its live updates, and its influence on the Indian economy.

New York Stock Market Index

Key Indices and Their Performance:

NASDAQ Composite: Known for its high concentration of technology and biotech companies, the NASDAQ Composite has shown significant volatility in 2024. The performance of major tech giants and innovative startups has heavily influenced this New York stock market index.

Dow Jones Industrial Average (DJIA): The DJIA, consisting of 30 major companies, is one of the oldest and most well-known stock market indices. In 2024, the DJIA has experienced fluctuations due to various factors, including economic data releases, corporate earnings, and geopolitical events.

S&P 500: New York stock market index includes 500 of the largest companies listed on the NYSE and NASDAQ. The S&P 500 is widely regarded as one of the best representations of the U.S. stock market. Its performance in 2024 has been closely monitored, reflecting the overall economic conditions and investor confidence.

New York Stock Market Now

Current Trends and Influences:

Corporate Earnings: Quarterly earnings reports from major corporations provide insights into New York stock market now financial health and future prospects. In 2024, mixed earnings results across sectors have led to varied market reactions, with technology and healthcare sectors showing notable performances.

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation figures have a direct impact on New York stock market index performance. In 2024, the U.S. economy has shown signs of resilience with steady GDP growth, though concerns about inflation have persisted, influencing investor behavior.

Monetary Policy: The Federal Reserve’s monetary policy, including interest rate decisions and quantitative easing measures, plays a crucial role in shaping market dynamics. In 2024, the Fed’s stance on interest rates has been a focal point for investors, impacting both equity and bond markets.

Geopolitical Events: Geopolitical tensions, trade relations, and international conflicts can lead to market volatility. In 2024, events such as trade negotiations, diplomatic developments, and regional conflicts have contributed to fluctuations in the New York Stock Market Now.

New York Stock Market Live

Real-Time Updates and Market Movements:

Investor Behavior: The behavior of retail and institutional investors significantly influences New York stock market index trends. In 2024, the rise of retail investors, facilitated by online trading platforms, has added a new dimension to New York stock market index dynamics, often leading to unexpected price movements.

Market Sentiment: Real-time market sentiment, driven by news events, analyst reports, and social media trends, can cause immediate market reactions. In 2024, platforms providing live updates and market sentiment analysis have become invaluable tools for investors.

Technological Advancements: Advances in trading technology, including algorithmic trading and high-frequency trading, have increased the speed and volume of transactions. These technological developments have contributed to greater market liquidity and efficiency in 2024.

New York Stock Market Index Impact on Indian Market

Interconnected Global Economy:

Capital Flows: The interconnectedness of global financial markets means that movements in the New York Stock Market Index can influence capital flows to emerging markets, including India. In 2024, shifts in investor sentiment in the U.S. have led to changes in foreign portfolio investments in Indian equities and bonds.

Exchange Rates: The performance of the U.S. dollar, influenced by the New York Stock Market Now impacts exchange rates. In 2024, fluctuations in the dollar have affected the Indian rupee, influencing trade dynamics and foreign exchange reserves.

Commodity Prices: The U.S. stock market’s performance can impact commodity prices globally. In 2024, changes in oil prices, driven by market sentiment and economic conditions in the U.S., have had ripple effects on India’s import costs and inflation.

Sectoral Impacts:

Automotive Sector: The automotive sector, particularly electric vehicles (EVs), has seen significant developments in the U.S. market. In 2024, the growth of the EV market in the U.S. has spurred investments and innovations in India’s automotive industry, promoting sustainability and technological advancement.

Technology Sector: The technology sector’s performance in the New York Stock Market Index has direct implications for Indian IT companies, many of which derive a significant portion of their revenue from the U.S. In 2024, strong performances by U.S. tech giants have been positive for Indian tech firms.

Pharmaceutical Sector: The healthcare and pharmaceutical sectors are closely linked between the U.S. and India. In 2024, advancements and investments in U.S. biotech and pharma companies have opened opportunities for Indian counterparts, enhancing collaborations and market access.

Challenges and Opportunities

Navigating Market Volatility:

Investment Opportunities: Despite market volatility, 2024 has presented numerous investment opportunities. Sectors such as renewable energy, healthcare, and technology have shown promise, attracting both domestic and international investors.

Risk Management: Investors in both the U.S. and India need to adopt robust risk management strategies to navigate market volatility. In 2024, diversification across asset classes and geographical regions has become essential to mitigate risks associated with New York stock market index fluctuations.

Policy Responses: Government and regulatory policies play a critical role in stabilizing markets. In 2024, coordinated policy responses between the U.S. and India, focusing on trade, investment, and economic reforms, have been crucial in addressing market challenges.

CONCLUSION

The New York Stock Market Index in 2024 has been a focal point for global investors, reflecting broader economic trends, technological advancements, and geopolitical developments. Its real-time performance and market movements have had far-reaching implications, influencing not only the U.S. economy but also global markets, including India. Understanding the dynamics of the New York Stock Market Index and its interconnectedness with the Indian market is crucial for investors, policymakers, and businesses seeking to navigate the complexities of the global financial landscape in 2024.

Stay updated with ISMT latest insights New York Stock Market Index in 2024, real-time analysis New York Stock Market Now live data, expert commentary.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#financeblog#economicoutlook#marketupdate#stockpredictions#useconomy2025#wallstreet#investmentstrategies#financialforecast#nyse2025#stockmarkettrends#stockmarketindex#newyorkstockmarket

0 notes

Text

Impact of Budget 2025 India Economic Growth

The Indian Union Budget 2024 India, presented on July 23, has laid down a comprehensive framework aimed at bolstering economic growth across various sectors. This budget 2024 India addresses critical areas such as infrastructure development, social welfare programs, agricultural sector initiatives, green and sustainable projects, MSME support, digital economy, education, healthcare, and employment generation. The strategic allocation of funds and policy measures are expected to stimulate economic activity, improve quality of life, and drive sustainable development. Here are the key highlights and their potential impacts on economic growth.

Budget 2024 Highlight

The Budget 2024 India has been crafted to address both immediate economic needs and long-term growth objectives. Key budget 2024 highlight include:

Fiscal Deficit Target: Aiming to bring the fiscal deficit down to 5.4% of GDP, reflecting a commitment to fiscal consolidation.

Tax Reforms: Introduction of a new tax regime with revised income tax slabs and simplified GST structure to ease compliance.

Infrastructure Investments: Increased allocation for infrastructure projects, including roads, railways, and ports.

Social Welfare Initiatives: Enhanced funding for healthcare, education, and social security programs.

Agricultural Support: Increased subsidies and support for technological advancements in agriculture.

Green Initiatives: Major investments in renewable energy and climate resilience projects.

MSME Development: Special schemes to support micro, small, and medium enterprises.

Digital Economy: Expansion of digital infrastructure and support for technological innovation.

1. Infrastructure Development:

Allocation: Significant investment in transportation, energy, and urban development.

Impact: Improved connectivity, reduced logistics costs, and a boost to GDP through construction activity.

2. Social Welfare Programs:

Allocation: Enhanced funding for social security schemes, healthcare, and education.

Impact: Improved living standards, poverty alleviation, and inclusive growth.

3. Agricultural Sector Initiatives:

Allocation: New schemes and subsidies for fertilizers, seeds, and irrigation.

Impact: Increased agricultural productivity, rural development, and food security.

4. Green and Sustainable Initiatives:

Allocation: Investments in renewable energy and environmental conservation projects.

Impact: Promotes sustainable growth, reduces reliance on fossil fuels, and creates new jobs in green sectors.

5. MSME Support and Development:

Allocation: Financial support and policy reforms for MSMEs.

Impact: Job creation, entrepreneurship, and innovation, driving economic growth.

6. Digital Economy and Innovation:

Allocation: Incentives for technology adoption and the establishment of innovation hubs.

Impact: Enhanced efficiency, productivity, and economic diversification.

7. Education and Skill Development:

Allocation: Increased funding for educational infrastructure and vocational training.

Impact: Development of a skilled workforce, higher employment rates, and improved global competitiveness.

8. Healthcare and Public Health:

Allocation: Investment in healthcare infrastructure and public health programs.

Impact: Improved health outcomes, productivity, and economic stability.

9. Employment Generation and Labor Reforms:

Allocation: Funding for job creation programs and labor market reforms.

Impact: Reduced unemployment, enhanced labor market efficiency, and economic growth.

Budget 2024 India Date and Time