#CompoundFeed

Explore tagged Tumblr posts

Text

Feed Enzymes Market demand surges due to animal nutrition and performance focus

The global Feed Enzymes Market is witnessing substantial growth as animal nutrition becomes a focal point for producers seeking higher yields and improved livestock performance. Increasing awareness around balanced animal diets and the advantages of enzyme supplementation are fueling market momentum across regions.

What Are Feed Enzymes and Why They Matter

Feed enzymes are biological catalysts added to animal feed to enhance digestion and nutrient absorption. Common enzymes like phytase, protease, and carbohydrase help break down anti-nutritional factors that limit feed efficiency. By improving the bioavailability of nutrients, these enzymes significantly impact livestock growth rates, feed conversion ratios, and overall health.

For example, phytase breaks down phytate-bound phosphorus in grains, reducing the need for inorganic phosphorus supplements. This not only improves animal health but also reduces environmental phosphorus waste. Similarly, protease enhances protein digestion, while carbohydrase helps break down complex carbohydrates, increasing the overall digestibility of feed.

Key Drivers Behind the Surging Demand

One of the primary drivers for the growing demand is the increasing cost of traditional feed ingredients. Producers are actively seeking solutions to reduce feed costs without compromising animal performance. Feed enzymes serve this purpose effectively by enhancing the utilization of nutrients already present in the feed.

Additionally, the ban and restriction on antibiotic growth promoters in several countries have opened up opportunities for natural alternatives like enzymes. They promote gut health and immunity in animals without the need for chemical additives.

Another key factor is the focus on reducing environmental pollution from livestock farming. Enzymes contribute to more sustainable practices by lowering nitrogen and phosphorus excretion, helping producers meet environmental compliance standards.

Regional Growth and Market Performance

The Asia Pacific region, particularly countries like China, India, and Vietnam, is experiencing the fastest growth in feed enzyme adoption. Rapid urbanization, increasing meat consumption, and expansion of the organized livestock sector are contributing to the trend.

In North America and Europe, technological advancements and high awareness about animal welfare are pushing for higher-quality feed formulations that include enzymes. These markets also benefit from well-established regulatory frameworks that encourage innovation in feed additives.

Latin America and parts of the Middle East are emerging markets, where feed enzyme adoption is growing steadily due to increased investment in livestock farming infrastructure.

Application Across Livestock Segments

Feed enzymes are used across various livestock segments including poultry, swine, ruminants, and aquaculture. In poultry, enzymes help improve weight gain and reduce feed costs. For swine, enzymes improve gut health and minimize digestive disorders. In ruminants, multi-enzyme blends enhance fiber digestion and increase milk yield. In aquaculture, enzymes aid in protein and fat digestion, which are crucial for healthy fish growth.

Tailored enzyme solutions for each species and stage of growth are becoming more common, reflecting the industry’s move toward precision nutrition.

Market Challenges and Considerations

Despite its advantages, the feed enzymes market faces certain challenges. One of the primary hurdles is the variability in enzyme performance due to differences in feed composition, processing conditions, and animal species. To address this, enzyme manufacturers are investing in R&D to create more stable and effective enzyme formulations.

The cost of enzymes can also be a concern for small-scale farmers. However, as awareness increases and production costs decline due to economies of scale, affordability is gradually improving.

Proper storage and handling of enzymes to retain their activity is another critical area that feed producers must manage effectively.

Future Outlook

Looking ahead, the feed enzymes market is set to continue its upward trajectory. Technological advancements such as genetically engineered enzymes and fermentation-based production methods are expected to enhance efficiency and cost-effectiveness. There is also a growing interest in synergistic blends that combine different enzymes to maximize nutrient breakdown.

As the livestock industry shifts towards sustainable, high-performance nutrition solutions, feed enzymes will play an increasingly central role. Market players that focus on innovation, customization, and education will likely lead the next phase of growth.

#feedenzymes#animalnutrition#livestockperformance#sustainablefarming#poultryfeed#enzymetechnology#compoundfeed#feedformulation#digestibility#animalhealth

0 notes

Text

AnimalFeed, #LivestockNutrition, #FeedAdditives, #PoultryFeed, #CattleFeed, #Aquafeed, #PetFoodMarket, #AnimalHealth, #AgricultureIndustry, #FeedMarketTrends, #AnimalNutrition, #LivestockIndustry, #CompoundFeed, #FeedIngredients, #FeedManufacturing

#AnimalFeed#LivestockNutrition#FeedAdditives#PoultryFeed#CattleFeed#Aquafeed#PetFoodMarket#AnimalHealth#AgricultureIndustry#FeedMarketTrends#AnimalNutrition#LivestockIndustry#CompoundFeed#FeedIngredients#FeedManufacturing

0 notes

Text

Animal Feed Market Trends and Forecast 2025

The Future of Animal Feed: How Market Growth Will Shape Global Meat Prices

The animal feed industry is undergoing a huge transition, which may influence how much we spend for meat in the next years. With billions of dollars in planned growth, understanding what is driving this expansion allows us to predict where food prices will go. What Does Market Growth Mean for Your Grocery Bill? The worldwide animal feed industry is now valued at approximately USD 533.4 billion in 2024, but experts anticipate that it will increase to USD 681.8 billion by 2033. That equates to a consistent CAGR of 2.8% every year. Some studies believe it might potentially reach $1,008.8 billion by 2031, expanding at a CAGR of 4.7% each year.

Why should you care about feed prices? Simple - animal feed makes up 60-70% of what it costs to raise livestock. When feed gets more expensive, meat prices usually follow. The good news is that this steady growth suggests we won't see the wild price swings we've experienced recently. The bad news? Meat prices will likely keep creeping up gradually.

Think of it this way: better feed technology might help farmers raise animals more efficiently, which could keep some costs down. But as more people around the world want quality meat, the demand for good feed keeps pushing prices up. It's a balancing act that will probably result in slowly rising meat prices over the next decade.

Why Emerging Markets Are Driving Poultry Feed Demand

Chicken and other poultry are becoming the go-to protein choice worldwide, especially in developing countries. Poultry feed now represents 39.0% of the entire animal feed market, making it the biggest segment by far.

There are several reasons why poultry feed is booming in emerging markets. First, chicken is relatively affordable compared to beef or pork, making it accessible to growing middle-class populations in countries like India, Brazil, and parts of Southeast Asia. Second, raising chickens requires less time and money upfront than other livestock, so small-scale farmers can get started more easily.

The Asia-Pacific region perfectly shows this trend. It controls 39.2% of the global market, worth about USD 286.2 billion, and it's growing faster than anywhere else at CAGR of 5.9%. Countries across Asia are seeing explosive growth in chicken consumption as people earn more money and move to cities where fresh meat is more readily available.

This isn't just about economics - it's about changing lifestyles. As people in emerging markets become more urbanized and affluent, they're eating more protein, and chicken is often their first choice because it's affordable, versatile, and widely accepted culturally.

Why Pellets Are Taking Over Feed Manufacturing

Walk into any modern farm, and you'll likely see pellet feed rather than the traditional mash feed that farmers used decades ago. There's a good reason for this shift - pellets simply work better in almost every way.

Pellets are made by taking regular feed ingredients, adding steam and pressure, then forming them into small, hard nuggets. This process creates several advantages that farmers love. First, pellets are much easier to handle, store, and transport than loose feed. They don't separate into different components during shipping, so animals get consistent nutrition in every bite.

From a practical standpoint, pellets last longer without spoiling, which is crucial in hot climates or places where storage conditions aren't ideal. They also reduce waste because animals can't pick through them to eat only their favorite parts, leaving the rest behind.

However, the market shows that preferences vary by region. Traditional mash feed still holds about 60% of the poultry feed market, especially in cost-sensitive areas where the extra processing costs of pellets don't make economic sense. But overall, the trend is clearly moving toward pellets as farming operations become more mechanized and efficiency-focused.

How Industry Giants Are Shaping the Future

Two companies - Cargill and BASF SE - are playing a huge role in determining where the animal feed industry goes next. In January 2023, these companies extended their partnership to develop better enzyme solutions for animal feed in the US market. This might sound technical, but it's actually quite important for everyday consumers.

What these companies are doing is creating feed that helps animals digest their food better and grow more efficiently. When animals can convert feed into meat more effectively, it reduces costs and environmental impact. The partnership combines BASF's research expertise with Cargill's massive distribution network and practical farming knowledge.

This collaboration started back in October 2021, and it shows how the biggest players in the industry are working together rather than competing on everything. They're focusing on making feed more sustainable and efficient, which could help keep future price increases

What This Means for the Future

The animal feed industry's growth to USD 681.8 billion by 2033 represents more than just bigger numbers - it reflects fundamental changes in how the world produces food. As emerging markets continue developing and their populations demand more protein, the pressure on feed production will only increase.

For consumers, this likely means gradually rising meat prices, but not the dramatic spikes we've seen during supply chain disruptions. The industry is becoming more efficient and sustainable, which should help keep increases manageable.

The dominance of poultry feed reflects changing global eating habits, with more people choosing chicken over other meats. The shift toward pellet feed shows an industry focused on efficiency and reducing waste.

Key Players

The key players operating in the global animal feed market are Charoen Pokphand Foods PCL (Thailand), New Hope Liuhe Co., Ltd. (China), Cargill, Incorporated (U.S.), Brf S.A. (Brazil), Tyson Foods, Inc. (U.S.), Nutreco N.V. (Netherlands), Archer-Daniels-Midland Company (U.S.), Alltech Inc. (U.S.), ForFarmers N.V. (Netherlands), De Heus Animal Nutrition (Netherlands), Royal Agrifirm Group (Netherlands), and Guangdong HAID Group Co., Ltd. (China).

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5393

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#AnimalFeed#LivestockNutrition#FeedAdditives#PoultryFeed#CattleFeed#Aquafeed#PetFoodMarket#AnimalHealth#AgricultureIndustry#FeedMarketTrends#AnimalNutrition#LivestockIndustry#CompoundFeed#FeedIngredients#FeedManufacturing

0 notes

Text

Global Animal Feed Market Analysis by Type and Region

The Future of Animal Feed: How Market Growth Will Shape Global Meat Prices

The animal feed industry is undergoing a huge transition, which may influence how much we spend for meat in the next years. With billions of dollars in planned growth, understanding what is driving this expansion allows us to predict where food prices will go. What Does Market Growth Mean for Your Grocery Bill? The worldwide animal feed industry is now valued at approximately USD 533.4 billion in 2024, but experts anticipate that it will increase to USD 681.8 billion by 2033. That equates to a consistent CAGR of 2.8% every year. Some studies believe it might potentially reach $1,008.8 billion by 2031, expanding at a CAGR of 4.7% each year.

Why should you care about feed prices? Simple - animal feed makes up 60-70% of what it costs to raise livestock. When feed gets more expensive, meat prices usually follow. The good news is that this steady growth suggests we won't see the wild price swings we've experienced recently. The bad news? Meat prices will likely keep creeping up gradually.

Think of it this way: better feed technology might help farmers raise animals more efficiently, which could keep some costs down. But as more people around the world want quality meat, the demand for good feed keeps pushing prices up. It's a balancing act that will probably result in slowly rising meat prices over the next decade.

Why Emerging Markets Are Driving Poultry Feed Demand

Chicken and other poultry are becoming the go-to protein choice worldwide, especially in developing countries. Poultry feed now represents 39.0% of the entire animal feed market, making it the biggest segment by far.

There are several reasons why poultry feed is booming in emerging markets. First, chicken is relatively affordable compared to beef or pork, making it accessible to growing middle-class populations in countries like India, Brazil, and parts of Southeast Asia. Second, raising chickens requires less time and money upfront than other livestock, so small-scale farmers can get started more easily.

The Asia-Pacific region perfectly shows this trend. It controls 39.2% of the global market, worth about USD 286.2 billion, and it's growing faster than anywhere else at CAGR of 5.9%. Countries across Asia are seeing explosive growth in chicken consumption as people earn more money and move to cities where fresh meat is more readily available.

This isn't just about economics - it's about changing lifestyles. As people in emerging markets become more urbanized and affluent, they're eating more protein, and chicken is often their first choice because it's affordable, versatile, and widely accepted culturally.

Why Pellets Are Taking Over Feed Manufacturing

Walk into any modern farm, and you'll likely see pellet feed rather than the traditional mash feed that farmers used decades ago. There's a good reason for this shift - pellets simply work better in almost every way.

Pellets are made by taking regular feed ingredients, adding steam and pressure, then forming them into small, hard nuggets. This process creates several advantages that farmers love. First, pellets are much easier to handle, store, and transport than loose feed. They don't separate into different components during shipping, so animals get consistent nutrition in every bite.

From a practical standpoint, pellets last longer without spoiling, which is crucial in hot climates or places where storage conditions aren't ideal. They also reduce waste because animals can't pick through them to eat only their favorite parts, leaving the rest behind.

However, the market shows that preferences vary by region. Traditional mash feed still holds about 60% of the poultry feed market, especially in cost-sensitive areas where the extra processing costs of pellets don't make economic sense. But overall, the trend is clearly moving toward pellets as farming operations become more mechanized and efficiency-focused.

How Industry Giants Are Shaping the Future

Two companies - Cargill and BASF SE - are playing a huge role in determining where the animal feed industry goes next. In January 2023, these companies extended their partnership to develop better enzyme solutions for animal feed in the US market. This might sound technical, but it's actually quite important for everyday consumers.

What these companies are doing is creating feed that helps animals digest their food better and grow more efficiently. When animals can convert feed into meat more effectively, it reduces costs and environmental impact. The partnership combines BASF's research expertise with Cargill's massive distribution network and practical farming knowledge.

This collaboration started back in October 2021, and it shows how the biggest players in the industry are working together rather than competing on everything. They're focusing on making feed more sustainable and efficient, which could help keep future price increases

What This Means for the Future

The animal feed industry's growth to USD 681.8 billion by 2033 represents more than just bigger numbers - it reflects fundamental changes in how the world produces food. As emerging markets continue developing and their populations demand more protein, the pressure on feed production will only increase.

For consumers, this likely means gradually rising meat prices, but not the dramatic spikes we've seen during supply chain disruptions. The industry is becoming more efficient and sustainable, which should help keep increases manageable.

The dominance of poultry feed reflects changing global eating habits, with more people choosing chicken over other meats. The shift toward pellet feed shows an industry focused on efficiency and reducing waste.

Key Players

The key players operating in the global animal feed market are Charoen Pokphand Foods PCL (Thailand), New Hope Liuhe Co., Ltd. (China), Cargill, Incorporated (U.S.), Brf S.A. (Brazil), Tyson Foods, Inc. (U.S.), Nutreco N.V. (Netherlands), Archer-Daniels-Midland Company (U.S.), Alltech Inc. (U.S.), ForFarmers N.V. (Netherlands), De Heus Animal Nutrition (Netherlands), Royal Agrifirm Group (Netherlands), and Guangdong HAID Group Co., Ltd. (China).

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5393

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#AnimalFeed#LivestockNutrition#FeedAdditives#PoultryFeed#CattleFeed#Aquafeed#PetFoodMarket#AnimalHealth#AgricultureIndustry#FeedMarketTrends#AnimalNutrition#LivestockIndustry#CompoundFeed#FeedIngredients#FeedManufacturing

0 notes

Text

Compound Feed Market: Driving Animal Nutrition to New Heights

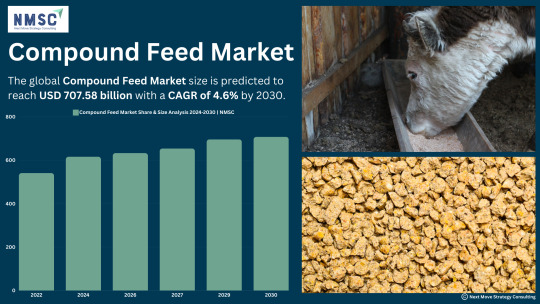

The Compound Feed Market is on the rise as the demand for high-quality, nutritious animal feed grows.

Get FREE Sample: https://www.nextmsc.com/compound-feed-market/request-sample

With advancements in feed formulation and a focus on sustainability, this market is playing a crucial role in enhancing livestock health and productivity worldwide.

Are you keeping up with the latest trends in animal nutrition?

#CompoundFeed#AnimalNutrition#LivestockHealth#SustainableAgriculture#FeedInnovation#GlobalMarketTrends

0 notes

Text

Empowering Feed Manufacturers: Cremach Pvt. Ltd.'s Unmatched Legacy in Milling Machinery

Cremach Pvt. Ltd. is a leading supplier of dependable, high-quality milling machinery designed for the compound feed industry. With experience of over 4 decades, the company excels in design, fabrication, supply, installation, automation, and commissioning of animal feed process machinery.

#compundfeed#cattlefeed#feedtechnology#hammermills#pelletmillsmachinery#feedmill#aquafeedplants#design#manufacturer#machine#compoundfeed#cremach#cremachpvtltd

0 notes

Photo

Global Compound Feed Market is predicted to exhibit 4.02% CAGR from 2018 to 2023 (forecast period) to reach a value of USD 539.9 billion by 2023.

Get More Information @ https://bit.ly/3mnJZlA

1 note

·

View note

Photo

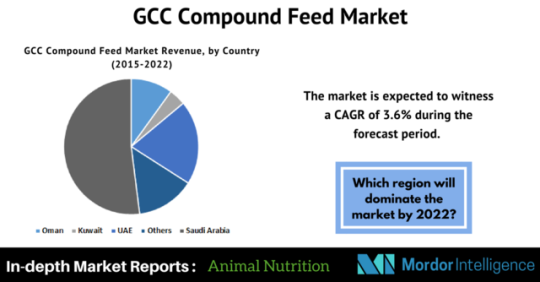

The GCC compound feed market was valued at USD 5 Billion in 2016 and is expected to reach over 6.039 billion by 2022, registering a CAGR of 3.6%, during the forecast period. http://bit.ly/2DELvJS

0 notes

Photo

Sunlight in the studio #sewing #samplemaking #patternmaking #apparel #custom #design #designer #knitwear #art #fashion #style #productdesign #productdevelopment #coverstitch #compoundfeed #serger #juki #savannah #ga (at 2308 Waters Ave)

#productdesign#knitwear#coverstitch#ga#sewing#custom#apparel#samplemaking#design#art#productdevelopment#patternmaking#compoundfeed#fashion#style#savannah#juki#serger#designer

0 notes

Text

𝐅𝐞𝐞𝐝𝐢𝐧𝐠 𝐭𝐡𝐞 𝐅𝐮𝐭𝐮𝐫𝐞: 𝐆𝐫𝐨𝐰𝐭𝐡 𝐢𝐧 𝐭𝐡𝐞 𝐂𝐨𝐦𝐩𝐨𝐮𝐧𝐝 𝐅𝐞𝐞𝐝 𝐌𝐚𝐫𝐤𝐞𝐭

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐑𝐄𝐄 𝐒𝐚𝐦𝐩𝐥𝐞: https://www.nextmsc.com/compound-feed-market/request-sample

The 𝐂𝐨𝐦𝐩𝐨𝐮𝐧𝐝 𝐅𝐞𝐞𝐝 𝐌𝐚𝐫𝐤𝐞𝐭 is on the rise as the global demand for high-quality animal nutrition continues to expand. With the increasing focus on food security and livestock health, compound feed plays a crucial role in boosting the efficiency and productivity of the animal farming sector.

𝐊𝐞𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬:

- Rising meat consumption, growing awareness of animal nutrition, advancements in feed production technology, and a shift towards sustainable farming practices.

- Inclusion of probiotics, prebiotics, and enzymes in feed formulations; increased demand for organic and non-GMO feed; focus on reducing antibiotic use.

- High costs of raw materials, fluctuating grain prices, and stringent regulations on feed additives.

𝐀𝐜𝐜𝐞𝐬𝐬 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.nextmsc.com/report/compound-feed-market

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬

· Cargill

· ADM

· Charoen Pokphand Foods

· Land O'Lakes, Inc.

· Nutreco

· Alltech

· Guangdong Haid Group Co.,Limited

Compound feed provides a balanced mix of essential nutrients, ensuring better growth rates, improved immunity, and optimal productivity in livestock. With innovations in feed ingredients and formulations, the market is moving towards more sustainable and efficient solutions, promoting healthier animals and a safer food supply chain.

Is your business aligned with the future of animal nutrition? Now’s the time to seize the opportunity!

#CompoundFeed#AnimalNutrition#SustainableFarming#LivestockHealth#MarketTrends#FoodSecurity#AgricultureInnovation

0 notes

Photo

The Global Compound Feed Market is exhibit 4.02% CAGR to reach a value of USD 539.9 billion by 2023

Get More Information @ https://bit.ly/3q45ATt

0 notes

Photo

The Global Compound Feed Market is predicted to exhibit 4.02% CAGR from 2018 to 2023 (forecast period) to reach a value of USD 539.9 billion by 2023

Get More Information @ https://bit.ly/2NWAfAo

#CompoundFeedMarket#Foodandbeverage Business#Market#MarketResearchFuture#mrfr#CompoundFeed#CompoundFeedIndustry

0 notes

Photo

The global compound #Feed market is forecasted to register a significant CAGR of 4.76% during the forecast period. http://bit.ly/2FroHym

0 notes