#Cumulative Delta Indicator

Explore tagged Tumblr posts

Text

Trading Indicators That Every Aspiring Traders Should Know

If you think trading is a game of wild guess by looking at the ups and downs, you are very much on the wrong side. From an in-depth study of the ABCs to being meticulous at every point of the journey, there is a lot that goes behind building a perfect trading strategy and getting results from it.

Among many of these elements, trading indicators are one of traders’ best friends. But that is only if you know them. From forex trading to share market trading, no matter which it is, indicators are a massive help.

No wonder why the ninjatrader cumulative delta is so popular among seasoned traders. But which indicators are a must-know for traders? Let us take a look at the answers to it.

MA (Moving Average)

This indicator is used to notice the direction of the current price trend without any kind of interference from short-term price spikes. The MA indicators combine the price points of a financial instrument over a certain time frame and divide it by the number of data points to present a single trend line.

The data used actually depends on the length of the MA. For instance, a 200-day MA needs 200 days of data. By using the MA indicator, you can study the levels of resistance and support and see the previous price action.

ATR (Average true range)

The ATR is a lagging indicator. It is actually derived from the currency pair’s average prices in the past 2 weeks. It shows how much currency pairs move and in which direction during the day. It assists the traders in understanding when they should consider initiating a trade or placing a stop-loss order.

The ATR is one of the best technical indicators for day trading since it enables you to add or subtract the ATR prices from the average closing price of the day. The traders can generally use it to come up with their total trading system.

Fortune AI

It is an advanced trading indicator that has been developed over the years. A lot of the traders enter the positions just on the basis of price action, candles, or market structures.

However, they ended up getting a stop loss because of the market volatility due to their opening positions without full confirmation. Traders generally lose their emotions while trading. They open positions on the basis of their emotions and psychology.

EMA (Exponential moving average)

EMA is another form of moving average. Unlike the SMA, it places a massive weight on recent data points, making data more responsive to new information. When used with other indicators, EMAs may assist traders in confirming massive market moves and gauging legitimacy.

Wrapping Up

In addition to all these, there is a stochastic oscillator, which is very famous among seasoned traders. When you are getting into this journey, it is crucial that you know the tools that can help you out, like the Cumulative Delta Indicator, which is a favourite among many traders.

Source: https://tumblrblog.com/trading-indicators-that-every-aspiring-traders-should-know/

0 notes

Text

Cumulative Volume Delta: Ghid Complet pentru Evaluarea Sentimentului Pieței prin Analiza Volumului

Cumulative Volume Delta: Ghid Complet pentru Evaluarea Sentimentului Pieței prin Analiza Volumului Introducere Cumulative Volume Delta este un indicator tehnic care măsoară diferența dintre volumul de cumpărare și cel de vânzare pe o perioadă specificată, oferind o perspectivă clară asupra sentimentului pieței. Prin calcularea volumului cumulativ pe baza prețurilor de închidere, indicatorul adună…

#analiza tehnica#sentiment piață#ordine de cumpărare#ordine de vânzare#Delta#indicator tehnic#trend#volum#Cumulative Volume Delta

0 notes

Text

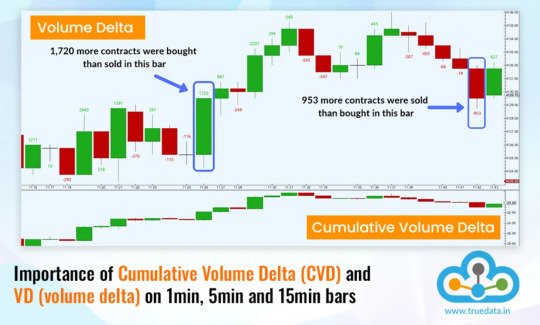

Cumulative Volume Delta (CVD) and VD (volume delta) on 1min, 5min and 15min bars

Volume Delta and Cumulative Volume Delta are among the prominent indicators used by traders to analyse different time frames and make suitable trading decisions. Integrating the use of CVD and VD in the trading plan helps traders in enhancing trend identification improving entry or exit timing and effective risk management strategies. The use of VD and CVD can contribute significantly to trading success for beginners as well as seasoned players in the trading arena.

Importance of Cumulative Volume Delta (CVD) and VD (volume delta) on 1min, 5min and 15min bars

#Cumulative Volume Delta#Cumulative Volume Delta Indicator#Importance of Cumulative Volume Delta and Volume Delta#How Cumulative Volume Delta works in trading

0 notes

Text

Bitcoin Traders Selling BTC Put Options

Bitcoin traders are increasingly selling BTC put options, indicating bullish price expectations.

The cumulative delta in BTC options and related ETFs reached $9 billion, highlighting significant sensitivity to changes in bitcoin's price.

0 notes

Text

Ensuring Zero Downtime During Office 365 Migrations Using EdbMails

In today's fast-paced business environment, organizational productivity depends heavily on email systems and collaborative platforms. Microsoft Office 365 stands as the pinnacle choice for enterprises seeking robust productivity tools. However, migrating to Office 365 presents significant challenges that can disrupt business operations if not handled properly. The primary concern during migration remains maintaining continuous access to critical data and applications.

The Challenge of Downtime in Office 365 Migrations

Traditionally, email migrations have meant scheduled downtime—often during weekends or after hours—creating stress for IT teams and potential productivity losses. For global organizations operating across time zones, finding an appropriate maintenance window becomes nearly impossible. Even planned downtime can translate to substantial financial losses as employees lose access to essential communication tools.

Research indicates that unplanned IT downtime costs enterprises an average of $5,600 per minute. While planned migration downtime costs less, the cumulative impact remains significant. Organizations must therefore prioritize solutions that minimize or eliminate downtime during Office 365 migration.

Understanding Zero-Downtime Migration Approaches

A zero-downtime migration strategy enables users to continue working seamlessly throughout the migration process. This approach requires specialized tools and methodologies that maintain system availability while transferring data between environments. EdbMails Office 365 Migration Tool has established itself as an industry leader in facilitating such transitions.

Unlike traditional migration methods that require complete system shutdowns, modern approaches employ parallel processing techniques. These methods create synchronized environments where data moves progressively while maintaining functionality in both source and target systems until cutover occurs.

Key Features of EdbMails for Zero-Downtime Migrations

Incremental Migration Capability

EdbMails implements a sophisticated incremental migration mechanism that transfers data in stages. The initial migration moves the bulk of historical data while subsequent incremental passes synchronize only new or modified items. This approach significantly reduces the final cutover time to mere minutes rather than hours or days.

The tool's delta synchronization algorithm identifies and transfers only changes made since the previous migration session. This capability proves invaluable for organizations with large mailboxes or limited migration windows.

Concurrent Processing Architecture

The multi-threaded architecture of EdbMails allows simultaneous processing of multiple mailboxes and folders. Administrators can configure the level of parallel processing based on available network bandwidth and server resources. This architecture dramatically accelerates migration speed without overwhelming system resources.

Automatic Retry Mechanism

Network interruptions can derail migration processes. EdbMails incorporates an intelligent retry mechanism that automatically resumes failed transfers without manual intervention. This feature ensures migration continuity even during temporary connectivity issues.

Granular Item Selection

The platform offers precise control over what items migrate. Administrators can filter content based on date ranges, item types, folder paths, and size limitations. This granularity allows organizations to prioritize essential current data for initial migration phases while scheduling less critical historical content for later transfers.

Implementing a Zero-Downtime Migration Strategy with EdbMails

Phase 1: Discovery and Planning

Before initiating migration, thorough assessment of the existing environment becomes crucial. EdbMails provides comprehensive pre-migration analysis tools that:

Identify total data volume requiring migration

Flag potential compatibility issues

Estimate migration timeframes based on available bandwidth

Detect corrupted items that might require attention

This discovery phase helps establish realistic migration timelines and resource requirements while identifying potential roadblocks before they impact the migration process.

Phase 2: Pilot Migration

Starting with a small user subset validates the migration approach and identifies potential issues before full-scale implementation. EdbMails facilitates this approach through its selective migration capabilities. Typically, IT staff mailboxes serve as excellent pilot candidates since they can provide immediate feedback on migration quality.

Phase 3: Bulk Data Transfer

Once the pilot proves successful, the main data transfer begins. During this phase, EdbMails transfers the majority of mailbox content while users continue working in their original environment. The key advantage here lies in transparency—users remain completely unaware of the background migration process.

Phase 4: Delta Synchronization

As users generate new content during the bulk migration phase, EdbMails tracks these changes through its incremental synchronization engine. Multiple delta synchronization passes may occur, each transferring progressively smaller data sets as the final cutover approaches.

Phase 5: Final Cutover

The moment of truth arrives during final cutover. Thanks to the previous delta synchronization passes, only minimal changes require transfer at this stage. EdbMails completes this final synchronization rapidly—typically in minutes rather than hours—minimizing user impact.

Advanced Techniques for Ensuring Business Continuity

Staggered Migration Approach

Rather than migrating all users simultaneously, EdbMails allows organizations to implement a staggered migration strategy. This approach divides users into logical groups—often by department or location—with separate migration schedules. Each group undergoes its own migration cycle, distributing the workload and reducing risk.

Migration During Business Hours

Contrary to conventional wisdom that relegates migrations to weekends or nights, properly executed EdbMails migrations can occur during regular business hours. Since users maintain full mailbox functionality throughout the process, organizations can leverage normal working hours for migration activities, reducing overtime costs and staff burnout.

Real-time Monitoring and Reporting

EdbMails provides comprehensive monitoring dashboards that display migration progress in real-time. These insights enable administrators to:

Track completion percentages across mailboxes

Identify bottlenecks affecting migration speed

Monitor resource utilization on migration servers

Receive alerts for items requiring attention

These monitoring capabilities ensure transparency throughout the migration process while providing documentation for compliance and audit purposes.

Addressing Common Zero-Downtime Migration Challenges

Network Bandwidth Constraints

Limited bandwidth can throttle migration speeds. EdbMails addresses this challenge through bandwidth throttling controls that balance migration performance against network availability for business operations. Organizations can schedule higher bandwidth utilization during off-peak hours while limiting resource consumption during critical business periods.

Large Mailbox Handling

Exceptionally large mailboxes present unique challenges during migration. EdbMails employs specialized handling for these scenarios through segmented transfers and prioritized content migration. The tool can prioritize recent items first, ensuring that users have access to their most relevant content early in the migration process.

Public Folder Migration

Public folders often contain critical business data accessed by multiple users. EdbMails includes specialized public folder migration capabilities that maintain accessibility throughout the transfer process. The tool preserves permissions, folder structures, and content while ensuring users retain access to this shared information.

Conclusion: The Business Value of Zero-Downtime Migration

Implementing a zero-downtime migration strategy with EdbMails delivers substantial business value beyond the obvious benefit of continuous operations. Organizations experience reduced project risks, lower migration costs, and enhanced user satisfaction throughout the transition.

The technology landscape continues evolving, and migration tools like EdbMails have transformed what was once a dreaded IT project into a manageable business process. By leveraging these specialized tools and methodologies, organizations can now approach Office 365 migrations as strategic opportunities rather than operational disruptions.

For enterprises prioritizing business continuity, EdbMails provides the technical foundation necessary to achieve seamless Office 365 migration without sacrificing productivity or risking data integrity. The result is a modern workplace transformation that happens behind the scenes—exactly as good IT should function.

0 notes

Text

Bitcoin Stabilizes at $86K: Potential Pitfalls or Persistence to Prevail?

Key Points

Bitcoin has experienced a moderate recovery, potentially due to a short squeeze.

The Cumulative Volume Delta (CVD) of Bitcoin indicates a high selling pressure.

Bitcoin has seen a slight increase of 1.55% in the past day, despite the market being dominated by sellers.

A short squeeze, a market condition where short sellers are forced to close their positions due to increased prices, seems to be the cause of this temporary recovery.

Bitcoin’s Market Dynamics

The market dynamics of Bitcoin have seen a significant shift, with sellers taking the upper hand. This is evidenced by Bitcoin’s Cumulative Volume Delta (CVD) dropping to a highly negative level, indicating a strong selling pressure.

However, a short squeeze seems to have changed the momentum, leading to a recovery that pushed Bitcoin’s value back to $86,259.

Bitcoin’s Performance and Recovery

In the past month, Bitcoin’s performance has been less than stellar, with a 17% drop in February. Despite this, the cryptocurrency has managed to recover and is currently valued at $86,259.

Despite this recovery, the market is still heavily dominated by sellers, as indicated by the declining CVD. This suggests that more investors are selling their Bitcoin, leading to a bearish market.

Typically, such a market condition leads to a further decline in prices, as Bitcoin struggles to find strong support. However, the sudden demand for short positions seems to have led to a short squeeze, causing a temporary recovery.

Despite the high number of sell orders, the market signals indicate a short-term recovery. This suggests that Bitcoin might see moderate gains in the near future.

The sudden shift in market sentiment is due to an increased demand for futures. This has led to a high demand for short positions, resulting in a short squeeze and a subsequent recovery.

Furthermore, Bitcoin’s fund market premium has turned positive, indicating a bullish futures market. This suggests that traders are willing to pay a premium fee to hold their positions, indicating a high demand for leveraged positions.

In conclusion, while sellers have been dominating the market, the high demand for short positions has led to a short squeeze and a subsequent recovery. If the demand for futures continues to rise, Bitcoin could see a short-term recovery to $89,300. However, if the market shock subsides, Bitcoin might drop to $83,400.

0 notes

Text

Understanding Option Chain: A Comprehensive Guide

An option chain is a listing of all available options contracts for a specific underlying asset. It provides crucial data for traders to analyze and make informed decisions about trading options. Here's a detailed explanation of the components, formulas, and usage of an option chain.

Key Components of an Option Chain:

Strike Price (K): The fixed price at which the holder of the option can buy (call) or sell (put) the underlying asset.

Expiry Date: The date on which the option contract expires.

Premium: The cost of buying the option.

Call and Put Options: Listed side-by-side in the option chain, calls are on the left, and puts are on the right.

Open Interest (OI): The total number of outstanding contracts for a particular strike price and expiration date.

Implied Volatility (IV): The market’s expectation of future volatility of the underlying asset, expressed as a percentage.

Delta (Δ\Delta): Measures the rate of change of the option’s price concerning the price change in the underlying asset.

Volume: The number of contracts traded during a given period.

How to Read an Option Chain:

Choose the Underlying Asset: Select the stock or index for which you want to trade options.

Look at the Expiry Date: Identify the relevant expiry date for your strategy.

Examine Strike Prices: Compare premiums, open interest, and volume for different strike prices.

Analyze Open Interest and Volume: High open interest indicates strong market activity.

Check Implied Volatility (IV): Use IV to gauge the expected price movement of the underlying asset.

Important Formulas Used in Option Chain Analysis:

Intrinsic Value of Call Option:Intrinsic Value=max(S−K,0)\text{Intrinsic Value} = \max(S - K, 0)

SS: Spot price of the underlying asset

KK: Strike price

Intrinsic Value of Put Option:Intrinsic Value=max(K−S,0)\text{Intrinsic Value} = \max(K - S, 0)

Time Value:Time Value=Option Premium−Intrinsic Value\text{Time Value} = \text{Option Premium} - \text{Intrinsic Value}

Option Pricing Using Black-Scholes Formula:C=SN(d1)−Ke−rtN(d2)C = SN(d_1) - Ke^{-rt}N(d_2)

CC: Price of call option

SS: Current stock price

KK: Strike price

rr: Risk-free interest rate

tt: Time to expiration

N(d)N(d): Cumulative standard normal distribution

For puts, use:P=Ke−rtN(−d2)−SN(−d1)P = Ke^{-rt}N(-d_2) - SN(-d_1)Where:d1=ln(S/K)+(r+σ2/2)tσtandd2=d1−σtd_1 = \frac{\ln(S/K) + (r + \sigma^2/2)t}{\sigma\sqrt{t}} \quad \text{and} \quad d_2 = d_1 - \sigma\sqrt{t}

σ\sigma: Volatility of the stock

Advantages of Using an Option Chain:

✓ Provides a clear view of market sentiment through OI and volume.

✓ Helps identify liquidity and activity at various strike prices.

✓ Enables traders to select the best strike price and expiry based on premium and IV.

Practical Tips for Analyzing an Option Chain:

Focus on Open Interest (OI): High OI at specific strike prices indicates key support or resistance levels.

Track Implied Volatility (IV): Use IV to identify whether options are cheap or expensive.

Monitor Volume: High volume often points to significant market activity and liquidity.

Compare Call vs. Put Data: Evaluate the call/put ratio to assess bullish or bearish sentiment.

Understanding the option chain is fundamental for traders aiming to profit from options trading. By analyzing components such as open interest, volume, and implied volatility, and applying relevant formulas, you can make informed trading decisions and better manage risk. Options trading requires skill and knowledge, but mastering the option chain is a crucial step toward success.

0 notes

Text

Hedera (HBAR) has risen 3.37% in value, reaching $0.11, driven primarily by spot market transactions rather than leveraged buying, according to analyst CrediBULL Crypto. This marks a unique and sustainable growth pattern, with the cryptocurrency outperforming both the broader market and Layer 1 peers, despite their respective declines of 0.90% and 1.00%. Over the past week, HBAR also posted a 1.29% increase, signaling strong momentum.

Notably, Hedera’s rising price coincides with a decline in Open Interest (OI) in derivatives, suggesting de-leveraging as traders close leveraged positions. This behavior contrasts with typical price surges fueled by leverage, highlighting a healthier market trend. Furthermore, flat or negative perpetual contract volume delta (perp CVD) alongside increasing spot cumulative volume delta (CVD) indicates that the rally is driven by genuine spot buying rather than speculative trading.

The shift toward spot-driven growth reflects long-term market stability, as spot buyers tend to hold assets longer, reducing the likelihood of sharp corrections. Hedera's rally exemplifies sustainable growth, showcasing how cryptocurrencies can achieve stability when fueled by authentic investor interest.

0 notes

Text

Decoding Bitcoin’s Future: Key Indicators Suggest Long-Term Resilience

Key Points

Bitcoin’s long-term options market and buying activity on US exchanges indicate potential long-term strength for the cryptocurrency.

Despite recent price drops, key indicators suggest that Bitcoin’s overall price trajectory remains upward.

Despite a challenging August that saw Bitcoin’s price drop more than 13%, there are indications of potential long-term strength for the cryptocurrency.

This price drop was influenced by several factors, including the unwinding of the yen, carry trades, and concerns about the US economy.

However, two key indicators suggest that Bitcoin could demonstrate resilience in the long run.

Indications from the Long-Term Options Market

One positive sign comes from Bitcoin’s long-term options market.

Data tracked by cryptocurrency platform Amberdata shows that Bitcoin’s 180-day call-put skew remains high, indicating confidence in its price strength over the next six months.

This skew measures the demand for call options versus put options.

A positive skew means investors are paying more for calls, reflecting a belief that Bitcoin’s price will rise.

Call options allow investors to buy Bitcoin at a set price in the future, while put options let them sell at a set price.

The current positive skew suggests that investors expect the Bitcoin price to go up, which is a good sign for its long-term performance.

Strong Buying Activity on US Exchanges

Another encouraging factor is the buying activity on US exchanges.

Despite recent price drops, data from Kaiko shows that buying activity on platforms like Coinbase, Gemini, and Kraken has been strong.

This is measured by cumulative volume delta (CVD), which tracks the difference between buying and selling volumes.

A positive CVD indicates more buying than selling, suggesting that traders are taking advantage of lower prices.

While offshore exchanges like Binance and OKX have seen more selling, the positive CVD on liquidity-rich US exchanges indicates that many traders, including institutional ETF issuers, are buying Bitcoin during the dip, which could help support its price.

Other Indicators and Historical Trends

In the short term, Bitcoin’s recent sharp drop and an RSI below 30 suggest it might be oversold, which could lead to a potential rebound soon.

Historically, such conditions have often preceded short-term recoveries, indicating that Bitcoin might stabilize or improve in the near future.

For the long term, Bitcoin remains in an upward trend channel, with key support levels around $45,000 and resistance at $70,000.

This positive trend suggests that, despite recent declines, Bitcoin’s overall price trajectory has been upward.

This pattern is similar to Bitcoin’s behavior during the March 2020 market crash, when a significant drop was followed by a strong rebound as economic conditions improved.

If current economic issues are resolved and conditions stabilize, Bitcoin could experience a similar recovery.

In summary, while Bitcoin faces short-term volatility, the long-term outlook is promising.

Investors and traders are advised to stay cautious amidst current volatility but to keep an eye on Bitcoin’s long-term potential.

0 notes

Text

🎯 Delta Option: The One Greek That Can Make or Break Your Trade

If you're trading options in India or anywhere globally, understanding Delta is non-negotiable. Whether you're hedging risk, buying calls on Reliance, or selling puts on Nifty, Delta tells you how sensitive your option is to price changes in the underlying asset.

Delta is one of the Options Greeks, but it stands out for one simple reason: it answers “How much will my option price move if the stock moves ₹1?”

Let’s break it all down — no fluff, just real trading logic, research, and Indian market examples.

📊 What Exactly is Delta in Options Trading?

Delta (Δ) measures how much an option’s premium changes with a ₹1 move in the underlying stock or index. It ranges from 0 to 1 for call options and 0 to -1 for put options.

So if a Nifty 50 call option has a delta of 0.6, and Nifty moves up by ₹1, the option’s premium should theoretically rise by ₹0.60.

In essence, Delta is: ✅ A sensitivity gauge ✅ A directional risk indicator ✅ A rough estimate of the probability that the option expires in-the-money (ITM)

🧠 Fun Fact: In academic circles, Delta is the first derivative of the option price with respect to the underlying asset. This comes from models like Black-Scholes and Binomial Trees, used even in the NSE Derivatives market.

📈 Real Example from Indian Stock Market: HDFC Bank Call Option

Say HDFC Bank is trading at ₹1,600. You buy a HDFC BANK 1600 CE at a premium of ₹45. The option has a delta of 0.52.

If HDFC moves to ₹1,610, the premium should increase by ₹(10 × 0.52) = ₹5.2. So your option could now be worth around ₹50.2.

📌 This delta changes as the stock moves — that's where Gamma comes in. But more on that soon.

🧮 How is Delta Calculated? Is There a Formula?

Yes, Delta can be calculated using the Black-Scholes Model, which is widely applied in both U.S. and Indian markets (NSE, BSE).

The call option Delta is represented as: Δ = N(d1) Where N(d1) is the standard normal cumulative distribution function.

For put options: Δ = N(d1) - 1

While this formula is technical, most traders use tools like Strike Money to visualize and analyze Delta directly on options charts. Strike Money lets you see Delta values across various strike prices in real-time, which is crucial when you’re making intraday or expiry-day decisions.

⏳ What Affects Delta? It’s Not Just the Stock Price

Delta isn't static. It evolves with multiple variables. Here’s what changes it:

🔹 Moneyness: At-the-money options (ATM) have a Delta around 0.5 (calls) or -0.5 (puts). As options move ITM, Delta approaches 1 or -1. OTM options have low Delta values.

🔹 Time to Expiry: As expiration nears, Delta becomes more binary — closer to 1 or 0 depending on how far in or out-of-the-money it is.

🔹 Volatility: Higher implied volatility (IV) affects the rate at which Delta shifts. This is tightly linked to Vega, another Greek.

🔹 Interest Rates: Though minor in impact, rate changes can affect Delta in long-term options (LEAPS).

⚖️ What is Delta Neutral? The Art of Hedging Like a Pro

Ever heard of Delta Neutral strategies?

A Delta Neutral portfolio is one where the sum of all Deltas = 0. That means the portfolio value doesn’t change if the underlying moves up or down slightly.

Example from Indian context: Let’s say you’ve sold 1 lot of Nifty 22700 CE with a Delta of -0.4. To neutralize it, you can buy futures or ITM calls with a combined Delta of +0.4.

This strategy is often used by institutional traders and market makers, especially when they run options books with thousands of contracts.

📖 According to a research paper published in the Journal of Derivatives, Delta-neutral strategies historically show better risk-adjusted returns in high-volatility markets like India during earnings seasons or budget announcements.

⚡ How Gamma Changes Delta: The Forgotten Greek That Matters

Delta doesn’t stay fixed. It bends, thanks to Gamma — the rate of change of Delta itself.

High Gamma means Delta shifts quickly, especially near expiry and ATM options.

If you’re shorting options in India, such as weekly Bank Nifty OTM puts, be careful of Gamma spikes. On expiry day, Delta can shoot from 0.2 to 0.8 in minutes.

Strike Money helps track Gamma across strikes, giving an edge to intraday scalpers and expiry traders.

🛠️ Using Delta in Strategy: Not Just a Number, But a Weapon

Here’s how Indian traders use Delta in real strategies:

📍 Buying Options: Go for 0.6 to 0.7 Delta calls/puts for directional trades. These are slightly ITM and have a better chance of finishing ITM.

📍 Selling Options: Many sell OTM options with Delta 0.2 or less. These have a high probability of expiring worthless but watch out for Gamma moves.

📍 Spreads: In a Bull Call Spread, choose a long leg with Delta 0.6 and a short leg with Delta 0.3. It creates a defined risk profile with net positive Delta.

📍 Iron Condors: Traders often balance Delta by selecting wings with opposing deltas. The goal is to keep the entire position Delta-neutral.

All these strategies are easily tested and tracked on Strike Money, where Delta overlays are built into the strategy builder.

🔍 Delta vs Gamma: What’s the Real Difference?

If Delta is how much your car is moving, Gamma is how fast you’re accelerating.

Delta tells you your current exposure. Gamma warns how fast that exposure might change.

A low Gamma environment (like during sideways markets) is good for short straddles/strangles. A high Gamma setup (like around RBI announcements) favors quick directional plays.

Both are essential for understanding non-linear P&L curves, especially in Indian indices like Nifty and Bank Nifty, where premiums can decay rapidly.

📉 Delta and Probability: Can You Trust It?

Many traders use Delta as a proxy for probability.

Example: A put option with Delta -0.25 is assumed to have 25% chance of expiring ITM. That means 75% probability of profit (POP) if sold.

But beware — Delta is not a true probability. It’s affected by volatility, time, and skew. Use it as a rough guide, not a guarantee.

A 2022 CBOE research paper showed that Delta’s correlation to actual expiry outcomes varied by as much as 15-20% in high IV environments.

📚 What Experts and Books Say About Delta

🧠 Sheldon Natenberg, in Option Volatility and Pricing, emphasizes Delta as the most useful Greek for both risk management and forecasting.

💡 Nassim Taleb, known for The Black Swan, discusses Delta’s fragility under tail risk — how minor movements become violent when Gamma kicks in.

In the Indian context, derivatives trainers like Nithin Kamath (Zerodha) and Pranjal Kamra often highlight Delta's role in systematic options writing and hedged setups.

🔥 Real-World Indian Data: How Traders Use Delta

Data from NSE's 2023 derivatives report reveals:

📈 Over 65% of options volume in India happens in strikes with Delta between 0.2 and 0.6 📉 The average profitability of long options improves with Delta > 0.5 📊 More than 80% of option sellers target low-delta (0.15-0.25) weekly options for premium decay

Strike Money’s user stats show that retail traders using Delta overlays and simulation tools were 28% more likely to maintain positive P&L over 3 months.

💡 Should You Use Delta in Your Trades?

Absolutely — but with clarity.

Delta isn’t just for professionals or quants. Even if you’re taking a directional bet on Infosys or hedging a portfolio against Nifty downside, Delta is the GPS of your trade.

Use Strike Money to:

📌 Visualize live Delta changes 📌 Backtest Delta-based strategies 📌 Avoid unintended directional exposure

It’s not about being right — it’s about knowing your risk before the trade.

❓ FAQs About Delta Option — Real Queries, Quick Answers

❓ Can Delta be greater than 1? No. Call Delta maxes out at 1; put Delta bottoms at -1.

❓ Is Delta same as probability? Not exactly. Delta approximates probability but is influenced by IV and time.

❓ Which Delta is best for buying? Anywhere from 0.5 to 0.7 for a decent mix of cost and directional movement.

❓ How does expiry affect Delta? Closer to expiry, Delta becomes binary — near 1 or 0 depending on ITM or OTM.

🧭 Final Take: Master Delta, Master Options

Delta is the heartbeat of every options trade. It tells you where your trade is headed, how fast, and what it’s vulnerable to.

In the Indian market — with high liquidity, weekly expiries, and rapid volatility shifts — Delta is not optional knowledge. It’s a requirement.

Start tracking it today with Strike Money, simulate your trades with Delta logic, and elevate from guessing to knowing.

📌 Remember: Prices lie. Delta doesn’t.

0 notes

Text

Trading Indicators That Every Aspiring Traders Should Know

If you think trading is a game of wild guess by looking at the ups and downs, you are very much on the wrong side. From an in-depth study of the ABCs to being meticulous at every point of the journey, there is a lot that goes behind building a perfect trading strategy and getting results from it.

Read More: https://tumblrblog.com/trading-indicators-that-every-aspiring-traders-should-know/

0 notes

Text

Bitcoin has been making waves in the financial world, with experts agreeing that $65,000 is a critical level for the popular cryptocurrency to focus on at the moment. As Bitcoin continues to gain momentum, hitting this key price point could signal significant movements in the Market. Stay tuned as we keep track of Bitcoin's journey towards the $65K mark. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Bitcoin’s Market structure shows it is near a re-accumulation zone, indicating a potential bounce to $65,065 once the coin recovers. Crypto trader Rekt Capital recently shared insights on Bitcoin's movement, stating that it has moved out of the danger zone and entered the re-accumulation area after satisfying the post-halving correction. Comparing it to the 2016 post-halving cycle, where bearish candlesticks preceded a significant surge in price, Rekt Capital suggested that Bitcoin's correction could be nearing its end. With the current price at $60,509, a potential move towards $65,065 is anticipated if BTC bounces back. The recent price drop of 5.61% in the last seven days led to numerous liquidations in the Market, as highlighted by data from Hyblock. The magnetic zone around liquidation levels indicates potential price movement towards $65,065, assuming a bounce in the price. Additionally, the Cumulative Liquidation Level Delta (CLLD) being negative suggests a bullish sentiment for Bitcoin's price, with short positions experiencing more liquidations. Long-term investors seem to be accumulating Bitcoin, as indicated by the Hodler Net Position Change metric. The shift from negative to positive values reflects investors buying 26,990 BTC on the 10th of May, potentially leading to further accumulation. Sustaining this momentum could push Bitcoin's price above $60,000 in the near future, setting the stage for a parabolic upside in the long run. However, traders should remain cautious as Bitcoin might experience further downside before a gradual price recovery, as suggested by Rekt Capital. Keeping an eye on these key metrics and Market trends could help navigate the volatile cryptocurrency landscape effectively. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. What is the significance of the $65,000 level for Bitcoin right now? The $65,000 level is important because it is seen as a key resistance level that Bitcoin needs to break through in order to continue its upward momentum. 2. Why is breaking through $65,000 important for Bitcoin? Breaking through $65,000 would signal to investors and traders that Bitcoin has strong bullish momentum and could potentially reach new all-time highs. 3. What could happen if Bitcoin fails to break through $65,000? If Bitcoin fails to break through $65,000, it could potentially face resistance and struggle to continue its upward trend, leading to a possible price correction or consolidation. 4. How does the $65,000 level compare to previous price levels for Bitcoin? The $65,000 level is significant as it is close to Bitcoin's previous all-time high of around $64,800, making it a key psychological level for traders and investors to watch.

5. What factors could influence Bitcoin's ability to break through $65,000? Factors such as Market sentiment, regulatory developments, macroeconomic conditions, and institutional interest could all influence Bitcoin's ability to break through $65,000. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

Canned Grains Market Investment Scope 2024-2030 Analysed in Latest Report: Business Growth Factors, Industry Demand And Forecast

"The market research Canned Grains offers market 2024-2030 sizing and predictions in seven main currencies: USD, EUR, JPY, GBP, AUD, CAD, and CHF. The availability of different currencies facilitates informed decision-making for organization executives. The years 2019 through 2022 are regarded as historical years in this report, while 2023 serves as the base year, 2024 is the expected year, and the years 2024 through 2030 are regarded as the forecast period.

Global Canned Grains Market: Manufacturers

El Mexicano, Freekeh Foods, Goya Foods, Pereg Natural Foods, Roland Foods, Delta Food Gate

Get FREE Canned Grains Market Sample report: https://altusmarketresearch.com/reports/sample/63172

The Global Canned Grains Market Assessment Requires the Use of the FPNV Positioning Matrix. By looking at important variables related to Product Satisfaction and Business Strategy, it offers a thorough assessment of suppliers and empowers consumers to make selections based on their own requirements. Then, using a sophisticated analysis, these vendors are grouped into four different quadrants, Forefront (F), Pathfinder (P), Niche (N), and Vital (V), which correspond to different success levels.

An informative look at the current situation of vendors in a specific market space can be found in the Canned Grains Market Share Analysis. We can help firms better evaluate their performance and their competition when vying for market share by analyzing vendor contributions to overall revenue, client base, and other critical indicators. Additionally, the Canned Grains analysis clarifies the degree of competition in each sector with regard to accumulation, fragmentation domination, and amalgamation features during the base year period under investigation.

Customization/Inquiry For Buying of Canned Grains Market Report @ https://altusmarketresearch.com/reports/enquiry/63172

The following advice is revealed in the Canned Grains market report:

Market Penetration: Gives thorough details on the Canned Grains market that the major companies are offering.

Market Development: Offers comprehensive details regarding profitable developing markets and examines market penetration across established market sectors.

Market diversification: Offers comprehensive data on investments, unexplored regions, new product launches, and recent advancements.

Market Trends: Offers a thorough grasp of the Russia-Ukraine Conflict, the High Inflation, and the Cumulative Effect of COVID-19

Competitive Assessment & Intelligence: Offers a thorough evaluation of the top companies' market shares, business plans, goods, certifications, regulatory approvals, patent portfolios, and manufacturing capacities.

Product Development & Innovation: Offers perceptive perspectives on upcoming technologies, research and development endeavors, and innovative product innovations.

Global Market: Type

Baked Bean Processed Peas Kidney Beans Others

Global Market: Application

Supermarket Convenience Stores Online Stores Others

Highlights of the Canned Grains Market analysis:

With 2023 serving as the base year, this research offers a thorough analysis of the Canned Grains market as well as market size (US$ Mn) and compound annual growth rate (CAGR%) for the forecast period (2024–2030).

It presents appealing investment proposition matrices for this market and clarifies possible revenue prospects across several segments.

Important information is also provided by this report regarding market trends, regional outlooks, opportunities, opportunities, constraints, and competitive strategies used by major competitors, as well as new product launches or approvals.

Based on the following criteria—company overview, financial performance, product portfolio, market presence, distribution tactics, significant advancements, strategies, and future plans—it profiles major participants in the Canned Grains market.

Marketers and the companies' management authorities would be able to make well-informed decisions about their future product launches, type upgrades, market expansion, and marketing strategies with the use of the insights from this study.

Various industry stakeholders, such as investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts, are served by the Canned Grains market study.

With the usage of numerous strategy matrices for examining the Canned Grains market, stakeholders would find it easier to make decisions.

Read Report Description: https://altusmarketresearch.com/global-canned-grains-market-63172

The report provides answers to queries like:

What are the Global Canned Grains Market's size and forecast? What are the COVID-19-related barriers and how will they affect the global Canned Grains market throughout the projected period? Which Global Canned Grains Market goods, sectors, applications, and areas should investors focus on during the forecast period? What is the global Canned Grains market's competitive strategy window for opportunities? What are the global Canned Grains market's regulatory frameworks and technological trends? What percentage of the global Canned Grains market do the top vendors hold? Which approaches and tactical maneuvers are deemed appropriate for breaking into the global Canned Grains market?"

0 notes

Text

Cardano Surges with Massive Buy Orders, Gearing Up for Price Breakout Amid Bullish Sentiment

Cardano (ADA) is stealing the spotlight in the cryptocurrency realm with a remarkable bullish surge, marked by an extraordinary 678% bid-ask volume imbalance, favoring bullish sentiments. The surge in buy orders is indicative of strong investor confidence, positioning ADA for a potential breakout and an impressive 32% rally to $0.68.

Crypto analyst Ali Martinez has identified a bullish descending triangle pattern on ADA's daily chart, suggesting a potential shift in the downtrend. ADA's ability to maintain support above the crucial $0.53 level is deemed crucial for the anticipated breakout towards $0.68.

ADA's standout performance is evident in its 10% surge within the last 24 hours, surpassing both Bitcoin and Ethereum, which recorded gains of 2.48% and 3.15%, respectively. This notable uptick is further supported by a substantial 121% increase in trading volume, underscoring the robust buying pressure driving ADA's surge.

While optimism prevails, challenges exist on the horizon. The Social Dominance metric implies that ADA might have more room to grow, while a negative Cumulative Value Delta suggests potential selling pressure.

ADA's community stands out for its resilience, with 23% of holders keeping their ADA for over five years, a testament to the unwavering confidence in Cardano's potential.

The eagerly anticipated Alonzo hard fork, set to introduce smart contracts on the Cardano blockchain, signifies a significant milestone. Alongside ongoing development initiatives and a pipeline filled with projects, this milestone is expected to fuel future adoption and contribute to ADA's value growth.

0 notes

Text

Bitcoin's Price Drops as Traders Sell the Fact, Led by Binance and OKX

Bitcoin (BTC) has faced selling pressure since spot exchange-traded funds (ETFs) started trading in the US. Data from Kaiko shows that the selling pressure has been focused on Binance, OKX, and Upbit, which are major crypto exchanges. As a result, Bitcoin's price has dropped by 12% from its recent high of $48,975. Traders have been taking profits on their long positions, which they had opened in anticipation of the ETF launch. This phenomenon, known as "sell the fact," has contributed to the downward pressure on Bitcoin.

The cumulative volume delta (CVD) indicator reveals that traders from Binance have played a significant role in the sell-off. Binance's CVD turned positive on the day of the ETF launch but has been declining ever since. According to Kaiko's data, there has been a net capital outflow of nearly 5,000 BTC from Binance. Upbit, the South Korean exchange, has experienced the second-largest net capital outflow, followed by Itbit and OKX. However, Coinbase and Bitstamp have seen positive CVDs, indicating a net capital inflow despite the price weakness.

Analysts suggest that Bitcoin's price could decline further to $40,000 or even lower before the pullback subsides. The initial performance of the ETFs has been weaker than expected, as they have not attracted the projected $4 billion in inflows on the first day. This supports the possibility of a deeper price drop. Traders will continue to monitor the market to see if the sell-off persists or if Bitcoin experiences a rebound in the near future.

Read the original article

0 notes

Text

Panic-induced Bitcoin Sell-off by Short-Term Holders: future Impact on BTC Explained

Key Points

Bitcoin’s short-term holders may have panic-sold following Bybit hack news, causing significant market volatility.

Analysis of the 90-Day Active Supply shows a decline in trading activity, indicating reduced selling pressure.

Bitcoin’s short-term holders (STHs), likely driven by panic following the Bybit hack news, may have realized substantial losses. This has resulted in notable market volatility for Bitcoin.

Indicators of Bearish Momentum

Over the past 16 hours, Bitcoin’s 4-hour chart on Binance showed significant bearish indicators. The Exponential Moving Average (EMA) cross revealed a bearish crossover, signaling short-term downward momentum. This aligns with Bitcoin’s price decline to $96,259.9, a -0.12% drop from the previous period.

The Relative Strength Index (RSI) stood at 46.05, reflecting a neutral but slightly bearish outlook. However, if it rebounds above 50, bullish sentiment might return, supporting price recovery.

STHs Offloading Bitcoin

The Cumulative Volume Delta (CVD) showed a net volume delta of -94.67K, reflecting strong selling pressure in the last 8 hours. This suggests that STHs may be offloading Bitcoin, potentially forming a short-term local bottom as selling pressure diminishes.

The Short-Term Holder Profit & Loss (P&L) to Exchanges Sum chart for the last 24 hours also highlighted substantial losses among STHs. This data suggests a potential local bottom, as distressed selling often exhausts downward momentum, creating a possible buying window for traders.

Decline in Trading Activity

Analysis of the 90-Day Active Supply chart for Bitcoin showed a notable decline in recent months. This metric indicates a decline in trading activity, with current trends suggesting that STHs had largely exited, potentially reducing selling pressure.

The Bitcoin netflow chart for aggregated exchanges over the last three months revealed a sharp net outflow of -546.11 Bitcoin in the past 24 hours. This sudden negative netflow typically indicates that holders are withdrawing Bitcoin to off-exchange wallets, suggesting reduced selling pressure.

The 24-hour netflow change of +269.71 Bitcoin suggests renewed buying interest. Despite short-term volatility, long-term indicators suggest a potential shift toward recovery as selling pressure subsides.

0 notes